1. Introduction

How should a Central Bank conduct monetary policy? Should it seek to control some monetary aggregate or should it target some interest rate? Periodically, the Fed has switched its policy targets. Prior to 1979, the Fed generally targeted the federal funds rate. Then, for the brief period 1979–1982 it targeted the narrow monetary aggregate, M1, gradually broadening the target over the period 1982–1993 to include M2, after which Chairman Greenspan announced that the Fed would no longer use monetary aggregates to guide policy. This choice of monetary targets gave rise to the “monetary instrument problem,” originally formulated by Poole (Reference Poole1970), who using a simple stochastic IS-LM model analyzed whether it is preferable to operate monetary policy by targeting the money supply or by controlling the interest rate. Poole’s study spawned an extensive literature, focusing on aspects such as the potential indeterminacy of the price level when pegging the nominal interest rate (Sargent and Wallace (Reference Sargent and Wallace1975), McCallum (Reference McCallum1981)) and the choice of the optimal monetary aggregate to target (Roper and Turnovsky (Reference Roper and Turnovsky1980), Barnett (Reference Barnett1982)).

The early literature focused exclusively on the implications of the choice of monetary policy for aggregate measures, specifically the stability of national income. While this is a natural objective, it is also important to determine the consequences the choice of monetary policy instrument may have for the distribution of wealth and income across heterogeneous agents in the economy. In fact, there is growing literature investigating the relationship between monetary policy and inequality measures, see Colciago et al. (Reference Colciago, Samarina and de Haan2019) for a comprehensive review. As the authors note, many studies are purely empirical and yield conflicting results. The lack of clear conclusion suggests the importance of comparing the distributional consequences of alternative forms of monetary policy within a more structured framework. The objective of this paper is to provide such a framework and to compare the implications for the distribution of wealth and income across heterogeneous agents, when the monetary authority targets the nominal money growth rate versus pegging the nominal interest rate.

While our primary focus is on the monetary instrument problem as articulated by Poole, we also briefly address the related monetary policy of “inflation targeting.” This policy was first introduced by the Reserve Bank of New Zealand in 1989 and has since been adopted by a number of Central Banks. The countries to have introduced some form of inflation targeting include the United Kingdom, the USA, Canada, Sweden, Australia, and South Korea. The target inflation rates are typically around 2% but often allow some flexibility in the range 1–3%.

In choosing the framework to employ for this analysis, two key issues must be addressed. These pertain to: (i) the nature of the heterogeneous agent model and (ii) the degree of money-price flexibility. With respect to the former, our choice is to adopt the “representative consumer theory of distribution” (RCTD) framework originally introduced by Caselli and Ventura (Reference Caselli and Ventura2000).Footnote 1 This approach assumes complete markets and homothetic utility. Its structure facilitates aggregation, with the evolution of the aggregate (macroeconomic) variables and the impact of policy being determined independently of any distributional characteristics. In fact, some support for this approach is provided by Krusell and Smith (Reference Krusell and Smith1998), who suggested that the underlying household wealth and income inequality have only relatively modest impact on the aggregate dynamics. Overall, we view the tractability of the RCTD approach, its amenability to calibration, and its facility to characterize transitional dynamics, as sufficiently appealing so as to adopt it over the more stylized incomplete asset markets approach based on Bewley (Reference Bewley1977) and Aiyagari (Reference Aiyagari1994).

But we also acknowledge that the RCTD approach imposes restrictions, such as the absence of idiosyncratic productivity shocks and limited market accessibility, which are at the heart of the incomplete markets setup. Also, to preserve homothetic utility and to take advantage of the aggregation it facilitates, constrains how money can be introduced into system. These restrictions impact the macro-dynamic equilibrium and have consequences for inequality.

Motivated in part by the doctrine espoused by Friedman (Reference Friedman1960), who long ago advocated the proposition that monetary policy should be directed to maintaining a stable nominal money growth rate, we focus on the long run. Thus, we address the monetary instrument problem in the context of a standard Ramsey model in which agents make their consumption and savings decisions to maximize their intertemporal utility, with prices being assumed to be completely flexible. We adapt the well-known Sidrauski (Reference Sidrauski1967) money-growth model to include heterogeneous agents, whose heterogeneity stems from their differential initial asset endowments. Instead of focusing on the usual aggregates such as the capital stock, employment, and output, we consider the implications for the distributions of wealth and income across agents. The reason for doing so is that in a long-run model such as this, with perfectly flexible prices, the role of monetary policy in influencing long-run real productive elements is limited. But, in contrast, the form of monetary control, by influencing the transitional path of financial variables, does have consequences for the distributions of both wealth and income, over time and in steady state.

Overall, while our choice of analytical framework—RCTD heterogeneity coupled with long-run monetary growth and flexible prices—is clearly restrictive, we nevertheless view it as providing a reasonable benchmark. Moreover, as our results below will confirm, it is compatible with substantial bodies of empirical evidence and can potentially help reconcile some of the conflicting results found in the literature.

Using the above setup, this paper addresses the distributional consequences of two types of changes. The first is a pure expansionary monetary policy. In this case, we find that with perfectly flexible prices, and in the absence of taxes impeding production, monetary policy in isolation has no dynamic consequences. If the central bank, maintaining a constant nominal money growth rate, engages in an expansionary policy by increasing its growth rate, there are no real effects. Instead, it will lead to an immediate increase in the price level leading to an instantaneous portfolio adjustment.Footnote 2 This reduces the share of assets denominated in nominal terms (money and bonds) in the economy, which, being held in greater proportion by the relatively less affluent, causes wealth inequality to immediately increase. But by reducing the real value of bonds and the income it generates, while the real wage rate remains unaffected, the price increase raises the share of income earned by labor, which favors the less affluent. The distribution of income is thus impacted by both these influences, and the net effect on income inequality depends upon which effect dominates. In contrast, if the monetary authority pegging the nominal interest engages in monetary expansion by reducing the interest rate, the price will immediately drop, causing precisely the opposite responses; wealth inequality will decline and the response of income inequality is uncertain.

Numerical simulations suggest that in either case the response of the price level is sensitive to the existing portfolio structure. These simulations also suggest that unanticipated permanent discrete changes in monetary policy may have a significant impact on inequality, and the qualitative response of income inequality may, or may not, coincide with that of wealth inequality.

The second scenario we consider is if the economy experiences a real shock, either due to policy or a structural change. In that case, we compare how the accompanying monetary policy will impact the ensuing transitional paths. For aggregate variables, this operates entirely through its impact on their speed of convergence, with the differential effects of alternative monetary policies turning out to be negligible. But for financial variables, the differential effects also depend upon the sensitivity of the initial response of the price level to the underlying real shock. These effects are more substantial, leading to somewhat more significant distributional consequences.

In general, there is a conflict between targeting the money growth rate and pegging the nominal interest with respect to their distributional consequences. Maintaining a constant money growth rate will lead to a larger increase in wealth inequality (both in the short run and over time), but a smaller increase in income inequality following an increase in government expenditure, than if the interest rate is pegged. An analogous comparison applies with respect to the distributional consequences of a productivity increase. Pegging the interest rate will lead to a larger decline in wealth inequality, but a smaller decline in income inequality, than if the money growth rate is set. In either case, inflation targeting is the least favorable from the viewpoint of minimizing wealth inequality but the most favorable in terms of constraining income inequality.

But in all cases, the differences caused by the alternative forms of sustained monetary policy are small. This finding provides some support for the view espoused by Bernanke (Reference Bernanke2015) and others, suggesting that inequality is driven primarily by the structural changes, themselves, and that the accompanying monetary policy plays only a limited role.

This paper is related to several diverse bodies of literature. Building on the early literature, a number of studies analyze the relationship between monetary policy and fiscal policy in terms of stabilizing the economy. Using the cash-in-advance monetary economy of Lucas and Stokey (Reference Lucas and Stokey1987), Sims (Reference Sims1994), and Woodford (Reference Woodford1994) showed that a policy of fixing nominal interest rates brings about price stability when the primary surplus defined as the difference between taxes and government expenditures is exogenously given. Using the same model, Schmitt-Grohé and Uribe (Reference Schmitt-Grohé and Uribe2000) focus on a balanced budget rule in which the secondary surplus, defined as tax revenues net of government expenditures and interest payments on the outstanding public debt, is required to be zero. They showed that fixing the nominal interest rate brings about price instability, while fixing the growth rate of money supply stabilizes the price. With the focus being on stabilization of the aggregate economy, none of these studies address optimal monetary policy from the perspective of wealth and income inequality.

There is also an extensive literature analyzing the impact of fiscal policy and increases in total factor productivity (TFP) on inequality. García-Peñalosa and Turnovsky (Reference García-Peñalosa and Turnovsky2011) focus on public consumption, while Chatterjee and Turnovsky (Reference Chatterjee and Turnovsky2012) address public investment. Both studies highlight the sensitivity of their impact on inequality to the different tax instruments used to finance the expenditures. Maliar and Maliar (Reference Maliar and Maliar2003) and Turnovsky and García-Peñalosa (Reference Turnovsky and García-Peñalosa2008) address the impact of increases in TFP on the distributions of wealth and income, while Lim and McNelis (Reference Lim and McNelis2013) compare the effects of alternative government expenditure rules on income inequality and welfare. Apart from Lim and McNelis, who introduce monetary policy via a Taylor rule, these studies abstract from the monetary sector and the potential influence of monetary policy.

