One widespread tenet of economics is that trade is welfare enhancing. Applied work in economics on the welfare effects of trade liberalization has partially confirmed this belief: while the overall effect may be positive, trade reform “…both destroys and creates jobs, with implications for income distribution” (Pavcnik Reference Pavcnik2017, p. 3). Of course, this is nothing new for economic historians; the dynamic tension between income gains and increased inequality from globalization has been one of the central focal points of economic history for decades (O’Rourke and Williamson Reference O’Rourke and Williamson1999). The consensus, however, seems to point to a positive relationship between trade liberalization and economic welfare, with the principal mechanism being productivity enhancement, driven in large part by import competition (see overview in Irwin Reference Irwin2019a). Recent work has indicated that, on average across countries, trade liberalization is welfare enhancing because income gains offset inequality (Artuc, Porto, and Rijkers Reference Artuc, Porto and Rijkers2019). In sum, “While some groups lose from trade, people around the world are generally much better off with trade than would be without it” (Irwin Reference Irwin2020, p. 7).

For reasons often related to data availability, most work on the welfare effects of trade liberalization does not consider the effects of trade reform episodes on third parties. Given the microeconomic framework of most applied work, country case studies are the norm, with observation frequently occurring at the industry- or even firm-level. Even work that presents dramatic evidence of the negative welfare consequences of trade liberalization for some workers (Autor, Dorn, and Hanson Reference Autor, Dorn and Hanson2013; Pierce and Schott Reference Pierce and Schott2016) does so within a national setting. This approach to evaluating the welfare consequences of trade reform overlooks the fact that local welfare improvements may come at the cost of populations or subsets of populations in third-party countries. Here I outline a particularly tragic third-party consequence of a special case of tariff reform: the British Sugar Act of 1846. The Sugar Act is a special case because, for the first time in history, it dramatically opened the British market—then the world’s sugar emporium—to noncolonial producers of cane sugar. Passed in the same session of Parliament as the repeal of the Corn Laws, the Sugar Act generated considerable controversy. Opponents, most famously Lord George Bentinck, predicted that the liberalization of the British sugar market would ruin the British colonies, increase the demand for cheaper varieties of slave-grown muscovado sugar, and entrench slavery in the noncolonial world at a time when the British were actively fighting the slave trade. Supporters, on the other hand, argued that the Sugar Act would be a boon for the British working class and for the revenue stream of the government, and that the fillip given to slavery was either a necessary evil, an ephemeral problem, or a non-existent threat. While a sizable literature has reviewed the dizzying parliamentary debates surrounding the passage of the Sugar Act (Deerr Reference Deerr1949; Disraeli Reference Disraeli1872; Huzzey Reference Huzzey2010), its welfare consequences—both first- and third-party—have never been empirically evaluated.

Historical work on the welfare effects of trade reform is also notable for the paucity of discussion on third-party consequences. Even classic examples of trade reforms with potentially large consequences for countries outside the domestic or imperial sphere do not fully explore international externalities. Work on the repeal of the Corn Laws highlights important distributional effects within Great Britain but does not study its effect on the international grains market, all the while maintaining the centrality of the terms of trade (Williamson Reference Williamson1990; Irwin and Chepeliev Reference Irwin and Chepeliev2021). Irwin’s (1988, pp. 1158–60) study of Britain’s general turn to free trade in the 1840s argues that foreign tariff changes most likely mitigated the welfare effects of terms of trade deterioration, but does not discuss the third-party consequences. De Bromhead et al.’s (2019) evaluation of Great Britain’s return to protectionism in the 1930s found that British trade policy drove a significant shift in the geographical distribution of imports in favor of the Empire, but does not explore the welfare consequences of this shift. Studies by Irwin and co-authors of tariff reforms for sugar, cotton, and manufactures on the other side of the Atlantic represent important revisions of the role of tariffs in nineteenth-century American economic development without acknowledging the (perhaps life or death) importance of reform for producers outside of the United States (Irwin and Temin Reference Irwin and Temin2001; Irwin Reference Irwin2007, Reference Irwin2019b). Recent work on the Smoot-Hawley trade war by Mitchener, O’Rourke, and Wandschneider (2022) is an exception, showing that countries that directly and indirectly engaged in the trade war through retaliation experienced considerable welfare reductions in 1930–1931.

An important empirical question regarding the welfare effects of trade liberalization is the degree of tariff incidence, that is, the estimation of the elasticity of import prices and quantities with respect to tariffs. This is a question that has recently returned to the literature with the China-United States trade war of 2018 (Amiti, Redding, and Weinstein Reference Amiti, Redding and Weinstein2019; Fajgelbaum et al. Reference Fajgelbaum, Goldberg, Kennedy and Khandelwal2020). As Williamson (Reference Williamson1990, p. 146) highlighted early on, welfare evaluations of tariff reform are contingent on the size of these trade elasticities. However, the data requirements (high frequency and quality price and trade data) for calculating the relevant elasticities severely hamper much historical work (exceptions are Irwin Reference Irwin2019b; Mitchener, O’Rourke, and Wandschneider 2022). Thus, in much of the work on the welfare effects of historical trade reform, these elasticities are either assumed (Williamson Reference Williamson1990; Irwin and Chepeliev Reference Irwin and Chepeliev2021) or calculated indirectly using gravity models (Estevadeordal, Frantz, and Taylor Reference Estevadeordal, Frantz and Taylor2003; de Bromhead et al. 2019; Arthi et al. Reference Arthi, Lampe, Nair and Hjortshøj O’Rourke2020).

This paper presents the British Sugar Act of 1846 as an illuminating historical example of the welfare effects of tariff reductions. I construct a new monthly series of sugar price and import volume data for a sample of ten countries between the years 1840 to 1853 to estimate three elasticities: (1) the tariff price elasticity, (2) the trade price elasticity, and (3) the “trade elasticity” (tariff trade elasticity). Using these elasticities, I calculate three welfare indicators: the pass-through coefficient and the consumption effect (compensating variation), the size of the reduction of the deadweight loss, and the gains from the trade in sugar to the British economy. By separating the elasticities for the sub-sample of slave economies (Brazil and Cuba), I calculate each of these indicators for both slave and non-slave-grown sugar. The results highlight important welfare gains for British consumers. My estimates suggest that the reduction of the duty on noncolonial sugar was associated with increases in sugar consumption of between 31 and 43 percent of pre-Sugar Act levels, as well as a reduction of the deadweight loss of around 41 percent of sugar import value. The overall gain from the Sugar Act, however, was most likely negligible: between –0.15 and 0.05 percentage points, depending on the choice of elasticity. These tiny gains from trade, however, were driven by large losses by the British West Indies (–0.34 percentage points), which more than offset considerable gains by noncolonial suppliers (0.15 percentage points). My calculations show that most of these gains were generated by increased trade with the slave economies; 57 percent of the consumption effect, 95 percent of the reduction of the deadweight loss, and a substantial portion of the increase in the gains from trade were associated with Brazil and Cuba alone.Footnote 1 Given the importance of the British sugar market at the time (especially for Brazil), it is not unrealistic to posit that the Sugar Act acted as a boost for slave-based plantation production in these countries.Footnote 2

The rest of the paper is structured as follows. The next section examines the debate immediately surrounding the passage of the Sugar Act. The third section presents the data and descriptive statistics. The fourth, fifth, and sixth sections present the consumption, deadweight loss, and gains from trade estimates, respectively. The seventh section concludes.

DEBATING THE WELFARE CONSEQUENCES OF THE SUGAR ACT OF 1846

On 27 July 1846, discussion was opened in the Committee of Ways and Means during the Commons Sitting on an amendment to newly appointed Prime Minister John Russell’s motion to equalize the duties on sugar regardless of origin. The amendment, put forward by George Bentinck, sought to add the words “in the present state of cultivation in the British East and West Indian possessions the proposed reduction of duty upon foreign slave-grown sugar is alike unjust and impolitic as tending to check the advance of production by British free labor and to give a great additional stimulus to the slave trade” (Deerr Reference Deerr1949, p. 437). Thus, from the outset, the debate on the passage of the Act concerned the third-party consequences and the impact on slavery and the slave trade outside of the British Empire.

The motion was part of a long series of events that led to the eventual dismantling of imperial preference. There were two sides to this preference: differential duties in Great Britain in favor of colonial imports and the same in the colonies for British produce and shipping. The former was wide-ranging; in 1840, more than 80 products were given imperial preference in the British tariff schedule (Schuyler Reference Schuyler1917, p. 432). Until the government of Robert Peel, British imperial preference had successfully weathered the American Revolution and the Napoleonic Wars. The rollback of imperial preference began earnestly in 1844 during Peel’s government, with the abolition of the duty on foreign wool and the reduction—but not abolition, which came in 1851—of the preference on colonial coffee. Outside of the passage of the Sugar Act, 1846 represented a major shock to the preferential system (Curtin Reference Curtin1954). The Corn Laws abolished the (admittedly small) preference for Canadian wheat and lowered the colonial preference for timber. Later that year, Russell introduced and passed a bill that permitted the British colonies to reduce or repeal imperial duties, which was swiftly enacted by the West Indian administration. What was left of imperial preference was subsequently abolished by the tariff acts of 1853 and 1860 (Schuyler Reference Schuyler1917).

Sugar was, however, “the keystone in the arch of imperial preference” (Schuyler Reference Schuyler1918, p. 77). Russell’s motion on the sugar duties was the culmination of more than a decade of intense debate, both in parliament and in public forums. While the parliamentary discussion had been underway since 1840, the effect of the duties on the cost of sugar for the working class had been a point of contention in commercial newspapers for much longer.Footnote 3 Between slave emancipation in 1834 and the debate and passage of the Sugar Act in 1846, the specific duty effectively served to prohibit noncolonial sugar from being entered into consumption, at an ad valorem rate of 288 percent, while the duty on colonial sugar added an extra 72 percent of the price of an already inflated West Indian product to the British consumer’s bill.Footnote 4 Instead, cheaper noncolonial sugar was diverted from the British market for consumption to the re-export market in Continental Europe. On the eve of emancipation in 1834, British consumption was primarily fed by sugar from the West Indies (the most important suppliers being Jamaica, British Guyana, and Barbados). Just under one-fifth (17 percent) of the volume retained for consumption was sourced from Mauritius and British India. Imports from the noncolonial countries—which included large volumes from Cuba, Brazil, Java, and the Philippines, but also smaller amounts from the United States and other producers in the Caribbean and South America—were entirely re-exported to Continental Europe, predominantly to Belgium, Holland, Italy, and Prussia (Green Reference Green1991).

