13.1 Introduction

This chapter describes and evaluates the dynamically evolving web of carbon markets at various government levels around the globe – a web which can be conceived of as polycentric in nature. Individual but interdependent carbon markets have developed in many jurisdictions since the late 1990s. The Kyoto Protocol and the Paris Agreement provide an overarching umbrella for a wide range of designs, but international agreements are not the only factor contributing to the inception, design and diffusion of carbon markets. Individual countries, subnational entities and the European Union (EU) have taken initiatives in response to various domestic and international dynamics. No existing carbon market is an exact replica of another: each has been tailored to domestic preferences, contexts and politics.

A truly effective and ambitious global carbon market would arguably require strong harmonised rules and a central and independent authority to manage it (Green, Reference Green2017: 484). As this appears politically very difficult to achieve and is thus a rather unlikely scenario in the short term, a more feasible way for the various carbon markets to contribute to global mitigation efforts may be presented by the current polycentric approach. The interplay between local and international developments has led to the emergence of such a carbon market structure and continues to shape its further evolution. In this chapter, we discuss which opportunities and challenges will arise by approaching further development this way – with the challenges relating to fragmentation and political and economic uncertainties.

Carbon markets are systems within which carbon allowances and credits are traded. Carbon allowances are permits for emitting a certain amount of greenhouse gases (GHGs). Carbon credits are generally the output of an offset programme that reduces the emissions of actors outside the scope of an emissions trading system (ETS); participants can buy such credits and count them towards their overall obligation within an ETS. Emissions trading is a policy instrument that creates a carbon market in a specific jurisdiction. It sets a maximum emissions limit for a specified group of emitters; this may involve an absolute limit on GHG emissions (as in the EU), a carbon-intensity target (as in China) or a reduction target compared to a business-as-usual scenario (as in South Korea). This jurisdiction-wide limit, also called the cap, contrasts with a command-and-control approach of prescribing limits for each individual emitter (Dales, Reference Dales1968).

Companies covered by an ETS can obtain emissions allowances for free, or purchase them in auctions or from other emitters. For predefined time periods, emitters must surrender to the authorities the number of allowances corresponding to their actual emissions during that time. Surplus allowances can usually be sold or ‘banked’ for future use. The price of a tonne of carbon is determined by the supply and demand of allowances. An ‘ambitious’ cap (one with a limit set significantly below expected demand) will create scarcity of carbon allowances, and is likely to result in a relatively high carbon price (Dales, Reference Dales1968; Tietenberg, Reference Tietenberg2006; van Asselt, Reference van Asselt, Jordan, Huitema, van Asselt, Rayner and Berkhout2010).

Carbon markets have been hailed as a flexible and efficient means to curb GHG emissions and to incentivise the decarbonisation of the economy by putting a price on carbon, thereby making investment in low-carbon solutions more attractive. A fundamental reason for the growing interest in emissions trading by various governments, as well as industries and other stakeholders, is that it allows governments to control total emissions levels in the ETS sectors and the basic rules governing market transactions. Meanwhile, stakeholders remain free to determine how many emission permits they buy or sell. In theory, this instrument combines, in a unique way, relative predictability of emission reductions with flexibility to achieve compliance. However, creating a market for an artificial commodity like carbon is an extremely complex endeavour. Several problems have arisen, as described in this chapter.

The adoption and proliferation of ETSs is one of the illustrations of the emergence of polycentric structures used in Elinor Ostrom’s (Reference Ostrom2010) pioneering article on coping with collective action and global environmental change. Our chapter adds a more systematic discussion of the polycentric structure of carbon markets. Since the late 1990s, carbon markets have developed at many levels of governance, ranging from the municipal and subnational to the supranational and international. The geographical spread and variety of designs are vast. In 2017, the International Carbon Action Partnership counted 21 individual ETSs, implemented in a total of 35 countries (ICAP, 2017). A few carbon markets have been linked and mutually adjusted to each other – notably the ETSs adopted by the EU, Norway, Iceland and Liechtenstein, as well as the California and Québec systems.

