Introduction

Firms that partner with others to develop innovative products in collaborative ventures, often facing technological uncertainty and power dynamics (Bouncken et al., Reference Bouncken, Fredrich, Kraus and Ritala2020b; Dickson & Weaver, Reference Dickson and Weaver1997), require an ability to manage these ventures effectively (Schreiner, Kale, & Corsten, Reference Schreiner, Kale and Corsten2009). The firm's procedures to guide the set-up of and coordination practices within alliances encompass organizational routines making up its alliance management capability (Draulans, de Man, & Volberda, Reference Draulans, de Man and Volberda2003; Schilke, Reference Schilke2014; Sluyts et al., Reference Sluyts, Matthyssens, Martens and Streukens2011). Alliance management capabilities differ from a firm's alliance strategy: While (1) an alliance strategy specifies how to build alliances in consideration of (2) its alliance management resources, (3) alliance management capabilities are the organizational routines to implement an alliance strategy. Although these three organizational aspects together reflect a firm's ability to manage alliances, how precisely they relate to each other remains unclear (Kohtamäki, Rabetino, & Möller, Reference Kohtamäki, Rabetino and Möller2018).

However, the formalization that comes with an ability to manage alliances may hinder the development of innovations (Degener, Maurer, & Bort, Reference Degener, Maurer and Bort2018; Russo & Vurro, Reference Russo and Vurro2019). Formalization can cause rigidity and reduce creativity and flexibility (Bouncken, Fredrich, & Pesch, Reference Bouncken, Fredrich and Pesch2016). As Mintzberg (Reference Mintzberg1994: 386) notes, ‘formalization is a double-edged sword, easily reaching the point where help becomes hindrance.’ Our study seeks to address this paradox and asks: does a firm's alliance management ability weaken or strengthen innovation performance in collaborative ventures? In focusing on this issue, two aims direct our inquiry. To clarify whether a firm's alliance management ability is associated with innovation performance, the first aim of this study is to examine how the three organizational aspects that make up a firm's alliance management ability (alliance strategy, alliance management capability, and alliance management resources) relate to each other, and to ascertain how these organizational aspects relate to innovation performance in collaborative ventures. Additionally, because innovation performance is typically contingent on the firm's innovation strategy and technological uncertainty, which both possibly condition the firm's alliance management ability (Li & Atuahene-Gima, Reference Li and Atuahene-Gima2002; Zhao, Cavusgil, & Cavusgil, Reference Zhao, Cavusgil and Cavusgil2014), the second aim of this study is to assess whether a firm's innovation strategy relates to its innovation performance in collaborative ventures and to investigate whether a firm's innovation strategy moderates the impact of certain elements that make up a firm's alliance management ability on innovation performance in collaborative ventures, and whether such possible moderation effect is contingent on technological uncertainty?

This study offers two fundamental contributions. First, it explains what comprises a firm's alliance management ability and distinguishes three elements: (1) alliance strategy, (2) alliance management capabilities, and (3) alliance management resources. The study examines the role of alliance management capabilities that represent the routines a firm uses to implement an alliance strategy. This role reflects a congruent relationship between a firm's strategy and its routines, which ultimately enhances performance (Miles & Snow, Reference Miles and Snow1978). Furthermore, drawing on the resource-based view (RBV) (Barney, Reference Barney1991), this study outlines how the performance effect of an alliance strategy is contingent on both alliance management capabilities and resources: alliance management capabilities mediate the relationship between the firm's alliance strategy and its performance, and alliance management resources strengthen the relationship between alliance management capabilities and performance. Clarifying what constitutes a firm's alliance management ability represents a contribution to the literature by integrating three commonly used, though often separately considered, elements in one theoretically coherent conceptualization that draws on the RBV.

Second, this study goes beyond elucidating the association of a firm's alliance management ability with its innovation performance in collaborative ventures and examines whether this impact is contingent on technological uncertainty. Although the commonly considered classical contingency argument of Burns and Stalker (Reference Burns and Stalker1994) implies that formalization may be problematic in mature organizations when confronting uncertainty, by leaning on Sine, Mitsuhashi, and Kirsch (Reference Sine, Mitsuhashi and Kirsch2006), the present study shows that collaborative ventures can be viewed as emerging organizations and that a firm's alliance management ability can be conducive, rather than disadvantageous, to generating innovations. In doing so this study helps clarify previously reported inconclusive findings of the role of formalization in alliances (e.g., Bucic & Gudergan, Reference Bucic and Gudergan1994) and illustrates that the paradox concerning formalization and innovation may not be manifested in alliances. Data from 441 firms operating in the electronics industry provide a suitable basis for examining differences in innovation performance through engagement in collaborative ventures.

The remainder of this paper is structured as follows: ‘Theoretical background’ section briefly summarizes the theoretical background of our conceptual framework. ‘Hypotheses’ section builds on these theoretical considerations and develops a model consisting of seven hypotheses illuminating a firm's alliance management ability. ‘Method’ and ‘Results’ sections present the methodology and results of our study. ‘Discussion’ section discusses our study's implications, identifies main limitations, and concludes with a summary of our core findings.

Theoretical background

Firms forming collaborative ventures commonly seek to draw on the partner's complementary resources to improve innovation performance (e.g., Gudergan et al., Reference Gudergan, Devinney, Richter and Ellis2012; Kwak, Reference Kwak2004). Producing innovations, with ensuing products that are superior in the market, is a chief performance target for these collaborations (Lee & O'Connor, Reference Lee and O'Connor2003) and relates to the introduction of novel technologies integrated into customer solutions, new benefits offered to customers, or new features to markets.

