Introduction

Foreign workers play an essential role in European and other developed countries. Population aging and social changes are behind the need for immigration to balance labour supply and demand, and immigration is increasingly perceived as a structural phenomenon that, if well managed, can significantly contribute to economic growth and welfare state sustainability. Recently, the COVID-19 pandemic has made even more visible the key role played by migrantFootnote 1 workers in essential activities like agriculture, retail trade, or the care economy, including health workers (Fasani & Mazza Reference Fasani and Mazza2020a).

The extent to which this positive social and economic impact of immigration is to be achieved depends, however, on the degree of success in designing and putting adequate migrant integration policies into practice. Migrant integration is defined by the European Commission as a ‘two-way process’ of mutual accommodation between new and old residents that ‘can and should be a win-win process, benefiting the entire society’ (European Commission 2020, p. 2). In the same vein, Nannestad (Reference Nannestad2007) considers that integration can be seen as a public good. To achieve this, the host society should be able to offer immigrants, and their families, real opportunities to fully participate in society.

Although migrant integration involves social, cultural, and economic factors, there is a strong consensus on the central role of economic achievements, particularly of labour market integration, in overall inclusion outcomes. Increasing the employment rate of migrants is an important challenge in some Central and Northern European countries (Bélanger et al Reference Bélanger, Christl, Conte, Mazza and Narazani2020, p. 10). In Spain and other southern and eastern newer immigration countries, however, migrants’ market participation is high, but migrants are often trapped in low-paid low-quality jobs that hinder their economic and social progress,Footnote 2 with all the negative consequences it entails (inequality, poverty, etc.).

This issue has special relevance in Spain, which is the second European Union –EU– EU country (after Germany) that hosted the largest number of non-nationals in 2020.Footnote 3 It is also one of the EU countries with the highest levels of income inequality and working poverty, as well as one of the top 5 regarding both the raw and the adjusted migrant pay gap (Amo-Agyei Reference Amo-Agyei2020). The existence of this migrant pay gap implies that migrants earn less than native workers for every hour worked. The wage penalty could be greater in the case of migrant women from poorer countries since they accumulate gender and origin-related disadvantages.

While almost all developed countries exhibit a significant pay gap against migrant workers, recent studies have uncovered a high degree of heterogeneity in the structure of the gap, with different patterns across the wage distribution or between sociodemographic groups. There are also striking differences regarding the part of the pay gap, which remains unexplained after considering workers’ characteristics such as age, education, and other observable variables related to the type of job. Although this ‘unexplained component’ of the observed gap can be due to several factors, not necessarily involving discrimination, disentangling where, and why, the migrant pay gap occurs can help policymakers to develop better integration measures.

An aspect that has been much less investigated so far is the role played by wage supplements in explaining the migrant pay gap. Depending on gender, occupations, sectors, and firm wage policies, wage supplements can represent a relevant part of the final gross wage received by workers. They can also contribute to widening wage disparities between different groups of workers, i.e., men and women, or foreign and native workers. In the case of the gender pay gap, some studies have suggested that gender-based wage determination practices may play a role in amplifying gender wage differentials (CCOO –Trade Union Confederation of Workers’ Commissions 2015; De Blas & Estrada Reference De Blas and Estrada2021; De la Rica et al Reference De la Rica, Dolado and Vegas2015; Sallé & Molpeceres Reference Sallé and Molpeceres2009).Footnote 4 For migrant workers, however, the issue has not yet been explored. Since immigrants are usually employed in poor-quality jobs involving bad working conditions, wage supplements could merely have a compensatory role, thus contributing to reducing observed pay gaps (Antón et al Reference Antón, Muñoz de Bustillo and Carrera2010a). Nevertheless, it can also be the case that wage supplements hide discriminatory practices against immigrants, as the calculation of some of these supplements involves a great deal of subjective assessment.

Our paper aims to contribute to this research topic. To that end, we analyse and decompose, using the Oaxaca-Blinder model, the migrant pay gap for the various parts of the total hourly wage earned by workers covered by the Spanish Wage Structure Survey 2018 (WSS-2018). This will enable us to find out where the differences arise and to what extent these gaps can be explained by a set of control variables theoretically affecting wages.

The structure of the paper is as follows. After this introduction, a review of recent literature concerning the migrant pay gap is offered. Then we briefly describe our data and methodology and present and discuss the results obtained. The paper ends with a summary of conclusions and some considerations for future research.

Literature review

Previous research has examined factors that could potentially explain the migrants’ wage gap, including differences in labour force participation, human capital, returns to skill, and labour market regulations. However, research on wage supplements is scarce and they have rarely been featured in this literature.

