1 Introduction

Trading is a cornerstone of economic exchange and may take on many forms. In a simple trade, two people may opt to exchange one item for another (e.g., trading an apple for a banana at lunch or swapping a pen for a pencil at the office). More complex trades involving items of differing value may require determining how many of one item are equivalent in value to another item (e.g., deciding that two notebooks are worth three folders). Although simple and complex trades are likely to differ across many dimensions, they share a key feature; namely, the two agents engaged in the trade each have something that the other wants. This is one of the reasons that trade can be so valuable — it leverages people’s own self-interest to cause resources to be distributed more optimally (Reference RicardoRicardo, 1817; Reference Smith and SeligmanSmith, 1776/1901).

Though important, knowing how to participate and engage in trades may be cognitively quite difficult. Pulling off a successful trade often requires us to think about what others may accept or reject when proposing trades, which itself can require knowing what others have and its value, and what one party will give up in order to get what they want. Despite the potential complexity involved in this type of exchange, simple, one-for-one trading is anecdotally quite common in childhood — e.g., trading a cookie for a chocolate. What is less clear is whether children are similarly adept at engaging in more complex “adultlike” trades in which someone gives up several of one resource to get one of a preferred resource. Here we examine both these simple and more complex trades to explore the sophistication of children’s early trading and whether children think that one would accept a numerically disadvantageous trade in order to get more of something one wants (i.e., give up two cookies to get one preferred item like a chocolate).

When it comes to trade, it is unclear whether children appreciate that the subjective value that each trading partner places on the items in question influences what trading partners are willing to pay — a key element involved in more complex trades. That is, do children understand that someone’s preferences will shape the kinds of trades that they will accept from others? One very real possibility is that children may fail to appreciate the role preferences can play when deciding how much of a resource others are willing to trade. They may believe that a trading partner will strictly attend to number. In doing so, children might believe that people will accept only numerically equal trades without realizing that they could have successfully proposed a numerically advantageous trade to themselves if their trading partner is receiving a preferred item. Or, they may strictly rely on resource value, not recognizing that two resources may be of equal value to most people but that one person may value one of the two resources much more strongly than the other or the general population. However, it also seems possible that young children may at least have some rudimentary understanding of trade and the fact that others will accept numerically lopsided trades to get a preferred resource. Prior to describing our studies that examine these possibilities, we briefly review key work in developmental psychology to highlight what has been done on this question and what important questions have been left unanswered that will be explored in our research.

Though there has been relatively little work examining how subjective value influences children’s trading expectations, there is work suggesting that children are sensitive to and use differential value to guide their distribution decisions quite early. For example, children as young as 3 years share fewer of their favored (versus disliked) stickers with others (Reference Blake and RandBlake & Rand, 2010) and distribute preferred stickers to preferred recipients (Reference Chernyak and SobelChernyak & Sobel, 2015). By age 4, children place differential value on objects, understanding that certain features of an object might make it “objectively” more valuable (Reference Echelbarger and GelmanEchelbarger & Gelman, 2017; Reference Gelman, Frazier, Noles, Manczak and StilwellGelman, Frazier, Noles, Manczack & Stilwell, 2015) and, relatedly, by age 5, incorporate demand and supply information to reason about an item’s desirability (Reference Huh and FriedmanHuh & Friedman, 2019). By the time children are 6-years-old, they use resource value to decide how resources should be divided between others (Reference Choshen-Hillel, Lin and ShawChoshen-Hillel, Lin & Shaw, 2019; Reference Shaw and OlsonShaw & Olson, 2013; Reference Sheskin, Nadal, Croom, Mayer, Nissel and BloomSheskin et al., 2016) and understand that fewer high-valued items can be used in place of several low-valued items (e.g., a $20 bill can purchase several small toys). Finally, by age 8, they not only recognize that objects can have different values, but they are also sensitive to the net value of trades and recognize whether a trade is good, bad, or fair (Reference Brocas and CarilloBrocas & Carrillo, 2019). Together, these results demonstrate that children have some rudimentary understanding of resource value by age 3 and, as they get older, they understand that more valuable resources can be exchanged for less valuable ones and that these differential values have consequences for one’s actions.

Though related, this prior work does not fully speak to whether young children understand how and why people make trades, especially those trades in which two parties subjectively value the same resource differently. Rather, it shows that young children systematically use item value to guide their decisions. However, though children may understand that some items are more valuable than others broadly (as has been observed in previous work), they might not recognize that people also may place different subjective values on these items — that is, someone might be willing to give away several dispreferred items to get one preferred item.

To make such trades, children need to first understand that different people can place a different subjective value on the same item. We know that children understand that people have different preferences (e.g., Reference Diesendruck, Salzer, Kushnir and XuDiesendruck, Salzer, Kushnir & Xu, 2015; Reference Kushnir, Xu and WellmanKushnir, Xu & Wellman, 2010; Reference Ma and XuMa & Xu, 2011). For example, preschoolers prefer their attachment objects to new versions of them yet understand that others would prefer new versions to their old attachment objects (Reference Gelman and DavidsonGelman & Davidson, 2016). Additionally, young children understand that others might not share their own preferences; for example, they understand that someone else can prefer broccoli to crackers even if they themselves prefer crackers to broccoli (Reference Repacholi and GopnikRepacholi & Gopnik, 1997). This previous work at least suggests that children should appreciate that someone would “trade” one of a preferred resource for one of a dispreferred resource — which clearly explains children’s simple and canonical trades.

