1 Introduction

From Reference Tocqueville and MayerAlexis de Tocqueville’s (1969) well-known chronicle of the United States in the early 1800s, Democracy in America, we know that associational, or nonprofit, activity, is a long-standing feature of American culture. And, with the nonprofit sector currently employing approximately 10 percent of the nation’s private (i.e., nongovernmental) workforce, behind only “retail trade” and “accommodation and food services” and ahead of “manufacturing,” this sector remains an important part of the nation’s economic and social life today (Reference Salamon and NewhouseSalamon and Newhouse, 2020). With the sector’s importance and its general popularity with the public, it is not surprising that in recent decades sector leaders have managed several important public policy victories at the federal level (e.g., the enactment of the mandate that nonprofits paid with federal funds should receive at least some reimbursement for overhead expenses) and fended off a few serious attacks on sector interests (e.g., proposals to cap the deductions that can be itemized by wealthy taxpayers).Footnote 1

However, at the same time that nonprofit leaders have achieved some advocacy successes, they have also been frustrated by their inability to advance sector interests even further, including in the face of the damage to sector interests sustained by the passage of the 2017 Tax Cuts and Jobs Act (TCJA) that is described in this Element.

Why has this important and generally popular nonprofit sector not done better in its public policy advocacy efforts? To address this puzzle, this Element examines the recent history and contemporary practice of federal-level, nonprofit sector-wide advocacy, defined as the work done by nonprofits, and especially national, nonprofit infrastructure organizations and national charities, to advocate on issues that apply to a broad cross section of the charitable (i.e., 501(c)(3)) portion of the nonprofit sector, spanning nonprofit health, education, human service, and other subsectors.Footnote 2 As discussed further in Section 3, among these federal, sector-wide issues that are of concern to nonprofit leaders are tax breaks for charitable donations and regulations concerning nonprofit lobbying and engagement in elections.

Federal-level, nonprofit sector-wide advocacy is currently dominated by five, major, national, nonprofit infrastructure groups – the Council on Foundations (COF), Independent Sector, National Council of Nonprofits, Philanthropy Roundtable, and United Philanthropy Forum – and they sit at the center of this analysis (see Section 2 for short descriptions of the five organizations). So too do several of the major national charities, such as United Way Worldwide, Jewish Federations of North America, and the YMCA of the USA, whose policy staffers have also taken an active role in promoting policies related to charitable giving. Several ad hoc and long-standing coalitions, such as the Charitable Giving Coalition and Leadership 18, involving many of the organizations named above in this paragrpah, have been an additional important feature of the advocacy landscape.

The Element is based on telephone interviews, averaging about one hour in length, with thirty-nine individuals – twenty-one with current or former staff or consultants to national, nonprofit infrastructure organizations or other national charities, ten with current or former congressional staff, and eight with state-level advocates. One individual was interviewed three times, two individuals were interviewed twice, and on two occasions two individuals were interviewed together. We assigned interviewees to one of the two categories – nonprofit or congressional staff – based on their primary perspective during their interviews. Note that several interviewees have had significant experience in both nonprofit and congressional staff positions, and were difficult to place in only one of the two categories. Interviewees were promised anonymity to encourage their candor in discussing their own and their colleagues’ advocacy activities, and so are not quoted by name in this Element. In addition to interviews, we drew on published papers from national infrastructure organizations and journalistic accounts of nonprofit sector-wide advocacy generally and of advocacy related specifically to the 2017 TCJA and congressional action in 2020 around COVID-19 relief and economic stimulus.

The Element largely covers new ground that is not addressed in the existing literature. This study takes a historical approach in contrast to many nonprofit research projects that employ social science methods.Footnote 3 Studies of nonprofit advocacy are increasing, but many analyses focus on advocacy by individual nonprofit organizations or on advocacy for subsector interests in fields such as healthcare, education, and the arts.Footnote 4 On nonprofit sector-wide advocacy, the work of historian Peter Dobkin Hall is relevant, especially his 1992 book, Inventing the Nonprofit Sector, but Hall’s work does not cover the most recent decades of sector-wide advocacy. Reference AbramsonAlan Abramson’s 2016 article in Nonprofit Policy Forum describes the major obstacles to nonprofit sector-wide advocacy, but is a shorter treatment that does not contain the discussions of advocacy strategies and tactics and case study details that are included in this Element. A 2021 paper by Williams and Doan, also in Nonprofit Policy Forum, focuses largely on the evolution of one important advocacy organization, Independent Sector.

This Element also makes a significant contribution in its analysis of the friction between two models of nonprofit advocacy, one emphasizing nonprofits’ public-interest orientation and the other highlighting nonprofits’ attention to their own private, particular organizational interests. That is, one of the central tensions that defines the nonprofit sector in the United States is that it is organized around the promotion of the public good and yet relies on voluntary institutions with their own distinct organizational concerns.

This tension is especially evident in nonprofit sector-wide advocacy, the efforts of the nonprofit sector to advocate on issues that apply to a broad cross section of nonprofit organizations, spanning nonprofit subsectors. On the one hand, many nonprofit advocates regard their advocacy efforts as uniquely characterized by the attempt to promote the public interest. On the other hand, this advocacy can also be understood as no different from that of other trade associations promoting their own particular interests. The story of the continuing tension between the “public good” and “trade association” models of nonprofit advocacy is a central feature of this Element.

In focusing on issues that apply to all or almost all nonprofits, the Element does not address nonprofit subsector policy issues, such as those related exclusively to health, education, or arts nonprofits. Although it does not completely ignore work done at the state and local level or directed toward federal agencies, its concern is largely federal-level, nonprofit sector-wide advocacy targeting Congress within the last decade and a half.

The Element chronicles the development of the current nonprofit sector-wide advocacy landscape. It begins by introducing major, federal, sector-wide advocates, including the “Big Five” advocacy organizations, and noting the broad range of issues considered by nonprofit advocates to be sector-wide; it sketches out the current state of resources devoted to nonprofit sector-wide advocacy by the organizations most active in engaging those issues and describes the tactics and strategies advocates deem most effective, with a particular emphasis on developing and coordinating “grasstops” local champions of nonprofit sector-wide issues. It then considers the two, distinct conceptions of nonprofit sector-wide advocacy – the first which understands nonprofit sector advocates as constituting interest groups, similar to those representing the institutional interests of business-related industry groups, and the second which regards nonprofit sector advocates as engaged in a distinctive enterprise, based on the principle that, unlike other industries, nonprofits’ primary interest is the public good.

Next, the Element discusses the challenges faced by nonprofit sector-wide advocates in cultivating champions and in navigating partisanship. It then chronicles one of the most significant developments in the recent history of nonprofit sector-wide advocacy: the fracturing of a centralized advocacy infrastructure and the growth of informal, issue-based coalitions, exemplified by the Charitable Giving Coalition. It then details two, short case studies in which many of these dynamics are exhibited: sector-wide advocacy during the TCJA, and advocacy in relation to congressional stimulus legislation in response to the coronavirus pandemic. Next, it briefly considers sector-wide advocacy in relation to campaigns for philanthropic reform. It ends with a discussion of recommendations for strengthening nonprofit sector-wide advocacy and brief reflections on what current dynamics suggest about the future of this advocacy.

2 Major, Federal, Sector-Wide Advocacy Organizations

Much of the advocacy on federal, nonprofit sector-wide policy issues discussed in this Element was conducted by five national nonprofit infrastructure organizations: Independent Sector, the National Council of Nonprofits, the Council on Foundations the Philanthropy Roundtable, and the United Philanthropy Forum. The following are short descriptions of these “Big Five” advocates, as some of our interviewees referred to them, along with some other coalitions and organizations that are important sector-wide advocates.

