6.1 Introduction

Over the last decade, fossil fuel subsidy reform has been rising on the agenda of international economic institutions such as the Group of 20 (G20), the Organisation for Economic Co-operation and Development (OECD), the World Bank and the International Monetary Fund (IMF). International environmental institutions such as the United Nations Framework Convention on Climate Change, by contrast, have been rather silent on the issue (see Chapter 8), with the exception of the United Nations Environmental Programme (UNEP 2015). Simultaneously, fossil fuel subsidies are increasingly debated in a number of countries, often leading – particularly in developing countries – to their reform. The question arises whether this correlation indicates a causal influence from the international economic institutions on domestic policies.

A growing body of literature is seeking to identify the role of different political, economic and social factors in fossil fuel subsidies and their reform (Victor Reference Victor2009; Cheon et al. Reference Cheon, Urpelainen and Lackner2013; Lockwood Reference Lockwood2015). Although studies of individual fossil fuel subsidy reforms point to the role of international economic institutions as one factor among many (Beaton and Lontoh Reference Beaton and Lontoh2010; Lockwood Reference Lockwood2015), there is no cross-country study of the influence of these institutions. This gap deserves to be addressed due to the impact of these institutions on government policy (Vreeland Reference Vreeland2007). An important aspect of the impact of these institutions is how – or, more precisely, through which causal mechanisms – they influence domestic policy. Whether the institutions have influenced domestic policy via socialisation into norms, learning or more coercive mechanisms of influence (Holzinger and Knill Reference Holzinger and Knill2005; Dobbin et al. Reference Dobbin, Simmons and And Garrett2007) is both academically and politically relevant.

To address these issues, this chapter aims to answer the following research questions: (1) through which causal mechanisms did international economic institutions influence domestic decisions regarding fossil fuel subsidies, and (2) to what extent did these institutions drive or shape fossil fuel subsidy reform?

These questions concern the impact of the G20, the IMF, the World Bank and the OECD on national policies defined as fossil fuel subsidies in Denmark, India, Indonesia, the United Kingdom and the United States. The chapter focuses on the mechanisms of influence rather than the institution from which they emerged, including the intervening causal steps of such influence rather than just the initial source (Heinze Reference Heinze2011: 5). Focusing on mechanisms rather than institutions is more politically relevant, since there is more scope to change the mechanism than the institution. It is also easier to identify and compare the effects of different mechanisms than of different institutions, given that each institution operates via several mechanisms and constitutes an element of an institutional complex (Biermann et al. Reference Biermann, Pattberg, van Asselt and Zelli2009), making it difficult to isolate its influence. International organisations are to be understood as constituting one subset of international institutions (Keohane Reference Keohane1989: 3–4).

This chapter first outlines the theoretical framework for studying international influences on domestic policy. It then outlines how this theoretical framework has been operationalised, followed by the application of the framework in the five country cases.

6.2 A Framework for Studying International Influence

This chapter draws on existing frameworks for comparing different mechanisms of influence from the international to the domestic level and identifies three casual mechanisms of influence: ideational, learning and power based (Dobbin et al. Reference Dobbin, Simmons and And Garrett2007; Bernstein and Cashore, Reference Bernstein and Cashore2012). Studying these influences requires a focus on their impact on policy processes and policy debates related to fossil fuel subsidy reform, including the actors within this process and the setting in which they operate (Kingdon Reference Kingdon2003). The chapter focuses on influence on the public and policymaking agendas and on policymakers discussing whether and how to reform fossil fuel subsidies (Kingdon Reference Kingdon2003: 2–3). How fossil fuel subsidy reform is carried out is important for its chances of success (Victor Reference Victor2009; Beaton and Lontoh Reference Beaton and Lontoh2010).

‘Ideational influences’ concern both the room for manoeuvre for actors to influence decision-making and how actors perceive the world. Both kinds of ideational influence may involve the emerging norm of fossil fuel subsidy reform, which draws attention to the issue of fossil fuel subsidies and defines these subsidies as inappropriate (see Chapter 5). The two kinds of ideational influence may also concern the various definitions of fossil fuel subsidies; debates, for instance, can be shaped by the definition that is used to determine whether a country has subsidies (see Chapter 2). The former kind of ideational influence includes influences on the public and policymaking agendas. Reports, statements or commitments by the institutions affecting the placement of fossil fuel subsidies on the public (media) and policymaking (within government, parliamentary committees, etc.) agendas constitute the most relevant instances of influence. Such influence allows actors favouring reform to initiate a debate about whether the country has fossil fuel subsidies and whether they should be reformed. In this way, ideational influence may allow for new framings (e.g. framing a policy as a fossil fuel subsidy), legitimise goals (e.g. to reform fossil fuel subsidies) and associate non-compliance with them with reputational costs.

The ideational influences affecting actors’ perceptions involves policymakers internalising specific goals and beliefs (particularly regarding appropriateness) and taking them for granted (Checkel Reference Checkel2005: 804). It is relevant to focus on whether policymakers have internalised beliefs regarding fossil fuel subsidies, such as the norm of fossil fuel subsidy reform or the more specific belief that a given kind of policy (such as tax exemptions) constitutes a fossil fuel subsidy. This chapter focuses on the institutions influencing policymakers directly, since this is the main channel of interaction between the international institutions and the domestic level.

‘Learning’ is understood as changing beliefs concerning the ‘best’ (generally most efficient or effective) way to achieve an objective based on experience, in this case that of other actors (Dobbin et al. Reference Dobbin, Simmons and And Garrett2007: 460). Unlike ideational influence, learning does not involve changes in actors’ goals or beliefs and ideational structures defining what is appropriate. Here it is pertinent to focus on international institutions actively disseminating best practices (see Lehtonen (Reference Lehtonen2007) regarding the OECD and Seabrooke (Reference Seabrooke2012) regarding the IMF) or acting as forums for peer-based learning (from both successful and unsuccessful reforms) among policymakers (Haas Reference Haas2000).

‘Power-based influences’ may affect the power of those opposed to, or conversely, in favour of fossil fuel subsidy reform. The institutions may alter the power of these actors by imposing direct conditionalities on the states (e.g. IMF or World Bank programmes) or by providing support (e.g. technical assistance) for reform. Such influences may hinder certain actions while empowering or disempowering particular constituencies (Kahler Reference Kahler2000). The power of international economic institutions is well documented, particularly the influence of IMF and World Bank structural adjustment programmes (Vreeland Reference Vreeland2007).