However, such one-for-one trades represent only a tiny part of the economics that underlie trade. Indeed, one barrier to trade in such situations may be notions of equality that are important to children (for review, see Reference Hook and CookHook & Cook, 1979). By as early as 3 years, children distribute resources evenly (Reference Olson and SpelkeOlson & Spelke, 2008) and react negatively to unequal distributions, especially those that favor someone else versus themselves (Reference LoBue, Nishida, Chiong, DeLoache and HaidtLoBue, Nishida, Chiong, DeLoache & Haidt, 2011; Reference Shaw, DeScioli and OlsonShaw, DeScioli & Olson, 2012). As they grow older, they grow increasingly averse to many forms of inequality and reject such inequalities, including those that favor themselves (Reference Blake and McAuliffeBlake & McAuliffe, 2011; Reference Shaw, Choshen-Hillel and CarusoShaw, Choshen-Hillel & Caruso, 2016). Therefore, young children may think that someone will trade one resource for another preferred resource but not believe that someone would trade several resources for a preferred resource. Alternatively, if they understand the basic concept of trading, then they should believe that someone may trade several dispreferred resources to obtain one preferred resource.

Across three studies, we examine how 5- to 10-year-old children think about others’ willingness to accept or reject trades. To do so, we used a third-party design in which children are told about a trade between two people involving cookies and chocolate. Children were then asked to predict whether one agent would accept or reject a trade proposed by the other (i.e., an experimenter). Our key manipulation was the preferences of the agent who could accept or reject the trade; the agent either had a preference for the resource they were trading for (e.g., they liked chocolates more than cookies) or liked both equally. If children understand the dynamics of trading and how subjective value affects willingness to trade, then they should be more likely to predict that an agent who prefers chocolates to cookies would give up more cookies for a chocolate than agents who prefer cookies and chocolates equally.

Note that, given our third-party design, we are not exploring what children themselves would do in this situation, but instead what they think others would do. This deliberate design decision was made to remove certain self-interested and strategic reasons for children’s decisions (e.g., children trying to play hardball in their trading) to allow us to examine children’s understanding of how preferences impact trade. We return to this question of children’s own negotiating strategies in the General Discussion.

Given the exploratory nature of this work, we recruited 5- to 10-year-old children, as we did not have a precise prediction about when in development children would incorporate preference information into their trading decisions. As reviewed above, by age 5 or 6-years-old children should have an understanding of preferences (Reference Kushnir, Xu and WellmanKushnir et al., 2010) and value (Reference Shaw and OlsonShaw & Olson, 2013), both of which seem to be prerequisites for trade. However, it could be that children understand those things without grasping the principle we are investigating here. If we find that children do make such predictions, this would provide some initial evidence that they understand at least one important cornerstone to trading.

2 Study 1

In Study 1, we test whether children consider preferences when evaluating proposed trades. In this study, children were asked to indicate whether a character, Mr. Frog, would accept or reject different trades proposed by another third party, an experimenter. Mr. Frog and the experimenter were endowed with different numbers of resources, with Mr. Frog always having more. This design decision was made to give the experimenter “room” to propose unequal trades that were numerically disadvantageous to Mr. Frog. Children learned either that Mr. Frog liked the items similarly (No Preference Condition) or that Mr. Frog preferred one item to another (Preference Condition).

If children incorporate Mr. Frog’s preference into their trading predictions, then we would expect children in the Preference condition to predict that Mr. Frog would accept more numerically disadvantageous trades than children in the No Preference condition. If children do not consider Mr. Frog’s preference when predicting trades that he would accept, then we would expect acceptance rates of numerically disadvantageous trades not to differ across conditions.

We also varied (within-participants) how lopsided the trades were: some trades were equal (e.g., 1 chocolate for 1 cookie), some differed by 1 resource (e.g., 1 chocolate for 2 cookies), and some differed by 2 resources (e.g., 1 chocolate for 3 cookies). Another principle that should influence one’s willingness to accept a trade is how much one is giving up. If children appreciate this feature of trade, then as trades become more lopsided (e.g., 1 chocolate for 2 cookies vs. 1 chocolate for 3 cookies), acceptance rates should also decrease. Data and sample stimuli are available at https://osf.io/szaw4.

2.1 Method

2.1.1 Participants

Participants included 156 children 5–10 years of age (M = 7.38, SD = 1.48; 88 female, 64 male, 4 unreported). Children were recruited from lab spaces in museums — one located in a mid-sized college town in the Midwest, the other located in a major metropolitan city in the Midwest — and in an on-campus lab in the same major metropolitan city. An additional four children were excluded: three due to experimenter error and one due to attentional issues. Children received a small thank-you gift for their participation.

