1 Introduction

Assessing risks is a commonplace task. We often try to appraise the probability of negative outcomes we fear, be it the dangers of trekking in an exotic jungle, the consequences of arriving late at an important meeting, or the likelihood of being rejected when asking someone on a date. More often than not, these risk assessments are made intuitively, without the benefit of statistical data, based solely on our beliefs, observations, past experiences, and “gut feelings”. Unlike deliberate, systematic thought processes, intuition-based judgments are particularly susceptible to fleeting cognitions, concrete associations, accessible imagery, and shifting moods (Reference Chaiken and TropeChaiken & Trope, 1999; Reference Epstein, Lipson, Holstein and HuhEpstein et al. 1992; Reference KahnemanKahneman, 2003; Reference SlomanSloman, 1996). Theoretical conceptualizations such as “risk-as-feeling” (Reference Loewenstein, Weber, Hsee and WelchLoewenstein, Webber, Hsee & Welch, 2001) and the “affect-heuristic” (Reference Slovic, Finucane, Peters and MacGregorSlovic, Finucane, Peters, & MacGregor, 2004; Reference Slovic and PetersSlovic, & Peters, 2006) postulate that transient emotional states play a major role in intuitive risk appraisals. The likelihood of a negative event, or the risk posed by a specific threat, is inferred from the magnitude of anxiety experienced when contemplating the outcomes of such an event. Thus, if the thought of being bitten by a poisonous spider induces considerable apprehension, we may infer that poisonous spider bites occur relatively frequently. If, however, we are aware of the existence of an antidote to the poison, this knowledge is likely to reduce our anxiety, and consequently attenuate the perceived risk of being bitten.

1.1 Affect-based risk assessments

The effect of the existence of an antidote on the risk of spider bites could be considered “magical” in the sense that whereas an antidote could mitigate the negative consequences of being bitten, logically its existence should have no bearing on the likelihood of the event taking place. But, due to the intuitive, emotion-based, nature of such risk assessment process, it is highly susceptible to any information that either enhances or dilutes the experienced anxiety. Interestingly, anxiety may affect risk assessments even if its source is not directly related to the threat contemplated. Reference Johnson and TverskyJohnson and Tversky (1983) showed that exposing participants to anxiety-inducing news stories increased frequency estimates for a large variety of risks ranging from natural disasters and diseases to acts of violence.

1.2 The insurance effect

Just like the spider-venom antidote, insurance has the power to mitigate the negative outcomes of adverse events. The possession of fire-insurance policy provides the insured with “peace of mind” knowing that in case of a fire, most of the damage will be covered and recompensed by the insurance company. This reduced level of anxiety may signal reduced threat, and consequently, the probability of fire may seem less likely. In an experiment by Reference TykocinskiTykocinski (2008), commuters on a train were asked to assess the likelihood that in the next five years they will suffer various medical misfortunes (e.g., will require surgery, physiotherapy, nursing care). Before making these risk estimates, half of the respondents were asked if they had medical insurance. The other half were asked about their medical insurance only after they completed the risk assessment items. Making the possession of an insurance policy accessible was expected to dilute the apprehension triggered by contemplating the different misfortunes, and consequently attenuate risk judgments. Indeed, although all of the respondents had medical insurance, reminding the participants of this fact resulted in lower assessments of personal risk. Interestingly, reminding people of their medical insurance had an attenuating effect on probability assessments of unrelated non-medical dangers as well (e.g., the probability of war in Europe).

1.3 Protective measures

Although the term “insurance” is usually reserved for the act, business, or system of insuring, the idea of insurance goes beyond this specific interpretation. Any measure which is expected to provide protection against negative outcomes of a known threat could be considered “insurance.” In fact, we may gain a sense of being protected not only by acquiring protective measures, but also by taking certain actions. For example, Reference Kogut and RitovKogut and Ritov (2011) showed that reminding people that they had recently donated to the cause of fighting cancer made them feel less vulnerable to this disease than those who did not donate. Superstitious behaviors such as “knocking on wood” could be considered protective acts (Reference KeinanKeinan, 2002). The goal of the current experiment was to conceptually replicate Tykocinski 2008 findings and extend them to a very different form of insurance.