2.1 Independent Sector

Independent Sector (IS) was established in 1980 with the mission of serving as a “vital meeting ground” that brings together foundations and corporate giving programs, which might also belong to the COF, with other nonprofit organizations. Today, IS’s membership totals approximately 465 grant makers and grant seekers, including the Ford Foundation, Bill and Melinda Gates Foundation, William and Flora Hewlett Foundation, YMCA of the USA, Boys & Girls Clubs of America, and United Way Worldwide, for example. Today, IS’s strategic priorities include advancing the health of the nonprofit sector; building a community “to ensure all people thrive”; and, especially relevant for this Element, advocating on sector-wide, nonprofit public policy issues. The organization reported 2022 spending of $11.0 million to advance these goals. During most of the period covered in this Element, IS was led by Diana Aviv and Dan Cardinali, with Akilah Watkins becoming IS’s new president and CEO in January 2023.Footnote 5

In response to new restrictions on foundations imposed by the 1969 Tax Reform Act, John D. Rockefeller III and other philanthropic leaders sought ways to bolster the foundation community and protect it from future policy attacks. To do so, these leaders supported the establishment in the mid-1970s of the Commission on Private Philanthropy and Public Needs (the Filer Commission), led by John Filer, CEO of the Aetna insurance company, which undertook a comprehensive assessment of the nonprofit sector. In its work, the Filer Commission supported the notion that foundations and the more popular, service-providing nonprofits from all subsectors were part of one nonprofit sector, a perspective that offered beleaguered foundations some of the cover and protection they sought (Reference Abramson, McCarthy and SalamonAbramson and McCarthy, 2012).

An important commission recommendation called for the establishment of a quasi-governmental body as “necessary for the growth, perhaps even the survival of the sector as an effective instrument of individual initiative and social progress” (Filer Commission report quoted in Reference Abramson, McCarthy and SalamonAbramson and McCarthy, 2012). When both government and philanthropic leaders balked at creating a new entity with official links to the government, a new private organization, Independent Sector, was formed through the merger of the National Council on Philanthropy and the Coalition of National Voluntary Organizations. The need to respond to critical public policy challenges posed by Reagan administration policies in the early 1980s and hostile hearings led by Senator Charles Grassley in the 2000s led to the strengthening of Independent Sector as an important advocate on sector-wide issues (Reference Abramson, McCarthy and SalamonAbramson and McCarthy, 2012).

Because of its membership and funding base and perhaps as a trade-off for becoming a strong voice on sector-wide issues, throughout much of its history Independent Sector has been seen as a voice especially of big, national nonprofits and foundations and as working to defend the nonprofit sector as it already exists (Reference Williams and DoanWilliams and Doan, 2021). According to this critique, Independent Sector has shortchanged local, reform-oriented, social justice organizations in much of its policy and other work.

2.2 National Council of Nonprofits

The National Council of Nonprofits (the National Council or NCN), formerly the National Council of Nonprofit Associations (NCNA), was established in 1989 as a “network of networks” that brings together the nation’s state and regional nonprofit associations, which themselves are membership networks. Today, the National Council’s network includes more than 50 state nonprofit associations and similar organizations representing 25,000 diverse nonprofits around the country. The National Council of Nonprofit’s 2022 spending for its policy and other work totaled $2.2 million. In recent decades, the National Council has been led by Audrey Alvarado and, since 2008, by Tim Delaney.Footnote 6

While Independent Sector has been seen as representing big nonprofits – and foundations – and especially focusing its work at the federal level, the National Council’s constituency tilts toward small and medium-sized nonprofits in local communities, and the organization supports and undertakes advocacy and lobbying at the local, state, and federal levels to strengthen nonprofits.

The state nonprofit association movement gained momentum in the 1980s and 1990s with “devolution,” the push by the Reagan administration and its allies to shift policy authority from the federal to the state level (Reference Reid, Boris and SteuerleReid, 1999; Reference Abramson, McCarthy and SalamonAbramson and McCarthy, 2012). According to nonprofit expert Dennis Young, federal devolution initiatives seemed “to be the same kind of catalyst for organizing nonprofits at the state level in the 1990s that congressional attacks on foundations in the 1960s were for galvanizing collective action by the sector at the national level” (Reference Young, Boris and SteuerleYoung, 1999, cited in Reference Abramson, McCarthy and SalamonAbramson and McCarthy, 2012). As state nonprofit associations emerged, many of them became part of Independent Sector’s network. Eventually, however, Independent Sector declined to be the hub for these organizations, and they subsequently formed their own association, then called the National Council of Nonprofit Associations, in 1989 (Reference O’ConnellO’Connell, 1997). Since then NCNA/NCN and Independent Sector have often been collaborators – and sometimes rivals – in their work as sector advocates.

2.3 Council on Foundations

The COF (the Council) is a national membership association that is a voice for its foundation members. The Council, which took its current name in 1964 but dates its origins to the 1949 establishment of the National Committee on Foundations and Trusts for Community Welfare, now counts over 850 members, including a mix of private foundations, community foundations, corporate grant makers, and other philanthropies. The Council, which reported 2022 spending of $10.8 million, works to strengthen and encourage philanthropy, including through public policy advocacy, and increase public trust in foundations. In recent decades, the COF has been led by Dorothy Ridings, Steve Gunderson, Vikki Spruill, and, since 2019, Kathleen Enright, the Council’s current president and CEO.Footnote 7

Reflecting its membership, the Council has largely focused its policy work on matters affecting its grant-maker members, leaving Independent Sector and other entities to take the lead in sector-wide advocacy affecting the large number of charitable nonprofits that are not foundations. The Council and some other elements of the infrastructure for the foundation community were established and reinforced at least in part because of the perceived need by foundations for a strong advocate for foundations in a policy environment that often seemed hostile to these entities. Through the 1940s, 1950s, and 1960s, foundations were often under attack for one reason or another, including by Senator Joseph McCarthy and his anti-communist allies who charged that foundations were facilitating un-American activities and by Congressman Wright Patman who argued that wealthy foundations were accumulating too much economic and other power (Reference HallHall, 1992).

While foundations avoided unfavorable legislation through much of this period of hostility, the 1969 Tax Reform Act (TRA) established some new constraints on foundations, including requiring a minimum payout of foundation assets; establishing a 4 percent excise tax on net foundation investment income, which was reduced in later legislation; and setting penalties for self-dealing in which foundation board members, members of a foundation donor’s family, or senior foundation staff benefit from transactions with the foundation (Council on Foundations, no date). As noted in Section 2.1, in response to the 1969 TRA the often-maligned foundation community sought to wrap itself more tightly with the more sympathetic other elements of the charitable nonprofit community. This interest in developing a coalition of foundations and other nonprofits helped lead to the formation of Independent Sector whose members include both grant-making foundations and grant-seeking nonprofits (Reference HallHall, 1992).

Like some other associations whose value for networking purposes has been weakened by advances in technology that provide alternatives to in-person conferences as methods for connecting, the Council has had a decline in membership over the last decade, falling from around 1,800 members in the early 2010s to 800–900 members in the early 2020s (Reference Abramson, McCarthy and SalamonAbramson and McCarthy, 2012). Some of the decline is due to the departure of COF members to other infrastructure groups, with, for example, some foundation affinity groups and regional associations of grantmakers affiliating with United Philanthropy Forum, community foundations joining CFLeads, and small foundations becoming members of Exponent Philanthropy.

