1. Introduction

Smallholder farmers face myriads of climate hazards and agricultural insurance has increasingly been promoted to provide protection (Hellmuth et al., Reference Hellmuth, Osgood, Hess, Moorhead and Bhojwani2009). However, take-up of agricultural insurance in Sub-Saharan Africa remains the lowest (Hess and Hazell, Reference Hess and Hazell2016). Instead, smallholder farmers continue to rely on less effective mechanisms such as asset depletion (Börner et al., Reference Börner, Shively, Wunder and Wyman2015; Yilma et al., Reference Yilma, Mebratie, Sparrow, Abebaw, Alemu and Bedi2017) or dependency on livestock (McPeak and Doss, Reference McPeak and Doss2006; Ng'ang’a et al., Reference Ng'ang’a, Bulte, Giller, Ndiwa, Kifugo and McIntire2016) and savings even when insurance options are available (Delavallade et al., Reference Delavallade, Dizon, Hill and Petraud2015). Agricultural insurance remains unpopular, unattractive and poorly demanded by a majority of farmers in low- and middle-income countries (Binswanger-Mkhize, Reference Binswanger-Mkhize2012). This is despite the evidence of its potential in improving farmers’ and pastoralists’ livelihoods, unlocking investments in production and eventual poverty reduction. In this review paper, we explore why take-up has remained low and what strategies might be employed to spur its take-up among farmers and pastoralists in Africa.

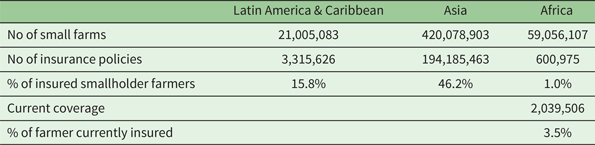

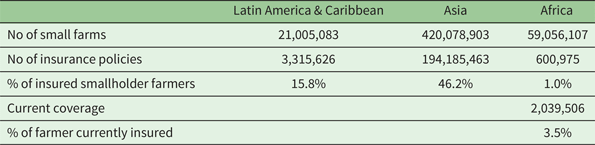

This review supplements other recent reviews (Marr et al., Reference Marr, Winkel, van Asseldonk, Lensink and Bulte2016; Smith, Reference Smith2016; Carter et al., Reference Carter, de Janvry, Sadoulet and Sarris2017; Jensen and Barrett, Reference Jensen and Barrett2017; Platteau et al., Reference Platteau, De Bock and Gelade2017; Yuzva et al., Reference Yuzva, Wouter Botzen, Brouwer and Aerts2018; Ali et al., Reference Ali, Abdulai and Mishra2020b) but also makes important contributions that other reviews have not addressed. First, the review exclusively focuses on Sub-Saharan Africa (SSA) due to its higher vulnerability to weather shocks than other regions (Coe and Stern, Reference Coe and Stern2011). In the region, droughts between 1980 and 2013 are said to have affected more than 360 million people and caused more than US$31 billion in losses (FAO, 2015). The 2008–2011 drought in Kenya alone led to US$11 billion in losses (FAO, 2015) and the 2016 drought in Malawi dented the country's economy by US$400 million (Reeves, Reference Reeves2017). The trend of losses is not likely to decrease (Haile et al., Reference Haile, Tang, Hosseini-Moghari, Liu, Gebremicael and Leng2020a; Spinoni et al., Reference Spinoni, Barbosa, Bucchignani, Cassano, Cavazos and Christensen2020). Despite these losses, insurance take-up remains the lowest in the world. Accordingly, of the 51 million smallholder farmers in Africa (Lowder et al., Reference Lowder, Skoet and Raney2016),Footnote 1 only about 1.3 per cent have agricultural insurance (Hess and Hazell, Reference Hess and Hazell2016). Our more updated estimate suggests current take-up around 3.5 per cent but this remains far below rates in Asia and Latin America (Table 1). The low insurance coverage situation in SSA therefore raises questions possibly specific to the region and requires closer assessment.

Table 1. Agricultural insurance coverage in smallholder farmers across developing and middle-income countries

Sources: Number of farms (Lowder et al., Reference Lowder, Skoet and Raney2016) – data does not include Somalia, Sudan, Eritrea, Mauritius and Burundi, Number of insurance policies (Hess and Hazell, Reference Hess and Hazell2016), Current coverage – authors’ estimates from several sources (see online appendix table A1).

This review further broadens the focus on various issues that previous reviews did not cover. For instance, Platteau et al. (Reference Platteau, De Bock and Gelade2017) assessed demand for micro-insurance, which is technically different from agricultural insurance. Marr et al. (Reference Marr, Winkel, van Asseldonk, Lensink and Bulte2016), Carter et al. (Reference Carter, de Janvry, Sadoulet and Sarris2017) and Jensen and Barrett (Reference Jensen and Barrett2017) specifically focused on index insurance only, which is only one of the several agricultural insurance types (Iturrioz, Reference Iturrioz2009). Yuzva et al. (Reference Yuzva, Wouter Botzen, Brouwer and Aerts2018) assessed the effect of basis risk and did not refer to many other challenges farmers might face in their take-up decisions. The reviews by Smith (Reference Smith2016) and Ali et al. (Reference Ali, Abdulai and Mishra2020b) are the closest to our study in consideration of a wide range of issues covered. A critical addition to these is the diversion from the ‘expert review’ methodology to one that provides more details on the process of literature search as well as inclusion/exclusion decisions. None of the existing reviews precisely covers Africa.

By condensing broad qualitative and quantitative literature, and taking an integrative-style review (Pautasso, Reference Pautasso2013), we expound on issues hindering the take-up of agricultural insurance, clustered in six key themes. These are: (1) product quality, (2) product and contract design, (3) income and affordability, (4) information, knowledge and education reasons, (5) behavioural and socio-cultural factors, and finally (6) the role of governments in policy setting, regulation and market stabilisation. These six themes all cut across demand and supply. From the demand side, there is an insufficient purchase of agricultural insurance products by farmers – partly because of budget limitations and because of the low knowledge of and about insurance. We elaborate on how demand can be spurred by providing demand subsidies, which relax farmer budgets and increase affordability. From the supply side, farmers require the products not only to be available but also to be of good quality since poor quality products are likely to leave farmers in worse off situations (Clarke, Reference Clarke2016). We not only explore how suppliers can be enabled to provide more insurance but also how to increase the quality of existing products. Moreover, while insurance remains voluntary, governments and related institutions can spur markets not only through infrastructure and meso-level services such as reinsurance, but also by setting up enabling policies and regulatory institutions that build confidence. Through enabling innovation and setting quality standards, governments can avoid low product equilibria (Clarke and Wren-Lewis, Reference Clarke and Wren-Lewis2013). These factors are not singular recommendations of dos and don'ts. Indeed, as figure A1 (in the online appendix) shows, they are interconnected and should be adjudged in the broader ecosystem.

The rest of this paper is organised as follows. In section 2, we provide a brief historical and current status of agricultural insurance in Africa. Section 3 gives our review methodology and literature search strategy elaborating on the inclusion and exclusion strategy. In section 4, we detail the results of this review, and make a short conclusion in section 5.

2. Agricultural insurance in Africa: an overview

Agricultural insurance has been present in some African countries since the early 20th century (Burger, Reference Burger1939; Adesimi and Alli, Reference Adesimi and Alli1980; Alli, Reference Alli1980; Atlas Magazine, 2017), however, the market remains very small. As of 2008, four out of 47 countries in the region had a functioning agricultural insurance program and an additional six were implementing pilot projects (Mahul and Stutley, Reference Mahul and Stutley2010). The last decade has observed gradual improvement ranging from agriculture micro-insurance (Di Marcantonio and Kayitakire, Reference Di Marcantonio, Kayitakire, Tiepolo, Pezzoli and Tarchiani2017) with several countries piloting index insurance (Sandmark et al., Reference Sandmark, Debar and Tatin-Jaleran2013). Hess and Hazell (Reference Hess and Hazell2016) found that about 653,000 farmers had some form of insurance coverage and our updated program coverage suggests over 2 million smallholder farmers have insurance in Africa (see table A1, online appendix). At the continental level, the African Risk Capacity (ARC), set up in 2012, has facilitated the entry of countries into regional risk pools (Vincent et al., Reference Vincent, Besson, Cull and Menzel2018). Currently, the ARC comprises 34 member states of which 11 took part in the 2019–2020 risk pool (see table A2, online appendix). While countries’ participation has increased, there is a need for more political support. In 2016, both Kenya and Malawi dropped out of the risk pool due to internal politics and have not been able to re-join ever since (Hohl, Reference Hohl2019). Moreover, for the risk pool to be more effective, more countries need to enrol. In general, while agricultural insurance in Africa has grown, coverage is still very small especially in comparison to other regions and the number of smallholder farmers and pastoralists in the region. While several countries have started pilot programmes and a few like Zambia are scaling up, climate shocks tend to be cross-country and covariate in nature; hence the necessity for regional and continental risk pools remains critical.

