1. Introduction

We examine the value of politically connected firm directors to the Chinese elite in terms of getting preferential access to resources. In order to do so, we build a new dataset of exogenous connections between directors of the board and members of the Politburo in China. We rely on a historical measure of connections using school ties that predate the current relationship of board directors with politicians. In this way, we rule out the possibility that our results are driven by the most able managers acquiring useful political connections as a result of their present position. We find that private firms with politically connected directors in the board get around 16% higher subsidies over sales, which translates into 7.2 million yuan on average (corresponding to USD 1.2 million using a 0.16 exchange rate), while connected state-owned enterprises (SOEs) pay 11% less in interest rates, translating into 31.9 million yuan (USD 5.1 million) lower payments on average per firm.

We also exploit the arrival of Xi Jinping to power and the launch of the anti-corruption campaign (henceforth ACC) to investigate if political connections as a means to obtain resources have become more or less important for firms after the campaign. Our empirical evidence shows that connections increased in importance for private firms in the wake of the ACC. Connected private firms have received more subsidies after 2012, while connected SOEs still get access to lower cost of debt, though at a lower magnitude than before the ACC. The different effect of the ACC for the private and state sectors is consistent with the distinct Chinese institutional environment that private and state firms face. Doing business through corruption has become harder for private firms after the ACC, increasing the relative importance of elite connections. By contrast, state firms are naturally connected to the political world, meaning that connected directors do not add additional value to the firm. Our results suggest that friends are purposely placed on mega-firms. This effect has become milder with the ACC.

From an empirical perspective, our new measure improves on the currently dominant proxy for Chinese connections used in the literature.Footnote 1 We proxy personal relationships with Politburo members by exploiting the alumni network of politicians. Most of the literature on Chinese connections builds the links using past or current working experience in the Party, an enormous organization with more than 90 million members. To mention some examples, Jia et al. (Reference Jia, Mao and Yuan2019), Wang (Reference Wang2015), and Li et al. (Reference Li, Meng, Wang and Zhou2008) consider a firm to be connected if at least one chairman is affiliated to the Chinese Communist Party or has working experience in some key Party organisms. By contrast, our measure captures whether a board director attended university with one of the 25 members of the Politburo, the highest political organism representing China's selective elite. To the best of our knowledge, we are the first to analyze the influence of past educational ties on resource allocation to private and state firms in China.Footnote 2 We additionally show that firms connected to politicians expelled from the Party lose their benefits, further increasing the credibility of our measure of connections.

Our measure has several other advantages. From an empirical perspective, it provides a better identification of connections than alternative measures as it is exogenous in two senses. First, it captures the value of ‘inherited’ connections, as opposed to connections built later in anticipation of economic benefits. Second, it is uncorrelated with China's recent events since it is a historical measure that predates the position of directors in the board. Finally, the educational tie allows us to disentangle the effect of the connection from other means of achieving resources, such as pecuniary corruption. Until now, any type of ‘personal allocation mechanism’ in China has been broadly termed as corruption. Our results show that political connections remain valuable after controlling for pecuniary corruption, suggesting that they are both relevant, even though they are distinct tools directly related to the procurement of resources. We also show that the firms that benefit from connections are not more efficient than others, despite their preferential treatment.

These findings have policy implications for our understanding of China's economic growth. Developing countries' institutions often lead to resource misallocation, preventing economic development (Hsieh and Klenow, Reference Hsieh and Klenow2009). Song et al. (Reference Song, Storesletten and Zilibotti2011) show that China's take-off has been largely due to an efficient factor reallocation. Despite this ‘factor reallocation great leap forward’, China is still in a stage of development where state discriminatory policies matter (Zilibotti, Reference Zilibotti2017). In order to maintain high economic growth rates, China needs to eliminate barriers that prevent the allocation of resources to its most efficient firms. Our paper brings evidence on an allocation mechanism – Politburo connections – that has been preventing the country from reaching its full growth potential as it inefficiently diverts productive resources. We thus point to a Chinese institutional feature whose improvement could translate into higher economic growth – and one that the ACC has not solved.

Our paper considers the unique institutional Chinese environment, where several SOEs coexist with private firms. Private and state firms are different in their nature and needs. Historically, Chinese SOEs have benefited from their relation to the state, sometimes obtaining lower cost of debt (Shailer and Wang, Reference Shailer and Wang2015) or facing a ‘soft budget constraint’ (Haley and Haley, Reference Haley and Haley2013; Lim et al., Reference Lim, Wang and Zeng2018). Our results show that connected directors bring positive subsidies to private firms whereas connected state companies enjoy lower cost of debt. Additionally, we find evidence suggesting that connections play a different role in each sector. While connections in the private sector act as a door to resources that would be difficult to obtain otherwise, connected directors in the state sector seem to be purposely appointed to mega-size companies.

Finally, our paper provides new insights into the literature examining the effect of the ACC and contributes to a broader literature that studies Chinese market institutions. Lack of strong enforcement of the rule of law in China has led to the development of alternative ‘hidden rules’ governing the market (Bi et al., Reference Bi, Shen and Khan2018). We examine if there has been a change in the value of the ‘being linked to the elite’ rule after 2012. We show that the value of personal ties with politicians does not disappear after the ACC. In the case of private firms, it became stronger: connected firms get more subsidies relative to non-connected firms. Our research is close to Chen and Kung (Reference Chen and Kung2019) who study the effect of family connections in China in terms of getting significant land price discounts. Similarly to Fang et al. (Reference Fang, Lerner, Wu and Zhang2018) and Giannetti et al. (Reference Giannetti, Liao, You and Yu2021), we study the effect of the ACC on the allocation of subsidies and cost of debt. However, we differ from them by our focus on an alternative channel: elite connections.

