1. Introduction: exploring the unknown

A major contribution of transaction cost economics has been to provide conceptual tools for identifying and exploring the variety of forms that the organization of transactions can take, going far beyond markets and the price mechanism. Coase (Reference Coase1937) initiated what became a central issue in the economics of organization, raising the puzzle of why there are firms if markets deliver optimal solutions to the allocation and use of resources. However, Williamson must get full credit for having embedded the Coasean intuition in a model capturing the richness of arrangements that characterize modern market economies. More specifically, we owe Williamson for the formal introduction of hybrid agreements as essential building blocks in ‘the institutional structure of production’ (Coase, Reference Coase1992).

Williamson's initial analysis of the sources of transactional failures and their remedies led to the exploration of the comparative advantages and flaws of markets and firms (later extended to all ‘unified organizations’). From ‘The Vertical Integration of Production: Considerations on Market Failures’ (1971)Footnote 1 to Markets and Hierarchies (1975), his focus was on finding a theoretical explanation for the trade-off between these polar arrangements, thus providing insights on their respective characteristics. The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting (1985) went further, specifying the conceptual framework to explore this trade-off, mainly through the determining role of the attributes of the transactions at stake, and by paying more attention to non-standard arrangements as alternatives to these polar forms. Indeed, Williamson acknowledged that ‘Whereas I was earlier of the view that transactions of the middle kind were very difficult to organize and hence were unstable, […], I am now persuaded that transactions in the middle range are much more common’ (1985: 83), and thereby opened the way for further investigation of ‘non-standard arrangements’. However, these arrangements remained poorly characterized.

Several years passed before the concept of ‘hybrids’ emerged and received appropriate attention. In ‘Comparative Economic Organization: The Analysis of Discrete Structural Alternatives’ (1991/1996, chap. 4), Williamson unambiguously introduced and characterized hybrids as a class of their own among the ‘generic forms of governance’ (p. 93), different from markets in that they ‘sacrifice incentives in favor of superior coordination’ and different from hierarchies in that they ‘sacrifice cooperativeness in favor of greater incentive intensity’ (p. 107). In doing so, transaction cost economics à la Williamson overcame a ‘rather messy situation marked by a cacophony of heterogeneous concepts, theories, and research results’ (Oliver and Ebers, Reference Oliver and Ebers1998: 549). The concept of hybrid allowed researchers to go beyond this cacophony mirrored in the descriptive terms used to identify these arrangements (clusters, networks, strategic alliances, supply chain systems, administered channels, etc.). It initiated the integration of these heterogeneous arrangements into a unified and coherent framework that orders and prioritizes the issues at stake.

Reviewing the developments that followed this breakthrough clearly exceeds the scope of this short essay, and I apologize upfront for referencing very few of an incredibly rich set of contributions.Footnote 2 In what follows, I first provide indications on how Williamson progressively established the theoretical status of these ‘non-standard’ arrangements (section 2). I then summarize some major steps made in the direction thus opened (section 3). Next, I discuss recent and promising developments as well as challenges regarding the nature, role, and relevance of hybrids as forms of governance of their own (section 4). I conclude on a more personal note.

2. Taking stock: the Williamsonian approach

Although some early contributions, for example, Richardson (Reference Richardson1972), already emphasized the need to pay attention to the forms of interfirm coordination that play such an important role in market economies and to move their analysis away from an exclusive micro-economics focus on markets and firms, economists long ignored this issue. In a pioneering analysis of franchising, Rubin (Reference Rubin1978) pointed out the absence of consideration of inter-organizational arrangements that he coined as ‘hybrids’ (p. 223). However, besides viewing these hybrids as challenging the ‘sharp distinction between interfirm and intrafirm transactions’ (ibid.), the article remained vague about their theoretical characterization.

2.1 Toward a conceptFootnote 3

Almost simultaneously, in his now famous analysis of the trade-off between Markets and Hierarchies, Williamson acknowledged the existence of ‘intermediate forms of contracting’ (1975: 91; and already 1971: 112), but considered them as ‘ambiguous’ and not as efficient as the polar forms in the long term, making them ‘unstable’ and ‘transitory’, a view that long persisted in the economic literature (see Hart and Moore, Reference Hart and Moore1990). However, likely under the influence of Macneil (Reference Macneil1974), Williamson made a major step forward with his highly influential contribution of 1979 (1979/1985, chap. 3), pointing out that when uncertainty makes contingent claims contracting unfits for ‘unprogrammed adaptation’ and/or when the specificity of investments exposes parties to significant contractual hazards, ‘a different contracting relation that preserves trading but provides for additional governance structure might be devised’ (1985: 70). Nevertheless, this observation remained in need of a concept.

The breakthrough materialized a decade later, following numerous empirical contributions describing ‘non-standard’ arrangements and assessing their importance in the actual organization of economic activities.Footnote 4 Besides emphasizing the existence of a whole class of such arrangements distinct from markets as well as from hierarchies, the ‘Comparative Economic Organization’ article from 1991 (1991/1996, chap. 4) stimulated a stream of research on the identification and characterization of the ‘generic forms of governance’ (p. 93), markets, hierarchies, and hybrids, through the lens of four features: the prevailing ‘contract law regime’, the modes of adaptation to disturbances, the importance of administrative controls, and the intensity of incentives.

I now turn to a more careful examination of these features and some gaps that led to renewed investigations.

