Introduction

Staatsolie Maatschappij Suriname N.V. is a fully integrated oil company, with the Republic of Suriname as its single shareholder. It was founded on 13 December 1980, initially only to promote and manage the petroleum potential of Suriname. The first successful well was drilled in 1982, and first production took place in 1983. Crude production has since then steadily increased to 17,000bopd (barrels of oil per day) at present. Of this volume about 15,000bopd is refined to premium diesel and premium gasoline. Staatsolie can satisfy all the premium diesel and 50% of the premium gasoline demands of Suriname for the foreseeable future. The remaining volume of about 2000bopd of crude oil is sold to clients in the Caribbean region.

Although Staatsolie's focus is on the exploration, production, refining and marketing of crude-oil products, it combines this role with that of ‘agent of the State’ of Suriname, the regulator tasked to assess, promote and manage primarily the deepwater acreage (Fig. 1), of which part is currently under production-sharing contracts (PSCs).

Fig. 1. Suriname's on- and offshore exploration and production blocks (source: Staatsolie/Petroleum Contracts, 2016).

To ensure Staatsolie's sustained growth, while limiting its exposure to the volatility of the oil business, the company developed its ‘VISION 2030’. This vision revolves around diversification of the product portfolio, essentially transforming Staatsolie from an oil company into an energy company. To fulfil this vision, Staatsolie is also pursuing industrial sugar-cane farming for ethanol production. Recent pilot test results for this agricultural part were encouraging. However, the project has been put on hold, subject to the selection of a suitable business partner. Studies have also been carried out regarding the hydroelectric potential, called the TapaJai project, focusing on increasing the potential of the current hydroelectric plant.

In addition, a fully operational thermal power plant operated by Staatsolie's subsidiary, Staatsolie Power Company Suriname N.V. (SPCS), delivers power to the refinery as well as the national grid. To meet the local fuel needs, Staatsolie has recently expanded its refinery with an investment of close to US$1 billion. In 2011, Staatsolie acquired the rights to the Texaco retail gas stations and branded them GOw2. This growth, driven by VISION 2030, combined with its increasing contributions to the state financial balance, illustrates the importance of Staatsolie in a small economy like Suriname's.

It is, however, acknowledged by all parties involved that this growth can only be sustained by an increase in production coupled with sufficient reserves to support it. This has resulted in accelerated exploration activities, both by Staatsolie itself as well as by the offshore operators under PSCs. Staatsolie's exploration activities involve both the on- and near-shore acreage to water depths of about 35m, while the IOCs focus on greater water depths.

The challenges and risks faced by Staatsolie and the other operators have to do with the nature of the Suriname–Guyana Basin, which exhibits a typical passive margin setting where trapping is primarily stratigraphic in nature. However, the recent oil discoveries in French Guiana and Guyana, combined with the conjugate-margin theory stressing the similarities of the petroleum geology of West Africa and northeastern South America, have further boosted interest in the basin, even at a time when the oil business has taken a downturn.

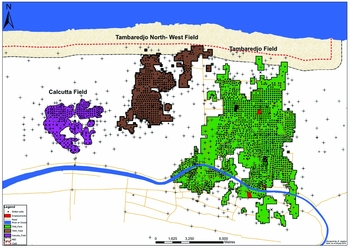

Currently Staatsolie continues production from its three onshore fields, Tambaredjo, Calcutta and Tambaredjo North-West (TNW), and is assessing various EOR methods such as polymer flooding, to optimise oil recovery.

Geological setting

The Suriname–Guyana Basin is situated on the northeastern part of the South American continent and includes the offshore and part of the onshore areas of French Guiana, Suriname, Guyana and eastern Venezuela (Fig. 2). The vast basin is dominated by its passive-margin setting dating from the Cretaceous and is similar to most other Atlantic margin basins (Fig. 3). To the south it is bordered by the crystalline Guiana Shield, a craton of Proterozoic age. This shield supplied the bulk of the clastic sediment in the basin.

Fig. 2. Location of the Suriname–Guyana Basin (http://mile2herald.wordpress.com, 2014).

Fig. 3. South–north schematic cross-section through the Suriname–Guyana Basin illustrating the various petroleum play systems present in the basin (Staatsolie internal report 2015).

The development of the Suriname–Guyana Basin is linked to that of the Atlantic (Pindell & Kennan, Reference Pindell and Kennan2001) and comprises three distinct phases:

-

• rifting, which started during the Late Jurassic (150Ma);

-

• inversion during the Late Cretaceous (130Ma);

-

• drifting, which started during the Late Cretaceous (80Ma).