3. Literature search methodology

We searched literature from Scopus and Web of Science covering the period up to September 2020. In the online appendix, we provide a detailed search process showing all variations of search terms used. In addition, we included grey literature from organisations known to work on agricultural insurance. These were the World Bank, the International Fund for Agriculture and Development, the International Food Policy Research Institute, the United Nations Institute for Environment and Human Security, and the Feed the Future Innovation Lab for Markets, Risk and Resilience of the University of California, Davis. All our literature is in English. We included both qualitative and quantitative studies.

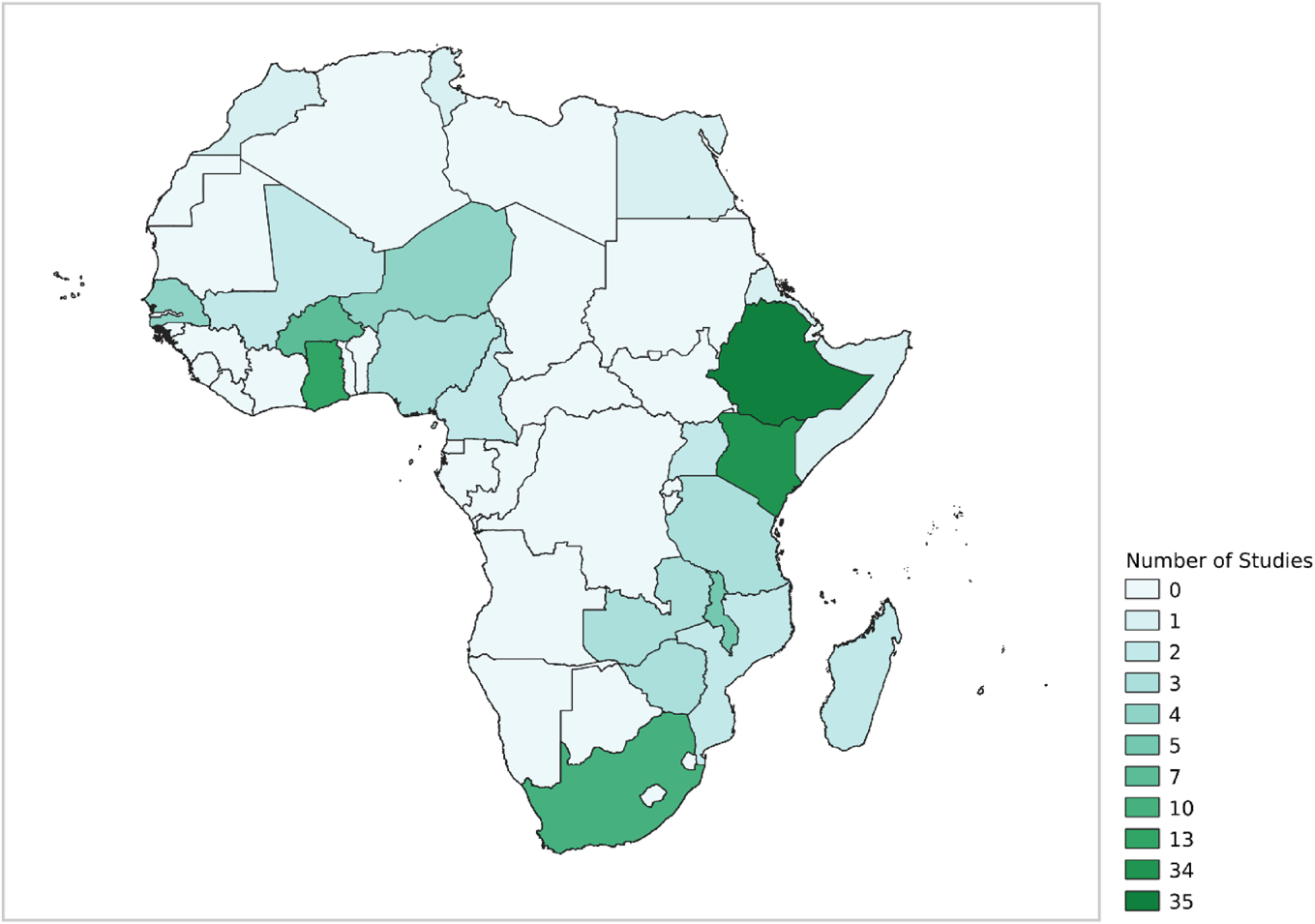

Starting with 687 documents, we selected 120 documents for final full-text review. The literature selected included qualitative, quantitative empirical studies as well as simulation studies. The majority of the literature (80/120 papers) was from the period 2016–2020, further underlining our effort to cover the most recent evidence. The studies reviewed were from 23 countries across the continent with 58 per cent from Ethiopia and Kenya, mainly from the evaluations of the Index-Based Livestock Insurance programmes. Whereas Zambia had the highest insurance coverage, only three studies were from the country. Figure 1 shows the distribution of the studies reviewed by country. Details of the inclusion criteria, studies reviewed by their research methodology, as well as the summary of their time coverage can be found in online appendix figures A1–A3, respectively.

Figure 1. Coverage of studies reviewed by country.

Source: Authors.

4. Results

4.1 Product quality

Agricultural insurance has come under scrutiny on how valuable it is to smallholder farmers in developing countries (Binswanger-Mkhize, Reference Binswanger-Mkhize2012). A key concern is that insurance products are often of poor quality and their acquisition can lead to worse outcomes than without them (Clarke, Reference Clarke2016). One aspect of poor product quality is the level of basis risk, which refers to the probability that insurance does not cover an insurance-holding farmer when they experience the insured shock because the level of the insurance threshold (often an index) is imperfectly correlated with losses incurred. Both simulations (Elabed et al., Reference Elabed, Bellemare, Carter and Guirkinger2013) and empirical studies (Hill et al., Reference Hill, Hoddinott and Kumar2013; Jensen et al., Reference Jensen, Mude and Barrett2018, Reference Jensen, Stoeffler, Fava, Vrieling, Atzberger and Meroni2019) have shown that when basis risk is higher, farmers are less likely to purchase insurance. There are three categories of basis risk. The first is the geographical/spatial basis risk (Jensen et al., Reference Jensen, Mude and Barrett2018), which measures the distance from a farmer's plot to the measurement point. The second is design basis risk which emanates from the models and variables used to construct an index (Elabed et al., Reference Elabed, Bellemare, Carter and Guirkinger2013; Jensen et al., Reference Jensen, Stoeffler, Fava, Vrieling, Atzberger and Meroni2019). The third is temporal basis risk which is related to the timeframe in which the index is measured (Díaz Nieto et al., Reference Díaz Nieto, Cook, Läderach, Myles and Jones2010). Simulation studies in Cameroon and Niger have indicated that basis risk might be as high as 50 per cent in most indices (Leblois et al., Reference Leblois, Quirion, Alhassane and Traoré2014a, Reference Leblois, Quirion and Sultan2014b), implying that there is a 50 per cent chance that an insured farmer's risk might not be covered by their insurance due to such poor correlation. To this farmer, purchasing insurance with substantial basis risk might not only introduce a loss of income (in paid premiums) but also leave her in a worse off situation since it also limits her alternative options (Barré et al., Reference Barré, Stoeffler and Carter2016; Clarke, Reference Clarke2016; Jensen et al., Reference Jensen, Barrett and Mude2016). To providers, there are reputation risks to contend with (Morsink et al., Reference Morsink, Clarke and Mapfumo2016; Reeves, Reference Reeves2017) further limiting their future market. Spatial basis risk is the most pronounced of the three categories. For instance, in some studies, increasing distance from the farmer's plot to the weather station reduced demand by up to 20 per cent (Hill et al., Reference Hill, Hoddinott and Kumar2013; Amare et al., Reference Amare, Simane, Nyangaga, De, Hamza and Gurmessa2019). Spatial basis risk is also linked to adverse selection, where some farmers might know local agro-climatic and agro-ecological conditions likely to affect the cropping or livestock outcomes, which may be unknown to the insurance provider. Jensen et al. (Reference Jensen, Mude and Barrett2018) found that households in locations that had higher average losses and those in locations that had less basis risk had higher insurance demand than the rest. The reverse can also hold, that households not enrolling in insurance are also aware of their disadvantageous locations. Moreover, it is not just the presence of basis risk but also the perception of its presence that influences farmers (Castellani, Reference Castellani2015; Chantarat et al., Reference Chantarat, Mude, Barrett and Turvey2017). These perceptions might be shaped by local geographies, which might not be considered during the construction of the index insurance product. Basis risk might also arise from random idiosyncratic shocks due to random variation in, for instance, rainfall. Evidence from northern Kenya showed the existence of these idiosyncratic shocks in villages covered by insurance which, even after insurance coverage, left insurance holders with 69 per cent of their original risk exposure due to basis risk (Jensen et al., Reference Jensen, Barrett and Mude2016).

