Alternative proteins (AP) are being positioned by manufacturers and proponents of these products as simultaneously addressing and offering solutions to a range of problems and limitations associated with livestock production and consumption, particularly the ecological, animal welfare and human health impacts of meat(Reference Sexton, Garnett and Lorimer1). However, AP manufacturers are still negotiating how to nutritionally position their products as similar or different to meat, and which positive and negative nutritional elements of meat to play off. By ‘alternative protein’, we refer to the range of novel products designed to imitate the look, taste, texture, aroma and other sensory attributes of conventional meat products – in other words, they seek to be indistinguishable from meat.

One of the primary framings of AP by proponents is in terms of the similarities and differences with meat. On the one hand, AP are designed not only to replicate the taste and texture of meat and meat products but also to simulate other attributes, such as their convenience and some of their nutritional characteristics. On the other hand, they aim to deliver these simulations without the detrimental ecological, welfare and health impacts associated with meat. These AP are thereby being positioned as better than the foods they simulate, and in this sense as hyper-real foods(Reference Scrinis2). Proponents of AP have argued that these products are able to provide some of the nutritional benefits of meat and of other plant-based foods (e.g. protein), while avoiding the health harms of meat (e.g. cholesterol)(3,4) . While some studies and commentaries highlight potential health benefits, others raise concerns regarding the highly processed – or ultra-processed – character of some AP products(3,Reference Bohrer5,Reference Khandpur, Martinez-Steele and Sun6) .

This study analyses how three distinct types of AP manufacturers (general food manufacturers, meat processors and AP-specific companies) are using nutrition and health-related claims to market AP products. It aims to document and describe: the extent to which nutrition and health claims are being used on front-of-pack labels (FOPL) and brand websites; the types of claims used and which nutrients, ingredients and health relationships they refer to. We also explore the extent to which the presence of ultra-processed ingredients and additives is acknowledged and explained by manufacturers.

The AP market is expected to grow exponentially in the next decade, with revenues reaching $290 billion by 2035(7). Given that AP are typically intended as an alternative or substitute for animal products, it is important to understand the extent to which AP products are marketed and labelled as similar or different to the nutrient, ingredient and processing profile and characteristics of the products they aim to mimic or replace. There is a ‘health halo’ associated with these products(Reference Estell, Hughes and Grafenauer8,Reference Tso, Lim and Forde9,Reference Wickramasinghe, Breda and Berdzuli10) . Yet, there is a lack of evidence on the short-term and long-term health effects of AP(Reference Tso, Lim and Forde9). As a result, little is actually known about whether and how these products can contribute to a healthy diet. Given this uncertainty, it is important to understand how companies are using nutritional marketing to promote AP, as this can influence consumer perception and choice(Reference Talati, Pettigrew and Neal11). This is particularly important given a lack of evidence-based dietary guidance on replacing meat with AP.

In mainstream dietary guidelines and nutrition discourse, meat is variously portrayed as both nutritious and potentially harmful to health. The claimed health harms of meat consumption include its links to heart disease, cancer and obesity, though these associations are also contested by many experts and the livestock industries(Reference Santo, Kim and Goldman12). Some of the claimed dietary and biological mechanisms of these meat-health associations are the saturated fat content, cholesterol, haem iron, high temperature cooking and nitrates and nitrites in processed meats(Reference Etemadi, Sinha and Ward13). At the same time, meat is also portrayed as a good source of essential nutrients, including complete protein and bioavailable iron, zinc and B12, as well as a number of other vitamins, minerals and bioactive compounds(Reference Santo, Kim and Goldman12,Reference Sievert, Lawrence and Parker14) .

A growing body of empirical research seeks to scientifically evaluate the nutritional quality and the health impacts of AP products(Reference Santo, Kim and Goldman12,Reference Stephens, Di Silvio and Dunsford15,Reference Crimarco, Springfield and Petlura16) . Proponents of AP argue that these products offer many of the nutritional benefits of meat without the associated health harms(3). Indeed, the term ‘alternative proteins’ taps into the current ‘nutrient fetish’ with protein and implicitly positions protein as a beneficial and necessary nutrient, despite research showing that protein is often over-consumed, especially in the Global North, where most AP are currently produced and consumed(Reference Chen and Eriksson17,Reference Contois18,Reference Mittendorfer, Klein and Fontana19) . AP can also be marketed as containing no or low quantities of cholesterol, saturated fats and nitrates. A 2019 audit of Australian AP found that the most frequent nutrient content and health-related claims were vegetarian/vegan/plant-based, protein and dietary fibre(Reference Curtain and Grafenauer20).

