I

At the turn of the twentieth century, mutual benefit societies grew to become important providers of sickness, accident and life insurance on both sides of the Atlantic. Based on collective ideas regarding self-help, workers organised in a variety of mutual benefit societies, known as fraternal, friendly and health insurance societies. Before the emerging public insurance schemes in Western Europe, or the development of the two pillars of employer-sponsored and government insurance in the US, mutual benefit societies offered an attractive form of working-class insurance (Beito Reference BEITO2000).

In Western Europe and the US, mutual health societies belong, with few exceptions, to the past. Moreover, they declined during the same period in which we observe the implementation of national social insurance schemes in many countries (Leeuwen Reference LEEUWEN2016). From an economic-theoretical standpoint the main motive for government intervention in insurance markets, ranging from large-scale social insurance programmes to the regulation of private markets for property, is the problem of adverse selection (Einav and Finkelstein Reference EINAV and FINKELSTEIN2011). The adverse selection argument has been influential also in the historical literature, and generated a long-lasting debate. In a study of European health insurance societies, Murray (Reference MURRAY2003) argues that voluntary societies faced a significant disadvantage compared to compulsory funds. In the account of the morbidity records, showing three-times higher claims among the voluntary funds, adverse selection is put forward as the key explanation. In a study of the US health insurance market in the 1950s, Thomasson (Reference THOMASSON2004) argues that adverse selection posed a greater problem for the non-profit insurer in the market for individual health insurance, possibly because of differences in the way they screened potential members relative to commercial insurance companies. In a critique of both Murray and Thomasson, Gottlieb (Reference MURRAY2007) argues that mutual health insurance societies were highly effective in screening new members and control for moral hazard since morbidity among US workers in the furniture industry did not differ between members and non-members.

In this article the presence of adverse selection in mutual health insurance is studied on the individual level by comparing whether those enrolled faced a greater risk exposure and/or were less healthy. For this purpose, we examine survival (longevity) for matched samples representing insured and uninsured individuals who were born and died in Sweden during the nineteenth and twentieth centuries; the insured individuals were enrolled in the nationwide mutual health insurance society Svenska Folket (The Swedish People). The sample is matched by age, sex and residence to create a sample of uninsured individuals. For the sample of insured individuals, we furthermore distinguish between: (i) lines of insurance (health and life insurance); (ii) policies (value of the policy); and (iii) kind of termination (voluntary/fatal).

In addition to previous historical studies on mutual benefit societies using morbidity records to infer information asymmetry (Gottlieb Reference GOTTLIEB2007; Murray Reference MURRAY2011; Andersson and Eriksson Reference ANDERSSON and ERIKSSON2017), the present article offers a cleaner test of the adverse selection hypothesis, as the risk of moral hazard is more limited, if it exists at all, when considering the hazard risk of mortality. By using longitudinal individual-level data, instead of society-level or cross-sectional data, we are able to examine the adverse selection hypothesis in relation to individual characteristics, insurance decisions and outcomes over an individual's life course.

We find no compelling evidence for the presence of adverse selection in the nationwide mutual health insurance society examined. There are no major differences between insured and uninsured individuals, or by lines of insurance (health insured and life insured), termination (voluntary/lapse or fatal outcome), or kind of policy (size/value of the policy). We therefore argue that adverse selection not was a major reason for government intervention in the health insurance market in Sweden in the early twentieth century.

The rest of the article is organised as follows. The next section reviews the literature on mutual benefit societies. Section III presents the theory of adverse selection. Section IV focuses on the data and method. Section V presents the study-case, and Section VI presents the empirical results. Section VII offers our conclusions.

II

Mutual benefit societies had their origins as early as in medieval guilds, protecting members from unanticipated medical costs, supporting dependent widows and orphans, and covering funeral expenses. Often these societies were descendants of the mutual aid arrangements that had evolved earlier in Europe within guilds (Lindeberg Reference LINDEBERG1949, p. 56). It was not until the nineteenth century that mutual benefit societies became widely diffused in the Western world. From the onset of the industrial revolution, the need to protect against loss of wage-labour income due to illness, accident and death in the absence of social protection networks created incentives to organise mutual insurance societies. Among wage earners in the growing urban areas in England, the Netherlands and other early industrial economies, mutual societies based on close social affinity either in occupation, location, social class and religion or other affiliations became increasingly popular (Gosden Reference GOSDEN1961; Dreyfus and Linden Reference DREYFUS and VAN DER LINDEN1996).

The rise in demand in Sweden for health insurance and the establishment of increasing numbers of health insurance societies took off from the mid nineteenth century, a period of rapid industrialisation and urbanisation (Lindeberg Reference LINDEBERG1949). From only a small percentage in the early 1890s, a substantial share of the labour force was covered by health insurance by 1910. Insurance coverage, measured as the proportion of insured members of total employment, increased from 14 to 30 per cent between 1901 and 1910. If only non-agricultural workers are included, 50 per cent of all male workers and 33 per cent of all female workers were insured by 1910 (Kommerskollegii 1912; Jungenfelt Reference JUNGENFELT1966; Schön and Krantz Reference SCHÖN and KRANTZ2012).

