Introduction

Trade-offs are inherent in governing systems with constrained resources. Especially in an era of permanent austerity (Pierson Reference Pierson1996), policy-makers in advanced economies face tough choices. On the one hand, they face social demands related to the emergence of new social risks (Bonoli Reference Bonoli2007), while, on the other hand, the fiscal leeway to expand public spending on social policies has shrunk significantly or is even no longer there (Levy Reference Levy1999; Häusermann Reference Häusermann2010). Consequently, welfare state politics has often become a zero-sum game, where expansions in one area come at the cost of cuts in others. For the purpose of this article, we thus define a trade-off as a situation where individual citizens or policy-makers are forced to prioritise particular policy areas by supporting or opposing spending increases in that area in exchange for cutbacks in another.Footnote 1 Existing research on the macrolevel has shown that these kinds of fiscal trade-offs are real: For instance, governments have been found to cut social and other public investment policies relatively more compared to social transfer policies (Streeck and Mertens Reference Streeck and Mertens2011; Breunig and Busemeyer Reference Breunig and Busemeyer2012; Kraft Reference Kraft2018).Footnote 2

Public opinion is considered an important input in the policy process, but due to limits in the availability of comparative survey data, research on the microlevel focused on unconstrained preferences, ignoring these trade-offs for a long time. Even though a lot of progress has been made on identifying individual- and macrolevel institutional determinants of preferences (see Svallfors (Reference Svallfors2012) and Kumlin and Stadelmann-Steffen (Reference Kumlin and Stadelmann-Steffen2014) for overviews), little is known about individual attitudes of and choices in fiscal trade-off scenarios.

However, there is some recent research in this area which we can build on, exploring the microlevel attitudes and preferences towards fiscal trade-offs among individuals (Busemeyer and Garritzmann Reference Busemeyer and Garritzmann2017; Gallego and Marx Reference Gallego and Marx2017; Neimanns et al. Reference Neimanns, Busemeyer and Garritzmann2018; Garritzmann et al. Reference Garritzmann, Busemeyer and Neimanns2018; Häusermann et al. Reference Häusermann, Kurer and Traber2019, Reference Häusermann, Pinggera, Ares and Enggist2021; Barnes et al. Reference Barnes, Blumenau and Lauderdale2022; Bremer and Bürgisser Reference Bremer and Bürgisser2022a, Reference Bremer and Bürgisser2022b).Footnote 3 An important takeaway from this work is that citizens are generally reluctant to support additional spending in one domain when this implies cutbacks in other parts of the welfare state. A second important finding is that the explanatory power of indicators related to narrowly defined material self-interest tends to increase in constrained/trade-off scenarios, while other indicators such as ideology tend to matter less.

This article connects and contributes to the literature on public opinion towards policy trade-offs. Rather than focusing on partisan ideology or material self-interest as previous studies have done, we study whether and to what extent predispositions about the size of the public sector and the role of the welfare state therein are associated with attitudes towards trade-offs – we refer to these predispositions as fiscal preferences. This research focus is motivated by a puzzling observation that arises from the literature on the social investment state as a new and rising paradigm of welfare state policy-making (Morel et al. Reference Morel, Palier and Palme2012; Hemerijck Reference Hemerijck2013, Reference Hemerijck2018; Busemeyer et al. Reference Busemeyer, Garritzmann, Neimanns and Nezi2018; Neimanns et al. Reference Neimanns, Busemeyer and Garritzmann2018).Footnote 4

This literature finds that social investment policies, in particular investing in education and skills, are highly popular across the board, but still, the politics associated with the recalibration of the welfare state often resemble a “political uphill battle” (Hemerijck Reference Hemerijck2018).Footnote 5 Our article provides a partial answer to the puzzle of why social investment reforms are difficult to implement: Apart from general fiscal constraints on social policy reform on the macrolevel (which we do not explore here), we find that support for social investment policies is particularly low among the traditional supporting coalitions of the welfare state if these investments go along with cutbacks in social transfer programmes. In contrast, support for social-investment promoting recalibration of the welfare state is higher among those that are generally sceptical about the welfare state. This constitutes a dilemma for policy-makers keen on promoting social investment reforms as they tend to come from mainstream left parties: In order to promote social investment, they either have to convince the traditional welfare state supporting coalitions to accept hard trade-offs or they need to appeal to welfare state sceptics that are usually not part of their electoral constituency.

To empirically verify this claim, we use a novel and unique dataset from the INVEDUC (“Investing in Education in Europe”) project, which provides survey data from eight Western European countries on individual preferences regarding trade-offs within the welfare state as well as fiscal policy preferences (see Busemeyer et al. Reference Busemeyer, Garritzmann, Neimanns and Nezi2018 for a general overview). Following a brief presentation of our theoretical framework in the subsequent section, we identify five distinct “fiscal policy types,” which are characterised and defined by different degrees of support for the welfare state relative to other areas of public spending. Further, we study to what extent these fiscal policy types are related to support for different kinds of trade-offs within the welfare state.