2.4 Philanthropy Roundtable

The Philanthropy Roundtable (the Roundtable) was established as an independent entity in 1991 and is the voice of conservative foundations and donors, championing the cause of philanthropic freedom, the right of funders to give how, to whom, and to whatever causes they want to support. In 2022, the Roundtable registered $12.3 million in spending on policy and other initiatives funded through contributions from more than 600 member organizations and individuals. The organization’s recent leaders have included long-time president and CEO Adam Meyerson, Elise Westhoff, and since 2023 Christie Herrera.Footnote 8

The Roundtable began in the 1970s as an informal network of conservative grant makers under the auspices of the Institute for Educational Affairs and led by Leslie Lenkowsky.Footnote 9 The Roundtable gained membership in the 1980s when a group of conservative foundations left the COF rather than endorse the Council’s new statement of “Principles and Practices of Effective Grantmaking,” which encouraged foundations to see themselves as having responsibilities to the public and not just as entirely private institutions and included the suggestion that foundations diversify their staff and other decision-makers (Council on Foundations, 1980; Reference FrumkinFrumkin,1998; Reference McDonaldMcDonald, 2021). As the Roundtable’s first executive director put it, “What the council thought of as a more inclusive practice to grantmaking, the Roundtable’s founders considered an intrusion on donors’ independence” (Dennis, no date). Like other sector advocates, the Roundtable has been a collaborator on some efforts – and has been a sought-after partner especially when Republicans have controlled the White House and Congress – and an antagonist on others, with examples of both stances evident in the case study on the TCJA in Section 9.

2.5 United Philanthropy Forum

Somewhat similar to the birthing of the National Council of Nonprofits out of Independent Sector, the United Philanthropy Forum (the Forum or UPF), formerly the Forum of Regional Associations of Grantmakers, separated from the COF in 1998 to become an independent organization. Like the National Council of Nonprofits, the Forum is a “network of networks,” comprising regional associations of grant makers, foundation affinity groups, and other philanthropy-serving organizations, most of which themselves are membership associations. Today, the Forum comprises more than 90 member organizations, such as the Council of Michigan Foundations, Philanthropy Southeast, Grantmakers in Health, and Hispanics in Philanthropy, which, in turn, represent more than 7,000 philanthropic organizations. The Forum’s 2022 expenditures of $4.4 million supported a variety of networking, knowledge-sharing, and advocacy activities. In recent decades, the Forum’s leaders have included Alison Wiley, Ellen Barclay, Michael Litz, and, since 2016, David Biemesderfer.Footnote 10

2.6 Other Major, Sector-Wide Advocates

While interviewees pointed to the Big Five as perhaps the most important sector-wide advocates, they named many other organizations – and coalitions of organizations – as also playing active roles on sector-wide issues in recent decades, especially around the TCJA and COVID as discussed in detail in this Element. As described in Section 8, the Charitable Giving Coalition emerged in 2009 because of dissatisfaction among some sector-wide advocates with Independent Sector’s refusal to oppose the Obama administration’s proposal to cap the charitable tax break for high-income taxpayers. The administration had developed the proposal to reduce the government’s loss in revenue from the tax break in order to devote more funding for health-care reform. However, many nonprofits prioritized preserving the value of the charitable tax break over using potential savings for health-care reform, which they may have believed could be funded from other sources. The Charitable Giving Coalition, which now has almost 150 members, is narrowly focused on preserving – and expanding – the charitable deduction.Footnote 11

Leadership 18 has been another important coalition active in advocating on sector-wide issues. This coalition now convenes twenty-two CEOs of the nation’s largest human service organizations that “seek to share our knowledge and to pursue new approaches that expand our reach and our impact for the common good.”Footnote 12 This group, and some of its individual members – including United Way Worldwide, YMCA of the USA, and Jewish Federations of North America – have been important advocates on many of the issues discussed in this Element, and their contributions are discussed in more detail in subsequent sections of this Element. Other groups and coalitions have been involved more selectively on particular sector-wide issues that especially affect them, with, for example, religious groups engaged – on both sides – in the debate on the Johnson Amendment concerning the right of religious and other nonprofit organizations to engage in electoral activity (see Section 9).

3 Sector-Wide Issues

Nonprofit sector advocates interviewed for this Element, from the organizations described in Section 2 and others, all appreciated the distinction between subsector issues and sector-wide issues. There was an impressive range of issues that they cited as being of the latter type, with these issues falling generally into four broad categories: taxes and fees, regulation, government institutions and procedures, and government spending. Based on our interviews; a review of news articles and organizational documents, such as policy agendas and annual reports on policy activities; and other existing studies (see, e.g., Reference AbramsonAbramson, 2016), we identified the topics listed in Table 1 as major, nonprofit sector-wide, policy issues:

Table 1 Nonprofit, sector-wide policy issues.

| Type of issue, governmental level, and policy issue |

|---|

| Taxes and fees |

| Federal |

| Tax deduction for charitable giving |

| Estate tax |

| Individual retirement account (IRA) tax rollover |

| Unrelated business income tax (UBIT) |

| Private foundation excise tax |

| Incentives for volunteerism |

| State and local |

| Property tax |

| Sales tax |

| Payments and services-in-lieu-of-taxes (PILOTS and SILOTs) |

| Regulation |

| Federal |

| Nonprofit advocacy and election activity (e.g., Johnson Amendment) |

| Nonprofit registration and reporting requirements |

| Employee regulations (e.g., overtime rules, minimum wage) |

| State and local |

| Nonprofit registration and reporting |

| Charitable fundraising |

| Nonprofit advocacy |

| Government institutions and procedures |

| Federal |

| Contracting procedures: Application and reporting requirements, timely payments, overhead allowance |

| Federal office on the nonprofit sector |

| Internal Revenue Service (IRS) funding |

| Electronic filing of IRS forms and public availability of this information |

| Civic participation: Census, redistricting, voter registration, get-out-the-vote |

| State and local |

| Contracting procedures, allowable pay for nonprofit staff |

| State offices on the nonprofit sector |

| Funding for state charity officials |

| Civic participation: Census, redistricting, voter registration, get-out-the-vote |

| Government spending |

| Federal |

| Spending on programs for which nonprofits are grantees, contractors, or otherwise funding beneficiaries (e.g., Paycheck Protection Program (PPP) assistance, postal subsidy) |

| Support for nonprofit capacity building |

| Support for service/volunteer programs (e.g., AmeriCorps) |

| State and local |

| Spending on programs for which nonprofits are grantees, contractors, or otherwise beneficiaries |

To be sure, however, only a handful of the issues listed in Table 1 were consistently cited as important by nearly all our interviewees. These standout issues include tax incentives for charitable giving; regulations regarding nonprofit advocacy, such as the Johnson Amendment which limits nonprofits’ ability to engage in partisan electoral activity; and possible new rules regarding a required minimum payout from donor-advised funds (DAFs), which are funds that donors set up in 501(c)(3) charitable nonprofits, such as community foundations or charitable funds that have been established by Fidelity, Vanguard, and other financial firms. Donors can take a tax deduction when they add funds to a DAF and then advise on the distribution of the funds. For a donor, setting up a DAF is an alternative to creating the donor’s own private foundation. One attraction of a DAF is that currently there is no minimum payment required for a DAF, whereas a private foundation must pay out 5 percent of its assets annually. Donor-advised funds have received increased attention, especially in recent years as the amount of funds held in DAFs has risen, leading some to want to establish a payout requirement to move more funding to nonprofits. These and other issues are discussed in Sections 3.1 and 3.2.

3.1 Federal Issues

3.1.1 Taxes

As noted at the start, the focus of this Element is federal, sector-wide issues, and the federal issue most often cited and which has received the most attention in recent years from advocates, and that gets the most attention in this Element, is charitable giving incentives in the tax code, and especially the promotion and defense of the charitable deduction. As noted in histories of the charitable deduction (Reference Crandall-HollickCrandall-Hollick, 2020; Reference DuquetteDuquette, 2019), the charitable tax break was established in 1917 shortly after the enactment of the modern federal income tax in 1913. The sharp increase in tax rates in 1917 that was needed to help finance US involvement in World War I worried some who feared that wealthy philanthropists would have little money left over after paying their taxes to donate to charities, which would result in additional demands on a cash-strapped, wartime government. The hope was that a new charitable tax break, enacted along with the tax rate increase, would encourage the wealthy to maintain their giving.