The sediments are primarily clastic, but reef carbonates developed at the palaeo shelf edges. The deeper parts of the basin contain turbidite and low-stand fans originating from massive shelf-edge canyons (R. Downie & J. Hall (Amerada Hess International London), internal report for Staatsolie, 2013).

Remnants of early rifting are present in the form of Jurassic grabens, of which at least two have been identified on the Surinamese shelf: the Nickerie and the Commewijne Grabens. Their onshore equivalent is the Takutu Graben on the border between Guyana and Brazil (Crawford et al., Reference Crawford, Szelewski and Alvey1985). These may have been formed as part of a failed-rift system in the early development stages of the basin (Pecten Suriname, internal report for Staatsolie, 1995).

The basin contains a proven world-class source rock of the Canje Formation of Cenomanian–Turonian age, which is equivalent to the Naparima Hill Formation in Trinidad and Tobago and the La Luna Formation in Venezuela (Crawford et al., Reference Crawford, Szelewski and Alvey1985).

The only three producing fields in the basin are situated onshore of Suriname in the shallow clastic sedimentary wedge, less than 900m thick, overlying crystalline basement. The porosities reach values of 35%, and permeability values of up to 1100mD have been recorded. The reservoirs vary in age from Paleocene to Miocene. The onshore and near-shore depositional settings are primarily of fluvio-deltaic origin with interbedded calcareous banks formed by seashells. These banks sometimes act as effective seals (Wong, Reference Wong2014). The three fields have combined oil in place of about 1 billion barrels (bbls).

Exploration history

Oil exploration in Suriname started in the 1930s, in the district of Nickerie, in the western part of Suriname where the presence of oil was first confirmed in well NN-1. Several exploration campaigns followed, with the first small, coincidental discovery in 1965, in a well drilled for water by the Geologisch Mijnbouwkundige Dienst (GMD) on a schoolyard in Calcutta, District of Saramacca, at a depth of about 160m (Wong, Reference Wong, Wong, De Vletter, Krook, Zonneveld and Van Loon1998).

This discovery was followed by another in the Weg naar Zee area in 1967. The search intensified from 1969 to 1970 when Shell drilled 20 exploration wells along the coast with limited success. No more onshore exploration took place until the early 1980s.

In 1980 Staatsolie was established, initially to manage the PSCs with IOCs. Currently Staatsolie holds all mining rights to hydrocarbons, both onshore and offshore. In its regulatory role Staatsolie first monitored the activities by Suriname Gulf Oil Company, a subsidiary of Gulf Oil Company (Gulf Oil).

Through agreements Staatsolie was able to acquire expertise from Gulf Oil and used this to start its own exploration campaign, in 1981, of three wells in the area of the first small discoveries in the Saramacca district, which were all successful. In 1982, a five-well pilot production project was successfully carried out near Tambaredjo, and Suriname became an oil-producing country (Wong, Reference Wong, Wong, De Vletter, Krook, Zonneveld and Van Loon1998).

These discoveries and subsequent exploration and appraisal in the area eventually resulted in the three currently producing fields. Due to the focus on production increase between 1981 and 2007, Staatsolie primarily carried out near-field exploration and appraisal aimed at increasing the reserves of the established fields. An 80km2 3-D high-resolution seismic survey was acquired over the Tambaredjo Field in 2000 in order to increase drilling success.

Several exploration campaigns were executed in the 1990s in the Weg naar Zee block, and in the early 2000s by Koch in the former Wayambo block, now called the Uitkijk block.

Faced with declining reserves and maturing fields, Staatsolie established a dedicated Exploration and Petroleum Contracts Directorate with the task of accelerating exploration in the on- and near-shore acreage, both of which were assigned to Staatsolie's own commercial activities. Promotion of the deeper offshore acreage also intensified, resulting in several international oil companies signing PSCs with Staatsolie.

The accelerated exploration onshore started with a regional 2-D seismic programme in 2008/2009 covering all blocks in various degrees. It clearly imaged for the first time the Bakhuis Horst, locally called the Calcutta High, (Fig. 4) which plays a critical role with regard to the onshore fields, which are situated on part of this structural high (Wong, Reference Wong, Wong, De Vletter, Krook, Zonneveld and Van Loon1998).

