1. Introduction

The term ‘entrepreneurial state’ has long characterized the efforts of South Korea (hereafter, Korea) to move away from the old developmental state model and to a new industrial system of innovation in which small- and medium-sized enterprises (SMEs) are incorporated. The entrepreneurial state approach has two goals. One is to reduce the vulnerability of an economy centered on chaebol (business conglomerates) to world market fluctuation by helping SMEs increase exports and participate in high-value-added global value chains alternatively. The other is to lay out the infrastructure for SME-oriented innovation and industry-wide technological collaboration, which can redress the country's two-speed economy, or ‘very strong exports versus weak domestic demand fundamentals’ (Oliver and Song, Reference Oliver and Song2011). Examples include President Kim Dae-jung's (1998–2003) ‘financial activism’ toward venture entrepreneurs (Thurbon, Reference Thurbon2016: 89–98), Lee Myung-bak's (2008–2013) ‘green growth’ strategy, and Park Geun-hye's (2013–2017) ‘creative economy’ plan. They all aimed to construct ‘local science and knowledge bases’ (Ebner, Reference Ebner, Cantner, Gaffard and Nesta2009; 385), make innovation policies ‘before the potential is understood by the business community’ (Mazzucato, Reference Mazzucato2011: 19), and combine industrial entrepreneurship with ‘social purposes’ such as economic diversification and job creation (Klingler-Vidra and Pardo, Reference Klingler-Vidra and Pardo2019).

However, Korea's entrepreneurial state approach has not necessarily succeeded. Although bold reforms have been introduced, they have hardly led to a new paradigm in which SMEs play a key role in innovation and entrepreneurship. Compared with Taiwan's diversified economy, particularly, the majority of SMEs have remained disadvantaged in terms of direct financial support, disconnected from production networks dominated by the chaebol, and largely unable to exploit new export markets (Gregory et al., Reference Gregory, Harvie and Lee2012; Jung, Reference Jung2015; Hsieh, Reference Hsieh, Choi, Lee and Shin2018). Many SME support policies have been too duplicated to avoid ‘a waste of resources’ and ineffective in overcoming ‘equity challenges’ between the chaebol and SMEs (Jones and Kim, Reference Jones and Kim2014: 5–18).

A similar episode took place during the administration of former President Moon Jae-in (2017–2022). His government adopted the entrepreneurial state approach to find a way to cope with the possible disruption of global semiconductor production chains. The semiconductor industry is the most advanced in the Korean economy, but remains profoundly divided. Two world-level giants, Samsung Electronics and SK Hynix, have exclusively designed, fabricated, and tested finished semiconductor chips. They have cooperated with a small number of subsidiaries producing semiconductor materials and parts while seeking what Yeung (Reference Yeung2016) called ‘strategic coupling’ with foreign companies for constructing global value chains. However, industrial innovation networks have remained underdeveloped domestically. Numerous SMEs have hardly met the technological demands of the chaebol without opportunities to participate in high-value-added production chains. Given the situation, the Moon government campaigned for the creation of a highly networked ecosystem of innovation in the semiconductor industry. The government issued a series of new semiconductor measures that would incorporate SMEs while providing tremendous subsidies to encourage SMEs to develop new technologies and cooperate with large businesses for the localization of semiconductor materials and components.

To date, much has been reported on the optimism produced by the Moon government, stressing that both the chaebol and SMEs have cooperated to localize supply chains in accordance with the government's entrepreneurial project. Nonetheless, closer investigation shows that, while Korea averted the acceleration of the disruption and achieved a measure of localization, it faced limitations in creating an industry-wide network of innovation. Only a few subsidiaries of the chaebol and their exclusive subcontractors contributed to localization of supply chains. There is no sign that small materials and components producers have moved up technologically and thus are collaborating with the chaebol for technological localization. Moreover, the majority of SMEs have hardly overcome technological handicaps while being exposed to the volatility of international markets.

Why has the limitation in incorporating SMEs repeated itself over decades despite the continuous entrepreneurial efforts of Korean governments? In this paper, we aim to answer the question by focusing on the new semiconductor industry policies of the Moon government. Many scholars have taken for granted the entrepreneurial orientation of the Korean state against the old developmental state model and ascribed limited entrepreneurship to the chaebol relying on the old practice of in-house production. However, this view does not provide a complete picture. An excessive stress on the chaebol as a countervailing force against the entrepreneurial state obscures the way the Moon government formulated and enacted the new semiconductor industry policies and the consequent contradiction inherent in these policies.

Building upon historical institutionalism and its attendant concept of increasing returns, alternatively, this study shifts attention to the way the Moon government played its entrepreneurial role. We argue that, as the government sought increasing returns that the old developmental state idea and institution could give, the likelihood of wider SME incorporation decreased. To corroborate this argument, we first identify orientational and organizational features of the Korean developmental state, i.e., nationalism and ‘developmental alliance’ (Hundt, Reference Hundt2012) between the state and the chaebol. Then, we explain that the pursuit of increasing returns from these two features of the Korean developmental state undermined the potential incorporation of SMEs. Nationalism enabled the Moon government to control policymaking processes. However, it blocked the emergence of policy contestation, which could otherwise have produced new information about public policies. As the government depended on the old political arrangement of developmental alliance to increase policy visibility through the capacity of the chaebol, the specific technological demands of small firms were seriously downplayed.

The remainder of this paper is organized into the following four sections. The next section reviews the limitation of the Moon government's entrepreneurial policies in incorporating small firms. Section 3 critically examines the conventional view and offers an alternative argument on the basis of the concept of increasing returns. Section 4 corroborates the argument by tracing the process in which nationalism and developmental alliance affected the formulation and implementation of the new semiconductor policies. The final section lays out a theoretical framework with which to explain why the entrepreneurial state does not always succeed.

