1 Introduction

It is arguable that the most important event in the world economy in recent decades has been the rise of China, from being poorer than sub-Saharan Africa at the start of economic reform to being an economic superpower today. That rise remains under-researched. Moreover, the great structural changes which accompanied economic growth require examination. In this case, the five published edited volumes that have resulted from the nationally representative China Household Income Project (CHIPFootnote 1) surveys have been a major source for understanding the effects of economic growth on such issues as the labour market, poverty, and inequality (Reference Griffin and ZhaoGriffin and Zhao, 1993; Reference Riskin, Zhao and LiRiskin et al., 2001; Reference Gustafsson, Li and SicularGustafsson et al., 2008; Reference Li, Sato and SicularLi et al., 2013; Reference Sicular, Li, Yue and SatoSicular et al., 2020, and issue 1 of the journal China & World Economy, 2022). The research based on CHIP has reached not only those who read texts in English but also Chinese language readers. Regarding the latter, papers have been collected in no less than twelve volumes (Reference Li and ZhaoLi and Zhao, 2020).

These periodic surveys, conducted for the years 1988, 1995, 2002, 2007, 2013, and 2018, provide a great opportunity to trace this remarkable transformation. Not only did they have much design and information in common but also the surveyors adapted their questionnaires as the economy and therefore research questions evolved. This series of research-motivated surveys over a period of thirty years is unique for China and probably for the developing world.

1.1 CHIP by CHIP

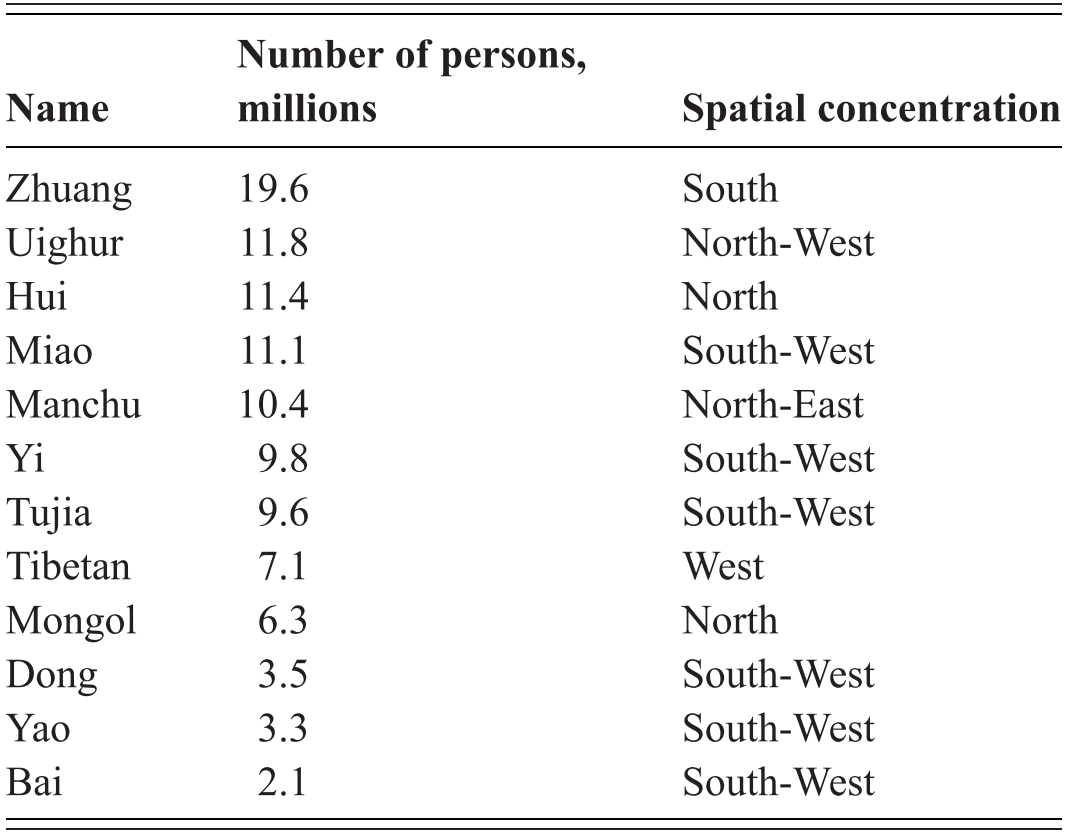

The six CHIP surveys, spanning thirty years of headlong growth and transformation, permit a detailed examination of many important aspects of a country’s economic development. The CHIP surveys each contains much common information about China’s households and their income over time, but also on China’s economic and social transformation. The combination of rapid economic growth and movement from a centrally planned to a market economy makes China the most interesting economy in the world. The connected but developing series of CHIP nationally representative surveys makes its evidence an ideal vehicle for understanding the evolving economy and society. The CHIP also provided inspiration for other efforts to collect economic information from households in China and thereby research based on it. Two close followers are the volumes edited by Reference Li and SatoLi and Sato (2006), which focused on urban China, and by Reference Gustafsson, Hasmath and DingGustafsson, Hasmath, and Ding (2021), which analysed ethnic disparities.

The remaining paragraphs of this section explain how CHIP began, and what the first survey attempted to achieve, and how the questionnaires changed as the economy and society developed.

In 1988, microeconomic information on Chinese households was sadly lacking. The Institute of Economics of the Chinese Academy of Social Sciences initiated a new national survey, funded from local and foreign sources, to be designed and analysed by Chinese and foreign scholars. Being a sub-sample of the national survey of the National Bureau of Statistics (as it is now named), it drew on the NBS data but added many new questions with research hypotheses in mind. The main objective of the first survey was to obtain an accurate picture of household incomes in this still partly planned but marketising economy.

Subsequent surveys differed in objectives and in information. It was important to examine changes over time, so required the same set of questions in each survey. However, the emergence of new issues required new questions and new hypotheses. For instance, privatisation, urbanisation, rural–urban migration, diminishing poverty, increasing inequality, accumulating wealth, and new policy interventions, each needed attention. Beyond the core questions, the CHIP surveys evolved to answer the new questions.

1.2 Issues and Questions

Much of the analysis of this Element is closely related to, and largely caused by, China’s remarkable economic growth over the thirty years. Without such rapid growth, our story would be very different. It is therefore important to understand from the outset how and why the economy has grown so rapidly. That is our first objective.

To what extent can the growth rate be explained by the sort of econometric analysis that economists conventionally use? What role does China’s particular political economy play? How have incentives been harnessed in the pursuit of economic growth? What role did the great structural changes – including privatisation, trade, and industrialisation – play in both contributing to and resulting from economic growth? These are the questions which we attempt briefly to answer in Section 2. This section differs from the others in that it necessarily relies on macroeconomic and other evidence rather than the microeconomic household-based evidence provided by the CHIP surveys.

In 1988, workers in rural China were mainly self-employed farm workers, restricted in their mobility from the village. In Section 3, we take a close look at the development of employment in rural China from 1988 to 2018. We ask: why, when, and how rapidly did the flight from agriculture into wage employment and self-employment occur? What characterises those who are wage earners or self-employed and not farmers? Did the move increase income? Have the income consequences changed as more and more people moved out of farming?

In 1988, workers in urban China were employed in an administered labour system, with barely any scope for market forces to operate. By 2018, a great many rural hukou holders were wage-employed as migrant workers, involving ‘the greatest migration in human history’. Most urban workers were now employed in competitive labour markets, although marketisation was by no means complete. There had been a vast change in the allocation, use, and remuneration of labour. How did this transformation come about?

How could labour market reform be achieved in the face of vested interests and the need for coordinating various interacting reforms, such as financial, enterprise, and housing reform? To what extent did the wage structure reflect the productivity of workers? Did the emergent labour market nevertheless remain segmented in various policy-related ways? These questions are the subject of Section 4.

Throughout the twentieth century, China was a labour surplus economy par excellence. The remarkable growth of the economy, and in particular the urban economy, required a great influx of labour into the cities and towns. The influx was accentuated by the slow growth of the urban-born labour force. There are now a very large number of rural persons working in urban locations.Footnote 2

China’s progress can be gauged against the famous Lewis model of a dual economy, in which economic growth occurs through the transfer of labour from the low-productivity rural (traditional) sector to the high-productivity urban (modern) sector at a market wage held down by surplus labour. Eventually, rural-born labour becomes scarce, migrant wages and rural incomes rise, and the economy moves from the classical to the neoclassical stage, in which the fruits of economic development become more widely spread. Between the two stages is a turning point.

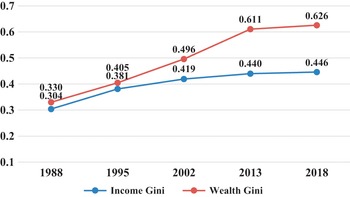

The Lewis model has huge implications for the alleviation of poverty and the reduction of inequality. It is an important question: has China passed the turning point? Is the transfer of labour from rural to urban China and the ensuing tightening of the labour market the reason why the Gini coefficient of household income per capita rose throughout our period until about 2010, since when it has remained fairly stable? These are the key questions posed in Section 5.

During the planning epoque state-owned enterprises provided income support and heavily subsidised housing for urban workers and their household members. Urban households typically did not pay any income taxes. In contrast, members of the rural households, at that time predominantly farmers, had no access to social security benefits but had to pay taxes. Those situations have changed as China has taken steps towards a market economy. For example, the government has come to take a much more active role in regulating and providing pensions and, more recently, has done this also for rural households. In Section 6, we take a fresh look at how the redistributive effect of public expenditures and revenues in China changed from 1988 to 2018. This we do for China as a whole and also separately for households living in rural and urban areas.

In Section 7, we turn our interest to income inequality and wealth inequality during the period from 1988 to 2018. We ask: how have these inequalities changed over the three decades of institutional change and rapid economic growth? We are interested in changes in the inequality of the two distributions, and particularly in how the urban to rural income and wealth ratios have contributed to income inequality and wealth inequality. As a guide to understanding, we also ask whether changes have differed during various sub-periods.