The development of health insurance societies in Sweden can be divided into two waves, from local/occupational-based health insurance societies (henceforth, local societies) to nationwide health insurance societies with affiliations all over Sweden (henceforth, affiliated societies). The first wave covered the years 1850–1900 and the second, 1900–55, when public health insurance was introduced. The first wave was characterised by local societies, which were small, local and/or occupation- or trade-based. This was also the case in the UK and the US, where the local societies dominated until the 1810s (Gosden Reference GOSDEN1961; Beito Reference BEITO1999). Because social control was crucial to the operation of the local society, they commonly excluded members who left the workplace or moved beyond a distance where they could be monitored or visited when claiming benefits (Lindeberg Reference LINDEBERG1949, p. 72). Members who wished to leave these societies were not entitled to recover any of the earlier investments made (Andersson and Eriksson Reference ANDERSSON and ERIKSSON2019). The early local societies often limited the number of members to 10, 20 or 50 and were often financed through ex post contributions (Nekby Reference NEKBY2004). These local societies had the character of fraternities and excluded women (Andersson and Eriksson Reference ANDERSSON and ERIKSSON2019). A considerable proportion of the societies accepted members only from a certain occupation, workplace or trade. Membership was occasionally made compulsory, where employers protected their workers from sickness and accidents through health insurance membership. However, in contrast to the development of compulsory mutual health insurance societies (Guinnane and Streb Reference GUINNANE and STREB2011), the Swedish health insurance societies were largely based on voluntary membership (Andersson and Eriksson Reference ANDERSSON and ERIKSSON2017).

A first regulatory initiative was enacted in the late nineteenth century. Like the British Friendly Societies Act of 1875, the purpose of the first Swedish registered health insurance societies Act of 1891 was to support and encourage the development of health insurance societies. Another reason was to encourage control over societies through an administrative subsidy for those societies that voluntarily registered with the government (Lindeberg Reference LINDEBERG1949, p. 41). One important aspect that came to change the future character of Swedish health insurance societies was the separation of the health insurance operation from the operation of the organisation from which the society had often derived (unions, temperance non-conformist church).

The second Swedish Act regulating health insurance societies was passed in 1910, and in contrast to the 1891 Act, the latter acknowledged the importance of risk diversification and required a minimum of 100 members. It prohibited the exclusion of members who moved to a different region and had membership in multiple societies. It also banned ex post assessments (except for temporary budget deficits). All these legal demands prompted a wave of mergers between health insurance societies into larger, national and more heterogeneous units and encouraged affiliated societies. Thereby, the 1910 Act reinforced an ongoing development of larger, affiliated societies. The first affiliated health insurance society had been established already in 1892, and by 1910, there were 28 affiliated societies with 564 lodges covering over 140,000 members or 22 per cent of market share.

The evolution of liberal affiliated orders in the Anglo-Saxon context in the late nineteenth century was influential in the development of mutual benefit societies among later industrialised countries in both southern and northern Europe (Dreyfus and Linden Reference DREYFUS and VAN DER LINDEN1996; Tomassini Reference TOMASSINI1996). British friendly affiliated societies were commonly orders which used rituals and signs and a ‘masculine form of sociability’ to create belonging (Cordery Reference CORDERY2003; Ismay Reference ISMAY2018). By contrast, the Swedish affiliated society became less focused on club-like characteristics. As mentioned previously, the regulation of 1891 imposed a separation of the board and financial part of the society from the operation of any existing organisation, order or fraternity. In contrast to developments in the UK and the US, it therefore became less common for Swedish health insurance societies to be connected to or part of an organisation that assisted in creating social proximity among members. Although the two largest (based on membership) national health insurance societies in Sweden were temperance health insurance societies, they were not connected to any temperance organisation. Hence, in Sweden, fraternalism and club-like characteristics rather characterised the early local societies. A higher proportion of women were members of affiliated societies compared to the small, local societies where women often were excluded (Andersson and Eriksson Reference ANDERSSON and ERIKSSON2019). Another difference between British and Swedish affiliated societies was that while British affiliations, such as the Ancient Order of Foresters, shared risks within each affiliation (Riley Reference RILEY1997), the Swedish affiliations shared financial risk within the entire society (Lindeberg Reference LINDEBERG1949). Hence, except for the temperance health insurance societies, the national health insurance societies asserted their general character, without any political or ideological focus. The focus of this study is the largest society among the latter, Svenska Folket, which was established in 1904 (Svenska Folket 1928).

According to previous research, the change in composition of health insurance societies over time may have had different implications for the ability to mitigate information asymmetry. First, local societies’ primary advantage over commercial insurers was their ability to overcome information asymmetry (Gottlieb Reference GOTTLIEB2007). Having regular face-to-face contact led to reciprocal social control, and faced with the risk of exclusion, strong social ties created incentives to avoid fraudulent behaviour. Only individuals known to members were accepted (if informal and formal rules were met) (Emery Reference EMERY1996). However, their operation seems to have been exceptionally vulnerable in other principal respects. One of the major issues was the insufficient distribution of risk, where members facing the same kind of risk (same occupation, workplace and neighbourhood) shared their losses mutually. Another concern of direct democracy was the lack of professional management, where rotating offices led to subsequent changes in position and limited accumulated know-how. The sociability function of the early local societies could lead to the unforeseen risk of sharing out the money, or that societies could be used for other purposes than intended when members collectively faced economic hardship (Lindeberg Reference LINDEBERG1949).

The major advantage of the second wave of larger affiliated societies was the distribution of risk on a greater, even national level. There was also a higher level of professional management in the affiliated societies than in the local societies. On the debit side, it might be argued that the capacity of the latter to mitigate information asymmetry was more limited, and actuarial principles were still typically not applied. Unless limitations on entry or age-scaled initiation fees were applied, all members were priced equally. The egalitarian pricing meant that the more risk-exposed, or less healthy workers would theoretically be more incentivised to join when priced for the average risk (Clawson Reference CLAWSON1989, p. 227; Gottlieb Reference GOTTLIEB2007).

