In this article we develop knowledge of behavioral aspects of retirement decisions. Based on a so-called “certainty effect”, we try to verify how the instability of the pension system affects retirement timing. Instability of the pension system is measured as scope and impact of implemented pension reforms. Retirement timing is measured as a gap between normal and effective retirement age.

Obtained results confirm the assumption that instability of the pension system affects retirement timing. In countries with relatively stable systems, people are more likely to postpone retirement beyond pensionable age; whereas, in countries with unstable systems, people tend to retire as soon as possible. These findings broaden the range of institutional (contextual) determinants of early workforce withdraw.

Introduction

Nowadays pension systems are under radical reconstruction. In many countries, they are being transferred from defined benefit (DB) into defined contribution (DC) schemes. This is a fundamental change. Previously workers reaching statutory retirement age were actuarially indifferent between retiring and working longer. They had no financial incentives to postpone retirement. Now, in turn, the system is more actuarially fair, which means that pension benefits depend on, among others, the length of working life (Barr and Diamond, Reference Barr and Diamond2006; Góra, 2008).

The shift from DB to DC scheme broadens individual freedom in retirement decision-making. It is assumed that individuals are free to choose whether to work or retireFootnote 1 . They adjust retirement behavior to their own needs, abilities, and preferences. Policy-makers usually set up only minimal retirement age, as a starting-point for obtaining pension entitlements. Beyond this threshold, workers have a right to retire, but may work as long as they need or want. In principle, the moment of workforce withdrawal is a result of a conscious decision.

Today retirement timing is an issue of great importance, due to crucial outcomes it provides to individuals, enterprises, and public authorities: to individuals, because it determines the level of pension income and quality of life in old age; to enterprises, because it determines the accessibility and diversity of the workforce; for public authorities, because it determines financial sustainability of public pension systems. Therefore many researchers try to find an answer to the following questions: Why do people decide to retire at a specific age? and How retirement decisions can be changed?

In theory, according to classical economics, rational individuals should retire at the personally optimal age. There is a body of evidence, however, that people hardly ever make rational retirement decisions, and this applies to both intentions and behavior. They usually tend to withdraw from the workforce as soon as it is only possible (Blanchet and Debrand, Reference Blanchet and Debrand2008). It applies to many countries, also those (e.g. Germany) offering financial incentives to postpone retirement, and introducing attractive forms of flexible workforce withdrawal (Seibold, 2021). It may suggest that people do not end up their careers at the optimal age, but rather earlier. Moreover, even a simple rethink leads to conclusion that retirement behavior is not rational. Over the last few decades, life expectancy increased significantly. People not only live longer, but also are healthy for much longer, so their abilities to work in old age increase. Simultaneously, the nature of work has changed radically, and now, in general, it is much more adequate for older workers. Paradoxically, despite the increase in both ability and opportunity to work, effective retirement age decreased (Coile, Reference Coile2015; Blundell, French and Tetlow, Reference Blundell, French, Tetlow, Piggott and Woodland2016). It shows that people can work longer, but do not take this chance. In economic terms, they make suboptimal decisions. The rationality of their retirement decisions is bounded.

Recognizing sources of bounded rationality is a crucial subject of economic research these days. Behavioral economics gave a new perspective on that problem, also regarding retirement decisions (Aaron, Reference Aaron and Aaron1999; Knoll, 2011). Shefrin and Thaler (1988) were pioneers in that field. They applied three psychological effects (self-control, mental accounting, and framing) to expand classical life-cycle theory and make it more behaviorally realistic. Subsequently, many other researchers tried to combine retirement timing with various cognitive biases: affective forecasting (Wilson and Gilbert, Reference Wilson and Gilbert2003), hyperbolic discounting (Bidewell, Griffin and Hesketh, Reference Bidewell, Griffin and Hesketh2006), framing effect (Fetherstonhaugh and Rose, 1999), social norms (Aaron, Reference Aaron and Aaron1999; Taylor and Earl, Reference Taylor and Earl2015), and default option (Vermeer, van Rooij and van Vuuren, Reference Vermeer, van Rooij and van Vuuren2019).

Today more and more researchers try to combine cognitive biases with retirement decisions. Nevertheless, despite growing interest, this field still remains relatively poorly recognized. Much has been theorized, but empirical evidence is very limited. With this article, we develop knowledge about behavioral determinants of retirement timing. We focus on a particular cognitive bias: certainty effect. Our main assumption is that (in)stability of the pension system influences retirement behavior. We verify whether, in countries with relatively stable pension systems, workers are more likely to postpone retirement (and thus, to spend more time in workforce), whereas in countries with unstable pension systems, by contrast, workers are more likely to retire as soon, as possible.

Determinants of retirement timing: theoretical background

People retire at a wide range of ages for a variety of reasons. Fisher et al. (2016) provided a detailed review of literature on determinants of retirement timing, including: physical, financial, demographic, psychological, work, family, cultural, macroeconomic, and institutional factors. In the same vein, Scharn et al. (2018) conducted a detailed literature review and identified 49 determinants of retirement timing that were classified into eight domains.

Decision to retire is one of the most important and complex choices people make during their lives. It is not just a one-time event (discrete choice), but rather a long-term decision-making process (Wang and Shultz, Reference Wang and Shultz2010; Feldman and Beehr, 2011). This process is shaped by two categories of factors: push and pull (Ebbinghaus and Hofäcker, 2013; Hofäcker et al., 2015; Hofäcker and Radl, 2016; Jensen et al., 2020). Push factors are negative conditions that crowd out older workers from employment. Pull factors are positive incentives that make retirement more attractive.