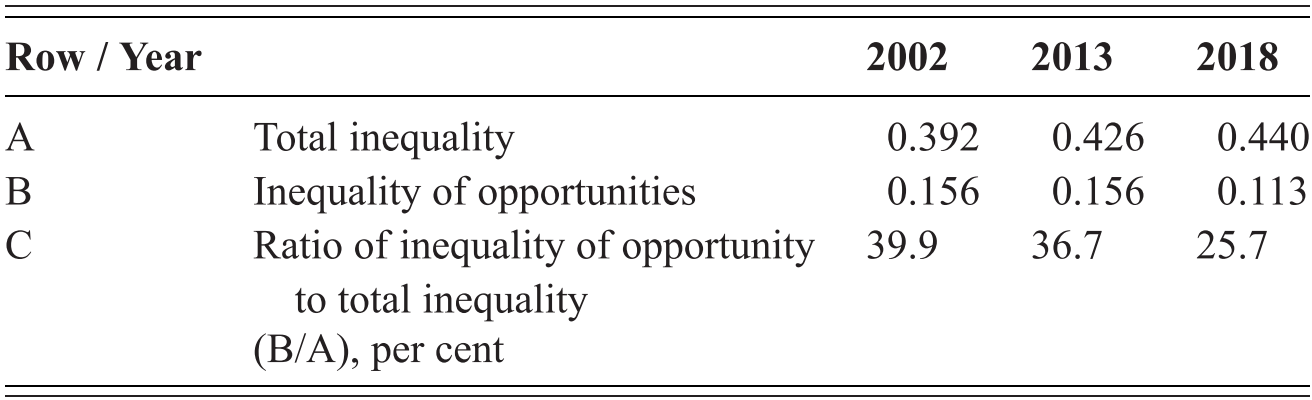

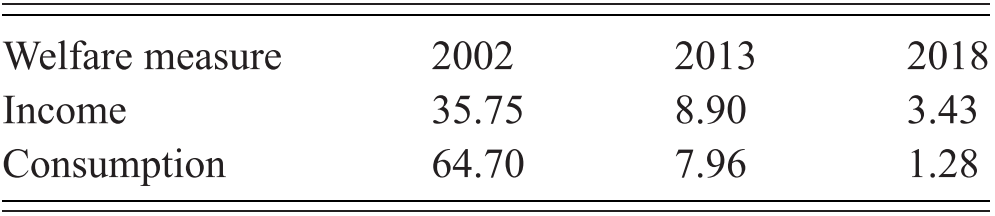

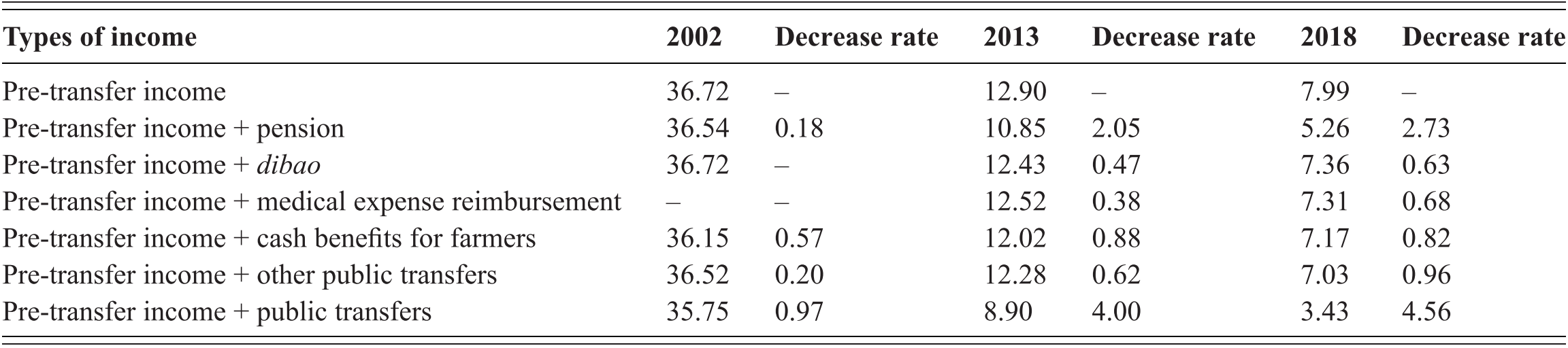

We continue to look at how income is distributed across households in Section 8, but from two other angles. One is from the perspective of inequality of opportunities (IOp). This approach requires that measures of income inequality be separated into two parts: one that reflects inequality for which the individual should be held responsible and another due to factors beyond the individual’s control. We report one attempt to quantify the two parts and this for the period 2002–18. Section 8 also focuses on people with lesser means: China’s income-poor. We use official criteria to assess how the rural poverty rate changed from 2002 to 2018. However, when many households in urban China are approaching a standard of living prevailing in high-income countries, criteria for defining poverty similar to those used in such countries will become relevant. What consequences will this have for mapping the extent and profile of relative poverty among urban people?

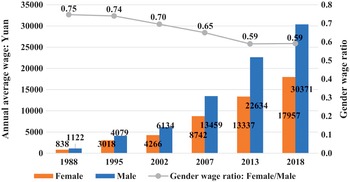

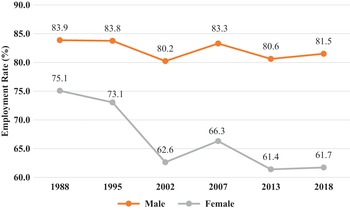

When the Chinese Communist Party (CCP) came to power at the end of the 1940s, the new government brought ambitious ideas influencing policies regarding social rights for women, particularly those living in urban areas. The new government also had higher ambitions than the previous one regarding the situation of ethnic minorities. In Section 9, we look closely at how inequality along those two dimensions of the population has developed since the end of the 1980s. We ask: has the gender wage gap in urban China increased since the introduction of economic reform in the 1990s? If so, how can this increase be understood? On average do members of particular ethnic minorities have a less favourable economic outcome than do members of the Han majority?

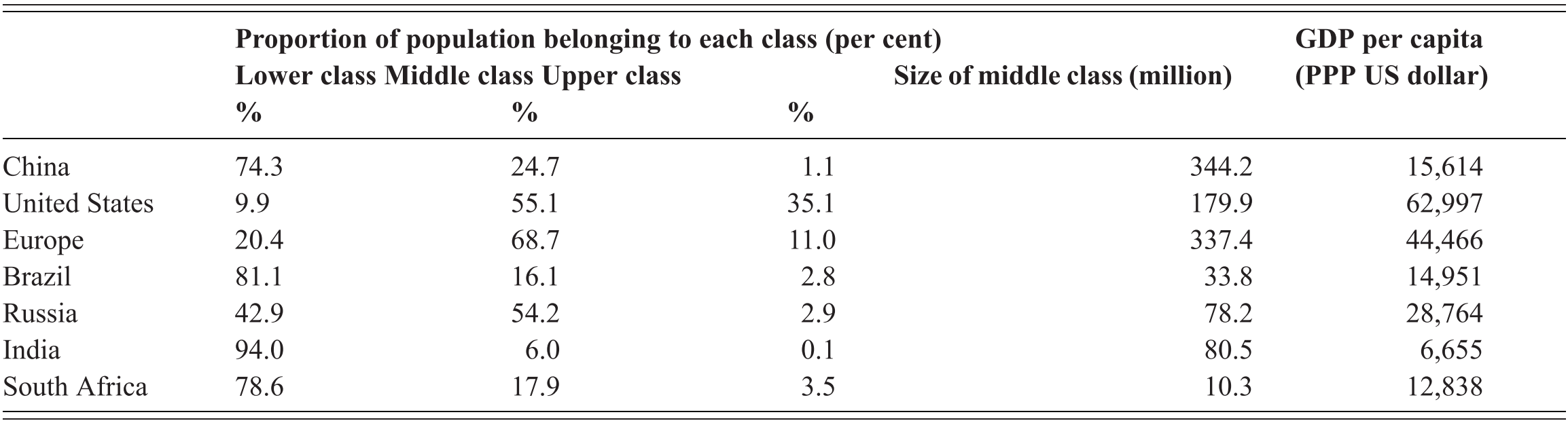

As the Chinese economy has grown so rapidly, one can expect that an increased number of people now live lives similar to those in high-income countries. In Section 10, we examine the number and proportion of people who live in households, that, if they lived in EU countries, would be considered neither poor nor very well off? Where do those members of the middle class live and to what extent are they wage earners? Are people who grew up in urban China more likely to be middle class than those who were rural-born, particularly those who have not migrated to an urban area? This new phenomenon has implications for market size and structure, but also sociopolitical implications. Finally, the contents of the various sections are summarised in Section 11.

1.3 Objectives and Methods

Our objective in this small volume is to provide a readable account of the remarkable effects of economic growth and transformation on China’s households, drawing in particular on the evidence to be derived from the six CHIP national household surveys. The emphasis is on interest and understanding. The Element draws on the results of many technical or rigorous sections in the CHIP volumes or journal articles based on CHIP, several written by us. We assume that our readers are more interested in the main results rather than the methods by which they were obtained.

In addition to answering the many specific questions listed in Section 2, we shall – if and where appropriate – consider three general questions. First, why did China’s progress on these issues differ from that of other comparable countries? Second, how do we contribute to the literature on China’s progress? Third, how do we engage with controversies, for instance arising from different data sources?

We three authors are jointly responsible for this Element as a whole. Nevertheless, there has been some division of labour, corresponding to each’s research interests and research publications. Thus, John Knight has taken the lead with Sections 2, 4, and 5. Bjorn Gustafsson has done so with Sections 3, 9, and 10. He and Meng Cai have jointly written Sections 6 and 7, and Meng Cai has taken primary responsibility for Section 8. All three of us have equally contributed to the Introduction (Section 1) and the Conclusion (Section 11).

