Introduction

Large-scale, complex environmental policymaking is an iterative process.Footnote 1 Because it is perceived as costly, environmental policy usually faces resistance from interests that anticipate bearing those costs. The result is often weak initial regulatory regimes that do not fully address targeted problems, with the hope that over repeated efforts, stringency will ratchet up. Successful outcomes in these cases happen when early resistance ebbs or is overcome.Footnote 2 Because interest groups at the national and subnational levels drive resistance and support, understanding the dynamic nature of policy resistance requires understanding how such interests change over time.

Although there are multiple potential causes for interest change over time, an emerging body of literature makes the case for the importance of positive feedback, in which policy, at one point in time, makes subsequent stronger policy moves more politically feasible. If feedback can be important in successful environmental policymaking, it follows that we need to understand what factors make positive feedback in environmental policy more likely or more effective.

In this paper, I argue that a critical factor influencing the potential for feedback dynamics in any environmental policymaking—decarbonization included—is the nature of industries affected by the policy or policies in question. I categorize industries into four ideal types: Winners, Losers, Convertible, and Management. As I argue below, each of these types is characterized by differing potential responses to policy controls on pollutants they produce or consume. Those differing responses mediate the potential for feedback. I will argue that the responses of Convertible industries in particular are often critical for the generation of rapid, impactful feedback that substantively increases the political feasibility of subsequent policymaking. In short, industry has characteristics that constitute a structural factor mediating the mechanisms of feedback between policy and industry; this structural factor can be systematically understood, and such an understanding has implications for scholarship and policy.

A complex literature explores the connections between industry and its interests, other interest groups, policymaking processes, and policy outcomes in environmental and energy policy. This literature broadly assumes that industry interests compete and cooperate both among themselves and with other interest groups to attempt, with some success, to influence policymaking processes to achieve outcomes they consider most congenial. As figure 1 suggests, there are many opportunities for scholarship in this complex relationship.

Figure 1: Linkages between industry and policy outcomes

Regarding industry itself, scholars have examined how industry characteristics and intra- / inter-industry processes, like preference formation, strategic choices, coalition-building, and competition, mediate industry efforts to influence policymaking.Footnote 3 A core finding is that the expected distributional impacts of policy on industry interests are determinants of industry preferences and, via industry influence, of policy outcomes.Footnote 4 Although industry is popularly seen as opposing environmental policy, the literature provides a more nuanced and flexible view: Industry interest groups may support or oppose environmental policy, based on characteristics and context.Footnote 5 Scholars also explore how industry interest groups and government actors make strategic choices in the policymaking process and in response to each other that impact environmental policymaking.Footnote 6

Within the policymaking process, scholars have investigated dynamics of political competition between interests and coalitions supporting or opposing environmental policy as they attempt to influence policymaking to defend and support their interests.Footnote 7 Scholars have also examined characteristics of policy outcomes and their interactions with interest groups in order to facilitate exploring outcomes more nuanced than a bimodal success/failure model.Footnote 8 This work exists within a broader literature, inside and outside of the areas of environmental and energy politics, on the impacts on policymaking of surrounding contextual factors including exogenous shocks,Footnote 9 issue area characteristics,Footnote 10 international context,Footnote 11 enabling and constraining effects from political institutions at multiple levels,Footnote 12 partisanship and party ideology,Footnote 13 environmental movement strength,Footnote 14 international policy diffusion and convergence,Footnote 15 public opinion,Footnote 16 and norms or discourse.Footnote 17

A particularly interesting line of research investigates feedback and path dependence, drawing on existing literatures that explore path dependence more generally.Footnote 18 Early applications of path dependence to the field of climate and energy policy focused on fossil fuel “lock-in.”Footnote 19 Later scholars have increasingly investigated the ways in which policy-industry feedback may instead work to increase the political feasibility of more stringent decarbonization policies.Footnote 20 There is growing recognition that successful decarbonization policy must be understood as the product of path dependent policy sequences.Footnote 21 More stringent policy often becomes possible only after earlier, more moderate policy;Footnote 22 and more politically challenging forms of policy, like carbon pricing, become more politically feasible after earlier, less challenging policies, like direct support for renewable energy,Footnote 23 a dynamic that might be referred to as a “green spiral.”Footnote 24

This paper makes two novel contributions to the above literature, relevant to two different parts of the issue area model sketched in figure 1, both of which should be seen as complementary to existing explanations. First, it adds to our understanding of differentiation within industry by describing a novel typology categorizing industry types. Second, it contributes to our understanding of causal relationships by connecting industry characteristics to the dynamics of policy-industry feedback. I show that the type of industries present in a jurisdiction help explain not only initial policy preferences, a point that is intuitive, but also the likelihood that feedback pressures from policy outcomes can actually act to change those interests and preferences over time in ways that lead to increased policy feasibility over time. When it comes to responding to feedback, not all industries are alike; to understand feedback processes, we need to understand systematically how industries differ. In addition to these two theoretical contributions, I also suggest a possible explanatory factor in several specific cases of intrinsic interest, including the uncommonly successful ozone negotiations and the unusual West Virginia case of renewable portfolio standard repeal.

These findings speak first and foremost to the literature described above on industry determinants of environmental policy success. Empirically, however, they also speak directly to policymakers in the area of decarbonization: I provide a lens for evaluating the early policy moves that make desired “ratcheting up” more likely. In addressing this question, I join scholarship that attempts to provide policy-relevant findings that may contribute to stronger climate policy over time.Footnote 25

Below, I first lay out the proposed typology and its application. After an explanation of my case selection, I then review four cases of policymaking—one international and three subnational U.S. state cases—exploring these cases for evidence of the proposed typology's usefulness. Finally, I conclude with discussion and a synthesis of key findings.