III

In parallel to the development the US, the strength of the temperance movement led to the establishment of several larger affiliated temperance health insurance societies in Sweden during the late nineteenth and early twentieth centuries (Rydbeck Reference RYDBECK1995; Cordery Reference CORDERY2003). Although the temperance movement was strong in the early twentieth century, far from all workers took an active part as members or were committed absolutists/teetotallers (Lundkvist Reference LUNDKVIST1977).

Without any connection to temperance, occupation or social class, independent affiliated societies, such as Svenska Folket, are expected to benefit less from a favourable or informed selection of members. If an egalitarian pricing policy is applied, where the pricing of risk and the distribution of benefits were shared equally across the pool of individuals enrolled by mutual benefit societies, the affiliated independent societies would face a greater risk of adverse selection.

In a setting where mutual benefit societies lack informational advantages, individuals would have information about expected claims that the society was lacking. If such societies further needed to attract new members to avoid financial insolvency in the long run (due to, e.g., lack of actuarial expertise), benefit societies would effectively be competing with each other. In such a setting, we would expect, in line with the basic adverse selection theory (see, e.g., Chiappori et al. Reference CHIAPPORI, JULLIEN, SALANIÉ and SALANIÉ2006), a positive correlation between risk and coverage. The reason would be that, unless health insurance societies could differentiate between high-risk and low-risk individuals in their selection of new members, the two groups would be offered the same price due to egalitarian pricing. This implies that individuals facing a high-risk exposure, or suffering from poor health, would be more incentivised to buy insurance if priced for the average risk. Societies lacking this information could not effectively avoid such risks.

When health insurance societies offered multiple insurance contracts (such as smaller and larger policies), another expected relation, in line with the basic adverse selection model, is that high-risk individuals would be incentivised to purchase more comprehensive coverage. Within a health insurance society, members facing a low risk would demand less comprehensive coverage than high-risk members, as the latter would be underpriced (if priced for the average risk). In the presence of adverse selection, not only are high-risk individuals expected to insure more, another expected outcome on the insurance market is that of underinsurance. According to the basic adverse selection model, individuals who face a low expected claim, in relation to the premium offered at the average cost, will remain outside the insurance pool (or purchase too small policies).

If adverse selection were a major concern, the independent affiliated societies would face an over-representation of high-risk individuals and, vice versa, an under-representation of low-risk individuals. Among the individuals insured, high-risk individuals would demand more insurance coverage and purchase larger policies to take advantage of the underpricing.

IV

Historical studies on the selection of individuals into mutual benefit societies are few and largely based on aggregated data (Murray Reference MURRAY2005, Reference MURRAY2011; Andersson and Eriksson Reference ANDERSSON and ERIKSSON2017). One exception is a study by Gottlieb (Reference GOTTLIEB2007), which examines morbidity in a sample of US manufacturing workers by enrolment in mutual aid societies. In the present article, we seek to offer a cleaner test of the adverse selection hypothesis by considering the hazard risk of mortality. As the morbidity measure arguably includes an element of moral hazard, such a mix (of moral hazard and adverse selection) is more limited, if it exists at all, when considering mortality. Hence, our study focuses on adverse selection. Further, theoretically, adverse selection could have occurred also by unhealthy individuals selecting into health insurance societies to receive health insurance benefits. Hence, our methodological approach focusing on mortality may omit to detect adverse selection in the morbidity experience of Svenska Folket. However, we note that in Sweden during the early twentieth century it was especially young people (aged 20–39) who suffered from tuberculosis, causing both lengthy sick leave periods and premature death (Puranen Reference PURANEN1984). We expect that those recently infected with tuberculosis would have more incentives to insure, not only in health, but also in life insurance than the uninfected. We will thereby capture adverse selection, if any, in terms of both morbidity and mortality.

Our empirical setting is most closely related to contemporary studies on selection in the life insurance market based on microdata, where the relation between life insurance uptake and mortality is examined. Cawley and Philipson (Reference CAWLEY and PHILIPSON1999) examined the relation using data from the US Health and Retirement Study (HRS). They measured the probability of death by self-perceived risk and actual death, where the subjective measure was based on questionnaires and the objective was captured using observed deaths over two waves of the HRS (1992 and 1994). After controlling for a set of individual characteristics, they found that the death rate for persons who had life insurance was lower than for those who lacked it. In a follow-up paper on the same data, He (Reference HE2009) restricted the sample to include individuals without life insurance in the first HRS wave (1992) only, and then examined the mortality rate between insured/uninsured individuals in the second wave (1994). She found that the individuals who were insured faced a greater mortality risk. In a more recent paper, Hedengren and Stratmann (Reference HEDENGREN and STRATMANN2016) use matched data including respondents from the US income and programme participation survey (SIPP) with administrative records providing survival information. As the latter provide hard evidence for whether an individual actually died, they avoid using alteration to infer death, as done in previous studies. When running a regression relating death with life insurance, they found no compelling evidence for adverse selection.

In our study, we expand the time frame of analysis to cover an individual's entire life span, thereby avoiding the right-hand censoring seen in contemporary studies. For our purposes, we are most interested in examining adverse selection in affiliated societies. As the early mutual benefit societies emerged in the larger cities, or at larger workplaces, the affiliated society expanded into smaller urban centres, villages or even rural areas where few individuals were insured. By tracing the enrolment of new members in one of the largest affiliated societies without selection of teetotallers only, such as in the temperance societies, we seek to examine the presence of adverse selection with respect to the uninsured population.

