1. Details of software download and set-up

DivFolio is an open public domain freely available software application developed in R Shiny environment for supporting wealth management in green finance. All materials and brief instructions are deployed on the GitHub repository:

https://github.com/QuantFILab/Divfolio.

Users can access the tool via three optional ways: web application, executable package, and running on RStudio.

Web Application

Web applications are the simplest way to access the tool online. Users are not required to install the application to a local machine. It only require an internet connection to utilize the tool. It was deployed on the shinyapps.io, an open source deployment sever provided by RStudio. The tool can be assessed via the URL:

https://quantfilab.shinyapps.io/divfolioserveri/

Note here that some features are limited due to processing capability of the deployment server. The details are given in Appendix A.2. For complete set of features, users can run the executable package locally on their computer or compile the github provided code, as described in the next section.

Executable Package

The executable package can be installed on Windows machines, Windows emulators on Mac, and Linux on the GitHub repository. It can be accessed on GitHub, https://github.com/QuantFILab/Divfolio, by downloading the folder name “ExecutablePackage” to the local machine and then doubly click on the Divfolio.exe to run the tool. It may take a long time to open the application in the first time. Unlike the web application mode, the executable package only requires an internet connection during installation. Once installed on the local machine, the users can utilize the tool without an internet connection. The executable file is self-contained, and it is not required to have an R environment installed to run the code. The file’s size is very large (1Gb), so it is advisable to download it on a network connection for faster file download. For an optimal user experience, it is highly recommended to follow the instructions provided on the GitHub repository for setting up and running the executable file. Note that the construction of the executable file utilised an R packaged called “electron-packer,” which we have unit tested and found it demonstrated satisfactory performance in our tests on Windows 10 operating system; however, we cannot vouch for comparable reliability on all possible operating systems. Given these constraints, and to prevent potential inconveniences, we suggest that if users find the executable is not configured to work with their operating system, they should revert to using DivFolio either via the Web application or running the source code from RStudio environment (or any IDE for R as outlined below).

Running from RStudio

Users who already have R installed may also run the Shiny application directly within an R environment that matches the specified user requirements as provided on the GitHub repository and in the readme file of the tool where required dependencies are listed. This option is suitable for R users. R and RStudio are required to be installed. In addition, the package “shiny” need to be called in R code. The code is simply:

library(shiny)

shiny::runGitHub("QuantFILab/Divfolio")

This option may be problematic when the package and R version do not match the code. Based on the most recent update, Version 4.2.2 or later of R is suggested. On GitHub, the most recent version of the packages and their dependencies can be found.

2. Introduction to DivFolio application

The main purpose of the software (DivFolio) is to support the development and assessment of portfolios that consider decarbonization and Environmental Social Governance (ESG) investing and divestment practices following the climate change prevention trends arising in wealth management practices. The software offers functionality for generating divestment plans and sustainable portfolios as well as for comparing the corresponding risk/return profiles, ESG scores, and customized attributes of portfolios, such as carbon intensity. The assessment is based on simulations that collect and incorporate relevant historical market data before and after divestment while also considering varying rates of divestment planning. The software allows the user to apply these assessments to publicly traded equity assets, exchange-traded funds (ETFs), exchange-traded notes (ETNs), and depositary receipts (DR).

Climate change has become a permanent long-term systemic risk. Regulators, consumers, and investors are becoming increasingly concerned about sustainability, which is driving a paradigm shift in investment and wealth management practices; see Fang et al. (Reference Fang, Tan and Wirjanto2019), Focardi & Fabozzi (Reference Focardi and Fabozzi2020), Benedetti et al. (Reference Benedetti, Biffis, Chatzimichalakis, Fedele and Simm2021), Tokat-Acikel et al. (Reference Tokat-Acikel, Aiolfi, Johnson, Hall and Jin2021) and Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022). At a macroeconomic level, the majority of G10 countries and United Nations member states are increasingly focusing on developing targets and strategies to incentivise the transition toward a low carbon economy globally via frameworks such as the Sustainable Development Goals (SDGs)Footnote 1 and the 2030 Agenda (Miralles-Quirós & Miralles-Quirós, Reference Miralles-Quirós and Miralles-Quirós2021). The resultant actions involve mixed strategies, including both direct actions in terms of cutting emissions and moving away from fossil fuel-intensive industry and power generation, but also indirect actions such as incentivizing changes in investment practices. This manuscript focuses on these indirect actions related to wealth management and investment practices that try to align capital deployment with a green finance framework in order to reward commercial entities actively engaging in aligning with the United Nations SDGs. These practices also seek to achieve optimal target scores on ratings, such as the ESG scoring systems, which many financial rating agencies are actively developing, see Pagano et al. (Reference Pagano, Sinclair and Yang2018). The current ESG scores are in their infancy, which brings a lack of alignment in ESG scoring and rating methodology (Dimson et al., Reference Dimson, Marsh and Staunton2020). Nevertheless, such methods will mature and standardize and eventually become the metrics by which investors will evaluate corporate activities when it comes to environmental perspectives and actions. It is important to understand how this can influence and consequently affect portfolio and wealth management performance, as all listed companies in most major economies are now being actively rated for ESG criteria. This places expectations on the companies to achieve adequate ratings to satisfy increasing numbers of environmentally focused investment practices both in the retail markets and the wealth management population.

These changing perspectives on how to monitor, track, and analyze actions aiming to mitigate the effects of climate change are being encoded in various ways. For example, via the ESG scoring frameworks being developed in the financial investment space or via the development of the notion of carbon footprints of investment portfolios, see examples in Boermans & Galema (Reference Boermans and Galema2019) and Boermans et al. (Reference Boermans and Galema2017) who studied carbon footprints of large pension funds. In the asset management space, there is an ongoing debate about how to best incentivize corporations in order to foster private sector initiatives that will actively create a paradigm shift in decision-making toward more sustainable and environmentally friendly corporate decisions, eventually leading to a reduction in environmental impact. Such movements in investment practice are critical indirect drivers of change as they generate active decision-making that eventually leads to mitigation strategies that reduce carbon emissions, a primary driver of climate change. Even though there are many alternative approaches to achieve these strategic changes, including engagement, this manuscript and the proposed software consider the concept of “fossil-fuel divestment strategies”. Investors and asset managers are increasingly interested in optimal divestment strategies of their holdings from companies that either produce large amounts of carbon as part of their primary business models, such as fossil fuel companies in the energy sector, or companies classified as non-compliant or performing poorly on the environmental component of ESG ratings. For most institutional investors, such as pension funds (Rempel & Gupta, Reference Rempel and Gupta2020) and mutual funds (Guo et al., Reference Guo, Liang, Umar and Mirza2022), divestment is sometimes expensive without careful long-term planning, and on fund management expense (Marupanthorn et al., Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022). Mechanisms to develop, study, and analyze various divestment strategies are an essential component of carbon reduction strategies, while the rate at which investors should divest has become a critical aspect of effective divestment (Marupanthorn et al., Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022). In this manuscript, we present a software application that provides a comprehensive approach to analyze asset allocation methodologies to address and assess this impact over time on global equity portfolios and ETFs.

DivFolio is a public domain free software that acts as a digital platform constructed as an R Shiny application that users can utilize at their own risk as a decision-making tool on optimal divestment strategies based on historical data. The application embeds both manual and automatic options. Users can study a variety of divestment strategies, either by manually selecting their preferred stocks to invest/divest from or by utilizing the software to automatically select divestment assets based on quantiles of ESG scores. Users would be only required to select a proportion of divestment positions. The software uses the multiperiod optimization, i.e., time-dependent portfolio optimization, divestment frameworks proposed in Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022). Note that these divestment strategies are designed for static-asset portfolio allocations, i.e., the investor does not aim to add new assets during divestment. The R Shiny application allows the user to select from globally listed equity assets, ETFs, and ETNs and to select these in both investment and divestment categories based on criteria such as ESG rankings, performance, and carbon emissions. The software interface also provides a variety of sets of multiperiod portfolio risk, return, and ESG-based analytics to explore the effects of divestment practices related to ESG and carbon footprints on different divestment and rate of divestment choices.

