Introduction

Inflation, after being a minor problem for many years, is now a critical issue in Nordic welfare states. It particularly affects the living conditions of people who already had difficulties making ends meet, including people who have to rely on public income transfers. Yet, due to the uneven distribution of inflation over different consumer items, other groups can also be affected, such as those relying on specific types of heating. Hence, there are critical welfare costs associated with inflation (Sinn, Reference Sinn1999). It affects people’s living conditions, quality of life, and happiness (Blanchflower et al., Reference Blanchflower, Bell, Montagnoli and Moro2014), even if the effects might differ depending on the risk-aversion in different households (Curran & Dressler, Reference Curran and Dressler2020).

Moreover, inflation has an impact on the wealth distribution, the level of income inequality (Bulíř, Reference Bulíř2001) and redistributes between generations, favouring young middle-class households with mortgages (Doepke & Schneider, Reference Doepke and Schneider2006). Overall, it is the unexpected inflation, as the current one, that has the largest impact on people’s welfare. Given the recent recovery from the extended COVID-19 pandemic, and generally rising income inequalities in Nordic countries in recent years (Søgaard, Reference Søgaard2018), it is important to examine how the Nordic welfare states have buffered people’s welfare over the past year in response to the sudden rising inflation.

This article therefore examines how changes in welfare policies adopted in 2021–2022 to alleviate the inflation crisis are likely to impact citizens’ living standards in the Nordic welfare states. In recent decades, Nordic countries have seen growing inequalities, and in some policy areas eligibility conditions were tightened and benefit levels reduced (Blyth, Reference Blyth2013; Jessop, Reference Jessop, Kettunen, Pellander and Tervonen2022; Alm et al., Reference Alm, Nelson and Nieuwenhuis2020), for instance with respect to unemployment benefits and activation efforts. Yet, compared to other groups of countries dealt with in this themed issue, the Nordic countries can still be characterised by their relatively universal and generous welfare benefits, and high levels of equality (van Gerven, Reference Gerven and Greve2022; Kangas & Kvist, Reference Kangas, Kvist and Greve2019; Greve, Reference Greve and Greve2019).

A priori, the need for far-reaching policy intervention is unanticipated in the Nordic countries, as their welfare systems have incorporated automatic stabilisers. As we will discuss in this article, benefits are indexed in line with changes in prices and/or wages depending on the type of benefit and with variations across countries, albeit often with a time lag. Therefore, the first research question to be addressed is why a change was needed. The second question pertains to how changes were implemented (e.g., whether new provisions were provided as single lump-sum income transfers or longer spells of support). The third question revolves around whether the changes imply new approaches to social policy than the ones usually considered part of universal welfare states. Hence, we assess the developments along Hall’s (Reference Hall1993) conception of degrees of policy changes.

Leaning on the larger theoretical discussion of how to assess the impact of the crisis on welfare states that can be found in the article by Béland et al. in this themed section, we briefly explicate this approach in the section on methodological and analytical approach. We then examine price development to answer the first question. Next, a comparative analysis of Nordic interventions in the inflation crisis is provided to answer the second question. Finally, to answer the third question, we provide a discussion of the reasons for change and whether they imply that there has been a deviation from the historical path. First, we provide some background in order to contextualise the study.