The next major war, World War II, prompted the enactment of the Revenue Act of 1942 that added many middle-class Americans to the tax rolls for the first time to help pay for the war. However, the incentive for these new middle-class taxpayers to claim a charitable deduction to reduce their taxes was soon weakened by the Revenue Act of 1944. The 1944 act added the standard deduction to the tax code, in the process reducing the attractiveness of the charitable deduction for many middle-class taxpayers who could save more on their taxes by taking the standard deduction rather than by itemizing their charitable deductions.

The lack of a charitable tax break for many non-itemizing, middle- and low-income Americans was addressed by the Economic Recovery Act of 1981 which enabled non-itemizers to claim a deduction for their charitable giving. However, this non-itemizer tax break was phased out and not renewed in the Tax Reform Act of 1986.

Even more taxpayers became non-itemizers, with no access to the charitable tax break, as a result of the 2017 TCJA that significantly increased the standard deduction (see Section 9). As discussed further in Section 10, especially since the 2017 act, restoring a tax break for charitable giving by non-itemizers has been a major goal for nonprofit leaders.

To be sure, the salience of the charitable deduction issue to our interviewees does not mean it was necessarily the most important one to all sector-wide advocates, but it was the “one thing that people could agree and link arms on,” as one advocate explained (though, as discussed in greater detail later in this Element, such unanimity was not absolute). Besides the charitable deduction, there are a host of other tax-related issues affecting charitable giving that sector-wide advocates are engaged with, including the individual retirement account (IRA) charitable rollover and the estate tax.

There are also tax-related issues that affect nonprofit practice, as opposed to charitable giving, such as the private foundation excise tax as well as issues related to nonprofit data disclosure, such as the recent successful campaign to mandate electronic filing of the Form 990 that nonprofits submit to the Internal Revenue Service (IRS) and the release of this information by the IRS in an open, machine-readable format.Footnote 13

The unrelated business income tax (UBIT) is another tax-related, sector-wide issue that received some attention during the period covered in this Element. The unrelated business income tax requires a nonprofit to pay taxes on revenue that it receives as payment for providing goods or services that are unconnected to its charitable mission. For example, revenue earned by a museum store selling reproductions of art in its collection has been judged as “related” and exempt from taxation because it increases the public’s understanding and appreciation of art. However, revenue received by the same museum store selling souvenirs of the city in which it is located has been found as unrelated to the museum’s art-related mission and subject to UBIT. A nonprofit dedicated to preventing cruelty to animals that receives income from boarding and grooming services for pets of the general public must pay UBIT on this income because it is not related to its mission (Internal Revenue Service, 2021).

The UBIT was enacted in 1950 as concern grew about nonprofits engaging in inappropriate activities unrelated to their charitable mission and providing “unfair competition” to businesses that were engaged in similar activities but who also paid taxes (Reference Arnsberger, Ludlum, Riley and StantonArnsberger, Ludlum, Riley, & Stanton, 2008; Stone, 2005). A well-known example of nonprofit activity that helped lead to the enactment of UBIT was the owning and operating of the C. F. Mueller spaghetti and macaroni manufacturer by New York University. In advocating for the enactment of UBIT legislation, Representative John Dingell warned his colleagues that unless UBIT legislation was passed, “the macaroni monopoly will be in the hands of the universities … Eventually all the noodles produced in this country will be produced by corporations held or created by universities … ” (Reference KnollKnoll, 2007). More recent policy activity related to UBIT is discussed in Section 9.

3.1.2 Regulation

Beyond tax issues, advocates also pay close attention to efforts to reform or regulate nonprofits, especially at the federal level, sometimes to encourage those efforts, other times to oppose them. The possible reform of donor-advised fund payout requirements, for instance, was frequently mentioned as an issue that advocates believed would occupy a considerable amount of time and energy in the near future. Government regulation of nonprofits’ status as employers, including with regard to overtime rules, has also attracted attention.

Next to charitable giving incentives, regulations related to nonprofit advocacy were perhaps the second most frequently cited concern of sector-wide advocates. With this issue, the work of advocates involved not just advocating on those policies to lawmakers, but also educating the nonprofit sector on them. In recent years, this area has been dominated by the struggle to preserve the Johnson Amendment, which prohibits partisan, election-related activity by charitable nonprofits.

The amendment was introduced in 1954 by then Senator Lyndon Johnson who faced a political opponent whose campaign, during the McCarthy era of bitter attacks on suspected communists, was receiving significant funding from two major anti-communist nonprofit advocacy groups (Reference Goldfeder and TerryGoldfeder and Terry, 2017). Enacted without congressional hearings or debate, the Johnson Amendment was originally motivated by a desire by Johnson and other politicians to keep nonprofits out of partisan politics. At the same time, it has also been supported by many nonprofit leaders who prefer to keep politics away from charitable nonprofits (Reference PennaPenna, 2018).

In his acceptance speech at the 2016 Republican National Convention, Donald Trump put repeal of the Johnson Amendment firmly on the political table, citing concern about the amendment’s taking away the free speech rights of religious and other nonprofit leaders. Section 9 picks up the story of the Trump administration’s effort to abolish the Johnson Amendment. According to some infrastructure organization leaders, for many locally based nonprofits, the preservation of the Johnson Amendment was the policy issue that activated the most interest in sector-wide advocacy, surpassing interest in charitable giving incentives.

3.1.3 Government Institutions and Procedures

Sector-wide advocates cited several other areas of work as important, including government contracting reform and efforts to establish a federal office on the nonprofit sector. Policies that would encourage volunteerism were also cited by a few sector-wide advocates, with several mentioning increased interest in the issue, though also noting it had not received nearly as much attention as policies related to charitable giving.

3.1.4 Government Spending

Nonprofit sector-wide advocates also made it clear that some of their sector-wide work involved promoting federal and state spending and budget policies that would benefit the nonprofit sector. And, they also sought to identify how nonprofits fit into and were affected by major pieces of legislation – such as the Affordable Care Act – and to flag concerns regarding unintended negative consequences of such legislation. In other words, sector-wide advocacy is approached not only as a matter of concern with specific policies but as a general form of attention and superintendence over government relations to the sector.

3.2 State and Local Issues

While federal nonprofit sector-wide issues are the focus of this Element, it is helpful to keep in mind that there are also many, critical, sector-wide matters that are decided at the state and local levels. State governments make their own decisions regarding issues that are also of concern at the federal level, including exemption from corporate income tax, tax breaks for charitable giving, nonprofit registration and reporting requirements, advocacy regulations, contracting procedures, and funding available for nonprofits. However, there are also some sector-wide issues that get particular attention at the state level, such as the duties required of nonprofit board members, nonprofit exemption from property and sales taxes, fundraising regulations, and allowable pay for nonprofit staff. Reflecting the significance of state regulations, it is state charity officials, often in state attorneys general offices, that have major responsibility for monitoring and enforcing laws and regulations affecting nonprofits even more than federal IRS staff.

A sector-wide issue in some localities is voluntary payments in lieu of taxes (PILOTs) by nonprofits. With municipalities under increasing fiscal pressure in recent decades, some cash-strapped cities, especially in the Northeast, have sought PILOTs from large, nonprofit hospitals and universities, which are often significant property owners that are not paying property taxes. The argument by these cities is that the nonprofits should reimburse the cities for the nonprofits’ heavy use of city police, sanitation, and other services (Reference Kenyon and LangleyKenyon and Langley, 2010).

Not surprisingly, of course, there is significant variation in how many of these issues play out in different states and localities. While some recent studies have described and analyzed these variations, particularly around regulation of nonprofits (see, e.g., Reference Lott, Shelly and Kunstler GoldmanLott et al., 2019; Reference Lott, Shelly, Dietz and MitchellLott et al., 2023; and Reference MitchellMitchell, 2023), there is a research gap that could usefully be filled by further examination of how nonprofit advocates seek to influence state and local sector-wide issues similar to the way this study is focused on nonprofit advocacy at the federal level.

