A. Introduction

Article 2 of Protocol No. 3 on the Statute of the Court of Justice of the European Union states that “[b]efore taking up his duties each judge shall … take an oath to perform his duties impartially and conscientiously….”

It has long been recognized that judges are not able to exclusively decide cases based on legal principles. Some legal realists suggest that the final judgment is influenced by the political or philosophical opinion of the judge.Footnote 1 Others argue that the sex and race of the judgeFootnote 2 or the potential gain for his or her personal careerFootnote 3 play a major role when making a judgment. From a more fundamental perspective, recent research by psychologists and behavioral economists shows that regardless of the political viewpoint, sex, or personal career opportunities, judges make systematic and predictable errors.Footnote 4 Behavioral economics does not deny that judgments may be affected by political or other personal interests, rather it suggests that judgments are considerably influenced by rules of thumb—so-called heuristics and biases—wholly apart from political orientation and potential personal benefits.Footnote 5 As one is not able to control the application of such mental shortcuts, Article 2 of Protocol No. 3 may be overcharging human capabilities by prescribing to decide impartially and conscientiously.

So far, experiments have been conducted to test the impact of selected cognitive illusions to sentences in criminal law cases, the amount of damages awarded in civil law disputes, and judges’ perceptions of diverse factual and legal issues covering cases from illegal immigration to fictional statutes regarding a Medical Marijuana Access Law.Footnote 6 Yet presently, there are no studies concerning the application of EU law.Footnote 7 At the same time, there is no reason to assume that EU judicial decision-making is exclusively shielded from cognitive biases.Footnote 8 On the contrary, due to the underlying common neurological processes which are unlikely to change depending on the field of law, it can be expected that heuristics and biases have just as much influence. For instance, when assessing the importance of public security within the proportionality test, courts are very likely to overestimate the danger of a terrorist attack given that such events are generally overrepresented in mass media.Footnote 9

The main goal of this Article is to raise awareness of the fact that there are infinite situations in which cognitive illusions affect judicial decisions. This fact needs to be acknowledged and consequently addressed if an impartial application of the law is to be upheld as required by Article 2 of Protocol No. 3 on the Statute of the Court of Justice of the European Union. Instead of conducting studies with regard to the influence of particular biases on one or more selected issues of European law, it seems beneficial at this stage of the academic debate to analyze the importance of behavioral economics for judicial decisions in EU law more broadly. In this way, it provides the basis for more targeted empirical testing. Arguably more importantly, the fact that there are infinite applications requires one to identify the underlying mechanisms of partially biased decision-making in order to develop more general means to mitigate or even eliminate cognitive biases rather than to focus solely on specific examples.

Consequently, the first part of this Article will outline the historical emergence of behavioral economics, its major claims and underlying psychological assumptions. Moreover, behavioral economics as a field and the literature on cognitive biases in particular are not universally endorsed and its major critiques will have to be addressed as well. This discussion is necessary due to the fact that behavioral economics strongly deviates from traditional economic models based on rational decision-making and to understand why it will be a major—if not impossible—task to eliminate all biases. The second part will discuss how cognitive biases play an important role within judicial decision-making in EU law, thereby analyzing the effects of some cognitive illusions—namely the anchoring effect, availability bias, zero-risk bias, and hindsight bias.

To show the far-reaching impact of biases and their effects on innumerable aspects of the decision-making process, as well as to emphasize the overall value and importance of behavioral economic findings for understanding, evaluating, and improving EU judicial decision-making, the analysis of selected biases shall relate to diverse legal issues. To be precise, I will examine: (1) The role of the reporting judge and the Advocate General; (2) the balancing approach within the proportionality test; (3) the remoteness test; and (4) the long- lasting debate on the boundaries of the Dassonville formula. Needless to say, such vast areas will not be discussed holistically but only from a behavioral economic perspective.

The Article will finally suggest means to mitigate or even eliminate biases. More specifically, the analysis will argue favorably regarding the use of economic models to determine the impact on fundamental freedoms and the adaption of judicial training pertaining to behavioral economics, and cognitive psychology. Moreover, the establishment of a de minimis rule and an unbiased jury with regard to specific factual issues will be proposed. Although such changes are a necessary first step, it does not seem feasible to avoid or mitigate all cognitive illusions. For this reason, in the more or less distant future, judgments based partially on artificial—rather than natural—intelligence may well be considered a possible alternative or supplement to achieve greater fairness, consistency, and legal certainty provided the accompanying risks of such endeavor can and will be taken care of.

B. Setting the Stage: The Foundations of Behavioral Economics

The concept of the homo economicus assumes that human beings are self-interested and make rational decisions based on facts, evidence, and preferences.Footnote 10 Human beings are therefore often considered as “resourceful, evaluating and maximizing.”Footnote 11 Studies conducted to evaluate the actual behavior of humans—especially when deciding under uncertainty—criticize this model. They suggest that, first, individuals do not merely act self-interested in terms of maximizing their own well-being and, second, they do not always decide rationally. In the following, these two major claims of behavioral economics will be briefly outlined by introducing studies concerning fairness games as well as prospect theory in order to form the basis for the more specific analysis of the effects of certain biases on EU judicial decision-making in the third part of this Article.

I. Fairness Games

Although the critique on the notion of rationality as part of the concept of the homo economicus has been far reaching, economic scholars of game theory have focused on disproving the element of a self-interested human being. Particularly, studies concerning the dictator and ultimatum game Footnote 12 illustrate that human beings may choose fair behavior over self-interest.

The classic ultimatum game is based on two players, who are unknown to each other. One of the participants will make an offer to the other participant on how to share a certain amount of money. If the other participant accepts the offer, then the money will be shared accordingly. If the other participant rejects the offer, then neither of the participants receive any money. Negotiations are not permitted. A self-interested, maximizing homo economicus would propose that she should get as much money as possible, whereas the responder of the offer will be left with as little money as possible. Moreover, the homo economicus on the receiving side of the offer would accept any offer, as it is better than receiving nothing at all. For example, if the tenderer makes an offer to share $100 by proposing that she gets $99.99, whereas the responder would get $0.01, the responder would accept. Knowing that the responder acting as a homo economicus will accept even the tiniest amount, the tenderer has reason to offer such tiny amount in the first place. On the contrary to such prediction, studies routinely show that the most frequent offer is a 50/50 split,Footnote 13 whereas, on average, the offer is a 63/37 split.Footnote 14

Such studies do not prove that the tenderer values fairness over self-interest because she might simply be aware of the risk that the responder may reject the offer and—for this reason only—offers more than $0.01. The experiment nevertheless shows that the responder does not act in accordance with the highest self-interest, for offers below 20% of the amount to split were routinely rejected.Footnote 15 It is therefore argued that the receiver incorporates fairness considerations into her decision.Footnote 16 At last, it should be noted that the absolute amount of the offered share does not make a difference. People in these studies did not behave more or less self-interested when the stakes were higher. Even when the offered amount was equal to wages of several months, individuals rejected offers on the same basis as individuals who were facing a relatively small amount of money.Footnote 17

The experiment of the so-called dictator game focuses primarily on the player making the offer. In this scenario, the responder does not have the option to reject the offer. In fact, she is not able to act within the experiment at all. Although the concept of a self-interested human being suggests that the offeror will take 100% of the amount, only 36% of the proposers choose to do so, while 64% decide to give the other party some portion of the resources.Footnote 18 Thus, the dictator game shows that human beings do not merely act self-interested, thereby shedding serious doubts on a crucial element of the concept of the homo economicus. The universalFootnote 19 human desire to be fair leads to choices that significantly deviate from purely self-interested economic models.Footnote 20