The end of the system of tenured labor (“apprenticeship”) in 1838, which followed emancipation, initiated a supply crisis that dramatically altered this state of affairs. Between 1838 and 1850, the supply of sugar from the West Indian colonies contracted by an average of 26 percent (Engerman Reference Engerman1984). Before the passage of the Sugar Act in 1846, the duties ensured that the slack in the supply retained for consumption was made up by imports from the British colonies in India and Mauritius. Despite these supplies, the average price of sugar in Great Britain rose to a 20-year high, generating considerable pressure on policymakers to both reform the duties that excluded noncolonial sugar from the British market and secure supplies of sugar from alternative sources (Drescher Reference Drescher2004; Absell Reference Absell2023).

Bentinck’s opening speech considered three related issues. The first was the plight of the sugar planters in the British possessions in the East and West Indies and Mauritius. As an extension, Bentinck connected the welfare of the British colonies to the supply of sugar and its cost to the British working class. The second was the impact of tariff reform on government revenue. The third was, as Bentinck put it, “the interests of the African race,” that is, the impetus given to noncolonial, slave-grown sugar and the slave trade (Hansard HC Deb 27 July 1846 vol. 88, p. 33). Thus, in the debate that followed before the vote on the amendment, the welfare of five groups was discussed: the colonial planters (in the West and East Indies), the British working class, the government, noncolonial planters, and slaves.

Disagreement quickly arose regarding the forecasted supply of sugar. The point of contention was whether these supplies of sugar could be sourced from within the British Empire, thus safeguarding the interests of British planters. Bentinck, citing reports from British merchants, estimated that, for the year 1846, British consumption would reach an upper bound of 246,000 tons. He calculated that this volume could be sourced from within the Empire: 125,000 from the West Indies, 100,000 from India, 55,000 from Mauritius, and, additionally, 20,000 from noncolonial, “free labour” producers (namely, China, Java, and Siam) (Hansard HC Deb 27 July 1846 vol. 88, p. 39).Footnote 5 Here, the Indian supply was key, but Bentinck offered a serious caveat: supply would be forthcoming only when the price was high, because at lower prices, Indian product was diverted to local consumption (Hansard HC Deb 27 July 1846 vol. 88, p. 35). Benjamin Disraeli developed this argument further, observing that the protection of Indian (not British) planters would increase not only the supply of sugar to the British market, but also the demand for British manufactures (Hansard HC Deb 28 July 1846 vol. 88, pp. 151–52). The Chancellor of the Exchequer, Charles Wood, argued that Bentinck’s supply estimate was too high and that his consumption estimate was too low, the latter due to a price elasticity of demand that was very likely close to or above unity (Hansard HC Deb 27 July 1846 vol. 88, p. 56).Footnote 6 This high price elasticity of British demand, together with the decrease of exports from India at lower prices, meant that the proposal to artificially inflate Indian prices to ensure demand was bound to fail (Hansard HC Deb 27 July 1846 vol. 88, p. 59). The correct approach, Prime Minister Russell argued toward the end of the debate, was to stimulate demand by reducing the duty-paid price, increase the supply, and, as a result, revenue: “…with diminished duties and diminished price there will be increased consumption; that with increased consumption you will have additional importations; and that with additional importations you must have an increase of revenue” (Hansard HC Deb 28 July 1846 vol. 88, p. 172). This would not be accomplished with colonial and noncolonial free-labor supplies alone.

Perhaps unsurprisingly, the predictions of the impact on the British colonies by the supporters of the amendment were nothing short of apocalyptic (Lord Ashburton predicted little less than “the loss of the colonies” (Schuyler Reference Schuyler1918, p. 80)). However, Wood argued that, over time, the colonies would benefit from the increased demand for sugar (Hansard HC Deb 27 July 1846 vol. 88, p. 63). Drawing lessons from British manufacturing, Russell further developed this argument, stating that increased competition would serve as an incentive to raise the productivity of West Indian plantations (Hansard HC Deb 28 July 1846 vol. 88, pp. 175–76). What’s more, Wood predicted that the revenue derived from increased consumption of slave-grown sugar would cover rising military expenditures on the frontiers of the Empire (“China and New Zealand – and what is going on at the Cape of Good Hope” (Hansard HC Deb 27 July 1846 vol. 88, p. 66)). He calculated the revenue from colonial supplies of sugar (240,000 tons at 14 shillings) at 3,460,000 pounds sterling, while opening to noncolonial sugar (15,000 free and 30,000 slaves) would yield revenue of 4,405,000; that is, a 27 percent increase in revenue from the liberalization of the sugar trade (Hansard HC Deb 27 July 1846 vol. 88, pp. 68–69). Bentinck, however, recognized that the gains to the British working class of a price reduction (which he estimated to be around six shillings per hundredweight) entailed a redistribution of the profit from colonial to noncolonial suppliers: “Somebody must lose; the consumer could not gain … without somebody losing their money. The sugar was grown … and, therefore, the profit … must go … into the pockets of the planters of Brazil and Cuba, or it must come out of the pocket of the British planter from his estates in the East or West Indies and the Mauritius” (Hansard HC Deb 27 July 1846 vol. 88, p. 42).

The crux of the debate, however, centered around the impact on the slave trade and slavery. For the opponents, there was no doubt that the Act would stimulate slavery. This was a bitter pill to swallow, after “a monstrous sacrifice of 20,000,000l. for the purpose of abolishing slavery in their Colonies” (compensation given to plantation owners) and “further sacrifice of 24,000,000l. in the increased price of their sugar, with the view of discouraging slavery elsewhere” (the estimated cost of maintaining the duty above the noncolonial price; Hansard HC Deb 27 July 1846 vol. 88, p. 53). Bentinck remarked that, on this note, the working class would willingly sacrifice the potential consumption gains that could be derived from the reduction of the tariff on noncolonial sugar: “There was not one man in England, beyond the circle of free traders, who would not cheerfully consent to pay the additional penny per pound,” the latter being his favored estimate on the saving from consuming slave-grown sugar (Hansard HC Deb 27 July 1846 vol. 88, p. 53).

Supporters of the Act used various lines of argument against this view. Those who agreed that the Act would encourage the slave trade framed this as a necessary evil that was offset by the reduction of the cost of sugar for the working class, the increase in fiscal revenue, and the general correction of the supply-demand disequilibrium caused by the preferential duties (in modern parlance: the deadweight loss). Those who did not agree that the Act would encourage the slave trade observed that slave-grown sugar would be consumed in Continental Europe regardless of its status in Great Britain. Finally, a select group of lawmakers (Robert Peel included) put forth the argument that the only way to vanquish slavery was to put it in direct competition with sugar produced by free labor. Evelyn Denison argued that, despite best intentions, British policy had “materially aggravated the horrors of the Slave Trade,” that “what was true of free trade was true also of free labour,” that “we must show the success of our own free-labour experiment,” and that “the best armament against the Slave Trade was the successful cultivation of sugar by free labour” (Hansard HC Deb 28 July 1846 vol. 88, p. 131). Thus, free trade was framed as being a necessary step toward the destruction of slavery, as the victory of free labor in conditions of perfect competition would demonstrate the inefficiency of slavery to other metropolitan nations playing with the idea of abolition (Hansard HC Deb 28 July 1846 vol. 88, p. 134). In the end, the Sugar Act was passed by a vote of 265 to 135, with both Whigs and Tories in the majority, and Bentinck’s amendment was disregarded (Schuyler Reference Schuyler1918, p. 79). The Act came into effect in August of that year.

From this disparate set of predictions, a series of necessarily empirical questions emerge: How much did British consumers benefit from the price reduction associated with the Act? Did the reduction of the duty reduce the deadweight loss incurred by the British economy? What was the overall gain for the British economy? And most importantly, how much of this was due to the increased trade in slave-grown sugar?

DATA AND DESCRIPTIVE STATISTICS

To estimate the elasticities necessary to assess the welfare impact of the Sugar Act, I exploit monthly data on the prices and volumes of raw sugar imported to the ports of London and Liverpool during the period January 1840 to December 1853. I use data from two cities because the data for prices in Liverpool and volumes in London are imperfect; the former aggregates the British West Indies into a single series while the latter are not consistently reported. However, a comparison of the London price series with price data for Liverpool and the Liverpool volume data with an annual series of sugar imports at the national level show that both series are representative of the nation-wide trend.Footnote 7 The price data for London is derived from several British commercial newspapers, namely John Bull and Bell’s Weekly Messenger, with data for the period May 1852 to December 1853 from the Shipping and Mercantile Gazette. The price data consists of monthly observations by origin and quality. Minimum and maximum prices are given for each variety in shillings per hundredweight (s/cwt), of which I take the average. I also average prices by quality, including values for different grades of “brown” and “yellow” sugar in the muscovado category and including higher grades in the white category. The prices of colonial sugar are duty-paid, while all others are presented duty-free (“in bond”), so I add the specific duty to the latter prices to calculate the duty-paid price. Monthly series are preferred to the annual series of volumes from the official statistics for several reasons: higher frequency data allow for the detection of short-run effects of tariff reform, and, as declared values were not used until 1853, unit values are missing from the official sources.

This price data is matched with import volume data from Liverpool taken from two sources: from January 1840 to March 1843, the Liverpool Mercury, and from April 1843 to December 1853, Gore’s Liverpool General Advertiser.Footnote 8 However, unlike the price data, taking monthly observations is not enough, as information on imports was listed throughout the month as the product arrived at port. Thus, I have reconstructed the full import series of sugar by origin to the port of Liverpool by taking monthly sums of the weekly observations available in the newspapers (each source was published four times a month). I then create a panel of ten countries by matching the volume data from Liverpool to the price data in London by origin. The temporal coverage is chosen not due to data availability, but rather to provide a sufficient event window to assess the immediate effect of the Sugar Act: five years before its implementation and the seven-year period afterward leading to the equalization of the duty in 1854.

The data suffers from two major weaknesses. First, the quality of the sugar is unknown. However, in the Online Appendix, I show that the prices of muscovado and white varieties were highly correlated, as were tariff adjustments. Thus, the issue of quality should not bias the welfare estimates. Second, the data represents gross imports, that is, including product that was later re-exported to ports in Continental Europe. While it is difficult to correct the series for the inclusion of re-exports, in what follows I compare results using expenditure shares of both total and retained for consumption import volumes.

