Hydrogen, the simplest of all molecules, made of the simplest of all atoms, is a material that has successfully accomplished many historic missions: it has powered the engines of space rockets and has served in the ammonia-based fertilizer revolution, the iron and steel sector, and electronics manufacturing. But the task of putting hydrogen in the center of the global energy scene has proven tantalizing, perpetually coming closer to materialization, but repeatedly being pushed to the future. Is it possible that the time has arrived for hydrogen to finally come into its own?

A secondary energy source or energy carrier, for example electricity and heat, hydrogen is produced from primary energy sources. It must then be stored and distributed (e.g., as gas or liquid or as a part of an appropriate carrier, such as ammonia and other energy-intensive fuels) for end-use applications through the right infrastructure, and finally converted back to energy. By the time all matter and energy-conversion steps have been taken, the costs and energy invested in the process appear to far outweigh the benefits of hydrogen production. At least that has been the case until recently.

With the Paris Agreement on climate accords in 2015, many countries have set the goal to limit global warming to 2°C or less by the end of the century. In the global collaboration projects and national roadmaps that have been published since, it is clear that hydrogen completes the toolset that is required in order for nations to reduce domestic greenhouse gas emissions and achieve deep decarbonization at a scale of 80% or more. Hydrogen production is expected to be a mixture of water electrolysis techniques, which are carbon-free if powered by renewables, and methane steam reforming or autothermal reforming with carbon capture and storage (CCS), which can reduce carbon emissions up to 90%.

Despite the fact that hydrogen generation from splitting water with electricity is a technique that was discovered more than 220 years ago, today only 4% of the almost 70 million metric tons of hydrogen consumed every year for industrial purposes is produced through water electrolysis. The rest is generated from fossil sources: natural gas, oil, and coal.

The low cost of renewable electricity, in combination with the successful scaling-up of electrolyzer manufacturing and a decrease of its capital expenditure, has heated up debates once more that electrolytic hydrogen can potentially match or even beat steam reforming costs. Unrealistic expectations have been raised before, resulting in much scepticism today. So what has changed? “It takes a lot of electricity to make hydrogen. What's different now is the revolution that made wind and solar power the cheapest sources of electric power in much of the world today,” said Ken Dragoon, executive director at Renewable Hydrogen Alliance, an advocacy organization dedicated to promoting the use of surplus renewable electricity to create climate-neutral fuels in North America. “Until we had these big surpluses of zero carbon low-cost power, [a] hydrogen [-based economy] really didn't make sense. All of a sudden, now it does,’’ said Dragoon.

At the moment, the cost of 1 kg of hydrogen produced by the methane steam reforming of natural gas is at USD$1.50. Green hydrogen, produced using electricity from renewables, costs up to 10 times more. But at the beginning of 2020, H2 V Energies, based in Quebec, Canada, started selling green hydrogen at USD$2.67 per kilogram, a price that is cheaper than diesel.

“In industry, cheaper hydrogen wins, and with the help of renewables, we are moving toward a tipping point where green hydrogen [that is hydrogen produced with energy coming from renewables] will have a massive impact in industry sectors like ammonia, refineries, and methanol,” said Bjørn Simonsen, investor relations and corporate communication at Nel, Norway. Nel is a world leader in alkaline and proton-exchange membrane (or polymer electrolyte membrane-PEM) electrolyzers for large-scale electrolytic hydrogen production.