As already noted, there is a recent burgeoning literature reviewing the relationship between central bank monetary policies and wealth and income inequality. This has included both the development of theoretical general equilibrium models identifying alternative distributional channels of monetary policy and the growing empirical evidence relating monetary policy and inequality. In their review, Colciago et al. (Reference Colciago, Samarina and de Haan2019) classify the literature into two categories, according to whether it focuses on (i) the implications of the underlying micro heterogeneity for the transmission of monetary policy shocks or (ii) the distributional effects of monetary policy. Prominent contributions in the first category include Kaplan et al. (Reference Kaplan, Moll and Violante2018) and Auclert (Reference Auclert2019), who adopt variants of the New Keynesian model to assess the heterogeneity of wealth holdings in determining the impact of monetary policy on aggregate variables, particularly consumption.Footnote 3 Within this classification, our paper belongs to the latter category, as does the more recent paper by Chang et al. (Reference Chang, Lin, Savitski and Tsai2020), who examine the impacts of money growth rate on distributions, using a cash-in-advance model with cash and credit goods, developed by Lucas and Stokey (Reference Lucas and Stokey1987).Footnote 4

In employing the flexible price (Sidrauski (Reference Sidrauski1967)) money-growth framework to focus on the long-run distributional consequences of monetary policy our approach contrasts with much of the monetary policy literature which employs short-run sticky price models. In doing so, we build on our recent work, Gokan and Turnovsky (Reference Gokan and Turnovsky2021, Reference Gokan and Turnovsky2023a), although the focus of the current paper is quite different. Both previous papers adopt the traditional policy of setting the nominal money growth rate as the policy instrument. The first paper showed that the super-neutrality of the money growth rate, associated with the Sidrauski growth model, does not extend to inequality. The latter paper used an endogenous growth setup to compare the impact of government consumption and investment on inequality under money-financing, while maintaining a fixed debt-money ratio.Footnote 5 In a forthcoming paper (Gokan and Turnovsky (Reference Gokan and Turnovsky2023b)), we apply this framework to address the widely adopted case where the monetary authority targets the inflation rate by means of a Taylor rule. There we find that the consequences for both wealth and income inequality depend crucially upon the intensity with which the nominal interest rate responds to the inflation rate. As will become clear, the implications for inequality obtained in the present paper contrast sharply from both the previous findings as well as those implied by application of a Taylor rule. This, together with the diverse empirical evidence, clearly justifies the need to consider the implications of alternative specifications of monetary policy for wealth and income distribution.

The remainder of this paper proceeds as follows. Section 2 sets out the analytical framework, while Section 3 describes the macroeconomic equilibrium corresponding to the two specifications of monetary policy. Section 4 discusses alternative measures of distribution and inequality and sets out their dynamics. Section 5 highlights the contrasting distributional consequences of a nominal expansionary monetary policy, in isolation. Section 6 selects parameter values that are consistent with the US economy and to be used in subsequent numerical simulations. Section 7 compares the impact of money growth targeting versus pegging the nominal interest rate when the economy experiences two real shocks (i) an increase in government consumption (demand shock) and (ii) a productivity increase (supply shock). Section 8 briefly compares the distributional consequences of inflation targeting with the other two forms of monetary policy. Section 9 relates the implications of this study to some of the recent empirical evidence, while Section 10 concludes. Technical details are relegated to the Appendix, where possible.

2. Analytical framework

This section summarizes the analytical framework. To the extent that it draws upon our earlier work, Gokan and Turnovsky (Reference Gokan and Turnovsky2021, Reference Gokan and Turnovsky2023a), our description can be brief, mostly dedicated to describing the alternative and contrasting specifications of monetary policy.

2.1. Firms

There is a single representative firm that employs a standard neoclassical production function to produce an aggregate good that can be either consumed or accumulated as capital:

where

![]() $Y$

,

$Y$

,

![]() $K$

, and

$K$

, and

![]() $L$

denote per capita output, capital, and labor. Profit maximization implies that the return to capital,

$L$

denote per capita output, capital, and labor. Profit maximization implies that the return to capital,

![]() $r,$

and the real wage rate,

$r,$

and the real wage rate,

![]() $w,$

are determined by the marginal product conditions:

$w,$

are determined by the marginal product conditions:

2.2. Heterogeneous households

The population comprises N heterogeneous households, indexed by i, and remains constant over time. Individual (household)

![]() $i$

owns

$i$

owns

![]() $A_{i}(t)$

units of real wealth at time

$A_{i}(t)$

units of real wealth at time

![]() $t$

and the economy-wide average of total wealth is

$t$

and the economy-wide average of total wealth is

![]() $A\!\left(t\right)=\frac{1}{\mathcal{N}}\int _{0}^{\mathcal{N}}A_{i}\!\left(t\right)\!di$

. The relative share of total wealth owned by individual

$A\!\left(t\right)=\frac{1}{\mathcal{N}}\int _{0}^{\mathcal{N}}A_{i}\!\left(t\right)\!di$

. The relative share of total wealth owned by individual

![]() $i$

is

$i$

is

![]() $a_{i}(t)\equiv A_{i}(t)/A(t)$

, the mean of which across agents is one. There are three sources of private real wealth in the economy: private capital,

$a_{i}(t)\equiv A_{i}(t)/A(t)$

, the mean of which across agents is one. There are three sources of private real wealth in the economy: private capital,

![]() $K_{i}(t)$

, real money balances,

$K_{i}(t)$

, real money balances,

![]() $M_{i}(t),$

and real government bond,

$M_{i}(t),$

and real government bond,

![]() $B_{i}(t)$

. Agent

$B_{i}(t)$

. Agent

![]() $i^{\prime}s$

holding of each component of private wealth is denoted by the subscript

$i^{\prime}s$

holding of each component of private wealth is denoted by the subscript

![]() $i$

, with his relative share of each being defined analogously to

$i$

, with his relative share of each being defined analogously to

![]() $a_{i}(t)$

.

$a_{i}(t)$

.

Each household has one unit of time that can be allocated either to leisure,

![]() $l_{i}(t),$

or to labor,

$l_{i}(t),$

or to labor,

![]() $1-l_{i}(t)=L_{i}(t)$

, so that summing across individuals, the average economy-wide labor supply and leisure are

$1-l_{i}(t)=L_{i}(t)$

, so that summing across individuals, the average economy-wide labor supply and leisure are

![]() $L=1-l=1-\frac{1}{N}\int _{0}^{N}l_{i}di$

. The agent maximizes lifetime utility, specified as a constant elasticity function of consumption,

$L=1-l=1-\frac{1}{N}\int _{0}^{N}l_{i}di$

. The agent maximizes lifetime utility, specified as a constant elasticity function of consumption,

![]() $C_{i}(t)$

, leisure,

$C_{i}(t)$

, leisure,

![]() $l_{i}(t),$

real money balances,

$l_{i}(t),$

real money balances,

![]() $M_{i}(t)$

, and a multiplicatively separable function,

$M_{i}(t)$

, and a multiplicatively separable function,

![]() $h(G)$

, of government expenditure, G, taken as given:

$h(G)$

, of government expenditure, G, taken as given:

where

![]() $\kappa \equiv (1-\gamma )^{-1}\gt 0$

denotes the intertemporal elasticity of substitution (IES). Empirical evidence overwhelmingly supports

$\kappa \equiv (1-\gamma )^{-1}\gt 0$

denotes the intertemporal elasticity of substitution (IES). Empirical evidence overwhelmingly supports

![]() $0\lt \kappa \lt 1$

, in which case

$0\lt \kappa \lt 1$

, in which case

![]() $\gamma \lt 0$

, ensuring that the utility function is concave in the three variables,

$\gamma \lt 0$

, ensuring that the utility function is concave in the three variables,

![]() $C_{i}(t), l_{i}(t), \mathrm{and}{\ } M_{i}(t).$

Footnote

6

In the less common case

$C_{i}(t), l_{i}(t), \mathrm{and}{\ } M_{i}(t).$

Footnote

6

In the less common case

![]() $\kappa \gt 1$

, the utility function is concave with respect to these variables, if and only if

$\kappa \gt 1$

, the utility function is concave with respect to these variables, if and only if

![]() $1\gt \gamma (1+\beta +\eta )$

.

$1\gt \gamma (1+\beta +\eta )$

.