Employment differentials between migrants and natives have been analysed in a considerable number of studies. Much of the evidence available for Spain and other European countries is based on the Labour Force Survey (LFS), which is the most widely used database for analysing the patterns of labour market participation. Key findings in this literature are the persistence of significant origin-related differences in labour force participation, temporary work, and sectoral and occupational distribution of workers (Münz Reference Münz2007; Zhang et al Reference Zhang, Nardon and Sears2022). Immigrant job characteristics make them especially vulnerable to unemployment when the economy faces negative shocks, such as the Great Recession or the COVID-19 crisis. Motellón & López Bazo (Reference Motellon and López-Bazo2015), for example, have shown that the job loss rate in Spain was higher for immigrant workers than it was for native-born during economic downturn, especially among males. More recently, Fasani and Mazza (Reference Fasani and Mazza2020b) documented disproportionate effects on migrant workers during the pandemic, both in Spain and in other EU countries.

Employment gaps in migrant population are reinforced when interacting with gender. In a recent study based on the EU-LFS data for the period 2005 to 2018, Grubanov-Boskovic et al (Reference Grubanov-Boskovic, Tintori and Biagi2020) show how the intersection between gender and migrant status shapes the likelihood of non-native women participating in the labour market. Their results underline the fact that non-EU-born women still have the lowest participation rates and that educational attainment seems to be less effective in narrowing the gender employment gap, compared to native women. Yet, using the same source, Lee et al (Reference Lee, Peri and Viarengo2022) show that female migrants converge more rapidly than male migrants do and find strong correlation between attitudes towards migrants and their employment convergence across sub-national regions. Regarding Spain, Sánchez-Domínguez and Guirola (Reference Sánchez Domínguez and Guirola Abenza2021) and Sánchez-Dominguez and Fahlén (Reference Sánchez-Domínguez and Fahlén2018) find that the segmentation of the Spanish labour market leads to a concentration of female immigrants in specific occupational niches with precarious employment conditions and forces them to deal with their care responsibilities differently than their native counterparts. These papers highlight how the dual structure of the Spanish labour market and the Spanish care regime interact to doubly penalise female immigrants as both immigrants and mothers. The dual labour market improves female immigrants’ access to employment (Jiménez-García Reference Jiménez-García2018; Rodríguez-Planas & Nollenberger Reference Rodríguez-Planas and Nollenberger2016), but it condemns them to the status of ‘outsiders’ in the secondary sector. As mothers, female migrants find it harder than native female workers to access skilled and stable occupations (Aysa-Lastra & Cachón Reference Aysa-Lastra and Cachón2015).

These differences in patterns of labour market participation indirectly influence wages, but several studies have analysed directly which factors contribute to explain the migrant wage gap, focusing on characteristics of workers, jobs, and firms. Most of these studies use the Wage Structure Survey (WSS), which is the main source of information on labour earnings at the European level, though there are also studies based on administrative data.

Given differences in employment behaviour between men and women, some of these papers restrict the analysis to men. This is the case of Murillo and Simón (Reference Murillo and Simón2017), who based their study on matched employer-employee microdata from the WSS and decomposition techniques. Their results show that the significant native-immigrant wage gap detected both in terms of average wages and differentials along the wage distribution is essentially explained by differences in observed characteristics, especially in years of experience and type of occupations. There is also evidence of different patterns depending on the origin of migrant workers, suggesting the importance of how we identify ‘immigrants’. Antón et al (Reference Antón, Muñoz de Bustillo and Carrera2010b), for example, explore the earnings gap between 25 and 55-year-old Latin American and Caribbean employees and other groups of foreign workers from both developing and developed countries. Using the Machado-Mata econometric procedure, earnings differentials across the whole wage distribution are decomposed into a component related to observable characteristics and others associated with different returns on such endowments. They find that the unexplained earnings differential between the native-born and Latin American and Caribbean immigrants increases across the wage distribution. Similar conclusions are obtained by Antón et al (Reference Antón, Muñoz de Bustillo and Carrera2010a), whose main finding is the existence of an important glass ceiling for foreign male workers from developing countries. These authors point to the limited transferability of human capital accumulated in home countries as a key factor limiting their access to high occupational levels.

