INTRODUCTION

A growing body of research on knowledge-inheriting spinoffs (Agarwal, Echambadi, Franco, & Sarkar, Reference Agarwal, Echambadi, Franco and Sarkar2004; Basu, Sahaym, Howard, & Boeker, Reference Basu, Sahaym, Howard and Boeker2015; Klepper, Reference Klepper2001) and knowledge spillover entrepreneurship (Acs, Audretsch, & Lehmann, Reference Acs, Audretsch and Lehmann2013; Plummer & Acs, Reference Plummer and Acs2014) links startup performance to knowledge originating from incumbents. These studies generally focus on emerging high-tech industries or complex product systems industries and emphasize the flows of technical knowledge particularly (Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004; Klepper & Thompson, Reference Klepper and Thompson2010; Minola, Hahn, & Cassia, Reference Minola, Hahn and Cassia2021; Sahaym, Howard, Basu, & Boeker, Reference Sahaym, Howard, Basu and Boeker2016). As startups conducting technology-intensive businesses tend to source more technical knowledge from incumbent firms (Chatterji, Reference Chatterji2009), and their fates hinge more on technical innovativeness (Dencker, Gruber, & Shah, Reference Dencker, Gruber and Shah2009), the current literature may be skewed toward overstating the effects of technical knowledge passed from incumbents while undervaluing other knowledge (Chatterji, Reference Chatterji2009; Feldman, Ozcan, & Reichstein, Reference Feldman, Ozcan and Reichstein2019). Important questions that emerge in the context of this literature are what knowledge (aside from technical knowledge) actually flows from incumbents to startups and relative contributions of different knowledge to startups.

Our study advances a more nuanced and comprehensive understanding of these questions. We propose an inductive typology of incumbent-to-startup knowledge flows and explore both the short- and long-run implications of each type on startup performance. Given the novelty of this project and its exploratory nature, we utilize a multi-case research design and limit inquiry to the Chinese synthetic-dye industry – a technologically mature industry that represents an empirical context insufficiently considered in prior research on incumbent-to-startup knowledge flows. We find eight types of knowledge, categorized as either functional or strategic in nature, flow from incumbents during the founding period of startups. Even more significantly, we find startups that receive functional knowledge (including technical knowledge) during the foundation period are more likely to survive than startups not receiving such knowledge – but this advantage only exists for a short time. The reception of initial strategic knowledge, by contrast, has the capacity to generate long-term success.

This study makes several important contributions to the knowledge inheritance theory and knowledge spillover theory of entrepreneurship. First, while our study corroborates prior research showing that incumbent-to-startup knowledge flows matter for the success of startups, it extends the empirical foundation of this finding by replicating it in a underexamined industrial context – a technologically mature industry (Tsang & Kwan, Reference Tsang and Kwan1999). Second, our study goes beyond the predominant approach, operationalizing knowledge by proxies, and captures more precisely the nature of knowledge that flows from incumbents to startups, yielding greater insight into the relationship between types of concrete knowledge and startup outcomes. Third, our study reveals that startups receiving sufficient functional knowledge only, which allows for success in the early years, are distinguished from those that have received strategic knowledge, a distinction bearing in significant ways on short-term versus long-term performance. These results confirm a formerly neglected speculation (Chatterji, Reference Chatterji2009; Klepper, Reference Klepper2001; Wennberg, Wiklund, & Wright, Reference Wennberg, Wiklund and Wright2011) that technical knowledge may not constitute the most important component of startup outcomes. Our analysis points to promising avenues for future research on how different types of incumbent-to-startup knowledge flows impact both firms and regions in which they are embedded and how such flows differ in different institutional settings.

LITERATURE BACKGROUND

In the last two decades, a vibrant body of research on knowledge inheritance and knowledge spillover suggests that incumbents serve as an effective source of initial knowledge for startups. The knowledge inheritance theory of entrepreneurship (Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004; Buenstorf & Fornahl, Reference Buenstorf and Fornahl2009; Furlan & Grandinetti, Reference Furlan and Grandinetti2016; Klepper & Sleeper, Reference Klepper and Sleeper2005) posits that spinoffs inherit substantial industry-specific knowledge and well-functioning routines ‘suited to their activities’ (Klepper, Reference Klepper2001) from their founders’ prior employment. This theory argues that the knowledge created but not commercialized by incumbents creates underexploited opportunities, which leads to entrepreneurship external to its origin and drives startups’ future performance. The knowledge spillover theory of entrepreneurship (Acs et al., Reference Acs, Audretsch and Lehmann2013; Ghio, Guerini, Lehmann, & Rossi-Lamastra, Reference Ghio, Guerini, Lehmann and Rossi-Lamastra2015; Plummer & Acs, Reference Plummer and Acs2014) more broadly links knowledge flows from incumbent firms to new firms that are not confined to spinoffs. This theory has sought to establish the influence of knowledge transfer on the performance of startups and industrial agglomeration (Furlan & Cainelli, Reference Furlan and Cainelli2020). Although the two streams of literature attend to different kinds of startups and adopt different perspectives on the vehicles and channels through which knowledge flows occur, both work on the notion that startups receiving existing knowledge from incumbents translate it into a benefit.

The numerous studies on knowledge inheritance and knowledge spillover from incumbents typically illustrate the vehicles and mechanisms through which knowledge generated within established firms is transmitted and enables startups to exploit opportunities using the knowledge (Acs et al., Reference Acs, Audretsch and Lehmann2013; Audretsch & Belitski, Reference Audretsch and Belitski2013; Di Lorenzo & van de Vrande, Reference Di Lorenzo and van de Vrande2019; Feldman et al., Reference Feldman, Ozcan and Reichstein2019; Gambardella, Ganco, & Honoré, Reference Gambardella, Ganco and Honoré2015). Some most frequently discussed mechanisms include entrepreneurs pursuing opportunities proximate to the businesses of their prior employers but not exploited by these incumbents yet (Klepper, Reference Klepper2001), startup founding team members and employees using their knowledge accumulated through experiential learning in their former organizations (Agarwal, Campbell, Franco, & Ganco, Reference Agarwal, Campbell, Franco and Ganco2016), and startups seeking for knowledge from incumbent employees through social networks (Phillips, Reference Phillips2002). Yet, even as these studies have established a positive relationship between incumbent-to-startup knowledge flows and new firm superiority, they provide little explicit evidence of actual knowledge flows, especially a full view of the knowledge flows per se that go into startups and their potentially distinct effects.

First, the current literature either does not specify the knowledge that flows from incumbents to startups, or it concentrates only on a very narrow scope of relevant knowledge. It stands to reason that these knowledge flows encompass a variety of knowledge (Klepper & Sleeper, Reference Klepper and Sleeper2005), but the literature lacks an integrative framework for systematically examining the initial knowledge passed from incumbent firms and then explaining the influence of different types of knowledge. Current studies of incumbent-to-startup knowledge flows predominantly consider technical knowledge and its impact (Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004; Basu et al., Reference Basu, Sahaym, Howard and Boeker2015; Franco & Filson, Reference Franco and Filson2006; Gambardella et al., Reference Gambardella, Ganco and Honoré2015; Minola et al., Reference Minola, Hahn and Cassia2021; Sahaym et al., Reference Sahaym, Howard, Basu and Boeker2016). Although a handful of studies have mentioned or discussed the flow of business ideas (Fryges & Wright, Reference Fryges and Wright2014), market-related know-how (Adams, Fontana, & Malerba, Reference Adams, Fontana and Malerba2016; Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004; Cantù, Reference Cantù2017), and organizational routines (Adams et al., Reference Adams, Fontana and Malerba2016; Feldman et al., Reference Feldman, Ozcan and Reichstein2019; Klepper, Reference Klepper2001; Klepper & Sleeper, Reference Klepper and Sleeper2005; Muendler, Rauch, & Tocoian, Reference Muendler, Rauch and Tocoian2012; Phillips, Reference Phillips2002) – particular ways of conducting organizational functions (Kostova, Reference Kostova1999), empirical research on the flows of these other types of knowledge is rather limited. However, a few researchers have speculated that nontechnical knowledge, such as the knowledge of problem formulation (Cross, Borgatti, & Parker, Reference Cross, Borgatti and Parker2001), contributes as much if not more than technical knowledge to the performance of startups (Gilbert, McDougall, & Audretsch, Reference Gilbert, McDougall and Audretsch2008; Maliranta, Mohnen, & Rouvinen, Reference Maliranta, Mohnen and Rouvinen2009; Wennberg et al., Reference Wennberg, Wiklund and Wright2011). Some (Chatterji, Reference Chatterji2009; Klepper, Reference Klepper2001) have even challenged the conventional conjecture that technical knowledge plays a critical role in startup performance, a contention that supports our call for a more comprehensive consideration of the elements of incumbent-to-startup knowledge flows.