Manufacturers frequently use nutrition and health claims on food labels to emphasise the positive nutritional attributes of their products, which can influence consumer purchasing and food choices(Reference Kaur, Scarborough and Rayner21). Yet, nutritional marketing can mislead and confuse consumers. Nutrition claims that emphasise single nutrient or ingredient attributes can draw attention away from any less healthy attributes of a product (such as a product marketed as ‘low fat’ that is high in sodium). The mere presence of any health-related claim can have a ‘health halo’ effect, whereby consumers perceive products carrying a claim to be healthier than those that are not(Reference Pulker, Scott and Pollard22,Reference Duran, Ricardo and Mais23,Reference Scrinis and Parker24) .

A current focus of debate relating to the nutritional positioning of AP is the type of processing they have been subjected to, including the processing techniques, ingredients and additives used in their production. Concerns are being expressed by some nutrition and public health experts of the extent to which AP can be categorised as ‘ultra-processed’, a precisely defined type of processed foods within the NOVA classification system(Reference Monteiro, Cannon and Moubarac25). Ultra-processed foods are defined as ‘formulations made mostly or entirely from substances derived from foods and additives, with little if any intact (whole) food’(Reference Monteiro, Cannon and Moubarac25). Consumption of ultra-processed foods is linked to a range of adverse health outcomes, including obesity, CVD, cancer, type 2 diabetes and all-cause mortality(Reference Elizabeth, Machado and Zinöcker26,Reference Bonaccio, Di Castelnuovo and Costanzo27,Reference Pagliai, Dinu and Madarena28,Reference Monteiro, Cannon and Lawrence29) . Some nutrition experts, as well as meat proponents, have highlighted the ultra-processed character of many AP products, drawing attention to ingredients and additives such as flavour enhancers and questioning whether these plant-based, ultra-processed foods are beneficial to human health(Reference Bohrer5,Reference Khandpur, Martinez-Steele and Sun6,Reference Santo, Kim and Goldman12,Reference Wickramasinghe, Breda and Berdzuli30) .

AP manufacturers are clearly conscious of these perceptions of their products, and some have begun to respond to these accusations, albeit in different fashions. Some companies have promoted their products as minimally processed, criticising other companies for using highly processed ingredients, whereas others have defended the role of advanced technologies in creating AP(Reference Splitter31). It is worth noting that some of the meat-based products that AP are intended to replace, such as some meat hamburgers and sausages, are also ultra-processed(3). Yet, meat is often also consumed in minimally processed form, and therefore the switch from meat to AP may lead to an increase in the consumption of ultra-processed foods.

Although the AP sector was initially the domain of start-ups, we see increasing involvement from some of the largest and most powerful corporations in the food system, including food manufacturing, commodity trading and meat processing companies. The food industry’s involvement in the AP sector takes several forms, including: financial investments (global food companies Tyson, Cargill, Kellogg’s, Fonterra, Louis Dreyfus, Danone, Kraft Heinz and Mars have all invested in AP); acquisitions of new AP start-ups or existing companies (e.g. Nestlé acquired Sweet Earth Foods); as well as in-house research and development to create new AP products (e.g. the launch of Tyson’s of ‘Raised and Rooted’ and Cargill’s ‘Ozo’ brands)(4,Reference Specht and Crosser32) .

Methods

Using Mintel New Products Database along with analysis of company websites and news reports, we identified which major food companies had plant-based meat analogues products in their portfolio. Plant-based meat analogues refer to products created using plant-sourced ingredients (e.g. soy, wheat, legumes) in contrast with those created via cell culture or fermentation technologies. This excludes products that do not seek to imitate the sensory properties of meat (e.g. tofu or falafels). To limit the scope of this study, we focused on products sold in the USA, where many transnational food companies and AP start-ups are headquartered. We also included the two largest AP start-ups (Impossible Foods and Beyond Meat) and two legacy AP companies (Tofurky and Quorn) for comparison. The sixteen selected companies broadly represent three sectors of the food system: general food manufacturers, meat processors and AP-specific companies (Table 1). These categories reflect the dominant positioning and branding of the parent company: general food companies sell a wide range of processed foods; meat processors predominantly sell various processed meat products and AP-specific companies exclusively sell AP products.