The origin of migrant workers is also considered by Simón et al (Reference Simón, Sanromá and Ramos2008), who show that immigrants from developing countries have a lower average wage and a more compressed wage structure than natives, whereas those from developed countries have higher wages and a more dispersed wage structure. The evidence obtained reveals that discrepancies in the wage distributions of natives and both groups of immigrants are largely explained by the segregation of immigrants in labour sectors, particularly in occupations, different from those of natives. Canal-Domínguez and Rodríguez-Gutiérrez (Reference Canal-Domínguez and Rodríguez-Gutiérrez2008) also conducted a similar analysis focused on foreign workers and concluded that there is a substantial pay gap that is not explained by observable characteristics, especially at the bottom of the wage distribution. Their results show that discrimination against immigrants is more pronounced for women than for men in the lowest wage segment, but the reverse is true amongst the best-paid. They also highlight the fact that the discriminatory component changes its sign at the very top of the wage distribution, which means that the return of productive features for highly paid workers is greater than for those born in Spain. We must stress that the definition of migrant workers used by these authors pulls together nationals from developed and undeveloped countries, which can partially explain these results.

Using a different source, the Continuous Sample of Working Histories (based on administrative Social Security data), Nieto (Reference Nieto2021) explores the impact of children on the career paths of immigrants and natives. He finds that immigrant parents suffer from a higher loss in earnings than native parents after childbirth. Additionally, there is an important gender pay gap emerging after childbirth for both immigrants and natives, related to changes in labour force participation of mothers. García-Perez et al (2012), using Social Security records in Spain, find that the wage differences between Spanish nationals and others in the same firm and job are substantially greater for almost every group of low-tenured foreign workers and also for those holding open-ended contracts.

So far, only a few studies focus specifically on female migrants in Spain. Antón et al (Reference Antón, Muñoz de Bustillo and Carrera2012), for example, explore the differential access to employment and the earnings gap faced by this group, considering the interaction between two potential sources of disadvantage for migrant women: gender and origin. In their analysis, the larger unemployment rate of female migrants is not explained by observable characteristics. In the case of earnings, although human capital endowments play a relevant role, there is an unexplained earnings penalty associated with both gender and migrant status, which rises across the distribution of wages.

The role of segregation in explaining migrant women’s comparatively low wages is stressed by Simón and Murillo (Reference Simón and Murillo2014) based on 2006 and 2010 WSS data. Using the Continuous Sample of Working Histories, Nicodemo and Ramos (Reference Nicodemo and Ramos2015) quantify the wage gap between native and immigrant women in Spain taking into consideration differences in their characteristics and the need to control for ‘common support’ (the fact that many jobs are carried out only by members of one group). Their results indicate that wage differences are larger at the top quantiles, whereas at the bottom, the unexplained wage gap contributes much less to the observed differences between native and immigrant women.

Finally, a factor that could contribute to understanding wage differentials, but which has not been very much explored so far, is wage supplements. Most of the papers reviewed consider wage without disaggregating them into different salary components. One exception is the study by Antón et al (Reference Antón, Muñoz de Bustillo and Carrera2010a), in which they excluded bonuses associated with dangerous working conditions, night shifts, and supplementary hours from their wage measure under the assumption that they could have a compensating nature, thus contributing to reduce observed wage gaps − but they did not explore the issue directly. Other papers have focused on wage components, but without examining wage differentials (Marín-García & Martínez-Tomas Reference Marín-García and Martínez-Tomas2022).

An interesting question in this regard is to what extent observed characteristics of jobs and workers can effectively explain migrant-native differences in the various retribution concepts. This question has sometimes been discussed with reference to the gender pay gap, but not, to our knowledge, when analysing native-migrant wage differentials. De Blas et al (Reference De Blas and Estrada2021), for example, showed that, in aggregate terms, women receive fewer wage supplements than men, something that is partly due to sectoral segregation, since it is precisely in the most feminized sectors (health, education, retail trade, and domestic work) where wage supplements and allowances are less widespread. The extent to which this involves direct or indirect discrimination practices against women (or other disadvantaged groups, such as migrant workers) is open to debate and has obvious theoretical and practical implications.

Data and methodology

Source of data

For the empirical analysis, we have used the Wage Structure Survey (WSS) 2018.Footnote 5 This is a quadrennial survey conducted by the Spanish National Institute of Statistics in which data are collected on more than 200,000 workers in more than 24,000 companies. The same survey is run with harmonised definitions and criteria across the European Union and provides the reference source for the analysis of wages in European countries. In Spain, the WSS is the only source offering simultaneously detailed data on wages and characteristics of workers, employers, and firms. Data on the wage structure are particularly relevant for this paper and the database includes not only the total gross wage obtained by each worker but also its breakdown into the various wage components (base wage, wage supplements, payment for overtime, and extraordinary payments).

