Introduction

Most farm workers in the United States are foreign-born, and a significant portion of these workers lack legal work authorization (NAWS 2022). Yet, a growing share of crop agriculture in the United States is performed by foreign guest workers employed on temporary work visas under the federal H-2A program (Calvin et al. Reference Calvin, Martin and Simnitt2022; Castillo et al. Reference Castillo, Martin and Rutledge2022). The question of how much H-2A workers earn per hour relative to their unauthorized peers has important implications for agribusiness profitability, immigration policy, rural development, and the overall wellbeing of farm workers. However, due to the scarcity of individual-level data on H-2A workers, this question is rarely addressed empirically in the agricultural labor literature. The National Agricultural Workers Survey (NAWS), which has been the main data source for the socioeconomic characteristics and legal status of farm workers since the 1990s, does not include H-2A workers in its sample. With H-2A hires growing exponentially in recent years, information provided by the NAWS is becoming increasingly limited in answering important questions. In this study, we utilize a unique data set, the Florida Citrus Harvesters Survey (FCHS) (Onel Reference Onel2016), to estimate hourly earnings differentials between H-2A and unauthorized harvest workers in Florida’s citrus industry – a major specialty crop industry in the state – given other observable worker characteristics. To our knowledge, this study is the first to estimate hourly earnings differentials between these two legal status groups of foreign-born crop workers in Florida.

The H-2A program gains popularity despite the high costs and administrative complexities involved in its utilization (Onel and Farnsworth Reference Onel and Farnsworth2016; Roka et al. Reference Roka, Simnitt and Farnsworth2017; Luckstead and Devadoss Reference Luckstead and Devadoss2019). The H-2A program provides legal, nonimmigrant visa classification to foreign-born workers seeking to perform agricultural work of a temporary nature, typically lasting no longer than 1 year, for which able, willing, and qualified U.S. workers are not available (Certification n.d.). In other words, the H-2A program is meant to supplement the domestic agricultural labor pool, some of which consists of unauthorized foreign-born workers who lack proper, legal documentation to work in the United States. Recent developments including rapidly rising agricultural wages, local reports of farm labor shortages, and rapid growth of the H-2A guest worker program suggest the tightening of U.S. farm labor markets (Richards Reference Richards2018; Werner et al. Reference Werner, Scotts, Mcleod, Mcleod, Halstead and Todd2019; Castillo et al. Reference Castillo, Simnitt, Astill and Minor2021; Calvin et al. Reference Calvin, Martin and Simnitt2022). The number of H-2A visas issued to foreign-born workers has increased every year since 2011. The growing popularity of the program can be attributed to its ability to provide growers with a consistent supply of workers throughout the season as well as with the ability to choose and retain the most productive workers in their labor pool. In fiscal year 2021, 257,898 visas were issued by the U.S. Department of State (2021) and 317,619 positions were certified by the U.S. Department of Labor (Office of Foreign Labor Certification 2022). This difference in the number of positions certified and the number of actual visas issued may be attributed to the fact that a single H-2A visa holder may hold more than one certified position (Zahniser et al. Reference Zahniser, Taylor, Hertz and Charlton2018; Martin and Rutledge Reference Martin and Rutledge2022). In 2021, Florida ranked first among all states requesting H-2A positions, with over 44,706 H-2A positions certified for work in the state. The existence of a large specialty crops sector, which is characterized by labor-intensive tasks, is a major factor for the quick adoption of the H-2A program in Florida.

There are several reasons for expecting H-2A workers to earn more than their domestic unauthorized counterparts. First, participating agricultural employers are required by federal law to pay their H-2A workers and any domestic workers working alongside H-2A workers the Adverse Effect Wage Rate (AEWR). The AEWR is a regional lower-bound wage rate set by the U.S. Department of Labor (DOL) for agricultural guest workers. The DOL sets the AEWR each year based on the annual weighted average hourly wage for crop and livestock workers in the previous year, as measured by the USDA’s Farm Labor Survey. The DOL releases 18 unique AEWRs each year, one for each of the 15 different regions and the three individual states (California, Florida, and Hawaii) in the USDA’s Farm Labor Survey. Employers who hire a fully domestic crew can offer their workers as low as the state minimum wage, but employers who have mixed crews of H-2A and domestic workers must offer the AEWR to all workers in such crews. One interesting implication of DOL’s methodology in determining AEWR is that the Farm Labor Survey includes within its sample, employers who employ AEWR recipients. Thus, in a given year, the average hourly livestock and crop worker wages as reported in the FLS are likely influenced by the AEWR of the same year, and these FLS-reported wages are used to set the AEWR for the following year. The result is a possible ratcheting effect or an autoregressive process, which may be contributing to the acceleration of the AEWR year over year (Rural Migration News Blog 2021; Calvin et al. Reference Calvin, Martin and Simnitt2022).

Second, anecdotal evidence suggests that H-2A harvest workers are likely younger and more productive than domestic workers, which may lead employers to replace their ageing domestic harvesters with H-2A harvesters who can harvest (thus earn) more per hour (Calvin et al Reference Calvin, Martin and Simnitt2022; Martin Reference Martin2017; Simnitt et al. Reference Simnitt, Onel and Farnsworth2017; Roka Reference Roka2018). Employers of H-2A workers have the option of inviting back their guest workers for subsequent seasons; thus, the program allows them to gradually select for and retain only the most productive of their workers.