In line with an economic approach, retirement decision is an economical choice; people exchange their time (leisure, recreation) for money (retirement income, consumption) (Laitner and Sonnega, 2012). Individuals (homo economicus) are rational, so tend to work until subjective value of the additional unit of money (possible by work) is offset by subjective loss suffered from giving up leisure and recreation. Moreover, rational people do not consider only the current level of income, but rather make lifetime plans (Ando and Modigliani, Reference Ando and Modigliani1963). Working-period is a time of wealth cumulation, whereas retirement is a time of wealth decumulation. Since people tend to avoid radical changes in the standard of living, they work as long as they collect sufficient resources to smooth consumption after retirement.

In line with a sociological approach, retirement decisions are closely related to norms, values, aspirations, and identities (Guillemard and Rein, 1993; De Tavernier et al., 2019). Those factors modify the impact of financial incentives: therefore, individuals are not affected by economic factors alike. Social stratification and intrinsic value of work play here a crucial role. People with strong work ethics, who build their own identities on professional positions, are less motivated to withdraw from the workforce. Such attitude may be additionally strengthened by negative connotations with retirement, as a social degradation and isolation. In contrast, people with low work ethics, and positive retirement expectations are less motivated to prolong their working life.

De Tavernier et al. (2019) conceptualized different types of retirement, taking into account two dimensions of retirement planning: pension wealth and identity (orientation). They noticed that voluntary retirement takes place when individuals have the required resources to sustain desired standard of living without working, and also have an alternative challenge or identity to enter after workforce withdrawal. If any of these conditions are disrupted, an involuntary retirement occurs. In such case individuals end up with insufficient means to uphold desired consumption level, or/and a lack of prospects or purpose in their retired life.

Retirement timing is shaped not only by personal characteristics, but also by contextual (macro-level) factors (Szinovacz, 2013; Hofäcker and Radl, 2016). It applies especially to institutional settings, which changed radically over the last fifty years. Starting from the 1970s Western countries struggled with a surplus of workforce, which caused so-called demographic unemployment (Wagner, Reference Wagner and Steinmann1984). At that time policy-makers implemented various measures promoting early labour market exit. It established and disseminated “early retirement culture” (Blöndal and Scarpetta, Reference Blöndal and Scarpetta1999; Guillemard, Reference Guillemard2003; Radl, 2014; Ehmer, 2015), In the 1990s, however, as a demographic situation changed, paradigmatic shift in public and political agenda was imposed, from “early exit” to “active ageing” (Zaidi et al., Reference Zaidi, Harper, Howse, Lamura and Perek-Białas2018). It contributed to the fundamental change in the pension system and labour market policy. The welfare state has been redesigned. A number of reforms restrained financial incentives to early workforce withdrawal (thus reducing the impact of pull factors), and also improved employability of older workers (thus reducing the impact of push factors) (Hofäcker and Radl, 2016). Despite many efforts, the situation has not changed everywhere, and as a result, European countries remain polarized between “early” and “late exit regimes” (Hofäcker et al., 2015).

Description of the research problem

Pension reforms set institutional settings and therefore influence retirement timing. According to Hofäcker et al. (2015, p. 208) institutional conditions at the nation-state level frequently set the relevant opportunities and constraints for retirement decisions within a population. Potentially, however, not only the character of changes play a role, but also its number and frequency. It can be presumed that while the recent reforms aim at prolonging working life, the fact of its implementation provides an opposite effect and discourages working beyond pensionable age. Such assumption is based on psychological phenomenon called “the certainty effect”.

Originally certainty effect was discovered by Maurice Allais in 1953, and hence is broadly known as “Allais paradox”. Kahneman and Tversky (1979, p. 265) described it as a decision-maker’s tendency to “overweight outcomes that are considered certain, relative to outcomes which are merely probable”. They confirmed empirically that action eliminating the probability of harm (i.e. from 1 percent to zero) is valued more than same-range action, which only reduces this probability (i.e. from 2 percentages to 1 percent). In their research (Tversky and Kahneman, Reference Tversky and Kahneman1981), respondents were asked to choose one of the following options: (A) a sure win of $30, or (B) 80% chance to win $45. Expected value in option A (1*$30=$30) is lower than in option B (0.8*$45=$36), but still it was chosen more often (78% respondents preferred option A, 22% preferred option B). It proves that most people favor risk-free options even when providing much lower outcomes (in monetary value). They usually prefer a smaller-certain gain over a bigger-uncertain one, just as in old catchphrase “A bird in a hand is worth two in the bush”.

Retirement decisions can become uncertain in two ways. First: people cannot effectively assess their future financial needs, especially regarding very old age, when they will become frail and dependent. Neither the level nor the period of expenses is known. Secondly, the reliability of the pension system may become a source of uncertainty. Recently implemented pension reforms radically modified institutional settings along with fundamental principles and entitlements. The aim of those changes was to uphold sustainability of social security system under demographic shift. However, solutions favorable on macro-scale (i.e. increasing retirement age, reduction of pension entitlements) were usually harmful on micro-scale (for individuals). Such turbulent environment naturally undermines trust in the system and increases uncertainty.