Basis risk can be reduced through several strategies. First, Morsink et al. (Reference Morsink, Clarke and Mapfumo2016) suggest that products can cover all possible losses related to the peril which the insurance product covers as opposed to a single dimension of losses. They call this strategy insured peril basis risk. Secondly, insurance might cover losses from agricultural production that might not be caused by the insured peril (production smoothing basis risk). To capture the entirety of insured peril basis risk, insurance product development might consider using multiple sources and types of data to better explain both the production risk and multiple dimensions of possible losses (Wang et al., Reference Wang, Karuaihe, Young and Zhang2013). While indices have always been constructed by single variables such as remotely sensed vegetation or rainfall or temperature data (Hochrainer-Stigler et al., Reference Hochrainer-Stigler, Van Der Velde, Fritz and Pflug2014; Vrieling et al., Reference Vrieling, Meroni, Shee, Mude, Woodard, de Bie and Rembold2014; De Oto et al., Reference De Oto, Vrieling, Fava and De Bie2019), more recently, new variables such as soil moisture have shown promise in indices (Enenkel et al., Reference Enenkel, Osgood, Powell, Petropoulos and Islam2017, Reference Enenkel, Osgood, Anderson, Powell, McCarty, Neigh, Carroll, Wooten, Husak, Hain and Brown2019; Von Negenborn et al., Reference Von Negenborn, Weber and Musshoff2018). Comparing index insurance based on a rainfall index and an evapotranspiration index, Von Negenborn et al. (Reference Von Negenborn, Weber and Musshoff2018) found that the rainfall-based index underestimates the effect of weather on the risk of repaying agricultural credit, especially during harvest months. The evapotranspiration-based index was, on the other, hand more precise in accounting for the spikes in weather on credit risk. Rainfall-based weather insurance had more basis risk than the evapotranspiration-based index. Enenkel et al. (Reference Enenkel, Osgood, Powell, Petropoulos and Islam2017) assessed the benefit of using soil moisture data and found that it had a higher agreement with vegetation anomalies than conventional rainfall data, implying that soil moisture data has the potential of reducing basis risk. However, it is important for insurance providers to consider both precision and time lags. Depending on the indices used, some products are likely to be more asset replacing while others are more asset protecting (Jensen et al., Reference Jensen, Stoeffler, Fava, Vrieling, Atzberger and Meroni2019). Some suitable products might be more costly while more precise (low basis risk) products might have more time lags and delays to trigger. Timeliness of products might depend on the amount of monitoring for which costs can be prohibitive to providers. More recently, picture-based crop monitoring offers promise. First tested and implemented in India (Ceballos et al., Reference Ceballos, Kramer and Robles2019; Hufkens et al., Reference Hufkens, Melaas, Mann, Foster, Ceballos, Robles and Kramer2019), it is currently being tested in Ethiopia (Porter et al., Reference Porter, Kramer, Assefa and Abzhamilova2020) and Kenya (ACRE Africa, 2020). Picture-based monitoring reduces the costs of monitoring while leveraging farmer participation and increasing their motivation and still providing real-time evidence of crop health to assess losses and triggering pay-outs.

These innovations, while promising, have drawbacks and should be carefully considered. For instance, remotely sensed data collection for variables such as evapotranspiration or soil moisture, is expensive in acquisition and processing (Coleman et al., Reference Coleman, Dick, Gilliams, Piccard, Rispoli and Stoppa2017). Secondly, the success of these innovations depends on the level of technology diffusion in rural SSA. For instance, while picture-based insurance contracts are based on farmers’ access to smartphones and the internet, overall internet adoption in Ethiopia is only per cent, according to the World Bank's World Development Indicators, and most likely much lower in rural communities. Moreover, low internet adoption and high internet costs introduce additional costs to farmers, which might wade off prospective demand. Technologies based on such platforms might therefore struggle to be adopted.

4.2 Product and contract design

A second major reason hampering agricultural insurance take-up in Africa is product design. By product design, we imply four main issues: (1) the spatial or geographic scale of coverage, (2) product item coverage, (3) timing of index triggers, and (4) insurance provided alongside other services (bundling).

4.2.1 Spatial coverage of insurance policies

Conventional insurance products are single-scale products with one trigger set at a certain spatial scale (Elabed et al., Reference Elabed, Bellemare, Carter and Guirkinger2013). For these, basis risk arises from both the random or systematic idiosyncratic risk as well as the design risk at the spatial scale of coverage. Because of higher basis risk from such contracts, farmers are less likely to purchase such insurance, especially those with more local agro-ecological information than insurance providers (Jensen et al., Reference Jensen, Mude and Barrett2018). Accordingly, design risk can be reduced by implementing multiple-trigger contracts where the index is not assessed on one scale but rather on more than one scale (Elabed et al., Reference Elabed, Bellemare, Carter and Guirkinger2013). In an experiment with Malian cotton farmers, Elabed et al. (Reference Elabed, Bellemare, Carter and Guirkinger2013) found that demand for a two-trigger or two-scale insurance contract was about 40 per cent higher than the conventional single trigger contract. They found that the multi-scale insurance contract reduced both false negatives, where an individual whose yield was below the average and he/she did not receive insurance payout (basis risk), and false positives, where an individual whose yield was above the average still received an insurance payout. One example of a multi-scale insurance product is an area-yield insurance product in Tanzania that introduces a conditional audit (Flatnes et al., Reference Flatnes, Carter and Mercovich2018). The authors compared a satellite-based index insurance contract and another contract that incorporated an audit requested by farmers if basis risk reached a certain threshold. Flatnes et al. (Reference Flatnes, Carter and Mercovich2018) found that willingness to pay an audit-incorporated contract was 64 per cent higher than the non-audit contract. This implies that a reduction in basis risk from better measurement and allowing farmer grievance management increases trust in products and demand.

4.2.2 Product item coverage profile

The product item coverage profile is another dimension of product design. Here, we imply a basic assessment of how many perils and how many crops the insurance product covers. Conventional insurance products cover a specific crop that is faced with one particular peril. However, farmers are not only faced with various covariate and idiosyncratic shocks but also grow multiple crops in a single growing season. Crop specific insurance products might, therefore, not be appropriate for such farmers. For instance, Berg et al. (Reference Berg, Quirion and Sultan2009), using simulated insurance contracts based on 20 years of production across five crops, found that farmers cropping maize and groundnuts were more protected compared to those growing millet, sorghum or cotton. Siebert (Reference Siebert2016) showed the necessity of using two different indices to cover millet and rice across similar climatic regions because of the negative correlation in the shocks affecting both crops. Therefore, in such cases where the incentives for the provision of single index-based insurance products are not conducive, providers might devise multi-crop and multi-peril insurance products with one or two ‘leading’ crops and additional ‘secondary crops’. Recent evidence shows farmers value multi-crop, multi-peril insurance products highly (Bulte et al., Reference Bulte, Cecchi, Lensink, Marr and van Asseldonk2019) though there is need for more research to assess the willingness to pay for such products versus the common single crop, single peril insurance products.

4.2.3 Trigger period

The other dimension of product design is the time of the trigger. For any kind of insurance, coverage happens at the onset of a shock, i.e., when an individual falls sick – for health insurance; when an automotive accident happens – for motor insurance; or when one losses employment – for employment insurance; and so forth. Basic agricultural insurance operates along similar lines: payoff occurs after the shock has been experienced. However, the difference between agricultural insurance is that shocks can be predicted with more confidence than with other kinds of insurance. When the possibility of shocks is known, what matters more is if the insurance can prevent the effects of the shock and if it can provide the insured with other options of production and consumption smoothing. Farmers and livestock owners are, therefore, likely to demand insurance based on how much it provides this protection.

Recent evidence suggests that insurance participation reduced herd offtake behaviour (selling of livestock) as pastoralists were less fearful and more confident that losses would be covered (Gebrekidan et al., Reference Gebrekidan, Guo, Bi, Wang, Zhang, Wang and Lyu2019). However, the prevention of losses is more important than the losses being covered. This is, therefore, a matter of how much loss insurance covers and how frequent the payments can be made to allow farmers to exercise protective options. Karlan et al. (Reference Karlan, Osei, Osei-Akoto and Udry2014) suggested that experimenting with small losses and higher frequency payouts could improve demand. Norton et al. (Reference Norton, Osgood, Madajewicz, Holthaus, Peterson and Diro2014) showed that farmers preferred high-frequency insurance when such products were on offer. By pointing at the benefits such as insuring high probability-small loss events (which are usually self-insured), farmers might find such products attractive (Norton et al., Reference Norton, Osgood, Madajewicz, Holthaus, Peterson and Diro2014). In addition to the frequency of payouts, their timing also matters. Optimising remote sensing data for instance and providing earlier payouts could allow vulnerable farmers to utilise mitigation strategies such as alternative forage sources for livestock (Vrieling et al., Reference Vrieling, Meroni, Mude, Chantarat, Ummenhofer and de Bie2016) or access to food to prevent farmers from falling below the minimum food requirements (Hochrainer-Stigler et al., Reference Hochrainer-Stigler, Van Der Velde, Fritz and Pflug2014). Vrieling et al. (Reference Vrieling, Meroni, Mude, Chantarat, Ummenhofer and de Bie2016) showed that payouts made between one to three months before the onset of the drought would give farmers more time to optimise protective alternatives.