Finally, the H-2A program reduces the amount of labor availability risk faced by the agricultural employer; H-2A employees are tied to their employer per the visa program requirements, and this allows employers who use the program to adequately plan for, hire, and retain a reliable source of workers. The H-2A employers face significant costs, including fees for recruitment, application and visas, costs of guest worker housing, and travel costs. However continued program growth across the country suggests that many employers find these higher costs worthwhile. In a sense, many H-2A employers might willingly pay an additional wage premium for their H-2A workers because of the managerial and labor risk management advantages that come with the H-2A program rules, including a steady supply of qualified workers for the entire duration of the work season.

Our study has several implications for employers and workers in citrus and other specialty crop industries. Labor is often the highest single input cost of specialty crop producers, thus estimating how much H-2A workers earn relative to domestic unauthorized workers is an important cost consideration for agricultural businesses (Castillo et al. Reference Castillo, Simnitt, Astill and Minor2021). In addition, most harvest workers in Florida are paid a piece rate or a combination of piece and hourly rate, regardless of their visa status. Thus, higher wages among H-2A workers may indicate that H-2A workers are more productive on average than their domestic unauthorized counterparts, providing a basis for follow-up research questions on productivity differences between crop workers of different legal statuses. Another implication of our study relates to the H-2A visa program rules. Critics of the H-2A program have long argued that the program is rife with misuse with some employers withholding workers’ pay (Centro de los Derechos del Migrante 2020; Martin Reference Martin2020; U.S. Department of Justice 2022). Quantifying relative hourly earnings of H-2A workers would provide some indication as to how successful employers are at remaining in compliance with the wage rules of the H-2A program. Finally, the relative earnings of H-2A workers have implications for rural development in these workers’ countries of origin; most H-2A workers send remittances during their job contract, transferring a significant portion of their earnings back to their home countries (e.g., Gibson and Mckenzie Reference Gibson and Mckenzie2014). As a result, higher earnings through the H-2A program would provide an incentive for more foreign-born individuals to accept H-2A jobs rather than entering the United States under a different visa or without a valid visa.

Relevant work

Motivated by concerns that migrants may depress the wages of U.S. citizen workers, several studies in the labor economics literature have focused on earnings differentials between domestic and immigrant workers in nonagricultural sectors. These studies have typically been formulated as estimates of elasticities of substitution between domestic and immigrant workers. Some have concluded domestic and immigrant workers are complements or very weak substitutes in the labor market (e.g., Borjas Reference Borjas1982; Grossman Reference Grossman1982), and others have found immigrant workers could have short-term depressing effects on domestic workers’ earnings in concentrated sectors (e.g., Muller and Espenshade Reference Muller and Espenshade1985). Applying a nested Constant Elasticity of Substitution (CES) approach to the NAWS data between 1989 and 2012, Wei et al. (Reference Wei, Onel and Roka2019) investigate substitutability among farm worker groups based on age, skill, and legal status. They find that neither authorized nor unauthorized immigrant farm workers have a significant impact on the employment of native farm workers. As mentioned earlier, the NAWS data used by Wei et al. (Reference Wei, Onel and Roka2019) exclude H-2A guest workers.

The Immigration Reform and Control Act (IRCA) of 1986 was a major piece of legislation that granted legal status to many of the nation’s unauthorized workers and made it illegal for employers to knowingly hire unauthorized workers. In the decades following the implementation of IRCA, various researchers have examined outcome differentials for authorized and unauthorized workers. Taylor (Reference Taylor1992) hypothesized that farm workers with legal status are more likely to be selected into higher paying, more skilled jobs than their unauthorized counterparts. Using a two-stage Heckit-type regression model, he estimates that unauthorized farm workers were significantly less likely to be employed in higher skilled jobs. Furthermore, he finds that, other things being equal, an unauthorized immigrant status was associated with a 29% decline in primary job earnings between legally authorized farm workers and their unauthorized counterparts. Similarly interested in the effect of legalization on worker earnings, Kossoudji and Cobb-Clark (Reference Kossoudji and Cobb-Clark2002) apply a quasi-experimental method (nonequivalent group technique) to a panel of men who entered the United States as unauthorized immigrants but were later granted amnesty under IRCA. These researchers find a wage penalty of 14–24% for being unauthorized and estimate that legalization under IRCA corresponds to an 11% wage increase for individuals who gained legal status. Kandilov and Kandilov (Reference Kandilov and Kandilov2010) apply a propensity score matching technique to NAWS data to estimate the effect of legalization on wages and benefits for U.S. farm workers. They estimate the ATT (Average Treatment effect on the Treated) of legalization on wages to be 5%. Furthermore, Kandilov and Kandilov (Reference Kandilov and Kandilov2010) find that legalization increases total compensation via a higher likelihood of the legalized worker receiving employee-sponsored health insurance and a monetary bonus. Findings from these studies suggest that legal status is a strong predictor of wages and earnings and that authorized workers are likely to earn more than their unauthorized counterparts.