Second, empirical evidence in support of a positive relationship between incumbent-to-startup knowledge flows and startup superiority mainly focus on startup creation and survival, while other salient performance indicators more closely related to sustained competitiveness are insufficiently investigated. Many studies show receiving knowledge from incumbent firms fosters the formation of startups (Adams et al., Reference Adams, Fontana and Malerba2016; Gambardella et al., Reference Gambardella, Ganco and Honoré2015; Knoben, Ponds, & Van Oort, Reference Knoben, Ponds and Van Oort2011; Yeganegi, Laplume, Dass, & Huynh, Reference Yeganegi, Laplume, Dass and Huynh2016) and improves the probability of their survival (Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004; Furlan, Reference Furlan2016; Muendler et al., Reference Muendler, Rauch and Tocoian2012; Phillips, Reference Phillips2002). While startup creation and survival deserve scholarly attention, a drawback of relying only on survival to approximate performance is that there is not always a correlation between a firm's life span and its financial performance (Furlan & Grandinetti, Reference Furlan and Grandinetti2016). For instance, startup exits include M&A and IPOs that represent success rather than failure. Yet, investigations of whether and how incumbent-to-startup knowledge flows affect other startup performance indicators that better capture sustained competitive advantages, such as innovation and growth, remain scant. The only five exceptions thus far are studies by Gifford, Buenstorf, Ljungberg, McKelvey, and Zaring (Reference Gifford, Buenstorf, Ljungberg, McKelvey and Zaring2021), Basu et al. (Reference Basu, Sahaym, Howard and Boeker2015), Fryges, Müller, and Niefert (Reference Fryges, Müller and Niefert2014), Gilbert et al. (Reference Gilbert, McDougall and Audretsch2008), and Wennberg et al. (Reference Wennberg, Wiklund and Wright2011). Of these studies, two concern startup innovation and three concern startup growth in terms of sales and employment, while still presenting inconsistent results. For example, Wennberg et al. (Reference Wennberg, Wiklund and Wright2011) find the commercial knowledge passed from incumbents raises the sales growth rate of spinoffs, whereas Gilbert et al. (Reference Gilbert, McDougall and Audretsch2008) suggest the spillover of technical knowledge from incumbents has no effect on startups’ sales growth. The inconsistency may stem from the different types of knowledge or the different time periods considered, while the sample startups in Wennberg et al. (Reference Wennberg, Wiklund and Wright2011) provide performance data for two to nine years after foundation, Gilbert et al. (Reference Gilbert, McDougall and Audretsch2008) collect only startup growth through two years after IPO. Thus, it is fair to say previous empirical literature is underdeveloped when it comes to scrutinizing whether the success of startups, especially competitiveness over a relatively longer period, is influenced by incumbent-to-startup knowledge flows.

Third, empirical studies usually operationalize the amount and quality of incumbent-to-startup knowledge flows using rough proxies as opposed to examining knowledge flows directly. The proxies recurring most often are the properties of incumbents and knowledge agents (e.g., spinoff founders or employees hired from incumbent firms). A number of studies employ survival (Dahl & Reichstein, Reference Dahl and Reichstein2007; Eriksson & Kuhn, Reference Eriksson and Kuhn2006; Furlan & Cainelli, Reference Furlan and Cainelli2020; Phillips, Reference Phillips2002), longevity (Dahl & Sorenson, Reference Dahl and Sorenson2013; Franco & Filson, Reference Franco and Filson2006; Klepper, Reference Klepper2001; Sørensen & Phillips, Reference Sørensen and Phillips2011), scale (Elfenbein, Hamilton, & Zenger, Reference Elfenbein, Hamilton and Zenger2010; Sørensen, Reference Sørensen2007; Sørensen & Phillips, Reference Sørensen and Phillips2011), research and development (R&D) strategies (Andersson, Baltzopoulos, & Lööf, Reference Andersson, Baltzopoulos and Lööf2012), and new market entry (Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004) of incumbent firms to gauge the quality of knowledge that spills over from these firms. Other studies use the rank of knowledge agents at incumbent firms (Andersson & Klepper, Reference Andersson and Klepper2013; Wezel, Cattani, & Pennings, Reference Wezel, Cattani and Pennings2006) or their industry-specific experiences (Andersson & Klepper, Reference Andersson and Klepper2013; Dahl & Reichstein, Reference Dahl and Reichstein2007; Dahl & Sorenson, Reference Dahl and Sorenson2013; Eriksson & Kuhn, Reference Eriksson and Kuhn2006; Gifford et al., Reference Gifford, Buenstorf, Ljungberg, McKelvey and Zaring2021; Wennberg et al., Reference Wennberg, Wiklund and Wright2011). A common shortcoming of these measures is that they assume a strong link between the knowledge possessed by incumbent firms and knowledge passed from them to startups – a link for which few studies have provided explicit evidence. While proxies such as a longer life span do imply an incumbent firm's knowledge enjoys a better evolutionary fit within the given environment, this relationship does not necessarily imply flows of that knowledge (in higher quality or in greater volume) to startups (Fryges et al., Reference Fryges, Müller and Niefert2014).

Finally, industrial settings that have been introduced in prior studies are within a limited range of emerging high-tech industries or technologically complex industries, whereas traditional or technologically mature industries are largely missing from the discussion. The industries that have been given priority involve semiconductors (Adams et al., Reference Adams, Fontana and Malerba2016; Di Lorenzo & van de Vrande, Reference Di Lorenzo and van de Vrande2019; Klepper & Thompson, Reference Klepper and Thompson2010), disk drives (Agarwal et al., Reference Agarwal, Echambadi, Franco and Sarkar2004; Franco & Filson, Reference Franco and Filson2006), biotech (Basu et al., Reference Basu, Sahaym, Howard and Boeker2015; Stuart & Sørensen, Reference Stuart and Sørensen2003), ICT (Lasch, Robert, & Le Roy, Reference Lasch, Robert and Le Roy2013), and automotive (Klepper, Reference Klepper2002), as well as knowledge-intensive service industries (Andersson et al., Reference Andersson, Baltzopoulos and Lööf2012; Agarwal et al., Reference Agarwal, Campbell, Franco and Ganco2016; Chatterji, Reference Chatterji2009; Wennberg et al., Reference Wennberg, Wiklund and Wright2011). Only a few scholars perform analysis at a sectorally aggregated level without regard to specific industries (Dahl & Sorenson, Reference Dahl and Sorenson2013; Gambardella et al., Reference Gambardella, Ganco and Honoré2015; Minola et al., Reference Minola, Hahn and Cassia2021; Santarelli & Tran, Reference Santarelli and Tran2012; Yeganegi et al., Reference Yeganegi, Laplume, Dass and Huynh2016). Even fewer take into account traditional domains such as the tire (Buenstorf & Klepper, Reference Buenstorf and Klepper2009) and laser (Klepper & Sleeper, Reference Klepper and Sleeper2005) industries. However, startups are constantly created in technologically mature industries since technical innovation is not the only entrepreneurial thrust and many startups are more reproducers of existing technologies (Aldrich & Martinez, Reference Aldrich and Martinez2001). In addition, current findings within high-tech industries may not be generalizable to other industries, as the characteristics of production technologies and complexity of products create different patterns of interactions between startups and incumbent firms (Rosenkopf & Schilling, Reference Rosenkopf and Schilling2007). Thus, technologically mature industries, which may exhibit distinct patterns from those found in emerging high-tech industries, deserve more attention.