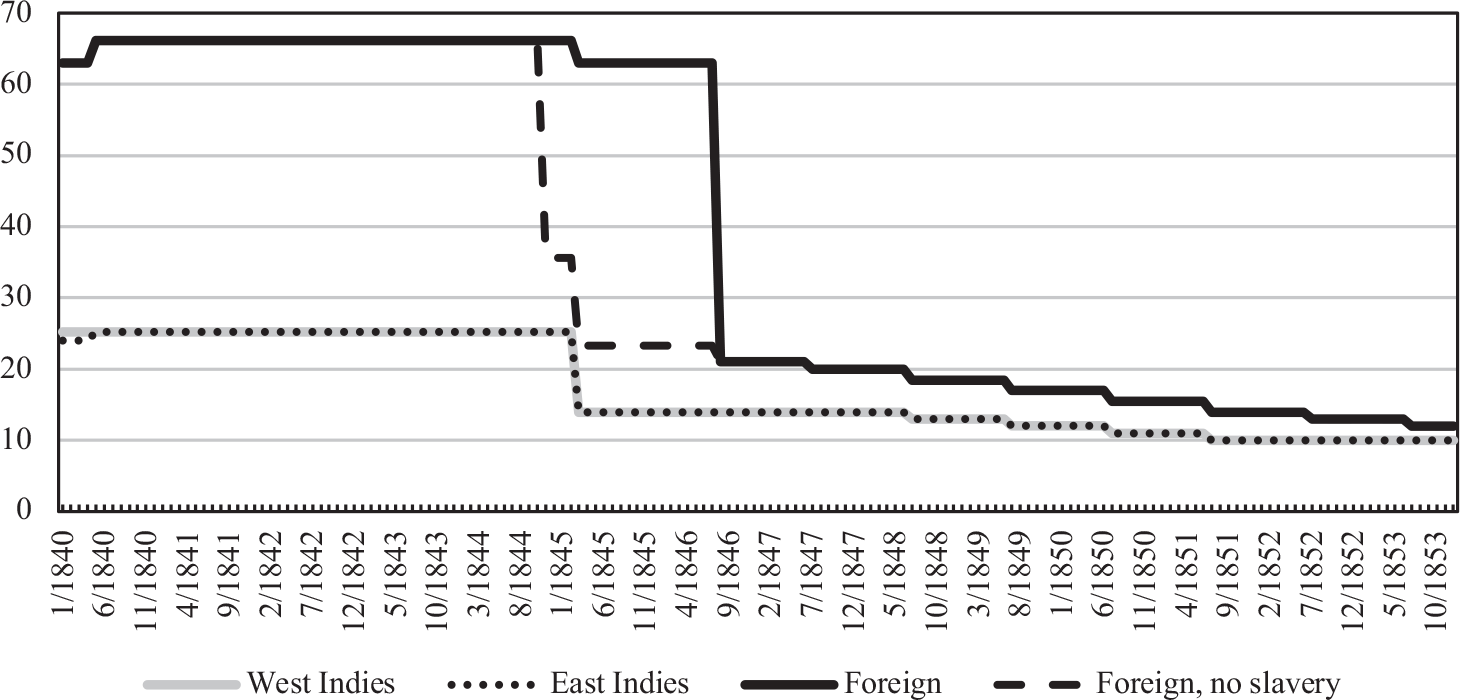

The scale of the tariff reduction brought by the Sugar Act is clearly visible in Figure 1, which shows the duty (in s/cwt) on muscovado sugar for the British West and East Indian colonies and noncolonial suppliers (categorized as “Foreign” in the British statistics). Prior to month zero of the Sugar Act (August 1846), the duty on noncolonial sugar was truly prohibitive; from May 1840 to February 1845 it stood at 66 s/cwt, being an average effective rate of 346 percent (of the average price of Brazilian, Cuban, and Philippine varieties), much higher than the colonial duty of 25 s/cwt, or the average effective rate of 77 percent (of the average price of West Indian, East Indian, and Mauritian sugar). In a failed effort to relieve the pressure of the supply crisis, the duty on sugar from non-slave growing regions was lowered in November 1844 to 36 s/cwt and again four months later to 23 s/cwt. However, this category was discontinued with the passage of the Sugar Act, perhaps because most of the noncolonial suppliers of muscovado sugar were slave-based economies. From March 1845 to the effective date of the Sugar Act, the duty was reduced to 63 s/cwt, lowering the average effective rate to around 227 percent, although the colonial duty was reduced further to 14 s/cwt, four and a half times lower than the noncolonial duty. With the passage of the Act, this gap was narrowed dramatically within the space of a month. In August, the colonial duty fell to 21 s/cwt, still higher than the colonial tariff by seven shillings, but reducing the effective rate to around 90 percent. Over the subsequent period, this gap would be gradually reduced until colonial preferences were finally removed in 1854.

Figure 1 SPECIFIC DUTY (SHILLINGS PER HUNDREDWEIGHT) ON MUSCOVADO SUGAR BY ORIGIN, JANUARY 1840–DECEMBER 1853

Source: United Kingdom (Reference Kingdom1859, p. 3).

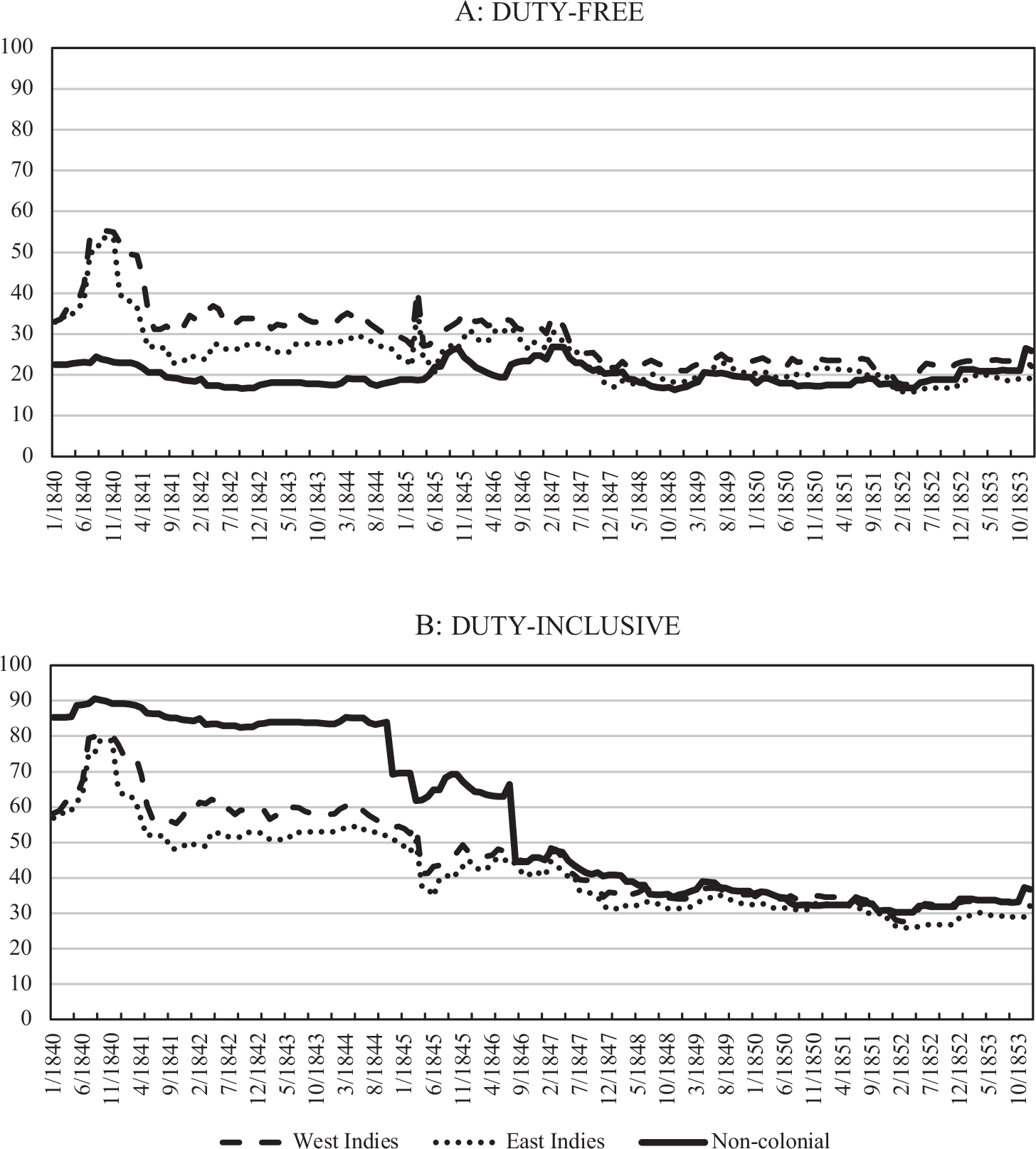

Figure 2 illustrates how these differential duties distorted the levels of import prices and thus determined the country composition of sugar retained for consumption in the British market. Panel A displays the wholesale prices of muscovado sugar, duty-free. Noncolonial varieties were clearly cheaper, although the period following the passage of the Sugar Act was characterized by a lower dispersion of prices. Price competition was fierce between Manilla, Cuba, and Brazil, with Philippine and Brazilian prices remaining slightly below those of the Cuban varieties. In the colonial realm, the price competitiveness of the East Indian colonies was already well-established during this period. Panel B shows the duty-inclusive prices. Not only did the duty increase the cost of sugar for British consumers, but it also inflated noncolonial prices over those of more expensive colonial suppliers. The result was that, until the Act, cheaper, noncolonial varieties were virtually priced out of the retained for consumption market. These varieties also happened to be predominantly slave-grown.Footnote 9

Figure 2 PRICES (SHILLINGS PER HUNDREDWEIGHT) OF MUSCOVADO SUGAR BY ORIGIN IN LONDON, JANUARY 1840–DECEMBER 1853

Notes: West Indies is the average of Barbados, Jamaica, Demerara/Berbice, Antigua, and St. Vincent varieties. East Indies is the average of Bengal and Mauritius varieties. Noncolonial is the average of Manilla, Cuba, and Brazil varieties.