Jensen et al. (Reference Jensen, Stoeffler, Fava, Vrieling, Atzberger and Meroni2019) also showed that the insurance product with a one-month early payment supported 91 per cent of the pastoralists compared to one with a one-month late payment, which was helpful to only 68 per cent of the households. However, such early-payment policies might have higher unaffordable premiums as Jensen et al. (Reference Jensen, Stoeffler, Fava, Vrieling, Atzberger and Meroni2019) further showed. In their study, the early-payment contract product would cover only 46 per cent of households if the premium loading were 50 per cent and almost none of the households if the loading were 100 per cent. Moreover, insurance products with high-frequency payments also increase provider transaction costs. Therefore, it is important to consider the desire for more attractive products alongside their related costs.

4.2.4 Bundling insurance with other services

Agricultural insurance can be combined with other products or services. Carter et al. (Reference Carter, Cheng and Sarris2016) made a theoretical case for combining insurance with other services such as credit (often referred to as bundling), suggesting it as one of the ways to make insurance popular. Insurance can be combined with credit services (Giné and Yang, Reference Giné and Yang2009; Meyer et al., Reference Meyer, Hazell and Varangis2018; Ahmed et al., Reference Ahmed, McIntosh and Sarris2020) or inputs such as drought-tolerant seeds, high yielding seeds or fertilisers (Leblois et al., Reference Leblois, Quirion and Sultan2014b; Lybbert and Carter, Reference Lybbert, Carter, Balisacan, Chakravorty and Ravago2015; Awondo et al., Reference Awondo, Kostandini and Erenstein2020; Visser et al., Reference Visser, Jumare and Brick2020). The basic idea is that farmers might be more enticed to purchase insurance if they get more services through one contract. It is also easier for providers to deliver multiple services without increasing their administrative and transaction costs, thereby lowering the unit costs for a single product. Another attraction to bundling insurance with credit is that farmers would generally pay insurance premiums off their credit and therefore do not have to pay cash up front, hence relaxing their budget stress. Karlan et al. (Reference Karlan, Osei, Osei-Akoto and Udry2014) showed that after removing credit constraints by providing a cash grant, insurance demand increased by 40–50 per cent in Ghana. Programmes delivering insurance by bundling it with other services seem to be the ones able to achieve some scale. The Zambia Farmer Input Support Programme offers an example of bundling insurance with inputs. Under this programme, farmers pay premiums when receiving inputs from a government programme. In case of triggers, the insurance companies (through the Ministry of Agriculture) pay farmers through e-vouchers to secure inputs for a new cropping season. The programme covered more than 900,000 farmers in the 2017/18 Zambian financial year (World Bank, 2019). Similarly, the second largest insurance programme in the region, ACRE Africa, currently providing coverage to over 313,000 farmers, works with input service providers under One Acre Fund, a farm inputs and credit providing organisation (Hess and Hazell, Reference Hess and Hazell2016).

There are, however, certain caveats to bundling insurance with other services. The first is that farmers generally prefer to have freedom in deciding which products and services to purchase and not to be forced to take products that they do not want, and products that might be inadequate for them later. In one of the major studies on agricultural insurance in SSA, Giné and Yang (Reference Giné and Yang2009) found that farmers who were offered loans with insurance for high yielding groundnuts had a 13 percentage point lower insurance demand compared to those with simple credit without insurance. Unlocking credit constraints alone increased demand for insurance while packaging credit with insurance might have given farmers fewer choices. Gallenstein et al. (Reference Gallenstein, Mishra, Sam and Miranda2019) arrived at a closely similar conclusion through a willingness to pay experiment in Ghana. They found that compelling farmers to purchase index insurance as they took out an agricultural loan generally lowered loan demand because it generally increased the cost of the loan when the insurance premium was included. Loan demand was 75 per cent compared to 54 per cent for a loan with insurance. Finally, regarding bundling with other technologies such as high yielding or drought-tolerant seeds, farmers need to have a good understanding of these technologies available as they might have different levels of benefits. Testing bundling across 19 improved maize varieties with insurance in 49 locations in Eastern and Southern Africa, Awondo et al. (Reference Awondo, Kostandini and Erenstein2020) found a high variation in the performance of different combinations such that farmers were highly likely to select a sub-optimal combination. Awondo et al. (Reference Awondo, Kostandini and Erenstein2020)'s simulations indicate that bundling has to be a very precise activity across regions with both providers and farmers choosing the best combination of systematic bundling, especially where more than one product is available. It is, therefore, important that bundling be considered carefully, as it might not solve all challenges.

4.3 Income and affordability

A major challenge with bolstering demand for agricultural insurance is farmers’ budget constraints. The prospective market for insurance is therefore divided into those with higher incomes demanding more insurance and those with lower incomes who cannot afford it (Hill et al., Reference Hill, Hoddinott and Kumar2013; Karlan et al., Reference Karlan, Osei, Osei-Akoto and Udry2014; Bogale, Reference Bogale2015; Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016; Tadesse et al., Reference Tadesse, Alfnes, Erenstein and Holden2017; Bishu et al., Reference Bishu, Lahiff, O'Reilly and Gebregziabher2018; Fonta et al., Reference Fonta, Sanfo, Kedir and Thiam2018; Janzen and Carter, Reference Janzen and Carter2019). Moreover, weather shocks in previous periods reduce farmers’ future income and demand. Conventionally, as farmers’ incomes improve, so does their demand for insurance. Agriculture income is, in particular, predictive of insurance demand (Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016; Abugri et al., Reference Abugri, Amikuzuno and Daadi2017; Bageant and Barrett, Reference Bageant and Barrett2017). However, as households’ incomes improve, so does the likelihood to move out of agriculture and therefore income diversification tends to dampen demand (Bogale, Reference Bogale2015). To increase demand, we highlight two avenues below that might increase demand through income-based interventions.

4.3.1 Demand subsidies

Demand can be induced through discounts and demand subsidies (Mcintosh et al., Reference McIntosh, Sarris and Papadopoulos2013; Giné et al., Reference Giné, Karlan, Ngatia, Lundberg and Mulaj2014; Karlan et al., Reference Karlan, Osei, Osei-Akoto and Udry2014; Tadesse et al., Reference Tadesse, Alfnes, Erenstein and Holden2017; Bulte et al., Reference Bulte, Cecchi, Lensink, Marr and van Asseldonk2019; Janzen and Carter, Reference Janzen and Carter2019; Matsuda et al., Reference Matsuda, Takahashi and Ikegami2019; Ahmed et al., Reference Ahmed, McIntosh and Sarris2020; Stoeffler et al., Reference Stoeffler, Carter, Gelade and Guirkinger2020). A third party such as the government would then pay the remainder of the premium. Moreover, discounts and subsidies might work in favour of politicians who make policy (Hazell et al., Reference Hazell, Sberro-Kessler and Varangis2017). Also, subsidies might lower the costs of insurance and overall costs of social protection as households participate in its financing (Janzen et al., Reference Janzen, Carter and Ikegami2020). Recipient households contribute to social protection financing but also reduce their future social protection needs if they are more protected.

However, two crucial issues remain of concern regarding demand subsidies. The first concerns the sustainability of subsidies and the eventual demand when subsidies end. There is limited evidence on this but one study in Ethiopia provides some useful information. Takahashi et al. (Reference Takahashi, Ikegami, Sheahan and Barrett2016) found that demand was not affected when subsidies ended. They found that households that purchased insurance after receiving a discount voucher in the first year did not change their demand behaviour in the subsequent year when discounts were lifted, as learning effects after purchasing insurance dominated price anchoring effects. The second issue is whether subsidies are the best use of public resources in comparison to alternative social protection mechanisms such as cash transfers or input support. With limited resources, policymakers have to choose the most effective instruments. Evidence on which instruments have better returns for farmers is mixed. In a simulation study, Ricome et al. (Reference Ricome, Affholder, Gérard, Muller, Poeydebat, Quirion and Sall2017) compared insurance subsidies with reducing the cost of credit, subsidising fertilisers or offering cash transfers. They found that insurance subsidies brought the least utility and lowest certainty equivalent income in smallholder groundnut farmers in Senegal in comparison to any kind of credit, fertilisers or cash transfers. In an assessment of farmer preferences, Marenya et al. (Reference Marenya, Smith and Nkonya2014) found that Malawian smallholder farmers reduced demand for crop index insurance when they were offered a slightly higher cash benefit, showing a preference for cash transfers. Mahul and Stutley (Reference Mahul and Stutley2010) also warned that premium subsidies might be inefficient and increasingly expensive for governments, especially given that once started, it is not easy to roll them back.