The momentum and upward trend in the proliferation of ETSs makes harnessing the market in the name of climate mitigation an increasingly important element of global climate governance. Against this backdrop, our chapter begins by describing the origins of the current global landscape of carbon markets. Both local and international dynamics have contributed to the polycentric structure in evidence today. Second, we conceptualise the interaction and linkage among ETSs today. Various ties can be identified, from formal market linkages to informal exchanges of lessons learned. Third, we highlight key carbon market design challenges and opportunities, including those related to a polycentric architecture. Here we discuss the interaction with other climate policies and carbon price management. We conclude with some suggestions for future research on harnessing the market for climate policy purposes, including the role of polycentric governance.

13.2 Origins of the Polycentric Carbon Market Structure

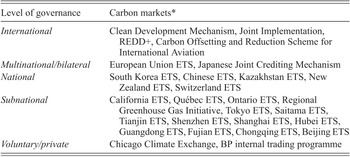

A growing number of jurisdictions have adopted GHG ETSs since the turn of the millennium. None of these systems is an exact copy of another: each system has been tailored to its domestic socio-economic context and political preferences (Knox-Hayes, Reference Knox-Hayes2016; Wettestad and Gulbrandsen, Reference Gulbrandsen, Sammut and Wettestad2017). Not only nation states but also subnational and supranational entities have adopted ETSs, as shown in Table 13.1. This section traces the evolution of GHG emissions trading, with an emphasis on the early phases. This brings out the conditions under which polycentric governance emerges.

Table 13.1 Key emissions trading systems at various levels of governance

| Level of governance | Carbon markets* |

|---|---|

| International | Clean Development Mechanism, Joint Implementation, REDD+, Carbon Offsetting and Reduction Scheme for International Aviation |

| Multinational/bilateral | European Union ETS, Japanese Joint Crediting Mechanism |

| National | South Korea ETS, Chinese ETS, Kazakhstan ETS, New Zealand ETS, Switzerland ETS |

| Subnational | California ETS, Québec ETS, Ontario ETS, Regional Greenhouse Gas Initiative, Tokyo ETS, Saitama ETS, Tianjin ETS, Shenzhen ETS, Shanghai ETS, Hubei ETS, Guangdong ETS, Fujian ETS, Chongqing ETS, Beijing ETS |

| Voluntary/private | Chicago Climate Exchange, BP internal trading programme |

The idea of harnessing markets for environmental policy was first developed by North American economists in the late 1960s (Coase, Reference Coase1960; Crocker, Reference Crocker and Wolozin1966; Dales, Reference Dales1968). It entered the climate policymaking realm in the 1980s, with ‘Project 88’ producing an important milestone report in the US context (for an overview of this early history, see Voss, Reference Voss2007; Mehling, Reference Mehling2012; Calel, Reference Calel2013; Paterson et al., Reference Paterson, Hoffmann, Betsill and Bernstein2014; see also Chapter 6). In Europe, the economist Michael Grubb presented a similar idea in the late 1980s (Grubb, Reference Grubb1989). The first major ETS was implemented by the US government in 1995; however, it addressed the air pollutants sulphur dioxide (SO2) and nitrogen oxide (NOX) that cause acid rain, rather than the GHGs that cause climate change (Baldwin, Reference Baldwin2008: 262; O’Neill, Reference O’Neill2017: 212). The idea of using a market logic found resonance in the US government’s ideology at the time.

Encouraged by its domestic implementation of SO2 and NOX emissions trading, the United States pushed the idea of carbon markets and flexible mechanisms in the negotiations on the 1992 United Nations Framework Convention on Climate Change (UNFCCC). Although the resulting convention text did not feature explicit carbon market provisions, the United States succeeded in getting three flexible mechanisms included in the 1997 Kyoto Protocol: the Clean Development Mechanism, directed at developing countries; Joint Implementation, targeting Eastern Europe and the countries comprising the former Soviet Union; and international emissions trading among the ‘Annex I’ (i.e. industrialised) countries. It was the initial experimentation and experiences of one influential country – the United States – with emissions trading that drove the uploading of the idea to the international level, much as polycentric theory predicts.