2 Why Has China Grown So Fast?

2.1 Introduction

The transformation of China’s economy and society over the economic reform period is primarily due to its rapid rate of economic growth, and to the various factors that made it possible. We draw on the book China’s Remarkable Economic Growth, which attempted to explain why China had grown so fast (Reference Knight and DingKnight and Ding, 2012). The annual growth rate of real gross domestic product (GDP) in China averaged 10.2 per cent in the decade 1980–90, 10.6 per cent in 1990–2000, and 10.3 per cent in 2000–7. Even after the global financial crash, China’s growth rate was relatively unaffected, averaging 8.9 per cent per annum over the decade 2007–17. China is unique among large economies in maintaining very rapid growth for forty years.

The dramatic rise of China over such a short period of time is arguably the most important recent economic event in the world economy. It poses questions that deserve to be answered. Why did it happen? How did it happen? Can it continue? Does its experience carry lessons for other countries? Can the conventional empirical approach of economists to economic growth provide satisfactory answers? Are the underlying causes of growth, which in turn explain the variables that economists can measure, no less important? These questions are the subject of this section. They set the stage for our analyses of economic growth’s socio-economic consequences to come in later sections.

2.2 Econometric Approaches

The approach to economic growth that economists conventionally adopt is by means of growth models and growth empirics. It was possible to analyse China’s economic growth by means of a cross-country panel data set.Footnote 3 The actual annual average growth rate of China’s real output per worker over the period 1980–2004 was 7.2 per cent and the predicted growth rate 6.7 per cent, a similarity which is reassuring. Comparing China with sub-Saharan Africa, the difference in predicted growth rates was 5.6 per cent. Capital accumulation accounted for no less than 54 per cent of this difference. Other contributions came from China’s slower population growth, higher level of human capital, conditional convergence gain, and more dramatic sectoral change.

A second exercise provided an explanation of growth rates across China’s provinces. Estimates of the contribution of total investment and its components show powerful positive effects.Footnote 4 Physical capital formation was the main explanation for the variation in provincial growth rates. The coefficient on the total investment/GDP ratio implies that a 1 percentage point rise in that ratio is associated with a 0.2 per cent higher growth rate of GDP per capita, and in the case of capital formation classified as ‘innovation investment’, the growth rate rises by 0.3 per cent per annum. Human capital was also found to contribute to growth at the secondary level and, especially, at the tertiary level. For instance, a 1 percentage point increase in higher education enrolment expressed as a proportion of population, when properly instrumented, leads to higher GDP per capita annual growth of 2.8 percentage points. This important contribution can be explained by the remarkable neglect of higher education, and consequent scarcity of tertiary graduates, throughout the first two decades of economic reform.

Rapid growth has involved a great structural transformation of the economy: a closed economy became an open economy enjoying the benefits of China’s comparative advantage; there was a relative expansion of the private sector and contraction of the state sector; a great transfer took place of labour from agriculture to industry, from rural to urban activities. In each case, resources were transferred from a less to a more productive sector. Reference Knight and DingKnight and Ding (2012: ch. 7) examine the contribution that these three forms of structural change made to its growth rate:Footnote 5 All three prove to be important, and when their full effect on China’s growth rate is combined in a single equation, they sum up to no less than 4.1 per cent of GDP per annum.

Prior to economic reform, China had an extremely closed economy. It began to move in the direction of a genuinely open economy in the 1990s: the nominal tariff was 43 per cent in 1992 and 17 per cent in 1999. The prospect of WTO membership, achieved in 2001, was a powerful motivating factor. China was now able to exploit its great comparative advantage in unskilled labour-intensive manufactures. The trade to GDP ratio was 10 per cent in 1978 but as high as 72 per cent in 2008. The estimates indicate that a 1 per cent rise in a province’s growth rates of international exports or imports raises its growth rate of GDP per capita by 0.2 per cent and 0.1 per cent, respectively. More trade raises economic efficiency via the improved resource allocation, technology, and competition that openness can bring.

The distinguishing feature of China’s institutional reform was the emergence of new forms of ownership, and this emergence serves as a proxy for other institutional reforms that accompanied it. Privatisation and new private firms expanded the private sector rapidly, and the greater share of private ownership in enterprise production raised productive efficiency. For instance, a 1 percentage point fall in the state share of (constant) industrial output raises the growth rate of GDP per capita by 0.03 per cent and a 1 percentage point rise in the private share raises it by 0.04 per cent. The private sector, with its incentives for profit and thus for economic efficiency, has been the institutional driving force in China’s growth.

It is particularly interesting to quantify the contribution of sectoral change to the growth rate. Reference Knight and DingKnight and Ding (2012) find that the effect of labour reallocation on growth is greater the higher is the average productivity in non-agriculture relative to agriculture, and that a 1 percentage point rise in the growth rate of the ratio of industrial output to total output in a province raises its growth rate of GDP per capita by 0.2 percentage points. Industrial growth makes a powerful contribution to China’s economic growth through improved sectoral allocation and externalities specific to industry.

2.3 The Underlying Causes

An understanding of this remarkable success requires an analysis not only of the ‘proximate’ determinants of economic growth outlined above but also of the ‘underlying’ determinants, which may be more important. Even in 1988, at the start of our study period and after the rural reforms of the early 1980s had raised rural incomes, China was still extremely poor. Although currency exchange rates can be misleading guides, in that year China’s GDP per capita was only 43 per cent that of sub-Saharan Africa. It is likely that people in China were poorer on average than those in black Africa. Under central planning the economy had suffered from bad policies and lack of incentives for economic efficiency. When the economic reformers within the CCP acquired power in 1978, they recognised that it was unpopular and had lost political legitimacy, which they tried to restore through rapid economic growth and rising living standards. They embarked on a reform programme that was efficiency-enhancing and interest-compatible.

The first decade was largely one of rural reform. The de-collectivisation of the communes and restoration of household production provided incentives for effort and investment, and permitted an explosion of township, village, and private enterprises that met the demand that the urban state-owned enterprises (SOEs) had neglected. It was ‘reform without losers’. The second decade involved several simultaneous urban reforms that overcame vested interests and created markets, developed a private sector, and accepted a relative decline of the state sector. After China’s entry into the WTO in 2001, there was a great expansion of export-led GDP.

It is arguable that throughout the reform period the authoritarian leadership has been most concerned with the need for ‘social stability’, and that the most important policy to maintain social stability, and so to keep the CCP in power, was to achieve rapid economic growth, and to place this objective above all others. As the political constraints on economic reform were overcome, China gradually became a ‘developmental state’ (Reference KnightKnight, 2014). We define a developmental state as one in which government accords the highest policy priority to economic growth and adopts institutional arrangements and incentive structures which will promote that objective. In China, political control is centralised but economic management is decentralised. This creates a classic principal-agent problem. Central government aims to solve the principal-agent problem by creating incentives for officials at all levels of government to pursue its own economic objectives. These objectives have primarily been the achievement of rapid economic growth.

There have been three forms of incentives: the system of state appointments, local fiscal powers for revenue retention, and powers of patronage. There are promotion and demotion arrangements at every level of government, which determine every state official’s career path. Each level of government controls personnel at the level immediately below. Evaluation has been based on performance in achieving state objectives and targets, in particular economic growth in the relevant jurisdiction. These performance criteria convert many bureaucrats into entrepreneurs. There is evidence, surveyed in Reference KnightKnight (2014: 1339–40), that the personnel incentive system is effective. The decentralisation of fiscal responsibility and power means that local economic development benefits local revenue and thus local government expenditure. A web of patronage enables officials to get the loyalty and support of subordinates. Patronage extends beyond the state sector because private businesses have to maintain good relationships with government and party officials. The power of patronage stems from hierarchical control – the right to grant permissions and refusals – over much of the economy.

The evidence highlights the great importance of huge capital accumulation for China’s rapid economic growth. The total investment to GDP ratio was as high as 30 per cent in the early years of reform, rising to 40 per cent in recent years (Reference Knight and DingKnight and Ding, 2012: Figure 1). How and why was investment so high? Such an investment rate would have been unsustainable without a matching saving rate. There are several evidence-based explanations (surveyed in Reference Knight and DingKnight and Ding, 2012: 160–5) of the very high saving, one of which is the difficulty of households and private businesses to obtain credit. The rate of return on capital was initially high and rose over time, assisted by rapid total factor productivity growth and abundant cheap, disciplined labour. Entrepreneurial expectations of rapid growth were important for high investment. The developmental state was crucial. Bureaucrats were rewarded for promoting investment and private business could take investment decisions confident that growth policies would be pursued. The Chinese economy has been in a virtuous circle with sustaining feedback effects. High investment contributed to rapid economic growth, and rapid growth then produced buoyant expectations, which in turn elicited high investment.

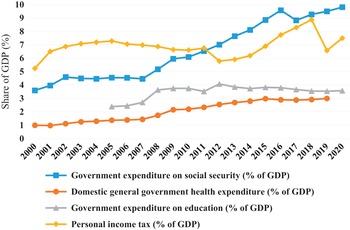

Figure 1 Trends in public revenues and expenditures (per cent of GDP)

2.4 China’s Future Economic Growth

China’s economic growth rate has begun to slow down, being 6.1 per cent in 2019. This reflects in part the movement towards full employment of labour and other resources. The labour force was now shrinking and labour costs were rising rapidly. It became increasingly important to improve the efficiency of resource use. The slowdown also reflects the forces of growth convergence that are evident in many countries as they develop: rapid capital accumulation began to cause diminishing returns to capital and lower expected returns to investment. Moreover, it is likely that the growing trade tensions and geopolitical competition of recent years has deterred some investment.

Higher education enrolments increased almost sixfold between 1998 and 2008 (Reference Knight, Deng and LiKnight et al., 2017). This expansion and also public support for R&D, patenting, and innovation – by moving comparative advantage towards more skill- and technology-intensive products – might delay the deceleration of growth that is predicted on the basis of international experience.

