1 - Introduction

Published online by Cambridge University Press: 16 August 2023

Summary

Thomas Piketty’s Le Capital au XXIe siècle was first published in Paris during the summer of 2013. On the appearance of an English edition in March 2014 it became an international blockbuster, being quickly translated into German, Spanish and Chinese. Sales of all copies by January 2015 were 1.5 million and rising, fuelled by popular concern about growing income inequality and the links between inequality and global economic instability. Thanks to Piketty, and to his large transnational team of colleagues, together with a spate of recent books on global wealth and income disparities, distribution is back at the centre of our concerns.

PIKETTY’S PROMISE

In light of the mass of new comparative data contained in Capital in the Twenty-First Century, and in associated publications and appendices, it is clear that some common long-run trends in inequality across the developed world had not been sufficiently recognized. In particular, Piketty emphasizes the notable increase in income-generating wealth of top income earners in recent decades, together with rising pay. His study of top incomes, and their genesis, has unsettled the widely held assumption that capital’s share in national income (via interest, dividends and capital gains) would always necessarily revert to a long-run constant. The social concentration of wealth through inheritance and its role in cumulatively ratcheting up incomes, and thus further increasing wealth in the top 10 per cent or so of the population, is now in the spotlight. It is this that underpins Piketty’s dire prediction that, in the absence of fiscal and other measures to arrest the trend, things can only get worse. The new patrimonial class will increasingly engineer the political and legal process to further their economic interests, the rewards to merit and education in society will break down, and crises will ensue across the social democracies within a few decades.

Following the work of Simon Kuznets in the early 1950s, economists had generally assumed that modern economic growth would in the long run reduce the gap between rich and poor. In the early post-war years it was relatively easy to accept the inverted U-shaped curve of income distribution that Kuznets had identified for developed economies.

- Type

- Chapter

- Information

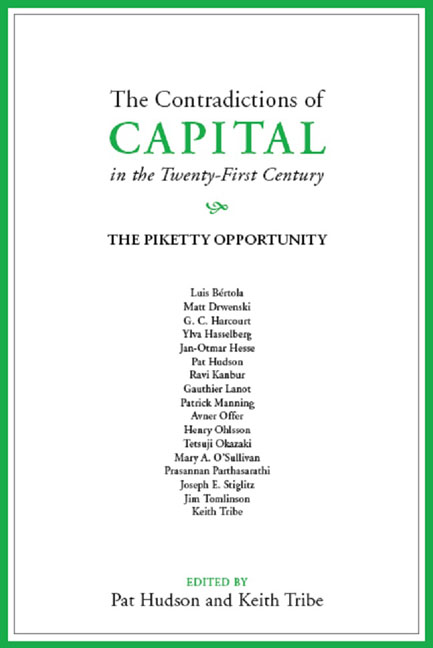

- The Contradictions of Capital in the Twenty-First CenturyThe Piketty Opportunity, pp. 1 - 10Publisher: Agenda PublishingPrint publication year: 2016