When the facts change, I change my mind. What do you do sir?

In its budget speech of February 19, 2008, the government of the Canadian province of British Columbia announced its implementation of a ‘revenue-neutral’ carbon tax.1 The tax started at $10 per metric ton of CO2 on July 1, 2008 and would follow a scheduled increase of $5 per year to reach $30 in 2012. Because I had been advising the government on climate policy, including design of the carbon tax, the premier of the province invited me to the budget speech along with environmentalists and business leaders. The idea was to show broad support in a high-profile event that included the official speech in the legislature, a gala reception, and media interviews. I declined to attend.

My reason was not that I opposed the tax. Rather, I was anticipating the political battle ahead, and wanted to maintain my position as a non-partisan academic expert who avoided hobnobbing with politicians at public events.

I have always been non-partisan in my climate policy advisory work, helping politicians across the political spectrum if they seemed sincere about climate action. But I knew that those opposed to the tax would try to paint my support as biased, motivated by a partisan preference for the governing, right-of-center party. They would try this even though I had been appointed a decade earlier by the left-of-center party to a five-year term as chair of the British Columbia Utilities Commission, had been an advisor to Canada’s Conservative minister of environment, and before that Canada’s Liberal government as it assessed options for achieving the country’s GHG reduction target under the Kyoto Protocol.

I correctly anticipated that there would be a vicious fight over the carbon tax in the year between its announcement and the provincial election. I also anticipated that this fight would be far from the evidence-based battles in which we academics engage. But even with my long experience in the cut-and-thrust of political policy debates, I did not anticipate how blatantly the tax’s opponents would lie about its effects. A new tax, even one that does not cause a net tax increase, is an enticing target for political shenanigans.

Why then did the BC government pursue such a politically risky policy? It’s important to understand the context, both globally and in this particular jurisdiction.

Globally, the period 2005 to 2008 was a ‘policy window’ for political action on GHG emissions. While ongoing conflicts in the Middle East were still dominating public attention, a shift began as Hurricane Katrina in 2005 set the stage for Al Gore’s 2006 movie, An Inconvenient Truth,2 and Nicholas Stern’s comprehensive report for Tony Blair’s UK government on the economic benefits of acting now to reduce GHG emissions.3 In 2005, the European Union implemented a cap on industrial emissions.4 In the US, Republican and Democrat senators and representatives were negotiating various bi-partisan bills to cap US GHG emissions, and international discussions intensified to bring the US back into either the Kyoto Protocol or, more likely, a new international agreement that would set emission limits for all countries, not just the wealthier ones. And Republican governors, like Mitt Romney in Massachusetts and Arnold Schwarzenegger in California, were pushing aggressive state-level climate policies to counter the reluctance of Republican President George W. Bush.

Although the Canadian Conservative government of Stephen Harper was also reluctant to act, as a minority government it needed to give lip-service support for Canada’s Kyoto target. In reality, it did as little as possible.

However, British Columbia’s premier, Gordon Campbell, was a policy wonk who was willing to show policy leadership even when that entailed political risk. In 2006, he got religious on the climate threat, and decided he should push to make British Columbia a model for climate policy. His new climate deputy minister, Graham Whitmarsh, contacted me and we began discussing policy options.

Campbell soon expressed interest in a revenue-neutral carbon tax because, as a right-of-center politician, he preferred its minimalist approach to government: giving a simple price signal that left businesses and households to decide for themselves if and by how much they would respond to the rising cost of fossil fuels. To be revenue neutral, government would lower personal and corporate income taxes to ensure that in each year these reductions in government revenues would equal its carbon tax revenues. To those low-income individuals who didn’t pay taxes, and thus would not benefit from a tax cut, the government would send lump-sum payments three times a year. The policy design team used the energy-economy model I had developed over the previous decade to estimate how carbon tax revenues would change as people changed technologies and perhaps behavior in response to the rising after-tax price of gasoline, diesel, heating oil, and natural gas. The price of electricity would change little because there are few electricity-derived GHG emissions in our hydropower-dominated jurisdiction.

Instead of the carbon tax, I had suggested that Campbell start with less politically risky policies, such as the flexible regulations I describe later in this chapter, while waiting to see if British Columbia could eventually join the emissions cap-and-trade policy that California was trying to convince western US states and some Canadian provinces to implement together. Campbell agreed, but also wanted the carbon tax. Ultimately, his was a shot-gun approach, adopting multiple pricing and regulatory policies, some of which overlapped significantly. After years of unsuccessfully trying to convince politicians to implement pricing or regulatory policies, I now found myself arguing for parsimony: reducing such policies to minimize regulatory complexity and implementation cost.

The ‘carbon tax war’ started on February 19, 2008. I experienced first-hand why politicians associated with carbon pricing have a high casualty rate.

During his previous seven years as premier, Campbell easily outpolled the opposition. With over a year until the next election, he held a 20-point lead. This is enormous in Canada’s first-past-the-post electoral system, where three and sometimes four parties split the vote, such that capturing only 40% of the total votes can deliver a landslide victory.

Recognizing the political gift, and desperate for any chance to improve its prospects, the left-of-center opposition party immediately launched an “ax-the-tax” campaign. No matter that this party’s own policy program promised a carbon tax. No one read these things anyway. And this sudden reversal enabled it to position itself at the head of mass opposition to the carbon tax which came from all directions – climate change deniers, fossil fuel interests, representatives of northern, suburban, and rural voters who claimed the tax was not revenue neutral for them, anti-tax advocates, truckers, talk show hosts, columnists, editorial boards. The major newspapers published a steady stream of anti-carbon tax op-eds, full of untruths.

My innocent and dumbfounded graduate students kept asking me why anyone would lie about the carbon tax. Why would opponents say it was a tax grab when it was revenue neutral? Why would they say it especially hurt the poor, when ours and the government’s widely publicized analysis showed the opposite, thanks to the direct payments to low-income people? Why did opponents say it would destroy the economy when the evidence showed it wouldn’t? Why did truckers say it hurt them when their costs could be passed on to customers? Why did northerners say it was unfair to them because of colder temperatures when data showed they had better insulated homes and so consumed the same amount of natural gas as southern British Columbians, and many also used untaxed wood for space heating? This is a sample of the relentless misinformation which my research group tried to correct by producing carefully researched reports and evidence-based op-eds in the weeks and months before and after the tax’s implementation.

My students also learned that political battles involve character assassination, with anyone as a potential target. We found out my house was under surveillance when reading in the newspaper about my hypocrisy as a carbon tax advocate who left his home fully lit during Earth Hour. As it turns out, on that fateful evening I was visiting friends in Toronto, where we dutifully extinguished all lights in a politically correct, candle-lit vigil. Meanwhile, back in Vancouver, my teenage kids were hosting a raucous Saturday night party, oblivious to the fact it was Earth Hour. Later, they were confused when, instead of lambasting them for an unsanctioned party, I groused about their choice of lighting. “Why couldn’t you have used candles?” “But you always said candles were a bad idea at teenage parties?”

Surveys by political scientists and professional pollsters confirmed that the ax-the-tax campaign was a huge success. Although publicized analysis by the government and my research team showed that 30% of British Columbians would be net financial losers under the revenue-neutral carbon tax (years later confirmed with hindsight analysis by my former student Nic Rivers and colleagues5), polls showed that the public believed the opposite, with 70% assuming they were net losers. People notice the posted price of gasoline far more easily than a change in the percentage of their income tax rate. Who other than accountants and economists knows their income tax rates?

Since many British Columbians hold strongly pro-environment views, there was substantial support for the carbon tax. But what matters for any political leader’s survival is to find enough support in key swing electoral districts (ridings) to win a general election. For Campbell, that likelihood was diminishing fast. In just six months, his 20-point lead evaporated, and the trend indicated he would lose the May 2009 election because he would be defeated in key swing districts. A sudden collapse of this magnitude only happens after a sex or corruption scandal.

However, Campbell got lucky in the fall of 2008. As the world spiraled into a financial crisis, British Columbians suddenly had bigger economic concerns, and Campbell had always polled best on managing the economy. Moreover, the global recession that followed the financial crisis caused the price of oil to drop from its high level of the previous four years. In the six months preceding the election, anti-tax campaigners had difficulty sustaining anger among the electorate since the carbon tax came into effect just as gasoline prices were plummeting. The first year of the carbon tax would have increased gas prices by only two cents per liter, but thanks to the oil price collapse, they actually fell by 15 cents.