4 Sector-Wide Advocacy Resources and Tactics

4.1 Advocacy Resources

The number of staff at nonprofit infrastructure organizations or national charities tasked with engaging in sector-wide advocacy as a primary responsibility has never been large, and it fell earlier in the last decade, as infrastructure organizations struggled with financial sustainability or underwent leadership changes.Footnote 14 Independent Sector’s policy staff, for instance, shrank from seven to three full-time positions at the end of December 2016, just as tax reform, one of the most important issues to confront the sector, was preparing to heat up. However, it does seem as if in the last few years several infrastructure groups have experienced modest increases in policy staff with responsibility for sector-wide advocacy. It was only within the last few years, for instance, that United Philanthropy Forum could claim any full-time policy staff. Many of the leading national charities, such as United Way Worldwide, YMCA of the USA, and Jewish Federations of North America, as well as subsector advocacy organizations, such as the Council for Advancement and Support of Education, have designated policy staffers that work on issues related to charitable giving.

Some advocates pointedly mentioned the small proportion of organizational resources devoted to government relations and sector-wide advocacy as a leading explanation for nonprofit advocacy disappointments. But while advocates suggested that additional resources for advocacy would certainly be helpful, they also indicated that infrastructure organizations and national charities could do more with the resources they already have to advance effective sector-wide advocacy.

Advocates also made clear that their resources extended beyond paid staff. On the one hand, several advocates highlighted infrastructure organizations’ increased use of consultants, often former congressional staffers, to take on lobbying responsibilities. To be sure, there was an undercurrent of criticism regarding this practice, because it prevented experience and relationships from developing internally within organizations and because there was some suspicion of consultants’ mixed agendas, based on their assortment of clients. But more positively, sector advocates pointed out that infrastructure organizations and national charities with federated networks could also rely on their members’ capacities and resources to undertake sector-wide advocacy. Since few of these locally based organizations have designated policy staff that focus on nonprofit sector-wide advocacy, their attention to sector-wide issues is variable. However, because of the large number of local organizations in federated networks, when engaged they can have a significant impact.

4.2 Advocacy Tactics

Nonprofit sector-wide advocates have adopted a wide range of approaches to their advocacy work. The most obvious of these is direct lobbying, whether targeting members of Congress and their staff, staff and leadership of executive branch offices and agencies, or state officials. But this lobbying often comes at the tail end of a much longer process of outreach, both on Capitol Hill and at the district level, to build relationships and educate lawmakers and their staff. This educative role is a key, if underappreciated, function of sector-wide advocacy, especially given the lack of familiarity of many members of Congress with the workings of nonprofits. Advocates frequently expressed surprise about the lack of sophistication of members of Congress and their staff when they discussed nonprofits. “I’ve sat in offices where people say, ‘What do you mean people get paid in your sector? I thought it was the voluntary sector,’” one advocate recounted. Advocates also stressed that their engagement with lawmakers and regulators did not end once a law was passed; they needed to closely follow policy implementation, especially given the lack of familiarity with nonprofits among those they lobbied, although sector advocates also acknowledged that this dimension of their work had sometimes been neglected.

Sector advocates also directed much of their work back toward the nonprofit community, to educate nonprofits on major issues affecting the sector and to cultivate community leaders to serve as advocates. Sector-wide advocates appreciated that nonprofits, both large and small, had different attitudes with respect to their involvement in these sector-wide issues; some followed them closely while others delegated that responsibility entirely to infrastructure organizations or national advocacy organizations, relying on their attention and guidance to alert them when it was necessary to become active. As one advocate noted, “We’re actually really good at getting people at a community level riled up.”

Infrastructure organizations trained member organizations in sector-wide advocacy methods, providing them with materials, helping to craft messaging and to build advocacy capacity, and coordinating them in national campaigns. They also had to push past two main challenges to grassroots activation: the lack of interest that some nonprofits had for sector-wide issues and confusion regarding the rules that might limit their participation in advocacy and lobbying.Footnote 15 Sector-wide advocates had to convince nonprofits of the importance of sector-wide issues and of nonprofits’ right to advocate for them. But the education and guidance did not flow merely in one direction. Member organizations also reported back to national infrastructure organizations, helping to instruct them on the issues that were the highest priority to communities across the country and to hone their own messaging.

Finally, another advocacy role that some national infrastructure organizations have assumed is to oversee the research landscape as it relates to nonprofit policy change. This can involve commissioning new studies and disseminating new and existing data and research to help with sector-wide advocacy.

5 Effective Nonprofit Sector Advocacy: Grasstops Strategy

With striking and uncharacteristic unanimity, two related focus points emerged from discussions with both advocates and congressional staff regarding the most effective approach to nonprofit sector-wide advocacy. While abstract talk of civil society might impress some, more effective by far was demonstrating to policymakers the concrete good nonprofits do, especially how nonprofits benefit local communities. This includes the good that nonprofits do as employers, which has been a focus of nonprofit advocates of late, although there was some disagreement about how much it resonated on Capitol Hill.

The corollary to this, as it relates to charitable giving, was that political leaders care most about getting money into the coffers of these organizations. So, in debates about tax policy, advocates stressed the importance of shifting conversations from donor-centric preoccupations to discussions of how giving helps organizations on the ground, doing vital work within communities. The only caveat here was some uncertainty as to the significance Congress placed on charitable giving as a civic entitlement, that should be enjoyed by as many individuals as possible, with a value distinct from – if not unrelated to – the instrumental good it does in communities.

Given the consensus on the need to communicate to political leaders the good that nonprofits do in communities across the country and, in particular, in the districts or regions that politicians represent or have close relationships with, advocates also agreed on a particular tactic to accomplish this: a grasstops strategy, in which leaders of local nonprofits, who might already have preexisting relationships with the politician or member of Congress in question and who might also already be contributing to their campaign, or might in the future, make the case on sector-wide issues. “When you’ve got local board members and respected leaders of the community who are well versed and tuned in to the right talking points … that is, without a doubt, the single most important ingredient to success for nonprofits,” explained one senior nonprofit advocate. Another claimed, “if it’s a CEO of a local United Way, we have a pretty good shot of getting a member-level meeting in the district and a decent shot of getting a member-level meeting in Washington, DC.” Community foundations were also cited as a useful ally in these communications, since their leaders often had close relations with lawmakers in their region. A few congressional staff also mentioned the sway that celebrities, like Bill Gates or the late Paul Newman, could hold if they took on issues related to nonprofits or charitable giving. In these assessments, the assumption was that sector-wide or national organizations could help facilitate these relationships and communications, but that their representatives and leaders would have much less sway with congressional members than local nonprofit leaders.

Given the consensus on the power of the grasstops strategy, it is somewhat surprising that several advocates acknowledged that until relatively recently, it had not received a great deal of investment from infrastructure organizations. Even during the peak of the lobbying campaign on the TCJA, one infrastructure staffer reported that the organization did not have adequate records of local nonprofit leaders who had existing relationships with members of Congress. Based on the resources that had previously been dedicated to this work, especially compared to the attention it receives from other industry interest groups, one advocate admitted that an observer would have to conclude that the nonprofit sector simply didn’t prioritize government relations.

If that was true in the past, nearly all advocates believed it was no longer the case. They agreed that this sort of relationship mapping, involving the development and maintenance of comprehensive records of contacts, allies, and local champions in districts represented by key legislators, was an urgent task. It involves both the collection and collation of information by infrastructure organizations and advocacy coalitions to identify current local champions, but also the proactive recruitment of local nonprofit leaders to fill in gaps in relationships with key lawmakers.

In contrast to interviewees’ emphasis on the importance of grasstops advocacy on sector-wide issues, there was little mention of grassroots activities involving the mobilization of ordinary citizens in sector-wide advocacy campaigns. Neither the Big Five nor other sector-wide advocacy organizations were especially equipped to do grassroots advocacy, and there were few signs of this kind of advocacy on the issues discussed in this Element, with advocacy around the Johnson Amendment being a bit of an exception with the engagement of some community members around the country beyond grasstops leaders (see Section 9). It may be that most sector-wide tax and regulatory issues are just not the kinds of issues that can ignite the interest of ordinary citizens or even of nonprofit clients who seem more likely to mobilize around particular government programs that touch them than broad, sector-wide issues whose impact on their lives is much less clear. While sector-wide advocates could undoubtedly benefit from increased grassroots advocacy, there are important challenges to expanding this approach, as described in Section 14.2. However, the importance of advocacy by local constituents to their elected representatives, whether the locals are grasstops or grassroots, is not in dispute.