Fig. 4. West–east seismic section along the coastal area of Suriname clearly showing the Bakhuis Horst. The small green dots signify oil finds, and the larger one the production field. The red dots are oil shows in the Cretaceous.

Simultaneous exploratory drilling in the Weg naar Zee and Commewijne Blocks resulted in small discoveries in Lower Paleocene reservoirs, the geological equivalents of the producing reservoirs in the Tambaredjo Field. The regional 2-D seismic programme was subsequently adjusted to assist in appraising these finds, and a tighter grid was acquired there. Eventually, in 2013, the Central Weg naar Zee discovery was handed over to the Production Directorate after several appraisal and production testing phases were concluded. About 4000bbls of oil was produced during the production test. The volumes at handover were estimated at about 23.7MMbbls STOIIP (million barrels stock tank oil-initially-in-place). This volume was deemed uneconomic at the time and remains as contingent resources.

In the period between 2007 and 2013, exploratory drilling programmes were also carried out to the south of the producing Calcutta and Tambaredjo Fields and in the Nickerie Block to the west (Fig. S1 in Supplementary Material). The Nickerie campaign only yielded marginal results in the deeper Cretaceous section and was deemed to be too high-risk to continue. This was also concluded for the Commewijne Block.

Paradise Oil Company (POC), a subsidiary of Staatsolie, was established in 2006 for dedicated exploration with third-party oil companies in the onshore Uitkijk and Coronie Blocks. Exploration wells in both blocks encountered oil shows in the Cretaceous interval, while only the Uitkijk Block showed some Lower Paleocene potential, building on earlier discoveries by Koch Oil Company in the early 2000s. However, these discoveries were not taken into production due to sub-economic volumes.

The onshore exploration campaign carried out by Staatsolie and POC lasted from 2007 until 2013, and involved about 160 exploration and appraisal wells, and about 700km of 2-D seismic. Oil was encountered throughout the Tertiary up to the Miocene sections as well as minor shows in the Cretaceous sediments. It demonstrated primarily stratigraphic trapping in a fluvio-deltaic setting with a weak structural element. The gravities of the oils vary from 8 to 16° API (American Petroleum Institute gravity), and all the recently discovered accumulations are presently deemed sub-economical, primarily due to the limited volumes.

In an effort to accelerate the exploration activities even further, it was decided to focus on the near-shore areas where the petroleum geology was interpreted as having more potential. Based on drilling results by Gulf and Elf Aquitaine in the 1980s, exploration of Block 4 started by acquiring more 2-D seismic followed by a 3-D seismic survey. This survey was completed in 2012. Following interpretation of the seismic and the search for a suitable drilling rig for the very shallow water with a muddy bottom, five of the planned nine wells were drilled. Four of these encountered oil and are still under evaluation. In addition, about 1200km of 2-D seismic was acquired over near-shore Blocks 1–7 and the results will be tied into the data acquired in Block 4. All this will form the basis for a revised Exploration Strategy for the near-shore acreage, in which Staatsolie will combine sole risk with joint-venture agreements. It is expected that the gradual deepening of the basin from south to north will have a positive impact on reservoir quality and thickness, and also the seal quality, especially in the Tertiary sediments.

Exploration potential

Reserves goals 2014–2030

Staatsolie is currently in the early stage of implementation of its VISION 2030, which requires a significant increase of reserves to support the envisioned production increase, which would be the engine for financial growth. The specific targets assigned to the Exploration Division are:

-

• reserves from the on- and near-shore: 130MMbbls;

-

• reserves from the offshore: 75MMbbls (based on Staatsolie's maximum available participating interest of 20%);

-

• foreign participation by Staatsolie (in the Greater Caribbean and South America): 50MMbbls.

As part of the plan to enhance oil recovery from the current fields by polymer flooding and/or CO2 /water alternating gas (WAG), the targets for the Production Asset are:

-

• reserves from EOR: 30MMbbls;

-

• reserves from ongoing field appraisal: 20MMbbls.

The total volume of expected reserves by 2030 from both exploration and the production programmes is set at approximately 300MMbbls.

Source rock potential

According to the United States Geological Survey (USGS) assessment, the Suriname–Guyana Basin could hold a mean risked reserves oil volume of about 15.3 billion bbls, which compares well in both area size and volumes with the proven Campos Basin offshore of Brazil, as shown in Table 1 (Schenk, Reference Schenk2002). It is obvious from the reserves target figures that the basin should have had sufficient source-rock generating potential, combined with reservoir-quality rocks, seals and trapping potential in order to materialise this potential.