We are only aware of a couple of studies looking specifically at wage differences between H-2A workers and their domestic counterparts. Using household survey data from the Mexican Migration Project, Apgar (Reference Apgar2015) uses least squares (LS) regressions to estimate wage differentials between agricultural workers based on their migration status. She finds that both undocumented workers and H-2A workers earn significantly less than legal-permanent residents, but this difference disappears after factoring in housing benefits for H-2A workers. While Apgar (Reference Apgar2015) provides a starting point for discussions of earning differentials between H-2A and other classes of agricultural workers, there are some shortcomings of this study. First, the results are averages for the entire Unites States and not by individual states. The H-2A program is not uniformly adopted across the entire country, and aggregating data for estimation prevents a clearer picture for large specialty crop states that employ the greatest number of H-2A workers, including Florida. There is also considerable variation in the regional AEWRs set by the DOL each year, with a difference of 23% between the lowest and highest AEWR wage rates in 2023. Second, Apgar (Reference Apgar2015) is unable to control for potentially large differences in wage rates in different agricultural subsectors.

Using the 2012 Florida Agricultural Worker Survey (FAWS), Emerson and Iwai (Reference Emerson and Iwai2014) estimate hourly earnings differentials between authorized workers (including a small group of H-2A workers along with other authorized groups) and unauthorized workers in the state of Florida. The FAWS questionnaire was identical to the NAWS questionnaire, except that, unlike NAWS, FAWS included H-2A workers in sampling. Emerson and Iwai (Reference Emerson and Iwai2014) account for potential self-selection and endogeneity biases in their estimation, but they do not find support for significant differences in earnings between the unauthorized and authorized groups of workers in Florida. They attribute this finding to a relatively small sample size of 453 workers, with H-2A crop workers consisting of only 9.2% of the total number of sampled workers in 2012. In contrast, Emerson and Iwai (Reference Emerson and Iwai2014) confirm significantly larger earnings for authorized seasonal crop workers using the national NAWS data between 1990 and 2011.

We complement the above-mentioned studies by estimating relative hourly earnings of H-2A guest workers compared to unauthorized immigrant workers harvesting citrus in Florida in the 2016–2017 harvest year, given major determinants of earnings and observable worker characteristics. The hypothesis is that H-2A workers earn more than their unauthorized counterparts after controlling for age, experience, education, and other relevant factors. However, our estimated coefficient associated with the H-2A status of a worker should not be interpreted as the treatment effect of program participation in worker hourly earnings, because data limitations do not allow controlling for unobservable factors that might be contributing to earning differentials between these two classes of workers. Nonetheless, the study contributes to a better understanding of this fairly unknown and quickly rising legal group of farm workers.

Sample data

For the empirical analysis, we use data from the FCHS, a survey of citrus harvest workers conducted throughout the state of Florida during the 2016–2017 harvest season. The FCHS survey was funded by the University of Florida, Institute of Food and Agricultural Sciences (UF/IFAS), and conducted by researchers and community partners from UF/IFAS and the Farmworkers Association of Florida (FWAF) (Onel Reference Onel2016). Harvest workers were interviewed face to face in seven different citrus-producing counties in South Florida, accounting for 68% of total citrus production in the state. Accessing H-2A workers and domestic workers is challenging for different reasons. Domestic (and mostly unauthorized) workers may hesitate to respond to direct research inquiries from outsiders for fears of deportation. H-2A workers, on the other hand, stay at employer-provided housing that is typically inaccessible without prior authorization from the employer. To overcome these challenges, unauthorized respondents were recruited and interviewed by the trusted staff members of a farm worker advocacy and community leader, the FAWF, while the H-2A workers were selected randomly at their housing camps with the assistance of University of Florida extension specialists. Both groups of workers were interviewed outside of their working hours at their places of lodging for reduced pressure as well as better response rates and quality of data. While the FCHS sampling scheme could not be randomized at higher selection levels due to the challenges mentioned above, the selection of individual workers was randomized once interviewers visited workers at their dwellings (unannounced). A total of 307 in-person worker interviews were completed in either English or Spanish by trained bilingual interviewers. The relative sample size of H-2A workers in the FCHS sample matched the anecdotal estimates (∼80%) provided by industry representatives such as the Florida Fruit and Vegetable Association (FFVA) in 2016. While narrower in content, the FCHS questionnaire is designed similarly to the NAWS questionnaire and includes various demographic and work questions. The paycheck information reported by each participant is particularly relevant to this study.

Workers interviewed through the FCHS were asked to recall their last paycheck and report the number of hours worked for the duration of that pay period as well as the pay received for those hours. Worker’s hourly earnings is the primary variable of interest in the present study. In practice, most harvesters in Florida are not paid by the hour but rather receive a piece rate or a combination of a piece rate and an hourly base rate. For those who did not get paid by the hour, we computed hourly earnings by dividing the gross value of their most recent paycheck by the number of hours they reported working for that pay period.Footnote 1 Workers were also asked to indicate their legal status among the categories of citizen, legal permanent resident, undocumented or pending status, H-2A guest worker, or other nonimmigrant visa status. Work history information, including experience in agricultural work and the type of employer (grower versus farm labor contractor [FLC]), were also collected with the FCHS.