6 Two Conceptions of Sector-Wide Advocacy: Special versus Public Interest

In surveying sector-wide advocacy over the last decade, two distinct conceptions of the sector as a sector emerge. In one, the nonprofit sector approaches policymakers as an interest group or trade association, much like a business association representing the banking, trucking, or hospitality industry. In this understanding, nonprofit sector-wide advocacy focuses on the promotion of the particular institutional interests of the sector’s constituents, whether official members of sector-wide advocacy organizations or not.

In the alternative conception, sector-wide advocacy focuses not merely on institutional interests but on the good of civil society, broadly conceived. To the extent that it is oriented primarily, as opposed to indirectly, toward the public good, nonprofit sector-wide advocacy in this version is fundamentally different from and self-consciously contrasts itself with the advocacy associated with business-based sectors.Footnote 16

The relationship between these two models has shaped how nonprofit leaders approach sector-wide advocacy. Some advocates have insisted that the sector’s distinctiveness compared with conventional interest groups is its greatest asset, one which must be preserved at all costs. Adherents of this view think that it is precisely because many of those being lobbied believed nonprofits did not simply pursue their narrow institutional interests, but were stewards of the common good, that they would be receptive to sector-wide advocacy. And to the extent that nonprofit sector-wide advocates modeled the tactics and messaging of trade association lobbyists, they threatened to undermine policymakers’ faith in that distinctiveness which, they conceded, might also be simultaneously eroding for other reasons, such as high-profile scandals or nonprofits’ embrace of business practices and for-profit modes of thinking. One nonprofit advocate even warned against infrastructure organizations placing ads in newspapers promoting the sector, since that move smacked too much of conventional interest-group lobbying. “It’s always important to maintain your nonprofitness,” the advocate instructed.

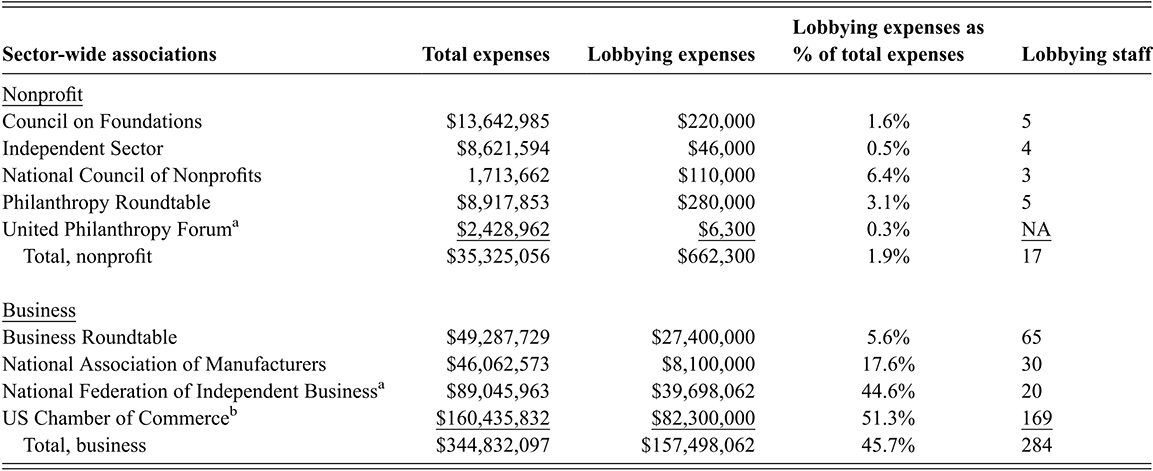

Other advocates framed the acknowledgment of nonprofit sector distinctiveness around a recognition of the sector’s limits, as opposed to its strengths. They argued that because nonprofit sector advocates lacked the financial resources available to major trade associations that represented business and commercial industries – the US Chamber of Commerce and its subsidiaries spent nearly $95 million on lobbying in 2018, for instance – attempting to compete on these grounds places nonprofits at a natural disadvantage.Footnote 17

Yet, while few advocates deny the potential utility of the idea of nonprofit distinctiveness, some take the opposite perspective and highlight the dangers of an overzealous commitment to it. It can, they point out, lead nonprofits to shy away from certain activities – such as lobbying on policies that affect their fundamental interests – deemed a violation of that identity. One advocate stressed that, even more significant than a differential of financial resources available to nonprofit and for-profit advocates, was a differential of “political will”; it was largely the unwillingness of nonprofit advocates to engage in politics that led to the lack of financial resources at their disposal.

Another critique of the emphasis on nonprofit distinctiveness was that it potentially blinded advocates to the ways in which they often did, in fact, operate much like traditional industry lobbyists. As one advocate commented, the funding model of infrastructure organizations, heavily reliant upon dues from members, encouraged those groups to justify the payments by delivering narrow, institutional “victories” for them. Furthermore, as several congressional staff pointed out, when advocates visited congressional offices with specific policies they wished to discuss – a universal charitable deduction or a revision of the private foundation excise tax, for instance – they were often assumed to be operating very much like lobbyists for other industries. By clinging too firmly to the pose of distinctiveness and institutional disinterestedness, advocates could become oblivious to the reality of how they were perceived, leaving them unprepared for reformist or regulatory attention. As one former congressional staffer noted, unlike some other sectors under congressional scrutiny, “[Nonprofit advocates] never really fully accepted that the message of ‘we are special people, you cannot touch us’ was going to fall flat.”

Ultimately, most advocates believed that the choice between a trade association and a public interest mandate was not mutually exclusive and that it was possible to construct some amalgam of the two. Yet, at certain points, a stark contrast between them was posited, and advocates were compelled to make a choice. This was especially the case with respect to recent debates over proposals for the sector to establish a 501(c)(4) organization or a political action committee (PAC) to support sector-wide advocacy that could raise money and, according to the laws and regulations that govern these organizations, engage more directly in electoral politics and more heavily in lobbying activity.Footnote 18

For some, if nonprofit sector advocates compete as one interest group among many, they do so at a considerable disadvantage because they lack the apparatus to direct financial resources to politicians favorable to their interests or to withhold financial support from those unfavorable. “Unless the sector develops the muscle to help or hurt candidates who back or oppose the things we want, then functioning as an interest group in that way is going to be minimally effective,” one advocate explained. Supporters of establishing a 501(c)(4) nonprofit or PAC with the mission of advocating on sector-wide issues believe that there are enough wealthy individuals closely associated with nonprofits, as board members, for instance, to adequately fund a c4 or PAC to compete with those created by business associations. Some pointed to the 501(c)(4) recently set up by Americans for the Arts as an example.Footnote 19

Not surprisingly, most of the advocates who believed nonprofit distinctiveness was a key asset considered developing a c4 or a PAC to be ultimately counter-productive, a squandering of the sector’s reputational resources. “Charities are the good guys, so if we start acting like we’re the muscle then we’re just becoming another trade association,” explained one advocacy leader. Another insisted that nonprofits had to remain “David” to other interest groups’ “Goliath.” Others pointed out the challenge of determining which candidates to back, especially with a broadly conceived understanding of the sector’s mission to advance the public good, since there is no obvious, single, litmus test to apply. Should, for instance, a candidate who supports the universal charitable deduction, but opposes increased federal funding to the arts, or progressive taxation, receive a nonprofit PAC’s support?

At this point, there seems to be little momentum behind the creation of a 501(c)(4) organization or PAC to conduct nonprofit sector-wide advocacy. But it remains a topic of discussion, a flashpoint for deeper debates over the nature of nonprofit sector identity.