Alliance management facilitates collaboration in such ventures (Schreiner et al., Reference Schreiner, Kale and Corsten2009). Supporting organizational routines, including administrative mechanisms to facilitate inter-firm coordination, constitutes a firm's alliance management capability (Schilke & Goerzen, Reference Schilke and Goerzen2010). The codification and internalization of alliance management know-how, in the form of alliance management routines, enhance collaborative performance (Hoffmann, Reference Hoffmann2005; Schilke & Goerzen, Reference Schilke and Goerzen2010; Sluyts et al., Reference Sluyts, Matthyssens, Martens and Streukens2011).

A dedicated alliance function (Kale, Dyer, & Singh, Reference Kale, Dyer and Singh2002) can support alliance managers in their pursuit of using such routines (Draulans et al., Reference Draulans, de Man and Volberda2003; Singh & Power, Reference Singh and Power2013). It is such a function – or similar infrastructure – that represents a resource base on which alliance managers can draw when fostering collaborations and their performance (Kale & Singh, Reference Kale and Singh2007; Kale et al., Reference Kale, Dyer and Singh2002). Therein, the alliance function, as a resource base, establishes an infrastructure that supports effective alliance management (Heimeriks & Duysters, Reference Heimeriks and Duysters2007). Such an alliance management resource base can develop when firms operate a portfolio of different collaborations and are embedded in dense networks of collaborations enabling experience to be institutionalized. Senior management involvement not only affects the extent to which a clear alliance strategy is specified but also influences the extent to which such alliance management infrastructure develops (Kandemir, Yaprak, & Cavusgil, Reference Kandemir, Yaprak and Cavusgil2006). Greater direction and resource availability improve alliances (Lambe, Spekman, & Hunt, Reference Lambe, Spekman and Hunt2002). The question, however, remains as to how alliance strategy specification, alliance management capabilities, and alliance management resources relate to each other and whether their formalization hampers or strengthens a firm's innovation performance in collaborative ventures.

To develop a more in-depth understanding of a firm's alliance management ability, the present study leans on Miles and Snow (Reference Miles and Snow1978) who argue that strategy assists in aligning a firm with its environment, and that internal structures and processes, in turn, must be congruent with the strategy if this alignment is to be effective. The RBV represents the theoretical basis that supports our argument, as it focuses on the link between strategy and a firm's internal resources. It explains how a firm's strategy, in consideration of its resources, affects firm performance, in general, and how this is supported by resource deployment processes (e.g., Barney & Mackey, Reference Barney, Mackey, Ketchen and Bergh2005; Sirmon, Hitt, & Ireland, Reference Sirmon, Hitt and Ireland2007). The routines that enable the latter reflect a firm's capabilities (e.g., Kale & Singh, Reference Kale and Singh2007; Slater, Olson, & Hult, Reference Slater, Olson and Hult2006) that affect performance (e.g., DeSarbo, Di Benedetto, & Song, Reference DeSarbo, Di Benedetto and Song2007). It is through them that a firm implements its strategy (Slater et al., Reference Slater, Olson and Hult2006) and, in turn, improves performance (Penrose, Reference Penrose1959). Yet, it is the extent to which capabilities leverage a firm's resources that determines differences in performance (Collis & Montgomery, Reference Collis and Montgomery1995).

This conceptualization is consistent with the arguments by Vorhies, Morgan, and Autry (Reference Vorhies, Morgan and Autry2009) who lean on DeSarbo et al. (Reference DeSarbo, Di Benedetto and Song2007) and Snow and Hrebiniak (Reference Snow and Hrebiniak1980) in that a firm's strategy defines its capabilities which, in turn, affect performance. Accordingly, performance improves via appropriately specified capabilities to deploy resources (cf. Ray, Barney, & Muhanna, Reference Ray, Barney and Muhanna2004) where the specification of capabilities with embedded routines arises from the strategy selected to leverage the organizational resource base.

Hypotheses

In applying the above reasoning, this paper advances hypotheses to clarify the impact of the three alliance management elements – strategy, capabilities, and resources – on innovation performance in collaborative ventures. As we seek to better understand the possibly paradoxical role of formalized alliance management in improving collaborations in inter-firm ventures but in impeding innovations that can be produced through such ventures, we also assess the impact of the firm's innovation strategy and technological uncertainty (Li & Atuahene-Gima, Reference Li and Atuahene-Gima2002; Zhao et al., Reference Zhao, Cavusgil and Cavusgil2014).

Formalized alliance management ability

Alliance strategy

An alliance strategy guides the development and maintenance of collaborative ventures, and it is the extent to which such a strategy is specified that reflects its formalization (Vlaar, Van Den Bosch, & Volberda, Reference Vlaar, Van Den Bosch and Volberda2007). An alliance strategy defines objectives and the overall direction that affect conduct in collaborations. Such guidance also enhances the performance in product innovation alliances (Easingwood, Moxey, & Capleton, Reference Easingwood, Moxey and Capleton2006). Explicit articulation of an alliance strategy improves comprehension of what is pursued in an alliance. In particular, the guidance offered through an alliance strategy contributes to coordinating new product development activities within and across collaborating firms (Gerwin & Ferris, Reference Gerwin and Ferris2004). This, in leaning on Chandler (Reference Chandler1962) and Miles and Snow (Reference Miles and Snow1978), improves performance.

Hypothesis 1. Greater alliance strategy specification is associated with greater innovation performance in collaborative ventures.

Alliance management capabilities

Organizational capabilities can be described as ‘specialized capabilities’ (cf. Grant, Reference Grant1996) or ‘architectural capabilities’ (cf. Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997): in our context, the former concern the integration of the specialized know-how that a firm can access to manage collaborations that have been initiated; the latter emphasize procedures to identify, evaluate, establish, or change collaborative ventures. In either case, such alliance management capabilities are made up of organizational routines that guide the conduct of activities in collaborative ventures (Al-Tabbaa, Leach, & Khan, Reference Al-Tabbaa, Leach and Khan2019).