DivFolio allows users to compare the risk/return profiles, ESG scores, and customized attributes of portfolios (before and after divestment) based on the simulation using historical data. Furthermore, advanced options are considered, such as the assessment of portfolio stability via clustering and Graphical Lasso-based diversification assessment of correlation structures. The tool is also useful for investigating the impact of divestment on portfolio performance in multidimensional views of risk/return of the portfolio over time, the portfolio stability in risk/return profile, and the diversification structure in the portfolio, as divestment unfolds over time. DivFolio also affords the user the benefits of a general-purpose portfolio performance comparison, especially in ESG investing and sustainable investing. Furthermore, users can customize the attributes of comparable portfolios by uploading prepared comma-separated values (CSV) files on the tool instead of generating portfolios in order to compare their existing portfolio positions to those automatically generated by the scenarios users select in the DivFolio application.

The aim of the paper is to present the DivFolio software, explain its functionality, and demonstrate its applicability. Therefore, the paper should be treated as a guideline manual for users. Given that this is a software paper, we focus on presenting and explaining the software and do not attempt to provide a detailed account of the financial interpretations of the associated divestment strategies. For the financial interpretations and implications of findings on divestment strategies, we refer users to the empirical study Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022) that presents the multiperiod optimization divestment frameworks built in DivFolio. Note that study, Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022) does not provide a description of DivFolio, even though DivFolio has been used to carry out the empirical analysis of the study. Furthermore, the case studies considered in this paper for demonstration purposes and the case studies investigated in Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022) are different to ensure novelty.

The remaining of this paper is arranged as follows. Section 3 explains the methodologies and algorithms embedded in the software. Section 4 presents illustrative examples on environmental score assets divestment in the energy and utility sectors and overall ESG score assets divestment in FTSE100. Section 5 presents an application of DivFolio to evaluate the impact of divestment on the risks and return of mixed pension portfolios using environmental risk score analysis. Section 6 concludes. The guidelines on how to use DivFolio are presented in Appendix A.

3. Overview of the methodology in the DivFolio application

The divestment methodology underpinning the DivFolio application and the corresponding mathematical frameworks are detailed in Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022). Accordingly, we keep this section brief and refer the interested reader to the aforementioned paper for details.

3.1. DivFolio: multiperiod optimal portfolio selection with divestment

The three sequential processes used in DivFolio are summarized below.

Process 1: Generation of core portfolios

DivFolio offers five core portfolio choices. The Passive Equal-Weighted Portfolio (PEW) is a buy-and-hold portfolio with a passive investment long-only structure that provides a long-term investment strategy. The weights of all assets are fixed and do not fluctuate over time, i.e.,

![]() $w_i = 1/N$

for

$w_i = 1/N$

for

![]() $i$

in the universe of

$i$

in the universe of

![]() $N$

assets, and short positions are forbidden. The Active Equal-Weighted Portfolio (AEW) is a portfolio in which the weights are balanced to achieve relative equal weighting. In other words, it is a return-weighted portfolio whose objective is to achieve the same return from each asset. The Global Minimum Variance Portfolio (GMV) tries to diversify assets with the lowest portfolio risk, as assessed by portfolio variance (Markowitz, Reference Markowitz1968; Markowitz, Reference Markowitz1952). In the case of the GMV portfolio, the optimal weights to invest for each asset are determined using the classical optimization problem that minimizes the variance of the portfolio’s return according to the Mean-Variance Markowitz framework as follows:

$N$

assets, and short positions are forbidden. The Active Equal-Weighted Portfolio (AEW) is a portfolio in which the weights are balanced to achieve relative equal weighting. In other words, it is a return-weighted portfolio whose objective is to achieve the same return from each asset. The Global Minimum Variance Portfolio (GMV) tries to diversify assets with the lowest portfolio risk, as assessed by portfolio variance (Markowitz, Reference Markowitz1968; Markowitz, Reference Markowitz1952). In the case of the GMV portfolio, the optimal weights to invest for each asset are determined using the classical optimization problem that minimizes the variance of the portfolio’s return according to the Mean-Variance Markowitz framework as follows:

where

![]() $\Sigma$

is the covariance matrix of the asset returns,

$\Sigma$

is the covariance matrix of the asset returns,

![]() $w$

is the vector of the asset weights, and

$w$

is the vector of the asset weights, and

![]() $1$

is the column vector of ones. The Maximum Sharpe Ratio Portfolio (MS) is a portfolio that aims to achieve the maximum risk-adjusted return. The optimization problem assigns weights so as to maximize the Sharpe ratio of the portfolio (Sharpe, Reference Sharpe1966). The MS’s optimization is given as the solution to the classical Mean-Variance Markowitz framework as follows:

$1$

is the column vector of ones. The Maximum Sharpe Ratio Portfolio (MS) is a portfolio that aims to achieve the maximum risk-adjusted return. The optimization problem assigns weights so as to maximize the Sharpe ratio of the portfolio (Sharpe, Reference Sharpe1966). The MS’s optimization is given as the solution to the classical Mean-Variance Markowitz framework as follows:

where

![]() $\mu$

is the expected return of the portfolio assets. DivFolio also provides a set of portfolio strategies based on risk factor decompositions using the Principal Portfolios (PC) framework. This is created through a convex combination of the sub-portfolios generated by each principal component of the assets covariance matrix, with the convex weight coefficient determined by the eigenvalues,

$\mu$

is the expected return of the portfolio assets. DivFolio also provides a set of portfolio strategies based on risk factor decompositions using the Principal Portfolios (PC) framework. This is created through a convex combination of the sub-portfolios generated by each principal component of the assets covariance matrix, with the convex weight coefficient determined by the eigenvalues,

\begin{equation} R_{PC} = \sum _{k = 1}^d \widetilde{\lambda }_k \sum _{i = 1}^N v_{i,k} R_i, \end{equation}

\begin{equation} R_{PC} = \sum _{k = 1}^d \widetilde{\lambda }_k \sum _{i = 1}^N v_{i,k} R_i, \end{equation}

where

![]() $i$

is an index of the asset in universe with

$i$

is an index of the asset in universe with

![]() $N$

assets and

$N$

assets and

![]() $k$

is an index of the principal component with

$k$

is an index of the principal component with

![]() $d$

outstanding principal components such that

$d$

outstanding principal components such that

![]() $ 0 \leq d \leq N$

,

$ 0 \leq d \leq N$

,

![]() $\widetilde{\lambda }_k$

is a normalized eigenvalue of the principal component

$\widetilde{\lambda }_k$

is a normalized eigenvalue of the principal component

![]() $k$

such that

$k$

such that

![]() $\sum _{k = 1}^d \widetilde{\lambda }_k$

= 1, and

$\sum _{k = 1}^d \widetilde{\lambda }_k$

= 1, and

![]() $v_{ik}$

is the coordinate of the principal component

$v_{ik}$

is the coordinate of the principal component

![]() $k$

of asset

$k$

of asset

![]() $i$

(Yang, Reference Yang2015). The improved version of the PC with minimum variance is used in the application.Footnote 2

$i$

(Yang, Reference Yang2015). The improved version of the PC with minimum variance is used in the application.Footnote 2

DivFolio allows the user to consider both short and long positions (which are permitted in portfolio formation), except for the strategies of PEW and AEW portfolios, which restrict short positions. However, to avoid excessive leverage in the portfolio that arises when unrestricted short positions are admissible, we impose a “box” constraint to mitigate excess leverage. We introduce the box constraint in the multiperiod portfolio optimization by re-normalizing asset weights incrementally. These constraints are as follows:

\begin{equation} w^s_{box} = \begin{cases} SL\times (w^s/\sum _{s \in S}{w^s}), & \ \sum _s w^s \gt SL, \\ w^s, & \sum _s w^s \leq SL, \end{cases} \end{equation}

\begin{equation} w^s_{box} = \begin{cases} SL\times (w^s/\sum _{s \in S}{w^s}), & \ \sum _s w^s \gt SL, \\ w^s, & \sum _s w^s \leq SL, \end{cases} \end{equation}

where

![]() $S$

is the collection of assets that is taking short positions, and the weight

$S$

is the collection of assets that is taking short positions, and the weight

![]() $w^s$

indicates the size of the short position for an asset from set

$w^s$

indicates the size of the short position for an asset from set

![]() $S$

. The total leverage on the short positions is capped at level

$S$

. The total leverage on the short positions is capped at level

![]() $SL$

. Therefore, there are

$SL$

. Therefore, there are

![]() $N-|S|$

assets making up the subset of long positions, denoted by set

$N-|S|$

assets making up the subset of long positions, denoted by set

![]() $L$

, each having long positions of weight

$L$

, each having long positions of weight

![]() $w^l$

. Next, a sum of long positions is normalized to be

$w^l$

. Next, a sum of long positions is normalized to be

![]() $1 + SL$

if the short ratio exceeds the limit as detailed below:

$1 + SL$

if the short ratio exceeds the limit as detailed below:

\begin{equation} w^l_{box} = \begin{cases} (1+SL)\times (w^l/\sum _{l \in L}{w^l}), & \ \sum _l w^l \gt SL, \\ w^l, & \sum _l w^l \leq SL. \end{cases} \end{equation}

\begin{equation} w^l_{box} = \begin{cases} (1+SL)\times (w^l/\sum _{l \in L}{w^l}), & \ \sum _l w^l \gt SL, \\ w^l, & \sum _l w^l \leq SL. \end{cases} \end{equation}

This ensures that the portfolio limits excess leverage according to the user-defined or regulation-defined restrictions on long-short equity funds in asset management.