Spurred by the Kyoto Protocol and failure to adopt an internal carbon tax for dealing with climate change, the EU set about designing an ETS to govern large industrial installations. The EU ETS Directive, adopted in 2003, established the main rules for a pilot phase (2005–2007) and a second phase that coincided with the Kyoto commitment period (2008–2012). Many companies supported market-based strategies, on the assumption that climate policy was imminent and market-based approaches were less expensive than traditional regulation. In 2000, BP launched an internal experimental ETS, outpacing policy developments in the EU (Victor and House, Reference Victor and House2006; Meckling, Reference Meckling2011).

Since the EU in the early 2000s was an international frontrunner (see also Chapter 8), and uncertainty was high among stakeholders, the initial design of its carbon market was generally decentralised, with considerable power over implementation of the system held by the EU member states. Allowances were handed out for free. Core target groups were the power sector and several energy-intensive industries. To provide additional flexibility, the 2004 Linking Directive allowed for the use of Clean Development Mechanism credits from the pilot phase, as well as Joint Implementation credits from 2008. In 2005, Norway launched a national ETS, aiming to link up to the EU ETS. Switzerland launched a voluntary ETS in 2008, which subsequently became mandatory for large, energy-intensive entities. Switzerland agreed in 2017 to link with the EU ETS. Based on its experiences and lessons learned during the first implementation phases, the EU significantly altered its ETS rules for the 2013–2020 phase, with more centralisation and greater auctioning of carbon allowances (Skjærseth and Wettestad, Reference Skjærseth and Wettestad2008, Reference Skjærseth and Wettestad2010).

In the United States, the voluntary Chicago Climate Exchange was established in 2003; and in 2005, seven governors (Connecticut, Delaware, Maine, New Hampshire, New Jersey, New York and Vermont)1 signed a memorandum of understanding establishing the Regional Greenhouse Gas Initiative, covering only the power sector. Unlike the EU, this system includes a carbon price management mechanism in the form of a price floor and ceiling, and allowances were auctioned from its launch in 2008. On the US West Coast, the 2006 Global Warming Act required the California Air Resources Board to develop a scoping plan and to explore the possibility of an ETS. This was followed in 2007 by the launch of the Western Climate Initiative (including British Columbia, Manitoba, Ontario, Québec and California) (Biedenkopf, Reference Biedenkopf2012).2 The California ETS was launched in 2012. Among its unique design features is a complex price floor system (Bang, Victor and Andresen, Reference Bang, Victor and Andresen2017). Former California governor Arnold Schwarzenegger was also central in launching the International Carbon Action Partnership in 2007 (Biedenkopf, Reference Biedenkopf2017).

In the Asia-Pacific region, Tokyo launched a climate strategy in 2007 that included an ETS. In 2006, Australia started a climate-policy assessment process which included an ETS discussion; subsequently, a carbon pricing mechanism was introduced. However, Tony Abbott’s election to the prime ministership in 2013 abruptly halted this development in Australia (Müller and Slominski, Reference Müller and Slominski2017). In 2008, New Zealand launched an ETS, featuring a rather unique ‘trading without cap’ design and broad sectoral coverage (Inderberg, Harmer and Bailey, Reference Inderberg, Harmer and Bailey2017).

As a potentially very important development in 2010, China’s National Development and Reform Commission designated 13 low-carbon zones and began contemplating GHG emissions trading. A milestone was reached in 2011 when the National Development and Reform Commission and the State Council announced ETS pilot projects in five Chinese cities and two provinces, eventually followed by a national carbon market, which was launched in 2017 but remains further to be elaborated and expanded (Stensdal, Heggelund and Maosheng, Reference Stensdal, Heggelund, Maosheng, Wettestad and Gulbrandsen2018). In 2013, Kazakhstan launched an ETS – which was put on hold in 2016 (Gulbrandsen, Sammut and Wettestad, Reference Wettestad and Gulbrandsen2018). In 2015, South Korea became the first East Asian country to start operating a national GHG ETS (Biedenkopf and Wettestad, Reference Biedenkopf, Wettestad, Wettestad and Gulbrandsen2018).