2.1.2 Materials and procedure

After receiving parental consent and providing assent, children were assigned to either a No Preference condition (n = 67) or Preference condition (n = 89).Footnote 1 Children were first introduced to a puppet named Mr. Frog and then asked whether they knew what it means to trade (74% responded yes; 3% missing). All children, regardless of their answer, were told, “Trading means that I can give Mr. Frog something and he can give me something back.” Mr. Frog had 5 cookies and the experimenter had 3 chocolates to trade. Though most children (112 of 156; 72%) viewed pictures of cookies and chocolates when evaluating trades, 44 (28%) evaluated trades involving real food (i.e., vanilla wafers and chocolates).

In the No Preference Condition, children learned that Mr. Frog liked both cookies and chocolates the same amount (He likes cookies, but he also likes chocolates. He likes cookies and chocolates the same amount. But he has five cookies and no chocolates.). In the Preference Condition, children learned that Mr. Frog really, really liked chocolates. (He likes cookies a little bit, but he really, really likes chocolates. He likes chocolates way better than cookies. But he has five cookies and no chocolates.). In both conditions, the experimenter reported liking the items the same amount (I like cookies and chocolates the same amount.). Following a comprehension check assessing whether children tracked whether Mr. Frog had a preference (92% responded correctly; those who did not received feedback), an experimenter proposed trades and asked children whether Mr. Frog wanted to trade with them (the experimenter). Trades proposed included: 1 cookie for 1 chocolate, 1 cookie for 2 chocolates, 1 cookie for 3 chocolates, 2 cookies for 3 chocolates, 3 cookies for 3 chocolates, 3 cookies for 4 chocolates, and 3 cookies for 5 chocolates. Thus, numerically disadvantageous trades included those that differed in number by 1 (e.g., 1 chocolate for 2 cookies) and 2 items (e.g., 1 chocolate for 3 cookies). Prior to predicting whether Mr. Frog would accept these trades, children were also asked whether Mr. Frog would want to trade 0 chocolates for 1 cookie (90% responded no). Following the proposed trades, children were asked why people trade (see supplemental materials for representative examples). Lastly, children were asked whether they liked cookies (31%) or chocolates more (64%; 4% were undecided; 1% missing).

2.2 Results

We first tested whether children in the Preference condition accepted more unequal trades than children in the No Preference condition. Under this analysis, we compared the proportion of equal and unequal trades accepted. Proportions were calculated because there were different numbers of equal and unequal trades — two equal trades and five unequal trades. Of the five unequal trades, three differed by one resource (e.g., 1 chocolate for 2 cookies; 1-diff) and two differed by two resources (e.g., 1 chocolate for 3 cookies; 2-diff). These latter two trade types were entered separately into our model, allowing us to test whether acceptance also differed by the degree to which the number of resources offered differed (i.e., equal, 1-diff, or 2-diff). Given the limited number of response options across the trade types and the ordered nature of the data, we treated our outcome variable as ordinal.

To analyze our data, we fit two multinomial cumulative logistic mixed-effects regression models with the proportion of trades accepted as the outcome variable (ordinal with ordered categories). In Model 1, participant ID was entered as a random effect, and preference condition (0 = Preference, 1 = No Preference), trade type (0 = equal, 1 = 1-diff, 2 = 2-diff), and age (continuous) were entered as our fixed effects of interest. In Model 2, participant ID was entered as a random effect, and the interaction involving preference condition and trade type, and age (continuous) were entered as our fixed effects of interest. This procedure in SAS models from the lower end of the scale, so that positive fixed effects estimates indicate greater probability of being in the lower end of the scale. Odds ratios greater than ‘1’ signal a greater probability of belonging to the lower range of the scale.

Model 1 yielded a significant fixed effect for preference condition, (F(1, 306) = 15.74, p < .001). Compared to children who learned that Mr. Frog preferred chocolates to cookies, children who learned that Mr. Frog liked these foods equally were 3.28 times less likely to predict that Mr. Frog would accept the trade (t(306) = 3.97, p < .001). This model also yielded a significant fixed effect for trade type (F(2, 306) = 64.38, p < .001). Collapsing across condition, children were 55.91 times more likely to predict that Mr. Frog would reject unequal trades versus equal trades (t(306) = 11.09, p < .001). Of the unequal trades, children were 3.08 times less likely to predict that Mr. Frog would accept 2-diff versus 1-diff trades (t(306) = 4.82, p < .001).

Model 2 yielded a significant interaction involving preference condition and trade type (F(5, 304) = 26.91, p < .001). Compared to children who learned that Mr. Frog preferred chocolates to cookies, children who learned that Mr. Frog liked these foods equally were 4.76 and 2.93 times less likely to predict that Mr. Frog would accept 1-diff and 2-diff trades (1-diff: t(304) = 4.10, p < .001; 2-diff: t(304) = 2.67, p = .008). In contrast, children across conditions were similarly likely to predict that Mr. Frog would accept equal trades (t(304) = 0.86, p = .389).

See Table 1 for an overview of acceptance rates by individual trade and condition.

Table 1: Percentage of children predicting Mr. Frog would accept proposed trades.