Table 1. USGS South and Central America Assessment showing the total undiscovered resources (Schenk, Reference Schenk2002). For gas fields, all liquids are included under the NGL (natural gas liquids) category. Undiscovered gas resources are the sum of non-associated and associated gas. F95 represents a 95% chance of at least the amount tabulated. Other fractiles are defined similarly. Fractiles are additive under the assumption of perfect positive correlation.

*MMBO, million barrels of oil; BCFG, billion cubic feet of gas; MMBNGL, million barrels of natural gas liquids. Results shown are fully risked estimates.

In order to get a better grasp of the true hydrocarbon potential of the basin, an integrated petroleum systems study was carried out by Fugro Robertson Limited in 2009 using all available data, including some contractor data, released under conditions of confidentiality (Fugro Robertson Limited (UK), internal report for Staatsolie, 2010). This study was followed by two additional studies in 2014 by CGG-Robertson and Beicip-Franlap after additional data had become available and gaps in the first study had been identified which could be discussed in these new studies.

In addition to third-party data, Staatsolie provided a significant amount of data, including aeromagnetic data, fluid-inclusion studies, seep and slick surveys, biostratigraphic data and geochemical studies.

Various geochemical studies have identified the existence of at least three oil families in the basin:

-

• Oil Family I crudes appear to have been derived from a marine shale at peak maturity for oil generation. These oils are primarily present onshore, in the Paleocene T-unit, and are biodegraded to a gravity of about 15° API.

-

• Analysis of Oil Family II crudes suggests a restricted lacustrine and/or hypersaline source rock. This sweet, bio-degraded oil with 0.2% sulphur and a gravity of 10.9° API primarily occurs onshore in the Nickerie Formation of Cretaceous age.

-

• Oil Family III only occurs in offshore well Abary-1. It is sweet oil with 0.07% sulphur and a gravity of 34.7° API (Buiskool Toxopeus J.M.A., internal report for Staatsolie, 2010).

The petroleum-systems studies resulted in three source rocks:

-

• The Cenomanian–Turonian source rocks are geochemically linked to oil in the producing fields. They are early to middle mature for oil in the modelled area on the palaeoshelf (Fig. 5). Total organic carbon (TOC) values range up to 4.5%. These source rocks were drilled in offshore well North Coroni Offshore-1 (NCO-1).

-

• Albian source rocks were also sampled in offshore well NCO-1. These have TOCs of up to 5% with excellent oil source potential and are peak mature to early mature for oil generation (Fig. 6). Albian source rocks are also proven in Deep Sea Drilling Project well 144, and have been studied intensively.

-

• Callovian source rocks are indicated by the data from the Demerara A2-1 well. TOC values of up to 1.5% were recorded (Fig. 7). These source rocks may indicate a restricted environment when the platform on which this well was drilled was situated south of the Central Atlantic Ridge until Aptian time.

Fig. 5. Cenomanian–Turonian source rock distribution map displaying the various maturity intervals (Fugro Robertson Limited, internal report for Staatsolie, 2010).

Fig. 6. Albian source rock distribution map displaying the various maturity intervals (Fugro Robertson Limited, internal report for Staatsolie, 2010).

Fig. 7. Callovian source rock distribution map displaying the various maturity intervals (Fugro Robertson Limited, internal report for Staatsolie, 2010).

A fourth, model-driven source rock has been proposed and has yet to be proven. This source rock would be located in the offshore syn-rift sequences in the Nickerie and Commewijne Grabens identified on seismic data (Fig. 8). This model is supported by gravity-modelling studies carried out in 2010 by Marc Longacre, geophysical consultant, identifying low-density basin fill in the two grabens. This could be of sedimentary or evaporitic origin, instead of volcanic as previously assumed (Longacre, internal report for Staatsolie, 2010). A comparable graben, the oil-containing Takutu Graben, can be found on the border between Guyana and Brazil, and is filled with lacustrine sediments of Triassic to Jurassic age (Petrobras Energía S.A., Reference Petrobras Energía2004) and a source rock with a TOC of 1.5–3%.

Fig. 8. Source rocks distribution map associated with Jurassic age grabens offshore of Suriname displaying the various maturity intervals. This source rock is yet to be proven by well data (Fugro Robertson Limited, internal report for Staatsolie, 2010).