Theoretical framework

Fiscal preferences and support for the welfare state: A two-dimensional view

Scholarship on individual and institutional determinants of citizens’ attitudes and preferences on the welfare state has grown significantly in recent years, thanks to the availability of high-quality comparative survey data. Studies have shown that material self-interest in terms of income, labour market status and risk, age or educational background can largely account for variation in individual-level attitudes and preferences (for a few examples from this tradition, see e.g. Papadakis and Bean Reference Papadakis and Bean1993; Iversen and Soskice Reference Iversen and Soskice2001; Svallfors Reference Svallfors2004; Cusack et al. Reference Cusack, Iversen and Rehm2006; Busemeyer et al. Reference Busemeyer, Goerres and Weschle2009; Beramendi and Rehm Reference Beramendi and Rehm2016; Rehm Reference Rehm2016; Neimanns Reference Neimanns2021). Furthermore, norms and ideological predispositions are also correlated with welfare state attitudes (Feldman and Zaller Reference Feldman and Zaller1992; Kangas Reference Kangas2003; Jost et al. Reference Jost, Krochik, Gaucher and Hennes2009; Dimick et al. Reference Dimick, Rueda and Stegmueller2018). Finally, recently, scholars have paid more attention to the role of policies and institutions that set in motion complex processes of policy feedback between the macro- and the microlevels (Pierson Reference Pierson1993; Gingrich and Ansell Reference Gingrich and Ansell2012; Kumlin and Stadelmann-Steffen Reference Kumlin and Stadelmann-Steffen2014; Jacobs and Weaver Reference Jacobs and Weaver2015; Busemeyer et al. Reference Busemeyer, Abrassart and Nezi2021).

What is missing in this literature so far, however, is an analysis of how general fiscal policy preferences might be connected to social policy attitudes. To some extent, this research gap is easy to explain for two reasons. First, it is a common assumption (which is also supported empirically) that support for different kinds of social policies tends to be correlated with overall support for the welfare state and the public sector. Furthermore, there are obvious concerns related to endogeneity in this respect: General support for a larger public sector and the welfare state could drive support for individual policies and vice versa. Given this close link between fiscal policy and social policy preferences, scholars have generally abstained from developing theoretical accounts regarding the potential relationship between the two. Second, on a more empirical level, conventional surveys of public opinion usually do not contain detailed questions on fiscal policy preferences, although there is important variation in attitudes across different dimensions of fiscal policy as we explain further below.

At a second glance, the relationship between fiscal policy preferences and support for particular social policies is not that obvious. Is it really the case that individuals who are generally in favour of expanding the size of the public sector equally support the expansion of social policies across the board or do they prioritise some areas over others? And what about individuals that are in favour of cutting back the welfare state, but are satisfied with the overall size of the public sector because they support spending in other domains beyond the welfare state – which social policies would they cut back first?

In short, we posit that there is a lot of variation in fiscal policy preferences that remains hidden if one only looks at the general support for or opposition to the welfare state. Conceptually, we distinguish between two dimensions: The first dimension refers to preferences regarding the overall size of the public sector, i.e. the amount of tax revenue and overall public spending relative to the national economic output. The second dimension captures preferences about the distribution of taxes and spending across the different subsectors of the public sector. As data from the OECD show (Appendix A), the welfare state – in particular, if it is broadly defined to include social protection, education, and health – covers the bulk of public spending. However, across OECD countries, a good third of public spending is devoted to other sectors, such as defence, environmental issues, or law and order policies. As has already been pointed out by Castles (Reference Castles2007), these other domains of public spending often get neglected in scholarly research.

In line with this idea, we argue that one cannot simply assume ex ante that a general inclination to support a larger public sector is automatically associated with higher support for a larger share of spending devoted to the welfare state (as part of the public sector). It might well be possible that individuals supporting a larger public sector would rather like to see more spending on defence or law and order policies than a further expansion of the welfare state. Vice versa, someone who is generally in favour of a smaller public sector might be in favour of cutting back other parts of spending (such as defence) but maintaining the current size of the welfare state. Eventually, it is an empirical question if preferences for the size of the public sector are correlated with preferences regarding the distribution of spending within this public sector. Conceptually, these are distinct dimensions. Below, we will show that there is also some empirical evidence that they are not as tightly correlated as often assumed.

In order to transform these general ideas into testable hypotheses, we propose a simple conceptual framework of fiscal policy types (Table 1), defined by the two underlying dimensions discussed above. In principle, the framework has nine cells, defined by three categories in the two dimensions each (more, the same, less overall spending plus more, the same or less focus on social policy). In practice, the number of cells is reduced because of particular constraints in the operationalisation due to the construction of the survey questions used in the analyses (see below for details) as well as theoretical considerations regarding the meaningfulness of certain combinations. Hence, mapping out the different combinations of fiscal policy preferences yields five “fiscal policy types”:

-

1. A group of citizens might be both willing to increase the size of the public sector and devote more resources to the welfare state. This type refers to public spending enthusiasts: they are in favour of expanding the size of the public budget by increasing taxes and/or debt to finance additional welfare state spending.

-

2. A second possible combination is that of support for additional social spending while keeping the overall size of the public budget constant. This group of welfare state fans is willing to support cutbacks in other parts of the public sector in order to finance more social spending, which is an important difference to the public spending enthusiasts. Due to the limitations of our data, we cannot distinguish further between those who would prefer to maintain the size of the public sector and those who would be willing to reduce the overall size of the public sector while still devoting more resources to social policy, relatively speaking. Hence, this group covers two cells in Table 1.