The database has also some drawbacks that should be considered. Firstly, although the sectoral coverage of the survey has been gradually improved, it still excludes agricultural, livestock, and fishing activities, as well as domestic workers, two sectors that rely heavily on migrant workers. Additionally, public administration employees are only partially covered.Footnote 6 Secondly, and equally important for our research topic, the survey excludes irregular migrant workers since the sampling method is based on Social Security contribution accounts. These two exclusions mean that the migrant population will be under-represented in this survey, compared to native workers. This aspect may also have a greater impact on the analysis of this database by gender since domestic work is mainly performed by women. A comparison with the data obtained from other sources, like the Labour Force Survey, confirms this fact: the percentage of workers with a foreign nationality according to the WWS-2018 is 7.4%, a figure well below the 11.7% of salaried foreign workers derived from the Labour Force Survey 2018.Footnote 7

To ascertain the presence or absence of outliers, before the statistical analysis, the distribution of the sample has been studied, thus avoiding the possibility of observations that may distort the study of the mean wages. As a future line of research, it would also be possible to control for selection into employment, that is, to consider the types of existing wage supplements, such as those related to supervisory tasks. Given the limitations of the database, detailed information on the sources of wage supplements is not yet provided.

Main definitions

Migrant worker

We define migrant workers as those who are neither Spanish nor European citizens, according to a classification based on nationality (see Table A1 in Appendix). This definition tries to conform as much as possible with the concept of economic migrant, within the constraints imposed by the dataset.Footnote 8 We must bear in mind that this definition excludes foreign-born workers who have acquired Spanish (or other European) nationality. This choice is motivated by data availability since the country of birth is not investigated in this survey. According to this definition, 3.3% of workers were classified as immigrants in 2018. In this analysis, we also differentiate between male and female migrants since determinants of wages can differ by gender.

Gross monthly and hourly wages

The survey collects information about wages on both an annual and a monthly base. In the latter case, the month of October is used as the reference period, because it represents a ‘normal’ month not affected by seasonal variations or special payments, such as Christmas bonuses. We have chosen this variable as our base indicator for this paper. Using the information about the number of hours worked in October, we derive a variable reflecting the hourly wage.

Wage components. Gross wages can be disaggregated into several components, whose analysis is relevant to this research work (Table 1).

Table 1. Composition of gross hourly wage for migrant and non-migrant workers (in euros)

Source. Authors’ analysis from WSS (2018).

The base wage is the main part of the total gross wage and indicates the minimum wage negotiated in collective agreements or between the employer and the employee.

Wage supplements represent the second biggest component of total gross wages (almost 30% for Spanish workers and about 17% for migrants). These supplements include bonus payments received by workers for varied reasons, related to personal characteristics and performance (seniority bonus, productivity bonus, specific knowledge, etc.) or workplace and/or job conditions characteristics (night work, toxicity, work on holidays, etc.). Currently, the WSS offers data on total supplements earned, as well as on supplements related to shift work, night work, or weekend work. These latter represent only around 5% of total wage supplements.

Finally, overtime payments are payments received by a worker for overtime hours, whereas extraordinary payments are payments and allowances not paid in each pay period, but due on an irregular basis. These extraordinary payments can be fixed (i.e., Christmas bonus) or variable.

Table 1 makes it clear that the differential between national and migrant workers is partly due to differences in wage supplements received by each group. Thus, the hourly base wage of Spanish/European workers in 2018 is around 15% over that earned by migrants (19% over in terms of monthly wage). In contrast, wage supplements received by native workers are more than double those received by migrants.

Other variables

The WSS offers relevant information on a set of variables important to analysing wage levels, such as education, seniority, type of contract, occupation, and activity sector. Some of these variables, such as education, occupation, or activity sector, are provided with a high level of disaggregation and have been grouped into broader categories.

In the case of education, we have distinguished six educational groups based on the CNED-2014 (National Classification of Education 2014) classification: primary or less (codes 1–10), lower secondary (codes 21–24), upper secondary (codes 32–38), upper vocational training (codes 41–52), short university degrees (codes 61–63), and long university degrees (codes 71/81).

Occupations are grouped into four categories according to the main subgroup codes of the CNO-2011 (National Occupational Classification 2011): low-skilled blue collar (codes 80–100 and 0), low-skilled white collar (codes 40–59), high-skilled blue collar (codes 60–79), and high-skilled white collar (codes 10–39).

Finally, activity sectors are organised into five groups based on the two-digits CNAE-2009 (National Classification of Economics Activities 2009): industry (codes 5–39), construction (codes 41–43), trade, hospitality, transport (codes 45–56), education, health, public administration (codes 84–88), and other services (codes 9–82 and 90–96).