Based on the modelling results of the Nickerie and Commewijne Grabens, showing a high level of maturity, and given their proximity, these source rocks have the potential to have charged deeper onshore oil accumulations. This possibility will be further investigated in future petroleum systems studies.

Based on the modelling carried out as part of the petroleum systems studies, it has been concluded that a total of 19.7 billion bbls of oil may have been expelled from the Cenomanian–Turonian source rocks alone (Table 2). In addition, the Albian may have expelled about 34.8 billion bbls and the Callovian 91 billion bbls using the medium value, for a total value of about 146 billion bbls. In addition, about 109 TCF (trillion cubic feet) of gas may have been expelled. These results, combined with the recent success of Exxon-Mobil's well Liza-1 offshore of Guyana and Tullow's Zaedyus discovery drilled in 2011 offshore of French Guiana, further underscore the significant potential of the Suriname–Guyana Basin. This supports the conjugate-margin theory, which shows great similarities between the Suriname–Guyana Basin and the proven hydrocarbon systems in West Africa (see Kelly & Doust, Reference Kelly and Doust2016).

Table 2. Values for oil and gas expelled from the three identified source rocks calculated based on the petroleum systems evaluations (Fugro Robertson Limited, internal report for Staatsolie, 2010).

Near- and offshore plays

In order to materialise this potential the reservoir, sealing and trapping potential of the basin is as important as the source-rock potential itself.

The offshore and near-shore play maps identify the primary play systems typically associated with the Atlantic Margin system. This consists of deeper active rift basins followed by quiet drifting phases resulting in a passive margin setting. The plays consist of slope, basin floor fan; slope-channel and carbonate deposits; structural plays occur as well (Fig. 9).

Fig. 9. Map showing the different identified play types in the offshore part of the basin (Staatsolie internal report).

The plays in the on- and near-shore areas are dominated by combination traps of stratigraphic pinch-out and fault displacement in a fluvio-deltaic to shallow marine depositional setting (Fig. 10).

Fig. 10. Map showing the different leads and prospects mapped in near-shore Block 4 based on 3-D seismic data (Staatsolie internal report).

Production

Production from the fields with currently more than 1600 producing wells (Fig. 11) has benefited from almost constantly increasing reserves growth during the early part of the company's history. However, this increase has not kept pace with increasing production during the last decade.

Fig. 11. Map showing the three onshore fields with more than 1600 production wells.

The graph in Figure 12 shows the proven and probable reserves development compared to the cumulative production up to 2014.

Fig. 12. Graph showing the reserves development from 1981 to 2015 (Staatsolie internal report).

As of 2014, the field had a cumulative production of about 110MMbbls and remaining reserves of about 92.5MMbbls. The ultimate recovery factor (URF) is estimated at 20%.

The development of the fields progressed from drilling land locations on a regular grid, to swamp locations which allowed a significant amount of flexibility in selecting subsurface targets with little preparation time, while successfully maintaining the natural environment as much as possible. Figures 13 and 14 show these two methods of field development.

Fig. 13. A typical land location in the Tambaredjo Field. The swamp areas are poldered and drained prior to building the locations.

Fig. 14. A developed swamp area in the field with the individual well locations connected by water trails.

Recognising the relatively low URF of 20% due to the low gravity of the crude, Staatsolie decided at an early stage that a portion of any new reserves should come from the existing fields where too much oil was left behind. Given the fact that infrastructure was already in place, any increase in reserves could be booked directly into production, increasing recovery and prolonging the field's life. These opportunities were investigated by evaluating various EOR methods, of which WAG and polymer flooding are the most recent. The WAG study showed a potential incremental recovery of 15%. A polymer-flooding field pilot project was executed in 2008 (Fig. 15). It showed that the technical reserves could be increased by 12% (Fig. 16). Injecting for a period of 20 years from 2017 onward is expected to recover incremental reserves of up to 5MMbbls. However, the break-even oil price of the proposed injection strategy was calculated to be US$48bbl−1, which at current oil prices means that the project is not economically feasible at present.

Fig. 15. Polymer Pilot Injection Plant at the Tambaredjo Field.

Fig. 16. Graph showing the incremental production after injection of polymer of various viscosities in pilot wells located in the Tambaredjo Field (Staatsolie internal report).