As the graph of political support over time in Figure 6.1 shows, the ax-the-tax campaign helped the left-of-center party, the NDP, overcome in just six months the 20-point lead of Campbell’s Liberal Party. But the economic crisis in late 2008 reversed the trend, and he held his support to win the election, just barely. The BC carbon tax survived its first electoral test. But, as the Duke of Wellington purportedly said after defeating Napoleon at Waterloo, “It was a near run thing.”

Figure 6.1 Political support in British Columbia (Dec 2006–May 2009)

Campbell stepped down in 2011 and his replacement froze the carbon tax, meaning that its effect declined with each year of inflation. For a while it looked like she might rescind it. But politicians in British Columbia are expected to annually balance the budget, so she would have needed to raise income taxes to offset the lost revenue from a canceled carbon tax. Those of us who had argued for revenue neutrality when designing the tax felt vindicated. This design gives the best chance for sustaining the tax. If it is linked to spending on energy efficiency, electric cars, or other GHG-related actions, the next government can cancel these while it eliminates the carbon tax to demonstrate its solidarity with “downtrodden motorists.” Implementing and then sustaining climate-energy policies of rising stringency is not politically easy.

* * *

I explained in Chapter 4 that GHG reduction is a global collective action problem – all countries, or at least all major GHG emitters, need to act in concert for global success. This requires a global enforcement mechanism, without which each country’s efforts are likely inconsequential, making it difficult for sincere politicians to push for domestic energy transformation.

But even if GHG emissions were only a domestic rather than a global environmental challenge – meaning that each country could prevent climate change within its borders by reducing its own emissions – public acceptance of transformative climate-energy policies would still be elusive. Deep decarbonization imposes near-term real and perceived costs, some of them seemingly concentrated in fossil fuel-endowed regions, to produce society-wide long-term benefits. This timing disconnect of costs and benefits is always politically difficult, and the geographical imbalance of real and perceived costs makes it even more so. Regions, corporations, and consumers with a vested interest in fossil fuels will impede energy transformation policies, with some propagating misinformation about climate science and the cost of deep decarbonization.

In the face of this opposition, politicians must recognize the low odds of achieving a climate-energy consensus. They must show leadership by enacting effective policies while knowing that fossil fuel interests will use aggressive tactics to prevent or delay these. Under this relentless pressure, few politicians stay the course, even those who are concerned and sincere.

Moreover, the divergence between the four-year electoral timeframe of most democratic systems and the multi-decade timeframe of deep decarbonization facilitates the deception strategies of insincere politicians, who promise to lower gasoline and electricity prices today and to dramatically reduce GHG emissions within 15 years. These faking-it politicians know they will have retired by the time their false GHG promise is exposed. And the challenges from these insincere politicians often compel the sincere politicians to retreat toward safely distant GHG targets and largely ineffective climate-energy policies.

Political scientists who research policy-making in democracies note that the challenges facing climate-energy policy are not unique. In his 1960s book, The Logic of Collective Action, Mancur Olson explained why policies that might broadly benefit society have a higher likelihood of failure if their costs (real or perceived) are concentrated among a smaller group that is highly motivated to campaign aggressively to prevent them.6 Some countries, and some regions within countries, certainly fit the bill for an agenda determined by their fossil fuel endowment.

Success in the face of powerful interests might be helped by broad-based efforts to educate and build consensus on the need for transformative climate-energy policies. But to rely on this alone is naïve. Indeed, politicians and climate action advocates who base their strategy on rationally convincing most people in fossil fuel-endowed regions of the necessity and fairness of energy-system transformation share responsibility for our ongoing failure. Instead, they must recognize the real-world constraints on rational policy-making, as explained by political scientists, sociologists, and social psychologists, and from this recognition develop strategies less dependent on a policy consensus for success.

In their book, Democracy for Realists: Why Elections Do Not Produce Responsive Government, Christopher Achen and Larry Bartels explain, “Group and partisan loyalties, not policy preferences or ideologies, are fundamental in democratic politics … For most people, partisanship is not a carrier of ideology, but a reflection of judgments about where ‘people like me’ belong.”7 Daniel Kahneman in his book, Thinking Fast and Slow, refers to our various group thinking cognitive biases, such as the ‘halo effect’ in which we give the benefit of doubt to someone from our group, even though their position may now be at odds with our initial position.8 And political scientists have long referred to the ‘Nixon goes to China’ phenomenon, whereby a political leader with unassailable credentials in the eyes of a particular group is allowed to effect change they would strongly oppose if pursued by a political leader external to their group. (Known as a hardline anti-communist, Republican President Richard Nixon visited China in 1972 to re-establish diplomatic relations, a more difficult gesture for left-of-center Democrat presidents, lest they be seen as soft on communism.)

As the popular leader of a right-of-center political party, Gordon Campbell was able to garner support from the political party most likely to oppose compulsory GHG policy, because he was a highly trusted leader of the tribe. If he thought they should act on climate, maybe they should. Thus, after years of ignoring the climate threat, members of this party were suddenly interested. It was particularly entertaining to watch previously skeptical cabinet ministers, whose narrative had been “there’s no sense acting until everyone acts,” suddenly arguing that “the time for action is now.” I was reminded of this reversal a decade later when observing US Republican politicians, who had earlier slammed Donald Trump as outrageous and despicable, changed their tune once he became president and leader of their party.

In its 2005–2009 term in office, the popular Campbell government was into its second mandate after a successful first four years. This aura of political success accorded Campbell almost dictatorial powers in pursuing his new passion for GHG policies – including a carbon tax. In fact, in just two years he legislated virtually all of the compulsory policies for reducing emissions.

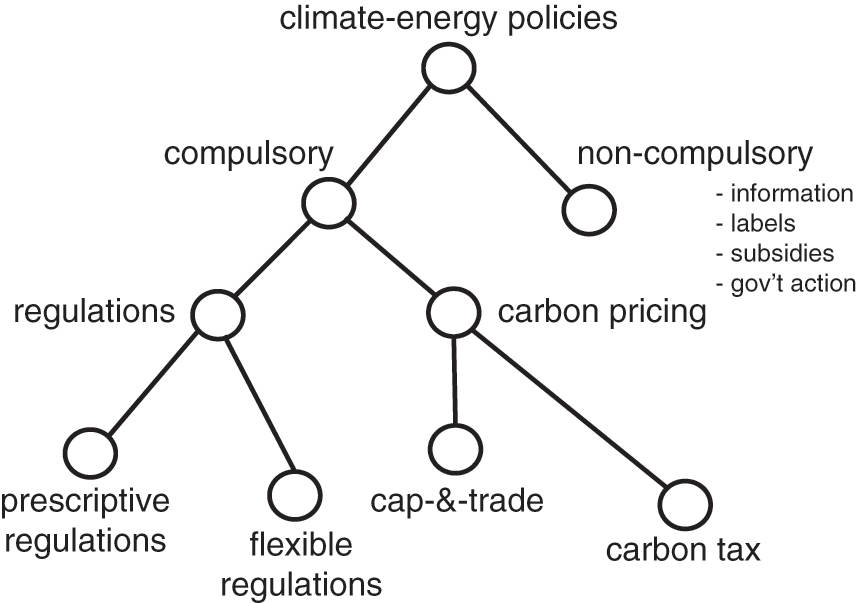

Figure 6.2 is a more detailed version of Figure 5.3 in Chapter 5. The initial version stopped at the level of regulations and carbon pricing, the two generic alternatives for compulsory policies. This abridged version of the figure enables me to focus on the distinction between non-compulsory policies, that on their own cannot cause a major energy system transformation, and the compulsory regulations or carbon pricing that can. The extended version in Figure 6.2 includes a bottom row showing multiple regulatory and carbon pricing options. While I have already explained the distinction between carbon pricing and cap-and-trade, the diversity of regulatory options, as depicted in the two categories on the bottom left, is often ignored in discussions of our climate-energy policies.

Figure 6.2 Climate-energy policy: details on regulations and pricing

The carbon tax is well understood, or at least by the tiny percentage of the public that is interested. To apply the tax, the government changes the tax rates it charges consumers of coal, natural gas, gasoline, diesel, heating fuel, jet fuel, and so on to reflect their carbon content, the assumption being that all of the carbon will eventually end up as atmospheric CO2. If, however, a coal plant is capturing and safely storing some of its emissions, the quantity of captured carbon is subtracted from the quantity of carbon in the consumed coal, so that the tax only applies to emissions that reach the atmosphere. The $30 carbon tax in British Columbia increased the price of gasoline by 7 cents per liter or 28 cents per gallon. The tax per liter of diesel is slightly different because this fuel has a different carbon content per liter.