In sum, while incumbent-to-startup knowledge flows are accepted as a crucial driver of startup creation and survival, a more complete and detailed picture of what knowledge actually flows and how the knowledge impacts the receiving startups would be a valuable addition to the literature. This study aims to help fill this gap by answering two questions: (1) What types of knowledge flow into startups from incumbent firms during the founding period of startups? and (2) How do different types of knowledge passed in this manner influence the survival and success of startups? To go beyond the high-tech industries already well considered in the literature, we focus on a technologically mature industry – the post-1978 Chinese synthetic-dye industry.

In the interest of achieving a more systematic understanding of knowledge passed from incumbents to startups, our inquiry begins with a phenomenon rather than any extant theory, allowing us the opportunity to produce an inductive categorization of knowledge. Prominent categorizations of knowledge – tacit versus explicit (Grant, Reference Grant1996) and procedural versus declarative (Moorman & Miner, Reference Moorman and Miner1998) – differentiate knowledge in an abstract way. Although useful to comprehend the mechanisms of knowledge transfer – for example, the widely accepted idea of turning tacit knowledge explicit to facilitate knowledge transfer and absorption – which a majority of current research on incumbent-to-startup knowledge inheritance and spillover concerns, these categorizations insufficiently indicate the types of concrete knowledge flows (Bingham & Eisenhardt, Reference Bingham and Eisenhardt2011: 1439) which is the foci of our study. What's more, since prior studies on incumbent-to-startup knowledge flows place an undue emphasis on technical knowledge, it is useful to take a phenomenon-driven approach to go beyond technical knowledge and to identify other types of knowledge that might potentially flow from incumbent firms to startups.

METHODS

Our research design is a multi-case study that employs a replication logic as well as cross-group comparison logic for exploration (Yin, Reference Yin1994). It allows us to track the chronological implications (Fraenkel & Wallen, Reference Fraenkel and Wallen1996; Santos & Eisenhardt, Reference Santos and Eisenhardt2009) of incumbent-to-startup knowledge flows during the founding period of startups, a period we define as the first four years of a startup given that over 60% of startups survive no more than five years (Kirchhoff, Reference Kirchhoff1994). Since the focus of our study is concrete incumbent-to-startup knowledge flows per se rather than the process of knowledge transfer, the case here is the individual startups whereas the unit of analysis is the different type of knowledge received by startups at founding (Patton, Reference Patton2015).

Research Setting

The Chinese synthetic-dye industry, a technologically mature industry, was chosen as our focal empirical setting for several reasons. First, it was a fertile site for independent entrepreneurship in the 1980s (Jiang & Murmann, Reference Jiang and Murmann2012). When the formerly suppressed domestic demand for dyes was suddenly released by the economic reform of 1978, hundreds of private startups emerged throughout the next decade. Second, our pilot studies suggest incumbent firms were the key source of initial knowledge for these startups due to their low legitimacy in China at the time. The fewer the other sources of knowledge, the more likely incumbent-to-startup knowledge flows would expose effects. Third, private startups were the largest beneficiary in the upheaval of this industry, even while still exhibiting significant variation in performance by the 2000s. This offers a three-decade window through which to assess both the short- and long-term impact of initial knowledge flows.

Private Chinese synthetic-dye startups in the 1980s relied heavily on full-time employees from incumbents, mostly state-owned enterprises (SOEs), for initial knowledge. Before the private sector was fully legitimized in 1992,[Footnote 1] private startup founders were unable to recruit chemistry graduates or experienced engineers because such workers were, by state plan, allocated to SOEs. Meanwhile, SOE employees did not see it as wrong to provide intellectual assistance to other firms, even to their direct competitors such as emerging startups, due to a traditional belief that intellectual property is a public good (Alford, Reference Alford1995). Neither did they run significant risks by divulging knowledge, because intellectual property rights (IPR) were not effectively enforced, and their salaries were not performance-based at the time. Some of them got paid by startups but not every time they shared knowledge, while some only received minimal gifts such as fresh food for the valuable knowledge they provided. No matter if they received money or not, mutual trust generally formed the basis of these knowledge flows. This mutual trust commonly stemmed from kinship, friendship, or from coming from the same hometown. Independent of material rewards, these SOE employees were motivated to share knowledge by the desire for self-realization and to enhance their reputation in their local family and village circles.

After 1978, the development of private startups in the focal industry proceeded in two stages that differed in market environment and competitive requirements. Initially, the nationwide dye shortage of the early 1980s led to profitability for a large number of startups. Many new private entrants competed by offering cheap products of poor (yet acceptable) quality to meet a surging demand. Once the dye shortage ended in 1988–1989 and the market was saturated, price became the compelling selling point. Small firms that had survived previously by offering low-quality products at higher costs were forced out of business by large-scale, low-cost rivals. While most of the startups dwindled in ever-stiffer competition, a small community that had started to combine low cost and a focus on a narrow range of products eventually grew into world-class companies and turned China from a trivial player in synthetic-dye production (10% of global output in 1978) to a global leader in terms of output (50% of global output in 2007). In retrospect, the most effective strategy for Chinese synthetic-dye startups in the 1980s was to compete through cost reduction by scaling up. A differentiation strategy did not work in this technologically mature industry where no radical innovations were introduced between 1978 and 2010 and where no sustainable advantage could be built on unique products or processes.

Case Selection

We adopted the theoretical sampling approach (Glaser & Strauss, Reference Glaser, Strauss and Denzin2017) involving deliberate selection of cases that provide rich information on incumbent-to-startup knowledge flows – the focal unit of our analysis. Our sampling was thus guided by the goal to choose cases that can help to gain a full picture of concrete incumbent-to-startup knowledge flows following a replication logic, to maximize understandings of whether the variance in the types of knowledge passed into startups translate into the variance in performance following a comparison logic, and to eliminate potential confusing effects of other influential factors on startup performance.

To meet the goal of controlling for potential confounding factors on startup performance, we purposively limited the geographical scope of our investigation to the Zhejiang Province of China, where we sampled all the six startup cases founded in the first development stage (1979–88) of our industrial setting, for two reasons: First, the majority of Zhejiang-based synthetic-dye startups were privately owned,[Footnote 2] while their peers elsewhere exhibited more diverse ownership forms. As state-owned and collectively owned firms enjoyed privileged access to valuable state-controlled resources in the 1980s, the private synthetic-dye firm population in Zhejiang had more similar and therefore equivalent in terms of the initial resource base. Second, focusing on only one province helps to control for possible regional influences, in particular proximity to knowledge (Stuart & Sørensen, Reference Stuart and Sørensen2003) and local institutions. This is especially important in China, where regional differences are high, and institutions play a key role in economic growth.

For the selection of final cases at the firm level, we set four criteria to implement our sampling strategy. First, firms were founded in the booming years between 1979 and 1988 and confronted the same favorable market, so as to eliminate the differences of market environment at founding. Second, the startup remained in business for at least five years. This time period is long enough to demonstrate the founder's intention to grow, which would affect a startup's development (Delmar & Johan, Reference Delmar and Johan2008). Third, founder's background, which is argued to cause significant impacts on startup performance, was held as constant as possible across cases. The startups sampled were all created by entrepreneurs from humble beginnings with respect to social status, education, and prior (i.e., senior management, entrepreneurial, and industry-specific) experiences. The founders were also poorly financed initially, and every founder collected only limited funds from family and/or friends. Finally, and most importantly, we selected two thriving, two marginally surviving, and two later failing firms to form three performance-based groups. Such a sample would allow for replication logic in establishing the reality of what knowledge actually flows from incumbents to startups and enhance the validity of our findings by cross-case checking (Eisenhardt, Reference Eisenhardt1989). In addition, it would enable intra-group replication and inter-group comparison, which can help to corroborate whether the cases of the same group received similar types of knowledge from incumbent firms and whether the cases of different groups differed in the knowledge received. This provides a strong foundation for identifying the links between different types of incumbent-to-startup knowledge flows and startup performance.