II. Rationality, Expected Utility, and Prospect TheoryFootnote 21

The conception of the homo economicus has also been reviewed on the element of rationality. The first major critique was made in 1955 by Herbert Simon’s widely discussed article on “bounded rationality.”Footnote 22 Accordingly, the rationality of human decisions at risk is limited because humans cannot calculate probabilities for any potential event that may or may not happen.Footnote 23 More broadly speaking, they are not able to access all of the relevant information needed to make a decision.Footnote 24 Human beings do not know all alternatives and potential outcomes and, hence, cannot accurately calculate the likelihood and value of such outcomes actually happening.Footnote 25 For this reason, Simon concludes that humans choose the first option that satisfies them and which they recognize as such.Footnote 26 This so-called process of satisficing is contrary to the concept of the homo economicus, which would argue that one always chooses the optimal alternative, thereby optimizing.Footnote 27 Although Simon was able to show that human cognitive abilities are not infinite and therefore boundedly rational, he did not describe how boundedly rational people actually make their decisions.

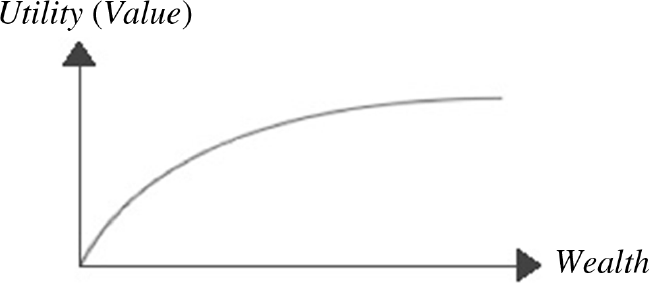

In 1979, Amos Tversky and Daniel Kahneman introduced prospect theory, arguably the greatest influence of psychology on the field of economics.Footnote 28 KahnemanFootnote 29 and Tversky took on the theory of decision-making under uncertainty that can be traced back as far as to Daniel Bernoulli in 1738. Bernoulli showed that the same dollar may be valued differently. That is to say, the utility depends on the current wealth of the person making the decision.Footnote 30 In fact, a wealthier person will find lesser value or utility in an economically beneficial outcome than people in poverty. As Thaler puts it, “to a peasant, a $100,000 windfall would be life-changing. To Bill Gates, it would go undetected.”Footnote 31 The following graph illustrates the widely accepted concept of the diminishing marginal utility of wealth—in other words—the fact that utility does not increase linearly with an increase in wealth (see Figure 1):

Additionally—and more importantly for the purposes of this Article—the graph is able to explain risk aversion. For example, if one had the option to choose between a certain gain of $1,000 or to get a 50% chance of gaining $2,000, one would always prefer the first option because the first $1,000 is valued higher than the second $1,000 due to diminishing marginal utility of wealth.Footnote 32

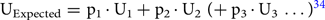

The theory of how to make decisions under uncertainty as introduced by Bernoulli was further developed by Neumann and Morgenstern and finally named expected utility theory.Footnote 33 To calculate the expected utility (UExpected), one needs to multiply the probability of a potential event (p1) happening with the utility of this event occuring (U1) and add the result from multiplying the probability of another potential outcome happening (p2) with the associated utility (U2). In case there are only two alternative outcomes, p2 equals 1 – p1.

UExpected = p1 · U1 + p2 · U2 (+ p3 · U3 …)Footnote 34

But, Kahneman and Tversky showed that expected utility theory partially contradicts people’s choices in reality. Instead of focusing on how people would make their decisions from the classical economic perspective, they set out to describe the actual choices people make.Footnote 35 Although prospect theory assumes that people try to maximize their utility, it also analyzes how—and to what extent—people’s decisions deviate in systematic and predictable manners. After all, it is a descriptive theory.

In particular, experiments show that choices made by participants depend on how the available options are framed. The fact that people may make different decisions over the same choice depending on the framing is illustrated by the widely discussed “Asian-Disease-Problem.”Footnote 36 In this experiment, Kahneman and Tversky asked participants to choose between two alternative treatments to combat an Asian disease, which is expected to kill 600 people.

I. If program A is adopted, 200 people will be saved.

II. If program B is adopted, there is a 2/3 probability that no people will be saved and a 1/3 probability that 600 people will be saved.

Accordingly, 72% of participants chose program A, to rescue 200 people for sure. Only 28% of the participants chose program B.Footnote 37 Such risk-avoiding behavior was not a big surprise, for Bernoulli’s discoveries in 1738 pointed toward that direction as well. Then, Kahneman and Tversky reformulated the outcomes of the potential treatments in the following way:

I. If program A is adopted, 400 people will die.

II. If program B is adopted, there is a 1/3 probability that nobody will die and a 2/3 probability that 600 people will die.

In this scenario, only 22% of the participants chose program A, while 78% chose program B.Footnote 38 Despite the outcomes of program A and B remaining exactly the same, participants chose differently. Although the decision of the vast majority of people in the first scenario could be described as risk averse, participants in the second scenario chose the riskier option. Because of this, Kahneman and Tversky concluded that when looking at gains, people are risk averse, whereas people are risk seeking when facing losses.Footnote 39 Consequently, people’s risk attitudes and decisions depend on how the available options are framed. This so-called framing effect Footnote 40 is a crucial part of prospect theory, yet there are many more systematic heuristics and biases.