To capture enrolment, we have drawn a sample of 40 parishes/local areas where affiliated lodges (sections) were established by Svenska Folket (est. 1904) during the first eight years of operation. For the 40 parishes included, we have sampled individuals who represent both the insured and the uninsured population. In practice, we first sampled all individuals enrolled, and in a second step sampled another 10 individuals of the same sex, born in the same year, at the same place. As the insured are left-censored (i.e. include only individuals surviving up until the policy was written), we impose the same censoring on their ‘statistical twins’. We also control for the presence of other insurers in the parishes sampled (see details below). Our sample consists of 18,148 individuals, 2,062 of whom were insured/enrolled by Svenska Folket (16 per cent of all members of the society are included).

Data on the insured are gathered from the society's original ledgers, where each new member was registered by name, date of birth, place of birth and policy (later events were registered subsequently). For some, the date of death has been registered, but to arrive at a full count, we have matched all insured individuals with the Swedish Death Index (SDI). SDI offers a population full count of all deceased in Sweden from 1900 onwards (Sveriges dödbok 7). Matching is based on the full name, date of birth and place of birth. Out of 2,732 identified members (in the 40 places considered), 2,062 were successfully matched with the SDI. For the uninsured, we use the SDI data to gather information on name, date of birth, place of birth, marital status, date of death and place of death.

Because our analysis is conducted on time-to-event data, we employ survival analysis. The association of enrolled/insured with mortality was examined using a proportional hazard regression model, as our data include complete life histories. The Cox-model takes the form:

where h(t|x j) is the hazard rate or instantaneous rate of transition at age t for an individual with characteristics xj. The expression assumes that all hazard rates are proportional to a baseline hazard h 0(t), which describes variation by age in the transition rate for a standard individual. We apply two models describing the effect of insurance on (all-cause) mortality.

Model 1 tests the impact of enrolment on mortality based on the expectations that individuals who are insured are less healthy or that they, when faced with greater risk exposure than average, are incentivised to purchase insurance. At first, we run only insurance (INS), and then subsequently add controls, including SEX, migration from birthplace (MIG), living in an area with earlier insurance enrolment (IC). To control for whether the presence of other insurers impacts selection (between insured and uninsured), we estimate a difference-in-difference coefficient by interacting the non-insured (UINS#IC) with the average share of insurance penetration in each parish (n = 40). If the selection of other insurers were different from Svenska Folket, the interaction term would be significantly different from zero. In the second Cox-model, we examine the association between LAPSE (voluntary drop-out), SIZE (vector of four classes) and TYPE, either health insurance or health and life insurance (HLINS), of policy on mortality among the insured. All models are run with cluster-robust errors (on places of enrolment).

V

Svenska Folket was the first independent nationwide affiliated mutual health insurance society in Sweden. Svenska Folket also published a monthly paper for its members, Vårt liv (‘Our life’). As stated in the original charter of the society, its purpose (§1) was to provide financial support to its members in the event of sickness, accident and death, and to help members achieve a healthy lifestyle. The charter further declared (§2) that membership was offered to both men and women, who at the point of entry were between the ages of 15 and 55, and who were considered ‘healthy’. Unless underlying sickness was apprehended, the good health of an applicant was attested to by incumbents only (without a doctor's examination). A three-month waiting period (§5) was applied for health insurance (Svenska Folket, F 2). The premium-benefit scheme for health insurance was based on egalitarian pricing, without any specific risk and/or age tariffs initially.

The restriction on entry by age was commonly applied by mutual health insurance societies in Sweden at the time. As shown by charters submitted to the Board of Trade, most health insurance societies applied an age range on entry between 15/16 and 50/55, and a three-month waiting period before the new member was eligible for sickness benefits. It is also shown that the societies used highly similar premium to benefit calculations, and egalitarian pricing of risk (Kommerskollegii 1908; Lindeberg Reference LINDEBERG1949). In contrast to most other mutual health insurance societies, Svenska Folket offered several premium/benefit classes, for both men and women across different industries, as well as domestic services. Svenska Folket aimed to attract the masses in the labour force.

During the first eight years of operation, its stock of members increased rapidly, and in 1911, Svenska Folket had become the third largest mutual benefit society with 17,731 members. Ten years later, there were 24,367 members, and by 1940 there were 76,900 members (Svenska Folket 1928; Vårt liv 1939). In the 1940s, legislative developments motivated the reorganisation of society both geographically and administratively (Vårt liv 1940, 1945). In 1955, the mutual health insurance system as a whole was replaced by a public health insurance scheme, in accordance with the 1947 compulsory health insurance Act in Sweden (Åmark Reference ÅMARK2005).

Svenska Folket's growth into one of the most popular mutual health insurance societies was not without difficulties. Although the ambition to attract workers across the labour force helped to spread individual hazard risk in a large pool of insured individuals, there was a growing concern about adverse selection. As shown in discussions referred to in board minutes and in a monthly paper distributed to members, the steady influx of members led to financial difficulties (Svenska Folket 1928). One of the reasons put forward was that the system of premium/benefit classes incentivised high-risk individuals to apply for the high classes, while the low-risk individuals went for lower classes. The claim was supported by summary statistics showing a higher net benefit share (benefit/premium) in the higher than in the lower classes (Vårt liv 1908).

The redistribution between classes turned into a long-lasting debate among members, as shown by the minutes of annual general meeting proceedings. Some argued that the redistribution was ‘fair’ because the insured who faced a greater risk of being unhealthy were suffering from misfortune (without personal responsibility). A common counterargument was that redistribution reflected differences in underlying risk that should be priced correctly to make the premiums actuarially fair. The debate along the lines of solidarity and actuarial principles was intensified at two general meetings. At first, the line of solidarity was the stronger one, but later the idea of actuarially fair principles won the vote. In 1912, prices were differentiated by occupations, and workers in high-risk occupations paid more than the less risk exposed. One idea behind the occupation-based tariffs was to reflect expected risk-premiums in gross wages (Vårt liv 1908, 1912).