Background

A number of characteristics of the Nordic countries are important to contextualise the impact of inflation and policy adjustments. First, the Nordic countries have a corporatist tradition of trade unions taking into consideration the profitability of the businesses. Their restrained wage demands during times of crisis is likely to slightly curb inflationary pressure (Cappelen, Reference Cappelen2018; Barth et al., Reference Barth, Moene and Willumsen2014). Second, and to some extent with the opposite effect, there is a political commitment to a high level of employment that encourages the Central Bank to be somewhat cautious with inflation-fighting measures (ECB, 2022; OECD, 2022b). Third, raising the interest rate to fight inflation has a particularly hard knock-on effect on some Nordic households due to their high indebtedness (a feature that is attributed to relatively generous welfare systems, cf. Comelli, Reference Comelli2021). Fourth, the Nordic welfare states stand out by having systems of taxes and transfers exhibiting the strongest automatic stabilisers in Europe (Dolls et al., Reference Dolls, Fuest and Peichl2011). Like many others, the Nordic countries update welfare benefit levels through the mechanism of annual indexation. Historically, this has been motivated by arguments ranging from ensuring a stable income development for benefit recipients to the aim of removing the options for changing benefit levels from the political agenda – hereby avoiding “the temptation to increase benefits during election years” (Weaver, Reference Weaver2010, 7). However, indexation can be a slow-working mechanism in times of unexpected inflation, resulting in a real decline in living standards, at least shortly. Lastly, economic support can have unintended consequences, for instance, if the economic support itself contributes to a continued higher level of inflation or reduces the incentive to save on energy consumption.Footnote 1

For understanding responses to the inflation crisis, it is important to be aware of the way in which social benefits are adapted to increasing prices, something that varies widely across the Nordic countries.Footnote 2 In many areas there is a relationship with the development in wages, but with a time delay, and there are exceptions to whether it is a full regulation based on the wage development or whether the change in benefit is reduced in different ways. Examples of such exceptions include the index for costs of living for certain benefits in FinlandFootnote 3 and regulation depending on decisions in parliament in Sweden. In Sweden, regulation according to the price index dominates. In Norway, several aspects are subject to regulation based on price developments. Even if it in principle is related to wage income, there might be a deduction which earlier was the case with unemployment benefits in Denmark. This means that the benefits develop slower than the change in wage income.Footnote 4

In all countries, the regulation is backward-looking, which means that in periods of strong and unexpected inflation, recipients of income transfers will experience a decline in their purchasing power. For a long period, indexation of benefits based on prices has resulted in hollowing-out of the benefits compared to wages that were rising faster than prices (and thus benefit levels were effectively reduced relative to common standards of living). Now, however, it may take a while for wages to adapt to the price increases, which means that indexation of benefit levels based on prices might result (at least for a while) in benefit levels catching up with living standards. Thus, when the countries go from periods of high inflation and wage increases to lower levels, there will be overcompensation. Still, indexation of benefits implies a change in the level and generosity of benefits, which are exaggerated in present times. It is against this backdrop that one should assess the policy interventions adopted in 2021–2022.

Methodological and analytical approach

The analysis in this article focuses on four large Nordic welfare states – Denmark, Finland, Norway, and Sweden – based on the perception that they can be expected to adopt the same approach. We will use policy documents from the individual countries combined with secondary data describing consequences in relation to who is affected by the changes in inflation. Given the recency of these developments and immediacy of this research, the focus will be on the immediate, short-term impacts, and limited to policy decisions taken in 2021–2022.

The emphasis is on changes in existing types of benefits and duties, and the possible emergence of new types of welfare benefits to private persons or households. Polices towards the business sector are thus not central in the analysis. Indirect support, such as setting limits to rents, is presented as part of the analysis, as this may indicate the breath of measures adopted beyond traditional welfare benefits. This form of indirect support also includes changes in the tax-system such as lowering levels of duties on heating and electricity.

We focus on policy changes following Hall’s (Reference Hall1993) understanding. In this framework, first-order changes are incremental adjustments and fine-tunings of existing policies. Second-order changes involve the development of new policy instruments, which Hall has described such changes as “normal policymaking” that “adjusts policy without challenging the overall terms of a given policy paradigm” (Hall, Reference Hall1993, p. 279). Third-order changes imply changing the hierarchy of goals behind the policies, i.e., a paradigm shift.