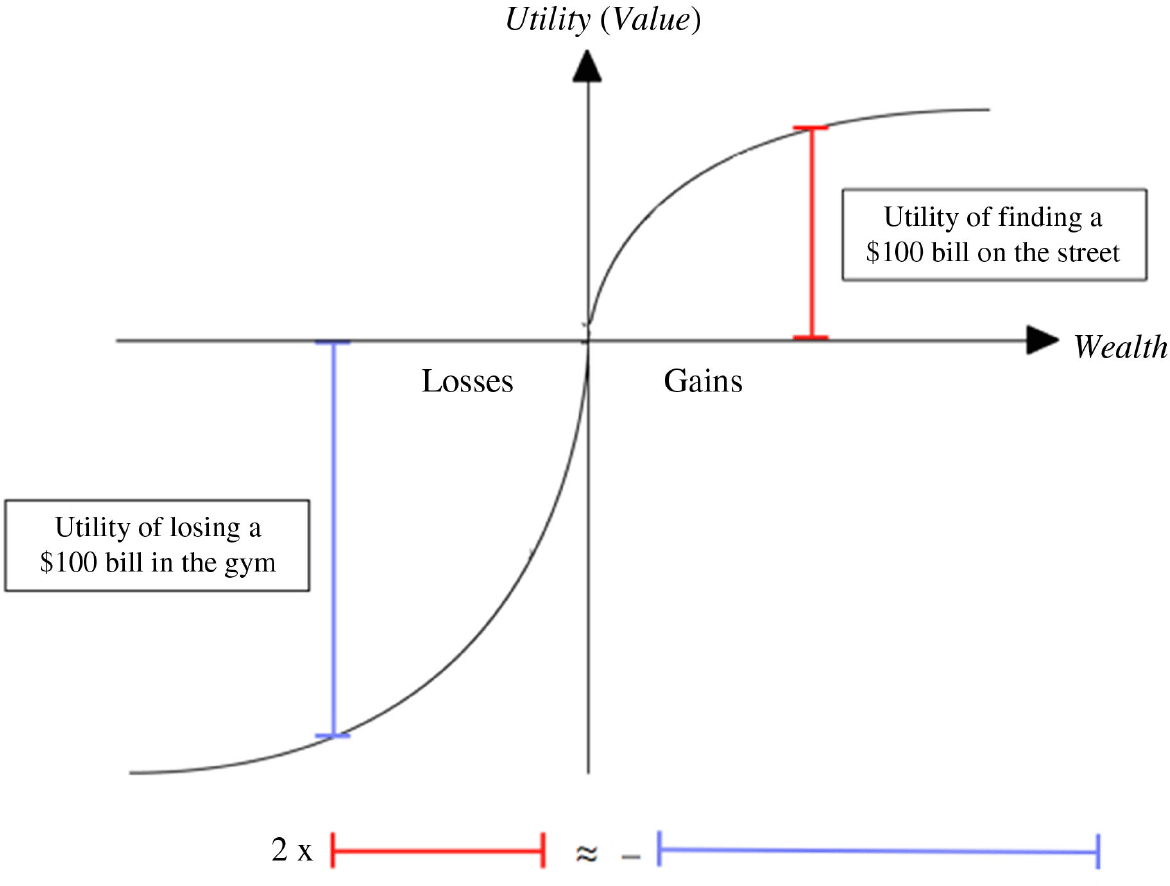

Another central element of prospect theory is the concept of loss aversion.Footnote 41 Loss aversion describes the tendency to prefer avoiding losses to acquiring gains. Simply put, people hate losing more than they like winning which is contrary to what expected utility theory suggests. The value of gains and equivalent losses is illustrated by Figure 2Footnote 42 below. For instance, people would hate to lose a $100 bill more than they would be happy about finding one. To be more precise, humans seem to hate losing about twice as much as they like winning.Footnote 43

Figure 1. Diminishing Marginal Utility of Wealth.

Figure 2. Value Function. The Utility of Losing and Finding $100 bills.

One example of loss aversion is the endowment effect. In a famous study at Cornell University, half of the participants were given a Cornell coffee mug while the other half did not get anything.Footnote 44 Any rational choice theory would suggest that the price that the owner of the mug wants to receive for selling the mug is on average the same as the price that the participants who did not get a mug in the first place are willing to pay. But the experiment showed that owners requested roughly twice as much—on average about $5.25—than potential buyers were willing to pay—on average about $2.50.Footnote 45 A similar study conducted by Krueger found that fans who were able to buy a ticket for the Super Bowl for $400 or less would not have been willing to pay $3,000, but they were also not willing to sell the ticket for $3,000.Footnote 46 Many related studies followed, confirming that owners value a good about twice as much as potential buyers, thereby determining the intensity of the endowment effect.Footnote 47

The result of such studies can be explained by the immediate effects of the broader principles behind loss aversion. While mug owners consider selling the mug as losing, buyers consider the transaction as gaining a mug. The reason why humans weigh losses twice as much as they weigh gains remains highly uncertain and widely discussed. Though, it should be noted that this work concentrates on the value of taking into account the effects when making judicial decisions, rather than discussing potential evolutionary psychological reasons, which may be able to explain such effects.Footnote 48

Despite the fact that there are different approaches to the notion of rationality, understanding this concept requires at the very least coherency among an individual’s choices. Because the decisions and preferences partially contradict each other, real-life human decision-making cannot be qualified as rational from the vast majority of perspectives on rationality and clearly not from the point of view of the traditional rational choice model. Crucially, this is so, regardless of whether the use of heuristics itself is rational. There may even be good evolutionary explanations for using fast and intuitive thought processes over slow and deliberative thinking. But, while the meta-decision to use more effective thought processes most of the time may be rational, the fact that more specific decisions deviate from those, that the concept of the homo economicus would predict, is sufficient to question the rationality of such decisions.

III. The Impact and Relevance of Behavioral Economics

Although prospect theory is a descriptive theory—which is usually less accepted by economists—its implications have been wide and intense.Footnote 49 Behavioral decision theory, as the field was primarily called in the 1980s and 1990s, led to many experiments being conducted by leading economic scholars such as George Akerlof,Footnote 50 Colin Camerer,Footnote 51 Matthew Rabin,Footnote 52 Reinhard Selten,Footnote 53 and Richard Thaler.Footnote 54 Financial theorists were among the first to reexamine their models, for instance the efficient market hypothesis.Footnote 55 In January 2015, the World Bank recognized that “organizations should implement procedures to mitigate [biases], and [this] may alter the entire field of development economics.”Footnote 56 Numerous governments have installed specific teams whose work is based on applying the findings of behavioral economics, such as the Behavioral Insights Team in the UK and Peru or the Nudge Units in, among others, the US, Australia, Germany, and Singapore.

Since the 1990s, the influence of behavioral economics on law is on the rise. Research—mostly conducted in the US—tries to implement the relevant findings towards different legal issues. The field—which is often referred to as behavioral law and economics—has been gaining more attention since the publication of Sunstein, Jolls and Thaler’s “A Behavioral Approach to Law and Economics.”Footnote 57 This article became the most cited source in legal studies since 1991Footnote 58 and the number of contributions in the field, mainly in the US,Footnote 59 has been rising ever since. Vast areas including European Union law, however, remain widely untouched.Footnote 60

It is crucial to note that biases and heuristics apply to all humans involved in a decision-making process. With regards to financial markets, an investor may analyze how she forms a choice herself. At the same time, it also may be relevant to explore how other participants in the relevant market act and how this may influence one’s own decision. As for judgments by the European courts, there are two potential dimensions in which an investigation into the importance of taking behavioral economics into account seems promising.

First, behavioral economics is able to predict reactions of the addressee of the judgment—at least to a certain extent and perhaps better than any rational choice model could do.Footnote 61 Because EU law is—to a great extent—based on case law, the judgment of the European Court of Justice (“ECJ” or the “Court”) arguably implies a legislative character.Footnote 62 From this perspective, the evaluation of cognitive illusions may be particularly useful with regard to any consumer related law.Footnote 63 As interesting as this first dimension may sound, this Article will focus on a second dimension: The impact of cognitive illusions on judicial decision-making within the European Union courts. Instead of concentrating on decisions and preferences of the addressees of the judgment, systematic biases of the judges themselves are the point of focus.

IV. Critique of Behavioral Economics

So far, it has been shown that heuristics such as the anchoring effect may play a significant role when making everyday decisions. But do heuristics and biases really occur when making important decisions? And do they still occur when experienced judges or experts make their decisions?

