The financial crisis of 2007–09 focused the attention of policy analysts and regulators on how shocks are transmitted across financial firms. A default at one firm can lead to losses at other firms with correlated positions, even if they are not contractually connected. For example, when the collapse of Lehman Brothers in October 2008 caused the Reserve Primary Fund, a money market fund with a large exposure to Lehman, to partially default, it triggered runs on money market funds broadly, including many that had no Lehman debt or connection to the Reserve Primary Fund. Research suggests that counterparty risk associated with direct interbank connections also played a role in 2007–09 by aggravating declines in risky asset prices and bank lending (Iyer et al. 2014; Heider, Hoerova, and Holthausen Reference Heider, Hoerova and Holthausen2015). However, clear evidence that contagion through direct interbank connections was a significant factor in the 2007–09 global financial crisis or precipitated any financial institution’s failure is limited (Scott Reference Scott2012), at least in part because the contractual relationships between banks are often complex and opaque.

Increasingly, researchers have studied the transmission of financial distress through interbank networks in historical settings, particularly in the United States before WWII, when network connections were less complex. Calomiris and Carlson (Reference Calomiris and Carlson2017), for example, find that network connections were a significant source of liquidity risk that contributed to bank failures in the Panic of 1893. Studying the Great Depression, Mitchener and Richardson (Reference Mitchener and Richardson2019) show that the interbank network amplified financial distress, and Calomiris, Jaremski, and Wheelock (Reference Calomiris, Jaremski and Wheelock2022) find that financial distress broadcast through the network contributed to bank closures.

Theoretical research concludes that the structure of the interbank network can affect the transmission of shocks and either enhance banking system stability or destabilize it. These studies find that greater interconnectedness can make interbank networks “robust-yet-fragile” in the sense that they make a network more resilient to relatively minor shocks but can spread financial distress in the face of shocks that wipe out the excess liquidity of the banking system (Allen and Gale Reference Allen and Gale2000; Gai, Haldane, and Kapadia Reference Gai, Haldane and Kapadia2011; Acemoglu, Ozdaglar, and Tahbaz-Salehi Reference Acemoglu, Ozdaglar and Tahbaz-Salehi2015). Highly connected, pyramid-shaped networks are especially vulnerable to shocks affecting the network’s core locations. Jaremski and Wheelock (Reference Jaremski and Wheelock2020) and Das, Mitchener, and Vossmeyer (Reference Das, Mitchener and Vossmeyer2022) show that the U.S. interbank network in the late nineteenth and early twentieth centuries had such a structure. The highly-connected pyramid structure was the outcome of laws and practices that limited branch banking and which allowed banks to use deposits at other banks to satisfy legal reserve requirements (Anderson, Paddrik, and Wang 2019; Ladley and Rousseau Reference Ladley and Rousseau2023). Evidence of significant contagion through network connections in financial crises has thus supported insights from theoretical studies about network structures.

This paper provides new evidence on network transmission of financial distress during the Panic of 1907 and ensuing recession, as well as of changes to the network’s structure after the panic. The Panic of 1907 was perhaps the most consequential panic of the National Banking era. The panic originated in New York City with the failure of a stock corner and was almost immediately broadcast through the correspondent banking system to the nation. Sprague (Reference Sprague1910, p. 259) summarized: “Everywhere the banks suddenly found themselves confronted with demands for money by frightened depositors; everywhere, also, banks manifested a lack of confidence in each other. Country banks drew money from city banks and all the banks throughout the country demanded the return of funds deposited or on loan in New York.”

The interbank network’s role in spreading the Panic of 1907 across the nation has been largely accepted in the mostly descriptive literature on the panic. However, previous studies have not investigated whether specific network connections played a role in the panic’s spread across the banking system or in transmitting distress between connected banks during the panic and ensuing recession. This partly stemmed from a lack of comprehensive data on network connections on the eve of the panic. Consequently, it is unclear whether the nationwide panic reflected transmission of distress through direct network connections to New York City or simply a heightened concern about banking conditions in general after the New York City shock.

This paper uses newly digitized data on the universe of interbank network connections in 1907 to study the interregional transmission of the panic and associated bank distress throughout the ensuing recession. We show that bank clearinghouses were more likely to suspend deposit withdrawals or issue cash substitutes in cities whose banks had direct correspondent links to the New York institutions at the center of the panic. Further, we provide quantitative evidence of the transmission of financial distress through direct interbank connections during the panic and ensuing recession. Banks with connections to other banks that closed or to the New York City institutions at the center of the panic were at greater risk of closing.

Finally, we investigate whether banks with connections to banks and trust companies at the center of the panic changed their correspondents after the panic. Although New York City remained the network’s primary node, we find that the percentage of network connections to the City’s institutions declined compared with the overall growth of the U.S. banking system. Moreover, the links to New York City became more concentrated among the City’s largest six national banks. Banks directly connected to New York trust companies and banks at the center of panic events were especially prone to shift their connections away from New York City and to concentrate their remaining New York connections among the City’s largest national banks.

This paper contributes to the literature on the Panic of 1907 as well as to the broad literature on the banking panics of the National Banking era. Studies about the Panic of 1907, such as James, McAndrews, and Weiman (Reference James, McAndrews and Weiman2013) and Tallman and Moen (Reference Tallman and Moen2018), discuss how shocks to the New York City banking market reverberated across the United States. Others examine how specific network connections affected customers of New York City trust companies and banks at the center of the panic. Frydman, Hilt, and Zhou (Reference Frydman, Hilt and Zhou2015) show that non-banking firms with connections to the involved New York City trust companies faced higher borrowing costs and had lower stock returns, dividend and profit rates, but find no effect of connections to New York City banks. Fohlin and Lu (Reference Fohlin and Lu2021) show that investors discriminated among New York City trust companies and that firms with connections to leading national banks maintained higher stock valuations during the panic. Building on this literature, we investigate whether correspondent connections to the banks that were central to the panic influenced deposit suspensions in other cities, the risk of individual banks closing during the panic and worsening recession, or long-run changes in how banks chose to connect to the network. Few banks outside of New York had correspondent relationships with the trust companies that were most involved in the panic’s events, but many were connected to the most involved commercial banks. Our research finds that connections to those banks were consequential, suggesting that clearinghouse support did not entirely prevent direct connections to banks at the center of the panic from affecting banks outside of New York City.

