Humans have repeatedly faced the challenge of resource scarcity resulting from population pressure and spatial or temporal variation in environmental conditions. In many instances, societies have successfully met these challenges through a variety of innovations – sociocultural, technological, governance, and economic. At other times, conflicts were the result in part of market shocks and demands for natural resources. All we need to do is consider what has occurred during the last few years as Russia invaded the Ukraine and as COVID-19 impacted access to resources because of supply-chain interruptions. Throughout the history of industrialization, nations have sought both access to and control of global oil supplies.

Further, after continued growth of industrialization and realization of the implications for our planet of human-induced climate change, the sustainability challenges that our society faces today are fundamentally different from the past as they are more global and interconnected [Reference Clark and Dickson1].

The world has become bigger through rapid urbanization, global population increase, an exploding middle-class, and dependence on low-labor multinational trade, resulting in the expanded production–consumption systems of our earth’s natural resources. The world has also become smaller because of increasingly advanced mobility, e–commerce, global financing, virtual meetings, and other technologies such as social media platforms.

In the context of global climate change, nations and multinational companies are increasingly seeking pathways to address and ultimately reverse human-caused climate impacts. These actions are resulting in both private companies and countries competing for renewable resources and critical earth elements essential for the next generation of sustainable technologies, as well as economic and national security. The rise of nationalistic policies, territorial disputes, and conflicts around the globe is threatening the availability of these resources, which threatens our industrial complex, jobs, the economy, defense, and national security.

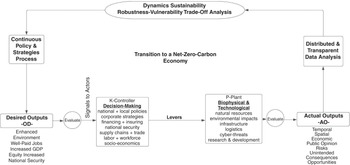

In this book, I introduce you to the term “dynamic sustainability,”Footnote 1 which I use to define this unique juncture in the history of our epic sustainability transition. At one end of the spectrum government policies and technology advancements are inching us closer to achieving the long-sought-after goal of transitioning from a fossil-fuel-based economy to a renewable green economy – what we call the net-zero-carbon economy or zero-carbon economy. This transition is dependent on a new generation of sustainable technologies that are accelerating at an unprecedented pace. In part this has been bolstered by both national and regional government policies since the 2015 Paris Climate Agreement. In many cases these policies are not meant simply to ensure a healthier environment but also have the added benefit of achieving near-term and longer-term economic gains.

Similarly, there now exist growing corporate governance pressures exuded by consumers, shareholders, and financial institutions, as evidenced by the shareholder-driven environmental and social governance (ESG) paradigm, which is further accelerating the sustainability transition by placing pressure on corporate executives to commit to a roster of sustainability commitments, including both significant greenhouse gas (GHG) emission reductions and enhanced governance of supply chains to protect environmental and social imperatives.

Yet, at the same time, society is being challenged by unprecedented competition and pressures for critical natural resources necessary to power the transition, which in part are further driving increased nationalistic policies impacting global trade and raising national security concerns. In the United States, domestic pressures are rising from both the rural–urban divide and the blue–red divide in national and local politics. Concerns over environmental justice and social equity further complicate the sustainability transition. As presented in this book, they raise the real possibilities for unintended consequences and risks to our environment, our society, national security, and the global economy.

In many ways, the sustainability transition of today is analogous to the first (1760–1820) and second (1871–1914) industrial revolutions in regard to advances in research and development and the creation of disruptive technologies. Yet our current industrial revolution is far more complicated and globally interconnected and comes at a time of unprecedented global pressures and civil unrest. In the United States the 2020 presidential election was emblematic of a rising rural–urban divide and red–blue divide, which the dynamics of the sustainable transition will further exasperate if not properly considered.

For many, the abstraction of sustainability is being supplanted by the realities of impactful policies and deployment of disruptive technologies. Around the world, national and regional governments as well as multinational corporations are developing plans and commitments to achieve short-term (2030) and longer-term (2050) GHG reductions. This includes committing to “net-zero” targets as a follow-up to the 2015 Paris Agreement. A recent report by the University of Oxford [2] indicates that 61 percent of countries have committed to net zero and over a fifth of the major companies on the Forbes list, with annual sales of nearly $14 trillion, have also made net-zero commitments. Many more governments and industries have also published interim targets as they seek to adopt a new generation of sustainable technologies and adopt organizational strategies to achieve net zero.

One of the clearer examples of dynamic sustainability is found in the pace and growth of the transition to electric vehicles (EVs), as presented in Figure 1.1.