Table 1 Major food companies with alternative protein (AP) products in their US portfolio

* Owned by Kellogg’s.

† Subsidiary of WH Group (Hong Kong).

‡ Perdue’s Chicken plus range is a ‘blended’ product (including meat and plant-based proteins); however, due to the similarity of nutritional claims made about the product, we have included them in our analysis.

§ Owned by Monde Nissin (Philippines).

We surveyed the company website of each AP brand to identify the range of AP meat-analogue products in their portfolio. From the original set of 325 products, we excluded products that did not seek to imitate the sensory characteristics of meat (e.g. tofu, falafels) and meal replacement products using AP (e.g. burritos, pizza). This left us with 216 products from sixteen companies (Table 1). We compared the FOPL images available on the company websites to in-store product labels and found them to be congruent. However, while FOPL images were available for all products online, stores do not tend to stock the full product portfolio of each company. Therefore, we used website FOPL images to ensure that all available products from each company were captured. We documented the exact wording of all FOPL health and nutrition claims.

We systematically viewed every page of each AP company website, and all web pages linked to from within the website, to identify all voluntary nutrition or health-related claims and statements. We also documented all descriptions of ingredients or manufacturing processes. We did not document mandatory nutrition information, including lists of ingredients, nutrient declarations/nutrition information panels, mandatory allergen declarations/advice or non-health-related labelling information or claims (including environmental claims). Voluntary declarations (such as ‘no peanuts’ and ‘soy-free’) were documented as health-related claims.

We also reviewed the sixteen parent food company websites for any additional nutrition/health-related claims or statements that related specifically to their AP brands and products but that differed to, or expanded on, claims and statements already identified from the AP brand websites. The URL of each web page containing a claim or statement was recorded and cross-checked. We entered all data into an Excel spreadsheet for coding and analysis.

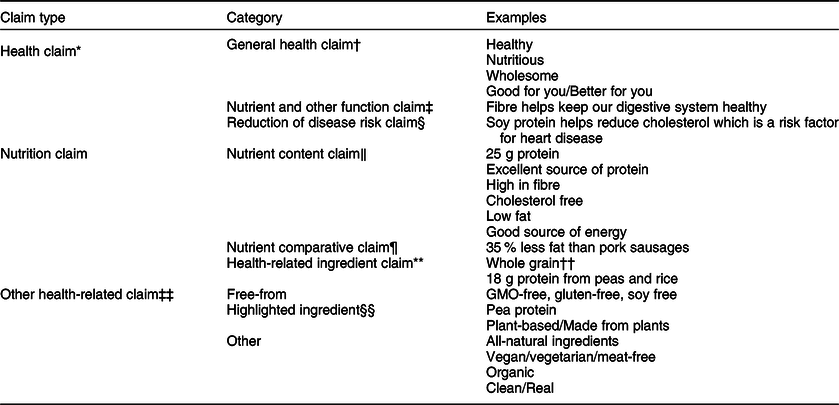

Claim classification was guided by the taxonomy for health-related food labelling developed by the INFORMAS (International Network for Food and Obesity/Non-Communicable Diseases Research, Monitoring, and Action Support)(Reference Rayner, Wood and Lawrence33,Reference Rayner and Vandevijvere34) . Health and nutrition claims were coded into three main types: (i) health; (ii) nutrition and (iii) other health-related. Claims were further coded by category and content (Table 2).

Table 2 Claim classification

* Health claim: Any representation that states, suggests or implies that a relationship exists between a food or a constituent of that food and health.

† General health claim: A claim that states, suggests or implies the product benefits a certain health system, without referring to a nutrient or the reduction of a certain disease or disease risk factor.

‡ Nutrient and other function claim: A claim that states, suggests or implies that the product benefits a certain health system and refers to a nutrient (referred to as a Structure/Function Claim under Food and Drug Administration (FDA) classification).

§ Reduction of disease risk claim: Any health claim relating the consumption of a food or food constituent to the reduced risk of developing a disease or health-related condition.

‖ Nutrient content claim: Any numerical or verbal representation that expressly or implicitly characterises the level of a nutrient required to be in nutrition labelling under US FDA rules.

¶ Nutrient comparative claim: A nutrient claim comparing the nutrient levels and/or energy value of two or more foods.