7 Challenges: Cultivating Champions and Navigating Partisanship

Nonprofit sector-wide advocates largely believed that they could expect the general goodwill of political figures; no member of Congress would openly express hostility to nonprofits in general or deny the importance of civil society to the health of American society. But advocates frequently differentiated that vague and insubstantial support to a more vigorous championing of the sector. As one explained, “Everybody loves us, but nobody wants to marry us.” Another commented, “When push comes to shove, we don’t have people who are going to go to the mat for us.” Ultimately, according to one former, senior congressional staffer, support “was plywood thin … I don’t know that there is anybody that I would think of that [nonprofits and charitable giving] was the first thing that they cared about.”

One of the main objectives of sector-wide advocates was to cultivate such figures in places of political power to encourage the creation of nonprofit champions. These were figures who would introduce bills promoting the interests of nonprofits and of charitable giving and convince others to do so as well. Champions were also willing to spend money on charities; otherwise, nonprofit advocates were compelled to pursue only revenue-neutral policies.

Advocates made clear that they hoped to recruit champions from either party; even as they tailored their arguments to Republicans – nonprofits as substitutes for government, or an emphasis on faith-based charities – or Democrats – nonprofits as instruments of equity – the nonprofit sector’s nonpartisan and trans-ideological appeal was a central element of nonprofit sector-wide advocacy messaging.

Yet over the last decade, that idea of charity’s nonpartisan appeal has had to confront the reality of surging partisanship and polarization. Several former congressional staffers mentioned suspicions that most leaders of nonprofits had Democratic leanings; one mentioned recently attending an annual meeting of one of the national infrastructure groups in which a speaker referred to “us” when speaking about Democrats potentially winning an upcoming election, a reflection of an unthinking assumption about the political allegiances of those in attendance.

Some sector advocates did acknowledge the dangers of the perception of being aligned with one party over the other, but most maintained that they continue to have strong relationships with both. Some even suggested that they were receiving more support from Republicans, dismissing the idea that Democrats were the sector’s natural allies. They did, however, largely recognize partisanship as a force that increasingly complicated their advocacy work, introducing additional pressures on lawmakers and political officials that at times ran counter to the pressures advocates sought to apply.

8 The Fracturing of Advocacy Infrastructure and the Growth of Issue-Based Coalitions

One especially effective advocacy tactic that national infrastructure organizations have adopted in the past, and which was cited by several of the advocates consulted, was the position of being able to claim to represent broad swaths of civil society. When the sector spoke – or seemed to speak – in one voice through a lead advocate or organization united behind a particular policy position, Congress was more inclined to listen to what the sector had to say. When the sector spoke in a fractured voice, when there wasn’t clear unanimity around policies or positions, sector advocates cautioned, policymakers were reluctant to throw their support behind any of them.

Yet, advocates also appreciated how difficult it was to sustain this consensus, especially given the vast range of organizations and institutions subsumed within the nonprofit sector and the priority the sector placed on pluralism. In the final decades of the twentieth century and in the early years of the twenty-first, various developments have amplified the sector’s intrinsic fractiousness, unleashing centrifugal forces that fragmented a more centralized model of advocacy leadership exercised by the established infrastructure organizations into disparate issue-based coalitions and numerous subsector interest groups. This dynamic has amplified the perceived tension between the functions of sector-wide advocacy: defending the specific interests of nonprofit institutions and promoting the interests of civil society more generally.

Several of the advocates interviewed invoked the memory of Bob Smucker, Independent Sector’s vice president for government relations during its first decades, in the 1980s and ‘90s, who expertly wrangled various member organizations into consensus, as an illustration of a since diminished model of strong, centralized, sector-wide advocacy. Yet the high-water mark for this model in recent decades likely occurred in the run-up to the Pension Protection Act (PPA) of 2006.Footnote 20 When Senators Chuck Grassley (R-Iowa) and Max Baucus (D-Montana) sought to craft legislation to reform the nonprofit sector, they worked closely with Diana Aviv, then president and CEO of Independent Sector. They requested Aviv, in part because of Aviv’s own suggestion and consultation with Finance Committee staff, to form a panel of nonprofit leaders to recommend proposals, both with respect to legislation and sector self-regulation, “to assist our legislative efforts to improve oversight and governance of charitable organizations.” They felt comfortable doing so because such a panel, under Aviv’s leadership, could be credibly said to “represent” the sector. Aviv ultimately put together a twenty-four-member panel. The question of whether that representation led to results, in the package of reforms contained in the PPA, that were better for the sector than what would have been imposed on it without the panel, is an open one. So too is the question of how faithful that representation was; some organizations worried that their positions were not given adequate voice. In any case, the centralized model was always a somewhat unstable one (Reference WolvertonWolverton, 2004).

The first major cracks in that model appeared around the proposal advanced by the Obama Administration in early 2009 to limit the tax break high-income taxpayers could receive for their itemized deductions, including the charitable deduction, at 28 percent (from 35 percent), and to use the savings to the Treasury to help create a $634-billion reserve fund to improve the health-care system (Perry, April 9, Reference Perry2009d). Nonprofit leaders expressed a range of views on Obama’s proposal. Some supported it out of a general desire to back the new Democratic president, and in response to pressure from the administration, and a belief that a limit on charitable deductions was a worthy price to pay for an improved health-care system, whose benefits would be enjoyed by many nonprofit organizations. In this view, health-care reform was in the public’s interest, which was the interest nonprofits were ultimately tasked with promoting; to stand in the way of the proposal was to succumb to the impulses of a sectoral “interest group mentality.” In contrast, other nonprofit leaders, including those from the United Way, the American Civil Liberties Union, and the heads of several fundraising professional associations, worried that the costs to charitable giving, and thus to nonprofit finances, would be too great (Reference Perry and PrestonPerry and Preston, 2009).

Many of the major national charities that opposed the Obama proposal grew concerned that the leading infrastructure groups were not defending the charitable deduction vigorously enough. They worried, in a sense, that in endorsing a model of advocacy that promoted the public good, the infrastructure groups would neglect the promotion of a more proximate good, nonprofits’ institutional interests. The COF had come out against the proposal, but Independent Sector had maintained a noncommittal position, with Aviv calling the proposal a Solomon’s Choice and refusing to publicly oppose it (Perry, March 11, Reference Perry2009a and March 27, Reference Perry2009b).

It was out of frustration with that decision that the policy staff at several leading national charitable and fundraising organizations established the “Charitable Giving Coalition.” The Coalition has no formal structure or designated staff; it relies on the advocacy resources of its member organizations, mostly large national charities. What it does have is a singular focus on the preservation of the charitable deduction. It has maintained that focus, helping to coordinate opposition to the capping of the charitable deduction as it reappeared in various legislative proposals over the next decade. While more research is needed to determine precisely how much credit the Coalition can take for scuttling the deduction limit, its members argue that it played a significant role in building opposition to the proposal on the Hill.

It is important to note that the genesis of the Charitable Giving Coalition was rooted in a defensive action; the defense of the charitable deduction could draw nonprofits into a shared advocacy campaign, without the emergence of a clear consensus around an affirmative or proactive program for supporting charitable giving. This defense of the deduction became one of the strongest bonding forces within sector-wide advocacy – though some claim its dominance has eclipsed other policies that were equally worthy of attention.

Initially, the Charitable Giving Coalition was formed as an alternative to IS, but after a number of years, as it became clear that policies promoting a cap on the charitable deduction would be a perennial challenge that the sector would need to regularly confront, IS joined the Giving Coalition and became an active member within it, as did the COF and the other national infrastructure groups.Footnote 21 Yet, according to several sector-wide advocates interviewed, the emergence of the Coalition did seem to reflect a downgrading in IS’s prioritization of “interest group” sector-wide advocacy; it was still committed to that role, but not as its primary responsibility. Some traced this shift to Dan Cardinali replacing Aviv as president and CEO of IS in 2016; facing significant budget constraints, Cardinali reduced the number of policy staff soon after assuming the position (Reference KoenigKoenig, 2016). This left an advocacy “void” or a “vacuum,” these advocates explained, that the Charitable Giving Coalition, as well as other advocacy organizations, such as the National Council of Nonprofits, moved into, to take more leadership in direct, “interest group” advocacy around sector-wide issues.