6.3 Methods

The countries studied in this chapter are Denmark, India, Indonesia, the United Kingdom and the United States. These countries have been selected based on their important roles in the international discussions of fossil fuel subsidy reform, yet they vary in terms of experiences with such reform. While the United Kingdom and Denmark have been reluctant to acknowledge that they provide fossil fuel subsidies, the other countries acknowledge their subsidies but have seen varying success on reform. Reform has been very limited in the United States and mixed in Indonesia (pre-2014), but successful reforms have taken place in India and Indonesia (post-2014). Interestingly, while the United Kingdom and Denmark have actively promoted fossil fuel subsidy reform at the international level, India has been outright sceptical of international efforts. Lastly, the countries studied cover both industrialised and emerging economies (but not least-developed countries due to those countries’ smaller share of global fossil fuel subsidies) and G20 members as well as non-G20 members. The focus is on the period following the 2009 G20 commitment on fossil fuel subsidy reform, after which fossil fuel subsidies became intrinsic to the activities of the international economic institutions.

Ideational influence on the public agenda has been operationalised by identifying articles in the two leading newspapers of each country that establish a connection between the international institutions’ activities regarding fossil fuel subsidies and the country in question. Such a connection could include using IMF or OECD estimates of a country’s fossil fuel subsidies when discussing reforming the policies included in those estimates. This number is compared to the total numbers of articles referring to fossil fuel subsidies domestically and internationally. The analysis also focuses on whether domestic actors (e.g. non-governmental organisations) were successful or, conversely, unsuccessful in exploiting the activities of the international institutions to promote subsidy reform.

Learning, power-based influence and ideational influence on the beliefs and goals of actors have been studied through process tracing, relying on a combination of official documents, key informant interviews, second-hand sources and the author’s observations as an official working on the topic. The official documents originate from the governments and institutions in question. The key informants (a total of 22) are primarily senior officials currently or previously responsible for fossil fuel subsidies at finance ministries or other key ministries or agencies in the countries studied, as well as in some cases representatives of the institutions that interact with the country. Since ideational and learning-based influences predominantly take place via direct interaction between officials and the institutions, the informants selected have been central to this interaction, which is why most of them come from finance ministries.

Ideational and learning-based influences on the beliefs and goals of actors can be identified in terms of whether the understandings and framings of key issues inherent to official documents change over time and whether informants point to such changes stemming from the institutions. Power-based influence is identified, first, by identifying whether the institutions had programmes in place that could influence the power of domestic fossil fuel subsidy actors within the country in question and, second, whether key informant interviews and secondary sources show that these programmes indeed influenced decision-making regarding fossil fuel subsidies.

The analysis also explores the degree to which the institutions were influential compared with other factors affecting whether and how countries would reform fossil fuel subsidies.

6.4 International Economic Institutions Addressing Fossil Fuel Subsidy Reform

The efforts of international economic institutions to address fossil fuel subsidies go back decades but were raised to a higher level by the 2009 G20 commitment to ‘phase out and rationalise over the medium term inefficient fossil fuel subsidies while providing targeted support for the poorest’ (G20 2009). The commitment resulted in a process, among others, by which the member states report their fossil fuel subsidy reform strategies and timetables. In the reports, it is up to the members to identify which fossil fuel subsidies exist in their own country and how to phase them out. Seven countries (Australia, Brazil, France, Japan, Saudi Arabia, South Africa and the United Kingdom) have claimed to have no inefficient fossil fuel subsidies, whereas other countries have submitted plans for phasing out their subsidies with varying degrees of ambition (Kirton et al. Reference Kirton, Larionova and Bracht2013: 62–69). In 2009, the G20 also asked the World Bank, the OECD, the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries to analyse the scope of fossil fuel subsidies and to provide suggestions for implementing this initiative.

Later, the G20 added the possibility for states to submit their fossil fuel reform strategies to voluntary peer reviews by other G20 members and representatives of international organisations. At the time of writing, the United States and China had completed their peer reviews, while those of Germany and Mexico were in progress.

Crucial to the discussion of whether a country has fossil fuel subsidies is what definition of fossil fuel subsidies is used and the degree to which one focuses on consumption or production subsidies (van Asselt and Skovgaard Reference van Asselt, Skovgaard, Van de Graaf, Sovacool, Ghosh, Kern and Klare2016). Regarding definitions, analysts can use an ‘inventory’ or ‘conferred-benefits’ approach, which focuses on identifying government activities that transfer benefits to specific groups (e.g. consumers of kerosene), or a ‘price-gap’ approach, which focuses on whether prices are below a benchmark price, or a combination thereof (OECD 2010; see Chapter 2). The benchmark price is generally based on the international price of the fuel in question and sometimes also includes transport, distribution, value-added tax and taxes corresponding to the externalities stemming from the fuel (Gerasimchuk Reference Gerasimchuk2014). Regarding producer subsidies (directed at the extraction of fossil fuels) and consumer subsidies (directed at the use of fossil fuels), the latter are concentrated in developing countries, whereas the former are common in both industrialised and developing countries.

Beyond the G20, the OECD addressed fossil fuel subsidies before the G20 commitment as part of their environmental performance reviews of individual member states, studies of pricing policies and general studies. The OECD’s activities created knowledge about fossil fuel subsidies and promoted the norm that fossil fuel subsidies should be reformed (Skovgaard Reference Skovgaard2017). Using a total support estimate approach (fundamentally an inventory approach that also includes price-gap analysis) to identifying fossil fuel subsidies, the OECD Secretariat found fossil fuel ‘support’Footnote 1 measures in all 34 OECD countries (OECD 2010, 2011). Furthermore, the OECD Secretariat has arranged workshops on fossil fuel subsidies for representatives of its members.

The IMF and the World Bank have both followed a two-pronged approach: they induce states following adjustment programmes to reform their subsidies, and they provide knowledge about and promote fossil fuel subsidy reform. The first approach dates back decades, as the two institutions have promoted the restriction of any kind of subsidy irrespective of its environmental consequences. The second took off after the G20 commitment, especially following the G20’s request to the World Bank and other organisations to analyse fossil fuel subsidies. Importantly, in 2013 and 2015, the IMF published reports using a price-gap approach that included environmental externalities in the benchmark; this approach led to estimates of global fossil fuel subsidies of, respectively, USD 1.9 trillion and 5.3 trillion (Clements et al. Reference Clements, Coady and Fabrizio2013; Coady et al. Reference Coady, Parry, Sears and Shang2015). The IMF’s definition constituted a radical break with the established definitions within international institutions, and as a result of this definition, the IMF estimates are many times higher than the estimates of global subsidies by, for example, the IEA (USD 325 billion in 2015, based on benchmark prices without such externalities; IEA 2016).