2. Beneath the entrepreneurial state

The new semiconductor industry policies in Korea are a subset of techno-nationalism. However, it must be noted that Korea's techno-nationalism is more defensive than usual mercantilist or nationalist projects in the USA, China, and Japan, which aim to promote technological superiority over other countries for security purposes (Luo, Reference Luo2022). Korea's Moon government focused on coping with the volatility and uncertainty associated with the acquisition of resources and endeavored to enhance indigenous production capabilities mainly to maintain ‘commercial competitiveness’ (Weiss and Thurbon, Reference Weiss and Thurbon2021: 485). Thus, the more correct interpretation of Korea's semiconductor policies is that they are part of ‘marketcraft’ (Vogel, Reference Vogel2018), or the regulatory art of the entrepreneurial state, which makes use of external crises to promote a new wave of innovation on an industry-wide scale.

In reality, Korea's new semiconductor measures were a direct response to the threat posed by Japan's Abe Shinzo cabinet in July 2019. The Abe cabinet decided to tighten regulations on Korea-bound shipments of three chemical materials (fluorinated polyamides, photoresists, and hydrogen fluoride) necessary for semiconductor production. The decision was a retaliation following the Korean Supreme Court's rulings that the 1965 Normalization Treaty was insufficient reparation for the damage caused to individual Koreans during the colonial period. Japan's decisions ignited a sense of crisis that Korea would face a critical interruption to the principal engine of the country's economic growth, i.e., semiconductor production and export.

The Moon government fought back in several ways. It dropped Japan as a ‘whitelist’ country with fast-track trade status, just as Japan did for Korea. It also filed a lawsuit with the World Trade Organization against Japan regarding export controls. The most remarkable action was, however, the campaigns for the localization of semiconductor supply chains by means of fostering cross-cutting collaboration between large and small firms.

President Moon ordered ministries to create new semiconductor measures which would support the creation of a highly networked system of industrial innovation by incorporating small firms into domestic chains of semiconductor production. Under the catchphrase of making Korea into a ‘global material, parts, and equipment industry powerhouse’ (Jung, Reference Jung2020), the government enacted three measures from 2019 to 2020: (1) the One-Shot Act, (2) Measures for Enhancing the Competitiveness of the Materials, Parts, and Equipment Industries, and (3) the Materials, Parts, and Equipment 2.0 Strategy.

These three measures were predicated on Korea's decades-long project of the entrepreneurial state in two aspects. First, they were intended to prevent a crisis in the semiconductor industry by reforming the domestic industrial structure of semiconductor production. Second, but more importantly, these measures promoted technological support for SMEs and encouraged the cooperation of large and small companies as a structural condition of the localization of necessary technologies. The government increased the budget for subsidies – from KRW 1.1 trillion (USD 950 million) in 2019 to KRW 2.1 trillion (USD 1.9 billion) in 2020 and to KRW 2.6 trillion (USD 2.2 billion) in 2021 – to stimulate the research and development activities of SMEs and their participation in government-sponsored projects on collective technology development.

The Moon government showed confidence in its achievements. In a speech on 10 May 2021, to celebrate 4 years in office, President Moon mentioned that ‘the cooperation between small suppliers of materials and large chipmakers has changed Korea into a powerhouse of not only semiconductors but also materials, parts, and equipment’ (Kim, Reference Kim2021a, Reference Kim2021b). The media followed this optimism, stressing that, while Japan had failed to halt Korea's semiconductor production, Korea had gradually substituted domestic production for Japanese materials (e.g., Park, Reference Park2021).

However, a closer scrutiny of Korea's experiences suggests mixed outcomes. On the one hand, there were positive signs in terms of crisis prevention through localization. As Table 1 shows, the annual growth rate of chip production temporarily decreased from 14.7% in 2018 to 5.7% in 2019, but increased again to 14.2% in 2020. Korea's semiconductor industry was able to reduce its dependency on Japanese materials. For example, both absolute and relative quantities of hydrogen fluoride imported from Japan have decreased. The reduced dependency on Japanese materials stemmed, in part, from Japan's loose application of the new regulations to fluorinated polyamides and photoresists (Kim, Reference Kim2021a, Reference Kim2021b: 27–28), diversified import channels, and direct investment of foreign materials suppliers in Korea. Of equal importance was, however, the fact that Korean firms developed their own technologies and replaced some of Japan's materials.

Table 1. Changes in global value chains of Korea's semiconductor industry

Source: National Assembly Budget Office (2020: 61–74); Korea Statistical Information Service (https://kosis.kr/).

Note: The change in import channels measures the change in yearly import volumes before and after Japan's trade restrictions.

On the other hand, however, the new semiconductor measures have generated little impact on the dynamics of small businesses so far. Table 1 demonstrates that the chaebol organizations, rather than new industry-wide clusters or networks, have played the key role in localizing supply chains. For example, SKC and SK Materials emerged as new domestic suppliers of fluorinated polyamides and photoresists, respectively. They are subsidiaries of SK Group. Samsung Group and SK Group bought out new companies such as Dowoo Insys, Soulbrain, Wonik IPS, and part of Kumho Petrochemical to produce necessary materials within groups. Only a few SMEs, including ENF Technology and RAM Technology, were newly integrated into the vertical production networks of Samsung Electronics and SK Hynix. However, it has not been reported that these conglomerates are purchasing new materials from external SMEs or establishing new partnerships with new SMEs for developing technologies.