-

3. A third group is satisfied with the current status quo in terms of social spending and, by implication, the overall size of government spending. These are the status quo lovers who neither support expansion nor cutbacks in public or social spending. Empirically, it is well-known that the group of status quo lovers is sizable in most countries, although it remains a matter of debate to what extent the strong support for the status quo expressed in public opinion surveys is a genuine measure of spending support or rather a methodological artefact (Goerres and Prinzen Reference Goerres and Prinzen2012).

-

4. The group of welfare state critics prefers to devote fewer resources to social policy and to spend more on other areas of government activity (such as defence, law and order, industrial policy). Again, our data do not allow us to further distinguish between individuals within this group who would like the overall size of the public sector to stay constant and those whose support for spending in other domains is so significant that it would imply an expansion of the public sector despite supporting cuts in social policy spending.

-

5. A fifth group are citizens that support the retrenchment of the welfare state as well as a reduction in public spending in general. We call this group the public spending sceptics. Empirically, we expect this group to be small in size since, at least in Western Europe, the welfare state and the public sector, in general, represent a significant share of economic activity. It has created a sizable clientele that depends on the continued existence of welfare state and public sector programmes and opposes retrenchment (Pierson Reference Pierson1993; Brooks and Manza Reference Brooks and Manza2007).

Table 1. A fivefold categorisation of fiscal and social preferences

In the empirical analysis below, we demonstrate the usefulness of this simple framework by highlighting the fact that there is meaningful variation in preferences across the different fiscal policy types. Furthermore, we engage in a short, rather exploratory analysis of the microlevel determinants of fiscal policy types, which shows that these are not strongly related to other indicators of material self-interest, providing some indicative evidence that they are not simply endogenous or covariates of other independent variables.

Fiscal policy types and social policy trade-offs

Next, we move on from general fiscal policy preferences to attitudes towards fiscal trade-offs, our dependent variable. We build on a burgeoning literature that highlights the importance of fiscal and social policy trade-offs, analysing public opinion with innovative survey questions (Busemeyer and Garritzmann Reference Busemeyer and Garritzmann2017; Gallego and Marx Reference Gallego and Marx2017; Garritzmann et al. Reference Garritzmann, Busemeyer and Neimanns2018; Neimanns et al. Reference Neimanns, Busemeyer and Garritzmann2018; Häusermann et al. Reference Häusermann, Kurer and Traber2019, Reference Häusermann, Pinggera, Ares and Enggist2021; Barnes et al. Reference Barnes, Blumenau and Lauderdale2022; Bremer and Bürgisser Reference Bremer and Bürgisser2022a, Reference Bremer and Bürgisser2022b). In other more commonly available research designs and surveys that do not focus on trade-offs, it is hardly possible to provide a more fine-grained analysis of the different dimensions of fiscal and social policy preferences due to the endogeneity concerns discussed above. This is different for detailed and hypothetical trade-off scenarios: It is unlikely that preferences about these trade-offs would influence the general predispositions of individuals towards the size of the public sector and the distribution of spending within it. Rather, it is plausible to assume that these general predispositions will determine attitudes towards specific trade-offs once they are activated and primed in surveys. Thus, our research design assumes (plausibly, we would argue) that general fiscal policy preferences are causally prior to attitudes towards particular trade-offs. Still, we do not claim to identify causal effects in the strict sense here, since the experimental part of the survey below does not involve an experimental manipulation of fiscal policy preferences, which are based on observational survey data.

Furthermore, from the perspective of welfare state research, our analysis aims at providing a partial answer to the puzzling observation that the recalibration of welfare states is politically challenging even though these kinds of policies are generally highly popular. It is well-known that another partial answer to this puzzle is given by the simple fact that policy-makers are constrained by fiscal austerity pressures in many countries. In this article, we rather probe whether there are deeper attitudinal patterns that explain why the political support for the social investment welfare state is actually not as high as it seems on the level of individual attitudes. Regarding the dependent variable, we, therefore, focus on support for social investment policies, traded off against cutbacks in the more traditional parts of the welfare state, i.e. social protection for the elderly and the unemployed (more details on the operationalisation are provided below).

Our central hypothesis is that general fiscal policy preferences regarding the size of the public sector and the distribution of public spending will be systematically associated with attitudes towards trade-offs. Public spending enthusiasts who support both a larger public sector and more spending on the welfare state within the public sector are most likely to be opposed to spending increases in one domain in exchange for cutbacks in other parts of the welfare state. Since they would like to see additional spending on all types of social programmes (social investment as well as social protection), they are likely to respond negatively to questions that force them to prioritise between different policies.

Welfare state fans, in turn, who are in favour of a larger welfare state, but would not necessarily expand the overall size of the public sector, should be more in favour of expanding social investment policies, as they respond to newly emerging social risks such as single parenthood, having low skills, or long-term unemployment. However, they are typically also part of the supporting coalition of the traditional welfare state. Hence, they are likely to be particularly cross-pressured and therefore indifferent when forced to choose between different social policies.

In contrast, welfare state critics who generally support generous public spending, but would like to see a redistribution of spending resources away from the welfare state to other domains, should be less reluctant to support trade-offs. Given that other forms of public spending are typically less redistributive than social spending and that, in turn, social investment policies are also likely to be considered less redistributive than social transfers, welfare state critics should be more supportive of expanding investment spending even if it means cutting back other social policy programmes, in particular if the latter are targeted at groups that are generally regarded as less deserving (see below).