6.5 Influencing Domestic Fossil Fuel Subsidies

6.5.1 United States

The OECD identifies US federal fossil fuel subsidies as tax expenditures in support of producers of oil, gas and coal and as consumption subsidies, particularly those directed at the energy costs of low-income households. Both are valued at greater than USD 1 billion (OECD 2016e). The IMF estimates that fossil fuel subsidies in the United States total USD 700 billion, of which non-priced externalities constitute more than USD 600 billion (IMF 2015). The US federal government has long acknowledged the existence of US fossil fuel production subsidies. Particularly in 2011 and 2012 – but also in budget proposals for other years – the Obama administration and Democratic senators attempted to end tax breaks for fossil fuel companies as part of budget-related negotiations. Yet these reforms did not pass the Senate due to opposition from Democrats from fossil-fuel producing states and Republicans (Rucker and Montgomery Reference Rucker and Montgomery2011; US Senate 2012). However, a liability cap and two royalty exemptions for oil and gas extraction – which amounted to tens of million dollars annually – were identified in the reports to the G20 as fossil fuel subsidies that could be reformed without congressional approval. They were terminated, respectively, in 2014 and in 2016 immediately following the presidential elections (US Government 2015; Bureau of Land Management 2016). Internationally, the United States has actively promoted fossil fuel subsidy reform, especially in securing the adoption of the G20 commitment (see Chapter 5). This active role complemented the Obama administration’s domestic effort to phase out federal tax breaks to fossil fuel producers (Interview 1). It was mainly the White House and the Treasury that addressed fossil fuel subsidies both domestically and internationally, the latter being the department most engaged on a day-to-day basis (Interview 2).

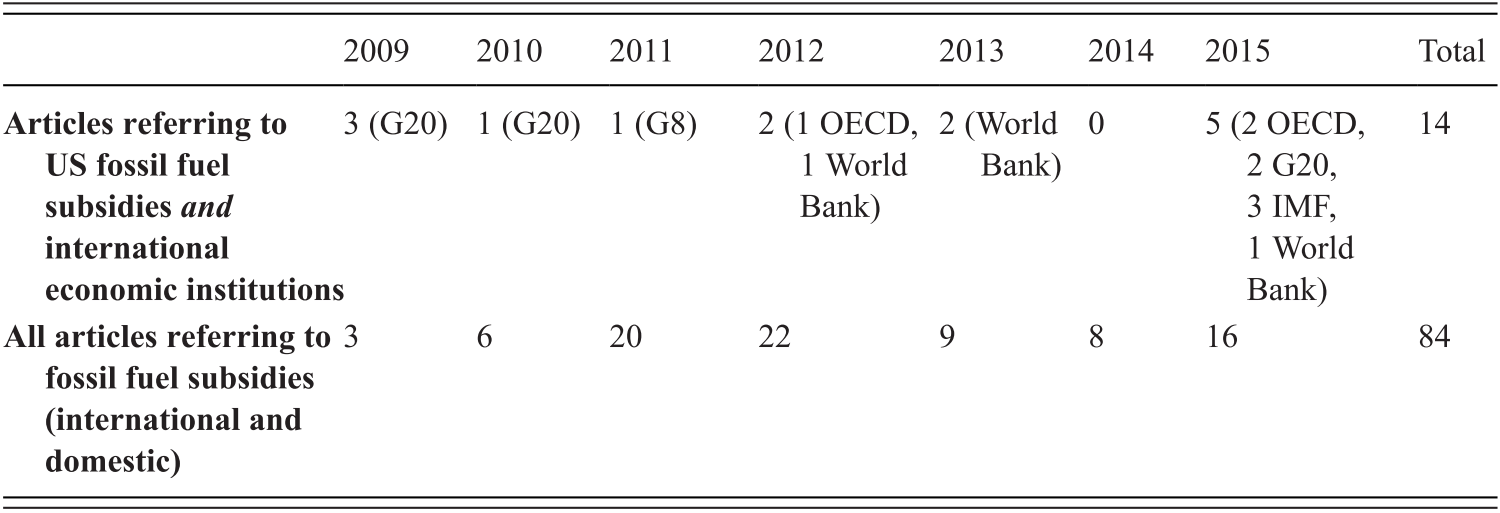

On the public agenda, fossil fuel subsidies have received more attention over the years (Table 6.1), but only within the domestic context about proposals to end tax breaks. As Table 6.1 shows, the total number of articles referring to fossil fuel subsidies increased with a peak of 22 in 2012. However, only a few of them referred both to fossil fuel subsidies (in a way that related to US subsidies) and to the international economic institutions, peaking with five articles in 2015. None of the articles made a connection between the activities of the international institutions and reforming domestic fossil fuel subsidy reform (e.g. by referring to the institutions’ reports when discussing fossil fuel producers’ tax breaks).

Table 6.1 Fossil fuel subsidy debate in the United States: New York Times and Washington Post coverage

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Total | |

|---|---|---|---|---|---|---|---|---|

| Articles referring to US fossil fuel subsidies and international economic institutions | 3 (G20) | 1 (G20) | 1 (G8) | 2 (1 OECD, 1 World Bank) | 2 (World Bank) | 0 | 5 (2 OECD, 2 G20, 3 IMF, 1 World Bank) | 14 |

| All articles referring to fossil fuel subsidies (international and domestic) | 3 | 6 | 20 | 22 | 9 | 8 | 16 | 84 |

The US government submitted a self-report of the federal policies it considered fossil fuel subsidies, which was reviewed by a team chaired by the OECD Secretariat and including representatives from China, Germany and Mexico. In this report and in the 2014 G20 progress report, the United States acknowledged that both tax reductions and support for low-income households’ energy costs constitute fossil fuel subsidies but argued that the latter were not inefficient and hence should not be reformed (US Government 2014, 2015). The 2015 report included four tax exemptions and a liability cap (ranging from USD 0 to 342 million) that had not figured in the 2014 report (US Government 2014). These five subsidies were identified in an interagency process carried out in anticipation of the peer review with the intention of identifying additional subsidies that merited inclusion (Interview 3).