2.3 Discussion

Results from Study 1 reveal that children predict others will accept numerically disadvantageous trades when they prefer one resource over another, but not when they like resources equally. Specifically, when children were told that an agent preferred chocolates over cookies, they predicted that the agent would trade away several cookies for a chocolate. When they were told the agent had no preference, they thought he was much less likely to accept unequal trades. Furthermore, we found that children also took into consideration the proportion of resources being given and received, thinking that someone would be less willing to accept a trade as it became more lopsided. These results provide preliminary support to the idea that children think that others use their subjective preferences to make economic trading decisions. Additionally, these findings reveal that children differentiate between more and less “lopsided” trades, suggesting that they integrate information about what cost an agent will incur to fulfill their preference.

This latter result is important for demonstrating that children are doing something a bit more sophisticated than simply matching the agent’s decision to accept or reject whether or not they have a preference. If we found that children thought that Mr. Frog would give up any amount of resources to get a preferred resource, this would suggest that children were only attending to Mr. Frog’s preferences and perhaps ignoring the costs he would incur to fulfill those preferences. However, we found that children think not only that preferences will increase Mr. Frog’s willingness to accept trades but also that they integrate this information with the potential costs to Mr. Frog. Thus, children were not solely tracking preference information when making economic decisions. Taken together, this study provides an initial demonstration that children can use subjective value in evaluating which trades another person will accept or reject.

3 Study 2

In Study 2 (preregistered: https://aspredicted.org/gb2uy.pdf), we test whether results from Study 1 extend to a trading context where both participants are endowed with the same number of resources and where children are not asked to predict whether Mr. Frog would accept a one-for-one trade. In our previous study, we had one person (i.e., Mr. Frog) start with more resources, and so it might be the case that children only think others will give away resources to get a preferred resource in contexts where they have more resources to start. To test this, we examined a trade in which both people start with the same number of resources.

3.1 Method

3.1.1 Participants

Participants included 78 children 5–10 years of age (M = 8.06, SD = 1.62; 39 female, 38 male; 1 missing). Children were recruited from a lab space in a museum in a major metropolitan city in the Midwest. Children received a small thank-you gift for their participation. Though we preregistered 72 participants, our final sample was 78 due to collecting data until the end of a shift at a data collection site. The results do not differ when we restrict our sample to include only the first 72 participants run in the study.

3.1.2 Materials and procedure

After receiving parental consent and providing assent, children were assigned to either a No Preference Condition (n = 39) or Preference condition (n = 39). As in Study 1, children were first introduced to Mr. Frog and then asked whether they knew what it means to trade (82% responded yes; those who did not received feedback). Children learned that the experimenter liked cookies and chocolates the same amount and learned that Mr. Frog liked them the same (No Preference Condition) or that Mr. Frog liked chocolates more than cookies (Preference Condition). Children were then given a comprehension check assessing whether children tracked whether Mr. Frog had a preference (85% responded correctly; those who did not received feedback). In contrast to Study 1, both Mr. Frog and the experimenter started with five resources each to trade (cookies and chocolates, respectively). For this experiment, we also began the trial with children in both conditions observing a trade from Mr. Frog in which the experimenter rejected a trade proposed by Mr. Frog — 1 chocolate for 1 cookie — by saying, “Hmm, I say ‘no’ to this trade.” This was done because in this experiment children were only going to be asked about one trade and we did not want them to think that Mr. Frog would reject the trade because he might think that a one-for-one trade is on the table. Importantly, this was done in both conditions and so any difference observed between the No Preference and Preference condition could not be explained by this feature of our design. That is, the fact that we included this initial interaction might explain an overall increase of accepting trades, but not a difference in accepting trades between the Preference and No Preference conditions, which is our key question.

The experimenter then offered Mr. Frog 1 chocolate for 2 cookies. Children were then asked whether Mr. Frog would accept this trade. Following their response, children were asked why Mr. Frog would accept or reject the trade, as they predicted (see supplemental materials), and whether the child themselves liked cookies (31%) or chocolates more (63%; 5% were undecided; 1% reported liking neither). In line with Study 1, we again expected children would be more likely to predict that Mr. Frog would accept this numerically disadvantageous trade in the Preference as compared to No Preference condition.

3.2 Results

We tested whether children in the Preference condition predicted that Mr. Frog would accept a numerically disadvantageous trade more than children in the No Preference condition and this was indeed the case (χ2(1, N = 78) = 9.95, p = .002, ϕ = .36). Whereas only 15% of children in the No Preference condition predicted that Mr. Frog would accept the numerically disadvantageous trade, 49% of children did in the Preference condition. In an exploratory analysis, we conducted a logistic regression to examine the effect of age on the likelihood of accepting a numerically disadvantageous trade. The logistic regression model was significant (χ2(1) = 4.96, p = .026), suggesting that older children are less likely than younger children to predict that Mr. Frog would accept the numerically disadvantageous trade; however age explained only 9% (Nagelkerke R 2) of the variance in accepting a numerically disadvantageous trade.

