5.1 IntroductionFootnote 1

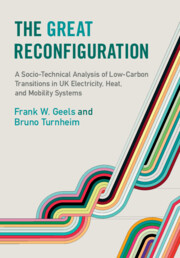

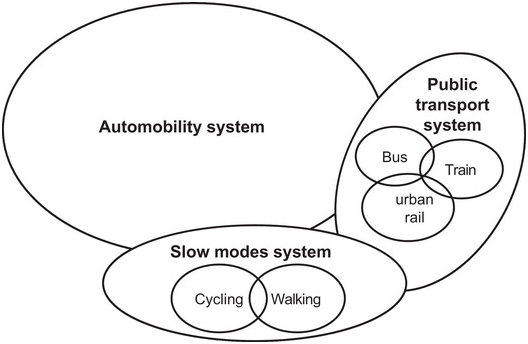

Land-based passenger mobility, which is the focus of this chapter, has several special characteristics. First, it is not one system, but multiple systems, which can be distinguished by transport modes and technologies (such as trains, trams, cars, bicycles, and buses) and ownership, including public transport (bus, train, trams) and private transport (cars, bicycles, motorcycles). The various transport modes are associated with specific socio-technical systems that have their own technologies, industries, markets, and user practices. Automobility, bus, and bicycle-systems partly overlap because of shared road infrastructure use (Figure 5.1). Railways and trams have their own dedicated infrastructures.

Figure 5.1 Schematic representation of different land-based passenger mobility systems

Second, although multiple systems co-exist, the automobility system is, by far, the largest in England (and most other Western countries), both in terms of passenger kilometres and number of trips (Table 5.1). Rail, bus, and cycling systems are much smaller but have a high degree of stability in underlying actor coalitions, institutionalised rules, and social practices. They should therefore be seen as subaltern systems rather than as niche-innovations (Geels, Reference Geels2012).

Table 5.1. Mode share of trips in passenger kilometres and number of trips in England in 2019 (DfT, 2020a: 2)

| Transport mode | % of passenger kilometres | % of number of trips |

|---|---|---|

| Car/van (driver + passenger) | 77 | 61 |

| Rail | 10 | 2 |

| Bus | 4 | 5 |

| Bicycle | 1 | 2 |

| Walk | 3 | 26 |

| Other (e.g., tram, subway) | 5 | 4 |

Third, the post-war mobility explosion (Figure 5.3) fundamentally transformed society by enabling increasing geographical and spatial dispersion, which deeply embedded cars in social practices. Whereas many families had traditionally lived in the same city or neighbourhood, the post-war mobility explosion enabled friends and families to live further apart, often in different cities. People’s homes also became more spatially separated from where they worked, went to school, shopped, enjoyed leisure activities, and went on holidays. The increasing spatial separation was not only enabled by cars but also made people more dependent on cars to sustain daily life practices, thus creating deep social, spatial, and cultural lock-ins (Urry, Reference Urry2004).

Fourth, land-based passenger mobility systems are infrastructure heavy. Although mobility systems are organised around artefacts (such as cars, trains, buses, bicycles), their use depends on the presence of roads, railways, tunnels, and bridges as well as fuel infrastructures. Infrastructures are thus deeply entwined with the use of artefacts, which gives mobility systems a different architecture than in the electricity system, where grid infrastructures are located between production and use.

Figure 5.2, which schematically portrays the automobility system, illustrates this inter-penetration of road (and fuel) infrastructures and use.

Figure 5.2 Schematic representation of the material elements and flows in the automobility system

Fifth, the spatial spread and density of infrastructures and mobility systems varies substantially. Road infrastructures are spatially very extensive, ranging from a backbone of high-speed motorways to very dispersed minor roads. This enables car drivers to go almost everywhere and reach any human settlement. Although buses (mostly) use the same roads as cars, bus transport services are less evenly spread, having higher frequency in high-density areas for commercial reasons. Rural and sparsely settled regions are therefore not well covered by bus systems, which thus increases car dependency of people living there. Rail systems and services also focus on mobility between high-density locations such as cities, which thus creates gaps in spatial coverage. As a slow transport mode, cycling is mostly used for local, especially urban, transport.

Sixth, automobility is an energy-intensive system, generating greenhouse gas (GHG) emissions directly (through driving cars) and indirectly (because manufacturing cars involves large amounts of energy and metals, while road building uses large amounts of concrete and asphalt). Bus, rail, and cycling systems generate fewer GHG emissions per passenger-kilometre, which is why modal shifts from cars to other transport modes represent one climate mitigation option (although some of the considerations above imply that such modal shifts are not equally feasible for all people everywhere in the country).

The automobility system expanded very rapidly after the Second World War, when people increasingly bought private cars which they used to cover larger distances (Figure 5.3). Overall passenger mobility quadrupled from 218 billion passenger-kilometres in 1952 to 873 billion passenger-kilometres in 2019, while Great Britain’s population increased by 32% in the same period (from 49.05 million to 64.90 million).

Figure 5.3 Domestic passenger mobility (in billion passenger-kilometres) by transport mode, 1952–2019 in Great Britain

In 2020 and 2021, the COVID-19 pandemic strongly affected the use of transport modes (Figure 5.4), because three national lockdowns (March–June 2020, November–December 2020, and January 2021–March 2021) restricted people’s mobility. The shocks were mostly temporary for passenger car use, which rebounded to pre-pandemic levels when restrictions were lifted. Railway and bus travel experienced deeper declines during the lockdowns and rebounded less strongly after re-openings. Bicycle travel, which is discussed in Section 5.5, increased strongly during the first lockdown in 2020 but has since declined.

Figure 5.4 Daily use of transport modes (cars, railways, bus) in Great Britain between March 2020 and July 2021 (excluding the Christmas 2020 break); figures are percentages of an equivalent day or week

Because of our interest in climate mitigation, this chapter focuses on land-based passenger transport modes (passenger cars, buses, railways, cycling), which in 2019 accounted for the majority (59%) of direct, domestic transport-related GHG emissions in the UK (Figure 5.5). Heavy goods and light duty vehicles both accounted for 16% of GHG emissions in 2019. Domestic shipping generated 4.5% of emissions and domestic civil aviation for 1%. The focus on domestic GHG emissions means that international emissions (from aviation and shipping) are not included in our analysis. By 2017, however, these had become quite significant: international aviation generated 35 MtCO2 (roughly 29% of domestic transport-related GHG emissions) and international shipping 7.8 MtCO2 (about 6% of domestic GHG emissions).

Figure 5.5 UK domestic transport-related greenhouse gas emissions 1990–2019, in MtCO2e

Figure 5.5 shows longitudinal trends in total domestic transport-related GHG emissions. Between 1990 and 2007, these emissions gradually increased from 128.1 to 137.5 million tons CO2-equivalent (MtCO2e). Following the financial-economic crisis, emissions decreased by 12.7% to 120 MtCO2e between 2007 and 2013. As economic activity picked up again, emissions increased between 2013 and 2017 to 126.1 MtCO2e. Emissions then decreased somewhat to 122.2 MtCO2e in 2019, and declined by 29% in 2020 because of the COVID-related lockdowns (CCC, 2021). Because this unprecedented decline is likely to be temporary, ‘we can expect a significant rebound in transport emissions’ in 2021 (CCC, 2021: 19). For that reason, our analysis of structural emission trends and underlying drivers goes up to 2019 and excludes 2020. For actors, policies, and some techno-economic developments such as sales, we do, however, include COVID-19 in our analysis.

From their 2007 peak, total domestic transport-related GHG emissions decreased by 11% to 2019. Developments varied for different transport modes.

Emissions from passenger cars, which is the single largest category, decreased by 12% between 2007 and 2019 (from 77.1 MtCO2e to 67.7 MtCO2e). This is a significant decrease considering that passenger car mobility increased by 10% in the same period (Figure 5.3).

Railway emissions remained unchanged between 2007 and 2019 (at 2 MtCO2e), while emissions from domestic aviation decreased (from 2.4 to 1.4 MtCO2e) in the same period.

Emissions from bus/coaches also decreased in the 2007–2019 period (from 4.8 to 3.1 MtCO2e), which is partly due to a 20% decrease in bus passenger mobility in this period (Figure 5.3).

GHG emissions from light duty road freight transport increased by 15% between 1990 and 2019 (from 16.8 MtCO2e to 19.2 MtCO2e), at least partly due to an increase in online shopping and home delivery. Emissions from heavy freight decreased by about 7% in the same period. Because of this chapter’s focus on passenger mobility, these freight-related developments are not further discussed.