Process 2: Divestment controlled by a user-specified divestment schedule

Mathematically, the divestment schedule is an extra restriction imposed by the portfolio optimization problem over multiple time periods corresponding to the user’s selected divestment time horizon. In addition, it represents a multiperiod problem since the divestment schedule,

![]() $D(t)$

, is time-dependent. As a guide to the user, DivFolio offers three (simple) functional rates of divestment, including, for instance, linear and hyperbolic decaying. The user can select parameters for these different divestment schedules, the start and end periods, and the set of assets to divest from. In the case of instant divestment, the controlling equation is denoted by

$D(t)$

, is time-dependent. As a guide to the user, DivFolio offers three (simple) functional rates of divestment, including, for instance, linear and hyperbolic decaying. The user can select parameters for these different divestment schedules, the start and end periods, and the set of assets to divest from. In the case of instant divestment, the controlling equation is denoted by

for all

![]() $t$

, where

$t$

, where

![]() $D(t)$

is the divestment schedule at time

$D(t)$

is the divestment schedule at time

![]() $t$

. The linear rate gradually withdraws divestable assets by the equal capital reduction of

$t$

. The linear rate gradually withdraws divestable assets by the equal capital reduction of

![]() $m$

each time step. The governing equation is given by

$m$

each time step. The governing equation is given by

where

![]() $t_{end}$

is the index of the last date of divestment. Finally, the hyperbolic rate allows to withdraw divestable assets more rapidly in the early time step, based on a hyperbolic decaying function with exponent

$t_{end}$

is the index of the last date of divestment. Finally, the hyperbolic rate allows to withdraw divestable assets more rapidly in the early time step, based on a hyperbolic decaying function with exponent

![]() $a$

that is user-defined. The governing equation is given by

$a$

that is user-defined. The governing equation is given by

where

![]() $a$

is the non-negative exponent. The end date of divestment is the last date of divestment. After this date, the sum of the weights of all divestable assets is set to zero.

$a$

is the non-negative exponent. The end date of divestment is the last date of divestment. After this date, the sum of the weights of all divestable assets is set to zero.

The resulting portfolio optimization problem is then a multiperiod problem with a functional constraint over time, which is approximated via a sequence of locally constrained portfolio optimization problems. This is very important for practical reasons related to the speed at which results are produced by the application. The performance of this approximation in large portfolios with 500+ assets is assessed in Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022). It is shown that, relative to slower numerical solvers, the approximation has acceptable accuracy and significantly speeds up the solution attainment.

To approximate the multiperiod problem, we separate the optimization into two subproblems: divestment and reinvestment. The process is applied when the portfolio is rebalanced. Let

![]() $L$

and

$L$

and

![]() $S$

be the sets of indices of the long-position and short-position assets, and the superscript

$S$

be the sets of indices of the long-position and short-position assets, and the superscript

![]() $\cdot ^{div}$

indicates the divestable assets. In the divestment stage, if the sum of the weight of the divestable assets hits or exceeds the divestment schedule

$\cdot ^{div}$

indicates the divestable assets. In the divestment stage, if the sum of the weight of the divestable assets hits or exceeds the divestment schedule

![]() $D(t)$

,

$D(t)$

,

![]() $\sum _{l \in L}w^{l,div}_{box} \geq D(t)$

, or/and,

$\sum _{l \in L}w^{l,div}_{box} \geq D(t)$

, or/and,

![]() $\sum _{s \in S}w^{s,div}_{box} \leq -D(t)$

, then it is scaled in the bound as follows:

$\sum _{s \in S}w^{s,div}_{box} \leq -D(t)$

, then it is scaled in the bound as follows:

\begin{equation} \widetilde{w}^{l,div}= D(t) \times \frac{w^{l,div}_{box}}{\sum _{l \in L}w^{l,div}_{box}}, \quad \text{or/and} \quad \widetilde{w}^{s,div} = -D(t) \times \frac{w^{s,div}_{box}}{\sum _{s \in S}w^{s,div}_{box}}. \end{equation}

\begin{equation} \widetilde{w}^{l,div}= D(t) \times \frac{w^{l,div}_{box}}{\sum _{l \in L}w^{l,div}_{box}}, \quad \text{or/and} \quad \widetilde{w}^{s,div} = -D(t) \times \frac{w^{s,div}_{box}}{\sum _{s \in S}w^{s,div}_{box}}. \end{equation}

Otherwise, we keep the weights without scaling, e.g.,

![]() $\widetilde{w}^{s,div} = w^{s,div}_{box}$

, or/and,

$\widetilde{w}^{s,div} = w^{s,div}_{box}$

, or/and,

![]() $\widetilde{w}^{l,div} = w^{l,div}_{box}$

.

$\widetilde{w}^{l,div} = w^{l,div}_{box}$

.

Process 3: Reinvestment of excess investment weight

The reinvestment stage is to reallocate the capital, called the excess weights, from the divestable assets to the investable assets. The excess weights are allocated to the assets according to their proportion in the portfolio such that the assets with larger position sizes, i.e., larger weights gain more than those with lower portfolio weightings. The excess weights are defined by

\begin{equation} w_{ex} = \begin{cases} \sum _{l \in L}\widetilde{w}^{l,div}_{box} - D(t), & \text{if} \ \sum _{l \in L}w^{l,d}_{box} \geq D(t), \\[4pt] \sum _{s \in S}w^{s,div}_{box} + D(t), & \text{if} \ \sum _{s \in S}w^{s,div}_{box} \leq -D(t), \\[4pt] \sum _{l \in L}w^{l,div}_{box} + \sum _{s \in S}w^{s,div}_{box}, & \text{if} \ \sum _{l \in L}w^{l,div}_{box} \geq D(t), \ \text{and} \ \sum _{s \in S}w^{s,div}_{box} \leq -D(t), \\[4pt] 0, & \text{otherwise}. \end{cases} \end{equation}

\begin{equation} w_{ex} = \begin{cases} \sum _{l \in L}\widetilde{w}^{l,div}_{box} - D(t), & \text{if} \ \sum _{l \in L}w^{l,d}_{box} \geq D(t), \\[4pt] \sum _{s \in S}w^{s,div}_{box} + D(t), & \text{if} \ \sum _{s \in S}w^{s,div}_{box} \leq -D(t), \\[4pt] \sum _{l \in L}w^{l,div}_{box} + \sum _{s \in S}w^{s,div}_{box}, & \text{if} \ \sum _{l \in L}w^{l,div}_{box} \geq D(t), \ \text{and} \ \sum _{s \in S}w^{s,div}_{box} \leq -D(t), \\[4pt] 0, & \text{otherwise}. \end{cases} \end{equation}

Then the new weight of the investable assets in the divested portfolio is calculated by

The obtained weight satisfies the normalizing condition,

![]() ${\widetilde{w}}^{l,div}{1} +{\widetilde{w}}^{s,div}{1} +{\widetilde{w}}^{inv}{1} = 1$

, where the superscript

${\widetilde{w}}^{l,div}{1} +{\widetilde{w}}^{s,div}{1} +{\widetilde{w}}^{inv}{1} = 1$

, where the superscript

![]() $\cdot ^{inv}$

indicates the investable assets.

