Book contents

- Frontmatter

- Contents

- Figures

- Tables

- Contributors

- 1 New instruments of monetary policy

- 2 Liquidity and monetary policy

- 3 Interest rate policies and stability of banking systems

- 4 Handling liquidity shocks

- 5 Asset purchase policies and portfolio balance effects

- 6 Financial intermediaries in an estimated DSGE model for the UK

- 7 Central bank balance sheets and long-term forward rates

- 8 Non-standard monetary policy measures and monetary developments

- 9 QE – one year on

- 10 What saved the banks

- 11 Non-conventional monetary policies

- Index

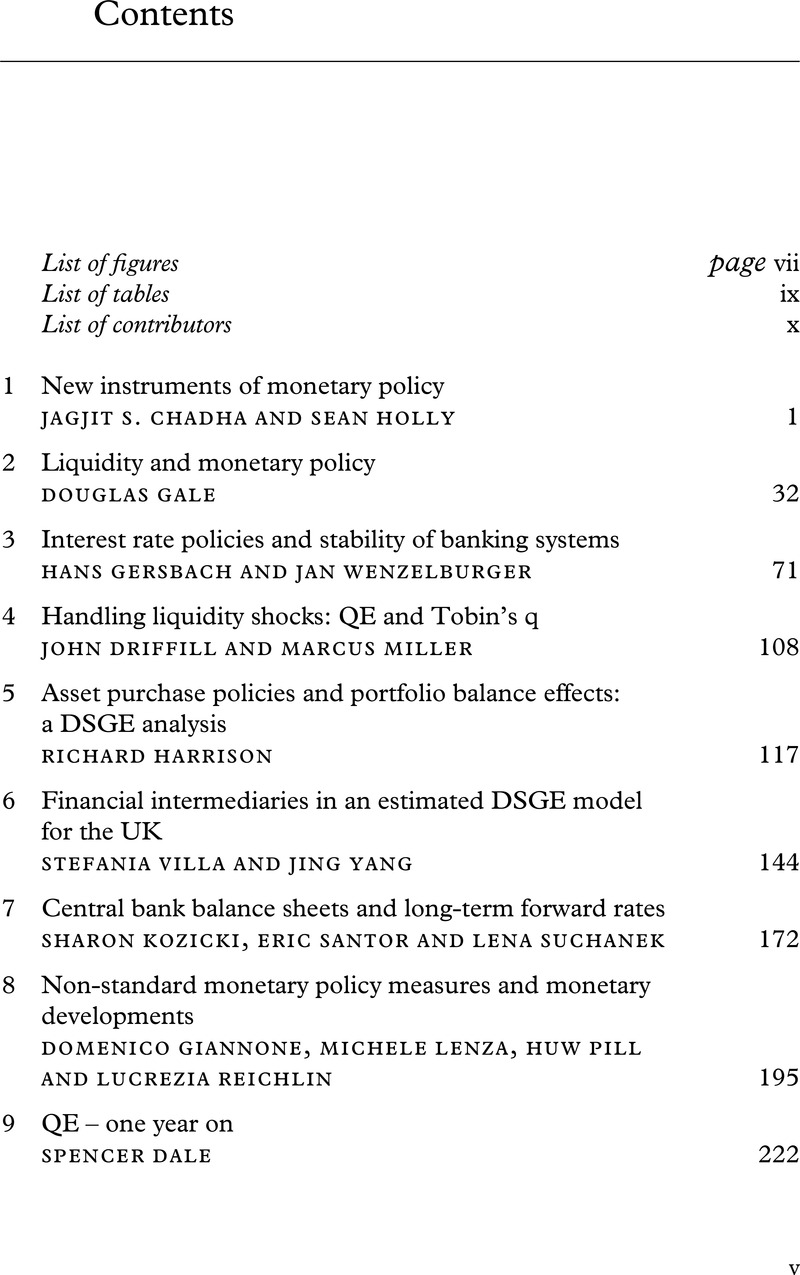

Contents

Published online by Cambridge University Press: 05 November 2011

- Frontmatter

- Contents

- Figures

- Tables

- Contributors

- 1 New instruments of monetary policy

- 2 Liquidity and monetary policy

- 3 Interest rate policies and stability of banking systems

- 4 Handling liquidity shocks

- 5 Asset purchase policies and portfolio balance effects

- 6 Financial intermediaries in an estimated DSGE model for the UK

- 7 Central bank balance sheets and long-term forward rates

- 8 Non-standard monetary policy measures and monetary developments

- 9 QE – one year on

- 10 What saved the banks

- 11 Non-conventional monetary policies

- Index

Summary

- Type

- Chapter

- Information

- Interest Rates, Prices and LiquidityLessons from the Financial Crisis, pp. v - viPublisher: Cambridge University PressPrint publication year: 2011