** Health-related ingredient claim (HRIC): Any representation that states, suggests or implies that a food has particular nutritional properties not related to its nutrient content but related to its content of an ingredient, either by specifying the amount of the ingredient present or linking it to terms such as ´good´, ´goodness´ or ´healthy´.

†† All ´wholegrain´ claims were classified as HRIC, irrespective of whether an amount was specified or any links to nutritional benefits were made.

‡‡ Claims that are not specifically related to a nutrient or disease but are still health-related, including claims relating to allergies/intolerances, food safety, vegan/vegetarian, ´natural´ products and the presence/absence of artificial additives.

§§ Claims highlighting a healthy/beneficial ingredient that do not meet the criteria for a HRIC (i.e. do not specify an amount of that ingredient or link it to terms such as ´goodness´ or ´healthy´) but are considered to infer that the product has particular nutritional properties by virtue of containing the ingredient.

When a single claim could be classified as more than one type of claim, it was coded into the highest-ranking category according to the following hierarchy: health claim > nutrient claim > health-related ingredient claim > other health-related. Where two or more claims were made within one sentence or phrase, they were coded as separate claims. For example, ‘20 g plant protein’ was coded as two separate claims: ‘nutrient content’ (protein, quantitative) and ‘highlighted ingredient’ (plant). All repetition (multiple variations of a claim on the same label) was included. For example, ‘plant-based’, ‘made from plants’ and ‘plant protein’ claims on the same label were included as three separate ‘highlighted ingredient’ (plant) claims.

Results

The 216 meat substitute products analysed included: burgers and meatballs (n 59), poultry substitutes (such as nuggets, tenders and fillets) (n 46), sausages (including links, hot dogs, sausage patties and sausage ‘crumbles’) (n 45), mince (including ‘ground’ and ‘crumbles’) (n 29), bacon and deli slices (including sliced ham and turkey, salami, pepperoni and bologna substitutes) (n 25), other red meat (beef/pork) substitutes (including jerky, strips and pieces) (n 11) and fish/seafood substitutes (n 3). There were three hybrid products – two containing chicken meat and one containing Angus beef – all blended with ingredients typical of AP products (such as textured wheat protein, plant protein isolates and additives). Several products contained egg.

An average of 6·5 front-of-pack nutrition or health-related claims was displayed per product, with all products carrying at least one claim. A total of 1394 health and nutrition claims were identified on FOPL, including 689 nutrition claims and 705 ‘other health-related’ claims (Table 3). A further 1865 claims were identified on brand websites, including 752 nutrition claims, 117 health claims and 996 other health-related claims. Nutrient-related claims were the most common claim sub-category across both FOPL and websites, followed by ingredient-related and free-from claims. The most common claims were: protein-related (on 94 % of FOPL), GMO-free (74 % of FOPL), plants/plant-based (62·5 % of FOPL) and vegan/vegetarian (56 % of FOPL).

Table 3 Health and nutrition claims (front-of-pack label (FOPL) and online)

Broadly similar patterns were observed across FOPL and website claims, with a wider range of claims made on brand websites (Table 3 and Fig. 1). Nutrient-related claims were slightly more dominant on FOPL (44 %, compared with 34 % of all website claims), while health and other health-related claims were more common on brand websites (60 %, compared with 51 % of FOPL claims). Health claims were completely absent from FOPL, yet almost all (14 of 16) brands made general health claims on their websites.

Fig. 1 Front-of-pack and website claims by sector

Slight differences were observed between the three brand sectors (Fig. 1). Ingredient-related claims were predominantly made by general food companies and meat processors, with few made by AP-specific brands, particularly on FOPL. Meat processor brands made few negative nutrient claims (average 0·2 per FOPL) and free-from claims (average 1·3 per FOPL). By comparison, AP-specific brands made an average of 1·2 negative nutrient claims and 2·2 free-from claims per FOPL.

Nutrient claims

Nutrient claims were dominated by protein claims, which made up 46·5 % of nutrient claims on FOPL (n 288) and 35 % on brand websites (n 226). Protein claims were the most common claim overall, representing 20·6 % of all FOPL claims and 12·1 % of all website claims. Protein claims were mainly expressed numerically (as a number or percentage; e.g., 11 g protein per serving) (n 160 FOPL claims, 104 website claims) or as ‘source of’, ‘excellent/good source’ or ‘high’ claims (n 128 FOPL claims, 74 website claims). Many were combined with ‘plant’, ‘clean’, ‘veggie’ or specific ingredient claims, for example: 20 g of plant-powered protein goodness (Happy Little Plants, Plant-Based Ground).