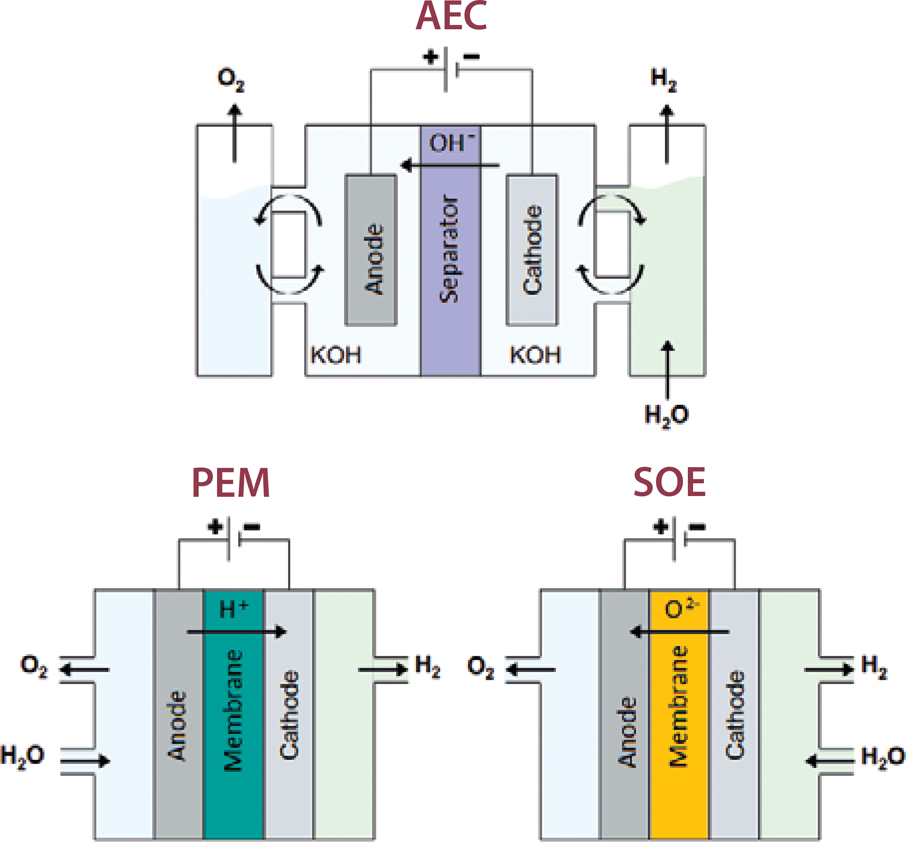

Electrolyzers use electric current to split water into hydrogen and oxygen. Their basic components are two electrodes, an anode for oxygen, a cathode for hydrogen, and a separator. Oxygen is normally vented, but it can also be a product useful for hospitals, space missions, or the chemical industry. Apart from alkaline and PEM technologies, solid-oxide electrolyzers (SOEs) are transitioning to the demonstration phase.

Alkaline electrolysis is the most mature of the technologies, which can scale up to hundreds of MW in size and has dominated the hydrogen production market, until recently. In alkaline electrolyzers, water oxidizes in the alkaline solution. “Classical alkaline electrolyzers use a non-selective microporous diaphragm that is impregnated with the same high concentration alkaline electrolyte solution (i.e., formally anything can pass through),” said Alexandr Simonov, lecturer at the Monash School of Chemistry in Melbourne, Australia, whose work focuses on designing and understanding the mechanisms and operation of high-performing electrocatalytic materials. To produce pure hydrogen with this method, extra peripheral equipment is necessary for the purification, drying, and compression of hydrogen. Thus, this method is usually cost-effective for very large systems only. “Selective OH– membranes are currently being developed, and they are typically not stable enough yet at temperatures above 60°C to be used in industry,” Simonov added.

In an industry marketplace where large-scale steam reformers for hydrogen production without CCS have capex prices between USD$300 and USD$500/kW, Nel first managed to make alkaline electrolysis an option by reducing the electrolyzer's cost. With their new HySynergy hydrogen production project in Fredericia, Denmark, where the initial capacity of the electrolyzer will be 20 MW and the location will be prepared to accommodate for a capacity increase of up to 1 GW, the cost of an alkaline electrolyzer system is decreased by 50%, a number that brings electrolyzers in parity with traditional steam methane reformers with no CCS. In Belgium, a 50 MW demonstration electrolyzer unit at the port of Ostend was announced in January 2020 that will use only excess renewable power, before the completion of an even bigger, commercial-scale unit in 2025.

PEM electrolyzers were commercialized in the last decade, and there is at least one Canadian manufacturer, Hydrogenics, which promotes PEM technology as a less expensive solution for larger electrolyzers. The electrolyte in this case is a polymer, permeable by protons produced by water splitting in the anode. At the cathode, the protons are reduced to hydrogen as a gas. Hydrogen and oxygen are always separated in a PEM electrolyzer, thus some safety issues in alkaline systems are avoided. Separation of the two gases also results in faster response and startup capability in this category, which means that they are more suitable for intermittent power supply. The method allows for the production of high-purity hydrogen directly compressed from the stack.

“The polymer is soft, flexible, and robust; it will not brake, and it works very well at low temperatures, so it is an emerging success for fuel cells and for hydrogen generation and will be in the foreseeable future,” said Truls Norby, professor at the University of Oslo, who specializes in protons in oxides for proton ceramic electrolytes, and also works with membranes for separation of oxygen, hydrogen, and CO2 (for CCS).

