The main UK political news since the February Review is the surprise call for a general election, to be held on 8 June. Financial markets appear to have viewed this development positively, perhaps based on electoral polls which suggest the Conservative Party would be returned to government with an increased majority strengthening the position of the Prime Minister as the country embarks on a negotiated withdrawal from the EU.

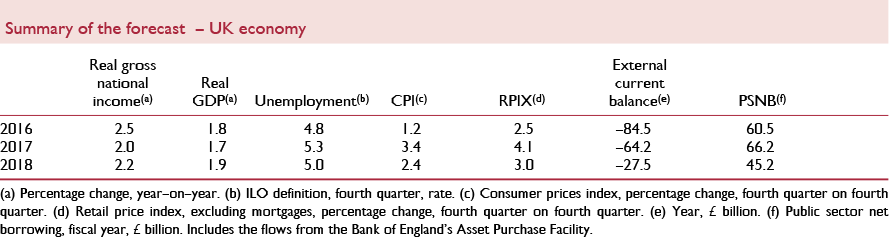

The economy expanded by 0.3 per cent in the first quarter of 2017; a marked slowdown from the rate of growth experienced in the previous quarter. The slowdown can be largely attributed to a softening in service sector output, consistent with a moderation in consumer spending, which was the engine of growth in 2016. We expect consumer spending to remain weak throughout this year and next as rising inflation erodes the purchasing power of households. Overall we forecast GDP growth of 1.7 and 1.9 per cent this year and next. These projected below trend growth rates are unchanged from what we published in the last Review.

We project consumer price inflation to peak at 3.4 per cent in the final quarter of this year, before gradually returning back towards the Bank of England's 2 per cent target. We expect the Monetary Policy Committee to look through this temporary spike in inflation and to maintain Bank Rate at 0.25 per cent until mid-2019, after which it tightens gradually by around 50 basis points per annum.

The labour market continues to be robust, with an unemployment rate of 4.7 per cent and the working age population employment rate reaching a record high of 74.6 per cent in the three months to February 2017. Despite the strong performance of the labour market, real wage growth remains subdued, perhaps indicating that some slack remains.

The Spring Budget contained few significant spending or taxation announcements, and thus our fiscal forecast remains largely unchanged from our February Review. We project public sector net borrowing to decline over our forecast period, from 3.2 per cent of GDP in fiscal year 2017–18 to just 0.2 per cent in 2021–22. The current fiscal rule requires the public finances to be returned to balance within the next Parliament, but the snap election call has brought forward the end of the next Parliament by three years. The modest amount of borrowing we project for 2021–2 now implies further fiscal consolidation is needed to ensure the current fiscal rule is not breached.