Passenger mobility from cars, railways, and buses was 11% higher in 2019 (854 billion passenger-kilometres) than in 2007 (771 billion passenger-kilometres). Nevertheless, combined GHG-emissions from these modes decreased by 14%, from 83.3 MtCO2e in 2007 to 71.8 MtCO2e in 2019 (Figure 5.5). This chapter aims to assess the underlying change processes that caused this reduction, while also analysing other relevant socio-technical developments in passenger mobility systems.

To that end, Sections 5.2, 5.3, 5.4, and 5.5 respectively investigate the main developments in automobility, rail, bus, and cycling systems. For each system, we first analyse techno-economic developments and then actors and institutions.

Section 5.6 analyses six niche-innovations, which are not only seen as having considerable carbon reduction potential but also represent different transition pathways, aimed at changing different parts of mobility systems. Electric vehicles and biofuels are two technological niche-innovations that aim to reduce GHG emissions from cars and buses. Tele-working is a niche-innovation that aims to reduce mobility by removing the need to commute to work. Car sharing and intermodal transport (including smart cards and Mobility-as-a-Service) are two niche-innovations that aim to reduce car ownership and increase intermodal travel. And self-driving personal cars promise to radically alter mobility, reduce accidents, enhance traffic flow efficiency, and thus reduce GHG emissions. The six niche-analyses are also divided into techno-economic developments and actors and institutions, which are, however, more fluid and less articulated than for regimes.

Section 5.7 provides interpretive assessments of low-carbon transition and degrees and kinds of whole system reconfiguration.

5.2 The Auto-Mobility System

5.2.1 Techno-Economic Developments

The automobility system is a large and stable system, centred on a primary artefact: the internal combustion engine (ICE) car. The system’s functioning also relies on a wide-ranging configuration of material components and infrastructures such as a complex roads network (which includes both roads and traffic management and signalling), petrol and diesel distribution, car manufacturing plants, and maintenance and repair facilities (Figure 5.2).This large material configuration is deeply embedded in the physical environment, particularly in urban settings where the car has co-evolved with the building and lay-out of cities and conurbations. These interactions between the automobility system and the built environment are a source of material lock-in but also sites where changes can be negotiated (e.g., traffic regulation, repurposing of roads).

ICE cars are complicated artefacts, requiring the assembly of many components, including vehicles frames (chassis), engines, steering wheels, brakes, glazing, and increasingly elaborate interiors and electronics. The car industry has therefore developed significant logistical innovations, oriented towards the assembly of heterogeneous components in highly automated facilities, relying on extensive networks of specialised suppliers, and the optimisation of component shipping (‘just in time’) to minimise idle stocks.

The automobility system expanded rapidly after the Second World War, as people bought more automobiles and passenger car mobility exploded (Figure 5.3). Growth slowed in the 1990s. Car mobility decreased by 2% between 2007 and 2013 because of high oil prices and the financial-economic crisis and subsequent recession. But between 2014 and 2019, passenger kilometres by cars, vans, and taxis bounced back and increased to a level that was 10% higher than in 2007.

The increase of passenger car mobility has been enabled (and driven) by expanding road infrastructures. The network of minor roads, which distributes traffic to urban and regional localities at relatively low speeds, gradually increased from 250,001 km in 1947 to 346,404 km in 2019 (Figure 5.6). To facilitate traffic flows at very high speeds over long distances, motorways were constructed as a new type of road in the late 1950s, reaching 3,742 km in 2019. The network of major roads, which includes motorways and trunk roads (which are both maintained by national highway agencies) and principal roads (which are maintained by local authorities), increased from 44,591 km in 1947 to 51,191 km in 2019. The different types of roads thus have different functions (local, medium- or long-distance traffic) and are maintained by different kinds of actors. The majority of total motor vehicle traffic (62% in 2019) is accommodated by major roads, including motorways, where cars travel at high speed and high density (Figure 5.7).

Figure 5.6 Length of different road types (in kilometres) in Great Britain, 1923–2019: Motorways on left-hand axis, all major and minor roads on right-hand axis

Figure 5.7 Motor vehicle traffic (vehicle miles) by road class in Great Britain, 1993–2019

Annual car sales have increased rapidly since the 1950s (Figure 5.8), but experienced recurring fluctuations due to macro-economic developments such as recessions and oil price changes (Figure 5.9). The 2007/8 financial crisis (and subsequent recession and austerity politics) and high oil prices depressed car sales until 2012. Sales increased again until 2016, when economic uncertainties following the Brexit referendum caused a new decline since 2017. Car sales plummeted by 28% in 2020 due to COVID-lockdowns.

Figure 5.8 Annual car sales (new registrations) of private and light goods vehicles in Great Britain, 1954–2020, in thousands

Figure 5.9 Crude oil price from 1978 to 2020, in 2020 constant dollars per barrel

The reverberations of the 2015 ‘Diesel-gate’ scandal (in which automakers were found to have cheated emission tests for many years) led to a particularly strong decline in diesel car sales (Figure 5.10). The sales of ‘other’ cars (which mostly include electric vehicles), which will be further discussed in Section 5.6.1, has gradually increased over the past decade, reaching 21% of all sales in 2020 (Figure 5.10).

Figure 5.10 Annual car sales (new registrations) of petrol, diesel, and ‘other’ cars in Great Britain, in thousands, 2001–2020

Real car purchase prices have decreased over time, while running costs (maintenance, fuel, insurance, taxes) have substantially increased (Figure 5.11). Total motoring costs have increased more slowly than the cost of living, however, which means that car travel has become relatively more attractive in the past two decades. Total motoring costs have also relatively increased less than bus and train fares, which rose faster than RPI (Figure 5.11).

Figure 5.11 Relative cost developments 1997–2019 (1997=100) various motoring costs, bus and rail fares, and cost of living (Retail Price Index)

The total passenger car fleet has grown steadily since the 1950s, and in the last two decades experienced a relative shift from petrol to diesel cars (Figure 5.12) until Diesel-gate reversed this trend. ‘Other’ cars (mostly electric vehicles) represented 3.4% of the fleet in 2020.

Figure 5.12 Passenger car fleet (total number of licensed vehicles) in Great Britain by fuel type 1994–2020 in thousands

Two gradual developments contributed to CO2 emission reductions in the car fleet. First, the relative consumer demand shift from petrol to diesel cars (Figure 5.10) helped to reduce emissions, because diesel cars are more fuel-efficient (but more polluting). Second, fuel efficiency performance of new diesel and petrol cars has improved substantially in the last 20 years due to many incremental innovations (Figure 5.13). An important caveat with these fuel efficiency numbers is that automakers have increasingly ‘gamed’ laboratory tests, leading to discrepancies of 30–40% with real-world driving conditions (CCC, 2015; Fontaras et al., Reference Fontaras, Zacharof and Ciuffo2017).

Figure 5.13 Sales-weightedFootnote 2 average new car fuel consumption in Great Britain, 1997–2019, in litres per 100 km

Two other developments first blunted and then partly reversed these fuel efficiency gains. First, people increasingly bought heavier cars with lower fuel efficiency. The percentage of heavy SUVs (Sports Utility Vehicles) in passenger car sales increased from 6.6% in 2009 to 13.5% in 2015 and then jumped to 21.2% in 2018 (UKERC, Reference Turnheim and Sovacool2019). Second, in response to the 2015 Diesel-gate revelations, people shifted from diesel to petrol cars, which are less fuel-efficient.

5.2.2 Actors

Firms: The car industry operates at a global scale, with multinational companies managing manufacturing plants in many countries. Six foreign-owned volume car manufacturers (Jaguar Land Rover, Nissan, Mini, Toyota, Honda, Vauxhall) have manufacturing plants in the UK, which produced 1.3 million cars in 2019 for both domestic and export markets, generating £79 billion turnover and £15.3 billion gross value added. Exported cars were worth $42 billion, accounting for 13% of the UK’s total export goods (SMMT, Reference Smith, Sochor and Karlsson2020). Although the UK ranks only 16th in global car manufacturing (SMMT, Reference Smith, Sochor and Karlsson2020), its car industry is still relatively important for the country. Around 180,000 people are directly employed in car manufacturing, while 860,000 employees work in the wider automotive industry, which also includes component suppliers, car dealerships, and petrol stations (SMMT, Reference Smith, Sochor and Karlsson2020). The industry’s economic clout gives it substantial lobbying power with the UK government (Shaw and Docherty, Reference Shaw and Docherty2014).