The original survey sample included a total of 307 participants, 3% of which were U.S. citizens or legal residents, 15% of which were unauthorized immigrants, and 82% of which were H-2A workers. According to the most recent NAWS report (2022), approximately 44% of the farm workers, excluding H-2A workers, interviewed nationwide over the years spanning 2019–2020, indicated they lacked legal work authorization (U.S. Department of Labor, 2022: i). There have been some arguments that the true percentage of agricultural workers without work authorization may be higher in the NAWS figures as workers may inaccurately report their true legal status to DOL officials due to fear of deportation (Bachmeier et al. Reference Bachmeier, Van Hook and Bean2014). Participants of the FCHS were relatively open about their legal status to the trusted community-based interviewers from the FWAF. In addition, workers in the FCHS were interviewed away from their workplaces to reduce pressure in responding to sensitive questions.

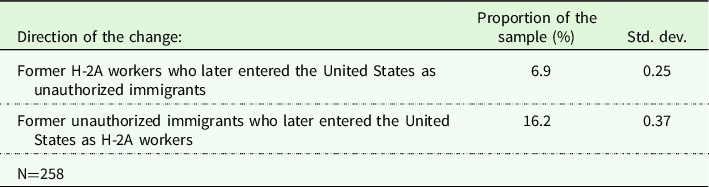

Of the total 307 observations, 250 observations were left for the analysis upon eliminating missing responses for the variables of interest and dropping the few permanent residents and citizens. Most of the workers in the estimation data set were H-2A workers (∼84%), with unauthorized domestic workers constituting the remaining ∼16% of the estimation sample. The decision to drop legal permanent residents and citizens from the analysis was mainly because after eliminating observations with missing responses from the data set, too few of observations from the legal permanent resident and citizen group remained, which were inadequate to estimate the earnings differentials for this subgroup. As a result, our analysis provides a comparison between H-2A workers and their unauthorized domestic counterparts. While qualitative differences invariably exist between H-2A and unauthorized citrus harvester workers, there is likely some movement of individuals between these two groups of workers. Preliminary analysis of survey data from the Mexican Migration Project (MMP) further suggests this may be the case. Of the 258 MMP survey participants who reported entering the United States on H-2A visas between 1987 and 2016, 16% disclosed they had previously entered the United States at least once as an unauthorized immigrant (see Table A1 in Appendix). Likewise, it is also plausible for an individual who was once employed as an H-2A worker to lose their H-2A status and work as an unauthorized worker in subsequent seasons. Such a switch from legal H-2A status to unauthorized status could potentially occur via abscondence (e.g., a temporary guest worker fails to return to their home country, taking up unauthorized immigrant status), or a subsequent migration as an unauthorized immigrant. The MMP data confirm this is a less frequent occurrence, with 7% of the former H-2A visa holders interviewed indicating they had subsequently entered the United States as an unauthorized immigrant at least once after the period they had been employed on an H-2A visa (Table A1 in Appendix).

Econometric methods

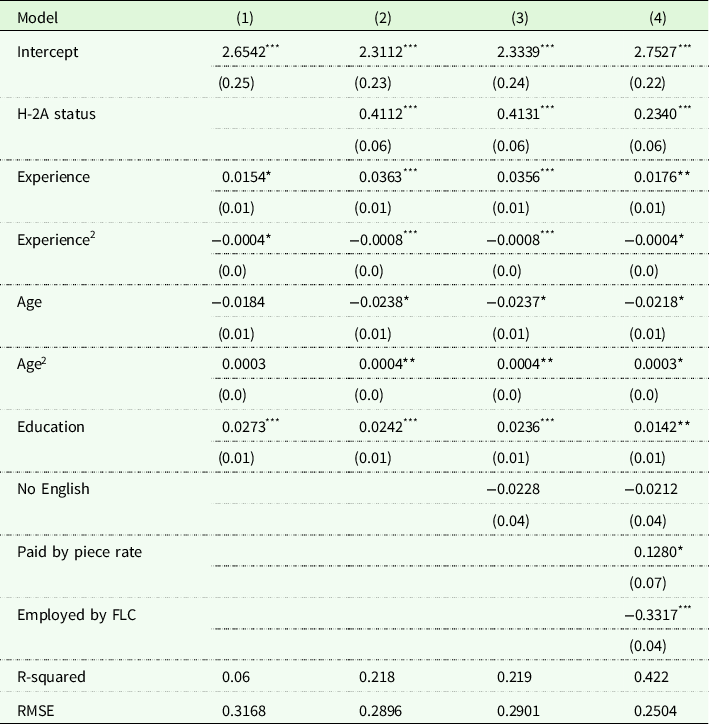

This study estimates workers’ hourly wages (in natural logarithmic form) using Classical and Bayesian regression techniques. A Mincer-type earnings equation is estimated first using the standard LS method (Table 2). Then, the same relationship was estimated using Bayesian inference (Table 3). Of particular interest to this study is the relationship between H-2A status and log of hourly earnings. We do caution against interpreting the coefficient estimate on the H-2A status as a causal effect of H-2A status on hourly earnings due to not being able to control for unobservable factors that might affect both H-2A status and earnings of workers. The inability to adequately control for such unobservable factors may lead to an endogeneity problem in LS estimation, which may in turn result in a larger estimated coefficient for the H-2A status in an hourly earnings equation than what would be the true treatment effect (Nackosteen and Zimmer Reference Nackosteen and Zimmer1980). The expectation toward a positive upward bias with classical LS estimation rises because more productive or ambitious migrant workers may be among those most likely to seek out or be selected for employment in the H-2A program. Our data set does not allow for adequately controlling for such unobservable factors using proper instruments. As such, our estimates on the H-2A status should be taken as the estimated difference in hourly earnings of H-2A workers after controlling for the observable factors that might affect worker earnings, such as worker and job characteristics.