Although enrolment into the society may have encountered the risk of adverse selection on the basis of workplace accident risk up until 1912, one may argue that the society effectively excluded any individual known to be unhealthy (see Section II above), and helping members to achieve a healthy lifestyle (Section I above) had a treatment effect on longevity. In relation to the first argument, one should note that admitting only ‘healthy’ members was potentially more difficult in Svenska Folket than in smaller, less rapidly growing societies. Although some members were familiar with each other, most were not. As losses were covered society-wide, and not within lodges, any incentive for social control was played down as insurance costs went up and down in response to the behaviour of unfamiliar members. Controlling a fellow worker had at best a marginal, if any, effect on individual members’ contributions.

To overcome the lack of informal control applied in smaller, fellowship-based societies, Svenska Folket had several formalised routines for administering applicants, claims and payments. The archive of Svenska Folket highlights the way in which the society sought to avoid high-risk members. New applicants had to fill out a detailed form on morbidity experiences and work capacity and the board of the lodge had to make an assessment regarding the health and morality of the applicant. The applicant had to report if he or she suffered or had suffered from any disease or had any physical defects. The applicant had to solemnly swear that all the information was correct, and it was beneficial for the applicant if he or she was known to the board of the lodge. The questions concerning current and previous sickness episodes did not only concern the applicant's own health but also the health of relatives and whether they suffered from any hereditary diseases. Primarily, Svenska Folket sought to avoid accepting members suffering from tuberculosis by also ensuring that cohabitants of the applicant did not suffer from the disease. Tuberculosis was the most common cause of death among young people (aged 20–39) in Sweden during the early twentieth century (Puranen Reference PURANEN1984). Among the infected (those with active disease), close to half died due to the lack of effective treatment. At the time, it was not possible to detect the disease at an early stage by using x-ray screening. Hence, it might have been difficult to avoid accepting individuals at an early stage of tuberculosis. However, if the applicant withheld information about previous sickness episodes or concealed the fact that cohabitants suffered from contagious diseases, it was a reason for forced exit (Svenska Folket, F 2).Footnote 1 Behind the strict procedure for new applicants were concerns about accepting those with an above-average morbidity risk, which put the savings of incumbent members of risk. In that regard, the careful screening of new members was a measure designed to balance incentives to enrol among individuals with an above average risk of morbidity.

To administer claims and payments, monthly meetings were held by each lodge and the minutes were returned to the central administration. One may argue that such meetings had a wider social function, but the omission of specific social events, symbols, rituals or expression of unique moral values from board minutes or from the monthly paper distributed to its members (Vårt liv 1905–11) makes the claim seem less reasonable.

One potential advantage related to size, however, was the ability to teach members about how to achieve a healthy lifestyle. After reviewing the monthly paper distributed to the members, we find several examples of health education including topics such as hygiene guidelines, measures against infection, diet recommendations, moderate drinking, physical activity, etc. (Vårt liv 1905–11). We note a surprising similarity to present-day recommendations. If applied, even the historical guidelines may have helped to improve health with respect to the food supply available at the time.

Unlike most other mutual health insurance societies, Svenska Folket offered life insurance policies to its members. While burial insurance, which mutual health insurance societies traditionally offered, became less attractive as workers’ wage earnings increased, and legislative initiatives limited its scope, life insurance turned into a mass market in the early twentieth century (Eriksson Reference ERIKSSON2011). Svenska Folket offered small whole-life insurance policies that were issued without a medical examination. Young members were favoured, both through an age-scaling scheme where benefits were reduced by age of entry and through a waiting-time scaling scheme where benefits increased with each year as an incumbent (Svenska Folket, F 2; Svenska Folket 1928). If younger members were more attracted by life insurance, a negative censoring effect on longevity may be at hand in relation to members holding health insurance only.

VI

In Table 1, variable definitions and summary statistics for insured and uninsured individuals are presented. We find that the age at the point (day) of death was on average 71.2 years among the uninsured and 72.0 among insured individuals. The standard deviation is somewhat greater among the uninsured (15.1 > 13.9), including both the most short-lived (16.8 years) and the most long-lived (107.8 years) individual observed in the sample.

Table 1. Variable definitions and summary statistics by uninsured and insured in longitudinal sample

Sources: Svenska folkets sjukkassafolket (D 1:1a, D 1:1b); Sveriges dödbok 7; Kommerskollegii (1908).

Most of the insured were male workers (76 per cent). A fairly large proportion migrated from their birth parish (the smallest geographical administrative unit, n = 2,573), but remained within the same county (the largest geographical administrative unit, n = 26). Migration was somewhat less common among the uninsured. In the areas/places where new branches were established by Svenska Folket, the insurance penetration (proportion of population insured per capita) was nearly 10 per cent on average, a figure close to the nationwide population average (8 per cent). If we assume that only the economically active population (aged 15–65) held insurance, the figure would reach approximately 13 per cent nationwide. As shown in Table 1, insurance penetration varied, where the highest figures are observed in the major urban areas and the lowest in the rural areas. By percentile (p), insurance penetration was 0 per cent, 6 per cent, 21 per cent and 28 per cent by p25, p50, p75 and p95, respectively, among the uninsured in our sample at the point in time when policies were written.