In this way, the G20 changed the policymaking agenda by placing the identification of fossil fuel subsidies on the agenda of several agencies that do not usually deal with the issue. It also changed the ideational context of action by reframing specific policies as fossil fuel subsidies and making it difficult to argue that they did not constitute such subsidies. The three subsidies reformed are among those acknowledged in the 2015 report, but not in the 2014 report (and were the only ones not requiring congressional approval); in this way, the Obama administration sought to live up to the G20 commitment to the greatest extent possible within the constraints of the political system. Yet the decision to terminate one subsidy – the liability cap – was made one year before the peer review, whereas the decision to terminate the royalty exemptions were already well under way during the review; the latter decision was adopted within the Department of the Interior in isolation from the policy processes addressing the G20 commitment (Interview 4). The peer review agreed with the US self-review regarding the subsidies identified (including support for low-income households’ energy costs not being inefficient), but it also argued that the support for inland waterway infrastructure mainly used to transport fossil fuels – not included in the self-report – constituted a fossil fuel subsidy (G20 Peer Review Team 2016: 31). It is noteworthy that the OECD chaired the peer review and hence exerted ideational influence over the United States due to the G20 commitment. Otherwise, the OECD’s definition of specific policies as subsidies – as included in its own reports – had little impact, since these policies had already been acknowledged as subsidies. Altogether, the G20 commitment institutionalised the norm of fossil fuel subsidy reform, which the Obama administration sought to adhere to within domestic constraints. The G20 commitment also held the United States accountable in regard to policies it was reluctant to define as fossil fuel subsidies.

In terms of learning, Treasury officials interacted with the IMF officials who developed the broader IMF definition of fossil fuel subsidies, which facilitated understanding of the issues in both organisations (Interview 5). Yet this collaboration did not induce the Treasury to adopt a price-gap approach that includes environmental externalities, in adherence with the IMF’s definition of fossil fuel subsidies (Clements et al. Reference Clements, Coady and Fabrizio2013).

Finally, the United States has not been subject to any conditionalities, support or other programmes from the international economic institutions that could alter the power of actors involved in decision-making regarding fossil fuel subsidies. Consequently, power-based influences (at least in the sense used here) did not play a role.

6.5.2 United Kingdom

The OECD identifies fossil fuel subsidies in the United Kingdom as consisting mainly of reduced rates of value-added tax for fuel and power and of the covering of liabilities related to coal mining. It estimates the value of these to be several billion pounds (OECD 2016d). The IMF estimates UK fossil fuel subsidies at GBP 40 billion, of which non-priced externalities constitute more than GBP 36 billion (IMF 2015). The UK government has promoted fossil fuel subsidy reform at the international level, including within the G20 (Interview 6). Internationally (in the reports to the G20) and domestically, the UK government has argued that the United Kingdom provides no inefficient fossil fuel subsidies (Kirton et al. Reference Kirton, Larionova and Bracht2013: 62–69). This argument is based on the definition of fossil fuel subsidies as ‘any Government measure or programme with the objective or direct consequence of reducing, below world-market prices, including all costs of transport, refining and distribution, the effective cost of fossil fuels paid by final consumers, or of reducing the costs or increasing the revenues of fossil-fuel producing companies’ (Department of Energy and Climate Change and HM Treasury 2013: para. 122).

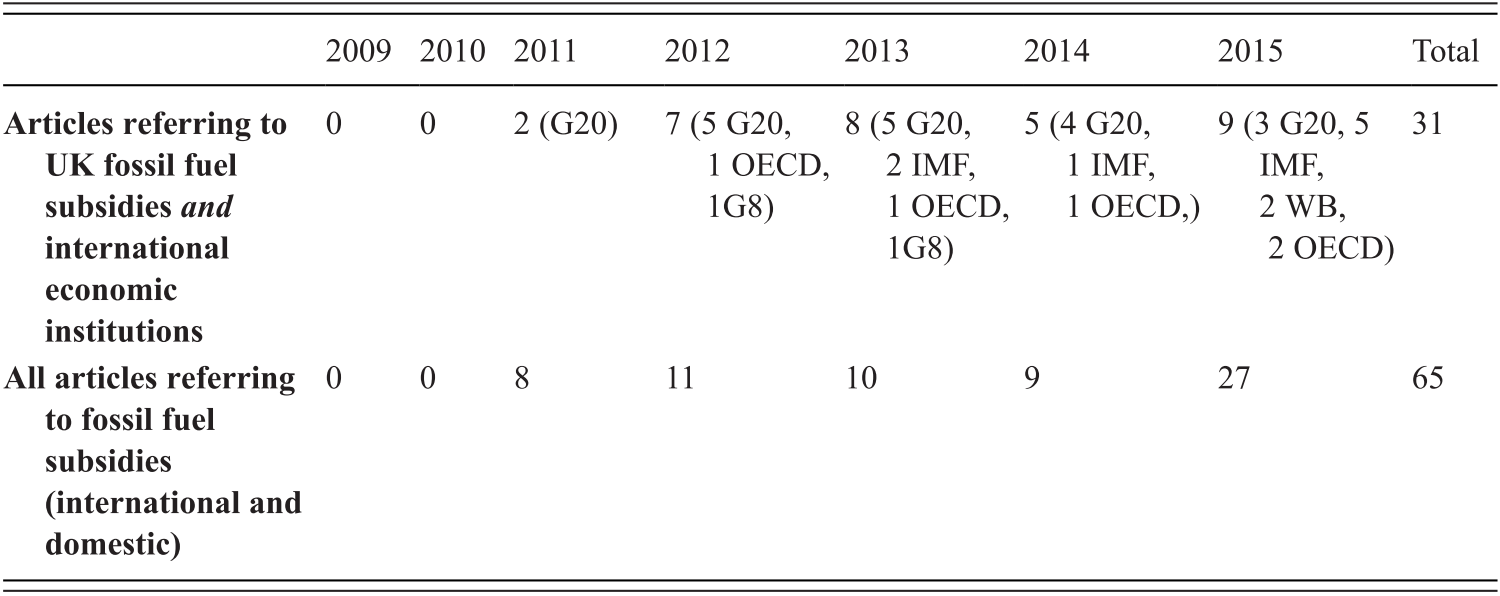

On the public agenda, the number of newspaper articles mentioning fossil fuel subsidies has increased substantially since 2011 (Table 6.2). Several articles link the G20 commitment and the IMF’s 2015 report to fossil fuel subsidies within the United Kingdom. Actors including members of the House of Commons’ Environmental Audit Committee pointed to the perceived inconsistency between the UK government’s high international profile on fossil fuel subsidy reform and the existence of, even growth in, fossil fuel subsidies domestically (Carrington Reference Carrington2015).