Much of the literature on nineteenth- and early twentieth-century U.S. financial crises, such as Calomiris and Gorton (Reference Calomiris, Gorton and Glenn Hubbard1991), Wicker (Reference Wicker2000), and Gorton and Tallman (Reference Gorton and Tallman2018), stress the importance of structural flaws in the banking system, such as unit banking and the absence of a lender of last resort, for the frequency and severity of banking panics. Clearinghouses served to some extent as local lenders of last resort, but the banking system was susceptible to frequent, severe disruptions that were amplified by direct interbank connections. The evidence presented herein supports the long-held view that the interbank network was an important source of contagion in the period and suggests that the Panic of 1907 would have had less national impact if the network structure had been flatter and less focused on New York City. The data thus support the mostly descriptive accounts about how the network transmitted a New York City stock market shock throughout the United States during the Panic of 1907 and subsequent recession, as well as theoretical research relating interbank contagion to network structure.

THE INTERBANK NETWORK AND PANIC OF 1907

In the nineteenth and early twentieth centuries, the U.S. banking system was comprised of thousands of mostly single-office (“unit”) banks. Because state and federal laws limited branch banking and prohibited interstate branching altogether, most banks kept deposits with banks or trust companies located in other cities to conduct business outside their home markets. These links formed the interbank network. Correspondent deposits constituted 12 percent of commercial bank assets in 1907 (Board of Governors 1959), but the percentage was higher for banks outside the central reserve cities (New York City, Chicago, and St. Louis). The network thus constituted a high proportion of total bank assets and an even larger proportion of liquid bank assets.

The network had a core-periphery structure, with New York City as the network’s central node and a few other large cities as secondary or regional nodes. New York City had long been the nation’s financial capital. Banks relied on their New York City correspondents to make and receive payments, to invest in securities and stock exchange loans, and for short-term loans (Watkins Reference Watkins1929). The structure of reserve requirements for national banks (those banks chartered by the Office of the Comptroller of the Currency) also contributed significantly toward making New York City the network’s central hub, as national banks were permitted to use deposits in New York City national banks to satisfy a portion of their legal reserve requirements.Footnote 1 Many of the smaller regional interbank hubs were those designated as reserve cities. Further, state-chartered banks, which were subject to reserve requirements specified by their states, were often permitted to use deposits placed in correspondents located in the state to satisfy a portion of requirements (White Reference White1983). Consequently, most banks had correspondents in different cities depending on their reserve requirements, investments, and customer needs. As of January 1907, 70 percent of U.S. banks and trust companies had at least one New York City correspondent. Chicago was the second-most important network node, but only linked to 30 percent of the nation’s banks. Although national banks held by far the largest volume of interbank deposits, New York City trust companies emerged toward the end of the nineteenth century as aggressive competitors for interbank deposits of state banks and other trust companies, which they used to invest in securities markets (Neal Reference Neal1971).

Payment flows through the interbank network were highly seasonal, reflecting fluctuations in agriculture and other commercial activity (Kemmerer Reference Kemmerer1910; Barsky and Miron Reference Barsky and Miron1989; Davis, Hanes, and Rhode Reference Davis, Hanes and Rhode2009; Carlson and Wheelock Reference Carlson and Wheelock2016). Although the aggregate demand for money and credit varied seasonally, demand varied somewhat by region so that banks in some parts of the country were depositing funds into their correspondents when banks in other parts were withdrawing funds. The regional nature of flows into and out of correspondent banks in the major cities during non-panic periods allowed the system to economize on cash and illustrates the robust nature of the network in dissipating local fluctuations in the demand for money and credit. However, a characteristic of major banking panics, such as the Panic of 1907, was that banks in all regions sought to withdraw funds from correspondents simultaneously. The demand for cash then far exceeded the capacity of the network to deliver, and its fragility became evident.

The Panic of 1907 began in mid-October 1907.Footnote 2 The panic’s proximate cause was the 16 October collapse of an attempt by New York City financiers Augustus Heinze and Charles W. Morse to corner the stock of United Copper Company. The collapse caused the failure of two brokerage houses connected to the scheme and precipitated runs on three banks that were connected to Heinze and his partners: Mercantile National Bank, New Amsterdam National Bank, and the National Bank of North America. Runs then spread to other banks and trust companies with connections to Heinze, Morse, and their associates, including Knickerbocker Trust Company, headed by Charles T. Barney, and then more broadly to other New York financial institutions. Banks across the city suspended payments on 26 October, and the New York Clearinghouse issued clearinghouse loan certificates to augment the reserves of its members, which at the time did not include any trust companies. The panic spread rapidly across the United States and within days banks suspended payments and local clearinghouses issued loan certificates in many cities (Andrew Reference Andrew and Sprague1910, table 1). Measures of economic activity indicate that the downturn that started in May 1907 worsened significantly during the panic and was especially acute while payments were limited or suspended (James, McAndrews, and Weiman Reference James, McAndrews and Weiman2013).

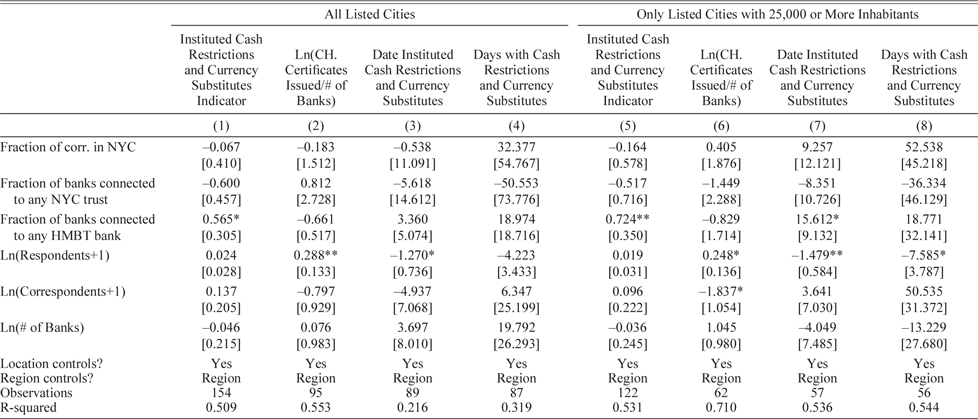

Table 1 DETERMINANTS OF CASH RESTRICTIONS AND CURRENCY SUBSTITUTES BY CITY

* = Significant at the 10 percent level.