To ensure that we could distinguish startup success from real failure, we expended considerable effort finding two failed cases in addition to finding really successful firms. The two marginally surviving firms were also included as a separate group because the causes of a startup's survival may differ from those of its growth (Cooper, Gimeno-Gascón, & Woo, Reference Cooper, Gimeno-Gascón and Woo1994).

The three performance outcomes that were evaluated decades after the startup foundation are (1) outright failure (i.e., the firm no longer exists), (2) success, and (3) marginal survival. Being successful after years of existence indicates sustained competitiveness of the startup. We distinguished success from marginal survival by showing that successful firms had much higher sales (market share and growth) and employment (size and growth) as shown in Table 1. We do not focus on profitability, as all the firms were privately owned in 2008 with the exception of one, and they did not have a legal obligation to disclose these data. In 2008, both high-performing cases occupied a market share of over 30% in terms of sales volume in at least one of the dye segments and had hired more than 1,000 employees, whereas the two moderate survivors had a much lower and decreasing share in all of the segments and hired fewer than 500 employees (see Table 1 for an overview of the key features of the six firms).

Table 1. General profiles of cases

Notes: [1] To uphold confidentiality, we do not specify the firm's IPO year because there are currently no more than five public synthetic-dye companies in China.

[2]The related interviews provided inconsistent information on the exact shutdown year of FB, which ranged between 1994 and 1996. The reasons that we justified it as a failed case are: (1) There was consistent and reliable interview information showing that FB had stopped dye manufacturing by 1995. It is a reasonable inference that the firm was at most selling stock if it was still operational in 1996. (2) FB was much smaller than the high-performing cases in 1994 (ten years after FB's foundation).

Data Collection

Our primary source of data is 71 interviews with individual respondents between December 2009 and October 2017. (A list can be found in Supplementary Appendix 1.) The 63 interviews conducted before April 2014 were open-ended in order to probe any unexpected leads and to remain close to the interviewees’ actual experiences, while the last eight interviews, conducted in 2017, were more structured, allowing us to focus on specific questions and better understand the sequence of events in particular firms. All the interviewees but three had worked or were working in the Zhejiang Province or neighboring provinces where the six focal firms searched the most for initial knowledge due to geographical proximity. A typical interview lasted between 90 and 150 min, with the longest interaction lasting over six hours. Each session was recorded whenever possible, and detailed notes were taken for every interview. Finally, roughly 100 short follow-up phone calls were made for information verification.

Since we focus on a not-so-recent sample of firms to look beyond the survival of startups and to facilitate the collection of formerly sensitive or even confidential information, this study may be subject to retrospect sensemaking (Eisenhardt & Graebner, Reference Eisenhardt and Graebner2007). We take several measures to mitigate potential maturation and subjective biases of interviewees, which meanwhile increase research validity and reliability (Lincoln & Guba, Reference Lincoln and Guba1985). First, no prompts were made to pursue specific questions on incumbent-to-startup knowledge flows unless the theme was first raised by the interviewees. This way, respondents would not be induced to make sense of the knowledge flows. Since every respondent in the pilot interviews emphasized incumbent firms as the vital source of knowledge for startup creation and success, we constantly kept an eye on this theme but carefully avoided any directed questions. In the 63 interviews before April 2014, respondents were asked to first remark broadly on the startup's performance and its impacting factors. Only when the knowledge received from incumbent firms was referred to as an important contributing factor would we follow up with questions regarding what types of knowledge were passed and what was the influence of this knowledge on the startup.

Second, the diverse background of interviewees provides a rich range of perspectives on events at different times so that the eventual accounts we synthesized would not suffer from distorted accounts given by any particular respondents. For each focal firm, we interviewed founders (all were still owners or directors in the surviving cases) and present managerial/R&D personnel to ensure within-firm accuracy. We also interviewed outsiders that include previous employees who had left the focal firms, industry experts, competitors, and primary knowledge providers and gatekeepers at incumbents. All of the outsider interviewees had worked in the industry for over 15 years (some even over 50 years) at the time of the interview, and they possessed information that can serve to verify the insiders’ perceptions. Because they were introduced to us by the China Dyestuff Industry Association and other industry associations, and because the sensitivity of some information decreased as time went on, they were open to discussing these previously sensitive issues in an intensive, detailed, and trusting manner (Hill, McGowan, & Drummond, Reference Hill, McGowan and Drummond1999). For example, several interviewees confirmed that they divulged market information to startups which enabled the startups to approach new clients before their own incumbent firms – a fact that they would not have admitted in the 1990s when they had not yet retired and their former employers were still active in business.

Third, interviews were enriched by a broad search for other complementary data sources. As a result, most of the important events and stories collected from interviewees were verified using documents contemporaneous with or very close in time to the period when the events occurred. These sources include secondary materials such as industry journals, published books, yearbooks, reports, and firm releases, plus primary materials such as personal notes and internal materials of firms and governments (the most informative ones can be found in Supplementary Appendix 2).

These materials helped to reduce retrospective bias in at least two ways. First, we could cross-check the figures (e.g., output volume, profit, prices of dyes, and raw materials), timelines of events, and other information provided by interviewees against early records wherever available. More importantly, we were able to distinguish the interviewees who recalled more accurately from those who did not. If information on one event collected from an interviewee was very consistent with evidence in documents, the other information and remarks on this event from the same interviewee, even if not covered by documents, could be taken as credible. Otherwise, we would drop the interviewee's descriptions about this event especially when his/her accounts were quite different from what we found in documents. For example, we dropped one respondent's descriptions of how MB launched new products in its early years because the sequence of product introduction differed significantly from what was listed in MB's internal records.

Second, we made great use of primary materials to make sure the evidence chain was not built on the maturation effect. It can be expected that some respondents – in particular, knowledge providers and gatekeepers at the incumbent firms – were likely to overevaluate incumbent-to-startup knowledge flows, whereas some others – in particular, startup founders and their early R&D employees – might attribute firm survival and success more to their own foresight and capabilities with the passage of time. Therefore, we paid special attention to whether the flows of some knowledge emphasized by interviewees actually changed the startup's behavior and were seen as important at the time of knowledge transfer and not later. For example, several outsiders noted that one senior engineer from the Shanghai No.8 Dyestuff Factory brought very impactful knowledge to SB in the 1980s. Their statements were enhanced by SB's internal annual report that mentioned this engineer and his contribution as early as the third year after its foundation.

Data Analysis

With no formal hypotheses developed a priori, our analysis followed an established process of inductive theory building (Strauss & Corbin, Reference Strauss and Corbin1998). We summarized and coded the interview data and other materials and developed analytical tables to navigate through the data (Miles & Huberman, Reference Miles and Huberman1994). The coding procedure was constructed building on emerging typologies and causation (Creswell, Reference Creswell1994: 162). While our overall analysis involved iteration between the data and emerging theoretical categories, it can be generally divided into three stages.

We began our data analysis by constructing individual histories of the six cases, describing the chronology and rationale for a startup's key moves that informants considered important for the firm's performance. In the iterative process of data collection and analysis, knowledge passed from incumbents at founding soon emerged as a frequently and consistently mentioned element of startup performance. Hence, we narrowed our focus to incumbent-to-startup knowledge flows, tracking what knowledge underpinned a startup's key moves, whether the knowledge came from incumbent firms, and how the knowledge was put into use and what effect it had. To improve external reliability, we only considered knowledge flows to have taken place when at least one insider and one outsider interviewee described it consistently and when the descriptions tallied closely with other records. In this way, we ensured that what we coded as knowledge flows reflected a collective understanding independent of individual bias or possible memory distortion. To get ready for evaluating the impacts of incumbent-to-startup knowledge flows, we traced, in particular, the chronology of startup's knowledge reception and key moves to confirm that what the interviewees claimed startups learned from incumbents was eventually put to use in the firm.