However, simply choosing between cash and insurance might reveal immediacy biases rather than effective long-term protection and poverty reduction potential (Delavallade et al., Reference Delavallade, Dizon, Hill and Petraud2015). The evidence indicates that while farmers might prefer cash, agricultural insurance provides better opportunities for long-term poverty reduction and disaster management. In a simulation study, Carter and Janzen (Reference Carter and Janzen2018) showed that enabling farmers to be insured dominated other social protection instruments such as cash transfers. By testing a multi-generational household model of consumption, accumulation and risk management, they found that a 50 per cent increase in premium subsidies propped up insurance and slowed both the poverty rate and poverty depth, leading to a 20 per cent increase in GDP growth. Jensen et al. (Reference Jensen, Barrett and Mude2017a, Reference Jensen, Ikegami and Mude2007b) also found that subsidy-supported insurance was overall more poverty averting compared to cash transfers. While cash transfers improved short-term health measures, insurance increased investments in productive assets, reduced livestock sales and increased adult-equivalent income (Jensen et al., Reference Jensen, Barrett and Mude2017a, Reference Jensen, Ikegami and Mude2017b). Finally, Janzen et al. (Reference Janzen, Carter and Ikegami2020), in another simulation study spanning over 50 years of data in Kenya and Ethiopia, showed that insurance not only had higher vulnerability reduction potential but also brought additional investment incentive potential. They found that with insurance, farmers could contribute to their social protection, hence reducing the overall costs of protection and reaching wider coverage. The study further revealed that without insurance, asset poverty increased by 50 per cent while with insurance it decreased by 42 per cent. A further 10 per cent of poverty reduction came from unlocking resources for farm investments. These studies show that higher adoption of agricultural insurance can help economies move from reactive social protection policies to more proactive policies and hence achieve more poverty reduction.

However, some insurance types, such as livestock insurance, seem to protect a section of households that are better off (Chantarat et al., Reference Chantarat, Mude, Barrett and Turvey2017; Ricome et al., Reference Ricome, Affholder, Gérard, Muller, Poeydebat, Quirion and Sall2017; Janzen and Carter, Reference Janzen and Carter2019). Chantarat et al. (Reference Chantarat, Mude, Barrett and Turvey2017) and Janzen and Carter (Reference Janzen and Carter2019) showed that effective coverage for livestock index insurance was between 10 and 15 total livestock units. The majority of rural households do not have as much livestock as these thresholds suggest. There is, therefore, room for other social protection instruments for various sub-groups. As Janzen et al. (Reference Janzen, Jensen and Mude2016) showed, poorer households receiving cash transfers retained and accumulated assets faster, while non-poor households with insurance protected and invested in their livestock more. Governments and insurance providers, therefore, need to think more about equity (Fisher et al., Reference Fisher, Hellin, Greatrex and Jensen2019) and consider insurance alongside other instruments so that insurance does not breed inequality.

4.3.2 Flexible payment mechanisms

Alternatively, insurance providers can offer flexible premium payment mechanisms, which relax budget limitations without affecting premiums. We highlight two of these, namely: (1) flexible time of payment, and (2) labour-based payments. In conventional insurance of all kinds, premiums are paid before coverage begins. For rural farming households, agricultural insurance premiums would have to be paid before the cropping season. However, at such times, smallholder farmers’ budgets are limited due to other necessary expenditures such as farm inputs and extension services. Insurance ends up being at the bottom of their priorities list (Binswanger-Mkhize, Reference Binswanger-Mkhize2012). One avenue of easing farmer budgets is by making flexible the time of payment. Casaburi and Willis (Reference Casaburi and Willis2018) tested a pay-at-harvest insurance product with smallholder sugarcane contract growers in Kenya. In their experiment, they found first that farmers demanded less insurance at the beginning of the season, not due to liquidity challenges but because paying upfront was not marginal appropriate for their expected return. Secondly, when farmers had the option of paying premiums after harvest, demand increased from 5 per cent in the pay-up-front option to 72 per cent in pay-at-harvest option. In a related study in Ethiopia, Belissa et al. (Reference Belissa, Bulte, Cecchi, Gangopadhyay and Lensink2019) found that when farmers had a pay-at-harvest option, demand increased from 8 per cent to 24 per cent. However, the main challenge with pay-at-harvest insurance products might be contract enforcement as default rates might be high. Contract enforcement might not have been an issue in the Casaburi and Willis (Reference Casaburi and Willis2018) study because they worked with contract farmers. These do not represent the average rural farmer. It is therefore essential for providers to consider default and contract enforcement for average smallholders.

Another budget relaxing payment mechanism is labour-based payments linked with other social protection programmes (Tadesse et al., Reference Tadesse, Alfnes, Erenstein and Holden2017; Vasilaky et al., Reference Vasilaky, Diro, Norton, McCarney and Osgood2019). An integral component of such social protection programmes is public works, where individuals are paid for a specific number of public works. Two studies evaluated the possibility of farmers paying premiums with their labour. Tadesse et al. (Reference Tadesse, Alfnes, Erenstein and Holden2017) conducted a willingness to pay for agricultural insurance in Ethiopia and found that individuals were more willing to work in return for insurance, even at lower daily wage equivalents than the conventional cash-for-work programmes. They find that 60 per cent of the farmers would pay insurance using their labour. In another study, Vasilaky et al. (Reference Vasilaky, Diro, Norton, McCarney and Osgood2019) used experimental games and offered real commercial insurance after the game. First, they find that participating in the Productive Safety-Net Programme (PSNP) increased insurance purchase by up to 19 percentage points. They then compared between cash-paying and labour-paying sub-samples. They found that while the effect of experimental games on purchasing insurance with cash increased insurance purchases by 10 per cent, it increased purchases by 17 per cent in households that paid insurance with labour. They further found that total insurance purchased was higher for labour-paying households compared to cash-paying households. From these two studies in Ethiopia, it seems convincing that linking agricultural insurance with other social protection programmes, in particular public works programmes, could achieve higher gains in encouraging more rural households to purchase insurance. However, the complementarity of insurance and other social protection mechanisms is not always guaranteed. Households enrolled in other social protection programmes might demand insurance less if they consider that current programmes provide sufficient insurance (Duru, Reference Duru2016).

Finally, there is the role of Information and Communications Technologies (ICTs) in enabling farmers to utilise payment platforms. Insurance companies are often thin on the ground and not able to reach most locations where farmers are located. Moreover, agricultural factor markets in SSA are grossly lacking in that most services are urban biased (Dillon and Barrett, Reference Dillon and Barrett2017; Allen IV, Reference Allen2018). Lack of well-functioning agricultural factor markets makes distribution expensive and prohibitive. However, ICTs help to bridge the gap of financial intermediation between suppliers and consumers by providing the last mile payment service. In other types of insurance such as health insurance, utilising the opportunities of mobile payment systems has enabled massive enrolment through mobile-based insurance payments (Wasunna and Frydrych, Reference Wasunna and Frydrych2017). However, agricultural insurance is still lagging. Of the 31 million mobile-based insurance policies worldwide that were issued by June 2015, only 7 per cent were for agricultural insurance (GSMA, 2015). However, some opportunities will require full leveraging. For instance, all insurance policies by ACRE Africa in Kenya, Tanzania and Rwanda are provided over mobile-based payment services. Other smaller initiatives have been registered in several countries, and mobile payment could provide options to suppliers. However, the cost of internet services and mobile-based payment service taxes and costs remain high in many countries. Removing or decreasing some of the costs of using these platforms might make it simpler for rural farmers to adopt such technologies.