$\cdot ^{inv}$

indicates the investable assets.

3.2. DivFolio: portfolio stability analysis by dynamic risk and return feature clustering using CLARA

DivFolio also collects throughout the multiperiod investment/divestment timeline, as selected by the user, a collection of portfolio risk measures and performance measures which act as feature vectors in period-by-period clustering analysis. This allows DivFolio to assess whether large changes in portfolio behavior are observed relative to non-divestment strategies as a result of different divestment strategies. It also forms a type of risk and performance-sensitive stability assessment for the portfolio strategies and divestment strategies as selected by the user.

Portfolio stability refers to the similarity of the relative movement of an attribute, such as return, volatility, VaR, drawdown etc., across a collection of portfolios over time. When one starts to impose divestment strategies of various forms within a given portfolio strategy, this reduces the possible universe of investable assets increasingly over time. This can affect risk and return profiles for the performance of the strategy relative to the same strategy without such restrictions. DivFolio provides valuable feedback in this regard by mapping which user-defined components of strategy and divestment set selection and divestment rate is most likely to cause instability in risk/return profiles. Therefore, users can seek outcomes that may minimise such effects in their investment decisions.

Producing results in a timely manner for DivFolio users is achieved using a machine learning unsupervised clustering technique based on the feature vectors for daily portfolio performance within each rebalancing period (using a default 30-day rebalancing window). As proposed in Kaufman & Rousseeuw (Reference Kaufman and Rousseeuw2009), Clustering Large Applications (CLARA) is utilized by DivFolio to group the following risk-return characteristics: return, volatility, Sharpe ratio, maximum drawdown, Sortino ratio, cumulative return, and value at risk into daily feature vectors for clustering for any given portfolio strategy. The risk profiles of each portfolio are presented as time series. CLARA is applied multiple times during distinct time frames. The performance of portfolios belonging to the same cluster is comparable and not significantly different, implying stability of the risk profiles of portfolios over time.

The algorithm for CLARA implemented in DivFolio is summarized in pseudo-code in the guide in the associated GitHub repository. CLARA is designed to pull numerous samples from the dataset, apply partitioning around medoids algorithm (PAM) to each sample, identify the medoids, and then return the optimal grouping. The PAM algorithm is then applied to

![]() $D'$

to identify the

$D'$

to identify the

![]() $k$

medoids, calculate the current dissimilarity utilizing these

$k$

medoids, calculate the current dissimilarity utilizing these

![]() $k$

medoids and the dataset

$k$

medoids and the dataset

![]() $D$

. If it is smaller than the previous iteration’s result, these

$D$

. If it is smaller than the previous iteration’s result, these

![]() $k$

medoids are retained as the optimal

$k$

medoids are retained as the optimal

![]() $k$

medoids. The entire procedure is repeated a predetermined number of times.

$k$

medoids. The entire procedure is repeated a predetermined number of times.

![]() $S$

is the subset index, and

$S$

is the subset index, and

![]() $Q$

and

$Q$

and

![]() $q$

are arbitrarily large values such that

$q$

are arbitrarily large values such that

![]() $Q \gt q$

initially.

$Q \gt q$

initially.

3.3. DivFolio: diversification profile of portfolios under divestment via Graphical Lasso regularization

Different portfolio constructions and divestment strategies (selection of divestment assets, rate of divestment, and timeline of divestment) may affect the diversification of portfolios over time. DivFolio includes a visual graph-based interface that allows users to assess these effects by plotting the evolution of the most significant (positive or negative) portfolio correlation relationships as the portfolio is progressively rebalanced over time, and the divestment assets are progressively removed from the portfolio.

This assessment is performed by using a robust covariance shrinkage technique. Graphical least absolute shrinkage and selection operator (glasso) Zhao et al. (Reference Zhao, Liu, Roeder, Lafferty and Wasserman2012) is suitable for studying the strongest/most robust dynamic correlation structure within a portfolio over time. From graphs of the correlation relationships over time within a portfolio undergoing divestment, one can learn about the influence that divestment may have on aspects of portfolio diversification. The glasso problem aims to find the best sparse and robust estimate covariance matrix under regularization. Mathematically, the optimization of the glasso considers the sparse Gaussian graphical model (Meinshausen & Bühlmann, Reference Meinshausen and Bühlmann2006) with the following minimization problem,

where

![]() $CG = \{G \in \mathbb{R}^{N \times N} | G_{i,i} = 0 \ \ \text{for} \ i = 1,\dots,N\}$

is a set of estimate sparse covariance matrix,

$CG = \{G \in \mathbb{R}^{N \times N} | G_{i,i} = 0 \ \ \text{for} \ i = 1,\dots,N\}$

is a set of estimate sparse covariance matrix,

![]() $\hat{G}$

is the best sparse estimate covariance matrix,

$\hat{G}$

is the best sparse estimate covariance matrix,

![]() $S$

is a simple covariance matrix, and

$S$

is a simple covariance matrix, and

![]() $\lambda$

is a positive regularization parameter governing the sparsity level. The optimization is analogous to fitting lasso to each variable using the other variables as predictions.

$\lambda$

is a positive regularization parameter governing the sparsity level. The optimization is analogous to fitting lasso to each variable using the other variables as predictions.

The strength of the correlation structure of the portfolio positions in assets can be investigated using glasso. The correlations of the assets in

![]() $\hat{G}$

that survive after regularization, i.e., the ones that remain nonzero after regularization, are the strongest relationships in the portfolio and have the strongest effects on diversification. DivFolio identifies these at each stage of rebalancing and divestment and provides a visual tool to explore these over time, allowing for the multiple comparisons of different portfolio strategies and divestment decisions. Thus, the application provides a powerful visual aid to capture the impact of investment decisions on portfolio diversification profiles over time in complex portfolio selections.

$\hat{G}$

that survive after regularization, i.e., the ones that remain nonzero after regularization, are the strongest relationships in the portfolio and have the strongest effects on diversification. DivFolio identifies these at each stage of rebalancing and divestment and provides a visual tool to explore these over time, allowing for the multiple comparisons of different portfolio strategies and divestment decisions. Thus, the application provides a powerful visual aid to capture the impact of investment decisions on portfolio diversification profiles over time in complex portfolio selections.

4. Illustrative example: divestment of a portfolio of UK stocks using DivFolio

We consider next an illustrative example based on a small portfolio of FTSE100 stocks from the Health Care, Energy, and Utilities sectors. We employ DivFolio to investigate the impact of a linear divestment schedule and assess performance in terms of improving the environmental score and affecting the risk profiles and other attributes over time. The asset universe consists of the following tickers: AZN.L, BP.L, DCC.L, GSK.L, HIK.L, NG.L, SHEL.L, SN.L, SSE.L, SVT.L, and UU.L, and the duration of the divestment is from January 2020 to December 2020. We select a set of assets from the Energy and Utilities sectors to be divested from based on their environmental scores being lower relative to Health Care sector assets. Divesting in this manner would improve the portfolio’s environmental rating. However, the divestment may drastically alter the risk profile or other characteristics of the divested portfolio relative to the original portfolio. All files used in this illustration can be found on our GitHub.

4.1. Guidelines of using DivFolio for the illustrative example

The input of the data for this example is detailed in the step-by-step visual aid in Figs. B.1–B.5 presented in the Appendix, with the optional tool components being illustrated in Figs. B.6–B.8. In each illustration, users are also shown the required format data files, if the manual upload is preferred, see for further details at our Github.

In Step 1, we enter a ticker into the software, for instance, the AstraZeneca PLC ticker, namely AZN.L. See an example of the DivFolio GUI in Fig. 1 for the corresponding collected foundation data, sustainability scores, candlestick chart of the asset’s price, and risk profiles for different time periods in Step 1. Next, each asset in the universe is added to the box in the Cart icon’s dropdown. The selected tickers are initially displayed in the Potential Assets box in Step 2. Next, we assign the investment status of the possible assets by dragging and dropping them into the Investable Assets or Divestable Assets boxes. The assets in Energy and Utilities sectors are dropped in the area of divestable assets, while the assets in Health care sector are dropped in the area of investable assets. We submit the assets list to receive the ESG scores by clicking the summary button. The data will be displayed on the table of attributes; see Fig. 2. The table should be saved as file F1 to avoid calling data from the server. To receive the returns in Step 3, we enter the initial date, 2020-01-03, and the final date, 2020-12-31, into the corresponding boxes in the Calendar icon’s dropdown menu. Then we click the Submit button. This table can be locally stored as an F2 file. Steps 1 to 3 are now complete in the sequential component.