** = Significant at the 5 percent level.

*** = Significant at the 1 percent level.

Notes: The table presents the marginal effects of a logit model in Columns (1) and (5) and ordinary least squares coefficients in the remaining columns. Each observation is a city. The column headings identify the dependent variables and sample used. Cities that did not issue currency substitutes are not included in Columns (2)–(4) or (6)–(8). “Location Controls” includes the logarithm of city population, the change in city population 1900 to 1910, and the change in the number of banks in the city 1900 to 1907, the change in bank assets in the city 1905 to 1906, the fraction of the county population that was non-white, the number of farms per capita, and indicators for whether the city was a central reserve or reserve city as well as the distance from the city to New York City. Standard errors are presented in parentheses below the coefficients.

Source: See text for data sources.

Although many studies have identified the interbank network as a source of contagion in the Panic of 1907 and other National Banking era panics, none has mapped the universe of network connections in 1907 or tested whether direct network connections transmitted distress across banks in the panic or ensuing recession. The rest of this paper makes use of a dataset consisting of the network connections of every U.S. bank both before and after the panic and recession to first test whether direct network connections help explain local responses to the panic, bank closure rates during and after the panic, and changes in correspondent links after the panic. Rand McNally Bankers Directories provide “a full and complete list of banks, bankers and savings banks in the United States” and their “principal” correspondents.Footnote 3 We use the January 1907 edition to identify the U.S. commercial banks operating before the panic and their correspondent relationships. In addition, we use data on network links from the July 1910 edition collected by Jaremski and Wheelock (Reference Jaremski and Wheelock2020) to investigate how banks changed their correspondent connections after the panic.

INTERBANK TRANSMISSION OF THE PANIC AND FINANCIAL DISTRESS

The panic originated in New York City in October, and though largely over by the end of January, its effects on banking and economic conditions lingered for several more months. The lack of comprehensive high-frequency data makes it difficult to gauge the extent of bank runs and deposit withdrawals at the height of the panic. However, two measures of financial distress can be observed: (1) clearinghouse actions to suspend payments and issue emergency currency and (2) permanent bank closures. The former reflects an immediate response to the panic at the city level, whereas the latter is a measure of financial distress during the panic and ensuing recession. This section examines both outcomes for evidence that the network contributed to transmitting financial distress across the nation.

Intensity of New York Correspondent Connections and Payment Suspensions

The New York City clearinghouse suspended cash payments and began to issue clearinghouse certificates on 26 October. The clearinghouses of Chicago and St. Louis—the nation’s two other central reserve cities—suspended and issued clearinghouse certificates on 28 October, as did clearinghouses in several other cities (Andrew Reference Andrew and Sprague1910, table 1). Clearinghouses in at least 95 cities had done so by the second week of November, and clearinghouse notes continued to circulate through January 1908 in most of those cities.

The suspension of payments as well as the amount and duration of clearinghouse certificate issuance provide clear measures of the immediate dissemination of the panic. Andrew (Reference Andrew and Sprague1910) collected information on cash payment suspensions and clearinghouse certificate issuance during the panic for the National Monetary Commission. For cities over 25,000, he lists separately those where cash payments were restricted or clearinghouse certificates issued (table 1) and all other large cities (p. 445).Footnote 4 For most cities where emergency liquidity was introduced, he provides the dates of issue, the total amount issued and the peak amount outstanding. In addition, Andrew (table 2) provides an incomplete list of cities with fewer than 25,000 inhabitants where cash payments were restricted or currency substitutes were issued.

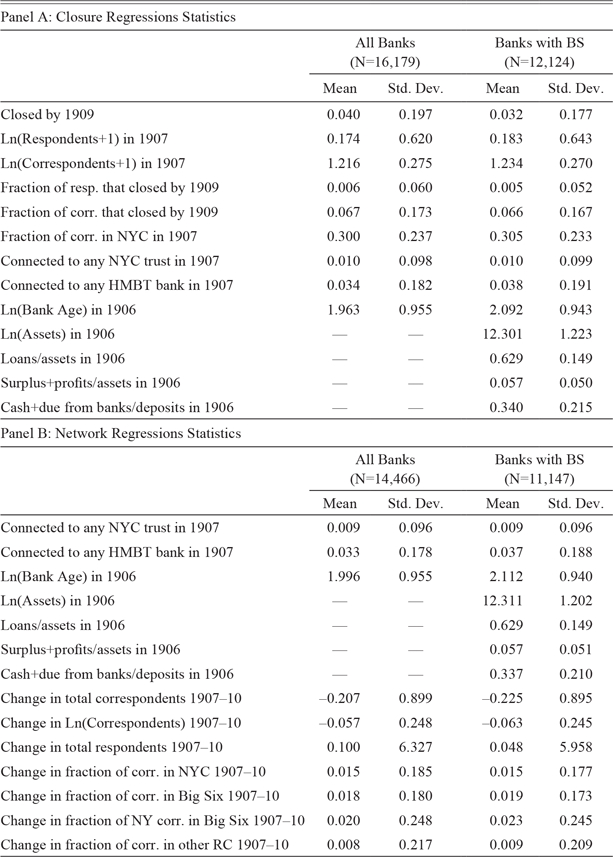

Table 2 SUMMARY STATISTICS

Notes: The table provides summary statistics for the variables included in the closure and network regressions reported in Tables 3 and 6. The “All Banks” sample includes all non-New York City banks; the “Banks with BS” sample includes all non-New York City banks in states that reported balance sheet information.

Source: See text for data sources.

We use information from Andrew’s tables to study the immediate spread of the panic from New York City. Specifically, we test whether cash payment suspensions and clearinghouse certificate issuance were more likely in cities where the correspondent connections of local banks were more concentrated among New York City financial institutions in general, New York City trust companies, or New York City banks affiliated with Heinze or his associates. The names of the financial institutions and individuals involved in precipitating the panic in New York were widely reported in the press. Depositors of a bank whose correspondents included trust companies or commercial banks that were most involved in the crisis might have been more likely to run and thus impair the bank’s liquidity. Moreover, banks with extensive connections to New York banks and trust companies might have been more pessimistic about quickly receiving funds they had on deposit with those institutions. An extensive literature finds that uninsured depositors are sensitive to risk and will run on banks that are thought to be in danger of defaulting (Gorton and Pennacchi Reference Gorton and Pennacchi1990; Calomiris and Jaremski Reference Calomiris and Jaremski2019). Thus, conceivably, payment suspensions and cash substitutes were more likely in cities whose banks had correspondent relationships with New York banks and trust companies, especially those at the heart of the crisis.