2. Connections and the Chinese institutional background

In this section, we provide context required to understand the role of connections in the Chinese institutional setting. Personal connections (‘guanxi’ practices) and corruption are widespread in China (Du et al., Reference Du, Lu and Tao2014; Hudik and Fang, Reference Hudik and Fang2020; Pei, Reference Pei2016). China's clan-based social organization has made personal relationships a key feature of its market economy (Greif and Tabellini, Reference Greif and Tabellini2017; Morgan, Reference Morgan2021). Connections to powerful elites can thus play a relevant role for market participants. Protection of property rights and access to goods controlled by the Chinese Communist Party depend to a great extent on personal relationships.Footnote 3

The spread of corruption in China since the market reforms period from 1978 has been well documented.Footnote 4 There have been occasional efforts to combat these practices. A policy that attracted worldwide attention was the 2012 ACC launched by President Xi right after his takeover. The crackdown's effect on cronyism is, however, unclear. On the one hand, the value of personal connections to politicians could have decreased as they can be understood as a form of non-pecuniary corruption. On the other hand, the political elite may have acted as a protective umbrella to its friends.

The 2102 ACC was novel in two senses, when compared to previous anti-corruption campaigns (Tang et al., Reference Tang, Ding and Xu2018). First, it was unexpected. President Xi announced it on November 8th, 2012, only 2 weeks after he was elected as General Secretary of the Party. Precedents showed that new policies were usually announced in the plenum of the Central Committee, which was expected to take place months later.Footnote 5 Second, the intensity and extent of the campaign has been the largest since 1978: more than 2 million people have been investigated for corruption.Footnote 6

It is unclear whether the ACC is just a political tool against political enemies or a real attack on corruption (Bian, Reference Bian2018). Empirically, there is mixed evidence on the real motivations behind the campaign: prosecution seems to be both driven by factionalist and anti-corruption motives (Griffin et al., Reference Griffin, Liu and Shu2021; Lorentzen and Lu, Reference Lorentzen and Lu2018). Part of the research evaluating the ACC up to now relies on the assumption that reducing corruption will automatically be a positive step toward a more efficient market economy. The results of Giannetti et al. (Reference Giannetti, Liao, You and Yu2021) and Fang et al. (Reference Fang, Lerner, Wu and Zhang2018) support this view since they find some convergence toward an economy with a more efficient resource allocation.

However, a lack of strong institutions that support a merit-based economy in China can lead to unintended consequences. Impersonal market institutions have been developed in China only during the last few decades and have become poorly ingrained in society (Duan and Martins, Reference Duan and Martins2019; Gong and Zhou, Reference Gong and Zhou2015; Mattingly, Reference Mattingly2016). A key question when analyzing the ACC is whether there are alternative, non-market-based mechanisms – such as political connections – by means of which goods are allocated. Osburg's field research provides some evidence showing that the ACC has made access to goods provided by the state even harder through the empowerment of a smaller elite (Osburg, Reference Osburg2018). Thus, the ACC may be shifting China toward an elite economy rather than a market-based economy. The empirical question of whether the ACC has affected the allocation of goods in the economy driven by elite connections is hence still a puzzle.

Illustrative evidence supports the interpretation of elite connections driving the allocation of resources in the economy both before and after the ACC. Figure 1 plots the average subsidies received by firms each year. Two points can be highlighted out of this figure. First, the trend of the subsidies received by firms connected to fallen politicians suggests that our measure of connection captures a real tie to the elite. Whereas before 2012 connected firms to these politicians received high and increasing amounts of subsidies, they experienced a sudden decline coinciding with their political fall. Second, connected firms not only received more subsidies than non-connected firms prior to the ACC, but the gap relative to non-connected firms tended to increase afterward.

Figure 1. Average subsidies received by firms. This figure shows the average subsidies received in year t by firms connected to Politburo politicians (dashed-dotted line); non-connected firms (dotted line); and firms connected to fallen politicians (solid line), namely, Bo Xilai, Zhou Yongkang, Xu Caihou, Guo Boxiong, and Sun Zhengcai. Quantities are expressed in million yuan and are deflated using the China's CPI.

Source: CSMAR and National Bureau of Statistics of China.

The literature on the increasing importance of SOEs in China and their concentration in the hands of powerful elites supports our hypothesis. Against predictions that the size of the Chinese state sector would decline in favor of the private sector following marketization, Chinese public ownership has grown in recent years by building pyramidal structures (Lardy, Reference Lardy2019; Naughton and Tsai, Reference Naughton and Tsai2015). These business empires, as Sutherland and Ning (Reference Sutherland and Ning2015) state, are ‘often orchestrated by those in very powerful positions that are accountable to very few’. This paper analyzes whether China is turning into a club-economy where an elite has privileged access to goods.

3. Methodology and data

In this section, we present our empirical model and the way we build our variables and sample. Next, we describe the characteristics of connected and non-connected firms.