Finally, it is more difficult to formulate concrete expectations for public spending sceptics who would like to shrink the overall size of the public sector. Ex ante, it is not obvious how these individuals would respond to forced questions about spending increases when in fact they would rather favour retrenchment. We hypothesise that mirroring the preferences of public spending enthusiasts, the sceptics should be more in favour of spending increases on education and social investment, because these are believed to be less redistributive and to contribute to the further development and growth of the economy, i.e. goals that benefit society as a whole rather than particular target groups of welfare state benefits.

As a subsidiary hypothesis to our expectations sketched out in the previous paragraphs, we posit that there are likely differences in attitudes towards different kinds of trade-offs, depending on whether the expected cutbacks are supposed to affect more or less deserving groups. Broadly speaking, the literature on “deservingness” (e.g. Kangas Reference Kangas2003; van Oorschot Reference van Oorschot2006; van Oorschot and Meulemann Reference van Oorschot, Meuleman, Kumlin and Stadelmann-Steffen2014; Jensen and Petersen Reference Jensen and Petersen2017) has demonstrated that citizens regard particular groups of welfare state beneficiaries as more or less “deserving” of support from the welfare state, depending on, for instance, whether potential beneficiaries are in control over their “neediness,” the degree of need, whether recipients share an identity with those that are expected to finance the welfare state, whether potential recipients have the right “attitude,” or whether there is some sense of mutual reciprocity. A limitation of the literature on “deservingness” is that it remains somewhat ambivalent regarding the underlying mechanisms that shape deservingness perceptions. On the one hand, the theory implies that normative considerations are central here. On the other hand, however, it could also simply be the case that deservingness perceptions reflect the “size” of particular welfare state constituencies and thereby the likelihood that individuals might require welfare state support at some point in their life. We cannot fully resolve this ambiguity here but recognise it as a limitation.

Van Oorschot (Reference van Oorschot2006) has identified a common pattern of deservingness perceptions across countries, according to which pensioners are typically regarded as more deserving of welfare state benefits compared to the unemployed. This is because pensioners have “earned” their right to redeem a pension through hard work throughout their lifetime so that there is a high degree of reciprocity as well as a shared identity between the working population (i.e. future pensioners) and pensioners. In contrast, the unemployed tend to be regarded as less deserving since they are believed to be in control of their need – they could “simply” get a job, and there is less of a shared identity between the economically secure middle classes and the unemployed. We expect that the notion of deservingness helps to explain variation in support across trade-off scenarios, i.e. individuals are expected to be more supportive of spending increases on social investment policies that go along with cutbacks in benefits for the unemployed rather than for pensioners. We expect this pattern to be more pronounced for those that are already quite sceptical of the welfare state and a large public sector.

As a final remark, we refrain from developing a special hypothesis on the status quo lovers since we treat them as the reference group in the empirical analysis below. Moreover, we do not develop hypotheses regarding variation across countries. Even though the survey we use covers eight countries, the survey respondents are assigned to four different treatment groups in each case, so that the number of observations per group per country is too small to derive reliable estimates. Instead, we regard our respondents as a stratified sample of the universe of the Western European population.

Empirical analysis

To analyse whether and how fiscal preferences influence attitudes towards the welfare state, we use data from the project “Investing in Education in Europe” (INVEDUC). Existing cross-national surveys such as the European Social Survey (ESS) or the International Social Survey Program (ISSP) generally do not include questions about both fiscal and social policies. Consequently, we use the INVEDUC survey, which was fielded in eight Western European countries in April and May 2014.Footnote 6 In each country, 1,000 to 1,500 respondents were randomly drawn from the population and interviewed by phone. The total number of observations was 8,905 (see Busemeyer et al. (Reference Busemeyer, Garritzmann, Neimanns and Nezi2018) for more details), and the summary statistics of our data are shown in Appendix B.