Some industries, such as cement and aluminum, and some sectors of the economy, such as agriculture and forestry, emit CO2 and other GHGs that are not the result of burning fossil fuels. Government can require producers of these emissions to report them so that it can charge the appropriate tax. But this gets complicated with the more difficult-to-measure emissions, such as methane released from a pile of cow manure. The government exempted these emissions to minimize the administrative challenges of implementation, not to mention the political costs of aggravating farmers with a new tax.

Government can use the carbon tax revenues in various ways. Some people argue it should subsidize emission reductions, with grants for home insulation, electric cars, transit expansion, and wind turbines. The counter argument is that the tax already incentivizes these actions, so revenues should be allocated where they best benefit society. According to economists, societal benefits are maximized by cutting taxes that hinder economic growth, which explains the Campbell government’s decision to cut corporate and personal income taxes.

People concerned with political acceptability, however, focus on more visible ways of returning the tax revenue. An ‘atmospheric dividend’ is one of many marketing terms suggested for periodic lump-sum payments that would return all carbon tax revenue directly to households. I confess to some skepticism with the argument that carbon taxes will be politically popular once we label and use them a certain way. For decades, I’ve heard arguments that carbon taxes would be accepted if only government used a clever label. “Don’t call it a tax, call it a carbon levy.” “No, call it a pollution charge.” “No, call it an atmospheric user fee.” “No, call it a (fill in the blank).” I’ve also heard for decades that if only the carbon tax revenue were used in such and such a way, then it would be politically acceptable. “Don’t keep the money in general revenue, cut income taxes.” “Don’t cut income taxes, give subsidies for voters to insulate their homes and buy low-emission vehicles.” “No, give money to those most impacted by the tax.” “No, give equal ‘dividend’ payments to each individual or household since they are all potential voters.” “No, give the money back as (fill in the blank).”

My review of the evidence and my anecdotal experience suggests that no matter what euphemism proponents offer, it takes no time at all for carbon tax opponents to convince an electorally significant share of voters (which only need be a few percent if this becomes the single issue that determines these people’s votes) that the tax is harming them financially, while government wastes millions in postage and advertisements to buy their vote with their own money. Barry Rabe explores this issue of how to ‘frame’ the carbon tax in his book, Can We Price Carbon?, and indeed finds that some strategies are less objectionable than others.9 But my point is that the framing of carbon tax implementers must overcome the well-financed ‘reframing’ campaign of carbon tax opponents, complete with well-funded and therefore widely circulated lies that confuse the public about the benefits and costs of the tax and the various ways of using its revenues. Research on the challenges of framing and reframing strategies for garnering public support of climate policies seems generally consistent with my skepticism.10

We learned from our experience in British Columbia that many people could not grasp how a revenue-neutral carbon tax would lower emissions. I was a regular on radio talk shows, which, to the chagrin of the government, intensified their focus on the carbon tax around July 1 each year, the date of its annual scheduled increase. The media loved this boost in ratings, as angry callers defiantly argued “I’ll use the carbon tax rebate to buy the same amount of gasoline when I fill up my pick-up truck, so this stupid policy changes nothing.”

I am never satisfied with my attempts to clarify in one-minute radio-clips why a revenue-neutral carbon tax would optimally reduce emissions, hence my sympathy for the poor politician trying to explain this in a candidates’ debate. Given more time to explain this in my undergraduate sustainable energy course, I’ve had some success. Still, an amazing number of students perform poorly with this on exam questions. They keep forgetting that each person or household or taxpayer receives an identical rebate, regardless of how much carbon tax they paid. One person might pay $120 in carbon taxes and another $80, yet both receive a rebate of $100. Both have an incentive to reduce their carbon emissions, and thus their carbon tax payments, since that reduction will not affect the size of their rebate. If the person originally paying $80 finds a way next year to pay only $60, they still get the $100 rebate. Because the carbon tax increases the relative prices of fossil fuel products, some people will consume less than previously, perhaps by changing behavior, perhaps by changing technology. The pick-up truck driver might not reduce his consumption in response to the carbon tax. It’s his prerogative to do nothing and call the tax stupid. But smart people will explore their options.

Thus, another challenge is to respond to comments like, “It’s unfair because I can’t change my behavior. I still need to get the kids to (name your activity) and there are no alternatives to the car where we live.” Again, it is easier explaining to my captive students that a carbon tax is not focused on changing behavior. It lets each person decide if they will change technology, change behavior, or do nothing and pay the full tax. They, rather than government, decide what is best for them, depending on their preferences and costs. Some people, like the pick-up driver, may use the same technology in the same way. But some will choose a more efficient gasoline option or a plug-in or biofuel option for their next vehicle purchase, without changing behavior. Some will carpool more frequently for kids’ events or commuting. Some will move to higher density suburbs or the inner city where destinations are closer, so that they drive less, and where vehicle alternatives like transit, walking, and cycling are more accessible. The net effect of these diverse individual responses to a rising carbon tax is a reduction in GHG emissions, without mandating that anyone behave in a particular way or purchase a particular technology. But good luck trying to get all voters to grasp this argument, especially that small percentage of suburban voters who have a disproportionate influence on the outcome of close elections.

I could go on about the travails of defending a carbon tax. This activity has been a big part of my life for over a decade. The experience helps explain my jaded response to those economists who refer to “the ease of explaining why the carbon tax is the best policy.” It didn’t help my attitude that throughout the past decade economists from around the world made pilgrimages to British Columbia to study our ‘ideal’ carbon tax, yet showed little interest in the real-world evidence I and others provided on how easy it is for opponents to mislead a modest, but electorally significant, share of voters with blatant lies.11

Because the other carbon pricing policy in Figure 6.2, cap-and-trade, avoids the word tax, there is hope that it may be more politically acceptable. As I described in Chapter 5, government sets a cap on emissions for all or some sectors of the economy, and auctions or freely allocates (called ‘grandfathering’) tradable emission permits (also called ‘allowances’) that sum to the total emissions cap. In future years, the cap declines according to a schedule, meaning that the number of permits issued by government each year also declines.

As with a carbon tax, this policy does not require a specific change in technology or behavior. If the policy is applied to industry, a given firm may reduce enough emissions that it has a surplus of tradable permits to sell to other firms. Or, it could do less reductions and be a permit buyer. The trading price of permits acts the same as a carbon tax, putting a price on emissions but letting individuals decide how to respond, depending on their costs and preferences. Because of this common feature, economists estimate that the carbon tax and cap-and-trade cost the economy about the same for a given reduction of GHG emissions.

The implementation of cap-and-trade does not require that individual households become active in the permit trading market. Instead, their electric utility, natural gas utility, and gasoline company buy and sell permits on their behalf, based on the carbon content of each form of energy they use, from production through to the final product, and this cost gets passed on to consumers in their electricity and natural gas rates, and in the price of gasoline. They react to this price increase just as they do to energy price increases caused by a carbon tax. This is why both the carbon tax and cap-and-trade are called carbon (or emissions) pricing policies.

They differ, however, in that cap-and-trade requires the establishment of a government institution to allocate permits and regulate their trading. In contrast, the carbon tax incurs no extra administrative costs. Government simply changes the rates of the taxes it already imposes on energy products. The emissions cap also differs in providing greater confidence that a given GHG target will be achieved – if the cap is binding and the allocated permits equal the cap. In contrast, people’s response to the carbon tax is less easy to predict, so we are uncertain of the GHG reductions that will result from a given carbon tax. The tax does, however, provide price certainty if government announces its level (whether constant or rising) for the next several years. This was something I lobbied strongly for as we designed the BC carbon tax, as this helps people trying to guess the future price of energy when buying their next long-lived technology like a furnace or car. We legislated its rising value from 2008 to 2012. In contrast, the price of GHG emissions (and therefore of energy) is uncertain under cap-and-trade, since it depends on the uncertain market for emission allowances.

