In this scheme, it is Latin America’s position to act as part of the periphery of the world economic system, in the specific role of producing food and raw materials for the large industrial centers.Footnote 1

Every state has an unlimited right to dispose of its resources as it sees fit.Footnote 2

When George Kennan visited Venezuela in February 1950, neither “dollar-rich” Caracas nor the Venezuelan model of sovereignty impressed him. “Here was a tropical country in the subsoil of which reposed great quantities of a liquid essential to the present stage of industrialization,” he wrote in his journal. Venezuelan control over that liquid rubbed him the wrong way. The price Western oil companies paid into “the coffers of the Venezuelan government” was no more than “ransom to the theory of state sovereignty.” It was ransom, he said, because Venezuelans “had not lifted a finger to create this wealth, would have been incapable of developing it, and did not require it for its own needs.” The cold warrior also made due note of the “Communist-dominated labor unions who control the workers in the oil fields,” but upon his return to Washington his written report emphasized less the threat of communism than the need for the United States to protect inexpensive access to “our” raw materials.Footnote 3

Kennan already had begun to disengage from the Cold War, but his critique of Venezuela’s application of state sovereignty to oil production was wrapped up in a related consensus. In that calculus, Western European and American planners defined what Venezuelans and other Latin Americans considered their inalienable right as a potential threat to US economic productivity, which was the key material and ideological weapon in the containment of communism. The passage of the US Defense Production Act the same year made global oil supply an official consideration of national security. In the following decades officials persistently invoked the link between oil consumption and the greater well-being of the “Free World.” That connection reflected and shaped an international economy in which raw material producers and industrial nations had specific roles.Footnote 4

The belief in the need to control the supply of raw materials applied especially to oil, historian and State Department adviser Herbert Feis wrote in 1946: “Enough oil within our certain grasp seemed ardently necessary to greatness and independence in the twentieth century.” That year planners projected that Western Europe would be importing 80 percent of its oil from the Middle East by 1951. The prediction was nearly correct; the NATO countries obtained about 75 percent of their oil from the Persian Gulf by 1953. The United States, its allies, and multinational corporations had arrived, in the decades since World War I, at a structure to secure that flow. Through a fine-spun series of cartel arrangements, five American companies – Socony-Vacuum (later Mobil), Standard Oil of California (Chevron), Standard Oil of New Jersey (Exxon), the Texas Company (Texaco), and Gulf – along with the British-owned Anglo-Iranian Oil Company (later British Petroleum), and Royal Dutch/Shell controlled over 90 percent of oil reserves outside of the United States, Mexico, and the Communist countries. The same companies, known as the Seven Sisters, accounted for nearly 90 percent of world oil production, owned almost 75 percent of world oil-refining capacity, and provided about 90 percent of the oil traded in international markets.Footnote 5

Economists, journalists, and policymakers in the West widely echoed Kennan’s position in explaining the economic and national security benefits of this structure, as well as the threat of nationalism to it. For Kennan, the ominous doctrine of state sovereignty had other repugnant repercussions. He even blamed that set of political beliefs for what he perceived as a loss of traditional culture. Oil wealth had turned Venezuela into a modern-day Goldsmith’s Deserted Village, a place where “the prolonged enjoyment of unearned income” and “delusions of popular nationalism” decayed culture and debauched the citizenry.Footnote 6

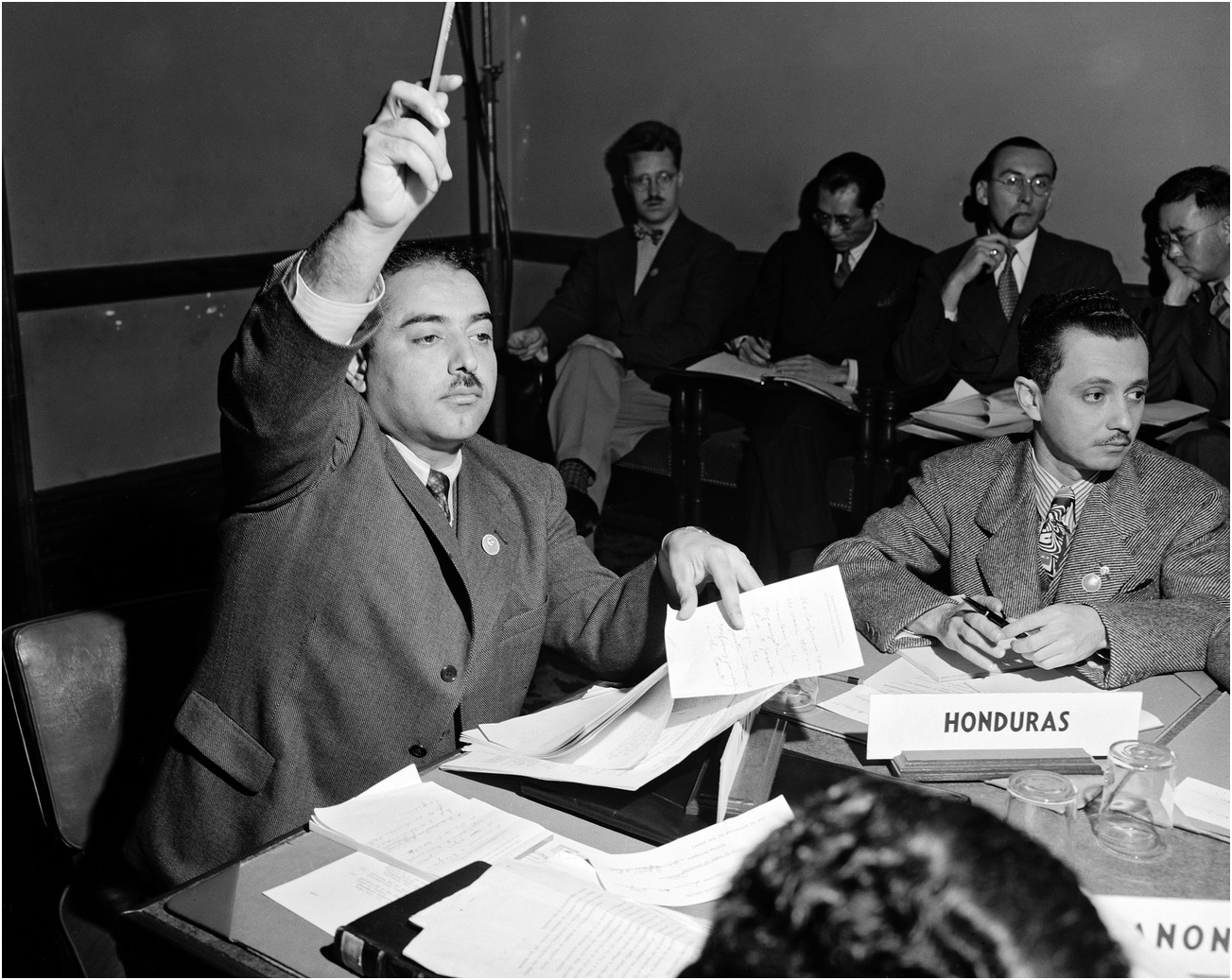

The Iranian representative to the United Nations, Djalal Abdoh, found insulting the idea that sovereign control was delusional or corrosive. He believed that the control of oil by multinational corporations had been made anachronistic by decolonization: corporate control and exploitation moved against the political stream of “the modern world,” he told members of the Economic and Financial Committee of the UN General Assembly in 1952. If Kennan and other Western policymakers assumed certain areas would provide low-cost raw materials to the benefit of the greater international economy, anticolonial elites like Abdoh darkened that vision with the bête noire of colonial continuity. Like Kennan, he believed the world was cleft in two. Unlike Kennan, he measured that divide on a material basis by which unfair mechanisms enriched one half of the globe and impoverished the other. The dominant forces that concerned him were not directly associated with the Cold War struggle for global primacy. Neither was the question of sovereignty viewed as a capitalist-socialist disagreement over the sanctity or vulgarity of private property. Instead, he insisted that the prolongation of imperial economic thralldom stood against the new era of decolonization.Footnote 7

Figure 1.1 Djalal Abdoh, then a deputy of the Majlis, at the San Francisco Conference, at which the United Nations was founded, April 25, 1945.

