This book is about strategy making under risk and uncertainty. The terms risk and uncertainty are interchangeable in ordinary speech. Nonetheless, Frank Knight, one of the major figures in early twentieth-century economics, distinguished between them.1 Risk is the condition in which past information is sufficient to compute the odds of what is likely to happen next, while uncertainty is the condition in which past information is not sufficient to compute the odds of what is likely to occur next. The capacity to predict what is likely to take place next, according to Knight, is based on empirical observations, knowledge derived from these observations, deductions from assumed principles, and judgments, which individuals and groups make.

Knight maintained that risk and uncertainty have important implications for competitive rivalries among business firms. He argued that the ability to make good bets about the future is the key to achieving competitive advantage. Under risk, all firms have access to similar information. If they use this information well, no firm sustains competitive advantage for a long period. On the other hand, under uncertainty, some firms may have the exceptional foresight to discern the future (or they may be just lucky); and if they can extend the gap between what they and their competitors know about the future, they achieve long-term competitive advantage. When uncertainty prevails, the stakes are high – the larger the uncertainty, the greater the possible gain; however, this condition increases the possibility of failure.

This book takes up the question of how major firms in the energy industry, defined here as the oil and natural gas and motor vehicle sectors, formulated their understanding of the future in light of the risks and uncertainties that they confronted. It examines the strategies of major energy industry companies in 2014–2015, when oil prices plummeted. How did their formulations about the future affect the actions they took, the strategies they carried out, and moves they made? How have these actions in turn affected their performance? Given the uncertainty these firms faced about future oil prices, to what extent did they shift their long-term investment priorities? The strategies and methods these companies employed to cope with the situation they faced has important implications for society. This book contributes to the strategic management literature by investigating how companies in the energy industry decided what to do in these circumstances.

A Hedge against Failure

The book explores how companies in the energy industry tried to mitigate the risk and uncertainty they confronted. When risk and uncertainty exist about the future, companies in industries as volatile as oil and natural gas and motor vehicles could not easily place their bets on a single outcome or solution. Their lack of certain knowledge about the future compelled them to invest in a variety of options that corresponded to different visions about what might take place next. The diversity of the bets that they made were mainly a hedge against failure. Yet this hedge was not foolproof. It could not completely insulate them from impending events they could neither foretell nor control.

This book shows that while the hedges, which companies in the energy industry took to protect themselves against the unknown, overall were similar, the particular hedges of the companies varied in slight, but important and subtle ways. Moreover, the diversity of the bets they made and the strategic initiatives they took gradually shifted over time. Locked in by existing commitments, they responded to rivals’ moves and reacted to feedback from their stakeholders. Their financial health and performance also affected what they did. Their insights about the future swayed them, but not completely, because the future was so difficult to fathom with a high degree of certainty.

The package of strategic investments they made to hedge against the unfolding of alternative futures was not static. It progressed in a dynamic way in which companies carved out separate competitive spaces, positioning themselves in dissimilar niches for different eventualities. The unfolding of variances in the strategies of these firms is a major theme of the book. All the integrated oil and natural gas companies suffered drastic losses in revenue and profitability from lower energy prices, while all the motor vehicle companies enjoyed growing demand for light trucks and SUVs because of low gasoline prices. However, after the perturbation of 2014–2015, the competition among firms in both the oil and natural gas and the automotive sectors started to shift. The companies this book examines distanced themselves from each other in new ways. The book traces the path by which ExxonMobil tried to become a major player in shale, while BP rapidly shed assets to pay off its continuing Deep Water Horizon obligations. Shell, on the other hand, essentially dropped the shale option entirely and moved in the direction of natural gas, while TOTAL invested in renewable energy and storage and started to acquire electric utilities.

The major motor vehicle manufacturers the book examines also moved in different directions. GM sold its European subsidiary, Ford announced it would no longer sell sedans in the United States, and both companies in their own way doubled down on autonomous vehicles and electrification. Reeling from the emissions scandal, VW maneuvered out of diesel and tried to top all motor vehicle companies in the number of electric models it would offer, while Toyota played to its strength in hybrids and promised to deliver even more electric vehicles than VW.

This book portrays the long-term investment decisions and strategies of major energy companies as they hedged their bets in dissimilar ways against an uncertain future. When information is available to all, competitive interactions converge and no firm is likely to benefit more than any other does. However, when information about the future is hard to come by and firms have diverse understandings of the future, their competitive interactions diverge, which is the story about these firms that this book tells.

The remainder of this chapter further discusses the distinction between risk and uncertainty. It then applies these concepts to escalating energy price volatility in the energy industry, reveals past miscalculations energy companies made in the face of inconstant prices, and concludes with a list of unsettled issues decision makers in this industry continue to face with particular emphasis on climate change.