Because of this uncertainty, real-world applications of cap-and-trade may include a modification which makes the two policies even more similar. The government sets a floor and a ceiling price for permits in the permit trading market, by promising to adjust the available permits each year to keep the price within these upper and lower bounds. This reduces price uncertainty, but on the flip side it increases uncertainty about the emission reductions. Finally, the two policies can be even more similar if government auctions some or all of the emission permits instead of freely allocating them. The auction revenues are similar to carbon tax revenues, presenting the same dilemma for government in terms of how best to use them from an economic and political perspective.

The most notable examples of GHG cap-and-trade policy are the European Union system applied to industry since 2005 and the California system applied to economy-wide emissions since 2013. The Canadian province of Quebec joined the California program in 2014, followed by the province of Ontario in 2017. In 2018, however, a newly elected Ontario Conservative government canceled the province’s cap-and-trade policy, having promised during the election campaign that, as a friend of struggling motorists, its first act would be to eliminate it. To gain votes, it incessantly referred to the cap-and-trade policy as “a carbon tax by another name.” It won in a landslide – having also promised cheaper beer.

* * *

Economists generally don’t like regulations. They argue that regulations (also called standards in the US) are not as economically efficient as carbon pricing because they constrain the choices of consumers and firms, with government regulators determining the technology that each should adopt. In contrast, by allowing each individual or firm to determine their preferred (presumably cheapest) response to rising fossil fuel prices, carbon pricing ensures that GHG emissions decline at the lowest possible cost – notwithstanding the claims of dishonest politicians that it’s an “economically disastrous” way of reducing emissions.

When regulations are particularly inflexible, we refer to them as ‘prescriptive’ or ‘command-and-control,’ terms that have been around since the late 1960s, when a surge in environmental concerns in wealthier countries triggered a wave of environmental regulations. Hindsight studies by economists showed that many of these prescriptive regulations had high costs relative to a pricing approach, for the same environmental benefit. And this is why economists keep proposing carbon taxes as the right response to the climate-energy challenge.12

However, not all regulations are created equally. Under pressure from industry and economists, regulators have increasingly opted for what are called ‘market-oriented regulations’ or ‘tradable performance obligations’ or ‘tradable standards’ or ‘flexible regulations.’ I call them ‘flex-regs,’ which non-experts tell me they find easiest to remember. Flex-regs have features that mimic the flexibility of carbon pricing.

While I distinguish only two categories of regulations in Figure 6.2 – flexible and prescriptive – we should place regulatory options along a continuum. At one end, extremely prescriptive regulations tell industry or consumers exactly how much to emit or which specific technology to adopt. At the other end, flex-regs focus on a market-wide outcome without dictating the specific behavioral or technological choices of individuals and firms. Flex-regs allow those under regulation to trade among themselves, with some overperforming and some underperforming, as long as the net effect is to achieve the aggregate market requirement.

In 2007–2008, I helped the British Columbia government implement two flex-regs – the clean electricity standard and the low carbon fuel standard. And in 2018 it launched the zero-emission vehicle standard. These flex-regs are similar to US policies of recent decades.

Almost 30 US states have a ‘renewable portfolio standard,’ a flex-reg mandating that a minimum percentage of electricity is generated from renewables each year.13 Because this is a requirement for the entire market, individual electricity providers are not required to achieve the minimum percentage, as long as they pay other providers to exceed the minimum. They make this payment by buying surplus renewable electricity credits from those electricity suppliers that exceed the market obligation. Its adoption by so many US states suggests that this flex-reg is less politically challenging than carbon pricing. Its adoption by Texas in 1999 is notable for contributing to a rapid deployment of windpower, which in turn helped lower the cost of this electricity source.14

Since the 1990s, I had been lobbying for a renewable portfolio standard in British Columbia, but with a twist. As an economist, I argued that the policy would be more economically efficient if it was not restricted to renewables, but instead open to any low-emission electricity source. In 2007, I found a receptive ear in the Campbell government and helped design a 90% ‘clean electricity standard,’ meaning that the mix of new electricity-generation investments must match the current generation mix, that being 90% clean (near-zero-emissions) in our hydropower-dominated jurisdiction. The remaining 10% could be natural gas turbines for regional backup, diesel generators in remote off-grid communities, or industrial cogeneration facilities using natural gas.

This was a big deal. Large hydropower is politically difficult in British Columbia. The first project in 40 years is under construction, but it will be the last. Called “Site C,” this project was reviewed and then shelved because of environmental opposition in the 1970s. The province also has vast deposits of low-cost, high-quality coal and natural gas. Thus, when we implemented the clean electricity standard in 2007, the main electric utility, BC Hydro, had already signed agreements for two private coal-fired power plants and was planning to construct its own 600-megawatt natural gas plant. The policy forced it to abandon these fossil fuel projects.

This type of policy in a jurisdiction with existing coal plants, such as the province of Alberta next door, would be less efficient than carbon pricing – which incentivizes the operators of existing coal plants to find a cost-minimizing balance of reduced operation of some plants and the shut-down of others. But in British Columbia, with its hydropower dominance, our analysis indicated that the flexibility of our clean electricity standard would result in similar total costs as a carbon tax for a given GHG reduction. And because the BC carbon tax of $10 rising to $30 by 2012 was not high enough to deter construction of new coal and natural gas plants, the clean electricity standard presented a less controversial way of preventing these investments. For the same environmental outcome, the carbon tax would have had to rise much faster.

The second key flex-reg we implemented in British Columbia in 2007 was the ‘low carbon fuel standard,’ a policy similar to the one California innovated a year earlier. The low carbon fuel standard requires that the average carbon intensity of energy sold for use in transportation decline over time. Although it is called a fuel standard, it is really an energy in transportation standard because it includes electricity, hydrogen, and any other form of energy used in transportation (even though these are not traditionally called fuels). The required reduction in carbon intensity applies to each form of energy’s ‘full-cycle emissions’ – the emissions when gasoline is burned, but also the ‘upstream emissions’ that occur when extracting oil, processing it, and then refining it into gasoline. This inclusion of upstream emissions applies equally to the production of diesel, biofuels, electricity, hydrogen, and any other form of energy used in transportation.

Policy commentators sometimes suggest that while flex-regs like the renewable portfolio standard and the low carbon fuel standard can contribute to GHG emission targets, they must be applied alongside carbon pricing policies for deep decarbonization. This is incorrect. With, for example, a target date of 2050, governments can set a clean electricity standard that achieves an extremely low electricity-carbon intensity and a low carbon fuel standard in which aggregate full-cycle emissions achieve near-zero for the slate of energy forms used in transportation. In 2017, my former student, Tiffany Vass, played the lead role in modeling a low carbon fuel standard for Canadian transportation that achieved an 80% reduction by 2050, including the cost-effective reductions in the upstream production of each form of energy.15

Like the renewable portfolio standard, the low carbon fuel standard is flexible in that individual transportation energy suppliers don’t need to achieve the required carbon intensity in a given year, as long as they buy credits from suppliers that surpass this requirement. A supplier of electricity, biofuels, or hydrogen for vehicles is given credits for selling these forms of low-emission energy for transportation. When gasoline sellers purchase some of these credits, so that their sales portfolio satisfies the carbon intensity requirement of the low carbon fuel standard, the ultimate effect is to lower the price of electricity and biofuels while raising the price of gasoline. But the policy is flexible because it doesn’t force consumers to buy electric or biofuel or hydrogen vehicles. It lets them decide how they will respond to the combination of a rising price for gasoline and a falling price for the electricity, biofuels, and hydrogen used in vehicles. They might get a more energy-efficient gasoline car, drive less, or switch to a low-emission vehicle.

Some economists argue that in spite of their flexibility, the low carbon fuel standard and renewable portfolio standard can be fairly expensive ways of reducing GHG emissions relative to the carbon tax and have not yet had a big impact.16 But many of these studies focus on near-term, modest targets for these flex-regs rather than on their likely performance if applied as lead policy for deep decarbonization. In this latter application, we and others have found that rising gasoline prices under both carbon pricing and this flexible regulation would become similar as the carbon intensity in transportation energy fell to very low levels. At that point, the economic efficiency difference between the flex-reg and carbon pricing is modest.17

A third important flex-reg, also in the transportation sector, is the vehicle emission standard. While the US has had vehicle ‘energy efficiency’ standards since the oil crisis of the 1970s, California has long focused its vehicle regulations on emissions that affect local air quality. However, since 1990, it has increasingly incorporated GHG emission limits into its vehicle regulations. Plug-in electric and hydrogen cars can have zero GHG emissions at the point of consumption, which California refers to as ZEVs – zero-emission vehicles.