3.3 Discussion

Results from Study 2 reveal that children are more likely to predict that others will accept a numerically disadvantageous trade when they are gaining a preferred resource as compared to when they have no preference. That is, children who learned that Mr. Frog preferred chocolates to cookies predicted that Mr. Frog would accept a numerically disadvantageous trade more (49%) than children who learned that Mr. Frog did not have a preference (15%). Thus, findings from Study 2 extend to situations where parties are endowed with the same number of resources, demonstrating that preference information continues to exert influence even when one party will end up with fewer resources overall as a result of endorsing the unequal trade.

However, another possible interpretation of our results thus far is that, when evaluating a third-party trade, children may think it is fairer for people to give up more of what they disprefer to get fewer of what they do prefer. That is, children might tell Mr. Frog to accept a numerically disadvantageous trade more when he has a preference not because that deal is better for Mr. Frog (i.e., trading more to obtain preferred resources rather than a resource he has no preference for), but because they think it is a less lopsided trade and is thus a fairer deal overall. Indeed, in such trades both trading parties get about an equal increase in utility from the trade in question, which children might think is fair. This would explain our results without children having to think about whether the trade is good for the person accepting the trade. One way to test this idea would be to ask children whether an agent would accept a particularly lopsided trade in which he gets more. If children’s third-party trade predictions reflect their fairness concerns about the lopsidedness of the trade, then children should say that an agent should reject an especially lopsided trade that favors himself — in which he gets more of a preferred resource — because this would increase the inequality in utility between the two parties. However, if children are more concerned with an agent getting a good deal for himself, then children should say that an agent should be more likely to accept a numerically advantageous trade as compared to a numerically disadvantageous trade.

4 Study 3

In Study 1 and 2, children who learned that Mr. Frog preferred chocolates to cookies were more likely to predict that Mr. Frog would accept numerically disadvantageous trades to obtain his preferred item than children who learned that Mr. Frog liked cookies and chocolates the same. We have argued that this is because they understand what Mr. Frog will and will not accept in a trade, but they could also simply be responding to how fair or lopsided the trade is. Indeed, children could have been ignoring their role as broker for Mr. Frog and simply responding that they think it is fair that someone give up more of a dispreferred resource for a preferred one because this would minimize discrepancies in utility between the two trade partners (as compared to the No Preference condition). Thus, children could have responded the way we predicted in our first two experiments by simply tracking how lopsided the trade was regardless of whose perspective children took.

For this reason, in Study 3, we manipulate whether the trade is lopsided in Mr. Frog’s favor (advantageous) or not (disadvantageous). To do so, we examine whether children predict Mr. Frog will accept numerically advantageous and disadvantageous trades proposed by an experimenter and whether children consider both unequal trades to be similarly unfair. If children’s predictions are guided by what they think is best for Mr. Frog, they should predict he will accept the advantageous trade more than the disadvantageous trade. If, however, children’s predictions are guided by fairness concerns, then they should predict he will accept the two trades equally (if they are focused on the raw inequality) or may even predict that Mr. Frog will accept disadvantageous trades more than the advantageous trades (if they are focused on inequalities in utility) as the former leads to a fairer distribution of resources (i.e., Mr. Frog obtains an item he prefers in exchange for numerically more items he disprefers). Note, we also measure the extent to which children evaluate these different trade types as fair/unfair.

4.1 Method

4.1.1 Participants

Participants included 80 children 5–10 years of age (M = 7.37, SD = 1.76; 41 female, 39 male). Children were recruited from a lab space in a museum and in an on-campus lab — both in a major metropolitan city in the Midwest. Children received a small thank-you gift for their participation.

4.1.2 Materials and procedure

Children first received parental consent and provided assent and were then introduced to Mr. Frog and asked whether they knew what it means to trade (89% responded yes; those who did not received feedback). Both Mr. Frog and the experimenter had five resources each to trade (cookies and chocolates, respectively), and children learned that Mr. Frog likes chocolates more than cookies (96% responded correctly to the comprehension check; those who did not received feedback). Children were then told that the experimenter was going to propose trades and children were to indicate whether Mr. Frog would want to trade with them (the experimenter). Trades proposed included: 1 chocolate for 1 cookie, 1 chocolate for 2 cookies (unequal-disadvantageous), and 2 chocolates for 1 cookie (unequal-advantageous). Children were also asked whether a proposed trade was fair or unfair, and how fair/unfair (6-point scale; 0 = very unfair, 6 = very fair). To arrive at this 6-point scale, children first indicated whether a proposed trade was fair or unfair (Do you think this trade is fair or unfair?) and indicated the degree to which that trade was fair (Do you think it’s a little fair, medium fair, or very fair) or unfair (Do you think it’s a little unfair, medium unfair, or very unfair). All proposed trades were presented pictorially. The order in which advantageous and disadvantageous trades were proposed, and the order in which children were asked to report on fairness were counterbalanced across participants. In addition to these trades, children were also asked whether Mr. Frog would want to trade 0 chocolates for 1 cookie (94% responded no). This was included to make sure children understood the fundamentals of trading and will not be discussed further. Lastly, children were asked whether they liked cookies (33%) or chocolates more (61%; 6% were undecided).