From Abdoh’s perspective, the right of a nation to control its resources was not a misdirected theory, as Kennan believed, but the conquest of a venal past. He and his counterparts worked in the United Nations to enshrine in international law a specific principle: permanent sovereignty over natural resources. This chapter examines the way in which their attempt to fashion permanent sovereignty as an imprescriptible right of nation-states was an early stirring of what would become the international sovereign rights program. The urgent preoccupation with sovereign rights in the United Nations, which drew on the legal thought of Abdoh’s Latin American interlocutors, provided common ground on which elites of different backgrounds built a long-term project.

In that context, permanent sovereignty was quickly linked to the economic doctrine of unequal exchange. Here again a Latin American interpretation, this one of global economic inequality, gave voice to a rising belief of sameness. By the mid-1950s, permanent sovereignty and unequal exchange had combined to become shorthand for discussions about global structural inequality and the common Third World drive to overcome it. Articulated in many different spheres of international society – legal thought, development economics, social theory, and imperial history – the shared vision of sovereign rights created a propitious environment for the marriage of anticolonial law to development economics.

The union of development economics to the international law of decolonization centralized the anticolonial elite experience. A new sovereign rights program thus drew influence at its birth from the fact that the cultural basis of international politics, the hierarchical division of the world into the powerful and the powerless, had been radically altered by decolonization. One event captured that moment and drove the process forward: the Iran oil crisis of 1951 to 1953.

The Iran oil crisis galvanized sovereign rights by bringing into the open, on a scale almost larger than life, the problem of economic continuity amidst political change that marked the decolonizing world. The crisis began when Iranian Prime Minister Mohammed Mossadegh called on the Anglo-Iranian Oil Company to respect sovereign control in April 1951. When rebuffed, he nationalized the foreign conglomerate. Historians have discussed in detail the origins of oil exploration in Persia and then Iran, the unfavorable oil concessions signed in 1901 and 1933, the 1951 nationalization, the ensuing crisis, and the American role in the 1953 overthrow of Mossadegh. Less is known, in contrast, about the contours of international debate spurred on by the crisis. This is too bad, because Mossadegh employed what became an influential public diplomacy of “economic independence” that grabbed the attention of an array of anticolonial nationalists, including Djalal Abdoh’s counterparts in the United Nations. They moved to legitimate the principle in international law, and their meetings in New York became the first touch points in what would become an expansive network of affiliation.Footnote 8

One way to begin that story is with the political career of the Iranian prime minister himself. Mossadegh held a deep-seated enmity toward the Anglo-Iranian Oil Company and foreign control of Iranian oil more generally. He argued against new petroleum exploration by either Soviet or US companies when Josef Stalin refused to remove the Red Army from Azerbaijan in 1946. He was among legislators in the Iranian parliament, the Majlis, who pushed through a 1947 law that forbade new concessions to foreign companies and directed the government to renegotiate Anglo-Iranian’s 1933 concession.

In the late 1940s, Mossadegh also followed closely the development of new deals between other producing nations and their foreign concessionaires. The standard concessionary agreements between the multinational oil companies and the producing countries, including Iran, had been for a fixed royalty rate per ton of oil produced. In 1943 and 1947, Venezuela passed new laws that changed the terms and resulted in the widely publicized “fifty-fifty” profit-sharing deal. When Mossadegh and other nationalists in the Majlis began to pressure the Anglo-Iranian Oil Company for a similar profit-sharing agreement, the company declined. Instead, in 1949 it offered Iran a contract known as the Supplemental Agreement, which guaranteed that annual royalty payments would not drop below £4 million, reduced the area in which it would drill, and pledged to train Iranians for administrative positions. All this was in return for an extension of the concession for another 60 years. The young Shah of Iran, Mohammed Reza Pahlavi, who had recently survived an assassination attempt, believed that he needed to accept the British offer to maintain revenues and political stability. His cabinet did so and then sent it on to the Majlis.Footnote 9

The Shah’s plan did not work, in large part because of a well-informed public opinion. “The 50–50 sharing of profits agreement … is well known in Tehran,” one official in the US State Department wrote. “Public opinion in Iran would never accept anything less than a 50–50 arrangement,” the Iranian ambassador in Washington said. The Majlis denounced the Supplemental Agreement and demanded that Anglo-Iranian begin splitting profits with Iran on a fifty-fifty basis, as American oil companies had also just agreed to do in Saudi Arabia. The legislative term ended before a vote could be taken. Accusations of royal bribery and fraud tainted the following elections. Mossadegh and others staged a sit-in that forced new elections, and he was elected prime minister. He immediately called for the establishment of an oil committee, which he chaired. The director of Iran’s petroleum institute, Manucher Farmanfarmaian, later described their meetings: “Mossadegh did not care about dollars and cents or numbers of barrels per day. He saw the basic issue as one of national sovereignty. Iran’s sovereignty was being undercut by a company that sacrificed Iranian lives for British interests.”Footnote 10

The feeling of lost sovereignty was broadly shared within Iran, as was the use of the language of decolonization to describe it. To take one instance, Anglo-Iranian’s highest-ranking Iranian employee, Mostafa Fateh, wrote a 23-page letter to a member of the board of directors. The company needed to recognize that “the awakening of nationalism and political consciousness of the people of Asia” would eventually force them to compromise. This self-aware germination of a new consciousness, often described as an awakening or a rebirth, would become central to the economic culture of decolonization and the sovereign rights program. Phrases like Fateh’s captured a sentiment that was flowering among anticolonial elites who believed that their politics drew not only on specific political or economic traditions but also on deeper human instincts of freedom and unity.Footnote 11

Fateh was in some ways an archetypal anticolonial elite. He was trained in political science and economics at Columbia University, and graduated with an MA in political science in 1919. As others would later, he began his path to contemporary relations in the oil industry with a close study of national history. In 1928 he wrote an article for the Bulletin of the School of Oriental Studies on Persian taxation from the pre-Christian era of Darius to the tenth century. In it, the details of the different tax programs were less important than their effect in creating a “highly organized and prosperous state” that survived interventions from the Greek, Arab, and Mongol empires. The article was nationalist in intention – the invading empires, unlike the governments led by native Persians, “had overwhelmed and massacred but never governed” the people of Iran.Footnote 12

Nationalism remained on Fateh’s mind throughout his career at Anglo-Iranian. In 1949 he summarized his views in a letter to a Majlis deputy. Iran had been “hoodwinked” in their 1933 concessionary contract, he wrote. The new company proposals in the Supplemental Agreement resembled those “of a covetous lender who exploits the dire needs of his neighbor by taking his collateral for giving him a loaf of bread.” In 1956 he wrote a long Marxist-inspired study that analyzed the earlier nationalist movements that led to the 1932 annulment of the original 1901 oil concession as “unjust and contrary to the sovereign rights of Persia.” (He was jailed in 1957 by the Shah’s government for the effort.) British intelligence documents reveal that Fateh was playing a complex double game. But he also expressed a widespread sentiment, and the Majlis oil committee recommended nationalizing Anglo-Iranian, an option legislators unanimously approved in April 1951.Footnote 13

The legislation contained provisions to audit the company and a process by which to weigh company claims for compensation, but the British government accused the Iranians of stealing their property. They demanded that the International Court of Justice arbitrate the dispute. Mossadegh rejected both the accusation and the demand. He believed that the court did not have jurisdiction over a fundamentally domestic issue. Here he posed an argument about domestic jurisdiction, which became one of several key concepts of the sovereign rights program.