The performance effects of activities that underpin internal product innovation management are, however, not straightforward (Lewis et al., Reference Lewis, Welsch, Dehler and Green2002): formalized routines with detailed planning are considered to improve performance (Zirger & Maidique, Reference Zirger and Maidique1990); then, a more flexible style provides greater autonomy and stimulates creativity (Kamoche & Cinha, Reference Kamoche and Cinha2001). We contend that collaborative innovations are different from internal innovations. Indeed, Gerwin and Ferris (Reference Gerwin and Ferris2004) argue that collaborative ventures require a coordinated product development approach. In a similar vein, Lambe et al. (Reference Lambe, Morgan, Sheng and Kutwaroo2009) find that greater formalization increases the impact of collaborative competence on new product development performance. Moreover, Bouncken (Reference Bouncken2011) shows that small firms improve their innovation performance in alliances through formalized operating routines, whereas large firms experience reduced performance when drawing on such routines.

Hence, notwithstanding that alliance management capability and the routines that make them up to improve collaboration (Sivadas & Dwyer, Reference Sivadas and Dwyer2000), formalized routines can constrain creativity and flexibility that underpin innovations (Vlaar et al., Reference Vlaar, Van Den Bosch and Volberda2007). Collaborative ventures that emphasize product innovation, however, have relatively fewer institutionalized structures than internal organizations have, and as such, they may not be overburdened by bureaucracy (Lambe et al., Reference Lambe, Spekman and Hunt2002). Hence, in such ventures, firms draw on the routines making up their specialized and architectural alliance management capabilities (Niesten & Jolink, Reference Niesten and Jolink2015) so that their collaborations are effective.

Hypothesis 2a. Greater alliance management capabilities are associated with greater innovation performance in collaborative ventures.

Alliance management capabilities are how a firm implements its alliance strategy (cf, Grant, Reference Grant1996). An alliance strategy does neither automatically proliferate within a venture nor does it inevitably determine practices within it. Therefore, an alliance strategy, to be effective, requires suitable implementation through organizational routines. Hence, it is through alliance management capabilities that a firm implements its alliance strategy (cf, Slater et al., Reference Slater, Olson and Hult2006) and, in turn, improves performance (cf, Penrose, Reference Penrose1959).

Hypothesis 2b. The relationship between alliance strategy specification and innovation performance in collaborative ventures is mediated through alliance management capabilities.

Alliance management resources

Firms draw on alliance management resources to improve their collaborations and, ultimately, their performance (Bitran et al., Reference Bitran, Bitran, Conn, Nagel and Nicholls2002; Kale et al., Reference Kale, Dyer and Singh2002). Such a resource infrastructure can be reflected in dedicated alliance management investment, networks of collaborations and expertise that can be accessed, a dedicated alliance function or similar infrastructure, and the like. Professionals within collaborative ventures can utilize the routines that make up the firm's alliance management capabilities to leverage such an alliance management resource base to effectively manage collaborative endeavors (Heimeriks, Reference Heimeriks2010; Heimeriks & Duysters, Reference Heimeriks and Duysters2007; Kale & Singh, Reference Kale and Singh2009). This resource base exerts a positive effect on alliance performance (Kale et al., Reference Kale, Dyer and Singh2002; Kandemir et al., Reference Kandemir, Yaprak and Cavusgil2006) but does so indirectly (Kale & Singh, Reference Kale and Singh2007). Sluyts et al. (Reference Sluyts, Matthyssens, Martens and Streukens2011) stress that commitment of the senior management – which can be evident in establishing and supporting suitable alliance management resources – provides a basis on which professionals within a collaborative venture can draw.

Hence, the firm's alliance management resources facilitate the effective deployment of alliance management capabilities (cf, Barney & Mackey, Reference Barney, Mackey, Ketchen and Bergh2005; Sirmon et al., Reference Sirmon, Hitt and Ireland2007). The purpose of drawing on alliance management resources when deploying alliance management capabilities is to accomplish certain outcomes (Kazanjian, Drazin, & Glynn, Reference Kazanjian, Drazin, Glynn, Hitt, Ireland, Camp and Sexton2002). Because alliance management resources by themselves do not produce outcomes, certain outcomes are only accomplished in a way that these resources support the deployment of alliance management capabilities through strengthening their effectiveness (Lippman & Rumelt, Reference Lippman and Rumelt2003). Hence and in reiterating Penrose's (Reference Penrose1959) notion, possessing resources is not sufficient to produce outcomes but relevant ordinary capabilities are needed. In this way, the effective leveraging of alliance management resources through alliance management capabilities is crucial to produce outcomes (Lichtenstein & Brush, Reference Lichtenstein and Brush2001). Thus, we suggest that performance improves through alliance management capabilities; a process that is amplified by the alliance management resources that they access (cf. Ray et al., Reference Ray, Barney and Muhanna2004).

Hypothesis 3. The relationship between alliance management capabilities and innovation performance in collaborative ventures is positively moderated by greater alliance management resources.

Innovation strategy and technological uncertainty

Firms that engage in collaborative ventures specify to varying degrees their innovation strategy (Li & Atuahene-Gima, Reference Li and Atuahene-Gima2002). An innovation strategy concerns the strategic goal and direction setting for the development and use of novel products and processes (Bouncken, Koch, & Teichert, Reference Bouncken, Koch and Teichert2007). The formulation of clear innovation objectives can improve flexibility and creativity by providing direction and clarity (Pearce, Robbins, & Robinson, Reference Pearce, Robbins and Robinson1987). Although creativity can suffer from formalizations, there are positive net effects on innovation performance through reduced ambiguity (Damanpour, Reference Damanpour1991). Hence, when working in collaborative ventures, firms improve their innovation performance through specifying innovation strategies (Bouncken, Pesch, & Gudergan, Reference Bouncken, Pesch and Gudergan2015; Li & Atuahene-Gima, Reference Li and Atuahene-Gima2002; Zhao et al., Reference Zhao, Cavusgil and Cavusgil2014).