Typology for industry

I propose a typology that classifies industries by the type of impact policyFootnote 26 has on them. Policy typically requires industry to change activity associated with production. Change is costly in several ways; it can:

• eliminate demand for previously profitable products;

• entail shifts in capital investment, requiring new investments and/or retirement of assets before the end of their useful lifetime;

• raise input costs for downstream users of impacted products by imposing costs on upstream producers.

Change can also be beneficial to industries that sell alternatives to polluting products, or that are better able to adapt to new paradigms than their competitors.

Typology

Winners: Winner industries directly benefit from environmental policy, because they provide goods or services for which policy expands demand. In the context of decarbonization, manufacturers of renewable generation equipment are an example. Winner industries have an interest in environmental policy and are expected to support it.

Losers: Loser industries are those for which a) environmental policy represents a potential existential threat,Footnote 27 typically because the goods or services they provide directly embody negative environmental impacts (e.g., their products are themselves pollutants),Footnote 28 meaning that relevant control policy is likely to result in a catastrophic reduction in the market for their current product lines; and b) do not have the capability to readily switch to producing non-polluting substitute products. In the context of decarbonization, the coal industry would be an example. Coal is nothing more than combustible carbon, and coal companies typically do not have the technological capacity to manufacture non-polluting energy products like solar panels or wind turbines. Loser industries have the strongest interest in avoiding environmental policy and are expected to most strongly oppose it.

Convertible: Convertible industries are industries that make polluting products but do have the capability to switch to non-polluting products. Like Losers, they initially provide goods or services that are polluting and will be directly threatened by environmental policy. Unlike Losers, Convertible industries have the expertise and capability to shift production to non-polluting alternatives. In the context of decarbonization, utilities and auto manufacturers would be Convertibles; they make carbon-emitting products initially, but their core capabilities are applicable to very similar non-emitting or low-emitting substitutes. Such a shift imposes transition costs, e.g., in new production facilities. But if the shift is made, these companies’ material interests change fundamentally: They transition from having an interest in opposing pollution controls to having an interest in supporting pollution controls to support markets for the non-polluting substitutes they have invested in.

Management: The prior categories make polluting goods and services or their substitutes; Management industries are largely those that either use polluting goods and services as inputs or create pollutants only as wastes secondary to production inputs (in climate, transportation is an example: vehicles burn fossil fuels and create GHG wastes as an input to the transportation service provided). Here, the primary impact of policy is to make a production input or process costlier. Management industries respond by either modifying processes (e.g., increasing efficiency, eliminating or substituting an input, or introducing additional controls on wastes) or bearing ongoing costs (e.g., of a taxed input or waste, or more-expensive substitute).

Because either strategy entails costs, Management industries typically resist environmental policy. Management industries differ from Losers in that environmental policy does not pose an existential threat to them; therefore, they don't typically resist policy as strongly as Losers do.Footnote 29 Conversely, they differ from Convertible industries in that simply paying increased costs for production upgrades or inputs does not change fundamental industry interests because it does not change what is produced, only how. Therefore, initial policy does not make Management industries more likely to support future, more stringent policy, though they may become more tolerant of existing policy to which they have adapted.

To some extent, Management industries are defined by what they are not: They do not benefit from policy (not Winners), do not face an existential threat (they can continue to operate, at some cost), and do not fundamentally change their interests (business as usual continues, just at a higher cost). In ozone, auto manufacturing was a Management industry: auto producers had to shift to using more expensive air conditioning modules with CFC substitutes. This increased input costs for auto manufacturers, which they disliked, but was ultimately a minor adjustment that neither posed an existential threat nor created a novel interest in supporting additional ozone controls.

Complexities and limitations

It is useful to acknowledge some limitations of the typology. The categories represent ideal types, with some potential overlap or ambiguity in practice; classification of specific industries can require understanding their contexts and perceptions of their own situation. The nuances discussed below suggest what amount to scope conditions for the classification of specific industries.

Policy context: Industry type can depend on policy stringency. An important example is natural gas (NG) in climate. NG wins under moderate controls on carbon emissions, but loses under strong controls aimed at a very-low-emission outcome. While these instances do not appear to be common in the issue areas I examine here, they are potentially quite interesting insofar as they provide a possible mechanism for negative rather than positive feedback.

The Loser-Management spectrum: the distinction between Losers and Management industries is a spectrum as much as a sharp division. Under some circumstances policy can pose existential threats even to industries that only use pollutants as inputs. For instance, in manufacturing, if energy is a major input and demand for a product is very elastic, policy that increased energy input costs substantially could pose an existential threat to an industry that would otherwise act like a Management industry. Similarly, if policy makes a polluting input entirely unavailable and no feasible substitute exists, an industry reliant on that input may respond like Losers. The more closely an industry approaches one of the scenarios, the more likely it is to resist policy as if it were a Loser. Typically, I class industries as Management when relevant pollutants are merely production input or wastes relative to the final service produced; when policy options under consideration do not appear stringent enough to pose an existential threat; and when the industry can feasibly respond to policy like a Management industry (e.g., by increasing efficiency, switching inputs, and/or bearing increased production costs).