He traveled to The Hague to address the ICJ. To the judges, he emphasized the history of British and Russian imperial competition over Iran, and took extra time to review the 1919 treaty granting Britain charge of national finances and the army. The British had used that position to “ensure their exclusive ownership of our oil,” he argued. “So what should have been the source of our national wealth became … the cause of serious and formidable problems.” Mossadegh made clear that the debate turned on a simple question that emerged from that history of imperialism: if an agreement was made between a private company and a government, was nationalization a matter essentially within domestic or international jurisdiction? The Iranian government insisted on domestic jurisdiction as a principle of sovereignty, he continued: “The decision we have taken to nationalize expresses the political will of a free and sovereign people. Understand, then, we are calling on the terms of the [United Nations] Charter to ask you to refuse to intervene in the matter.”Footnote 14

The court ruled in Iran’s favor in July 1952. But this was in practical terms a barren victory. Anglo-Iranian announced that it would sue any tankers carrying Iranian oil at their point of destination. The legal threat – supported by the British and American governments, as well as the other multinational oil companies – was remarkably effective and forced Iranian oil production down by 90 percent. As the other multinational oil companies increased production in Iraq, Kuwait, and Saudi Arabia to offset the production loss, the British government pressed its advantage. Their ambassador to the United Nations, Gladwyn Jebb, continued to assert that Iranian oil was “clearly the legal property of the Anglo-Iranian Oil Company.”Footnote 15

Mossadegh also traveled to New York to present his case to the UN Security Council. He infused his argument about domestic jurisdiction with an internationalist entreaty that placed Iran squarely in the global context of decolonization. “It is gratifying to see that the European powers have respected the legitimate aspiration of the people of India, Pakistan, Indonesia, and others who had struggled for the right to enter the family of nations on terms of freedom and complete equality,” he began. The nationalization, by a country that had long held formal independence, sought the same objective, Mossadegh said: “Iran demands just that right … It expects this exalted international tribunal and the great Powers to help it, too, to recover its economic independence, to achieve the social prosperity of its people, and thus to affirm its political independence.”Footnote 16

His argument drew a tight connection between decolonization – “political independence” – and the right to use sovereignty to impose economic control. Iran had remained nominally independent for much of its history, as Fateh had also noted. But for the prime minister, his nation also stood within the transformative vision of decolonization. For self-determination to be realized, “economic independence” needed to follow. Mossadegh, then, criticized not only the past actions of British imperialist pressure but also the engrained economic inequality it left behind. In the light of such a conception, the delegates from Yugoslavia and India supported Mossadegh in the Security Council. The oil concession naturally fell under Iran’s jurisdiction, they agreed. The conflict between the company and the government “was an exclusively domestic matter.”Footnote 17

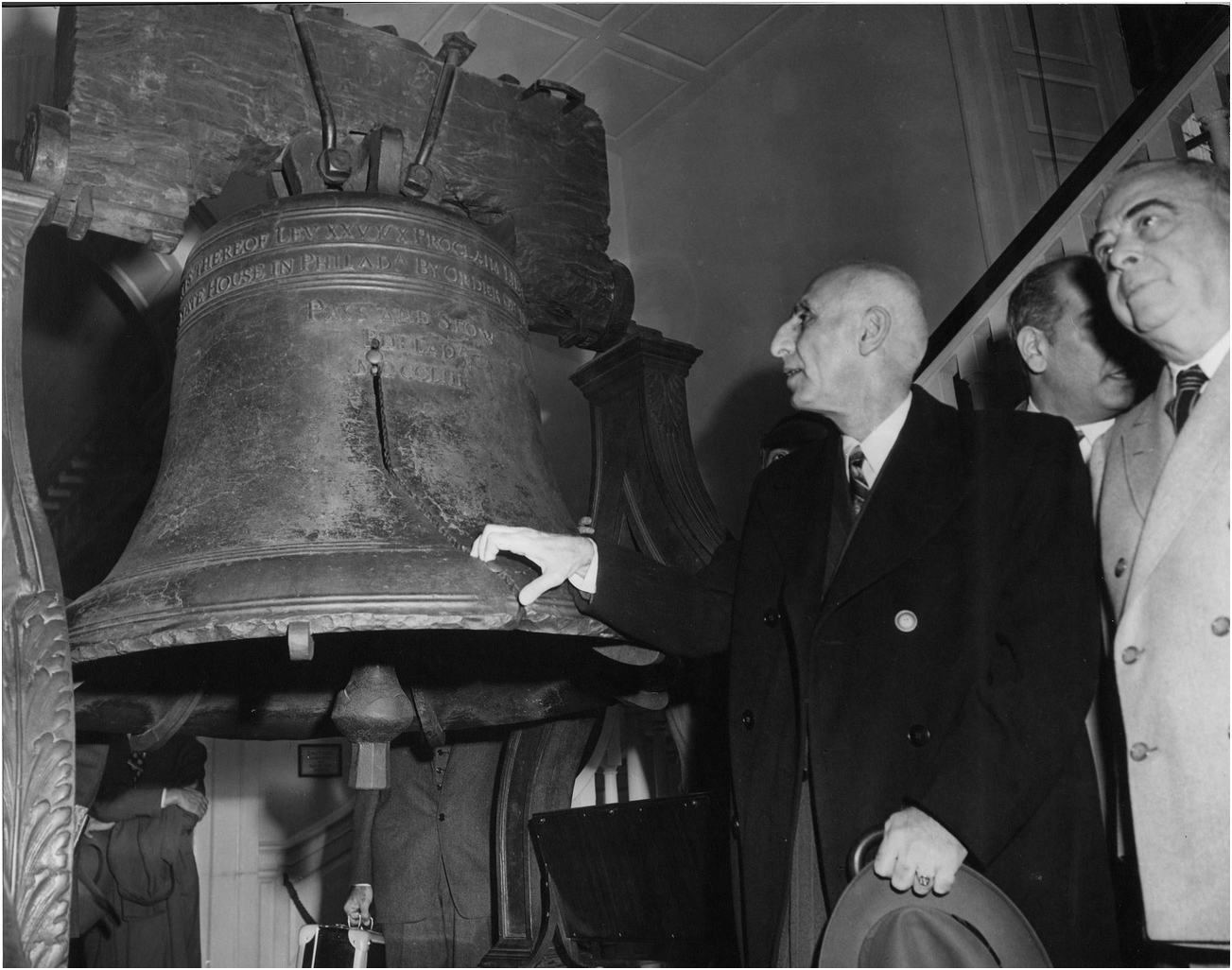

The argument was one of stark clarity, and it echoed down the rest of the century. It also reverberated across space. Mossadegh and other Iranian elites maintained with great consistency that the problem of Iranian oil was symptomatic of global imbalances resulting from imperialism. They also placed the Iranian crisis in other comparative frameworks. The disparity between Venezuelan and Saudi oil incomes, on the one hand, and Iranian income, on the other, he told one American official, was the starkest illustration of the “theft” committed by the Anglo-Iranian Oil Company. At a train stop in Philadelphia after the Security Council meeting, he lectured a 200-person crowd in Independence Square on the similarities between the Iranian nationalization and the universal idealism of the American Revolution. “An ancient nation with many centuries of recorded history and a great culture and civilization has every right to achieve its political and economic freedom,” he declared. “It is also entitled to use its natural resources to eradicate the misery and poverty that are plaguing the lives of the Iranian people.” He then symbolically touched the Liberty Bell.Footnote 18

Figure 1.2 Iranian Prime Minister Mohammed Mossadegh examines the Liberty Bell, c. 1951.