Hypothesis 4a. Greater innovation strategy specification leads to greater innovation performance in collaborative ventures.

Although both an innovation strategy and an alliance strategy foster separately innovation performance in collaborative ventures, we argue that they are also synergistic in enhancing innovation performance: generally, well-aligned strategies relate to organizational performance (Hill & Cuthbertson, Reference Hill and Cuthbertson2011), and congruent organizational decisions are mutually supportive (Choudhari, Adil, & Ananthakumar, Reference Choudhari, Adil and Ananthakumar2010) so that when firms engage in collaborations to innovate those strategies that specify the approaches to collaboration and innovation should act in a reinforcing manner. In support, Vanhaverbeke et al. (Reference Vanhaverbeke, Belderbos, Duysters and Beerkens2015) find that in emerging industries, technological capital – which they conceptualize as past (internal) R&D performance – and alliance capital – which refers to the outcome of the firm's alliance management ability as reflected in its alliance portfolio – are synergetic in affecting performance. They associate this with the capacity to deal with technological uncertainty. Indeed, the specification of these organizational strategies is particularly advantageous in contexts of high uncertainty. For instance, Zhao et al. (Reference Zhao, Cavusgil and Cavusgil2014) show that when firms use an innovation strategy while integrating suppliers in new product development processes, the performance impact on creating superior products increases with greater technological uncertainty. Similarly, Li and Atuahene-Gima (Reference Li and Atuahene-Gima2002) find that the performance effect of using an innovation strategy is strengthened by environmental turbulence and by the collaborative effort devoted to the alliance. Thus, innovation and alliance strategies act synergistically, and their impact increases when facing greater technological uncertainty.

Hypothesis 4b. Greater innovation strategy specification positively moderates the relationship between alliance strategy specification and innovation performance in collaborative ventures.Hypothesis 4c. The positive two-way interaction effect between innovation strategy specification and alliance strategy specification on innovation performance in collaborative ventures is positively moderated by technological uncertainty. To put it differently: There is a positive three-way moderation effect.

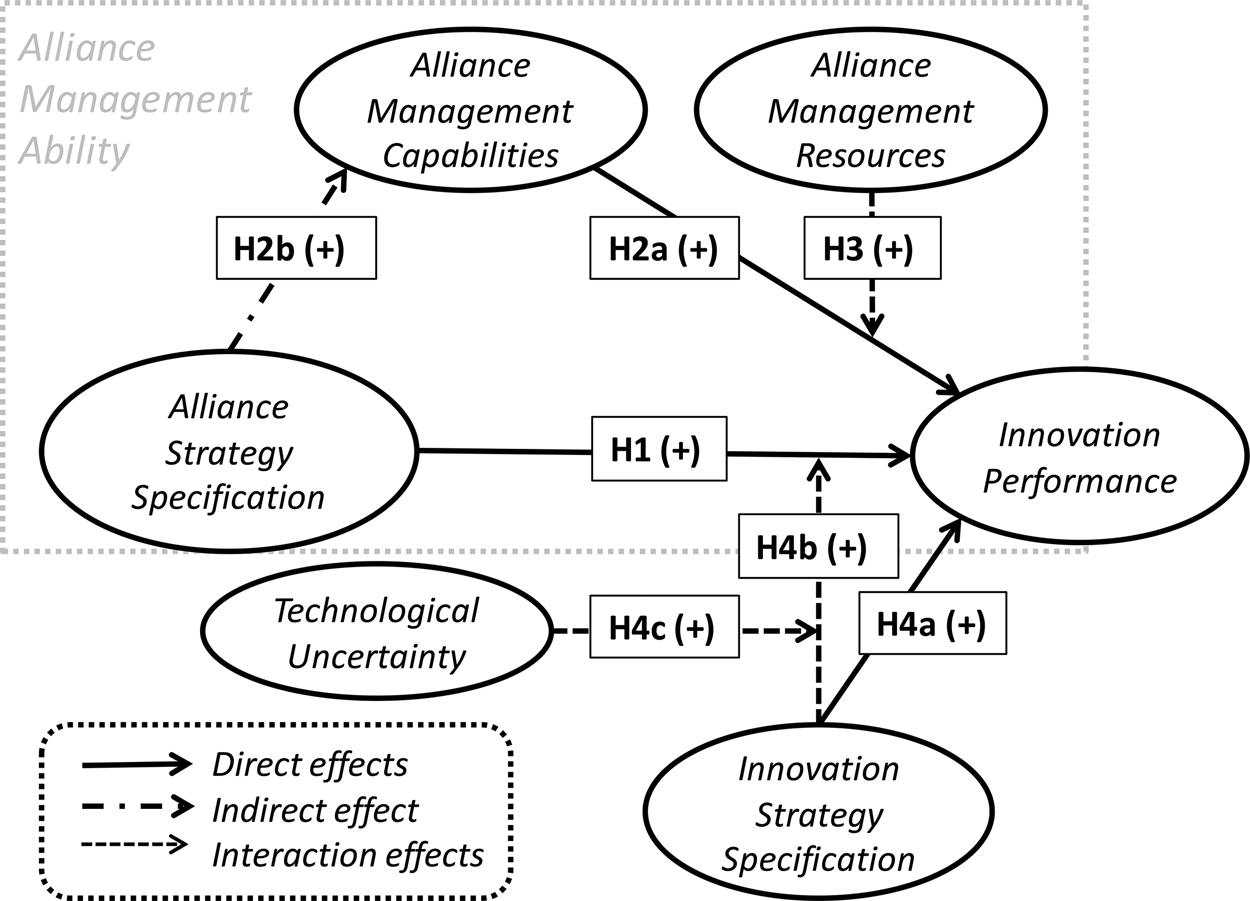

Figure 1 illustrates the conceptual model and hypotheses. It outlines how the elements that constitute a firm's alliance management ability relate and how they are associated with innovation performance in collaborative ventures. It also details the role of two contingency factors: the firm's innovation strategy and technological uncertainty.