Table A2 (see Appendix) shows frequencies for variables used in the paper, disaggregated by migrant status. As we can see from this table, non-European migrant workers are younger than Spanish or other European countries’ workers, have less seniority and lower educational levels, work more frequently on temporary and part-time jobs, perform fewer supervisory tasks, and are disproportionately concentrated in specific (generally low-paid) occupations and activity sectors.

Methodology

The empirical strategy applied in this study is based on the decomposition model proposed by Oaxaca (Reference Oaxaca1973) and Blinder (Reference Blinder1973). This is possible because the variable that determines the existence of a potentially non-explained part, the nationality, is random. Likewise, we have information on many control variables that are useful to disentangle the explained from the unexplained parts of the observed differences.

According to the econometric methodology employed, the hourly wage variables have been transformed into logarithmic terms to improve the coefficients’ interpretability. In particular, the following sequence of equations is used.

-

a) Firstly, we estimate wage and wage components regressions controlling for nationality group. As said before, wage variables are expressed in logarithmic terms, so that the

${\beta _i}\;$

coefficients show, for each regressor, the percentage change in hourly wages generated by a unit increase in the independent variables (nationality and controls). The general form of the model will be the following:

${\beta _i}\;$

coefficients show, for each regressor, the percentage change in hourly wages generated by a unit increase in the independent variables (nationality and controls). The general form of the model will be the following: $$\ln \left( {wag{e_i}} \right) = \;\alpha + {\beta _1}nationalit{y_i} + {\beta _2}\;control{s_i} + \;{\varepsilon _i}$$

$$\ln \left( {wag{e_i}} \right) = \;\alpha + {\beta _1}nationalit{y_i} + {\beta _2}\;control{s_i} + \;{\varepsilon _i}$$

Where nationality is a dichotomic variable that takes the value one when the individual is an immigrant (i.e., does not have Spanish or another European country nationality) and zero when he/she is not. On the other hand, controls represent the set of control variables introduced to improve the estimation of the nationality group effect.

-

b) Secondly, the difference in wages is decomposed into an explained and an unexplained part, following the classic Oaxaca-Blinder (Reference Blinder1973) methodology.

\begin{align*} \;mean\left( {\ln \left( {wag{e_{non - migrant}}} \right)} \right) - mean\left( {\ln \left( {wag{e_{migrant}}} \right)} \right) = \\ = \;{\beta _{non - migrant}}(mean\left( {{X_{non - migrant}}} \right) - mean\left( {{X_{migrant}})} \right) \\ + mean\left( {{X_{migrant}}} \right)\left( {{\beta _{non - migrant}} - {\beta _{migrant}}} \right)\end{align*}

\begin{align*} \;mean\left( {\ln \left( {wag{e_{non - migrant}}} \right)} \right) - mean\left( {\ln \left( {wag{e_{migrant}}} \right)} \right) = \\ = \;{\beta _{non - migrant}}(mean\left( {{X_{non - migrant}}} \right) - mean\left( {{X_{migrant}})} \right) \\ + mean\left( {{X_{migrant}}} \right)\left( {{\beta _{non - migrant}} - {\beta _{migrant}}} \right)\end{align*}

Where

![]() $mean\left( {{X_{migrant}}} \right)\left( {{\beta _{non - migrant}} - {\beta _{migrant}}} \right)$

represents the part potentially corresponding to discrimination. In this case, the variable X reflects the incidence of the control variables on the difference in wage supplements according to the group to which the individual belongs, whether non-migrant or immigrant. At this point, it is worth clarifying that the non-migrant structure is used for the analysis as it allows us to select based on the relevance of the objectives and their ability to capture wage differentials dynamics in a specific context.

$mean\left( {{X_{migrant}}} \right)\left( {{\beta _{non - migrant}} - {\beta _{migrant}}} \right)$

represents the part potentially corresponding to discrimination. In this case, the variable X reflects the incidence of the control variables on the difference in wage supplements according to the group to which the individual belongs, whether non-migrant or immigrant. At this point, it is worth clarifying that the non-migrant structure is used for the analysis as it allows us to select based on the relevance of the objectives and their ability to capture wage differentials dynamics in a specific context.

This latter part is hypothetically linked to discrimination since it stands for the part of the wage gap that cannot be explained by characteristics of workers, jobs, or firms theoretically determining wages, such as age, experience, educational level, or type of job.