2.2 Characteristic features

The late introduction of ‘hybrids’ in his transaction cost model was part of Williamson's theoretical concern to better substantiate the ‘discrete alignment’ between the attributes of transactions and the ‘generic forms of governance’ and, empirically, to take on board the growing literature on inter-organizational arrangements and their importance in the actual organization of transactions. The identification of the four features mentioned above helped him to contrast the properties of hybrids as distinct from markets as well as from ‘unified organizations’ (or ‘hierarchies’).

With respect to ‘contract law regime’, the feature most emphasized in the 1991/1996 contribution,Footnote 5 Williamson relied on Macneil's differentiation between three types of contractual arrangements. ‘Classical contracts’ refers to contingent claims contracts. He then contrasts these contracts, which prevail on markets, and the kind of contract that shapes the activities of hybrids.Footnote 6 This last kind of contract corresponds to arrangements in which parties develop a specific relationship while maintaining autonomous ownership. This contract differs from the classical one in that it ‘(1) contemplates unanticipated disturbances for which adaptation is needed, (2) provides a tolerance zone (…) within which misalignments will be absorbed, (3) requires information disclosure and substantiation if adaptation is proposed, and (4) provides for arbitration in the event voluntary agreement fails’ (1996: 96). In such a context, the identity of parties to the transaction matters. Last, when it comes to the type of contract that prevails within firms, Williamson used the term ‘forbearance’ since the law gives ‘forbearance’ to the upper management to operate as its own court of appeal and to rely on ‘fiat’ when highly consequential disturbances require more elastic and adaptive solutions than contracts in hybrids allow.

Although Williamson acknowledged upfront that ‘…there is more to governance than contract law’ (1996: 101), the qualification of hybrids with respect to the other three features remained much more schematic in this model and was largely subsumed under the discussion of ‘contract law’.Footnote 7 These complementary features can be summarized as follows. The modes of adaptation are the mechanisms through which different types of organization adjust to changing and often unexpected disturbances. Sticking to the polar cases of markets and hierarchies, Williamson contrasts the spontaneous, decentralized adaptation that relies on prices, which refers to markets in the vein of von Hayek (Reference von Hayek1945); and ‘the conscious, deliberate, and purposeful efforts to craft adaptive internal coordinating mechanisms’, which refer to hierarchies in the vein of Barnard (Reference Barnard1938).Footnote 8 The administrative mechanisms of control refer essentially to bureaucratic devices and their costs, again contrasting transactions operated through markets (low cost) and those integrated in hierarchies (high costs). Last, the reference to incentives primarily states the merits of markets, with the ‘high-powered’ incentives provided by an appropriation regime in which transactors directly benefit from their adaptation capabilities, while hierarchies suffer from ‘low-powered’ incentives, due to the dominant role of administrative command and control in securing coordination.

In the features thus specified what room is left for hybrids? Williamson's answer is well-known: ‘The hybrid mode displays intermediate values in all four features’ (1996: 104). More explicitly, the combination of distinct ownership, which preserves the autonomy of the parties, with flexible contracts facilitating mutual adaptation, explains the existence and resilience of hybrids. In sum, hybrids differ from markets as well as from hierarchies in that: (1) they could adapt better to ‘consequential disturbances’ through the development of ‘elastic contracting mechanisms’, (1996: 96), without sacrificing the powerful incentives rooted in the maintained autonomy of ownership among partners; and (2) they could provide efficient tools for managing the risks of opportunism generated by moderate dependency due to mildly specific investments, without falling into the bureaucratic biases of full integration. However, these comparative advantages face limits due to mild incentives compared to markets and to ambiguities of rent-sharing due to the complex allocation of rights in these contractual arrangements.

Hence Williamson's qualification of hybrids as ‘characterized by semi-strong incentives, an intermediate degree of administrative apparatus, semi-strong adaptation of both kinds, and a semi-legalistic contract law regime’ (1996: 105) leaves us with limited insights about the specific characteristics and the role of these arrangements.

3. Moving forward: digging deeper in the specificity of hybrids

Although short on providing details about how the four features would differentiate hybrids from the polar forms of ‘markets’ and ‘hierarchies’, Williamson remained aware that ‘the hybrid form of organization is not a loose amalgam of market and hierarchy but possesses its own disciplined rationale’ (1996: 119). Twenty-five years later, where are we with respect to hybrids (or, to use a favorite expression of Williamson, ‘What's going on here’)? The huge number of contributions inspired by Williamson on these hybrid arrangements allows a much better understanding of the concept, of the forces motivating parties to go hybrid, and of the type of governance adopted.

3.1 Substantiating the concept

The stream of research following Williamson's breakthrough substantiated his initial insights, without necessarily using the term ‘hybrid’. These fluctuations in terminology reflect the theoretical difficulty of capturing the very nature of hybrids.Footnote 9

A rather pessimistic view was summarized by Masten (Reference Masten1996: 12) who stated that ‘Given the variety of hybrid forms, the nature of hybrids, their advantages and disadvantages, and the rules that influence their form must be assessed on a case-by-case basis’. In sum, hybrids would be doomed to remain ‘theoretical orphans’ (Borys and Jemison, Reference Borys and Jemison1989). If such a theoretical vacuum persists, it would support the challenging view of Hodgson (Reference Hodgson2002) who saw the idea of ‘hybrids’ as a Trojan horse to abandon the ‘legal-based definition of the firm’.Footnote 10

These are not very satisfying perspectives if we take seriously the considerable role of inter-organizational arrangements coordinating activities through modalities that exceed what the price mechanism can do and yet do not rely on fiat. The abundant literature on the variety of these arrangements bolsters the Coasian-Williamsonian view that we need a theory explaining their existence and their role, and to address the observation that ‘firms have invented far more ways to work together than organizational economics has so far expressed’ (Baker et al., Reference Baker, Gibbons and Murphy2008: 146).