Country differences in price developments and funding of government measures

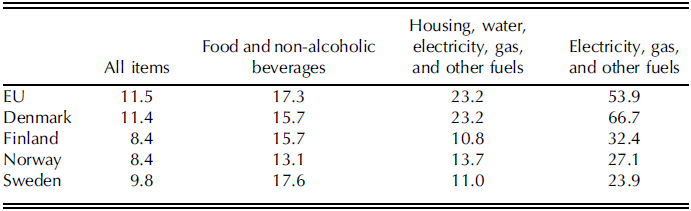

Table 1 shows developments in prices from October 2021 to October 2022 to illustrate core issues related to where inflation has been high as well as differences across the Nordic countries. The specific impact of increases in prices for electricity, gas, and other fuels far exceeds overall inflation. We observe notable country differences. Overall inflation is highest in Denmark, and this is directly related to the rise in energy prices, which also is considerable higher here than in the other Nordic countries. While Denmark is approximately at the European Union (EU) average, we note that the inflation crisis has been relatively less severe in the other Nordic countries. This variation in overall level among the Nordic countries, as well as the variation concerning which sub-elements saw the highest increase, is a possible reason for national difference in policy changes. The impact of this variation in price development on various goods and services depends on households’ specific conditions, particularly housing situations, e.g., old/new, energy renovated or not, type of heating (natural gas, electricity, district heating).

Table 1 Development in prices in four Nordic countries and the EU from October 2021 to October 2022 (Annual rate of change)

Source: Eurostat, PRC_HICP_MANR, accessed the 18 November 2022, Statistics Eurostat.

In 2022, the Nordic countries experienced a decline in real wages, with Finland seeing a decrease of 1.1 percent, Denmark experiencing a decrease of 1.4 percent, Norway a decrease of 1.1–1.7 percent (depending on sector), and Sweden seeing the largest decrease at 2.4 percent (Statista, 2023; Norwegian Government, 2023).

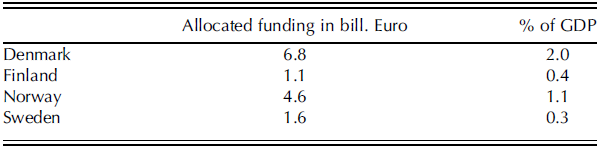

Those who rely on benefits or have low incomes will face greater challenges in adapting to price changes as they tend to spend larger shares of their income on food and heating. Thus, an issue has been how to support those most affected by the change. An overview of national strategies in this regard is depicted in Table 2. It shows the overall funding allocated for policies to shield consumers against rising energy prices.

Table 2 Governments’ allocated funding in response to energy crisis, Sept. 2021–Oct. 2022

Note: The amounts do not include liquidity support for individuals or companies.

Source: https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices, accessed 31 October 2022.

The noticeable variation in allocated funding, as shown in Table 2, will be discussed later in the article. The trend in policy response generally corresponds to the trend in need. Hence, the higher increase in spending on policy response in Denmark and Norway may reflect the higher surge in housing and energy price (as displayed in Table 1) in these countries, compared with Sweden and Finland.Footnote 5

Comparisons of interventions

This section provides a comparison of the types of interventions carried out in the four Nordic countries in response to rising prices. The intention is to examine differences and similarities in the interventions. Due to the length of the article, we only focus on the central changes brought about in the four countries.

The Danish, social democratic government with broad political agreements, implemented several interventions specifically to cope with the rising energy prices, in the context of a higher increase in energy prices than in most other EU member states.Footnote 6 These varied interventions, mainly as lump sums, were an attempt to target the support to those most in need. However, it proved to be difficult as the situation is diverse with respect to type of heating, energy consumption, and because of differences in housing standard. Private rents were changed in line with the overall consumer price index, which implied a strong increase in rent in private accommodation (see Table 1). The parliament decided a cap on a possible increase with the argument that the increase in the consumer price index was influenced by costs other than the increased costs of the owners of the private flats.Footnote 7 A reduction in the duties on electricity, not only supporting-low income groups, was also decided for the first six months of 2023.

In Finland, to compensate households for the rising electricity prices, the left-green-centre government outlined in September 2022 a number of measures with an estimated cost of 112 million euro in its budget proposal for 2023 (Ministry of Interior, 2022). The value-added tax rate on electricity was reduced from 24 to 10 percent between 1 December 2022 and 13 April 2023. Furthermore, the government announced a fixed-term tax credit for electricity (for middle- and high-income households with soaring electric bills of 500–1500 euro/month) and a new fixed-term financial support for electricity for low-income households not able to benefit from the tax deduction. Additionally, a supplemental child benefit instalment was introduced for families with children for the month of December 2022. To meet the needs of commuters and transport businesses, the value-added tax on trains, busses, taxies, and flights was removed from January to April 2023.

