Book contents

- Frontmatter

- Contents

- Abbreviations

- 1 Introduction

- 2 International taxation: policy and law

- 3 Some shortcomings of the tax treaty system

- 4 History of tax treaties and the permanent establishment concept

- 5 The role of the OECD Model Tax Treaty and Commentary

- 6 Defining the personality of permanent establishments under former Article 7 and the pre-2008 Commentary and the 2008 Commentary

- 7 Intra-bank loans under the pre-2008 Commentary and 1984 Report

- 8 Intra-bank interest under the 2008 Report

- 9 Business restructuring involving permanent establishments and the OECD transfer pricing methods

- 10 New Article 7 of the OECD Model and Commentary

- 11 Unitary taxation

- 12 Conclusion

- Bibliography

- Index

- References

Bibliography

Published online by Cambridge University Press: 07 September 2011

- Frontmatter

- Contents

- Abbreviations

- 1 Introduction

- 2 International taxation: policy and law

- 3 Some shortcomings of the tax treaty system

- 4 History of tax treaties and the permanent establishment concept

- 5 The role of the OECD Model Tax Treaty and Commentary

- 6 Defining the personality of permanent establishments under former Article 7 and the pre-2008 Commentary and the 2008 Commentary

- 7 Intra-bank loans under the pre-2008 Commentary and 1984 Report

- 8 Intra-bank interest under the 2008 Report

- 9 Business restructuring involving permanent establishments and the OECD transfer pricing methods

- 10 New Article 7 of the OECD Model and Commentary

- 11 Unitary taxation

- 12 Conclusion

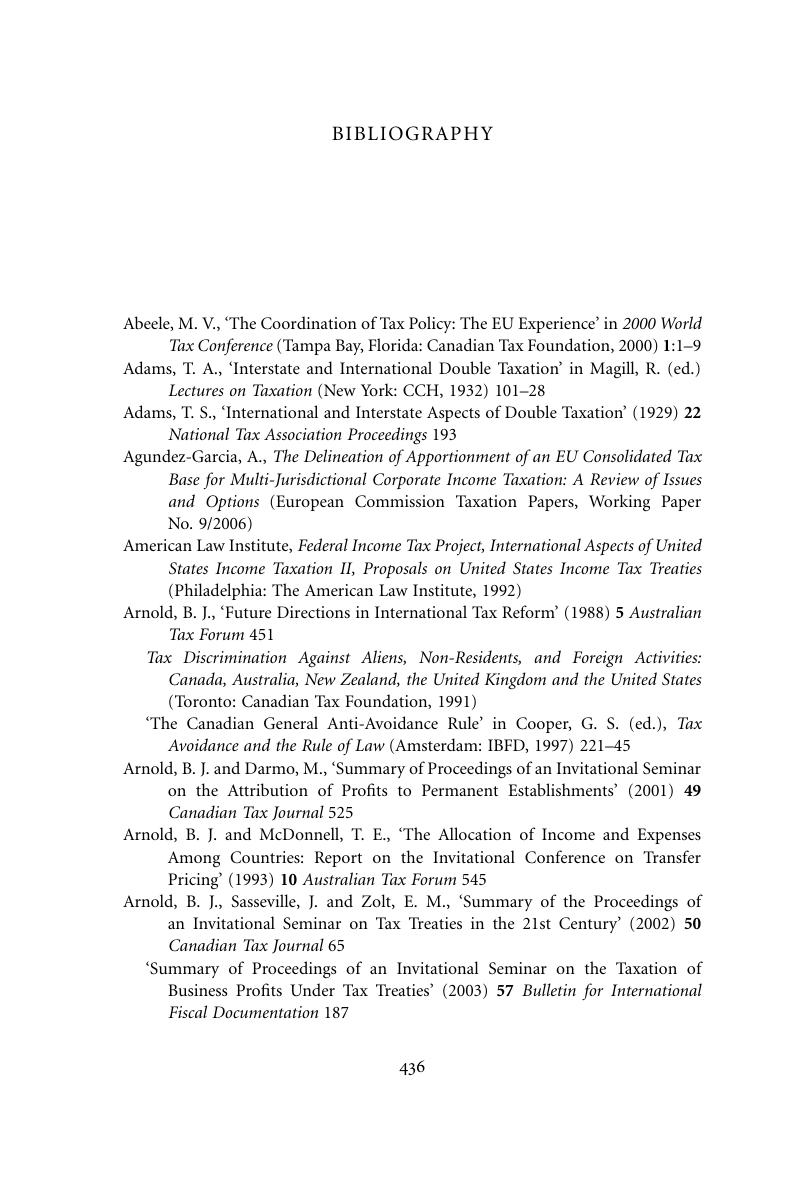

- Bibliography

- Index

- References

Summary

- Type

- Chapter

- Information

- International Taxation of Permanent EstablishmentsPrinciples and Policy, pp. 436 - 453Publisher: Cambridge University PressPrint publication year: 2011