We use four different outcome measures to test for a relationship between New York connections and local responses: (1) An indicator for whether a city’s banks or local clearinghouse substantially restricted cash transactions or issued clearinghouse certificates; (2) the total value of clearinghouse certificates issued per bank; (3) the date at which clearinghouse certificates were first issued; and (4) the number of days that clearinghouse certificates circulated before their retirement. To reflect the intensity of connections to New York City, we use (1) the fraction of the total number of correspondents of banks within a given city that were comprised of New York City banks and trust companies; (2) the fraction of banks in the city that were connected to any New York City trust company; and (3) the fraction of banks in the city that were connected to any New York City bank implicated in precipitating the panic, which we identify as banks of which Charles Morse, Augustus Heinze, Charles Barney, Edward Thomas, or Orlando Thomas was an owner, officer, or director (hereafter referred to as “HMBT banks”).Footnote 5 We also control for the logarithms of the number of correspondents and respondent connections of the banks within the city to capture its importance to the overall network, and the logarithm changes in population 1900–1910 and number of banks 1900–1907 to control for any pre-trends across cities.

Figure 1 shows that banks connected to HMBT banks (top panel) or any New York City trust company (bottom panel) were located throughout the country. Although more predominant in the East, the distribution matched the geographic distribution of banks, which reflected the concentration of population and economic activity in the East at that time.

Figure 1 LOCATIONS OF BANKS CONNECTED TO HMBT BANKS AND NEW YORK CITY TRUST COMPANIES

Notes: The figures display the location of banks with a correspondent connection to either an HMBT bank or a New York City trust company in 1907. The size of the dot reflects the number of banks with a connection.

Source: Rand McNally Bankers Directory (1907).

We estimate the following specification with logit regressions for binary outcomes and ordinary least squares for continuous outcomes:

where Suspension c is a vector of the four suspension variables described previously, Ln(Resp) c and Ln(Corr) c are the logarithms of the number of respondents and number of correspondents of city c in 1907, respectively; %NYCCorr c is the fraction of city c’s correspondents that were located in New York City in 1907; %NYCTrust c and %HMBTBank c are, respectively, the fraction of city c’s commercial banks that were connected to either a New York City trust company or to a state or national bank of which Heinze, Morse, Barney, or Thomas were principals; Ln(Banks) c is the logarithm of the number of commercial banks in city c in 1907; C c is a vector of location characteristics from Haines (Reference Haines2008), which includes indicator variables for whether the city was a central reserve or reserve city, the logarithm of the city’s population in 1910, the logarithm change in city population 1900 to 1910, the logarithm change in the number of banks in the city from 1900 to 1907, the fraction of the county that was non-white, and the number of farms per capita; C c also includes the linear distance to New York City from city c to capture any pure geographic spillover effects; Region c is a vector of indicators for the region in which the city was located; and e c is the White-robust standard error.

We estimate Equation (1) for two samples. The first includes the 165 cities listed in Andrew (Reference Andrew and Sprague1910), whereas the second excludes the 33 cities with fewer than 25,000 inhabitants. Neither sample is large, especially for the outcomes that are conditional upon issuing any clearinghouse certificates. The larger sample has the advantage of allowing for more controls without raising concerns about degrees of freedom, whereas estimation based on the smaller sample provides an indication of any bias introduced by including the smaller cities.

Table 1 reports estimation results for Equation (1). The results indicate no effect on any of the dependent variables of additional connections to either New York City banks and trust companies generally or the City’s trust companies specifically. However, cities where higher fractions of banks were connected to HMBT banks were more likely to suspend payments and issue clearinghouse certificates.Footnote 6 A one standard deviation increase in the fraction of banks connected to HMBT banks (0.153) is associated with an additional 8.6 percent probability of suspending. Cities whose banks had more respondents tended to suspend earlier and for less time. The evidence indicates that specific network connections affected the decision to declare a suspension and issue currency substitutes, while the volume and timing of emergency currency were a function of the number of respondents that the city’s banks had. Hence, direct network connections were important for transmitting the New York City shock to the rest of the nation.

Interbank Connections and Bank Closure Risk

The Panic of 1907 was a major financial crisis that had significant economic repercussions. Although it produced relatively few outright bank failures compared with the Panic of 1893 or the Great Depression of the 1930s, many banks closed permanently during the panic and subsequent recession. Comparing the listings of banks in the January 1907 and January 1909 editions of Rand McNally Bankers Directory, we identified 654 national and state-chartered banks that were present in 1907 but not at the end of 1908 (excluding banks that merely changed their name, location, or charter type). These represent a mix of failures (involuntary liquidations with receivers appointed), voluntary liquidations, and mergers, of which most were likely due to financial distress given the period involved.Footnote 7

We study bank closures that occurred at the height of the panic and the full year of 1908, when most bank and firm failures occurred. We do this in part because data sources do not identify precisely when most banks closed, and so we do not have a comprehensive list of banks that closed during the panic per se. Even if we could identify all the banks that closed permanently during just the panic weeks, restricting the sample to just those weeks would miss banks that were either weakened by the panic and later closed or those that closed as a result of the ensuing recession. Quantitative estimates of the impact of interbank connections on bank closures over the longer period likely understate their impact at the height of the panic. Thus, if we find that interbank connections were important for closures over the longer window, it is likely that they were even more important for transmitting distress at the height of the panic.