Risk and Uncertainty

Knight maintained that under risk, the likely distribution of outcomes is known, while under uncertainty, the distribution of outcomes is largely unknown because of the uniqueness of the situation.2 John Maynard Keynes, the great English economist, made a similar distinction.3 Risk, he argued, was like roulette. The outcomes were subject to probability. On the other hand, there was no scientific basis on which to form a calculable probability with respect to uncertainty and likely outcomes were unknown. In the category of outcomes that were unknown, Keynes placed the prospect of a European war, the price of copper, the rate of interest twenty years into the future, and the obsolescence of an invention. These were uncertain events, without odds of prediction, and not risky ones.

Nassim Nicholas Taleb, the contemporary analyst, focuses on the problem of randomness, and has brought attention to risk’s limits in the form of outliers he calls “Black Swans” wherein it is nearly impossible to form a calculable probability.4 Ex-US Defense Secretary Donald Rumsfeld has pointed to instances of absolute uncertainty, with the distinction he has made between “known” unknowns and “unknown” unknowns.5 Statisticians too speak about the distinction between risk and uncertainty, arguing that variations that come about because of common causes constitute risk, while those that come about because of special causes constitute uncertainty. The former yield quantifiable, regularly observed patterns, while the latter produce non-quantifiable and irregular patterns, whose frequency and severity human beings cannot predict with confidence.

When companies in the energy industry make long-term, expensive, capital-intensive, and often irreversible investment decisions, they face known and unknown unknowns as well as black swan-like outliers. They cannot be definite about where they are along this continuum. Outliers and unknown unknowns challenge them in many ways. They must consider the state of technology, politics, and society in which their firms find themselves and where the economy is headed. They must make sense of infrequently occurring events, such as technological breakthroughs, embargos, revolutions, wars, invasions, economic expansions, and contractions, and interpret their meaning and long-term impact, which is particularly difficult, since knowledge of past events does not necessarily provide good insights about what to expect next.6 Events in different spheres such as the economy and technology are related, which makes the capacity for prediction more onerous.

Unsettled issues weigh heavily on decision makers because of the uncertainty, and serious miscalculations are possible. Under these circumstances, rational calculation may not be a fully reliable guide, and, according to Keynes, it must be supplemented by “animal spirits.” He wrote that “as living and moving beings, we are forced to act … [even when] existing knowledge does not provide a sufficient basis for a calculated mathematical expectation.”7 He then quipped that to act at all in these circumstances, it is necessary to put aside the thought of rational calculation “as a healthy man puts aside the expectation of death.”8

Patterns may become obvious after the fact, but before the fact, when it really counts, the ability to recognize and control the future is limited. The effectiveness of decision makers is curtailed. How can energy decision makers cope, given the large role that special causes and uncertainty play in the context in which they operate? The argument in this book is that decision makers in the energy industry must make bets on the future without certainty of the outcomes. They frame problems and try to give meaning to their choices without full knowledge of the long-term impacts. They manage by making assumptions about the future that sometimes are based on very spurious assumptions. Without sufficient past evidence upon which to draw, they cannot construct sound causal inferences about what is to come next.9