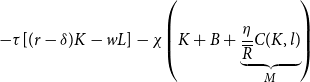

The optimization is performed subject to the agent’s wealth accumulation constraint

where

![]() $\delta$

denotes the (constant) rate of capital depreciation, assumed to be tax-deductible,

$\delta$

denotes the (constant) rate of capital depreciation, assumed to be tax-deductible,

![]() $R(t)$

denotes the nominal interest rate,

$R(t)$

denotes the nominal interest rate,

![]() $\pi (t)$

denotes the rate of inflation,

$\pi (t)$

denotes the rate of inflation,

![]() $\tau$

is the constant income tax rate (common to both capital and labor income),

$\tau$

is the constant income tax rate (common to both capital and labor income),

![]() $\mathrm{and}{\ } T_{i}$

is lump-sum transfers/taxes which the government sets to maintain its intertemporal solvency and that the agent takes as given. For notational convenience, we omit the time index

$\mathrm{and}{\ } T_{i}$

is lump-sum transfers/taxes which the government sets to maintain its intertemporal solvency and that the agent takes as given. For notational convenience, we omit the time index

![]() $t$

whenever possible.Footnote

7

Carrying out the optimization yields the following relationships:

$t$

whenever possible.Footnote

7

Carrying out the optimization yields the following relationships:

where

![]() $\lambda _{i}$

is the agent’s shadow value of wealth. Using

$\lambda _{i}$

is the agent’s shadow value of wealth. Using

![]() $l=1-L$

enables us to express w and r as functions of l rather than L.

$l=1-L$

enables us to express w and r as functions of l rather than L.

Equations (5a)–(5e) are standard optimality conditions that determine allocations at a given time, while (5f) are transversality conditions that ensure intertemporal viability of the household’s consumption and savings decisions. We define the economy-wide averages

![]() $X=N^{-1}\int _{0}^{N}X_{i}di$

for all relevant variables,

$X=N^{-1}\int _{0}^{N}X_{i}di$

for all relevant variables,

![]() $X=K,B,M,C,l$

. Since all agents face the same wage rate and same rates of return on assets, the optimality conditions imply:

$X=K,B,M,C,l$

. Since all agents face the same wage rate and same rates of return on assets, the optimality conditions imply:

so that agent

![]() $i^{\prime}$

s share of the three averages maintains the same constant value,

$i^{\prime}$

s share of the three averages maintains the same constant value,

![]() $\zeta _{i},$

over time.Footnote

8

Equation (6a) further implies that all agents choose the same growth rates for consumption, leisure, and real money balances (although their levels differ):

$\zeta _{i},$

over time.Footnote

8

Equation (6a) further implies that all agents choose the same growth rates for consumption, leisure, and real money balances (although their levels differ):

which, in turn, implies that the aggregates grow at the same respective rates. These relationships which are a key implication of RCTD play an important role in facilitating the aggregation.

2.3. Government

Government expenditures include its spending on a publicly provided consumption good and the interest payments on its outstanding debt, while earning revenues from the taxes imposed on labor income and capital income. It finances the deficit by issuing a mixture of government bonds and nominal money. With the constraint imposed by its monetary targeting rule, it also imposes lump-sum transfers/taxes in order to ensure its intertemporal viability. Therefore, the consolidated government budget constraint expressed in real terms is

Our focus is on the specification of monetary policy, and in particular comparing the distributional consequences of:

(i) Maintaining a constant growth rate of nominal money supply, as initially proposed by Friedman (Reference Friedman1960). For this to be sustained at the constant rate,

![]() $\overline{\theta }$

, requires that the real money growth rate is

$\overline{\theta }$

, requires that the real money growth rate is

![]() $\dot{M}(t)/M(t)=\overline{\theta }-\pi (t)$

.

$\dot{M}(t)/M(t)=\overline{\theta }-\pi (t)$

.

(ii) Pegging the nominal interest rate at

![]() $R(t)=\overline{R}$

, as initially analyzed by Poole (Reference Poole1970), with the real money supply being determined by (9c) below.

$R(t)=\overline{R}$

, as initially analyzed by Poole (Reference Poole1970), with the real money supply being determined by (9c) below.

3. Macroeconomic equilibrium

For either policy, the dynamics of the aggregate economic variables are derived by summing the optimal conditions across agents, derived in Section 2, and dividing by the population,

![]() $\mathcal{N}$

. As already noted, by employing the RCTD framework the dynamic evolution of the aggregate economic variables is determined independently of any distributional characteristics.

$\mathcal{N}$

. As already noted, by employing the RCTD framework the dynamic evolution of the aggregate economic variables is determined independently of any distributional characteristics.

3.1. Maintaining constant nominal monetary growth rate

To derive the macroeconomic equilibrium, we proceed as follows. First, summing (5b) over individual agents and using (2) we obtain

![]() $C=(1-\tau )\beta ^{-1}F_{L}(K,L)l\equiv C(K,L)=C(K,l)$

.Footnote

9

The macroeconomic equilibrium can then be described by the following dynamic equations:

$C=(1-\tau )\beta ^{-1}F_{L}(K,L)l\equiv C(K,L)=C(K,l)$

.Footnote

9

The macroeconomic equilibrium can then be described by the following dynamic equations:

together with

![]() $L=1-l,\,\,\dot{L}=-\dot{l}$

, and where

$L=1-l,\,\,\dot{L}=-\dot{l}$

, and where

![]() $\Lambda _{\theta }\equiv \left(1-\gamma \right)\left(1+\frac{s}{\varepsilon }\frac{l}{1-l}\right)-\beta \gamma \gt 0$

,

$\Lambda _{\theta }\equiv \left(1-\gamma \right)\left(1+\frac{s}{\varepsilon }\frac{l}{1-l}\right)-\beta \gamma \gt 0$

,

![]() $\Pi _{\theta }\equiv -\left(1-\gamma \right)\frac{s}{\varepsilon }\lt 0, \mathrm{s}\equiv KF_{K}/Y$

is capital’s share of output, and

$\Pi _{\theta }\equiv -\left(1-\gamma \right)\frac{s}{\varepsilon }\lt 0, \mathrm{s}\equiv KF_{K}/Y$

is capital’s share of output, and

![]() $\varepsilon \equiv F_{K}F_{L}/FF_{KL}$

is the elasticity of substitution in production

$\varepsilon \equiv F_{K}F_{L}/FF_{KL}$

is the elasticity of substitution in production

![]() $.$

As long as the production function

$.$

As long as the production function

![]() $F(K,L)$

is a general constant returns to scale function, both

$F(K,L)$

is a general constant returns to scale function, both

![]() $s$

and

$s$

and

![]() $\boldsymbol{\varepsilon}$

are functions of the capital-labor ratio

$\boldsymbol{\varepsilon}$

are functions of the capital-labor ratio

![]() $K/L$

.Footnote

10

$K/L$

.Footnote

10

3.2. Pegging the nominal interest rate

If monetary policy takes the form of pegging the nominal interest rate at

![]() $R(t)=\overline{R}$

, the macroeconomic equilibrium is specified by:

$R(t)=\overline{R}$

, the macroeconomic equilibrium is specified by:

where

![]() $\Lambda _{R}\equiv \!\left(1-\gamma \left(1+\eta \right)\right)\left(1+\frac{s}{\varepsilon }\frac{l}{1-l}\right)-\beta \gamma \gt 0$

,

$\Lambda _{R}\equiv \!\left(1-\gamma \left(1+\eta \right)\right)\left(1+\frac{s}{\varepsilon }\frac{l}{1-l}\right)-\beta \gamma \gt 0$

,

![]() $\Pi _{R}\equiv -\left(1-\gamma\! \left(1+\eta \right)\right)\frac{s}{\varepsilon }\lt 0$

. In this case, the real money stock is obtained by aggregating (5c), and having obtained

$\Pi _{R}\equiv -\left(1-\gamma\! \left(1+\eta \right)\right)\frac{s}{\varepsilon }\lt 0$

. In this case, the real money stock is obtained by aggregating (5c), and having obtained

![]() $K,L$

from (9a) and (9b) is determined by

$K,L$

from (9a) and (9b) is determined by

3.3. Steady state

Regardless of the form of monetary policy, equations (8a), (8b), (9a), and (9b) indicate that the following hold in steady state, denoted by the superscript*

Therefore, the steady-state values of capital, labor (leisure), output, the wage rate, return to capital, and consumption are all determined independently of the nominal money growth rate and how it is being determined. That is, in the long run monetary policy is super-neutral insofar as these real quantities are concerned.Footnote 11

For the long-run value of inflation to be independent of how monetary policy is implemented, the steady-state values of real money balances obtained under the two monetary regimes must be equal. This will be met if the monetary authority adopts policies that satisfy

![]() $\overline{\theta }=\overline{R}-\rho$

, in which case

$\overline{\theta }=\overline{R}-\rho$

, in which case

Since our objective is to compare the dynamic consequences of the two forms of monetary policy, we assume that they satisfy this condition and are thus compatible with the same steady state.Footnote 12

3.4. Local aggregate dynamics

We begin by setting out the aggregate dynamics corresponding to the two forms of monetary policy.