One move in this direction is to take stock of the regularities that arise from the diversity of empirical analyses on existing hybrid arrangements (for an early appraisal see Ménard, Reference Ménard2004). Notwithstanding their terminological differences, these varied studies find that a first and central characteristic of hybrids is that the parties maintain legal control over their strategic property rights, thus remaining distinct residual claimants, while pooling part of their resources and the related decision rights.Footnote 11 Building on this distinction between property rights, decision rights, and expected payoffs (see Baker et al., Reference Baker, Gibbons and Murphy2008), it is possible to revisit the initial Williamsonian perspective on hybrids by examining how the allocation of these rights (and some assets) connects to their core mechanism of governance by contrast to the polar cases of markets and ‘unified organizations’ (typically the firm).

Let us consider two firms, 1 and 2, respectively endowed with assets {A, a} and {B, b}, with A and B related to their core activities and remaining within their direct (legal) control, while other assets (a and b) may deliver higher payoffs if used jointly. Decision rights (DA, da) and (DB, db) are associated with these distinct assets with an expected delivery of payoffs (ΠA, πa) and (ΠB, πb). To capture the different modalities of governance, we introduce the notion of a ‘strategic center’, defined as an entity endowed with discretionary power to coordinate. The allocation of rights and payoffs (incentives) for the ‘discrete structural alternatives’ can be summarized as follows (Figure 1; see Ménard, Reference Ménard, Gibbons and Roberts2013a for more details).

Figure 1. Hybrids contrasted.

The initial Coasian-Williamsonian approach focused on the trade-off between firms and markets. On market, firms can trade the usage of their assets (e.g. selling or leasing their respective goods and services), possibly using contingent contracts, and relying on prices as the key coordinating tool; in this arrangement, there is no room for a strategic center overarching decisions from legally distinct firms. However, if assets are specific and interdependent enough, a major breakthrough of transaction costs economics is to predict that concerned firms will have a strong incentive to secure their control over the relevant assets through merger or acquisition; the resulting ‘unified organization’ makes hierarchy the key mechanism of coordination, with decision rights concentrated in last resort in the hands of a strategic center (e.g. the board of directors).

But what happens if firms expect benefits from the joint usage of assets a and b (if they don't do it, πa = πb = 0) while still having incentives to remain full residual claimants over the benefits generated by the usage of assets A and B? Parties then have the motivation to develop a specific governance structure that relies on a mix of (incomplete) contractual agreements allowing mutual adjustments to unexpected events (horizontal arrow linking the two firms in Figure 1) and of devices coordinating their joint activities, from relatively low-powered ones (e.g. joint committees, managers devoted to monitoring the agreement – see Palay, Reference Palay1985) to high-powered strategic centers (e.g. an entity monitoring a joint-venture). What ultimately matters for the characterization of hybrids is that parties rely on the forms of governance to coordinate their joint activity while remaining legally distinct and even competitors on other segments of their activities. This is the type of arrangements that Williamson (Reference Williamson1991/1996) intended to capture in extending his initial ‘make-or-buy’ model to include hybrids.

Another characteristic of the governance of hybrids comes from hazards that are particularly high when jointly used assets result from co-specialized investments, that is: complementary and even jointly-owned investments specifically made to generate the expected payoffs. To face the risk of opportunistic behavior, parties are motivated to substantiate the governance structure by implementing: (1) mechanisms to select partners, particularly through intensive usage of screening: identity matters, contrarily to what characterize competitive markets; (2) devices and procedures to support the joint planning and coordination of transactions made particularly complex by the coexistence of distinct ownerships; and (3) modalities to share information specific enough to allow unprogrammed adaptation without infringing on the practices of firms that remain competitors on the segments of their activities.

Fulfilling these constraints has a strong impact on the nature and characteristics of contracts linking parties. On the one hand, contracts play a key role in creating ‘transactional reciprocity’. On the other hand, a key motivation to go hybrid is to facilitate ex-post adaptation, which relies on contracts that are incomplete, providing only a framework, a blueprint to the relationship. However, the resulting ‘relational’ nature of hybrid contracting is a potential source of haggling. For example, risks exist of some party taking advantage of the arrangement to preempt strategic inputs and/or capture customers. Numerous examples from franchising (e.g. in the fast food industry) or strategic alliances (e.g. in the airline industries) have substantiated these risks. The significance of these challenges may command different types of governance (see below).

In sum, the fundamental lesson from the post-Williamson literature on hybrids is that they differ from markets in that adaptation cannot be done unilaterally, and they differ from unified organizations in that adaptation cannot be done by fiat. By combining competition and cooperation, hybrids subsume the role played by prices on markets and by command in integrated settings. Hybrids are thus defined with a much more specific content than their initial characterization as a rather vague mix of markets and hierarchies. They are arrangements in which two or more partners pool strategic decision rights as well as some property rights, passing these rights across fixed boundaries of organizations that remain legally distinct and keep autonomous control over key assets. Consequently, hybrids rely on specific governing modalities to coordinate their joint activities and arbitrate the allocation of payoffs, governance that goes beyond the relation between legally independent firms dealing with each other through market arrangements (Ménard, Reference Ménard, Gibbons and Roberts2013a: 1066). Before considering recent developments on these specific modalities, an issue left open by Williamson deserves attention: why would parties agree to engage in the risks of pooling resources, giving up their exclusive control over such important decision rights and even property rights and somehow relying on trust?