4.4 Education, knowledge and information

Most rural farmers are not only illiterate but also unaware of new technologies such as insurance. An assessment in Ethiopia found that 49 per cent had never heard of insurance, 41 per cent did not know how it worked, and 25 per cent did not know where to find it (World Bank, 2018). More educated farmers and pastoralists portray higher demand and the less educated portray lower demand (Giné and Yang, Reference Giné and Yang2009; Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009; Hill et al., Reference Hill, Hoddinott and Kumar2013; Bogale, Reference Bogale2015; Okoffo et al., Reference Okoffo, Denkyirah, Adu and Fosu-Mensah2016; Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016; Abugri et al., Reference Abugri, Amikuzuno and Daadi2017; Bishu et al., Reference Bishu, Lahiff, O'Reilly and Gebregziabher2018; Fonta et al., Reference Fonta, Sanfo, Kedir and Thiam2018; Amare et al., Reference Amare, Simane, Nyangaga, De, Hamza and Gurmessa2019; Janzen and Carter, Reference Janzen and Carter2019; Vasilaky et al., Reference Vasilaky, Diro, Norton, McCarney and Osgood2019). Literacy is not only important in order to know about insurance but also to correctly understand insurance contracts. When farmers are not able to understand concepts like basis risk, demand remains low (Stoeffler and Opuz, Reference Stoeffler and Opuz2020). Education and information tend to run concurrently. While insurance providers might not change the literacy skills of the farmers, they can provide more information. The evidence shows that where information has been provided, farmers and pastoralists increase their understanding of insurance as well as demand (Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009; Lybbert et al., Reference Lybbert, Galarza, McPeak, Barrett, Boucher and Carter2010; McPeak et al., Reference McPeak, Chantarat and Mude2010; Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016; Belissa et al., Reference Belissa, Bulte, Cecchi, Gangopadhyay and Lensink2019; Vasilaky et al., Reference Vasilaky, Diro, Norton, McCarney and Osgood2019; Ali et al., Reference Ali, Egbendewe, Abdoulaye and Sarpong2020a). Information might be provided through games (McPeak et al., Reference McPeak, Chantarat and Mude2010; Vasilaky et al., Reference Vasilaky, Diro, Norton, McCarney and Osgood2019), information brochures (Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016), or training sessions (Dercon et al., Reference Dercon, Hill, Clarke, Outes-Leon and Seyoum Taffesse2014). However, it is not merely information or literacy, but a better understanding of insurance concepts and underlying mechanisms that is is crucial. While farmers might know more about insurance, demand does not seem to improve with knowledge automatically (Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016). Exposure needs to be consistent to nudge demand. Previous experience also matters in that farmers who have previously insured are more informed and hence more likely to purchase insurance again (Karlan et al., Reference Karlan, Osei, Osei-Akoto and Udry2014; Castellani and Viganò, Reference Castellani and Viganò2017; Belissa et al., Reference Belissa, Bulte, Cecchi, Gangopadhyay and Lensink2019). Insurance providers could therefore invest in increasing insurance awareness through more marketing campaigns and training.

4.5 Behavioural and socio-cultural factors

Farmers and pastoralists are also influenced by behavioural, social and cultural factors in their decisions to purchase insurance. These factors are portrayed through risk perceptions, trust and, in some communities, cultural and religious beliefs play a role. We elaborate on these below.

4.5.1 Risk perceptions and attitudes

Generally, risk perception can be in three dimensions. (1) Risk aversion – where individuals have a concave utility function in that as risk increases, they are more likely to adopt risk mitigation mechanisms. (2) Risk neutrality – where individuals are indifferent to risk. (3) Risk loving – where individuals portray a convex utility function such that they increase risky ventures even when the possibility of loss is high. Risk-averse farmers are more likely to demand insurance more than risk-loving and risk-neutral farmers. Risk aversion in agricultural insurance can be categorised in two aspects. The first is risk aversion towards the probability of a weather shock happening and the farmers having losses. For this kind of risk aversion, insurance is always attractive (Outreville, Reference Outreville1998). An increase in risk aversion is associated with more insurance take-up (Belissa et al., Reference Belissa, Lensink and van Asseldonk2020; Haile et al., Reference Haile, Nillesen and Tirivayi2020b). Risk aversion is further informed by how individuals assess the probability of a shock happening. Previous shocks provide reference points on which to assess possible losses or losses averted (gains) from a future shock and therefore influence risk aversion (Lybbert et al., Reference Lybbert, Galarza, McPeak, Barrett, Boucher and Carter2010; Hill et al., Reference Hill, Hoddinott and Kumar2013; Karlan et al., Reference Karlan, Osei, Osei-Akoto and Udry2014; Bogale, Reference Bogale2015; Fonta et al., Reference Fonta, Sanfo, Kedir and Thiam2018; Janzen and Carter, Reference Janzen and Carter2019). For instance, previous shocks expressed in the units of tropical livestock units lost in the previous year was associated with an increase in demand for insurance (Janzen and Carter, Reference Janzen and Carter2019). Previous shocks can also alert individuals to undertake protective and precautionary actions including risk-averse behaviour and hence increase the likelihood of purchasing insurance (Clarke, Reference Clarke2016).

However, farmers might underestimate the probability of weather shocks and therefore demand less insurance (Abugri et al., Reference Abugri, Amikuzuno and Daadi2017; Dougherty et al., Reference Dougherty, Flatnes, Gallenstein, Miranda and Sam2019). When farmers underestimate the probability of several shocks and insurance failures such as basis risk, they develop compound risk aversion, which greatly affects demand as experimental evidence from Mali shows (Elabed et al., Reference Elabed, Bellemare, Carter and Guirkinger2013; Elabed and Carter, Reference Elabed and Carter2015). Compound risk aversion is related to ambiguity aversion. Ambiguity aversion occurs when farmers are not able to correctly interpret the value of new technologies such as agricultural insurance (Bryan, Reference Bryan2019). Evaluating experiments in Kenya and Malawi, Bryan (Reference Bryan2019) found that ambiguity averse farmers insured less. However, what seems to be important is not just risk aversion but how the insurance provider frames the narrative. While risk-averse farmers might demand less insurance, when the narrative is framed from a loss dimension, loss-averse farmers are more likely to purchase insurance (Visser et al., Reference Visser, Jumare and Brick2020) because they prefer the certainty of non-decreasing welfare with insurance (Serfilippi et al., Reference Serfilippi, Carter and Guirkinger2020). In an experiment in Burkina Faso, Serfilippi et al. (Reference Serfilippi, Carter and Guirkinger2020) found that when farmers were offered a premium rebate contract, where they received the equivalent of their premiums in a bad year, they demanded higher insurance than when the contract did not specify a rebate but rather conventional coverage. An additional 41 per cent willingness to pay emanated simply from this framing as farmers’ welfare would decrease less with premium rebate than with no rebates. An appropriate framing could overcome some component of risk aversion and attract demand.

4.5.2 Low trust

Distrust in insurance products and insurance providers reduces agricultural insurance demand among farmers and pastoralists pastoralists (Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009; Suarez and Linnerooth-Bayer, Reference Suarez and Linnerooth-Bayer2010; Karlan et al., Reference Karlan, Osei, Osei-Akoto and Udry2014; Tadesse et al., Reference Tadesse, Alfnes, Erenstein and Holden2017). Low trust is partly related to education and inadequate knowledge and information about formal insurance. Farmers are therefore not able to understand how new technologies such as insurance work (McPeak et al., Reference McPeak, Chantarat and Mude2010; Bryan, Reference Bryan2019). Farmers reveal distrust in: (1) the insurance product, (2) the insurance providers, (3) the technology on which insurance is based, and (4) interpersonal trust among individuals (Platteau et al., Reference Platteau, De Bock and Gelade2017). Lack of trust in the product can be improved if farmers receive better information about insurance (see section 4.4). Distrust in insurers might be related to three issues. First, insurers generally have a low presence in rural areas in SSA. Agricultural insurance is generally new and has not proliferated in rural areas. Rural farmers are less likely to trust institutions that they do not have a previous relationship with and do not know well. With this bottleneck, insurance providers could use channels of higher trust such as community-based groups. We expand on this issue in sub-section 4.5.5. Other channels might include well-known financial institutions, such as banks and microfinance organisations, and input retailers (World Bank, 2018) or farmer organisations (Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009). In some instances, farmers trust governments over commercial insurance companies (Tadesse et al., Reference Tadesse, Alfnes, Erenstein and Holden2017). In general, it can be very useful to leverage existing trusted institutions rather than starting new operations. It might also be useful if prospective providers conduct sufficient market research before they launch operations. Strategies to reduce basis risk can increase trust in indices.

4.5.3 Farmer participation

To increase insurance acceptability, farmer-driven product design should be fostered and prioritised, especially at early design stages (Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009; Greatrex et al., Reference Greatrex, Hansen, Garvin, Diro, Blakeley and Le Guen2015). Patt et al. (Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009) provided two examples of participation that increased trust. In Ethiopia, farmers and experts worked together using local materials to assemble historical rainfall distribution data of the area. Farmer provided information was found to highly correlate with historical meteorological data, and insurance experts, therefore, used it to calculate the monthly weights for rainfall in these areas. The second example was in Malawi where through farmer workshops, farmers participated in calculating the payout levels under different rainfall regimes, increasing both their understanding and building trust in the products. Leblois et al. (Reference Leblois, Quirion and Sultan2014b) gave another dimension of farmer participation. They compared an index constructed with a simulated cotton sowing date with that provided by the farmers, collected through a farmer association. They found that the index that used farmer-provided sowing date data was preferred and also reduced basis risk more than the simulation-based product. Indeed, in their example, it was easy to access this farmer provided data. However, it might be at a cost to insurance providers in the absence of such a farmer organisation that records this kind of data. The evolving picture-based insurance in Ethiopia (Porter et al., Reference Porter, Kramer, Assefa and Abzhamilova2020) and Kenya (ACRE Africa, 2020) improves farmer participation in monitoring and loss verification. It is, therefore, able to contribute to reducing basis risk as well as increasing farmer trust through their participation.