Technological change: innovation can redefine categories; for instance, if “clean coal” became a reality, the coal industry might look more like a Convertible or Management industry.

Firm-level exceptions: finally, focusing on the industry level necessarily disregards nuance. Individual firms may be exceptional. A diversified firm might have an ambiguous classification.Footnote 30 A firm may function differently than its industry because of the specifics of its business; for instance, while agriculture is primarily Management, a specialized agricultural firm that could easily switch from a high-GHG crop to a much lower-GHG crop might behave like a Convertible firm. These instances are exceptions, however, and hence I argue that, with these limitations noted, the types retain their usefulness.

Applying the typology

The conceptually important difference between types is how they change in response to initial rounds of policymaking. Industry mix within a jurisdiction matters because it governs the likely nature of industry changes in response to initial policy moves, and the likely speed with which those responses change policy coalitions, creating feedback. Winners and Losers change in size—growing or shrinking based on the distributional impacts of policy—but their interests stay constant. Management industries don't undergo major changes to either size or interests; by definition, policy-imposed costs for Management industries must be managed and absorbed, but do not cause fundamental change.

Convertible industries, however, are the industries whose interests may change. If initial policy pushes Convertible industries over the conversion barrier, they can rapidly change position from opposing to supporting policy, for two reasons. First, additional, more stringent policymaking can act to solidify markets for new non-polluting products, preventing wasted investment. Second, when companies within a Convertible industry respond at different rates, first movers may support further policymaking simply because it advantages them against slower-moving competitors.

Case selection and methodology

I explore two case studies in depth and two more briefly. Case study material derives from qualitative research using primary and secondary source material and reviews of archived news reporting, which is used, particularly in the in-depth cases, to support process tracing of relevant political dynamics.

Cross-issue area cases

Case selection for this research was two-tiered. The case of ozone negotiation (international) and climate policymaking (in California) served as exploratory case studies in which I first identified and explored the explanatory value of the typology. In themselves, both are cases with intrinsic importance: The ozone negotiations encapsulate much of the core policymaking for the ozone issue area as a single case, while California has the longest and richest history of renewable support policy and renewable energy development of all U.S. states. Process-tracing in these cases provided a basis for inductive derivation of the typology and demonstration of its usefulness.

Additionally, comparison of cases across both issue area and jurisdiction also provides at least anecdotal evidence that the usefulness of the typology is generalizable along multiple axes. Comparing ozone and climate does necessitate comparing across levels. Much of the relevant policy contestation in ozone policy occurred at the international level, while most substantive policymaking in climate policy plays out primarily in national and subnational jurisdictions.

I argue, though, that including cases at different levels here requires us to accept only a few assumptions: that international-, national-, and state-level policymaking are all subject to industry influence; that such influence expresses underlying industry preferences based at least partly on industry's material interests; and that the level examined hosts a policy arena in which policy contestation occurs and political actors to which industry can express its preferences. If these hold, we should expect to see analogous impacts from the industry types across all levels; comparing across them is not clearly more hazardous than comparing across any jurisdictional boundary.Footnote 31

Otherwise, the ozone and climate issue areas differ substantially in terms of industry mix but are most similar to each other across multiple other background variables.Footnote 32 Both are environmental problems of great severity and global impact, plagued by an evolving scientific understanding of a complex atmospheric phenomenon. Both initially presented broad coalitions of economic interests opposed to pollutant controls, which at first stymied substantive policymaking. Both have seen national-level policymaking in the context of a parallel UN-managed convention-protocol approach to international policymaking. They do differ in scope—climate is a substantially larger problem that implicates more of the global economy. The larger scope of the climate issue area is certainly one reason climate policymaking is more challenging, but I will argue that while scope matters, the typology also helps explain that difference, and that indeed the two factors are related: The broad scope of climate is partly what creates a difficult industry mix at the international level.

Cross-jurisdiction cases (within-issue area)

Having compared the typology across issue area, I focused on climate and selected two additional cases in an attempt to broaden the representativeness of the cases chosen across multiple jurisdictions. The universe of most directly comparable cases is finite: here, for strongest comparison, I restrict the options to U.S. states, which share a federal context. Moreover, since my typology stresses industry mix as a determinant of response to policy, it makes sense to consider only cases in which substantial policymaking has occurred. Texas and West Virginia introduce distinct and useful variation.

Texas serves essentially as a most-similar case,Footnote 33 a state with many similarities and two important differences relative to California. Like California, Texas is a large U.S. state within the broader U.S. federal context, with significant wind and solar resources, a large population, a diverse economy, substantial installed renewable energy (RE) generation assets, and a history of first-round renewable support policy in the form of a renewable portfolio standard (RPS). But RPS outcome differs: In California, the RPS continued to expand after initial creation, while in Texas it stagnated. I investigate whether differences in industry mix help explain these different outcomes.

Additionally, while California has a recent history of Democratic political dominance, Texas has a recent history of Republican political dominance. Since U.S. politics are highly polarized and climate and renewables support are associated with the Democratic party, party control is an important potential explanatory factor for RE policymaking. Process tracing within these two cases suggests the proposed typology is nonetheless useful in explaining across variation in party dominance.

But I also briefly examine a case more comparable to Texas in terms of party dominance: West Virginia. Like Texas, West Virginia is a Republican-dominated state that passed an RPS. In West Virginia, however, the RPS was subsequently repealed. The West Virginia case therefore serves two functions: First, in comparison to Texas it provides a data point that the typology helps explain variation in policy outcome when political party control is constant. Second, West Virginia is also of interest because RPS repeal is quite rare, making it something of a deviant case.Footnote 34 Examining West Virginia allows me to investigate whether the typology helps explain this outlier.