Obviously, the government expanded subsidies to encourage the chaebol and SMEs to cooperate for the development of new technologies. However, effects of financial subsidies have been weak. The activation of ‘non-market institutions’ of technology transfer across the industry can facilitate wider SME incorporation (Benassi et al., Reference Benassi, Durazzi and Fortwengel2020). Based on this line of reasoning, the Moon government urged the industry to use the Corporate Partnership Open Platform more extensively. However, the chaebol used this program only to provide financial assistance or business consultation to SMEs, not for sharing new skills with them widely (Baek, Reference Baek2019: 5–6).

No doubt, the mixed outcomes do not indicate the new semiconductor industry policies were a complete failure. The period of time observed here is too short to announce a failure. Both large firms and small resource suppliers need a longer process for developing and testing new technologies and negotiating on business contracts. Most critically, there is no objective standard that can be used to judge how many SMEs must be turned into the chaebol's partners. It would be a huge cost for the chaebol to switch from the current mode of production to a completely different mode in which they have to cooperate with the much larger number of SMEs.

In light of the following two facts, alternatively, we suggest that the new semiconductor industrial policies were limited as state entrepreneurship in favor of SMEs. One fact is that the incorporation of a few SMEs into the chaebol's production networks has not been associated with the overall technological upgrade of SMEs. Although Korea was able to localize some semiconductor materials, this localization has not gone in tandem with technological spin-offs across the semiconductor industry. Seeing the experience of TSMC (Taiwan Semiconductor Manufacturing Company) as a reference point can help to assess Korea's situation. As Wong and Lee (Reference Wong and Lee2022) stated, one key difference between TSMC and Samsung Electronics is that the former achieved a higher degree of knowledge localization than the latter on the basis of intraregional collaboration and technological spin-offs to small firms in industrial districts. For this reason, they concluded that ‘Hsinchu excluding TSMC’ has higher values of localization, decentralization and intraregional collaboration than ‘Suwon excluding Samsung’ (Wong and Lee, Reference Wong and Lee2022: 979). Since the implementation of the new semiconductor industrial policies, there has been no sign that Korea is now moving to the TSMC model in terms of the degree of network-based innovation. Individual large firms have been the main innovators, and their technologies and knowledge have not been widely shared across the industry.

The other fact is that, despite the Moon government's efforts to support SMEs, the business performance of these firms has continued to deteriorate. In particular, the new semiconductor industrial policies and accompanying subsidies could not protect the majority of SMEs from the new volatility of international markets. Beijing's ‘Made in China (zhongguozhizao) 2025’ initiative has increasingly reduced its imports of materials and parts from Korean SMEs (Jeong, Reference Jeong2021: 7). The worsening performance of many SMEs was all the more remarkable because their business performance has been increasingly decoupled from that of the chaebol. Since early 2020, Samsung Electronics and SK Hynix have taken advantage of the worldwide chip shortage and improved their production performance. However, non-chaebol-linked SMEs failed to benefit from the new semiconductor boom.

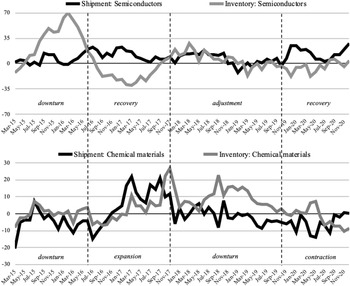

Figure 1 illustrates this decoupling by comparing the business cycles of the semiconductor-producing sector and the chemical materials sector since 2015. In this study, this cycle is determined by simultaneously considering the growth rate of shipment and that of inventory. If the shipment growth rate is positive and the inventory growth rate is negative for a sector, this sector is located in the recovery phase. The reverse situation results in a downturn. If both rates (shipment growth and inventory growth) are positive, the sector is expanding; if both are negative, this results in contraction.

Figure 1. Year-over-year growth rates of shipment and inventory since 2015.

Source: Drawn based on Korean Statistics Information Service (KOSIS) (https://kosis.kr); Ministry of Trade, Industry, and Energy (each year).

In the past, the production performance of chemical materials producers evolved in a pattern loosely similar to that of giant semiconductor producers. From early 2015 to mid-2016, when the latter experienced a downturn, the former also faced a downturn, recording a negative shipment growth rate and a positive inventory growth rate. When semiconductor companies recovered from mid-2016 to late 2017, the chemical materials producers entered into a phase of business expansion with increasing shipments and inventory investment. From late 2019, the situation changed dramatically when China's localization project began to affect Korean SMEs. Although Samsung Electronics and SK Hynix exited the adjustment phase and restored production dynamics, small chemical suppliers found themselves in a situation of production atrophy. The shipment growth rate of the chemical materials sector has remained negative since mid-2019, and inventory investment has also decreased since early 2020. In other words, Korea's SMEs in the chemical materials sector have been increasingly estranged from giant semiconductor producers, despite the government's entrepreneurial policies for connecting the two.

3. New entrepreneurship through old institutions

What limited the entrepreneurial project of the Moon government for fostering SME-oriented innovation in the semiconductor industry? Minister of SMEs and Startups Park Young-sun commented on this issue at a meeting of the Korea Chamber of Commerce and Industry: Samsung and SK were not purchasing new materials made by small domestic firms (Choi, Reference Choi2019). This comment reflects a conventional perspective, which regards the Korean state as a distinctive version of the entrepreneurial state while blaming the chaebol for attempting only to preserve their production capacities. However, this view cannot capture the contradiction inherent in President Moon's entrepreneurial state approach. Based upon historical institutionalism and its concept of increasing returns, this section explains why the government was also responsible for limited SME incorporation.