3.2 Why do firms go hybrid?

The question about the motivation to go hybrid partially parallels the question raised by Simon (Reference Simon1951) about labor contracts: why do autonomous economic entities abandon their control over substantial rights? However, there is a fundamental difference between the two situations: choosing to go hybrid requires reconciling legal autonomy and partial economic interdependence without the advantage of the governance of transactions within a ‘unified organization’ relying on fiat to pilot adaptation.

Consistent with Williamson's (Reference Williamson1996) intuition, two main sets of arguments allow to understand why autonomous and even competing firms would prefer to organize a subset of their transactions through a hybrid arrangement rather than relying on markets (and the price mechanism) or on integration (and the role of fiat in the last resort).

The first argument comes from the creation of value expected from co-specialized investments. Co-specialized investments can respond to different strategies that command different modalities of governance. One strategy is to rely on complementary investments, as when partners specialize in different components to be combined in a later phase of the process. Supplier parks in which different and even competing firms share resources (e.g. logistic services) provide an example. A different strategy is for parties jointly to invest in a specific segment of their activity, such as joint R & D projects or joint ventures. The literature has explored different factors explaining the choice of co-specialized investments. One motivation may come from the volume of investments required, providing incentives to pool resources, thus creating assets dedicated to the relationship. For example, the joint acquisition of specific assets may relax financial constraints, either by allowing financial transfers across firms' boundaries, as when cross-subsidies help developing the network; or through the joint provision of guarantees (which can be formal, as when parties share liabilities; or informal, as when parties benefit from the reputation of the network) that facilitate access to external credit. Another motivation to share resources may come from the expected benefits from synergies, as when the development of a network allows access to a segmented market, with different partners creating complementarities through their specialization (e.g. supplying different regions; or providing complementary goods or services that allows reaching more buyers, or more diversified ones). Last, partnership may also be motivated by the expected benefits of sharing competences and developing co-learning, potentially a decisive advantage in knowledge-based activities.

A second argument emphasizes the role of uncertainty in the decision to go hybrid. The fundamental idea is that sharing some resources would help parties to face uncertainties, providing ‘buffers’ to absorb external shocks and easing adaptation to unprogrammed events. As with co-investment, the motivation to go hybrid may vary according to the different sources of uncertainty and the challenges they raise. Beside unexpected events due to elements exogenous to the agreement, such as flawed institutions or shocks originating in the natural environment, the Williamsonian tradition has long emphasized the role of opportunism and/or bounded rationality as the main sources of contractual hazards. However, numerous critiques, going back to Hart (Reference Hart1990), have noticed that in all economic models, actors are presumed to be opportunistic (self-interested) but do not necessarily behave opportunistically if well-organized markets prevent them from acting accordingly; and even if parties are rational, contracts can be incomplete. Recent studies, however, consider the more general issue of the different factors imposing unprogrammed adaptation. These might be due to strategic behavior in the contexts of incomplete or biased information; to the fundamental transformation introduced by relation-specific investments on the supply side, with complementarity exposing to the risk of disruption in the provision of a strategic component, or on the demand side, with complementarity exposing suppliers to the risk of maladaptation of their distributors to changes in demand; or to ex-post haggling made possible by the incompleteness of contracts (Williamson, Reference Williamson1985, chap. 3; Gibbons, Reference Gibbons2010). The idea underlying all these situations is that hybrid arrangements provide flexibility that contingent-claim contracts cannot offer, while they permit parties to maintain a relative autonomy rather than falling under the rigidities of dependence ruled through fiat.

Whether they are motivated by the expected benefits of co-specialized investments or by the possibility to better face uncertainty, the key for understanding the choice of hybrid organizational solutions is that they allow parties to reach these goals without losing their autonomy. However, there are limits that prevent hybrid solutions to systematically prevail.Footnote 12 Moderate incentives, with comparison to market solutions; problems coming out of rent sharing, with comparison to both markets and integrated firms; and transaction costs of drawing adequate contracts and fulfilling their incompleteness with appropriate governance show some of these limits. In other words, hybrids develop in an environment shaped by non-contractibilities because they are viewed as efficiency-enhancing, but only as long as an appropriate mode of governance is implemented. I now turn to this last aspect.

3.3 What governance?

Although a universally accepted typology of hybrid arrangements is still missing, a better identification of the various forms their governance can take has progressively emerged (see Lafontaine and Slade, Reference Lafontaine, Slade, Gibbons and Roberts2013; Ménard, Reference Ménard, Gibbons and Roberts2013a). Indeed, once the potential benefit of going hybrid is acknowledged, the question remains of what governance can allow hybrids to reach that goal. How can cooperation among otherwise distinct and competing partners be secured that can achieve coordination at low cost without losing the advantages of decentralized decisions? In a nutshell, what governance can reconcile legal autonomy and transactional interdependence?

The answer depends of course on the type of motivation at work. In that respect, this issue does not differ from the trade-off among alternative market structures or among different internal organizations of the firm. The difference may come from the less stabilized typology of hybrids in relation to their alignment with the types of transactions they intend to process. However, important progress has been made in that respect as well.

Indeed, numerous empirical studies show that in order to allow unprogrammed adaptation without threatening sustainability, hybrids must fulfill at least three conditions.