Sources: Prices from John Bull, Bell’s Weekly Messenger, The Shipping and Mercantile Gazette; duties from United Kingdom (Reference Kingdom1859, p. 3).

TARIFF PASS-THROUGH AND COMPENSATING VARIATION

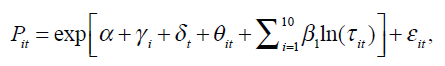

To ascertain whether the Sugar Act was beneficial for British consumers, I calculate the consumption effect (specifically, the negative compensating variation) of the tariff reductions associated with the Act (Absell 2024). This, however, first requires the estimation of the tariff pass-through coefficient. To calculate the degree of pass-through, I estimate the elasticity of the duty-free price with respect to the tariff using the following specification:

$${P_{it}} = \exp \left[ {\alpha + {\gamma _i} + {\delta _t} + {\theta _{it}} + \mathop \sum \limits_{i = 1}^{10} {\beta _1}\ln \left( {{\tau _{it}}} \right)} \right] + {\varepsilon _{it}},$$

$${P_{it}} = \exp \left[ {\alpha + {\gamma _i} + {\delta _t} + {\theta _{it}} + \mathop \sum \limits_{i = 1}^{10} {\beta _1}\ln \left( {{\tau _{it}}} \right)} \right] + {\varepsilon _{it}},$$

where P it is the duty-free price of sugar from producer i in month t and τ it the corresponding tariff. Given that including τ in ad-valorem terms would create simultaneity bias, the estimated elasticities correspond to the change in price associated with the change in the specific duty in the same month.Footnote 10 Thus, they represent the immediate gains for producers and consumers from changes in the tariff. As Figure 1 shows, there were several tariff adjustments made both before and after the Sugar Act for colonial and noncolonial producers: six for colonial producers (two pre-Sugar Act, four post-), and ten for noncolonial producers (two pre-, eight post-). I include country (γ), month (δ), and country-year (θ) fixed effects to control for unobserved time-invariant heterogeneity across countries, unobserved shocks over time that affect all countries, and those specific to countries, respectively. I estimate Equation (1) using Poisson pseudo-maximum likelihood (ppml) (Silva and Tenreyro 2006).Footnote 11 To detect anticipatory or follow-through effects, I also include a monthly lead and lag of τ. Since I lack comparable retail price data, it is not possible to calculate the exact pass-through to the consumer. However, it is possible to infer this by observing the size of the tariff’s impact on import prices (Irwin Reference Irwin2019b).

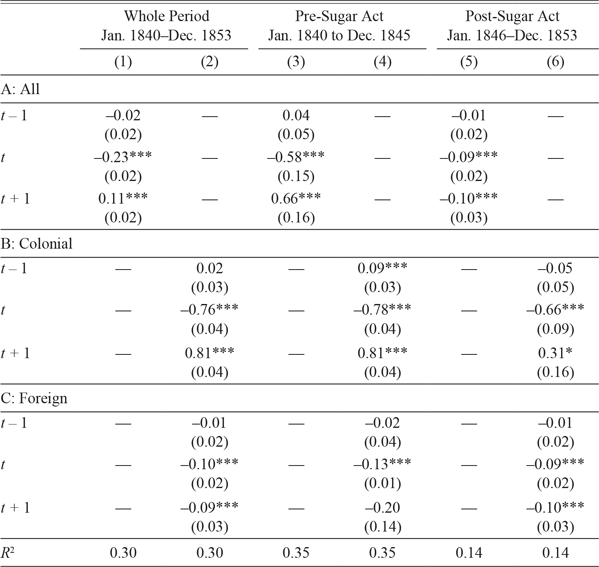

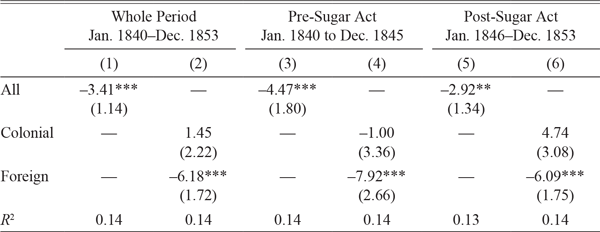

Table 1 displays the results. The coefficient in Panel A, Column (1), that captures the elasticity for all suppliers over the entire period, –0.23, is the tariff absorption elasticity and is interpreted in the following manner: a 1 percent tariff reduction is associated with a 0.23 percent higher duty-free price and a 0.77 percent lower price for the consumers; exporters gained 23 percent of the tariff reduction and consumers 77 percent. Tariff pass-through was incomplete. However, the latter assumes zero markups by the importer, which is quite an untenable assumption.Footnote 12 Thus, the tariff pass-through coefficient (1 + β 1) should be interpreted as an extreme upper-bound estimate of the tariff reduction passed on to consumers. Columns (3) and (5) of Panel A display the coefficients for the pre- (January 1840–December 1845) and post- (January 1846–December 1853) Sugar Act periods, respectively. The incompleteness of tariff pass-through was larger before the Sugar Act than after it. Prior to 1846, only 42 percent of the tariff reductions were passed on to consumers, while afterward, this increased dramatically to 91 percent.

Table 1 TARIFF PASS-THROUGH, BEFORE AND AFTER THE SUGAR ACT

Notes: The dependent variable is the duty-free price (in shillings per hundredweight). Robust standard errors clustered at the country-level in parenthesis. Regressions include month, partner, and partner-year fixed effects. Estimated with ppmlhdfe. Number of observations is 1,660. Significance levels: *** p<0.01, ** p<0.05, * p<0.1.

Sources: Prices from John Bull, Bell’s Weekly Messenger, The Shipping and Mercantile Gazette; duties from United Kingdom (Reference Kingdom1859, p. 3).

This significant increase in the tariff pass-through coefficient reflects a composition effect: the shift from inelastic to elastic suppliers. This is illustrated by the results in Panels B and C of Table 1, which display the coefficients for colonial and noncolonial suppliers, respectively. Inspection of the coefficient for the whole period in Column (2) immediately reveals a large degree of heterogeneity across suppliers: colonial exporters absorbed 76 percent of the tariff reduction, while noncolonial suppliers retained only 10 percent. This was a difference that already existed prior to the Sugar Act (in Column (4)) and continued during the period immediately following its passage (Column (6)). For the colonial suppliers, there was a reduction in tariff absorption from 78 to 66 percent over the two periods, due to the sudden entrance of noncolonial competition in the retained for consumption market. For the latter, the tariff absorption elasticity dropped from 13 to 9 percent following the Sugar Act. The results suggest that there were no anticipatory effects of these tariffs, which is surprising given the length of time that these measures were discussed in Parliament and reported by the British press. The lagged coefficients indicate significant follow-through effects, although the size and direction of these effects depend on the period and supplier.

Using the estimated elasticities from Equation (1), I calculate the consumption effect associated with the tariff reductions following the Sugar Act as:

Where

![]() $\widehat {{W_i}}$

represents the negative compensating variation, that is, the negative of the amount that a household or consumer must be compensated to maintain their consumption of sugar at pre-tariff reduction levels (Deaton Reference Deaton1989; Han et al. Reference Han, Liu, Ural Marchand and Zhang2016, p. 227). In the case of a welfare gain stemming from a tariff reduction,

$\widehat {{W_i}}$

represents the negative compensating variation, that is, the negative of the amount that a household or consumer must be compensated to maintain their consumption of sugar at pre-tariff reduction levels (Deaton Reference Deaton1989; Han et al. Reference Han, Liu, Ural Marchand and Zhang2016, p. 227). In the case of a welfare gain stemming from a tariff reduction,

![]() $\widehat {{W_i}}$

will be positive; λ

i

is the expenditure share of country i, calculated as the value of imports of country i divided by the total value of sugar imports; β

1i

is the country-specific tariff absorption elasticity; and dln(1 + τ

i

) is the size of the tariff reduction. These three parameters varied across suppliers. Thus, I calculate the consumption effect for both colonial and noncolonial groups of countries as well as for each individual country in the sample. Instead of calculating a consumption effect for each of the reductions following the Sugar Act, I estimate the overall effect using the tariff cut from January 1846 to December 1852 and the expenditure shares and tariff absorption elasticities for each country over this period.

$\widehat {{W_i}}$

will be positive; λ

i

is the expenditure share of country i, calculated as the value of imports of country i divided by the total value of sugar imports; β

1i

is the country-specific tariff absorption elasticity; and dln(1 + τ

i

) is the size of the tariff reduction. These three parameters varied across suppliers. Thus, I calculate the consumption effect for both colonial and noncolonial groups of countries as well as for each individual country in the sample. Instead of calculating a consumption effect for each of the reductions following the Sugar Act, I estimate the overall effect using the tariff cut from January 1846 to December 1852 and the expenditure shares and tariff absorption elasticities for each country over this period.

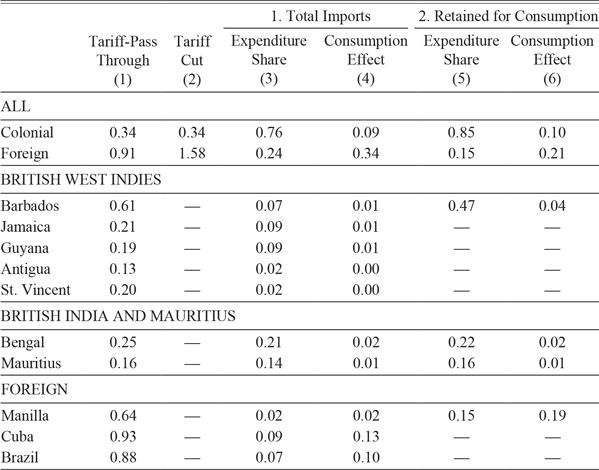

Table 2 displays the estimates of the consumption effect for colonial and noncolonial (“foreign”) suppliers and for each of the ten countries in the sample. Column (1) shows the tariff pass-through coefficient (1 + β 1); that is, the percentage of the tariff reduction passed on to consumers (again, assuming zero markups). As mentioned earlier, with one exception (Barbados, with a coefficient of 0.61), pass-through for the colonies was much lower than for the noncolonial countries included in the sample. The coefficients for the former group of countries ranged from 0.13 (Antigua) to 0.25 (Bengal, representing British India). On the other hand, the pass-through for Manilla was 0.64, and the two slave economies in the sample, Cuba and Brazil, showed the highest coefficients, of 0.93 and 0.88, respectively. Column (2) gives the size of the tariff cut dln(1 + τ i ) for both groups of countries: between January 1846 and December 1852, the tariff for colonial suppliers was reduced by 34 percent and that for noncolonial suppliers by 158 percent. Given that the sizes of these cuts did not vary within each of the groups, the values are not reproduced for individual countries. Column (3) displays the expenditure shares for the countries of the sample. The colonies held around 76 percent of the share over this period, with Bengal occupying the first place (21 percent), followed by Mauritius (14 percent), and Jamaica and Guyana (both with 9 percent of the share). Most of the market share of noncolonial countries (24 percent) was held by Cuba (9 percent) and Brazil (7 percent).