3.1 Methodology

We conduct panel regression analysis to test the value of politically connected members of the board. Our baseline specification is the following:

The dependent variable Outcome i,s,p,t accounts for resources received or paid by firm i, in industry s, at the province p, in year t. We focus on access to subsidies and cost of debt.Footnote 7 For both of these, access under good conditions partly depends on discretionary choices by government officials (Feng et al., Reference Feng, Johansson and Zhang2015; Li et al., Reference Li, Meng, Wang and Zhou2008; Long and Yang, Reference Long and Yang2016).Footnote 8 We compute the total amount of financial subsidies received from the government each year scaled by total revenues the previous year. As for cost of debt, we follow the previous literature and measure it as interest expenses over total debt (Giannetti et al., Reference Giannetti, Liao, You and Yu2021; Wang, Reference Wang2015).Footnote 9

Our main independent variable is Connection, a dummy that equals one if the firm has at least one director in the board connected to a member of the Politburo in power in year t − 1. We identify the connections as follows. First, we obtain past education history from the board members in Chinese companies. This information is provided by China Stock Market and Accounting Research (CSMAR). We collect: university attended, graduation year, and type of degree.Footnote 10 Additionally, we hand-collect education information about the Politburo members, both for those politicians in the Politburo before 2012 and for the ones after the elections of 2012, when Xi Jinping took office.Footnote 11 These are the 25 members of the central and top-level political committee. Our measure of connection indicates whether a member of the board has attended the same university as any member of the Politburo, within 4 years of each other, and has studied the same degree type. For directors about whom we do not have data on when they attended university, we use their age.Footnote 12 This 4-year window provides a sensible span when it is likely that the director and the politician met at university.Footnote 13

We account for Entertainment as a measure of corruption to disentangle the effect of corruption and political connections. Cai et al. (Reference Cai, Fang and Xu2011) showed that the item Entertainment and Traveling Costs displayed on the footnotes of the financial statements of firms is a good proxy for corruption in China. We also obtain these data from CSMAR, and for the sake of simplicity, we refer to these costs, scaled by sales, as Entertainment. We follow the growing literature that uses this accounting item to analyze corruption (Fang et al., Reference Fang, Lerner, Wu and Zhang2018; Giannetti et al., Reference Giannetti, Liao, You and Yu2021; Griffin et al., Reference Griffin, Liu and Shu2021; Lin et al., Reference Lin, Morck, Yeung and Zhao2016).Footnote 14

We assume that the effect of connections and corruption is not immediate. Additionally, we only see the composition of the board at the end of each year, so we do not know if new directors arrive at the beginning or at the end of the year. Lagging the variable Connection 1 year hence provides enough time for directors to bring resources to the company.Footnote 15

We also add a vector of control variables xi,s,p,t−1 based on a large extant literature (Bliss and Gul, Reference Bliss and Gul2012; Pittman and Fortin, Reference Pittman and Fortin2004; Rajan and Petersen, Reference Rajan and Petersen1994). We control for leverage, since highly leveraged firms are likely to be considered riskier by lenders. Firms with higher profitability measures are usually in a better position to repay debts, so we add cashflows from operation to control for the ability of the firm to generate cash internally. We also include market-to-book ratio (as higher market valuation could translate into lower cost of debt); capital expenditure; size, measured as the log of total assets; and intangibility, a key determinant of investment (Pan and Tian, Reference Pan and Tian2017). Following the previous literature, we use the same controls for subsidies but we exclude cash holdings and growth (Feng et al., Reference Feng, Johansson and Zhang2015; Li et al., Reference Li, Tan and Zeng2021; Wang, Reference Wang2015). When relevant, we control for state-ownership, as firms held by the government have been shown to obtain greater benefits than their private counterparts (Harrison et al., Reference Harrison, Meyer, Wang, Zhao and Zhao2019; Wu et al., Reference Wu2012). The variable State is a dummy that equals one if the state is the ultimate largest shareholder of the company. Additionally, we add board controls: the ratio of board independent directors, and the board gender ratio.Footnote 16 Finally, we control for time-invariant specific characteristics that may be correlated with omitted explanatory variables by using fixed-effect specifications (firm ρ i, industry θ s, province δ p, and year φt). Standard errors are also clustered by firm, industry, province, and year.Footnote 17

Differences between state and non-state firms make them hard to compare. Thus, we divide our sample into private and state-owned companies to see which sector is driving the results and whether connections function in a different way in private and state-owned firms. We also divide our sample in two periods to assess the magnitude of the effect before and after the launch of the ACC in 2012. Our windows span from 2007 to 2012 and from 2013 to 2017 because in China the President and the Central Politburo are elected for 5 years in the National Congress. Connected directors in the first period are those linked with one of the 25 members of the 17th Politburo; and in the second period, to one of those of the 18th Politburo.