Escalating Price Volatility

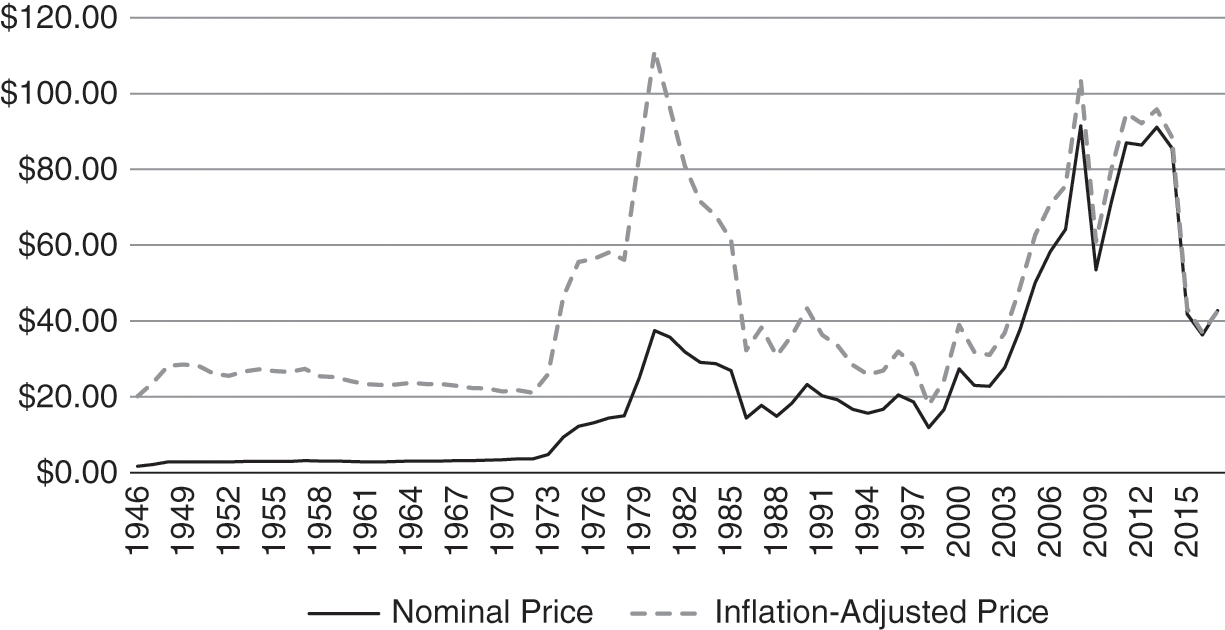

Decision makers in the energy industry have confronted considerable uncertainty about energy prices. Since 1973, the history of energy prices has been one of booms and busts; they have risen and fallen for unique and hard-to-predict reasons. Their rise and fall have been a consequence of events, such as the 1973 Arab oil embargo, the Iranian Revolution, and the Iran–Iraq War, the growth of Southeast Asian economies, the global financial crisis, and the rise of hydraulic fracking as a substitute for conventional oil and natural gas. From 1880 to 1970, price stability was greater; the conditions decision makers confronted more stable with some exceptions, such as the 1890s, when growing European production increased supply, and the 1920s, when the automobile’s adoption increased demand. However, after 2000, decision makers confronted continued oil price booms and busts (see Figure 1.1). Natural gas prices, also unstable, in turn affected electricity prices.

Figure 1.1 Annual average domestic crude oil prices

(Inflation adjusted July 1946–July 2017 in $/barrel)

Everything else being equal, when prices were lower they should have lifted economic growth. Greater economic growth then should have stimulated demand for more energy. However, the relationship between energy prices and economic growth is complicated. Lower energy prices do not necessarily spur additional economic activity; rather, they may be a sign of economic weakness and signify less energy demand. A reason they may indicate less demand has been shifts in the advanced economies of the world from material goods to information and services. If the Chinese economy were to swing strongly to services or, conversely, slow because of bad loans, or even a meltdown, energy demand also would weaken and prices would fall.

Declines in energy prices have also come about because of greater supply. The growth of hydraulic fracking was of vital importance because it opened up previously untapped supplies of oil and natural gas. Its arrival on the scene led to questions about whether oil supplies would ever peak. Indeed, major oil companies took note of peak demand rather than peak supply in their calculations. Shell predicted it could occur as early as 2025 and BP forecast that it could take place by 2035. On the other hand, ExxonMobil denied it would ever happen. These different assessments of the future had implications for the strategies the companies adopted, as later chapters will show.

Another implication of the decline in fossil fuel prices was their impact on renewable energy. Though renewables amounted to just a fraction of the energy used, their gain had been remarkable. However, with lower fossil fuel prices, their further progress could be curtailed.

Greater supply of fossil fuels first led Saudi Arabia to increase production in order to drive the frackers out of business and restore its dominant market share. However, this strategy lowered prices to the point that the kingdom’s revenues fell. The Organization of the Petroleum Exporting Countries (OPEC), under its leadership, then chose to restrict oil supplies, but whether this decision would stick, and for how long, was unknown. Would OPEC have enough discipline to maintain supply restrictions? Petro-dominated states such as Russia, Iran, Venezuela, Nigeria, and Iraq might choose not to keep oil from the market to protect their fragile economies and societies. Security in the world could grow because low oil and gas prices held petro-dominated states like Russia, Iran, and Venezuela in check. On the other hand, it could deteriorate as these nations became more desperate under the stress of low oil prices.

Miscalculations

The focus of this book is on decision makers in fossil fuel and motor vehicle companies. The former explored for oil, natural gas, and, to a very small extent, coal, and transported, produced, refined, and sold these resources. The motor vehicle firms relied on fossil fuels to provide people with the mobility they were seeking. Electric utilities generated power, much of it from fossil fuels, but also from alternatives like renewables, and they transmitted and distributed electricity to end users. The choices of the fossil fuel, motor vehicle, and electric utility companies interacted with each other yielding unintended consequences and compounding the uncertainties they confronted. While low fossil fuel prices negatively affected the oil and natural gas companies, they were a boon to the motor vehicle firms because they allowed them to sell more larger and profitable light trucks and SUVs. The energy industry is not coordinated, which contributes to company misunderstanding about the meaning of prices. The following examples illustrate some of the miscalculations energy decision makers made because of their confusion about future price signals.