When the sample is limited to considering only the insured, we find that a fairly small proportion (1.3 per cent) of members died within close proximity (<4 years) to enrolment. Almost half of the members voluntarily left the society before they died (exiting for reasons other than death). The average member purchased a policy in the size class 2. Equally large shares of the enrolled (20 per cent) purchased policies in classes 1 and 3, and only a few (1 per cent) went for the highest premium (class 4). The premium class reflects only the size of the policy, without any adjustments to risk (equal pricing). We find that most of the members held both health and life insurance. Of all members, 34 per cent had only health insurance, and the remaining held both health and life insurance policies. Initially, the life insurance policies had, besides waiting time for newly accepted members, also age-scaled premium/benefit schemes to favour younger applicants. From 1910, standardised age-scaled premiums based on actuarial calculations (and one-year waiting time) were imposed in accordance with schemes applied by industrial life insurance companies at the time (Svenska Folket 1928).

Table 1 shows only minor differences in the average age of death between the individuals who were enrolled/insured and the non-enrolled/uninsured. To show potential differences over the life cycle that average figures may compress, we illustrate survival using Kaplan–Meier estimates of the uninsured and insured individuals in our longitudinal sample.

Because the sample represents individuals who survived up until the point when an insurance policy was written (including the uninsured statistical twins), the estimate is equal to 1 up until the age of 20 (first observed entry at age 14). At around the age of 30, the survival estimates start to drop. The slope is somewhat steeper for the uninsured in the age range 30–50 years before it starts to converge from the age of 50. The survival estimates are much the same for insured and uninsured individuals from the age of 70 onwards.

Although we can observe a gap in the survival estimate, the differences between the two samples are small. When running a log-rank test on the survival distributions of two samples, we cannot reject the null hypothesis (Pr > chi2 = 0.6593) for the full sample. When running the test for those who died between 30 and 60 years of age, where we observe a gap in the Kaplan–Meier estimates, we cannot accept the null hypotheses (Pr > chi2 = 0.0346) at the 5 per cent level of significance.

To consider a wider set of covariates on the mortality hazard rates of the two samples, we have estimated the first equation on the impact of enrolment on mortality using a Cox-model (see Equation 1). The coefficient estimates presented in Table 2, Panel A show no significant effect of being insured on mortality in the full sample. For the other covariates, we find that women live longer than men and that individuals leaving their birth parish reach higher ages, especially if they stay within the region. We find no impact of interacting insurance penetration, which further confirms the absence of any adverse selection also with respect to the presence of other mutual health insurance societies. If other mutual health insurance societies selected differently when present in the same location as Svenska Folket, we would find a significant outcome of the interaction term (Insurance penetration # Uninsured). By accepting the null hypothesis, we may conclude that longevity among members of Svenska Folket was similar to that among members of other mutual health insurance societies.

Table 2. Coefficient estimates of Cox-regression on the impact of insurance on mortality

Note: Robust standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1

Source: See Table 1.

However, as shown by the Kaplan–Meier estimates, the survival curves show diverging trends in mortality hazard risk in the age range 30 to 60. To examine whether the survival curve diverged, and to meet the proportional hazard assumption, we have divided the sample into two subperiods; the first covering individuals who died in the age range 30 to 60, and the second individuals still living between 30 and 60 years of age. When rerunning the model (see Equation 1) for the restricted Sample 1 (individuals who died between 30 and 60), the result shows a negative and significant impact of insurance on mortality (Table 2, Panel B). When adding the covariates, we find that sex turns negative, indicating higher age-specific mortality among women. Migration from one's parish lowers mortality hazard risk as expected by the healthy migrant effect,Footnote 2 while the remaining covariates are insignificant. When re-running the model for the restricted Sample 2 (individuals still living between 30 and 60), the result shows no significant impact of insurance on mortality. For the other covariates, we find that sex turns positive, while the sign and significance remain similar for the other covariates.

Our analysis of the impact of enrolment on mortality gives few reasons to believe in an adverse selection in the mutual health/life insurance society. Although individuals who were less healthy or who faced greater risk were incentivised to purchase insurance when priced for the average risk, there were other forces counteracting any effect of adverse selection on enrolment. Before making any claim that adverse selection was no concern for the mutual benefit society, however, there are additional aspects to consider.

As shown in previous literature on adverse selection in life insurance markets, individuals may enter only to leave voluntarily (lapse) a few years later (He Reference HE2011). Any adverse or favourable selection on lapsing will impact the aforementioned findings on enrolment.