The growth rate might suffer from a negative shock, for instance, a financial crash resulting from its immature financial system or a loss of investor confidence owing to social instability. The housing bubble that has emerged in recent years carries the threat of a collapse in house prices and of the heavily indebted property developers. There is evidence that happiness (i.e. subjective well-being scores) has not risen despite the rapid growth of household income per capita (Reference Knight, Deng and LiKnight and Gunatilaka, 2011; Reference Knight, Li and WanKnight, Ma and Gunatilaka, 2022). and that economic growth has involved a societal cost (Reference KnightKnight, 2016). China’s economic governance institutions can generate corruption and rent-seeking. According to the World Governance Report (World Bank, 2018), in 2018, among more than 200 countries China was in the 8th percentile (from the bottom) on ‘voice and accountability’, and in the 46th percentile on ‘control of corruption’. Rapid economic growth has taken its toll of the environment. China’s remarkable growth rate up to now cannot be extrapolated into the future with any confidence.

2.5 Conclusion

The empirical analyses provided results that are important for understanding China’s remarkable economic growth. In particular, capital was accumulated very rapidly, and this involved great structural transformation, from a closed to an open economy, from state to private production, and from agriculture to industry. Each of these transfers meant higher productivity and thus contributed to the growth rate.

These are the proximate determinants of economic growth but the underlying determinants are also crucial. China’s political economy required rapid growth in order to maintain social stability, which in turn required incentive structures at all levels of government towards that objective. This developmental state created a self-sustaining virtuous circle of economic growth.

It is interesting to contrast China’s successful experience of opening up its economy with that of many other countries in the developing world, which instead experienced de-industrialisation and poor economic performance. The explanation is to be found in China’s powerful comparative advantage in relatively unskilled labour-intensive products together with the other factors, listed above, that contributed to China’s industrial success. This combination was generally lacking in other countries whose governments attempted to open up their economies. There are reasons why recent policies might delay the deceleration of China’s growth that can be expected from international experience. However, various threats could break the virtuous circle that has maintained rapid growth up to now.

Other developing countries might wish to emulate China’s economic growth success by creating a similar developmental state. They should be aware, however, that it might come at a cost to society: authoritarian governance can involve a lack of accountability with potential for socio-economic ill-effects.

3 Rural Development: From Being Farmer to Work as Wage Earner or Self-Employed

3.1 Introduction

In this section, we will look in more detail at development in rural China. The economic history from the introduction of the People’s Republic in 1949 was first a story about strong influences from the Soviet Union. Private ownership of land was abolished, and user rights were handed over to its cultivators. This was followed by collectivisation and thereafter the establishment of Peoples Communes. China’s development policy, at that time, created a very large division between the, by size, minority population in the cities and the majority in the rural areas. Those two categories were separated by the hukou system, which registered all inhabitants as either urban or rural. The development strategy of the People’s Republic meant promoting growth of industries in urban areas, while the rural population had to deliver agricultural products at very low prices. (Reference Knight and SongKnight and Song, 1999) Unlike urban residents, rural inhabitants had to fund their housing and health care by themselves. Rural inhabitants also had to pay fees for basic education, and they did not have access to pensions and other social insurance benefits. Thus, the urban population was prioritised at the expense of the rural population.

When the activities of the People’s Communes have been positively valued, this has related to their providing rudimentary health care and basic education. However, for many observers in the West it took time to understand the scale of the mass famine and the excess mortality that plagued rural China from the end of the 1950s to the first years of the 1960s. In those years Chinese agriculture was unable to retain enough food to feed the rural population. This fact is important to understand why China’s economic reforms began in the rural areas. They started after the death of Mao Zedong in 1976, and soon almost all the People’s Communes were abolished. Farmers obtained the right to cultivate land privately, but not to sell it. The reforms were followed by very rapid increases in agricultural production as farmers responded to the new incentives.

Another very important change during the first reform years was that rural people were given opportunities to look for income-rewarding activities outside agriculture. Some could find employment in the Township and Village Enterprises (TVEs) that grew rapidly. An alternative was to start small enterprises in, for example, trade, transport, or services. Other new job opportunities could be found in the cities. Stimulated by the very large wage differences, many rural people rushed to the cities. As it was (and to some extent still is) difficult to convert a residence permit (hukou) from rural to urban, most migrants moved back to their rural origin after a period in the cities.

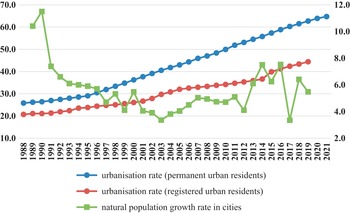

The great rural to urban migration has had far-reaching consequences for the size of the rural population. In 1980, and according to official statistics, 80 per cent of China’s population lived in a rural area. Owing to births and longer lives, the size of the rural population grew until 1995, when it peaked at 860 million. However, because of the large migration streams, the size of the rural population thereafter began to decrease. As consequence, in 2018 the rural population numbered 564 million and made up only 40 per cent of China’s population.

Much of rural policy in China since the end of the 1980s has to be seen in the light of the policy in place during the preceding decades. Corrective measures have led to the abolition of agricultural tax and the introduction of subsidies on agricultural production. Rural households’ fees for basic education have been abolished and the private costs for health care reduced. A lately introduced measure was to establish a system of social assistance (dibao) in China’s rural areas. Such a system had been introduced in China’s urban areas in the 1990s.

In this section, we will take a closer look at how China’s rural areas have changed since the end of the 1980s by studying how different types of employment have changed. We will examine the proportion of people and of households that are employed as farmers, as self-employed, and as wage earners. We will discuss the characteristics and the incomes of people and households with these different kinds of employment. We will also investigate the economic benefits from changing from farming to self-employment or to wage employment, and how such gains have changed over time.

3.2 The Different Kinds of Employment

When studying rural development in China, the well-known Lewis model is a useful point of departure (Reference LewisLewis, 1954; Reference GollinGollin, 2014). In this framework the economy consists of two sectors: the ‘modern’ (capitalist) and the ‘traditional’ (subsistence sector). The former includes industries using capital and technology that can be of an advanced nature. Workers have different levels of qualifications, and their wages are influenced by demand and supply. The traditional sector employs farmers, handicraft workers, petty traders, and domestic servants who live near the subsistence level as supply of unqualified workers is ‘unlimited’. Economic development in the Lewis framework takes place as employment in the modern sector increases at the expense of jobs in the traditional sector. We will return to the Lewis model in Section 5 looking more closely at development in urban China.

In rural China the introduction of economic reforms led to a rapid increase in wage employment and in self-employment. To transfer out of farm employment is not a random process. For example, initially the transition into self-employment was most important in the richer, more developed regions of China (Reference Mohapatra, Rozelle and GoodhueMohapatra et al., 2007). Reference Xiao and WuXiao and Wu (2021), analysing 2010 data, reported that good health and longer education increased the probability of being self-employed. Among men, being married increased the probability of being self-employed. However, one should also understand that during the decades here studied agriculture became increasingly commercialised and also more productive – processes we have not studied.

In the following we will summarise the study of Reference Gustafsson and ZhangGustafsson and Zhang (2022). They define three types of employed individuals among adults aged under sixty-five living in rural China: farmers, self-employed, and wage earners. Estimates of their proportions based on CHIP surveys for the years from 1988 to 2018 will be reported. Rural households in China typically have more than one adult member aged under sixty-five. As different members can have different sorts of employment, we will report estimates of employment categories at the household level. Hybrid categories are also included.

3.3 The Development of Different Kinds of Employment in Rural China

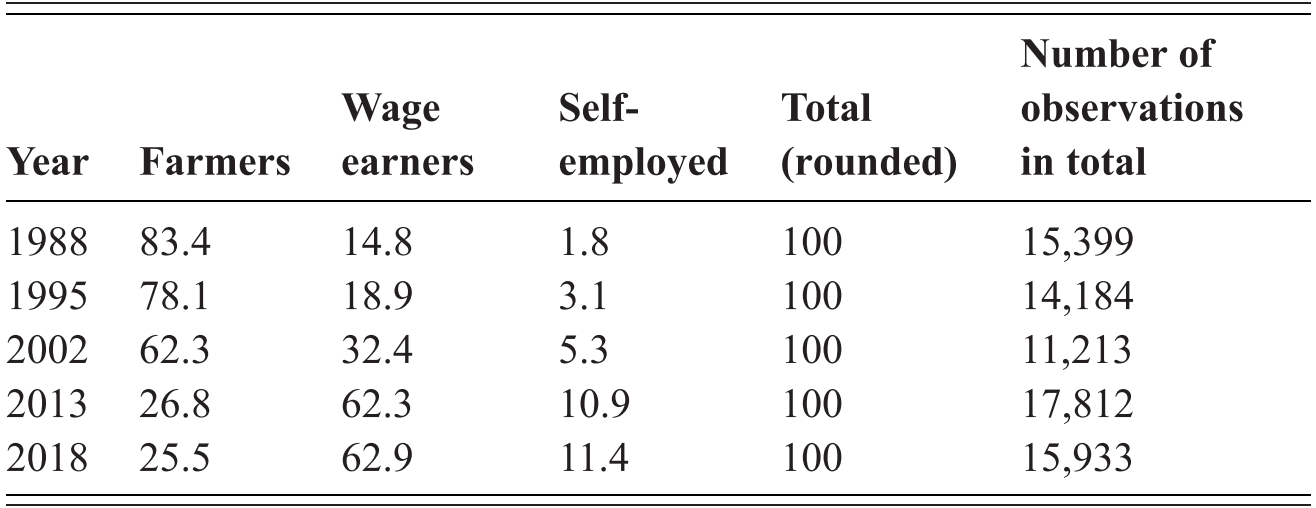

We now turn to estimates of how the proportion of rural adult individuals were employed in the CHIP survey years. Several observations can be made based on what is reported in Table 1. First, we can note that the proportion of adults employed as wage earners or in self-employment expanded between most years studied. Between 1988 and 1995 the expansion was slow. The percentage of adults working as farmers decreased only from 83 per cent to 78 per cent. More change took place between 1995 and 2002 as the proportion of farmers reduced to 62 per cent. The largest drop in the proportion of farmers happened from 2002 to 2013. In that year no more than 27 per cent of the adults were classified as farmers. Thereafter, very little change in the proportions took place.