Fossil Fuels

A miscalculation brought on by a mistaken anticipation of high oil prices occurred in Kazakhstan.10 This country was home to the world’s largest single oil discovery since 1968, a vast oil field in Kashagan about fifty miles offshore the northeast Caspian Sea. Shell and other oil companies with which it collaborated, including ExxonMobil, Eni, TOTAL, and ConocoPhillips, expected huge rewards from this field, which, after the end of the Cold War, was the world’s biggest oil development. Kazakhstan’s president Nursultan Nazarbayev gave the oil companies nearly unrestricted access in hopes that, in turn, this former Soviet republic would be able to modernize its economy. The oil companies invested immense sums. By 2005, they expected that more than 1.5 million barrels of oil would reach markets daily, an amount roughly equal to the needs of a country the size of the United Kingdom. Instead, nine years later, the project was $30 billion over budget, and the project had produced no oil. With losses incurred by the parties of more than $50 billion, the oil companies put the Kashagan project on indefinite hold. They made numerous blunders. At the prices then prevailing, producing oil from Kashagan was not worth it and it was unclear if prices ever would be high enough to justify a resumption of the project. The project also suffered from many management disputes, as it turned out to be hard to coordinate the efforts of so many companies with diverse interests. The parties involved completely underestimated the obstacles of producing in this field.

Motor Vehicles

Another miscalculation of note was GM’s 1990s plunge into electric cars.11 After the company demonstrated a concept electric vehicle (EV) at the 1990 Los Angeles Auto Show, the California Air Resources Board (CARB) put in place a zero-emission vehicle mandate that called for 2 percent of auto company fleets sold in the state to be emission free by 1998, 5 percent by 2001, and 10 percent by 2003. GM’s response was to introduce a first-generation EV powered by lead–acid batteries with a range of between 70 and 100 miles. It followed up in 1999 with a second-generation EV that had nickel–metal hydride batteries and slightly better range. By 2002, GM had sold more than 1,100 EVs. Customers could also acquire the cars via a leasing program. Though driver reaction was generally favorable, GM viewed the initiative as a failure. Battery technology had not advanced, vehicle range continued to be low, and gasoline prices did not justify widespread acceptance. The company made far more money selling sports utility vehicles and light trucks than EVs. At the insistence of GM and the other automakers, CARB agreed to rescind its clean car mandate. GM then canceled the EV program and declared that it had lost over a billion dollars. Against the protest of drivers, the company destroyed all the electric cars it produced. To much fanfare and relative success Toyota, on the other hand, introduced the hybrid electric Prius, just before gasoline prices started to rise again.

Renewable Power

US venture capitalists (VCs) miscalculated with the renewable power investments they made in the first decade of the twenty-first century.12 These investments looked good before the fact, yet took a turn for the worse as a series of unexpected events unfolded. The acceleration of the investments occurred before the VCs knew that the US Congress would not pass climate change legislation, the 2007–2008 financial crisis would take place, Europe’s recovery would be slow, and European incentives to renewable power would weaken. In addition, Chinese companies rushed existing low-cost wind and solar technologies into the market, which made the advanced technological choices that VCs favored look foolish. Even more important was the role of hydraulic fracking in lowering fossil fuel prices, a surprise that few expected. It was a feasible and cost-effective technology that revitalized US natural gas and oil production. Clean energy investors did not foresee this development, and many of their investments failed.

Nuclear Energy

Another miscalculation had to do with nuclear power.13 Hope for a revival led to Toshiba’s 2006 $5.4 billion purchase of Westinghouse’s nuclear power production capabilities. Analysts warned that the company was paying too much. Japan’s Fukushima disaster made the decision seem mistaken, yet Toshiba, despite delays and the downsizing of many projects, reaffirmed its commitment to nuclear power. Its involvement in a project for the first nuclear power plant reactors built in the United States in decades was years behind schedule and billions of dollars over budget. The company had to lay off 78,000 workers, and its CEO had to resign. In 2016, Toshiba was close to bankruptcy.