1.4 Gas masks reminders study

In anticipation that Iran might attack Israel with non-conventional weapons, the Israeli ministry of defense instructed all Israeli citizens to collect gas masks from designated distribution centers which were opened for this purpose. Distribution of the gas masks began in April 2010, and most citizens complied. As these gas masks are considered to be effective against chemical and biological weapons, we may consider the possession of a mask as conceptually equivalent to the possession of an insurance policy. Thus, following the findings of Reference TykocinskiTykocinski (2008) it was predicted that reminding people that they own gas masks would decrease the perceived risk of an attack.

1.5 Method

Participants.

Residents in the center of Israel were called and asked to respond to a short survey. The respondents were randomly chosen from the phone book of area codes 03 “Tel Aviv” and 09 “Hertzliya”; together these two area codes encompass listings for about 50% of the population in Israel. One hundred forty-seven respondents (107 female and 40 male, average age 48) agreed to participate. Of these, 135 indicated that they have gas masks. The results of 12 respondents who said that they do not have masks were omitted from the analysis.

Telephone interview.

The respondents were asked to answer two “threat estimate” questions on a scale ranging from 0—“no chance at all” to 10—“very high chance”. The questions were: (a) “In your opinion what are the chances that during the next three years Iran will attack Israel?” and (b) “In your opinion if Iran will attack Israel what are the chances that non-conventional weapons will be used in this attack?”Footnote 1 The question “Do you have a gas mask?” was posed either before or after the “threat estimate” questions, creating two conditions: “reminded” and “not-reminded”.Footnote 2

1.6 Results

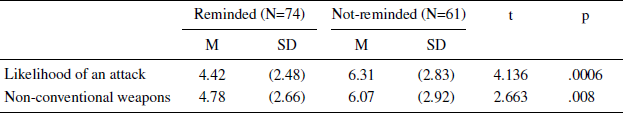

Although, logically, gas masks cannot affect the probability of an attack, they are likely to mitigate the consequences of a biological or chemical attack if it does take place. In this sense, gas masks are equivalent to an insurance policy. Consistent with Reference TykocinskiTykocinski (2008) findings, reminding people that they are in possession of a gas mask significantly attenuated the perceived threat. As can be seen in Table 1, participants who were reminded of the masks in their possession before completing the “threat estimate” questions, rated both the likelihood of an attack and the likelihood of the use of non-conventional weapons in case of an attack, significantly lower than participants who were not reminded of the gas masks in their possession.

Table 1: Means and standard deviations of threat estimates as a function of a gas mask reminder condition.

2 Discussion

The current research expands the idea of “insurance” beyond the strict interpretation of this term. Based on the findings, we can expect any measure that is capable of mitigating the negative outcomes of a threat to have the “calming” effect we associate with actual insurance policies, and consequently to minimize the perceived risk. In a sense, this is a paradox. We seek protective measures against the negative outcomes of a potential threat when a threat looms large in people’s minds. Yet, once equipped, those same protective measures inspire a sense of safety which makes the perceived threat shrink. Often, people who are insured show carelessness in protecting themselves and their insured possessions (Reference Dave and KaestnerDave & Kaestner, 2009; Reference StancioleStanciole, 2008). This phenomenon (known as “moral hazard”), is generally explained in terms of the belief that if something happens “the insurance company will take care of it”. It is possible, however, that the “shrinking of the threat”, may also contribute to this effect.

2.1 Interpretation

One could argue that Iran is indeed less likely to attack Israel knowing that the citizens of Israel are equipped with gas-masks, and that our respondents took this strategic consideration into account when judging the probability of an attack. There are several reasons why this alternative explanation is unlikely. First, the findings faithfully replicated the earlier Reference TykocinskiTykocinski (2008) findings, where the possession of medical insurance could not have had any bearing on the likelihood of getting sick. In addition, gas masks are generally believed to be effective against chemical and biological weapons, but not against nuclear weapons, whereas in recent years most of the discourse in Israel regarding the threat of an attack from Iran revolved around the fact that Iran has been developing nuclear capabilities. Finally, such a perception is at odds with the actual experience of the citizens in Israel who are aware that Israel’s possession of the “Iron-Dome” system (which according to news reports successfully intercepted eighty-percent of the rockets recently directed at Israel) did not stop the rocket attacks coming down on Israel from the Gaza Strip.