3.4.1 Constant nominal money growth rate

To obtain the local aggregate dynamics when the monetary authority maintains the growth rate of nominal money supply constant, that is,

![]() $\theta =\overline{\theta,}$

we linearize (8) around steady state:

$\theta =\overline{\theta,}$

we linearize (8) around steady state:

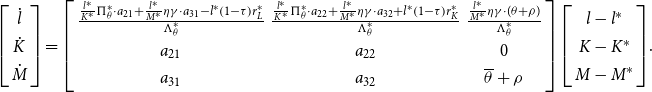

\begin{equation}\left[\begin{array}{c} \dot{l}\\ \dot{K}\\ \dot{M} \end{array}\right]=\left[\begin{array}{ccc} \frac{\frac{l^{*}}{K^{*}}\Pi _{\theta }^{*}\cdot a_{21}+\frac{l^{*}}{M^{*}}\eta \gamma \cdot a_{31}-l^{*}\left(1-\tau \right)r_{L}^{*}}{\Lambda _{\theta }^{*}} & \frac{\frac{l^{*}}{K^{*}}\Pi _{\theta }^{*}\cdot a_{22}+\frac{l^{*}}{M^{*}}\eta \gamma \cdot a_{32}+l^{*}\left(1-\tau \right)r_{K}^{*}}{\Lambda _{\theta }^{*}} & \frac{\frac{l^{*}}{M^{*}}\eta \gamma \cdot (\theta +\rho )}{\Lambda _{\theta }^{*}}\\ a_{21} & a_{22} & 0\\ a_{31} & a_{32} & \overline{\theta}+\rho \end{array}\right]\left[\begin{array}{c} l-l^{*}\\ K-K^{*}\\ M-M^{*} \end{array}\right]\!.\end{equation}

\begin{equation}\left[\begin{array}{c} \dot{l}\\ \dot{K}\\ \dot{M} \end{array}\right]=\left[\begin{array}{ccc} \frac{\frac{l^{*}}{K^{*}}\Pi _{\theta }^{*}\cdot a_{21}+\frac{l^{*}}{M^{*}}\eta \gamma \cdot a_{31}-l^{*}\left(1-\tau \right)r_{L}^{*}}{\Lambda _{\theta }^{*}} & \frac{\frac{l^{*}}{K^{*}}\Pi _{\theta }^{*}\cdot a_{22}+\frac{l^{*}}{M^{*}}\eta \gamma \cdot a_{32}+l^{*}\left(1-\tau \right)r_{K}^{*}}{\Lambda _{\theta }^{*}} & \frac{\frac{l^{*}}{M^{*}}\eta \gamma \cdot (\theta +\rho )}{\Lambda _{\theta }^{*}}\\ a_{21} & a_{22} & 0\\ a_{31} & a_{32} & \overline{\theta}+\rho \end{array}\right]\left[\begin{array}{c} l-l^{*}\\ K-K^{*}\\ M-M^{*} \end{array}\right]\!.\end{equation}

where the elements of the matrix in (11) are defined in Appendix A.1. There we suggest that under plausible conditions, convincingly met by our calibrated model, the dynamic system has one negative eigenvalue

![]() $\mu _{\theta }(\!\lt 0),$

so that all aggregate variables converge to their respective steady states at the common rate

$\mu _{\theta }(\!\lt 0),$

so that all aggregate variables converge to their respective steady states at the common rate

![]() $| \mu _{\theta }|$

.

$| \mu _{\theta }|$

.

With

![]() $l(0)$

and

$l(0)$

and

![]() $M(0)$

free to jump instantaneously in response to new information (the latter through a jump in the price level

$M(0)$

free to jump instantaneously in response to new information (the latter through a jump in the price level

![]() $P(0)$

), while

$P(0)$

), while

![]() $K(t)$

is constrained to evolve gradually from its initial value,

$K(t)$

is constrained to evolve gradually from its initial value,

![]() $K_{0}$

, the stable equilibrium paths for

$K_{0}$

, the stable equilibrium paths for

![]() $K, l$

, and

$K, l$

, and

![]() $M$

can be expressed as:

$M$

can be expressed as:

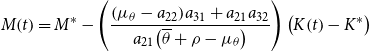

\begin{equation} M\!\left(t\right)=M^{*}-\left(\frac{\left(\mu _{\theta }-a_{22}\right)\! a_{31}+a_{21}a_{32}}{a_{21}\!\left(\overline{\theta }+\rho -\mu _{\theta }\right)}\right)\left(K\!\left(t\right)-K^{*}\right) \end{equation}

\begin{equation} M\!\left(t\right)=M^{*}-\left(\frac{\left(\mu _{\theta }-a_{22}\right)\! a_{31}+a_{21}a_{32}}{a_{21}\!\left(\overline{\theta }+\rho -\mu _{\theta }\right)}\right)\left(K\!\left(t\right)-K^{*}\right) \end{equation}

In Appendix A.1, it is noted that while sgn (

![]() $\mu _{\theta }-a_{22}$

) is potentially ambiguous, it is most likely negative, as is certainly the case in our simulations. In that case, if the economy experiences an expansion in the aggregate capital stock

$\mu _{\theta }-a_{22}$

) is potentially ambiguous, it is most likely negative, as is certainly the case in our simulations. In that case, if the economy experiences an expansion in the aggregate capital stock

![]() $(K_{0}\lt K^{*})$

, following initial jumps, average leisure,

$(K_{0}\lt K^{*})$

, following initial jumps, average leisure,

![]() $l(t)$

, and real balances,

$l(t)$

, and real balances,

![]() $M(t)$

, will both increase monotonically to their respective steady-state values,

$M(t)$

, will both increase monotonically to their respective steady-state values,

![]() $l^{*}$

and

$l^{*}$

and

![]() $M^{*}$

, during the subsequent transition.Footnote

13

$M^{*}$

, during the subsequent transition.Footnote

13

Using the government budget constraint, (7), and the transversality condition, (5f), the time path for government bonds,

![]() $B(t),$

can be solved in the neighborhood of the steady state as:

$B(t),$

can be solved in the neighborhood of the steady state as:

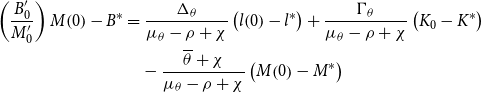

where

![]() $\Delta _{\theta }$

and

$\Delta _{\theta }$

and

![]() $\Gamma _{\theta }$

are defined in Appendix A.1, and the derivation of (13) is also provided. There we point out that to satisfy the transversality condition, and with the nominal stock of bonds being sluggish,

$\Gamma _{\theta }$

are defined in Appendix A.1, and the derivation of (13) is also provided. There we point out that to satisfy the transversality condition, and with the nominal stock of bonds being sluggish,

![]() $B^{*}$

and

$B^{*}$

and

![]() $\chi$

are set so as to satisfy the appropriate initial and steady-state conditions for (13), given by (A5a) and (A5b). In equilibrium, government bonds also converge at the rate

$\chi$

are set so as to satisfy the appropriate initial and steady-state conditions for (13), given by (A5a) and (A5b). In equilibrium, government bonds also converge at the rate

![]() $| \mu _{\theta }| .$

$| \mu _{\theta }| .$

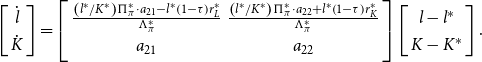

3.4.2 Pegging the nominal interest rate

If monetary policy is specified in terms of pegging the nominal interest rate, that is,

![]() $R(t)=\overline{R}$

, the local transitional dynamics are described by:

$R(t)=\overline{R}$

, the local transitional dynamics are described by:

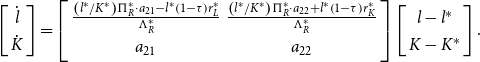

\begin{equation}\left[\begin{array}{c} \dot{l}\\ \dot{K} \end{array}\right]=\left[\begin{array}{cc} \frac{\left(l^{*}/K^{*}\right)\Pi _{R}^{*}\cdot a_{21}-l^{*}\left(1-\tau \right)r_{L}^{*}}{\Lambda _{R}^{*}} & \frac{\left(l^{*}/K^{*}\right)\Pi _{R}^{*}\cdot a_{22}+l^{*}\left(1-\tau \right)r_{K}^{*}}{\Lambda _{R}^{*}}\\ a_{21} & a_{22} \end{array}\right]\left[\begin{array}{c} l-l^{*}\\ K-K^{*} \end{array}\right].\end{equation}

\begin{equation}\left[\begin{array}{c} \dot{l}\\ \dot{K} \end{array}\right]=\left[\begin{array}{cc} \frac{\left(l^{*}/K^{*}\right)\Pi _{R}^{*}\cdot a_{21}-l^{*}\left(1-\tau \right)r_{L}^{*}}{\Lambda _{R}^{*}} & \frac{\left(l^{*}/K^{*}\right)\Pi _{R}^{*}\cdot a_{22}+l^{*}\left(1-\tau \right)r_{K}^{*}}{\Lambda _{R}^{*}}\\ a_{21} & a_{22} \end{array}\right]\left[\begin{array}{c} l-l^{*}\\ K-K^{*} \end{array}\right].\end{equation}

where the elements of the matrix are defined in Appendix A.2. In this case, one of the two eigenvalues is negative,

![]() $\mu _{R}(\!\lt 0),$

so that all aggregate variables converge to their steady state at the common rate

$\mu _{R}(\!\lt 0),$

so that all aggregate variables converge to their steady state at the common rate

![]() $| \mu _{R}| .$

From (14), the saddle path describing the transitional dynamics of capital and leisure is described by (12a) and (12b), with

$| \mu _{R}| .$

From (14), the saddle path describing the transitional dynamics of capital and leisure is described by (12a) and (12b), with

![]() $\mu _{R}$

replacing

$\mu _{R}$

replacing

![]() $\mu _{\theta }$

. The transitional path of real money supply tracks that of consumption in accordance with equation (9c), while the dynamics of government bonds are now

$\mu _{\theta }$

. The transitional path of real money supply tracks that of consumption in accordance with equation (9c), while the dynamics of government bonds are now

subject to the constraints (A8a) and (A8b), and where

![]() $\Delta _{R}$

and

$\Delta _{R}$

and

![]() $\Gamma _{R}$

are defined in Appendix A.2.