3.2 Data and descriptive statistics

We use data provided by the CSMAR. Our sample covers publicly listed firms in the two mainland Stock Exchange markets: Shanghai and Shenzhen Stock Exchange.Footnote 18

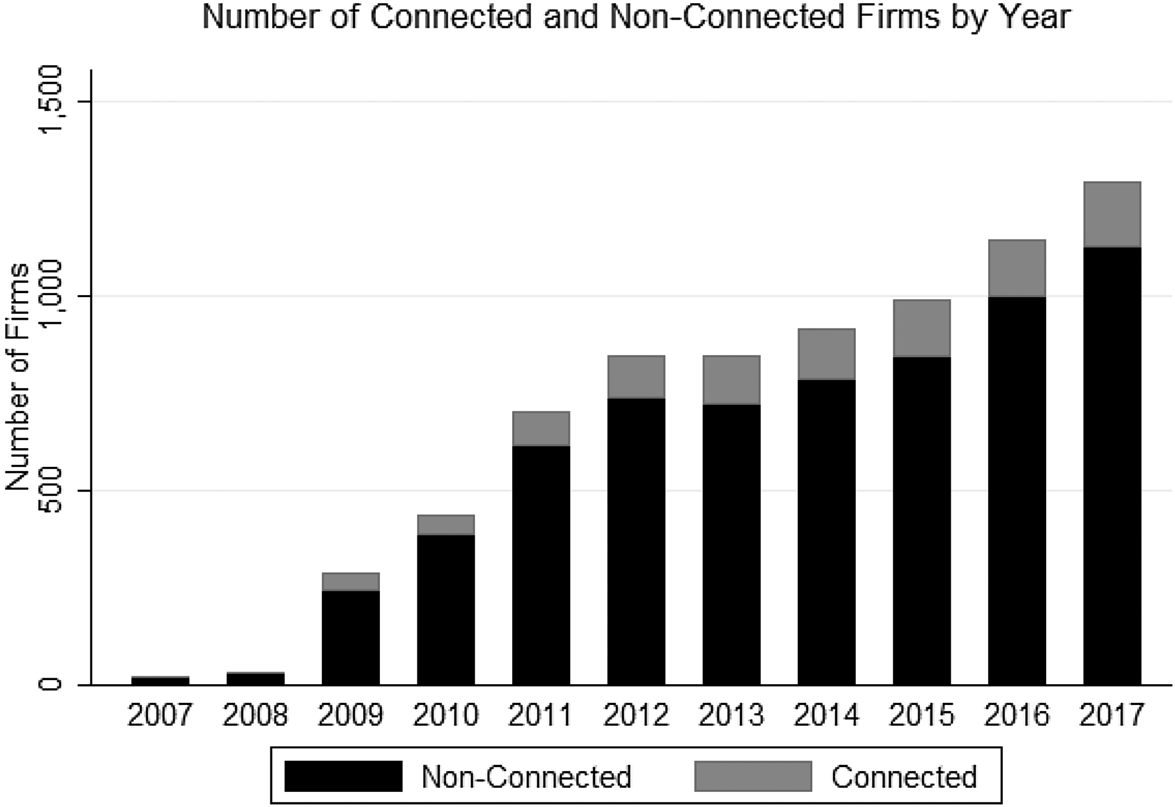

We first identify connections in the full CSMAR universe and then merge these data with accounting data. Both the number of Chinese listed firms and data availability in CSMAR increase over the years. We drop financial, special treatment, B-shares firms; and those firms that experienced an IPO in year t or t − 1. We eliminate observations with missing directors' education data or missing accounting data.Footnote 19 We end up with 7,266 firm-year observations, out of which 999 have at least one member of the board connected to a Politburo politician (for a distribution by year, see Figure 2). We have data on 1,867 firms: 1,395 are private firms and 512 are SOEs.Footnote 20

Figure 2. Distribution of connections by year.

We follow a matching strategy to rule out two potential concerns. First, different characteristics between connected and non-connected firms may explain the different outcomes. Additionally, belonging to a specific industry may lead to a firm receiving larger subsidies. From 2005 until 2015, the Chinese Government spent about 1% of GDP in subsidizing R&D (Fang et al., Reference Fang, Lerner, Wu and Zhang2018). Thus, industries with more intensive R&D were more eligible for subsidies.Footnote 21 The matched sample allows us to perform the analysis on two groups of firms with similar observable characteristics. Non-connected firms are selected from (1) the same accounting year, (2) the same industry, and (3) equal state ownership. Next, we match our treatment observations to cases from the control group without replacement, by establishing a maximum caliper distance along size and leverage. Following this procedure, our matched sample contains 4,532 firm-year observations, out of which 825 correspond to connected firms.

Table 1 reports the characteristics of the sample variables, both the total sample and the matched sample (panel A). Subsidies received from the government on average amount to 138.7 million yuan per firm, which corresponds to 1.6% of firm sales.Footnote 22 Firms pay on average interest expenses equivalent to 1.9% of their debt. Corruption, proxied by the variable Entertainment, represents 1.1% of firms' total sales. However, there is large variation among firms: the standard deviation is 1.5%. Moreover, we can see that while some firms have entertainment expenses close to zero, others spend up to 13.8% of sales in Entertainment (9.15% in the matched sample).

Table 1. Descriptive statistics

Robust standard errors in parentheses.

***p < 0.01, **p < 0.05, *p < 0.1.

This table describes the sample of Chinese listed firm-year observations. Panel A describes the characteristics of firms in the total and matched samples. Panel B reports the mean differences between connected and non-connected firms, both in the total and matched sample. Panel C reports the mean differences in the matched sample between connected and non-connected after splitting firms into private and state-owned. All accounting and board variables are obtained from CSMAR.

We consider our baseline to be the matched sample. Panel B in Table 1 reports univariate t-test on differences in means between connected and non-connected firms. Connected firms are significantly more leveraged, own more assets, and spend less on Entertainment. Differences in sales growth, market-to-book ratio, and capital expenditure are significant as well. Finally, there are more state firms that are politically connected than not.