The argument that biases do not apply to experts—whether economists, sociologists, or lawyers—is one of the major critiques of behavioral economics. Yet, many studies show that experts, including judges, are just as likely to rely on irrelevant factors as any other person.Footnote 64 For instance, Englich and Mussweiler asked German judges with courtroom experience of, on average, 15 years to give a judgment on a specific criminal law case.Footnote 65 If the prosecutor pleaded for a sentence of 34 months’ imprisonment, judges on average decided to give a sentence of slightly more than 35 months.Footnote 66 Yet, if the prosecutor pleaded for 12 months’ imprisonment, judges on average decided to hand down a sentence of 28 months.Footnote 67

On the one hand, one may criticize such studies by outlining that biases do not appear when facing very important decisions such as real-life judgments by the European courts. In contrast to the many studies that have been conducted, when it comes to actual influential decisions to make, judges may be more motivated to give an accurate judgment. Additionally, one might argue that they have more time and resources to devote to the decision.Footnote 68 On the other hand, regardless of whether judges are able to obtain better background information or in-depth facts before making a decision, information and time will always be limited.Footnote 69 It has even been argued that more detailed information may lead to more powerful illusions.Footnote 70 It shall further be noted that if judges are unaware of the potential cognitive shortcuts, “extra time and resources will be of no help.”Footnote 71 Lastly, Kachelmeier and Shehata demonstrate that systematic errors such as the framing effect may still remain even if the outcome involves a two-month salary—showing that the decision was indeed a very important one.Footnote 72

The fact that experts are also biased can be explained by examining how the brain makes decisions more generally. Referring to the highly influential dual-process theory, Kahneman points out that there are two types of thinking.Footnote 73 While system 1 thinking may be described as fast, automatic, frequent, emotional, stereotypic, and subconscious, system 2 thinking is considered to be slow, effortful, infrequent, logical, calculating, and conscious.Footnote 74 The great majority—approximately 95% of all decisions individuals make—is merely based on system 1 thinking.Footnote 75 It is not only fast, but the decisions are also mostly correct in terms of maximizing expected value, making it a very efficient type of thinking. Case in point, a soccer player does not thoroughly analyze whether it may be better to pass the ball to the right or the left wing. She just does it. An employee does not reconsider everyday whether it may be better to take the bike or the train to go to work. She just takes the one she always uses, even though parameters such as the weather or the train schedule may have changed. And given the efficiency of system 1 thinking, it may itself be rational to rely mostly on system 1 thinking.

But, even if most of the decisions made by system 1 are correct and one can easily see that humans without the related thought processes will have significant problems in everyday life, the system will be mistaken at times. For example, in the previously introduced study by Englich and Mussweiler, German judges decided differently depending on the plead of the prosecutor thereby laboring under the anchoring effect. As it was already argued and empirically supported by Konecni and Ebbesen, judicial decisions are—to a great extent—based on system 1 thinking.Footnote 76 Even though judges are experienced, well-trained, and highly motivated decision-makers, they are vulnerable to cognitive illusions.Footnote 77 And for this reason, it is important to find methods to mitigate cognitive biases.Footnote 78

Another major criticism focuses on the theoretical basis of behavioral economics. Because there is no fundamental underlying theory, behavioral economics is not able to predict human behavior as well as rational choice theory.Footnote 79 In particular, Gigerenzer criticizes that behavioral economics achieves little more than describing certain phenomena, which are rather vague and not clearly defined.Footnote 80 There is no question that a clear and full-fledged theory of how humans actually make decisions would be a, or even the, great discovery. Nevertheless, it may still be beneficial to implement the findings of behavioral economics. In order to mitigate biases, knowing what biases could occur may be even more important than knowing why they occur, especially in relation to judicial decision-making.Footnote 81 Although a theory is, of course, preferable, behavioral economics at this stage may be better understood and used as a very pragmatic tool to improve judicial decision-making.Footnote 82 From this perspective, the lack of a consistent theory does not have major consequences for behavioral law and economics in general or for this Article in particular.Footnote 83

V. Summary

So far, it has been argued that the concept of the homo economicus does not accurately describe how humans behave in the real world. In particular, it was highlighted that two crucial elements—namely the self-interested and rational character of human decision-making—cannot be upheld given the findings of behavioral economists and cognitive psychologists. The research conducted by Tversky and Kahneman particularly points out that various cognitive illusions apply when making decisions under uncertainty. Although rules of thumb may lead to easier and faster decision-making and can ultimately be very efficient, they may also cause systematic errors. The efficiency of system 1 thinking makes it a great tool for everyday decisions, but when it comes to judgments of the European courts, it may be worthwhile to engage in system 2 thinking. As it is currently not feasible to switch deliberatively between different thought processes, it may be most beneficial to try to eliminate—or at least mitigate—the effect of cognitive biases. For this reason, the following analysis will come back to some of the abovementioned biases, their application in selected substantive and procedural legal issues, and will make concrete policy suggestions.

C. Applying Cognitive Illusions to EU Judicial Decision-Making

The third part of this Article is going to focus on the application of specific biases in the context of EU law with a special emphasis on the fundamental freedoms of the internal market. Given the fact that prospect theory is a descriptive theory, it seems advantageous to introduce selected biases by giving examples from recent studies. Hereafter, the relevancy of accounting for the specific cognitive illusion in the process of judicial decision-making regarding EU law will be examined. At the final stage of each analysis, potential solutions to overcome the bias will be discussed. The primary focus will lie on the anchoring effect (I.), availability bias (II.), zero-risk bias (III.), and hindsight bias (IV.).

I. Anchoring Effect

1. Introduction

Anchoring is a cognitive bias that describes the tendency of individuals to rely too heavily on the first piece of information offered—the “anchor”— when making decisions.Footnote 84 Once an anchor is set, the consequent decisions are made by adjusting away from that anchor.Footnote 85 But, people adjust insufficiently.Footnote 86 Even more problematic seems that anchors that do not provide any useful information may still influence the judgment. This concept applies even if the decision-maker knows that the initial information does not add any value to the decision-making process.Footnote 87

In one study, Tversky and Kahneman asked participants to spin a wheel of fortune.Footnote 88 The wheel was rigged to stop at either ten or at sixty-five.Footnote 89 After spinning the wheel, participants had to estimate the percentage of African countries in the United Nations.Footnote 90 When the wheel landed on ten, participants on average estimated that 25% of African countries are members of the United Nations.Footnote 91 Yet, when the wheel landed on sixty-five, participants estimated that 45% of African countries are in the United Nations.Footnote 92 Even payoffs for accuracy did not change the result.Footnote 93 In another study, participants—Group One—were asked whether Mahatma Gandhi died before or after the age of nine.Footnote 94 Other participants—Group Two—were asked whether he died before or after the age of 140.Footnote 95 Thereafter, both groups were asked at what age Gandhi died.Footnote 96 While Group One estimated that Gandhi died at the age of 50, Group Two estimated that Gandhi was 67 years old when he died.Footnote 97 Despite the fact that it was clear to participants that Gandhi certainly died neither at the age of nine nor at the age of 140,Footnote 98 the estimates of Group One and Two differed significantly,Footnote 99 hence, irrelevant information can have a great effect on the human process of decision-making.Footnote 100

The most striking study with legal implications concerning the anchoring effect may be the previously introduced results by Englich and Mussweiler regarding the impact of the prosecutor’s pleaFootnote 101 or the rolling of dice before handing down a sentence.Footnote 102

2. Reporting Judge and Advocate General: Spotting Anchors within the Procedure

As these examples show, the anchoring has a significant effect on people’s decision-making process regardless of whether the anchor provides useful guidance or not. Because the effect applies to laypeople as well as to experts, there is no reason to assume that decisions of judges applying EU law are not affected. It is therefore crucial to consider where potential anchors are located and how to avoid them. Two of the potentially countless sources of anchors are rather obvious and play a significant role within judicial decision-making in EU law: The reporting judge and the Advocate General.

The most notable work of the Advocate General is to deliver a written opinion, the so-called reasoned submission, which is often referred to as the “starting point” for the deliberation of judges.Footnote 103 Indeed, the influence of the Opinion of the Advocate General is significant, perhaps illustrated by the fact that most judgments follow the Opinion.Footnote 104 For instance, the ECJ in Chen Footnote 105 cited the Advocate General almost exactly. Still, one must bear in mind that simply following the Advocate General’s proposal does not mean that those judges were biased. After all, it may well have been the correct way to solve the particular case.

