Book contents

- Frontmatter

- Contents

- List of Tables, Figures, and Charts

- List of Cases

- Preface to the Revised Edition

- Value Added Tax

- 1 SURVEY OF TAXES ON CONSUMPTION AND INCOME, AND INTRODUCTION TO VALUE ADDED TAX

- 2 FORMS OF CONSUMPTION-BASED TAXES AND ALTERING THE TAX BASE

- 3 VARIETIES OF VAT IN USE

- 4 REGISTRATION, TAXPAYER, AND TAXABLE BUSINESS ACTIVITY

- 5 TAXABLE SUPPLIES OF GOODS AND SERVICES, AND TAX INVOICES

- 6 THE TAX CREDIT MECHANISM

- 7 INTRODUCTION TO CROSS-BORDER ASPECTS OF VAT

- 8 TIMING, TRANSITION AND VALUATION RULES

- 9 ZERO RATING AND EXEMPTIONS AND GOVERNMENT ENTITIES AND NONPROFIT ORGANIZATIONS

- 10 GAMBLING AND FINANCIAL SERVICES (OTHER THAN INSURANCE)

- 11 INSURANCE

- 12 INTERJURISDICTIONAL ASPECTS OF VAT IN FEDERAL COUNTRIES AND COMMON MARKETS

- 13 REAL PROPERTY

- 14 PROPOSALS FOR U.S. TAX ON CONSUMPTION

- APPENDIXES

- Index

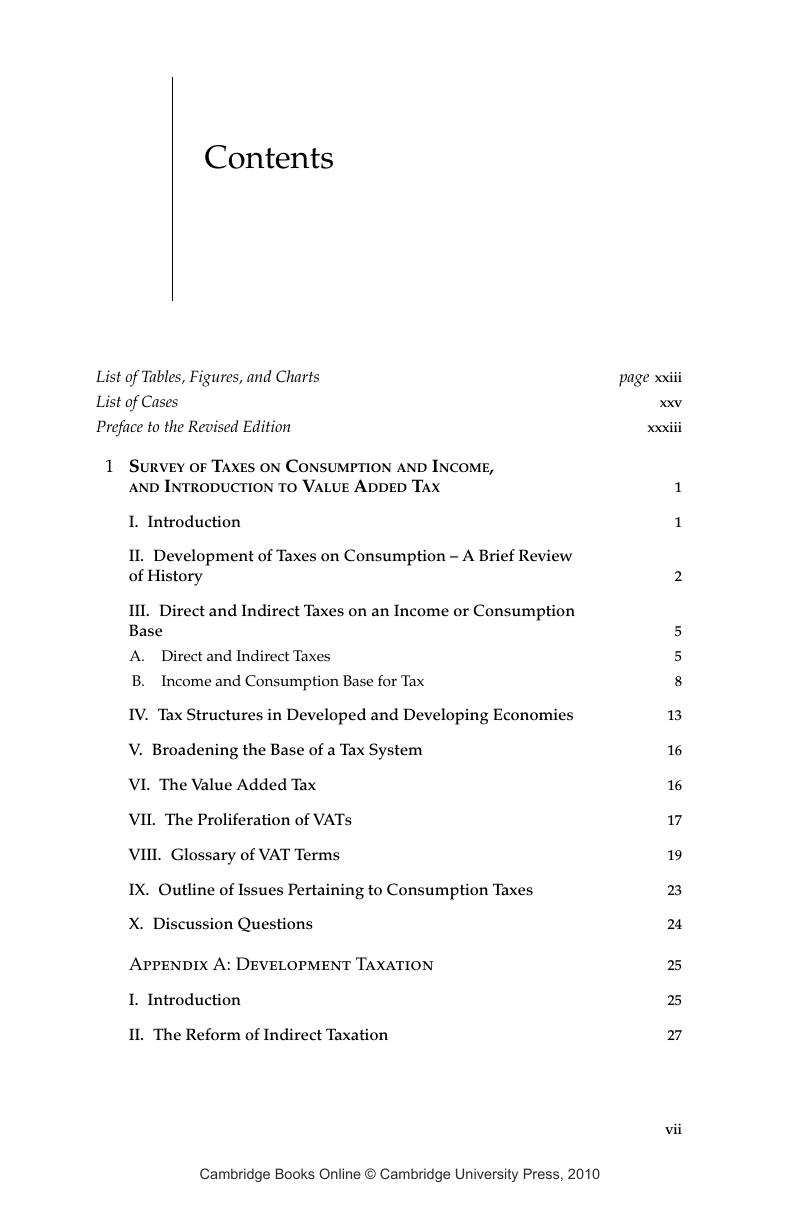

Contents

Published online by Cambridge University Press: 06 January 2010

- Frontmatter

- Contents

- List of Tables, Figures, and Charts

- List of Cases

- Preface to the Revised Edition

- Value Added Tax

- 1 SURVEY OF TAXES ON CONSUMPTION AND INCOME, AND INTRODUCTION TO VALUE ADDED TAX

- 2 FORMS OF CONSUMPTION-BASED TAXES AND ALTERING THE TAX BASE

- 3 VARIETIES OF VAT IN USE

- 4 REGISTRATION, TAXPAYER, AND TAXABLE BUSINESS ACTIVITY

- 5 TAXABLE SUPPLIES OF GOODS AND SERVICES, AND TAX INVOICES

- 6 THE TAX CREDIT MECHANISM

- 7 INTRODUCTION TO CROSS-BORDER ASPECTS OF VAT

- 8 TIMING, TRANSITION AND VALUATION RULES

- 9 ZERO RATING AND EXEMPTIONS AND GOVERNMENT ENTITIES AND NONPROFIT ORGANIZATIONS

- 10 GAMBLING AND FINANCIAL SERVICES (OTHER THAN INSURANCE)

- 11 INSURANCE

- 12 INTERJURISDICTIONAL ASPECTS OF VAT IN FEDERAL COUNTRIES AND COMMON MARKETS

- 13 REAL PROPERTY

- 14 PROPOSALS FOR U.S. TAX ON CONSUMPTION

- APPENDIXES

- Index

Summary

- Type

- Chapter

- Information

- Value Added TaxA Comparative Approach, pp. vii - xxiiPublisher: Cambridge University PressPrint publication year: 2007