Protein quality claims were made on five brand websites, with most being complete protein claims, for example: Peas, mung bean and rice provide a complete protein (Beyond Meat). Some referred to protein digestibility, with Quorn and Impossible Foods referring to the Protein Digestibility-Corrected Amino Acid Scoring (PDCAAS) method, which is the regulatory tool used to support protein content claims in the USA: Soy protein concentrate…has a published PDCAAS of 0·95. For reference, conventional ground beef from cows has a published PDCAAS of 0·92 (Impossible Foods)

There were few claims about levels of healthy/desirable nutrients or constituents other than protein (n 52 FOPL claims), with the most common being for: fibre (on 11 % of FOPL, n 23 claims), followed by iron and vitamin B12 (on 6 % of FOPL, n 13 claims each). Of the twenty-three products that carried a FOPL fibre claim, eight contained whole grains, nuts, seeds, legumes or vegetables and eight contained mycoprotein – a fungus-derived single-cell protein marketed by Quorn as being naturally high in fibre. A slightly higher number of non-protein-related positive nutrient claims were made on brand websites (n 88 claims), but these were still eclipsed by protein claims (n 226).

In contrast, ‘negative’ nutrient claims about the absence, or presence in low levels, of undesirable nutrients or other constituents were common. Almost one in three FOPL (30 %) displayed a cholesterol claim, 28 % a energy claim, 23 % a total fat claim and 23 % a saturated fat claim. Of 279 FOPL negative nutrient claims, fifty-seven were comparative claims. Most were made in comparison with a reference meat product, for example: 32 % less fat than regular ground beef (MorningStar Farms – Incogmeato). Similarly, negative nutrient claims were made on fifteen of sixteen brand websites (n 328 claims), with the most common being for cholesterol (n 86 claims), energies (n 58), total fat (n 72) and saturated fat (n 68). Of these, sixty-eight were comparative.

Ingredient-related claims

Ingredient-related claims were classified into two categories: (1) Health-related ingredient claims (according to the INFORMAS definition) and (2) ‘Highlighted ingredient’ claims (which did not meet the INFORMAS criteria for a health-related ingredient claim but were considered to likely have the same meaning to the consumer). ‘Plant/plant-based/plant protein’ claims were, by far, the most common ingredient-related claim (192 FOPL claims and 205 website claims). Remaining ingredient claims mainly focused on protein source ingredients and predominantly soy, which was the subject of forty-one FOPL claims and thirty website claims. Beyond ‘plants’ and protein source ingredients, there was relative silence on other ingredients, particularly on FOPL.

More wholegrain, vegetable and ‘other grains/seeds/pulses’ claims were made on brand websites than on FOPL. Most of these were made by the few general food company and meat processor brands with products containing wholegrains and/or vegetables in their portfolios, for example: ¼ cup of chickpeas and cauliflower per serving (Chicken Plus) and A veggie burger that actually features veggies, packed with protein and spilling with the aromas of gourmet grains and whole beans (Sweet Earth Foods).

Free-from and ‘other health-related’ claims

While not specifically defined as a sub-category in the INFORMAS taxonomy, a high number of ‘other health-related’ claims were classified as ‘free-from’ claims (326 FOPL and 384 website claims) – the second most common claim category after nutrient claims. The most common of these, by far, were GMO-free claims (163 FOPL and 115 website claims). Three quarters of all products (74 %, n 159) displayed a FOPL GMO-free claim, with ninety of these displaying the ‘GMO-project verified’ symbol. GMO-free claims were made by twelve brands on FOPL and ten brands on their websites. For the most part, brands either made GMO-free claims for all of their products or did not make any GMO-free claims, although four brands had a mixture of products with and without GMO-free claims.

Other common free-from claims related to: allergies/intolerances, such as Soy-free, Dairy-free and Gluten-free; absence of meat/animal products, such as: Contains no meat (Yves Veggie Cuisine) and No animal hormones or antibiotics (Impossible Foods) and absence of artificial ingredients (including nitrates/nitrites, and artificial colours/flavours/preservatives). Multiple free-from claims were often combined, particularly on brand websites, for example: With no GMOs. No synthetically produced ingredients. No known carcinogens. No hormones. No antibiotics. No cholesterol. (Beyond Meat).