UK car manufacturing steadily increased after the 2007/8 financial crisis but decreased markedly after the 2016 Brexit referendum (Figure 5.14), which created deep uncertainties for UK-based automakers, who are deeply entwined with Europe for imports and just-in-time deliveries of components as well as for exports (since the EU accounts for more than half of UK car exports). Automakers therefore worried about the risk of a ‘no deal’ Brexit and the imposition of trade tariffs of 10% or more, which would have threatened the long-term competitiveness of UK-based manufacturing plants. Investments in new projects and UK plant upgrades, which are normally around £2.5 billion per year, decreased to around £590 million in 2017 and 2018, as global car companies delayed or diverted spending (Campbell and Inagaki, Reference Campbell and Inagaki2021). Ford and Honda decided to close UK manufacturing plants as part of a wider global restructuring move. Although the 2020 Brexit deal removed the tariff risk, Toyota and Vauxhall’s new owner Stellantis, formed by a merger in 2021 of Fiat Chrysler and PSA, are still reviewing their options for future investments and closures. Both companies operate vehicle plants in mainland Europe, which they may decide to expand. Car manufacturing plummeted by 29% in 2020 due to the COVID-19 pandemic (Figure 5.14), which led to plant shutdowns and reduced production in response to shrinking demand.

Figure 5.14 Passenger cars produced in the UK in millions, 2003–2020

Operating in a global environment, automakers face several problems that are more important to them than climate change (Geels, Reference Geels2012; SMMT, Reference Smith, Sochor and Karlsson2020): 1) survival in cut-throat competition, 2) under-utilisation of factories and cost pressures, 3) market saturation in developed countries, 4) declining passenger car sales and manufacturing output since 2017 in the UK (Figures 5.8 and 5.12) and globally, which erodes profitability (Miller, Reference Miller2019); the COVID-19 pandemic further exacerbated these sales problems in 2020.

In response to these pressures, automakers have focused on cost-savings, mergers and collaborations, factory efficiency improvements, sales in emerging economies, and continuous incremental product innovation (in engines, safety devices, air-conditioning, occupant comfort, and entertainment). The combination of earlier ICT devices (such as on-board electronics, anti-lock braking, real-time information technologies, and navigation technologies) with improved sensing devices and faster computers has given rise to high expectations about driverless cars, which are discussed in Section 5.6.6.

Automakers also face climate change pressures and have therefore incrementally improved internal combustion engines (with variable valve timing, direct fuel injection), leading to fuel efficiency improvements (Figure 5.13). Automakers have also dedicated efforts towards developing alternative fuel cars (e.g., electric, hybrid, and plug-in hybrid vehicles). Automakers initially pursued these new technologies reluctantly because of uncertainties and to protect their sunk investments (Penna and Geels, Reference Penna and Geels2015). Since 2015, however, most automakers have seriously committed to strategic reorientation activities (Bohnsack et al., Reference Bohnsack, Kolk, Pinkse and Bidmon2020).

The large investments in electric vehicles, driverless cars, and ventures into car sharing (further discussed in Section 5.6.4) are financially challenging for automakers, whose profits have been squeezed by declining passenger car sales since 2017. An article in The Economist (19 January 2019), titled ‘The big freeze: Carmakers scramble to prepare for a chilly future’, summarised the challenge as follows: ‘Even if coping with these [economic] problems were not enough, carmakers also need to make big investments in electric cars, autonomous vehicles and “mobility” services, such as car-sharing and ride-hailing.’

Users: Cars are deeply embedded in everyday life and used for many different purposes, for example, commuting to work, shopping, leisure, social visits, escort of other people (e.g., children), business, and personal business (Sheller, Reference Sheller, Geels, Kemp, Dudley and Lyons2012).Footnote 3 Commuting and leisure account for most passenger-kilometres, although average travel distance for these purposes has decreased somewhat since 2002 (Figure 5.15). Car use decreased sharply in response to COVID-lockdowns in 2020 and 2021 (Figure 5.4) but also rebounded quickly when restrictions were lifted, because many people depend on cars to support many daily life practices.

Figure 5.15 Average distance travelled by car/van for different purposes (miles per person per year, England), 2002–2019

Since the mid-1980s, the percentage of households without cars has steadily decreased, while double car ownership has increased (Figure 5.16). Nevertheless, average per capita passenger car mobility decreased by about 9% between 2002 and 2011, but then increased somewhat (Figure 5.17). In 2019, however, per capita passenger car mobility was still 3% below 2002, providing some support for the ‘peak car’ hypothesis (Metz, Reference Metz2010; Millard-Ball and Schipper, Reference Millard-Ball and Schipper2011).

Figure 5.16 Household car availability as percentage of the population in England, 1985–2019

Figure 5.17 Average per capita passenger travel by cars and light vans in Great Britain, 1971–2019 (kilometres per capita per year)

There is ongoing debate in the literature about the underlying causes for this phenomenon, with some scholars (e.g., Goodwin and van Dender, Reference Goodwin and van Dender2013; Metz, Reference Metz2013; Newman and Kenworthy, Reference Newman and Kenworthy2011; Wadud and Baierl, Reference Wadud and Baierl2017) emphasising social, cultural, and demographic factors such as changes in lifestyle and cultural attitudes, aging of the population, and younger generations showing less interest in cars. Other scholars, however, emphasise economic factors such as rising fuel costs, lower incomes due to the financial-economic crisis, and changing tax rules for company car use (especially increased taxation on fuel provided for private use) (Bastian et al., Reference Bastian, Börjesson and Eliasson2017, Reference Bastian, Börjesson and Eliasson2016; RAC, 2012).

Although people frequently complain about congestion and rising motor running costs, most of them like the act of driving (Sheller, Reference Sheller2004) and the associated ‘feelings of liberation and empowerment’ (Shaw and Docherty, Reference Shaw and Docherty2014: 75). Many consumers also see cars as the most practical transport mode (in terms of speed, convenience, carrying capacity), except in large cities such as London, where car passenger mobility has been declining since the late 1990s (RAC, 2012), because of increasing congestion, parking problems, and costs. The London congestion charge, introduced in 2003, made automobile use in the city centre increasingly expensive as the charge gradually increased from £5 in 2003 to £8 in 2005, to £10 in 2011, to £11.50 in 2014, and £15 in 2020. Between 2002 and 2018, passenger car and van use in London declined by 35–40%, while underground, surface rail, and cycling increased over the same period, suggesting a substantial modal shift is under way (Figure 5.18).

Figure 5.18 Indexed transport modes in London, 2002–2018 (in terms of distance)

Table 5.2 further reinforces the specificities of London’s passenger mobility system, where public transport (bus, tube, rail) is used much more for commuting purposes than in the rest of the country. Strikingly, 22% of London’s commuting trips involve multiple transport modes, which suggests the presence of an effective intermodal mobility system.

Table 5.2. Commuting trips in different areas by mode or multimode in percentage (short walks excluded): England, 2012–2016 (data from DfT (2018))

| All areas | London | Urban areas | Rural areas | |

|---|---|---|---|---|

| Car/van | 69 | 36 | 75 | 90 |

| Bus | 7.5 | 13 | 6.7 | 1 |

| Tube/London Rail | 2.5 | 11 | 0.2 | 0.1 |

| Rail | 2.3 | 7.1 | 1.4 | 0.3 |

| Walk | 5.4 | 4.7 | 6.2 | 1.2 |

| Bicycle | 4.3 | 4 | 4.5 | 2.5 |

| Taxi | 0.7 | 0.5 | 0.9 | 0.2 |

| Other | 1.3 | 1.7 | 1.3 | 2 |

| Multi-mode | 7 | 22 | 3.8 | 2.5 |

When buying a new car, most consumers find conventional criteria (e.g., price, car size, reliability, comfort, safety, running costs, appearance, engine performance, image) more important than climate change mitigation (Geels, Reference Geels2012). Increased adoption of SUVs, for instance, is driven by appreciation of safety, comfort, size, and reliability (UKERC, Reference Turnheim and Sovacool2019).

Among young people, however, the prevalence of cars and driver’s licenses has decreased since the 1990s (DfT, 2017). These trends led to speculations about changing cultural attitudes about cars among young people (McDonald, Reference McDonald2015). Recent studies, however, suggest these trends may be more related to higher fuel costs, youth unemployment, and a tendency for millennials to delay adult life stage decisions such as having children or buying a house (Delbosc, Reference Delbosc2016; Garikapati et al., Reference Garikapati, Pendyala, Morris and Mokhtarian2016). Quantitative analyses of several large European datasets between 2014 and 2018 found that young people (‘Millennials’) do own and use cars less often than post-war Baby Boomers, but that the difference is diminishing as improving economic conditions have led Millennials to buy and use more cars (Colli, Reference Colli2020).

Policymakers: A prime consideration of UK transport policymakers has long been to stimulate economic growth by facilitating the smooth flow of goods and people. From the 1960s to the 1990s, the so-called predict and provide policy paradigm (Goulden et al., Reference Goulden, Ryley and Dingwall2014) therefore aimed to provide enough road capacity to match forecast increases in car and freight traffic. This resulted in the construction of an extensive road network (Figure 5.6). The promotion of UK-based car manufacturing has been another policy priority in recent decades, aimed at supporting jobs and economic growth (Wolmar, Reference Wolmar2016).

UK transport policy has also aimed to address several negative externalities of car traffic such as congestion, traffic accidents, air pollution, and climate change (Geels, Reference Geels2012). In the 1990s, the predict-and-provide paradigm ran out of steam, as policymakers realised that the construction of more roads stimulated the increase of road traffic, which exacerbated congestion and other problems (Owens, Reference Owens1995). The Labour government’s (1997–2010) New Deal for Transport: Better for Everyone White Paper (1998) explicitly abandoned ‘predict and provide’ as unsustainable and instead introduced new principles. One new principle was traffic management, which aimed to improve the flow of vehicles on existing roads using speed limitations, priority lanes, roundabouts, and ICT devices (e.g., video cameras, communication technologies, electronic signalling devices, computer networks) to monitor and influence traffic (Geels, Reference Geels2007b). Another new principle was demand management, which aimed to reduce the amount of road traffic by changing travel habits and promoting alternative modes. Plans were made to stimulate and better align public transport modes, captured by new concepts such as ‘integrated transport’ and ‘sustainable transport’.

Although these plans suggest that transport policy became less ‘pro-car’, road building did not stop. In fact, between 2000 and 2019, the motorway infrastructure was lengthened by 275 km or 8% (Figure 5.6). Policy plans also encountered opposition. The Labour government’s plans to increase fuel duties more rapidly, for instance, encountered fuel protests and road blockades in 2000, which threatened to paralyse the country. This, in turn, led to an institutionalised fear not to go against what the public wants and to the postponement of the ambitious policy plans in the 1998 New Deal for Transport. Explicit efforts to shape travel habits and stimulate modal shifts (from cars to other transport modes) were gradually dropped and increasingly replaced by a focus on technological improvements (in cars, roads, railways, busses), leaving it to consumers to choose the options they preferred. Although policymakers did stimulate public transport (to some extent), ‘successive administrations have backed away from doing anything that they thought would be construed as overtly “anti-car”’ (Shaw and Docherty, Reference Shaw and Docherty2014: 175).

The continuing importance of cars was also visible in responses to the financial-economic crisis, which led policymakers to not only support financial institutions but also the car industry. To prop up demand, policymakers introduced scrappage schemes that provided £2,000 rebates for replacing old vehicles with new ones. They also invested in new road building, signalling a return of ‘predict and provide’ (Goulden et al., Reference Goulden, Ryley and Dingwall2014). In 2014, the government announced a £15 billion roadbuilding programme. The 2020 Spending Review further invested £27 billion through a five-year Road Investment Strategy aimed at building 4,000 miles of new strategic roads and motorways.

Austerity policies after the 2007/8 financial crisis also led to major reductions in government funding for local authorities, which are responsible for parking policy, local traffic plans, and for maintaining minor and principal roads, which make up the bulk (87%) of the total road infrastructure (Figure 5.6). Reduced local infrastructure spending resulted in deteriorating conditions of local roads (Wolmar, Reference Wolmar2016).

Climate change has climbed rapidly on transport policy agendas since the late 2000s. Although public transport, cycling, biofuels, and other options received some (fluctuating) support, the policy emphasis overwhelmingly came to focus on electric vehicles (further discussed in this chapter). The focus on the ‘greening of cars’ came from both European and UK policymakers. European policymakers introduced CO2 emission performance standards for new cars in 2009, which were subsequently tightened in 2014 and 2019. And UK transport policymakers introduced a raft of policies to stimulate electric vehicles (further discussed later), aiming to both address climate change and stimulate domestic vehicle manufacturing (Mazur et al., Reference Mazur, Contestabile, Offer and Brandon2015; Skeete, Reference Skea, van Diemen, Hannon, Gazis and Rhodes2019).

In the context of Diesel-gate and climate change debates, the government announced plans in 2017 to phase-out petrol and diesel cars by 2040. In February 2020, the phase-out date was brought forward to 2035 and in November 2020 to 2030. This phase-out policy will create mass markets for electric vehicles. Although the stimulus and phase-out policies thus became increasingly interventionist and disruptive in some ways, they also signalled that cars would remain central in future low-carbon transitions and UK transport policy.

This continued commitment to cars was reinforced by the government’s Road to Zero report (DfT, 2018b) that almost exclusively focused on road transport and electric vehicles, which were explicitly linked to industrial strategy (Brand et al., Reference Brand, Anable, Ketsopoulou and Watson2020). Partly in response to criticisms of this narrow focus, the Department for Transport launched a consultation paper in March 2020 (DfT, 2020a), which announced intentions to develop the ‘first comprehensive action plan’ (p. 3) for decarbonising the whole transport system. In July 2021, the government published the resulting new strategy, the Transport Decarbonisation Plan (DfT, 2021a), which indeed addresses all transport modes and freight. The strategic vision also strikes a new tone because two of its six strategic priorities emphasise modal shift towards public and active transport (in line with the new bus, rail, and cycling strategies announced in 2020 and 2021, which are discussed later) and place-based solutions focused on local transport systems, which have remained marginal in UK transport policy for the past two decades. The other priorities, however, continue to focus on low-carbon technologies for passenger vehicles, freight transport, aviation, and shipping, and aim to position the UK as a ‘hub for green transport technology and innovation’ (p. 40). Electric vehicles remain a core plank of the strategy, with the government planning to consult on the introduction of a Zero Emissions Vehicle mandate (which would impose sales targets on automakers) and phase-out plans for small and heavy diesel trucks by 2035 and 2040, respectively.

Although the new discursive emphasis on modal shift and place-based solutions is interesting and welcome, the plan did not announce new money for these options compared to earlier statements in February 2020, which are further discussed later. The plan’s ambivalence is also clear in the Ministerial foreword, which on the one hand says that ‘we must make public transport, cycling and walking the natural first choice’ (p. 6), but on the other hand states that the plan is ‘not about stopping people doing things: it’s about doing the same things differently. … We will still drive on improved roads, but increasingly in zero emission cars’ (p. 4). So, while the strategic vision is full of good intentions, it remains unclear if there will be sufficient policies to achieve the stated goals.

Wider Publics: Concerns about air pollution, the countryside, and the quality of urban space led to strong anti-car and anti-road narratives and protests in the 1980s and 1990s (Roberts and Geels, Reference Roberts and Geels2018), which succeeded in halting the road-building programme announced in the 1989 White Paper Roads for Prosperity. But in wider public debates, cars remained culturally associated with positive values such as freedom, individuality, and success (Sheller, Reference Sheller, Geels, Kemp, Dudley and Lyons2012), although there appear to be generational differences, with young adults showing more varied attitudes (Colli, Reference Colli2020; McDonald, Reference McDonald2015).

Public debates also remain concerned with congestion and fuel prices, which create pressures on policymakers to address these issues. Climate change has become an important issue in public debates about transport, but discourses focus more on electric vehicles than on reduced car use or ownership (Bergman et al., Reference Bergman, Schwanen and Sovacool2017). Local air pollution, which is responsible for between 28,000 and 36,000 premature deaths in the UK each year (PHE, 2019), has also risen high on public agendas, because many UK cities breached air pollution standards for many years. The 2015 Diesel-gate scandal caused public outrage and anger, because cheating automakers clearly privileged car sales over air pollution and public health considerations. Negative public debates not only contributed to declining diesel car sales but also prepared the ground for later phase-out policies of diesel and petrol cars.

5.2.3 Policies and Governance

Policies

Many formal rules and regulations shape automobility and road transport, including traffic rules, drivers’ licenses, road taxes, excise duties, road infrastructure design and construction rules, parking rules, and vehicle standards (on emissions, safety, noise, recycling, materials). Regulations and policies with regard to climate change have gradually strengthened over time, initially stimulating incremental changes (such as engine efficiency improvements), but increasingly also stimulating more radical technical changes (e.g., electric vehicles).

The UK government introduced CO2-banding in its Vehicle Excise Duty in 2001, which reduced vehicle sales taxes for fuel-efficient cars. This stimulated the adoption of diesel cars (Figure 5.10). In 2015, however, the new Conservative government replaced this CO2-banding with a flat-rate annual fee, starting in 2017. The unintended consequence of diesel car diffusion was an increase in local air pollution (NOx, particulate matter), which has remained a topic of heated public health debates since 2016, leading to decreasing diesel car sales (Figure 5.10) and phase-out regulations.

In 2009, the European Commission introduced new car CO2-regulations of 130 g/km for 2015 fleet average company sales. These regulations accelerated fuel efficiency improvements (Figure 5.11). In 2009, the European Commission also introduced the Renewable Energy Directive, which stipulated that 10% of transport energy should come from renewable sources by 2020, which stimulated bio-fuel deployment (further discussed in Section 5.6.2). In 2014, the CO2-emission target was tightened to 95 g/km in 2020/21. In 2019, the European Commission not only confirmed that automakers had to meet this target for the average of all their sales but also added stiff fines for companies that would miss the target, namely €95 (£83) for every gram they are over the limit, multiplied by the number of cars sold that year. As a transitional arrangement, the highest-polluting 5% of new cars registered in 2020 are excluded for the 2021 calculation of fines over the previous year. For 2021, however, all major carmakers are expected to miss their emissions targets, which may lead to €20 billion fines in 2022 (which are likely to be especially large for Volkswagen and PSA). To lower their fleet average emissions, automakers are therefore rushing to market new electric vehicles, or even pool emission numbers with companies such as Tesla (Jolly, Reference Jolly2020a).

UK policymakers also introduced policies to stimulate electric vehicles (further discussed in Section 5.6.1). In 2009, they created the Office for Low Emission Vehicles (OLEV), which disbursed £400 million of government funding between 2011 and 2015 on R&D, consumer subsidies, and recharging infrastructure. Between 2015 and 2020, a further £500 million was spent on supporting ultra-low emission vehicles (ULEVs), which emit less than 75 gCO2/km, that is, electric vehicles and plug-in hybrids. The 2030 phase-out policy of diesel and petrol cars is another policy to support ULEV markets.

London’s policymakers introduced a congestion charge in 2003, which aimed to reduce traffic flows, air pollution, and noise pollution in the central London area. In 2017, London also introduced a toxicity charge in response to increasing air pollution concerns in central London. The £10 charge applies to older and more polluting cars and vans that do not meet Euro 4 standards. In 2019 this charge was replaced by the Ultra-Low Emission Zone (ULEZ), which in Central London charges fees to pre-2006 petrol cars and vans and pre-2015 diesel cars and vans.

Governance Style

Beyond specific regulations and policy instruments, the UK transport governance style has several characteristics. One characteristic is that the Department for Transport ranks relatively low in the wider political and departmental pecking order, which means that transport-related issues rarely receive high priority: ‘Transport is rarely seen as a particularly important are of concern in relation to other policy matters’ (Shaw and Docherty, Reference Shaw and Docherty2014: 8). Consequently, transport has not received long-term sustained funding, as Shaw and Docherty (Reference Shaw and Docherty2014: 4) note: ‘In four decades up to early 2000s, the UK spend on average 40% less as a proportion of GDP on its infrastructure each year than other leading countries in Europe.’ Combined with the UK ‘tendency of muddling through’ (Shaw and Docherty, Reference Shaw and Docherty2014: 6), the result is that UK transport has fallen behind leading European countries in the resilience and reliability of core infrastructure, comfort, and ease of using public transport, and the aesthetics of urban space.

Another characteristic is that UK transport governance ‘is highly centralized, with very little power at the local level’ (Wolmar, Reference Wolmar2016: 106). Although local policymakers have become increasingly concerned about ‘quality of life’ issues such as air pollution, congestion, noise, and parking, their policy responses are constrained by their financial and regulatory dependence on Westminster. London is an exception because it has substantial policy discretion and because Transport for London (TfL) received dedicated funding from the Government (until 2018) and the Greater London authority.

A third characteristic is an increasing policy focus on technology and infrastructure projects rather than travel behaviour change or spatial planning. Successive transport ministers preferred ‘large-scale road and (now) rail projects’ over ‘decidedly unsexy but very important local schemes’ (Shaw and Docherty, Reference Shaw and Docherty2014: 103). Wolmar (Reference Wolmar2016: 80) links this focus to the widespread use of cost-benefit analysis in transport decision-making and the emphasis in these analyses on time savings made by the users of new infrastructure: ‘This tends to favour bigger schemes as the benefits can be presented as very large, and also results in ignoring schemes that deliver other benefits than time savings’, such as traffic calming, safety, and environmental issues. The 2021 Transport Decarbonisation Plan (DfT, 2021a) and the new bus, rail, and cycling strategies, which are further discussed later, deviate somewhat from this characteristic because they introduced a new emphasis on modal shift, behaviour change, and local solutions besides the ongoing technological focus.

A fourth characteristic is that UK transport governance is relatively light touch and market-based, leaving it to consumers to choose their transport mode and vehicle (perhaps incentivised with some market-based instruments). Exceptions were the more interventionist 1998 New Deal for Transport plan (which was only limitedly implemented) and the recent phase-out policies of diesel and petrol cars. The 2021 Transport Decarbonisation Plan and the new bus and cycling strategies are also more interventionist because they hope to shift people from cars to public and active transport modes. The scope for change may be limited, however, by structural and cultural lock-in mechanisms that have created car dependence in many places: ‘Decades of transport policies favouring road transport and the associated, established car culture mean that for many journeys people have little practical choice, or at least perceive that they have little practical choice, other than to drive to where they want to go’ (Shaw and Docherty, Reference Shaw and Docherty2014: 176).

5.3 The Railway System

5.3.1 Techno-Economic Developments

The railway system consists of extensive, costly infrastructures, which enable trains to travel uninterrupted between cities and villages, where stations enable passengers to enter and exit. Rail infrastructures include both trunk lines for long-distance, high-speed travel between major cities, and local networks with regional services that stop frequently. While trunk lines are electrified, many UK local networks still operate diesel trains. Railway signalling is a system used to direct railway traffic and prevent collisions.

Rail infrastructure length has decreased substantially since the Second World War, with particularly steep reductions following the 1963 Beeching plans, which by 1968 had reduced tracks by 7,000 km (Figure 5.19) and halved British Rail’s supply of rolling stock and number of railway stations (Roberts and Geels, Reference Turnheim, Asquith and Geels2019). Only a third of UK railways are electrified, which is low compared to France (52%), Germany (58%), and Italy (71%). This is the result of the ‘slow and piecemeal way in which successive governments chose to electrify the rail network’ (Shaw and Docherty, Reference Shaw and Docherty2014: 109).

Figure 5.19 Length of railway infrastructure and electrified routes (in kilometres) in Great Britain, 1946–1919

Rail use declined slightly in the post-war decades, increased somewhat in the 1980s, and has more than doubled since the mid-1990s (Figure 5.20), despite rail fares increasing faster than the retail price index (Figure 5.11). Increased rail travel caused overcrowding in trains and congestion on the rail network, which led to increasing infrastructure investment. Many infrastructure projects focused on rail improvements in/out/across London, for example, Thameslink, Crossrail, high-speed railways to Europe (since 2007), and a second high-speed railway to Manchester and Leeds (called ‘HS2’). These new projects (slightly) increased rail length after 2012. Services between other UK cities have remained less developed and are where ‘the shortcomings of integrated network planning are most obvious’ (Haywood, Reference Haywood2007: 210).

Figure 5.20 Passenger kilometres by rail, Great Britain, 1952–2019, in billion kilometres

Rail travel collapsed due to COVID-lockdowns, reaching levels as low as 5% of normal use in April 2020 (Figure 5.4). Since then, rail travel has recovered slowly, but in July 2021 was still 50% below pre-pandemic levels.

5.3.2 Actors

Firms: British Rail, which was a vertically integrated state monopoly overseeing rail network development, maintenance, and operations, was privatised in 1994–1997. This created a complex network of actors, including: a) Train Operating Companies (TOCs) that operate 16 railway franchises for specific routes, b) rolling stock operating companies that lease trains to TOCs, c) Network Rail, which owns, maintains, and operates the railway infrastructure, d) the Office of Rail Regulation that oversees the industry, and e) the Department for Transport (DfT), which awards and sets general conditions for the railway franchises. Climate change is of limited importance to most of the industry actors, whose strategies mostly focus on financial gaming of the complex franchise and lease system, by privatising gains and collectivising costs.

TOCs compete for franchises, which they operate to optimise profits. TOCs earn income through: a) passenger revenues, which increased from £4.6 billion in 2000 to 10.2 billion in 2019 (through increased fares and passenger journeys), b) other train-related income (e.g., catering in trains and stations), which was $1.2 billion in 2019, and c) direct government payments (through franchise awards and performance grants), which were £1.2 billion in 2019 (ORR, 2020); these government payments were negative between 2011 and 2017 (because of the way franchises were structured), but turned positive again in 2018 and 2019 (see also Figure 5.22). TOCs lease trains from rolling stock operating companies, pay ‘track access charges’ to Network Rail for the use of rail infrastructure, and have several other operating expenditures, which have historically been lower than total income, allowing TOCs to make net profits of about 2–3% of revenue. But since they do not invest in trains or tracks, TOCs extract these profits at very low risk, leading to returns-on-capital that can be as high as 120% (Bowman et al., Reference Bowman, Folkman, Froud, Johal, Law and Leaver2013).

TOCs also benefit from large indirect subsidies in the form of relatively low track access charges (which is a political decision), which are not enough to cover the investments by Network Rail in track maintenance and expansion, and these have therefore been paid through a mixture of government subsidy and debt accumulation, as we describe next.

The publicly owned Network Rail organisation became responsible for railway infrastructure when Railtrack (which was created after privatisation) went bankrupt in 2002. Because privately owned Railtrack made limited investments in track and signalling infrastructure, Network Rail had to address this backlog while also expanding and upgrading railways to accommodate growing rail traffic. Despite increasing rail traffic, TOC payments for infrastructure use decreased from £2.2 billion in 2008 to £1.6 billion in 2012 (Bowman et al., Reference Bowman, Folkman, Froud, Johal, Law and Leaver2013). Although ‘track access charges’ increased again from £1.6 billion in 2015 to £2.5 billion in 2019 (ORR, 2020), TOC payments continued to fall short of Network Rail investments. Government payments to Network Rail have increased substantially over time, from £1.7 billion in 2002 to £7.1 billion in 2019 (see Figure 5.22). Additionally, Network Rail has borrowed money from the financial markets to finance rail infrastructure investments. By 2012, this had resulted in cumulative debt of £30 billion (Bowman et al., Reference Bowman, Folkman, Froud, Johal, Law and Leaver2013), which by 2019 had ballooned further to £52 billion (ORR, 2020). This money thus forms an indirect subsidy to TOCs, which (with political consent) have managed to socialise infrastructure costs.

The COVID-related decline in passenger travel and fare incomes created major financial problems for the railway companies, which led policymakers to suspend the franchise model and provide emergency support to railway companies to prevent bankruptcy.

Users: Rail use increased despite soaring rail ticket prices, which increased by 102% between 1997 and 2014, making UK rail fares among the highest in Europe. People use trains for various purposes. Although leisure is the single largest end-use category, commuting and business-related travel together accounted for more than half of all railway passenger kilometres (51%) in 2019 (Figure 5.21).

Figure 5.21 Average distance travelled by railways for different purposes (miles per person per year, England), 2002–2019

Rail travel is dominated by the ‘London effect’: almost two-thirds of all rail journeys started or ended in London (DfT, 2019a). The most important explanation for increased rail travel growth is the socio-economic boom in Greater London and the South East, which stimulated more train travel in/out of London.

About half of the new rail travellers are drawn from the group of regular car users. Growth in rail use has thus led to some modal shift, which has been largest for ‘men living outside London but travelling into London regularly for work-related purposes’ (RAC, 2012: 84). Although there is ongoing debate about underlying causes of increased rail travel, proximate reasons are: a) rising London house prices forcing people to live elsewhere and commute to work, b) reduced company car use (related to fuel taxation changes), c) the London congestion charge and other car-hindering measures (RAC, 2012).

Railway usage decreased by 95% in April 2020 during the first national lockdown and has only slowly recovered since then (Figure 5.4), owing to ongoing COVID restrictions (such as the 2 metre distance rule) and health concerns that made people more reluctant to travel with others in confined spaces. It remains to be seen if this is a structural trend that will negatively impact public transport.

Policymakers: Policymakers privatised the railways with the stated aims of improving service quality, increasing competition and cost-efficiency, reducing public subsidies, encouraging investment, and improving environmental performance (Haubrich, Reference Haubrich2001). Reality turned out differently, and aims have not been met with regard to service quality, cost-efficiency, and private investment (Haubrich, Reference Haubrich2001; Jupe, Reference Jupe2013). Despite promises to the contrary, public subsidies also increased substantially (Figure 5.22), especially for Network Rail, which imply indirect subsidies to TOCs, who thus pay too little for the use of railway infrastructure.

Figure 5.22 Government support to the rail industry, 1985–2019 in £million

To accommodate the growth in rail travel and address emerging problems, policymakers have substantially supported rail infrastructure expansion since the early 2000s (Figure 5.22). These investments have focused more on large-scale, eye-catching projects (such as HS2, Crossrail) than on improvements in existing tracks or the signalling infrastructure (Wolmar, Reference Wolmar2016).

The various railway problems were investigated in the 2006 Eddington Review, the 2011 McNulty Review, and the 2013 Brown Review. The McNulty Review, for instance, criticised the lack of efficiency improvement, which created a 40% gap with European comparators. The review also found that the ‘causes of GB rail’s excessively high costs are many and complex’, including ‘fragmentation of structures and interfaces, roles of government and industry, ineffective and misaligned incentives, a franchising system that does not encourage cost efficiency sufficiently, management approaches that fall short of best practice, and a railway culture which is not conducive to partnerships and continuous improvement approaches’ (p. 5).

Despite the critical reviews and public debates, policymakers did not show much appetite to substantially change institutional framework conditions (Jupe, Reference Jupe2013). Although Labour politicians repeatedly criticised existing arrangements and advocated railway renationalisation in the past 10 years, their proposals had limited direct effects because they were not in government. But the criticisms did have indirect effects in keeping problematic railway arrangements in the spotlight and shaping the discourse. The COVID-19 shock, which substantially disrupted the railway industry, then provided the conditions for Conservative politicians to introduce major institutional changes, which are further discussed later.

Wider Publics: Public debates about railways are mostly negative, focusing on overcrowding, delays, high train fares, and public subsidies (Taylor and Sloman, Reference Taylor and Sloman2013). Although debates on the European continent often emphasise the public-good role of railways in providing mobility access for people without cars, this argument has been far less salient in UK debates in recent decades, where railways are mostly framed as a private enterprise (Roberts and Geels, Reference Roberts and Geels2018). There have, nevertheless, been ongoing critical debates about the dysfunctionalities of privatisation and liberalisation of the railways, which created the conditions for substantial institutional change (i.e., the Great British Railways reforms) when the COVID-pandemic disrupted the railway industry.

Public debate has focused on new infrastructure projects, which policymakers portray as economically necessary. Opponents, however, questioned the wisdom of large investments for HS2 (estimated at more than £100 billion) and criticised negative effects on the countryside. The COVID-pandemic reignited these debates because potential alterations in commuting and business travel erode the HS2 business case, leading the National Infrastructure Commission (NIC, 2020) to suggest that HS2 infrastructures beyond Birmingham should be ‘reviewed’ and potentially not go ahead.

5.3.3 Policies and Governance

Railway governance has been very London-centric and focused on large-scale projects (e.g., Crossrail, Thameslink, HS2) rather than on whole system improvement, including technical issues such as railway electrification and signalling. Instead of improving bottlenecks in existing railways, policy attention has mostly focused on new high-speed lines. But according to Wolmar (Reference Wolmar2016: 88), ‘HS2 is a political project pushed through as a grand projet by politicians for reasons that do not stand up to political scrutiny. In effect, it is transport policy on a whim.’ Although railway polices made some piecemeal improvements, there is a ‘failure to follow through on an overarching vision for developing the railways’ (Shaw and Docherty, Reference Shaw and Docherty2014: 106).