The Anglo-Iranian nationalization was a crisis of immense proportions, and its legality was becoming a fiery topic in international circles. It was in that context that the UN General Assembly passed a resolution in December 1952 declaring that “the right of peoples free to use and exploit their national wealth and resources is inherent in their sovereignty.” The resolution on permanent sovereignty meant, in part, to validate the Iranian nationalization. It was also about a broader set of principles, as the discussion between Djalal Abdoh and several Latin American delegates mapped out the early connection between decolonization and the sovereign rights program. In short, the UN conversations testify to a frame of mind that bonded anticolonial elites together.Footnote 19

Delegates representing what one US commentator lumped together as the “whole Asian-Arab, Latin American, Soviet thesis” began their attempt to convert the concept of self-determination into a binding legal doctrine of national resource ownership in the UN General Assembly in 1950. UN Secretary General Trygve Lie noted at the beginning of the session that one quarter of the population of the world had gained political independence in the previous six years. The pressure toward “freedom and equality” would only continue to increase, he said, as indicated by the surge of support for a Draft Covenant on Civil and Political Rights. The concept of permanent sovereignty became a part of that debate when several representatives argued that enshrining self-determination in international law would hasten the liquidation of colonialism.Footnote 20

The General Assembly passed the complicated task of establishing the right and defining the legal machinery of self-determination to Djalal Abdoh’s Economic and Financial Committee, which began work in 1952. There, as part of the more sweeping objective of creating an international law that reflected the new reality of decolonization, the delegates from Uruguay and Bolivia proposed a resolution on permanent sovereignty. The revolutionary government of the latter had just nationalized its mining industries, an act US Secretary of State Dean Acheson feared would have “a bad effect in other countries.” The Uruguayan, Angel Maria Cusano, brought the meeting to order by arguing that the “immense natural wealth” of poorer nations could help bring about “the ideal of economic independence.” Luis Adolfo Siles, the Bolivian ambassador who would later describe the United Nations as a global forum for the oppressed, discussed “the bitter experience” of Iran when he seconded the proposal.Footnote 21

The position of the Latin American ambassadors was the result of a century-long sensitivity to foreign intervention and gunboat diplomacy. In 1868 the Argentine diplomat Carlos Calvo had put forward what came to be known as the Calvo Doctrine, an argument that foreign contractors were subject to local law. The goal of the doctrine was to defuse the threat of foreign intervention caused by investor and settler disputes. Latin American governments had inserted it as a provision in treaties, national constitutions, local legislation, and private contracts with foreign companies ever since. In discussing that right with Abdoh and other lawyers in the United Nations, they sought to use the momentum of decolonization to endow the doctrine with international status.Footnote 22

Abdoh, who had served with Mossadegh in the Majlis in the 1940s, agreed with the South Americans’ legal argument and saw the benefit of internationalizing it. His position was also a likely one, for intellectual reasons as well as political ones. Or, better, his intellectual preparation and the political world he came to inhabit were inseparable. Like Mostafa Fateh, he shared certain characteristics of the new international class of anticolonial elites. His 1937 doctoral thesis at the University of Paris law school had concentrated on the “concept of social need” in Iranian contract law. He was concerned in particular with the “moral element” of the 1928 Civil Code – the same code that Fateh had defended as the successor to centuries of Persian governance. One fine-tune contradiction worried him: the law outlawed violence to force consent but was silent about what he considered the subtler “defects of consent” that occurred in negotiations between unequal parties. That silence suggested to Abdoh the need to reconsider the notion of “unilateral will” as it related to contracts. In an argument that he would directly echo in his public rationale for the Iranian nationalization and for the adoption of the permanent sovereignty resolution at the United Nations, he held that any situation in which “a victim” was forced into an “unfair contract … by nature marred the validity of the contract.” The rightful parting of an individual from his property could only happen based on free volition. The distinction between consent and will needed to disappear, he concluded.Footnote 23

The implications of that discrepancy were not difficult to deduce in the case of Iranian oil. Abdoh defended Iran’s “sovereign right” to nationalize its oil on Eleanor Roosevelt’s NBC television show in May 1951. Roosevelt, who as a US delegate to the United Nations in the late 1940s had argued that the rights of nations had no place in discussions about the human rights of individuals, began the interview with a point-blank question: Why had Iran canceled the 1933 oil concession? Abdoh responded that the concession, a contract between a private corporation and a nation, was “subject to Iranian law.” Furthermore, he told Roosevelt, a private contract could not restrict the “legislative right” of Iran to change it. The Iranian nation had been forced to consent to an unfair oil concession, and the nationalization righted that wrong. To write permanent sovereignty into international law through a UN amendment, then, was to safeguard the economic rights of vulnerable countries – in the language of his dissertation, to protect will from consent. “Thus, in nationalizing her oil, Iran is only exercising an indisputable sovereign right,” he concluded. “It is because of their awareness and because the Iranian people have fully realized their rights that the oil industry was nationalized.”Footnote 24

Abdoh added to the UN committee that Mexico’s 1938 oil nationalization had upheld the legitimacy of permanent sovereignty. The Mexican delegate to the committee, former Treasury Secretary Ramón Beteta, had been influential in his application of the Calvo Doctrine during that dispute. What US officials euphemistically called the “economic protection” of Latin America was for him no different than the recent Italian invasion of Ethiopia, he wrote in 1937. Employing a similar dialectic that Mossadegh would later use at the Security Council, he linked economic control to national independence. Speaking after Abdoh in 1952, he confirmed his belief in the “interrelationship between the economic development of the under-developed countries and the free exploitation of their own resources.”Footnote 25

Abdoh and the Latin Americans explicitly introduced a link between what they considered the international right to self-determination and resource ownership. Their interactions also resulted in an analogy that likened their experiences, a point that was not lost on them or the shrewdest international observers. Herbert Feis, the American economic historian who helped write US foreign oil policy in the 1940s, linked the Iran crisis to the contemporary Bolivian and decade-old Mexican arguments about “the right to use their sovereign power to expropriate.” That connection was cast in an intrepid light at the UN committee. No suitable method existed in the past for nations such as Bolivia or Iran to communicate their shared position of defiance, the Bolivian Adolfo Siles told Abdoh. That “unfortunate phase” had passed “largely due to the influence of the United Nations,” an institution that was unique in history because it was a place where the poorer countries could “promote respect for an international right.” The significance of the United Nations resided in its existence as a medium for the language and experience of similarity. When his government nationalized its tin mines, the nation had “experienced the full feeling of economic independence” for the first time in its history. For that reason, Abdoh’s concerns touched him as familiar: the “maneuvers” of Anglo-Iranian in the wake of nationalization mirrored that of the former owners of Bolivia’s mines.Footnote 26

Thirty-one states voted for the resolution on permanent sovereignty in December 1952. The presidents of the New York Stock Exchange and the Guarantee Trust Company joined the delegations from the United States and Western Europe in lamenting the outcome. Abdoh took umbrage with their opposition. The “habit of exploiting the economies of others” moved against the ideal of international cooperation based on state sovereignty, he said in a moving speech after the vote. “The Countries of the Middle East and Latin America have become conscious of their rights, and the existing state of affairs cannot be allowed to continue.” Like Mossadegh in the Security Council, Abdoh was clear about the thrust of his message: permanent sovereignty was a right conferred by decolonization.Footnote 27

There was idealism here, to be sure, but strategy too. In emphasizing permanent sovereignty as an international right, Abdoh surely hoped that international support for the oil nationalization would limit the likelihood of retaliation against Iran. It did not. A US-sponsored coup overthrew Mossadegh and reinstated the Shah in August 1953. Acrimony characterized the subsequent negotiations about the future of Iranian oil. In the end, through a new concession with the newly instituted Iran Consortium, Iran received formal title to its oil and a fifty-fifty profit-sharing agreement. But contractual stipulations against sovereign rights revealed serious limits to that paper sovereignty. On the crucial question of jurisdiction, the 1953 contract moved arbitration to “a jurisprudence intermediate between public international law and private international law,” a position opposite the one put forth by Mossadegh, Abdoh, and in the UN resolution.Footnote 28

The coup also indicated the marginality of the sovereign rights position in its earliest days. The US National Security Council produced a paper on Middle Eastern oil the same year. Oil was “crucial to the strength” of European recovery and the Cold War battle against the Soviet Union. The Eisenhower administration would continue to support corporate arrangements to buffer those interests from the politics of anticolonialism. At the same time, the US government would verbally distance itself from private interests to avoid accusations that “the American system is one of privilege, monopoly, private oppression, and imperialism,” as one US official put it.Footnote 29

But the link between “the American system” and “imperialism” was one that would fester in the minds of anticolonial elites for the foreseeable future. This was in part because the nationalization had been a boomerang of a weapon for nationalist Iran. The experience of Mossadegh, in other words, provided a harsh lesson for other erstwhile nationalists. It would serve as a cautionary tale for years.