The matched sample offers more balanced characteristics among connected and non-connected firms, as shown in the last columns of panel B in Table 1. Panel C in Table 1 shows the univariate differences in control variables after splitting the matched sample into private and state-owned companies. While there is no statistically significant difference between connected and non-connected firms in the private sector except for capital expenditure and the board independence ratio, it is not possible to match connected and non-connected SOEs along size. This is due to the distribution of connections according to firm size in the state sector, which includes most of China's mega-companies. Indeed, more than 77% of the top 10% biggest companies in our sample are SOEs.Footnote 23 Figure 3 plots the distribution of connections on the total sample conditional on their size, and distinguishing between the private and state sectors. The distribution of connected and non-connected firms is similar in the private sector, even if slightly shifted to the right for connected companies. However, there is a clear divergence in the case of SOEs. Most connections in the state sector occur in mega-companies: 48% of connected SOEs have total assets above 21.9 billion yuan, corresponding to the largest top 10% of companies, while only 21% of non-connected SOEs are that large.Footnote 24

Figure 3. Distribution of connections by size. Charts (a) and (b) show the distribution of non-connected and connected private firms by size. Charts (c) and (d) show the distribution of non-connected and connected SOEs by size. Firms above 24 are those whose total assets surpass 26.5 billion yuan per year.

Source: CSMAR.

Finally, a potential concern regarding the variable Entertainment, which accounts for pecuniary corruption, is that it could be highly correlated with being connected. In that case, our measure of connection might just be a proxy of the variable Entertainment and we would not be able to disentangle their effects. But, in fact, the linear correlation between Connection and Entertainment is only −0.061.Footnote 25

4. Empirical findings

The different nature of private and state firms requires that we study how they obtain subsidies and cost of debt separately. We later distinguish two sub-periods: before and after the ACC. Finally, we explore the relationship between connections and two additional outcomes: investment and sales growth.

4.1 The value of connections: private and state sectors

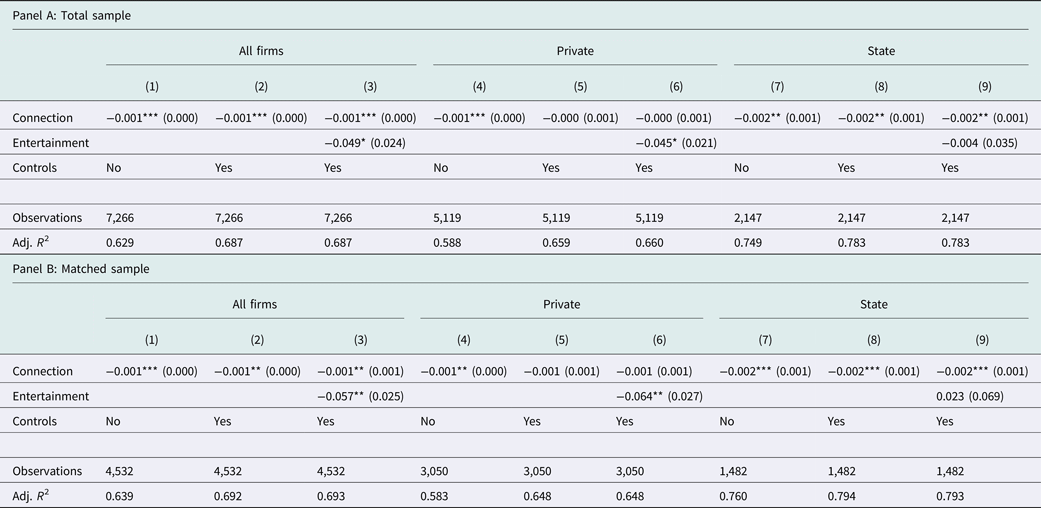

We now analyze the relation between political connections and our two key dependent variables, subsidies and cost of debt. The results are reported in Tables 2 and 3. Panel A of the tables corresponds to the regression analysis run over the total sample, and panel B shows the results for the matched sample.Footnote 26

Table 2. Connections and subsidies

Robust standard errors in parentheses.

***p < 0.01, **p < 0.05, *p < 0.1.

In this table, we estimate regressions at the firm level. The dependent variable is the total subsidies over sales in year t. The independent variable of interest is Connection, a binary variable equal to 1 if there is at least one director of the board connected to a member of the Politburo in year t − 1, and zero otherwise. Independent variables are lagged 1 year. All specifications include firm, year, industry, and province fixed effects.

Table 3. Connections and cost of debt

Robust standard errors in parentheses

***p < 0.01, **p < 0.05, *p < 0.1.

In this table, we estimate regressions at the firm level. The dependent variable is the cost of debt in year t. The independent variable of interest is Connection, a binary variable equal to 1 if there is at least one director of the board connected to a member of the Politburo in year t − 1, and zero otherwise. Independent variables are lagged 1 year. All specifications include firm, year, industry, and province fixed effects.