In Norway the centre-left government introduced subsidies for household electricity consumption already in January 2022,Footnote 8 paying 80 percent (later increased to 90 percent) of the part of the electricity bill that exceeds Norwegian Kroner 0.70 per kilowatt hour (Sgaravatti, Tagliapietra, and Zachmann, Reference Sgaravatti, Tagliapietra and Zachmann2022). In addition, the tax on electricity has been reduced during the winter season (Norwegian Government, 2021). As the level of energy consumption largely follows income level, the distributive effect of these interventions favours high-income households, albeit still also important relatively to income for low-income families. To target low-income households, extraordinary support in the form of a heat-cheque has been paid out to the select group of recipients of the means-tested housing allowance (residing in Southern Norway, where electricity prices have been highest). However, the substantial proportion in the target group also receiving means-tested social assistance saw this extra support being deducted from their social assistance payment (Nationen, Nov-10-2021)Footnote 9 . As rental costs having risen at an even higher rate than the general price developments, low-income groups in such accommodation have seen economic hardship in recent years now increased by risin inflation (Bredvold & Inderberg, Reference Bredvold and Inderberg2022).

Energy prices increased less in Sweden than in the other Nordic countries studied here, but overall inflation was still higher than in Finland and Norway (Table 1). Increased interest rates have contributed – combined with the inflation – to the (sense of) insecurity and concern in the Swedish public, with consumer confidence being at a long-term low.Footnote 10 An increase in the interest rate directly affects what households spend on accommodation each month (from already high levels). If wages do not keep up, the purchasing power of workers decreases. Additionally, and similar to the welfare responses in other Nordic countries, the public debate and proposed policy measures in Sweden targeted the rising energy and fuel prices. An electricity price compensation was implemented already during the winter of 2021–2022 that gave households a maximum compensation of approximately 184 euro/month (i.e., 532 EURO in total). Since the size of compensation was based upon electricity consumption, the largest compensation went to the benefit of rural households and those living in a large house. Several other fuel and electricity policies were proposed during the summer of 2022; however, as Sweden had an election in September and the government changed, much of the policy implementation was postponed to 2023. A minor tax reduction on fuel costs has also been proposed.

Comparison of types of interventions

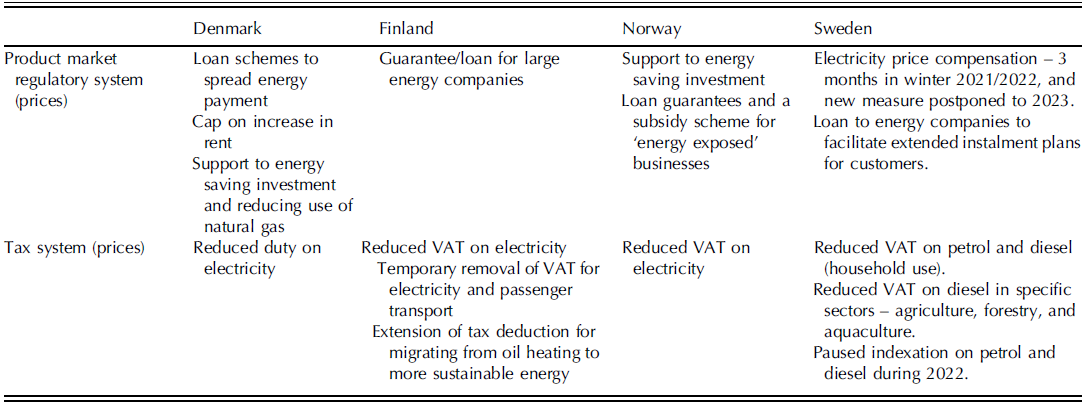

This section provides a comparative analysis of policy changes focusing on whether they are related to prices (product or tax-system), securing income (benefits and tax and duties), or securing consumption.