There are important limitations to this case selection. I do not argue that it provides a representative sample of cases or any kind of natural experiment; both the project scope and the relatively small universe of possible cases make it difficult to convincingly do either, nor is there a sampling strategy that plausibly controls for all alternate explanatory variables.

Therefore, certain types of claims are ruled out. I do not claim to test how frequently the typology is an important explanatory factor within the universe of possible cases, or precisely what percentage of variation in outcomes seen across all cases is, overall, explained by this factor. And while I believe these cases do provide compelling evidence for my typology, a small-N, non-representative sample does not allow me to entirely rule out the possibility that this empirical result is also non-representative; at best, what I present is suggestive of generalizability.

In sum, the logic of case selection here is partly exploratory, aimed at theory-building and initial theory-testing; but with the intent to provide in addition some evidence of generalizability. I hope to convince the reader first, that the typology proposed is useful in understanding outcomes in at least some cases of intrinsic interest, in combination with other explanatory factors; and second, that the cases examined are diverse enough to provide plausible grounds for believing the proposed typology is of broader usefulness.

Ozone

Scientists recognized in the 1970s that certain classes of chemicals deplete the stratospheric ozone layer,Footnote 35 which provides protection from solar UV radiation. This developing understanding resulted in policymaking efforts to control ozone depleting substances (ODS), first domestically and later, beginning with negotiations in 1985, internationally.

A variety of chemicals widely in use at the beginning of this policymaking process were implicated by ODS controls. Most salient were the chlorofluorocarbons (CFCs), a family of chemicals used in aerosol sprays, cooling applications, solvents, and in the manufacture of foams and packing materials. Other initial targets of policymaking included halons (fire extinguishers and refrigerants); methyl chloroform (primarily a solvent); carbon tetrachloride (used as a fire suppressant, a solvent, and a CFC precursor); and other less widely-used chemicals. In later rounds of negotiation, some additional substances were added to the list of targets for negotiated reductions. These included hydrochlorofluorocarbons (HCFCs), partial substitutes for CFCs with lower but non-zero ozone depleting potentials; and methyl bromide, primarily used in agricultural fumigation.

Reduction of ODS in practice happened two ways: In some applications, the chemical could be entirely eliminated, as in aerosol sprays. Other applications required the substitution of chemicals with comparable properties but lower ozone depleting potential. Applications of this second type typically shifted to either HCFCs, a well-known class of chemicals with, as noted above, a lower ozone depleting potential; or hydrofluorocarbons (HFCs), chemicals whose production technology was less well-developed and more expensive, but which had zero ozone depleting potential.

Industries and their classification

As implied by this summary, there was a set of industries that produced and used these chemicals and would be significantly impacted by ODS controls:

Chemicals manufacturers—particularly a small set of large chemical manufacturers in the United States, United Kingdom, France, and Germany—had the expertise to manufacture both ODS and their substitutes.

Manufacturers of refrigerators, building air conditioning units, and similar cooling equipment as well as the automobile and automobile equipment industries used ODS because they were, at the time, the chemicals best suited to make safe, low-cost, effective cooling devices.

The semiconductor and electronics manufacturing industries used ODS as manufacturing solvents.

The agriculture industry used methyl bromide extensively to eliminate pests and sterilize soil.

There were also niche applications; however, these were smaller-volume, less politically relevant, and could be handled with exemptions, if necessary.

What is important to note is that these industries are mostly Convertible and Management industries. Because the production of CFCs, HCFCs, and HFCs all use related expertise, the same companies that made CFCs were also the makers of non-depleting substitutes. Therefore, the chemicals industry, the industry most directly impacted by ODS controls, was a classic Convertible industry: It had the ability to make both polluting and (after a certain amount of capital investment in new production facilities) non-polluting goods.

Meanwhile, most of the other industries impacted used CFCs as inputs. These industries are Management industries; their use of polluting inputs exposed them to input and process costs. Given the availability of substitutes, policy was not an existential threat; but neither did adaptation give these industries novel interests in additional policy. One exception is agriculture, which, as I discuss below, was the sole major industry to behave like a Loser in this case.

Convertible and management industries and ozone policy

Changes in the interests of the Convertible chemicals industry underpin the speed of international ozone policymaking. The negotiations began in Vienna in 1985, a round where efforts produced the Vienna Convention but no actual ODS controls; 1987 produced the Montreal Protocol, a moderate agreement requiring partial cuts in some ODS; and proceeded through two more major negotiating rounds in London (1990) and Copenhagen (1992) that twice significantly raised the stringency and broadened the scope of policy. Between 1985 and 1992, the world went from being unable to agree on any binding ODS reduction to putting in place a series of stringent controls that addressed the bulk of the ozone depletion problem.