Figure 1 Screenshots of the sustainability score, the candlesticks of historical data, and the bar chart of risk profiles in various time windows in Step 1.

Figure 2 Screenshots of the drag and drop menus: potential assets, investable assets and divestable assets, and the table of attributes in Step 2.

Figure 3 Screenshots of the table of rebalancing portfolio weight, the time series of asset weight, assets allocation, and the allocation of attributes in the portfolio in Step 4.

Figure 4 Screenshots of the distribution of attributes for long positions, the distribution of attributes for short positions, the distribution of portfolio risk profiles, and the efficiency frontier in Step 4. Screenshots of the distribution of the percentage of relative change between non-divested and divested portfolios in Step 5.

Figure 5 Screenshots of the table of divestment schedule, the portfolio weight after divestment, the sum of weights of divestable assets, the sum of allocated weights and investable assets weights in Step 5.

Figure 6 Screenshots of the time series of asset weight, the assets allocation, the attribute allocation in the portfolio, the distribution of attributes for long positions, and the distribution of attributes for short position in Step 5.

We aim next to generate the global minimum variance portfolio with a short limit of 0.3 in Step 4; see Fig. 3. For pairs of assets with an extremely high linear correlation, only one should be selected if the portfolio is to undergo a mean-variance optimization. We navigate to the drop-down menu of the bars icon, pick global minimum variance, toggle limit short-selling weight, and enter 0.3 in the short-selling limit box. The portfolio is rebalanced typically monthly. Therefore, we set the option for rebalancing frequency and the number of days for computing weights to 20. The process may be time-consuming proportionally to the number of assets in the portfolio. Portfolio weights will be shown in the Table of rebalancing portfolio weight. This table is equivalent to the file F3. A selection of some of the outputs of DivFolio based on the steps described in previous sections is shown in Figs. 3 and 4. Note that the efficient frontier is only accessible for the portfolio created by DivFolio. The efficiency boundaries are formed by the backward lag return of

![]() $\tau$

days selected in Step 4, whereas the dots represent the expected return vs the risk of the portfolios whose weights were derived using the backward lag return of

$\tau$

days selected in Step 4, whereas the dots represent the expected return vs the risk of the portfolios whose weights were derived using the backward lag return of

![]() $\tau$

, but applied to the subsequent return window.

$\tau$

, but applied to the subsequent return window.

Further, we assume a linear rate of divestment with a slope

![]() $m = -0.1$

, by setting the end date at 2020-12-10. DivFolio’s generated divestment schedule is displayed, and the results of this stage are equivalent to file F4, which can be downloaded locally for future use. Fig. 5 displays examples of comparison outputs from DivFolio that illustrate differences between divested portfolio and the non-divested portfolio. The weight of the divestable assets reduces over time according to the divestment schedule. Step 5 that displays changes in the attributes over time are also examined in the panel of attribute allocation in the portfolio and their distribution in the plots of the distribution of attributes for long and short positions (see Fig. 6).

$m = -0.1$

, by setting the end date at 2020-12-10. DivFolio’s generated divestment schedule is displayed, and the results of this stage are equivalent to file F4, which can be downloaded locally for future use. Fig. 5 displays examples of comparison outputs from DivFolio that illustrate differences between divested portfolio and the non-divested portfolio. The weight of the divestable assets reduces over time according to the divestment schedule. Step 5 that displays changes in the attributes over time are also examined in the panel of attribute allocation in the portfolio and their distribution in the plots of the distribution of attributes for long and short positions (see Fig. 6).

4.2. Sequential assessment with DivFolio

We assess the divestment effect of the global minimum variance long-short portfolio (less than 30% in short weight) with a linear schedule for one year, from 2020-01-03 to 2020-12-31. We consider divesting holdings from the Energy and Utilities sectors and after completing the sequential process from Steps 1 to 5, we present an illustration of results obtained using DivFolio. Note that, it is beyond the purpose of this paper to demonstrate every aspect of the DivFolio software output. We only provide some illustrative selections of the results generated by the software. This illustration intends to demonstrate the tool’s outcomes and should not be considered a detailed case study. The interested reader in a such detailed analysis of financial portfolios and divestment strategies using DivFolio are referred to Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022).

Fig. 1 demonstrates core attributes for each individual asset. These attributes help users with decisions about which assets are relatively weaker on ESG, E, S, or G scores compared to others, so they can make more informed decisions on portfolio divestment. In Fig. 1 demonstration, we see an example of the pharmaceutical company AstraZeneca PLC, its ESG, E, S, and G scores, as well as its share price, trading volume profiles, and a risk profile decomposition over multiple time scales for the individual asset.

In Fig. 2, the user has an interactive display of various sets of assets they may choose to invest or divest from. Note that the user also has a selection of predefined global indexes with a visual tool for selection by country, should they be exploring assets in various countries and wish to have automated asset population features. In this illustrative example, we have selected UK-listed equity assets (as indicated by the .L after the ticker). This figure demonstrates how easy it is to get a summary of the current portfolio decisions regarding assets to invest in and those to divest from over time.

Fig. 3 illustrates the types of results this stage of the DivFolio software provides the users. For instance, we see that for the user-selected portfolio investment set/divestment set of assets and user-selected portfolio strategy and divestment rate (set in Step 3) the output from Step 4 summarizes visuals of the performance of the portfolio over time. It displays each asset position weights in the portfolio, the sector weightings concentrated on in the portfolio over time for each asset, and long/short investment position total positions over time together with their portfolio weighted ESG, E, S, and G scores.

Furthermore, as shown in Fig. 5, users are provided with further information regarding the portfolio performance. For example, for each period of time when rebalancing is undertaken, they can see the risk-return plane efficient frontiers and where their portfolio sits in this regard, as divestment is performed. Furthermore, they observe the violin (box plot and density) plots of the risk measures for the portfolios daily performance for that rebalancing period and the portfolios views of the ESG, E, S, and G scores for comparable divested and non-divested portfolios. In this illustrative example, users are provided with a detailed breakdown of the ESG portfolio positions for the divested assets and contrast to the positions that otherwise would have been taken, had divestment not been applied, for the user-selected portfolio strategy, see Fig. 6.

In addition, users are provided with a detailed breakdown of the ESG scores for the portfolio, throughout the divestment process. It allows one to assess the effects of divestment choices. Fig. 6 also displays an illustrative example of the portfolio’s environmental score benefits from divestment. It is clear that over time, the divestment portfolio is improving in the E scores; however, this comes at the cost of worsening S and G scores for the portfolio. This is evident from both the sequential decomposition plots of the portfolio long and short ESG, E, S, and G scores over time, and the net results from the boxplots provided contrasting the non-divestment case with the divestment outcomes of the portfolio ESG score analysis. Hence, this example illustrates that the reinvestment in the Health care sector from funds divested from the Energy sector degrades performance in the total ESG score of the portfolio since the environmental score improvement is offset by the social and governance scores degrading.

The software also allows users to assess the portfolio risk measures, by providing a comprehensive risk assessment of the users’ portfolio strategy when combined with divestment choices. Fig. 6 illustrates a comparison of risk profiles that is very valuable for investors’ decision-making regarding divestment practices. For instance, this example demonstrates that divestment creates excess risk in all dimensions of the risk assessment. The larger body of the boxplot indicates greater profile variation. The mean and median of the risk profile distribution of the divested portfolio are also less favorable than those of the original portfolio, indicating that divestment in this case has made the portfolio riskier.