4.5.4 Cultural perceptions

We discuss culture in two dimensions: first, the general position of women in society and second, the influence of religion. While women comprise a very large demographic within farming households, their roles regarding decision making in agriculture investments are largely limited by restrictive cultural norms (Fisher and Carr, Reference Fisher and Carr2015; Perez et al., Reference Perez, Jones, Kristjanson, Cramer, Thornton, Förch and Barahona2015). Such barriers also permeate insurance adoption (Delavallade et al., Reference Delavallade, Dizon, Hill and Petraud2015; Abugri et al., Reference Abugri, Amikuzuno and Daadi2017; Born et al., Reference Born, Spillane and Murray2019) among others. Since women farmers are likely to be poorer than men farmers, their involvement in insurance is limited (Delavallade et al., Reference Delavallade, Dizon, Hill and Petraud2015; Abugri et al., Reference Abugri, Amikuzuno and Daadi2017; Fonta et al., Reference Fonta, Sanfo, Kedir and Thiam2018). Though in some cases there are no significant differences between women and men farmers regarding insurance adoption (Bageant and Barrett, Reference Bageant and Barrett2017), gendered data on the adoption of insurance is not broadly available (Born et al., Reference Born, Spillane and Murray2019), and this limits analysis of how women farmers are affected in agricultural insurance provision. Such data would be essential in tailoring insurance products to cater to any gender-disaggregated needs (Fletschner and Kenney, Reference Fletschner, Kenney, Quisumbing, Meinzen-Dick, Raney, Croppenstedt, Behrman and Peterman2014; Born et al., Reference Born, Spillane and Murray2019).

Regarding the influence of religion, individual beliefs might conflict with market-oriented technologies such as insurance. This issue has been observed in northern Kenya (Johnson et al., Reference Johnson, Wandera, Jensen and Banerjee2019) and Niger (Fava et al., Reference Fava, Upton, Banerjee, Taye and Mude2018), both predominantly Muslim regions. In Kenya, Johnson et al. (Reference Johnson, Wandera, Jensen and Banerjee2019) qualitatively detail the case of index-based livestock insurance in northern Kenya regarding expectations, aspirations and the challenges experienced. In their narrative, they show that some of the difficulties related to low sales emanated from the way predominantly Muslim communities viewed profit-making insurance products as not culturally and religiously permissible under the Sharia Law. To build more trust in insurance, a new provider that adhered to the cultural and religious preferences of the communities was introduced in the market (Banerjee et al., Reference Banerjee, Khalai, Galgallo and Mude2017; Johnson et al., Reference Johnson, Wandera, Jensen and Banerjee2019). The result was an increase in trust, retention of a higher number of local agents (Banerjee et al., Reference Banerjee, Khalai, Galgallo and Mude2017), expansion into other areas and insuring of greater numbers of livestock units (Johnson et al., Reference Johnson, Wandera, Jensen and Banerjee2019). Though the costs of operations remained high, and the model was costly (Banerjee et al., Reference Banerjee, Khalai, Galgallo and Mude2017), the positive effects on trust-building and expansion were clear. With this experience, the inception of index insurance in Niger was purposefully made sharia-compliant (Fava et al., Reference Fava, Upton, Banerjee, Taye and Mude2018). This suggests that insurance providers can, after learning, leverage such normatively hidden preferences such as religion and make their products popular and attractive. Moreover, insurance, being a financial product, would need to heed different norms that govern financial products across different regions.

4.5.5 Offering insurance to groups

On a theoretical level, De Janvry et al. (Reference De Janvry, Dequiedt and Sadoulet2014) offered several reasons why insurance provided through groups should be considered more. First, community-based informal social support and risk management organisations are very important in building trust. Social support groups are formed for social support in all kinds of idiosyncratic shocks to households and have gained prominence mainly for easing targeting difficulties due to their near-universal coverage community (Bold and Dercon, Reference Bold and Dercon2014). They, therefore, act as effective points of information dissemination and reduce the costs of reaching clients (Bhattamishra and Barrett, Reference Bhattamishra and Barrett2010).

Secondly, these institutions already have a good understanding of insurance since they already provide informal insurance under the basis of risk-sharing. Thirdly, the nature of their reciprocal relationships (Fafchamps, Reference Fafchamps, Benhabib, Bisin and Jackson2011) implies that trust levels in these organisations are generally high. Providers of agricultural insurance might find them appropriate platforms for introducing and distributing insurance (Trærup, Reference Trærup2012; Dercon et al., Reference Dercon, Hill, Clarke, Outes-Leon and Seyoum Taffesse2014; Belissa et al., Reference Belissa, Bulte, Cecchi, Gangopadhyay and Lensink2019). Because individuals trust groups in which they already have informal membership, they prefer group-based contracts to individual contracts (Hill et al., Reference Hill, Hoddinott and Kumar2013; Dercon et al., Reference Dercon, Hill, Clarke, Outes-Leon and Seyoum Taffesse2014; Sibiko et al., Reference Sibiko, Veettil and Qaim2018; Belissa et al., Reference Belissa, Bulte, Cecchi, Gangopadhyay and Lensink2019). Belissa et al. (Reference Belissa, Bulte, Cecchi, Gangopadhyay and Lensink2019) observed that in contrast to individual index insurance take-up of only 8 per cent, when farmers had the offer of insurance through their informal groups, take-up rates increased to 43 per cent. Some of the benefits of group-based insurance include cost-effectiveness in information transmission and the pre-existing experience of risk-sharing (Dercon et al., Reference Dercon, Hill, Clarke, Outes-Leon and Seyoum Taffesse2014). Finally, groups enhance community social capital that enables the flow of information. In Ghana, Karlan et al. (Reference Karlan, Osei, Osei-Akoto and Udry2014) found that farmers who knew a farmer who had been insured and received a payout were more likely to purchase insurance in forthcoming years. Therefore, farmers improve their trust in insurance by observing the experiences of other farmers in their networks.

Nonetheless, there are three important caveats to make in the encouragement of group-based contracts. The first is the complexity of making legally-binding agreements with informal groups. Informal groups do not have a legal framework in which they operate beyond the informal trust and norms of group members. In such cases, even when contracts with informal groups are preferred, providers cannot enter into contracts with them (Dercon et al., Reference Dercon, Hill, Clarke, Outes-Leon and Seyoum Taffesse2014). Providers offering group contracts would, therefore, have to make prudent decisions, including investing in contract monitoring at the individual level for each individual in a group.

Secondly, there might be fears that group contracts might promote moral hazard if farmers change their behaviour on issues such as farm investment. There is a need for more research to test these fears. One such research study is Bulte et al. (Reference Bulte, Cecchi, Lensink, Marr and van Asseldonk2019) who tested whether taking insurance made farmers invest less in their farms in Kenya. They did not find supporting evidence; instead they found that insured farmers invested more in their farms. Stoeffler et al. (Reference Stoeffler, Carter, Gelade and Guirkinger2020) arrived at a similar result in Burkina Faso, where they observed that enrolment in insurance encouraged intensive farm investments.

The third caveat, related to moral hazard, is the concerns of free riding and crowding out informal social insurance systems. The argument is that formal insurance, promoted and provided through informal groups, weakens informal mechanisms and hence crowds out existing informal social protection mechanisms. Though the evidence is mixed, free riding might not be ruled out (De Janvry et al., Reference De Janvry, Dequiedt and Sadoulet2014), and it has been observed in other insurance types (such as health insurance). Two recent studies both assessing crowding out due to index-based insurance in Ethiopia do not find confirmatory evidence (Matsuda et al., Reference Matsuda, Takahashi and Ikegami2019; Takahashi et al., Reference Takahashi, Barrett and Ikegami2019). While evidence of crowding out is still scarce, suppliers would need to closely monitor the behaviour of the insured and check that such innovations do not disrupt existing systems.

4.6 The role of governments

So far, this review has explored demand from farmers and supply from insurance providers. A key connection to complete the circle is the role of governments in both demand and supply dimensions. Meso- to macro-level factors might pose a challenge for a single insurance provider. Many providers require market regulation and policy oversight and governments can induce demand through various support strategies to farmers. In this section, we consider the role of governments in: (1) reducing the costs of delivering insurance through better market coordination, (2) providing both consumer and provider subsidies, and (3) developing and updating policies to suit an increasingly dynamic market.