PEMs are in the market today, and they are working very well, but of course there is always the potential for improvement of current technologies. For one, PEM systems rely on rare, expensive and finely dispersed precious metal catalysts on the electrodes, such as platinum and iridium, which researchers are looking to replace with lower cost materials. “Even if PEM systems are not very efficient, sunlight is free. You can have as much energy as you like and get as much hydrogen as you need. There is not enough iridium to make catalysts, so we need a breakthrough there,” said Norby. Furthermore, “you cannot use steam, which you have in many cases in industrial plants, nuclear plants, and geothermal plants, and which would make the electrolyzer more efficient,” Norby said. Another issue with PEM units is that the proton-exchange membrane is acidic, making it corrosive to the bipolar plates and current collectors. For this reason, titanium can be used instead of stainless steel, with the drawback that it ends up being a large part of the total cost of the device.

Conceptual depiction of three electrolysis cell technologies: alkaline electrolysis (AEC), proton-exchange membrane electrolysis (PEM), and solid-oxide electrolysis (SOE). Credit: Johannes Kepler Universität Linz.

Extensive work over the years to develop alternatives to precious metal catalysts for PEM systems has resulted in many solutions that work in a laboratory setting. Researchers at the Stanford SUNCAT Center for Interface Science and Catalysis have demonstrated for the first time the translation of a low-cost, non-precious metal catalyst from 1 cm2 lab-scale experiments to a commercial-scale 86 cm2 PEM electrolyzer. Nel manufactured the as-mentioned electrolyzer prototype using a cobalt phosphide (CoP) catalyst for the hydrogen electrode made from CoP nanoparticles deposited on carbon to form a fine black powder. The device was able to operate nonstop for more than 1700 h in the initial tests.

Enapter, an Italian-German startup, has presented another approach by producing a scalable electrolyzer the size of a microwave oven that can produce green hydrogen to support residential or industrial needs. The “anion exchange membrane” (AEM) electrolyzer is “essentially an alkaline system with low-cost materials, but functions in the same way as PEM electrolyzers do, with a solid polymer membrane that separates the anode and cathode. Our AEM electrolyzer operates with a patented cathode, where hydrogen can be directly stored from the stack, with no further treatment,” said Jan-Justus Schmidt, co-founder and CEO of Enapter. In addition, the anode works with a solution of 1% KOH in water, so it is not strongly corrosive, and it can be handled or even shipped without great safety concerns. According to Schmidt, because of its use of low-cost materials, AEM electrolyzers manufactured at scale have the potential to produce lower cost green hydrogen compared to other electrolyzer technologies, particularly with respect to decentralized hydrogen production plants.

The US Department of Energy (DOE) is also funding AEM electrolyzer development efforts within the HydroGEN framework, expecting that the elimination of the most expensive PEM electrolyzer components will offer more than 75% stack cost reduction, thus opening a pathway to meeting the DOE hydrogen production cost target of < USD$2/kg. In early 2020, the EU also chose to fund three different consortia with €2 million each to develop novel materials for AEM electrolysis.

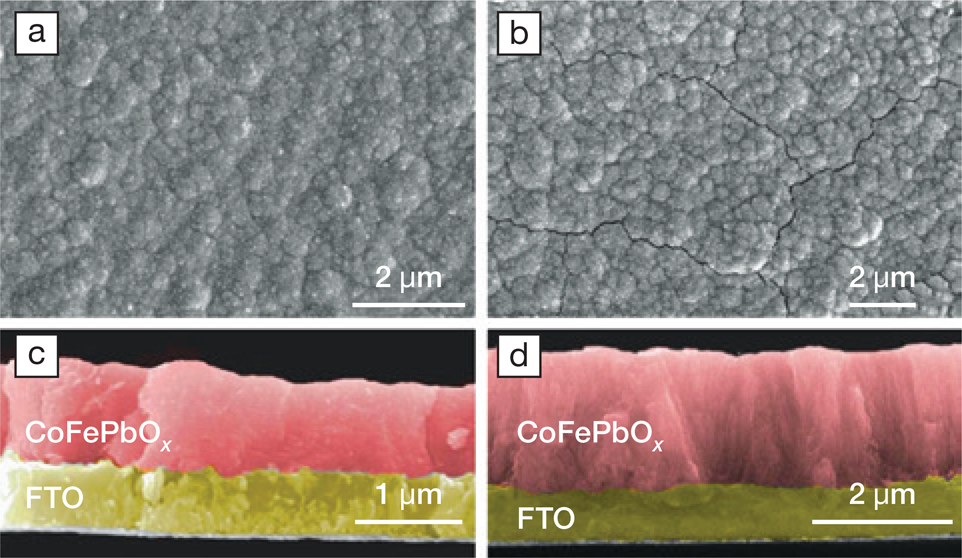

In Australia, Simonov works with his colleagues toward solving the iridium instability and scarcity challenge. Simonov believes that water splitting with acidic electrolytes is most likely to be the future of low-temperature green hydrogen production, if a way is found around the corrosion of noble metals in the extremely harsh conditions at the anode. “We have replaced iridium with a self-healing catalytic system, less efficient but based on more abundant and cheap elements. It is a system with unparalleled stability in very aggressive acidic conditions and an industrially relevant temperature elevated up to 80°C,” said Simonov. Their solution relies partly on cheap renewable electricity to be viable. The Australian Renewable Energy Agency (ARENA) is funding their research, with the goal of raising the efficiencies and developing a scalable electrode fabrication process suitable for industry.