Although negotiations were nominally global, in practice there were a set of key players in the ozone negotiations. Because these countries hosted the vast majority of ODS production, they essentially controlled the fate of the ozone negotiations as well. These players were the United States (host to CFC producers DuPont and several other smaller producers); Britain (Imperial Chemical Industries (ICI)); France (Atochem); and Germany (Hoechst). Japan and the USSR also produced ODS in meaningful quantities, but were not major players because their concerns were satisfied early on: The USSR got a clause in the Montreal Protocol that grandfathered in its contemporary planned capacity,Footnote 36 while Japan's main concern was the use of CFC-113 in its semiconductor industry, which was dealt with via arrangements that allowed it flexibility in meeting its requirements.Footnote 37

Initially, the main advocates for controls were the United States and various less powerful northern European countries (which had greater exposure to ozone thinning). In 1986, Germany swung from opposition to support of controls, after which the United States was able to successfully push for international policy in the form of the Montreal Protocol in 1987—as noted above, a moderate agreement with partial ODS cuts. By 1990, the United Kingdom had also begun actively supporting controls, leaving only France resisting, and allowing for a more stringent amendment to the Protocol. In 1992, even France was on board, and controls tightened further.

Understanding the potential for change in the Convertible chemicals industry is key to understanding the speed with which this process played out. The interests of DuPont, ICI, and Atochem were critical to shaping their host countries negotiating positions.Footnote 38 And these interests were subject to rapid change because of the Convertible nature of the chemicals industry. Prior to negotiations, the major CFC manufacturers displayed a united international front against controls.Footnote 39 When negotiations began in 1985, few players had introduced any significant domestic controls. The United States was an exception. DuPont's interests began to shift as the United States imposed domestic controls on CFCs and DuPont sought a level playing field internationally.Footnote 40 DuPont split from its fellows abroad, disrupting their international interest coalition.Footnote 41

The other players joined in sequence. Germany's shift to support in 1986 appears to owe less to industry interests and more to growing attention to ozone policy from the unusually powerful green faction in German politics.Footnote 42 But between Montreal in 1987 and Copenhagen in 1992, DuPont, ICI, and Atochem made capital investments in production facilities for ODS substitutes. DuPont and ICI invested rapidly and heavily in production capacity for substitutes. France's Atochem was slower, making some movements toward production of HCFCs by 1990 but not really committing until after the 1990 London negotiations tightened controls. France continued to resist ODS controls through 1990. But by the final negotiations in 1992, parts of the chemicals industry were calling for more regulation,Footnote 43 and all major players were on board.

When these companies committed substantial capital investment to production facilities for pollutant substitutes, their interests changed: Growing support for policy from these companies derived from concerns over the slow pace at which the market for that production capacity was growing.Footnote 44 As a result, an entire pre-existing industry rapidly shifted from the opposing to the supporting coalition: the dynamic of a Convertible industry.

The other industries were almost uniformly Management industries that used ODS as production inputs, and they behaved as predicted. They initially grumbled about the costs of policy but, with substitutes available and the increased cost guaranteed by global policy to be level across competitors, they did not constitute a major barrier to increasingly stringent policy.

The exception is the agriculture industry, users of methyl bromide (MB), a relatively late addition to the list of known ozone-depleting substances. Although MB was only an input to agricultural production, the agriculture industry saw it as necessary, and no clear alternative for it had been developed for this application. This is a case in which lack of an input substitute caused an otherwise Management-type industry to act like a Loser; agriculture staunchly resisted regulation.Footnote 45 Fortunately for the success of the ozone negotiations, by 1992 this was only true for one major application of a single chemical, and did not impact negotiation on other ODSs. But MB did prove a sticking point. By 1992, players had agreed only to a freeze on MB production at 1991 levels.Footnote 46

In sum, the ozone as an issue area was relatively easy to achieve policy success partly because it was dominated by Convertible industries with few Losers or strongly impacted Management industries. This is not to say that industry type is all that mattered—in particular, as noted above, the smaller scope of ozone policy relative to climate is permissive; and the ozone issue area benefits from various ad hoc factors including the fact that the United States, the most powerful player, was a leader in pushing for policy, which made securing an initial policy agreement easier. In addition to these factors, however, the shift of Convertible industries from opponents to supporters of policy allowed for a rapid shift in national negotiating positions from mostly-opposing to mostly-favoring strong policy.

Climate

The problem of anthropogenic climate change has a rich history of policymaking efforts over the past thirty years. It also draws on prior efforts to promote energy efficiency and/or renewable energy that derives from earlier concerns like energy independence or air pollution. At the international level, policymaking efforts have been frustrating and slow. 1992 saw the creation of a framework for negotiation, followed only in 1997 by the Kyoto Protocol, an agreement by some developed-world countries to restrict emissions very marginally.

The next major milestone did not come until 2009, when nations met in Copenhagen to negotiate a Kyoto follow-on. Though seen by many as a failure, Copenhagen did produce the Copenhagen Accord, a collection of voluntary national GHG control commitments. This paved the way for the 2015 Paris Agreement, which formalized a process for collecting and updating such voluntary national commitments going forward—a shift in strategy, whose ultimate results remain to be seen. 2015 was the first point at which the majority of the world's nations made emissions control commitments; and even these are non-binding and insufficient to fully mitigate climate change.

However, a patchwork of national and subnational policymaking efforts is underway, independent of but increasingly reflected in the international process as it moves to the voluntary commitment framework. These jurisdiction-specific policymaking efforts have mixed results, including some relatively impressive success stories. Unlike the ozone case, where there was little variation in the industry mix across key players, jurisdictions vary substantially in terms both of the mix of industry types. I argue here that teasing out the relationship between mix of industry type, policy, and outcome helps us understand these varying degrees of progress.