Remaining ‘other health-related’ claims were dominated by vegan/vegetarian/veggie claims, particularly on FOPL. A wider range of other claims were made on brand websites, particularly variations of ‘natural product’ claims, for example: Made with only simple ingredients (Lightlife) and As natural, organic, and non-GMO as we can be (Sweet Earth Foods).

Health claims

No products displayed FOPL health claims. Of 117 health claims identified on brand websites, eighty-eight were general health claims such as nutritious, healthy and good for you. These were made by almost all brands (14 of 16) on their websites. Four brands also made ‘nutrient and other function’ claims (n 21) and/or ‘reduction of disease risk’ claims (n 8) on their websites. All of these were protein- or fibre-related, and most were made by Quorn about its proprietary ingredient, mycoprotein, for example: Unlike meat, mycoprotein is completely free from cholesterol and studies suggest that it helps maintain normal blood cholesterol levels and may even lower LDL ‘bad’ cholesterol (Quorn Nutrition). Most of these claims were made on Quorn Nutrition, a dedicated site linked to from the main Quorn website. This site also contained dedicated pages and external links to peer-reviewed evidence on cardiometabolic health, weight management, muscle maintenance and sustainable nutrition, which were not reviewed for further claims.

Elaboration on ingredients and processing methods

Eight brand websites, representing all three sectors, provided some description of ingredients beyond the mandatory ingredient list, although the vast majority of these were general statements about ‘natural’, ‘real’ and/or familiar ingredients, for example: We use transparent, straightforward and real ingredients to make our OZO products including pea protein, fruits, vegetables and water (Ozo). Five brand websites contained statements specifically addressing additives, with all emphasising ‘naturalness’ and familiarity, for example: Methylcellulose (a culinary binder commonly found in ice cream, sauces, and jams), and food starch (a carbohydrate commonly found in foods like canned soup) bring it all together (Impossible Burger).

Six brands – all meat processor and AP-specific manufacturer brands – made statements about their manufacturing process, with most being simple descriptions of fermentation (Impossible, Ozo and Quorn). The remainder were vague descriptions of simple/minimal processing methods. For example, Lightlife’s explanation of the production of its burger states: STEP 1: Mix our plant fiber with water, oil and seasoning. STEP 2: Hydrate pea protein by blending with water, oil, seasoning and natural flavors… (Lightlife). Similarly, Beyond Meat’s explanation states: Using heating, cooling, and pressure, we create the fibrous texture of meat from plant-based proteins. Then, we mix in fats, minerals, fruit and vegetable-based colors, natural flavors, and carbohydrates to replicate the appearance, juiciness, and flavor of meat (Beyond Meat).

Ultra-processing was mentioned on two brand websites – Lightlife and Impossible. Lightlife directly criticised Beyond and Impossible products for being ‘hyper-processed’: There are two kinds of plant-based proteins: The kind made by ‘food tech’ companies that use GMOs, hyper-processed ingredients, and unnecessary additives and fillers to attempt to mimic meat in every way. And then there’s us (Lightlife). While Impossible argued that everything is processed: The truth is that almost everything we eat (from applesauce to yogurt) is a combination of nature and science; it’s all a process, often including blending, mixing, fermentation or baking (Impossible Foods).

Impossible was the only brand to explicitly critique the nutrition and health attributes of meat, and then only in external articles linked to from the brand website: A growing body of epidemiological data suggests that eating a lot of ‘red meat’ — the colloquial term for mammalian muscle — may be bad for your health and that replacing animal-derived protein in the diet with plant-derived protein could significantly reduce overall mortality rates (Pat Brown, CEO and Founder, Impossible Foods(Reference Brown35).

Discussion

Nutrient claims were the most common claim type identified on both FOPL and company websites, with a roughly equal balance of ‘positive’ and ‘negative’ nutrient claims. Positive nutrient claims were dominated by protein claims, while negative nutrient claims were mostly made for cholesterol, energies, total fat and saturated fat. Several brands also made claims about sodium/salt, sugars and trans fats – negative nutrients associated with processed meats and processed foods generally. The focus on protein in this category is not surprising, given the framing of meat as a protein food.