Nevertheless, these results should be interpreted with caution. On the one hand, unexplained differences might partly reflect the effect of relevant omitted variables: we would therefore be overestimating the impact of discrimination. To avoid this possibility, we have used a wide range of control variables, taking advantage of the richness of WSS data. On the other hand, and this can be less obvious, some variables usually included as regressors, such as activity sector, occupation, supervisory roles, or temporary contracts, are not randomly assigned among migrant and non-migrant workers and could, in practice, entail a certain degree of (previous) discrimination. As the model assumes that all these are independent variables, the results could be, in that case, underestimating real discrimination. This could occur if, for example, immigrants are segregated into bad-quality jobs, or if there are barriers preventing immigrants from advancing to leadership positions. In the research process, we have conducted a combination of estimates based on the introduction of control variables or not, which has allowed us to preliminarily check the validity of the conclusions and the robustness of the results obtained in the Oaxaca and Blinder (OB) decomposition models.

Analysis and results

As a previous step in our analysis, we have verified whether mean wage differences between the two groups of workers (migrant and non-migrant workers) are statistically significant or not. To that end, a means difference test has been performed for both the total gross wage and the various wage components (Table 2).

Table 2. Means difference test for hourly wage variables

Source. Authors’ analysis from WSS (2018).

Notes. All data is in euros. ***significant at 1% level; **significant at 5% level; *significant at 10% level.

Table 2 confirms that there are statistically significant differences between immigrants and Spanish/European workers regarding average wage values, i.e., for gross wage, base wage, and wage supplements.

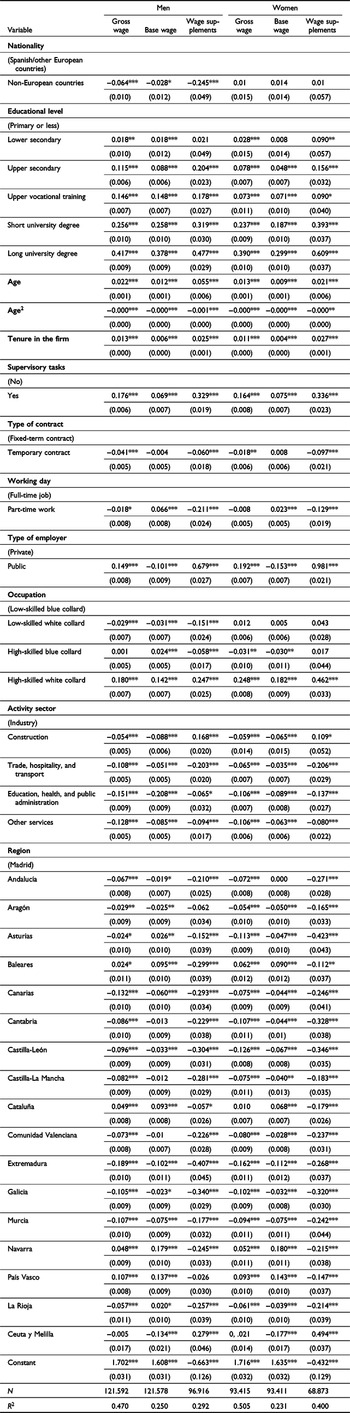

To further explore these differences, we use OLS models including nationality as a regressor, together with other control variables that are potentially important for explaining the relationship (Table 3).

Table 3. OLS model for gross wage, base wage, and wage supplements. The dependent variable in natural logarithms

Source. Authors’ analysis from WSS (2018).

Notes. ***significant at 1% level; **significant at 5% level; *significant at 10% level.

Robust standard errors in parenthesis.

Table 3 shows the effect that a migrant status (as defined above) has on gross wage, base wage, and wage supplements. These estimates have also been made separately for male and female workers since wage determinants can differ between sexes. Following previous literature related to the analysis of the labour market, we have included as regressors sex, age, education, years of seniority in the company, the fact of doing or not supervisory tasks, the type of contract (temporary or indefinite), the kind of job regarding working hours (full or part-time job), the type of employer (public or private), the occupational group, the activity sector, and the region where the firm is located.

The results in Table 3 show that, after controlling for all these variables, being an immigrant is irrelevant to determine base wages but has a negative and significant impact on both wage supplements and gross wages. In the case of wage supplements, being a migrant worker reduces hourly earned wage supplements by 15.6% points compared to non-migrant workers, all other factors being equal. In terms of gross wages, the migrant wage penalty reaches 3.9% points. Regarding explanatory factors, being employed in the public sector, having a university degree, working in a high-skilled white-collar occupation, and performing supervisory tasks are features related to higher wage supplements. On the other hand, being a woman, having a part-time job, and working in the retail trade, hotels/catering, or transport sectors have a significant negative impact on the number of wage supplements received. In the case of gender, after controlling for the rest of variables, being a woman reduces hourly supplements by more than 30% compared to men and has a negative effect of more than 13% on final hourly gross wages.