Arguably, the reporting judge may even produce a more distinct anchor, as she is preparing the preliminary reportFootnote 106 for the General Meeting (“réunion générale”), thereby setting the first—and psychologically most influential—anchor in the whole proceeding. Furthermore, the judge rapporteur delivers the first draft of the judgment, while the Advocate General is still preparing her Opinion. In the preliminary report, the reporting judge will already address the central issues of the case.Footnote 107 Thereafter, when solving the case, judges will often try to confirm what has already been suggested by the reporting judge, thereby suffering from the anchoring effect.Footnote 108

To completely eliminate the bias, it would be better if every single judge would solve the case on her own before looking at any draft or suggestions. As Guthrie et al. argue, “it is much easier to avoid stepping on a patch of ice than it is to keep your footing once you have stepped on it.”Footnote 109 At the same time, the function of the reporting judge is to make the chambers more efficient due to the immense workload.Footnote 110 Thus, an elimination of the cognitive bias in this way would go hand in hand with an elimination of the provided efficiency by this procedure. Yet, as Judge van der Woude points out, there may be a different, more efficient way to mitigate the bias. Instead of trying to confirm, judges should try to disprove what has been suggested and only if they are not able to do so, the suggestions made should be confirmed.Footnote 111 In fact, the process of trying to disprove what has been suggested can lead to thinking about alternative solutions, which can be a mitigating factor to many biases, especially to the anchoring effect.Footnote 112 This is particularly relevant for the anchoring effect because simply being aware of a potential anchor does not mitigate the effect.Footnote 113

Moreover, the ability to imagine alternative outcomes is based on creativity, which is particularly strong among groups.Footnote 114 In this regard, it shall be noted that more than 80% of cases for the European Court of Justice sit in in chambers of three or five judges.Footnote 115 An increase in the number of judges in every case—rather than only the most important or controversial cases—would certainly improve creativity, thereby mitigating the anchoring effect. In light of limited financial means, however, it seems questionable—although theoretically desirable—whether this could be achieved in practice.Footnote 116

To summarize, the anchoring effect is very difficult and costly to overcome. Yet, certain mental techniques—namely trying to think about alternative solutions—are able to limit the effect to a certain extent. Regarding this matter, judicial training in behavioral economics is necessary in order to mitigate the bias—a suggestion which will also be emphasized in the subsequent examination surrounding the availability bias.

II. Availability BiasFootnote 117

1. Introduction

According to Tversky and Kahneman, “people assess the frequency of a class or the probability of an event by the ease with which instances or occurrences can be brought to mind.”Footnote 118 The “most influential examination” so far has been carried out by Lichtenstein et al. in 1978.Footnote 119 In their study, participants were asked to consider pairs of causes of death—for example “strokes” and “all accidents combined”—before participants were asked to indicate which one causes more people to die.Footnote 120 Pertaining to the example already stated, 80% of respondents considered death by accident to be more likely than death by stroke.Footnote 121 In reality, strokes cause about 85% more death than all accidents combined.Footnote 122 Other examples showed that subjects considered death by accident and death by disease as equally likely, although death by disease is roughly 18 times more likely than death by accident. Tornadoes were seen as more likely to cause death than asthma, yet asthma is de facto 20 times more likely to cause death than tornadoes.Footnote 123

Although participants sometimes correctly identified the cause of death that occurs more frequently, their ratios given were far too large.Footnote 124 For instance, death by a motor cycle accident is indeed more likely than death by diabetes, however, participants assumed, on average, that it is 356 times more likely. In reality, motor cycle accidents are only 1.4 times more likely to cause death.Footnote 125 Lichtenstein et al. showed that frequencies of dramatic events such as cancer, homicide, and tornadoes are overestimated, whereas the frequency of “quiet killers” is underestimated.Footnote 126

The availability bias is closely related to the anchoring effect and, hence, similar problems arise when it comes to determining what the bias may cause. Nevertheless, there have been a tremendous amount of studies locating the source of the bias in different scenarios such as personal experienceFootnote 127 and media reports.Footnote 128 For instance, unusual events—such as shark attacks and airplane crashes—are often reported disproportionately in mass media, and thus people overestimate the likelihood of such events occurring in the future.Footnote 129

Research in behavioral law and economics so far has been mostly concerned with legislative bodies. This fact is relevant because cognitive biases are particularly strong when making decisions under uncertainty such as enacting new laws. Legislative bodies which usually enjoy a wide margin of discretion—for its members are often directly elected by the citizens—therefore need to conduct in-depth studies about the potential risks, effects, and unintended consequences of the law in question. At the same time, one must not forget that the judiciary often enjoys some discretion as well. Yet, while the issue of factual uncertainty remains providing a breeding ground for the availability bias, courts have been engaging much less with economic and statistical evidence concerning the effects of their judgment regarding the fundamental freedoms.Footnote 130 This lack of engagement is particularly true for the European courts. The following analysis will therefore start by briefly outlining the margin of discretion that the EU judiciary enjoys regarding both the application and justification of the fundamental freedoms before moving on to suggest ways to mitigate the availability bias with a special focus on the proportionality test.

2. The Judiciaries’ Margin of Discretion Regarding the Fundamental Freedoms

Regarding EU internal market law, scope and restrictions of the fundamental freedoms have been interpreted extremely widely by the European Court of Justice. Pertaining to the free movement of goods pursuant to Article 34 TFEU, the infamous paragraph five of Dassonville states that “all trading rules enacted by Member States which are capable of hindering, directly or indirectly, actually or potentially, intra-Community trade are to be considered as measures having an effect equivalent to quantitative restrictions.”Footnote 131 Because the subsequent case law—in particular Keck & Mithuard,Footnote 132Cassis de Dijon,Footnote 133Italy v. Commission (motorcycle trailers)Footnote 134 and Mickelsson & Roos (jet-skis)Footnote 135—missed out on establishing any clear boundaries, almost all measures enacted by a Member State somehow restrict the free movement of goods in terms of Article 34 TFEU. Similarly, Säger Footnote 136 and Alpine Investment Footnote 137 established a wide scope of the freedom to provide and receive services pursuant to Article 56 TFEU. With regard to the free movement of capital, the treaty itself, namely Article 63 TFEU, established a wide scope because it—in contrast to other freedoms—does not distinguish between discrimination-based and other restrictions.Footnote 138

In the “give and take world of Cassis de Dijon,” the wide application of the restrictions of the fundamental freedoms goes hand in hand with an equally wide scope of potential justifications.Footnote 139 Arguably, there are three main reasons for this phenomenon. First, the non-exhaustive list of mandatory requirementsFootnote 140 has been extending ever since and covers wide areas such as “consumer protection,”Footnote 141 “effectiveness of fiscal supervision,”Footnote 142 the “protection of the environment,”Footnote 143 “public health,”Footnote 144 and the “protection of national or regional socio-cultural characteristics,”Footnote 145 as well as more specific subjects such as the “protection of cinema as a form of cultural expression”Footnote 146 or the “protection of books as cultural objects.”Footnote 147

Second, some case law signals that the scope of the application of the already widely interpreted mandatory requirements is also extending. In particular, one is able to spot the tendency of the Court to apply mandatory requirements in cases of distinctly applicable measures. For instance, in Schindler, the Court justified a directly discriminatory measure by referring to consumer protection.Footnote 148 In the area of environmental protection, the Court refused to acknowledge that—for historical reasons—Footnote 149environmental protection has not been listed as a justification within the treaty but now needs to be applied equally. Instead, in Preußen Elektra Footnote 150 and more recently in Essent,Footnote 151 the Court circumvented the issue by simply applying “environmental protection” as a means of justifying restrictions to the market. It remains unclear whether mandatory requirements can still—as stated in Cassis de Dijon Footnote 152—be applied exclusively to indistinctly applicable measures or whether their scope has been broadened in general, or at least with regard to certain requirements, such as with the protection of the environment.