$\Gamma _{R}$

are defined in Appendix A.2.

These results depend in part upon the form of the underlying utility function (3) and may be summarized by the following observations:

-

(i) The steady states of the real variables (output, employment, capital, consumption) are independent of how monetary policy is conducted.

-

(ii) The steady state of the monetary variables (inflation and real money) is independent of how monetary policy is conducted, provided

$\overline{\theta }=\overline{R}-\rho$

.

$\overline{\theta }=\overline{R}-\rho$

. -

(iii) The differential effects of targeting the monetary growth rate or pegging the nominal interest rate on the transitional paths of the real variables operate entirely through its impact on their respective adjustment speeds,

$| \mu _{\theta }|$

,

$| \mu _{\theta }|$

,

$| \mu _{R}|$

.

$| \mu _{R}|$

. -

(iv) The differential effects on transitional paths of the monetary variables reflect both the differential adjustment speeds,

$| \mu _{\theta }| | \mu _{R}|,$

and the initial jump in the price level necessary for the real money supply to follow the respective stable transitional paths (12c), (9c).

$| \mu _{\theta }| | \mu _{R}|,$

and the initial jump in the price level necessary for the real money supply to follow the respective stable transitional paths (12c), (9c).

4. Dynamics of wealth and income inequality

We now turn to the implications for the distributions of wealth and income. Since the impact of monetary policy manifests itself through the aggregate variables discussed in the previous section, no further identification of the specific form of monetary policy is necessary. Also, because this procedure is adapted from our earlier work, details are relegated to Appendix B. Instead, our focus here is to identify the various channels whereby aggregate variables influence the distribution.

4.1. Relative wealth and wealth inequality

The evolution of the relative wealth of individual i, described by equations (B3) and (B4), reflects two underlying sources of dynamics. First are those of the aggregate variables,

![]() $K(t),\,\,l(t)$

, described by (11) and (14), that generate the returns to capital and labor for the two forms of monetary policy. Second are the internal dynamics of relative wealth,

$K(t),\,\,l(t)$

, described by (11) and (14), that generate the returns to capital and labor for the two forms of monetary policy. Second are the internal dynamics of relative wealth,

![]() $a_{i}(t)$

, which depend upon the coefficient of

$a_{i}(t)$

, which depend upon the coefficient of

![]() $a_{i}$

in (B1) evaluated at steady state, and under weak restrictions can be shown to be positive. Specifically, if private consumption exceeds after-tax labor income, then aggregating the optimality condition, (5b), over individuals implies

$a_{i}$

in (B1) evaluated at steady state, and under weak restrictions can be shown to be positive. Specifically, if private consumption exceeds after-tax labor income, then aggregating the optimality condition, (5b), over individuals implies

![]() $l^{*}\gt \beta /(1+\beta )$

which in turn ensuresFootnote

14

$l^{*}\gt \beta /(1+\beta )$

which in turn ensuresFootnote

14

Imposing (16), (B2) then implies that the greater is an agent’s steady-state relative wealth, the more leisure he enjoys and the less labor he supplies. This reflects the fact that wealthier agents have a lower marginal utility of wealth.Footnote 15

In general, the individual’s initial relative wealth,

![]() $a_{i}(0)$

, is endogenous. This is because money and bonds, being denominated in nominal terms, are subject to real shocks due to the jump in the price level,

$a_{i}(0)$

, is endogenous. This is because money and bonds, being denominated in nominal terms, are subject to real shocks due to the jump in the price level,

![]() $P(0)$

, at the time a policy change or structural change occurs. Equation (C2) sets out the relationship between the jump in

$P(0)$

, at the time a policy change or structural change occurs. Equation (C2) sets out the relationship between the jump in

![]() $P(0)$

and initial relative wealth, showing that the impact of

$P(0)$

and initial relative wealth, showing that the impact of

![]() $P(0)$

on

$P(0)$

on

![]() $a_{i}(0)$

depends upon the difference between the individual’s allocation between the real asset (capital) and the nominal assets (money plus bonds,

$a_{i}(0)$

depends upon the difference between the individual’s allocation between the real asset (capital) and the nominal assets (money plus bonds,

![]() $N_{0}$

) and the economy-wide allocation.

$N_{0}$

) and the economy-wide allocation.

Because of the linearity of (C3) and (C4), we can readily transform these equations into a relationship describing the evolution of the standard deviation of wealth across agents,

![]() $\sigma _{a}(t)$

, which serves as a convenient and tractable summary measure of wealth inequality:

$\sigma _{a}(t)$

, which serves as a convenient and tractable summary measure of wealth inequality:

and which converges in steady state to

![]() $\sigma _{a}^{*}=\frac{1}{\alpha (0)}\cdot \sigma _{a}(0)$

. Equation (17) highlights how the evolution of

$\sigma _{a}^{*}=\frac{1}{\alpha (0)}\cdot \sigma _{a}(0)$

. Equation (17) highlights how the evolution of

![]() $\sigma _{a}(t)$

is driven by two factors, (i) initial wealth inequality,

$\sigma _{a}(t)$

is driven by two factors, (i) initial wealth inequality,

![]() $\sigma _{a}(0)$

, and (ii) the evolution of relative wealth,

$\sigma _{a}(0)$

, and (ii) the evolution of relative wealth,

![]() $a_{i}(t)$

, driven by

$a_{i}(t)$

, driven by

![]() $\alpha (t)$

, defined in (B3).

$\alpha (t)$

, defined in (B3).

Appendix C shows that the initial post-shock wealth inequality across individuals is

where

![]() $\varpi \equiv N_{0}/(P(0)K_{0}+N_{0})$

is the ratio of nominal assets to total wealth,

$\varpi \equiv N_{0}/(P(0)K_{0}+N_{0})$

is the ratio of nominal assets to total wealth,

![]() $\sigma _{k,0},\sigma _{n,0}$

are standard deviations of the initial endowments, and

$\sigma _{k,0},\sigma _{n,0}$

are standard deviations of the initial endowments, and

![]() $\nu$

is the correlation of endowments across agents. It is evident from (18) that one channel through which any shock impinges on wealth inequality is via its impact on the initial price level,

$\nu$

is the correlation of endowments across agents. It is evident from (18) that one channel through which any shock impinges on wealth inequality is via its impact on the initial price level,

![]() $P(0)$

, and how this interacts with the pattern of initial endowments and their distribution, see equation (C5). There we show that if: (i) the economy-wide endowment of capital exceeds that of financial assets (

$P(0)$

, and how this interacts with the pattern of initial endowments and their distribution, see equation (C5). There we show that if: (i) the economy-wide endowment of capital exceeds that of financial assets (

![]() $\varpi \lt 1/2$

), and (ii) nominal assets are less unequally endowed across agents than is capital (

$\varpi \lt 1/2$

), and (ii) nominal assets are less unequally endowed across agents than is capital (

![]() $\sigma _{n,0}\leq \sigma _{k,0}$

), an increase in the initial price level will increase initial wealth inequality. This is because an increase in

$\sigma _{n,0}\leq \sigma _{k,0}$

), an increase in the initial price level will increase initial wealth inequality. This is because an increase in

![]() $P(0)$

will increase the relative quantity of capital in agents’ portfolios, and since wealthier agents hold relatively more capital, wealth inequality will increase; the opposite applies to a decrease in

$P(0)$

will increase the relative quantity of capital in agents’ portfolios, and since wealthier agents hold relatively more capital, wealth inequality will increase; the opposite applies to a decrease in

![]() $P(0)$

. We view the conditions (i) and (ii) as entirely plausible and shall refer to this channel as “the initial price response” channel.

$P(0)$

. We view the conditions (i) and (ii) as entirely plausible and shall refer to this channel as “the initial price response” channel.