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Total | |

|---|---|---|---|---|---|---|---|---|

| Articles referring to UK fossil fuel subsidies and international economic institutions | 0 | 0 | 2 (G20) | 7 (5 G20, 1 OECD, 1G8) | 8 (5 G20, 2 IMF,1 OECD, 1G8) | 5 (4 G20, 1 IMF, 1 OECD,) | 9 (3 G20, 5 IMF, 2 WB, 2 OECD) | 31 |

| All articles referring to fossil fuel subsidies (international and domestic) | 0 | 0 | 8 | 11 | 10 | 9 | 27 | 65 |

Importantly, the ideational influence from the G20 commitment put fossil fuel subsidies on the policymaking agenda when the House of Commons’ Environmental Audit Committee (which includes members of all major parties) issued a report on energy subsidies challenging the UK government’s claim that it does not subsidise fossil fuel (2013). The report opened new venues for actors – including environmental organisations and renewable-energy companies – opposed to fossil fuel subsidies. Many of these actors testified to the Committee, which relied on these testimonies in its report, particularly their criticism that the government’s fossil fuel subsidy definition was too restrictive (House of Commons Environmental Audit Committee 2013: 6–9). The Committee used a price-gap approach that (unlike the government) included value-added tax in the benchmark price and defined, for example, a consequently lower value-added tax on households’ and small businesses’ electricity bills as a GBP 3.6 billion subsidy. The Committee – unlike the UK government – also defined tax rebates for high-cost oil and gas fields and fracking as subsidies.

UK officials from the Treasury and other ministries interacted regularly with the different international economic institutions, as the Treasury was responsible for developing the UK government’s definition of fossil fuel subsidies and for the G20, the IMF and, to a lesser extent, the World Bank. The two other ministries with important roles – the Department of Energy and Climate Change and the Department for International Development – focused mainly on the international level (Interviews 7 and 8). This interaction increased awareness of the issue but did not amount to fundamental ideational and learning-based influences on Treasury beliefs and goals regarding British fossil fuel subsidies. This was mainly because even before the institutions became closely involved, the Treasury perceived fossil fuel subsidies in terms similar to those of the economic institutions, namely as undesirable, because of their macroeconomic effects and, as a secondary consideration, their environmental effects (Interview 6; see Stern (Reference Stern2006: 277–79) for an example of how the Treasury perceived fossil fuel subsidies through an environmental economics perspective). The Treasury interacted most closely with the IEA, which defines fossil fuel subsidies (using a price-gap approach excluding environmental externalities) in a way similar to how the UK government had already defined it (Stern Reference Stern2006: 277–79).

Finally, similarly to the United States, the United Kingdom has not been subject to any programmes from the international economic institutions that could alter the power of relevant actors, and hence power-based influences did not play a role concerning UK fossil fuel subsidies.

6.5.3 India

According to the OECD, fossil fuel subsidies in India consist almost exclusively of selling diesel, kerosene and liquefied petroleum gas at a loss and are estimated at hundreds of billions of Indian rupees or billions of US dollars (OECD 2016b). The IMF estimates Indian fossil fuel subsidies at USD 277 billion, of which non-taxed externalities constitute more than USD 250 billion (IMF 2015). The Indian government acknowledges the existence of Indian fossil fuel subsidies and has since 2013 carried out a series of reforms, liberalising prices and focusing subsidies on the poor (see Chapter 12).

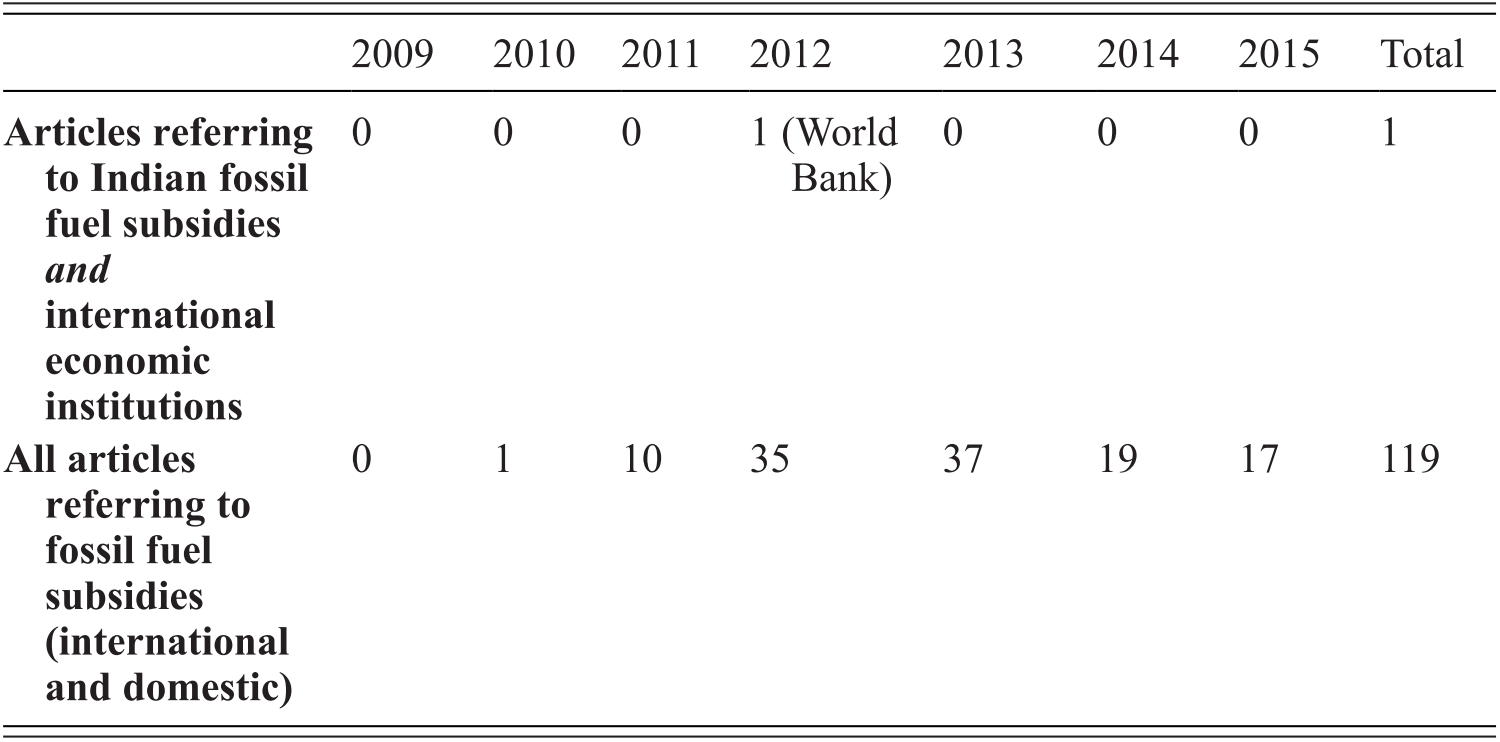

The ideational influence of the institutions on the public agenda is extremely limited (Table 6.3). Only once did the two major newspapers refer to fossil fuel subsidies and one of the institutions (the World Bank) in the same article, although without explicitly linking them and instead focusing on the Rio+20 summit and the ‘green economy’ (Ganesh Reference Ganesh2012). Rather, fossil fuel subsidies were framed solely as a domestic issue on the public agenda, yet they increased in importance.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Total | |