At the same time, though, the Iran oil crisis also helped bring to life the new international narrative of sovereign rights. In permanent sovereignty, the members of the Economic and Financial Committee forged a legal principle they believed would cultivate solidarity and encourage national and international projects to redress past and ongoing economic injustices – hopefully with more success than Mossadegh had. Other anticolonial lawyers could now turn to permanent sovereignty as a basic right of nations in the international community. That critical shift would continue to build on the idea of decolonization as a new but inevitable process.

The UN conversations about permanent sovereignty also reveal another important and lasting element of the economic culture of decolonization. The notion of an alliance of victims becoming an alliance of agents colors the whole history of sovereign rights. The tendency toward convergence in the United Nations shrank the territorial, political, and cultural distance between elites enough to make that exchange possible. A concurrent overlap in economic thought, centered on the concept of unequal exchange, complemented and bolstered the rise of permanent sovereignty in international law. In this case, too, the Latin American experience would help shape the content of the new sovereign rights program.

For the small cluster of lawyers working on the permanent sovereignty resolution, the United Nations represented a spectacular opportunity to democratize global politics. It was at the UN too that the assertion of permanent sovereignty as a right fused with a popular economic theory about the material legacy of imperialism. This also happened in the early 1950s when a cluster of theories and information about international trade that had long floated around rather loosely found an articulate voice in a recent UN hire, the Argentine central banker Raúl Prebisch. After he seized on the doctrine of unequal exchange, also known as the terms of trade thesis, a core set of assumptions quickly became influential among development economists. Crucially, the doctrine also helped other anticolonial elites understand and explain the inclusive vision of decolonization discerned by Mossadegh, Abdoh, and the others.

Prebisch outlined the basic argument for unequal exchange in his 1949 keynote address to the first conference of the UN Economic Commission for Latin America. The raw material exporting nations of Latin America had been left with economies that relied on the sale of raw materials and the import of finished goods, Prebisch said. That historical imbalance led to the exportation of raw materials at subdued prices vis-à-vis finished products. Subsequently, the low prices of raw materials curtailed the potential for development in Argentina and, more broadly, Latin America.

Relative costs, price trends, and other dry economic technicalities encased the argument. But there was more to the argument than macroeconomic analysis. Prebisch also said that unequal exchange was connected to the same sort of question of decolonization and international justice that concerned Mossadegh and the UN delegates in 1952. In the neat columns of his trade tables, he found a trend that pointed to deep-rooted causes for international economic inequalities. The lack of national control over raw material production led to endemically low prices, he believed, and international trade thus enriched industrialized nations at the expense of Latin American raw material producers. This relationship, which he termed unequal exchange, played the crucial role in Latin American poverty: “From there come the differences, so accentuated, in the quality of life of the masses of those countries and these.”Footnote 30

Figure 1.3 “Executive Secretaries of ECLA, ECAFE, and ECE Give Press Conference at UN Headquarters,” June 4, 1952. Raúl Prebisch is on the far left and Gunnar Myrdal is on the far right.

The doctrine of unequal exchange was thus more than just academic analysis. It was an ethical appeal to reconsider an international economy unfairly tilted by dint of history. Prebisch arrived at this posture along what was a familiar course for anticolonial elites. As it had for Mostafa Fateh and Djalal Abdoh, Prebisch’s concern with inequality began early in a career that initially dealt with domestic questions. In his first published article as a professional economist in 1920, he discussed the rising costs of living for the Argentine “working class” as something “felt in the flesh.” In a 1924 article he condemned the private “hoarding of land” in Argentina as an “obstacle to national development and social justice.” By the time he had become an established national figure in the mid-1930s, he had transferred that ethics to Argentina’s foreign economic relations through his systematic critique of the Ottowa trade accords.Footnote 31

But if Prebisch had limited his analysis to Argentina or even to Latin America in 1949, unequal exchange may not have been so influential. By then he was ready to go further: the commercial trends he described formed part of a larger order. He devised stark yet universal descriptors – “center” and “periphery” – to identify a worldwide hierarchy. He did so in a way that invited a connection to the nascent law of permanent sovereignty. That correlation would catch on in part because Prebisch’s terms were both specific and vague. When used to interpret the historical price trends for raw materials, a forceful and clear dichotomy emerged between the center and the periphery. Yet a plurality of the world’s nations and aspiring nations – lands that otherwise had disparate political, cultural, and geographical histories – formed Prebisch’s periphery. The spatial ambiguity of the periphery also lent it an expansive territorial application, which aligned with the argument put forth by the UN diplomats, namely that economic liberation was a next step in the process of decolonization.

Prebish explicitly made the argument a global one. If the collective benefits of trade gradually reached throughout the industrial world, he said, they did not “extend into the periphery of the world economy.” Here was the significance of the theory for Prebisch and for the elites that would use it: “the periphery of the world economy.”Footnote 32

The more advanced theoretical content of the argument, and this was another crucial insight, further suggested the validity of such a sweeping application. Here Prebisch indicated the broader nature of the Argentine and Latin American experience through his explicit contradiction of the classical theory of comparative advantage. Taking a position against what he called the “false universality” shared by Smith, Ricardo, Mill, Marshall, Keynes, and others, he argued that international trade was not advantageous for all. Rather, it favored the technological advancement and industrial productivity of the nations of the center, which in turn forged a potent legacy in which the value of raw materials declined as productivity rose. The allegedly “natural” operation of trade was anything but, Prebisch said. Comparative advantage was not a scientific law with absolute or universal scope. Instead it was an outcome of policy derived from past power relations. It followed that the wealth of the center had less to do with the benefits derived from the expansion of commerce than with the inequitable structure of that commerce.Footnote 33

Prebisch was among the first to grasp the massive economic implications of decolonization and its potential to challenge international conventions. But his insight was not invented of new cloth. The early surge of the doctrine of unequal exchange among development economists, and the link anticolonial elites would find between it and permanent sovereignty, occurred within a dynamic intellectual environment.

The underlying question of global economic injustice had, after all, been raised before. Imperialism, capitalism, and poverty were standbys of international thought, and unequal exchange built on a whole body of contemporary political-economic ideas. But while Prebisch and other development economists shared certain traits with the other principal schools of the postwar era, including those associated with central planning and modernization theory, their understanding was distinct. And as individual development economists put forward unique but related theories that turned on sovereignty-driven notions of economic justice, the basic assumptions of the doctrine of unequal exchange became so influential that most anticolonial elites accepted it as a universal truth by the mid-1950s. Its content and its context together provide an interesting map of how anticolonial elites understood the past and the present of international capitalism at mid-century.