Theoretically, if the pension system is stable workers can make effective retirement plans. After reaching pensionable age, they may choose whether to end up career early and get lower benefits or to postpone retirement and get higher benefits. In such case extending working life is a risk-free option. However, if the system is unstable, workers reaching official retirement age make decision under uncertainty. They have to choose whether to retire earlier and get lower, but certain benefits, or rather to postpone retirement and get only “potentially” higher benefits. The more the pension system is unstable, the more risky is extension of working life.

The aim of the article is to verify whether stability of the pension system influences retirement timing. Basing on the certainty effect it can be presumed that high instability of retirement rules demotivates to extent working life. In countries with relatively stable pension systems, people are more likely to postpone retirement, whereas in countries with relatively unstable pension systems by contrast, they tend to retire as soon as possible. We provide empirical verification of this assumption. For this purpose, we put together two measures: (1) retirement timing, and (2) instability of pension system. None of these measures is evident, so require detailed discussion and clarification.

In our study, we analyze macro-level variables (with countries as units), constructed on the basis of OECD’s biennial report “Pensions at Glance” (2009, 2011, 2013, 2015, 2017, 2019, 2021), We take into consideration 21 European countries with available data: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxemburg, Netherlands, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, and UK. The period covered by the study is 2009-2020.

Retirement timing: source of data

Retirement timing may be analyzed at two levels: micro and macro. At the micro-level (an individual), it refers to the age at which an individual withdraws the workforce. At the macro-level (a country), in turn, it refers to the average age of all individuals withdrawing workforce in a given period. Such a collective approach is called “effective retirement age” or “effective age of retirement”.

In most international studies effective retirement age is calculated using labour force survey data, with moving out of the labour market treated as a proxy for retirement. As such, people above a specific age that are not in the workforce at the time of the survey are treated as retired. Such simplification facilitates the analytical process but also causes some methodological issues. First of all, such approach includes as “retired” also people who never worked or are not able to find a appropriate employment. In turn, people who have already removed from their main job, and feel “retired”, are considered as “workers” just because they still perform some form of paid work to supplement their old-age pension benefits. Anyway, Scherer (2002, p. 7) noticed that

for purposes of international comparison (…) it is difficult to arrive at a definition which does correspond more closely these common usages of the term, while being measurable with available data. While it is possible to define retirement more satisfactorily in national surveys of the retirement process, none of these definitions has been adopted as an international standard. Data using any of them are not available for other countries. For these reasons “net withdrawal from the labour force” is probably the only definition of “retirement” which is operationally useable for international comparison at present.

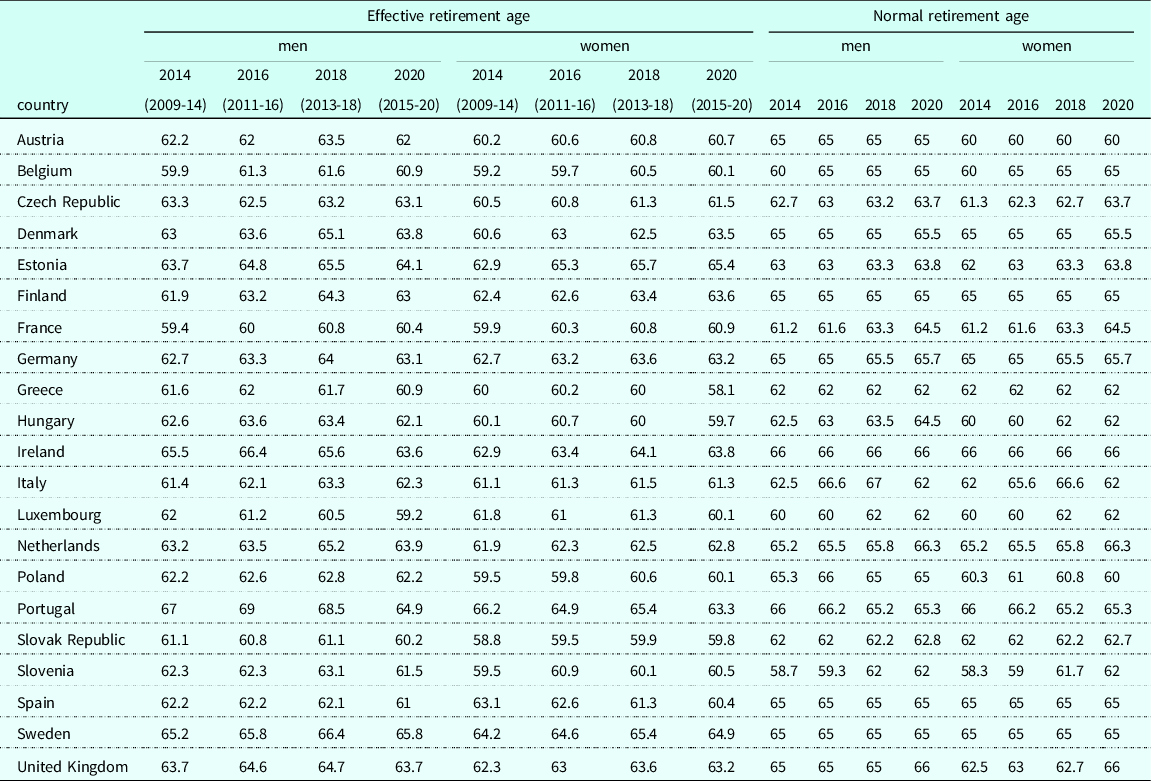

In general, women withdraw from the workforce earlier than men, as shown in Table 1. However, this is not the rule everywhere. In 2020 the gap between the effective retirement age of men and women was the biggest in Greece, Hungary, and Poland (respectively: 2.8, 2.4, and 2.1 years). On the other side, in Estonia, Luxembourg, Finland, France, Ireland, and Germany women worked longer than men (the gap in those countries was 1.3, 0.9, 0.6, 0.5, 0.2 and 0.1 respectively).