|---|---|---|---|---|---|---|---|---|

| Articles referring to Indian fossil fuel subsidies and international economic institutions | 0 | 0 | 0 | 1 (World Bank) | 0 | 0 | 0 | 1 |

| All articles referring to fossil fuel subsidies (international and domestic) | 0 | 1 | 10 | 35 | 37 | 19 | 17 | 119 |

This framing corresponds to the Indian government’s scepticism about addressing fossil fuel subsidy reform on the international level, including within the G20. Ideational influences have been limited by this scepticism, particularly regarding the G20 framing of fossil fuel subsides as an environmental issue, since the Indian government preferred to frame it as an economic and fiscal issue (see e.g. Dasgupta Reference Dasgupta2013). The scepticism reflects the historically predominant (yet increasingly challenged) view within the Indian elite that climate change is the responsibility of industrialised countries and that developing countries should not commit to climate change actions (Thaker and Leiserowitz Reference Thaker and Leiserowitz2014). Nonetheless, the Indian government has implicitly acknowledged the relevance of the norm to India by reporting its plans to reform fossil fuel subsidies to the G20.

The Ministry of Finance and the Ministry of Petroleum and Natural Gas are responsible for the reforms. According to the former and current officials of the two ministries interviewed, the main reasons for undertaking these reforms have been fiscal and macroeconomic: there are cheaper ways of alleviating poverty, and the fossil fuel subsidies were detrimental to the public budget and the balance of trade (as they increased oil imports). Two contextual factors made the reform possible: low oil prices and the liberalisation of the Indian economy since the early 1990s. Low oil prices created the scope in which to liberalise fuel prices without attracting public protests. Although the liberalisation of the Indian economy is arguably the result of ideational influences promoting the belief in free-market economic governance (Mukherji Reference Mukherji2013), more specific ideational influences concerning fossil fuel subsidies have not been significant.

Concerning learning, the World Bank arranged workshops that provided opportunities for peer-based learning from other emerging economies that had undertaken similar fossil fuel reforms and in this way influenced the shape of concrete fossil fuel subsidy reforms in India (Interview 9).

In the period after 2009, India has not been subject to any programmes from the international economic institutions that could alter the power of relevant actors, and hence power-based influences did not play a role concerning Indian fossil fuel subsidies during the period studied here.

6.5.4 Indonesia

The OECD identifies fossil fuel subsidies in Indonesia as constituted mainly by the setting of oil product prices below the market price; it estimated this support as totalling more than IDR 100 trillion or USD 10 billion (OECD 2016c), which at times equals 4.5 per cent of gross domestic product or 20 per cent of public expenditure (Dartanto Reference Dartanto2013). The IMF estimated Indonesian fossil fuel subsidies at USD 70 billion, of which non-taxed externalities constitute more than USD 50 billion (IMF 2015). The Indonesian government acknowledges that these policies constitute fossil fuel subsidies and has since 2000 attempted, with varying success, to reform them (see Chapter 11). Since Joko Widodo became president in 2014, subsidies to petrol have been phased out and diesel subsidies reduced (IISD 2015).