Development economists shared some terrain, for example, with Marxist critics of imperialism who had long built bridges between the extraction of raw materials, territorial conquest, and imperial rivalry. Indeed, unequal exchange would become associated intimately with a global Marxist critique by the mid-1960s to form a crucial plank of popular calls against “neo-colonialism.” But Prebisch and most other development economists were not Marxists. For one, they did not believe in a historical dialectic dominated by class warfare. Neither did they find capitalism to contain the seeds of its own destruction; Prebisch sought rather to enlarge and rework the international market while redistributing power within it. Furthermore, most cared little for the ideological debate between communism and capitalism and even less for the Cold War. They looked at the past with a different tradition in mind: the powerful and expanding desire of imperialists to exploit the resources of others.Footnote 34

Development economists also shared some traits with what one historian has called the “court vernacular” of capitalist development in the West, modernization theory. Like modernization theorists, they sought a transition to a better life through development – what Albert O. Hirschman, who moved between these schools of thought, called “the process of change of one type of economy into some other more advanced type.” Like modernization theorists, development economists saw increased capital accumulation as the motor of that progress. Like modernization theorists, most did not doubt the desirability of development of a Western variety – they believed that the overall effect of development would be to multiply the opportunities for mutually profitable exchange among people. Hirschman in particular found elegant Walt Rostow’s analogy of “take-off” to describe that process.Footnote 35

But Prebisch, Hirschman, and other development economists differed from the mandarins of modernization on two principal questions. First, what caused Third World poverty? Second, from where would new capital to alleviate poverty come? Most modernization theorists placed the onus for poverty on the “backwards cultures” of “traditional societies.” In emphasizing the difference as societal, they tended to banish the histories of colonialism, unequal exchange, and other exploitation from their economic analysis. Development economists found those histories central and held that the challenge confronting the Third World was intractable without acknowledging the vestigial impacts of colonial rule.

The first question, on the causes of poverty, shaped the development of economists’ understanding of the second, the source of capital for development. Hans Singer, who put forward a nearly identical thesis of unequal exchange at the same time as Prebisch, felt strongly about both points. From his position at the United Nations, he disagreed with the American and Western European emphasis on foreign aid and investment. There existed “a gathering conviction … that things cannot be allowed to go on as they are,” he said. It did not make sense to “help the underdeveloped countries along while at the same time they are allowed to lose on the swings of trade.” The dispute about the source of capital was a difference of quality, then, not degree. The argument for nationalist policies to create indigenous capital was a position steeped in the experience and the interest of the periphery.Footnote 36

Yet, although important, these differences should not be overstated. While it is true that development economists put forward a distinct view from that of their Marxist and modernizing counterparts, it is also important to note that rapid and often bewildering political change characterized the era of decolonization. It was a transformative time and different ideas battled for primacy. Thus, economists from different schools often coopted each other’s insights. It would be too simple to say that sovereign rights economists navigated a middle course between Cold War maxims. The web was more densely woven; no aspect of development economics could claim an uncluttered pedigree or influence.

One distinctive feature is that the development economists turned their attention to decolonization and its effects on international capitalism more intently. For them, US-Soviet tensions had little bearing on the important questions they asked. Instead, they were interested mostly in the ongoing split between former colonizers and former colonies. Within that focus, the idea that low raw material prices meant to benefit imperial power was shared by many experts. In fact, it had been put forward by influential theorists of imperialism for half a century. They all gave different amounts of weight to trade balances, but John Hobson, Joseph Schumpeter, Leonard Woolf, and John Maynard Keynes each took into consideration what Keith Hancock described in his 1950 Marshall Lectures as the relationship between “the trappings of sovereignty” and “the wealth of colonies.” In one of the earliest examinations of the new concept of “economic development,” Schumpeter linked empires’ wealth to their ability to undertake “the conquest of a new source of supply of raw materials.” His 1946 obituary of Keynes emphasized the connection Keynes drew between profitable capital investment and the “conquests of new sources of food and raw materials.” The historians Ronald Robinson and John Gallagher built on those positions in their influential 1953 article, “The Imperialism of Free Trade,” in which they argued that commercial control had long been an alternative to formal colonial power. Their new categories, formal and informal empire, covered the same physical and cognitive space as Prebisch’s periphery.Footnote 37

Scholars from the United States formed part of the consensus that linked political conquest, formal or informal, to economic subordination. Thorstein Veblen, for example, keyed in on “the handsome margin of profit” from advancing “the frontiers of the pecuniary culture among the backward populations” as proof of his larger thesis about predation in modern society. Parker Thomas Moon, a Columbia University professor who advised Woodrow Wilson at the Paris Peace Conference, also emphasized industrial demand for low-priced raw materials as the driving force of imperialism. The Harvard economist John H. Williams used “uneven development,” a phrase central to Lenin’s theory of imperialist rivalry, to describe the effects of international trade in 1929. Eugene Staley, an economist at the Council on Foreign Relations, recommended policies in the 1930s and 1940s that reflected the confluence of interests between the industrialization of the “underdeveloped countries” and the projected US need for raw materials. Historians William Appleman Williams and William Leuchtenberg had also begun to point to the similarities between American commercial diplomacy and European imperialism by the early 1950s.Footnote 38

A number of economists also preceded Prebisch in making international economic inequality their primary concern. The work of Romanian economist Mihail Manoilescu on what he called “unequal exchange,” which he associated with protective measures for national manufacturing sectors, and the “backwards economies” of Eastern Europe influenced Prebisch and other Latin American theorists of inequality. In the early 1940s, too, the Austrian economist Paul Rosenstein-Rodan and the American historical economist Charles Kindelberger laid more groundwork for unequal exchange in the field of statistical analysis, in this case through close examinations of short-term capital movements in and out of “the economically backward areas.” If Prebisch took a divided world as his sphere, these economists already had begun to attach importance to his center-periphery formula, even if it was not identified as such.Footnote 39

In the sense that unequal exchange built off the momentum of decolonization, it was similar to permanent sovereignty. The gravamen of Prebisch’s analysis was as much about the political moment as it was about its intellectual context. In any case, it immediately struck a chord with other professional economists, including those who disagreed. “At no previous period in history have such large regions and vast populations found themselves drawn irresistibly into new orbits of economic activity,” the first professor of Colonial Economic Affairs at Oxford, S. Herbert Frankel, told students in 1952. Frankel, who would later become a founding member of the free-market Mount Pelerin Society, nonetheless accepted the central premise of development economists. He explained his rationale for doing so vividly. “The great disintegrating process” of decolonization had begun to erase old economic patterns, he said. A close reading of the recent past pointed to the shortcomings of a definition of decolonization “based mainly on political criteria.” Rather, its unfolding was a “seed-bed of change” that augured economic adaptation.Footnote 40

Frankel became a critic of unequal exchange. But many other development economists agreed with Prebisch and put forward similar or related theories in the 1950s. Like Frankel, Columbia University professor Ragnar Nurkse set the “underdeveloped” periphery against the “developed” center. Unlike Frankel, the Estonian-born economist agreed with Prebisch that the historical relationship between the center and the periphery preserved the poor nations in what he called “the underdevelopment equilibrium.” The wealth created by international trade in the nineteenth-century world economy “was partly due to the fact that there was a periphery—and a vacuum beyond,” he wrote in 1953.Footnote 41

Like others had, Nurkse also downplayed the ideological differences of the Cold War. The “much-debated issue” of whether the forces of economic progress should be deliberately organized by states or left to private enterprise was “essentially a question of method,” he said, and was less important than “the economic nature of the solution.” What he meant was that his underdevelopment equilibrium was not a decree of fate. Nations could escape endemic poverty if they could increase the amount of capital available to their economies.Footnote 42

One of the more philosophical economists who joined Prebisch and Nurkse in questioning the “classical theory” of international trade was Hla Myint. The Rangoon University professor, who received his PhD in welfare economics at the London School of Economics, thoroughly scrutinized the gains promised by international trade to “backward countries.” For him, the problem was the disjuncture between the niceties of trade theory and “the process by which some of the backward countries were opened up.” Economists would do well to decouple “backward” human resources from “under-developed” natural resources in their discussions of “the nature of economic backwardness,” Myint added in a lecture written for the Oxford Economic Papers. His intent focus on raw materials, free of what he considered the racist assumptions underlying the “phenomenon of backwardness,” led him to two important conclusions. First, the “economic struggle” faced by the poor nations was part of the deliberate concentration of power “in relation to the world at large.” Second, the “mutual interaction” between poverty and resource control was “an essentially dynamic and historical process taking place over a period of time.” A knavish injustice dominated that history, Myint believed, by which poverty came from the “artificial” and “disequalizing” obstacles to development put in place by colonial powers.Footnote 43