2.2 An affect-based phenomenon

The insurance effect is an affect-based phenomenon. I suggest that, given an issue about which people are genuinely concerned, making the existence of protective measures accessible, reduces their anxiety, which in turn signals lower threat. It is also possible, however, that momentary shifts in anxiety levels rather than the absolute magnitude of experienced anxiety at a given time, play an important role in producing the effect. One could argue, for example, that asking people about protective measures in itself may cause alarm, which is then only minimally augmented by reminding them of the threat. Although this interpretation seems inconsistent with the fact that insurance was demonstrated to be associated with positive emotions (Reference TykocinskiTykocinski, 2008, Experiment 2b), it clearly demonstrates the need for further in depth explorations into the mechanism underlying the insurance effect. Such exploration could also reveal the extent to which the impact of making protective measures salient may generalize to affect non related threats.

2.3 The insurance effect, field vs. laboratory demonstrations

The current study demonstrated the insurance effect in a field experiment. The strength of field experiments is in their natural settings and diverse participant population. Relative to laboratory experiments however, field studies rarely afford the same level of control, manipulation precision, or the latitude to explore process mediators and boundary conditions. In this sense field experiments are like a “snap-shot of reality” that is grounded in a specific time and place, a quality that makes them difficult to replicate. For an in-depth exploration of an effect observed in the field, the researcher must turn to the laboratory and reproduce the effect under controlled, well-defined, replicable conditions. Indeed Reference TykocinskiTykocinski’s (2008) initial field demonstration of the insurance effect (Experiment 1) was supplemented with four laboratory experiments (2a, 2b, 3a and 3b) reproducing the effect under controlled conditions, and gaining further insight into the psychological mechanism underlying the effect. As the participants in these laboratory studies were much younger and hence less likely to be concerned with health issues, Tykocinski used the context of travel and car insurance, instead of health-insurance, for her laboratory studies.

2.4 van Wolferen et al. replication attempt

Recently, Reference van Wolferen, Inbar and Zeelenbergvan Wolferen, Inbar and Zeelenberg (2013) reported their failure to directly replicate the Tykocinski’s 2008 health-insurance field study in three experiments of their own. What can be learned from the failure to replicate this field study? Unfortunately, not much. In attempting to replicate Tykocinski’s field study, the researchers adopted her manipulation and measures but overlooked crucial contextual aspects. For example, in their second experiment van Wolferen et al. tried to match the participant population of the original study by tapping train commuters. However, the reason for using train commuters in the original experiment was that these commuters were on a train ride that took one hour and twenty minutes, giving them ample time to contemplate and respond to the questions. In contrast, van Wolferen et al., directed their questions to people standing in front of the Tilburg central train station, people who probably did not have much time to spare. More generally, for an affect-based mechanism to operate, the population studied must have realistic concerns regarding the issue in question. It is not clear to what extent undergraduate students (van Wolferen et al. Experiment 1) are likely to be worried about health misfortunes. These examples illustrate the difficulties inherent in any attempt to directly replicate a field study. Surprisingly, Reference van Wolferen, Inbar and Zeelenbergvan Wolferen et al. (2013) neglected to attempt any replication of the four laboratory studies reported in Tykocinski’s 2008 paper, and opted instead to attempt replicating a single field experiment. Given this fact, the authors’ suggestion that possibly “the protection effect reported in Reference TykocinskiTykocisnki (2008) was merely due to chance” seems unwarranted. The authors also raise the possibility that there are relevant cultural differences in risk-salience between the populations studied. Whereas identifying relevant concerns of the population is essential for a successful demonstration of the effect, I doubt that Israelis are in general more susceptible to the insurance effect.Footnote 3 That said, I entirely agree with the authors that future explorations aimed at identifying moderators and boundary conditions for the insurance effect will be very valuable in addressing these questions.

2.5 Conclusion

The goal of the current paper was to conceptually replicate and extend the insurance-effect to other kinds of protective measures. I suggested that increasing the accessibility of the existence of protective measures, which, like insurance policies, could mitigate the negative consequences of a known threat, reduces the anxiety associated with the threat, which in turn makes the threat seem less likely to occur. Indeed, reminding people of the gas masks in their possession reduced their assessments of the possibility that Israel will be attacked by Iran. In a sense, in people’s minds, the “antidote” was turned into a “vaccine”.