Third, the scope of fundamental rights has been broadened extensively due to a) their double-function as a “sword” and a “shield”Footnote 153 and b) the extensive interpretation of Article 51 of the Charter of Fundamental Rights in Franson.Footnote 154 From the extensive application of mandatory requirements and fundamental rights, it follows that more cases will be decided by balancing different fundamental freedoms and fundamental rights within the proportionality test.

3. Biased Balancing within the Proportionality Test

Although the proportionality test was initially meant to be a four-stage test,Footnote 155 in practice the test has become highly unstructured. The third and fourth stages of the test— namely whether the measure in question is “suitable for securing the attainment of the objective which the measure pursues”Footnote 156 and that it “must not go beyond what is necessary in order to attain it”Footnote 157—in several cases have been transformed to a single test of balancing.Footnote 158 On the one hand, this kind of balancing necessarily implies a great degree of discretion thereby “placing judges at the outer limits of their legitimate judicial role, where the judiciary risks substituting its assessment for that of the legislature.”Footnote 159 On the other hand, balancing among the different fundamental freedoms, fundamental rights, and general principles of EU law requires the European courts to assess on a case-by-case analysis which freedom or right prevails.Footnote 160 Accordingly, the courts must determine to what extent a right has been restricted and to what extent it is necessary to protect a right by declaring measures which would impose unjustified restrictions on the right or freedom in question as incompatible with EU law. To name a classic example, the Court in Schmidberger had to examine whether Austrian authorities granting permission for a demonstration on the Brenner motorway thereby closing the motorway for nearly 30 hours, was an unjustified infringement of the free movement of goods pursuant to Article 34 TFEU in conjunction with the principle of Community loyalty as now laid down in Article 4 (3) TEU.Footnote 161 In this situation, it was necessary to find a balance between the right to freedom of expression and assembly and the free movement of goods.Footnote 162

Needless to say, it is not practically feasible to measure the impact on fundamental rights directly. Even if there was such an instrument or at least good proxies, it remains uncertain whether a strong restriction to the free movement of goods could be justified by a slight infringement on the freedom of expression and assembly or vice versa. Thus, the courts are facing an inter-rights comparability problem that arguably may be one of the most difficult to overcome.

As cognitive illusions, such as the availability bias, apply when making decisions under such factual—and in this case additional legal—uncertainty,Footnote 163 one can only imagine the impact of sensational events extensively covered by the media, such as terrorist attacks and environmental catastrophes in Western societies, on the examination of the importance of the mandatory requirements in question. Individuals, including judges, will overestimate the likelihood of such an event reoccurring and will therefore—especially in the aftermath of the event—overvalue the danger to the environment or public security. This analysis does not suggest that overall environmental protection or public security should be decreased, rather it emphasizes that human intuitions are not accurately reflecting the true probabilities and dangers to the affected goods, which can lead to a false valuation process on the importance of such goods. If anything, the behavioral sciences indicate that humans tend to value future lives much less than those of the present, casting doubt on whether humans would act differently—that is to say, support stronger environmental protection measures—if they were immune to the present bias.Footnote 164 The purpose of this example is to illustrate the general fact that rare and sensational events vastly covered by the media are potential sources of the availability bias.

Though it is tough to grasp—or even prove—the extent to which judgments are based on the availability bias, it is crucial to acknowledge that the lack of proof of influences on the availability bias in specific cases does not mean that the bias did not affect the judgment. Luckily—and this is crucial to notice—it also does not signify that there are no means to mitigate such effects.

4. Mitigating Factors

There are a number of potential solutions to overcome the availability bias. First, several studies including those regarding judicial decision-making show that judicial experience can mitigate the availability bias.Footnote 165 For example, judges performed better than students in a number of different studies focusing on the availability bias.Footnote 166 But still, judges were biased to a significant extent.Footnote 167

Additionally, although there are decisions to make—such as the evaluation of the potential restriction to the freedom of expression and assembly in Schmidberger—that are unfeasible to cast into numerical figures, it should be recognized that economic models may be able to evaluate the impact on fundamental freedoms. For instance, in Schmidberger, the likely effects—from an ex ante perspective—of the Brenner motorway demonstration on the market, and more particularly on the free movement of goods pursuant to Article 34 TFEU, could have been analyzed. In this matter, it seems to be a mystery why the courts are treating economic evidence differently in cases involving matters of competition law and matters concerning the internal market.Footnote 168 The obvious solution is to add economists as consultants to the courts or simply to require relevant economic or statistical evidence—at least in very important decisions—to overcome the availability bias. Of course, a set of practical issues would then arise, such as what cases are sufficiently important to require such evidence.

A more promising and realistic way to mitigate the effects of the availability bias in the near future is again to educate judges about cognitive illusions. Judicial training in behavioral economics was already suggested with regard to the anchoring affect,Footnote 169 and the case for it is therefore strengthened. It should not go unnoticed that such training would be particularly beneficial with regard to the availability bias because sheer awareness of it will mitigate the effect.Footnote 170

III. Zero-Risk Bias

1. Introduction

In the late 1980s, parents of small children were asked to react to the following scenario:Footnote 171

(1) The insect spray you currently use costs $10 per bottle. This spray causes 15 inhalation poisonings and 15 child poisonings for every 10,000 bottles of insect spray that are used.Footnote 172

(2) You become aware of a more expensive insect spray, which would reduce the number of inhalation and child poisonings to five each for every 10,000 bottles used. How much would you be willing to pay for this spray?Footnote 173

On average, parents were willing to pay an additional $2.38 to reduce the risk by two thirds.Footnote 174 But, when parents were asked what they would pay to eliminate the risk completely, they were willing to pay an additional $8.09 on average.Footnote 175 This means that to eliminate the last third of the risk, parents were willing to pay more than three times as much as they were willing to pay to eliminate two thirds of the risk. Thus, how much a parent is willing to pay to eliminate risk depends not only on the level of risk itself—such as how much the risk would decrease—but also on whether this would eliminate the risk completely.Footnote 176