(1) Their governance must secure the commitment of parties if co-investments are going to be made. Contracts, which define ‘legally binding promises’ (Macneil, Reference Macneil1974: 693), provide important safeguards in that respect, through the selection of reliable contractual parties (based on reputation and trust built through repeated games …or social networks) and the adoption of clauses designed to limit the risks of opportunistic behavior and provide means to solve conflicts. However, parties decide to go hybrid not to avoid contractual incompleteness, but rather because they require incomplete contracts to stay flexible, a point already made by Williamson. This makes the relational properties facilitating adaptation and commitment at the core of hybrid arrangements. It also explains the implementation of devices complementing contracts, from regular meetings to the creation of specific committees or a fully autonomous strategic center, in order to reinforce the credibility of commitments.

(2) The protection of residual claimant rights is another condition that the governance of hybrids must fulfill to secure their resilience. With partners remaining holders of their strategic property rights, stability requires decision-making rules that differentiate hybrids from unified organizations.Footnote 13 Of particular significance in that respect are rules for sharing rents generated by jointly-monitored or even jointly-owned resources. Different solutions have been examined, particularly in the literature on franchising and on R & D ventures, for example, rules based on observable components (e.g. royalties based on sales in franchising) or on ‘equity principle’ (e.g. rules for sharing risks when parties join efforts to innovate). However, these rules face agency problems, typically due to measurement obstacles when joint investments overlap other activities of participating firms that remain competitors, or when multi-tasks make the specific contributions of different partners hard to observe. The often cited statement (Klein, Reference Klein1996) that hybrids remain stable as long as expected gains exceed the expected opportunity costs of leaving the agreement does not provide an answer to these measurement problems.

(3) These difficulties lead naturally to a third condition for making hybrids viable and sustainable: the need for enforcement mechanisms in their governance. Hybrids have developed distinctive and well-structured private orders, using specific devices and/or mechanisms to jointly organize transactions, coordinate related activities, and solve disputes. Some of these mechanisms are embedded in contracts, for example, geographic restrictions, vertical constraints regarding suppliers, agreements over prices, etc. Imposing quality control over outputs from joint investments is another example, as when securing the reputation of a brand name is particularly challenging for partners simultaneously delivering outputs outside of the scope of the agreement. To monitor their relation and solve conflicts, numerous hybrids go further, implementing dedicated committees, establishing ‘internal courts’ and/or even formal strategic centers to circumvent the absence of the ‘forbearance’ rule of integrated organizations (see e.g. Li et al., Reference Li, Eden, Hitt, Duane Ireland and Garrett2012).Footnote 14