Table 2 CONSUMPTION EFFECTS OF THE SUGAR ACT (JANUARY 1846 TO DECEMBER 1852)

Sources: Prices from John Bull, Bell’s Weekly Messenger, The Shipping and Mercantile Gazette; duties from United Kingdom (Reference Kingdom1859, p. 3); volumes from Liverpool Mercury, Gore’s Liverpool General Advertiser; expenditure shares retained for consumption: United Kingdom (Reference Kingdom1855, various years).

Column (4) gives the consumption effect. The welfare gain in terms of consumption of the tariff cut on noncolonial sugar, at 34 percent, is large—over three times the gains from colonial sugar (9 percent). This is because tariff absorption elasticities, as mentioned, were particularly small for Cuba and Brazil, while the tariff cut was large. The estimates using expenditure shares from total imports suggest that the consumption gains from reducing the tariff on Cuban and Brazilian sugar alone were over 20 percent. To put this into perspective, Han et al. (Reference Han, Liu, Ural Marchand and Zhang2016, pp. 228–30) calculated a mean consumption gain of 7 percent from China’s ascension to the WTO in 2001 and subsequent tariff reductions on tradable goods, with the poorest households gaining around 14 percent. For India, Ural Marchand (Reference Marchand2012, pp. 272–74) estimated consumption gains of around 14 percent in rural areas and 24 percent in urban areas from the comprehensive phase of tariff liberalization that occurred in the country over the period 1988–2000.Footnote 13 Using different methods, Hersh and Voth (Reference Hersh and Voth2022, p. 6) estimate a compensating variation of between 4.0 and 5.8 percent for the British sugar trade over the period 1600–1800.

A major weakness of this approach is that expenditure shares using total imports can be deceptive, as they include re-exports and thus inflate the share of noncolonial suppliers and, in turn, the estimates of the consumption effect. Thus, in Column (5), I also present estimates using the shares retained for consumption. Unfortunately, the statistics on retained consumption group colonial and noncolonial producers together, so I am unable to calculate consumption effects for individual countries. As Column (6) shows, however, the use of retained for consumption expenditure shares does not change the story to a significant degree. Gains are lower but still large for the noncolonial suppliers (21 percent), while the effects for the British West Indies, India, and Mauritius remain unchanged (at 4, 2, and 1 percent, respectively).

Why were tariff pass-through coefficients higher for noncolonial suppliers, concretely for Cuba and Brazil? The literature on incomplete tariff pass-through provides several potential explanations for this finding (Gullstrand, Olofsdotter, and Thede Reference Gullstrand, Olofsdotter and Thede2014; Han et al. Reference Han, Liu, Ural Marchand and Zhang2016; Nizovtsev and Skiba Reference Nizovtsev and Skiba2020). Of immediate interest to this study, Ludema and Yu (Reference Ludema and Yu2016) found that higher productivity firms have a lower tariff-absorption elasticity, and their stated mechanism was a quality adjustment. In the context of the post-Sugar Act world, however, the source of productivity was related to the labor market. The fact that slave economies were characterized by the lowest tariff absorption elasticities says much about the observed pattern of tariff pass-through.

In fact, West Indian planters were explicit in their intention to pass the tariff cut on to their laborers. Earl Grey, writing to Governor Light of British Guiana in April 1848, opined that “…any reduction of the price of colonial sugar occasioned by the reduction of the protecting duty levied on foreign sugar, must fall mainly on the labourers employed in the colonies” (United Kingdom Reference Kingdom1848, p. 98). However, the labor supply was, by most reports, increasingly resistant to coercion. Anecdotal evidence from Guiana, Grenada, the Virgin Islands, and Tobago suggests that British West Indian planters absorbed more of the tariff not because of their monopolistic position, but rather because they could not pass on falling prices to their (now free) laborers.Footnote 14

Such was not the case in Barbados, where Earl Grey expressed his satisfaction at “… the cheerfulness with which the labourers have acquiesced in a reduction of wages” (United Kingdom Reference Kingdom1848, p. 17). Barbados, alongside Antigua and St. Kitts, was identified by Engerman as having the lowest land-labor ratios of the West Indian colonies, and “the lack of opportunity for land ownership precluded the large-scale withdrawal of ex-slave labor from sugar production” (Engerman Reference Engerman1984, p. 197). High population densities surely increased the ease with which planters could push through the wage cuts. Antigua, however, is an outlier in the sense that while colonial administrators were able to successfully reduce wages, the tariff absorption elasticity remained high.Footnote 15 In the Philippines, where production was characterized by farmers or tenants working small holdings, it is likely that foreign merchants, engaging in monopsonistic practices, were able to transfer part of the tariff cut to the peasantry (Wolters Reference Wolters1992). The slave economies, while suffering from their own supply-side problems, were clearly unhampered by wage negotiations with free labor and were thus able to absorb less of the tariff cut.

DEADWEIGHT LOSS

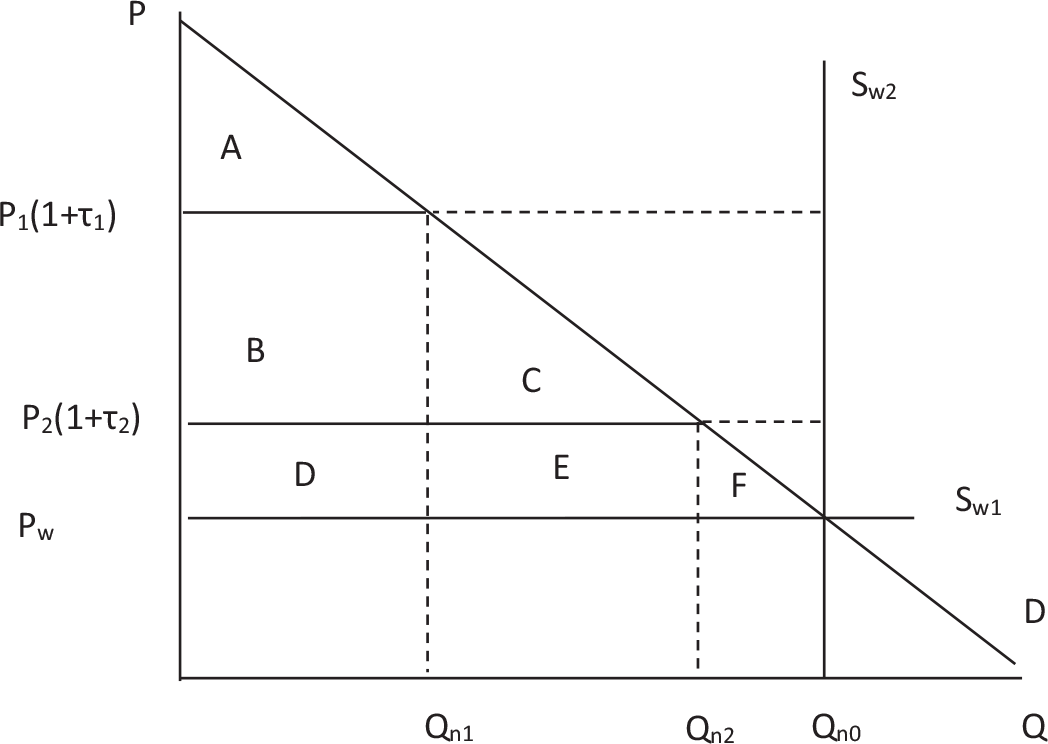

Figure 3 models the effect of a tariff reduction on deadweight loss (DWL) when the foreign export supply is (a) perfectly elastic (Sw1) and (b) perfectly inelastic (Sw2); Pw is the foreign export price and P1(1+τ1) is the duty-paid import price before the tariff cut. In the case that supply is perfectly elastic, consumption is at Qn1. Area A is the difference between the consumer’s marginal value and the amount paid for the imported good: the consumer surplus. Area BD is the amount gained in tariff revenue for the government, equal to Q1*τ1. Area CEF (under the demand curve) is the DWL generated by the presence of the tariff. The reduction of the tariff reduces the price to P2(1+τ2). Consumption increases to Qn2. The consumer surplus increases to ABC. Tariff revenue is DE. The DWL generated by the new tariff is F. The difference between DWL1 and DWL0 is the reduction of the DWL. Amiti, Redding, and Weinstein (Reference Amiti, Redding and Weinstein2019, p. 190) observe that the welfare effect of a tariff depends on how steep the export curve is. For suppliers with greater elasticities, the reduction of the DWL will be larger. This can be demonstrated by comparing the case of export supply with perfect elasticity with that of perfect inelasticity. In the latter case, supply remains at Qn0 regardless of the price. Thus, at P1(1+τ1) there is an excess of supply (equivalent to Qn1 - Qn0), consumer surplus remains at A, and tariff revenue is BCDEF. As there is no loss of consumer surplus or revenue due to the intervention, there is no DWL. A reduction of the tariff to P2(1+τ2) simply transfers revenue from the government to the consumer, as consumer surplus becomes ABC and tariff revenue DEF. As the foreign export curve becomes more elastic and Sw2 gradually shifts to the right toward Sw1, the size of the DWL before the tariff cut (P1(1+τ1)) becomes CEF.

Figure 3 EFFECT OF TARIFF REDUCTION ON DEADWEIGHT LOSS UNDER ASSUMPTIONS OF PERFECTLY ELASTIC (Sw1) AND PERFECTLY INELASTIC (Sw2) SUPPLY

Source: Author’s elaboration, adapted from Amiti, Redding, and Weinstein (Reference Amiti, Redding and Weinstein2019).