3.1. Chaebol and in-house production

The theoretical contrast between the state and the chaebol has been conventional in the literature on Korean political economy since the early 2000s, when the term ‘economic democracy’ or ‘fair market’ surfaced as a reform priority. The literature has portrayed the government as a political agency that aims to reduce the concentration of economic power and to level the playing field for SMEs (e.g., Doucette, Reference Doucette2015). The literature has also depicted policymakers as visionary reformists who seek to lead a wide range of firms, including SMEs, to joint action for technological innovation and increased productivity (Ebner, Reference Ebner2007; Wang, Reference Wang2007). According to this line of reasoning, the Moon government's efforts can be considered a political entrepreneurship designed to foster the localization of supply chains on the basis of technological collaboration between large and small firms.

Conversely, the literature tends to portray the chaebol as a countervailing force against the entrepreneurial state. It has been presented that large firms and their association (i.e., the Federation of Korean Industries) have not cooperated well with state projects that would overhaul the industrial structure (Lee, Reference Lee2008). The chaebol have been reluctant to depart from the dominant market power derived from the developmental state model and uncooperative for the state's efforts in support of wider industrial networks. When the government has campaigned for a fair trade between the chaebol and SMEs, for example, the chaebol have exercised their power to pay less than the agreed amounts and take core technologies away from subcontracting partners (Park, Reference Park2007; Kalinowski, Reference Kalinowski2009; Yun, Reference Yun2011).

This conventional view may help one to ascribe the limitation of President Moon's entrepreneurial state to lack of cooperation from the chaebol exclusively (e.g., Kwak, Reference Kwak2019). The chaebol had less interest than the government in developing technologies together with many SMEs or purchasing new items from them. For example, the National Assembly Budget Office (2020: 141–142) found that, although 130 SMEs succeeded in producing materials and parts to be used for semiconductor production, Samsung Electronics and SK Hynix had hardly purchased any new items from these SMEs.

Rather than linking themselves to external SMEs, the chaebol have tended to depend on in-house production as the primary means of defending themselves against business uncertainties. During business downturns, the Korean chaebol have strengthened production within the group through business diversification and vertical integration (Amsden, Reference Amsden1992; 115–129; Matsusaka, Reference Matsusaka2001). Figure 2 illustrates the in-house production strategy of the four major chaebol over the past two decades. The four chaebol have increased intra-house production and intra-firm purchases through inter-subsidiary transactions. In-house production and transactions have given enormous benefits to the chaebol because increasing sales volume in this way can help the chaebol to maintain market shares and obtain greater financial resources from banks.

Figure 2. Number of subsidiaries of Korea's four major chaebol.

Source: Drawn based on E-group, Fair Trade Commission (https://www.egroup.go.kr).

Figure 2 illustrates the chaebol's likelihood to depend on in-house production during business downturns. According to this figure, the number of subsidiaries of SK Group, Hyundai Motors, and LG Group has increased disproportionately to the change in the return on equity (ROE) rate. That is, the less three chaebol have earned, the more they have tried to internalize production through corporate expansion. Samsung appears to be more cautious than the other three groups in its efforts to increase subsidiaries. However, this group also increased the number of subsidiaries in the late 2000s when the ROE rate began to stagnate after the East Asian financial crisis (Lee, Reference Lee2002).

The practice of in-house production explains how the chaebol would respond to the current uncertainty in semiconductor supply chains. They have acquired necessary materials by internalizing the supply of resources through their own subsidiaries and long-term subcontractors. SK Group has already deployed this strategy since it purchased Hynix in 2012. It was necessary to protect their newly acquired firm from the fluctuation of prices for semiconductors and materials. While urging its subsidiaries to produce reliable materials, Samsung Group bought out domestic companies and established exclusive subcontracting relations with other small companies.

The chaebol's practice of in-house production during recession has explanatory power concerning limited SME incorporation. As the chaebol have almost exclusively depended on their internal production networks, potentially upstream SMEs could be forestalled from selling new products to downstream conglomerates (Lee, Reference Lee2019b). The chaebol have purchased materials and parts from their own subsidiaries or long-term subcontractors without linking themselves to external SMEs or cooperating with them to develop new technologies in the long run.

3.2. When old institutions pay off

The chaebol's practice of in-house production obviously explains why the incorporation of SMEs into semiconductor production has been slow or limited in Korea despite strong entrepreneurial efforts of the Moon government. However, the chaebol factor does not present the whole picture of limited entrepreneurship of the Korean state. In particular, an excessive emphasis on the chaebol factor obscures the way the government formulated and implemented the new semiconductor measures and their resulting contradictions per se. According to historical institutionalism, the ideological purpose or political commitment of policymakers does not seamlessly translate into public policies. In fact, policymaking is mediated through underlying ideational and institutional conditions that have self-reinforcing properties (e.g., Hall and Taylor, Reference Hall and Taylor1996). To understand the real mechanisms of policy formulation and implementation, this study seeks to identify the orientational and organizational features of Korea's developmental state regime that the Moon government managed to use to create new semiconductor policies.

In this study, the term orientation refers to the ideational constraints that determine ‘what is acceptable or conceivable, thus shaping state actors’ reactions to external forces and their receptiveness to new ideas’ (Vogel, Reference Vogel1996: 21). The most important orientational factor underpinning Korea's developmental state is nationalism. Korean nationalism is a ‘hegemonic ideology’ (Cho, Reference Cho2008) that has called for concerted action to catch up to advanced countries (e.g., Japan) by exploiting comparative advantages and by persuading the people to comply with the national goal of industrialization (Woo-Cumings, Reference Woo-Cumings and Woo-Cumings1999: 10–11). Nationalism has survived democratization and globalization because the political elites have continued to frame trade and industrial policies as the means to build ‘an advanced country’ or seonjingug (Lee and Lee, Reference Lee and Lee2015).