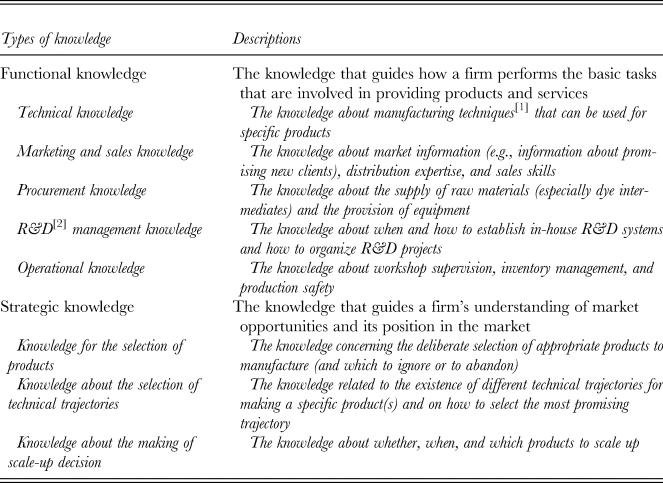

After synthesized individual case histories had been developed, we employed the standard two-cycle coding techniques to extract the precise types and categories of knowledge passed from incumbent firms to startups during the founding period of startup. In the first cycle of coding, we compared and categorized the materials in regard to the knowledge that flowed. As the analysis went on, some knowledge was found repeatedly to be present and hence was extracted as first-order codes. In the second cycle of coding, we sought for similarities and differences between first-order codes and integrated similar first-order codes to generate the second-order themes, which emerged to be the eight types of knowledge in Figure 1. Meanwhile, it became gradually clearer that our respondents related some types of knowledge to decisions about where (e.g., selecting a niche market) and how (e.g., selecting a technical trajectory that fits a niche market) to carve out a spot in the competitive landscape, and related other knowledge (e.g., manufacturing technologies) to functions that enabled a firm to provide offerings once its market positioning was decided. Eventually, we created a framework that includes eight types of knowledge, which in turn can be theoretically aggregated into two broad categories (see Table 2).

Figure 1. Coding structure

Table 2. Categorization of knowledge transferred from incumbent firms to sampled startups during their foundation

Notes: [1] Knowing how to produce a product is different than knowing how to improve its manufacturing techniques, which is classified as R&D management knowledge in this framework. [2]In our focal context, R&D refers to the introduction of existing products that are new to the firm and/or incremental shop-floor improvements in the manufacturing procedures for existing products, as ‘no completely new dyes or new procedures have been discovered in China’ (I.14) in the past three decades. The success of these R&D activities hinged more upon managerial than innovative capabilities.

Once the categorization of incumbent-to-startup knowledge flows was completed, we sorted the six cases into three groups: failure, marginal survival, and success as detailed above. We then conducted two types of analyses: intra-group and inter-group. Intra-group analysis centered on uncovering precisely what types of knowledge each group received from incumbent firms during foundation. For this purpose, we juxtaposed and compared the two cases in every group to note their similarities and differences. After we had a good understanding of each group, we started inter-group analysis to look for the emergence of patterns showing how incumbent-to-startup knowledge flows may have contributed to startup performance (see Table 3). On this basis, we formed tentative theoretical conjectures and refined them by frequently revisiting the raw data and consistently reconsidering our insights.

Table 3. Knowledge transferred from incumbent firms during startup foundation and the startup's long-term performance

EMPIRICAL FINDINGS

Incumbent-to-Startup Flows of Functional Knowledge

Five types of functional knowledge are found to flow from incumbents to startups. Unexpectedly, the four underperforming cases and the two very successful cases are quite similar in the initial mix of functional knowledge acquired from incumbent firms (see Table 4).

Table 4. Functional knowledge transferred from incumbent firms to sampled startups during their foundation

Technical knowledge

All six cases received this knowledge from incumbent firm employees during their foundation. A good example is FA, which produced Sulfur Black (a sulfur dye) as its first product. SA sourced its earliest manufacturing techniques of Sulfur Black from a subsidiary of the state-owned Shanghai No.10 Dyestuff Factory. As its founder said, ‘A workshop director of the Shanghai No.10 Dyestuff Factory gave us a copy of “The Procedure to Make Sulfur Black”, which was published internally by his factory. We had two workers who graduated from junior middle school read the book first. The two then tried to start production and told other workers who only finished primary school what to do. We also printed by stencil a simplified procedure handbook to facilitate workers’ understanding’ (I.52). A comparison between the two books (R.3, 10) showed that FA's product formulas and manufacturing procedure and those of the incumbent were exactly alike. Yet, the procedure needed to be tailored to FA's equipment, and knowledge required also came from incumbent factory. One of the two FA workers who got to know the manufacturing procedure first noted, ‘The most challenging part was how to start production using our “primitive” equipment. My boss found an old worker from the Shanghai No.10 Factory. He was able to decide the proper temperature – sometimes five degrees higher or lower, and the appropriate amount of raw materials to put in. He did this in front of us over and over, as the quality of raw materials was unstable and we had to adjust these details each time. We got to know under which conditions we should make the temperature a bit lower than that explicated in the standard instructions’ (I.49, 50).

The other five cases also gleaned initial manufacturing techniques from incumbents. These startups, without exception, started businesses by making technologically mature products using product formulas and manufacturing procedures shared by incumbent employees. For instance, to initiate production of Resin CPU (a dyeing auxiliary) – the earliest product of SA, the unskilled workers at SA learned not only product formulas and manufacturing procedures of this product but also know-how to tailor manufacturing procedures all from state-owned incumbents. (For more detailed evidence about this case, see Supplementary Appendix 3).

Marketing & sales knowledge

Six startups we studied received this knowledge from incumbent firms during their founding years. To illustrate, the founder and employees of SA sourced sales-related know-who and know-how from Shanghai Dyestuff Co., Ltd. and the Shanghai No.1 Silk Dyeing Factory. Regarding the know-who for locating clients, SA found its very first customer and many early customers owing to the assistance offered by incumbent employees. The founder said, ‘My relative at the Shanghai No.1 Silk Dyeing Factory introduced me to our first client – the Suzhou Silk Dyeing Factory. He wrote a recommendation letter in July 1979 [when SA just started full-scale production]. This enabled me to meet the leaders of the Suzhou Silk Dyeing Factory. They would not have taken us seriously and it was impossible for us to get such a large order without my relative's recommendation’ (I.8; M.6). Later on, the startup utilized information from incumbent firms to identify potential customers, approach customers, and close sales. A factory director of the Shanghai Dyestuff Co., Ltd. summarized (I.43), ‘I particularly required Ma [Footnote 3], the Retail Department Director of Shanghai Dyestuff Co., Ltd., to notify SA whenever clients inquired about any products that SA could make.’ Once, in 1981, SA received information from Ma on an emerging buyer even before his retail department officially informed a subsidiary of its own company. SA was able to make the first move and secure this new client who did not intend to contact non-SOE suppliers (I.43, 44; R.8).

Regarding the know-how of selling tactics, the introduction of the industry-specific common sales agency model into SA was largely based on the insights of incumbent firm employees. As SA tried to sell to more customers from 1981 to 1982, the sales team discovered the ‘kickback’ approach that had worked well for small township enterprises did not perform well with large collectively owned and SOEs. Two sales representatives from the Shanghai No.1 Dyestuff Factory identified the reason. One explained, ‘Unlike small dyeing factories that procured from different local suppliers, large clients were accustomed to purchasing from stable large distributors. SA should attempt to create relationships with established distributors of good reputation, rather than trying to sell all the products directly’ (I.40). Assisted by these incumbent employees, SA ‘quickly understood the agency model widely used in the industry, developed distributors of their own, and marketed to large clients through their own agents’ (I.40).