This impact on initial wealth inequality persists throughout the subsequent evolution of wealth inequality, as implied by (17). But during the transition, the other channel,

![]() $\alpha (t)$

, defined by (B3), comes into effect. From (B3) we see that

$\alpha (t)$

, defined by (B3), comes into effect. From (B3) we see that

![]() $\alpha (t)$

declines as leisure increases over time. This is because the positive relationship between leisure and capital described by the aggregate dynamics, (12b) and (14), implies that if capital is accumulated over time, labor supply falls, causing the capital-labor ratio to increase. This in turn implies that during the transition an increasing wage rate is accompanied by a declining return to capital, which favors the less affluent, leading to a steady decline in wealth inequality over time. This effect, which reflects the changing productivity of capital and labor, can be termed the “wage-return to capital” channel.

$\alpha (t)$

declines as leisure increases over time. This is because the positive relationship between leisure and capital described by the aggregate dynamics, (12b) and (14), implies that if capital is accumulated over time, labor supply falls, causing the capital-labor ratio to increase. This in turn implies that during the transition an increasing wage rate is accompanied by a declining return to capital, which favors the less affluent, leading to a steady decline in wealth inequality over time. This effect, which reflects the changing productivity of capital and labor, can be termed the “wage-return to capital” channel.

4.2. Relative income and income inequality

From equation (B8a), we see that relative income is driven in part by relative wealth. To describe this channel, we need to determine the agent’s position in real money balances, M, and income-yielding assets,

![]() $V\equiv K+B$

, relative to his overall wealth. These are given by equations (B5) and (B6), respectively. In the case of the latter, with capital and bonds yielding the same rate of return, and in the absence of risk, investors view these two assets as perfect substitutes, enabling us to characterize only their composite distribution (

$V\equiv K+B$

, relative to his overall wealth. These are given by equations (B5) and (B6), respectively. In the case of the latter, with capital and bonds yielding the same rate of return, and in the absence of risk, investors view these two assets as perfect substitutes, enabling us to characterize only their composite distribution (

![]() $v_{i}\equiv V_{i}/V$

). Comparing (B5) and (B6), we see that the relative asset holdings of an agent who has above average wealth,

$v_{i}\equiv V_{i}/V$

). Comparing (B5) and (B6), we see that the relative asset holdings of an agent who has above average wealth,

![]() $a_{i}(t)\gt 1$

are:

$a_{i}(t)\gt 1$

are:

![]() $v_{i}(t)-1\gt a_{i}(t)-1\gt M_{i}/M-1,$

meaning that his portfolio comprises disproportionately more of the income-earning assets, and less money than his overall relative wealth position represents. For a relatively poor agent,

$v_{i}(t)-1\gt a_{i}(t)-1\gt M_{i}/M-1,$

meaning that his portfolio comprises disproportionately more of the income-earning assets, and less money than his overall relative wealth position represents. For a relatively poor agent,

![]() $a_{i}(t)\lt 1$

, the opposite applies.

$a_{i}(t)\lt 1$

, the opposite applies.

Of the several potential measures of income inequality, we shall focus on before-tax personal income, defined as income from the income-earning assets, (capital and bonds) plus income from labor. Thus, the relative before-tax personal income of agent i is

![]() $y_{i}(t)\equiv Y_{i}(t)/Y(t)=[r(t)V_{i}(t)+w(t)L_{i}(t)][r(t)V(t)+w(t)L(t)]^{-1}$

, which is related to the agent’s relative wealth by (B8a) and (B8b). This can then be transformed to the following relationship between income inequality and wealth inequality:

$y_{i}(t)\equiv Y_{i}(t)/Y(t)=[r(t)V_{i}(t)+w(t)L_{i}(t)][r(t)V(t)+w(t)L(t)]^{-1}$

, which is related to the agent’s relative wealth by (B8a) and (B8b). This can then be transformed to the following relationship between income inequality and wealth inequality:

where

The term

![]() $\varphi (t)$

measures the income generated by the individual’s portfolio of assets, as reflected in his relative wealth. Because of the homogeneity of the underlying utility function, it is driven by economy-wide averages and is therefore common to all individuals. It comprises two components: (i) the share of personal income from the income-earning assets, bonds plus capital, and (ii) relative labor income, reflected in the second term, which reflects the fact that more (less) wealthy agents supply less (more) labor. In our benchmark calibration, the second term, which is negative, is dominated by the first term, implying

$\varphi (t)$

measures the income generated by the individual’s portfolio of assets, as reflected in his relative wealth. Because of the homogeneity of the underlying utility function, it is driven by economy-wide averages and is therefore common to all individuals. It comprises two components: (i) the share of personal income from the income-earning assets, bonds plus capital, and (ii) relative labor income, reflected in the second term, which reflects the fact that more (less) wealthy agents supply less (more) labor. In our benchmark calibration, the second term, which is negative, is dominated by the first term, implying

![]() $0\lt \varphi (t)\lt 1$

. In steady state, (19) converges to:

$0\lt \varphi (t)\lt 1$

. In steady state, (19) converges to:

We conclude with two observations. First, it is apparent from (20) that the two channels through which the aggregate variables impinge on wealth inequality,

![]() $\sigma _{a}(t)$

, also indirectly impact income inequality. But by influencing

$\sigma _{a}(t)$

, also indirectly impact income inequality. But by influencing

![]() $\varphi (t)$

, they will exert an additional direct impact on income inequality. In the short run, the discrete change in the price level,

$\varphi (t)$

, they will exert an additional direct impact on income inequality. In the short run, the discrete change in the price level,

![]() $P(0)$

, will impact the real income generated by government bonds, which in addition to any initial jumps in

$P(0)$

, will impact the real income generated by government bonds, which in addition to any initial jumps in

![]() $l(0)$

and its impact on

$l(0)$

and its impact on

![]() $r(0)$

and

$r(0)$

and

![]() $w(0)$

will impact

$w(0)$

will impact

![]() $\varphi (0)$

. Over time,

$\varphi (0)$

. Over time,

![]() $\varphi (t)$

will continue to reflect the evolving returns to capital and wage rate embodied in the wage-return to capital channel. Second, the effects of the channels we have identified are highly sensitive to the source of the structural change and specifically whether they reflect demand or supply shocks. As we demonstrate below, both analytically and in our simulations, this is because they lead to opposite responses in

$\varphi (t)$

will continue to reflect the evolving returns to capital and wage rate embodied in the wage-return to capital channel. Second, the effects of the channels we have identified are highly sensitive to the source of the structural change and specifically whether they reflect demand or supply shocks. As we demonstrate below, both analytically and in our simulations, this is because they lead to opposite responses in

![]() $P(0)$

, which have opposite effects on the initial wealth inequality, which then persist over time.

$P(0)$

, which have opposite effects on the initial wealth inequality, which then persist over time.

5. Nominal monetary expansion and inequality

In this section, we compare the impacts of monetary expansions under the two modes of monetary policy—setting

![]() $\theta =\overline{\theta }$

and pegging

$\theta =\overline{\theta }$

and pegging

![]() $R=\overline{R}$

—on inequality. In both cases, the economy starts out from the same initial steady state,

$R=\overline{R}$

—on inequality. In both cases, the economy starts out from the same initial steady state,

![]() $\overline{\theta }_{0}=\overline{R}_{0}-\rho$

, the only difference being in the form of the nominal monetary expansion. In the first case, it occurs via an increase in the money growth from

$\overline{\theta }_{0}=\overline{R}_{0}-\rho$

, the only difference being in the form of the nominal monetary expansion. In the first case, it occurs via an increase in the money growth from

![]() $\overline{\theta }_{0}$

to

$\overline{\theta }_{0}$

to

![]() $\overline{\theta }_{1}$

; in the latter case, it is accomplished by a reduction in the nominal interest rate from

$\overline{\theta }_{1}$

; in the latter case, it is accomplished by a reduction in the nominal interest rate from

![]() $\overline{R}_{0}$

to

$\overline{R}_{0}$

to

![]() $\overline{R}_{1}$

. In either case, the real capital stock remains unchanged at its initial level,

$\overline{R}_{1}$

. In either case, the real capital stock remains unchanged at its initial level,

![]() $K_{0}$

, implying that

$K_{0}$

, implying that

![]() $l,\,\,L,\,\,Y,C$

also remain unchanged at their initial equilibrium levels.Footnote

16

$l,\,\,L,\,\,Y,C$

also remain unchanged at their initial equilibrium levels.Footnote

16

There are no transitional dynamics. The required adjustment is that the real stock of money must jump instantaneously in order for the equilibrium marginal rate of substitution between money and consumption, (10c), to be maintained. If the nominal money supply and government debt are constrained to evolve gradually, the required equilibrating adjustment occurs through a jump in the price level.Footnote 17

Recalling (10c), increasing the money growth rate from

![]() $\overline{\theta }_{0}$

to

$\overline{\theta }_{0}$

to

![]() $\overline{\theta }_{1}$

implies an immediate reduction in real money balances, attained by an increase in price from its pre-shock level,

$\overline{\theta }_{1}$

implies an immediate reduction in real money balances, attained by an increase in price from its pre-shock level,

![]() $P_{0}$

. Let

$P_{0}$

. Let

![]() $M_{0},M^{\prime}_{0}$

denote the pre-shock levels of the real and nominal money stocks:

$M_{0},M^{\prime}_{0}$

denote the pre-shock levels of the real and nominal money stocks:

which implies

where the proportionate change in bonds follows from the government budget constraint, (A5a).