The industry mix relevant to climate is quite broad and covers all four of my types. I note that my analysis does not attempt to include all possible industries impacted by decarbonization policy; in particular, I do not attempt an exhaustive list of Management industries. Rather, I use several identification strategies to attempt to identify industries most relevant to decarbonization politics. First, a set of industries are well-known to be impacted; these include sectors like oil, coal, and renewable energy. In addition, I include industries I found to be active (e.g., expressing opinions publicly, cited by policymakers as important in the area, or known to be engaged in lobbying) during a review of case materials. Finally, since any energy-intensive industry may perceive decarbonization policy as impacting its interests significantly, I reviewed the industry profiles of my cases, matching important state industries against energy intensive sectors to search for industries not otherwise included that should be considered. Table 1, below, provides a descriptive summary of important industries across states.

Table 1: Descriptive summary of major industries by categories across state cases

Different industry mixes, different outcomes

A comparison of three U.S. states suggests the importance of understanding the mixes of industry type within a particular jurisdiction when assessing the potential for long-term success in decarbonization policy.

California

As of 2017, California has succeeded in creating an ambitious RPS, a cap-and-trade program, and a host of complementary measures; and it has ratcheted up stringency over time. California's history of success owes a great deal to the particular mix of industries it possessed at the point that climate became politically salient and since.

California has strength in Winner industries like green equipment and services and renewable generation, which predate climate policymaking,Footnote 47 and which have grown strongly since that policymaking began. Quite recently Tesla, an all-electric auto manufacturer, has become notable. But equally importantly, California has two major Convertible industries, both of which it has succeeded in converting over the past several decades. First, California's venture capital (VC) industry, a powerful economic block with global leadership, was searching for new areas of investment following the IT boom, and settled on green industry as one focus, shifting the VC industry's interests behind decarbonization policy during the 2000s.Footnote 48

Second, utilities also typically act as Convertible industries: Initially, if their portfolios are dominated by fossil fuels generation, they tend to resist carbon controls. But if their interests change—e.g., if generation mixes change to include a substantial amount of renewable generation—they acquire incentives to support renewables and climate policy. The conversion of California's utilities began in the 1980s, when California introduced decoupling, policy that disconnected utility profits from sales, to realign utility interests toward the promotion of efficiency instead of sales volume. This eliminated one interest barrier to decarbonization policy.