Table 1. Effective and normal retirement age in chosen EU countries (both sexes; 2014, 2016, 2018, and 2020)

Notes:Effective retirement age is calculated as a weighted average of (net) withdrawals from the labour market at different ages over a 5-year period for workers initially aged 40 and over. In order to abstract from compositional effects in the age structure of the population, labour force withdrawals are estimated based on changes in labour force participation rates rather than labour force levels. These changes are calculated for each (synthetic) cohort divided into 5-year age groups.Normal retirement age assuming labour market entry at the age of 20, and contributing in every year from that time. In countries where there are different retirement-income programs for different group of workers, the data relate to the main, national scheme for private-sector workers. It does not take account of earlier retirement ages or more favorable treatment of, for example, public-sector employees or workers in specific hazardous or arduous occupations. If pension ages differ with women’s marital status or the number of children that they have, pension ages are shown for childless, unmarried women.Source: (OECD, 2015, 2017, 2019, 2021).

Effective retirement age differs across countries and over time. In the period 2009-2020 it decreased in average by 0.2 year in case of men, and increased by 0.3 year in case of women. In 2020 average age of workforce withdrawal in all analyzed countries was 62.5 for men, and 61.8 for women. However, particular countries differ greatly in this respect. Men retire the earliest in Luxembourg (59.2), and the latest in Sweden (65.8). Women retire the earliest in Greece (58.1), and the latest in Estonia (65.4).

Each country sets some official threshold beyond which people are allowed to apply for full old-age pension benefits. This threshold is called “normal retirement age”, and is defined as the age of eligibility to all components of the pension system. Usually this threshold is clearly defined in national legislation. However, it is composed differently and varies greatly from country to country (OECD, 2011). Some countries give the opportunity to retire earlier, before reaching normal age, if only certain contribution requirements are met. Some other countries (e.g. Finland, Sweden), in turn, do not set up a “normal” retirement age at all, but instead define a range of ages at which the pension may first be drawn.

Table 1 presents a variety of normal retirement ages across countries and over time. Between 2009 and 2020 it changed in most analyzed countries. In 12 of them it increased, in some cases radically, such as in Belgium (+5 years for both sexes), Slovenia (+3.7 for women, and +3.3. for men) or France (+3.3 for both sexes). In one case (Portugal) retirement age decreased (-0.7 for both sexes). In Poland, in turn, initially retirement age increased, but eventually the pension reform was reversed and retirement age decreased to original level.