By the late 1950s, the consensus on international economic inequality had become so thick that even economic historians such as Karl Polanyi and Bernard Semmel had begun to look for the political roots of mid-nineteenth-century classical trade theory and the context of calls among the European ruling classes for reviving “the lost art of colonization.” The problem, they and all the rest accepted as given, was that the price of primary commodities had been determined as part of a material relationship between rulers and subjects. This idea was persuasive and popular. It was held widely in the 1950s, including by the three men who, along with Prebisch, were arguably the most influential development economists of the era: Albert O. Hirschman, William Arthur Lewis, and Gunnar Myrdal.Footnote 44

Like Mexican Ambassador Ramón Beteta, Hirschman described early in his career the ways that a perceived need for raw materials drove Italian fascist expansionism into Africa in the 1930s. In 1957, as he began to establish himself as an expert in the field, he wrote about the “dualism” within the underdeveloped countries, the separation between industry and raw material production on a regional level, as a reflection of the broader “uneven development” of the international system. A year later he wrote about the corrosive problems that could stunt economic growth at the earliest, most fragile moments of statehood. Of the utmost importance to safely navigate the path of independence to development was the improvement of a nation’s “ability to invest.” Crucially, what he described as “viable political forces” could set policies to “help narrow the gap between the developed and the underdeveloped countries.” Those forces, in turn, needed to retain the “developmental advantages of sovereignty” granted by decolonization.Footnote 45

Lewis, who arrived at the London School of Economics in the 1930s from the British colony of St. Lucia, ran in the same Pan-Africanist circles as George Padmore, C. L. R. James, and Paul Robeson. His first major work ascribed the “harvest of vice and woe” in Africa and the West Indies to the “reckless quest for wealth” by British imperialists, a pursuit that ultimately led to the slashing of prices for sugar and banana exports. In 1949 he published a survey of the international economy between the two world wars that, unlike other contemporary textbooks, focused on the declining prices of raw materials as a factor in global depression. “The changing trends in the demand and supply of primary products” were crucial, he said, because the less developed economies had become important consumers of the goods manufactured in Europe and the United States. For him, the terms of trade had moved against primary products consistently after 1883, mostly as a result of the “opening up of new countries.”Footnote 46

As they did for Prebisch, Lewis, and Hirschman, the assumptions of classical economists also formed a target for Gunnar Myrdal. The Swedish economist had spent the decade after his career-making 1944 analysis of US race relations, An American Dilemma, studying the forces underlying international inequality. (He was not alone among development economists in drawing the connection between American segregation and the economics of imperialism. Nurkse found the moment to link in one phrase the lag between economic theory and “the actual course of events” to the history of US race relations. “John Brown’s body lies a-molding in the grave,” the Estonian emigré wrote, “but his soul goes marching on.”) Like Prebisch, Myrdal attacked the belief in comparative advantage as a “scientific law” that existed above “the political element” of international society. He elaborated on that point in his popular 1956 textbook, An International Economy. The appearance of “economic development of underdeveloped countries” as a banner phrase in international debate symbolized the arrival of a new set of interests, he wrote. Their international influence reaffirmed his belief that it was misguided to pretend that the study of economics could be “objective” or “purely scientific.”Footnote 47

Myrdal believed this critique was especially pertinent to neoclassical theories of the perfect market. In Rich Lands and Poor, written in 1957 for a Harper & Row series aimed at the general public, he used the doctrine of unequal exchange to explain how “the backwash effect” in the international economy disproved the idea of the perfect market. It was, in fact, the very real play of political forces in the market, he argued, that tended to increase the inequalities between regions.Footnote 48

He linked the influence of that economic belief to what he called the “Great Awakening” of decolonization in a speech the same year: “All international relations” shivered under the reverberations of that “political avalanche,” the repercussions of which he expected would “fill the history of the rest of the century.” From that perspective, he predicted that the Cold War would be reduced to an “unpleasant nuance or perverted modality” of history. The more important issues of world affairs would revolve around the “many things in common” held by the poor nations: their skin colors were darker, they carried resentful memories of imperial rule and personal discrimination, and they were poor. Above all, he intoned, they were “conscious of it.”Footnote 49

That mindfulness, often expressed in terms of rebirth or awakening, was the supreme common denominator of the elites who would connect unequal exchange to permanent sovereignty. The notion of a self-conscious awakening was central to the formation of a cohesive school of thought among the anticolonial elites: they regarded themselves, and were regarded by their closest observers, through their similarities. The prime similarity, their mobilizing root, was this stirring sense of becoming conscious to the possibilities of decolonization. An alert and progressive synthesis thus defined their character and, as Myrdal noted, led to higher expectations. The anticolonial elites he observed would discuss their dissatisfaction with political independence at length. Myrdal’s arguments about the newly political nature of economics – along with the doctrine of unequal exchange, Hirschman’s uneven distribution, Lewis’s dual economies, and so on – built on the same core belief.

The actual concrete policies to redistribute wealth varied in these and other assessments, but the basic assumption remained: an unjust past bequeathed an international economy stacked against the periphery. For the development economists, as for so many other intellectuals in the 1950s, the imperial past was part of a symmetry of belief about what Hans Singer called the “interlocking vicious circles” of poverty.Footnote 50

The Oxford historian Albert Hourani summarized the emerging consensus in 1953: “[T]he essence of imperialism” was less in the official legal and diplomatic controls of colonial rule than in its “material consequences” and subsequent “moral relationship … of power and powerlessness.” In a 1955 lecture at the National Bank of Egypt, Myrdal also turned his gaze upon “the very large and steadily increasing economic inequalities between the developed and underdeveloped countries.” The many deviations within and across that great division did not invalidate its generalization about the inequality between the rich and the poor nations, he continued. Besides, it was completely natural that the leaders of the poor nations “put part of the blame” on the “world economic system which keeps them so poor while other nations are so rich and becoming richer.”Footnote 51

The meetings of the Third Committee of the UN General Assembly in 1955 validated that sort of observation. Delegates there – in particular the permanent representative of Saudi Arabia to the United Nations, the Lebanese anticolonial elite Jamil Baroody – acted to clinch the link between permanent sovereignty and unequal exchange.

The immediate political context of the discussions between Baroody and his counterparts was the ongoing debate over the Suez Canal. As with the Iran oil crisis, international discussions again provide new insight into perceptions of the nationalization and the way it affected notions of international economic justice. In fact, the disputes over Iranian oil and the Suez Canal were closely linked in the minds of anticolonial elites. Mohammed Mossadegh had visited Egypt in 1951, directly after his trip to the United States, and had been welcomed as a nationalist hero. The two nations even signed a treaty against British imperialism before his departure. “[T]he Iranian move for the nationalization of oil induced extremists in Egypt to demand … the nationalization of the Suez Canal” even before Gamal Abdel Nasser took power, the professor of Middle East Studies at Johns Hopkins, Majid Khadduri, explained to his colleagues in late 1951.Footnote 52

But the connection was greater than one of regional nationalism. For one, the discussions at the United Nations reveal that the doctrine of unequal exchange was becoming standard fare for discussions about inequality among diplomats who were not professional economists. The United Nations again had played a central role in this. The UN Department of Economic Affairs, for example, made Prebisch’s critique readily available to the leaders of anticolonial movements, new nations, and the other members of his periphery. Mimeographs of the analysis were translated into English and French, reprinted in journals, and distributed as pamphlets. The department also published and distributed another widely-read essay by Prebisch, “Some Theoretical and Practical Problems of Economic Growth,” in 1951.Footnote 53