The nationalist orientation continued to be the dominant mindset of policymakers in the Moon government. They saw trade disputes with Japan as integral to the historical rivalry between the two nations (Shin, Reference Shin2020: 101–102), and determined that liberating Korea's semiconductor production from Japanese chains – or ‘decoupling from Japan’ – must be the nation's mission. President Moon urged the semiconductor industry to develop Korea's ‘industries of materials and components’ to ensure that they are no longer ‘subject to technological hegemony’ by Japan (Kim, Reference Kim2019). Kim Hyun-jong, President Moon's deputy security advisor, condemned Japan as an enemy of the entire Korean nation when the disputes accelerated. He also criticized the Abe cabinet for other nationalist reasons, including the proposed additional sanctions on North Korea while inter-Korean negotiations were underway and the decision to postpone the US–Korea joint military exercises during the Pyeongchang Winter Olympic Games (Blue House, 2019a).

Organization indicates the relationship between state actors and industry, ‘structuring the incorporation of interest groups, defining state capabilities, and shaping state and societal interests’ (Vogel, Reference Vogel1996: 22). Hundt (Reference Hundt2012) characterized the key institutional arrangement of the Korean developmental state as ‘developmental alliance,’ referring to the ongoing concerted efforts between the state and large firms that are geared toward industrialization. According to Kang (Reference Kang2003: 442–445), in addition, this alliance was stable during the authoritarian period because mutual hostage relations existed between the state and the chaebol. In other words, no one could gain the upper hand because both were powerful enough to harm the other. State officials valued close ties with the small number of chaebol as a mechanism of industrial policy coordination and as an informal channel of bribery and rent seeking. They hardly extended consultation and partnership toward non-chaebol actors due to the actors' weak or indirect contributions to industrialization.

Democratization has not substantially changed the arrangement of developmental alliance. Governments have predicted that they can take a fast track to achieve policy goals and to make reforms more visible if the chaebol cooperate. Therefore, many have attempted to make big deals with a limited number of large businesses to accomplish macroeconomic goals such as job growth and investment. The Korean chaebol has become highly internationalized, but have still needed favorable domestic regulations that can guarantee market dominance and can offset uncertainties in the international market.

As shown in Table 2, exclusive policy bargains have continued between all administrations and the chaebol when economic challenges occurred. Governments have asked the chaebol to create more jobs and to expand investments to minimize the domestic impact of external shocks; in response, the chaebol has called for corporate tax cuts and deregulatory measures in return for their compliance with government reforms. The Moon administration is the same as preceding ones. President Moon met with chaebol leaders in person to ask for their cooperation in carrying out important policies, including technology localization. In exchange for the chaebol's contribution to these policies, the government gave favors to large businesses, including deregulatory measures and loose enforcement of business regulations.

Table 2. President–chaebol deals in hard times

Note: Summarized by the authors.

At this point, we propose that the real process in which the government used to formulate and enact the semiconductor measures was, to a large extent, determined by a nationalism and developmental alliance rather than the government's normative and entrepreneurial claims for industry-wide cooperation. The Moon government has mobilized nationalism, or a strong sense of rivalry with Japan, while extensively bargaining with a handful of the chaebol to facilitate technology localization.

Both nationalism and developmental alliance influenced the new semiconductor measures not only because the ‘institutional arrangements obstruct an easy reversal of the initial choice’ (Levi, Reference Levi, Lichbach and Zuckerman1997: 28), but also because ‘each step along a particular path produces consequences which make that path more attractive for the next round’ (Pierson, Reference Pierson2000: 253). The developmental state idea and institution produce increasing returns, which are much higher in general than risky long-term investments in constructing SME-based innovation systems.

According to Gourevitch (Reference Gourevitch1986), an industrialized country promotes incorporation of larger number of industrial actors when ‘crisis open(s) the system of relationships, making politics and policy more fluid’ (p. 22). This promotion required the country to undergo two types of domestic political dynamics: (a) policy battles among a range of political and industrial actors concerning the direction of the industrial policies, and (b) challenges to build a new political settlement that leads to a new mode of production network and income redistribution (Gourevitch, Reference Gourevitch1986: 21–28).

Gourevitch's account implies that the government must take two types of risk related to its new entrepreneurial project to make an SME-based innovation system. First, as long as entrepreneurship for SME incorporation necessitates policy battles, the government can lose control over the policymaking process. Second, achieving reform outcomes will take plenty of time because political settlements need to be adjusted in advance. However, the government can alleviate the risk by taking advantage of the nationalist mobilization and by bargaining with experienced developmental alliance partners. The former enables the government to control the policymaking process, whereas the latter helps to enhance the visibility of reform efforts.

This study hypothesizes that as the Moon government sought increasing returns from nationalism and developmental alliance, the possibility of wider SME incorporation decreased. Concretely, the government was able to obtain societal consensus on policy direction by appealing to the people through nationalist campaigns. The public sphere was once overwhelmed by nationalism, while any alternative voices went unheard. On the other side of nationalism, the government failed to collect a sufficient amount of information necessary to develop new semiconductor policies. Meanwhile, developmental alliance was still considered a useful tool because the chaebol was highly capable at developing local technologies and resources as quickly as possible. However, the chaebol's cooperation made it unnecessary for the government to seek bottom-up innovation resources. The government praised, or rather marketed, the chaebol's progress as a sign of Korea's entrance into the new industrial model, without paying close attention to the complicated technological demands of SMEs.