“In Australia, we are witnessing the birth of a hydrogen economy. The country has been so rich in fossil resources, that people here did not realize that hydrogen exists. It took all of these horrible bush fires and droughts connected to the overall climate change for the government to intensify the development of renewables, as well as interactions at the highest level with its international partners in Asia, in the first place, South Korea, and Japan,” said Simonov.

Japanese interest in renewable hydrogen is longstanding, and the country has an action plan to reform the land of the rising sun to a “hydrogen society.” Japan's goal is to reduce the capex cost of electrolyzers for water electrolysis to around USD$450/kW. To achieve this goal, they want to use the outcomes of the demonstration test in Fukushima Hydrogen Energy Research Field (FH2R), in Namie, Fukushima, to expand hydrogen util-ization in designated regions for public deployment. FH2R is a collaboration among the government-supported New Energy and Industrial Technology Development Organization (NEDO), Toshiba, Tohoku Electric Power, and Iwatani Corporation.

Koji Amezawa is a professor at Tohoku University, Japan. He specializes in solid oxide fuel cells and electrochemistry. His work mainly covers the development of electrolyzers with higher efficiency and durability. His research interest is in SOEs, and he works together with Norby on proton ceramic electrolyzers (PCEs), which operate with ceramic electrolytes at very high temperatures (600–800°C), thus enabling higher electrical efficiencies than other electrolyzers.

“SOEs, and especially PCEs, not only split the water to produce hydrogen, but can also directly, electrochemically compress hydrogen to 100 atm or above if the engineering around it can take it. This way, you skip the costly initial step that requires large mechanical compressors to take hydrogen from 1 atm to 100 atm, before small mechanical compressors take it the rest of the way to the required 1000 atm,” said Norby.

“Materials degradation and lifetimes are critical shortcomings that must be improved. The trend is to reduce temperatures down to 600°C,” said Amezawa. Also, to produce hydrogen at a scale corresponding to terawatts of electricity once used in fuel cells, the plants today would need to use ceramic membrane surfaces that would cover areas meas-ured in square kilometers, something that no one is able to do yet.” A square centimeter of a proton ceramic membrane can produce 1 W of power. A breakthrough is needed here as well,” said Norby.

Scanning electron micrographs of electrodes made with the earth-abundant CoFePbOx catalyst, self-healing and stable at industrially relevant temperatures and in strongly acidic conditions. The glass electrodes, on which oxidation of water to oxygen takes place, are coated with fluorine-doped tin(iv) oxide (FTO), and they are produced at 23°C (a, c) and 60°C (b, d). Top view (a, b) and side view (c, d), photos were colored manually post-analysis. Credit: Alexandr Simonov, Nature Catalysis.

Small countries such as Norway can make a difference by investing in projects such as research on ceramic membranes. In the meantime, numerous hydrogen roadmaps have appeared across the world in the last year. In Germany, in late March, the Fraunhofer Institute for Solar Energy Systems presented a pilot project that will test feed hydrogen into the local gas network as a part of the Fraunhofer Society's plan toward a hydrogen economy in Germany. In January 2020, the DOE announced a USD$64 million funding scheme to advance innovations that will build new markets for the H2@Scale initiative. From this, up to USD$15 million is meant for the improvement of large-scale, high-volume electrolyzer manufacturing R&D.

The future of hydrogen from electrolysis could not be brighter or more important. According to a January 2020 report by Thomas Koch Blank and Patrick Molloy from the Rocky Mountain Institute, “When considering what a global energy system on a 1.5°C or 2°C pathway will look like by 2050, hydrogen consistently plays a critical role as a low-carbon fuel. In fact, for several of the hydrogen application areas discussed, there are no other viable pathways to decarbonization.”

“Hydrogen generation via water electrolysis is not a recent invention. It is a very old technology, and if humanity would not have discovered enormous oil resources in the beginning of the 20th century, we would already be using hydrogen. Now in the 21st century, this is very good timing for hydrogen,” said Simonov.