To estimate the impact of network transmission of financial distress, we build upon the network-augmented model of Calomiris, Jaremski, and Wheelock (Reference Calomiris, Jaremski and Wheelock2022). In their study of the Great Depression, the authors begin with a model in which the closure outcome is regressed on bank characteristics such as its size, age, and various balance sheet measures that other studies have found to be important for explaining a bank’s likelihood of closing. They then add variables intended to capture the influence of interbank connections. These variables include the numbers of correspondents and respondents (if any) a bank had, and the fractions of its correspondents and respondents that closed. The authors find that having more respondents or larger fractions of correspondents and respondents that closed increased a bank’s closure risk. Having more respondents might reduce a bank’s risk in normal times (when inflows and outflows of respondent deposits were less correlated) but increase risk in panics when the bank’s respondents were all attempting to withdraw their deposits simultaneously. Having deposits in a larger number of correspondents would likely reduce a bank’s risk, however, especially in a crisis period, through diversification. The likely explanation for the impact of correspondent closures is that they would cause a bank to lose access to liquid assets, while the impact of respondent closures on a bank’s own closure risk is that they stripped the bank of a key funding source.

We expand the network-augmented closure model to test whether network connections to New York City institutions affected a bank’s closure risk in the Panic of 1907 and ensuing recession using measures like those in Equation (1). Banks with correspondent connections to New York City banks and trust companies, especially those at the center of the panic, could have been affected in various ways. Six of those City banks and trusts closed, which directly impaired the assets of their respondents. Although the New York clearinghouse supported the city’s banks (but not its trust companies), surviving HMBT banks continued to experience substantial deposit outflows in 1908 even as the city’s other banks recovered. Surviving HMBT national banks experienced a 22.8 percent decrease in total deposits and an 18.1 decline in interbank deposits between August 1907 and September 1908, while other surviving New York City national banks had increases of 26.7 percent in total deposits and 26.2 percent in interbank deposits. Because banker directories published correspondent names, respondents of New York City banks and trusts that were most directly associated with the panic might have also experienced a loss of reputation and increased funding costs due to their connections. Moreover, previous studies (Sprague Reference Sprague1910; Moen and Tallman Reference Moen and Tallman2019) highlight that large national banks added liquidity to the call loan market during the panic, which could have helped their respondents.

We estimate the determinants of bank closure between January 1907 and December 1908 using the following logit modelFootnote 8 :

$$Closur{e_i} = {\rm{\;}}a + {\beta _1}Ln{\left( {Resp} \right)_i} + {\beta _2}Ln{\left( {Corr} \right)_i} + {\beta _3}RespClosure{s_i} + {\beta _4}CorrClosure{s_i} + {\beta _5}{\rm{\% }}NYCCor{r_i} + {\beta _6}NYCTrus{t_i} + {\beta _7}HMBTBan{k_i} + {\rm{\;}}{\beta _8}{B_i} + {\beta _9}{X_i} + {\beta _{10}}Regio{n_i} + {e_i},{\rm{\;}}\left( 2 \right)$$

$$Closur{e_i} = {\rm{\;}}a + {\beta _1}Ln{\left( {Resp} \right)_i} + {\beta _2}Ln{\left( {Corr} \right)_i} + {\beta _3}RespClosure{s_i} + {\beta _4}CorrClosure{s_i} + {\beta _5}{\rm{\% }}NYCCor{r_i} + {\beta _6}NYCTrus{t_i} + {\beta _7}HMBTBan{k_i} + {\rm{\;}}{\beta _8}{B_i} + {\beta _9}{X_i} + {\beta _{10}}Regio{n_i} + {e_i},{\rm{\;}}\left( 2 \right)$$

where Closure i is an indicator for whether bank i had closed permanently by the end of December 1908, Ln(Resp) i and Ln(Corr) i are the logarithms of the number of respondents and number of correspondents of bank i in 1907, respectively; RespClosures i and CorrClosures i are the fractions of bank i’s respondents or correspondents that closed by December 1908, respectively; %NYCCorr i is the fraction of bank i’s correspondents in 1907 that were located in New York City; NYCTrust i and HMBTBank i are indicators for whether bank i had among its correspondents a New York City trust company or a commercial bank with connections to Heinze, Morse, Barney, or Thomas, respectively; B i is a vector of bank balance sheet items (log of total assets, loans/assets, surplus and undivided profits/assets, cash and balances due from banks/deposits), the bank’s charter type, and the logarithm of bank age; X i is a vector of characteristics in 1910 from Haines (Reference Haines2008) that includes indicator variables for whether the bank’s county had a central reserve or reserve city, the logarithm of county population, the fraction that was urban, the fraction that was non-white, and the number of farms per capita; X i also includes the linear distance to New York City from bank i to capture geographic spillovers, Region i is a vector of region indicators; and e i is the standard error that is clustered by state.

We obtain available balance sheet information for individual national banks as of 4 September 1906, from the Annual Report of the Comptroller of the Currency for 1906, and for state-chartered banks from state banking reports for 1906. Because some states did not publish reports with balance sheet information for their state-chartered banks (Mitchener and Jaremski Reference Mitchener and Jaremski2015), we estimate Equation (2) with (1) a full sample consisting of all U.S. commercial banks but where the regressions omit balance sheet variables, and (2) a restricted sample consisting of commercial banks in the 31 states that reported balance sheet information (which represents 71 percent of all U.S. banks). In this way, we show that the network effects are not the result of sample selection choices or omitted balance sheet variables.Footnote 9 Table 2 reports the means and standard deviations for the variables included in the model. The top panel provides statistics for the variables included in Equation (2) for both the limited and full datasets, which consist of all non-New York City state and national banks in existence in January 1907. A comparison of the statistics for the full and limited samples suggests no systematic differences.