4.2 Results

To examine children’s predictions regarding which trades Mr. Frog would accept, we fit a mixed effects logistic regression model with acceptance level (yes, no) as the outcome variable (binary), with participant ID as a random effect, and trade type (equal, advantageous, disadvantageous) and age (continuous) as the fixed effects of interest. This model yielded only a significant fixed effect for trade type, F(2, 157) = 9.58, p < .001. We followed up on this significant effect with planned comparisons revealing that children were 46.62 times more likely to predict that Mr. Frog would accept advantageous trades versus disadvantageous trades (t(157) = 4.05, p < .001), and 406.22 times more likely to predict that Mr. Frog would accept equal trades versus disadvantageous trades (t(157) = 4.31, p < .001). We also note that children were 8.71 times more likely to accept equal trades than advantageous trades (t(157) = 2.79, p = .006).

To examine children’s fairness ratings, we fit a mixed effects linear regression model with fairness rating (1–6) as the outcome variable, with participant ID as a random effect, trade type (equal, advantageous, disadvantageous) and age (continuous) as the fixed effects of interest. This analysis yielded only a significant fixed effect of trade type (F(2, 158) = 136.82, p < .001). Controlling for age, children rated equal trades as more fair than both advantageous and disadvantageous trades (respectively: t(158) = 13.44, p < .001; t(158) = 15.07, p < .001). Children rated advantageous and disadvantageous trades as similarly fair (t(158) = 1.63, p = .106).

See Figure 1 for an overview of acceptance rates and fairness ratings by trade type.

Figure 1: Study 3 mean (standard error) acceptance rates (top) and fairness ratings (bottom) by trade type.

4.3 Discussion

Children predicted that Mr. Frog would accept unequal trades, especially unequal trades that advantaged him (i.e., where Mr. Frog gave numerically fewer resources than he received in return) at a relatively high rate. At the same time, children viewed unequal trades as less fair than equal trades but did not think that disadvantageous trades (in which someone gives away more of a dispreferred resource) were more or less fair than advantageous trades (in which someone gives away fewer of a dispreferred resource). Taken together, these results suggest that children are not merely using fairness concerns to make their judgments about the trades that Mr. Frog will accept. Had they been doing so, they would have predicted that Mr. Frog would accept the numerically disadvantageous trade more (as this trade leads to a fairer distribution of resources) or at the very least, they would not have differentiated between advantageous and disadvantageous trades, which were viewed as equally unfair. Instead, they seem to be reasoning about what would be in Mr. Frog’s best interest, thinking that he would be more likely to accept an advantageous versus disadvantageous trade.

Children also predicted that Mr. Frog would accept equal trades more than advantageous trades, which might be surprising if children were truly trying to max out Mr. Frog’s earnings. We suspect that this prediction may be related to at least some children believing that Mr. Frog has a fairness preference (or confusing their own fairness preferences with Mr. Frog’s). A wealth of research suggests that children direct others to share equally (Reference Hook and CookHook & Cook, 1979; Reference Olson and SpelkeOlson & Spelke, 2008) and some research even suggests that children will reject outcomes in which they get more than others (Reference Blake and McAuliffeBlake & McAuliffe, 2011; Reference Shaw, Choshen-Hillel and CarusoShaw et al., 2016). Thus, fairness concerns could have played some role here, yielding lower acceptance rates of advantageous trades. Indeed, children did in fact see the equal trades as substantially more fair than either of the unequal trades. However, we note that such a fairness-based explanation cannot fully explain children’s differential responses in the advantageous and disadvantageous conditions — these two conditions were seen as similarly unfair, but children thought Mr. Frog would accept the advantageous trades much more often.

Although we did not test this directly, the reader may note that children predicted Mr. Frog would accept a numerically disadvantageous trade at a lower rate than observed in both Study 1 and Study 2. We suspect that this is due to both Mr. Frog and the experimenter being endowed with the same number of starting resources (in contrast to Study 1) and children not having the information that the experimenter would reject a 1 chocolate for 1 cookie trade (as in Study 2). Again, in our previous studies these factors can explain why children might think that Mr. Frog would be more likely to accept trades in general, but not why he would be more likely to accept trades in the Preference condition as compared to the No Preference condition, since these factors were held constant across conditions.

5 General Discussion

Across three studies, we found that 5–10-year-old children make predictions about the trades that third parties will accept based on these third parties’ preferences. Specifically, in Study 1 and Study 2, children who learned that an agent preferred one item to another predicted that agent (Mr. Frog) would accept more numerically disadvantageous trades to secure their preferred item than children who learned that the agent liked both items the same. This pattern of results was observed when the parties involved in trading had unequal (Study 1) and equal (Study 2) starting resources and was relatively stable across our age range. We further found that children’s predictions about trades that others would accept did not merely reflect what children thought was fairer — i.e., that it is more fair for someone to give up more of a dispreferred resource. Indeed, Study 3 revealed that children thought Mr. Frog would be more likely to accept a lopsided trade that advantaged him rather than one that disadvantaged him (even though both of these trades were perceived as equally unfair).