4. Explaining limited SME incorporation

This section corroborates the proposed argument by illustrating the effects of nationalism and developmental alliance on President Moon's entrepreneurial project, which varied across two phases of state entrepreneurship. The effect of nationalism was persistent and more essential in the phase of policy formulation, lasting until early 2020. In this phase, nationalism not only allowed the Moon government to take command of the policymaking process but also deprived it of opportunities to obtain sufficient policy information from the industry. The policy implementation phase began in early 2020, which was when the effect of developmental alliance manifested. The government depended heavily on large businesses' capability to visualize policy outcomes in a short time. Consequently, when implementing the new semiconductor measures, there was not sufficient consideration to incorporate small firms as potential producers.

4.1. Price of nationalism

The Moon government created its own narrative of nationalism by blending Korea's ethnic nationalism with its unique interpretation of Korean democracy. It emphasized the country's century-long progress in democratization as a matter of national pride. President Moon made this narrative concrete through his contribution to Frankfurter Allgemeine Zeitung in September 2019. He situated important events from the twentieth and the twenty-first centuries, such as the 1st March Independence Movement of 1919, and a series of democratization movements, including the Gwangju Uprising of 1980 and the Candlelight Revolution of 2016, on the historical continuum of democratic advancements and claimed that this continuum was achieved through ‘the greatness of the ordinary.’ Furthermore, he suggested that ‘the powerful solidarity of ordinary people’ will overcome the division of the Korean Peninsula, which has suppressed the ‘freedoms of thought, expression, and conscience’ (Moon, Reference Moon2019).

Coincidentally, the trade trouble between Korea and Japan began when this new nationalism was at its peak in Korea. The conflict solidified a sense of hostility toward Japan's Abe cabinet and gave birth to mercantilist propaganda, which was virtually non-existent after Korea's rise as an economic powerhouse. The government utilized Professor Ha-Joon Chang's ‘kicking-the-ladder-away’ strategy to criticize Japan. President Moon argued that Korea's economic development and imminent parity with Japan forced the Abe cabinet to ‘weaponize a sector where it has a comparative advantage’ and ‘kick the ladder away while others [including Korea] are following in its footsteps.’ Moon reminded the people that ‘we have long surpassed Japan's absolute advantages in many technological areas and caught up with this country successfully’ (Blue House, 2019b).

Nationalist campaigns gave political advantages to the ruling Democratic Party and the government preparing for new semiconductor industrial policies (Hong, Reference Hong2020). The conservative opposition, such as the Liberty Korea Party and the Bareun Future Party, warned that worsening bilateral relations with Japan would undermine the security cooperation system in Northeast Asia and advised the government to stop ‘escalating historical and economic conflicts with Japan’ (National Assembly Secretariat, 2019). They proposed that the government renegotiate with Japan to have more time to consider new policies deliberately. Some business leaders also raised concerns.

However, the government forced the conservative opposition to rescind their arguments by depending on the fierce nationalist sentiment. Hundreds of people marched in front of the Japanese Embassy in Seoul and the Consulate General in Pusan in solidarity with the anger expressed by the government. Consequently, social groups such as the Korean Confederation of Trade Unions and the Citizens' Coalition for Economic Justice stopped criticizing the government for its social and economic policies and joined the nationalist campaigns. Remarkably, many citizens shared the government's nationalist spirit. The majority of Koreans, including conservatives, supported Moon's responses to Japan's actions and voluntarily organized ‘I-won't-go-I-won't-buy’ campaigns that called for a boycott of Japanese products and travel (Lee, Reference Lee2019a: 100–102).

To capitalize on this sentiment, the government and the ruling party responded to the conservatives by claiming that contemporary conflicts with Japan have authoritarian or conservative roots. The Moon government argued that if it had not been for the 1965 Normalization Treaty signed by the dictator Park Chung-hee and the 2015 Comfort Women Accord signed by his daughter President Park Geun-hye, there would not have been a need to correct false history or face Japan's retaliation.

However, controlling the policymaking process through nationalism has a negative side. The absence of policy contestation made it difficult for the government to collect widespread information that is valuable for making new semiconductor policies. Even the voices of the chaebol went unheard. For example, at a meeting with the representatives of large Japanese companies (e.g., Toyota and Sumitomo), Sohn Kyung-shik, the chairman of the Korea Enterprises Federation, expressed concerns about the uncertainty in supply chains and indicated that ‘the trade dispute between the countries will only harm both’ (Park and Lee, Reference Park and Lee2019). However, the Moon government did not respond to these voices.

More importantly, the government opposed its slogan by improvising to formulate the first semiconductor policy, the One-Shot Act, without embracing the voices of SMEs. According to a survey conducted by the Korea Industrial Technology Association (KOITA) in August 2020, approximately 30% of SMEs did not know the new semiconductor policies and 60% did not apply for subsidies due to a lack of information (KOITA, 2020: 3). Moreover, the government did not develop measures to address the workplace concerns of SMEs. Small firms have claimed that it would be difficult for them to develop new technologies without resolving labor shortages and technology drain due to large firms. However, the One-Shot Act lacked institutional measures to tackle these problems and draw SMEs into semiconductor production.