While additional ETSs were being developed or contemplated in several countries, the EU continued to adjust its carbon market rules drawing on its experiences. After mid-2011, the EU ETS carbon price dropped, provoking a crisis of confidence. In 2014, the EU adopted a temporary postponement of the auctioning of some 900 million allowances (‘backloading’). The European Commission also launched a proposal for a price-stabilising mechanism, the Market Stability Reserve, aimed at providing longer-term price stability. Adopted in 2015, it is due to start operating in 2019 (Wettestad and Jevnaker, Reference Wettestad and Jevnaker2016).

In addition, several jurisdictions, including Brazil, Mexico and Thailand, are considering (or in the process of) establishing national carbon markets (ICAP, 2017). About half of the intended nationally determined contributions submitted prior to the Paris climate summit in 2015 mentioned the use of carbon market mechanisms (EDF and IETA, 2016). This includes international mechanisms such as the REDD+3 mechanism (addressing emissions from deforestation) and other systems that might emerge from the UNFCCC process and the Paris Agreement. Symptomatic of the increasingly polycentric spread of carbon markets, the design of carbon markets and carbon price levels were discussed at the 2017 Davos economic summit (Carbon Pulse, 2017). Summit participants called for a carbon price of around $40–50 USD in 2020, a level that the Organisation for Economic Co-operation and Development (OECD) originally advocated in 2016 (OECD, 2016).

The Paris Agreement promises to complement the proliferation of subnational, national and regional ETSs with a global umbrella establishing rules for market mechanisms. Article 6 establishes that parties may cooperate to implement their nationally determined contributions under the Agreement through a global market mechanism. The Paris Agreement contains several elements encouraging the further development of markets locally. An important further process within the UNFCCC context is the improvement of carbon accounting rules (Jevnaker and Wettestad, Reference Jevnaker and Wettestad2016). Achieving a level playing field in terms of how emissions data are accounted for in different jurisdictions is of key importance for building trust and for the legitimacy of carbon markets.

The evolution of carbon markets has been a rollercoaster ride, with the rise of ambitious carbon markets but also the decline of some initiatives like the Australian ETS. GHG ETSs have evolved as independent experiments with unique innovative designs that reflect distinct domestic contexts and politics – in line with two of the core propositions of polycentric governance: local action and experimentation.

However, the development of the individual systems is linked to varying degrees, and through various types of interaction. The origins of ETS as an idea and its very first applications were local, but the early uploading to the international level has spurred the further development of the polycentric carbon market structure. Its emergence and evolution does not have one single cause: the origins can rather be found in the interplay among various political processes, individual entrepreneurs (see Chapter 7) and levels of governance. In the following section, we focus on the interactions that binds carbon markets together.

13.3 Lessons about Design, Interaction and Linkage

The various ETS policies constituting the polycentric carbon market system did not emerge completely independently of each other. ETSs are linked through several types of interaction, ranging from the direct linking of systems to the exchange of experiences and lessons. Policy diffusion mechanisms (see Chapter 9) can help account for interactions beyond the formal and direct linkage of individual ETSs (Wettestad and Gulbrandsen, Reference Wettestad and Gulbrandsen2018). Key features of polycentric systems are the enhancement of innovation, learning, adaptation and trust.

Three types of interaction stand out. First, the different variants of GHG ETSs have produced a set of lessons which reveal elements that may underpin success and some that lead to failure. There has been a certain degree of convergence amongst trading systems around the globe, for example on the inclusion of price management provisions. While not every lesson has found its way into the actual design of ETS policies, policymakers are usually aware of and seek to draw lessons from other systems (Wettestad and Gulbrandsen, Reference Wettestad and Gulbrandsen2018).

It is challenging to achieve a well-functioning ETS. Crafting a market for an artificial commodity such as carbon entails several uncertainties. Setting the fundamental level of the overall emissions limit is a matter under political control. In addition come two unpredictable factors that may have a sizable impact on the carbon price: economic development and technological innovation. As experienced in the EU, an economic slowdown and the availability of too many allowances can lead to a decrease in the demand for and the price of carbon allowances (Jevnaker and Wettestad, Reference Jevnaker and Wettestad2017). The availability and costs of low-carbon technologies can influence the threshold at which investing in innovation becomes economically more feasible than purchasing carbon allowances. Not least for these reasons, policymakers tend to examine existing systems before devising their own.