Predicting fiscal policy types by socio-demographic characteristics

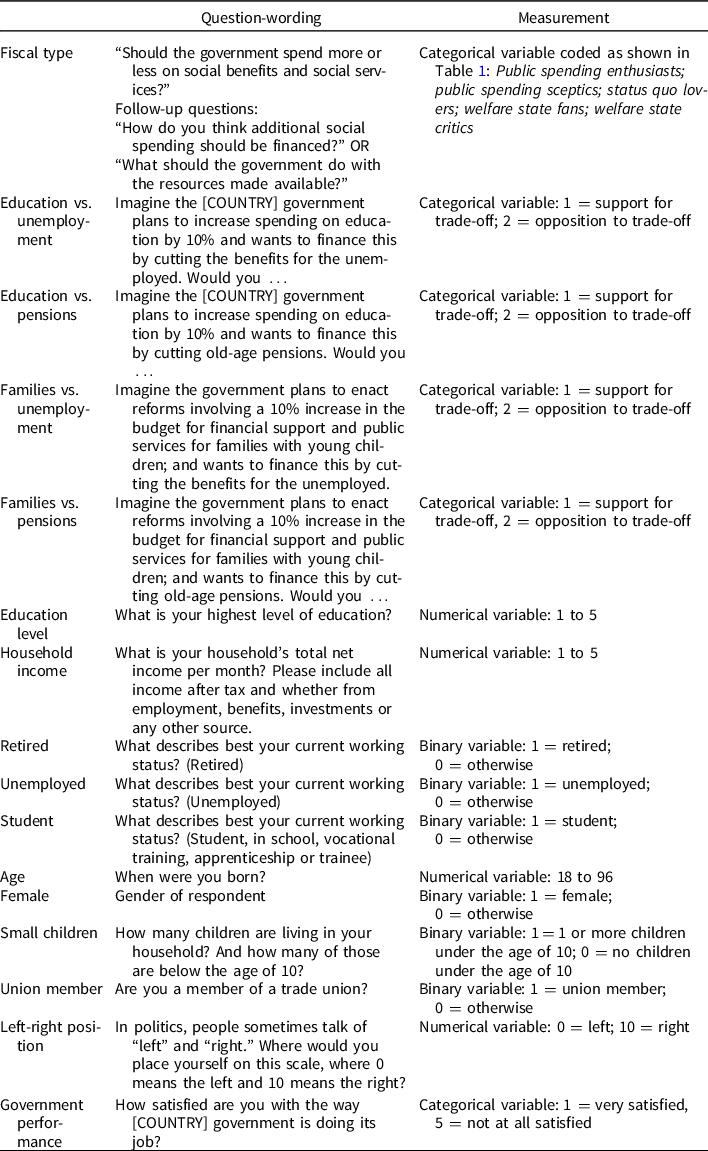

The survey mostly included questions about education policies, but it also included questions about fiscal and social policy trade-offs. Table 2 shows the operationalisation of all variables from the survey used here. In order to measure fiscal policy preferences, we use three questions about attitudes towards fiscal policies to construct the five types as outlined above. Respondents were first asked the following filter question: “Should the government spend much more, more, the same, spend less or much less on social benefits and social services?” Respondents who chose the category “the same” were coded as status quo lovers. When responding “more” or “much more,” respondents were asked a follow-up question: “How do you think additional social spending should be financed?” Respondents who indicated that the government should spend (much) less were subsequently asked: “What should the government do with the resources made available?” The options for both follow-up questions included changes in taxes, public debt, and other areas of public spending. Respondents supporting (much) more social spending and indicating that this additional spending should be financed by tax or debt increases were coded as public spending enthusiasts, whereas those that prefer to “cut back other areas of spending” were coded as welfare state fans. Analogously, those who wanted (much) less spending in principle were divided into welfare state critics (when indicating that spending decreases on social policy should go along with spending increases “in other areas of public spending”) and public spending sceptics (when stating that decreasing social spending should be associated with decreasing taxes and public debt).

Table 2. Operationalisation of dependent and independent variables

The distribution of respondents across these categories in all countries is plotted in Figure 1.Footnote 7 It shows that the largest group of respondents are status quo lovers, preferring to keep spending levels as they are. The second-largest group, about a third of all respondents, are the welfare state fans, supporting a greater focus on social spending while keeping the overall balance of government spending constant. These respondents hence support a recalibration of government spending towards more social spending and less spending in other areas such as defence, police, or the environment. About 13% can be identified as public spending enthusiasts who do not mind increasing social spending via higher taxes and debt. Even though there are fewer respondents who generally favour cutbacks in social spending, about 12% of respondents make up the group of welfare state critics that support cutbacks in social spending while keeping public spending on other domains constant. Only 5% are fully fledged public spending sceptics that demand general retrenchment of public and social spending.

Figure 1. Distribution of the different fiscal types in all countries (pooled).

Note: The figure shows the share of respondents classified according to the framework shown in Table 1.