Figure 1. Alliance management and innovation performance in collaborative ventures.

Method

The research design of this study is cross-sectional, focusing on manufacturers of electronics engaged in collaborative ventures set up to foster innovation. This is appropriate as firms commonly innovate through collaborative ventures (e.g., Sampson, Reference Sampson2007). Objective data about these firms' alliance-related practices and capabilities are not readily available. Consequently, we utilize survey data.

Sample

We randomly selected 3,300 manufacturers of electronic components (SIC code 36) from German-speaking countries (Germany, Switzerland, Austria, Liechtenstein, and Luxembourg) in the Amadeus database to serve as our sampling frame. We used a mail-based survey and asked mid- to senior-level managers to complete the main survey and forward a supplementary one that measured innovation performance to an appropriate colleague. Following two reminders, we received 441 usable responses for both the main survey and the supplementary one from 533 firms that responded. This response rate of 16.2% is adequate (Menon et al., Reference Menon, Bharadwaj, Adidam and Edison1999). The sample characteristics are as follows: average (median) firm size was 2,586 (98) employees, and average (median) sales volume was approximately one billion (15 million) Euro.

Measurement

This study draws on established – though adapted – measurement models and some newly developed ones (see Table 1; for all items and characteristics). The development of the measurement models involved detailed discussions with four managers of collaborative ventures to determine appropriate items and make adjustments in the wording when ambiguity existed. All models are of the reflective mode and use 5-point Likert-type scales.

Table 1. Measurement model

Notes: AVE, average variance extracted; VIF, variance inflation factor; bca CI, bias-corrected and accelerated confidence interval; HTMT, heterotrait–monotrait ratio.

All factor loadings are significant (t > 3.1 respectively p < .001).

The measurement model for the dependent construct innovation performance is adapted from Lee and O'Connor (Reference Lee and O'Connor2003) product superiority measurement to fit our context (Bouncken & Pesch, Reference Bouncken, Pesch and Das2014). Technological uncertainty was measured by three items adapted from Lewis et al. (Reference Lewis, Welsch, Dehler and Green2002). The construct of innovation strategy specification measured the extent to which a firm has an explicit innovation strategy and is consistent with Bouncken et al. (Reference Bouncken, Pesch and Gudergan2015). As existing literature has not always dealt precisely with the elements that constitute a firm's alliance management ability, we created three new measurement models based on a review of various related measurement models and on feedback from four professionals involved in the type of collaborative venture that we study. Accordingly, alliance strategy specification is measured by four items. The construct of alliance management resources reflects the know-how and infrastructure that a firm can access to improve its collaborations. Based on our theoretical argument and discussion with alliance professionals and their insights, we leaned on a set of items that were utilized by Kandemir et al. (Reference Kandemir, Yaprak and Cavusgil2006) and Bouncken and Fredrich (Reference Bouncken and Fredrich2016) to examine alliance orientation and concluded with four items that reflect a firm's alliance management resources. The construct of alliance management capabilities draws on a four-item reflective measurement model.

Exploratory factor analyses supported the necessary condition of uni-dimensionality for confirmatory factor analysis. All measurement models exhibit sufficient reliability. All thresholds concerning convergent and discriminant validity were met (Fornell & Larcker, Reference Fornell and Larcker1981; Henseler, Ringle, & Sarstedt, Reference Henseler, Ringle and Sarstedt2015).

The conceptually substantiated mode of all measurement models is verified through a vanishing confirmatory tetrad analysis that draws on bias-corrected and Bonferroni-adjusted bootstrap confidence intervals for the null hypothesis of the reflective and alternative hypothesis of the formative mode (Gudergan et al., Reference Gudergan, Ringle, Wende and Will2008).

Data characteristics

As a crude assessment of non-response bias, we compared early (i.e., no reminders) versus late responders (i.e., one or two reminders) for differences in item-level variances. Since none of the 25 items showed significant mean differences (p < .05), we concluded that non-response bias is not prevalent in our data. We limited single-source bias by collecting responses from a second informant from each firm using a supplementary survey to measure the dependent construct innovation performance. We assessed the inter-rater reliability with Cohen's κ (Cohen, Reference Cohen1968), yielding fair to moderate agreement levels (Landis & Koch, Reference Landis and Koch1977). We also calculated weighted κs to measure slight agreement. Hence, we do not need to be concerned with a single source bias.

To assess sources of common method bias, we ran Harman's single-factor test in exploratory factor analysis with all items, which produced six factors with eigenvalues greater than 1. The first extracted factor accounted for 31.40% of the variance, and four factors were needed to extract the majority of the variance (53.84%). Also, to examine the extent to which a common factor mattered, we allowed all independent items to load on a general factor. We estimated its effect on performance which further supported that such a general factor was not meaningful (i.e., small effect size accounting for 3.8% of the variance in the performance construct: f 2 = .057). Hence, the use of a common method does not appear to be an issue in our study. We assessed the distribution of our data by examining Mardia's multivariate skew and kurtosis measures (DeCarlo, Reference DeCarlo1997) that were highly significant (p < .001), indicating a violation of the multivariate normality assumption and favoring non-parametric procedures such as bootstrapping.

Analytical approach

We applied PLS-SEM using SmartPLS 3.0 (Ringle, Wende, & Becker, Reference Ringle, Wende and Becker2015) to assess our hypotheses, as it has less restrictive assumptions yielding fewer identification problems and does not require normally distributed data (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017) which applies to our study.