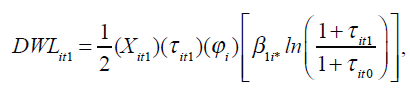

I calculate the deadweight loss associated with country i in time t as

$$DW{L_{it1}} = \frac{1}{2}\left( {{X_{it1}}} \right)\left( {{\tau _{it1}}} \right)\left( {{\varphi _i}} \right)\left[ {{\beta _{1i{\rm{*}}}}ln\left( {\frac{{1 + {\tau _{it1}}}}{{1 + {\tau _{it0}}}}} \right)} \right]$$

$$DW{L_{it1}} = \frac{1}{2}\left( {{X_{it1}}} \right)\left( {{\tau _{it1}}} \right)\left( {{\varphi _i}} \right)\left[ {{\beta _{1i{\rm{*}}}}ln\left( {\frac{{1 + {\tau _{it1}}}}{{1 + {\tau _{it0}}}}} \right)} \right]$$

where X

it

= Q

it * P

it

is the value of imports for country i at time t, τ

it1 is the tariff following the cut, φ

i

is the trade price elasticity for country i, β

1i

is the tariff absorption elasticity from Equation (1),

![]() $$ln\left( {\frac{{1 + {\tau _{it1}}}}{{1 + {\tau _{it0}}}}} \right)$$

is the log of the change in tariff from t

0 to t

1 (Pelzman and Bradberry Reference Pelzman and Bradberry1980; Amiti, Redding, and Weinstein Reference Amiti, Redding and Weinstein2019), and φ

i

essentially captures the slope of the supply curve that determines, together with the size of the tariff reduction and the tariff absorption elasticity, the size of the reduction of the DWL. As the DWL is cumulative, I calculate Equation (3) for each country and month, setting January 1846 as t

0, and sum the months for the period January 1846 to December 1853 to obtain an estimate of the total effect.Footnote

16

To contextualize the size of these gains, I also calculate the gains and losses associated with the tariff changes prior to the Sugar Act (in the period from January 1840 to December 1845, which included several cuts, most importantly the reduction of the colonial tariff at the beginning of 1845, prior to the effective date of the Sugar Act). Furthermore, I examine the trends in tariff revenue between the periods and calculate the net effect of tariff revenue and the deadweight loss.

$$ln\left( {\frac{{1 + {\tau _{it1}}}}{{1 + {\tau _{it0}}}}} \right)$$

is the log of the change in tariff from t

0 to t

1 (Pelzman and Bradberry Reference Pelzman and Bradberry1980; Amiti, Redding, and Weinstein Reference Amiti, Redding and Weinstein2019), and φ

i

essentially captures the slope of the supply curve that determines, together with the size of the tariff reduction and the tariff absorption elasticity, the size of the reduction of the DWL. As the DWL is cumulative, I calculate Equation (3) for each country and month, setting January 1846 as t

0, and sum the months for the period January 1846 to December 1853 to obtain an estimate of the total effect.Footnote

16

To contextualize the size of these gains, I also calculate the gains and losses associated with the tariff changes prior to the Sugar Act (in the period from January 1840 to December 1845, which included several cuts, most importantly the reduction of the colonial tariff at the beginning of 1845, prior to the effective date of the Sugar Act). Furthermore, I examine the trends in tariff revenue between the periods and calculate the net effect of tariff revenue and the deadweight loss.

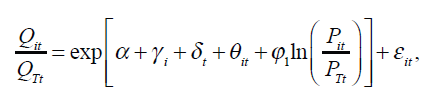

Calculation of Equation (3) requires a value for φ i , which is estimated as

$$\frac{{{Q_{it}}}}{{{Q_{Tt}}}} = {\rm{\;exp}}\left[ {\alpha + {\gamma _i} + {\delta _t} + {\theta _{it}} + {\varphi _1}\ln \left( {\frac{{{P_{it}}}}{{{P_{Tt}}}}} \right)} \right] + {\varepsilon _{it}},$$

$$\frac{{{Q_{it}}}}{{{Q_{Tt}}}} = {\rm{\;exp}}\left[ {\alpha + {\gamma _i} + {\delta _t} + {\theta _{it}} + {\varphi _1}\ln \left( {\frac{{{P_{it}}}}{{{P_{Tt}}}}} \right)} \right] + {\varepsilon _{it}},$$

where

![]() $$\frac{{{Q_{it}}}}{{{Q_{Tt}}}}$$

is the share of the volume of imports from country i at time t in total imports T and

$$\frac{{{Q_{it}}}}{{{Q_{Tt}}}}$$

is the share of the volume of imports from country i at time t in total imports T and

![]() $$\frac{{{P_{it}}}}{{{P_{Tt}}}}$$

is the ratio of duty-paid price of muscovado sugar from country i at time t to the average duty-paid price P

T

. I also include country (γ), month (δ), and country-year (θ) fixed effects. As previously noted, this is estimated using ppml with high dimensional fixed effects and robust standard errors clustered at the country-level.Footnote

17

Equation (4) is, for all purposes, an elasticity of substitution that indicates the elasticity of a country’s market share with respect to changes in relative prices (Broda and Weinstein Reference Broda and Weinstein2006; Crozet and Erkel-Rousse Reference Crozet and Erkel-Rousse2004).Footnote

18

$$\frac{{{P_{it}}}}{{{P_{Tt}}}}$$

is the ratio of duty-paid price of muscovado sugar from country i at time t to the average duty-paid price P

T

. I also include country (γ), month (δ), and country-year (θ) fixed effects. As previously noted, this is estimated using ppml with high dimensional fixed effects and robust standard errors clustered at the country-level.Footnote

17

Equation (4) is, for all purposes, an elasticity of substitution that indicates the elasticity of a country’s market share with respect to changes in relative prices (Broda and Weinstein Reference Broda and Weinstein2006; Crozet and Erkel-Rousse Reference Crozet and Erkel-Rousse2004).Footnote

18

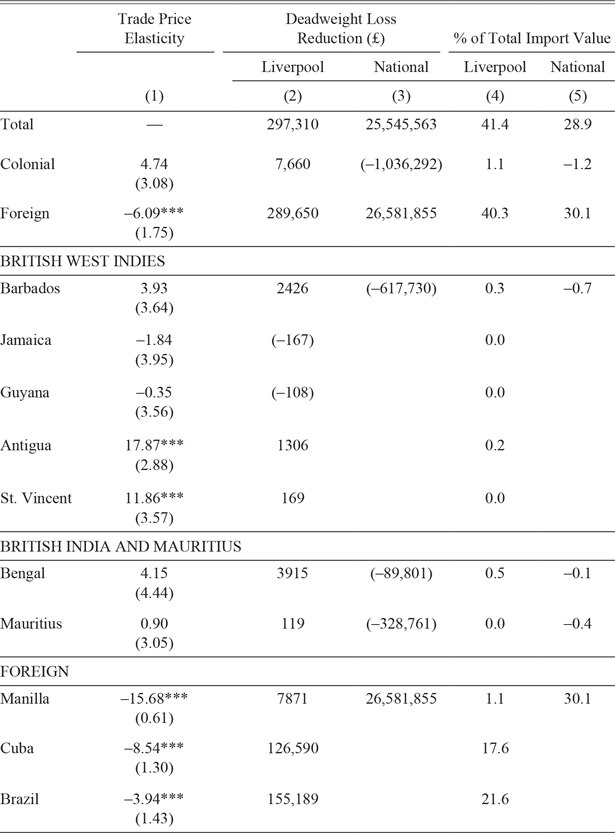

Table 3 displays estimates of the trade price elasticity for the whole period (Columns (1) and (2)), as well as the periods prior to (Columns (3) and (4)) and following (Columns (5) and (6)) the Sugar Act. The absolute value of the statistically significant point estimates lies in the range of one to 13 found in the literature (Erkel-Rousse and Mirza Reference Erkel-Rousse and Mirza2002); the elasticity for the whole period is –4.47 prior to the Sugar Act and –2.92 after. There is, however, a significant difference in the elasticities of the colonial and noncolonial countries. The former is insignificant and positive from January 1846 onward. The elasticity of the noncolonial suppliers is large (–6.09 to –7.92) and significant. This indicates that Charles Wood was partially right: the price elasticity of demand was significantly higher than unity, but only for noncolonial varieties of muscovado sugar.

Table 3 TRADE PRICE ELASTICITY, BEFORE AND AFTER THE SUGAR ACT

Notes: The dependent variable is the share of total quantity of imports. Robust standard errors clustered at the country-level in parenthesis. Regressions include month, partner, and partner-year fixed effects, as well as a single lead and lag (unreported). Estimated with ppmlhdfe. Number of observations is 1,649. Significance levels: *** p<0.01, ** p<0.05, * p<0.1.

Sources: Prices from John Bull, Bell’s Weekly Messenger, The Shipping and Mercantile Gazette; duties from United Kingdom (Reference Kingdom1859, p. 3); volumes from Liverpool Mercury, Gore’s Liverpool General Advertiser.

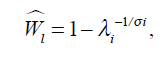

The estimates of the cumulative deadweight loss or gain in pounds sterling given in Table 4 show that all the gains derived from the Sugar Act were associated with noncolonial sugar. Column (1) gives the trade price elasticity for each of the countries in the sample. Again, only the three noncolonial countries show negative and statistically significant coefficients. With the exceptions of Jamaica and Guyana, the coefficients for the colonial countries are positive, and two of them (Antigua and St. Vincent) are significant. This indicates that the price transmission mechanism broke down in the colonial market for sugar for the passage of the Act; either the colonies did not respond to changes in relative prices, or they did so perversely. Column (2) shows the value of the reduction of the deadweight loss using the Liverpool data. Of the total 297,310 pounds of the reduction of the deadweight loss generated by the tariff cuts over the period January 1846–December 1853, 97 percent (289,650) corresponded to the noncolonial group. Of this group, almost all (98 percent) was generated by slave economies (44 percent from Cuba and 54 percent from Brazil). To place these numbers in context, Column (4) shows the value of the reduction of the deadweight loss as a percentage of total sugar import value. The gains accrued from tariff reductions on colonial products only represented 1 percent of total import value, while those corresponding to noncolonial suppliers were 40 percent. Again, Cuba and Brazil occupied a large part of this share. As discussed earlier, one potential problem with these estimates is that they are based on the total value of imports to Liverpool only and so may not represent national gains or losses. Column (3) shows the reduction of the deadweight loss using the national data, and Column (5) this value as a percentage of the national import value. Again, the reduction of the deadweight loss is solely associated with tariff reductions for noncolonial suppliers. Indeed, estimates using the national data suggest that the reductions associated with the colonial suppliers resulted in deadweight losses of over one million pounds. In terms of the value of sugar imports, the gain attributable to noncolonial countries is still sizable, albeit smaller, at 30 percent.