Table 1 Individual employment categories in rural China, 1988, 1995, 2002, 2013, and 2018, percentage

| Year | Farmers | Wage earners | Self-employed | Total (rounded) | Number of observations in total |

|---|---|---|---|---|---|

| 1988 | 83.4 | 14.8 | 1.8 | 100 | 15,399 |

| 1995 | 78.1 | 18.9 | 3.1 | 100 | 14,184 |

| 2002 | 62.3 | 32.4 | 5.3 | 100 | 11,213 |

| 2013 | 26.8 | 62.3 | 10.9 | 100 | 17,812 |

| 2018 | 25.5 | 62.9 | 11.4 | 100 | 15,933 |

Why had the change in employment structure come to a halt in 2013? One reason, important if possibly not the only answer, is changes in public policy. For example, the abolition of farm taxes and the introduction of agricultural subsidies and other policy reforms corresponded to an increase of farmers’ income of 20–30 per cent (Reference NaughtonNaughton, 2018: 272–7).

Looking at the numbers in Table 1 in more detail, we see that each year more people were employed as wage earners than as self-employed. True, the expansion of self-employment is impressive: rising from 2 per cent of rural adults in 1988 to 12 per cent in 2018. However, between the same two years the proportion wage earners increased from 15 to 63 per cent. When disaggregating the numbers reported in Table 1 it becomes evident that the decline in farming employment was initially more pronounced in the eastern region of China. For example, in 1988, 24 per cent of adults in the eastern regions were wage earners, while the corresponding proportion in the western regions was as low as 5 per cent. Over time these regional differences became less pronounced, although differences have remained.

Shifting the focus from the individual’s employment to how members of households were employed gives a supplementary picture. It becomes evident that initially very few households had specialised in wage earning or in self-employment. In 1988, only 4 per cent of all households had all their adult members employed as wage earners and only 0.6 per cent were in self-employment. However, thereafter specialisation in each of these activities increased rapidly. To mix employment within a household also became common, particularly among the self-employed. For example, while in 2013, 7 per cent of rural households had specialised in self-employment, an additional 12 per cent had at least one adult involved in such employment.

3.4 Analysing Type of Employment and the Pay-Off from Different Types of Employment

We now turn to what characterises individuals who have a high probability to belong to one of the three forms of employment, summarising the most important results in Reference Gustafsson and ZhangGustafsson and Zhang (2022), where the situations in 1995 and 2018 were compared.

Rural workers in China have aged from being on average thirty-six years in 1995 to forty-four years in 2018, a year when farmers were on average fifty-two years old. Age is important for type of employment. The probability of working as a wage earner is negatively related to age while the opposite is the case for being a farmer. Among men, being married increases the probability of being self-employed and reduces that of being a wage earner, whereas the opposite is the case among married women. Those results indicate that employment decisions are taken at the household level and are influenced by prevailing gender norms.

A positive relationship between being a member in China’s Communist Party and being a wage earner, and a negative relationship of CCP membership and being a farmer is found. This relationship was weaker in 2018 than in 1995. A possible interpretation is that party membership has become less important as labour market forces have become stronger. Not surprisingly, the relationship between the length of education and the probability of being a farmer is negative and the probability of being a wage earner is positive. While positive relationships between income in the county where the household lived and the probability of being wage earner as well as being self-employed were found for 1995, this was not the case in 2018. This difference indicates that a spatial convergence process had taken place in rural China across those years.

Reference Gustafsson and ZhangGustafsson and Zhang (2022) also analysed income per capita among households with different forms of employment. They found that the income gap between households specialised in self-employment or wage earning and farming increased rapidly from 1988 to 1995. In 1995, the self-employed households received average incomes more than four times that of farmer households. An income function analysis showed that, although to some extent such differences could be attributed to productive characteristics, a household had strong incentives to change from farming to specialise in self-employment. Over the following years, when an increasing number of persons became wage earners or self-employed, such pay-offs decreased. However, even in 2018 a household with given characteristics could receive a higher income in self-employment or wage employment than in farming.

3.5 Conclusions

Rural China has experienced very large changes in employment during the three decades since the end of the 1980s. Among adults there has been a rapid flight from agriculture to wage employment or self-employment. These changes were particularly rapid between 2002 and 2013, when the changes were, compared also to what other countries have experienced in history, rather rapid. However, after 2013 such changes appear to have come to a halt, possibly temporarily and as response to changed policy.

People who have become wage earners are younger and more educated than those who work as farmers. Self-employment in rural China is an activity mainly for married men, not for married women. Moving from agriculture to wage employment or self-employment have led to higher income. Such income gains were highest back in 1995, when few households had made that move.

4 The Labour Market and Economic Reform: From Labour System to Labour Market

4.1 Introduction

Sections 4 and 5 are both concerned with China’s labour market. This section shows how the labour system evolved to become a labour market, with important implications for both efficiency and equity. It draws on the book on this subject by Reference Knight and SongKnight and Song (2005). The next section shows how the labour force, initially abundant, eventually became scarce, with important implications for people’s incomes and for society.

To ensure the efficient and equitable use of China’s labour force, how should the society and economy be organised; in particular, what role should a labour market play? At the start of our period of study the administered labour system remained largely intact in urban China, and restrictions on labour remained pervasive in rural China. The remarkable growth and transformation of the economy – involving the creation of new product and factor markets and ‘the greatest migration in human history’ – has necessitated vast and rapid change in the allocation, use, and remuneration of labour. The accompanying labour market reform has affected the quality of life of hundreds of millions of people.

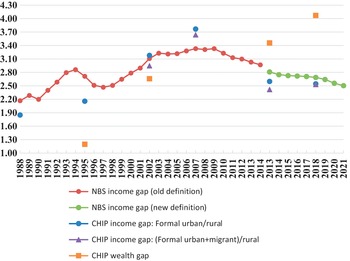

4.2 The Labour System

Under central planning China was compartmentalised into an ‘invisible Great Wall’ between rural and urban areas. There was, and to some extent still is, a rigid system of household registration (hukou), which accorded different rights and duties to urban and rural people, to the disadvantage of the latter. Despite it having been a peasant-led revolution, there was a large rural–urban divide in incomes and in many spheres of life, as analysed in the earlier book by Reference Knight and SongKnight and Song (1999). The disbanding of the communes in the first half of the 1980s and the restoration of incentives raised peasant incomes but, as urban reforms advanced, the ratio of urban to rural household income per capita grew, and it reached a peak of 3.32 in 2009. This reflects in part the unbalanced nature of political influence, however latent it might have been (Reference Knight, Li, Song, Boyce, Cullenberg, Pattanaik and PollinKnight et al., 2006).

Rural–urban migration was outside the labour system. It was limited at the start of our study period but began to grow in the 1990s and became a flood in the 2000s. It took a particular form, reflecting tenurial institutions and government policy. In principle, the large gap between urban and rural income per capita provides a great incentive for migration, and there was apparently no shortage of would-be migrants. However, the Chinese government has controlled and curbed the inflow of migrants into the cities and towns, partly to protect urban people against labour market competition and partly to avoid the ills of excessive migration that are evident in parts of the developing world. Rural–urban migrant inflows have been regulated to meet the urban demand for migrant labour, and migrants have been allowed into the cities only on a temporary basis. Urban settlement of rural–urban migrants and conferment of the rights of urban people are made very difficult, although changes have taken place in recent years, especially in the smaller and medium-sized cities.

4.3 The Evolving Wage Structure

China evolved gradually from having a centrally planned urban labour system towards having a flexible urban labour market (Reference Knight and SongKnight and Song, 2005). As a labour market develops, so we expect wage levels more closely to reflect the forces of demand and supply and wage structure more closely to reflect the productivity of labour and the efficiency of its use. How did China’s urban wage structure evolve? It is possible to examine changes in the wage structure drawing on the CHIP surveys, as analysed in Reference Knight and SongKnight and Song (2005) for 1988–95, Reference Knight, Song, Gustafsson, Li and SicularKnight and Song (2008) for 1995–2002, and Reference Gustafsson, Hasmath and DingGustafsson and Wan (2020) for 2002–7 and 2007–13.

In the late 1980s most urban workers were employed in SOEs, and these ‘work units’ provided them with mini-welfare states. Urban hukou labour was allocated bureaucratically and movement from one work unit to another was extremely rare, wages were administered according to a national pay scale, and the wage structure was highly egalitarian. It was said the ‘brain workers’ were paid less than ‘hand workers’. The period 1988–95 witnessed some decentralisation in decision-making in labour matters. Government and its SOE agents were willing to trade off some wage equality for more efficiency through the provision of incentives.

Wage inequality rose sharply: the Gini coefficient of urban wages increased from an extremely low level of 0.23 in 1988 to 0.31 in 1995. The median real wage rose by as much as 6 per cent per annum. Wage function analysis showed the rewards for human capital increasing from very low levels: the returns to education and the returns to occupation-based skills both rose. The initial upwards shape of the age-earnings profile – reflecting institutionalised payments for seniority – became more bowed, in line with human capital theory. However, there was also evidence of emerging wage discrimination against women (further discussed in Section 9) and for Communist Party (CPC) members. Segmentation grew between the wages of the expanding private sector and the, less competitive, state sector.

The pace of labour market reform quickened over the subsequent seven years, 1995–2002. The state no longer took responsibility for matching the demand and supply of urban labour, and employers increasingly determined the wages of their employees. Wages became more open to market forces. However, this process was experienced very unevenly.

In the late 1990s, government was forced by increased loss-making and the consequent fiscal costs to retrench urban workers from the SOEs. Many millions of workers in urban China lost their jobs, and open unemployment became a major problem for the first time. The true rate of urban unemployment rose from 4.2 per cent in 1990 to 11.5 per cent in 2000 (Reference Knight and SongKnight and Song, 2005: 35). The urban hukou employees who were retrenched (11.4 per cent of the total) experienced long durations of unemployment, and many faced a tough competitive informal labour market and lower re-employment wages, despite the fact that city governments, trying to protect their residents, responded by curbing the employment of migrants (Reference Appleton, Knight, Song and XiaAppleton et al., 2002). After the bloated public-owned sector was deflated, economic efficiency improved and net rural–urban migration grew once again.