To assess our hypotheses, we followed standard procedure and estimated several models consecutively, adding complexity at each stage. We started with estimating a simple base model in which we incorporated the direct effects of alliance strategy specification and innovation strategy specification and included the control variables. This is followed by more complex extended mediation model estimations in which we first introduced the indirect effect of alliance management capabilities and then accounted for the contingency effects of alliance management resources and technological uncertainty. Furthermore, we carried out more complex estimations in what we refer to as the full model. Adding quadratic terms (Ganzach, Reference Ganzach1998) and several additional interactions in all stages and between contingency variables uncover true interactions and avoid misinterpreting spurious significances as statistical artifacts of omitted parameters.

We drew inferences based on 5,000 bootstrap resamples of our final sample. To estimate the interaction effects, we used the (complete) product indicator approach. The three-way interaction and quadratic effects were estimated using the two-stage approach (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017).

To control for variance in innovation performance due to firm size and different subindustries (Bouncken, Fredrich, & Kraus, Reference Bouncken, Fredrich and Kraus2020a), we included the natural logarithm of the number of employees and an industry dummy for the biggest subgroup (i.e., 40% manufacturers of semiconductors and related devices, SIC = 3674). Furthermore, as the duration of collaborative ventures in our sample ranges from 4 months to 50 years with a median of 2.5 years, we controlled for this by including the interaction of alliance strategy specification and the natural logarithm of the duration into our full model.

Results

We assess all estimated models by evaluating the variance explained (R 2 and adjusted R 2 to account for model complexity) and the cross-validated redundancy measure Q 2 (calculated through a blindfolding procedure; omission distance d = 10). Models exceeding values of zero have predictive relevance. Values of explained variance (R 2) greater than .19, .33, or .67 are considered weak, moderate, or substantial, respectively (Chin, Reference Chin and Marcoulides1998).Footnote 1

Base model results

Model 1 includes control variables and accounts for the linear direct effects of alliance strategy specification and innovation strategy specification on innovation performance. Table 2 outlines the results concerning Hypothesis 1 and Hypothesis 4a by path coefficients, levels of significance, 90% bias-corrected bootstrap confidence intervals, and effect sizes.

Table 2. Hypotheses results of Models 1, 2a and 2b

sup, support; rej, reject; bca CI, bias-corrected and accelerated confidence interval.

Notes: †p<.10, *p<.05, **p<.01, ***p<.001.

The results show that the effect of alliance strategy specification on innovation performance is significant (H1: β = .194, p < .001); in support of Hypothesis 1. Innovation strategy specification also has a significant positive effect on innovation performance (H4a: β = .242, p < .001); supporting Hypothesis 4a. Manufacturers of semiconductors significantly outperform those firms from the other subsectors concerning innovation performance. The other control variables have rather negligible effects.

Extended mediation model results

The first extended mediation model, Model 2a, introduces linear indirect effects through alliance management capabilities. Additionally, Model 2b accounts for direct linear effects of the two contingency variables – technological uncertainty and alliance management resources – on both, the mediator variable alliance management capabilities and the dependent variable innovation performance. Table 2 outlines the results of Models 2a and 2b.

In Model 2a we examined the contingent indirect effect of alliance strategy specification transmitted through alliance management capabilities on innovation performance. Our results indicate a positive relationship (H2a: β = .146, p < .05), which supports Hypothesis 2a. To test for indirect effects, we multiplied the first and second stage mediation effects. As the direct effect of alliance strategy specification on innovation performance becomes insignificant (H1: β = .090, p > .10), we discovered a positive indirect-only mediation effect (Zhao, Lynch, & Chen, Reference Zhao, Lynch and Chen2010). The overall model fit by the explained variance is still relatively low.

In Model 2b, we assessed the robustness of the indirect effect and included linear direct effects of both contingency variables – technological uncertainty and alliance management resources – on the endogenous variable. The indirect effect of alliance strategy specification reduces (H2b: β = .072, p < .10) but remains significant; supporting Hypothesis 2b. The explained variance of Model 2b, however, is just about ‘weak’.

Full model results

Our full models contain control variables, direct and indirect linear effects, and introduce additional (interaction) effects. The inclusion of curvilinear trends by adding quadratic terms leads to more realistic models as most relationships are conditionally monotone rather than conditionally linear (Ganzach, Reference Ganzach1998). Given our three-way interaction and contingent mediation hypotheses, we included several additional interactions in all stages and between contingency variables as control variables in our models. This allows isolating variance explanation that enables determination of true interactions and limiting misinterpretation of spurious significances due to highly correlated linear effects, quadratic terms, or lower-order interactions in the case of our three-way interaction. We further included the interaction of alliance strategy specification and alliance duration to account for variations of innovation performance during different stages of the relationship life cycle (Jap & Ganesan, Reference Jap and Ganesan2000).

Table 3 summarizes the results of full Models 3a, 3b, and 3c. These three models are alike except for the interactions between the contingency variables technological uncertainty (full Model 3a) and alliance management resources (full Model 3b) and the effects associated with alliance strategy specification (first stage and direct effect) and alliance management capabilities (second stage effect). Thus, Models 3a and 3b serve as a starting point before controlling the total effect associated with alliance strategy specification for different levels of the contingency variables. In the following, we restrict our descriptions of results to the full Model 3c consisting of all effects, referring to Models 3a and 3b when analyzing the contingent mediation hypotheses.

Table 3. Hypotheses results of Models 3a, 3b and 3c

sup, support; rej, reject; bca CI, bias-corrected and accelerated confidence interval.

Notes: †p < .10, *p < .05, **p < .01, ***p < .001.

The interaction between alliance strategy specification and innovation strategy specification does not unfold a significant effect on innovation performance (H4b: β = .038, p > .10); rejecting Hypothesis 4b. When additionally calculating this interaction accounting for different levels of technological uncertainty, a significant three-way interaction on innovation performance (H4c: β = .121, p < .05) emerges, supporting Hypothesis 4c.