Consider that in a matter of less than three months between September and November 2020, both California (the world’s fifth largest economy) and the United Kingdom (the world’s sixth largest economy) announced policy changes that have triggered what is likely to be the longer-term demise of the internal combustion vehicle. By 2035 every new car sold in California will be required to be emission free [3] and the United Kingdom moved up its similar plans to ban new petrol cars by 2030 [4].

Even before these policy announcements were formalized, the financial markets had already rewarded the vision of sustainable mobility. Tesla, which sold approximately 500,000 EVs in 2020 as compared to Ford’s 4.2 million cars (primarily internal combustion), achieved a market cap of $480 billion, which is higher than the next nine global auto manufacturers combined, excluding Toyota [5].

Legacy automakers around the world facing the pressures of new government policies and shareholder expectations lined up to make public announcements about their transition to the EV market. This is best exemplified by General Motors who in January 2021 announced their plans to exclusively offer Zero Emission Vehicles by 2035 [6].

While the transition to a more sustainable form of transportation provides the promise of reduced environmental impacts, especially GHG emissions, the dynamics of this transition present many risks and the potential for unintended consequences that, if not planned for, can ultimately impair the sustainability transition.

Notably, the transition will drive a significant demand for additional electricity generation. The average EV requires 30 kilowatt-hours to travel 100 miles – the same amount of electricity a typical American home uses each day [Reference Brown7]. A US Department of Energy study found that US electricity capacity needs to double to power 186 million light-duty EVs in 2050 [8].

If the transition to EVs to meet the goals of advancing sustainability is to be successful, then the increased demand for electricity must be met by renewable sources, such as wind, solar, and potentially green hydrogen. In the United States the transportation sector accounted for 29 percent of GHG emissions in 2019, which was the largest amount of emissions by sector. It was closely followed by electricity generation at 25 percent [9].

To meet the demand for renewable electricity in the United States, there will likely be a significant expansion of offshore wind. The recently elected Biden Administration has proposed installing 30 gigawatts of new offshore wind energy by 2030,Footnote 2 which is a substantial increase for a country with only one offshore wind farm in place as of 2021 [10].

While key to meeting the needs of a net-zero economy, this rapid expansion of offshore wind is likely to expose growing tensions with the $5.5 billion fishing industry [11], tourism industry, and real-estate developers who fear the impacts of offshore wind turbines on fishing production, as well as the visual impacts from shorelines. Even environmentalists including non-governmental organizations are voicing concern over the potential environmental risks of wind blades to birds and of ocean-based seismic surveys used for locating wind turbines, which are known to have adverse impacts on whales, other cetaceans, pinnipeds, turtles, fish, and possibly other marine creatures [Reference LeMoult12]. The effects of such operations on species can occur over very large areas in the ocean and include disruption of communication, increase stress, and cause behavioral changes such as avoidance of key habitat. The dynamics are further complicated by the fact that there is a growing dependence on the critical earth resources necessary to produce key components in EVs, charging stations and renewable energy sources such as onshore and offshore wind turbines.

The EV transition and resultant dependence on the growth of the renewable energy sector hinges on the availability of specific critical earth elements including certain rare-earth elements (REs) including neodymium (Nd), praseodymium (Pr), and dysprosium (Dy) for the production of permanent magnet electric generators [13]. The United States as well as the rest of the world are highly dependent on limited numbers of foreign sources of raw and processed critical earth elements. In fact, between 2014 and 2017 China supplied 80 percent of the rare earths (a subset of critical earth elements) to the United States. China is home to at least 85 percent of the world’s capacity to process RE elements [14]. China’s dominance in this sphere is a result of a very strategic global engagement strategy, including access to these resources throughout the world via their Belt and Road strategy, while the United States in recent years has taken an isolationist policy pathway with limited engagement with countries with rich critical earth resources. Additionally, in part due to environmental concerns and burdensome permitting processes, the United States has lagged in the development of mining and processing of critical earth minerals.

With near-monopolistic control coupled with increased nationalism and growing trade tensions with the United States, China has threatened limiting exports of critical earth elements, which will impact the US military who require these resources for advanced avionics and munitions. Limiting access to critical minerals can also ensure the growth of China’s sustainable technology sectors, including the race for dominance in the EV sector [Reference Yu and Sevastopulo15].

So how are the United States and other countries responding to both the unprecedented demand for critical earth elements and other resources and the domination of China? One example that highlights national security concerns is exemplified by the US Department of Defense in 2020 issuing a number of contracts as part of the Defense Production Act to increase the supply and production of REs and RE salts [16].