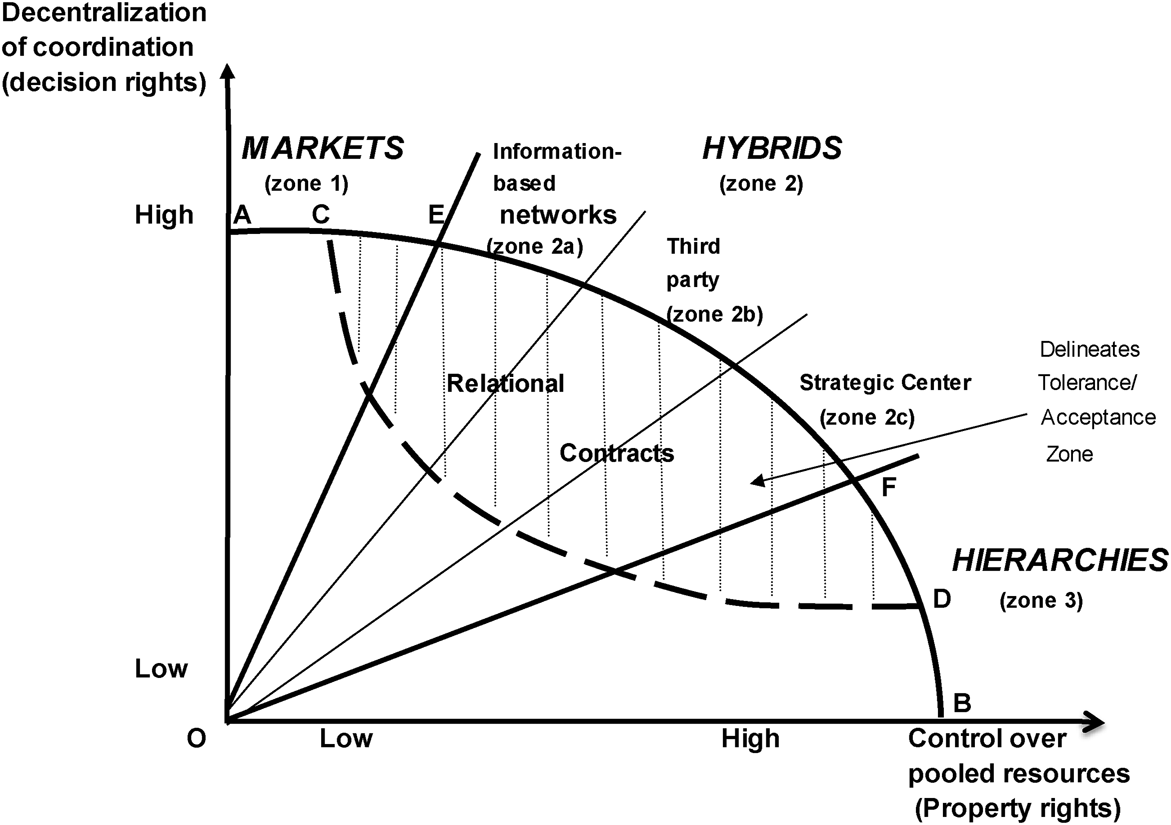

3.4 A typology of hybrids

To fulfill these conditions, hybrids have therefore adopted a variety of ‘mechanisms of governance’, making their configuration more complex than the simple mix of market-like and hierarchy-like properties of the initial statement (Williamson, Reference Williamson1996; also Makadok and Coff, Reference Makadok and Coff2009). Building on contributions digging deeper in the middle column of Figure 1, Ménard (Reference Ménard, Gibbons and Roberts2013a, Reference Ménard2018) devised a typology of the governance of hybrids that goes beyond simply departing them from the decentralized organization of transactions through the price mechanism or their centralization within a unified organization. This typology links the ‘relational contract’ approach and the Williamsonian emphasis on ex-post adaptation imposed by co-specialized investments and the need to face unprogrammed events. It hypothesizes that the type of hybrid governance depends on the respective allocation of decision rights and property rights, which themselves depend on the significance of shared strategic resources. The more specific the pooled resources, the tighter the control over their associated property rights (horizontal axis); and the more coordination required by the specificity of these pooled resources, the more centralized decision rights tend to be (vertical axis).

Figure 2 summarizes the main characteristics of the resulting typology. The external frontier [A, B] defines the optimal ‘discrete structural alternatives’ that could be reached with respect to the degree of control and coordination required. The internal frontier [C, D] designates formal agreements, with no room for relational adjustment, so that beyond this curve the organization of transaction can hardly be sustainable beside the exception of ‘spot markets’ [A,C] or ‘unitary command firm’ [D, B]. All other arrangements involve relational contracting (see section 4) and are located in the lens-shaped area, with varying degree of efficiency. Although significant activities develop in zones 1 (markets) and 3 (hierarchies), the focus here is on hybrids (zone 2) delineated by rays OE and OF. Within this zone, the discussion above suggests that the more partners expect to gain from pooling strategic assets, the more motivated they are to sacrifice their autonomous control over property rights. Symmetrically, the more they expect to gain from coordination over co-specialized investments, the more motivation they have to endorse centralized decision-making.

Figure 2. Typology of governance structuresFootnote 19.

Combining theoretical contributions along this line of reasoning (e.g. Baker et al., Reference Baker, Gibbons and Murphy2008) with the rich empirical studies already available (Ménard, Reference Ménard, Gibbons and Roberts2013a), three leading types of hybrid governance structures can be differentiated. On the left of zone 2 (zone 2a) are arrangements close to classical markets, although they differ in that they involve pool resources (which ‘hand-in-glove’ supply relationship do not have). Information-based networks and other types of loose alliances illustrate, with partners coordinating mainly through shared information, joint logistic, etc., while keeping strategic control over their key assets, so that they basically remain distinct residual claimants. The tight network in the diamond industry (Bernstein, Reference Bernstein1992), or porous frontiers and continuous exchanges among biotech firms in the Boston area (Powell, Reference Powell1996) provide illustrations.Footnote 15 On the right of zone 2 (zone 2c), hybrid arrangements get close to integrated firms, with partners relying on tight coordination of their decisions as well as control over their pooled resources through the implementation of formal strategic centers empowered with statutory authority over strategic investments. However, they differ from a firm in that parties remain legally distinct entities with coordination capacity limited to pooled resources. As a result, the allocation/appropriation of residual gains represents a major challenge, overcome essentially through tight, informal relationships. Joint ventures in R & D projects or strategic alliances in the airline industry are examples. In between (zone 2b) are governance structures in which partners keep full control over the hard core of their assets, although they simultaneously develop some relationship-specific investments that require delegating significant decision rights. Such arrangements tend to rely on independent third parties to monitor tensions and coordinate efforts, whether the third party is a public or semi-public entity, as with the organizations that certify origins and/or quality in the European food industry, or a private one, as with ‘private voluntary standards’.

I submit that almost all types of hybrid governance fall into one of these categories.Footnote 16 This typology also suggests the existence of an underlying logic to the variety of arrangements in market economies, substantiating what Coase (Reference Coase1992) called ‘the institutional structure of production’. References to Williamsonian contributions as well as to the relational contract literature also suggests an integrative theoretical framework taking on board hybrids as well as markets and hierarchies and allowing to better understand the complex trade-offs that go beyond the initial ‘make-or-buy’ dualism.

4. Looking ahead: a progressive research agenda

Notwithstanding the large set of contributions on inter-organizational arrangements already published, the research program on hybrids remains a work in progress, with new terrains to explore and new puzzles to solve. Here I mention a few.

4.1 The status and role of relational contracts

The recent literature on relational contracts opens a promising avenue for modeling and testing the functions of a core device at work in hybrids and for contributing to their inclusion into a post-Williamsonian model of governance structures. In a nutshell, relational contracts establish how contractually based collaboration among parties can facilitate adaptation and provide dispute-solving mechanisms, defining a governance so dependent on parties' relationship that it cannot be enforced by a court (Arrunada and Zanarone, Reference Arrunada and Zanarone2020; Gibbons, Reference Gibbons2021, section 3). Here, I focus on their role in hybrids.Footnote 17

A central assumption in that respect is that hybrids prosper thanks to their comparative advantage when it comes to unprogrammed adaptation. Because they rely upon contracts that presume incompleteness and target establishing and securing relationships sustained by the promise of the future, they help to minimize the risks of hold-up, haggling, and other contractual hazards. As stated by Goldberg (Reference Goldberg1980: 339): ‘…parties will be willing to absorb a lot of apparent static inefficiency in pursuit of their relational goals’.