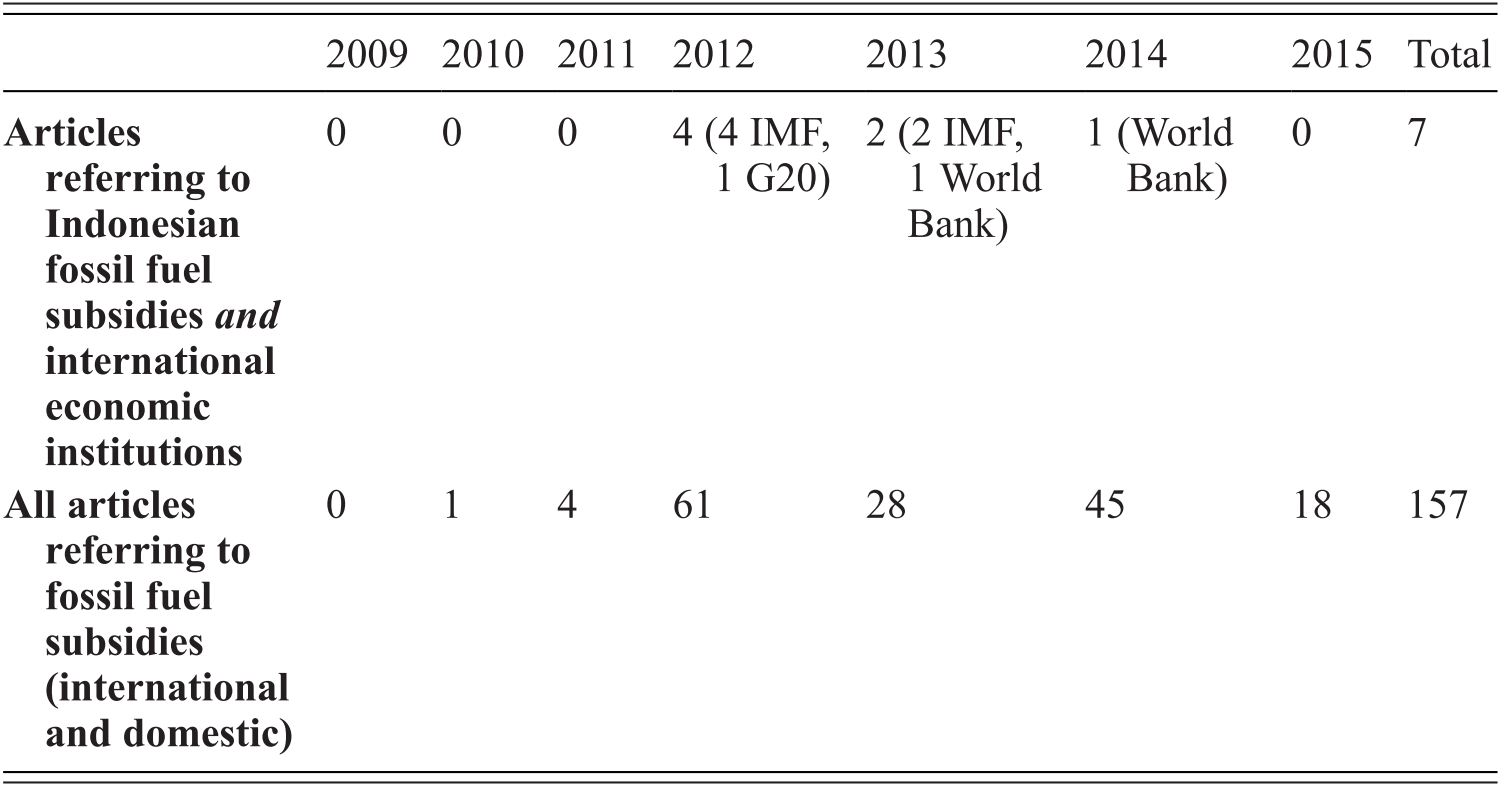

The institutions’ ideational influence on the public agenda has been very limited (Table 6.4). Most newspaper articles focus on solely on domestic aspects of subsidy reform. The few articles that link these reforms to the institutions mainly rely on IMF reports – especially the 2013 report – to substantiate calls for fossil fuel subsidy reform. Generally, the Indonesian public are unaware of the existence of fossil fuel subsidies or tend to underestimate them (see also Chapter 11).

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Total | |

|---|---|---|---|---|---|---|---|---|

| Articles referring to Indonesian fossil fuel subsidies and international economic institutions | 0 | 0 | 0 | 4 (4 IMF, 1 G20) | 2 (2 IMF, 1 World Bank) | 1 (World Bank) | 0 | 7 |

| All articles referring to fossil fuel subsidies (international and domestic) | 0 | 1 | 4 | 61 | 28 | 45 | 18 | 157 |

Regarding ideational influences, Indonesia has continuously reported its plans and efforts to reform fossil fuel subsidies to the G20 and committed itself to undergo a peer review (Steenblik Reference Steenblik2016). The fossil fuel subsidy reform norm has been influential among government policymakers, since failure to live up to the commitment is considered politically embarrassing (Interview 10). World Bank interaction with policymakers and technical officials has been close and has covered all three kinds of influence; in addition, it has shaped the most recent round of fossil fuel subsidy reform when the Widodo presidency moved the issue up the policymaking agenda. First, ideational influence – in terms of co-producing and disseminating an analysis of fossil fuel subsidies – was important in influencing policymakers’ beliefs concerning these subsidies, particularly by framing the subsidies in terms of inequality (most are captured by the non-poor) and the other purposes (especially infrastructure) that the money could finance (Interview 11). The IMF and, to a lesser degree, the OECD have also been influential in providing analysis of Indonesian fossil fuel subsidies. The IMF collaborated with the World Bank, following a standard division of labour in which the IMF focused more on the monetary exchange rate and broad fiscal setting, whereas the World Bank focused on sectoral and microeconomic issues (Interview 12). While civil servants (at least during the period studied) considered fossil fuel subsidies problematic and hence could not be influenced in this direction, an analysis of how to undertake fossil fuel subsidy reform could influence them to a greater degree (Interview 13). The institutions also could influence the policymaking agenda by framing the subsidies in terms of inequality and the possibilities for using the money for other purposes (Diop Reference Diop2014). Second, regarding learning, the World Bank facilitated important learning about the experiences of other countries replacing fossil fuel subsidies with targeted measures – such as direct cash transfer to the poor – by inviting officials from Indonesia’s planning ministry Bappenas to Brazil to learn from their cash-transfer scheme (Interview 11). This influence shaped the compensatory measures that experts argue are crucial to the successful reform of fossil fuel subsidies (Beaton and Lontoh Reference Beaton and Lontoh2010; OECD 2011).

Finally, power-based influence can be discerned, since the World Bank provided the technical assistance necessary for creating the cash-transfer scheme (Interview 11), thus making certain policies possible by altering the resources available. According to Chelminski (Chapter 11), the provision of social assistance constituted the most important factor and a necessary condition for the success of the recent reforms; thus, without this power-based influenced from the World Bank, it is far from certain that the reforms would have succeeded. In 2002, and thus before the period mainly studied here, the IMF programme following the 1997 Asian financial crisis led to increases in fixed fuel prices (Government of Indonesia 2002; see also Chapter 11). After this programme ended, the absence of direct leverage meant that the IMF played the part of a trusted policymaker rather than an active stakeholder (Interview 12).

However, the drivers underlying Indonesian fossil fuel subsidy reforms are primarily domestic. The Indonesian Ministry of Finance has been an important driver of such reforms (and interacted closely with the World Bank) due to concerns about the impact of reforms on the budget (Interview 14).

6.5.5 Denmark

According to the OECD, the Danish government subsidises fossil fuels by reducing energy taxes for fuels used for specific purposes and for oil extraction. The subsidies, as identified by the OECD, are estimated to amount to billions of Danish kronor or hundreds of millions of US dollars (OECD 2016a). According to the IMF, fossil fuel subsidies in Denmark amount to USD 5.8 billion, of which non-taxed externalities constitute more than USD 4 billion (IMF 2015). The Danish government has acknowledged that fossil fuel production is subsidised but argues that tax expenditures for consumption do not constitute subsidies because total fossil fuel taxes exceed the total externalities (Danish Ministry of Climate Change 2015). Internationally, the Danish government has promoted fossil fuel subsidy reform, particularly through the Friends of Fossil Fuel Subsidy Reform (see Chapter 9).