Table 4 CUMULATIVE REDUCTION OF THE DEADWEIGHT LOSS DERIVED FROM THE SUGAR ACT

Note: Significance levels: *** p<0.01, ** p<0.05, * p<0.1.

Sources: Prices from John Bull, Bell’s Weekly Messenger, The Shipping and Mercantile Gazette; duties from United Kingdom (Reference Kingdom1859, p. 3); volumes from Liverpool Mercury, Gore’s Liverpool General Advertiser; volumes retained for consumption: United Kingdom (Reference Kingdom1855, various years).

While the gains from the reduction of the deadweight loss attributable to noncolonial suppliers were large, the effect on revenues was not what the Exchequer had predicted. Instead, the level of tariff revenue declined over the period. This decline was associated with the dramatic reduction in revenue from the West Indian colonies due to the fall in the volume of imports and from noncolonial suppliers due to the fall in the tariff. There was a lesser reduction for British India and no change for Mauritius, due to increased imports. Thus, while the British economy benefited from the considerable reduction of the deadweight loss, the fiscal situation of the government was not immediately improved by the tariff reduction.Footnote 19

GAINS FROM TRADE

Until now, welfare gains have been calculated using a representative sub-sample of countries. An estimate of the full gains from the sugar trade following the Sugar Act, however, requires the complete universe of Great Britain’s sugar suppliers, which is only available on an annual basis from official statistics. Given that I focus on a single commodity, the gains from trade are sure to be small. Rather, the relevant question here is: What was the size of the slave economies’ share in the gains from the sugar trade following the Act?

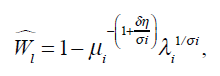

Recent work on the gains from trade has demonstrated that the welfare effect of a tariff is a function of domestic expenditure and trade elasticity (the elasticity of trade values with respect to variable trade costs). Arkolakis, Costinot, and Rodríguez-Clare (Reference Arkolakis, Costinot and Rodríguez-Clare2012, p. 95) showed that “the absolute value of the percentage change in real income as we move from the observed equilibrium to autarky” can simply be calculated as

$$\widehat {{W_i}} = 1 - {\lambda ^{ - 1/\sigma }},$$

$$\widehat {{W_i}} = 1 - {\lambda ^{ - 1/\sigma }},$$

where λ is the share of domestic expenditure (or one minus the import penetration ratio) and σ is the trade elasticity. Felbermayr, Jung, and Larch (Reference Felbermayr, Jung and Larch2015) argued that the results obtained using the Arkolakis, Costinot, and Rodríguez-Clare (Reference Arkolakis, Costinot and Rodríguez-Clare2012) welfare formulation were sensitive to changes in the distribution of tariff revenues. In the historical context, Federico and Tena-Junguito (Reference Federico and Tena-Junguito2017, pp. 615–18) found that for 1913, the Felbermayr, Jung, and Larch (Reference Felbermayr, Jung and Larch2015) formulation generated estimates that were on average 3.5 to 4.1 percentage points higher than those derived from the baseline Arkolakis, Costinot, and Rodríguez-Clare (Reference Arkolakis, Costinot and Rodríguez-Clare2012) formula. To capture the effect of the change in tariff revenues, Equation (5) is augmented to include the tariff multiplier µ i ,

$$\widehat {{W_i}} = 1 - {\mu _i}\left( {1 + \frac{{\delta \eta }}{{\sigma i}}} \right)\lambda _i^{1/\sigma i},$$

$$\widehat {{W_i}} = 1 - {\mu _i}\left( {1 + \frac{{\delta \eta }}{{\sigma i}}} \right)\lambda _i^{1/\sigma i},$$

where µ i is measured as the share of tariff revenue in aggregate income. For the term δη, I use the upper limit of 0.65 (which corresponds to the Melitz model) used by Mitchener, O’Rourke, and Wandschneider (2022).

The share of domestic expenditure on sugar, λ, can be calculated from historical data on British nominal GDP (Thomas and Williamson Reference Thomas and Williamson2023) and the total value of sugar imports, which comes from the Tables of the Revenue, Population, Commerce, &c. of the United Kingdom (United Kingdom, various years). Prior to 1854, declared values were not reported in the British trade statistics. To arrive at an estimate of total value, I multiply the volumes given in Tables with the annual averages of the wholesale prices from the monthly series. This is done by country and then summed to yield the total value. The monthly price series only covers the ten-country sample used in previous sections, so missing countries are assigned averages of observed prices depending on location.

The key parameter in Equations (5) and (6), σ, is not observed in the data and therefore must be estimated. The method for estimating trade elasticities differs in the literature and largely depends on data availability and application (Fontagné, Guimbard, and Orefice Reference Fontagné, Guimbard and Orefice2022). Given the quality and frequency of the data on hand, I estimate σ with a reduced-form gravity model using the imputed values of the full universe of Great Britain’s sugar imports from Tables. The sample includes 57 countries. To extend the temporal variation of the series, I take the data from 1834—the year of British slave emancipation—to 1852, when British trade statistics began to be published in the Annual Statement, which aggregated the imports of the British West Indies until 1865. My approach follows the structural gravity model as formulated by Anderson and Yotov (Reference Anderson and Yotov2010, pp. 2159–60) and as applied to historical British data by de Bromhead et al. (2019, pp. 340–43):

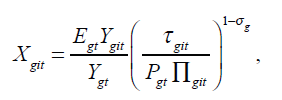

$${X_{git}} = \frac{{{E_{gt}}{Y_{git}}}}{{{Y_{gt}}}}{\left( {\frac{{{\tau _{git}}}}{{{P_{gt}}{{\rm{\Pi }}_{git}}}}} \right)^{1 - {\sigma _g}}},{\rm{\;}}$$

$${X_{git}} = \frac{{{E_{gt}}{Y_{git}}}}{{{Y_{gt}}}}{\left( {\frac{{{\tau _{git}}}}{{{P_{gt}}{{\rm{\Pi }}_{git}}}}} \right)^{1 - {\sigma _g}}},{\rm{\;}}$$

where X git is the value of British imports of product g from country i at time t, E gt is the total expenditure on product g at time t, Y git the output of product g from country i at time t, Y gt the world output of product g at time t, τ git the variable trade cost factor for product g at time t, P gt and Π git the inward and outward multilateral resistance terms, respectively, and σ g the elasticity of substitution parameter for product g. Given that I focus on a single commodity, the subscript g is redundant for the estimating equation. Ideally, the estimation of Equation (7) would be performed on high-frequency data with both dyad and country-year fixed effects to capture E t , Y t , and the multilateral resistance terms. However, given the smaller dimensions of the panel, I am limited to including only year- (controlling for E t , Y t , and P t ) and country- (controlling for Π i ) fixed effects. I thus exploit country-year variation of trade values and tariffs, which requires additional controls for Y it . Unfortunately, I lack annual data on total sugar output for this period for most countries in the sample. I also lack data on nominal GDPs (the literature’s proxy for Y git ). The closest—albeit imperfect—available proxy of economic performance is the total value of exports at current prices, which is available for most countries in the sample (Federico and Tena-Junguito Reference Federico and Tena-Junguito2019).Footnote 20 In many cases, total exports will capture the trend in sugar output, as the major part of the sugar harvest was sent abroad. However, this was clearly not the case for several larger countries (the United States, Brazil, and British India). This is an important caveat on the use of total exports and a potential source of measurement error.

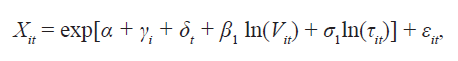

The estimating equation is

$${X_{it}} = \exp \left[ {\alpha + {\gamma _i} + {\delta _t} + {\beta _1}\ln \left( {{V_{it}}} \right) + {\sigma _1}\ln \left( {{\tau _{it}}} \right)} \right] + {\varepsilon _{it}},$$

$${X_{it}} = \exp \left[ {\alpha + {\gamma _i} + {\delta _t} + {\beta _1}\ln \left( {{V_{it}}} \right) + {\sigma _1}\ln \left( {{\tau _{it}}} \right)} \right] + {\varepsilon _{it}},$$

where, again, X it = Q it * P it is the value of imports of sugar from country i in year t, V it is the value of total exports in current prices from country i in year t, τ it is the tariff in shillings per hundredweight, and γ i and δ t are country- and year-fixed effects. As before, I estimate Equation (8) with ppml and robust standard errors clustered at the country-level.

Columns (1) and (2) of Table A1 in the Online Appendix show the trade elasticity without and with the time-variant control, respectively. The inclusion of total exports only marginally decreases the size of the elasticity, from 1.67 to 1.63. Columns (3) and (4) show the elasticities for colonial and slaveholder interactions, respectively.Footnote 21 While the size of the elasticities of colonial and noncolonial suppliers is the same (1.65 and 1.64), only the latter is statistically significant. However, the slaveholding and non-slaveholding groups (coefficients of 1.52 and 1.34), which include colonial and noncolonial suppliers, are statistically significant, indicating a considerable degree of heterogeneity across countries. Figure 8A in the Online Appendix shows the trade elasticity by country, together with the mean effect from Column (2) of Table 1A. There is a large amount of variation in the size and direction of the effect. The size of the elasticity ranges from –2.99 (Ceylon) to 4.15 (Cayenne). The elasticities for the British East Indies and Mauritius (–1.81 and –1.46) and Cuba and Brazil (–1.41 and –1.29) lie in a comparable range, while those of key West Indian colonies (Jamaica and Guyana) lie below unity.