Together, these results provide novel insight into children’s understanding of trade in at least two ways. First, they show that 5–10-year-old children are sensitive to preference in trading contexts, something that has not been previously examined. They understand that the same item can be valued differently by different people and that these different values have consequences for trading. That is, when a trading partner has something preferred by another agent, that trading partner can likely leverage this preference to secure more of that agent’s dispreferred item in exchange for fewer of that agent’s preferred item.

Second, these studies demonstrate that children also consider the lopsidedness of a trade when deciding what an agent will accept; children were less likely to predict that Mr. Frog would trade 3 cookies for 1 chocolate than they were to predict that Mr. Frog would trade 2 cookies for 1 chocolate. Taken together, these results suggest that children can integrate information about preferences and cost to the agent when making decisions about which trades an agent is likely to accept or reject. Second, this work bridges relevant findings from both developmental psychology and economics (e.g., Reference Diesendruck, Salzer, Kushnir and XuDiesendruck et al., 2015; Reference Gelman and DavidsonGelman & Davidson, 2016; Reference Harbaugh, Krause and BerryHarbaugh, Krause & Berry, 2001; Reference Webley, Barrett and Buchanan-BarrowWebley, 2005), two literatures typically working in parallel and not together, to highlight the early emergence of complex forms of trading. This result is timely, in light of not only renewed attention to children’s economic understanding from both basic and applied perspectives, but also recent work examining more social forms of exchange, such as negotiations (e.g., Reference Santhanagopalan, Kinzler, Keysar and SahSanthanagopalan, Kinzler, Keysar & Sah, 2019) and resolution of conflicts over resources (Reference Pietraszewski and ShawPietraszewski & Shaw, 2015). More generally, our findings highlight the benefit of working with children and designing studies with them in mind to examine our early-emerging capacities for economic exchange.

Considering these contributions together, our findings suggest that complex trade is not necessarily a convoluted form of social exchange reserved for adults; this opens up a host of questions on the origins and building blocks of this form of exchange. As an entry point into this line of work, we chose to only manipulate preference — specifically, whether an agent preferred one item to another or not. In doing so, we could isolate the influence of preference information on children’s trading predictions. In addition, we tested children’s predictions across a range of possible trades, allowing us to examine both the robustness and flexibility of these predictions.

Moving forward, we hope that future work will build upon our findings by examining children’s own negotiation in trading situations like those outlined here, as our design did not leave room for children to enter into a negotiation on behalf of Mr. Frog. Given that children can engage in rudimentary “negotiations” with their parents by age 5 (Reference Kuczynski and KochanskaKuczynski & Kochanska, 1990; e.g., refusing to cooperate with them to get their way) and recognize what it means to enter into an agreement and what it looks like to break an exchange agreement (Reference Harris, Núñez and BrettHarris, Núñez & Brett, 2001), we think examining negotiation in the context of trading would be a fruitful area for future work. It is possible, for example, that differences in the decision to even enter into a negotiation would emerge across our age range. It may not occur to our youngest children that negotiating in this context is an option. It also seems possible that young children may be very inflexible in their negotiations (i.e., not being willing to give up more to get fewer of a preferred resource). Relatedly, it might also be interesting to examine the different strategies that children use when attempting to negotiate with others and how these relate to their understanding of trade. For example, do children adjust their own offers based on what they know about others’ preferences? Do they low ball others, or do they understand that this can sometimes shut down trades? Do they fail to make gains from trade because they get too greedy?

Future work could also examine the ways in which having a stake in the trade itself induces children to behave differently than observed in our third-party context. On the one hand, children’s preference for one item over another could induce them to accept more unequal trades than they think others would (as observed in third-party situations). On the other hand, children may be less willing to accept unequal trades to obtain preferred items than they predict others are, and thus accept fewer unequal trades for themselves. Indeed, we know that children show endowment effects (Reference Harbaugh, Krause and VesterlundHarbaugh, Krause & Vesterlund, 2001), wanting more for their own items than they would pay for the same item from someone else.

Lastly, because our studies were not specifically designed to detect age differences, future work should test whether manipulating the complexity of the trading task yields more consistent age effects. It is quite possible that a more complicated trade scenario would have yielded consistent differences across our age range. For this reason, our lack of age differences should not be taken to indicate that there are no developments in children’s reasoning about trade between the ages of 5 and 10 years. On this point, work in this area should also consider children’s opportunities to engage in trade as one predictor of children’s sophistication with trade. For example, children with older (and even younger) siblings may be required to negotiate over resources more regularly, giving them additional opportunities to engage in swap-like exchanges. Such experiences may result in children understanding what it means to trade and what it looks like to break agreements earlier (cf. Reference Harris, Núñez and BrettHarris et al., 2001).