4.3. DivFolio’s advanced analytics Options I, II, and III

We next examine some examples of the types of results that users can obtain from the optional advanced analytics by DivFolio and demonstrate the functionality of the individual advanced analytics tools embedded in DivFolio, namely Options I, II, and III. Recall that these tools allow the comparison of multiple portfolios. To produce this illustrative example, we use File F5 from DivFolio in Step 5 containing the weights of four portfolios as of the rebalancing date. These portfolios include the original portfolio (PEW), the divested portfolio with a linear rate of divestment (Linear,

![]() $m = -0.1$

), the hyperbolic rate (Hyber,

$m = -0.1$

), the hyperbolic rate (Hyber,

![]() $a = 1.2$

), and the instant divestment (Instant). The names of the portfolios are listed in the ‘PORTNAME’ column. Note that, the file F2 is obtained from Step 1. Files F1 and F6 can be either used here as they contain the commonly required columns of “Ticker” and “Status”.

$a = 1.2$

), and the instant divestment (Instant). The names of the portfolios are listed in the ‘PORTNAME’ column. Note that, the file F2 is obtained from Step 1. Files F1 and F6 can be either used here as they contain the commonly required columns of “Ticker” and “Status”.

We conduct a performance comparison of these four portfolios by using Option I. Fig. 7 compares the relative weights of the divestable and the investable assets along with a plot of attribute allocation in a portfolio calculated by Eq. (A3). Fig. 8 compares the distribution of weighted attributes for the long position (there is no short position in the PEW) and the distribution of risk profiles. The distribution of attributes for PEW and instant rates is uniform, as their weights remain constant over time. Finally, the plots of the relative change in the percentage of each portfolio compared to the benchmark (PEW) are illustrated in Fig. 9.

Figure 7 Screenshots of the time series of assets weight, the sum of weights of divestable assets, the sum of weights allocated to investable assets and the attribute allocation in portfolio in Option I.

Figure 8 Screenshots of the distribution of attributes for a long position (left) and the distribution of risk profiles (right) in Option I.

Figure 9 Screenshots of the distribution of the percentage of relative change compared to benchmarks in Option I.

Option II contains the stability analysis results. The number of days in the time window,

![]() $\tau$

and the number of days used in cluster analysis,

$\tau$

and the number of days used in cluster analysis,

![]() $t$

, are both set to 20 days (monthly) for this illustration. Fig. 10 compares the aggregate risk profiles with the average of the previous 20 days. Distinctions between the benchmark, immediate, and hyperbolic rates of divestment are evident. Fig. 11 depicts the heatmaps of cluster labels utilizing CLARA for each risk profile. Since the beginning of the study period, the instant and hyperbolic divestment rates have produced stable portfolio performance throughout the study results, as their labels of the cluster have remained consistent over time, except for the Sharpe and Sortino ratios at the first rebalance.

$t$

, are both set to 20 days (monthly) for this illustration. Fig. 10 compares the aggregate risk profiles with the average of the previous 20 days. Distinctions between the benchmark, immediate, and hyperbolic rates of divestment are evident. Fig. 11 depicts the heatmaps of cluster labels utilizing CLARA for each risk profile. Since the beginning of the study period, the instant and hyperbolic divestment rates have produced stable portfolio performance throughout the study results, as their labels of the cluster have remained consistent over time, except for the Sharpe and Sortino ratios at the first rebalance.

Figure 10 Screenshots of the aggregate time series of risk profiles in Option II.

Figure 11 Screenshots of the clustering results in Option II.

In Fig. 12, Option III component analyzes the diversification profile of portfolios under divestment. The most persistent and strongest correlations between pairs of assets in the portfolio positions are extracted, in a graph format, where each vertex is a portfolio asset position over time and each edge is a strong correlation relationship between the portfolio sub-positions at this point in time. The figure contrasts the graph structure of correlation in Eq. (A6) in three-time steps of rebalancing: the second, ninth, and twelfth out of twelve times rebalancing. Over time, the weighted covariance of the portfolio’s assets decreases proportionally, as shown by fewer links than the initial rebalancing in all portfolios. The consistency of the graph structures during and after divestment suggests that, in this example, the allocation of investment weight from divestable assets to investable assets does not significantly impact the correlation relationships between the changing positions for pairs of assets over time.

Figure 12 Screenshots of the portfolio network structure of covariance in Option III.

5. Applying DivFolio to evaluate the impact of divestment on risk and return in mixed pension portfolios using environmental risk score analysis

Fully funded pension schemes designate specific reserves for members’ pensions and channel investments into assets such as equities and real estate to foster capital appreciation. While these schemes present distinct investment prospects and transparent valuation metrics, they are also susceptible to market volatilities and administrative expenses. Furthermore, unfunded schemes – often referred to as Pay-as-you-go systems – depend on contemporaneous contributions to meet pension obligations. These systems are inherently streamlined, cost-efficient, and insulated from market perturbations. However, they grapple with challenges stemming from demographic trends and legislative amendments. Aligning both funds using the mean-variance methodology can potentially fine-tune the equilibrium between risk and return, underscoring the rationale for the integration of funded pensions with their unfunded counterparts Dutta et al. (Reference Dutta, Kapur and Orszag2000).

In this section, we demonstrate the application of the DivFolio framework to evaluate the impact of divestment on the risk and return profile of mixed pension funds, integrating both funded and unfunded components within the mean-variance framework.

5.1. Mixed pension fund portfolio

We explore the interplay between risk and return in both fully funded and mixed funded-unfunded pension structures, referencing the work in Dutta et al. (Reference Dutta, Kapur and Orszag2000). Let

![]() $ r$

represents the return from the funded pension, and

$ r$

represents the return from the funded pension, and

![]() $ g$

the return from the unfunded pension. If

$ g$

the return from the unfunded pension. If

![]() $ w^f$

signifies the investment weight of the funded pension, then

$ w^f$

signifies the investment weight of the funded pension, then

![]() $ 1-w^f$

represents that of the unfunded pension. Given the portfolio dynamics of the mixed pension fund, the pension return is represented as

$ 1-w^f$

represents that of the unfunded pension. Given the portfolio dynamics of the mixed pension fund, the pension return is represented as

Adopting the minimum variance portfolio approach, our objective function becomes:

where

![]() $ \gamma$

denotes the risk-aversion parameter. For cases where

$ \gamma$

denotes the risk-aversion parameter. For cases where

![]() $ \mu _r \gt \mu _g$

, an analytical solution is provided in Aaron (Reference Aaron1966):

$ \mu _r \gt \mu _g$

, an analytical solution is provided in Aaron (Reference Aaron1966):

\begin{equation} w^{f}_{\ast } = \frac{\mu _r - \mu _g + \gamma (\sigma _g^2 - \sigma _{rg})}{\gamma (\sigma _{r}^2 + \sigma _{g}^2 - 2\sigma _{rg})}, \end{equation}

\begin{equation} w^{f}_{\ast } = \frac{\mu _r - \mu _g + \gamma (\sigma _g^2 - \sigma _{rg})}{\gamma (\sigma _{r}^2 + \sigma _{g}^2 - 2\sigma _{rg})}, \end{equation}

with

![]() $ \sigma _{rg}$

being the covariance between

$ \sigma _{rg}$

being the covariance between

![]() $ r$

and

$ r$

and

![]() $ g$

.

$ g$

.

5.2. Mixed pension fund divestment methodology

The mixed pension portfolio can be bifurcated into two distinct segments: the unfunded and the funded pension portfolios. Within our analytical paradigm, GDP growth serves as the representative metric for the returns of an unfunded pension, denoted as

![]() $ g_t$

. This choice is anchored in the methodology elucidated in Dutta et al. (Reference Dutta, Kapur and Orszag2000). The GDP growth rate at any given time can be expressed as

$ g_t$

. This choice is anchored in the methodology elucidated in Dutta et al. (Reference Dutta, Kapur and Orszag2000). The GDP growth rate at any given time can be expressed as

Note that the divestment strategy is not applicable to the unfunded segment.