However, drawing lessons and understanding the pitfalls of an ETS does not necessarily mean that policymakers will act upon all advice received. The domestic context may necessitate certain adjustments or design deviations, or political considerations may lead to decisions aimed at appeasing certain stakeholders and at attracting a broad support base (Knox-Hayes, Reference Knox-Hayes2016). For example, the fact that electricity prices in South Korea and China are controlled by the government has required a creative approach to ETS design, since the mechanisms on which a market logic is based – influencing (consumer) decisions through price signals – cannot be applied. This explains why the South Korean and Chinese systems also cover ‘indirect emissions’ that occur through the consumption of electricity (Biedenkopf and Wettestad, Reference Biedenkopf, Wettestad, Wettestad and Gulbrandsen2018; Stensdal et al., Reference Stensdal, Heggelund, Maosheng, Wettestad and Gulbrandsen2018).

Key lessons include the risks of free allocation, the crucial importance of sound measurement, reporting and verification (MRV) systems and the need for price management provisions. Policymakers can allocate allowances to emitters free of charge to ease the compliance burden for covered companies, and to help garner political support for the gradual introduction of an ETS (Schmalensee and Stavins, Reference Schmalensee and Stavins2015). On the other side of the coin, free allocation of allowances has led to ‘windfall profits’, which occur when power producers that are covered by a GHG ETS receive allowances for free and then make a profit by passing on the allowance price to their customers, charging higher electricity prices. Such windfall profits can be avoided by auctioning allowances (Brown, Hanafi and Petsonk, Reference Brown, Hanafi and Petsonk2012: 19–23). During the first phase of the EU ETS, electricity utilities reaped large windfall profits, a matter addressed in subsequent phases (Convery, Ellerman and de Perthuis, Reference Convery, Ellerman and de Perthuis2008: 226). The EU experience contributed to state-level authorities on the US East and West Coasts designing their ETSs with greater auctioning of allowances (Biedenkopf, Reference Biedenkopf2012; Bang et al., Reference Bang, Victor and Andresen2017; Lygre and Wettestad, 2017).

The availability of accurate and reliable data is a precondition for sound allowance allocation and setting the overall emissions limit. Both aspects are crucial for avoiding allowance over-allocation (Schmalensee and Stavins, Reference Schmalensee and Stavins2015). A solid system for the MRV of GHG emissions from all sources covered by the system is central to a well-functioning GHG ETS – as the EU learned during its first ETS phase in 2005–2008, and likewise Kazakhstan, which established its ETS in a hurry, without a proper MRV system in place (Gulbrandsen et al., Reference Gulbrandsen, Sammut and Wettestad2017). For this reason, building MRV capacity has constituted a major part of most externally funded ETS capacity-building projects (Wang, Reference Wang2013: 8–12; Jotzo and Löschel, Reference Jotzo and Löschel2014: 7; Biedenkopf, van Eynde and Walker, Reference Biedenkopf, van Eynde and Walker2017).

Carbon prices vary with demand and supply. Given the relative unpredictability of these two variables (demand in particular), several trading systems have experienced significant price fluctuations. The EU ETS has faced plummeting carbon prices since 2008 (Wettestad, Reference Wettestad2014; World Bank, 2016: 36–38). The designers of the Regional Greenhouse Gas Initiative and the California ETS learned the lesson of the importance of carbon price management early in their initial policy design phase, thereby avoiding the need for later recalibration of the rules.

In 2016–2017, South Korean allowance prices rose to the highest of any existing ETS at the time (i.e. around €21). The resulting government decision to increase allowances on the market appears to have weakened the South Korean ETS, calling into question its ability to achieve national climate mitigation targets (Biedenkopf and Wettestad, Reference Biedenkopf, Wettestad, Wettestad and Gulbrandsen2018). These examples illustrate some of the lessons that have surfaced through experimentation in various contexts. They teach ETS designers that price management mechanisms may seem important, but that price response decisions must be weighed carefully.