Table 1. Descriptive statistics

Notes: ***, **, and *denote significance of group mean differences at 1%, 5%, and 10% levels, respectively.

Table 2. Determinants of log hourly earnings of Florida citrus harvesters: classical regressions

Notes: ***, **, and *denote significance at 1%, 5%, and 10% levels, respectively. Standard errors are in parentheses.

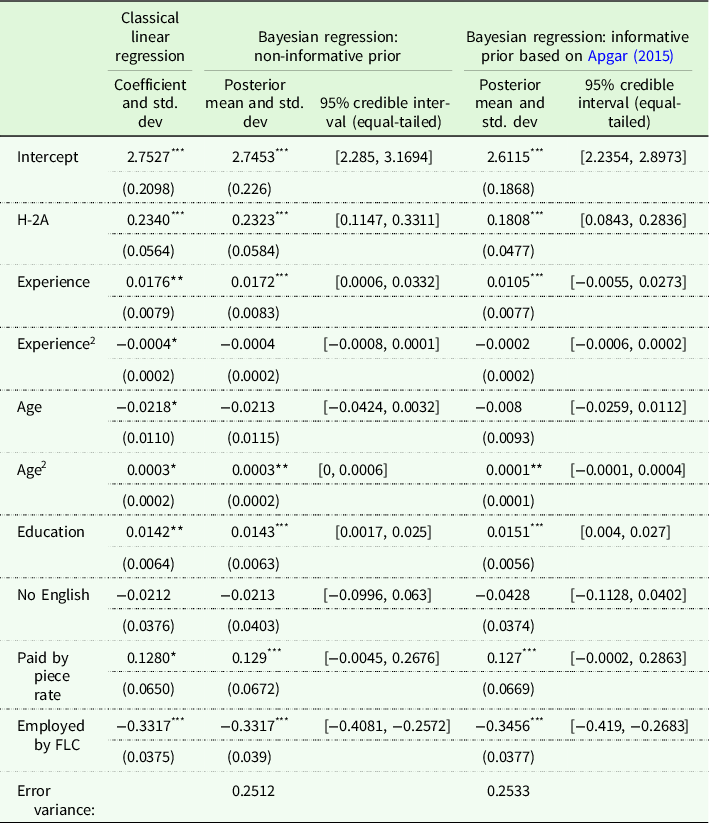

Table 3. Determinants of log hourly earnings of Florida citrus harvesters: Bayesian inference

Notes: Informative priors for the variables, H-2A, age, education, and no English were set based on the estimated coefficients of Apgar (Reference Apgar2015). ***, **, and *denote significance at 1%, 5%, and 10% levels, respectively. Standard errors are in parentheses (LS standard errors are bootstrapped with 1000 replications). “FLC” stands for farm labor contractor.

The Mincer-type earnings equation to be estimated in this analysis is of the form:

where Y is a vector including the log of hourly earnings for each worker, X is a matrix of observable explanatory variables including an intercept term, B is the vector of coefficients, and

![]() ${\rm{\varepsilon }}$

is the error term. The explanatory variables included in matrix X are consistent with those proposed by Mincer (Reference Mincer1974) and those included in Emerson and Iwai (Reference Emerson and Iwai2014) for estimating Florida farm worker earnings. We model hourly earnings as a function of nine explanatory variables, including an indicator variable for the H-2A status, years of experience in agricultural work, years of experience in agricultural work squared, worker’s age in years, age squared, years of formal school education, an indicator variable called “no English” which takes the value of one if the worker does not speak any English, an indicator variable called “piece rate” which takes the value of 1 if the worker is paid by the piece rate, and an indicator variable named “FLC” which takes the value of 1 if the worker is employed by a FLC as opposed to directly by a grower.

${\rm{\varepsilon }}$

is the error term. The explanatory variables included in matrix X are consistent with those proposed by Mincer (Reference Mincer1974) and those included in Emerson and Iwai (Reference Emerson and Iwai2014) for estimating Florida farm worker earnings. We model hourly earnings as a function of nine explanatory variables, including an indicator variable for the H-2A status, years of experience in agricultural work, years of experience in agricultural work squared, worker’s age in years, age squared, years of formal school education, an indicator variable called “no English” which takes the value of one if the worker does not speak any English, an indicator variable called “piece rate” which takes the value of 1 if the worker is paid by the piece rate, and an indicator variable named “FLC” which takes the value of 1 if the worker is employed by a FLC as opposed to directly by a grower.