The other five cases also reported receiving and utilizing marketing & sales knowledge from incumbent firms during their founding period. For instance, MA was able to close sufficient sales immediately after establishment because of marketing channels offered by the Shanghai No.9 Dyestuff Factory. (More detailed evidence about this case is in Supplementary Appendix 3.)

Procurement knowledge

Interviewees also highlighted the flow of this type of knowledge into six cases during foundation, when dye-related products including key intermediates and some dye production equipment ‘were still purchased and sold according to government plans in the 1980s’ (I.1; T.5). The startups sampled received the know-how and valuable contacts concerning raw material provision and, as a result, ensured supply of intermediates shortly after foundation. The experiences of SB are revealing. This startup encountered a nationwide shortage of H-acid and 1-aminoanthraquinone – two key intermediates for making its earliest products – when it was erected in 1985. As one early SB manager described, ‘We were running out of supply and sent purchasing agents everywhere to search for H-acid. Our boss [the founder of SB] turned to a senior manager in the Planning Department of Shanghai Dyestuff Co., Ltd. who was in charge of material plan-making for the company. He and his colleagues provided us the latest information to guide our search for intermediates. They knew which factory had imported H-acid left in warehouse and which factory wanted to sell inside-plan H-acid to collect outside-plan money’ (I.24). The director himself confirmed that ‘I accurately informed SB the factories that produced the two intermediates, the amount these factories could spare or sell out of plan, and the prices they may ask for. I introduced SB to these factories and helped them build relationships with multiple intermediate suppliers’ (I.29). Multiple reliable suppliers enabled SB to feed production lines continually with high-quality intermediates at very fair prices (I.24, 42; R.16).

The reception of knowledge regarding the acquisition of cost-effective equipment was also noted by interviewees. Startup founders had to be very careful in deciding what equipment to get and how, meaning that many favorable deals were initiated and facilitated thanks to information from incumbent employees. Take SA for example: it was able to obtain necessary equipment to start production only with the assistance of incumbent employees. As its founder said, ‘A 0.5-ton reactive vessel was indispensable to make Resin CPU [the first product of SA]. We did not have the quota of steel in the state plan to purchase it. My relative worked at the Shanghai No.1 Silk Dyeing Factory. He told me that his factory had the equipment and helped us to borrow it. Otherwise, we had to wait god knows how long to get the quota and equipment. It would be impossible for us to start production on time in 1979’ (I.8; M.6). Later on, at the introduction of two employees at Shanghai Dyestuff Co., Ltd., SA found and bought ‘some well-maintained old equipment lying idle in a branch [of Shanghai Dyestuff Co., Ltd.], which was more than enough and qualified to make acceptable products at an incredibly low price’ (I.21). Another example is FA. It replaced its initial primitive equipment with suitable albeit not the most advanced equipment in the second year after foundation, based on knowledge provided by incumbent employees. (More detailed evidence about this case is in Supplementary Appendix 3.)

R&D management knowledge

Reception of this knowledge from incumbents during the founding period was observed in each of the six cases. It encouraged the initiation of organized in-house R&D and fueled the introduction of new products. One revealing illustration is MA. The founder admitted, ‘I did not understand the difficulty and importance of establishing a complete lab for a dye firm, let alone what facilities and human resources composed a minimum R&D system’ (I.22). Enlightened by a manager at the Shanghai No.9 Dyestuff Factory and three engineers from Shanghai Dyestuff Co., Ltd., he quickly realized the need to create a formal R&D department after startup foundation. ‘They told me that a R&D department performed at least three functions’, he explained: ‘(1) new product introduction, (2) quality control & after-sale service, and (3) sample analysis & chromatic examination’ (I.22). Ever since 1987 – the second year after MA was founded – the founder has frequently pursued advice on lab construction from incumbent employees and invested accordingly as long as the startup's finances permitted. First, to cultivate R&D personnel of its own, capable workers were carefully selected and appointed to work closely with incumbent engineers invited to help on site. One of these former workers who were selected said, ‘We were told to pay special attention to the three R&D functions and to gain the skills of managing an entire R&D project’ (I.24). Second, MA also received codified knowledge – a book that detailed the formulas and prevailing technical trajectories of all synthetic dyes made in China. It substantially helped MA employees make sense of the tacit know-how learned by doing or watching.[Footnote 4] For example, a few written instructions could clarify the reasons whether and why it was plausible to eliminate several filtration steps (as they occasionally observed incumbent workers doing) without significantly lowering product quality (I.37, 38). Third, this knowledge received set the tone for MA's subsequent R&D direction. The firm erected an R&D department in 1992 – the sixth year after its foundation – once China's policies changed to enable the hiring of R&D personnel from the open market. However, as the founder and former employees commented, ‘our first R&D director and over two thirds of key members were early employees who learned R&D and R&D organization from incumbent employees’ (I.2 2, 25, 37). Another example is SB, where ‘three experienced engineers from the Shanghai No.8 Dyestuff Factory laid the managerial and structural foundation for the entire R&D system’ (I.35, 42). (More detailed evidence about this case is in Supplementary Appendix 3.)

Operational knowledge

This type of knowledge was received from incumbents by all six startups during their founding periods. For example, MB's earliest workshop supervisors were cultivated by four engineers from the Shanghai No.9 and No.10 Dyestuff Factories. As the founder and a former employee said, ‘It took much longer to train workshop supervisors than ordinary workers. These supervisors should know well not only about our products and our workers but also about how to coordinate production and material storage, how to eliminate waste, how to arrange production schedules of different dyes and so on. Because of the explicit guidance of engineers and old workers from the Shanghai No.9 Dyestuff Factory, our own two earliest workshops supervisors learnt to independently manage a workshop within about 50 months [after MB's establishment]. Usually, it should have taken much longer if we had to dig these tricks out all by ourselves, and would have generated much more waste’ (I.9, 67). These remarks were confirmed by interviews with incumbent engineers (I.5, 13). Comparatively, we encountered several other new firms founded during the same period, which also aimed to launch vat dyes of high procedure complexity as MB. However, they confronted a persistent inadequacy of operational knowledge and spent five to six years in general exploring the appropriate way to operate on their own. Ultimately, they had to quit this segment due to below-average efficiency. The other five cases parallel MB in terms of receiving operational knowledge. (More illustrative evidence, for instance the evidence regarding the case of SA, can be found in Supplementary Appendix 3.)

Incumbent-to-Startup Flows of Strategic Knowledge

In addition to functional knowledge, two longer-term successful cases received also three types of strategic knowledge from incumbents whereas the four cases that languished or failed in the long term did not receive any (see Table 5). The lack of initial strategic knowledge inflows impeded more effective efforts to search for, to acquire and to utilize functional knowledge in a targeted and persistent manner, and as a result hindered startup's subsequent development.

Table 5. Strategic knowledge transferred from incumbent firms to sampled startups during their foundation

Knowledge about the selection of products

The two longer-term successful cases received and benefited from knowledge about the selection of products during the founding period. While this knowledge was often passed as rules of thumb, not as fine-grained principles, it directed startup executives to make decisions about their product portfolios very early.

In the case of SA, its product lines in the 1990s were to a large extent shaped by the strategic mindset passed from the managers at Shanghai Dyestuff Co., Ltd. during the mid-1980s. The incumbent employees not only criticized SA's initial arbitrary selection of new products but also recommended a more appropriate product portfolio. Benefiting from the knowledge received, SA was the first among all Chinese township enterprises to produce disperse dyes. This allowed it to quickly respond to policy changes in 1992 and expand on an unprecedented scale afterward by producing disperse dyes that were in large, increasing demand. The startup became the largest disperse dye manufacturer in terms of output volume in 1998 and the largest dye firm in 2005, but its primary products remained disperse dyes and related chemicals, just as suggested by the employees at Shanghai Dyestuff Co., Ltd. thirty years before. (More detailed evidence about this case is in Supplementary Appendix 3.)