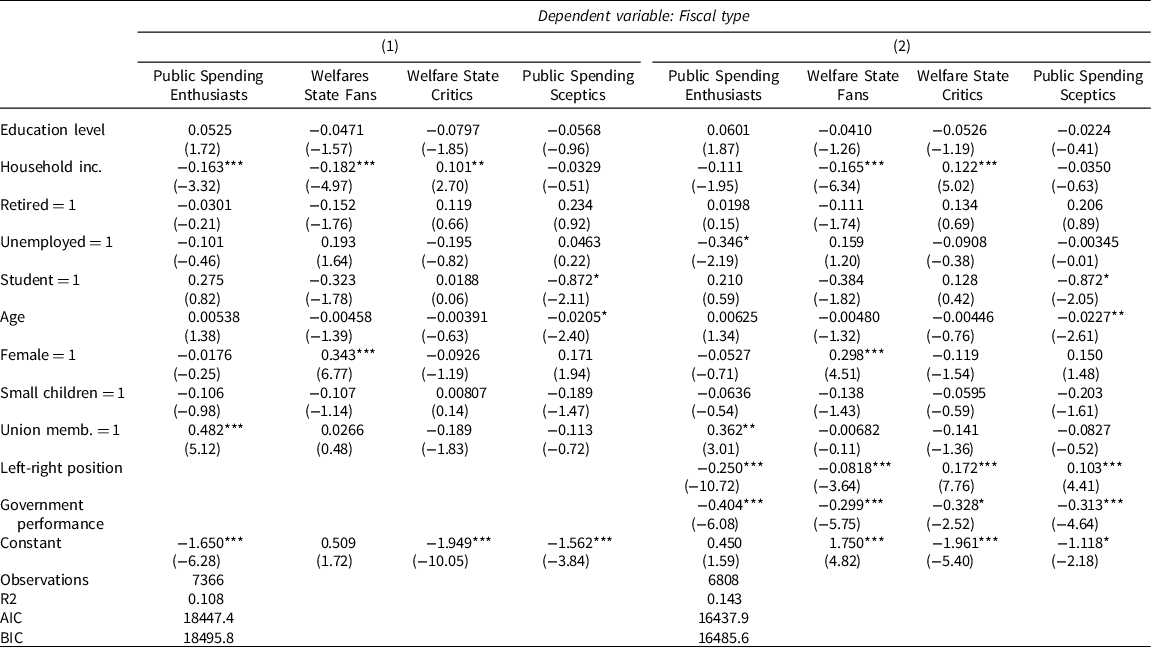

Still, aggregate distributions hide a lot of variation at the individual level. Even though the main part of our analysis focuses on the association between fiscal policy types and attitudinal patterns for different kinds of social policy trade-offs, we perform a brief analysis of the determinants of fiscal policy types. We use multi-nominal logit regression models, which predict the probabilities of respondents falling into the different fiscal policy types as defined above, using the status quo lovers as the reference category. Our independent variables include education, income, labour market status, age, gender, union membership, and ideology. To control for possible clustering of observations at the country level, we use country-fixed effects and clustered standard errors.Footnote 8

The results are shown in Table 3. By and large, we do not find any strong associations between individual socio-economic characteristics and fiscal policy types, as shown by model 1 (in the first four columns). The only significant exception here is individual income: Respondents with a lower household income are more likely to be public spending enthusiasts or welfare state fans, while people with a higher income are more likely to be welfare state critics. Union members are more likely to be public spending enthusiasts, while women tend to be welfare state fans, which is in line with previous work in the literature. Apart from these results, however, we do not find any solid evidence that fiscal policy types are determined by educational background, age, or labour market status. Hence, even though this is only indicative evidence, we are confident that our measure of fiscal policy taps into dimensions of individual-level attitudes that are not fully explained by socio-demographic characteristics.

Table 3. Predicting fiscal type by different socio-economic characteristics and attitudes

t statistics in parentheses.

*p < 0.05, **p < 0.01, ***p < 0.001.

Model 2 includes controls for respondents’ ideology and evaluation of the government’s performance, which are correlated more strongly with fiscal policy types. First, people who evaluate the government’s performance positively are more likely to be status quo lovers than any other group. They are least likely to be public spending enthusiasts, but they are also much less likely to support a reduction of public spending or a shifting of resources across areas of government spending. In contrast, people with strong ideological predispositions are less likely to support the status quo. As could be expected, people that consider themselves right-wing are less likely to be public spending enthusiasts and welfare state fans and more likely to be welfare state critics or public spending sceptics.

The association between fiscal policy types and attitudes towards social policy trade-offs

In the next step of the analysis, we assess whether and to what extent fiscal policy preferences are related to attitudes about trade-offs in social policy. Regarding our main dependent variable, we make use of several trade-off questions in the INVEDUC survey. In the first scenario, respondents were asked:

“Imagine the [Respondent’s country] government plans to increase spending on education by 10 % and wants to finance this by cutting the benefits for the unemployed. Would you strongly agree, agree, neither agree nor disagree, disagree, strongly disagree?”

In the second scenario, respondents were confronted with “cutting old-age pensions” in exchange for increasing education spending, whereas in the third and fourth scenarios, education spending was exchanged with “financial support and public services for families with young children,” again to be traded off with cutbacks for the unemployed (third scenario) and old-age pensions (fourth scenario), respectively. Of course, the proposal to increase spending by 10% is necessarily arbitrary to some extent. The challenge here is to use question-wording that is comparable across countries with significantly different preexisting spending levels. The “10%” figure suggests a significant, yet still realistic and not dramatic increase in spending, relative to existing spending levels.

Respondents were randomly assigned to the different scenarios and were only asked about their opinion towards one trade-off scenario, achieving an equal balance of respondents according to their socio-economic profile across these groups (see Appendix C). Since the sample was split four ways in each country, the number of observations per country and treatment condition is not sufficient to engage in detailed analyses of cross-country attitudes on trade-offs. We thus focus on the cross-national sample in the following.Footnote 9 In order to simplify the analysis and to improve the ease of interpretation of findings, we transformed responses on the five-point scale of agreement/disagreement into binary variables where a value of “1” indicates agreement (strongly agree or agree) whereas the remaining categories are coded as “0.”

The distribution of support for recalibrating the welfare state across the four different trade-off scenarios is shown in Figure 2. It indicates that support for recalibration is relatively low across the board, as respondents generally oppose cutbacks of existing social programmes. Yet, support for the recalibration towards social investment policies still varies strongly by trade-off scenario: when education spending is increased at the expense of unemployment benefits, 21% of respondents are supportive, while only 8.5% are supportive when this is financed at the expense of old-age pensions. Similarly, 18% of respondents support the increase of financing support and public services for families with young children when it comes at the expense of unemployment benefits but only 9.6% support it when this leads to a reduction of old-age pensions. When cutbacks are targeted at a social group that is seen as less deserving – the unemployed – support for unpopular trade-offs is thus much higher than when it is targeted at more deserving individuals, confirming our auxiliary hypothesis put forward above.Footnote 10

Figure 2. Support for trade-offs across the four different scenarios.