To explain the phenomenon, it is necessary to revisit prospect theory. Whereas any rational choice model would suggest that it does not matter whether you increase the chances of a lottery winning from 0% to 1%—or from 1% to 2%—because the likelihood increases in each case by exactly 1%, prospect theory is able to differ between “qualitative changes” and mere “quantitative changes.”Footnote 177 The increase from 0% to 1% creates the possibility of winning,Footnote 178 while the increase from 1% to 2% only makes the existing possibility more likely to happen. Similarly, the insect spray study illustrates that individuals value the elimination of a risk much higher than a mere reduction of the risk, even if the reduction has a greater value in terms of expected value.Footnote 179 The zero-risk bias therefore can be defined as the tendency to prefer the elimination of risk, even if alternative options produce a greater expected value. To express it differently: Individuals—including judges—overweigh small risks and are willing to pay more than the expected value to eliminate them altogether because the decision weights that people assign to outcomes differ from the probabilities of those outcomes.Footnote 180 The formula for rational decision-making by von Neumann and Morgenstern introduced earlier in this workFootnote 181 therefore needs to be changed in a way so that it resembles decisions weights (d1, d2, d3, … ) instead of real probabilities (p1, p2, p3, … ) if one wants to be able to predict human behavior more accurately. Consequently, the equation would state:

$${{\rm{U}}_{{\rm{Expected}}}}{\rm{ = }}{{\rm{d}}_{\rm{1}}} \cdot \cdot \cdot {{\rm{U}}_{\rm{1}}}{\rm{ + }}{{\rm{d}}_{\rm{2}}} \cdot \cdot \cdot {\rm{ }}{{\rm{U}}_{\rm{2}}}\left( {{\rm{ + }}{{\rm{d}}_{\rm{3}}} \cdot \cdot \cdot {{\rm{U}}_{{\rm{3\; \ldots }}}}} \right)$$

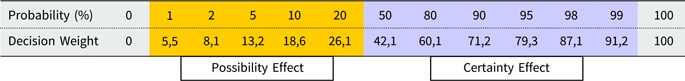

$${{\rm{U}}_{{\rm{Expected}}}}{\rm{ = }}{{\rm{d}}_{\rm{1}}} \cdot \cdot \cdot {{\rm{U}}_{\rm{1}}}{\rm{ + }}{{\rm{d}}_{\rm{2}}} \cdot \cdot \cdot {\rm{ }}{{\rm{U}}_{\rm{2}}}\left( {{\rm{ + }}{{\rm{d}}_{\rm{3}}} \cdot \cdot \cdot {{\rm{U}}_{{\rm{3\; \ldots }}}}} \right)$$To get a sense of the deviation of decision weight and real probabilities, Table 1Footnote 182 provides an overview of what decision weights individuals assign selected probabilities. Accordingly, the difference between the probability of 0% and 1% corresponds to a difference of 5.5 points in terms of decision weight. The difference between 1% and 2%, however, only corresponds with a difference of 2.6 points (8.1 – 5.5) in terms of decision weight. Thus, it confirms that individuals value the difference between 0% and 1% higher than the difference between 1% and 2%.

Table 1. Average decision weights assigned to different probabilities

Source: Kahneman, Daniel, 2011, Thinking Fast and Slow, p. 315.

2. Zero-Risk Bias and the Old Debate on the Limits of Dassonville

The zero-risk bias is, as all biases are, applicable to countless situations of judicial decision-making with regard to EU law. Due to its limited scope, this Article will concentrate on one specific and widely discussed issue, namely the ongoing discussion on the limits of the Dassonville formula.Footnote 183 On the one hand, the wide scope of the free movement of goods pursuant to Article 34 TFEU based on a market-access approach may be understood as a great advantage from the point of view of market integration. On the other hand—as the Sunday trading cases Footnote 184 and the Danish bees case Footnote 185 show—such a wide interpretation of Article 34 TFEU may overload the court’s capacities. Meanwhile, various ways of tackling the issue have been discussed before and after the controversial judgment in Keck & Mithuard.Footnote 186 Despite the numerous possibilities to clarify the current case law—for example, in Italy v. Commission (motorcycle trailers)Footnote 187 and Mickelsson & Roos (Jet-skies)Footnote 188—legal certainty, which still remains a general principle of EU law, is clearly suffering.

Keeping in mind the human tendency to overweigh the complete elimination of a risk, the risk that EU law may not be able to cover certain measures that restrict market access may also be overvalued.Footnote 189 In fact, the Court’s initial concern in Keck & Mithuard that the “tendency of traders to invoke Article 30 of the Treaty [now Article 34 TFEU] as a means of challenging any rules whose effect is to limit their commercial freedom even where such rules are not aimed at products from other Member States” is still valid.Footnote 190 Despite the acknowledgement of this development, the Court came up with the rather unsatisfying judgment, distinguishing between certain selling arrangements and product requirements.Footnote 191 Even in post-Keck case law, the ECJ failed to draw clear boundaries of the scope of Article 34 TFEU. In particular, any form of remoteness test that analyzes whether the link between the measure in question and the restriction to the market would be “too uncertain”Footnote 192 or “too indirect”Footnote 193 cannot possibly satisfy even the lowest requirements set out by the principle of legal certainty.

The only option—it is often argued—that meets a certain standard of legal certainty and is still able to avoid a situation in which the courts have to deal with the slightest restrictions to the market may be a de minimis rule.Footnote 194 Not only is a de minimis rule able to set out clear boundaries, it is altogether considered the more efficient tool to protect the internal market, which is the ultimate purpose of Article 34 TFEU. While the courts would not have to deal with measures that only result into minor restrictions to the market, such as the 0.3% of the Danish territory in the Danish bees case,Footnote 195 the courts—given their limited resources—could deal with cases involving more significant restrictions to the free movement of goods more extensively. By doing so, the objective of Article 34 TFEU—the protection of the single market—would be pursued significantly more efficiently.

So far, so good. But what exactly does an understanding of behavioral economics add to this debate in general or to the already discussed teleological argument in particular? Indeed, the following behavioral economically informed argument must be put very carefully, as those who do not consider the efficiency of the protection of the single market as a legitimate judicial goal will have their problems with such argumentation. In fact, if one does not consider the efficiency of the judicial system as a legitimate goal—for example, due to a deontological approach to Justice—one may not buy into the following argument at all. But, if one—like most scholars—puts some value on teleological arguments, behavioral economics has something to say about Dassonville.

The ECJ, when assessing whether and how to limit the scope of the Dassonville formula, must take into account that the effect of excluding minor cases from the scope of EU law may be overvalued. More precisely, cases covering 1% of the entire scope of Article 34 TFEU or other fundamental freedoms may be valued as covering as much as 5.5% of the scope as suggested by Table 1 above. If the court looks at the issue from the positive perspective—that is to say, what cases may be covered instead of looking at what cases may not be covered—the effect would be even greater. As Table 1 indicates, a reduction of the scope to 99% of the current Dassonville level may be valued as a reduction to 91.2%. Thus, cases not covered from the point of view of the Court would amount to 8.8%, instead of only 1%. Hence, whichever way the Court looks at the reduction—whether from the positive or negative perspective—it will overestimate the number of cases excluded due to a potential de minimis rule.Footnote 196

If one now takes into account that the zero-risk bias may reasonably be a strong driving force behind supporting arguments against a de minimis rule, the trustworthiness of the underlying intuitions can be seriously questioned. In case one does not put any value on teleological arguments and strongly opposes any de minimis rule in principle, one may not be convinced by this analysis. Yet, if one is generally open towards the teleological approach, but intuitively considers the number of potentially excluded cases as too high, it must be asked whether this intuition can be explained by the zero-risk bias and should therefore not be trusted. Consequently, taking into account the zero-risk bias when analyzing the limits of Dassonville does not necessarily create a substantial new argument per se, rather it suggests that the risks or downsides of a de minimis rule may be much smaller than expected. For this reason, the argument for the teleological approach of efficiently protecting the internal market may be undervalued overall and should instead be given greater meaning.