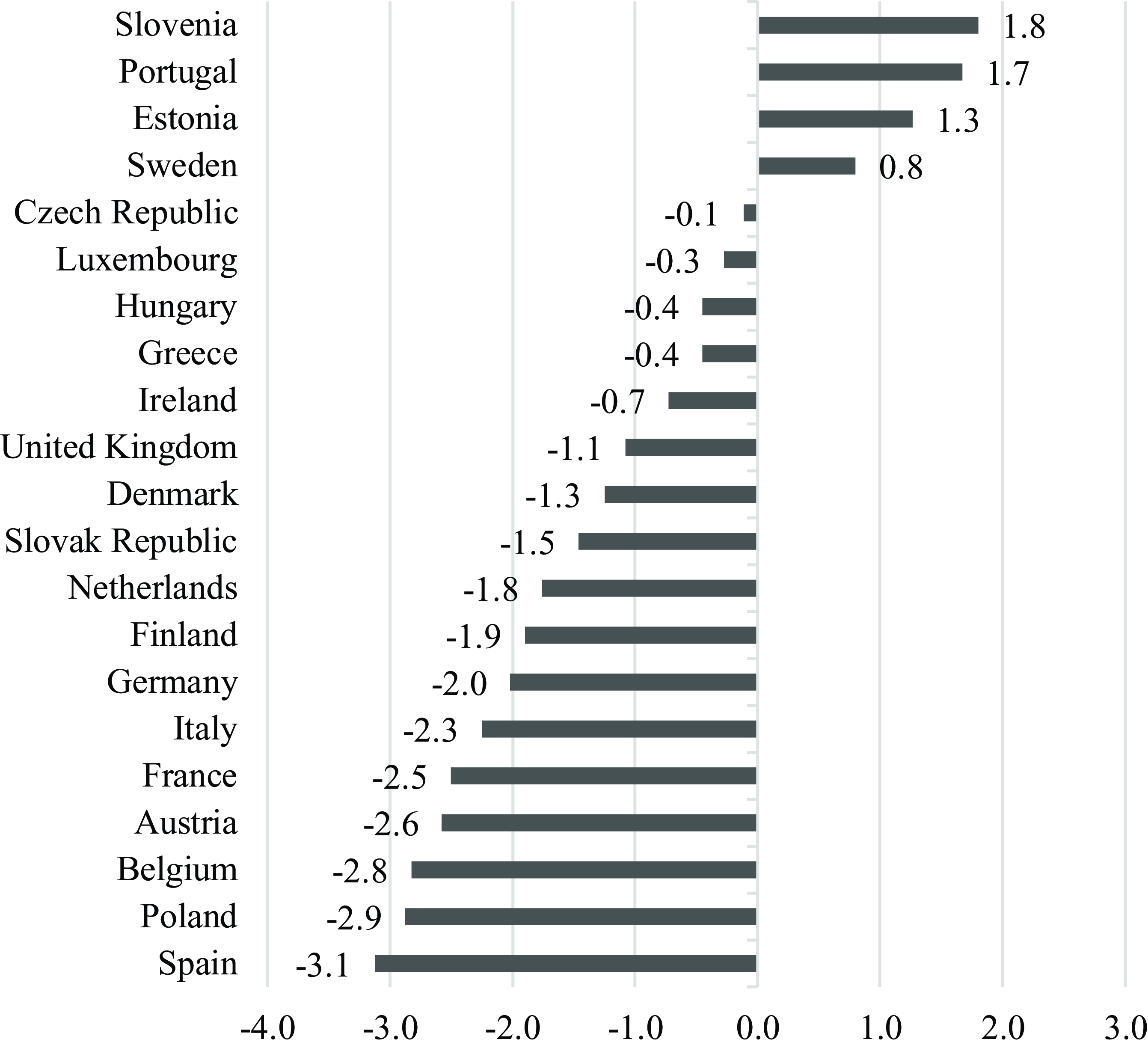

People may withdraw from the workforce at a different age. As such, at the macro-level, effective retirement age may differ from normal retirement age. As shown in Figure 1 and Figure 2, the averageFootnote 2 gap between these two measures varies, in case of men from 1.8 in Slovenia to −3.1 in Spain, and in case of women from 1.8 in Estonia to −3.9 in Belgium. Generally, in most analyzed countries, people withdraw from the workforce before reaching statutory age. This is particularly evident in Belgium and Spain. By contrast, in Estonia, Slovenia (only men), Portugal (only men), and Austria (only women) effective retirement age is considerably higher than the normal retirement age. In those countries workers tend to postpone retirement beyond the official threshold.

Instability of the pension system: source of data

From the very beginning of its existence, the pension system has been subjected to numerous modifications. It is so also today. Policy-makers are forced to implement pension reforms to ensure fiscal sustainability and social efficiency. Although the scope of current changes is unprecedented, there are still new ideas for a radical system reorganization.

Every pension reform makes the system unstable, because it interferes with the construction and institutional settings (rules, principles, procedures). The level of this instability varies from country to country. In some cases changes are rare and evolutionary, but in the other cases changes are more frequent and revolutionary in nature.

The level of (in)stability of the pension system can be measured in various ways. One of them is simple summing up the number of pension reforms that have been implemented in a specific country, in a specific time. This score presents how frequently the system was modified. As such, the higher is the number, the more unstable is the pension system. Such an approach is advantageous for its simplicity, but it does not give a whole picture. Moreover, in some cases it may create misleading impressions. This is because pension reforms are diverse: from minor modifications, to structural reconstructions. Each of them may have a radically different impact on the stability. Therefore, it may turn out that the pension system in one country, where several minor reforms were implemented, is much more unstable than in another country, where at the same time only one reform was implemented, but of fundamental importance.

Comprehensive measurement of the (in)stability of the pension system requires taking into account two components: (1) the scope of pension reforms (How many changes are being done?), and (2) the impact of pension reforms (How serious are those changes?). Therefore it is necessary not only to calculate the number of pension reforms, but also to assess their significance.

The first step to assess (in)stability of the pension system is to evaluate the scope of the pension reforms. Although this element seems to be easy to calculate, in fact it is quite problematic and requires several crucial assumptions. This is because the term “pension reform” is not strictly defined and can be understood in various ways: either broadly, as any system change, or narrowly, as a series of comprehensive changes leading to an improvement of the system. Such a lack of clarity generates certain complications. Firstly, a radical (structural) reorganization of the pension system may be treated either as several separate reforms (broad approach) or as one complete reform (narrow approach). Secondly, changes of the pension system are evaluated either as favorable (constructive, functional) or unfavorable (destructive, dysfunctional). Changes that are considered as unfavorable may be taken into account as a reform (broad approach) or not (narrow approach). Under the narrow approach, the reform must have a modernizing character (improvement), otherwise it is not treated as reform, but as a deform or anti-reform.

In order to avoid such misunderstandings, in our study we use a broad approach. Pension reform is any change made by policy-makers that interferes with institutional settings, modifies the organizational structure, or changes the way the pension system operates. As such, every change is a reform, regardless of positive or negative assessment. In our research the number of changes matters, not their quality (reform or anti-reform).

One more problematic issue needs to be solved. Let us assume the following situation. In one country a radical (structural) reconstruction of the pension system has been carried out, including modification of several elements, e.g. official retirement age, level of contribution, and the formula for calculating benefits. All these changes were implemented simultaneously. In another country the same changes were made, but they were implemented sequentially, as separate reforms spread over time. At the beginning retirement age was changed, then level of contributions, and at the end the formula for calculating benefits. After all, the same changes were made in both countries, but the number of reforms was different. In the first case only one complex reform was implemented, while in the second case three simple reforms. To avoid potential misunderstandings, we assume that reform is a single change of the pension system. So if the reconstruction is complex (modifies several elements at once), then each change is calculated separately as a single reform.