Downstream developments

As part of VISION 2030, the diversification strategy also involved expansion of the refining capacity to 15,000 barrels of crude per day. The refined products, which are premium diesel and premium gasoline, are produced to the highest quality standards. The expansion started in 2012 and went on stream in December 2014 (Fig. 17). The investment was about US$1billion, of which US$400 million was spent locally. The project provided about 1800 jobs at its peak. The refinery will provide Staatsolie annual revenues of about US$100 million.

Fig. 17. View of the new Staatsolie Refinery taken from the Suriname River.

Simultaneously with the refinery expansion, the SPCS was upgraded to provide energy to both the national grid and the refinery. The plant generates 96MW (Fig. 18).

Fig. 18. Facilities of the Staatsolie Power Company Suriname (SPCS).

To further create value in its downstream part of the business, Staatsolie acquired the retail operations of ChevronTexaco, called Suritex in Suriname, and rebranded it to GOw2 Energy Company Suriname N.V. Premium gasoline and premium diesel produced at the refinery for the local market has been sold through this subsidiary since 2015 and to Sol Suriname. N.V., which operates the previously acquired Shell gas stations in Suriname.

In an effort to enter the biofuel sector, an ethanol sugar-cane project was initiated. This consisted of an agricultural subsidiary focused on the planting and harvesting of sugar cane, and an industrial part, the refinery. This project has been put on hold as Staatsolie is still seeking a partner for investment in the industrial part.

Financial performance and social responsibility

With the collapse of the bauxite industry, Staatsolie has become the largest contributor to the Surinamese economy. On average, Staatsolie has contributed annually about US$300 million to the State in 2013/2014 (Fig. 19). With the new refinery this is expected to increase by about US$50 million per year. In 2012 Staatsolie had for the first time in its history surpassed the US$1 billion mark in generated revenues (Fig. 20).

Fig. 19. Staatsolie tax and dividend payment to the shareholder (Staatsolie internal report).

Fig. 20. Staatsolie financial performance up to 2014 (Staatsolie internal report).

In addition to the direct financial contribution, Staatsolie has also generated a significant spin-off industry from which it buys goods and services. The company employs about 1000 people and another 800 in outsourced activities.

Along with Staatsolie's financial contribution to Surinamese society, it demonstrates its corporate citizenship, an important pillar of VISION 2030, by contributing to a wide range of community projects in education, culture, sports, health, safety, environment and projects for the underprivileged. The Staatsolie Foundation for Community Development supports sustainable projects in the community.

The company also funded the building of the Institute for Graduate Studies of the Anton de Kom University of Suriname (Fig. 21) and recently funded and facilitated a multiyear Master's Program in Petroleum Geology, the only one of its kind in the Caribbean.

Fig. 21. Staatsolie Building of the Faculty of Graduate Studies, Anton de Kom University of Suriname, funded by Staatsolie.

Conclusions

For the last 35 years Staatsolie's dedicated staff have capitalised on the company's petroleum resources with dedication and perseverance and a thorough knowledge of geology and technique, when many international experts did not recognise its future. They have proven that a state-owned company can successfully combine commercial and institutional roles, contributing significantly to the State's finances and setting an example for other companies. Step-out and exploration drilling are expected to gradually increase production. Subject to rising oil prices, onshore and near-shore heavy-oil discoveries may be developed and polymer flooding and/or other EOR methods may further increase production.

The under-explored offshore part of the Suriname–Guyana Basin has significant oil potential, as proven by the recent apparent major light oil discovery offshore of Guyana and a smaller discovery in French Guiana, and the many discoveries in comparable basins and plays in West Africa and Brazil.

Implementation of VISION 2030 would turn Staatsolie from an integrated oil company into an energy company by diversification into, amongst others, hydroelectric power generation and production of biofuel from sugar cane. In order to achieve these goals Staatsolie will continue to invest in the development of its human capital and technology, as it has done successfully during the last 35 years.

Acknowledgements

Many colleagues have contributed to this document. Special thanks go to Melissa Amstelveen, Enid Bergval, Karuna Bhoendie, Marny Daal, Dion Howard, Ricardo Kandhai, Sharon Kastamoenawi, Kathleen Moe Soe Let, Eshita Narain, Nohar Poeketi, Maria Tannapaikam, Vernon Texel, Corine Tonawi and Albert Vermeer. It has been a privilege and an honour to have been allowed to write this document on behalf of Staatsolie, which would not have existed without the vision and passion of Mr Eddy Jharap, the founder and 25 years Managing Director of our beloved company.

Supplementary Material

Supplementary material is available online at http://dx.doi.org/10.1017/njg.2016.32.