Consequently, the One-Shot Act became a contingency plan that could quickly be implemented to cope with the rivalry with Japan and to save the chaebol from the risk of production interruptions. The act stipulated that the Fair Trade Commission would pardon the chaebol if they expanded intra-group transactions to secure necessary materials. The chaebol regarded the One-Shot Act as an indication that the government would no longer apply strict regulations to their corporate governance structure while attempting to establish or acquire new subsidiaries necessary for in-house production. The Fair Trade Commission withdrew from the investigation of the chaebol's alleged misconduct. For example, SK Group chairman Chey Tae-won had been suspected of committing fraud and embezzlement while taking over Slitron (a producer of semiconductor silicon wafers) from LG. However, after SK Slitron was praised as an icon of supply chain localization, the commission could not show continued willingness to investigate this case.

4.2. Chaebol's discretion unabated

The Moon government had room to prepare for additional policies in early 2020 when the semiconductor industry moved away from the risk of recession due to worldwide semiconductor shortage. The new measures, including the Measures for Enhancing Competitiveness of Materials, Parts, and Equipment Industries and the Materials, Parts, and Equipment 2.0 Strategy, were no longer contingency plans but rather sophisticated policy packages to lay down the infrastructure for large and small firms to collaborate. The government selected 100 SMEs as hidden champions, or gangsogieob (small but strong companies), whose technologies are qualified to cooperate with large firms for localization. In addition, it launched investment funds to target venture companies and installed test beds across the country that allow all companies to test new technologies. Simultaneously, financial subsidies more than doubled and were extended not only to SMEs in the semiconductor industry, but also to those in the electronics, automotive, and biotechnology industries.

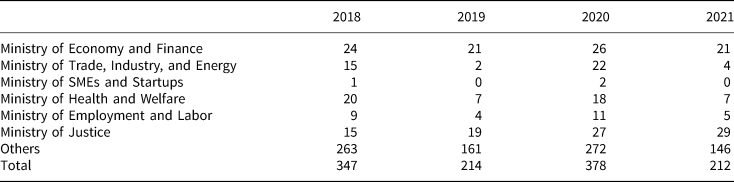

Because as the Ministry of Trade, Industry, and Energy (MTIE) and the Ministry of Economy and Finance (MEF) are tightly connected to the chaebol, one possible way to push the above pro-SME reforms was to bolster the power of the Ministry of SMEs and Startups (MSS). The Moon government established this ministry in 2017 to foster a favorable business environment for SMEs, to resolve manpower shortages by reducing wage disparities, and to strengthen the capability of small businesspeople. However, the government did very little to strengthen the MSS for the purpose of state entrepreneurship; the transition costs that accompanied such actions are too high. Empowering this new agency requires an adjustment of administrative jurisdiction vis-a-vis the MTIE and MEF because it is very difficult to reduce the power of these old ministries (Table 3).

Table 3. Number of bills submitted by ministries to the legislature

Source: Ministry of Government Legislation (each year).

Consequently, the MSS's power over the formation of the new semiconductor policies remained severely constrained. On the one hand, the number of new policies suggested by this ministry was surprisingly small. According to Table 4, which counts the annual numbers of bills submitted by several ministries to the National Assembly from 2018 to 2021, the MEF, the MTIE, the Ministry of Health and Welfare, the Ministry of Employment and Labor, and the Ministry of Justice took advantage of the ruling party's landslide victory in the 2000 general elections by submitting an increasing number of bills to the National Assembly. This table helps demonstrate that the MTIE played a key role in creating the new semiconductor measures, whereas the MSS played a small role in designing semiconductor policies. Despite its official mission to create pro-SME policies, this agency hardly capitalized on the favorable legislative environment after 2000 to institutionalize support for SMEs in need of technological assistance and fair trade with the chaebol. It only submitted two additional bills after the elections and proposed no independent bills in 2021.

Table 4. How many hidden champions were long connected to the chaebol

Source: MSS (2020).

Note: The relationship was surveyed by the authors; other sectors from which hidden champions were selected include machinery and metals, auto parts, and electronic industry.

On the other hand, the new policies created by the MSS (if any) had no impact on incorporation of the large number of SMEs. One of the two bills submitted by the MSS in 2020, the Collaborative Cooperation Act, shows that that this ministry seriously considered the chaebol's discretion, as the MTIE and the MEF used to do. The overall purport of this new act was, in fact, to strengthen the ministry's power to curb exclusive subcontracting relations and to restrain the chaebols' abusive exercise of power against small subcontractors. However, this regulation was not very strong. The chaebol was still allowed to engage in exclusive subcontract relations if they need certain subcontractors for technological localization and report the case to the ministry in advance. In other words, the MSS did not decisively expand value chains toward external SMEs as an alternative pathway for semiconductor industry development.

In comparison, the Moon government heavily depended on the discretion of the chaebol to enact its entrepreneurial goal. The pursuit of reform measures yielded high returns with the support of the chaebol because these firms had historically proven their high capabilities of achieving what the government wanted in a timely way. Therefore, the government granted the chaebol power to lead in making industrial cooperation feasible. For example, on 10 October 2019, President Moon visited a Samsung facility and praised the company's plan to invest KRW 13 trillion (USD 11 billion), along with its signing of a memorandum of understanding (MOU) to cooperate with many SMEs, describing their actions as ‘a crucial opportunity for our country to become self-sufficient’ (Blue House, 2019c). However, all of the SMEs that signed the MOU were Samsung's exclusive subcontractors, which resulted in strengthening the mechanism of in-house production.

The government also made use of the chaebol's internal networks when it ran the hidden champion program. According to Table 3, which presents surveys of 43 hidden champions in the semiconductor material, display, and elementary chemical sectors, only a few SMEs in each sector were not connected to the chaebol before they were selected as hidden champions. The majority of selected SMEs were the chaebol's exclusive subcontractors for at least a decade (13 SMEs in the semiconductor material sector, 5 in the display sector, and 6 in the chemical sector). Moreover, the hidden champion program reinforced the hierarchical relationship between the chaebol and the selected hidden champions. Many of the latter tried to tighten the links by hiring retiring chaebol officers or by allowing the chaebol to hold a high ratio of stocks.