California’s ZEV mandate gets the most attention. By notifying vehicle manufacturers years in advance that they must achieve minimum percentage targets for ZEV sales, and imposing penalties for non-compliance, the ZEV mandate incentivized the development and commercialization of plug-in electric and hydrogen fuel cell vehicles. The former are now developing quickly, in part thanks to Elon Musk’s brainwave of targeting wealthier buyers with a high-performance status car. Since Tesla obviously exceeds its annual ZEV percentage sales requirement, each year it has surplus credits to sell to other manufacturers, and the revenue from these sales helps it lower the price on its electric vehicles.

To pay for these credits, or to sell more of their own ZEVs in an effort to meet the mandate, sellers of gasoline vehicles must increase the price of these, in effect creating a cross-subsidy from gasoline vehicle purchasers to ZEV purchasers. Buyers of gas-guzzling pick-up trucks and luxury cars may pay $1,000 to $2,000 more for these planet-harming acquisitions, but with the typical extra costs of vehicle features, they’re unlikely to notice they are subsidizing ZEV purchasers.

From a cost perspective, the ZEV is more expensive than a carbon tax because it doesn’t price gasoline. The carbon tax gives consumers more flexibility, as some may opt to drive a gasoline car less as the carbon tax rises. But the ZEV has flexibility attributes that help reduce compliance costs. As noted, its credit trading feature allows manufacturers to decide who among them will produce more electric and hydrogen cars, presumably those for whom this activity will be most lucrative. Also important, it does not favor specific technologies, allowing vehicle sellers and buyers to determine through their choices the ultimate mix of electric, hydrogen, and perhaps plug-in hybrid vehicles that fulfill the ZEV mandate in a given year. And the policy drives competition that continuously lowers the costs of deep decarbonization of personal vehicles. A similar policy can be applied to commercial trucks of various sizes, perhaps including biofuels as a near-ZEV (ultra-low-emission) option.

In sum, flexible regulations, like the renewable portfolio standard, the low carbon fuel standard and the vehicle emission standard, are not as cost-effective as carbon pricing for a given GHG reduction. But, if designed to maximize the flexibility for firms and households as they respond to these flex-regs, the cost-effectiveness difference may be reasonable, especially for the full energy system transformation required by deep decarbonization. This is something that more researchers are exploring, especially since the two policy approaches appear to perform so differently in terms of political acceptability and their likelihood of implementation.18 My research team is contributing to this work.19

After the 2009 failure in the US of the cap-and-trade bill (the Waxman-Markey bill),20 President Obama spent the remaining seven years of his presidency pursuing sector-specific regulatory alternatives to economy-wide carbon pricing. He focused his efforts on the electricity and vehicle sectors, where US executive powers are well established through the regulatory mandate of the Environmental Protection Agency.21

In the vehicles sector, he tightened energy efficiency standards (called “Corporate Average Fuel Economy” or “CAFE”) and incorporated stricter emission performance criteria. However, the challenge, from a deep decarbonization perspective, is that energy efficiency has diminishing returns: better fuel economy means that driving costs less, which motivates more vehicle use. Because of this ‘rebound effect,’ which I return to in Chapter 10, the increased use of a more energy-efficient device negates some of the reduction of energy and emissions it was intended to cause.

In the electricity sector, Obama implemented the “Clean Power Plan,” a regulation under the Environmental Protection Agency that required declining emissions from coal-fired power plants.22 In order to make the regulation less costly, it included multiple flexibility provisions. Emission reductions could be measured by intensity or absolute amounts. While each state was given a target based on past emissions, states could trade among themselves to lower costs.

These efforts by President Obama to use his executive powers were laudable. But, given the limited terms of US presidents, this is a tenuous approach to deep decarbonization, as the next occupant of the White House can reverse executive orders. Donald Trump wasted little time in halting Obama’s tightening of vehicle regulations and his clean power plan.

These reversals raise an issue that is debated by climate policy advocates and experts. Is it easier for future governments to reverse regulations or carbon pricing? Some people have strong views on this. But it seems to me that no climate policy can be inoculated against the will of future governments to eliminate it. The best chance is if the stringency of the policy rises fast enough to cause much of the desired energy transition before a future government can reverse it. If many coal plants are closed before a climate skeptic like Donald Trump attains power, he will have greater difficulty resurrecting them.

The elimination of coal-fired power plants in the Canadian province of Ontario is one such example. From 2004 to 2014, one political party held office long enough to implement an ambitious policy of closing all coal plants, which had previously provided 25% of the province’s electricity. The government rushed to finish the transition within a decade, aware that no future government could resuscitate the decommissioned plants. It succeeded.

In contrast, carbon pricing is problematic if intended to play the lead role in energy system transformation. Implementing governments need to retain power long enough for it to have a significant effect, such as forcing the closure of coal plants. But this requires rapidly increasing the tax, which increases the likelihood that the implementing government will lose the next election – Catch 22. This is why in British Columbia we implemented the clean electricity standard, even though we were also implementing a carbon tax. By our calculations, the latter, at its initial level and rising schedule chosen by government, would not have prevented construction of the planned coal and natural gas plants.

Advocates of carbon pricing frequently point to all the jurisdictions that have a price on carbon, be it a carbon tax or cap-and-trade. What they fail to mention is the stringency. I have not seen evidence of a rising carbon price that alone would sufficiently increase coal and gasoline prices to lead a major energy system transformation. The UK has used a combination of carbon pricing and regulation to phase out its coal plants. The carbon price is no doubt contributing, but so are the regulations and other government policies.23

Scandinavian countries have had high carbon taxes for over two decades. But the initial implementation of carbon pricing involved modest adjustments to already-high gasoline and diesel taxes that had been raised in the 1970s to reduce dependency on oil imports. Increases in the price of gasoline between 1990 and 2010 were mostly caused by rising world oil prices. In recent years, however, the carbon price in Sweden has been rising, and certainly has had an important effect, especially in the choice of energy for heating buildings – both individual and in district heat systems. Unfortunately, other countries lack the public trust in government that is needed to follow the carbon pricing of Scandinavian countries.24 And even there, it is not easy to distinguish the carbon price effect from the other subsidy and regulatory policies that reduce energy use and GHG emissions in electricity generation, buildings, industry, and transportation.25

Since the failure of cap-and-trade in 2009, the application of carbon pricing in the US seems inconceivable. But that is not the case for the 40 million Americans living in California. That state’s cap-and-trade system charges about $20 per metric ton of CO2, which equates to 16 cents per gallon of gasoline. Thus, Californians have carbon pricing. But how important is this policy to the state’s ambitious GHG reduction efforts?

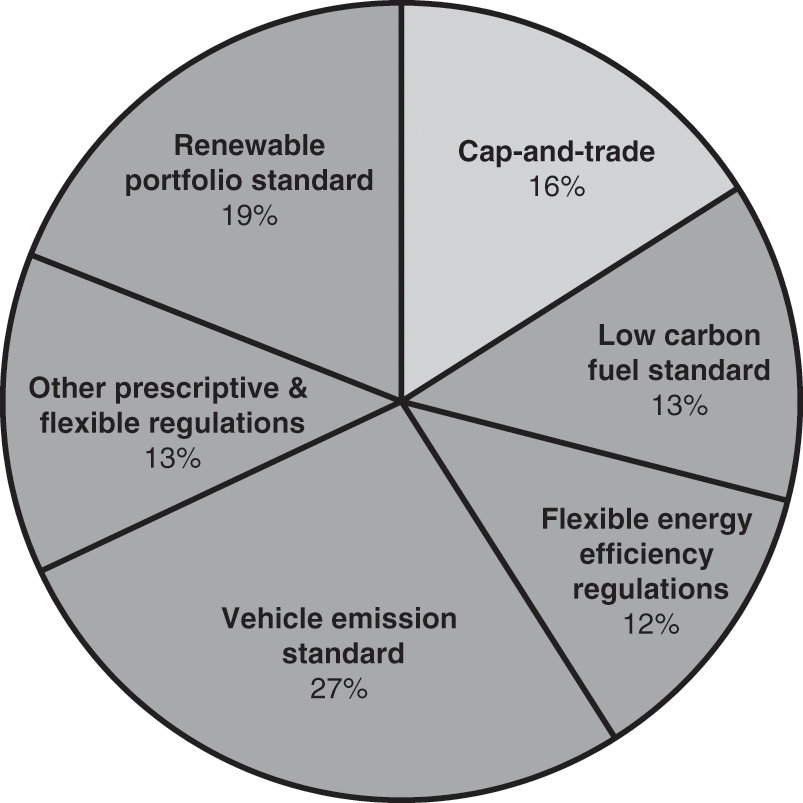

The pie chart in Figure 6.3, made from data of the California Air Resources Board, shows the relative contribution of different policies to that state’s projected GHG reductions. Note that carbon pricing (light gray) contributes only 16%, while regulations of various types contribute most of the rest (dark gray). Of these, flex-regs are dominant, including the renewable portfolio standard in electricity and the low carbon fuel standard and vehicle emission standards (and ZEV mandate) in transportation. Economists might wish it were otherwise, but in the most climate-sincere state in the US, this is the climate-energy policy reality.