Table 4 shows the same OLS model estimated independently for male and female workers. This separate analysis suggests two interesting conclusions. Firstly, migrant status has no additional effect on female wages once the rest of variables have been considered. Secondly, the wage penalty associated with a non-European nationality is stronger for men and even occurs in base wages (−2.8%), it is however much higher in wage supplements (−24.5%). In terms of the final hourly gross wage, a non-European worker will earn 6.4% less than a European worker, after controlling for the rest of the characteristics.

Table 4. OLS model for gross wage, base wage, and wage supplements disaggregated by sex. Dependent variable in natural logarithms

Source. Authors’ analysis from WSS (2018).

Notes. ***significant at 1% level; **significant at 5% level; *significant at 10% level. Robust standard errors in parenthesis.

The OLS models presented so far have assumed that the control variables have the same coefficients for both migrant and non-migrant workers. However, previous research on discrimination has shown that returns on characteristics (i.e., education) can differ between groups. To go one step further and to be able to analyse the possible existence of discretionary practices in the establishment of wages and their components, we consider the use of one of the most well-known wage breakdown methods, the Oaxaca-Blinder decomposition, to be appropriate. As explained in the methodology section, this method allows the wage difference to be broken down into a part explained by control variables and a part that remains unexplained. This latter could potentially correspond to the part reflecting discretionary practices in establishing the final amount received by the worker, either as a base salary or as a supplement.

Table 5 shows the Oaxaca-Blinder decomposition for the whole sample according to the type of payment we refer to. Table 6 offers the same results estimated separately for men and women. The explanatory variables included (not shown) are the same as the ones previously considered in Tables 3 and 4.

Table 5. Oaxaca-Blinder decomposition models: all workers

Source. Authors’ analysis from WSS (2018).

Notes. ***significant at 1% level; **significant at 5% level; *significant at 10% level. Robust standard errors in parenthesis.

The model includes all the previously introduced control variables: sex, age, age2, tenure, education, supervisory role, temporary work part-time work, public employer, occupation, sector of activity, and region).

Table 6. Oaxaca-Blinder decomposition model: disaggregated by sex

Source. Authors’ analysis from WSS (2018).

Notes. ***significant at 1% level; **significant at 5% level; *significant at 10% level.

Robust standard errors in parenthesis. The model includes all the previously introduced control variables: sex, age, age2, tenure, education, supervisory role, temporary work part-time work, public employer, occupation, sector of activity, and region).

The most relevant result from applying the Oaxaca-Blinder decomposition method is that the unexplained part of the observed differences between migrants’ (non-European) and non-migrants’ (Spanish/European) wages is statistically significant, both in the case of wage supplements and gross wage. This result is true both when all workers (men and women) are considered (Table 5) and when only men are considered, and in all cases, the sign is positive. The results in Tables 5 and 6 indicate that, while the gap in base wages is explained by the variables included in the model, this is not the case for wage supplements and gross wages. That is, the difference in wage supplements and gross wages between migrants and non-migrants is not fully explained by the variables introduced as controls, which could imply that a discriminatory element is present in wage-setting mechanisms for migrant workers. In the case of women, however, the migrant wage gap is explained by the control variables included in the model, as suggested by the OLS models.

Conclusions and discussion

The migrant pay gap issue has received far less attention than the gender-related inequalities in academic literature, and almost no studies have focused on wage differences stemming from wage supplements. In this paper, we have used data on wage components from the 2018 Spanish Wage Structure Survey to analyse this issue, using OLS models and the classic Oaxaca-Blinder (Reference Blinder1973) methodology to decompose the observed hourly wage differences into two parts, namely the explained and the unexplained gaps. Although this ‘unexplained part’ can be due to several factors, not necessarily involving discrimination, disentangling where, and why, the migrant pay gap occurs can help policymakers to develop better integration measures.

Our results show that gross wage differences between migrants (defined as workers with a non-European nationality for this analysis) and non-migrant workers (Spanish or nationals from other European countries) are not fully explained by the set of control variables used (measuring observed characteristics of workers, jobs, or firms). Furthermore, when we break down the gross wage into its main components, we find that wage supplements play a key role in the final gap, significantly contributing to widening origin-related differences, for the whole sample of employees and, above all, for male workers in the sectors studied. This could suggest the existence of discriminatory wage determination practices contributes to cutting down migrant workers’ final earnings, increasing their poverty risk, and undermining their integration prospects. In addition to effects on inequality, this could also have an impact on efficiency, by increasing difficulties to fill vacant positions in certain jobs and sectors.