Capacity building has become a tool for fostering the diffusion of GHG ETSs. Because establishing a carbon market requires significant financial, technical and knowledge resources, most countries realise they must expand capacity massively in order to construct an effective system, not least as regards emissions MRV. Capacity building can help a country to design and implement a well-functioning GHG ETS, and the close interaction among actors from different jurisdictions can generate trust. Capacity building is hence a crucial element and tool for carbon market diffusion and for linking individual policies in the polycentric system (Biedenkopf et al., Reference Biedenkopf, van Eynde and Walker2017).

Formal linking of individual carbon markets is the type of interaction that truly binds a polycentric system together. Efficiency gains can be generated by making it possible for System A to use allowances from System B for complying with obligations in System A (and vice versa). Options for low-cost emissions reductions can be increased if cost levels and emission abatement options vary between the systems. Adding more actors can mean greater liquidity, curbing the influence of individual market players and price volatility. Joining carbon markets also helps to reduce the risk of emitters relocating to jurisdictions with lower carbon prices, as the price in linked markets tends to level out at comparable amounts.

However, this is also a highly challenging endeavour, as the linked markets must be compatible, and it makes the involved jurisdictions interdependent. Market rules and decisions like free allocation of allowances can have impacts not only on the carbon market to which they apply but also to any market linked to it (Görlach, Mehling and Roberts, Reference Görlach, Mehling and Roberts2015; Ranson and Stavins, Reference Ranson and Stavins2016). As noted, few GHG ETSs have been linked thus far.

Despite the challenges and risks, actors like the EU have expressed their interest and ambition to develop further linkages, which would increase the degree of polycentricity of the overall global structure. For example, in 2009, the EU launched the (unattained) goal of an OECD-wide carbon market by 2015 and ‘even broader’ in 2020. And the EU also had envisioned a trans-Atlantic carbon market, when a legislative proposal for establishing a national US carbon market seemed likely to be adopted in 2009.

However, this US proposal (known as the Waxman-Markey Bill) was not put to a vote in the US Senate, meaning that the EU had to look elsewhere for linking partners. Contacts between Australia and the EU were stepped up from 2011, but the linking process was abandoned when Australia halted its ETS policies. The closest type of interaction that can bind individual carbon markets together seems also to be the most challenging one. More widespread forms of interaction involve capacity-building initiatives and learning processes amongst the various carbon markets, joining them into a polycentric system.

13.4 A More Polycentric Carbon Market Architecture: Challenges and Opportunities

In this section we ‘zoom out’, focusing on some challenges and opportunities of a more polycentric form of governance. The main challenges – which may also provide opportunities – concern the operation of interlinkages among ETSs, the interaction between ETSs and other climate policies, and diverging levels of carbon prices.

An increasing number of public and private actors – including consultants, ministries, development cooperation agencies, international organisations and universities – are engaging in GHG ETS interaction. They have the potential to act as managers of the polycentric system, and can contribute to aligning and linking individual ETSs more efficiently. However, this role can both further integrate the polycentric system and contribute to its fragmentation. Conflict and competition may cancel out the contributions of these actors, whereas coordination and cooperation can mutually enhance their impact (Biedenkopf et al., Reference Biedenkopf, van Eynde and Walker2017).

The UNFCCC discharges several important functions fostering ETS interaction. For example, the growing emphasis on transparency and solid MRV systems as embedded in the Paris Agreement can enable the proliferation of ETSs and the creation of offset programmes, as solid data provide a foundation for reliable systems. Implementation of the Paris Agreement might lead to new carbon market structures that could create offset markets and joint implementation of climate mitigation commitments. The further elaboration of Article 6 of the Paris Agreement will lay the foundations for these processes and polycentric structures.

Another important driving force is the World Bank. Its Partnership for Market Readiness and Carbon Pricing Leadership Coalition (World Bank, 2017) aim at sharing and orchestrating carbon pricing experiences and building capacity (see Chapter 11). Other central actors include the International Carbon Action Partnership and the International Emissions Trading Association, both engaged in the dissemination of expertise and the fostering of ETS adoption in numerous places.