Figure 6.3 Contribution of California policies

Many economists talk as if carbon pricing is the only legitimate option for driving the energy transition. But the politicians and regulators who are actually having an impact in leading jurisdictions like California view the world differently. While they may pay lip service to carbon pricing, the lead policy to drive energy system transformation thus far has been prescriptive regulations and flex-regs. Our experience with the carbon tax in British Columbia has helped me understand why.

* * *

There is a long-standing joke that we economists are a breed of social scientists who try to figure out if what works in our theories could possibly work in the real world. My decades of climate-energy policy experiences keep reminding me of that joke. Politicians who show leadership in the difficult task of energy system transformation are telling us something by their actions. But are we researchers willing to learn from these, and use that knowledge to help them do better?

Because they involve the trading of credits, flex-regs change the prices that influence the decisions of producers and consumers of energy. In fact, the credit or permit trading prices can be used to estimate the ‘implicit carbon price’ of a flex-reg like the renewable portfolio standard. Taking the difference in energy costs between renewables and emitting generators (coal and natural gas) and dividing this by the difference in the emissions of the two groups, gives a ratio of cost (or implicit carbon price) per unit of CO2 reduced.

This implicit carbon price of flex-regs can be compared with the ‘explicit carbon price’ of cap-and-trade or carbon taxes to estimate their relative economic costs. Thus, if a $20/tCO2 carbon tax reduces emissions 1 million metric tons in the transport sector while a flex-reg like the low carbon fuel standard requires an implicit carbon price of $40 to achieve the same reduction, the carbon tax is more economically efficient by $20 per metric ton reduced.

This is useful information. But sincere politicians who want to lead on climate-energy policy need more.

First, they need to know the most economically efficient design for the flex-reg in a given sector and how they can mesh that policy with flex-regs in other sectors. What is the best design of the renewable portfolio standard or low carbon fuel standard? And what stringency of flex-reg for each sector will ensure that the costs per ton of GHG reduced are similar across the economy?

Second, sincere politicians need to know the relative political acceptability of each climate policy. For a given level of GHG emissions reduction in a given sector, how much more difficult is one policy than another? We shouldn’t tell climate-sincere politicians to stick an electoral bullseye on their backs without first informing them of the political and economic benefits and costs of the policy alternatives. As the failures of the last three decades suggest, this type of analysis is important if we are to accelerate progress on the climate-energy challenge.

I’ll bet French President Emmanuel Macron wishes his advisors had done more polling on the relative political acceptability of different climate policies before he announced in 2018 a small carbon tax increase to raise the price of gasoline by 3 cents per liter and diesel by 5. This might have spared him four months of protests by the gilets jaunes (yellow vests) – suburban and rural people for whom the tax increase symbolized the disregard for their cost of living concerns by the urban educated elites who dominate French society.26 Macron was forced to reverse the tax increase, but the severe drop in his popularity seemed irreversible.

Given the simultaneous implementation of multiple climate policies in British Columbia, my jurisdiction provided an excellent test case for comparing the economic costs and political acceptability of a carbon tax and the two flex-regs we implemented – the low carbon fuel standard and the clean electricity standard. (The government also tightened energy efficiency regulations and implemented a carbon offsets system for government agencies, but these are less effective policies, as I explain in later chapters on energy efficiency and offsets.)

In 2012, my former student, Katya Rhodes, led our team in surveying 400 British Columbians to assess their climate-energy policy knowledge and preferences.27 Our initial questions probed citizen knowledge of climate policy. Even though our jurisdiction had just experienced a high-profile political campaign, in which carbon pricing and other climate policies were center stage, we found that few people knew about these policies. Like researchers and interest group advocates, we climate policy experts tend to mistakenly believe that many non-experts share our interests, a common misconception known as “the curse of knowledge.”

Having long been aware of the curse of knowledge, I often caution my research team not to over-estimate public awareness of the climate-energy policies with which we are obsessed. (That’s why I encourage them to door-knock in suburban areas to discuss climate-energy policy during election campaigns – the ideal myth-busting exercise for young and old policy analysts.) Our survey results did not disappoint. If given no prior information, only 25% of respondents knew about the carbon tax, and less than 2% knew about any of the other climate policies. When we made it easier, by describing and embedding the five legitimate policies within a list of 15 policies of which 10 were fictional, still only 60% guessed the carbon tax, and none of the other four true policies were identified by more than 15% of respondents. While politicians, interest groups, experts, and media pundits had loudly and continuously debated climate policies for two straight years, most of the public had tuned out. As one grad student later told me, “When would someone on Facebook and Instagram hear about this?”