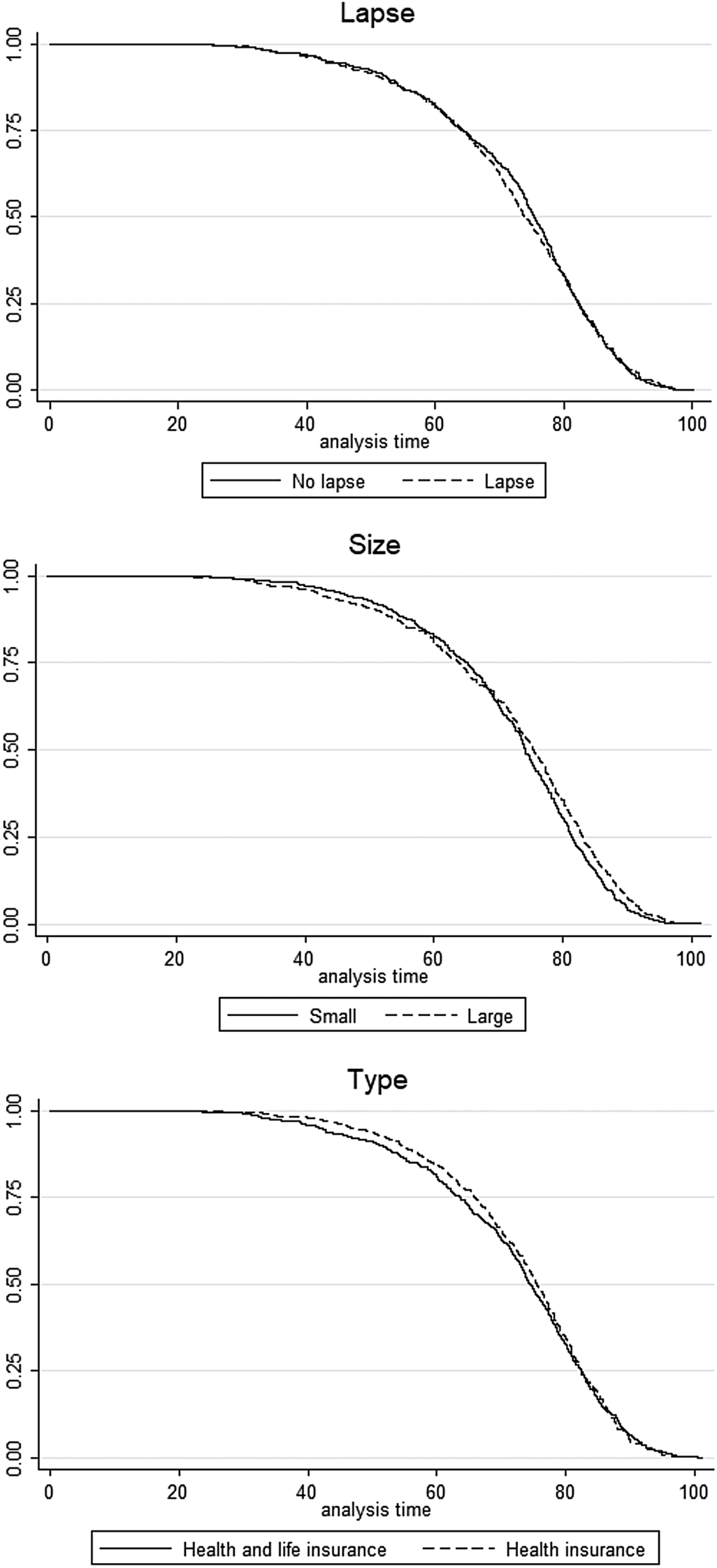

In Figure 2 (top panel), Kaplan–Meier survival estimates by lapse/no-lapse are shown. We find a fairly similar survival estimate among individuals enrolled independent of whether they terminate policies voluntarily (lapse) or remain within the benefit society. Individuals who lapse had a slightly steeper decline in survival in their 70s, if any. We cannot reject the null hypothesis of equality even when restricting the log-rank test to individuals who died in their 70s (Pr > chi2 = 0.2092).

Figure 1. Kaplan–Meier survival estimates among insured and uninsured individuals

Source: See Table 1.

As put forward in previous studies on health insurance (Jopp Reference JOPP2011), individuals who face a greater risk or are less healthy may choose larger policies. In mutual benefit societies, more risk-exposed individuals selecting a larger policy are incentivised by the equal pricing of risk.

Figure 2 (mid-panel) shows Kaplan–Meier survival estimates by large (classes 3 and 4) and small policies (classes 1 and 2). For the larger policies, the slope in the survival estimate is slightly steeper for individuals with larger policies who died in their 40s and 50s, but much less so in the higher ages when those with larger policies live longer. When running a log-rank test for equality on the entire sample, we cannot accept the null hypothesis of equality (Pr > chi2 = 0.0136). If the sample is restricted to those who died in their 70s or older, the difference is significant at the 1 per cent level (Pr > chi2 = 0.0031).

Considering that life insurance, more than health insurance, reflects individuals’ mortality risk, one may expect that individuals who only purchased health insurance faced a lower mortality risk. On the other hand, the scaling of benefits/premiums by waiting time and age favoured the entry of young members. If effective, we would expect a censoring effect, where younger members held both health and life, and older members only the latter because the benefits were low at late entry. However, we find no significant difference in the age of entry between the two samples (Diff = .27, Pr(|T| > |t|) = 0.5167). When comparing the Kaplan–Meier survival estimates by type of insurance, there is a slight difference in survival, suggesting that members holding life insurance faced a more rapid decline in survival in their 40s and 50s. However, when running a log-rank test for equality, we cannot reject the null hypothesis (Pr > chi2 = 0.4986).

The lack of difference suggests that the screening of members was equally effective in health and life insurance, and that contractual differences between life and health insurance were largely offset. At least theoretically, one might however expect that the health insurance contract gave stronger incentives to individuals with above average morbidity risk to health insure only. Unless morbidity and mortality were correlated, any adverse selection on morbidity would be unidentified in the survival analysis. When considering the correlation between morbidity and mortality, one should note, as previously mentioned, that the most common cause of death among young people during the period under study was tuberculosis. It caused both lengthy periods of sick leave and premature death (Puranen Reference PURANEN1984). After examining the cause of death among members of Svenska Folket who were already suffering from disease between 1915 and 1935, we find that tuberculosis accounted for 81 per cent of all infectious and parasitic diseases (ICD A00–B99), i.e. it was the most common cause of death amongst young people (Svenska Folket, D 2). Any adverse selection in that regard would be seen in terms of both mortality and morbidity.

To consider a wider set of covariates on the mortality hazard rates among the enrolled, we have estimated the second equation on the impact of lapse, size and type on mortality using a Cox-model. Table 3 presents the coefficient estimates.

Table 3. Coefficient estimates of Cox-regression on the impact of lapse, size and type of insurance on mortality

Note: Robust standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1. * When running the models on Voluntary lapse, individuals deceased between 70 and 80 are excluded in sample 1 and included in sample 2. When running the models on Size of policy, individuals deceased after 70 years of age are excluded in sample 1, and included in sample 2. When running the model on health insurance, individuals deceased between 30 and 60 are excluded in sample 1, and included in sample 2.