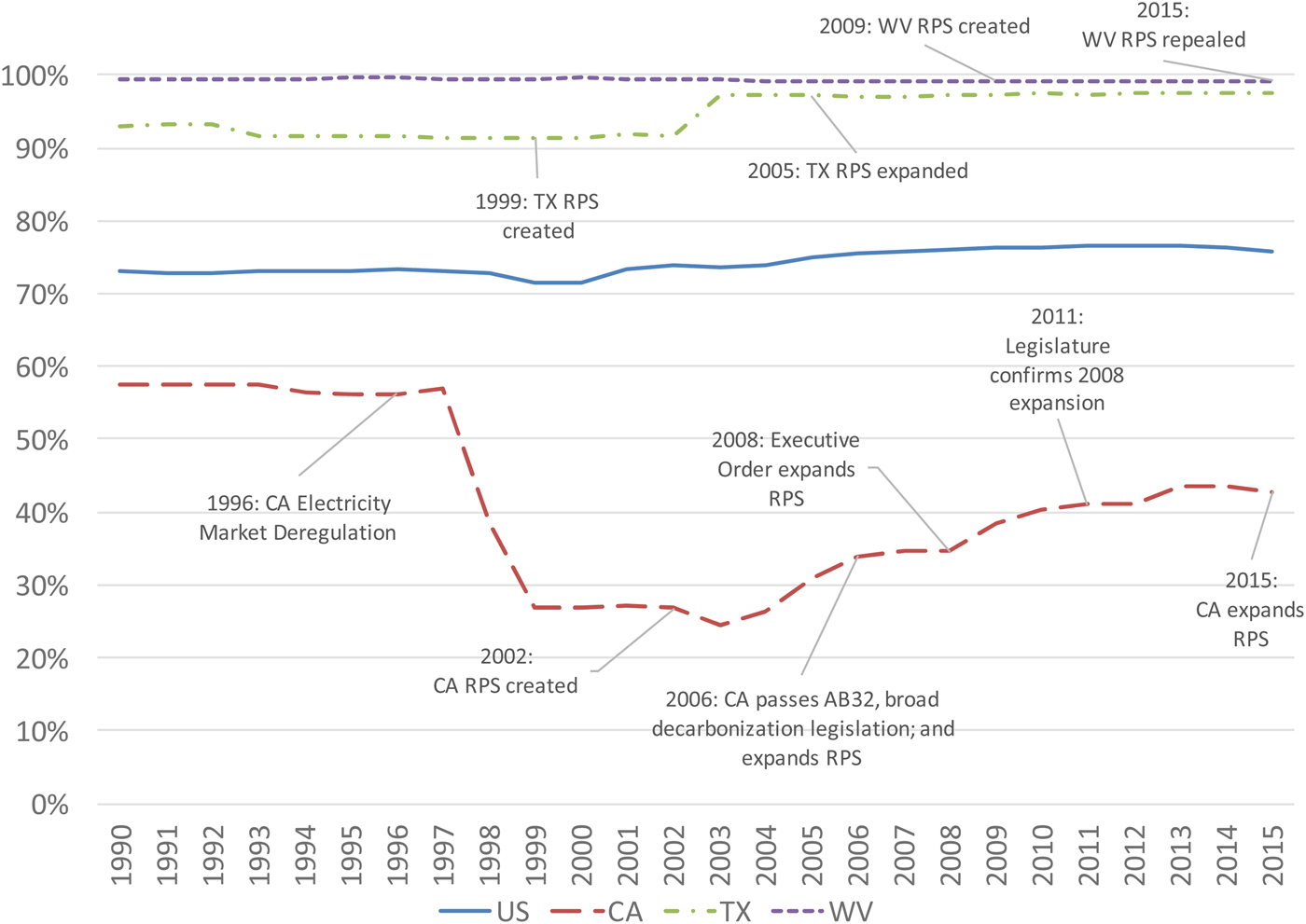

In the late 1990s, California initiated deregulation of its electricity industry. Although deregulation was a spectacular failure and was ultimately rolled back, a provision requiring utilities to divest their generation assets had already substantially changed the industry (see figure 2). Many of the legacy assets divested were fossil-based; so during this period the percentage of utility-owned assets that were fossil fuel-burning dropped from around 60 percent (already low relative to the rest of the United States) to around 25 percent of total utility assets during the mid-2000s (share later rebounded, but only to around 40 percent). Major utilities like PG&E began to see their low-carbon portfolio as a competitive advantage.Footnote 49 Utilities’ owned low-carbon portfolios consist of assets like conventional hydroelectric, nuclear, and remaining natural gas generation; though these do not fulfill RPS requirements, they do make utilities substantially less exposed to complementary climate policy including California's cap and trade system. And although California utilities largely do not own the qualified renewable assets used to meet RPS requirements, they still have interests in these assets continuing to be supported by policy, since in many cases RPS requirements are fulfilled by long-term contracts, yoking utility interests to their contracted suppliers in the medium to long term. Since the mid-2000s, California utilities have been supporters of California's RPS and other policies, expressing their opposition to Proposition 23, a 2010 ballot proposition that would have suspended California's climate legislation.Footnote 51, Footnote 52

Figure 2: Fossil fuel generation assets as a percentage of all utility-owned generationFootnote 50

What isn't in California is important, too. California lacks coal, both production and use, and is not a major center for heavy industry. The state does have a substantial oil industry and some natural gas, with Chevron headquartered in state, several large refineries along the coast, and moderately sizeable oil reserves. The oil industry is, indeed, one of the few strong barriers to carbon reduction policy in California. However, oil is not significantly implicated in electricity production, and the major oil players have focused primarily on avoiding transportation fuel regulation, with some success,Footnote 53 rather than electricity and broader economy-wide measures.

Collectively, then, the lack of a broad coalition of Losers is permissive; California's Winner industries provide a growing core coalition supporting decarbonization policy; and the conversion of important Convertible industries substantially broadened that coalition. California's ongoing success, while certainly related to other factors like a history of pro-environmental attitudes and a well-functioning air-quality bureaucracy, rests in part on its favorable mix of industry types.

Comparison with West Virginia and Texas further highlights this dynamic. As table 1 shows, both of these states have a broad potential coalition against decarbonization policy composed of Loser industries, and fewer pre-existing Winner and Convertible industries. Moreover, in both cases Convertible industries have not been successfully converted.

Texas

Texas's industry mix differs from California's in three ways. First, with less of a history in renewables innovation, Texas does not have as strong a contingent of Winner industries. This curtails the core coalition for decarbonization policy, although strong growth in wind generation capacity has grown the renewables generation industry in recent years. Second, while Texas does have a utility industry, it does not have California's large VC community. This difference means fewer important Convertible constituencies in Texas that could shift rapidly to supporting decarbonization policy. Nor does not appear that utility conversion has happened in Texas as it did in California. Texas utility profits are not decoupled from sales volume,Footnote 54 and the share of fossil-fuel assets in their owned generation remains high (figure 2), though as in California, long-term contracts with third-party renewable energy producers, where present, may influence their positions. Third, Texas has strong Loser industries: a very strong oil industry, and an equally strong NG industry that is strongly linked to oil and sees an RPS as competition.

The outcome derived from this landscape is a moderate, stagnant RPS (nominally created in 1999 but increased to a substantive requirement in 2005). Texas's electricity industry has achieved its RPS targets well before target dates, suggesting they are not particularly stringent relative to what Texas's resources and energy economy allow. A new RPS proposed in 2009 failed.Footnote 55 In 2015, the original legislation faced a repeal challenge; legislators argued the law had achieved its goals and was no longer needed. Electricity demand growth in Texas had been slow,Footnote 56 and reporting described the move as emblematic of a “turf battle” between wind and natural gas interests.Footnote 57 The growing renewable generation industry was able to fend off this challenge and preserve the 2005 RPS, but subsequent expansion of the RPS hasn't happened.

Texas's industry mix was and is permissive of a moderate portfolio standard, which appears to have activated and grown a coalition of Winner industries sufficient to defend the existing standard against attack. But Texas's utility industry does not appear to have converted, and the resulting industry mix today does not support the strengthening of policy over time seen in California.

West Virginia

West Virginia has an even lower-potential industry mix. West Virginia has a strong coalition of Loser and heavily impacted Management industries—especially coal, but also natural gas and chemicals. It had and continues to have little in the way of substantial activity from Winner industries. West Virginia's main Convertible industry, its electric utilities, does not appear to have converted (figure 2).

Unsurprisingly given this mix, although carbon reduction policy made it onto the political agenda in West Virginia, it was undermined by local interests from the start, and did not survive subsequent challenges. West Virginia's RPS was ineffective from the start, including within its definition of alternative fuels a number of highly questionable technologies including natural gas and “clean coal,” favoring in-state fossil fuel interests and meaning that utilities would not necessarily to have to invest significantly in true renewables to meet its requirements.Footnote 58 The RPS did not activate, grow, or convert sufficient interests to survive, and was repealed in 2015.