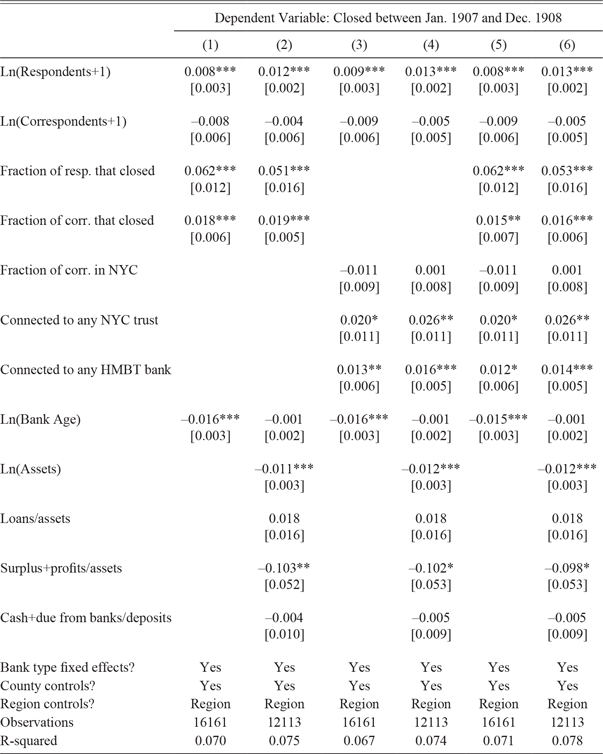

Table 3 reports the marginal effects of the independent variables in Equation (2).Footnote 10 The first specification shows that a bank’s risk of closing in 1907–08 was greater when a higher percentage of its correspondents or respondents closed. Closures among a bank’s correspondents would limit access to a portion of the bank’s assets, at least temporarily, while closures among a bank’s respondents would eliminate funding sources. We also find that having more respondents increased a bank’s risk of closing. Although having more respondents might ordinarily provide diversification among its funding sources, relying on respondents for funding could be risky in a panic or recession when many of a bank’s respondents were attempting to withdraw their funds simultaneously. Because we do not observe high-frequency flows of deposits or the precise date of each closure, it is not possible to definitively identify the direction of causality. Even if we could date precisely when every bank closed, the simple fact that one bank closed before its correspondent (or respondent) does not necessarily mean that the direction of causality went from the first bank to close to the second. A correspondent bank might close from withdrawals by its respondents as the latter were attempting to forestall their own demise. However, the results indicate clearly that contractual contagion within the interbank network was an important source of bank closure risk during the 1907 panic and subsequent recession.

Table 3 DETERMINANTS OF BANK CLOSURE AFTER THE PANIC OF 1907

* = Significant at the 10 percent level.

** = Significant at the 5 percent level.

*** = Significant at the 1 percent level.

Notes: The table presents the marginal effects from a logit model. Each observation is a bank operating in January 1907. The dependent variable is an indicator variable equal to 1 for banks that closed by December 1908. “County Controls” includes the logarithm of county population, fraction of county population above 2,500, the fraction of the county population that was non-white, the number of farms per capita, and indicators for whether the bank was located in a county with a central reserve or reserve city as well as the distance from the bank to New York City. Standard errors clustered across all banks in a state are presented in parentheses below the coefficients.

Source: See text for data sources.

The second and third specifications test whether specific connections to New York City banks and trust companies contributed to a bank’s closure risk. We find no evidence that a bank’s closure risk was associated with the share of its correspondents comprised of New York institutions in general. However, banks were at greater risk of closing if they had a correspondent relationship with a New York City trust company or with one of the HMBT commercial banks. Moreover, the size and statistical significance of connections to trust companies and HMBT banks are qualitatively unaffected by including the fractions of a bank’s respondents or correspondents that closed, suggesting that the New York connections do not reflect the network connections to closed banks in general. And, because the results are qualitatively similar across the two samples, it is unlikely that they reflect the omission of balance sheet factors in the larger sample. Further, signs on the balance sheet variable coefficients are consistent with those of other studies of bank closure, suggesting that our model is well specified.

In sum, our evidence indicates that network connections were a conduit for bank distress during 1907 and subsequent recession. The evidence closely matches the literature on the Panic of 1907. The traditional story has been that the financial panic originated in the New York stock market and engulfed the U.S. banking system by way of the interbank network. The fact that specific distant connections to a handful of New York City banks and trust companies were correlated with immediate payment suspensions and subsequent bank closures provides the first empirical evidence for papers on the subject. More preliminary results presented in the Online Appendix show a correlation between network transmission and measures of real economic activity.

DID THE PANIC REORIENT THE NETWORK?

The interbank network played a key role in transmitting the New York City-based financial shock to the rest of the nation. The literature, however, has not examined whether the network changed in response to the shock. Here we investigate whether banks adjusted their network connections after the Panic of 1907.

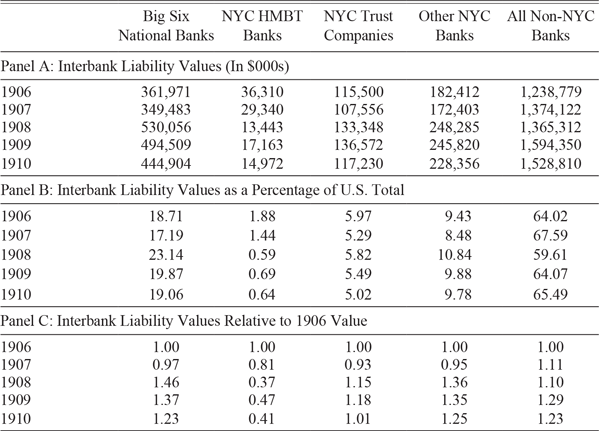

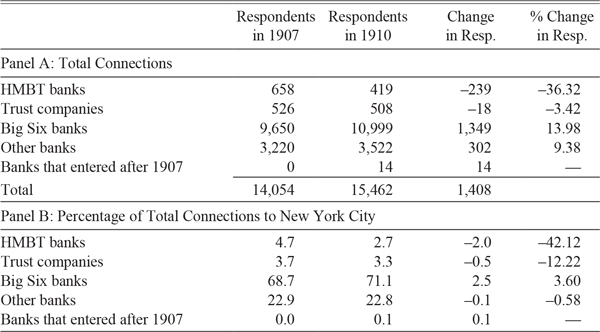

We start by showing broad changes in the volumes of interbank deposits in Table 4 and the number of interbank connections by various groups of banks in Table 5. Clearly, banks did not suddenly abandon New York City correspondents. The total interbank liabilities of all New York City banks grew from 32 percent of total U.S. interbank liabilities in 1907 to 40 percent in 1908 before falling back to 35 percent in 1910. As shown in Table 5, the number of interbank connections to New York City also rose by 10 percent from 1907 to 1910.

Table 4 TRENDS IN INTERBANK LIABILITIES (1906–1910)

Notes: The table provides the total interbank liabilities for various groups of banks between 1906 and 1910. It is important to note that reporting periods differ slightly for the different groups of institutions. Data for national banks and New York state banks and trust companies are typically reported for August or September dates whereas the data on U.S. total interbank liabilities reported in Board of Governors (1959) are June values.