As discussed in the introductory section, Florida citrus industry has moved rapidly toward H-2A employment during the years the sample data collection took place. The unbalanced distribution of the two legal status groups, with a significantly larger proportion of H-2A workers compared to unauthorized workers in the sample, have prompted us to supplement our classical regression analysis with a Bayesian estimation technique for more robust estimation results. A significant advantage of Bayesian estimation compared to Classical estimation methods is that it does not assume large sample sizes and that it maintains power and precision even in relatively small samples where the ratio of parameters to observations may be as much as 1:3 (Lee and Song Reference Lee and Song2004; Van de Schoot and Miocevic Reference Van de Schoot and Miocevic2020). Bayesian inference consists of combining what is known about a model’s parameters with a data-driven estimation procedure. In practice, this combination entails multiplying a prior distribution,

![]() $p\left( {\rm{\theta }} \right)$

, by the likelihood function,

$p\left( {\rm{\theta }} \right)$

, by the likelihood function,

![]() $L\left( {{\rm{\theta |}}y} \right)$

, to estimate the parameters of interest. The prior distribution,

$L\left( {{\rm{\theta |}}y} \right)$

, to estimate the parameters of interest. The prior distribution,

![]() $p\left( {\rm{\theta }} \right)$

, is typically inferred from previous studies, although in practice some researchers have implemented an ad hoc approach to choose priors. Such an approach typically entails assuming normality of all parameters or some other combination of expected distributions. Lee and Song (Reference Lee and Song2004) demonstrate that Bayesian estimation can also be carried out with non-informative priors, although the full power of Bayesian estimation under these circumstances goes unrealized.

$p\left( {\rm{\theta }} \right)$

, is typically inferred from previous studies, although in practice some researchers have implemented an ad hoc approach to choose priors. Such an approach typically entails assuming normality of all parameters or some other combination of expected distributions. Lee and Song (Reference Lee and Song2004) demonstrate that Bayesian estimation can also be carried out with non-informative priors, although the full power of Bayesian estimation under these circumstances goes unrealized.

Bayesian estimation starts with choosing the likelihood (or log-likelihood) function for the equation to be estimated. We derive the likelihood function for our Bayesian estimation process beginning with a maximum likelihood specification for the linear regression model:

where n is the number of observations, k is the number of covariates,

![]() ${y_i}$

is variable to be explained,

${y_i}$

is variable to be explained,

![]() ${x_i}$

is a vector of explanatory variables as defined after Equation 1,

${x_i}$

is a vector of explanatory variables as defined after Equation 1,

![]() ${\rm{\beta }}$

is a vector of parameters, and

${\rm{\beta }}$

is a vector of parameters, and

![]() ${\sigma ^2}$

is the variance.

${\sigma ^2}$

is the variance.

Next, we derive the joint probability distribution for the parameters in question by multiplying the likelihood function by the prior distribution of the form

![]() ${\rm{\;g}}({\rm{\beta }},{\sigma ^2}|{\rm{\theta }})$

, where the joint pdf is of the form:

${\rm{\;g}}({\rm{\beta }},{\sigma ^2}|{\rm{\theta }})$

, where the joint pdf is of the form:

By integrating the pdf, one arrives at the cumulative distribution function (cdf), denoted by

![]() ${\rm{h}}\left( {\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}} \right)$

, and the posterior distribution,

${\rm{h}}\left( {\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}} \right)$

, and the posterior distribution,

![]() ${{\rm{f}}^{\rm{*}}}({\rm{\beta }},{\sigma ^2},\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}$

), is achieved by dividing the joint pdf by the cdf:

${{\rm{f}}^{\rm{*}}}({\rm{\beta }},{\sigma ^2},\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}$

), is achieved by dividing the joint pdf by the cdf:

$${{\rm{f}}^{\rm{*}}}({\rm{\beta }},{\sigma ^2},\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}),{\rm{\;}} = {{\mathop \prod \nolimits_{i = 1}^n {1 \over {\sigma \sqrt {2\pi } }}exp\left[ { - {{{{\left( {{y_i} - \beta {x_i}'} \right)}^2}} \over {2{\sigma ^2}}}} \right]{\rm{g}}({\rm{\beta }},{\sigma ^2}|{\rm{\theta }})} \over {{\rm{h}}\left( {\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}} \right)}}$$

$${{\rm{f}}^{\rm{*}}}({\rm{\beta }},{\sigma ^2},\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}),{\rm{\;}} = {{\mathop \prod \nolimits_{i = 1}^n {1 \over {\sigma \sqrt {2\pi } }}exp\left[ { - {{{{\left( {{y_i} - \beta {x_i}'} \right)}^2}} \over {2{\sigma ^2}}}} \right]{\rm{g}}({\rm{\beta }},{\sigma ^2}|{\rm{\theta }})} \over {{\rm{h}}\left( {\left\{ {{y_i},{x_i}} \right\}_{i = 1}^n,{\rm{\theta }}} \right)}}$$

The posterior distribution is nearly impossible to integrate analytically (Davis and Klaus Reference Davis and Klaus2010). Therefore, its form is approximated through repeated sampling of the data using software developed specifically for Bayesian inference. We use R/Stan, which utilizes the Hamiltonian Monte Carlo algorithm for estimating the posterior for Equation (4) (Stan Development Team 2014). We estimate the hourly earnings model twice using both non-informative and informative priors. The informative prior incorporates coefficient estimates previously obtained by Apgar (Reference Apgar2015).