Another route to resource independence is the race to locate new and untapped reserves. Currently, Russia, the United States, China and other countries are racing to take advantage of how global climate change is altering conditions and access to the Arctic. The opening of waterways due to ice melt provides new opportunities to acquire resources where estimates place 13 percent of the world’s undiscovered oil (90 bb of oil), 30 percent of its undiscovered gas (669 T cu ft), and an abundance of critical earth resources such as uranium and rare-earth minerals [Reference Rowe17, 18]. The strategic importance is witnessed as Russia developed new basesFootnote 3 and refurbished former Cold War bases in the Kola Peninsula near the city of Murmansk and NATO developed counterstrategies [Reference Bermudez19].

Closer to home, the dynamics of the sustainability transition will have strong implications for legacy industries of the US economy. Consider the implications as we transition to non-internal combustion engine vehicles powered by renewable electricity. In 2020, America continued to be the world’s leading producer of oil and natural gas [20] and, according to an industry-sponsored report, supported over 11.3 million jobs and accounted for up to 7.9 percent of the US GDP in 2019 [21]. In 2020, US petroleum consumption averaged about 17 million barrels per day (b/d), not including biofuels, which was about 13 percent lower than the pre-COVID-19 years [22]. This in large part was supported by 76,000 miles of pipeline and 141 operable petroleum refineries [23]. The United States accounts for approximately 25 percent of global gas production [24]. Natural gas in 2020 as measured by gross withdrawals and averaged 111.2 billion cubic feet per day (Bcf/d) [25], for which 38 percent (11.62 Tcf) was used for electricity in lieu of coal (higher GHG emissions) and both nuclear and renewables with much lower GHG emissions [26].

And it is just not the production and distribution side of fossil fuels that will be impacted by our sustainability transition. When you need to fill up your car with gas, you generally seek out one of the over 145,000 retail gas or convenience stores [27], such as 7-Eleven, BP, or Circle K. The dynamic implications are multifold. There will be implications for employment and state tax revenues due to much-reduced collections of gas tax and sales tax from products sold at these establishments. How will cities prepare for the eventual shuttering or re-imagining of these corner property establishments? And how will the US Environmental Protection Agency and state environmental agencies prepare for the potential abandonment, monitoring, and possible remediation of the over 540,000 underground storage tanks containing fuels spread across the United States [28]? The dynamics of the current sustainability transition come at a time of stress for the American farmer and rural America due to trade policies that have seen American agricultural exports to China fall from $15.8 billion in 2017 to $5.9 billion in 2018 and continue to remain depressed [Reference Chinn and Plumley29].

Both corn, which is used in ethanol production, and soy, an additive for biodiesel, are important economic drivers for rural America. Corn, primary grown in the Midwest, is the United States’ largest crop, covering over 91.7 million acres in 2019 – about 69 million football fields [30]. Forty percent of US corn is used to produce the renewable fuel additive ethanol [31]. In 2019 this amounted to over 15.8 billion gallons of fuel ethanol with an economic impact of more than 68,600 direct jobs, $43 billion to the GDP – a significant economic driver for rural America [32].

If I was an American farmer, working hard in rural parts of our nation and barely making a profit, what might my attitude be when my family’s livelihood is placed at risk by a rapid decrease in corn-derived ethanol as those living primarily in heavily urbanized blue states along the coasts transition to EVs? How have our public and corporate policymakers considered actions that can both sustain and possibly even grow rural agriculture and related industries, new industries? The answer in many cases is that they have not.

In this book, I hope to raise awareness of these dynamics. I will lay out many of the exogenous factors that, coupled with the unprecedented rapid pace of the sustainable technology transition, are creating unique challenges and pressures that have the potential to result in unintended consequences to the environment, economy, and society, as well as risking our collective desired outcomes for the sustainability transition.

Some of these challenges are near-term, easier to quantify, and likely reversible. Other challenges from the transition have unknown implications and outcomes. Yet, each of these dynamics also provides opportunities, such as repurposing American agriculture and our legacy energy infrastructure for the development and production of a new generation of sustainable and carbon-SMART commodities and products to meet rapidly increased demand by manufacturers, brands, retailers, and consumers around the world. The United States can again be a manufacturing leader and create both jobs and wealth, not just in its cities but again in its forgotten rural regions.

However, this will take leadership, foresight, and in many cases an updated approach to corporate management and government policies. Even in times of heightened polarization, what I lay out I believe holds the promise of enabling conservatives and liberals, rural and urban, industry and government to come together to make the nation stronger and healthier.

While I outline many details of what has gone wrong and what could go wrong, this book is about possibilities and the promise of renewal in the United States (Figure 1.2). I hope you too see the opportunities. But most importantly, what I want to present is a way of thinking and managing at times of significant dynamics that impact policies, markets, and national security.