IV. Hindsight Bias

1. Introduction

The hindsight biasFootnote 197 was discovered by Baruch Fischhoff and Ruth Beyth, who conducted a survey before the president of the United States at the time, Richard Nixon, visited Russia and China in early 1972.Footnote 198 Participants were asked to estimate the likelihood of 15 different scenarios, such as whether the United States and Russia would agree on anything significant or whether Mao Zedong would agree to meet Nixon.Footnote 199 After Nixon returned, participants were asked to recall the probabilities that they assigned to each scenario as accurately as they could.Footnote 200 The outcome was clear: Subjects assigned scenarios that actually took place much higher probabilities than they initially did, while events that did not happen were assigned lower probabilities than before.Footnote 201 To put it briefly, the hindsight bias is the inclination to perceive events that have already occurred as being more predictable than they actually were before they took place.Footnote 202 Further studies indicate that the bias occurs because people update their beliefs about the world as soon as they become aware of a certain outcome.Footnote 203

2. Hindsight Bias, Schmidberger, and the Remoteness Test

Because judges usually evaluate events after they have already occurred, they are particularly vulnerable to the hindsight bias.Footnote 204 Due to the significance of the proportionality test within EU law,Footnote 205 the decisive question is often whether the measure under consideration was suitable and necessary to achieve its aim, thereby taking an ex ante perspective. For instance, in Schmidberger, the ECJ had to assess the impact that the closing of the Brenner motorway had on the free movement of goods from the perspective of the Austrian authorities at the time, before the actual closure happened. Nevertheless, the Court argued that “in the present case various administrative and supporting measures were taken by the competent authorities in order to limit as far as possible the disruption to road traffic.”Footnote 206 Yet, whether such supporting measures had been taken at the time of the demonstration is irrelevant if those measures were not required or foreseen when authorizing the closure of the motorway, for this argument is based on the actual—rather than expected—outcome of the initial closing of the highway. In fact, it does not matter whatsoever whether the impact on the fundamental freedom of the free movement of goods was less than one could have expected. It merely matters whether—at the time of the authorization—one could expect that such matters would be undertaken and, therefore, expect that the restriction to Article 34 TFEU would be limited to a certain extent.

Similarly, any form of a remoteness test used to determine whether a measure falls within the ambit of Article 34 TFEU will face significant problems due to the hindsight bias, as judges are not able to evaluate whether an outcome can be sufficiently connected to the effects of the measure in question if they are already aware of the actual outcome. In fact, applying the hindsight bias would suggest that the European courts will overvalue the causal link between the actual outcome and the measure being considered. This inevitably causes a too-rare application of the remoteness test which can be empirically supported by pointing out that the remoteness question is not even discussed in most cases.Footnote 207 Even in cases in which the issue is either raised by the parties involved or by state submissions, the Court still prefers to avoid getting into a detailed analysis of the test.Footnote 208 If the test is applied, Shuibhne notes that “questions of causal connection seem … to be assumed rather than tested in free movement case law.”Footnote 209 Without proper statistical analysis, however, it is not possible to avoid the hindsight bias. Contrary to what the analysis of the availability bias and anchoring effect may suggest, even many years of legal experience combined with advanced knowledge about the hindsight bias are not able to function as a mitigating factor.Footnote 210

Because people are vulnerable to the hindsight bias even when they are aware of it, a potential solution to the issue would require that those who analyze the causal connection under consideration are not aware of the actual outcome—regardless of whether this involves the remoteness test or questions of suitability and necessity. The person cannot know what actually happened and must analyze the situation merely by looking at the measure and what could potentially happen or not. Thus, one may argue that judges already involved in the case are not in the best position to analyze causal connections from relevant past events.

Provided that a clear economic or statistical analysis is not possible, it seems advisable to conduct surveys asking participants—who are not aware of the actual outcome—what effects the measure in question might have or whether it could restrict market access. The questions and their exact framing must be carefully assessed in each case, however, given the strong effect of the hindsight bias and the overarching importance of some of the cases decided by the European courts, the establishment of such an “unbiased jury” for the investigation of specific causal connections might be beneficial. Although research suggests that judges could also mitigate the hindsight bias by thinking about alternative outcomes—as was already suggested regarding the anchoring effectFootnote 211—an unbiased jury would not only be able to mitigate but even eliminate the hindsight bias.Footnote 212 If such an approach will not be valued as a feasible improvement to the courts decision-making procedures, then it further strengthens the case for judicial training in behavioral economics.

D. Concluding Remarks

The Article started by introducing the major claims of behavioral economics, thereby focusing particularly on different aspects of prospect theory and how rational decision-making models based on the assumption of the homo economicus deviate from actual choices made by individuals. Because heuristics and biases are closely linked to the different functions of System 1 and System 2 thinking, experts—including judges—are also subject to cognitive illusions.

In the next part of this Article, the value of taking into account behavioral economics when making judicial decisions in EU law was demonstrated by analyzing the impact of selected biases to diverse legal issues, as well as offering potential solutions for overcoming or mitigating cognitive illusions. More specifically, the following was proposed:

I. Judicial training pertaining to behavioral economics should be provided to mitigate cognitive illusions, such as the anchoring effect, availability, and hindsight bias. Because it does not seem feasible to cover all potential sources of cognitive illusions, the training should not only focus on specific applications of various biases, but it should also outline how and under what circumstances such biases may occur in general. As discussed above, sheer awareness can often be a first step to mitigate biases, but more specific techniques, such as thinking about alternative solutions in order to reduce the anchoring effect, are also crucial.

II. If possible, the courts should increase the amount of economic and statistical evidence necessary to mitigate different biases such as the availability and hindsight bias with particular regard to the proportionality test. As indicated in the analysis of the Schmidberger judgment, the tool has its limits when fundamental rights are at stake. Yet, when balancing different fundamental freedoms, it may be a significant means to overcome biases.

III. On a more specific note, the analysis of the zero-risk bias has indicated that an extensive scope of the fundamental freedoms may be overvalued because the amount of cases that are not covered by EU law may be considerably less than one can intuitively grasp. After analyzing what restrictions to the market shall be covered, a clear de minimis rule to all fundamental freedoms in EU law would not only avoid future zero-risk biases, but also raise legal certainty. Also, the financial means that go into cases with the tiniest restrictions to the internal market may be better spent on statistical evidence in more significant cases and judicial training, thereby protecting the single market more efficiently.

IV. Last, but certainly not least, the analysis of causal connections from an ex ante perspective, as required within the proportionality test or by any form of remoteness test, will be strongly influenced by the hindsight bias. For this reason, the Article suggested the establishment of an unbiased jury consisting of individuals who are not aware of the actual outcomes of the case. This having said, more research is essential to develop the exact conditions for such an endeavor to succeed.

All in all, the examination of only a few of the many potential shortcomings in human thinking regarding judicial decision-making has underlined the importance of taking into account behavioral economic findings. By focusing on a small number of cognitive biases, their effects in certain scenarios, and on understanding selected cases, the analysis indicated that there is much left to explore. The recommendations made should, therefore, merely be regarded as first steps, rather than as ultimate solutions to improve judicial decision-making in the European Courts.

Regarding second steps, one needs to keep in mind that human abilities are limited both in physical and mental terms. For thousands of years, technology has been focusing on tackling the obvious, physical limits. Some of the proposals made may help to overcome or avoid some of our cognitive limitations. But, while some biases can be mitigated to some extent with different techniques, it does not seem feasible to eliminate them completely. Relying on natural intelligence will likely never guarantee flawless judgments. Despite bearing fundamental risks, artificial intelligence may provide means to achieve greater fairness, consistency, and legal certainty in the future.