The retrenchment programme might be thought of as a controlled experiment, creating a labour market overnight. However, those urban workers who were not laid off maintained their higher wages, being relatively protected from competition. The Gini coefficient of urban wages increased from 0.31 to 0.37, partly because of this new segmentation. Urban hukou real wage growth averaged 7 per cent per annum over the seven years but unskilled wages lagged well behind. The earlier pattern of change in wage structure continued. Human capital was increasingly rewarded. For instance, over the fourteen years from 1988, the premium of college education over primary education rose from 8 per cent to 88 per cent. Whereas in 1995 the age-wage profile was sharply bowed because it was the younger and the older age groups who encountered the strongest competition, by 2002 it took the normal market shape because there was now more competition across the age range. There was a high degree of wage segmentation across ownership types and across provinces. Decomposition analysis showed that in both periods the greatest contributions to the increase in mean real wages were made by the human capital and the province variables.

Analysis of the 2002, 2007, and 2013 urban surveys by Reference Gustafsson, Hasmath and DingGustafsson and Wan (2020) revealed a Gini coefficient of wage inequality rising from 0.35 to 0.38 but then remaining at 0.38. One reason for the recent stability of wage inequality is the behaviour of the coefficient on years of schooling. This fell from 0.102 to 0.068 between 2007 and 2013. That fall is likely to be the result of the remarkable, almost sixfold, expansion of higher education between 1990 and 2008, with a consequent fall in the returns to college education after 2007 (Reference Knight, Deng and LiKnight, Li and Deng 2017). Nevertheless, years of schooling still contributed about half of wage inequality in 2013. Years of experience continued to be well rewarded: twenty years of experience can be estimated to raise the wage by 80 per cent. Communist Party membership received a wage premium, as also did being male: its coefficient rose from 0.19 to 0.28 over the eleven years.Footnote 6 State firms and foreign-owned firms continued to be the best-paying ownership types.

4.4 Labour Market Segmentation

How can the continuing labour market imperfections be explained? Perhaps it was the lack of wage discrimination in 1988 that was the outlier. Wage differences, for instance by gender or by affiliation, are found in many market economies, not only in urban China. However, we could not distinguish between the pure discrimination effect and the effect of related but unobserved characteristics such as ability; in fact, few studies manage to do so.

Some of the observed wage segmentation is specific to China. Differences in the pace of reform created spatial segmentation of wages but controls on movement prevented it from being curtailed by equilibrating immobility of labour. Mobility of workers from one firm to another constrained the creation of a labour market. Even in 1999, the average duration of an urban hukou employee’s completed job was twenty years, and 78 per cent of them were still in their first job. Job stickiness begets wage stickiness. Until the new millennium urban workers’ job mobility was low and wage differences across firms were not ironed out by labour market competition.

Reference Knight and LiKnight and Li (2005) provided a partial explanation for the conditional wage differences by ownership type. They analysed the effect of enterprise profitability on wages in China’s formal sector. Standardising for individual worker characteristics, firm profitability was found to raise wages substantially. In the close-knit Chinese danwei there are reasons why a failure to share profits can lead to the tacit withdrawal of cooperation by workers. Thus, there was evidence of profit-sharing, the likely explanation for which was this form of efficiency wage behaviour.

There is one sort of labour segmentation that cannot be captured by our older data sets because they cover only urban residents with urban hukous. Rural–urban migrants, with rural hukous, were for many years at a great and discriminatory disadvantage in the urban labour market; there is conflicting evidence as to whether it is still common. They had to take the least attractive jobs – the jobs that urban-born people did not want. Their wages were lower, more likely being the result of market forces than of institutional factors. They had fewer of the rights that urban-born workers possessed, such as rights to pensions, to health insurance and unemployment insurance, and so on (Reference Knight and SongKnight and Song, 2005). Many migrants returned home permanently after an urban spell, and those who kept coming back retained close links with their rural households. Permanent urban settlement has encountered serious obstacles, especially in the largest cities, although the degree of segmentation has gradually weakened over time.

Another form of wage segmentation was that between the informal and the formal sector. In the former, wages were set competitively, while in the latter, wages were higher – for institutional or efficiency reasons – than the competitive level would have been. Reference Liang, Appleton and SongLiang et al. (2016) treated possession of a formal contract of employment as the criterion for formality, reflecting sharp differences in wage benefits and non-wage benefits. On that basis, according to the CHIP survey of 2013, formal employees were 43 per cent of total urban employment and informal workers 57 per cent, the latter being divided between informal employees (42 per cent) and business owners (15 per cent). Most rural hukou workers were informally employed. The rapid growth of urban employment and particularly of rural–urban migrants meant that a larger proportion of the urban labour market became competitive and informal, so making more wages responsive to the forces of demand and supply.

4.5 Conclusion

By comparison with China’s rural reform, urban reform was slow and gradual, well described by the saying ’crossing the river by feeling the stones’. There were two main obstacles to progress. One was the vested interests of SOEs and their privileged urban workers. The other was the need for coordination of various interacting reforms – for instance enterprise, housing, and financial reform – giving rise to problems of sequencing. Both obstacles were relevant to the slow pace – over thirty years – of moving from a labour system to a labour market.

There is a good deal of evidence for the main hypothesis that an urban labour market has emerged, and that its wage structure has evolved to reflect the productivity of labour. The process was slowed by the need for other reforms. For instance, some constraints on the mobility of labour were lifted only in the new millennium, and some remain in the largest cities. The urban labour market remains seriously segmented in policy-related ways: China is still moving towards a competitive labour market.

This section’s contribution has been to provide a fascinating account of how, over thirty years, an important country – gradually, without a clear road map, solving problems along the way, avoiding a big bang, and probably uniquely in the world – started from the shackles of an inflexible labour system and moved a long way towards the formation of a functioning labour market.

5 The Labour Market and Migration: From Labour Surplus to Labour Scarcity

5.1 Introduction

Throughout the twentieth century China was a surplus labour economy par excellence. Even at the time of liberation – mid-century – almost all of the arable land was in use, and in the next half century the rural population and labour force more than doubled. In the 1980s, the increase was absorbed mainly by rural industrialisation outside the planning system, but as urban reforms progressed the main absorption of the growing rural labour force was through rural–urban migration.

The remarkable growth of the Chinese economy – averaging 10 per cent per annum over the reform period, and in particular the growth of the urban economy – required a great inflow of labour into the cities and towns. This need was accentuated by the slow growth of the urban-born labour force. The draconian one-child family policy, introduced in the late 1970s, began to slow down the growth of the urban-born labour force in the 2000s; its effect had been delayed by Mao’s baby boom of the 1960s and 1970s and its echo when the baby boomers reached reproductive age. The number of rural–urban migrant workers in China is now rather large. The phenomenon has been referred to as ‘the greatest migration in human history’.

Reference LewisLewis (1954), the article introduced in Section 3, on ‘economic development with unlimited supplies of labour’ may well be the most famous and the most cited article in development economics. It presents a model of a dual economy in which economic growth occurs through the transfer of labour from the, less productive, traditional sector to the, more productive, modern sector. In the initial, ‘classical’ stage, traditional sector labour is freely available to the modern sector at a constant wage. As economic development proceeds, traditional sector labour becomes scarce and its supply curve to the modern sector becomes upwards-sloping, and increasingly steeply so. This is the ‘neoclassical’ stage, in which the benefits of economic development become more widely shared, including rural people who migrate and those who remain. Between the two stages is a turning point.

The Lewis model has huge implications for the alleviation of poverty and the reduction of inequality. Entry to the second stage might be the most important market mechanism for tackling income inequality in a developing country. Therefore, it is an important question: has China passed the turning point and entered the second stage of the Lewis model? We draw on Reference KnightKnight (2021).

5.2 The Great Migration

Table 2 covers the period 1990–2020. Before that time rural–urban migration was heavily constrained. The table records that the number of rural hukou workers in the urban areas increased from 42 million (25 per cent of urban formal employment) in 1995 to 257 million in 2015 (64 per cent of urban formal employment), and by extrapolation 320 million (70 per cent) in 2020. Migrants as a proportion of the rural-born labour force increased from 8 per cent in 1990 to 20 per cent in 2005, and to 41 per cent in 2015. A slightly different picture emerges from NBS direct estimates of rural hukou people working in towns and cities derived from representative rural surveys (‘directly measured’, not ‘as a residual’).Footnote 7 The survey figure exceeded the residual figure by 24 million in 2000 and by 47 million in 2010 but fell short of it in 2020 (extrapolated from 2018) by 26 million. The number of rural–urban migrants grew most rapidly in the period 2005–10, when the growth of real GDP was particularly rapid, averaging over 11 per cent per annum. The slower increase in surveyed migrants after 2010 can be attributed to the drastic contraction of the age group twenty to twenty-nine in rural China, structural change towards skill- and technology-intensive activities for which many rural workers were ill-prepared, and the deceleration of economic growth.

Table 2 Chinese trends in urban employment, urban-born labour force, rural–urban migration, and rural resident labour force (million)

| 1990 | 1995 | 2000 | 2005 | 2010 | 2015 | 2020 | |

|---|---|---|---|---|---|---|---|

| Urban employment | 170 | 190 | 232 | 273 | 346 | 404 | 459 |

| Urban-born labour force | 128 | 136 | 143 | 148 | 151 | 147 | 139 |

| Rural–urban migrants: directly measured | n.a. | 67 | 113 | 126 | 242 | 277 | 294 |

| as residual as % of urban | 42 | 54 | 89 | 125 | 195 | 257 | 320 |

| Employment residual as % of rural-born | 25 | 28 | 38 | 46 | 56 | 64 | 70 |

| Labour force | 8 | 10 | 15 | 20 | 31 | 41 | 51 |

| Rural-born labour force | 519 | 544 | 578 | 610 | 663 | 666 | 654 |

| Rural resident labour force | 477 | 490 | 489 | 485 | 468 | 409 | 334 |

Notes: The baseline for the projections is provided by the official 1 per cent Population Survey of 2005. It contains detailed information for cities, towns, and rural areas on population by age, on age-specific mortality rates, and on age-specific labour force participation rates. The number of entries to and retirements from the urban-born labour force are estimated in each year from 2005 onwards; people are assumed to enter at age eighteen and to retire at age sixty. The five-year age-specific mortality rates in 2004 are used to estimate annual deaths in each age group. The age-specific participation rates of 2005 are used to convert the population of working age to labour force. The figure for directly measured rural–urban migrants in 2020 (294 million) is extrapolated from 2018 (286 million).