However, the relational characteristics of these incomplete contracts may also create hurdles when it comes to identifying their specific role in hybrids. First, as mentioned above (see also Figure 2), relational contracts can also play a role in some markets, as when two firms repeatedly trade together without pooling resources; and definitely in firms, typically within the employment relationship. So far, almost all empirical tests on relational contracts relate to hybrids, a point acknowledged by Gibbons (Reference Gibbons2010; see also Gil and Zanarone, Reference Gil and Zanarone2017). Nevertheless, a puzzle remains that requires further exploration: what makes relational contracts in hybrids different (if they differ) from those operating within firms? Do they have characteristics that make them specific to non-integrated settings? Second, the incompleteness that is central to explaining why parties rely on relational contracts is also the source of potential problems. For example, sharing rules in hybrids are often blurred, which may reduce incentives to cooperate or even feed temptations to renege, motives that the expected losses from exiting do not fully counter. Moreover, contractual incompleteness might generate problems of coordination or even lead to costly (and potentially destructive) conflicts, for example, because of diverging interpretation among partners about how to adapt and/or how to share costs of adaptation (Gibbons, Reference Gibbons2021). Resulting transactional failures suggest the need to dig deeper into other aspects of the mechanisms of governance of hybrids that make them sustainable.

4.2 Looking for specific control mechanisms

These gaps and limits of a purely contractual approach suggest that motivations behind the existence of hybrids (parties expect gains from cooperation) and their stability (parties expect gains from co-specialized investments to durably exceed their value in alternative uses) need to be secured by ‘relational governance’, which exceeds the role of relational contracts (Poppo and Zenger, Reference Poppo and Zenger2002). This issue is particularly challenging since the coordinated use of assets in hybrids complements and/or competes with other activities that do not fall under the agreement. As Malcomson (Reference Malcomson, Gibbons and Roberts2013: 1059) pointed out, ‘Relational contracts in these models are a substitute for enforcement by courts, not a substitute for careful planning’.

This is to say that contracts cannot do it all! The sovereignty of partners to hybrids is a continuous source of strain, with securing the stability of the arrangement often synonymous with debunking the autonomy of partners! Finding the appropriate equilibrium in the allocation and operation of decision rights relies on combining formal control mechanisms and informal components to infuse order in joint activities and to mitigate conflicts while allowing benefits from mutual gains (Williamson, Reference Williamson1996: 12; Ménard, Reference Ménard, Gibbons and Roberts2013a: 1088). The existing literature has mostly focused on the formal aspect of the relationship. Although much remains to be done in this direction, less formal components have been largely neglected if not treated with disdain, particularly among economists. Informality can take many directions, from modalities to smooth conflicts and limit costs of monitoring (e.g. imposing constraints to exit, or creating joint problem-solving procedures), to the exercise of authority (e.g. empowering a strategic center, creating private courts, or using threats, typically ostracism), or the reliance on social ties and trust (e.g. easing mutual adaptation through shared values embedded in communities, clans, clubs). Trust, for example, may contribute to the explanation of the type of hybrid chosen for coordinating similar transactions depending on the set of values and social environment in which it develops (Williamson, Reference Williamson1996: 256 sq.). Behind this variety of solutions is the search by partners to hybrids to find ways to reduce transaction costs by facilitating the convergence of expectations and conformity to the rules. These widely ignored components of ‘private ordering’ at work in hybrids deserve much more consideration.

4.3 Sharing rules

Parties' acceptance of interdependence and their renunciation of strategic rights in the expectation of jointly generating rents superior to what a non-cooperative organization of transactions could provide are central to the sustainability of hybrids. The main term here is ‘jointly’. In an environment characterized by co-specialized investments and uncertainties that saddle hybrids with non-contractibilities, establishing rent-sharing rules that can check opportunism and motivate sustainable commitment is quite a challenge. Indeed, such rules require the prospect for each participant to: (1) remain the residual claimant on payoffs from assets not pooled; (2) expect a ‘fair’ share of the rent generated by joint assets; and (3) even benefit from spillover effects (e.g. the reputation of joint activities benefiting transactions unrelated to the arrangement). Without appropriate sharing rules, parties are motivated to scale back their investments, become less flexible with respect to needed adaptation, forgo activities raising hazardous measurement problems, or even exit the agreement.

The problem is that we know very little about sharing rules in hybrids, with the possible exception of franchising. For arrangements that typically operate in a context in which non-contractibilities are unavoidable, capturing these rules into tractable forms is particularly challenging, which is exactly what Macaulay (Reference Macaulay1963) pointed out when he emphasized the role of ‘handshake’ based on trust in inter-firm agreements.

4.4 Plural forms

Although identified over two decades ago (Bradach, Reference Bradach1997; Ménard, Reference Ménard1996), the existence of plural forms is another puzzle that has recently attracted renewed attention. The idea of plural forms actually refers to two different situations. In one situation, competing organizational arrangements (e.g. a firm and a hybrid) persistently coexist operating in the same sector, delivering homogeneous products, using similar technologies, and mobilizing comparable assets so that the transactions at stake are quite similar (Ménard, Reference Ménard2004: 26). In the other situation, different arrangements chosen by the same firm coexist to organize similar activities (e.g. organizing part of their transactions in-house and part through inter-firm contracts – Ménard, Reference Ménard2013b).