Source: See Table 1.

When running the full sample, the result shows (Table 3, Panel A) that voluntary termination of policies (lapse) has no significant impact on mortality. The size of policy has a negative impact on mortality, albeit significant only in the combined models (4 and 8). Health insurance has a negative impact on mortality, albeit significant only in the combined models. The estimated hazard ratio equals .89 for the larger policies and .88 for health insurance in the full model (8). The result on size suggests a favourable selection, as the individuals facing a lower hazard risk of mortality purchased larger policies. When interacting size with health insurance, the impact of size becomes insignificant, while health insurance upholds the interaction effect. For the other covariates, we find that women live longer than men, and that migration had only a minor, if significant, impact on selection.

However, as the Kaplan–Meier estimates indicate diverging trends in mortality hazard by age, the full sample has been divided into subsamples to examine potential differences between different age groups and to meet the proportional hazard assumption. The division into subsamples is similar to that applied to the log-rank tests above. When re-running Equation 2 by subsamples, we find no significant impact of lapse on mortality risk in either of the two subsamples. There is also no significant impact of the size of policy in either of the two subsamples. Health insurance has a negative impact on insurance in the combined models, but only in the subsample excluding individuals who died between 30 and 60 years of age (Table 3, Panel B).

VII

One of the key economic-theoretical arguments for the national health insurance schemes implemented in the Western world during the twentieth century is based on the theory of adverse selection. Through compulsory access to health insurance, the welfare cost that is caused by adverse selection due to underinsurance among less risk-exposed individuals is reduced (Eniav and Finkelstein Reference EINAV and FINKELSTEIN2011). It has been argued that any government intervention to offset adverse selection in health insurance markets was based on an economic rationale reflecting the demand to reduce welfare costs.

In the present article, we have examined the issue of adverse selection in the health insurance scheme in the early twentieth century when nationwide societies expanded in Sweden. Our empirical analysis is based on a case that, on theoretical grounds, is expected to have suffered from adverse selection for two main reasons. First, our focus case (Svenska Folket) was the first nationwide mutual health insurance society that – to a more limited extent than societies with a smaller scope or other affiliation – could rely on strong social control of members, which previous studies have put forward as advantageous (Emery Reference EMERY1996; Gottlieb Reference GOTTLIEB2007). Second, by offering several premium/benefit classes with an egalitarian pricing scheme, Svenska Folket was more exposed than competing societies to attracting workers who were at higher risk or less healthy.

To empirically examine the issue of adverse selection, a sample of members of Svenska Folket was first matched with a sample of non-members (of the same age, sex and residence at the point of enrolment), and then compared with respect to accumulated mortality risk. By conducting a survival analysis on longevity among individuals in the two samples, we trace whether the selection into the insurance pool was characterised by adverse selection. Among the insured members, we further examined the impact of lapse, size and type of policy on survival to further elucidate the presence of adverse selection.

Our analysis gives no compelling evidence for the presence of adverse selection in mutual health insurance societies. We find no differences between members and non-members, and we find no difference between parishes with respect to the presence of other mutual health insurance societies. Hence, there is no evidence for any significant differences in longevity between insured or uninsured individuals or by membership in Svenska Folket or other mutual health insurance societies. Among the members of Svenska Folket, we find only minor differences between lines of insurance (health insured and life insured), by termination (voluntary/lapse or fatal outcome), or kind of policy (size/value of the policy). If anything, we find a slightly favourable selection among members of Svenska Folket who died in the age range 30–60 years, and a small adverse selection among the members with both health and life insurance with respect to longevity. Theoretically, Svenska Folket should be exposed to the risk of adverse selection given the loss of social proximity that the smaller societies offered. Due to its national character, Svenska Folket also faced a higher risk of adverse selection than smaller societies that comprised more homogeneous risks. It is likely that the lack of adverse selection illustrates that the improved risk diversification and professionalisation in the affiliated societies trumped any lost advantages of the small, homogeneous societies. We find that Svenska Folket applied a strict and formal procedure before accepting new members, including an in-depth check of each individual's sickness history, and whether relatives suffered from hereditary diseases and if cohabitants suffered from contagious diseases, such as tuberculosis. The strict procedure applied indicates that incumbents had strong incentives to avoid accepting applicants of above average risk to protect their savings. It is further likely that the measures applied offset the individual incentives among workers facing greater risk or being less healthy to become members. One of the reasons why the selection was neither adverse nor favourable might have been that the two forces (incentives of applicants vs incentives of incumbents) were effectively balanced. Although some applicants with undetected diseases probably managed to become members, others, with more obvious signs of ill-health, were effectively screened, and so the two forces were balanced out at the aggregate.

The present study focuses on the selection of members taking place when Svenska Folket, during only eight years of operation (1904–11), advanced to become the third largest mutual health insurance society in Sweden. The organisational structure, with formalised administrative routines running from the central administration to the local lodges, became a role model for the development of large mutual health insurance societies in Sweden after the 1891 and 1910 health insurance Acts. The mutual structure was not without government intervention, through subsidies and regulations, but it was nevertheless successful in reaching close to the entire labour force by the late 1930s.

From a wider perspective, one may argue that the absence of adverse selection and underinsurance in mutual health insurance largely offset any potential welfare gains that an implementation of a statutory health insurance could offer. Lacking strong economic motives for implementing statutory health insurance, in line with the adverse selection argument, made other motives, such as ideological or political ones, more decisive in advancing the implementation of statutory health insurance in Sweden.

Archival material (Svenska Folket)

Svenska Folket, Archival material (D 1:1a; D 1:1b; F 2) by volume, NAD, URL and archive: