1. Introduction

Insurance companies are exposed to different kinds of risk, and risk management is a fundamental aspect of the insurance business. One is financial risk, which, to a large extent, can be hedged by trading in the financial market. Another type of risk is insurance risk. In the context of life and health insurance, the insurance risk of the insurer encloses both unsystematic and systematic biometric risks. We refer to unsystematic insurance risks as the risks related to the randomness of insurance claims (for instance, the randomness of deaths in a portfolio with fixed mortality intensity Dahl & Møller, Reference Dahl and Møller2006), which may produce an adverse result for the insurance portfolio, and we assume that unsystematic insurance risks are negligible for large portfolios of insurance contracts. Such risks arise in multi-state life and health insurance as the pattern of states of the policyholder is random (Christiansen, Reference Christiansen2013). Systematic insurance risk refers to the risk associated with unpredictable changes in the insurance claims intensity, for instance, in the underlying mortality intensity, disability intensity, and lapse rate (in other words, when observing systematic deviations from expected values rather than around them Pitacco, Reference Pitacco2009), which may generate systematic divergence between anticipated and actual outcomes.

Insurance contracts are typically long-term obligations for the insurance company, and therefore, an unforeseen development of, for instance, the underlying mortality of an insurance portfolio may result in large losses and the worst-case scenario ruin, for the insurance company.

Possibilities for hedging insurance risks, especially the systematic ones, are few. One proposal is the so-called natural hedging, which utilizes that liabilities of different insurance products have different sensitivities towards changes in the underlying transition intensities of a Markov process describing the state of the policyholder. This enables the construction of portfolios of insurance products invariant to changes in the transition intensities. The typical example is in the survival model, where the liabilities of a life annuity increase (decrease) and those of a term insurance decrease (increase) when the death intensity decreases (increases). Therefore, we can construct a portfolio with a combination of the two products where the liabilities are immune to changes in the death intensity. This is denoted natural hedging and is studied in Cox & Lin (Reference Cox and Lin2007) and Wang et al. (Reference Wang, Huang, Yang and Tsai2010). Natural hedging in a multi-state setup with the possibility to hedge disability risks is studied in Levantesi & Menzietti (Reference Levantesi and Menzietti2017) and Nyegaard (Reference Nyegaard2022). Natural hedging is an insufficient tool for risk management of systematic insurance risks since the optimal natural hedging portfolios differ a lot from the demands of the insurance market.

Another proposal is in with-profit life insurance, where systematic insurance risks are handled by choosing prudent transition intensities for pricing insurance benefits. The expected surplus is then returned to the policyholders as a bonus. For a long-term agreement, as an insurance contract typically is, what seems safe-side transition intensities at initialization may not be on the safe side 20 or 30 years later. This is, for instance, the case for death rates, where longevity improvements have occurred faster than expected during the last 40 years.

What constitutes safe-side transition intensities depends on the insurance product. For a life annuity, a low death intensity is on the safe side, while a high death intensity is on the safe side for term insurance. Insurance companies face different types of risks, and what is characterized as an adverse development of future transition intensities varies from company to company. Therefore, the demand for hedging systematic insurance risks depends on the type of business.

In life and health insurance, the main challenge consists of managing longevity and disability risks, which, for their systematic nature, cannot be mitigated through ordinary diversification strategies. Alternative risk transfer allows life and health insurers to hedge longevity and disability risk without transferring the entire insurance portfolio. The need to manage these systematic risks is growing as the demand for disability insurance policies has risen globally. Existing literature on this topic focuses on mortality-linked securities to hedge mortality or longevity risks in the survival model. Two examples of traded mortality-linked securities, the Swiss Re mortality bond and the EIB/BNP longevity bond, are discussed in Blake et al. (Reference Blake, Cairns and Dowd2006). In general, Blake et al. (Reference Blake, Cairns and Dowd2006) and (Reference Blake, Cairns, Dowd and Kessler2019) discuss the concept of and the issues that arise with mortality-linked securities. Mortality-linked securities are also studied by Dahl (Reference Dahl2004) and Lin & Cox (Reference Lin and Cox2005). Pricing of mortality-linked securities requires a stochastic model of the mortality intensity. Biffis (Reference Biffis2005) studies affine models of the mortality intensity and Luciano et al. (Reference Luciano, Spreeuw and Vigna2008) model mortality intensities for dependent lives.

Although the longevity market is growing, it is not yet well-developed enough to be a liquid and mature market. However, since the insurance and reinsurance industry has insufficient capital to cope with longevity risk, there is the belief that longevity will become a new asset class this century (Blake, Reference Blake2018). The same cannot be asserted for the development of the disability market. While Blake (Reference Blake2018) describes the conditions for a new capital market for longevity securitization to succeed, Maegebier (Reference Maegebier2015) provides a theoretical discussion of the potential use of disability-linked securities, highlighting benefits and disadvantages. From the analysis by Maegebier (Reference Maegebier2015), the main reasons having discouraged the development of disability risk securitization until now seem to be the national segmentation of the disability products, the different disability definitions, and related documentation. A standard definition of disability, increasing market transparency and data availability, would augment the market liquidity for potential disability-linked securities, consequently promoting future alternative risk transfer for disability insurance. The above considerations highlight the importance of designing and studying the securitization of the various systematic risks affecting a life or health portfolio, such as longevity risk and disability risk.

This paper aims to go beyond the survival model and investigate how to manage systematic insurance risks in a multi-state setup by studying securities linked to the model’s transition intensities and not only securities linked to mortality in the survival model. Disability-linked securities are studied by D’Amato et al. (Reference D’Amato, Levantesi and Menzietti2020) as a possibility to hedge systematic disability risks for long-term care insurance modeled in discrete time. Our formulation applies to any choice of state space of the Markov model, and we study de-risking in life and health insurance in continuous time. Therefore, the proposed model can be used to securitize all those insurance products based on a multi-state model, for example, long-term care insurance and dread disease insurance.

In this paper, we consider a multi-state setup in continuous-time life and health insurance, where the state of the insured is modeled by a continuous-time Markov process. We model the vector of transition intensities of the Markov process,

![]() $\mu$

, by a diffusion process, and develop a model for the unfunded liabilities quantifying the systematic insurance risk of the insurance company. The insurance company faces a potential loss if the liabilities exceed the assets, that is, the unfunded liabilities are positive. The unfunded liabilities are affected by the stochastic process

$\mu$

, by a diffusion process, and develop a model for the unfunded liabilities quantifying the systematic insurance risk of the insurance company. The insurance company faces a potential loss if the liabilities exceed the assets, that is, the unfunded liabilities are positive. The unfunded liabilities are affected by the stochastic process

![]() $\mu$

, and if

$\mu$

, and if

![]() $\mu$

behaves adversely, the insurance company may face a loss. Hence, it would be convenient for the insurance company if there existed a market for

$\mu$

behaves adversely, the insurance company may face a loss. Hence, it would be convenient for the insurance company if there existed a market for

![]() $\mu$

-linked securities to be able to minimize the risk of a potential loss and for risk management purposes. We assume in the paper that there exists a market for trading two types of

$\mu$

-linked securities to be able to minimize the risk of a potential loss and for risk management purposes. We assume in the paper that there exists a market for trading two types of

![]() $\mu$

-linked securities, the de-risking option and the de-risking swap, and describe the optimization problem faced by the insurance company to choose the optimal amount of de-risking. The purpose of the model is to quantify systematic insurance risks in a multi-state setup and identify the kinds of hedging strategies that minimize risks. We illustrate the de-risking strategies in a numerical example in the disability model. The numerical example is based on the stochastic model for the transition intensities. We model the transition intensities in the disability model (the transition from active to disabled and the transition from active to dead) with a Cox-Ingersoll-Ross process, and estimate the parameters on data of a cohort of the Italian population qualified for a disability benefit paid by the Italian Government to disabled people.

$\mu$

-linked securities, the de-risking option and the de-risking swap, and describe the optimization problem faced by the insurance company to choose the optimal amount of de-risking. The purpose of the model is to quantify systematic insurance risks in a multi-state setup and identify the kinds of hedging strategies that minimize risks. We illustrate the de-risking strategies in a numerical example in the disability model. The numerical example is based on the stochastic model for the transition intensities. We model the transition intensities in the disability model (the transition from active to disabled and the transition from active to dead) with a Cox-Ingersoll-Ross process, and estimate the parameters on data of a cohort of the Italian population qualified for a disability benefit paid by the Italian Government to disabled people.

The stochastic process

![]() $\mu$

is, in contrast to for instance stock prices and interest rates, not observable, and it is based on assumptions about the state space and possible transitions of the insured. There exist a lot of statistical methods to estimate

$\mu$

is, in contrast to for instance stock prices and interest rates, not observable, and it is based on assumptions about the state space and possible transitions of the insured. There exist a lot of statistical methods to estimate

![]() $\mu$

and a derivative with

$\mu$

and a derivative with

![]() $\mu$

as the underlying is special since its value depends on the data from which

$\mu$

as the underlying is special since its value depends on the data from which

![]() $\mu$

is estimated. This introduces basis risk for an insurance company buying the derivative if the portfolio of the insurance company differs from the data basis of the derivative. We disregard this kind of basis risk in our model.

$\mu$

is estimated. This introduces basis risk for an insurance company buying the derivative if the portfolio of the insurance company differs from the data basis of the derivative. We disregard this kind of basis risk in our model.

The structure of the paper is as follows. In Section 2, we introduce the double-stochastic multi-state Markov setup and model the assets, the liabilities, and the unfunded liabilities. Section 3 introduces the de-risking strategies: the de-risking option and the de-risking swap. The optimization problem is described in Section 4. In Section 5, we illustrate the de-risking strategies in a numerical example. Section 6 concludes the paper.

2. Setup

2.1 Doubly-stochastic Markov setup

Let

![]() $(\Omega, \mathbb{F}, \mathbb{P})$

be a probability space, and

$(\Omega, \mathbb{F}, \mathbb{P})$

be a probability space, and

![]() $\mathcal{J} = \lbrace 0, 1, \ldots, J \rbrace$

be some finite state space. As in Buchardt et al. (Reference Buchardt, Furrer and Steffensen2019), we consider a doubly-stochastic Markov setup, where the state of the holder of an insurance contract is described by a stochastic (jump) process on

$\mathcal{J} = \lbrace 0, 1, \ldots, J \rbrace$

be some finite state space. As in Buchardt et al. (Reference Buchardt, Furrer and Steffensen2019), we consider a doubly-stochastic Markov setup, where the state of the holder of an insurance contract is described by a stochastic (jump) process on

![]() $(\Omega, \mathbb{F}, \mathbb{P})$

taking values in

$(\Omega, \mathbb{F}, \mathbb{P})$

taking values in

![]() $\mathcal{J}$

. The number of possible transitions in the state-space is denoted by

$\mathcal{J}$

. The number of possible transitions in the state-space is denoted by

![]() $K$

, and we consider a

$K$

, and we consider a

![]() $K$

-dimensional stochastic process

$K$

-dimensional stochastic process

![]() $\mu = (\mu _{jk})_{j,k \in \mathcal{J}, j \neq k}$

on

$\mu = (\mu _{jk})_{j,k \in \mathcal{J}, j \neq k}$

on

![]() $(\Omega, \mathbb{F}, \mathbb{P})$

with continuous, non-negative sample paths taking values in

$(\Omega, \mathbb{F}, \mathbb{P})$

with continuous, non-negative sample paths taking values in

![]() $[0, \infty )^K$

. For each

$[0, \infty )^K$

. For each

![]() $j, k \in \mathcal{J}$

, the process

$j, k \in \mathcal{J}$

, the process

![]() $\mu _{jk}$

relates to the instantaneous transition rate of a continuous time, finite-state Markov chain with state space

$\mu _{jk}$

relates to the instantaneous transition rate of a continuous time, finite-state Markov chain with state space

![]() $\mathcal{J}$

. The dynamics of

$\mathcal{J}$

. The dynamics of

![]() $\mu$

are assumed to be in the form

$\mu$

are assumed to be in the form

where

![]() $W$

is a

$W$

is a

![]() $P$

dimensional Brownian motion,

$P$

dimensional Brownian motion,

![]() $\alpha ^\mu : [0, \infty )^{K + 1} \mapsto \mathbb{R}^K$

is a deterministic and sufficiently regular function satisfying the Lipschitz condition, and

$\alpha ^\mu : [0, \infty )^{K + 1} \mapsto \mathbb{R}^K$

is a deterministic and sufficiently regular function satisfying the Lipschitz condition, and

\begin{align*} \sigma ^\mu (t, \mu ) = \begin{pmatrix} \sigma ^\mu _{11}(t, \mu ) & \quad \sigma ^\mu _{12}(t, \mu ) & \quad \ldots & \quad \sigma ^\mu _{1P}(t, \mu ) \\[3pt] \sigma ^\mu _{21}(t, \mu ) & \quad \ddots & \quad & \quad \vdots \\[3pt] \vdots & \quad & \quad \ddots & \quad \vdots \\[3pt] \sigma ^\mu _{K1}(t, \mu ) & \quad \sigma ^\mu _{K2}(t, \mu ) & \quad \ldots & \quad \sigma ^\mu _{KP}(t, \mu ) \end{pmatrix}, \end{align*}

\begin{align*} \sigma ^\mu (t, \mu ) = \begin{pmatrix} \sigma ^\mu _{11}(t, \mu ) & \quad \sigma ^\mu _{12}(t, \mu ) & \quad \ldots & \quad \sigma ^\mu _{1P}(t, \mu ) \\[3pt] \sigma ^\mu _{21}(t, \mu ) & \quad \ddots & \quad & \quad \vdots \\[3pt] \vdots & \quad & \quad \ddots & \quad \vdots \\[3pt] \sigma ^\mu _{K1}(t, \mu ) & \quad \sigma ^\mu _{K2}(t, \mu ) & \quad \ldots & \quad \sigma ^\mu _{KP}(t, \mu ) \end{pmatrix}, \end{align*}

for deterministic and sufficiently regular functions

![]() $\sigma ^\mu _{ij} : [0, \infty )^{K + 1} \mapsto [0, \infty )$

, satisfying the Lipschitz condition to ensure the uniqueness of the solution. Furthermore, we assume that

$\sigma ^\mu _{ij} : [0, \infty )^{K + 1} \mapsto [0, \infty )$

, satisfying the Lipschitz condition to ensure the uniqueness of the solution. Furthermore, we assume that

![]() $\alpha$

and

$\alpha$

and

![]() $\sigma$

are chosen such that

$\sigma$

are chosen such that

![]() $\mu (t) \in [0, \infty )^K$

almost surely. We omit the age of the insured in the notation since we assume it is a one-cohort model where the age of the insured is

$\mu (t) \in [0, \infty )^K$

almost surely. We omit the age of the insured in the notation since we assume it is a one-cohort model where the age of the insured is

![]() $x_0$

at time 0. The extension to also account for a multiple-cohort model requires that we include age as a parameter in

$x_0$

at time 0. The extension to also account for a multiple-cohort model requires that we include age as a parameter in

![]() $\mu$

and the coefficients

$\mu$

and the coefficients

![]() $\alpha$

and

$\alpha$

and

![]() $\sigma$

.

$\sigma$

.

The assumption that the transition intensities are modeled by a diffusion process is in line with assumptions on the models of the mortality intensity for instance Dahl (Reference Dahl2004) and Jevtić et al. (Reference Jevtić, Luciano and Vigna2013). Luciano et al. (Reference Luciano, Spreeuw and Vigna2008) have a similar model for the mortality intensity, where a jump measure in the dynamics of the mortality intensity is included. The natural filtration generated by the stochastic process

![]() $\mu$

is

$\mu$

is

![]() $\mathcal{F}^\mu = \big ( \mathcal{F}^\mu _t \big )_{t \geq 0}$

, where

$\mathcal{F}^\mu = \big ( \mathcal{F}^\mu _t \big )_{t \geq 0}$

, where

![]() $\mathcal{F}^\mu _t = \sigma (\mu (s) : 0 \leq s \leq t)$

, and we interpret

$\mathcal{F}^\mu _t = \sigma (\mu (s) : 0 \leq s \leq t)$

, and we interpret

![]() $\mathcal{F}^\mu$

as all information about

$\mathcal{F}^\mu$

as all information about

![]() $\mu (t)$

for

$\mu (t)$

for

![]() $t \in [0, \infty )$

. We assume that

$t \in [0, \infty )$

. We assume that

![]() $\mathcal{F}^\mu$

is an augmented filtration satisfying the usual conditions.

$\mathcal{F}^\mu$

is an augmented filtration satisfying the usual conditions.

Similar to Buchardt et al. (Reference Buchardt, Furrer and Steffensen2019), we can construct a jump process

![]() $Z = \big ( Z(t) \big )_{t \geq 0}$

on

$Z = \big ( Z(t) \big )_{t \geq 0}$

on

![]() $(\Omega, \mathbb{F}, \mathbb{P})$

taking values in

$(\Omega, \mathbb{F}, \mathbb{P})$

taking values in

![]() $\mathcal{J}$

with

$\mathcal{J}$

with

![]() $Z(0) = 0$

, where

$Z(0) = 0$

, where

![]() $Z$

conditional on

$Z$

conditional on

![]() $\mathcal{F}^\mu$

is a continuous-time Markov chain with transition intensities

$\mathcal{F}^\mu$

is a continuous-time Markov chain with transition intensities

![]() $\mu$

. We assume that

$\mu$

. We assume that

![]() $Z$

indicates the state (e.g. Active, Disabled, or Dead) of the holder of an insurance contract who is

$Z$

indicates the state (e.g. Active, Disabled, or Dead) of the holder of an insurance contract who is

![]() $x_0$

years old at time

$x_0$

years old at time

![]() $t = 0$

. The natural filtration generated by

$t = 0$

. The natural filtration generated by

![]() $Z$

is given by

$Z$

is given by

![]() $\mathcal{F}^Z = \big ( \mathcal{F}^Z_t \big )_{t \geq 0}$

, and we interpret

$\mathcal{F}^Z = \big ( \mathcal{F}^Z_t \big )_{t \geq 0}$

, and we interpret

![]() $\mathcal{F}^Z$

as information about

$\mathcal{F}^Z$

as information about

![]() $Z(s)$

for

$Z(s)$

for

![]() $s \in [0, t]$

. There exist transition probabilities of

$s \in [0, t]$

. There exist transition probabilities of

![]() $Z$

conditional on

$Z$

conditional on

![]() $\mu$

given by

$\mu$

given by

since

![]() $Z$

is Markov conditional on

$Z$

is Markov conditional on

![]() $\mathcal{F}^\mu$

. The fact that

$\mathcal{F}^\mu$

. The fact that

![]() $Z$

has transition intensities

$Z$

has transition intensities

![]() $\mu$

conditional on

$\mu$

conditional on

![]() $\mathcal{F}^\mu$

implies that

$\mathcal{F}^\mu$

implies that

for all

![]() $t \geq 0$

, and

$t \geq 0$

, and

![]() $i,j \in \mathcal{J}$

,

$i,j \in \mathcal{J}$

,

![]() $i \neq j$

. The transition probabilities conditional on

$i \neq j$

. The transition probabilities conditional on

![]() $\mu$

satisfy Kolmogorov’s backward and forward differential equations. We introduce the processes

$\mu$

satisfy Kolmogorov’s backward and forward differential equations. We introduce the processes

![]() $N^k(t)$

that count the number of jumps of

$N^k(t)$

that count the number of jumps of

![]() $Z$

into state

$Z$

into state

![]() $k \in \mathcal{J}$

up to and including time

$k \in \mathcal{J}$

up to and including time

![]() $t$

$t$

where

![]() $Z(s-) = \lim _{h \downarrow 0} Z(s - h)$

. If

$Z(s-) = \lim _{h \downarrow 0} Z(s - h)$

. If

![]() $\mu$

is a deterministic process, this setup corresponds to the classical Markov chain setup in life insurance as described in, for example, Hoem (Reference Hoem1969) and Norberg (Reference Norberg1991).

$\mu$

is a deterministic process, this setup corresponds to the classical Markov chain setup in life insurance as described in, for example, Hoem (Reference Hoem1969) and Norberg (Reference Norberg1991).

2.2 Insurance contract

Now, we model the payments of an insurance contract. Payments link to sojourns in states and transitions between states and therefore payments depend on

![]() $Z$

. The payment stream has dynamics

$Z$

. The payment stream has dynamics

where

![]() $b_j$

and

$b_j$

and

![]() $b_{jk}$

for

$b_{jk}$

for

![]() $j,k \in \mathcal{J}$

,

$j,k \in \mathcal{J}$

,

![]() $j \neq k$

are deterministic functions. The payments

$j \neq k$

are deterministic functions. The payments

![]() $b_j$

link to continuous benefits or premiums during the sojourn in state

$b_j$

link to continuous benefits or premiums during the sojourn in state

![]() $j$

, and the payments

$j$

, and the payments

![]() $b_{jk}$

link to payments upon transition from state

$b_{jk}$

link to payments upon transition from state

![]() $j$

to state

$j$

to state

![]() $k$

. Benefit payments are positive and premium payments are negative. In general,

$k$

. Benefit payments are positive and premium payments are negative. In general,

![]() $b_j(t)$

and

$b_j(t)$

and

![]() $b_{jk}(t)$

can be stochastic processes adapted to

$b_{jk}(t)$

can be stochastic processes adapted to

![]() $\mathcal{F}^Z_t$

.

$\mathcal{F}^Z_t$

.

2.3 Assets and liabilities

The basis of our model is an insurance company that sells insurance contracts with payments specified by

![]() $\text{d} B(t)$

to a cohort of policyholders aged

$\text{d} B(t)$

to a cohort of policyholders aged

![]() $x_0$

at time

$x_0$

at time

![]() $t = 0$

. The assets and liabilities of the insurance company are affected by the underlying mortality rate, disability rate, etc. of the portfolio modeled by the stochastic process

$t = 0$

. The assets and liabilities of the insurance company are affected by the underlying mortality rate, disability rate, etc. of the portfolio modeled by the stochastic process

![]() $\mu$

. Hence, the insurance company is exposed to systematic insurance risks if its valuation basis differs from the realized

$\mu$

. Hence, the insurance company is exposed to systematic insurance risks if its valuation basis differs from the realized

![]() $\mu$

. We assume that the portfolio is large such that unsystematic insurance risks are negligible. We aim to quantify the effect of systematic insurance risks on the assets and liabilities of the portfolio under the assumption that

$\mu$

. We assume that the portfolio is large such that unsystematic insurance risks are negligible. We aim to quantify the effect of systematic insurance risks on the assets and liabilities of the portfolio under the assumption that

![]() $\mu$

is modeled by Equation (1). Insurance companies are also exposed to financial risks. Since the focus of this paper is the hedging of systematic insurance risks, we assume that the interest rate is a deterministic function

$\mu$

is modeled by Equation (1). Insurance companies are also exposed to financial risks. Since the focus of this paper is the hedging of systematic insurance risks, we assume that the interest rate is a deterministic function

![]() $t \mapsto r(t)$

and that the insurance company invests in an account with interest rate

$t \mapsto r(t)$

and that the insurance company invests in an account with interest rate

![]() $r(t)$

. The interest rate

$r(t)$

. The interest rate

![]() $r(t)$

is also used for discounting the value of future payments. The deterministic assumption on the interest rate is not realistic in practice. In the paper, we use a deterministic interest rate as it provides clearer and easier-to-interpret results. However, all the results in the paper can be generalized to a stochastic model of the interest rate and the financial market.

$r(t)$

is also used for discounting the value of future payments. The deterministic assumption on the interest rate is not realistic in practice. In the paper, we use a deterministic interest rate as it provides clearer and easier-to-interpret results. However, all the results in the paper can be generalized to a stochastic model of the interest rate and the financial market.

2.3.1 Model of the assets

The expected assets at time

![]() $t$

are given by the expectation of premiums minus benefits in the interval

$t$

are given by the expectation of premiums minus benefits in the interval

![]() $[0, t]$

accumulated with the interest rate. We denote the expected assets at time

$[0, t]$

accumulated with the interest rate. We denote the expected assets at time

![]() $t$

by

$t$

by

![]() $\tilde{A}(t)$

$\tilde{A}(t)$

where

![]() $A_0$

is the initial assets. The assets depend on the stochastic process

$A_0$

is the initial assets. The assets depend on the stochastic process

![]() $\mu$

since the payment stream depends on

$\mu$

since the payment stream depends on

![]() $Z$

, which in the doubly-stochastic Markov setup, depends on

$Z$

, which in the doubly-stochastic Markov setup, depends on

![]() $\mu$

. Calculation of the expectation in Equation (2) is non-trivial, and instead of focusing on

$\mu$

. Calculation of the expectation in Equation (2) is non-trivial, and instead of focusing on

![]() $\tilde{A}(t)$

, we study the expected assets conditioned on

$\tilde{A}(t)$

, we study the expected assets conditioned on

![]() $\mu$

$\mu$

with the relation

Due to the Markov property of

![]() $Z$

conditioned on

$Z$

conditioned on

![]() $\mu$

and that

$\mu$

and that

![]() $Z(0) = 0$

, we have that

$Z(0) = 0$

, we have that

\begin{align*} A(t) = A_0 e^{\int _0^t r(u) \text{d} u} - \int _0^t e^{\int _s^t r(u) \text{d} u} \sum _{i \in \mathcal{J}} p^\mu _{0i}(0, s) \left( b_i(s) + \sum _{j: j \neq i} \mu _{ij}(s) b_{ij}(s) \right) \text{d} s. \end{align*}

\begin{align*} A(t) = A_0 e^{\int _0^t r(u) \text{d} u} - \int _0^t e^{\int _s^t r(u) \text{d} u} \sum _{i \in \mathcal{J}} p^\mu _{0i}(0, s) \left( b_i(s) + \sum _{j: j \neq i} \mu _{ij}(s) b_{ij}(s) \right) \text{d} s. \end{align*}

2.3.2 Model of the liabilities

The liabilities are the expected present value of future payments of the insurance contract. We assume that the insurance company uses a deterministic valuation basis for the calculation of the liabilities given by assumptions on the interest rate

![]() $\hat{r}(t)$

and assumptions on the transition intensities

$\hat{r}(t)$

and assumptions on the transition intensities

![]() $\hat{\mu }(t)$

. We assume that

$\hat{\mu }(t)$

. We assume that

![]() $\hat{r}(t) = r(t)$

and that

$\hat{r}(t) = r(t)$

and that

![]() $\hat{\mu }(t)$

is deterministic and independent of the stochastic process

$\hat{\mu }(t)$

is deterministic and independent of the stochastic process

![]() $\mu$

. The assumption that the valuation basis

$\mu$

. The assumption that the valuation basis

![]() $\hat{\mu }(t)$

is deterministic and fixed in the entire time horizon of the insurance contract is strict, in the sense that in the real world, the insurance company would update its valuation basis based on the development of its insurance portfolio. A less strict assumption would be to let the valuation basis be stochastic, but such that the valuation basis determined at time

$\hat{\mu }(t)$

is deterministic and fixed in the entire time horizon of the insurance contract is strict, in the sense that in the real world, the insurance company would update its valuation basis based on the development of its insurance portfolio. A less strict assumption would be to let the valuation basis be stochastic, but such that the valuation basis determined at time

![]() $t$

is measurable with respect to

$t$

is measurable with respect to

![]() $\mathcal{F}^\mu _t$

, and therefore a deterministic function of

$\mathcal{F}^\mu _t$

, and therefore a deterministic function of

![]() $\mu (t)$

at time

$\mu (t)$

at time

![]() $t$

.

$t$

.

With deterministic transition intensities, we are in the classical Markov chain setup in life insurance. The liabilities at time

![]() $t$

are given by

$t$

are given by

where the superscript

![]() $\hat{\mu }$

denotes that

$\hat{\mu }$

denotes that

![]() $Z$

has transition intensities

$Z$

has transition intensities

![]() $\hat{\mu }$

. The state-wise liabilities,

$\hat{\mu }$

. The state-wise liabilities,

![]() $\hat{V}^i(t)$

, where we condition on

$\hat{V}^i(t)$

, where we condition on

![]() $Z(t) = i$

for

$Z(t) = i$

for

![]() $i \in \mathcal{J}$

, are deterministic and satisfy Thiele’s differential equation

$i \in \mathcal{J}$

, are deterministic and satisfy Thiele’s differential equation

\begin{align} & \frac{\text{d}}{\text{d} t} \hat{V}^i(t) = r(t) \hat{V}^i(t) - b_i(t) - \sum _{j: j \neq i} \hat{\mu }_{ij}(t) \hat{R}^{ij}(t), \\ & \hat{V}^i(n) = 0, \nonumber \end{align}

\begin{align} & \frac{\text{d}}{\text{d} t} \hat{V}^i(t) = r(t) \hat{V}^i(t) - b_i(t) - \sum _{j: j \neq i} \hat{\mu }_{ij}(t) \hat{R}^{ij}(t), \\ & \hat{V}^i(n) = 0, \nonumber \end{align}

where

![]() $\hat{R}^{ij}$

is the sum-at-risk upon transition from state

$\hat{R}^{ij}$

is the sum-at-risk upon transition from state

![]() $i$

to state

$i$

to state

![]() $j$

and is given by

$j$

and is given by

The liabilities at time

![]() $t$

depend on the state of the insured at time

$t$

depend on the state of the insured at time

![]() $t$

,

$t$

,

![]() $Z(t)$

, and are therefore stochastic. Hence in the doubly-stochastic Markov model, the liabilities depend on the stochastic process

$Z(t)$

, and are therefore stochastic. Hence in the doubly-stochastic Markov model, the liabilities depend on the stochastic process

![]() $\mu$

. Similar to the model of the assets, we model the expected liabilities at time

$\mu$

. Similar to the model of the assets, we model the expected liabilities at time

![]() $t$

$t$

for

2.3.3 The unfunded liabilities

The insurance company faces a potential loss or gain if the development of

![]() $\mu$

is different from the valuation basis

$\mu$

is different from the valuation basis

![]() $\hat{\mu }$

. We aim to quantify the loss or gain as a basis for deciding whether a de-risking strategy described in Section 3 is useful for the insurance company. The expected unfunded liabilities at time

$\hat{\mu }$

. We aim to quantify the loss or gain as a basis for deciding whether a de-risking strategy described in Section 3 is useful for the insurance company. The expected unfunded liabilities at time

![]() $t$

are given by

$t$

are given by

for

![]() $L(t) = V(t) - A(t)$

. We refer to

$L(t) = V(t) - A(t)$

. We refer to

![]() $L(t)$

as the unfunded liabilities. If the unfunded liabilities are positive, the insurance company faces a potential loss, since the liabilities exceed the assets, and the insurance company faces a potential gain if

$L(t)$

as the unfunded liabilities. If the unfunded liabilities are positive, the insurance company faces a potential loss, since the liabilities exceed the assets, and the insurance company faces a potential gain if

![]() $L(t)$

is negative. Using Kolmogorov’s forward differential equations for the transition probabilities and Thiele’s differential equation in Equation (3) we obtain that

$L(t)$

is negative. Using Kolmogorov’s forward differential equations for the transition probabilities and Thiele’s differential equation in Equation (3) we obtain that

\begin{align} \frac{\text{d}}{\text{d} t} L(t) =&\ r(t) L(t) + \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} p_{0i}^\mu (0, t) \big (\mu _{ij}(t) - \hat{\mu }_{ij}(t) \big ) \hat{R}^{ij}(t), \nonumber \\ =&\ r(t) L(t) + \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} l_{ij}(t), \\ L(0) =&\ \hat{V}^0(0) - A_0, \nonumber \end{align}

\begin{align} \frac{\text{d}}{\text{d} t} L(t) =&\ r(t) L(t) + \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} p_{0i}^\mu (0, t) \big (\mu _{ij}(t) - \hat{\mu }_{ij}(t) \big ) \hat{R}^{ij}(t), \nonumber \\ =&\ r(t) L(t) + \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} l_{ij}(t), \\ L(0) =&\ \hat{V}^0(0) - A_0, \nonumber \end{align}

for

![]() $l_{ij}(t) = p_{0i}^\mu (0, t) \big (\mu _{ij}(t) - \hat{\mu }_{ij}(t) \big ) \hat{R}^{ij}(t)$

.

$l_{ij}(t) = p_{0i}^\mu (0, t) \big (\mu _{ij}(t) - \hat{\mu }_{ij}(t) \big ) \hat{R}^{ij}(t)$

.

The differential equation in Equation (5) above yields that the unfunded liabilities gain interest rate and increase or decrease with a rate,

![]() $l_{ij}(t)$

, that is a probability-weighted sum of all possible transitions in the state space with terms that depends on the difference between the stochastic transition intensity,

$l_{ij}(t)$

, that is a probability-weighted sum of all possible transitions in the state space with terms that depends on the difference between the stochastic transition intensity,

![]() $\mu _{ij}$

, and the transition intensity from the valuation basis,

$\mu _{ij}$

, and the transition intensity from the valuation basis,

![]() $\hat{\mu }_{ij}$

, times the sum-at-risk. The rate

$\hat{\mu }_{ij}$

, times the sum-at-risk. The rate

![]() $l_{ij}(t)$

is similar to the surplus contribution rate (see e.g. (3.7) in Norberg, Reference Norberg1999) in with-profit life insurance, where the surplus increases due to the difference between prudent technical transition intensities used for pricing and the best estimate market transition intensities used for valuation.

$l_{ij}(t)$

is similar to the surplus contribution rate (see e.g. (3.7) in Norberg, Reference Norberg1999) in with-profit life insurance, where the surplus increases due to the difference between prudent technical transition intensities used for pricing and the best estimate market transition intensities used for valuation.

The unfunded liabilities have a solution given by

\begin{align} L(t) = \left(\hat{V}^0(0) - A_0\right)e^{\int _0^t r(u) \text{d} u} + \int _0^t e^{\int _s^t r(u) \text{d} u} \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} l_{ij}(s) \text{d} s. \end{align}

\begin{align} L(t) = \left(\hat{V}^0(0) - A_0\right)e^{\int _0^t r(u) \text{d} u} + \int _0^t e^{\int _s^t r(u) \text{d} u} \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} l_{ij}(s) \text{d} s. \end{align}

The representations in Equations (5) and (6) illustrate what affects the unfunded liabilities, and the effect is highest when the difference between

![]() $\mu$

and

$\mu$

and

![]() $\hat{\mu }$

is large. For instance, if the realized mortality or disability rates of the insurance portfolio differ from the rates in the valuation basis. The unfunded liabilities are stochastic since they depend on

$\hat{\mu }$

is large. For instance, if the realized mortality or disability rates of the insurance portfolio differ from the rates in the valuation basis. The unfunded liabilities are stochastic since they depend on

![]() $\mu$

, and the insurance company faces a potential loss upon an adverse development of

$\mu$

, and the insurance company faces a potential loss upon an adverse development of

![]() $\mu$

. Therefore, the insurance company has an interest in hedging the unfunded liabilities against systematic insurance risks.

$\mu$

. Therefore, the insurance company has an interest in hedging the unfunded liabilities against systematic insurance risks.

3. De-risking strategies

In this section, we introduce

![]() $\mu$

-linked securities as a risk management tool for insurance companies to reduce systematic insurance risks. We assume that the insurance company can invest in

$\mu$

-linked securities as a risk management tool for insurance companies to reduce systematic insurance risks. We assume that the insurance company can invest in

![]() $K$

$K$

![]() $\mu$

-linked securities each of them paying a continuous rate or cash flow of

$\mu$

-linked securities each of them paying a continuous rate or cash flow of

![]() $d_{ij}\big (t, \mu _{ij}(t)\big )$

for

$d_{ij}\big (t, \mu _{ij}(t)\big )$

for

![]() $i,j \in \mathcal{J}$

,

$i,j \in \mathcal{J}$

,

![]() $i \neq j$

. There is a risk that the counterpart providing the de-risking defaults. This is denoted credit risks and is not studied here. D’Amato et al. (Reference D’Amato, Levantesi and Menzietti2020) implement the possibility that the counterpart defaults in their model as a binomial variable in discrete time.

$i \neq j$

. There is a risk that the counterpart providing the de-risking defaults. This is denoted credit risks and is not studied here. D’Amato et al. (Reference D’Amato, Levantesi and Menzietti2020) implement the possibility that the counterpart defaults in their model as a binomial variable in discrete time.

If the insurance company invests in the securities for de-risking purposes, the unfunded liabilities including de-risking are given by

\begin{align*} L^D(t) =&\ L(t) - \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} h_{ij} D_{ij}(t), \\ =&\ \left(\hat{V}^0(0) - A_0\right)e^{\int _0^t r(u) \text{d} u} + \int _0^t e^{\int _s^t r(u) \text{d} u} \left( \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} \big (l_{ij}(s) - h_{ij} d_{ij}(s, \mu _{ij}(s))\big ) \right) \text{d} s. \end{align*}

\begin{align*} L^D(t) =&\ L(t) - \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} h_{ij} D_{ij}(t), \\ =&\ \left(\hat{V}^0(0) - A_0\right)e^{\int _0^t r(u) \text{d} u} + \int _0^t e^{\int _s^t r(u) \text{d} u} \left( \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} \big (l_{ij}(s) - h_{ij} d_{ij}(s, \mu _{ij}(s))\big ) \right) \text{d} s. \end{align*}

where

![]() $h_{ij}$

is the amount of

$h_{ij}$

is the amount of

![]() $\mu _{ij}$

-linked security bought. Let

$\mu _{ij}$

-linked security bought. Let

We define the hedging price of the

![]() $\mu _{ij}$

-linked de-risking strategy,

$\mu _{ij}$

-linked de-risking strategy,

![]() $P_{ij}$

, as the sum of the expected present value of the payments of the derivative and the hedging costs,

$P_{ij}$

, as the sum of the expected present value of the payments of the derivative and the hedging costs,

where

![]() $a_{ij}$

is the hedging cost for the derivative with cash flow

$a_{ij}$

is the hedging cost for the derivative with cash flow

![]() $d_{ij}(t, \mu _{ij}(t))$

. The hedging costs are a risk premium on top of the expected value of the de-risking cash flow for the counterpart to take in the risk.

$d_{ij}(t, \mu _{ij}(t))$

. The hedging costs are a risk premium on top of the expected value of the de-risking cash flow for the counterpart to take in the risk.

We consider two different types of de-risking strategies with different choices of

![]() $d_{ij}(t, \mu _{ij}(t))$

. The first is a de-risking option, and the second is a de-risking swap, and we discuss the advantages and drawbacks of each type.

$d_{ij}(t, \mu _{ij}(t))$

. The first is a de-risking option, and the second is a de-risking swap, and we discuss the advantages and drawbacks of each type.

3.1 De-risking option

The insurance company is interested in hedging against a scenario where

![]() $\mu$

differs a lot from

$\mu$

differs a lot from

![]() $\hat{\mu }$

since then the insurance company faces a potential loss. A possible choice of

$\hat{\mu }$

since then the insurance company faces a potential loss. A possible choice of

![]() $d_{ij}(t, \mu _{ij}(t))$

is

$d_{ij}(t, \mu _{ij}(t))$

is

with a European call option structure exercised at time

![]() $t$

with strike

$t$

with strike

![]() $\hat{\mu }_{ij}$

. For this de-risking option, the rate

$\hat{\mu }_{ij}$

. For this de-risking option, the rate

![]() $l^D_{ij}(t, \mu _{ij}(t))$

becomes

$l^D_{ij}(t, \mu _{ij}(t))$

becomes

\begin{align*} l_{ij}^D(t, \mu _{ij}(t)) = \begin{cases} (p^\mu _{0i}(0, t) - h_{ij})(\mu _{ij}(t) - \hat{\mu }_{ij}(t)) \hat{R}^{ij}(t), \quad &\text{if } \mu _{ij}(t) \gt \hat{\mu }_{ij}(t)\\[5pt] - p^\mu _{0i}(0, t) (\hat{\mu }_{ij}(t) - \mu _{ij}(t))\hat{R}^{ij}(t), \quad &\text{if } \mu _{ij}(t) \leq \hat{\mu }_{ij}(t) \end{cases} \end{align*}

\begin{align*} l_{ij}^D(t, \mu _{ij}(t)) = \begin{cases} (p^\mu _{0i}(0, t) - h_{ij})(\mu _{ij}(t) - \hat{\mu }_{ij}(t)) \hat{R}^{ij}(t), \quad &\text{if } \mu _{ij}(t) \gt \hat{\mu }_{ij}(t)\\[5pt] - p^\mu _{0i}(0, t) (\hat{\mu }_{ij}(t) - \mu _{ij}(t))\hat{R}^{ij}(t), \quad &\text{if } \mu _{ij}(t) \leq \hat{\mu }_{ij}(t) \end{cases} \end{align*}

The rate above is always negative if

![]() $h_{ij} \gt p^\mu _{ij}(0, t)$

and if the sum-at-risk,

$h_{ij} \gt p^\mu _{ij}(0, t)$

and if the sum-at-risk,

![]() $\hat{R}^{ij}(t)$

, is positive. The sign of the sum-at-risk depends on the insurance product, and it is possible that

$\hat{R}^{ij}(t)$

, is positive. The sign of the sum-at-risk depends on the insurance product, and it is possible that

![]() $\hat{R}^{ij}(t)$

is positive for some

$\hat{R}^{ij}(t)$

is positive for some

![]() $t \in [0, n]$

and negative for others. The insurance company should only choose to invest in a de-risking option with a call option structure if the sum-at-risk is positive. Otherwise, the investment increases the unfunded liabilities and introduces basis risk for the insurance company. If the sum-at-risk is negative, a European put option structure is preferred to minimize

$t \in [0, n]$

and negative for others. The insurance company should only choose to invest in a de-risking option with a call option structure if the sum-at-risk is positive. Otherwise, the investment increases the unfunded liabilities and introduces basis risk for the insurance company. If the sum-at-risk is negative, a European put option structure is preferred to minimize

![]() $l^D_{ij}(t, \mu _{ij}(t))$

$l^D_{ij}(t, \mu _{ij}(t))$

To make a perfect hedge of the rate

![]() $l_{ij}$

in the unfunded liabilities, the transition probabilities should be included in the de-risking cash flow. This is not possible, since we assume that

$l_{ij}$

in the unfunded liabilities, the transition probabilities should be included in the de-risking cash flow. This is not possible, since we assume that

![]() $d_{ij}(t, \mu _{ij}(t))$

depends on

$d_{ij}(t, \mu _{ij}(t))$

depends on

![]() $\mu _{ij}(t)$

and

$\mu _{ij}(t)$

and

![]() $p^\mu _{ij}(0, t)$

depends on other transition intensities as well.

$p^\mu _{ij}(0, t)$

depends on other transition intensities as well.

Here, the cash flow of the de-risking option depends on the sum-at-risk of an insurance product, such that the option is designed to reduce systematic insurance risks of a specific product. Another possibility is a de-risking option where the rate only depends on the difference between the stochastic

![]() $\mu$

and

$\mu$

and

![]() $\hat{\mu }$

. This introduces more basis risk for the insurance company since the option is not designed for a specific insurance product, but for the counterpart selling de-risking strategies, it is a more liquid product. In this case, the European call option structure is

$\hat{\mu }$

. This introduces more basis risk for the insurance company since the option is not designed for a specific insurance product, but for the counterpart selling de-risking strategies, it is a more liquid product. In this case, the European call option structure is

and the European put option structure is

If the sum-at-risk,

![]() $\hat{R}^{ij}(t)$

, for the transition from state

$\hat{R}^{ij}(t)$

, for the transition from state

![]() $i$

to state

$i$

to state

![]() $j$

is positive at time

$j$

is positive at time

![]() $t$

, the insurance company should buy the European call option, since it faces a potential loss if

$t$

, the insurance company should buy the European call option, since it faces a potential loss if

![]() $\mu _{ij}$

exceeds

$\mu _{ij}$

exceeds

![]() $\hat{\mu }_{ij}$

, and the insurance company should by the European put option if

$\hat{\mu }_{ij}$

, and the insurance company should by the European put option if

![]() $\hat{R}^{ij}(t)$

is negative.

$\hat{R}^{ij}(t)$

is negative.

D’Amato et al. (Reference D’Amato, Levantesi and Menzietti2020) study a disability option on the transition probabilities for hedging disability risks of long-term care insurance in discrete time. For long-term care insurance products, the sum-at-risk for the transition from Active to Disabled is positive, and D’Amato et al. (Reference D’Amato, Levantesi and Menzietti2020) use a European call option structure on the transition probability from Active to Disabled.

3.2 De-risking swap

Inspired by D’Amato et al. (Reference D’Amato, Levantesi and Menzietti2020), we consider a plain vanilla de-risking swap with

![]() $\mu _{ij}(t)$

as the underlying. The cash flow of the swap is the difference between a fixed and a floating leg. We assume that the fixed leg depends on

$\mu _{ij}(t)$

as the underlying. The cash flow of the swap is the difference between a fixed and a floating leg. We assume that the fixed leg depends on

![]() $\hat{\mu }$

and that the floating leg depends on the stochastic transition intensities

$\hat{\mu }$

and that the floating leg depends on the stochastic transition intensities

![]() $\mu$

. By buying this contract, the insurance company agrees to pay the fixed leg to the counterpart in return for the floating leg, and the hedging cash flow is the difference between the fixed and the floating leg. One possible choice of the hedging cash flow

$\mu$

. By buying this contract, the insurance company agrees to pay the fixed leg to the counterpart in return for the floating leg, and the hedging cash flow is the difference between the fixed and the floating leg. One possible choice of the hedging cash flow

![]() $d_{ij}(t, \mu _{ij}(t))$

is

$d_{ij}(t, \mu _{ij}(t))$

is

where

![]() $\rho$

is a fixed proportional risk premium for the counterpart to take on the risk of paying a stochastic, floating leg,

$\rho$

is a fixed proportional risk premium for the counterpart to take on the risk of paying a stochastic, floating leg,

![]() $\mu _{ij}(t) \hat{R}^{ij}(t)$

is the floating leg, and

$\mu _{ij}(t) \hat{R}^{ij}(t)$

is the floating leg, and

![]() $\hat{\mu }_{ij}(t)(1 + \rho ) \hat{R}^{ij}(t)$

is the fixed leg.

$\hat{\mu }_{ij}(t)(1 + \rho ) \hat{R}^{ij}(t)$

is the fixed leg.

For this choice of de-risking swap, the rate

![]() $l^D_{ij}(t, \mu _{ij}(t))$

becomes

$l^D_{ij}(t, \mu _{ij}(t))$

becomes

The interest of the insurance company is that

![]() $l^D(t, \mu _{ij}(t))$

is low and preferably negative to keep the unfunded liabilities at a minimum. The contributions to the unfunded liabilities are stochastic since they depend on

$l^D(t, \mu _{ij}(t))$

is low and preferably negative to keep the unfunded liabilities at a minimum. The contributions to the unfunded liabilities are stochastic since they depend on

![]() $\mu$

, and the insurance company faces the risk of adverse development of

$\mu$

, and the insurance company faces the risk of adverse development of

![]() $\mu$

. The de-risking swap seek to minimize the variation of

$\mu$

. The de-risking swap seek to minimize the variation of

![]() $l^D_{ij}\big (t, \mu _{ij}(t) \big )$

by interchanging the uncertainty in

$l^D_{ij}\big (t, \mu _{ij}(t) \big )$

by interchanging the uncertainty in

![]() $\mu$

with the deterministic

$\mu$

with the deterministic

![]() $\hat{\mu }$

to reduce risk for the insurance company

$\hat{\mu }$

to reduce risk for the insurance company

As with the de-risking option, the rate of de-risking swap presented in Equation (11) depends on the sum-at-risk of a specific insurance product or combination of insurance products. For the counterpart selling the de-risking strategies, a more liquid product is to let the hedging cash flow depend on the difference between the stochastic

![]() $\mu$

and

$\mu$

and

![]() $\hat{\mu }$

such that

$\hat{\mu }$

such that

since then, the de-risking swap does not depend on a specific type of insurance product. For this choice of de-risking swap, the contribution rate to the unfunded liabilities is

which introduces more basis risks to the insurance company.

We assume that the hedging costs of both the de-risking option and the de-risking swap are proportional to the expected present value of the de-risking cash flow

The hedging price and the hedging costs are determined as the expected present value under the real-world measure of the future payments of the security. In financial mathematics, securities are priced under the risk-neutral measure determined by the market price of risk. Here, we assume a deterministic financial market governed by the deterministic interest rate

![]() $r(t)$

, and therefore the stochasticity in the future payments of the security comes from the stochastic process

$r(t)$

, and therefore the stochasticity in the future payments of the security comes from the stochastic process

![]() $\mu$

. A model of

$\mu$

. A model of

![]() $\mu$

under a risk-neutral measure requires a value of the market price of insurance risk, which again requires actual market prices of de-risking securities, which do not exist. Therefore, to include the hedging price and the hedging costs as an expectation under a risk-neutral measure, we need to include the market price of insurance risk as a parameter in the model. Dahl (Reference Dahl2004) studies this in the survival model, and the extension to a multi-state model is straightforward.

$\mu$

under a risk-neutral measure requires a value of the market price of insurance risk, which again requires actual market prices of de-risking securities, which do not exist. Therefore, to include the hedging price and the hedging costs as an expectation under a risk-neutral measure, we need to include the market price of insurance risk as a parameter in the model. Dahl (Reference Dahl2004) studies this in the survival model, and the extension to a multi-state model is straightforward.

4. The optimization problem

We assume that insurance companies can buy all the presented de-risking options from Section 3.1 and de-risking swaps from Section 3.2 in a frictionless market. The insurance company must choose the amount of de-risking to buy by choosing

![]() $h_{ij}$

for all possible transitions. In this section, we formulate an optimization model to choose the optimal amount of de-risking for the insurance company. The formulation is inspired by Lin et al. (Reference Lin, MacMinn and Tian2015), where the authors study de-risking for defined benefit plans in the survival model, and D’Amato et al., (2020), where the authors formulate an optimization model to choose the amount of de-risking disability risks in the disability model without reactivation in discrete time. Our formulation is for a general multi-state model in continuous time.

$h_{ij}$

for all possible transitions. In this section, we formulate an optimization model to choose the optimal amount of de-risking for the insurance company. The formulation is inspired by Lin et al. (Reference Lin, MacMinn and Tian2015), where the authors study de-risking for defined benefit plans in the survival model, and D’Amato et al., (2020), where the authors formulate an optimization model to choose the amount of de-risking disability risks in the disability model without reactivation in discrete time. Our formulation is for a general multi-state model in continuous time.

We assume that there is a capital cash flow for each transition with the rate

![]() $k_{ij}(t)$

such that the insurance company amortizes the unfunded liabilities continuously. Hence, if the unfunded liabilities increase, there is a capital injection with the change, and if the unfunded liabilities decrease, there is a withdrawal with the change, such that

$k_{ij}(t)$

such that the insurance company amortizes the unfunded liabilities continuously. Hence, if the unfunded liabilities increase, there is a capital injection with the change, and if the unfunded liabilities decrease, there is a withdrawal with the change, such that

where we ignore that the unfunded liabilities gain interest. Let

The total discounted costs of all the de-risking strategies are

where

![]() $\psi _1$

and

$\psi _1$

and

![]() $\psi _2$

are penalty factors on the capital inflow and outflow, respectively.

$\psi _2$

are penalty factors on the capital inflow and outflow, respectively.

Inspired by Lin et al. (Reference Lin, MacMinn and Tian2015), we assume that the objective of the insurance company is to minimize its expected total costs when choosing the de-risking strategy at time 0. The constraints in the optimization problem are that the expected unfunded liabilities at the termination of the contract are less than zero such that, in expectation, the assets exceed the liabilities during the course of the contract, and that the hedging price of all de-risking strategies should be lower than the assets minus the liabilities at time 0. To control the worst-case scenarios or downside risk, we impose a constraint on the conditional value-at-risk (CVaR) of the unfunded liabilities again inspired by Lin et al. (Reference Lin, MacMinn and Tian2015).

Now, we formulate the optimization problem

\begin{align} \min _{(h_{ij})_{i,j \in \mathcal{J}, i \neq j}} &\mathbb{E} \big [ TC \big ], && \nonumber \\ \text{subject to} & && \\ & \mathbb{E}\big [ L^D(n) \big ] \leq 0, && \nonumber \\ & CVaR_\alpha \big ( L^D(n) \big ) \leq \tau, && \nonumber \\ & \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} h_{ij} P_{ij} \leq w_0, \nonumber && \end{align}

\begin{align} \min _{(h_{ij})_{i,j \in \mathcal{J}, i \neq j}} &\mathbb{E} \big [ TC \big ], && \nonumber \\ \text{subject to} & && \\ & \mathbb{E}\big [ L^D(n) \big ] \leq 0, && \nonumber \\ & CVaR_\alpha \big ( L^D(n) \big ) \leq \tau, && \nonumber \\ & \sum _{i \in \mathcal{J}} \sum _{j: j \neq i} h_{ij} P_{ij} \leq w_0, \nonumber && \end{align}

where

![]() $w_0$

is the initial wealth of the insurance company given by

$w_0$

is the initial wealth of the insurance company given by

![]() $w_0 = A_0 - \hat{V}^0(0)$

. We note that the optimization problem is non-linear in

$w_0 = A_0 - \hat{V}^0(0)$

. We note that the optimization problem is non-linear in

![]() $h_{ij}$

. Calculation of the expectations and the CVaR that appear in the optimization problem requires simulation-based methods.

$h_{ij}$

. Calculation of the expectations and the CVaR that appear in the optimization problem requires simulation-based methods.

5. Numerical example

We consider long-term care (LTC) insurance paying a lump sum upon disability in the disability model (see Fig. 1). We consider only one level of disability, therefore there are two possible transitions from the initial state Active: the policyholder can become disabled (

![]() $\mu _{01}$

) or the policyholder can die (

$\mu _{01}$

) or the policyholder can die (

![]() $\mu _{02}$

). We disregard recovery from the Disabled state, due to the chronic nature of the disability, therefore there is only one transition from the state Disabled: the disabled policyholder can die (

$\mu _{02}$

). We disregard recovery from the Disabled state, due to the chronic nature of the disability, therefore there is only one transition from the state Disabled: the disabled policyholder can die (

![]() $\mu _{12}$

). The insurance product is a payment upon disability,

$\mu _{12}$

). The insurance product is a payment upon disability,

![]() $b$

, paid by a single premium,

$b$

, paid by a single premium,

![]() $\pi$

, at time 0. The policyholder is

$\pi$

, at time 0. The policyholder is

![]() $x_0$

years old at the policy issue (

$x_0$

years old at the policy issue (

![]() $t=0$

), and the insurance contract terminates at time

$t=0$

), and the insurance contract terminates at time

![]() $n$

.

$n$

.

Figure 1. The disability model.

First, we model the stochastic process for the transition intensities in Section 5.1, and second, we solve the optimization problem in Section 5.2.

5.1 Modelling intensities

Following Christiansen & Niemeyer (Reference Christiansen and Niemeyer2015) that study the sufficient and necessary conditions under which general transition forward rates are consistent with respect to the relevant insurance claims, we assume that

![]() $\mu _{01}(t)$

,

$\mu _{01}(t)$

,

![]() $\mu _{12}(t)$

, and

$\mu _{12}(t)$

, and

![]() $(\mu _{02}(t)-\mu _{12}(t))$

are independent. Christiansen & Niemeyer (Reference Christiansen and Niemeyer2015) demonstrate that this assumption implies that

$(\mu _{02}(t)-\mu _{12}(t))$

are independent. Christiansen & Niemeyer (Reference Christiansen and Niemeyer2015) demonstrate that this assumption implies that

![]() $\mu _{02}(t)$

and

$\mu _{02}(t)$

and

![]() $\mu _{12}(t)$

are dependent. It follows that

$\mu _{12}(t)$

are dependent. It follows that

![]() $\mu _{01}(t)$

can be independently estimated using a standard diffusion process (e.g., Cox-Ingersoll-Ross (CIR)), and the same can be done for

$\mu _{01}(t)$

can be independently estimated using a standard diffusion process (e.g., Cox-Ingersoll-Ross (CIR)), and the same can be done for

![]() $\mu _{02}(t)$

or

$\mu _{02}(t)$

or

![]() $\mu _{12}(t)$

. The difference

$\mu _{12}(t)$

. The difference

![]() $(\mu _{02}(t) - \mu _{12}(t))$

can be modeled as a constant, deterministic function or stochastic but independent with respect to

$(\mu _{02}(t) - \mu _{12}(t))$

can be modeled as a constant, deterministic function or stochastic but independent with respect to

![]() $\mu _{02}(t)$

.

$\mu _{02}(t)$

.

We model

![]() $\mu _{01}(t)$

and

$\mu _{01}(t)$

and

![]() $\mu _{02}(t)$

with two different time-inhomogeneous CIR processes. The CIR process has been widely used in the actuarial literature for modeling the mortality intensity (see, e.g., Dahl, Reference Dahl2004; Biffis, Reference Biffis2005; Henriksen & Møller, Reference Henriksen and Møller2015; Zeddouk & Devolder, Reference Zeddouk and Devolder2020; and Huang et al., Reference Huang, Sherris, Villegas and Ziveyi2022). Moreover, the CIR process has the advantage of giving non-negative processes for the transition intensities. Furthermore, we assume that the difference

$\mu _{02}(t)$

with two different time-inhomogeneous CIR processes. The CIR process has been widely used in the actuarial literature for modeling the mortality intensity (see, e.g., Dahl, Reference Dahl2004; Biffis, Reference Biffis2005; Henriksen & Møller, Reference Henriksen and Møller2015; Zeddouk & Devolder, Reference Zeddouk and Devolder2020; and Huang et al., Reference Huang, Sherris, Villegas and Ziveyi2022). Moreover, the CIR process has the advantage of giving non-negative processes for the transition intensities. Furthermore, we assume that the difference

![]() $(\mu _{02}(t) - \mu _{12}(t))$

is a time-dependent constant.

$(\mu _{02}(t) - \mu _{12}(t))$

is a time-dependent constant.

Therefore, the estimated dynamics of the transition intensities are given by

\begin{align*} & \text{d} \mu _{01}(t) = \phi _{01} \big ( \beta _{01} - \mu _{01}(t) \big ) + \sigma _{01} \sqrt{\mu _{01}(t)} \text{d} W_1(t), \\[4pt] & \text{d} \mu _{02}(t) = \phi _{02} \big ( \beta _{02} - \mu _{02}(t) \big ) + \sigma _{02} \sqrt{\mu _{02}(t)} \text{d} W_2(t), \\[4pt] & \mu _{02}(t) - \mu _{12}(t) = \Delta (t), \end{align*}

\begin{align*} & \text{d} \mu _{01}(t) = \phi _{01} \big ( \beta _{01} - \mu _{01}(t) \big ) + \sigma _{01} \sqrt{\mu _{01}(t)} \text{d} W_1(t), \\[4pt] & \text{d} \mu _{02}(t) = \phi _{02} \big ( \beta _{02} - \mu _{02}(t) \big ) + \sigma _{02} \sqrt{\mu _{02}(t)} \text{d} W_2(t), \\[4pt] & \mu _{02}(t) - \mu _{12}(t) = \Delta (t), \end{align*}

where

![]() $\Delta$

is a deterministic function,

$\Delta$

is a deterministic function,

![]() $W_1(t)$

and

$W_1(t)$

and

![]() $W_2(t)$

are two independent Brownian motions.

$W_2(t)$

are two independent Brownian motions.

We estimate the parameters of the CIR model for

![]() $\mu _{01}(t)$

(or

$\mu _{01}(t)$

(or

![]() $\mu _{02}(t)$

) from the survival probabilities that a person in state

$\mu _{02}(t)$

) from the survival probabilities that a person in state

![]() $0$

at age

$0$

at age

![]() $x_0$

in the year

$x_0$

in the year

![]() $t$

will remain in state

$t$

will remain in state

![]() $0$

at age

$0$

at age

![]() $x_0+n$

and year

$x_0+n$

and year

![]() $t+n$

, assuming that only the cause of decrement

$t+n$

, assuming that only the cause of decrement

![]() $j=1$

(or

$j=1$

(or

![]() $j=2$

) is operating,

$j=2$

) is operating,

![]() $p'_{01}(t,t+n)$

(or

$p'_{01}(t,t+n)$

(or

![]() $p'_{02}(t,t+n)$

) (to simplify notation, we have omitted the age). The procedure followed is described in Appendix A.

$p'_{02}(t,t+n)$

) (to simplify notation, we have omitted the age). The procedure followed is described in Appendix A.

We have calibrated the processes to the cohort of the Italian population aged

![]() $x_0=50$

in 2013 (the initialization time

$x_0=50$

in 2013 (the initialization time

![]() $t=0$

) and set

$t=0$

) and set

![]() $n=30$

. Data has been taken from Baione et al. (Reference Baione, Conforti, Levantesi, Menzietti and Tripodi2016), which fitted the transition probabilities to the people qualified for a disability benefit paid by the Italian Government to disabled people, consisting of a universal cash benefit not subject to age limitations and unconnected to a means’ test. The data set provides the mortality of active people, the mortality of disabled people, and the transition from active to disabled.

$n=30$

. Data has been taken from Baione et al. (Reference Baione, Conforti, Levantesi, Menzietti and Tripodi2016), which fitted the transition probabilities to the people qualified for a disability benefit paid by the Italian Government to disabled people, consisting of a universal cash benefit not subject to age limitations and unconnected to a means’ test. The data set provides the mortality of active people, the mortality of disabled people, and the transition from active to disabled.

The values of the

![]() $\phi$

’s,

$\phi$

’s,

![]() $\beta$

’s, and

$\beta$

’s, and

![]() $\sigma$

’s are reported in Table 1 below.

$\sigma$

’s are reported in Table 1 below.

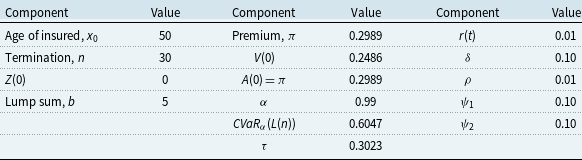

Table 1. Parameter values

5.2 Solving the optimization problem

We assume that the policyholder is 50 years old and in active state at the initialization at time

![]() $0$

and holds an insurance contract paying a sum of

$0$

and holds an insurance contract paying a sum of

![]() $b = 5$

upon disability before termination at time

$b = 5$

upon disability before termination at time

![]() $n = 30$

at the age of 80. We assume a constant interest rate,

$n = 30$

at the age of 80. We assume a constant interest rate,

![]() $r(t)=0.01 \: \forall t$

. The parameters defining the hedging cost for the de-risking option and the de-risking swap are assumed to be

$r(t)=0.01 \: \forall t$

. The parameters defining the hedging cost for the de-risking option and the de-risking swap are assumed to be

![]() $\delta =0.1$

and

$\delta =0.1$

and

![]() $\rho =0.01$

, respectively. Finally, we assume the same penalty factors on the capital inflow and outflow,

$\rho =0.01$

, respectively. Finally, we assume the same penalty factors on the capital inflow and outflow,

![]() $\psi _1=\psi _2=0.1$

. All the relevant parameters defining the numerical example are reported in Table 2.

$\psi _1=\psi _2=0.1$

. All the relevant parameters defining the numerical example are reported in Table 2.

Table 2. Components in numerical example

In this example, the liabilities in state 1,

![]() $\hat{V}^1(t)$

, and in state 2,

$\hat{V}^1(t)$

, and in state 2,

![]() $\hat{V}^2(t)$

, are equal to zero, since the only payment is upon a transition between state 0 and 1, and therefore, there are no future payments on the contract if the policyholder is disabled or dead. Hence, the sum-at-risk,

$\hat{V}^2(t)$

, are equal to zero, since the only payment is upon a transition between state 0 and 1, and therefore, there are no future payments on the contract if the policyholder is disabled or dead. Hence, the sum-at-risk,

![]() $\hat{R}^{12}(t)$

, (see Equation (4)) is equal to zero for all

$\hat{R}^{12}(t)$

, (see Equation (4)) is equal to zero for all

![]() $t$

. The unfunded liabilities depend on

$t$

. The unfunded liabilities depend on

![]() $\mu _{12}(t)$

through the rate

$\mu _{12}(t)$

through the rate

![]() $l_{12}(t)$

, which is equal to zero since

$l_{12}(t)$

, which is equal to zero since

![]() $\hat{R}^{12}(t)$

is equal to zero (see Equation (5)). Therefore, the expected unfunded liabilities do not depend on the transition intensity

$\hat{R}^{12}(t)$

is equal to zero (see Equation (5)). Therefore, the expected unfunded liabilities do not depend on the transition intensity

![]() $\mu _{12}(t)$

, and it is only necessary to define the valuation basis by the two transition intensities

$\mu _{12}(t)$

, and it is only necessary to define the valuation basis by the two transition intensities

![]() $\hat{\mu }_{01}(t)$

and

$\hat{\mu }_{01}(t)$

and

![]() $\hat{\mu }_{02}(t)$

. We assume that

$\hat{\mu }_{02}(t)$

. We assume that

![]() $\hat{\mu }_{01}(t) = 0.95 \cdot \mathbb{E} \big [ \mu _{01}(t) \big ]$

and

$\hat{\mu }_{01}(t) = 0.95 \cdot \mathbb{E} \big [ \mu _{01}(t) \big ]$

and

![]() $\hat{\mu }_{02}(t) = 1.05 \cdot \mathbb{E} \big [ \mu _{02}(t) \big ]$

. Under these assumptions, the single premium,

$\hat{\mu }_{02}(t) = 1.05 \cdot \mathbb{E} \big [ \mu _{02}(t) \big ]$

. Under these assumptions, the single premium,

![]() $\pi$

, is equal to 0.2989, while the initial reserve in the active state,

$\pi$

, is equal to 0.2989, while the initial reserve in the active state,

![]() $V(0)$

, is equal to 0.2486. We choose the target level for the conditional value-at-risk as

$V(0)$

, is equal to 0.2486. We choose the target level for the conditional value-at-risk as

![]() $\tau = 0.5 \cdot CVaR_\alpha (L(n))$

.

$\tau = 0.5 \cdot CVaR_\alpha (L(n))$

.

We calculate the expected total costs,

![]() $\mathbb{E} \big [ TC \big ]$

, the expected total unfunded liabilities,

$\mathbb{E} \big [ TC \big ]$

, the expected total unfunded liabilities,

![]() $\mathbb{E}\big [ L^D(n) \big ]$

, and the conditional value-at-risk of the unfunded liabilities,

$\mathbb{E}\big [ L^D(n) \big ]$

, and the conditional value-at-risk of the unfunded liabilities,

![]() $CVaR_\alpha (L(n))$

, with and without de-risking based on 5000 simulations of

$CVaR_\alpha (L(n))$

, with and without de-risking based on 5000 simulations of

![]() $\mu _{01}(t)$

and

$\mu _{01}(t)$

and

![]() $\mu _{02}(t)$

. We study the de-risking option with and without the sum-at-risk and the de-risking swap with and without the sum-at-risk. The solution to the optimization problem is the pair

$\mu _{02}(t)$

. We study the de-risking option with and without the sum-at-risk and the de-risking swap with and without the sum-at-risk. The solution to the optimization problem is the pair

![]() $(h_{01}, h_{02})$

that minimizes the expected total costs.

$(h_{01}, h_{02})$

that minimizes the expected total costs.

Without de-risking, the expected total costs of the insurance company is 0.0279. The objective of the insurance company is to lower the expected total costs by investing in de-risking securities. The assets at initialization of the insurance contract are 0.2989 and the liabilities equal 0.2486, hence, the insurance company has

![]() $w_0 = 0.0503$

to buy de-risking at time 0. We plot the sums-at-risk for the transitions from Active to Disabled and from Active to Dead, respectively, in Fig. 2.

$w_0 = 0.0503$

to buy de-risking at time 0. We plot the sums-at-risk for the transitions from Active to Disabled and from Active to Dead, respectively, in Fig. 2.

Figure 2. Sums-at-risk.

5.2.1 The de-risking option

The sum-at-risk from state 0 (Active) to state 1 (Disabled) is positive. Therefore, we consider the de-risking option with the European call option structure (Equation (7) with the sum-at-risk and Equation (9) without the sum-at-risk) for this transition. On the contrary, the sum-at-risk from state 0 (Active) to state 2 (Dead) is negative. Therefore, we consider the de-risking option with a European put option structure for this transition (Equation (8) with the sum-at-risk and Equation (10) without the sum-at-risk). In Fig. 3, we illustrate the expected total costs and the constraints from the optimization problem as functions of

![]() $h_{01}$

for a fixed value of

$h_{01}$

for a fixed value of

![]() $h_{02}$

. The expected total cost, the expected unfunded liabilities, and the conditional value-at-risk decrease in

$h_{02}$

. The expected total cost, the expected unfunded liabilities, and the conditional value-at-risk decrease in

![]() $h_{01}$

, while the hedging price increases in

$h_{01}$

, while the hedging price increases in

![]() $h_{01}$

. The values of

$h_{01}$

. The values of

![]() $h_{01}$

that meet the constraints in the optimization problem are the values where the conditional value-at-risk is lower than

$h_{01}$

that meet the constraints in the optimization problem are the values where the conditional value-at-risk is lower than

![]() $\tau$

and where the hedging price is lower than

$\tau$

and where the hedging price is lower than

![]() $a_0$

. Since the expected total cost has a decreasing trend, the optimal solution for

$a_0$

. Since the expected total cost has a decreasing trend, the optimal solution for

![]() $h_{01}$

(given

$h_{01}$

(given

![]() $h_{02}$

) is given by the larger value of

$h_{02}$

) is given by the larger value of

![]() $h_{01}$

within the feasible region. This means that, given the longevity/mortality de-risking strategy, the insurance company should maximize the coverage from disability risk. We can see in Fig. 3 that the optimal values for

$h_{01}$

within the feasible region. This means that, given the longevity/mortality de-risking strategy, the insurance company should maximize the coverage from disability risk. We can see in Fig. 3 that the optimal values for

![]() $h_{01}$

are 0.47 and 2.27, respectively with and without sum-at-risk.

$h_{01}$

are 0.47 and 2.27, respectively with and without sum-at-risk.

The optimal values of

![]() $h_{01}$

and

$h_{01}$

and

![]() $h_{02}$

for the de-risking options, when both are variable, are reported in Table 3. The expected total costs are negative in both cases. It can be concluded from Equation (13) that, thanks to the de-risking strategy, the weight of capital outflows (negative) is greater than the sum of the weights of capital inflows (positive) and the cost of the hedging strategy. We can also observe that the expected total cost is slightly lower for the de-risking option with the sum-at-risk than without the sum-at-risk. This indicates that the better hedge for the insurance company is to buy the de-risking option with the sum-at-risk than without, even if the difference is little. For both de-risk strategies, it is evident that the insurer must purchase higher amounts of disability options (

$h_{02}$