Findings

Table 1 presents descriptive statistics for the legal status subsamples of H-2A workers and unauthorized domestic workers as well as the full (or, pooled) sample. The proportion of citrus harvest workers who are guest workers (H-2A) is high, with 84% of the workers identifying as H-2A guest workers. While this ratio of guest workers to domestic unauthorized workers is larger than the estimate from the FAWS of 2012, it strongly conforms to external data that the percentage of H-2A visa holders among citrus harvest workers has exponentially increased in recent years (Emerson and Iwai Reference Emerson and Iwai2014). A conspicuous jump in the number of employer-filed petitions for H-2A workers in the Florida citrus industry occurred between the years 2012 and 2016. The recent increase in the proportion of H-2A workers among Florida citrus harvesters has been linked to the spread of citrus greening and consolidation of citrus operations, and the anecdotal evidence collected by extension agents confirms this rather quick shift toward a majority H-2A workforce in the Florida citrus industry (Roka Reference Roka2013, Reference Roka2018).

On average, H-2A workers in our estimation sample earn more per hour than their unauthorized counterparts. Calculated hourly wages of the H-2A portion of the sample were $12.00 compared to unauthorized workers $9.18. This difference of $2.82 is statistically significant according to the group mean t-tests (Table 1). Difference in average hourly earnings could be due to agricultural employers maintaining separate crews of H-2A and domestic workers and paying their domestic crews less than the AEWR, or it could be because H-2A harvesters are typically younger and more productive pickers than their domestic counterparts. While we do control for age later in our analysis, we do not have information in the sample data on whether a domestic (unauthorized) worker works alongside H-2A workers and gets AEWR as the minimum wage. The average hourly earnings for the H-2A group were above the AEWR for the state of Florida in 2016 ($10.70). However, the unauthorized group made less than the AEWR, on average at $9.18 per hour.

The unauthorized workers in the sample have significantly more experience in farm work (25 years) than their H-2A counterparts (19 years). This difference is unsurprising given that, on average, the unauthorized portion of the sample is a decade older (41 years) than the H-2A workers (31 years). Additionally, the H-2A group is more educated with formal schooling, on average. Mean years of schooling is 8 years for H-2A workers compared to 6.3 years for domestic unauthorized workers. Some of this difference in mean average schooling may reflect the difference in average ages between the two legal status groups, with generally younger H-2A cohorts being more likely to have benefited from improved access to education in their formative years.

Workers in the H-2A group indicated lower levels of spoken English proficiency than those in the unauthorized group, with 77% of them reporting that they speak no English at all, compared to 56% of unauthorized workers. Like individuals holding other nonimmigrant visas, H-2A workers must have permanent residency in a foreign country (which in our data set is usually Mexico). Given that H-2A workers maintain residence in non-English speaking countries and are only in the United States on short-term contacts, it is understandable that they would have less time to develop English ability than their unauthorized counterparts, who are more likely to live for extended periods in the United States.

Data were also collected on how workers were compensated: whether they received a piece rate, an hourly rate, or some combination of the two. Most workers in both groups indicated they were paid based on a piecemrate or a combination rate scheme. Similar shares of both groups, unauthorized and H-2A, indicated receiving a piece rate (93 and 90%, respectively), suggesting that visa status may have no bearing on whether a worker receives hourly or piece rate compensation. A growing portion of H-2A workers across the U.S. fruit and tree-nuts sector are employed through FLCs. FLCs are essentially labor brokers or middlemen who hire and assemble crews of farm workers, manage their payroll and activity on site, and lease their labor services to growers and other end users. Growth of H-2A usage among FLCs has been documented by Castillo et al. (Reference Castillo, Simnitt, Astill and Minor2021) who suggest that growers and ranchers may prefer hiring H-2A workers through FLCs because these contractors have expertise, allowing them to navigate the legal recruitment and employment processes easier. Furthermore, employing H-2A indirectly through an FLC may provide cost savings to small-scaled farms. H-2A workers employed through FLCs often provide work for multiple end users (growers) throughout the duration of their contract. Thus, these growers essentially split program costs such as housing, travel, and application and visa fees with other growers who are also leasing H-2A labor services from the same FLC.

The classical LS estimation results for the Mincer-type wage equation (Equation 1) are reported in Table 2. The coefficient on the H-2A status in the log of hourly earnings equation is 0.23 in the last column of Table 2, implying that being an H-2A worker corresponds to 23% higher hourly earnings. This value is slightly higher than similar estimates for authorized farm workers in the literature. Using the FAWS data, Emerson and Iwai (Reference Emerson and Iwai2014) estimate that unauthorized Florida farm workers would receive 15% more in hourly earnings if they were compensated the same as their authorized peers (including H-2A). Using the NAWS data, Kandilov and Kandilov (Reference Kandilov and Kandilov2010) estimate net earnings gain of 5–9% from holding authorized status (excluding H-2A) among agricultural crop workers.