However, the choice of migrant measure does not affect the basic story that migrant numbers have continued to increase in the face of the static urban-born labour force. With the exception of college graduates or those coming from the armed forces – who are given urban hukous – rural hukou migrants have been absorbed into the urban labour market partly by entering newly created jobs and partly by moving to jobs that urban-born workers no longer occupied.

5.3 The Lewis Turning Point

In about 2010 there were signs that China’s traditional labour surplus was drying up and that scarcity of rural–urban migrant labour – at existing wages – had begun to appear in at least some parts of China. An inconclusive literature on the Lewis turning point emerged. The most significant contribution was made in a special issue on this topic in China Economic Review in 2011. The different authors did not agree on whether China had reached the turning point of the Lewis model. This is not surprising because of their different methodologies and data sets and because a turning stage rather than a single point is to be expected in such a large and diverse country characterised by poorly integrated labour markets. In their contribution Reference Knight, Deng and LiKnight et al. (2011), using national data, found that migrant real wages began to rise more rapidly at about that time. However, they also adduced evidence that a substantial rural labour surplus remained. The authors attributed this apparent inconsistency to institutional and other restrictions which held back the remaining supply of the rural labour force. The passage of time would be needed to answer the question being posed. A decade later the topic now attracts less attention, essentially because there is more agreement that scarcity of unskilled labour has indeed become a general phenomenon.

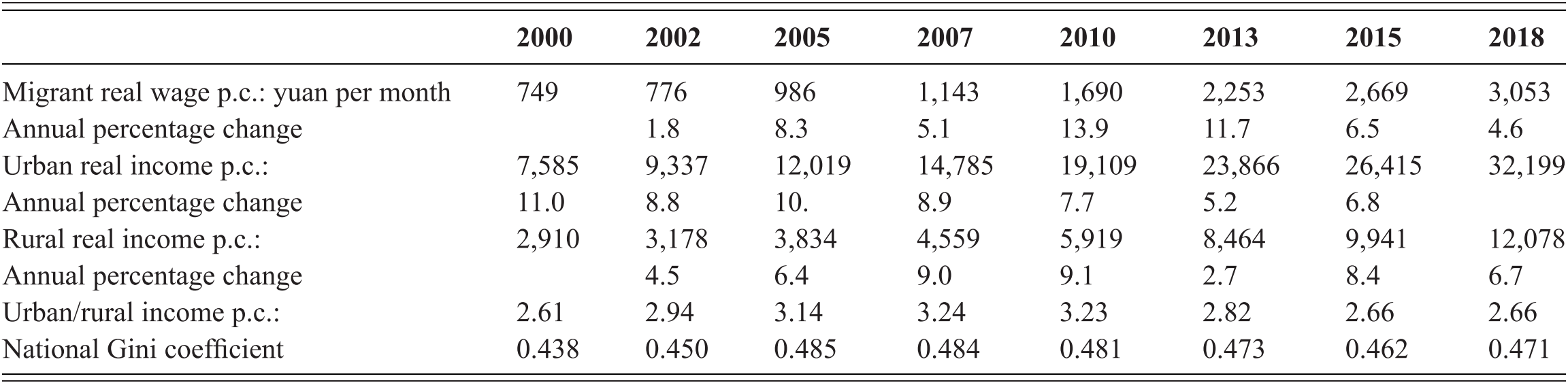

When the supply of labour is in abundance, the market wage of relatively unskilled labour is held down by competitive forces. One test of whether an economy moves from the first to the second stage of the Lewis model is to be found in the behaviour of unskilled market wages, in particular the wages of rural–urban migrants. Table 3 shows how the migrant real wage increased over the period 2000–18. It implies that migrant real wages grew over the periods 2002–07 by 8.0 per cent per annum, 2007–13 by as much as 12.0 per cent per annum, and 2013–18 by 6.3 per cent per annum. These results are consistent with China entering the second stage of the Lewis model in the period 2007–13, when the increase in rural–urban migration was at its peak, but the deceleration of real wage growth in the next five years is unexpected.

Table 3 Chinese rural–urban migrant average real wage per month; urban and rural household real income per capita per annum; and their ratio, household income per capita Gini coefficient, 2000–18

| 2000 | 2002 | 2005 | 2007 | 2010 | 2013 | 2015 | 2018 | |

|---|---|---|---|---|---|---|---|---|

| Migrant real wage p.c.: yuan per month | 749 | 776 | 986 | 1,143 | 1,690 | 2,253 | 2,669 | 3,053 |

| Annual percentage change | 1.8 | 8.3 | 5.1 | 13.9 | 11.7 | 6.5 | 4.6 | |

| Urban real income p.c.: | 7,585 | 9,337 | 12,019 | 14,785 | 19,109 | 23,866 | 26,415 | 32,199 |

| Annual percentage change | 11.0 | 8.8 | 10. | 8.9 | 7.7 | 5.2 | 6.8 | |

| Rural real income p.c.: | 2,910 | 3,178 | 3,834 | 4,559 | 5,919 | 8,464 | 9,941 | 12,078 |

| Annual percentage change | 4.5 | 6.4 | 9.0 | 9.1 | 2.7 | 8.4 | 6.7 | |

| Urban/rural income p.c.: | 2.61 | 2.94 | 3.14 | 3.24 | 3.23 | 2.82 | 2.66 | 2.66 |

| National Gini coefficient | 0.438 | 0.450 | 0.485 | 0.484 | 0.481 | 0.473 | 0.462 | 0.471 |

Notes: The migrant real wage is calculated using the urban consumer price index, and is shown at 2010 constant prices. The urban and rural real income per capita are calculated using the urban and rural consumer price indexes, respectively, and are shown at 2010 constant prices.

Interpretation is complicated by the existence of and changes in minimum wage legislation. Minimum wages are likely to be important for rural–urban migrants, being normally at the bottom of the urban wage distribution. In principle, minimum wage policies can serve two purposes. One is to protect the immobile and the weak against exploitation in a labour market governed by market forces. In that case, minimum wage increases are an endogenous policy response to broader wage increases generated by market forces. The other purpose is to raise wages at the bottom of the wage distribution above the levels that would be determined by market forces. In that case, exogenous minimum wage policy provides an alternative explanation for the rising wages of migrants.

Provinces were required to set minimum wages for their cities and counties, and these became important in the first decade of the new century. They appeared to increase most rapidly in real terms, by 7 per cent per annum between 2004 and 2009 and by 10 per cent per annum between 2009 and 2012, after the Chinese government demanded tougher enforcement (Reference Fang, Lin, Li and LinFang and Lin, 2020). Thereafter, the government became concerned about the burden of higher wage costs on enterprises (Reference DengDeng, 2017) and no longer set minimum wage target increases. Reference Ye, Tim, Li, Li and LinYe et al. (2020), using the 2013 CHIP urban survey, found that 13 per cent of employees earned less than the hourly minimum wage, and that the average shortfall below it was substantial for young and less educated workers. It had been possible for employers to increase the hours of work that were required in response to increases in the monthly minimum wage. These policies and this evidence cast doubt on a market interpretation of rapid migrant real wage growth in the 2003–12 period but might help to explain the slower growth after 2013. Migrant real wage behaviour does not provide a conclusive test of entry into the second stage of the Lewis mechanism.

What effect can the arrival of rural labour scarcity have on the urban–rural income ratio?. On the one hand, it should drive up unskilled market wages in the cities. On the other hand, the reduced availability of labour in rural areas relative to the availability of land and other resources should raise rural labour incomes. Therefore, the ratio might either fall or rise. However, the fact that only part of the urban labour force is affected whereas the effect on rural households is likely to be widespread tips the balance towards a fall in the ratio. Moreover, if migrants (increasing in number) remit part of their (now higher) wages to their rural households, that also should reduce the urban–rural income ratio.

The ratio of urban household income per capita to rural household income per capita, having risen since the mid-1980s, peaked at 3.32 in 2009 and began to fall almost monotonically thereafter; it was down to 2.66 in 2017. The national Gini coefficient of income per capita, having risen for many years, peaked at 0.490, and fell monotonically to 4.62 in 2015. Thus, not only did the urban–rural household income ratio fall but also the national Gini coefficient of household income per capita, as Table 2 shows. This relationship is likely to be causal because of the great importance of the urban–rural income ratio for the Gini in the Chinese case. In 2007, for instance, according to the CHIP survey of that year, the ratio of urban to rural household income per capita was 4.10 (using a broader definition of income). The urban Gini was 0.34 and the rural Gini was 0.36, whereas the national Gini, reflecting the wider income distribution, was no less than 0.49. It is through narrowing the urban–rural income gap that the Lewis mechanism can reduce the national Gini coefficient.

Other forces tend to raise the Gini coefficient. For instance, both the urban and the rural Ginis of household income per capita continued to rise as the national Gini fell. That might explain why the Gini edged upwards a little after 2015. The rise in the urban Gini is likely to reflect increasing possession of, or returns to, other factors of production, such as human and physical capital.

It is an important question, therefore, as to whether the scarcity of migrant labour, which emerged in about 2010, precipitated the decline in the urban–rural income per capita ratio, which began to fall consistently for a time after 2010. The implication would be that the arrival of labour scarcity was a powerful market mechanism for reducing income inequality.