The funded pension portfolio is constructed using constituents from major national indices, specifically the S&P 500 for the United States and the FTSE 100 for the United Kingdom. To model this, we employ an equal-weighted portfolio strategy. Given a portfolio with

![]() $N$

constituents, the capital is evenly allocated across each asset, such that

$N$

constituents, the capital is evenly allocated across each asset, such that

![]() $w_{i} = \frac{1}{N}$

. The return of this non-divested portfolio can be formulated as

$w_{i} = \frac{1}{N}$

. The return of this non-divested portfolio can be formulated as

\begin{equation} r_{t}^{\text{non-div}} = \sum _{i = 1}^N w_{i,t} r_{i,t} \end{equation}

\begin{equation} r_{t}^{\text{non-div}} = \sum _{i = 1}^N w_{i,t} r_{i,t} \end{equation}

where

![]() $w_{i,t} = \frac{1}{N}$

signifies the investment weight, and

$w_{i,t} = \frac{1}{N}$

signifies the investment weight, and

![]() $r_{i,t}$

represents the return of asset

$r_{i,t}$

represents the return of asset

![]() $i$

at time

$i$

at time

![]() $t$

. On the other hand, the return of the divested funded portfolio is defined as

$t$

. On the other hand, the return of the divested funded portfolio is defined as

\begin{equation} r_{t}^{\text{div}} = \sum _{i = 1}^N w^{\text{div}}_{i,t} r_{i,t} \end{equation}

\begin{equation} r_{t}^{\text{div}} = \sum _{i = 1}^N w^{\text{div}}_{i,t} r_{i,t} \end{equation}

In this equation,

![]() $w^{\text{div}}_{i,t}$

is the investment weight that is constrained by the divestment schedule. This weight is determined by the divestment methodology outlined in Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022) and can also be generated using the DivFolio tool.

$w^{\text{div}}_{i,t}$

is the investment weight that is constrained by the divestment schedule. This weight is determined by the divestment methodology outlined in Marupanthorn et al. (Reference Marupanthorn, Nikitopoulos, Ofosu-Hene, Peters and Richards2022) and can also be generated using the DivFolio tool.

Ultimately, the mixed pension portfolio is derived from the amalgamation of both the funded and unfunded portions. The return of the original portfolio, which does not incorporate any divestment, can be computed as

where

![]() $w^{f,\text{non-div}}_{\ast }$

denotes the weight of the funded portion in the mixed pension portfolio for a non-divested portfolio,

$w^{f,\text{non-div}}_{\ast }$

denotes the weight of the funded portion in the mixed pension portfolio for a non-divested portfolio,

![]() $r_{t}^{\text{non-div}}$

is the return from the non-divested funded portfolio, and

$r_{t}^{\text{non-div}}$

is the return from the non-divested funded portfolio, and

![]() $g_t$

represents the GDP growth rate as previously defined.

$g_t$

represents the GDP growth rate as previously defined.

Similarly, the return for the divested mixed pension portfolio can be expressed as

where

![]() $w^{f,\text{div}}_{\ast }$

is the weight of the funded portion in the mixed pension portfolio for a divested portfolio. The proposed formulation assumes that divestment strategies affect only the funded portion of the mixed pension portfolio, leaving the unfunded portion unchanged.

$w^{f,\text{div}}_{\ast }$

is the weight of the funded portion in the mixed pension portfolio for a divested portfolio. The proposed formulation assumes that divestment strategies affect only the funded portion of the mixed pension portfolio, leaving the unfunded portion unchanged.

5.3. Experimental design and data description

The primary objective of this case study is to discern the effects of divestment, informed by environmental scores, on the risk-return profile of mixed pension funds relative to their foundational investment strategies. Emphasizing assets that rank in the uppermost 50% based on environmental risk scores, the methodology entails the application of two specific divestment rates: instantaneous and fast. Initially, the divestment strategy targets a segment of the funded pension portfolio. The historical return data and the ESG evaluations related to equities in the indices; the latter datasets are retrievable using the DivFolio platform. The simulation’s temporal dimension spans a decade, from 2013 to 2023, focusing intently on the primary indices of two pivotal financial markets: the USA’s S&P 500 and the UK’s FTSE 100. Note that the chosen equities must have available ESG information and should have been active in the market from 2013 to 2023. The portfolio undergoes an annual rebalancing process, wherein each quarterly iteration maintains consistent investment weights until the subsequent rebalancing phase. Subsequently, this segment of the funded pension merges with the unfunded fraction, which correlates with national GDP growth. For the GDP growth metrics, the data were meticulously sourced from the Federal Reserve’s economic database.

We examine the impact of divestment on both the risk and return of the funded pension portfolio and the mixed pension portfolio. This study seeks to assess the viability of divestment strategies for mixed pension schemes, focusing on both slow and instantaneous divestment approaches. The term “slow divestment” is defined as a linear rate aiming to decrease the allocation of assets falling within the bottom 50% of the environmental (E) risk score by 0.05 on an annual basis. Additionally, we consider the covariance between the funded and unfunded portfolios, as well as the investment weight of the minimum variance pension. From this, we can infer whether divestment aids in reducing the correlation between these investments. We also explore the combined effect of divestment and risk aversion on optimal funding. To this end, the objective of this case study is to demonstrate the feasibility of incorporating the DivFolio tool into actuarial investment analysis.

5.4. Incorporating DivFolio into the mixed pension portfolio divestment problem

Building upon the insights from the preceding sections, this section details the methodological approach for integrating the DivFolio tool into the divestment procedures for mixed pension portfolios, specifically focusing on the funded pension portfolio component. For users aiming to reproduce the results without downloading directly from the server, files F1 through F5 for both S&P 500 and FTSE 100 are made available in the GitHub repository under the folder “Example Files for Pension Divestment.”

Batching ESG Data in Step 2

To retrieve the constituents of the index, users should utilize the “Selecting Assets from World Major Indices” panel. Subsequently, they should batch the ESG data for all assets in the selected index, ensuring to do so for both the S&P 500 and FTSE 100. For indices with a significant number of constituents, users might need to batch the data in smaller subsets to avoid being blocked by the Yahoo Finance database.

Once the ESG data are obtained, it is imperative to address any missing ESG values. This cleaning process can be efficiently undertaken using the “Table of Attributes” panel. The option to remove rows with missing data is accessible via the “remove NA rows” button located at the bottom of this panel.

Next, users should proceed to manage the divestment by employing the tickbox option titled “Manage Divestment”. From the dropdown menu, select “E”. Then, input 0.5 in the “Percentile” box and choose “less than” from the “Top or Bottom” dropdown menu. After making these selections, update the ESG table summary. Users can preserve these results by downloading the table as a CSV file to their local machine.

If users encounter difficulties, particularly being blocked by the server during the ESG data batching process, they can access files F1 for both the S&P 500 and FTSE 100 from the provided GitHub repository folder “Example Files for Pension Divestment," i.e., F1US.csv and F1UK.csv. This alternative method ensures reproducibility of the results.

Batching Historical Returns in Step 3

In Step 3, the historical returns of equities within the indices can be batched. First, users should set the data range for batching from 2012-04-01 to 2023-01-01. We selected the starting date as 2012-04-01 because we are using a calculation window of either four months or a year. Once the data are retrieved, address any missing data by navigating to the “Missing Data Handling” panel and selecting the “Linear Interpolation” option. Missing data can lead to computational errors in subsequent steps. This procedure should be repeated for the constituents of both the S&P 500 and FTSE 100.

After downloading the data, it is essential to convert it to quarterly returns before moving on to the next step, given that the GDP data are recorded at a quarterly frequency. It is noteworthy that DivFolio currently lacks a function for data frequency conversion. However, this transformation can be accomplished using other platforms, such as Excel or separated R script. For convenience, the transformed data are also available in the GitHub repository, named F2US.csv and F2UK.csv.

Portfolio Optimization in Step 4

Calculating portfolio weight is covered in Step 4. Here, instead of directly using the data from Step 3, we utilize the “upload file” feature due to the need to refine the data frequency after obtaining data in Step 3. The refined files, labeled F2US.csv and F2UK.csv, are available in the GitHub repository. Once the file is uploaded, users should select the passive equal weight option and set the rebalancing period to 4 days (which represents 4 months in this context), mirroring the calculation window of 4 days. Details on the portfolio return, risk profiles, and sustainability can be accessed on this channel. This process can be repeated for the constituents of the US and UK indices.

The table of portfolio weights should be retained if the users intend to use Options I, II, and III to construct the file type F5. These files are also available on the GitHub repository, labeled as F3US.csv and F3UK.csv.