Privatisation of British Rail in the 1990s was a major institutional change that under-delivered on the promises that were made in advance. Although the effects of privatisation were disappointing, successive governments were unwilling to substantially adjust the institutional framework, despite providing increasingly large subsidies (Figure 5.22). Repeated criticisms by the Labour opposition contributed to the erosion of the taken-for-granted legitimacy of existing institutional frameworks. In response to the COVID-pandemic, the government first provided substantial financial support to the railway companies, amounting to £12 billion in the first post-lockdown year (DfT, 2021b: 6), to prevent bankruptcy and ensure some continued service provision through the Emergency Measures Agreements (from March to September 2020) and the Emergency Recovery Management Agreements (from September 2020 to March 2022).

In May 2021, the government then introduced substantial institutional reform that aimed to simplify arrangements by creating a new arm’s length public body, Great British Railways (GBR), which from 2023 ‘will own the infrastructure, receive the fare revenue, run and plan the network and set most fares and timetables’ (DfT, 2021b: 7). GBR will also contract with train companies to operate trains to the timetable and fares it specifies. Train companies are expected to compete for the contracts, which will incentivise them on punctuality and efficiency rather than revenue raising (as in the franchise model). Although the government says it is committed to grow the railways, the institutional reforms also clearly aim to ‘secure significant efficiencies’ (p. 8) and reduce public subsidies because ‘the current sums being paid to operate and maintain the railways are not sustainable’ (p. 7). Many of the details are still to be decided, so it remains to be seen what the effects of these reforms will be.

5.4 The Bus System

5.4.1 Techno-Economic Developments

Buses share many road infrastructures with cars and cyclists, although some cities have started to introduce segregated bus lanes on some roads. Bus services are thus more flexible than (fixed) railways but do follow particular routes, which in many cities are determined by private bus companies. Some stops along routes are merely indicated by signs, whereas others also have shelters that protect waiting passengers from the weather. Although timetables indicate bus frequencies and arrival times, traffic congestion and other contingencies frequently cause delays, which create uncertainties for waiting passengers. Bus stops can be fitted with real-time passenger information displays that reduce these uncertainties by more reliably indicating estimated times of arrival. Buses mostly provide short- to medium-distance services within cities, although coaches also offer long-distance services between cities, and are often cheaper than trains.

Bus use is in long-term decline, with total bus passenger kilometres declining by 22% between 2010 and 2019 (Figure 5.3). In London, however, the number of bus journeys has increased substantially since 1995, accounting for about half of English bus passenger journeys in 2019 (Figure 5.23). Bus travel has become more expensive with fares rising faster than the retail price index, and faster than rail fares (Figure 5.11). The COVID-19 pandemic reduced bus travel by almost 90% in April 2020, which subsequently only partly rebounded to about 60% of pre-pandemic levels by July 2021 (Figure 5.4).

Figure 5.23 Number of English passenger journeys (in millions) on local buses, 1982–2019

The great majority of buses in Great Britain (85%) still use diesel fuel (Table 5.3). Diesel-electric hybrid buses, which are 20–30% more fuel efficient, have also found some use, but mostly in London and far less in the rest of the country. Electric and gas-based buses are still relatively rare. Electric buses are mostly used in London, although a few city regions (e.g., Nottinghamshire, North Yorkshire, Greater Manchester) also experienced some deployment.Footnote 5

Table 5.3. Percentage of fuel consumption in buses operated by local bus companies in 2019/2020 (constructed using data from Department of Transport Statistics; Bus Statistics; Table BUS0609)

| London | England | England outside London | Scotland | Wales | Great Britain | |

|---|---|---|---|---|---|---|

| Electric (not hybrid) | 4 | 2 | 1 | 1 | 0 | 1 |

| Diesel-hybrid | 40 | 14 | 3 | 6 | 0 | 12 |

| Methane, bio-methane | 0 | 1 | 2 | 0 | 0 | 1 |

| Diesel | 56 | 84 | 95 | 94 | 100 | 85 |

5.4.2 Actors

Firms: The bus industry (except in London, and a few other places, including Nottingham and Reading) was deregulated in 1986, and subsequently privatised, which initially resulted in a range of small companies, but subsequent take-overs created an oligopoly (Langridge and Sealey, Reference Langridge and Sealey2000), dominated by five bus groups (First, Go-Ahead, Stagecoach, Arriva, National Express). The bus market is locally organised, with companies competing for specified tenders.

Privatisation allowed bus companies to decide on their routes, fares, and timetables. The promise was that increased competition between bus companies would result in improved services, lower fares, and increased bus use (Cowie, Reference Cowie2002). The results have been exactly the opposite: bus use has decreased, except in London (which did not privatise bus services); fares have increased faster than the retail price index (Figure 5.11); and service quality has decreased (Stradling et al., Reference Strachan, Cowell, Ellis, Sherry-Brennan and Toke2007). Bus companies mostly compete on costs, paying only moderate attention to innovation and quality improvement.

Despite being privatised, the bus industry is heavily subsidised. Decreases in public support, from 49% of total revenue in 2009 to 41% in 2019 (Figure 5.24), reinforced the industry’s cost focus at the expense of other considerations. Although air pollution and climate change are not core considerations, bus companies have used government subsidies to gradually adopt hybrid and electric buses (especially in London). The COVID-pandemic substantially disrupted the bus industry, leading to emergency government support.

Figure 5.24 Operating revenue (in £millions at current prices) for local bus services in England, 2004–2019, through passenger fare receipts and (three forms of) government support

Users: Buses are the most frequently used and most accessible mode of public transport (McTigue et al., Reference McTigue, Monios and Rye2018). Bus use is primarily local. Most trips are between one and five miles. Buses are essential for people without cars, accounting for over 60% of all public transport trips. Bus use is most prevalent among lower income families, students, the young, and elderly people (DfT, 2014). People aged over 60 received concessionary bus travel passes in 2001 to enhance their access to mobility services. Local bus use is primarily for shopping, education, leisure activities, and commuting (DfT, 2017). Bus use has been declining, especially outside London, because of rising fares and declining service frequency and punctuality. Decline was further accelerated by the COVID pandemic and only partially rebounded (Figure 5.4), owing to lingering health concerns among the elderly and shifts to online teaching for students, which both may lead to long-term structural shifts.

Policymakers: Policymaking for bus transport has been fragmented since deregulation and privatisation, with national policymakers setting regulatory frameworks and controlling financial purse strings, and local authorities implementing policies and contract tendering. In response to the negative effects of privatisation, policymakers have tried since the late 1990s to improve coordination, innovation, and service quality in the fragmented bus industry. Despite various new policies, which are further discussed later, the problems have not been solved. One reason is that national funding for buses has decreased since the financial crisis, especially for bus operator grants and public transport support to local authorities (Figure 5.24).

Another reason is that local transport planning is hindered by limited policy discretion and dependence on national funding sources (Marsden et al., Reference Marsden, Ferreira, Bache, Flinders and Bartle2014). Local transport policymaking is also hampered by several barriers: shortage of skilled staff, limited political support from city councils, lack of funding, and insufficient strategic alignment between objectives and resources (McTigue et al., Reference McTigue, Monios and Rye2018).

A third reason is that local councils have ‘insufficient political will to improve bus infrastructure where it involves reallocating road space away from cars, little desire to upset their local bus companies by interfering with their existing operations and a lack of in-house expertise capable of actually fashioning and managing a fully integrated transport network’ (Shaw and Docherty, Reference Shaw and Docherty2014: 90).

London, which privatised but not deregulated its bus services, is an exception. Bus use in London has expanded significantly since the early 2000s (Figure 5.23) for several reasons. First, successive mayors (Livingstone, Johnson) made buses a policy priority. Second, bus services remained regulated by Transport for London, which sets high standards in its bus tenders. Third, substantial financial support of around £600 million/year was made available to expand and improve London’s bus system (Shaw and Docherty, Reference Shaw and Docherty2014).