With

![]() $l(t)$

unchanged at its initial steady state, (B3) implies

$l(t)$

unchanged at its initial steady state, (B3) implies

![]() $\alpha (t)=\alpha (0)=1$

, and (17) implies

$\alpha (t)=\alpha (0)=1$

, and (17) implies

![]() $\sigma _{a}^{*}=\sigma _{a}(t)=\sigma _{a}(0)$

, where recalling (18),

$\sigma _{a}^{*}=\sigma _{a}(t)=\sigma _{a}(0)$

, where recalling (18),

![]() $\sigma _{a}(0)$

is endogenously determined due to the initial jump in the price level reported in (21’). As shown in equation (C5), the effect of the price jump on

$\sigma _{a}(0)$

is endogenously determined due to the initial jump in the price level reported in (21’). As shown in equation (C5), the effect of the price jump on

![]() $\sigma _{a}(0)$

depends critically upon: the relative importance of nominal assets in economy-wide wealth (

$\sigma _{a}(0)$

depends critically upon: the relative importance of nominal assets in economy-wide wealth (

![]() $\varpi$

), and the relative variations in the initial endowments of financial versus real assets across individuals (

$\varpi$

), and the relative variations in the initial endowments of financial versus real assets across individuals (

![]() $\sigma _{n,0}/\sigma _{k,0}$

). Under the previously identified weak conditions (

$\sigma _{n,0}/\sigma _{k,0}$

). Under the previously identified weak conditions (

![]() $\varpi \lt 1/2, \sigma _{n,0}\leq \sigma _{k,0}$

), (C5) implies

$\varpi \lt 1/2, \sigma _{n,0}\leq \sigma _{k,0}$

), (C5) implies

![]() $d\sigma _{a}^{*}/dP(0)=d\sigma _{a}(0)/dP(0)\gt 0$

.

$d\sigma _{a}^{*}/dP(0)=d\sigma _{a}(0)/dP(0)\gt 0$

.

Under these same conditions, a monetary expansion brought about by a reduction in the nominal interest rate yields

which implies

In this case, the reduction in the nominal interest rate reduces the initial price level, in which case under the conditions (

![]() $\varpi \lt 1/2,\sigma _{n,0}\leq \sigma _{k,0}$

) we obtain

$\varpi \lt 1/2,\sigma _{n,0}\leq \sigma _{k,0}$

) we obtain

![]() $d\sigma _{a}^{*}/dP(0)=d\sigma _{a}(0)/dP(0)\lt 0$

.

$d\sigma _{a}^{*}/dP(0)=d\sigma _{a}(0)/dP(0)\lt 0$

.

Turning now to income inequality, again there are no transitional dynamics. Given the response in wealth inequality, the effect on income inequality is

where

implying that an increase (decrease) in the initial price level reduces (raises) the real income generating effect of wealth,

![]() $\varphi ^{*}$

. The impact on income inequality reflects two effects. First, to the extent that the price rise increases wealth inequality it also directly increases income inequality. But, in addition, the discrete price increase reduces the real value of government bonds, and therefore the interest income they generate. Since these bonds are held more proportionately by wealthier agents, this reduces the degree of income inequality. The net impact on income inequality thus depends upon the relative sizes of these two offsetting effects. Comparing (23) and (C5), we see that the two effects are essentially determined independently. Accordingly, income inequality may quite plausibly rise or fall with increasing wealth inequality.

$\varphi ^{*}$

. The impact on income inequality reflects two effects. First, to the extent that the price rise increases wealth inequality it also directly increases income inequality. But, in addition, the discrete price increase reduces the real value of government bonds, and therefore the interest income they generate. Since these bonds are held more proportionately by wealthier agents, this reduces the degree of income inequality. The net impact on income inequality thus depends upon the relative sizes of these two offsetting effects. Comparing (23) and (C5), we see that the two effects are essentially determined independently. Accordingly, income inequality may quite plausibly rise or fall with increasing wealth inequality.

The notable feature is that the two forms of monetary expansion have precisely the opposite impacts on wealth and income inequality and can be summarized in the following proposition, specified for the more plausible case where

![]() $d\sigma _{a}^{*}/dP(0)=d\sigma _{a}(0)/dP(0)\gt 0$

.

$d\sigma _{a}^{*}/dP(0)=d\sigma _{a}(0)/dP(0)\gt 0$

.

Proposition 1:

-

(i) A nominal monetary expansion specified by an increase in the monetary growth rate increases the price level, reducing the value of the nominal assets and causing wealth inequality to increase. This is offset by a decline in the income generating effect of wealth,

$\varphi ^{*}$

, with the net impact on income inequality depending upon which effect dominates.

$\varphi ^{*}$

, with the net impact on income inequality depending upon which effect dominates. -

(ii) If the monetary expansion takes the form of a reduction in the nominal interest rate, precisely the opposite occurs. The price level falls, wealth inequality declines, and

$\varphi ^{*}$

increases, with the net impact on income inequality depending upon which effect dominates.

$\varphi ^{*}$

increases, with the net impact on income inequality depending upon which effect dominates.

Any apparent contradiction between these two forms of nominal monetary expansion is readily resolved by observing that with perfectly flexible prices the initial jump in the price level following an increase in the nominal monetary growth rate dominates the (gradually) growing nominal money supply. The real stock of money immediately declines, so paradoxically, this turns out to be a contractionary policy in real terms. In contrast, reducing the nominal interest rate directly stimulates the real demand for money and is expansionary.

An interesting aspect of Proposition 1 is that although neither form of monetary expansion affects the economy’s real productive capacity—both leaving

![]() $K,L,Y,C$

unchanged at their initial levels—the difference is that (i) increases the inflation rate, while (ii) reduces it. In view of the fact that much of the empirical literature view the monetary policy–inequality relationship in terms of inflation, it is useful to re-express the proposition in these terms.Footnote

18

$K,L,Y,C$

unchanged at their initial levels—the difference is that (i) increases the inflation rate, while (ii) reduces it. In view of the fact that much of the empirical literature view the monetary policy–inequality relationship in terms of inflation, it is useful to re-express the proposition in these terms.Footnote

18

Proposition 2: Monetary policy that increases the rate of inflation will increase wealth inequality. Its effect on income inequality depends upon whether the increase in wealth inequality dominates its effect on the income generating effect of wealth,

![]() $\varphi ^{*}$

.

$\varphi ^{*}$

.