The preferred aggregate elasticity of 1.63, as well as the observed range of –2.99 to 4.15 for the country-level estimates, accord with the estimate by de Bromhead et al. (2019, p. 343) of 1.47 for colonial goods during the period 1924–1938, and is close to that estimated by Fajgelbaum et al. (Reference Fajgelbaum, Goldberg, Kennedy and Khandelwal2020) of 2.47 using monthly U.S. imports at the product-level from January 2017 to December 2018, and the range of product-level estimates for the period 1995–2018 from Boehm, Levchenko, and Pandalai-Nayar (Reference Boehm, Levchenko and Pandalai-Nayar2023) of 1.75 to 2.25. On the other hand, they are low compared to the elasticity of 5.25 estimated for tradables over the period 2000–2014 by Freeman et al. (Reference Freeman, Larch, Theodorakopoulos and Yotov2021), the product-level average of 5.3 for benchmark years ranging from 2001 to 2016 by Fontagné, Guimbard, and Orefice (Reference Fontagné, Guimbard and Orefice2022), or the preferred elasticity of six by Amiti, Redding, and Weinstein (Reference Amiti, Redding and Weinstein2019), using the same monthly data as Fajgelbaum et al. (Reference Fajgelbaum, Goldberg, Kennedy and Khandelwal2020). If anything, what the literature on trade elasticities has demonstrated is that the estimation of these elasticities is sensitive to the method employed, country sample used, level of disaggregation at the product-level, and period covered (see Fontagné, Guimbard, and Orefice (Reference Fontagné, Guimbard and Orefice2022) for an overview). Given the limitations and quality of the data, my chosen empirical specification is necessarily constrained. However, to demonstrate how sensitive the results are to changes in the size of the trade elasticity, I also display the results using Reference Amiti, Redding and WeinsteinAmiti, Redding, and Weinstein’s (2019) upper-bound elasticity of six, estimated using a similar methodology and monthly data.

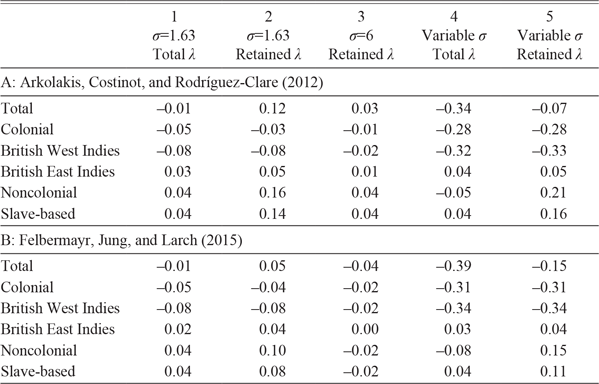

Panel A of Table 5 presents the gains from trade using the Arkolakis, Costinot, and Rodríguez-Clare (Reference Arkolakis, Costinot and Rodríguez-Clare2012) formula, with the aggregate elasticity of 1.63 from Column (2) of Table 1A (Columns (1) and (2)), the upper-bound elasticity of six (Column (3)), and the country-specific elasticities shown in Figure 8A (variable σ, Columns (4) and (5)). I also present estimates using expenditure shares in total imports (total λ) and adjusted for the share retained for consumption (retained λ). Following Mitchener, O’Rourke, and Wandschneider (2022), I calculate the gains from trade for the periods 1840–1845 and 1846–1852 and interpret the difference as the effect of the Sugar Act. The results from Panel A show that the gains from trade are sensitive to both the expenditure share (whether shares are from total imports or imports retained for consumption) and the trade elasticity. The estimates with constant elasticity and total expenditure shares (Column (1)) indicate that there was no gain from the Sugar Act (a –0.01-percentage point difference). This aggregate effect, however, reflected a gain from trading with noncolonial suppliers (0.04) that was offset by a loss from trading with colonial suppliers (–0.05). The former gain was driven by trade with the slave-based suppliers (0.04; Brazil, Cuba, and Puerto Rico), while the latter was the sum of the sizable loss from trading with the British West Indies (–0.08) and the smaller gain from increased trade with the British East Indies (0.03). Column (2) maintains the elasticity but applies the retained for consumption shares. The net effect is marginally positive (0.12) and the gains from the noncolonial trade are much larger (0.16, with 0.14 accounted for by the slave-based producers). When the elasticity is arbitrarily raised to six, as it is in Column (3), most of these gains disappear, and the net effect is like that of Column (1): marginal overall gains, negative gains from the colonial trade, and positive ones from the noncolonial trade, most of which were attributable to the slave-based economies.

Table 5 CHANGE IN GAINS FROM TRADE, FROM 1840–1845 TO 1846–1852 (PERCENTAGE POINTS), BY ORIGIN

Notes: Trade elasticity estimated with ppmlhdfe, including country and year fixed effects, robust standard errors clustered at country level. Column (3) takes an assumed upper-bound elasticity of six.

Sources: Prices from John Bull, Bell’s Weekly Messenger, The Shipping and Mercantile Gazette; duties from United Kingdom (Reference Kingdom1859, p. 3); volumes from United Kingdom (Reference Kingdom1855, various years); total exports from Federico and Tena-Junguito (Reference Federico and Tena-Junguito2019).

Columns (4) and (5) display the results using country-specific elasticities and both total and retained expenditure shares, respectively. The former shows a larger negative effect (–0.34), which is driven by a greater loss from trading with the West Indian colonies (–0.32). When retained for consumption shares are used, as in Column (5), this latter result is corrected, and the gain from noncolonial trade is large and positive (0.21). These results demonstrate that the assumption of constant elasticities across suppliers, prevalent in the literature on gains from trade, may bias the size and distribution of the gains and losses from trade.

Panel B of Table 5 displays the results using the Felbermayr, Jung, and Larch (Reference Felbermayr, Jung and Larch2015) formulation. As Federico and Tena-Junguito (Reference Federico and Tena-Junguito2017) observed, the inclusion of the tariff multiplier marginally increases the gains and losses from trade. However, except for Column (4), the overall effect is marginal. In the preferred estimates shown in Column (5), the losses from trade with the West Indian colonies (–0.34) are partially offset by gains with the East Indies (0.04) and noncolonial suppliers (0.15), the latter being associated almost entirely with the slave economies (0.11). Finally, altering δη in the standard range marginally changes these results. Setting δη=0 results in a net loss in Column (5) of –0.19, which reflects the reduction of the loss from the British West Indies (to –0.32) and the gains from the noncolonial suppliers (to 0.10, 0.07 for the slave producers). The general pattern of the distribution of gains and losses, however, holds.

CONCLUSIONS

The findings of this paper allow us to set the record straight on the debate surrounding the consequences of the British Sugar Act of 1846. As is always the case in any debate on trade reform, neither side was completely right. Bentinck and supporters were correct when they claimed that the Act would represent a substantial loss for the West Indian trade. Yet the results of this paper show that the income losses from trade with the British West Indies (–0.34 percentage points) were offset by gains from trade with the East Indies (0.04) and noncolonial (0.15) suppliers. Prime Minister Russell’s prediction that the Act would increase consumption—the safest bet of the debate—turned out to be true: results show a consumption gain of between 31 and 43 percent of pre-Sugar Act levels, with most of this gain coming from increased consumption of noncolonial (slave-grown) sugar. Nevertheless, Russell was wrong about the revenue stream. At least in the period immediately following the passage of the Act, the revenue generated by the sugar trade declined, driven principally by a vertiginous drop in revenue from British West Indian (due to falling volumes) and noncolonial (due to the tariff cut) imports. The results of this paper also show that the supporters of the Act were right in the claim that the legislation would quickly correct the supply-demand disequilibrium that had so plagued the British economy since at least the end of apprenticeship in the colonies: the six years following the Act, the deadweight loss associated with the noncolonial tariff on unrefined sugar was reduced by between 29 and 41 percent of total import value.

The conclusions that this paper draws on the focal point of the debate—Bentinck’s assertion that the Sugar Act stimulated the production of sugar using African slaves—are unambiguous. Sadly, Bentinck was right; it is evident that both British consumers and the slave economies profited from the liberalization of the British sugar market. Results show that 57 percent of the consumption effect, 95 percent of the reduction of the deadweight loss, and around 73 percent of the noncolonial gains from trade were associated with the slave economies. The somber reality is that without the trade with the Spanish West Indies and Brazil, the welfare gains generated by the Sugar Act would have been accrued solely from the trade with the British East Indies and Mauritius. These gains were smaller: a 3 percent consumption effect, a reduction of the deadweight loss of only 0.5 percent of total import value, and gains from trade of around 0.04 percentage points. In the end, however, free labor proved victorious over enslaved labor, but not in the way that Evelyn Denison had envisioned. The colonial share of the British market continued to be appropriated by Brazil and the Spanish West Indies until the 1870s. Thereafter, both free and slave-labor producers were rapidly priced out of the market by subsidized European beet sugar. The result was a crisis in the cane sugar-producing world that continued into the twentieth century (Absell Reference Absell2022).

This paper has not provided direct evidence of the effect of the Sugar Act on the production of cane sugar in the slave-based economies. However, the scant, in some cases anecdotal, supply-side evidence that does exist for Brazil suggests that the passage of the Act had a strong and immediate effect on the northeastern sugar industry. British consul reports from Brazil shortly after the passage of the Act indicated that in Pernambuco “… The removal of the differential duties on the import of sugar in England, added to the fortunate contingency of an abundant harvest here, not only at once raised the export of sugar from 40,000 tons to 61,000 tons, but its average price from Rs. 1/600, or 3s. 7¼d., to Rs. 2/, or 4s. 6d. per arroba,” while in Paraíba “Sugar cultivation is on the increase and is likely to continue so as long as the market in England is open to Brazil as well as to other parts of the world” (United Kingdom Reference Kingdom1848, pp. 428–29, 452). Most important, the records from the Trans-Atlantic Slave Trade Database for Bahia and Pernambuco show that per annum imports of slaves increased by 994 between the periods 1840–1845 and 1846–1851, the absolute difference being 12,780 slaves. The case of the Spanish West Indies is less clear cut, given that exports—and slave imports—were greatly affected by the hurricane of 1846 (Schwartz Reference Schwartz2016, p. 150). Exports and slave imports picked up again in the 1850s, and it is not unrealistic to suggest that the liberalization of the world’s largest sugar market had much to do with that growth.

The lesson for the literature on trade liberalization is that third-party consequences should be explicitly taken into consideration and balanced against local welfare effects. Only then might we develop an understanding of the global effects of tariff reform. The great tragedy of the British Sugar Act of 1846 is only revealed through such an analysis: that the liberalization of the sugar trade resulted in the increased consumption of slave-grown sugar, and thus most likely contributed to the maintenance—if not expansion—of this horrific institution in the Americas. While the net welfare effect of liberalization might be “welfare enhancing,” the case of the Sugar Act shows that free trade can co-mingle with and even exacerbate human rights abuses. A terrible irony of British history is that one of the consequences of the emancipation of slavery in the British colonies was the entrenchment of slaves outside of the Empire.