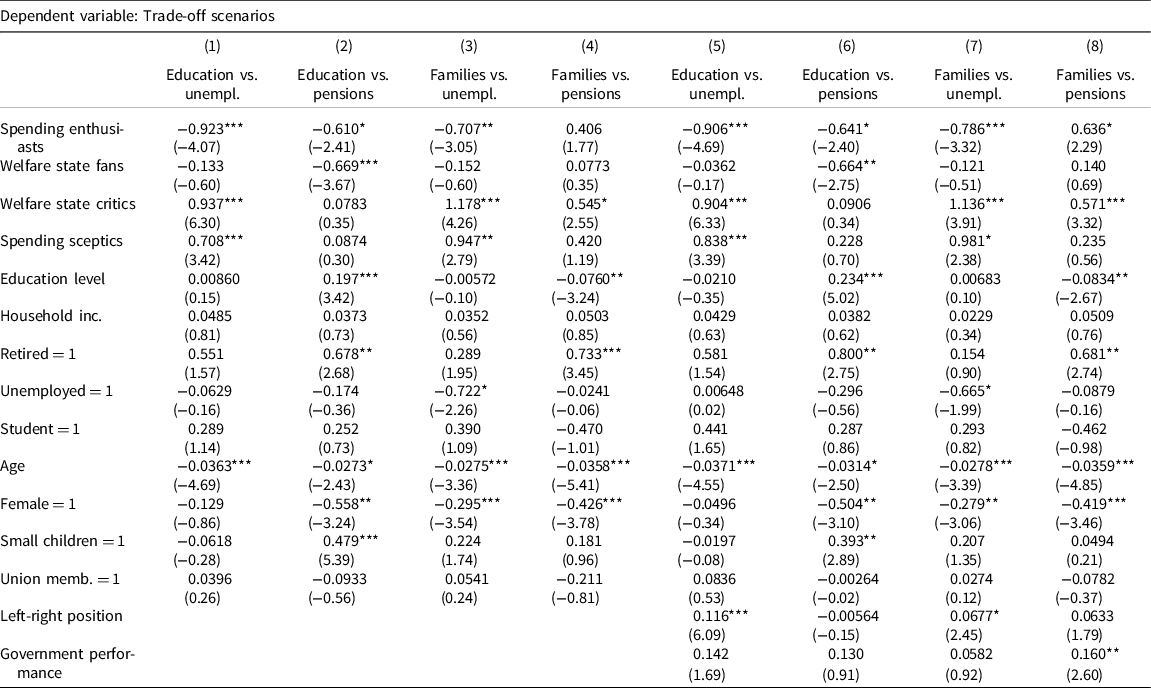

In the following analysis, we use responses to the four scenarios as the dependent variable and the fiscal policy types as the key independent variables. We run logistic regression models and rely on the same control variables as above.Footnote 11 The results are shown in Table 4. To ease the interpretation of the results, we also plot the marginal effects of the different fiscal policy types on support for the trade-off scenarios in Figure 3.

Table 4. Predicting support for social policy trade-offs by fiscal type

t statistics in parentheses.

*p < 0.05, **p < 0.01, **p < 0.001.

Figure 3. Marginal effect of fiscal types on support for different trade-off scenarios.

Note: Marginal effects are calculated based on Model 1–4 in Table 4. Ninety-five percentage confidence intervals are shown and country-fixed effects included.

The results suggest that attitudes about social investment-related trade-offs are, indeed, systematically correlated with the fiscal policy types, confirming our central hypothesis. As expected, public spending enthusiasts are opposed to spending increases across the board if these spending increases go along with cutbacks in other public spending programmes, with one important exception. Somewhat surprisingly, they are in favour of spending increases for families with young children in exchange for cutbacks in pensions. As shown above, this last scenario is relatively unpopular, but public spending enthusiasts are apparently more willing to support the recalibration of the welfare state when this benefits a clearly identifiable and visible group, such as young families, which might be perceived as even more deserving of welfare state support than pensioners, potentially because of greater need.

Again in line with our expectations, the second group – the welfare state fans – seems to be cross-pressured and does not have clear preferences that are different from the status quo lovers in most scenarios. They generally support spending for a variety of different welfare state beneficiary groups, which means that they are not different from the status quo lovers when it comes to welfare state recalibration. By definition, they support an increase in government spending on social policies at the expense of other areas of government spending and hence favour a broader trade-off over the narrow trade-offs studied here, which pit different welfare state constituencies against each other. Yet, there is one exception to this general trend: when spending on education is supposed to be financed by cutbacks in old-age pensions, welfare state fans are more likely to disagree than status quo lovers. As expected in our subsidiary hypothesis, welfare state fans thus dislike cuts in social programmes aimed at deserving recipients (pensioners), and this is especially the case when such cuts benefit a diffuse group (the “educated”).