To assess Hypothesis 3, and especially the second stage contingent mediation argument, we compare the results of Models 3b and 3c. A necessary condition for an indirect effect to be called a contingent mediation contains a significant change in the first stage and/or second stage of an indirect effect; irrespective of the direct effect being contingent on such variable (Edwards & Lambert, Reference Edwards and Lambert2007). Regarding Hypothesis 3 we find a significant positive interaction between alliance management resources and the second stage of the indirect effect associated with alliance strategy specification (or alliance management capabilities) in our full Model 3c (Model 3c: βAMR×ASS→IP = .091, p > .10; βAMR×ASS→AMC = .032, p > .10; H3: βAMR×AMC→IP = .173, p < .05). We compared the indirect effect associated with alliance strategy specification before and after the inclusion of the three interactions (Model 3b: H2b: β = .080, p < .05; Model 3c: H2b: β = .069, p < .10). The significance level of the indirect effect weakens after accounting for interactions with alliance management resources, indicating that part of the indirect effect unfolds through alliance management resource differences. We conclude from (a) the insignificant direct effect of alliance management resources on innovation performance, (b) the significant positive interaction effect between alliance management resources and the second stage of the indirect effect associated with alliance strategy specification, and (c) the still significant indirect effect at the 10% level, that the (indirect-only) mediation effect is positive and contingent on alliance management resources; offering support for Hypothesis 3.

The explained variance of Model 3c can now be characterized as ‘weak’ (adjusted R 2> .19). There are only a few meaningful effect sizes after taking inflated type II error and attenuation bias into account (see Tables 2 and 3). We additionally calculated the effect size measure κ2 for indirect effects. This standardized κ2 measure defined as ab/M(ab) cannot be negative and ranges from 0 (no linear indirect effect) to 1 (maximum potential linear indirect effect); reflecting the proportion of the maximum possible indirect effect that could have occurred (Preacher & Kelley, Reference Preacher and Kelley2011). The controlled indirect effect associated with innovation strategy specification cannot be interpreted as a linear indirect effect (κ2 = .006, p > .10; κ2<.01, analogous to r 2 interpretations by Cohen, Reference Cohen1988). Similarly, the linear indirect effect associated with alliance strategy specification can be interpreted as ‘small’ (κ2 = .051, p < .10; .01<κ2<.09).

Figure 2 illustrates the estimation results for all hypotheses given full Model 3c. It shows how the indirect effect of alliance strategy specification mediated through alliance management capabilities on innovation performance is affected separately by the two contingency variables.

Figure 2. Full model estimations.

We then followed Edwards and Lambert (Reference Edwards and Lambert2007) to calculate and plot the contingent direct and indirect effects. Those indicate that the extent to which firms benefit from specifying their alliance and innovation strategies is contingent on technological uncertainty (see Exhibit 3.1 in Figure 3). If technological uncertainty is low, innovation performance weakens with a simultaneous pursuit of alliance and innovation strategies; with growing technological uncertainty, firms increase their innovation performance when simultaneously pursuing their alliance and innovation strategies.

Figure 3. Contingent direct and indirect effects of alliance strategy specification on innovation performance.

The direct performance consequences of alliance strategy specification without the mediation through alliance management capabilities are greatest if alliance management resources are high and technological uncertainty is low (see Exhibit 3.2 in Figure 3). Furthermore, both technological uncertainty and alliance management resources affect the indirect impact of an alliance strategy. Exhibit 3.2 illustrates how the indirect effect of an alliance strategy influences performance depending on the two contingency variables – technological uncertainty and alliance management resources. Both contingency variables have a positive impact on the indirect performance effect associated with alliance strategy specification. The indirect effect of alliance strategy specification is particularly strong when alliance management resources are high, independent of technological uncertainty.

Hence, high alliance management resources amplify the direct and indirect performance effects of alliance strategy specification. And, with increasing technological uncertainty, the total effect is more strongly caused by the indirect effect of alliance strategy specification through alliance management capabilities. Consequently, alliance management capabilities should be more strongly emphasized as a way of implementing an alliance strategy when technological uncertainty increases. Under high technological uncertainty, we also find that innovation strategy specification increases innovation performance in a three-way interaction.

Discussion

Despite this study's careful research design, we must address two methodological limitations. First, the relatively small amount of variance explained might point to a low empirical relevance of our model. Yet, as the purpose of this study is not to identify all sources of innovation performance in collaborative ventures but instead to investigate whether a firm's alliance management ability affects innovation performance and whether such is contingent on the firm's innovation strategy and technological uncertainty, the performed analyses are in line with our study's aims. Second, there is an ongoing debate about the appropriability of PLS-SEM for theory testing (Henseler et al., Reference Henseler, Dijkstra, Sarstedt, Ringle, Diamantopoulos, Straub and Calantone2014; Rönkkö, Reference Rönkkö2014; Rönkkö & Evermann, Reference Rönkkö and Evermann2013; Rönkkö et al., Reference Rönkkö, McIntosh, Antonakis and Edwards2016). Therefore, scholars should be aware of potential methodological shortcomings and closely follow future advances addressing these issues (e.g., Schamberger et al., Reference Schamberger, Schuberth, Henseler and Dijkstra2020). Furthermore, future research should explore in greater depth the moderated mediation effects discussed in this study (Hayes, Reference Hayes2018) and consider complementarity analyses using necessary condition analysis of strategic frames (Klimas, Czakon, & Fredrich, Reference Klimas, Czakon and Fredrich2021). Table 4 refers to our research questions and summarizes related findings. Moreover, we propose promising future research directions connected to our findings.