SB, the other longer-term success case, also received from incumbent employees important suggestions on advantageous products and changed accordingly from a general manufacturer to a specialist on Reactive Blue 19 and related intermediates. The startup produced miscellaneous dye-related products for which it could source technical support in its first three years. Although no crisis seemed to be looming, two senior managers at Shanghai Dyestuff Co., Ltd. separately suggested that SB quit producing other dyes and focus on Reactive Blue 19, which alone would constitute a large market segment because of its diverse uses (I.28, 34, 42). SB followed the advice, withdrawing from all products other than Reactive Blue 19[Footnote 5] and related intermediates after 1989 (the fourth year after its foundation). As with SA, the change in the product line of SB began with intermediates that were less complex technically, followed by the dye of Reactive Blue 19 itself. To our knowledge, SB was the only Chinese dye firm that concentrated on such a narrow range of products, but this choice proved prescient. Having all the crucial raw materials internally supplied, SB's production cost of Reactive Blue 19 was 10% lower than that of its competitors, enabling it to start a price war and drive out all rivals.

In contrast, the other four cases did not receive the knowledge on product selection early on. Nor did they purposefully introduce a mix of dyes and intermediates that would jointly constitute a low-cost strategy. Their founders and executives were either ignorant of the value of having a well-structured product portfolio to facilitate cost reduction (MA and FA) or they realized the importance but did not have sufficient knowledge themselves to make the right choice (MB and FB). The founders recalled they ‘casually introduced profitable dyes for which manufacturing technologies or distribution channels were available’ (I.22, 52, 53, 67), which is to say they missed the opportunity to penetrate the most promising dye segments as early as possible.

The failure of FA is illustrative. Its founder positioned this startup in the niche of the Sulfur Black 1 dye without a clear strategic orientation, but simply because ‘it was easy to make and [a workshop director at the Shanghai No.10 Dyestuff Factory] would help sell it’ (I.52). This ad hoc selection of a first product, which was the most low-end dye made in China and which launched a price war shortly after its birth, deprived FA of growth potential although it made money within a very short time. In 1984, one year after FA's establishment, ‘the inside-plan [Footnote 6] prices of raw materials for Sulfur Black 1 all increased, but the inside-plan price of Sulfur Black 1 did not rise’ (I.57). Large SOEs found little motivation to make a planned amount of this dye and contracted out production. When the incumbent workshop director helped to place FA on the list of Sulfur Black 1 suppliers for the Shanghai No.10 Dyestuff Factory, the founder believed ‘this would be a stable customer’ (I.52) and put all funds into this product. FA launched and sold Sulfur Black 1 after the Spring Festival of 1984 with the director's help, as expected. Yet, neither the director nor other informants stressed to FA's founder that the sulfur dye segment was already overpopulated. When the inside-plan price of Sulfur Black 1 went up 25% in 1985, SOEs reopened their production lines for it. This caused an immediate nationwide oversupply and SOEs responded by cutting prices 5%–10%. FA ran into great difficulties before it secured an initial set of clients. However, with hope that the market of sulfur dyes might recover soon, it escalated its commitment to Sulfur Black 1, which was indispensable for a full-fledged sulfur dye manufacturer, as FA's initial investments actually positioned itself. This financially weak startup was outpaced by large SOEs in capacity expansion, new product introduction, and/or cost reduction ever after, despite all of its functional efforts. In fact, sulfur dyes remain the only dye segment that is to this day led by SOEs that were all established before 1978. As the founder admitted, ‘The first step was wrong, and all the steps that followed continued the downward trend of the firm’ (I.52). He disbanded FA in 1990.

Knowledge about the selection of technical trajectories

This type of knowledge is found to be received by both longer-term high-performing cases in the form of simple heuristics. By alerting entrepreneurs to multiple technical trajectories for a specific product(s), and the need to select appropriate trajectories carefully, it led the two firms to pursue the most promising ones based on explicit rationales and allowed them to build enduring first-mover advantages.

For example, when SB chose to focus on Reactive Blue 19 in 1989, as mentioned above, there existed two competing technical trajectories for this dye – the conventional and widely applied Early Esterification versus the new and rarely implemented Late Esterification. SB initially opted for the former one without much consideration, but its founder's friends at Shanghai Dyestuff Co., Ltd. soon informed the founder of latest developments in the latter trajectory and advised a switch to this more economically efficient mode. The founder, a former SB employee, and one of the founder's friends at an incumbent firm explained the rationale. ‘The Late Esterification trajectory was relatively new and immature at that time. SOEs knew it but did not implement it. However, the strength [an index showing the capability of dyes to dye fabrics and a higher index indicating stronger capability] of Reactive Blue 19 made following this trajectory easily go up to over 120%, while the strength of output made using the Early Esterification trajectory could hardly reach 115%. As a result, the Late Esterification trajectory could reduce significantly the manufacturing costs of Reactive Blue 19 and the client's dyeing costs. Meanwhile, this trajectory also had a disadvantage. It generated a greenish shade, not the reddish shade that Chinese dyeing firms took as the “standard” shade of Reactive Blue 19 at that time’ (I.34, 42, 60). The cofounder and managers of SB received the above knowledge as early as 1988 (the third year after SB's foundation) and discussed with incumbent employees a potential switch to the Late Esterification trajectory many times. They were still hesitant about making this significant switch in 1989 when they decided to focus on the business of Reactive Blue 19 and started to build a new section of the plant to accommodate this. Nevertheless, they were eventually convinced by two managers at Shanghai Dyestuff Co., Ltd., who both accentuated that ‘clients’ preference would change as long as you can keep providing the greenish dyes cheaper’ (I.34).

As the earliest Chinese reactive-dye firm to launch Late Esterification in mass production, SB spent two years (1990–1992) and heavy investments on the switch that proved worth the expense. Using this trajectory, SB increased the strength of Reactive Blue 19 to 200% in 1993 (M.4; J.27) and penetrated this market segment with a compelling low price. As incumbent employees expected, Chinese dyeing firms came to favor the greenish shade of inexpensive Reactive Blue 19 and this shade was accepted as the new ‘standard’ by the late 1990s. Witnessing this steady change in demand, other Chinese reactive-dye manufacturers began to implement the Late Esterification trajectory too. But it would take years to accomplish the change. This gave SB sufficient time to expand the production of Reactive Blue 19, to start in-house manufacturing of intermediates for further cost reduction, and to consolidate its position as the globally dominant supplier of Reactive Blue 19 and related intermediates. The case of SA is similar to SB in that it consistently obtained explanatory information and suggestions for technical trajectories of new products (I.8, 70). The available evidence, however, does not unequivocally suggest that the particular technological trajectories SA chose were a direct result of the advice of incumbent firms rather than their own evaluation of the relative merits of different technological trajectories they had clearly learned about from incumbent firms. To be conservative, we do not count this instance as transfer of strategic knowledge (see row 2 in Table 5).

There is no evidence that the longer-term marginally surviving cases and the failed cases received the knowledge of this type from experts working in incumbent firms. Since the differences in technical trajectories could not be easily discerned from final products, the startup founders and employees who were all poorly educated in chemistry were either unaware of other technical trajectories or did not understand the respective strategic and economic values of various technical trajectories when deciding which one was suitable. Consequently, the four cases did not select the technical trajectories for early products on a well-informed comparison across different trajectories, but simply employed the most common or traditional one for which ‘technical assistance was readily available’ (I.6, 9, 22, 52). How much value they could appropriate from the trajectories and whether they could do better than competitors by these random choices was completely a matter of luck.