Unsettled Issues

Long-term and expensive investments in projects in the energy industry can go awry. To launch these large-scale projects decision makers must have optimistic biases, but the problems their companies encounter often snowball, and the companies must withdraw as their losses mount. Unsettled issues, including the following, continue to weigh heavily on decision makers in the energy industry:

Many nations are in turmoil politically. Governments play a central role in incentivizing actors in the energy industry to take up certain activities, and, conversely, they play a disproportionate role in discouraging them from taking up other activities. The impact of government policies on the energy industry is uneven, inconsistent, hard to predict, and subject to sudden shifts. The types of regimes that will be in power and the choices they will make to subsidize, encourage, suppress, and regulate companies are unclear. How will companies operate when there are non-liberal, autocratic democracies in place in many countries? The global security picture is also in doubt because of failed states in the Middle East and ongoing warfare.

Technologies have been shifting rapidly. The shale oil revolution could spread to Europe, China, Africa, and much of the rest of the world. Renewable energy has also made substantial progress and has become a feasible alternative to fossil fuels in some situations. A number of different technological revolutions are merging. The forging together of information technology with transportation, industry, housing, and commercial building may bring about shifts in business models. New systems of driving, producing goods and services, and heating and cooling buildings are possible and can lead to substantially greater efficiency in the use of energy. Communities of scientists and engineers continue to forge ahead with technologies that can disrupt calculations about what is economically feasible and prudent. How far can they go? Will rapid advances in petro-algae technology, for example, take place? Will a breakthrough in battery technology occur? What effect would these developments have on energy industry decision making?

The global economic future is unclear. There are threats of trade wars, vast amounts of bad debt in China, and the lingering stasis of European Union (EU) countries. How much growth there will be and where it will take place are in doubt. Also uncertain is to what extent this growth will translate into increased demand for energy.

Climate Change

At the forefront of issues the industry faces, and one of the most uncertain factors it confronts, is climate change. This threat could tip the balance of human survival and compel nations to take new steps to combat this problem. While it remains somewhat hard to trace the direct causal consequences to the accumulation of human-created greenhouse gas emissions (GHGs) in the atmosphere, they already were having an impact on the occurrence of extreme weather and the price of agricultural commodities. Almost certainly, with the melting of glaciers and ice sheets, there would be a rise in sea levels, the full impacts of which were unknown.

The evolution of policies to offset climate change has had an uneven history. In the 1992 Earth Summit, the United States agreed, along with many other countries, to work to stabilize GHGs at levels that prevent dangerous interference with the climate system. Under the plan then in effect, nations had “common, but differentiated responsibilities,” which meant that industrialized countries, mainly responsible for historical emissions, had to act first, and sustainable development became the highest priority for developing countries.

The next step was the Kyoto Protocol. Signed in 1997, but only ratified in 2005. Under the accord, industrialized countries committed to reducing average annual emissions in 2008–2012 to 5 percent below 1990 levels. The EU’s commitment was for an 8 percent reduction, while the United States was supposed to reduce its emissions by 7 percent, but the US Congress (in the Byrd–Hagel resolution of 1997) unanimously rejected the Kyoto agreement, ostensibly because of a lack of commitment from developing nations to reducing their own emissions. The Kyoto accord allowed industrialized nations to buy emission allowances and reductions from developing countries or each other, rather than reducing their own emissions.

A breakthrough took place in 2016 with the Paris summit. Both developed and developing nations agreed to limit their emissions and submit to regular reviews. Developing nations promised to help finance poorer nations’ emission reductions and bring them aid to cope with climate change’s negative consequences. Country commitments under the Paris Accord were voluntary, however; and even if carried out, there was likely to be a planetary warming of almost 3 degrees above pre-industrial levels, which would mean that droughts, floods, heat waves and sea level rises still were likely to arise.

Under the Trump administration, the United States declared that it would abandon its Paris commitments. The fate of the Paris Climate Accord, therefore, was in doubt. After the administration declared it would leave the Accord, would other governments also threaten to do the same? Without the United States, could the Accord survive? Its implementation was far from certain, which created another unknown for energy-industry decision makers.

Climate change and relevant policies related to it had major effects on the companies that produced and consumed energy. They raised the price of doing large-scale energy projects. ExxonMobil, for example, since exploiting the carbon-rich tar sands of Canada no longer seemed economical, had had to follow its peers and take a $2 billion write-down on its oil reserve in this region.14

Conclusion

This chapter has presented the problem of this book: strategic choice under risk and uncertainty among companies in the energy industry. It has argued that it is a unique challenge whose scope and problematic nature is not easy to reduce. A key element in the challenge is price volatility, which rests on a host of political, economic, and technological considerations and unsettled issues. Another key challenge is climate change. Funders of energy developments regularly have to reassess where to put their money. Companies make short- and long-term bets on different energy sources. Where they are likely to invest next is challenging because of the lack of precedents given the risks and uncertainties they face.