Table 3 shows interventions in relation to the rise in prices. The table shows a remarkable similarity in the type of interventions adopted in the countries. It should be expected that, in particular, the reduced duties will be shortlived, whereas the support to investment to save energy in the future will have a longer lasting impact. The main deviation is the cap on rent in Denmark, which is not paralleled in the other countries. Loan schemes and paused indexation on petrol and diesel in Sweden can be argued to represent a new way to deal with an inflation crisis. These types of changes reflect a universal approach benefitting a large number of citizens, including also persons with higher levels of income.

Table 3 Interventions in the four Nordic countries in relation to the rise in prices in 2022

Source: See Table 2, and national information.

Table 4 shows elements that have changed within the welfare systems. Again, the approach taken in all four countries has strong characteristics of universalism, but here are also some interventions that direct more money to groups in societies often construed as ‘deserving’, such as the elderly and families with children, as well as students. However, we also note that some of the interventions in the tax-system may run counter to the ideal of redistribution, as tax deductions also benefit higher income groups. Likewise, the increase in employment allowances, as we see in Denmark, only benefits those who have a job.

Table 4. Changes in benefit and tax systems related to securing income

Source: See Table 2, and national information.

The Nordic countries do not have statutory minimum wages, in contrast to most OECD countriesFootnote 11 and thus no automatic increase in income for those with the lowest income in the countries. However, through collective agreements in reality there are minimum wages, which typically are adjusted when having wage negotiations.

In Table 5, instruments are shown that can influence consumption and that have been used in the Nordic countries. The table indicates that besides the classical instruments of higher levels of social security benefits, the Nordic countries have also tried to make a stronger targeting in the wake of the specific increase in energy prices. Although it is a limited measure, it can be interpreted as a deviation from the universal approach and a more targeted way to reach the most vulnerable groups in societies.

Reasons behind the changes—and why variation

Across the Nordic countries, the sudden and high increase in energy prices that resulted in high levels of inflation was particularly difficult to cope with for low income groups, as the benefit indexation systems in place were not geared to provide sufficient compensation. Waiting until the indexation mechanism would kick in would imply a high risk of seeing more people living at risk of poverty, potentially causing severe social exclusion such as homelessness. Anticipating the yearly indexation to follow, policy makers opted for one-off payments to address the acute situation, rather than increasing the general level of benefits. Hence, to answer our first question, the need for interventions seems to be due to the fact that the sudden and high inflation had a disproportionate impact on low income groups, who were not adequately compensated by existing benefit indexation systems. The interventions aimed to mitigate the negative effects of the price increase and support those most affected by it.

The interventions align with the traditional Nordic welfare model, which aims to counter poverty and social exclusion (Fridberg and Kangas, Reference Fridberg, Kangas and Ervasti2008). However, additional eligibility criteria were introduced to ensure that benefits were targeted towards those most affected by the sudden increase in energy prices. The objective was to maintain a high degree of equality and reasonable living standards for all, particularly for low-income households who were most vulnerable to the impact of the price increase. The measures of support to those presumably most hit by the crisis in each of the Nordic countries, as discussed in relation to Tables 3 and 4, thus represent a form of path-dependency.

Next, we consider our second question on how the changes were implemented. With respect to benefits, changes have been quite similar across the countries and households with low incomes appear as having been especially favoured. The picture is, however, more varied related to reductions in energy taxes as this has also implied that the middle- and higher-income groups have benefitted from the changes. In a way, this seemingly resembles the old debate on supporting the middle class as a way to ensure support for welfare interventions (Gugushvili and Laenen, Reference Gugushvili and Laenen2021; Korpi and Palme, Reference Korpi and Palme1998). Thus, even if following in the tradition of trying to ensure a high degree of equality including income transfers to those most in need, the interventions have also benefitted the middle class.