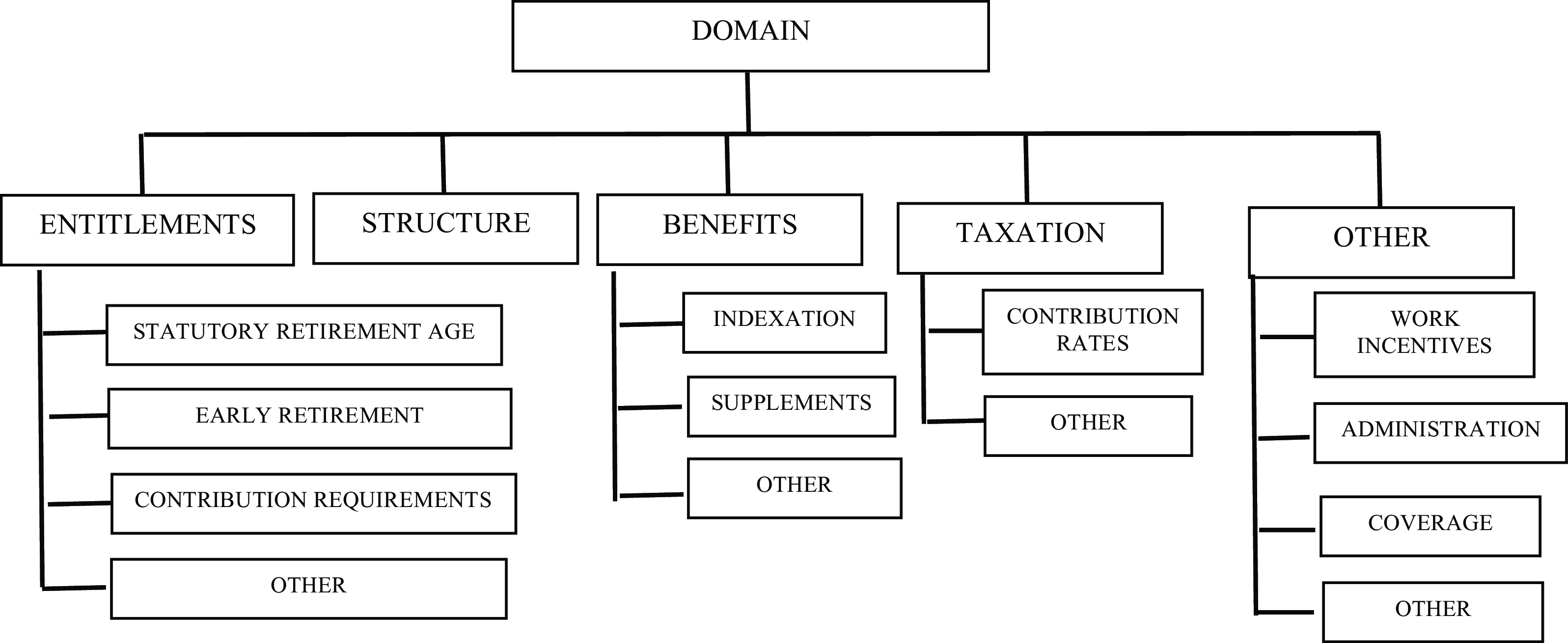

We propose to distinguish five essential domains in which pension reforms are implemented, as presented in Figure 3. The domain “structure” includes changes of the pillar composition, with such elements as: the method of financing (funded, PAYG), a formula of benefit calculation (defined contribution, defined benefit), and character of participation in the system (voluntary, compulsory). The domain “entitlements” includes changes in eligibility criteria, such as: retirement age or contribution requirements. Domain “benefits” includes changes in calculating old-age pension benefits, such as: valorization process, supplements, the minimum benefit level. Domain “taxation” includes all changes in broadly understood fiscalism in regard to pension system (e.g. contribution level). The last domain “others” contains all changes in the pension system that were not included by the previous domains.

Figure 3. Domains of the pension reforms.

Source: Own elaboration.

The second step to assess (in)stability of the pension system is to assess the impact of the pension reforms. Reforms may have different “firepower”. Particular changes range from minor (e.g. annual freeze of benefit valorization) to major (e.g. reconstruction of the pillar system). Each of them differs in terms of undermining system’s stability.

Evaluating the impact of pension reforms is more complicated than calculating its number. This is because the scope is a qualitative feature that can be objectively measured, whereas impact is a qualitative feature that (due to its nature) is difficult to measure. However, impact is an ordinal feature, so pension reforms can be ranked from the least to the most “powerful”. Such spectrum between two extremes can be divided into categories that contain reforms of similar significance. In our study we adopted the division into three ordinal categories:

-

1) minor: a slight change or correction of the pension system, affecting a selected or/and relatively small group of citizens (e.g. temporary change in indexation, or one-off additional pension benefit),

-

2) moderate: a serious change that is crucial to the functioning of the entire pension system or at least its essential part, affecting all citizens or the vast majority (e.g. changes in contribution level, or modification of early retirement entitlements),

-

3) major: a fundamental change of pension system, of key importance, with a large impact on all citizens (e.g. modification of the pillar composition, or changes in pensionable age).