Table 3 compares the classical estimation results with the Bayesian estimation results. Comparison of the posterior means of each coefficient and associated standard deviations between the Classical LS results in the first column and the Bayesian regression results with a noninformative prior in the middle column suggest that the Bayesian estimates are fairly similar to those from the LS estimation when non-informative priors are used. In contrast, the Bayesian regression results in the last columns were estimated using an informative prior. Prior distributions for coefficients on the H-2A status, education, no English ability, and age were selected based on Apgar’s findings (Reference Apgar2015). The means of posterior distributions of the coefficients from the Bayesian estimation using informed priors suggest that H-2A workers earn 18% more per hour than their unauthorized counterparts. This estimate is slightly lower than the estimated coefficient from the Classical LS model and the Bayesian regression with a non-informative prior, and it is slightly higher than the estimated difference in earnings attributed to legal status reported by Emerson and Iwai (Reference Emerson and Iwai2014) for Florida farm workers. One significant benefit of the Bayesian inference over the Classical inference is that the Bayesian methods provide more information about the coefficients of interest as opposed to the Classical methods, which only provide a point estimate for each marginal effect. Table 3 includes the equal-tailed 95% credible interval for each Bayesian coefficient. There is a 95% chance that the effect of H-2A status on hourly wage rates of Florida citrus workers is between 8% and 28% according to the model with the informative prior. Posteriors means of the coefficients on education, paid by a piece rate, and employed by an FLC also fall within their respective 95% credible intervals. In the Bayesian regression results, lack of English language ability is not a significant determinant of hourly earnings in the context of migrant citrus harvesters, which is consistent with the results from the Classical LS estimations reported in Table 2.

Conclusion

We estimate hourly earnings differentials between H-2A and domestic unauthorized citrus harvesters in Florida using regressions with both Classical inference and Bayesian inference methods. We find that the H-2A status is significant and positively correlated with reported hourly earnings, and its coefficient has a value ranging from 0.18 to 0.23. Having the H-2A status as opposed to the unauthorized status corresponds to an increase in average hourly earnings ranging from 18 to 23% for migrant citrus harvesters in Florida. Thus, participation in the H-2A program provides better earnings for migrant harvest workers in Florida, given observable demographic and work characteristics.

A major reason for this difference in hourly earnings may be that employers are obligated to pay their H-2A workers at least the AEWR, a wage rate that exceeds the state minimum wage. Another reason for this positive association may be that younger and more productive workers, who have higher hourly earning potentials due to Florida’s piece rate payment scheme, may be more likely to participate in the H-2A visa program as H-2A employers have the power to recruit these types of workers from abroad. In some instances, productive unauthorized workers in the United States may even leave the country to enter back as H-2A workers. These findings also have significant implications for Florida’s agricultural employers, as labor remains the highest input cost for specialty crop producers. Furthermore, our findings on positive hourly earnings differentials suggest that H-2A workers may be more productive than domestic unauthorized workers, although analysis using production data would be necessary to confirm actual productivity differences. Additional findings suggest that experience, age, schooling, employment by an FLC, and getting paid a piece rate are all significant predictors of hourly earnings.

This research provides new evidence that the H-2A program participation is positively associated with higher hourly earnings for citrus workers, that citrus growers on average are paying their H-2A workers at least the AEWR, and that the advantage enjoyed by H-2A workers extends beyond the housing and transportation benefits they receive under the H-2A guest workers program. The AEWR is meant to hedge against the depression of the domestic wage rate due to an influx of foreign workers. Given our finding that the average hourly wage rate for H-2A workers is above the AEWR, the AEWR does not appear to be strictly binding for the H-2A harvesters. While the federally set AEWR may be binding for the least productive individuals, a significant proportion of H-2A citrus harvester in Florida picked fruit at rates that resulted in higher hourly earnings than the AEWR. In contrast, the AEWR may be binding for the unauthorized workers, prompting the separation of domestic and H-2A worker pools. The extent to which employers separate work crews based on H-2A status is an interesting question from a production perspective. A related question is whether the net marginal benefit of an H-2A worker exceeds that of a non-H-2A worker for a producer. Undoubtedly, a major driver of the H-2A program growth is uncertainty experienced by agricultural employers regarding the domestic farm labor supply. The explicit costs of employing an H-2A workers are higher; however, potential savings from losses due to instability of the domestic labor pool likely maintain H-2A hires as the better option for many employers. If the total net benefit of employing H-2A workers indeed exceeds that of employing domestic workers, then another future research question would be how much of this net benefit might be attributed to productivity differences and how much is due to managerial advantages of employing a stable and available crew that is bound to the petitioning employer by federal mandate. Evaluating these questions would be possible in the future as reliable production data become available for each legal status group including the H-2A workers.

Data availability statement

Files used in estimation are available from authors.

Acknowledgments

We are grateful for the assistance of Antonio Tovar-Aguilar, Nezahualcoyotl Xiuhtecutli, and Maria Carmona of the Farmworkers Association of Florida in gathering part of the data used in this study. We thank the two anonymous reviewers and the editor for their helpful comments and suggestions.

Disclaimer

The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination policy.

Funding statement

This research is supported by the following grant. The funding agency was not involved in the design of the study and collection, analysis, and interpretation of data and in writing the manuscript; “Creating sustainable workforce for small fruits and vegetables industry in Florida: The impact of federal immigration programs and solutions to labor shortages,” University of Florida, Institute of Food and Agricultural Sciences, Early Career Scientist Seed Funding, 2015.”

Competing interest

None.

Appendix A

Table A1. Percent of Mexican farm workers changing legal status when entering the United States

Note: Compiled from data provided by the Mexican Migration Project (MMP) 174; sample was limited to individuals who had entered the United States on an H-2A visa at least once between 1987 and 2016.

source data accessible at http://mmp.opr.princeton.edu.