As the state's goal of industry-wide cooperation and technological localization became subject to the chaebol's discretion, the government became further distracted from SMEs' workplace concerns. Industrial specialists have acknowledged that technological localization would not be sustainable without resolving the skilled labor shortage in SMEs (National Assembly Budget Office, 2020: 38–40; Jeong, Reference Jeong2021). Therefore, the government has designed a KRW 300 billion (USD 260 million) project to foster 3,000 master's degree holders and Ph.D.-qualified experts in the field of semiconductor research and development for the next 10 years. However, this project was again predicated on the chaebol's discretion. Since the fund was composed of the government's contribution and investments from Samsung and SK Hynix, the chaebol had a strong influence over the operation of this fund.

Therefore, this project fell short of adequate methods to address SMEs' concerns. Although the skilled labor shortage is concentrated in SMEs with relatively low wages, the government did not propose any institutional measures to tackle wage disparities. Most importantly, the new education program was not sufficiently combined with the systematic collection and analysis of data concerning workplace demands for skilled manpower. This lack of data resulted in this project being disapproved by a special committee of the Ministry of Science and Technology Information and Communication, which has a legal authority to conduct a preliminary feasibility study on state sanctioned projects that cost more than KRW 50 billion (USD 42 million).

5. Conclusions

This study acknowledged the reemergence of the entrepreneurial state in Korea in response to trade disputes with Japan and its limitations in achieving the goal of turning SMEs into semiconductor production chains. It found that this limitation did not simply originate from the chaebol's adherence to in-house production but rather from the way that the Moon government performed its role for the entrepreneurial state. The Moon government sought increasing returns from the old developmental state idea and institution as a shortcut to reform success, leading it to undermine the conditions for wider SME incorporation. Nationalism enabled the government to control the policymaking process but made it difficult for it to obtain sufficient policy information from industrial society through policy contestation. The government's dependence on the chaebol's discretion and capability to enhance the visibility of reformed outcomes resulted in the distinctive demands of the majority of small firms being downplayed.

The analysis in this paper implies more than the power of path dependency or the argument that old institutions block social progress. It also reveals that there is political calculus behind the Moon government's continued use of the old idea and institution of the developmental state. The government actively capitalized on nationalism and developmental alliance for political returns. Moreover, it publicly criticized this old developmental state model, but opted to make use of the model's underlying legacies to make its entrepreneurial reform more stable and visible.

The insight from this paper helps to enrich researchers' understanding of why the entrepreneurial state does not always succeed in Korea in two ways. First of all, this study recommends that scholars analyze this question as an independent research puzzle. The burgeoning literature has erroneously taken for granted ‘the entrepreneurial developmental state’ in East Asia (Pardo and Klingler-Vidra, Reference Pardo and Klingler-Vidra2019) and ‘the entrepreneurial aspects of state activity that had been already prevalent with the East Asian developmental states’ (Ebner, Reference Ebner, Cantner, Gaffard and Nesta2009: 386). However, as shown in this study and other episodes in Korea, the developmental state has not automatically transformed into an entrepreneurial state and the former has sometimes inhibited the emergence of the latter. Therefore, it is necessary to explore how the existing institutions of the developmental state constrain and facilitate the new experiments of the entrepreneurial state.

Second, this study lays out a theoretical framework to explain why the entrepreneurial state does not necessarily succeed. Similar to Korea, if the old political economy model pays off and provides a shortcut to realize new entrepreneurial goals, the government is less likely to undertake fundamental changes in the existing political economy structure. This framework holds true not only for the semiconductor case but also for other cases of limited entrepreneurial state in Korea. After observing the efforts to construct SME-based regional clusters during the reign of liberal Presidents Kim Dae-jung and Roh Moo-hyun (2003–2008), Hsieh (Reference Hsieh, Choi, Lee and Shin2018) found that Korea's innovation system remained highly ‘national’ and ‘homogeneous,’ and oriented towards ‘firm-specific support’ (pp. 70–72). The conservative administrations' policies for startups and entrepreneurs were also not successful because large businesses kept dominating the market and rarely abandoned unfair trade practices (Paik, Reference Paik2016). Given this limitation, Hsieh (Reference Hsieh, Choi, Lee and Shin2018) concluded that Korea's entrepreneurial state had hardware (i.e., innovation policies) but lacked ‘coherent visions on what the software should be’ (p. 75). In addition, the proposed framework in this study strongly implies that Korea's hardware has been compromised by the merits of the old institutions of the developmental state.

Additionally, this framework can apply to widespread entrepreneurial projects on techno-nationalism in several advanced countries. Many scholars understand that a country's shift away from the risk of decoupling of global value chains and movement towards a techno-nationalist system depends on the states' political entrepreneurship, which can reshore, localize, and subsidize key manufacturing sectors (Vanchan et al., Reference Vanchan, Mulhall and Bryson2018; Wu and Jia, Reference Wu and Jia2018; Wan et al., Reference Wan, Orzes, Sartor and Nassimbeni2019; Nakamura, Reference Nakamura2022). However, the outcomes do not simply result from the government's techno-nationalist commitment. They are also related to the institutional conditions under which the government conducts the entrepreneurial task. To grasp what would really happen in techno-nationalist competition, it is necessary to investigate whether the state and the industry share the same vision about national economies in respective countries and, more importantly, how these two have coordinated industrial policies in the past.

Conflict of interest

The authors declare none.