We first focus on panel A in Table 2, where we find that alumni networks become important only in the private sector. Columns 1–3 show that for all firms the result is not statistically significant. However, when we split the sample into private and state-owned firms, as we do in columns 4–9, connections become relevant for the private sector. Connected private firms get 0.2 percentage points higher subsidies than non-connected firms, as shown in columns 4–6.Footnote 27 We do not find the same effect of connections in the state sector. However, we cannot rule out that connected SOEs receive higher subsidies. Our results are likely driven by the large size of the state firms where connections take place. The huge size of these companies' sales makes the variable Subsidy (total subsidies over sales) small. This explains why connections are not significant in the case of state firms. In fact, if we use total subsidies in the regression analysis, we observe that connected SOEs receive significantly higher subsidies as well (see online Table A21).

Connections matter also in terms of receiving cheaper debt, as reported in Table 3, columns 1–3. We find no effect for private firms in finding lower cost of debt, shown in columns 4–6. However, connections are relevant in the case of SOEs. Connected state-owned firms pay 0.2 percentage points lower interest rates on their debts, all else constant, as we show in columns 7–9. The 0.2 percentage points magnitude that we find are relative to an average of 1.9% (see Table 1), which implies that connected firms pay 11% lower cost of debt, or in monetary terms, 31.9 million yuan less.

We now turn to our baseline results (panel B), where we eliminate potential biases coming from heterogeneity on the observable characteristics. We proceed with the regression analysis over a matched sample. The coefficients obtained (reported in panel B of Tables 2 and 3) reinforce previous findings. Connected private firms obtain 0.3 percentage points higher subsidies. Since average subsidies over sales amount to 1.6% (see Table 1), this corresponds to 16.1% higher subsidies.Footnote 28 The economic significance is large: 7.22 million yuan per firm on average. Connected state firms in turn benefit from a 0.2 percentage points lower cost of debt, as we report in Table 3, panel B, columns 7–9.Footnote 29 This corresponds to 11% lower cost of debt for these firms, corresponding to average savings per firm of 31.87 million yuan (USD 5.1 million).

For both the total and the matched sample, the value of connections remains strong when controlling for corruption, which is proxied by Entertainment expenses. This means that Connection is not just capturing the effect of spending more money on Entertainment and Traveling Costs. However, controlling for Entertainment does not rule out the possibility of connected firms also obtaining resources by means of corruption. We test this hypothesis by adding an interaction term.Footnote 30 We observe that there is no joint significance of the interactive relationship between Connection and Entertainment. This leads us to conclude that connection matters independently of the expense on Entertainment.

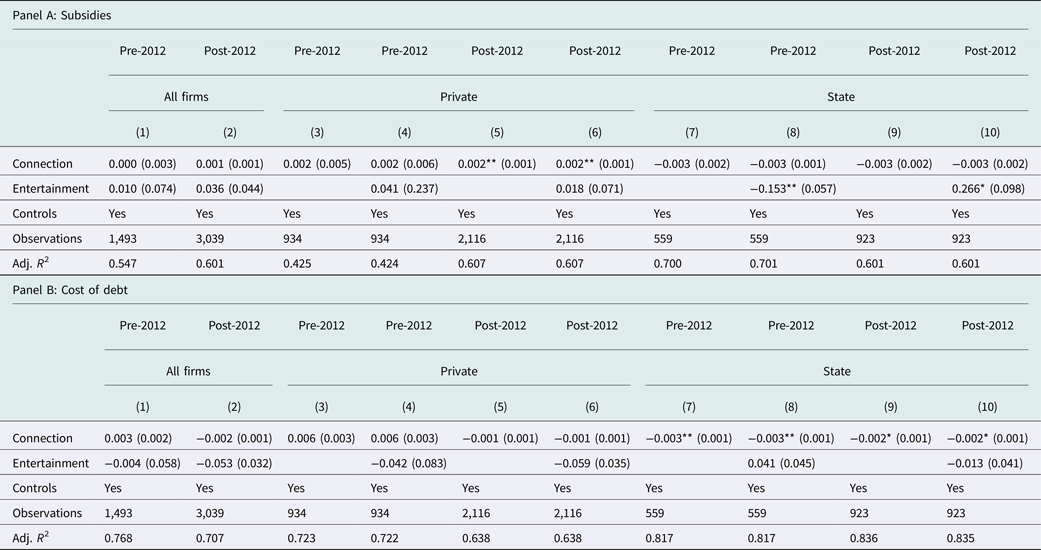

4.2 Connections around the ACC

We now examine whether there has been a change in the value of political connections with the launch of the ACC in 2012. Fang et al. (Reference Fang, Lerner, Wu and Zhang2018) and Giannetti et al. (Reference Giannetti, Liao, You and Yu2021) study whether the ACC has been effective at reducing corruption, measured by Entertainment. We are interested instead in the value of personal connections, as opposed to ‘pecuniary corruption’.

We show in panel A of Table 4 that connections became important in the private sector after the President's arrival to power, supporting Osburg's theory of the rising importance of the elite (Osburg, Reference Osburg2018). Before 2012, connected directors in private firms did not bring subsidies to the companies, as we observe in columns 3 and 4. By contrast, connected private firms received 0.2 percentage points higher subsidies after Xi Jinping's arrival to the Presidency, as shown in columns 5 and 6.

Table 4. Subsidies and cost of debt before and after the ACC

Robust standard errors in parentheses

***p < 0.01, **p < 0.05, *p < 0.1.

In this table, we estimate regressions at the firm level, splitting the matched sample between before and after the ACC. Pre-2012 period dates from 2007 to 2012, while Post-2012 period spans from 2013 to 2017. Panel A shows results for subsidies, while Panel B for cost of debt. Independent variables are lagged 1 year. All specifications include firm, year, industry, and province fixed effects.