Wider Publics: The public image of buses is poor. They have become viewed as a ‘last resort’ means of transport (Shaw and Docherty, Reference Shaw and Docherty2014). Public debates are mostly about negative issues such as rising fares and low service quality (Knowles and Abrantes, Reference Knowles, Abrantes, Docherty and Shaw2008; Stradling et al., Reference Strachan, Cowell, Ellis, Sherry-Brennan and Toke2007). There is no consensus about how to improve bus services (Currie and Wallis, Reference Currie and Wallis2008). It is surprising that air pollution problems have not led to stronger debates about dirty diesel buses, although this has begun to change in the last few years.

5.4.3 Policies and Governance

The negative unintended consequences of bus privatisation and deregulation gave rise to several policy initiatives. The 2000 Transport Act allowed local authorities to introduce ‘quality partnerships’ to stimulate innovation. In this partnership, local transport authorities would agree to improve bus stop infrastructure (e.g., raised kerbs, shelters, real-time passenger information), if bus companies invested in new vehicles and driver customer care training (White, Reference White2010). These partnerships had limited success, however.

The 2008 Local Transport Act aimed to facilitate collaboration between operators and local authorities to co-ordinate ticketing and timetabling. The 2011 Local Transport White Paper further aimed to enhance the ‘whole journey experience’ and promoted integrated ‘smart’ ticketing. These national policies had limited effects (except for London), because they ‘failed to compensate for the fragmentation installed in the horizontal level by the bus deregulation’ (Sørensen and Gudmundsson, Reference Sørensen and Gudmundsson2010: 14–15).

To address local air pollution and climate change, national policymakers also tried to stimulate the uptake of hybrid and electric buses via the Green Bus Fund (£90m between 2009 and 2015) and the Low Emission Bus Scheme (£41m between 2015 and 2017), which have delivered over 1,600 buses in service. Wider diffusion was hampered, however, by the stop-start dynamic of national funding sources and changing priorities (McTigue et al., Reference McTigue, Monios and Rye2018). The Ultra-Low Emission Bus Scheme (£48million) aimed to drive further uptake between 2018 and 2021.

In response to the pandemic, policymakers introduced the COVID-19 Bus Service Support Grant (CBSSG), which provided about £1.4 billion support funding between March 2020 and July 2021.Footnote 6 This grant enabled bus companies outside London to provide service levels of up to 100% of pre-pandemic levels, which supported people relying on bus services, including many key workers. From September 2021, however, the government intends to reduce recovery funding from £27 million per week to about £8 million per week, which may substantially affect bus companies if travel patterns have not substantially increased.

Before the pandemic, in February 2020, the Johnson administration already announced a £5 billion bus and cycling fund to stimulate both transport modes, although it reportedly also aimed to stave off criticisms of the £100 billion HS2 go-ahead decision (Stewart and Walker, Reference Steward2020). These plans were maintained and elaborated during the pandemic, which highlighted the importance of local transport and structural reform, culminating in the National Bus Strategy for England, launched in March 2021 (DfT, 2021c). Using £3 billion of funding over five years it aims to reform and improve bus services outside London and reverse their decades-long decline. Specific goals include: a) the introduction of simple, cheap flat fares (which enable multiple trips in one day), b) multi-modal tickets that can be paid with a contactless card, c) more frequent and reliable services, d) high service standards and improved digital information, e) new priority lanes for buses, and f) the introduction of about 4,000 electric buses (representing about 10% of the bus fleet). To achieve these goals, the National Bus Strategy also introduced the option of Enhanced Partnerships between Local Transport Authorities (LTAs) and bus companies, which give LTAs more influence over timetables, multi-operator ticketing, and bus services improvements, and made access to the additional £3 billion funding conditional on LTAs and bus companies implementing Enhanced Partnerships by April 2022.

For much of the studied period, the bus governance style had several characteristics that hampered policy effectiveness. First, buses had relatively low political priority, despite their importance for particular social groups. For many years, policymakers have given less attention (and resources) to buses than to trains or cars, because buses are less about big infrastructure projects and thus less eye-catching (Wolmar, Reference Wolmar2016). Second, governance is fragmented between national and local levels. Although local authorities are expected to develop Local Transport Plans, they have limited legislative or financial powers to enable strategic policymaking (McTigue et al., Reference McTigue, Monios and Rye2018). Third, national bus funding has not only diminished since 2009 but also frequently changed direction in terms of priorities, which further complicates local strategic policymaking. Because of these three characteristics, bus policymaking and implementation has been piecemeal, fragmented, and relatively ineffective in addressing persistent problems. Aiming for ambitious reform, the recent National Bus Strategy has increased the political priority of and funding for buses but remains a rather top-down policy. Its future success will therefore depend on local uptake and implementation and on the degree to which users will return to buses.

5.5 The Cycling System

5.5.1 Techno-Economic Developments

Basic bicycle technology has long stabilised, although innovations continue to be made, for example, folding bikes and electric bicycles. The average price of new UK bicycles was £427 in 2016 (Newson and Sloman, Reference Newson and Sloman2018). Sales of new bicycles fluctuated between 3 and 3.6 million per year between 2003 and 2016 (Conebi, 2017).

UK cyclists mostly share road infrastructures with cars, vans, buses, and lorries. Only a few UK cities (e.g., London, Brighton) have infrastructures with separate cycling lanes, although other cities have recently begun to follow suit.

The post-war transition towards cars was accompanied by a steep decline in British cycling from 23 billion passenger-kilometres in 1952 to 6 billion in 2019 (Figure 5.25). This represented a reduction from 11% of all passenger kilometres travelled in 1952 to 0.7% in 2019. Since the mid-2000s, British cycling has been on an upward trend, but it remains a very small regime with stabilised rules and practices, carried by relatively small social networks. UK cycling is low by EU standards (Pucher and Buehler, Reference Pucher and Buehler2008), accounting for less than 1% of travel distance and 2% of trips (Table 5.1). The pandemic was an external shock that triggered a relatively rapid 46% increase in cycling in 2020 (DfT, 2021d), with particularly large expansion during and immediately after the first lockdown (Figure 5.26).

Figure 5.25 Passenger kilometres by pedal bicycles, Great Britain, 1952–2019, in billion kilometres

Figure 5.26 Daily use of bicycles in Great Britain between March 2020 and July 2021; figures are percentages of an equivalent day or week

5.5.2 Actors

Firms: UK companies produce only a small quantity of bicycles, about 80,000 per year. The largest UK company is Brompton, which produces folding bikes. Most bicycles are imported from the Far East, principally Vietnam, Cambodia, China, and India. Bicycle sales account for about half of the total value of the bicycle retail market with the other half derived from sales of accessories, clothing, tyres, repairs, and maintenance (Newson and Sloman, Reference Newson and Sloman2018).

Users: Cycling remains a marginal activity in the UK, perceived by most people as good for recreation or commuting daredevils but not for many other purposes. Bicycle use concentrates in cities with favourable conditions (e.g., London, Cambridge, Oxford, Brighton). In London, cycling has seen the fastest relative growth of all transport modes (Figure 5.18), especially for commuting purposes (Aldred and Jungnickel, Reference Aldred and Jungnickel2014). Between 2001 and 2018, cycle flows across central London increased by 340% (Figure 5.27). Nevertheless, cycling still only accounted for 1.5% of all passenger-kilometres in London in 2018.

Figure 5.27 Trend in cycle flows (in thousand cycles per day) across central cordon, 1977–2018

The majority (62%) of London’s cyclists are male, 38% female. Most of London’s cyclists are young urban professionals: 32% are from the 25–34 age group, 27% from the 35–44 age group, and 16% and 15% respectively from the 16–24 and 45–54 age groups (TfL, 2015). The main motivations for London’s cyclists are increased fitness, and travel time and money savings. The main deterrents mentioned by non-cyclists are safety concerns, bad weather, health reasons, lacking accessibility, and limited confidence (De Boer and Caprotti, Reference De Boer and Caprotti2017).

The COVID-19 shock created opportunities for cyclists because the first lockdown in particular substantially reduced car traffic (Figure 5.4). On some days during and after the first lockdown cycling was more than 300% above pre-pandemic levels (Figure 5.26), as people cycled for their daily exercise on quiet roads. As lockdowns were lifted and car traffic returned to pre-pandemic levels (Figure 5.4), cycling also returned to pre-2020 levels in most places (Figure 5.26), which suggests that the cycling increase may not be a long-term structural trend. Some cities such as Manchester, however, report that cycling in July 2021 was still 20% above pre-pandemic levels (Laker, Reference Laker2021).