Table 4. Summary of findings and future research directions

Scholarly implications

The findings indicate that the specification of both alliance and innovation strategies increases innovation performance in collaborative ventures. Alliance management capabilities are the means through which alliance strategy specification improves performance: they mediate the relationship between the alliance strategy and innovation performance. These findings support the importance of alliance management capabilities emphasized by authors such as Niesten and Jolink (Reference Niesten and Jolink2015), Schilke (Reference Schilke2014), Schilke and Goerzen (Reference Schilke and Goerzen2010), and Sluyts et al. (Reference Sluyts, Matthyssens, Martens and Streukens2011). Our findings further imply that professionals within collaborative ventures can utilize the routines that make up a firm's alliance management capabilities to leverage its alliance management resource base to effectively manage collaborative endeavors. This substantiates the general importance of having alliance management resources (Heimeriks, Reference Heimeriks2010; Heimeriks & Duysters, Reference Heimeriks and Duysters2007; Kale & Singh, Reference Kale and Singh2009; Kale et al., Reference Kale, Dyer and Singh2002) and is consistent with Kale and Singh (Reference Kale and Singh2007) in that their performance impact, however, is not direct. In doing so, the present study outlines in detail how innovation performance in collaborative ventures is affected by a firm's alliance management ability and how distinguishing the elements that constitute this ability matters. Previous studies are less systematic in this regard.

Our insights also offer support for Miles and Snow (Reference Miles and Snow1978), indicating that implementation of an alliance strategy through appropriate alliance management capabilities that can leverage related resources reflects how a firm's internal structures and processes are congruent with its espoused organizational strategy. Furthermore, in support of the RBV (Barney, Reference Barney1991), our findings suggest that heterogeneity in firm resources – in the present context alliance management resources – explains differences in firm performance: whereas alliance management resources matter, resource deployment processes in the form of alliance management capabilities enable their impact on innovation performance. This study's findings are the first that comprehensively and empirically demonstrate that a firm's alliance strategy shapes its alliance management capabilities, and these, in turn, leverage its alliance management resources to bolster innovation performance in collaborative ventures. Hence, a firm's alliance management ability comprises three elements: (1) alliance strategy, (2) alliance management capabilities, and (3) alliance management resources.

This study also adds to understanding the apparent paradox about formalization versus innovation, specifically whether a firm's (formalized) alliance management ability advances innovation performance in collaborative ventures. Commonly, formalization is viewed to stifle innovation; and in a similar vein, the use of formalized routines is assumed to constrain product innovations (Drach-Zahavy et al., Reference Drach-Zahavy, Somech, Granot and Spitzer2004). Yet, this study shows that the alliance management ability improves innovation performance in collaborative ventures. These findings are consistent with previous empirical insights showing that formalization in the form of routines can increase the effectiveness of innovation alliances (Sivadas & Dwyer, Reference Sivadas and Dwyer2000). Thus, despite the commonly accepted argument of Burns and Stalker (Reference Burns and Stalker1994), which infers that in mature organizations, formalization is problematic when confronting uncertainty, this study supports Sine et al. (Reference Sine, Mitsuhashi and Kirsch2006). Hence, in collaborative ventures – representing emerging organizations – an alliance management ability is conducive, rather than disadvantageous, to produce innovations. This impact is more pronounced with greater technological uncertainty. These insights suggest that the paradox concerning formalization and innovation may not necessarily apply to alliances.

Managerial implications

While a key managerial consideration is that managers should not be concerned about formalizing their alliance management ability but should rather strengthen the latter, specific implications are twofold: First, to strengthen their alliance management ability managers (i) should specify their alliance strategy which may encompass clarifying how to collaborate and how to derive collaboration goals through systematic planning, and making collaboration activities part of their long-term strategy; (ii) should develop routines to establish an effective alliance management capability which may be achieved through informing employees regularly about the espoused alliance strategy, putting in place clear codes of conduct concerning collaboration practices, and specifying principles about how to deal with partners; and (iii) should create an alliance management resource base with various systems and accessible sources – on which alliance professionals can draw – through investments that enable identification of suitable partners and cultivation of existing collaborations, and embedding the firm within a dense network involving different collaborations and collaboration partners. Second, managers should specifically consider strengthening their firm's alliance management ability when dealing with greater technological uncertainty; when they also should put in place an innovation strategy.

Conclusion

In summary, this paper explains what constitutes a firm's alliance management ability. In doing so, it distinguishes three elements – alliance strategy, alliance management capabilities, and alliance management resources – and demonstrates that they jointly influence innovation performance in collaborative ventures. In leaning on Sine et al. (Reference Sine, Mitsuhashi and Kirsch2006), the study shows that collaborative ventures are emerging organizations. Formalizing an alliance management ability is beneficial, rather than detrimental, to generating innovations when faced with technological uncertainty.

Ricarda Bouncken (PhD, U St. Gallen, CH) is chair professor of Strategic Management and Organization at the University of Bayreuth, Germany, since 2009. Previously, she was a chair professor at the University of Greifswald and the Brandenburg Institute of Technology in Cottbus, Germany. Her research centers on the management of innovation, particularly in alliances and its embeddedness in corporate strategies. She is an Associate Editor for the Review of Managerial Science and European Management Journal and published her work in journals such as the Academy of Management Journal, Journal of World Business, Long Range Planning, Global Strategy Journal, and British Journal of Management.

Viktor Fredrich (PhD, U Bayreuth, DE) is currently working at the University of Bayreuth as a postdoc researcher at the chair of Strategic Management and Organization. His research focuses on quantitative analysis of topics including innovation in alliances, coopetition, and digitalization. He has published his research in journals such as Journal of World Business, Industrial Marketing Management, Long Range Planning, British Journal of Management, and Journal of Business Research.

Siggi Gudergan (PhD, U Sydney, AU) is Professor of Strategy with a particular focus on organizational innovation and transformation. His research has progressed understanding about the nature and role of dynamic capabilities and their performance implications applied to contexts such as alliances and internationalization. He has published widely, including in Long Range Planning, Journal of the Academy of Marketing Science, Journal of Business Research, Industrial Marketing Management, Management International Review, Journal of International Management, and Journal of Product Innovation Management.