Turning to panel B of Table 4, we find that connected SOEs display preferential treatment in terms of lower interest rates both before and after 2012, as seen in columns 7–10. However, the magnitude and significance change. While in the first period connected SOEs paid 0.3 percentage points lower interest rates, after 2012 the difference went down to 0.2.Footnote 31

Consistent with our results in the previous section, we find that connections did not have an effect on the state sector in terms of getting subsidies (see columns 7–10 in panel A of Table 4), nor in the private sector in terms of reducing the cost of debt (see columns 3–6 in panel B of Table 4). We will discuss and provide an interpretation of these findings in the following section.

4.3 Connections and firms' behavior

Finally, we explore whether the effect of connections on resource allocation is reflected on other outcomes. We focus on sales growth and investment, since they proxy firm-level market performance, and firm strategic decisions. The main question is whether the access to higher subsidies for connected private firms or lower cost of debt for connected SOEs translates into better outcomes.

We find that neither higher subsidies nor lower cost of debt induce firms to obtain more sales, as reported in Table 5, Panel A. Regressions in columns 1 and 2 show that sales in connected firms, in fact, grow around 5 percentage points less than that in non-connected firms. These results are confirmed when we instead run the regression on the matched sample, as shown in columns 5–8, even though the negative correlation is significant only for state-owned firms.

Table 5. Sales growth and investment

Robust standard errors in parentheses.

***p < 0.01, **p < 0.05, *p < 0.1.

In this table, we estimate regressions at the firm level. The dependent variable is growth of sales from year t− 1 to year t in panel A, and investment in panel B. The independent variable of interest is Connection, a binary variable equal to 1 if there is at least one director of the board connected to a member of the Politburo, and zero otherwise. Independent variables are lagged 1 year. All specifications include firm, year, industry, and province fixed effects.

Connected private firms invest less although not significantly so, as shown in panel B. Coefficients are positive and significant in SOEs. Both in our total and matched samples, state firms display 0.9 percentage points higher investment (columns 4 and 8 in Table 5).

Our results are suggestive of an inefficient allocation of resources, which seem to be distributed according to personal criteria, namely linkages to the political elite, as opposed to impersonal but efficient criteria. Connected private firms obtain significantly higher subsidies even though they display no better performance in terms of sales growth and investment. Connected SOEs receive preferential interest rates while showing worse outcomes in sales growth.

5. Discussion

In this section, we interpret the effect of connections in the private and state sectors. We argue that connected directors in the private sector bring resources to the firm while this is not the case for SOEs. Next, we provide an explanation of the differential effect of the ACC for the private and state sectors. Finally, we rule out alternative explanations.

5.1 Value of connections in the private and state sectors

We find that connections play a different role for the private and the state sectors. Our results indicate that connections in China matter for private sector firms to receive higher subsidies and for the state sector to receive favorable financial conditions.Footnote 32 These results are not surprising if we consider China's context.

China's financial and banking sectors are controlled by the government and serve as a means to finance government's projects. This is achieved by fueling money into SOEs, which are the main tool of the Party to conduct social policies, such as decreasing unemployment or controlling strategic sectors (Lin and Li, Reference Lin and Li2008; Zhang et al., Reference Zhang, Zhang and Liu2017). Loans are investments, and their profitability could directly affect officials' political career paths. However, officials are not evaluated according to returns on subsidies since subsidies are transfers of money that are not expected to be returned. Banks operate according to political criteria. Officials can freely provide loans to SOEs, whether profitable or not, without bearing personal risks by justifying that they are meeting Party directives. On the contrary, the state's command of the banking sector makes it harder for private companies to get loans as it implies taking a financial risk without political justification. Banks' subordination to political priorities makes them ‘prefer to lend to companies that enjoy explicit or implicit government support’ (Bisio, Reference Bisio2020).Footnote 33 In some periods, the banking sector has been almost closed to private companies (Allen et al., Reference Allen, Qian and Qian2005; Haggard and Huang, Reference Haggard, Huang, Brandt and Rawsky2008; Lardy, Reference Lardy2019).

Moreover, the timespan of our sample coincides with the 2008 financial crisis, when Chinese authorities announced a 4 trillion-yuan (USD 586 billion) stimulus package with the goal of providing a financial buffer to state companies, which were meant to lower unemployment and embark on investment projects. The stimulus package had a crowding out effect and increased shadow banking in the country (Chen et al., Reference Chen, He and Liu2020; Huang et al., Reference Huang, Pagano and Panizza2020). Overall, this means that being friends with the elite does not compensate for the risk that an official in the financial sector bears when granting an ‘unjustified’ loan to a private company, as opposed to lending to state companies.

Subsidies, by contrast, constitute an alternative financial resort for which private companies are eligible. By contrast with banks, government can legitimately grant subsidies to private companies without bearing similar financial risks. Indeed, we find connections play an effective role in the private sector when it comes to getting access to subsidies. As for the state sector, connected firms receive the same amount of subsidies as those that are not.