Apart from protein, few other positive nutrient claims were made on FOPL or brand websites. This is perhaps surprising given that meat is also positioned positively in relation to its iron and vitamin B12 content. For some AP products, this may reflect their relatively low Fe and/or vitamin B12 content relative to meat, or the presence of these nutrients at levels below that needed to be eligible to make a nutrient content claim under US Food and Drug Administration rules. For a nutrient content claim, a product must contain at least 10 % of the Reference Daily Intake or Daily Reference Value per reference amount customarily consumed to make a ‘good source’ claim, and at least 20 % to make a ‘high in’ claim (21CFR101.54). Yet, a number of products did contain at least 10 % Daily Reference Value for iron and/or vitamin B12 (according to information provided on their Nutrition Information Panels) but did not carry a content claim for these nutrients. A similar finding was observed in an Australian audit of AP products, which found that while many products were eligible to make claims about dietary fibre, vitamin and mineral content, or being low in fat or sodium, few products made these claims on their FOPL(Reference Curtain and Grafenauer20).

Overall, the marketing strategy of manufacturers of AP focused on replicating some of the nutritional benefits of meat (primarily protein), while avoiding some of the detrimental nutrients associated with whole and processed meats. Both positive and negative nutrient claims were closely aligned with nutrients commonly associated with meat, rather than highlighting other nutrients or ingredients as a point of difference. The exception to this is fibre, which was the focus of the second highest number of positive nutrient claims after protein. Fibre content claims were made by five brands on FOPL, and on nine brand websites, representing all three brand sectors.

This focus of nutrient claims on meat-related nutrients demonstrates the constraints associated with products framed as imitations/simulations of meat, albeit as superior to the foods they aim to simulate. In this respect, there are similarities with the history of margarine and its design and marketing in relation to butter(Reference Scrinis2). Manufacturers of AP have also resisted the temptation to fortify foods with high levels of micronutrients or other food components in order to make enhanced health claims or to position their products as ‘functional’ foods. This is in contrast to the trend towards the ‘functionalisation’ of the marketing of many ultra-processed foods(Reference Scrinis36). Instead, the current strategy appears to define the nutritional qualities of AP in relation to meat and to highlight specific similarities or differences with meat, rather than to introduce new elements or points of difference.

Ingredient-related claims were mostly confined to general references to ‘plants’ or ‘plant-based protein’, as well as specific references to ‘peas/pea protein’ and ‘soy/soy protein’. Given that the term ‘protein’ is increasingly being used interchangeably in current discourse as both a nutrient and an ingredient, many of these claims effectively function as hybrid nutrient-ingredient claims. In the same way that the INFORMAS taxonomy considers all ‘wholegrain’ claims to imply that a product has particular nutritional properties(Reference Rayner and Vandevijvere34), all ‘protein’ and ‘plant-based’ ingredient claims in this category could be considered to infer particular nutritional or health benefits beyond the scope of the claim. While ‘plant-based’ is the distinguishing feature of AP products, the term also currently carries a health-halo given the perceived health benefits of plant-based diets(Reference Curtain and Grafenauer20,Reference Willett, Rockström and Loken37,Reference Swartz, Laestadius and Kevany38) . ‘Plant-based’ claims on foods thereby function as implied health claims. To capture this, we applied the INFORMAS definition of health-related ingredient claims but added ‘highlighted ingredients’ as a new sub-category of ‘other health-related’ claims. This new sub-category captured ingredient claims which did not meet the criteria for health-related ingredient claims (i.e. did not specify a number or percentage, or explicitly link the ingredient to terms such as ‘good’, ‘goodness’ or ‘healthy’). The vast majority of claims classified in this sub-category were plant and/or protein-related.

We observed some differences between the three sectors (general food manufacturers, meat processors and AP-specific companies) in how they leveraged health and nutrition claims to market their products. Meat processor brands made the fewest negative nutrient and free-from claims. This is not surprising considering that free-from claims are used to position AP as better than meat and contain implicit criticism of meat products, a marketing strategy that meat companies would understandably want to avoid. Instead, meat processor brands focused more on protein claims (only one product by these brands did not have a protein claim on its FOPL) and highlighting healthy ingredients, especially on their websites. The focus on protein aligns with the subtle rebranding of ‘meat’ companies as ‘protein’ companies in recent years, with Tyson Foods claiming, ‘we are more than chicken. We’re protein leaders’ and Maple Leaf Foods claiming to be the ‘leading protein company’ in Canada(39,Reference Splitter40,41) . In contrast, food manufacturers had a much greater focus on both free-from and negative nutrient claims.