Divestment in Step 5

The results from Step 4 are instrumental for this step. In this step, users should choose the instant divestment schedule and the linear divestment schedule with a slope parameter of

![]() $-0.05$

, respectively. Next, repeat for both US and UK. Upon completion, two files containing the divested portfolio weights for each country will be generated. These files, named F5USInst.csv, F5USSlow.csv, F5UKInst.csv, and F5UKSlow.csv, are available on the GitHub repository.

$-0.05$

, respectively. Next, repeat for both US and UK. Upon completion, two files containing the divested portfolio weights for each country will be generated. These files, named F5USInst.csv, F5USSlow.csv, F5UKInst.csv, and F5UKSlow.csv, are available on the GitHub repository.

At this juncture, we possess adequate data to produce file F5, especially if comparisons involving Options I, II, and III are sought. In the interest of conciseness, we have chosen not to showcase screenshots from DivFolio. However, the results can be effortlessly recreated with the tool. Instead, we leverage the data acquired from these files to construct the mixed pension portfolio and its associated divestment strategies in the subsequent section.

5.5. Mixed pension funds analysis

This step should be executed either in a distinct R script or on a platform other than DivFolio. First, users should obtain the GDP data from the FRED database. If needed, this data can also be found on Github under the name gdpandport.csv. Subsequently, they should compute the quarterly GDP growth using Eq. (16). After this, merge the GDP growth data with the funded components from Steps 4 and 5 to formulate the mixed pension portfolio returns using Eqs. (20) and (19). This procedure should be carried out for both the US and UK portfolios. The requisite R script for this processing is provided in the Github repository as mixedpension.R.

Table 1 presents the mean and variance of the quarterly GDP growths, acting as a proxy for the unfunded portfolio. The table also details the returns on the equally weighted non-divested and divested portfolios for the period 2013–2023 in both the US and UK. These portfolios represent the funded portfolio. The covariance and correlation between the unfunded and funded portfolios are highlighted in the last two columns. The funded segment of pensions (equity) is characterized by a high mean return coupled with a substantial risk. For the US, divested funded portfolios produce superior returns relative to the non-divested ones, which is further echoed in the variance figures. Instantaneous divestment in the US offers enhanced returns when juxtaposed with the original portfolio. In contrast, in the UK, gradual divestment does not outperform the original portfolio. Interestingly, while divestment decreases portfolio correlation in the US, it amplifies it in the UK.

Table 1. GDP growth rates and total equity return comparisons: non-divested vs. divested portfolios (2013–2023)

Note: Covariance and correlation metrics were employed to evaluate the relationship between GDP growth and the return on equity for each dataset. There is no statistically significant difference between the quarterly average (mean) returns of equities pre-and post-divestment (PEW vs. Slow and Instant). This finding is based on a

![]() $ t$

-test at a 99% confidence level with 39 observations for each dataset, or

$ t$

-test at a 99% confidence level with 39 observations for each dataset, or

![]() $ n_1 = n_2 = 39$

, covering a quarterly period from 2013-01-01 to 2022-07-01.

$ n_1 = n_2 = 39$

, covering a quarterly period from 2013-01-01 to 2022-07-01.

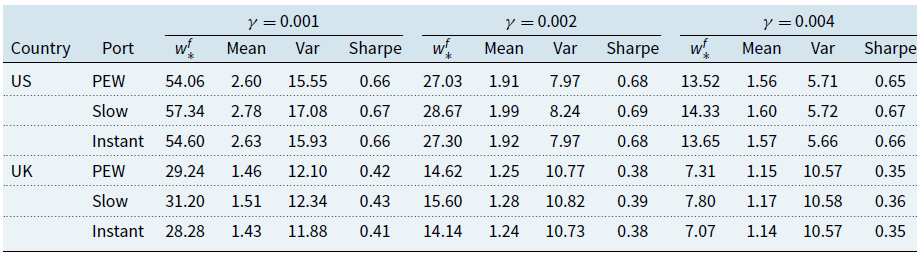

Table 2 presents the optimal mean-variance weights calculated using Eq. (15), taking into account risk aversion. Since variance-covariance parameters differ across countries, there will be a corresponding variation in the optimal funding levels. Additionally, this table includes the mean, variance, and the Sharpe ratio, which are derived from the returns of the mixed pension funds in Eqs. (19) and (20) between 2013 and 2023.

Table 2. Funding weight (%), expected return (%), variance, and Sharpe ration of the mixed pension portfolios with varying risk aversion parameters

Note: There is no statistically significant difference between the quarterly average (mean) returns of equities pre-and post-divestment (PEW vs. Slow and Instant). This finding is based on a

![]() $ t$

-test at a 99% confidence level with 39 observations for each dataset, or

$ t$

-test at a 99% confidence level with 39 observations for each dataset, or

![]() $ n_1 = n_2 = 39$

, covering a quarterly period from 2013-01-01 to 2022-07-01.

$ n_1 = n_2 = 39$

, covering a quarterly period from 2013-01-01 to 2022-07-01.

With the same risk aversion parameters, the optimal funding weight for the US is greater than that for the UK. Furthermore, slow divestment leads to the highest return and Sharpe ratio. The plot of Sharp ratio versus the log of risk aversion parameters for the US and UK can be found in Fig. 13. However, the improvement in portfolio return due to divestment does not have a statistically significant effect on the return. Specifically, the difference in mean returns pre- and post-divestment for the portfolios is not statistically significant, as evidenced by the

![]() $ t$

-test at a 99% confidence level.

$ t$

-test at a 99% confidence level.

Figure 13 Comparison of risk aversion vs. Sharpe ratio for original mixed pension portfolio vs. divested portfolio by scanning environmental risk score.

With the same risk aversion parameters, the optimal funding weight for the US is greater than that for the UK. Furthermore, slow divestment leads to the highest return and Sharpe ratio. The plot of the Sharpe ratio versus the log of risk aversion parameters for the US and UK is illustrated in Fig. 13. We find that the enhancement in portfolio return attributed to divestment does not significantly impact the return. Specifically, the difference in mean returns before and after divestment for the portfolios is not statistically significant, as confirmed by the

![]() $ t$

-test at a 99% confidence level. In addition, the maximum difference in the Sharpe ratio before and after divestment is only

$ t$

-test at a 99% confidence level. In addition, the maximum difference in the Sharpe ratio before and after divestment is only

![]() $3\%$

in the US with

$3\%$

in the US with

![]() $\gamma = 0.004$

between the PEW and the slow divestment.

$\gamma = 0.004$

between the PEW and the slow divestment.

The divestment strategy, based on environmental score scanning, at least in our case study, does not statistically affect the average quarterly return of the mixed pension fund portfolios. Even if the statistical test overlooks it, slow divestment yields both a better return and a superior return per risk for both the US and UK portfolios. Therefore, there is an incentive to prioritize divestment by scanning for environmental risks in the mixed pension fund.

6. Conclusion

This paper introduces DivFolio, an innovative and multipurpose software application for assisting investors, both retail and professionals such as portfolio and asset managers, global investment and fund managers, with ESG-related portfolio divestment decisions. The application is created in a R/Shiny environment, making it accessible to non-programmers. The software provides options for portfolio design, evaluating asset performance, creating ESG reports, comparing risk/return profiles of portfolios with and without divestment, assessing the stability of risk profiles using clustering, and examining the correlation structure via graphical lasso. The divestment capabilities distinguish DivFolio from other accessible portfolio management applications. By uploading data files, users are also able to customize the attribute for divestment, rather than only the sustainability scores that are embedded in the software, extending the tool’s application to more general divestment and portfolio comparison challenges.

A detailed set of guidelines are presented in the paper to explain the functionalities of the software and demonstrate divestment-related applications. There are two key modes offered in the software. The first mode is a sequential mode guiding users through selections of investment and divestment assets, a variety of portfolio and divestment strategies and analytics. The second mode is standalone and consists of three optional functionalities that can be executed individually. The first functionality (Option I) compares risk profiles and attributes of multiple portfolios, contrary to pairs of portfolios attained from the first mode. The second functionality (Option II) provides cluster analysis to determine the stability of portfolios risk profiles over time, offering a relative performance risk assessment of portfolios with and without divestment. The last functionality (Option III) compares the correlation structure between assets and portfolios. Regularization allows Graphical Lasso to extract sufficiently strong correlations, being advantageous for assessing the impact of divestment on the correlation of assets in portfolios.