While we acknowledge that we cannot claim causality out of our empirical strategy, we argue that connected directors in the private sector bring resources to the firm. The exogeneity of our measure of connections leaves only as a potential endogeneity concern the fact that connected directors are placed on specific companies. If connected directors are randomly allocated, implying that they have not been placed in specific companies, then the conditional distribution of connected firms by size should replicate that of non-connected firms. This is what happens in the private sector (see Figure 3). We also observe from Figure 1 that the fall of the politicians to whom any given firm is connected leads to an immediate decrease in subsidies to those firms.

On the contrary, we cannot rule out that connected directors in SOEs are intentionally placed in mega-companies. As we stated before, 48% of connected SOEs are mega-companies while only 21% of non-connected state firms are that large. There are several potential explanations for such placements. One is pure cronyism, meaning that friends are placed in companies where they can extract resources for personal benefit. A second reason for politicians' friends being appointed to such companies is to act as watchmen: to monitor SOEs and to ensure that they achieve government's goals. Zhang et al. (Reference Zhang, Zhang and Liu2017) provide a third reason called the ‘adaptive power-sharing hypothesis’. They claim that the Party uses ‘lucrative central SOEs as a source of patronage (…) to appease powerful political elites in the ruling party’, which would mean that state firms are capstones sustaining China's political equilibrium. The placement of connected directors in mega-companies in the state sector does not rule out causality by itself. Indeed, when we truncate the sample by eliminating the largest 10% of firms, connected SOEs still receive cheaper debt (see online Table A22). However, the fact that they could have been placed in specific companies prevents us from disentangling the two effects.Footnote 34

5.2 Connections after the ACC

We find that connections became stronger in the private sector after the launch of the ACC, but weaker in the state sector. These mixed outcomes are explained by the different role played by corruption in the private and the state sectors. Corruption in the private sector plays a ‘greasing wheels’ role: it has been a widespread channel for eased access to resources (Lin et al., Reference Lin, Morck, Yeung and Zhao2016; Pan and Tian, Reference Pan and Tian2017). As a consequence of the ACC, corruption suffered a negative shock, meaning that this conventional door to resources was closed, or at least, hampered (Fang et al., Reference Fang, Lerner, Wu and Zhang2018; Giannetti et al., Reference Giannetti, Liao, You and Yu2021). Hence, the value of the alternative and less visible channel of connections to the political elite increased after the ACC, as shown by our findings.

In the state sector, by contrast, connections did not increase in value and significance after the ACC. Two reasons explain this finding. On the one hand, corruption plays a different role for SOEs. In the state sector, there is no need to engage in corrupt practices to obtain more resources from the state (Lin et al., Reference Lin, Morck, Yeung and Zhao2016; Pan and Tian, Reference Pan and Tian2017). Therefore, it makes sense that the ACC negative shock on corruption did not increase the value of connections as they are not substitute channels. On the other hand, SOEs are a first natural and easy target of the ACC: they face larger scrutiny from political authorities, as echoed by the Chinese press following the ACC.Footnote 35

Overall, these findings reinforce our previous argument that connected directors have a causal effect on the private sector. The fact that their value increased in private firms after the ACC supports our argument that they act as resource providers. This cannot be claimed for the state sector.Footnote 36

6. Conclusion

In this paper, we measure the value of connections to the Chinese Politburo members for firms, through an exogenous measure of political connections relying on past educational networks. We build a new database, which allows us to evaluate the value of political connections before and after the ACC. We find that private firms with connected members in the board get more subsidies than non-connected ones: 0.3 percentage points higher subsidies over sales, which translates into 7.2 million yuan on average (approximately USD 1.2 million). In turn, connected SOEs access debt at 0.2 percentage points cheaper rates than non-connected SOEs (approximately 31.9 million yuan or USD 5.1 million). Our results suggest that connections seem valuable for Chinese firms as they provide an additional channel to access resources. However, despite the resource allocation power of connections, these do not translate into higher sales growth or higher investment ratios. On the contrary, we find that connected firms display around 5 percentage points less sales growth than non-connected firms. Our results hence support the viewpoint that a substantial degree of misallocation exists in China due to political reasons.

Additionally, we show that being connected to the elite has remained a relevant channel to access resources since 2012. The previous literature showed that pecuniary corruption decreased substantially after the fierce ACC (Fang et al., Reference Fang, Lerner, Wu and Zhang2018; Giannetti et al., Reference Giannetti, Liao, You and Yu2021). But according to our findings, the effect of connections did not disappear after the campaign. In fact, our evidence suggests that the value of connections increased in terms of obtaining subsidies for private firms. By contrast, the effect decreased, but still persists, for state-owned companies with respect to their costs of debt.

Finally, our results support the hypothesis that connections play a different role in the private and state sectors. Connections in private firms open access to resources that could be difficult to obtain otherwise. This is consistent with the increasing value of connections in the private sector after the ACC, as they could act as an alternative channel to corruption in order to get resources. We cannot claim the same for the state sector.

The nature of personal relationships in the context of Chinese history and political institutions means that policies such as the ACC are unlikely to be impartial or to succeed fully. Regardless of its intention, a single campaign cannot be expected to build an institutional bargain that supports impersonal markets in which politics does not play a role.

Acknowledgements

We would like to thank Raúl Bajo, Ron Chan, Pedro Martins, Antonio Moreno, Stephen Morgan, as well as seminar participants at the University of Navarra, the University of Manchester, and the University of Rome, Sapienza. We also thank Nick Ridpath for excellent research assistance.

Note – The online appendix and replication files for this paper are available at https://zenodo.org/record/5877532.