The processed or ultra-processed character of the ingredients and additives in these products was rarely referred to on food labels or websites. The majority of products analysed would be classified as ultra-processed foods, due to the presence of ingredients such as cosmetic additives (such as flavourings, emulsifiers, thickeners) and modified proteins (such as soy protein isolate or vital wheat gluten)(Reference Monteiro, Cannon and Levy42). Only a small number of companies discussed these additives on their websites, and references to additives or highly processed ingredients on the FOPL were very rare. The clear exception to this pattern is Impossible Foods, whose website defended its use of GM haem and contained links to articles and videos explaining and justifying its use of the substance. Lightlife and Beyond Meat took a different approach by portraying their products as minimally processed. Yet, their explanations of the manufacturing process tended to lack detail, and both companies glossed over the technologies used to create the plant-based protein ingredients. This is consistent with many processed and ultra-processed foods, which often have many health or nutrition claims, but little in the way of transparency about their ingredients or manufacturing processes. Indeed, the focus on specific nutrients can serve to create a ‘nutritional façade’ that distracts attention from or conceals the ingredients and processing techniques used in the manufacture of these products(Reference Scrinis2). General food manufacturers were unique in that they did not discuss manufacturing processes on their websites. Nevertheless, the explanation of additives on several websites suggests that companies are aware of consumers concerns about food additives and processing. The negative health consequences associated with consumption of ultra-processed foods highlights the need for robust evaluations of how AP products impact health(Reference Wickramasinghe, Breda and Berdzuli10).

While we anticipated that the information on FOPL and websites would substantially differ, we instead found that, apart from a little more diversity and elaboration, the information presented on FOPL and websites was very similar. For the most part, AP brand websites provided basic nutrient and ingredient information about their products and did not elaborate on the broader issues or debates about AP products. AP-specific companies and meat processors were more likely to engage with some of the issues and debates about meat production and consumption, though with the exception of Impossible Foods, companies did not provide detailed position statements. Currently, it does not appear the food companies analysed in this study (or their AP brands) are taking a particularly strong stance on the issues and debates associated with livestock production and consumption, or the promissory narratives made about AP products.

Conclusions

This paper presents the first comprehensive analysis of the types of health and nutrition-related claims being made about AP products on their FOPL and company websites. This US-based exploratory study reveals the different ways that general food manufacturers, meat processors and AP-specific companies are seeking to present AP products as healthful or nutritious. It also considers some of the challenges that companies face in positioning AP products as healthy against the backdrop of debates about ultra-processed foods. We found that companies emphasise claims about protein and plant-based and largely remain silent on types of processing. Our study used company websites as a source of FOPL; thus, this may not reflect the prevalence of products and claims consumers see in stores.

We also observed that these AP products are primarily positioned in relation to meat – the presence or absence of nutrients and food components found in meat was highlighted, whereas other nutrients or ingredients are discussed far less frequently (even when products are eligible to make claims about them). Given that food companies position their AP products as alternatives to or substitutes for meat products, this tendency to market AP in terms of their similarities and differences to the nutrient profile of meat products can shape public understanding of the healthfulness of AP and their role in healthy and sustainable dietary patterns. Robust evidence on the health effects of incorporating AP into diets is needed, in order to be able to evaluate these nutritional marketing techniques and inform the development of evidence-based guidance for consumers.

As the AP sector continues to grow and new products and companies enter the market (especially ‘cultured’ products using fermentation and cell-based technologies), companies may adopt new nutritional marketing and positioning strategies. This study provides a snapshot in time of a dynamic and rapidly evolving market segment, and future research can build on this work to explore how new market and regulatory dynamics play out.

Acknowledgements

Acknowledgements: Not applicable. Financial support: J.L.N. and G.S. received a seed funding grant from the University of Melbourne Future Food Hallmark Research Initiative. Conflict of interest: There are no conflicts of interest. Authorship: J.L.N. and G.S. developed the project aims and research design. L.H. collected and analysed the data. All authors collaborated on the first draft of the paper and subsequent iterations. All authors read and approved the final manuscript. Ethics of human subject participation: Not applicable.