Sources: Information for New York City national banks come from the Comptroller of the Currency’s Annual Report. Information on New York City state banks and trust companies come from New York’s Annual Report of the Superintendent of Banks. Information for non-New York City banks is obtained by subtracting the New York City bank data from the national totals provided by Board of Governors of the Federal Reserve System (1959).

Table 5 CONNECTIONS TO NEW YORK CITY BANKS AND TRUST COMPANIES 1907–1910

Note: The table lists the number of respondents of New York City banks and trust companies and their change between January 1907 and July 1910.

Sources: Rand McNally Bankers Directory (1907) and Jaremski and Wheelock (Reference Jaremski and Wheelock2020).

While the number of interbank connections to New York City banks rose between 1907 and 1910, the increase was less than the 21 percent increase in the total number of U.S. banks and trust companies over that period. Moreover, while the percentage of total network connections to New York City banks rose by 0.4 percentage points between 1907 and 1910, the number of U.S. banks that had at least one New York City correspondent fell by 5 percentage points. By comparison, the growth in connections to Chicago banks outpaced growth in the total number of banks. Nonetheless, the number of connections to Chicago remained only about half the number of New York City connections. New York City’s continued dominance is not surprising given the role of the City’s banks in the securities markets and international trade.

Although the panic did not cause a substantial reorientation of the interbank network away from New York City, it seems to have led banks to change their correspondent relationships within New York City. Conceivably, the apparent riskiness of trust companies and the HMBT banks led some banks to move their correspondent links away from those institutions to other, perhaps more stable banks. Shown in Table 4, National Bank of Commerce, First National Bank, National Park Bank, National City Bank, Chase National Bank, and Hanover National Bank (the “Big Six” referred to by Tallman and Moen (Reference Tallman and Moen2012)) combined had an especially large 52 percent increase in interbank liabilities from 1907 to 1908 and saw their share of total U.S. interbank liabilities rise from 17 percent to 23 percent. The flood of deposits into the Big Six banks likely reflected a flight to safety. Their market share declined somewhat as the panic and recession faded, but still exceeded the pre-panic level in 1910. The major New York City national banks also tended to have the largest gains in respondent connections (see Table 5). Although 91 of the 143 New York City banks and trust companies operating in 1907 had at least one respondent, the Big Six national banks alone had 68.7 percent of the city’s total respondents in 1907, which rose to 71.1 percent in 1910.

National banks outside New York City experienced essentially no change in interbank liabilities in 1907–08, while state-chartered banks and trust companies experienced modest declines. The shares of interbank liabilities held in banks and trust companies outside New York City recovered somewhat in 1909 and 1910. The interbank liabilities of HMBT banks dropped sharply and did not recover, however. By 1910, the liabilities of HMBT banks were less than half their 1906 value, and they had lost 36.3 percent of their respondents. Over the same period, New York City trust companies had a small gain in interbank liabilities but a 3.4 percent decline in the number of respondents. Most of the banks and trust companies at the center of the panic that survived experienced large declines in the numbers of respondents. By contrast, the number of respondents among all other New York City banks rose by 12.8 percent.

The data on total interbank liabilities and numbers of interbank connections indicate that New York City remained the center of the nation’s interbank network. However, there was a substantial reorientation of interbank liabilities and connections within New York City toward the largest national banks. Ironically, while this reorientation likely reflected an attempt by individual banks to reduce solvency or liquidity risks associated with depositing funds in trust companies or marginal banks, the increased concentration of interbank deposits in a small number of correspondent banks may have had competitive or systemic risk implications.

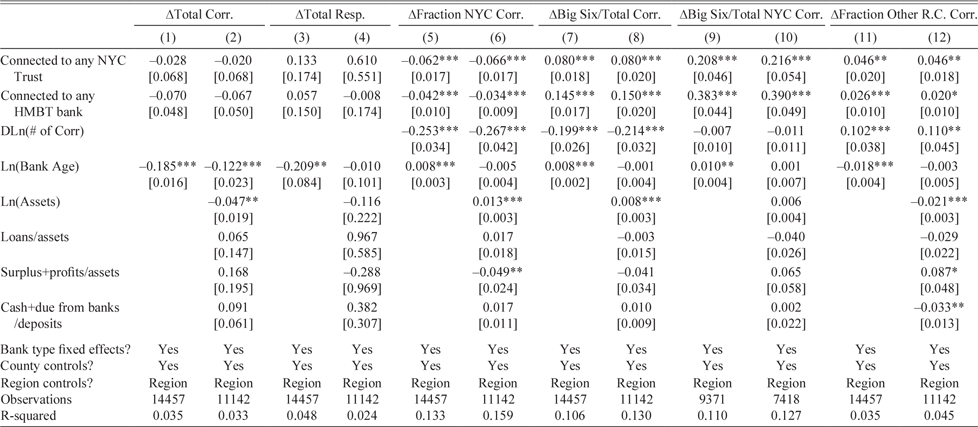

The increased concentration of correspondent links and deposits among the largest national banks suggests that respondent banks sought to lessen their liquidity risks, especially those that had been customers of trust companies or the HMBT banks. To investigate this possibility, we estimate regressions to test whether having connections to New York City trust companies or the HMBT banks affected how correspondent relationships changed after the panic. Specifically, we test whether banks (1) reduced their total correspondent or respondent connections; (2) redirected their correspondent relationships away from New York City banks and trust companies; or (3) shifted toward the Big Six banks that dominated the market.