One question raised by these non-standard arrangements concerns their stability over time and, more generally, the dynamics of hybrids. Are these plural forms transitory, a step toward recourse to markets (e.g. outsourcing) or full integration (e.g. learning from outsiders before absorbing them)? And if they are resilient, what are the sources of their comparative advantage with respect to the choice of polar forms (markets; unified firm) or even of more standard joint ventures? Although elements to answer these questions exist (some can be derived from section 3), they remain limited when it comes to explaining the internal dynamics of hybrids and how they evolve over time with respect to the alternative choice of markets or integration. Exploring these issues open paths for future theoretical as well as empirical investigations.

4.5 Challenges to competition policies

Existing competition policies remain largely based on the dualism of markets versus hierarchies. Indeed, most assessments (and debates) about anti-competitive cases rely on the examination of the behavior of targeted firms (e.g. is their merger motivated by a strategy to control the relevant market?) and/or the existing market structure (e.g. does it unduly favor one firm?). Because participants in hybrids share some rights and cooperate accordingly, for example, by accepting geographical restrictions, while simultaneously competing in other dimensions, for example, to attract buyers from the same market, these arrangements challenge well-established competition policies.Footnote 18 Variations in decisions made by competition authorities (e.g. determining unfair trading practices with respect to these arrangements –see Falkowski et al., Reference Fałkowski, Ménard, Sexton, Swinnen, Vandevelde, Di Marcantonio and Ciaian2017) or even in the rules that should apply to these arrangements (e.g. the fluctuating position of the European Union regarding producers' organization in the agrifood sector) illustrate the difficulty the existing policies face.

Debates surrounding these issues also point out the role of institutions in making room for the development of hybrids and/or in determining the type of hybrid chosen. A promising approach to these questions has been to consider shifts of parameters in the initial Williamsonian model (e.g. Oxley, Reference Oxley1999). However, there is only an embryo of research on these issues. We need to know much more about how the institutional environment impacts these parameters, therefore the choice of going hybrid and the choice of a specific type of hybrid. First, the legal status of hybrids remains uncertain, particularly with respect to the allocation of property rights and the liabilities of participants. Fluctuations in legislation and in decisions from competition authorities are illustrative. As pointed out by Hodgson (Reference Hodgson2015, chaps. 4 and 8) and Gindis (Reference Gindis2020), legal considerations are central to capture the essence of organizations understood as institutional arrangements. Second, there is also the need to better identify and understand the transmission mechanisms operating through the ‘meso-institutions’ that link the general rules of the game, defined at the macro-institutional level, and the actual modalities of organizing transactions at the micro-institutional level (which includes hybrids). A better and more detailed knowledge of these interactions requires solving measurement problems in order to comparatively assess the conditions under which hybrids are superior to alternative arrangements (e.g. with respect to consumers, or to innovation) and to capture the impact of different institutional environments on the choice and performances of ‘discrete structural alternatives’, including hybrids.

Much remains to be done on these issues. Gaps in theory as well as in empirical research have led some economists to question whether we need a concept of hybrid rather than sticking to the traditional dichotomy of markets and firms (Hodgson, Reference Hodgson2002) or whether a theory of hybrids going beyond case studies is at all possible (Masten, Reference Masten1996). From a very different perspective, numerous contributors have endorsed Alchian and Demsetz (Reference Alchian and Demsetz1972) who considered that all contracts share fundamental properties, whatever the type of organizational arrangements, so that there would be a perfect continuum from markets to within firms. In that respect, I fully share Williamson's view (Reference Williamson1996: 94) that such considerations do not allow us to capture the richness of the mechanisms of governance populating market economies and that we need a theory of ‘discrete structural alternatives’. By analogy, abandoning this research agenda would be like concluding that since all cells in human organs share similar properties (also shared with other mammals) differentiating organs or specie does not matter.

5. Conclusion

Williamson did not initiate the analysis of what he (lately) identified as hybrids. Numerous empirical studies of various forms of inter-organizational arrangements were already available when he published his 1991/1996 article on ‘The Analysis of Discrete Structural Alternatives’. What he did, and this was a major breakthrough, was to introduce a framework to capture the essence behind the variety of these arrangements and to position them in relation to the alternative solutions of markets and hierarchies that he had already explored. Williamson's shift in focus with his increasing attention to hybrid organizations also illustrates his openness to new ideas and his commitment to understanding real-world phenomena, a position he shared with the other founders of New Institutional Economics.

Whether the term hybrid will prevail over time or not, the central perspective opened by Williamson will remain accurate: there is a whole set of transactions that cannot be understood through the traditional lenses provided by market theory or the properties of integrated organizations. These transactions develop through non-integrated settings, with transaction cost economics providing concepts to analyze these arrangements in a unified theoretical framework. Even contributions not endorsing this perspective refer to these concepts, whether to reformulate them, extend them, or challenge their relevance.

Although I had been in touch with Williamson before, I had the chance to spend a full year in Berkeley when the 1991 article was published. It immediately resonated since I was working on inter-organizational arrangements at the time. Needless to say, numerous discussions followed that year and thereafter. Although I have never been a ‘formal’ student of Williamson, I learned so much from his contributions that I definitely consider him my mentor, as well as my long-time friend. His departure is a big personal loss and, much more importantly, a big loss for economics and more broadly for the social sciences. But I am persuaded that his analysis of hybrids, and more generally his contributions to the economics of organizations, will remain a corner stone for future research on the variety of organizational arrangements that provide the backbone of modern economies.

Acknowledegements

Special thanks to Robert Gibbons, John Groenewegen, Geoffrey Hodgson, Mary Shirley, and three anonymous referees for their very useful comments and suggestions on the first draft of this article. The usual disclaimer fully applies.