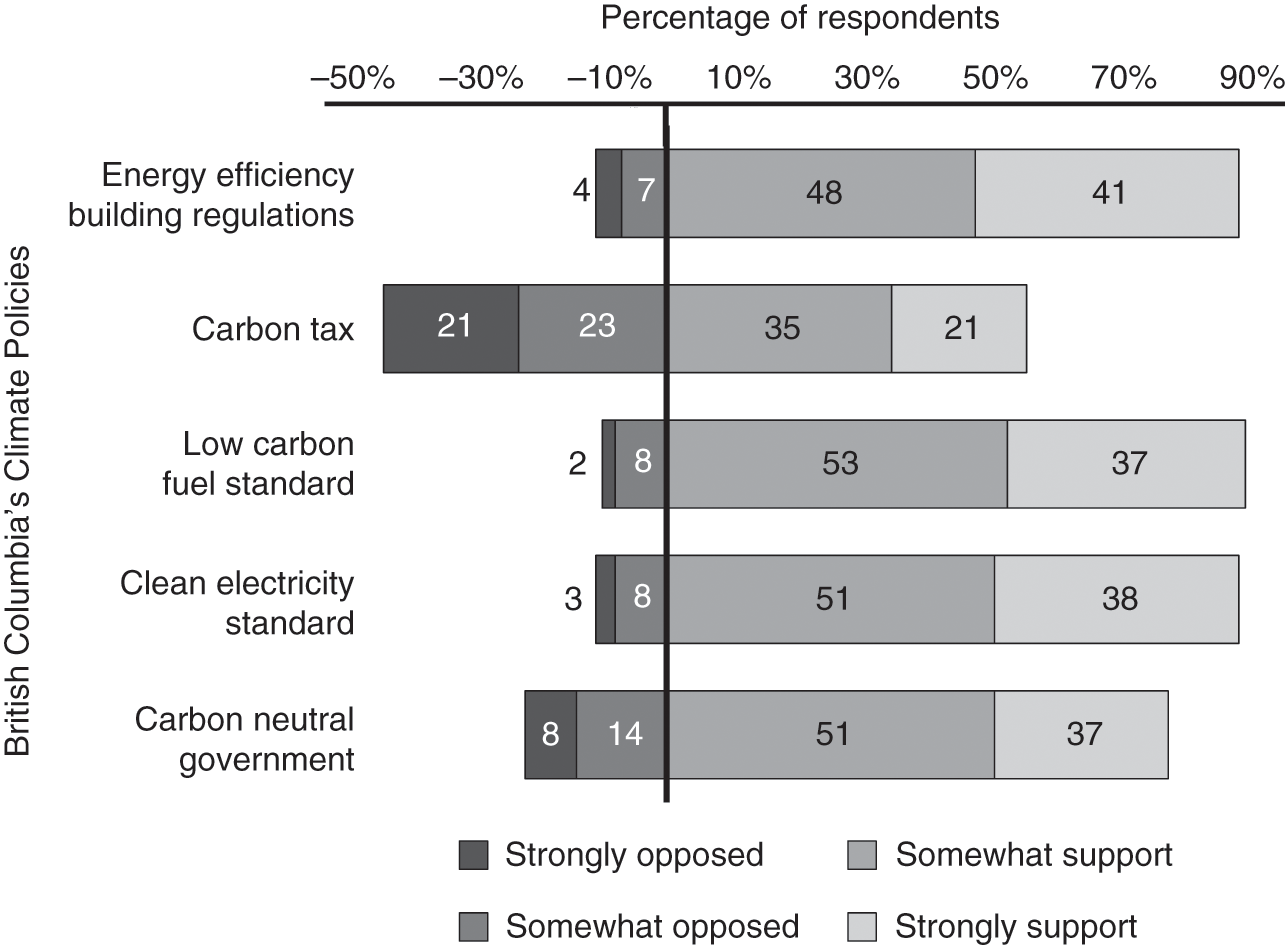

Our questions also probed the degree of ‘strong opposition’ to each of the key policies. We believed that strong opposition would be greatest for the carbon tax. Over the years, I had noticed how those opposed to climate policy could more easily incite public anger at the carbon tax, with less success when criticizing flex-regs like the renewable portfolio standard and vehicle emission standards, even when experts explained in the media that these latter were costlier.

During my previous decades of interaction with policy advisors viewing public surveys, I noticed how often they focused on the size of strong opposition rather than on total support versus total opposition. Strong opposition is key because a significant number of people are ‘single-issue voters’: a politician’s view on one key issue, like abortion or gun control or taxes, can be decisive in determining how these people vote. And people often vote against rather than for something. In the US 2016 presidential election, many survey respondents admitted, “While I didn’t like Donald Trump, I really didn’t like Hillary Clinton. So I voted for Trump.”

If a policy like the carbon tax provokes enough strong opposition, this offers a ‘wedge issue’ for opposition politicians trying to gain traction with voters, especially where the issue might tip the balance in critical ‘swing’ districts. Elections are often won or lost by the voters in swing districts, which in Canada and the US are usually suburban areas. Inner cities and rural constituencies tend to be more stable in their voting preferences.

Considerable evidence supports my anecdotal observations. In his book, The Myth of the Rational Voter: Why Democracies Choose Bad Policies, Bryan Caplan reviews a large US opinion survey which finds that many Americans don’t agree with economists about the benefits of certain types of policies, notably the economic efficiency gains from using tax changes for societal ends – except in the case of clear and unequivocal tax cuts.28 This is consistent with surveys in British Columbia, which I noted above, in which most people believed they were net losers under the revenue-neutral carbon tax, even though evidence provided by government and independent academics like me showed the opposite. Like the survey respondents described by Caplan, many people suspected it was a veiled tax grab.

Suburbanites drive a lot. Even though many want action on GHG emissions, some can be persuaded that a carbon tax is so unfair it should determine their vote. And it only takes a shift of 2–5% of voters in swing districts for success in the first-past-the-post electoral systems of the US, the UK, and Canada. Thus, opposing a carbon tax is an enticing strategy for a politician presenting herself as a populist champion of the middle class. And, as we witnessed in British Columbia, this strategy can be compelling even for left-of-center politicians with environmentalist credentials, as they promise to eliminate the carbon tax and reduce emissions thanks to magical policies they were only willing to fully reveal after the election.

In the final part of the survey, we thus probed strong opposition as an indicator of ‘political acceptability’ or ‘likelihood of implementation.’29 Figure 6.4 from the survey results confirms our hypothesis that the carbon tax had by far the largest percentage of strong opposition, a result that did not change even after we provided a neutral description of each of the policies in terms of its cost-effectiveness – which favored the carbon tax. It is noteworthy that all policies had more supporters than opponents – consistent with the strong environmental values of British Columbians. Even the carbon tax had majority support of 56%, a finding that environmental advocates got from their surveys too, which, in their eyes, justified their media mantra that “the public wants politicians to tax carbon.” But strong opposition to the carbon tax was ten times its level for the low carbon fuel standard (21:2) and seven times its level for the clean electricity standard (21:3). To veteran policy advisors, this would be the critical finding from our survey.

Figure 6.4 Climate policy preferences in British Columbia

These policy preferences might be understandable if the carbon tax was doing the heavy lifting as the lead policy for causing GHG reductions. But my research team had been commissioned by the government in 2006–2008 to model the combined effects of the policies, and we later simulated the individual effect of each policy if applied on its own.30 We estimated that expected emissions in 2020 would be reduced 15 metric tons by the clean electricity standard and 3 metric tons by the low carbon fuel standard.31 In contrast, if used alone, the carbon tax would reduce annual emissions by only about 3 metric tons in transportation and 3 metric tons in electricity from what they otherwise would have reached by 2020.

Our survey findings from British Columbia’s policy experiment are consistent with US public opinion surveys. I earlier mentioned Barry Rabe’s book, Can We Price Carbon?, which is full of valuable insights from survey research on US public opinion with respect to climate science and climate policies.32 He and collaborators maintain a website which they update with the latest surveys to show how opinions shift over time and with different policy designs. The results tend to support our finding for British Columbia, namely that while total public support for carbon pricing in the US can equal or even exceed total opposition, the ‘strong opposition’ response consistently receives 30% and higher.33 In contrast, ‘strong opposition’ to a flex-reg like the renewable portfolio standard is usually below 10%.

Rabe’s surveys also probe the extent to which different uses of carbon pricing revenues in the US, such as subsidizing renewable energy or ensuring revenue neutrality, reduce the size of the strong opposition response. I note, however, that these survey responses tend to be hypothetical. In our British Columbia experiment we learned first-hand that while government might earnestly try to communicate the benefits to individuals and households from its particular use of carbon tax revenues (in our case giving all the money back as tax cuts), many people accepted the untrue claims that government was absconding with the revenues. The easy success of this lie illustrates the difficulty of predicting from surveys how competing narratives (one of them false) play out in the real world – with its cognitive biases, competing information, and imbalance of access to communications media.

Real-world climate-energy policy adoption also supports our survey implication that flex-regs would have a higher probability of implementation. Almost 30 US states are using the renewable portfolio standard to transition toward wind, solar, and other renewable electricity technologies. While some industries and politicians have vigorously opposed this policy, blaming it for increased electricity prices and reduced reliability, their admitted successes in slowing the adoption and rising stringency of renewable portfolio standards pales in comparison to their complete success in preventing all state and national efforts to implement carbon taxes and almost all efforts to implement economy-wide cap-and-trade, with the exception of California.

I reiterate that even when we explained that the two flex-regs were costlier than the carbon tax, for a given amount of GHG reduction, the relative ratios of strong opposition between the carbon tax and the flex-regs remained the same. People’s policy preferences were more influenced by the word tax than by our statements of relative cost-effectiveness.

* * *

I see our survey as an early contribution to what I hope becomes a growing body of interdisciplinary research that combines the methods of economists in assessing the economic efficiency of different climate-energy policies with the methods of other social scientists in assessing the likelihood of their implementation. We need these disciplines working together because even a slightly better chance for deep decarbonization policy can be critical.

We must keep reminding ourselves that all effective climate-energy policies are politically difficult. Even flex-regs, while outperforming carbon pricing, are difficult to implement at stringency levels that would transform the energy system. Success requires a government that is firmly committed to market transformation and unwilling to yield to industry arguments that it cannot produce enough renewable electricity or electric vehicles or biofuels. With flex-regs, government must impose on a few key industries strong penalties for non-compliance, thus incentivizing these players to subsidize between consumer groups to achieve the mandated sales targets. If, instead, government will only implement flex-regs at a stringency acceptable to vehicle manufacturers or electric utilities or fossil fuel distribution companies, the requirements will be unambitious, further delaying the deep decarbonization transition.

At least flex-regs only require that sincere politicians prevail in a political struggle with the electric or fuel or vehicle industry, facilitating a divide-and-conquer policy strategy. Carbon pricing, in contrast, requires sincere politicians to overcome widespread misinformation campaigns by a coalition of insincere politicians, fossil fuel companies, and wealthy and powerful anti-climate action advocates. Of course, climate policy opponents will try to distort any effective policy in order to defeat it – branding flex-regs like the low carbon fuel standard as hidden taxes and government overreach. But, if the comparative policy surveys are indicative, the task for these opponents are more difficult with flex-regs than with carbon pricing.