Take MA and FB as examples. MA founder remarked on their haphazard selection, ‘I did not see the necessity of checking other ways to make Direct Yellow G [MA's early product] in the first few years after I founded the firm. Nor did I have time or capabilities to do the search. My friends at the Shanghai No.9 Dyestuff Factory did not mention other technical trajectories when they said they could share with me the manufacturing techniques of this dye. I just went on with what they could offer me. It was the same for Direct Black EX [another early product of MA]’ (I.22). Many other startups were fatally trapped by poorly selected early technical trajectories given the high costs of shifting to other trajectories. For instance, FB – a failed reactive-dye firm – did not attach importance to the selection of the technical trajectory for making Reactive Blue 19 due to the absence of relevant knowledge until SB exploited the potential of the Late Esterification trajectory as described above. The FB founder said, ‘the employees from the Shanghai No.3 Dyestuff Factory told us how to make this dye, but did not lead me to think about other technical trajectories or tell me other trajectories’ (I.53). Following the popular Early Esterification trajectory, the firm was quickly squeezed out of this dye segment when the Late Esterification trajectory became dominant.

Knowledge about the making of scale-up decisions

This type of strategic knowledge was channeled from incumbent employees into both of the longer-term successful firms during their foundation. It raised awareness of the importance of early and rapid scale-up, directing firms to take the lead in implementing a (focused) low-cost strategy, to consistently follow the strategy, and to preempt potential rivals by achieving economies of scale at a faster pace.

SA owes its expansion decisions largely to several informants from Shanghai Dyestuff Co., Ltd. As one of these incumbent employees recalled, in the early 1980s they counseled SA that it was not worth chasing the latest or the most advanced products since the firm's limited funds ‘would be exhausted by intensive R&D on too many advanced products before it could put any into mass production or extract revenues from any’ (I.21). Instead, they expected that ‘scale and cost would soon rule and suggested SA take down competitors by scaling up at the earliest opportunity’ (I.21). Beyond clarifying the strategic importance of achieving economies of scale, incumbent employees further advised SA to give the highest priority in the scaling-up process to products that experienced the largest demand rather than products that had the highest profit margin at that moment. This was partly why they proposed disperse dyes and related products to SA in 1981–1982. As the General R&D Manager who joined SA in 1993 – the year SA started mass production of disperse dyes – recalled: ‘My old boss [the cofounder] told me that, thanks to the advice from employees at Shanghai Dyestuff Co., Ltd., the firm had a clear road map for expansion early in the 1980s. These outsiders advised that Disperse Blue 2BLN and Disperse Black 300 – the two most abundantly consumed disperse dyes – would be a very good starting point to enter the segment of disperse dyes when SA could afford the move. Also, SA should try to arrive at minimum efficient scale consumption of key intermediates for disperse dyes as early as possible, which would deliver cost-effective in-house production and drive down the costs of dyes’ (I.4).

SA's continual improvement and expansion of dispersant manufacturing in the middle 1980s, as well as its sequence of product introduction in the early 1990s, once it started to make disperse dyes, mirrored the large-scale, low-cost strategy principles of ‘scaling up and reducing the costs of the highest-volume dyes’ (I.2, 3, 4). The firm launched Disperse Blue 2BLN in 1992 and then Disperse Black 300 in 1994, to which it devoted all its R&D and financial resources. In the meantime, it kept an eye on the potential production of key intermediates for further cost reduction. The son of SA's cofounder and the current president explained, ‘We made a plan in 1993 – as soon as we started the [disperse] dye business – that we would start the manufacturing of lentine [one key intermediate for disperse dyes] whenever our annual consumption of this intermediate reached 2,000 tons [Footnote 7]’ (I.7). After purposely scaling up its production of Disperse Black 300, which consumed lentine in large amounts, and while extending its business to include several other dyes (e.g., a disperse purple) that shared this intermediate, SA's annual lentine consumption went beyond the preset threshold amount of 2,000 tons in 2002. The firm then initiated a project in 2003 to produce lentine in-house. By the end of 2005, SA's ‘production cost of lentine was CNY 6,000/ton below the industry's average and could make remarkable profits at a price at which competitors could not break even’ (I.2, 3, 4).

SB, the other longer-term success case, resembles SA in terms of receiving valuable advice during its founding years on the overwhelming importance of scaling up, on the products to scale up, and on the minimum production scale for key products. (More detailed evidence is in Supplementary Appendix 3.) To summarize, the knowledge SB received about scaling-up decisions made it pursue a low-cost strategy ever since its fourth year and encouraged it to scale up the production of key products (Reactive Blue 19 and related intermediates) at the first chance available.

By contrast, all the four cases of low longer-term performance did not receive such knowledge about the necessity for and means by which to scale up early. In the absence of a clear strategic focus to attain low-cost advantages earlier than competitors, these startups allocated valuable resources in an ad hoc manner. First, they expanded blindly the production of any products that could temporarily offer high profitability and they stopped making those that no longer seemed highly lucrative. Second, unlike SA and SB, which set a proper schedule for new product introduction to balance scaling-up and resource constraints, these startups did not sequence and integrate product launches at different time points; rather, they focused on isolated trends in the present. As a consequence, these four new ventures ran into trouble when large-scale production and low prices became a competitive requirement in the post-1990 market.

To illustrate, MA introduced a diverse range of reactive dyes – polycondensation dyes and acid dyes – aimlessly in its ten years and therefore passed on a valuable opportunity to scale up early and at a relatively low cost. It occasionally enhanced manufacturing capacities of the dyes ‘that sold well and were technically feasible’ (I.22) and frequently withdrew from ongoing expansion projects to launch new products with higher profit margins. This strained MA's ‘limited funds and technical capabilities and slowed down its growth’ (I.22). Spreading scarce resources thinly across several dye categories, MA had never increased its capacity of any product to a level at which a decisive economy of scale could have emerged. Because none of the dyes it launched was produced at a volume of more than 400 tons annually, it made less economic sense for MA to start in-house production of intermediates. When the industrial boom came to an end in 1989, MA had to meticulously and painfully manage its supply of intermediates, of which the prices fluctuated very strongly (I.25). Due to high material costs and a gross profit rate that was ‘so low that cost control was central for survival’ (I.22), MA remained a marginal player afterward. The founder told us in 2009 that they were ‘prepared to shut down the firm anytime’ (I.22).

Implications for Startup Performance of Incumbent-to-Startup Knowledge Flows

As we have seen, all six cases received functional knowledge from incumbent firms during foundation but only the two longer-term successful startups received strategic knowledge. This is significant as it indicates that different categories of knowledge can have a differential impact on startup performance. The utility of incumbent-to-startup knowledge flows for startups depends not only on the amount and quality of knowledge delivered but also on the precise category of knowledge. Put differently, if somewhat informally, it's not simply a matter of ‘yes versus no’, or ‘more versus less’, but actually a matter of asking the fundamental question of ‘what’ knowledge.

While prior studies emphasize that functional knowledge – especially technical knowledge – from incumbents can predict startup performance in emerging high-tech industries, we find that, in a technologically mature industry, this category of knowledge relates only to the creation and short-term survival of startups as opposed to their long-term success. For one thing, founders of the six cases agreed that receiving functional knowledge prompted entrepreneurship. As they generally summarized, ‘It is prerequisite to know manufacturing technologies, who would be our customers, how many and how we could sell, where to find raw materials, how to launch new products, how to manage a production line, and how we could keep a workshop running safely. Otherwise, we would lack the minimum inputs to start a dye business and would always remain nascent entrepreneurs’ (I.8, similar points by I.22, 42, 52, 53, 67). Additionally, incumbent firms were the only reliable source of all ‘prerequisite’ functional knowledge because professional human resources, chemical materials, distribution channels, and manufacturing equipment in the synthetic-dye industry were under government control in the China of the 1980s. The Secretary-General of the China Dyestuff Industry Association, who has worked in the industry since the 1960s, commented on this by noting, ‘All the private new firms that managed to produce and sell some dyes received more or less initial functional knowledge from incumbent firms. Those that did not could register as a dye firm but in name only. They were definitely unable to become a serious business’ (I.1).