We estimate the following ordinary least squares regression at the bank level for banks that survived from January 1907 through June 1910:

$$\Delta Networ{k_i} = {\rm{\;}}a + {\beta _1}NYCTrus{t_i} + {\beta _2}HMBTBan{k_i} + {\rm{\;}}{\beta _3}{B_i} + {\beta _4}{X_i} + {\beta _5}Regio{n_i} + {e_i},{\rm{\;}}\left( 3 \right)$$

$$\Delta Networ{k_i} = {\rm{\;}}a + {\beta _1}NYCTrus{t_i} + {\beta _2}HMBTBan{k_i} + {\rm{\;}}{\beta _3}{B_i} + {\beta _4}{X_i} + {\beta _5}Regio{n_i} + {e_i},{\rm{\;}}\left( 3 \right)$$

where ΔNetwork i is a vector of network variables for bank i, specifically the changes between 1907 and 1910 in (1) total correspondents; (2) total respondents; (3) fraction of correspondents located in New York City; (4) fraction of total correspondents comprised of the Big Six banks; (5) fraction of total New York City correspondents comprised of the Big Six banks; and (6) fraction of total correspondents comprised of banks located in other reserve or central reserve cities.Footnote 11 The other variables retain the definitions described previously. We include a control for whether a bank had multiple New York City correspondents in 1907 in all regressions and the log change in a bank’s total number of correspondents in certain regressions as noted later. The lower panel of Table 2 reports the means and standard deviations for the variables included in the model.Footnote 12

Table 6 reports coefficient estimates for Equation (3). First, we examine patterns in the raw changes in total correspondents and total respondents. We find no evidence that banks with connections to the HBMT banks before the panic had declines in total correspondents or respondents. Next, we investigate changes in correspondent links to New York City banks and trusts. Controlling for the change in a bank’s total number of correspondents, we find that banks were more likely to reduce the fraction of their correspondent links going to New York City if they had a New York City trust company or HMBT bank correspondent before the panic.

Table 6 CHANGES IN NETWORK CONNECTIONS (1907–1910)

* = Significant at the 10 percent level.

** = Significant at the 5 percent level.

*** = Significant at the 1 percent level.

Notes: The table provides the results of OLS regressions. Each observation is a bank that survived from January 1907 through July 1910. The dependent variables are provided in the column headings. “County Controls” includes the logarithm of county population, fraction of county population above 2,500, the fraction of the county population that was non-white, the number of farms per capita, and indicators for whether the bank was located in a county with a central reserve or reserve city as well as the distance from the bank to New York City. The regressions also control for banks with more than one New York City correspondent in 1907. Standard errors clustered across all banks in a state are presented in parentheses below the coefficients.

Source: See text for data sources.

We also find that connections to New York City trusts and HMBT banks influenced a bank’s choice of New York City correspondents. Again controlling for the change in a bank’s total number of correspondents, we find that banks having a New York City trust or HMBT bank correspondent before the panic were more likely to have increased their ties to one or more of the Big Six banks, either as a fraction of their total correspondent relationships or as a fraction of their correspondent relationships with New York City banks and trusts, by 1910. This suggests that banks that had been connected to riskier institutions before the panic were more likely to shift toward the very largest, and perhaps safest, banks by 1910. Finally, we show that banks with connections to New York City trusts or HMBT banks before the panic were more likely to shift their connections to banks in Chicago, St. Louis, or other reserve cities.

To provide further evidence, we examined commercial banks present in both 1907 and 1910 that had one and only one New York City correspondent in 1907. We then tracked whether they changed that specific New York City correspondent by 1910. Banks with an HMBT or New York City trust correspondent in 1907 were much more likely to either switch their relationship to another institution in the city or pull out of the city altogether. Specifically, only 32.5 percent of HMBT-connected banks and 58.4 percent of trust company-connected banks retained their New York City correspondent, compared with 83.7 percent of all others. And, if they retained a New York City correspondent, most switched to another New York City correspondent (55.5 percent and 28.3 percent, respectively).

The detailed network data indicate how the network shifted in response to the Panic of 1907. While New York City remained the center of the nation’s interbank network, there was a sizable shift in the financial institutions that banks located outside of the city chose as their New York City correspondents. Connections grew more concentrated among the Big Six national banks. Finally, banks that had a New York City trust company or an HMBT bank correspondent before the panic were more likely to reduce their connections to New York City or move their connection to a Big Six bank. Thus, the evidence indicates that banks responded to the panic by reorienting their correspondent ties, which induced some restructuring of the interbank network.

CONCLUSION

The interbank network has long been recognized as an important conduit by which the Panic of 1907 was transmitted from New York City to the rest of the nation. However, the evidence to date has been largely anecdotal or circumstantial. Similarly, quantitative evidence of the transmission of financial distress through direct relationships in the banking system in any era is limited. Using newly digitized data on all U.S. bank correspondent relationships on the eve of the panic, this paper provides quantitative support for the importance of network connections in broadcasting the panic throughout the nation. We show that payment suspensions and issuance of cash substitutes were more likely in cities whose banks had more connections to New York City commercial banks at the center of the panic. Cities with higher numbers of respondent links were also more likely to issue large amounts of cash substitutes to meet the demand for liquidity. Further, we show that throughout 1907–08, banks with either correspondent or respondent connections to other banks that closed were themselves more likely to go out of business. And we find that banks with connections to New York City trust companies or commercial banks at the center of panic events were at increased risk of closing. Direct network links thus were a conduit for disseminating banking distress during the panic and recession.

Finally, we show that following the panic, the network reoriented away from the institutions most associated with panic events. A full analysis of how the panic affected the network’s structure is a topic for future research, but the evidence presented here that banks connected to the panic’s central players were more likely to reorient their connections away from New York City or to move their connections to stronger banks within the city indicates that the panic was driving changes in the network. Hence, the paper adds evidence that interbank network structures change in response to financial shocks. Moreover, evidence of a shift in correspondent links to the largest banks following the panic suggests that flight to quality in interbank markets has the potential to increase network concentration and, hence, systemic risk.

The Panic of 1907 was the last major banking crisis of the National Banking era. In its wake, Congress established a National Monetary Commission to investigate defects in the U.S. banking system and ultimately enacted the Federal Reserve Act of 1913 to establish a lender of last resort and lessen the banking system’s dependence on the interbank network. In providing direct loans to its member banks facing liquidity problems, the Federal Reserve somewhat lessened the vulnerability of its members to payment suspensions by their correspondents. Further, the Act eliminated provisions of the National Banking Acts that permitted national banks to hold a portion of their required reserves in deposits at correspondent banks. These changes somewhat reduced the concentration of interbank deposits in New York City and other reserve cities (Jaremski and Wheelock Reference Jaremski and Wheelock2020). However, the Federal Reserve Act did not alter state and federal prohibitions on branch banking or require state-chartered banks to join the Federal Reserve System. Further, unlike correspondent deposits, banks earned no interest on their deposits at the Federal Reserve and did not receive investment and other services. Consequently, the interbank network remained in place. The return of banking panics and transmission of contagion through the network in the early 1930s proved that the reforms and network responses stemming from the Panic of 1907 had not ended U.S. banking instability.