As regards the third question, a likely reason for continuing on the historical path is the long history of development of the Nordic welfare states. Nevertheless, there have been general elections in both Sweden and Denmark in 2022 (and in Finland in 2023), and the economic situation and pressure on low-income families has been on the agenda. Parties thus have made electoral promises to help low-income families with the consequences of rising energy prices and inflation in general. Hence, differences in electoral support, for instance with regards to who is seen as deserving, might also be one of the reasons for the decided type of changes. It has been argued that in Europe there has been a rebalancing of support across generational issues (Riekhoff, Reference Riekhoff2021; Birnbaum et al., Reference Birnbaum, Birnbaum, Nelson and Palme2017), while there is still high legitimacy for a strong support towards the elderly.

A clash between different ends has overall most likely reduced the magnitude of policy interventions as there is a risk of prolonging the inflationary crisis if providing more money from the welfare state than having financed, even if the money is available. This dilemma has been reflected in the political debates, while at the same time not being a sufficiently strong argument for resisting increasing support. Furthermore, the interventions are likely to have been spurred by the need to reduce the risk of growing levels of unemployment as without economic support the overall demand might have been reduced too strongly.

The increase in energy prices has also implied, in line with traditional economic understanding, an incentive to save on energy and thereby supported the environmentally friendly development. Hence, the conflict between reducing CO2 and supporting low-income households has manifested itself during the crisis. Overall, there have been some new elements in the Nordic countries line of policy, such as a stronger attempt to support those most affected by change in energy prices, exemplified by the new criterion for receiving benefits and a cap on rent. Such new elements can be interpreted as a second-order change in Halls understanding given that the new elements (lump-sum benefits, cap on rents, change in duties) are part of a process of changing the welfare states, albeit without changing the core paradigmatic issues of the Nordic welfare states.

Lastly, judging on the basis of the interventions adopted so far, there does not seem to be a different perception across Nordic welfare states as regards who is in need. Changes in the duties on electricity is not only seen as a way of supporting low-income families, but also companies, i.e., branches where the energy costs have increased the risk of bankruptcy (such as bakers, supermarkets, butchers, etc.).

Concluding remarks

Overall, the Nordic welfare states’ interventions to alleviate the cost-of-living crisis have to an important extent been designed to reach low-income groups. This is particularly apparent in the way lump-sum payments have been implemented. Yet, lowering of Value Added Taxes duties on electricity tends in absolute terms to be more important for middle- and high-income earners, albeit, in relative terms, important for low-income households. The rationale for the Nordic countries’ strategies of also accommodating the interests of the middle-class is in line with Korpi and Palme’s (Reference Korpi and Palme1998) argument that ‘bribing’ this group can be important to ensure their support towards interventions to help those most in need. Thus, further underlining the caveat that some measures benefit higher income groups more (in absolute terms) because of their consumption patterns, and that there are cases where means-tested benefits crawled back energy subsidies targeted at the poor. Nevertheless, this again supports that there has been a high degree of path-dependency in protecting those seen as most in need.

However, also new elements were introduced that are outside the tradition of income transfers in the Nordic countries, such as one-off benefits, caps on rents, reductions in duties on electricity and certain types of fuel, and rights to loans with a state guarantee to pay later. The introduction of these new elements can be considered as a second-order change in Halls framework, but not a third-order change as the overall paradigm of protecting protect the most vulnerable remained strong. Nevertheless, the introduction of these new elements suggests that strong changes in the societal conditions can pave the way for innovation in the way welfare states interact with new market conditions and thereby impact on the overall type of living conditions in new ways without paradigmatic changes in the approach.

The policy interventions and changes further indicate that despite indexation still being important, also in their function as automatic stabilisers, the way they are constructed now renders them less useful to cope with sudden and substantial changes in specific elements included in the way price indices are measured. This limitation is due to energy prices exerting only a limited impact on the overall price index, while having a crucial significance, alongside food prices, for low-income families. The indexation mechanism is further limited due to the fact that the impact of changes will first take place with some time delay. Still, the changes and responses have been balancing the need for support especially to low-income groups at risk of continued inflationary pressure, seemingly a reason why there have not been strong permanent changes in the welfare state systems.