We also note that we generally found high rates of accepting equal trades in our studies, indeed almost all children thought that Mr. Frog would accept a one-for-one trade. There are at least two reasons why children may have believed that Mr. Frog would be open to trading resources that he valued similarly. First, in our studies, accepting trades always allowed him to diversify his array of snacks because he started with only one of the two snack types. Across this age range, 5–10 years, children have been shown to prefer varied sets of novel items and foods to non-varied sets (Reference Echelbarger and GelmanEchelbarger & Gelman, 2017; Reference Echelbarger, Maimaran and GelmanEchelbarger, Maimaran & Gelman, 2020). Therefore, children could have thought that Mr. Frog would like to diversify his resources, even when told that he liked the two foods equally. Second, trading may simply be fun. In our scripts, we stated that Mr. Frog “is ready to play” and “wants to trade.” For this reason, children could have inferred that Mr. Frog found trading to be fun and therefore predicted that he would be more likely to engage in trades involving equally valued resources. Future work could explore situations in which there are stronger barriers to trade.

Though these findings contribute novel insight into children’s understanding of trading, this body of work is not without limitations. First, by deliberately limiting children’s evaluations to only third-party contexts, a key next step will be to determine whether acceptance of unequal trades is amplified or attenuated in first-party trading contexts. Second, the trades children evaluated did not include items of high monetary value. It is possible that trading behaviors differ according to whether a resource is of high versus low monetary value. For example, higher-valued items may be more difficult to part with irrespective of whether it is preferred or not. That is, children may be more reluctant to trade objectively higher-valued dispreferred items for lower-valued, but preferred items. For this reason, future research should examine the influence of item value on children’s trading. Third, our sample largely included middle class children from the United States. In light of findings demonstrating cross-cultural differences in how children distribute resources (e.g., Reference Blake, McAuliffe, Corbit, Callaghan, Barry, Bowie and WarnekenBlake et al., 2015; Reference Choshen-Hillel, Lin and ShawChoshen-Hillel et al., 2019; Reference Rochat, Dias, Liping, Broesch, Passos-Ferreira, Winning and BergRochat et al., 2009) as well their risk and time preferences (i.e., children living in areas with greater market integration were observed to be more risk-seeking and future-oriented than children in regions with less market integration; Reference Amir, Jordan, McAuliffe, Valeggia, Sugiyama, Bribiescas, Snodgrass and DunhamAmir et al., 2020), future work should endeavor to examine trading across more diverse groups of children.

We anticipate that children across cultures may share some of these basic intuitions about trade because trade and barter have been important in many different societies and throughout much of human history (Reference Greaves and KramerGreaves & Kramer, 2014; Reference HumphreyHumphrey, 1985). However, there are also probably important differences in key cultural norms and practices that influence how these abilities emerge across cultural contexts. For example, whether one sees a situation as indicative of a communal or exchange relationship (Reference FiskeFiske, 1992) will be powerfully influenced by one’s culture, which will then dramatically impact whether one seeks to maximize value for oneself (exchange relationship) or for both parties (communal relationship). Work in this area with adults has shown that interpersonal closeness leads adults to consider the joint benefit of their selections for both themselves and a close (vs. distant) other (Reference Clark and MillsClark & Mills, 1979; Reference Tu, Shaw and FishbachTu, Shaw & Fishbach, 2016). Said another way, seeing a relationship as more communal leads adults to want to maximize value for both parties versus just themselves. Indeed, even simple framing manipulations that shift how one thinks about a relationship can powerfully shape how one shares or hoards resources (Reference DeScioli and KrishnaDeScioli & Krishna, 2013). Thus, future work would benefit from exploring children’s early intuitions about trade cross-culturally to discover the similarities and differences.

As trading is a cornerstone of economic exchange, it is important to understand how people come to conceive of and engage in it. To examine this, we recruited young children, as they shed light on the emergence of key capacities associated with trading. We found that by age 5, children use subjective valuation to guide their predictions of when one would or would not accept a trade. With our findings in mind, we urge researchers to more thoroughly consider trading as a rich context for probing children’s intuitions about preferences, economics, and social exchange more broadly.

Appendix

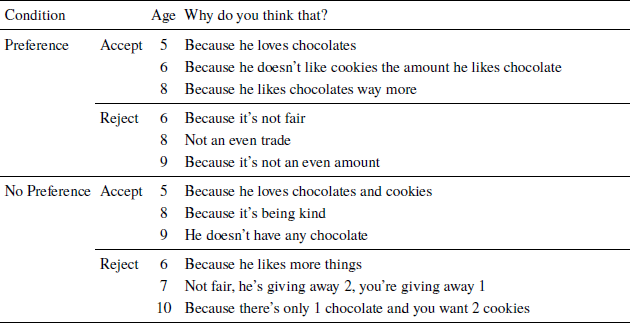

Study 1: Why do people trade?

As a part of the task, children were asked to discuss why they think people trade. Responses were recorded for exploratory purposes and may only reflect the gist of what children reported. Examples from Study 1 follow. Note that even the youngest children demonstrate a good understanding of why people trade and regularly report that people trade to obtain more preferred (liked) items.

Study 2: Why would Mr. Frog accept/reject trade?

In Study 2, children are asked to indicate whether Mr. Frog would accept a numerically disadvantageous trade (i.e., 1 chocolate for 2 cookies). Children were then asked to describe why they think he would accept/reject that trade (“What do you think that?”). The sample statements below suggest that when reasoning about acceptance, children may appeal more to preferences, whereas equality concerns may dominate reasoning about rejection.