Among female workers, being an immigrant in the sectors that contain the database used does not seem to add any additional wage penalty once all other explanatory variables have been considered. This is true both for the gross wage and for the examined wage components (base wage and wage supplements). Although much more research is needed on this topic, a reason for these findings could lie in common patterns of female work performance that put women (both migrant and non-migrant) in a disadvantaged position in the labour market.

In any case, our results point to the need of eliminating direct and indirect discriminatory wage practices among employers to reduce wage (and income) inequality. Firm equality plans, measures to combat stereotypes and promote pay transparency, effective external controls, and neutral classifications of jobs and tasks are proving useful in reducing the gender wage gap and should be extended to fight ethnic or origin-related discrimination. To make work pay has become a common lemma in recent social policy. It would require the promotion of fair wage-setting practices among companies, avoiding any kind of discrimination.

To conclude, we would like to note some limitations of the results presented. As mentioned before, the WSS does not provide an accurate description of the migrant population in Spain, since it excludes farm and domestic workers, as well as irregular workers in any of the sectors. These workers, many of them women, typically have the most vulnerable positions in the labour market, suffer from worse working conditions, and earn lower wages than other immigrants. In this respect, the extent of the wage gap found using WSS data should probably be read as the minimum true value. In addition, as explained above, this article has not addressed the indirect, and often previous, forms of discrimination that can hamper migrant workers’ career progress, such as difficulties in the recognition of qualifications or occupational segregation, despite its obvious importance.

It is important to acknowledge another relevant limitation of our study, namely that our analysis focused solely on the mean and did not consider the wage distribution. This limitation highlights an opportunity for further research and exploration. Future studies could extend our findings by investigating wage distribution and analysing its impact on the results. By examining the distribution, we could gain a more comprehensive understanding of the dynamics and nuances within the wage structure, providing deeper insights into the factors influencing income disparities and gender. Therefore, we recognise the significance of exploring wage distribution as an extension of our research, and we encourage future investigations in this direction to broaden the scope of knowledge in this field.

Acknowledgements

The authors are grateful to the Autonomous Community of Madrid for the financial support provided through the research project OPINBI-CM (H2019/HUM5793).

Competing interests

None.

Appendix A

Table A1. Distribution of workers by nationality

Note. N = Number of observations.

Source. Authors’ analysis from WSS (2018).

Table A2. Distribution of migrant and non-migrant workers by characteristics: number of observations and vertical percentages (%)

Source. Authors’ analysis from WSS (2018).

Notes. N = Number of observations. Non-migrant = Spanish or another European country nationality. Migrant = non-European country nationality.

Fernando Pinto is a professor and researcher in the Department of Business Economics, Applied Economics II, and Fundamentals of Economic Analysis at the Rey Juan Carlos University in Madrid. He holds a PhD in Economics and a Master's in Economic Analysis of Law and Public Policies from the University of Salamanca. His main research areas are labour economics and public economics. He has conducted research visits, among others, at the Oxford Department of International Development at the University of Oxford (Oxford, United Kingdom) and the Department of Economics at San Diego State University (San Diego, California, United States). Additionally, he has participated as a speaker in numerous national and international conferences and seminars within his field of study.

Rosa Martínez is an economist and sociologist currently working as a member of the Department of Applied Economics and Public Management, at the UNED university, Madrid. She was researcher at the Institute for Fiscal Studies, lecturer at the Complutense and Rey Juan Carlos Universities, and Associate Fellow of the Centre for Interuniversity Research and Analysis of Organizations (CIRANO). As a member of the Economics of Inequality and Poverty Analysis (EQUALITAS) group, her main research areas are poverty, inequality, migration, long-term care, and social policy.

María Jesús Delgado Rodriguez is Associate Professor at the Faculty of Economics and Business Sciences at the Rey Juan Carlos University in Madrid. She received her PhD in Economics and Business Studies from Universidad Complutense of Madrid. My main lines of research are devoted both to the proposal of new indices and methodological tools for the evaluation of public policies and to the analysis of the international cycle, efficiency, and productivity with advanced statistical and econometric techniques.

Encarnación Murillo is a professor and researcher of Applied Economics at Universidad Rey Juan Carlos (Madrid). PhD in Economics (Universidad Autónoma of Madrid). Visiting researcher in different national and international centers, such as: Institute for Fiscal Studies (IEF) or Foundation for Applied Economic Studies (FEDEA), both in Madrid (Spain); and, European Policies Research Centre (EPRC), Glasgow (Scotland); International Center for Public Policy (Georgia State University, US) and European University Institute (EUI), Florencia (Italy); among others. Her research work focuses mainly on the topics: public economics and social and territorial cohesion in the EU. In addition, she has participated in numerous projects and conferences related to these fields