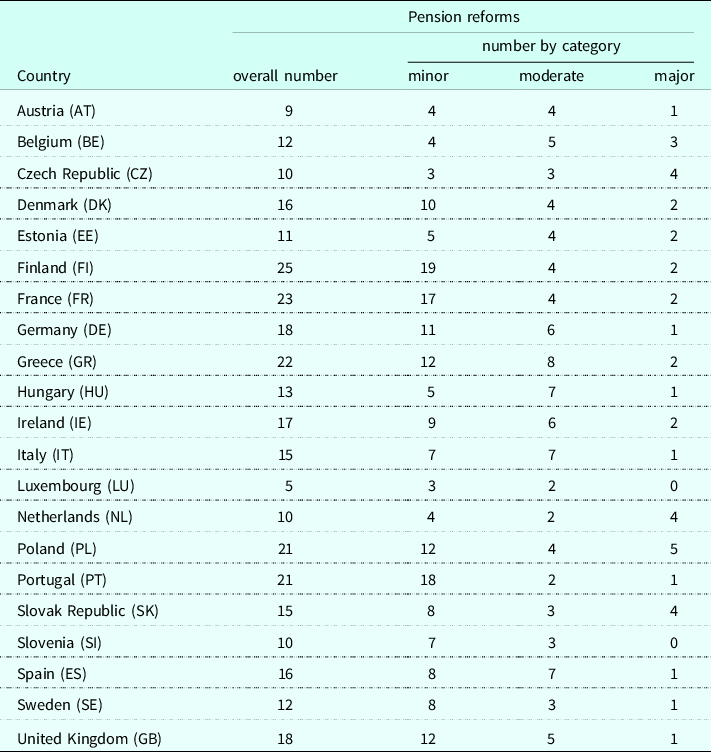

Basing on reports “Pensions at Glance” we collected the data on all pension reforms implemented between 2009 and 2020 in 21 European countries. Next, this data was modified in accordance with established requirements. Complex reforms were divided into simple elements, and assigned to appropriate domains. Subsequently, each simple reform was assessed in terms of significance, and classified into the ordinal category. The obtained results are presented in Table 2.

Table 2. The number of pension reforms (overall and by category) in 21 European countries, 2009-2021

European countries differ in terms of stability of the pension system. In 2009-2021 the lowest number of pension reforms was implemented in Luxemburg, Austria, and Slovenia, and the highest number in Finland, France, and Greece. It is not easy to distinguish any geographical or socio-economic feature combining countries with a similar levels of (in)stability. For example, among Scandinavian countries, in Sweden system was relatively stable, whereas in Finland it was relatively unstable. Among post-Soviet countries, in Slovenia it was relatively stable, whereas in Poland by contrast, relatively unstable.

Results

The research aims to recognize the influence of (in)stability of the pension system on retirement timing. We want to verify, whether in countries with unstable system people (on average) tend to withdraw from the workforce as soon as it is only possible, whereas in countries with stable system by contrast, people (on average) are more likely to postpone retirement beyond official retirement age.

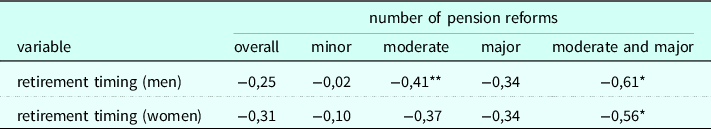

We put together two measures: (1) the retirement timing, i.e. the average (in 2009-2020) gap between effective and normal retirement age (separately for men and women), and (2) the number of implemented pension reforms (overall, and by category). Table 3 contains correlation matrix between those measures. In all cases relationship is negative. Correlation coefficient takes the highest value (for both men and women) with the summed up number of moderate and major pension reforms. In case of minor pension reform correlation coefficient is very weak, and statistically insignificant. It means, that among European countries retirement timing is influenced by the instability of pension reforms, but only in accordance to medium- and high-impact reforms. We found moderate downhill relationship. In case of men, the correlation coefficient was −0.61 (significant at p<0.05). In case of women, the correlation was slightly weaker, with coefficient −0.56 (significant at p<0.05).

Table 3. Correlation matrix (n=21)

Figure 4 presents scatterplot in accordance to men, and Figure 5 presents scatterplot in accordance to women. There is a group of countries, such as Belgium, Spain, and Italy with high number of implemented moderate and major pension reforms, where the age of workforce withdrawal is very low in relation to normal retirement age. In those countries pension system is unstable, so postponement of retirement is a high-risk decision. In order to avoid risk individuals tend to retire as soon, as it is only possible. In the other hand, there is a group of countries, such as Slovenia, Portugal, and Estonia with low number of moderate and major pension reforms, where the age of workforce withdrawal is very high in relation to normal retirement age. In those countries pension system is stable, so postponing retirement is a risk-free decision. Individuals are more willing to work longer in order to receive higher pension benefits.

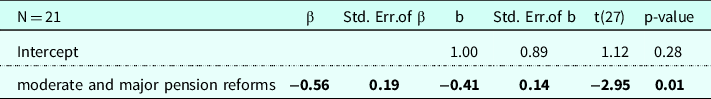

Tables 4 and Table 5 present the estimation results of two regression models. In the first model dependent variable is retirement timing among men (Table 4). In the second model dependent variable is retirement timing among women (Table 5). The number of moderate and major pension reforms is the predictor in both models. In the first model the number of reforms predicts 37% variability of retirement timing among men (adjusted R-square = 0.37). Increase of the instability indicator by 1 unit causes a decrease in retirement timing among men by over five months (b = −0.45). In the second model the number of reforms predicts 31% variability of the retirement timing among women (adjusted R-square = 0.31). Increase of the instability indicator by 1 unit causes a decrease in retirement timing among women by almost five months (b = −0.41). It means that, in the analyzed period (2009-2020), implementation of one moderate or major pension reform resulted in the reduction of the effective retirement age (in relation to normal retirement age) by about five months.

Table 4. Estimation results of the regression model for dependent variable: retirement timing (men)

R= 0.61 R2= 0.37 Adjusted R2= 0.33 F(1,9)=11.001 p<0.00363 Std. Error of estimate: 1,23Source: Own elaboration.