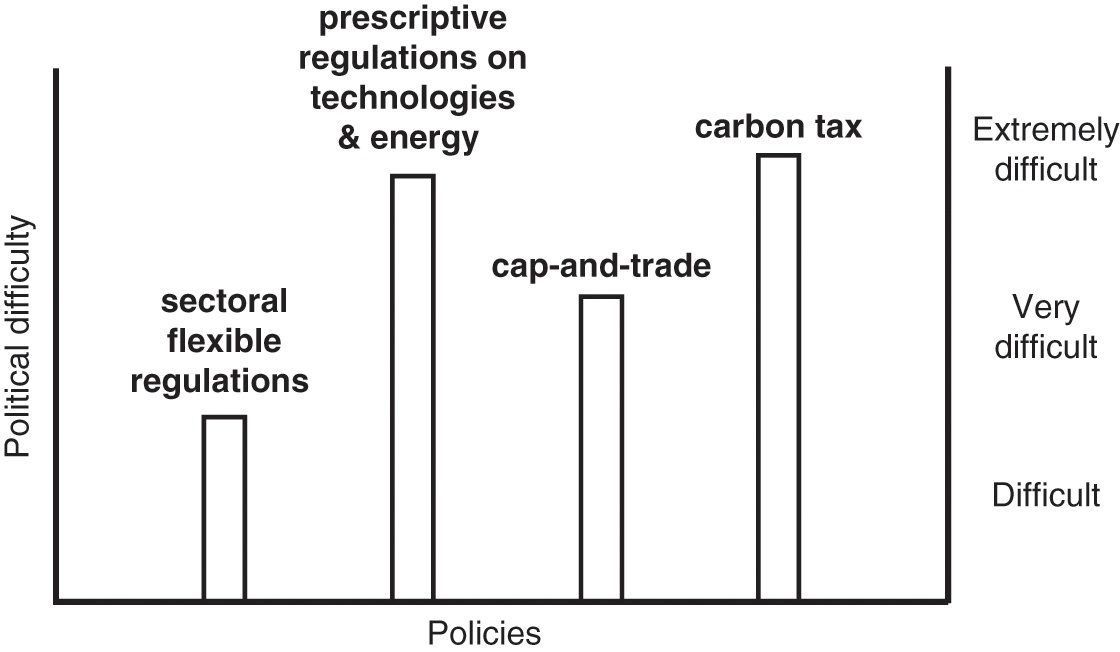

In Figure 6.5, I present my summary assessment of the case study and survey evidence on the relative political acceptability of the four main policy categories, in the case where each is implemented as the lead policy for deep decarbonization. Note that the figure shows all climate-energy policies as politically difficult when set at stringencies that would decarbonize the energy system over just a few decades. Thus, the vertical axis ranges from extremely difficult at the top to difficult at the bottom. Nothing is easy.

Figure 6.5 Political difficulty of climate policies

Obviously, I rate carbon tax as extremely difficult. Cap-and-trade scores as less politically difficult for several reasons, most important being absence of the word tax. Prescriptive regulations on individual technologies and energy are almost as politically difficult as the carbon tax because relying primarily on these for deep decarbonization would be very costly, inciting a public backlash against the rapidly rising costs of energy services. Economically inefficient policies can lead to GHG reduction costs that are 10 times higher than they would be under efficiently designed carbon pricing. In contrast, sectoral flex-regs, such as the renewable portfolio standard and the low carbon fuel standard, have proven to be politically easier than explicit carbon pricing. Hence their ranking between very difficult and difficult.

Perhaps we should expect no policy to play a leadership role. In assessing the Swedish carbon tax, I noted how that country also relies significantly on subsidies, regulations, and direct government actions in electricity, district heating, public transport, etc. The use of multiple, overlapping policies to address the same GHG reduction objective might strike many economists as economically inefficient, even dumb. But given the urgency of deep decarbonization, this approach might be acceptable, especially if it has better prospects for transforming the energy system in just a few decades because of political acceptability.

One variant of this would be a policy sequencing approach. Instead of spinning our wheels for another two decades by harping on politically unacceptable levels of carbon pricing, we economists could urge governments to emphasize flex-regs in the early stages of the transition, shifting to carbon pricing later. A renewable portfolio standard, not a carbon tax, has been key in helping solar and wind penetrate the US electricity market and achieve falling costs. The California ZEV mandate, not a carbon tax, has been key in helping electric vehicles develop and capture niche markets, with wider dissemination now imminent. Regulations, not a carbon tax, has helped in the development of biofuels, some of which have low emissions in production. During the early phases of market penetration with flex-regs, it is the producers of coal-fired power who subsidize renewables (renewable portfolio standard) and the purchasers of gasoline vehicles who subsidize electric vehicles (zero-emission vehicle standard) and the purchasers of gasoline who subsidize biofuels, electricity, and hydrogen in transportation (low carbon fuel standard). But in the consolidating phase, carbon pricing could take over. It will be less politically difficult to raise gasoline prices with a carbon tax when 40% of cars are electric and 40% of trucks are electric or biodiesel. Imagine carbon tax opponents trying to incite outrage from die-hard gasoline users when so many of their friends, family, and competitors are no longer sympathetic to the complaints of those unwilling to acquire low-emission options that are readily available and widely accepted. Carbon pricing as consolidator, flex-regs as catalyst.

One could argue, moreover, that while carbon pricing is the cheapest policy to reduce GHGs in a mythical world in which politics does not affect policy choices, it might not be the cheapest option in the real world in which it does. This would be the case if its dogged pursuit tragically sustains our multi-decade failure, keeping us on a GHG trajectory whose devastation dwarfs the economic inefficiency losses from instead pursuing flex-regs.

In my talks, I sometimes use cost estimates from Nicholas Stern’s 2006 report, The Economics of Climate Change.34 He estimated that failure to reduce emissions would devastate global GDP by 20% while a global carbon tax to prevent that devastation would cost 5% of global GDP in GHG reduction costs. What if sectoral flex-regs applied to the entire economy to prevent the 20% loss were likely to cost 7% of GDP, because they are less economically efficient? And, what if the likelihood of implementation of the flex-regs was 50%, but for the global carbon tax only 20%, because of political acceptability differences? Integrating this information into an ‘expected benefit-cost’ calculation (‘expected’ because it includes probabilities) suggests that insistence on carbon taxes would be economically inefficient. Multiplying the costs by their likelihoods shows that the expected GDP effect of carbon tax insistence causes a 17% loss of global GDP (.2x5% +.8x20%) while the flex-reg strategy causes only a 13.5% loss of global GDP (.5x7%+.5x20%). (Note that either way the likely outcome is not good because I assume a high likelihood of continued failure in both cases.)

The key takeaway? Insisting that we price carbon in hopes of a modest cost saving over flex-regs could be, as my mother used to say, “penny wise, but pound foolish.”

But in closing this chapter, I should not be too hard on economists. Our training has shaped our policy preferences, making us acutely aware that through economically efficient policies humanity can achieve more good things with the same resource endowment. We certainly cannot afford to waste scarce human and natural resources as we try to simultaneously reduce GHG emissions and increase energy supply to the billions of poor people whose lives it would significantly improve. This is why we economists have lots to offer on the climate-energy challenge. We know that, given the attraction and low cost of fossil fuels, humanity must either price carbon or regulate technology and energy choices.

Also, we are trained to probe the true effect of these compulsory policies in comparison to the many other “solutions” on offer. This is critical, for as humanity continues to fail with the climate-energy challenge, frustrated, sincere people have earnestly considered a range of actions and approaches. As Mike Hulme noted in his book, Why We Disagree About Climate Change, the climate-energy challenge has over time become like a “Christmas tree on which we each hang our own baubles,” using it to advance agendas that are tangential to rather than essential for deep decarbonization.35 Problems arise when these agendas distract us from the few things that absolutely must happen, namely the compulsory policies that cause the rapid phase-out of coal in electricity and gasoline in transportation.

In the following chapters, I describe how some of these agendas, even though based on valid perspectives and aspirations, can deflect us from the simple, basic task of energy system transformation and the necessity of compulsory regulations or carbon pricing to cause that transition. And I suggest how these agendas can be modified slightly so that they don’t inadvertently deflect us from that essential task.