This development represented a trade-off; interest-group sector-wide advocacy would lack the centralizing, unifying pole that a single, established infrastructure organization could provide and which could be key in developing a proactive reform agenda, or in managing the give-and-take between different preferred policies or interests within the sector – accepted under the directives of the common good. The weakening of centralizing forces within sector-wide advocacy could potentially contribute to policymakers’ sense of the sector as fractured, which might in turn undermine the sector’s influence. On the other hand, the weakening of those bonds freed up ad hoc and informal, issue-based coalitions to assume a greater degree of responsibility for sector-wide advocacy; they could likely do so with greater focus and agility for the particular interests and policies they sought to promote and defend than could an established infrastructure organization. Correspondingly, that dynamic could also free up established infrastructure organizations to assume novel forms of sector-wide leadership and advocacy that attended more directly to the relationship between civil society and the public good.

Over the next decade, the centrifugal forces continued to shape nonprofit sector-wide advocacy, as several other of these issue-based coalitions emerged, seeding a multipolar, advocacy landscape. Under the leadership of Adam Meyerson, the Philanthropy Roundtable began to engage more intensely with sector-wide advocacy, creating the Alliance for Charitable Reform (ACR) in 2005, in response to the push for nonprofit and charitable reform that led to the PPA.Footnote 22 The Roundtable and ACR are especially committed to the defense of donor prerogatives, privacy, and freedom from regulation and have developed strong connections to conservatives and Republican officials. More recently, Jeff Hammond, a former staffer in the office of Sen. Chuck Schumer (D-New York), began to represent private and especially community foundations on the Hill, assuming the position of a more traditional trade lobbyist, crafting a distinct advocacy position for community foundations. The rise of DAFs, which increasingly became a target for reformers and which provide significant funding for many community foundations, helped to precipitate this turn to trade association representation, reflecting concerns about the vulnerability of institutional interests which called out for active, targeted defending.

In the wake of the conflict over Obama’s proposal to cap the charitable deduction, Leadership 18, which had been established earlier in the decade as an executive learning community made up of the head of United Way and the CEOs of many of the national social service nonprofits it funded, decided to take on an increased advocacy role on sector-wide issues as well.Footnote 23 Much like the Charitable Giving Coalition, with which it shared several key member organizations, Leadership 18 CEOs’ ultimate turn to public advocacy stemmed from a belief that their institutional interests were not being adequately championed by the existing infrastructure organizations. As its name attests, the group initially had eighteen members; it now has several more. The CEO of United Way Worldwide serves as its standing vice chair with the chair rotating among the other members.

A brief lull in major legislative action involving charitable giving after the initial clash over Obama’s proposal obscured the full significance of the fracturing of sector-wide advocacy. But as legislative action picked back up – especially with the 2014 tax reform draft bill proposed by Representative David Camp (R-Michigan), which contained several provisions related to nonprofits and charitable giving – the new advocacy paradigm, dominated by informal, single-issue coalitions and the pursuit of particularistic interests, began to emerge more powerfully. Its benefits and flaws could be more clearly identified. Defenders saw it as consistent with the pluralism and diversity that was the strength of the sector. Given that reality, efforts to maintain too tight a hold through centralizing institutions will always be volatile, and consensus will always be difficult to sustain. Some organizations rely on charitable donations, others on government contracts, while others place more value on encouraging volunteering. Ad hoc, informal coalitions, operating outside the bounds of the established infrastructure organizations and built around particular issues, would attract and make the most effective use of those organizations for whom the issues were critical, allowing others to participate more variably – or not at all.

But some sector-wide advocates did acknowledge that such a structure came with a cost. A more fragmented model of advocacy could potentially erode a shared sense of sector-wide identity that was an important sector-wide asset and that fed some of the narratives behind key messaging. Even if issue-based coalitions were effective in defensive campaigns, beating back reforms that might damage certain institutional interests, how effective were they in crafting a “unifying narrative,” one advocate asked, about the centrality of civil society in American life? They could tell many little stories well, but perhaps not one convincing, big story. Several congressional staff interviewed noted this danger, warning that the nonprofit sector had gained a reputation for disunity, which undermined its clout. Could more centrifugal forces be counterbalanced by centripetal ones, rooted in the more established infrastructure organizations, that considered the health and well-being of civil society in its broader configurations?

Further, it’s worth asking the extent to which these more informal coalitions should be considered sector infrastructure. Would investments in them – of time and attention, if not necessarily of financial resources – result in a durable, long-term presence?

9 Tax Cuts and Jobs Act: A Case Study

Nearly all the dynamics that nonprofit advocates and congressional staff identified as key to understanding the development of sector-wide advocacy appeared in vivid relief during the lobbying and advocacy around the passage of the TCJA. Congress passed and President Trump signed the TCJA in December 2017. It was the largest rewrite of the United States tax code in over thirty years and included broad changes to the individual and corporate tax rules, most significantly a permanent reduction of the corporate tax rate. It also contains several provisions with significant impact on nonprofits and charitable giving. It was, not surprisingly, the object of intense lobbying by the business sector and specific subsectors of it – combined, the Chamber of Commerce, the Business Roundtable, and the National Association of Realtors spent more than $56 million on lobbying in the final quarter of 2017 – as well as by nonprofit advocacy organizations (Reference Vogel and TankersleyVogel and Tankersley, 2017; Reference Gale, Gelfond, Krupkin, Mazur and ToderGale et al., 2018; Reference BrodyBrody, 2018).

Generally speaking, business lobbyists considered the TCJA a victory. This should not be especially surprising; the Center for Public Integrity identified sixty-three “major changes to the business tax code” in the bill, the vast majority favorable to business interests (Reference Cary and HolmesCary and Holmes, 2019). It represented a vindication in many respects of the vast apparatus of business-sector lobbying. But for many nonprofit advocates, it represented a significant disappointment and a sign of the sector’s lack of clout. One former sector-wide advocate summed up the results of the sector’s lobbying for the bill as “an unquestionable loss.” Another admitted the nonprofit sector “got crushed.” More specifically, looking back on the TCJA lobbying melee, some sector-wide advocates identified evidence of both the benefits and drawbacks of the sector’s more fragmented, less cohesive model of advocacy. In this respect, the experience provided an education that would help set the sector up for more success during the COVID-19 crisis.

But there are two reasons why the TCJA offers an imperfect case study to gauge the effectiveness of nonprofit sector-wide advocacy. First, nearly all those interviewed for this Element remarked on what they believed to be the inevitability of the bill’s passage and the intractability of several of its provisions that would likely have the most negative impact on the nonprofit sector. “When a bill is being written by just a few people and there’s really nobody that can stop it, I don’t want to beat myself up too much” for its passage, commented one advocate. “The Republicans were going to pass tax reform and anyone who got in their way was going to be steamrolled,” another remarked. “And there wasn’t a damn thing any of us could do.”

Second, a large part of the damage the TCJA did to charitable giving, and the reason for much of the advocacy community’s sense of demoralization, was indirect, through the near doubling of the standard deduction; the charitable sector, as one former congressional staffer explained, took on “unintended collateral damage” from that policy shift. “We have spent an enormous amount of time up on the Hill, and we get back the talking point, ‘Oh, don’t worry – we’ll preserve the charitable deduction.’ That makes it seem like many lawmakers don’t understand, themselves, what the ramifications of this legislation are,” Steven Taylor, senior vice president at United Way Worldwide, explained to the Washington Post in October 2017 (Reference JohnsonJohnson, 2017).Footnote 24