4.6.1 Reducing the costs of delivering insurance

Whereas other kinds of insurance (such as health or motor insurance) have a concept of self-protection such as better use of preventive health services or more disciplined driving (which in turn might lower premiums), farmers do not have much leverage over the weather. Moreover, climate change increases the frequency and intensity of weather-related risks, and most shocks are covariate in nature. Agricultural insurance, therefore, becomes a high-frequency, high loss insurance type making it more complicated than other kinds of insurance.

The cost of commercially viable agricultural insurance is therefore high and prohibitive to both the provider and farmers. The costs of providing agricultural insurance can be subdivided into start-up costs, operational costs and transaction costs. Insurance companies are required to have sufficient reserve capital to ascertain meeting insurees’ claims when they arise. Providers also have to pay reinsurance costs to insure their losses too. For high loss events such as weather shocks, thresholds for reserve capital are high. The predictable losses increase the cost of reinsurance which is in turn transmitted to the consumers through increased premiums (Miranda and Mulangu, Reference Miranda and Mulangu2016). The second type of costs is related to operational costs associated with development, maintenance and monitoring of indices and insurance payoff thresholds. The infrastructure to acquire and process data needed for the indices can be expensive for single and small providers. For more precise insurance products, providers require more information, even up to plot-level data. The third dimension of costs is transaction costs. These include administrative costs incurred to reach the farmers and pastoralists, especially in remote areas. Where there is low demand, the costs of maintaining insurance company staff in remote areas are high (Johnson et al., Reference Johnson, Wandera, Jensen and Banerjee2019). A combination of all these costs puts insurance providers at risk (Meze-Hausken et al., Reference Meze-Hausken, Patt and Fritz2009). Insurance providers can ease some of the costs through better coordination mechanisms. For instance, many smaller micro-insurance providers can work in association and thus pool both human and capital resources together to afford some of the costs of market entry (Meze-Hausken et al., Reference Meze-Hausken, Patt and Fritz2009).

Governments can reduce costs through the provision of infrastructure. Infrastructure such as weather stations and their maintenance can be provided as public services. While these exist in many countries, their sparse distribution (Webster, Reference Webster2013; Parker, Reference Parker2015) suggests that governments need to invest more in this infrastructure to make weather services more affordable and available even for commercial use (Georgeson et al., Reference Georgeson, Maslin and Poessinouw2017). Governments can also provide risk layering and aggregation which is a process in which overall risk is classified across levels of severity to provide insurance and reinsurance services. Governments can then provide insurance and reinsurance services to providers involved in highest risk and high severity events across geographical spaces. There is no published example of these services in Africa to include in this review, however, the Mongolian Index-Based Livestock Insurance Programme (Rao et al., Reference Rao, Davi, D'Arrigo, Skees, Nachin and Leland2015) and the crop insurance programme in Tajikistan (Weber et al., Reference Weber, Fecke, Moeller and Musshoff2015) might provide some insights for Africa.Footnote 2 In Tajikistan, Weber et al. (Reference Weber, Fecke, Moeller and Musshoff2015) discuss insurance products designed with inter-regional and intra-regional risk aggregation and risk coverage scenarios to achieve risk reduction. In Mongolia, livestock losses are insured at three levels (Rao et al., Reference Rao, Davi, D'Arrigo, Skees, Nachin and Leland2015; Hohl, Reference Hohl2019: 299). At 6 per cent mortality, pastoralists are required to self-insure for this low risk. Between 6 and 30 per cent of mortality, insurance providers cover losses. At mortalities of more than 30 per cent, insurance providers are also adversely affected and unable to provide effective coverage. In turn, the Agricultural Reinsurance Company covers the losses of both the insurance provider and the pastoralists. In both cases, the government had a dominant role in providing meso-level insurance thus enabling insurance providers to function effectively. A comparable example from Africa is the ARC that provides drought risk pooling reinsurance to countries through its annual risk pools (Awondo, Reference Awondo2019). Similar to sub-regions in Tajikistan, Awondo (Reference Awondo2019) found that as more member countries join the ARC risk pool, the risk was better covered. Moreover, the buffer fund per country, required to cover extreme drought events, decreases as more countries participate, indicating strong benefits for risk pooling.

4.6.2 Subsidies and other public goods

Governments can also provide subsidies to make insurance affordable. Almost all agricultural insurance programmes in both high and low-income countries already have some form of subsidisation. The level of subsidies determines how much insurance is made affordable. Moreover, providing demand (premium) subsidies increases take-up rates and take-up does not decrease when subsidies end (see section 4.3.1). Mahul and Stutley (Reference Mahul and Stutley2010) suggested eight reasons why governments should support agricultural insurance programmes. These included systemic risk associated with agriculture risks; information asymmetries between providers and insurance seekers; weaknesses and insufficiency of post disasters programmes (especially with building sustainable resilience); limited international reinsurance markets; limited and expensive agriculture risk market infrastructure (such as weather stations); low-risk awareness, lack of (formal) insurance culture; and finally, regulatory impediments.

Furthermore, governments can support providers through provider subsidies (Mahul and Stutley, Reference Mahul and Stutley2010; Hazell et al., Reference Hazell, Sberro-Kessler and Varangis2017). Provider market enhancing subsidies aim at developing strong risk market infrastructure and might include subsidies for infrastructure improvements, provider start-up costs, market stabilisation subsidies and reinsurance subsidies (Miranda and Farrin, Reference Miranda and Farrin2012). One example of such subsidies is the joint World Bank – Government of Kenya initiative that supports public-private partnerships to provide premium subsidies ranging from 50 to 100 per cent of premiums for the most vulnerable pastoralists (Hazell et al., Reference Hazell, Sberro-Kessler and Varangis2017). Moreover, with more purpose and coordination, these subsidies can be provided at cross-country and regional levels. For instance, countries joining the Africa Disaster Risk Financing Facility receive a 50 per cent subsidy upon entry (ARC, 2018). The success of broad subsidy programmes needs both fiscal discipline and a view beyond political motivations. Political electoral motivations led to the withdrawal of Kenya and Malawi from the 2016/17 ARC risk pool (Hohl, Reference Hohl2019: 288) and such happenings could jeopardise the success of the industry.

4.6.3 Policy, regulation and legal environment

Finally, the key role of government support in developing policies, regulating the markets and creating an enabling environment for insurance providers, cannot be overstated. There are two dimensions of how governments might act. First, governments as the main market player through the provision of other agricultural services such as extension and farm inputs can include agricultural insurance in its core services provided such as in Zambia (World Bank, 2019). Other relatively larger programmes such as ACRE Africa in East Africa also provide insurance alongside farm inputs. This combination of services with inputs is often referred to as bundling. Although evidence on bundling insurance with other services is clear (see section 4.2.4) we do not have strong views regarding making programmes compulsory as is the case in Zambia. However, national governments can take decisive and cost-effective actions especially by leveraging an already existing infrastructure of delivering other services, and mandatory insurance might be one of the options.

Governments can also provide regulation and market coordination functions. The principal role of the government should be to address market and regulatory imperfections so that private insurance and reinsurance providers can participate (Mahul and Stutley, Reference Mahul and Stutley2010). Market regulation is therefore necessary to both farmers and pastoralists on the one hand and insurance providers on the other. It protects farmers from underhanded and predatory behaviour from providers and creates a competitive environment for providers. From a demand perspective, without government regulation, there is a high likelihood of a low product quality equilibrium (Clarke and Wren-Lewis, Reference Clarke and Wren-Lewis2013; Carter and Chiu, Reference Carter and Chiu2018), which in turn hurts farmers through poor, unhelpful products. From a supply-side perspective, regulation keeps prices in check to avoid high premiums and low demand and finally exiting by providers due to poor markets.

Effective regulation ought to be embedded in the law and regulatory organisations have to be legally empowered to act to balance markets. One major challenge is that agricultural insurance is relatively new in many SSA countries and laws and regulations on it are nonexistent or still in the early stages of development (Jegede et al., Reference Jegede, Addaney, Mokoena, Filho and Jacob2020; Onyiriuba et al., Reference Onyiriuba, Okoro and Ibe2020). Countries, therefore, need to re-evaluate their policies and laws, given recent innovations. There is some progress but it could be made faster with better in-country and across countries’ coordination. Two examples of progress on this front are the West African Inter-African Conference of the Insurance Markets (CIMA) countries and in Kenya. Pre-2012, the CIMA countries operating a regional regulatory body on insurance and reinsurance had only one article regarding agricultural insurance (Mahul and Stutley, Reference Mahul and Stutley2010). In 2012, 14 CIMA countries adopted a new law that allowed regulation and oversight of agricultural insurance (World Bank, 2015a). In Kenya, the government has updated the Insurance Bill and expanded the jurisdiction of the Insurance Regulatory Authority to agricultural insurance (World Bank, Reference World Bank2015b). These two examples provide opportunities on how countries and inter-country bodies can update their laws, regulations and policies to provide more space for insurance providers while setting standards with emerging technologies.

5. Conclusion