The economic argument of unequal exchange had also begun to fuse with the legal question of permanent sovereignty. When Djalal Abdoh and the Latin American delegates contemplated permanent sovereignty as a means to protect the rights of poor nations in 1952, the Latin Americans had used the doctrine of unequal exchange to explain the need for new international laws. Uruguayan ambassador Cusano, for example, described “the catastrophic balances of trade for raw materials” in his call for the resolution. And when Bolivian ambassador Siles compared the corporate exploitation of tin resources with those of oil, he argued that foreign companies involved in each had amassed “tremendous wealth” by manipulating the “terms of trade” for raw materials.Footnote 54

Unequal exchange and permanent sovereignty came even closer together in the 1955 meetings, where delegates again discussed permanent sovereignty. The committee had been assigned the broad question of social and humanitarian affairs, but its anticolonial elites devoted considerable time to the discussion of what they called “economic self-determination.” A division over the link between natural resources and self-determination pitted the United States, the United Kingdom, and the Netherlands against an “Asian-African-Arab group” led by Baroody and Abdul Rahman Pazhwak, a diplomat from Afghanistan. Like other UN diplomats and the development economists, both men connected national law and the international economy with the greater process of decolonization.Footnote 55

The renewed emphasis on permanent sovereignty revealed another key operating idea of the sovereign rights program. No state could “exercise the right of political self-determination” if it were not “the master of its own resources,” Baroody said. Widespread economic inequality meant that problem was not strictly a “colonial issue,” Pazhwak added. Instead it reflected the need to act on the universal right to self-determination, a right that “had in our age acquired a compelling moral force.” To codify permanent sovereignty in international law, he continued, was an attempt “to spare the future the calamities of the past.” What anchored their view of permanent sovereignty was their broad conception of colonial legacy. They contrasted the bitter past with a better present endowed with democratic qualities at the same time as they noted the powerful legacy of imperialism.Footnote 56

Like other anticolonial elites, both men came to this position from a combination of national and international experience. For Pazhwak, who had just returned from the Afro-Asian summit in Bandung, this had to do with the writing of history itself – five years earlier he wrote a pamphlet that decried the “distorted” depiction of Afghanistan as a passive “buffer state” at the expense of its own rich history.Footnote 57

For Baroody, the legal struggle to negate the economic past also carried on as part of a longer history. The Saudi ambassador received his undergraduate degree from the American University of Beirut in 1926. Before joining the Saudi UN delegation in 1945, he had written a collection of well-received poems, represented Lebanon at the 1939 World’s Fair in New York, advised the editors of Reader’s Digest on their new Arabic edition, and taught Arabic at Princeton. A 1949 debate about world government, sponsored by the American Academy of Political and Social Science, revealed the nature of his political-historical views. Baroody placed Soviet and American policies of “modern expansion” – the race of the “big powers” to extend “their economic frontiers” outside their territorial limits – within a thousand-year history of colonialism for economic gain that dated back to the beginning of the Crusades in 1095. The scramble for “the abundant but slightly developed natural resources” of the Middle East represented a new stage in that history of “power politics at its worst.” Tellingly, both American and Soviet diplomats had “little regard to the welfare and aspirations of the people caught between the titanic blocs.” To reverse the trend toward imperial continuity within the Cold War, Baroody urged the leaders of the poor nations to forge a “collective foreign policy toward the outside world.”Footnote 58

Both Baroody and Pazhwak wove their fabric of explanation out of the skein of a vast but precisely interpreted history. They were also forward-looking. The era had passed, they said, when gunboats and soldiers, traders and investors, civil servants and diplomats could bring to heel noncompliant nationalists. The political climate of decolonization did not permit it. “The right of peoples to self-determination was an accepted axiom of modern thought,” Baroody told Pazhwak and the other UN delegates in 1955. A new resolution on permanent sovereignty was necessary “to prevent what had been a frequent occurrence in the nineteenth century, namely that a weak and penniless government should seriously compromise a country’s future by granting concessions in the economic sphere.”Footnote 59

These discussions reveal that permanent sovereignty over natural resources was beginning to be described as an inalienable right of nations. In formulating the legal principle and the economic problem it sought to resolve, the anticolonial elites at the United Nations continued to make the national international: they turned the unique experience of individual nations into a metonym for international suffering under colonialism. The trope whereby national experiences personified greater injustice in the international economy was a common feature of the economic culture of decolonization thereafter. Added to that was the argument that political freedom without economic power was inconsistent.

For the anticolonial elites, the standards governing international trade and foreign investments in raw materials were unnatural holdovers of a bygone age, concocted by the more powerful states and enforced unilaterally against the weak. In turn, permanent sovereignty and unequal exchange became shorthand for discussions about the global economy in which all poor nations took part. More than that, the economic frame made more tangible the important gravitational pull of Third World likeness—an underlying sense of affinity based in mutual history and the common drive to overcome that history. That consensus on international asymmetry favored the birth of the economic culture of decolonization and the sovereign rights program in the 1950s.

The new consensus also led to the rise of sovereign rights as a legitimate force in international politics. So appealing was the message of economic inequality and a legal solution that even an arch-antagonist like George Kennan conceded its influence. At a calmer moment, he struck a more earnest tone in his Latin America journal. Regarding US relations with Venezuela, he lamented “this unhappy relationship in which each country was beholden to the other in a manner slightly disgraceful.” He hoped that the international community could find “some better answer” to the problem, a way to balance “the needs of those economies which are capable of developing the natural resources of this earth and those other peoples who have been permitted to extend over those resources the delicate fiction of modern sovereignty.”Footnote 60

The self-aware unity of the anticolonial elites, based on Kennan’s delicate fiction, was in its origins an outward-looking strategy, and anticolonial elites increasingly endeavored to conceive of it as such. The sovereign rights program thus stood somewhere between social-scientific theory and moral ethos. It was at the same time an attempt to identify the meaning of decolonization for international capitalism and to transform any given event into an exercise of the interpretation of its underlying meaning. Gunnar Myrdal published a lecture on “Economic Nationalism and Internationalism” a half-decade after Kennan pondered the future of sovereignty. It may be the most profound short analysis of the effects of decolonization on international economic thought ever written. For him, it was impossible to deny the feedback loop between decolonization and the new economic arguments. “Intensified economic nationalism in all countries are interrelated in a circular fashion, each change being at the same time the cause and effect of the other changes, with the result that the changes cumulate,” he wrote.Footnote 61

But for all his insight, Myrdal overlooked one crucial characteristic of the moment. Permanent sovereignty and unequal exchange caught on together because each connected people with their circumstances in ways they found valuable. The intimate relationship between anticolonial law and international capitalism, in other words, was that the circumstances of life on the periphery endowed that vision with a peculiar force. Albert O. Hirschman may have come closest to capturing the moment when he wrote that anticolonial elites such as Djalal Abdoh, Jamil Baroody, and Rahman Pazhwak arrived at their similar conclusions through an “elucidation of immediate experience” that pointed to “variations upon a common theme.”Footnote 62

Again, true enough. But still too simple. It is more accurate to say that unequal exchange and permanent sovereignty fit so logically into the patterns of thought of elites, echoed so lucidly their realities of life and emergent codes of behavior, that the ideas could mean something very real to a wide variety of actors. The link between economic inequality and its legal remedy loomed large because the two positions made sense together to so many people. That is, the combination of anticolonial law with development economics was an argument that had the virtue of portraying a position that a variety elites could accept as a foregone conclusion.

Permanent sovereignty and unequal exchange overlapped naturally. The anticolonial elites came to understand that proposition of mutual recognition through a process that emphasized ideas and politics, thoughts and actions. When a small group of Arab experts turned their gaze on what Myrdal called the “closely controlled enclaves for exploiting oil” in the second half of the 1950s, they ensured that this culture of decolonization would generate far more than a tempest in a UN teapot.Footnote 63