Conclusions

These cases suggest a number of lessons.

Industry types matter to policy outcomes, and to the potential for feedback

In terms of the likelihood that positive feedback will occur, industries are not created equal. The cases reviewed in this paper suggest that policy feedback in environmental policymaking will find most fertile ground in jurisdictions with (obviously) many Winner and few Loser industries, and (more interestingly) many Convertible industries. Similarly, policy that targets Winners and Convertible industries first is likely more effective in policy sequencing.

Convertible industries are high-leverage

We can make further distinctions. It is more difficult to sort out the differential impacts of developments in Winner vs. Convertible industries, since they are often targeted by the same policy. But I argue that both logic and case evidence strongly suggest that Convertible industries are high-leverage targets.

The cases of ozone (internationally) and climate (in California) policy suggest that Convertible industries allow for the rapid addition of large, mature industry groups and coalitions to support policymaking. With ozone, where Convertible industries dominated the landscape of impacted firms, changes in coalition size happened rapidly. With climate, the economy-wide impact of carbon reduction policy means a full suite of Winners, Losers, Convertible, and Management industries is impacted. It makes sense that we don't see rapid shifts in supporting and opposing coalitions as in ozone, particularly in international negotiations, where all industry interests converge. The lack of industry concentration in Convertible industries is certainly not the only challenge international climate policymaking faces, but I argue that the difference in global industry mixes is one of several key factors in explaining its difficulty.

At the national and subnational level, the precise mix of major industry groups impacted by climate policy varies substantially by jurisdiction, with different distributions of industry types. The state cases suggest that the availability of large Convertible industries, and whether policy changes those industries’ interests, is an important determinant of positive feedback.

Winners matter most to outcomes when they can scale quickly

It follows that Winners (and policies targeting them) are most likely to matter when they can grow rapidly. This is not always the case in decarbonization—utility-scale generation is capital-intensive with long lead times. Emerging industries can require time-consuming development, commercialization, and market growth to get big enough to rival entrenched Losers. Convertible industries suffer less from this problem because, even if they have to make major new investments, they still start with a large existing base of resources—significant revenues, an established bureaucracy and market networks, technological know-how, a customer base, etc. Changing the interests of an existing Convertible industry will, all else being equal, be faster than growing a new industry from scratch.

But there are instances where Winner interests emerge rapidly. Distributed generation has the potential to scale up much more quickly than utility-scale. Corporations that offer third-party agreements for rooftop solar have grown explosively over the past decade; SolarCity, one such company, founded in 2006, employed more than 15,000 employees as of 2015.Footnote 59

Denmark and Colorado offer different examples. When Denmark began supporting wind power, many early windmills were built by local land-owners and small cooperatives.Footnote 60 This rapidly created a new Winner group, citizen turbine owners. Similarly, Colorado's passage of an RPS created a novel business for ranchers leasing turbine siting rights.Footnote 61

Three characteristics likely make for Winner industries that matter most: low capital intensity, rapid production timelines, and the ability to scale to many stakeholders quickly.

Rationale for devolving climate policy to national and sub-national levels and using a policy- rather than emissions target-focused approach

As discussed above, the ozone issue area industry mix was fairly uniform and narrow across countries, making it amenable to rapid shifts in interests even at the international level. By contrast, climate issue area at the international level brings together a saturated mix of policy types, including all of the world's most resistant Loser industries. This suggests a novel framework, complementary to other existing lines of argument, for understanding the greater progress made at the national and sub-national levels: it is easier at the national and subnational level to find jurisdictions that may have narrower and more favorable industry mixes (e.g., a higher proportion of Convertible industries). This provides an additional rationale for the desirability of international approaches that focus more on domestic policymaking, tailored to domestic contexts. The material in this paper alone cannot conclusively support this rationale for policy devolution—that would require a broader survey of the landscape of national and subnational interest mixes, an area for future research—but I argue that the logic is intuitively satisfying and the cases presented here are suggestive.

Similarly, the targets and timetables approach previously taken in international climate negotiations is inherently questionable. Weak, jurisdiction-wide emissions reduction goals suggest moderate economy-wide policies like (weak) carbon pricing and incremental efficiency improvements. These primarily affect Loser and Management industries, the two least productive policy targets. Both of these points suggest the shift in approach seen at the 2015 Paris climate negotiations may be productive, if it orients negotiations toward eliciting national-level policymaking with policy-specific commitments targeting local Winner and Convertible industries in ways appropriate to local policy landscapes.

Summing up

This paper argues that industry type matters to the potential for policy success and resulting policy feedback. Success stories tend to be those cases with one or (typically) more of the following characteristics: low starting levels of Loser industries; high potential for growth in Winner industries; presence of important Convertible industries ripe for conversion; and policy that acts effectively to convert Convertible industries and grow Winner industries.

Two areas of future research present themselves. First, I stress that my findings should be understood as complementary to existing theories of success in environmental policymaking, and further exploration of the interactions between this explanatory factor and others—both systems-level, like institutions and political context, and firm-level, like firm culture and history—would be desirable; in particular, in what circumstances this explanatory factor is most determinative relative to others. Second, I anticipate future work that delves deeper into the circumstances under which policy does or does not effectively target Convertible industries to convert them. Such future research will sharpen the practical policy lessons to be gained from this model.