Table 5. Estimation results of the regression model for dependent variable: retirement timing (women)

R= 0.56 R2= 0.31 Adjusted R2= 0.28 F(1,19)=8.69 p<0.00826 Std. Error of estimate: 1,25Source: Own elaboration.

Discussion

In this study we focused on institutional determinants of retirement timing. It is not a new research topic. So far, however, it was analyzed in the context of construction of the pension system (Arkani and Gough, Reference Arkani and Gough2007), pensionable age or some other eligibility criteria (Brown, Reference Brown2011; de Grip, Fouarge and Montizaan, 2013), and financial incentives or disincentives to retire at a certain age (Coile and Gruber, Reference Coile and Gruber2007). With our research, we broaden this domain. Obtained results support assumption that also stability of the pension system plays a vital role in shaping retirement timing. The high number of pension reforms interferes with institutional settings of the system. It undermines trust and increases uncertainty. In such circumstances workers are more likely to prefer a risk-free option, i.e. earlier retirement with lower-certain pension benefits, rather than postponement retirement with potentially higher but uncertain pension benefits.

Our study corresponds with one of the major questions of the pension research: why in some countries it is so unpopular to extend working life beyond normal retirement age? Employment opportunities for older workers are increasing, people are living longer and are healthier. Nevertheless, there is still a strong resistance to postpone retirement, even though it is financially advantageous. To some extend it is caused by forces that pull people into retirement or push them out of the labour market. There are many different factors that may be crucial in particular cases. There is, however, also other factor, that is common for all individuals living in a given country, which is the lack of trust in the pension system and uncertainty regarding durability of retirement rules. This is why in countries with relatively stable system people are more likely to postpone retirement beyond pensionable age. They can make a rational decision under retirement planning, and choose the most profitable option (personally optimal). Whereas in countries with unstable system, people make retirement decisions under uncertainty. They are not sure, whether current arrangement will remain unchanged. They may suspect that rules will deteriorate in the future, so it is better to retire earlier under known conditions, even if it is less profitable. Postponing retirement is treated as risky behavior. Such concerns seem justified, taking into consideration the direction of the past pension reforms, that usually were unfavorable to individuals.

Besides theoretical aspect, our findings also have an important application value. It enables to reconsider and reinforce methods of pension policy. Many efforts have been made to increase effective retirement age so far. Many legislative and organizational solutions were implemented to achieve this goal. The results of our research, however, reveal a paradox of such initiatives. The point is that to some extend they are counterproductive, which means they provide unintended outcomes, contrary to intentions. Those changes make the system unstable, and that in turn demotivates people to postpone retirement.

As for the limitations of the research, some methodological concerns should be highlighted. Our main idea was to find relationship between instability of the pension system and retirement timing. To achieve this goal, we took into consideration the scope and the impact of pension reforms implemented in a group of European countries. We made calculations basing on OECD’s reports “Pensions at Glance”. This source of data has both advantages and disadvantages. The main advantage is that the reports are highly accessible, have a convenient construction for analysis, and appear frequently (every two years). As such, our calculation method can be replicated in another research (for another period, or another group of countries). The disadvantage, however, is unknown quality of information contained in the reports. We cannot be sure, whether high stability of the pension system in some countries results from restraint of policy-makers with regard to implementing pension reforms, or rather it is a result of indulgence and/or unreliability of public authorities in reporting on implemented pension reforms.

Another limitation is that our study does not take into account the differences in the construction of the pension systems across European countries. Institutional settings vary from country to country (Soede and Vrooman, 2008). Some are more actuarially fair, whereas some others are more actuarially neutral. If the pension benefits are indifferent with retirement timing, early workforce withdrawal may be seen as a rational behavior. Moreover, work in old age does not have to be caused by economic reasons, but can be motivated by some non-financial factors, such as psychological well-being, social interactions, and generativity.

Our research supports assumption that instability of pension system influences retirement timing. We are not able, however, to define time-related associations. As shown by Hofäcker (Reference Hofäcker, Hess, Naumann and Torp2015), most pension reforms have a time-lagged effect. The delay between reform implementation and behavioral reaction differs from one country to another, and from one social group to another. Basing on our results it is difficult to determine such lag. It just shows the link between (long-term) system instability and (averaged) retirement timing. It is not possible to infer the impact of specific reform on particular change in retirement behavior. Besides implementation of the pension reform is a process extended in time, so it is hard to asses the impact of reform-tempo, as well as to which stage of the implementation process human reactions are the most sensitive. Do people adjust their (retirement-) behavior to the announcements made by policy-makers, or rather to the new regulations? In other words: adjustments are more anticipative or reactive in nature? These issues still remain unresolved and require further research.

Finally, individual decisions are shaped not by the facts, but by the way those facts are perceived. As such, retirement timing seems to be shaped not by the objectively measured instability of the pension system, but rather by the imagination about that instability. The actual impact of the reform, however, does not have to be the same as its publicity. For example, in one country minor reform may be the subject of numerous media reports, whereas in the other country major reform may be omitted in mass-media. It results in a misleading impression of the real stability of the system. Therefore, as for the direction of further research, it is necessary to recognize individual (subjective) opinions on the stability of the pension system, and to evaluate its impact on the retirement timing.

Funding

Polish National Agency for Academic Exchange, PPN/BEK/2018/1/00360

Conflicts of interest/Competing interests

None

Availability of data and material

Not applicable

Code availability

Not applicable

Ethics approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Not applicable