The third group – the welfare state critics – is generally less supportive of the traditional welfare state. It is easier for them to accept cutbacks in welfare state programmes, and they are thus more willing to support the expansion of education and family policies even in the face of cutbacks in other parts of the welfare state. As expected in our subsidiary hypothesis, the support for spending increases depends on whether the cutbacks would affect more or less deserving target groups: In the scenarios where recalibration towards social investment comes at the expense of the unemployed, welfare state critics are much more supportive of the trade-offs compared to the scenarios where recalibration comes at the expense of old-age pensioners. This is generally true for both education and family policies, although welfare state critics are more willing to accept lower pensions when this benefits a clearly identified and deserving group, namely young families.

Finally, Figure 3 shows that public spending sceptics are not much different from welfare state critics. Here, we would have expected a more uniform pattern of support across the trade-off groups, as in the case of public spending enthusiasts. However, similar to the welfare state critics, the public spending sceptics are on average more accepting of social investment spending increases, since these policies may be perceived as less redistributive and potential more beneficial for overall economic growth and development. We also find different levels of support for spending increases, depending on whether the target group of cutbacks are deemed deserving or not. Given the small size of the group of public spending sceptics, the confidence intervals of these coefficients are larger, however.

Models 5–8 in Table 4 indicate that the general patterns discussed above hold even when we include ideological variables as independent variables in the regression. Of course, these variables are endogenous to some extent, but the models show that our main findings are robust to the inclusion of these additional factors. For instance, people who evaluate the performance of the government positively may be more likely to support cutbacks because they trust that the government will navigate the trade-offs appropriately. People who consider themselves right-wing are more likely to support cutbacks that hurt the unemployed than policies that hurt pensioners. Thus, especially right-wing individuals seem to consider notions of “deservingness” in their evaluation of the different trade-off scenarios. For our purposes, however, it is important to note that these effects do not diminish the importance of the fiscal policy types. All results observed in models 1–4 still hold, which indicates that taking into account individual, varying fiscal policy preferences provides important additional insights into the attitudinal dynamics of social policy trade-offs.

Conclusion

To sum up, this article has provided a differentiated analysis of preferences towards fiscal and social policy trade-offs, contributing to a new and expanding field of research. The article’s contribution is twofold. First, our article helps to understand how individuals perceive and react to fiscal trade-offs in the social policy domain. Existing research shows that the common determinants of preferences towards individual social policies cannot explain how individuals react to trade-offs (Busemeyer and Garritzmann Reference Busemeyer and Garritzmann2017) but knowledge of the factors that drive attitudes towards trade-offs is still limited. Our findings point to the importance of fiscal policy preferences for attitudes towards trade-offs. Furthermore, we show that fiscal policy preferences are more complex than commonly assumed. We have argued conceptually and shown empirically that the common assumption of a tight correlation between support for a larger public sector and more spending devoted to the welfare state is too simplistic. Instead, it is necessary to distinguish between preferences regarding the overall size of the public sector and the distribution of spending across different subsectors and the balance between social and non-social spending in particular. Applying this more fine-grained conception of fiscal policy preferences is particularly helpful when studying the dynamics of fiscal trade-offs that are inherently related to the distribution and redistribution of spending resources across different parts of the public sector.

Second, and more directed at the social investment literature, our article provides a partial answer to the puzzling observation that a recalibration of welfare states towards the social investment model is politically difficult, despite the overall popularity of social investment policies (Bremer and Bürgisser Reference Bremer and Bürgisser2022b). One important aspect here is our finding that overall support for the redistribution of resources between different social policy areas, which would be required to the extent that not all additional spending on social investment can be financed with tax or debt increases, is low. Importantly, it is particularly low among those who tend to be staunch supporters of a large public sector and a generous welfare state. Vice versa, willingness for such a recalibration is higher among those who have a sceptical view of the welfare state.

Politically speaking, this poses a dilemma for the proponents of the social investment welfare state who typically come from the mainstream left. To win support for recalibration, they would need to appeal to welfare state critics or public spending sceptics, who are not traditionally part of their constituency. To achieve this, policy-makers from the left may want to emphasise the non-ideological and more economic aspects of social investment policies, including how they support economic development and growth rather than social inclusion. In contrast, policy-makers from the mainstream right interested in expanding social investment need to appeal to the welfare state supporters by combining social investment with policies that foster social inclusion in order to win broad support for welfare state recalibration.

Our analysis, however, cannot account for the fact that policy preferences may not be fixed. Forming attitudes towards trade-offs is difficult because – by definition – they involve tough choices. As a result, we find that people rely on general predispositions towards the state to form preferences, but elites may also be able to influence preferences through cueing or framing. It is an important question for future research whether and to what extent proponents of the social investment state may use this to generate support for welfare state recalibration in advanced economies. Another issue for future research would be to pay more attention to the variation of fiscal policy preferences across countries – an issue which we did not focus on in this article, as we were primarily interested in analysing the association between fiscal policy preferences and attitudes towards trade-offs more broadly.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/S0143814X22000095

Data Availability Statement

Replication materials are available in the Journal of Public Policy Dataverse at https://doi.org/10.7910/DVN/LQUPJW.

Acknowledgements

We are grateful for insightful comments from four anonymous reviewers and the editors of the Journal of Public Policy. Robin Hetzel provided invaluable research assistance. This research was supported with a Starting Grant from the European Research Council (ERC), Grant No. 311769.