A first glance at the actors involved in facilitating carbon market interaction suggests a certain division of labour, with different actors engaging with different ETSs or ETS elements. However, deeper analysis of external capacity building supporting China’s ETS pilot projects and national policy process has shown that coordination can still be improved (Biedenkopf et al., Reference Biedenkopf, van Eynde and Walker2017). There are many organisations, among them the World Bank, the International Carbon Action Partnership and the International Emissions Trading Association, and national governments engage in ETS awareness-raising – with the risk of overlap and possibly diverging advice.

Interlinkages within the polycentric carbon market system appear to work fairly well, with little outright conflict or destructive competition. However, their functioning could be improved by avoiding overlaps and by improving interaction management. The management of interactions in polycentric carbon market structures has not yet received much detailed academic attention. Table 13.2 lists some of the key actors and initiatives that foster interaction among, and promote the adoption of carbon markets.

Table 13.2 Selected major international initiatives to foster interaction and promote carbon markets

| Actor type | Carbon market initiatives* |

|---|---|

| International organisations | UNFCCC/Paris Agreement; World Bank Partnership for Market Readiness; World Bank Carbon Pricing Leadership Coalition; Asian Development Bank |

| Governmental organisations | German Development Cooperation Agency; Norwegian Climate and Pollution Agency; UK Foreign and Commonwealth Office; California Environmental Protection Agency; International Carbon Action Partnership |

| Private organisations | International Emissions Trading Association; the Wake-Up Coalition (EU ETS); University of New South Wales (Australia); Environmental Defense Fund (US-based); the Energy Foundation |

* Selected initiatives promoting carbon markets and their interaction; this is not an exhaustive list.

Emissions trading is not the only climate-policy instrument in use. Often it is a core element of a broader policy mix, where overall climate policy goals are broken down into sub-goals, such as improving energy efficiency, increasing the share of renewable energy and diffusing low-carbon technology. While an ETS can help in achieving these aims, it cannot determine how emitters choose to comply. Moreover, an ETS usually covers only some of the emitters within a given jurisdiction – private households, transportation and the land-use sector are excluded from most ETSs. Additional climate policies are usually adopted, to interact with ETS policies. This interaction can be mutually supportive, not least for the overall goal of reducing GHG emissions. However, successful non-ETS policies can contribute to lowering the allowance price, which weakens the incentive structure that an ETS strives to establish. From a polycentric perspective on carbon markets, this complicates linkages among the individual ETSs.

The differing designs and prices globally also pose challenges to the functioning of the system as a whole, as such differences lead to an uneven playing field and can create incentives for carbon leakage. Also, some ETSs (like that of the EU) have experienced significant price fluctuations over the course of time. The contribution of carbon prices to decarbonising the economy (see Chapter 14) depends on such prices reaching levels high enough for cleaner energy choices and technology development to become economically more attractive than purchasing carbon allowances (Bowen, Reference Bowen2011: 7).

However, price incentive effects and dynamics differ among industries and factories, making it extremely difficult to reach precise conclusions as to the carbon price necessary for achieving decarbonisation. Experimentation within a polycentric system can provide flexibility to find appropriate price levels. Low carbon prices may require complementary policy measures, in turn making the design of the policy mix a crucial factor.

While the carbon price has fluctuated drastically in the EU, with no price management mechanisms in operation so far, it has proven more stable in other systems. When the EU system was launched in 2005, the price climbed to around €30, fell to close to zero in 2007, climbed to above €30 again in 2008, before falling steadily to around €5 in 2017. California, with a complex price floor system, had a more stable allowance price ranging between about $10 USD to slightly above $13.5 between 2012 and 2017 (i.e. close to the price floor). In China’s pilot projects, allowance prices were generally low, between about $8 and $1 between mid-2014 and mid-2016. In the early phase of these projects, prices were somewhat higher, peaking at more than $18 in Shenzhen in 2013.