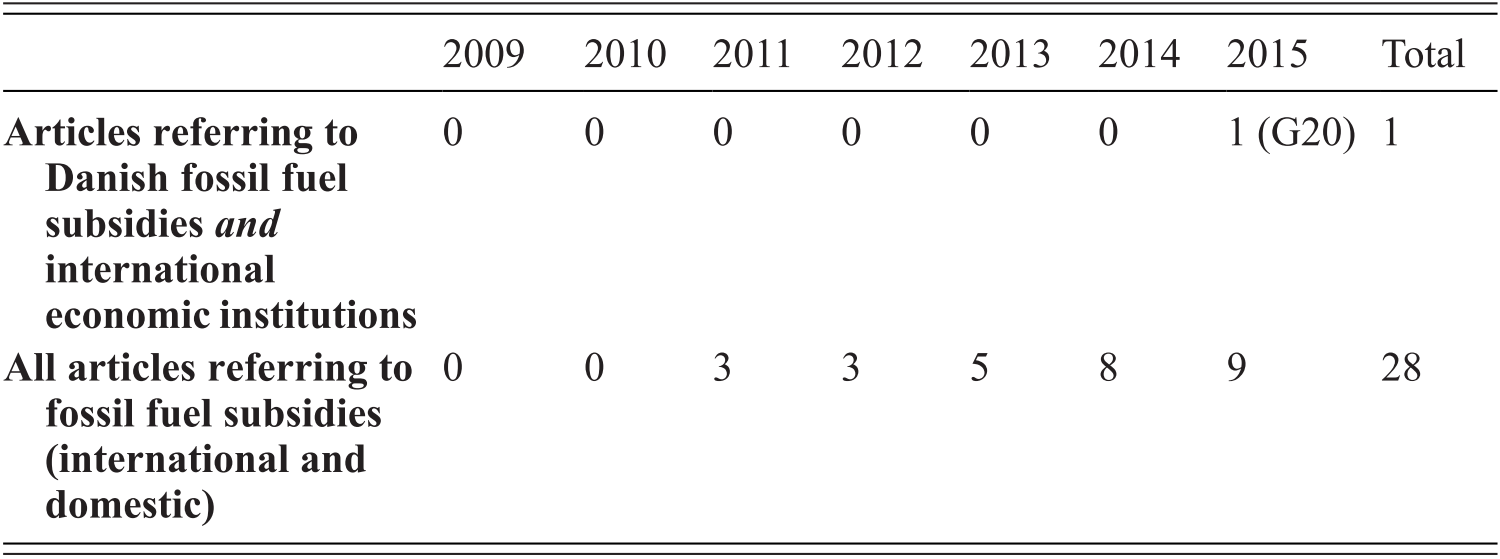

The ideational influence on the public agenda is limited (Table 6.5). Despite the increasing focus on fossil fuel subsidies since 2010, only one article linked one of the institutions (the G20, of which Denmark is not a member) and Danish fossil fuel subsidies (Nielsen and Andersen Reference Nielsen and Andersen2015). Generally, fossil fuel subsidies have been framed as an international rather than a Danish phenomenon.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Total | |

|---|---|---|---|---|---|---|---|---|

| Articles referring to Danish fossil fuel subsidies and international economic institutions | 0 | 0 | 0 | 0 | 0 | 0 | 1 (G20) | 1 |

| All articles referring to fossil fuel subsidies (international and domestic) | 0 | 0 | 3 | 3 | 5 | 8 | 9 | 28 |

Regarding ideational influences on the policymaking agenda, ‘green’ politicians have referred to the IMF’s estimate that Danish fossil fuel subsidies amount to USD 1,000 per capita, and they have thereby forced the government to admit to granting fossil fuel production subsidies (Danish Ministry of Climate Change 2015; Poll Reference Poll2016). Concerning influences on the beliefs of policymakers, participation in workshops about fossil fuel subsidies arranged by the OECD increased knowledge and awareness of the topic within the Finance Ministry and other ministries. Yet, the Danish ministries have mainly focused their attention on consumption subsidies and have addressed fossil fuel subsidies mainly as a developing-country phenomenon, which does not necessitate changes to Danish policy (Interview 15). Consequently, learning has only been relevant in terms of changing Danish beliefs regarding how best to undertake fossil fuel subsidy reform in developing countries, not in industrialised ones.

As with several of the other countries studied here, Denmark has not been subject to any programmes from international economic institutions that could alter the power of relevant actors, and hence power-based influences did not play a role.

6.6 Conclusion

Although the correlation between international economic institutions’ promotion of fossil fuel subsidy reform and domestic reform did not amount to the former causing the latter, important causal influences were nonetheless at work. The analysis shows that the three kinds of influence of the international economic institutions varied in importance.

First, the ideational influence on the public agenda was limited, whereas the influence on the policymaking agenda in Denmark and the United Kingdom was significant. Most importantly, the G20 commitment established fossil fuel subsidy reform as a norm that governments had to take seriously. Even India – which was sceptical of the norm, though it did undertake domestic reforms – had to acknowledge the relevance of the norm in its G20 reports. The UK and Danish governments supported the norm but claimed it did not apply to them. But they were pushed by actors exploiting the G20 commitment and the IMF reports to enter into debates about the validity of those claims, and those debates centred on which definition of fossil fuel subsidies was most relevant. These findings underscore the importance of the institutions in promoting the norm of fossil fuel subsidy reform and the importance of definitional questions in domestic norm diffusion (see Chapter 5).

Second, learning mattered in terms of workshops organised by the World Bank and, to a lesser degree, the OECD. These workshops helped change beliefs regarding how to reform fossil fuel subsidies among government officials. In India and Indonesia, learning was important in relation to actual fossil fuel subsidy reform, and it shaped how the reforms were carried out.

Third, power-based influences were relevant only in the case of Indonesia, in which World Bank technical support and, at an earlier stage, an IMF programme were influential in shaping Indonesian fossil fuel reform. A key take-away from this is that international power-based influences can be very important under specific conditions (particularly conditionalities in times of crisis) but that these conditions are relatively rare.

Despite their (predominantly ideational) influence on discussions of fossil fuel subsidies, the economic institutions were not significant causes of fossil fuel subsidy reform (except for reforms in Indonesia in the early 2000s), but they played a significant role in shaping reform in developing countries.

Exploring the scope conditions for the different kinds of influence could be a useful venue for future research, beyond the fact that fiscal and economic crises and government changes provide windows of opportunity. Furthermore, it makes sense to adopt a longer-term perspective and explore the role of international economic institutions not only when fossil fuel subsidy reform is introduced but also in terms of maintaining those reforms.

Acknowledgements

I would like to thank Harro van Asselt, Thijs van de Graaf, Ron Steenblik and the anonymous reviewer for their extremely useful comments and suggestions at the various stages of writing this chapter as well as Moa Forstorp, Jasmiini Pylkkänen and Benni Yusriza for their assistance in collecting data. The research for this chapter was undertaken as part of the project ‘International Economic Institutions and Domestic Actors in the Climate Regime Complex’, which has been funded by the Swedish Research Council (Vetenskapsrådet), the Bank of Sweden Tercentenary Foundation (Riksbankens Jubileumsfond) and the Swedish Research Council Formas (Forskningsrådet Formas).