The CHIP surveys report that household real income per capita in rural areas doubled over the years 2007–13, increasing by 13 per cent per annum. Wage income was the most important component of that growth, accounting for 35 per cent of the increase in rural income per capita and growing by 12 per cent per annum. Non-agricultural income grew by 13 per cent per annum and net transfer income (including migrant remittances) by as much as 29 per cent per annum. Each of these rapid increases might have resulted from a growing scarcity of rural labour insofar as it improved the ratio of rural resources to rural labour and the opportunity cost of migration. This evidence for the period from 2007 onwards is consistent with growing scarcity of unskilled labour.

Nevertheless, as with the rise in minimum wages, the strengthening of government fiscal policies against rural poverty complicates the story. Social benefits as a proportion of the final income of rural households increased from 0.7 per cent in 2002 to 6.4 per cent in 2013 owing to the expansion of pensions and minimum income guarantees, known as dibao (Reference Gao, Yang, Zhai, Wang, Sicular, Li, Yue and SatoGao et al., 2019, using CHIP data). Reference Hoken, Sato, Sicular, Li, Yue and SatoHoken and Sato (2019), also analysing CHIP, show that rural net transfer payments to rural households from public and private sources combined grew from –4.0 per cent of final income in 2002 to 7.7 per cent in 2013. Much of the increase in private transfers represented migrant remittances. These could reflect the tightening of the labour market but public transfers would not.

5.4 Conclusion

We have documented the remarkable transfer of labour from the rural areas to the urban areas of China over a period of thirty years. For twenty of those years, this occurred while the ratio of urban to rural income per capita consistently increased. This rise was in turn an important reason for the increase in the national Gini coefficient of income inequality that we have observed. However, the ratio fell in the third decade, and national income inequality stopped rising and might have fallen a little.

Was this fall of the Gini the Lewis model in action? We have adduced evidence that the turning point was reached in the year 2010 or thereabouts. Although the evidence is consistent with our interpretation, we could not discount a role for minimum wages and for fiscal transfers. Entry to the second stage of the Lewis model cannot in any case be long delayed and will be a powerful market mechanism for reducing income inequality in future years. We will return to the issue of how income inequality in China as a whole has evolved in Section 7.

It is interesting to contrast China’s experience of rural–urban migration with that of comparable countries. Although China’s migration has been called ‘the greatest migration in human history’, its extent and its form were nevertheless restricted by government. China’s inflows did not produce the vast slums in and around cities that are observable in many developing countries. The experience of slower growing economies reflects both their limited growth of urban formal sector employment opportunities and their unlimited migration into the cities. In China, by contrast, many new urban jobs were created as the urban economy grew rapidly, by well over 10 per cent per annum, and central and local governments were able to match the migrant inflows to the growing demands for labour. Both private and public enterprises had profit incentives to expand production: China possessed the comparative advantage to become ‘the workshop of the world’.

6 Public Revenues, Expenditures, and Inequality

6.1 Introduction

Public transfers that households receive through social security schemes provide a safety net for people’s livelihood and help to ensure social fairness and stability in China. A major reason for low inequality in the developed countries, as revealed by international experience, lies in the government redistribution policies (Reference Cai and YueCai and Yue, 2016). Research on developed and developing countries has indicated that government transfers and personal income taxation can lower income inequality. However, as a major component of government public expenditures, social security expenditures play a more crucial role in narrowing income inequality. Their redistributive effect is much greater than that of the personal income tax (Reference MilanovicMilanovic, 2000; Reference Mahler and JesuitMahler and Jesuit, 2006; Reference KristjánssonKristjánsson, 2011).

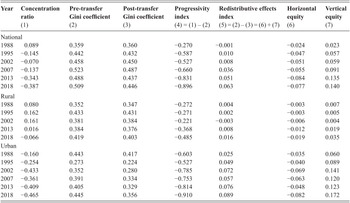

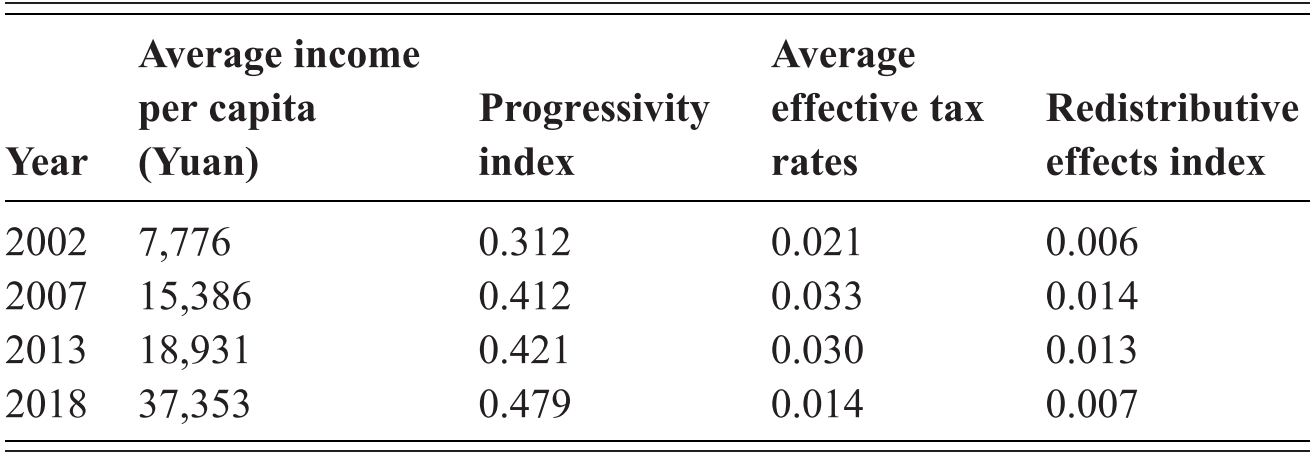

In Section 6, we analsze how the distribution of income is altered by public expenditures and revenues. Here we mainly focus on social security transfers and the personal income tax. We attempt to answer and explain the question: is inequality of post-transfer/tax income narrower than that of pre-transfer/tax income?

6.2 A Brief Introduction to Public Revenue and Expenditure Redistributive Polices in China

Although China has a multitiered government, in this section we take the approach of aggregating the public sectors into one entity and evaluate the joint redistributive effects of social security expenditures and personal income tax from both the central and local governments. Chinese households receive public transfers from governments mainly through a variety of social security programmes, of which the principal element is pension insurance.

Pension schemes in China include Pensions for Civil Servants and Public Sector Units (PSUs), the Employee Social Insurance Pension System, and the Urban and Rural Residents Social Pension Scheme (URSPS).Footnote 8 The targeted population of the Employee Social Insurance Pension Scheme is limited to those who worked for enterprises. Self-employed, irregular-working and non-working residents in urban and rural areas were included in the URSPS. In some sense, the enterprise worker pension and the pension scheme for civil servants and PSU workers are pension schemes for employees working in the formal sectors, whereas the urban and rural resident pension insurance is designed for those working in the informal sector (World Bank and Development Research Center of the State Council of the People’s Republic of China, 2013). The three pension schemes have been established in an attempt to cover the entire population of present China.

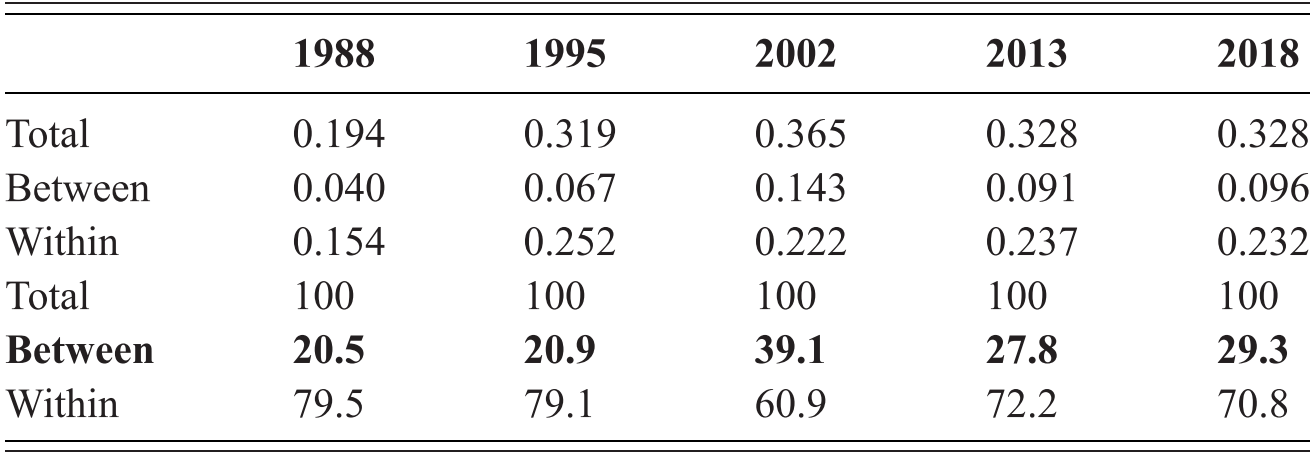

Besides pension, medical insurance is also an important social insurance programme in China. It reimburses medical expenses actually incurred by households, which include spending in hospitalisation and outpatient services. Participants in the Urban Employee Basic Medical Insurance include employees in either the public sector or the private sector in the urban areas. Residents who do not work or work in informal sectors are covered by the Urban and Rural Residents Basic Medical Insurance system. By the end of 2020, China’s basic medical insurance covered 1.36 billion people and the number of pension insurance participants reached 1 billion. China has thus by now established the world’s largest social security safety net. However, it should be noted that during much of the period covered here most older rural people were not receiving any pension and rural people had to pay for their health care by themselves. Most probably it is still common for elderly in rural areas to not seek medical treatment for their illnesses. In addition, the rate of reimbursement for the New Rural Cooperative Medical Insurance is lower than its counterpart in urban areas, see Reference Feng, Yu and LouFeng et al., 2015.