Although prices in the individual ETSs differ, all appear low compared to the carbon price that experts deem necessary to trigger decarbonisation. This raises doubts as to whether the polycentric carbon market system as it is today can deliver deep and fast decarbonisation. The emissions reduction goals set by the various governments are generally met – but broader effects on decarbonisation seem to be lacking (see Chapter 14). The low allowance prices can be attributed mainly to moderate caps in existing systems (Schjølset, Reference Schjølset2017), but also other design features and flaws may make systems incapable of reacting to demand fluctuations resulting from other mitigation policies or external factors (weather, oil prices, etc.). Hence, price management mechanisms are important for moving prices closer to the estimated threshold at which low-carbon investments become economically viable. That also draws attention to the link between the polycentric market structure and national climate policies (see Chapter 3).

Within a polycentric system, widely diverging carbon price levels create competitive inequalities among the entities covered by the various trading systems. Binding the polycentric system closer together through interaction mechanisms that lead to an approximation of carbon prices could level the playing field within the system. However, it would not change the competition with entities operating in jurisdictions outside the polycentric system. Companies covered by one of the ETSs within the polycentric system must compete on an uneven playing field with companies not covered by an ETS. This could have repercussions for the overall effectiveness of the polycentric carbon market system, with companies relocating to jurisdictions without carbon markets (Ostrom, Reference Ostrom2010).

13.5 Conclusions

Over the past 20 years, the field of international carbon trading has grown, from a system initially dominated by the Kyoto Protocol’s country-to-country flexible mechanisms to something far more diffuse. As of 2017, there were 21 individual emissions trading systems in existence at global, regional, national and subnational levels. International and local factors have jointly influenced the diffusion of various ETSs across highly diverse jurisdictions. These ETSs interact in a range of ways – in particular, mutual learning, capacity building and formal market linking. They thereby form a system of polycentric governance, which faces some challenges while also creating some opportunities.

Because a harmonised global carbon market linking all existing systems is highly unlikely to develop, today’s flexibly developing system seems a workable alternative for contributing to global climate mitigation efforts. However, the polycentric nature of this system may lead to overlaps and conflicts, as well as synergistic interactions among the actors involved. Moreover, interaction with other policies may undermine the functioning of carbon markets by inducing drops in the price of allowances – but such policies can also be a necessary complement to emissions trading by more directly supporting low-carbon investments.

Finally, the overall price level across today’s carbon market system appears too low to provide forceful incentives for decarbonising the economy. Yet, the various ETSs that make up the system have succeeded in achieving their individual GHG emissions reduction goals. The mixed picture of achievements and remaining challenges provide ample scope for further research on the polycentric carbon market system – its separate parts, and its overall structure.

Few studies have focused on the role of orchestrators or network managers. A growing number of international organisations, national and subnational governments, ministries, and non-state actors like development cooperation agencies, foundations and companies, are getting involved in connecting ETS developments and encouraging their further diffusion. While the institutional carbon market landscape is becoming increasingly dense and polycentric, there has been scant academic attention to the interaction among the actors and their contribution to shaping the carbon market system.

Recent years have seen several informative studies of the adoption of ETSs and the main factors shaping them (e.g. Knox-Hayes, Reference Knox-Hayes2016; Wettestad and Gulbrandsen, Reference Wettestad and Gulbrandsen2018). There is a need for more in-depth research on the interaction between international processes and domestic politics in shaping ETS designs. A polycentric governance lens offers a useful tool for further conceptualising these processes.

Most trading systems are still rather young. As they mature, carbon price formation and overall functioning are bound to become key research issues, as effective functioning is crucial for systems to fulfil their potential as central drivers of the low-carbon transition. Research has identified the establishment of price-management mechanisms, price floors in particular, as central to effective functioning. However, price floors and management systems vary considerably, and much remains to be learned about their design and operation.

Finally, not least due to the current overall low ambitions and allowance prices in the carbon markets, low-carbon technology development seems so far to have been driven primarily by other economic logics and subsidy systems, rather than carbon markets. A key question then becomes if the polycentric carbon market system will pick up speed fast enough to become a forceful policy driver – or if this instrument will come ‘too late to the low-carbon party’.4