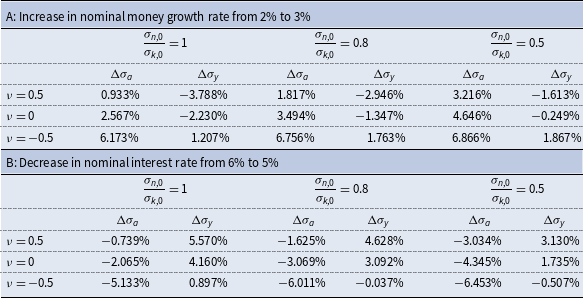

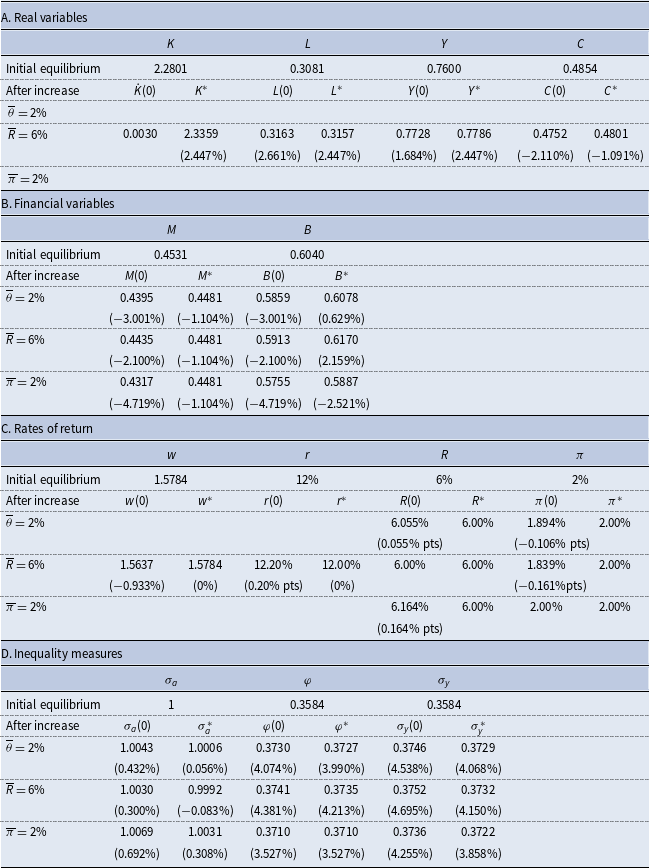

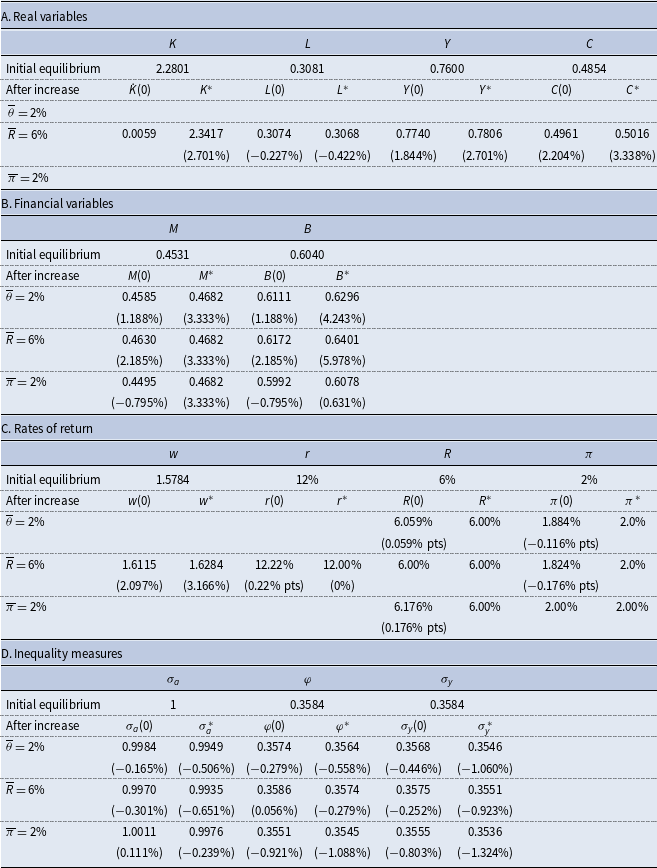

Table 1 provides some numerical examples illustrating the ranges of likely responses of wealth and income inequality due to the price change associated with the monetary expansion. The parameters are based on the calibration discussed in Section 6, below. In the absence of any solid information on the relative magnitudes of the distribution of initial endowments,

![]() $\sigma _{n,0}/\sigma _{k,0}\equiv \lambda$

, and their correlation,

$\sigma _{n,0}/\sigma _{k,0}\equiv \lambda$

, and their correlation,

![]() $\nu$

, we let these two parameters vary over the range indicated in the table. In all cases, increasing the monetary growth rate by 1 percentage point (p.p.) increases wealth inequality, while decreasing the nominal interest rate by 1 p.p. reduces wealth inequality. As is readily seen, the comparative impacts on wealth and income inequality are sensitive to both

$\nu$

, we let these two parameters vary over the range indicated in the table. In all cases, increasing the monetary growth rate by 1 percentage point (p.p.) increases wealth inequality, while decreasing the nominal interest rate by 1 p.p. reduces wealth inequality. As is readily seen, the comparative impacts on wealth and income inequality are sensitive to both

![]() $\lambda$

and

$\lambda$

and

![]() $\nu$

. The examples suggest that if

$\nu$

. The examples suggest that if

![]() $\nu \geq 0$

, the income generating effect dominates so that wealth and income inequality are impacted in opposite ways, But if nominal and real assets are negatively correlated, the wealth effect dominates and wealth and income inequality respond in the same direction. In light of (B5) and (B6), which imply that poor agents hold relatively more money than do affluent agents, the negatively correlated case

$\nu \geq 0$

, the income generating effect dominates so that wealth and income inequality are impacted in opposite ways, But if nominal and real assets are negatively correlated, the wealth effect dominates and wealth and income inequality respond in the same direction. In light of (B5) and (B6), which imply that poor agents hold relatively more money than do affluent agents, the negatively correlated case

![]() $\nu \lt 0$

seems plausible.Footnote

19

$\nu \lt 0$

seems plausible.Footnote

19

Table 1. Changes in inequality in response to changes in monetary policy

NB Table 1A also obtains for (i) increase in nominal interest rate from 6% to 7%; (ii) increase in inflation target from 2% to 3%. Table 1B also obtains for (i) decrease in nominal money growth rate from 2% to 1%; (ii) decrease in inflation target from 2% to 1%.

![]() $\sigma _{k,0},\sigma _{n,0}$

denote initial distributions of capital and nominal assets across agents.

$\sigma _{k,0},\sigma _{n,0}$

denote initial distributions of capital and nominal assets across agents.

![]() $\nu$

denotes correlation between initial distributions of capital and nominal assets across agents.

$\nu$

denotes correlation between initial distributions of capital and nominal assets across agents.

6. Calibration

While monetary policy in isolation does not generate transitional dynamics, it does influence the transitional path generated by real structural changes, such as an increase in technology. To compare the dynamic responses of the economy to such changes under the alternative monetary policies, we employ numerical simulations.

The parameter values we adopt for this purpose are reported in Table 2 and are chosen to be consistent with US parameters over the last decade, insofar as is feasible for a small stylized model such as this. In choosing these values, we should also note the following. In the case of the aggregate economy-wide average variables, we assume that the monetary policies are consistent with a common steady state. However, this does not yield the same rate of convergence among the different monetary policies, although the differences are small. This is important since the nature of the transition, and in particular the speed of convergence, is a critical determinant of the responses in the various inequality measures to the alternative shocks. A characteristic of the RCTD approach to distribution being adopted is that all measures of inequality are relative to those of initial wealth, which is arbitrarily given and normalized to unity. In the initial equilibrium, the steady-state values of the standard deviations of wealth, income-earning assets, and income are identical among the three monetary policies.

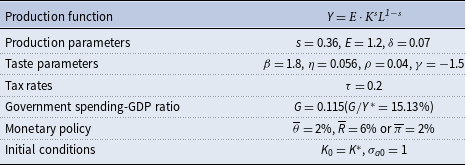

Table 2. Basic parameters (benchmark)

The production function is Cobb-Douglas, with the capital elasticity being set at its conventional value,

![]() $s=0.36$

, TFP is

$s=0.36$

, TFP is

![]() $E=$

1.2, while the annual rate of depreciation is assumed to be 7%. This yields an equilibrium capital-output ratio of 3.

$E=$

1.2, while the annual rate of depreciation is assumed to be 7%. This yields an equilibrium capital-output ratio of 3.

Regarding the parameters pertaining to utility, the rate of time preference,

![]() $\rho =0.04$

, is standard, while the IES corresponding to

$\rho =0.04$

, is standard, while the IES corresponding to

![]() $\gamma =-1.5(0.4)$

is well within the estimated range as reported by Guvenen (Reference Guvenen2006) and Havranek et al. (Reference Havranek, Horvath, Irsova and Rusnak2015). The elasticity of leisure in utility is the critical factor determining the agent’s allocation of time, and setting

$\gamma =-1.5(0.4)$

is well within the estimated range as reported by Guvenen (Reference Guvenen2006) and Havranek et al. (Reference Havranek, Horvath, Irsova and Rusnak2015). The elasticity of leisure in utility is the critical factor determining the agent’s allocation of time, and setting

![]() $\beta =1.8$

yields the steady-state allocation of time to leisure of

$\beta =1.8$

yields the steady-state allocation of time to leisure of

![]() $l^{*}=0.6919$

which is comparable to the evidence provided by Cooley (Reference Cooley1995) and other related studies.

$l^{*}=0.6919$

which is comparable to the evidence provided by Cooley (Reference Cooley1995) and other related studies.

Information on

![]() $\eta$

is less direct. In the case of real money balances, our choice of

$\eta$

is less direct. In the case of real money balances, our choice of

![]() $\eta =0.056$

is justified as follows. First, it depends upon how broadly one views money with respect to the utility benefits it provides. For this purpose we adopt the broad measure, M3. The implied value of the real money balances becomes

$\eta =0.056$

is justified as follows. First, it depends upon how broadly one views money with respect to the utility benefits it provides. For this purpose we adopt the broad measure, M3. The implied value of the real money balances becomes

![]() $M^{*}=0.4531$

, so that the real money balance to consumption ratio is

$M^{*}=0.4531$

, so that the real money balance to consumption ratio is

![]() $M^{*}/C^{*}=0.9333.$

The average value of the real M3-consumption ratio for the period 2002–2020 in the USA is 0.88, suggesting that the parameter choices pertaining to money are generally consistent with the data.

$M^{*}/C^{*}=0.9333.$

The average value of the real M3-consumption ratio for the period 2002–2020 in the USA is 0.88, suggesting that the parameter choices pertaining to money are generally consistent with the data.

With regard to monetary policy, many advanced economies set a target rate of inflation equal to 2%. Accordingly, we set the growth rate of nominal money supply at

![]() $\overline{\theta }=$

2%, nominal interest rate at

$\overline{\theta }=$

2%, nominal interest rate at

![]() $\overline{R}=6\mathrm{\% }$

so that the steady-state inflation rate becomes 2% for both monetary policies.Footnote

20

With the inflation rate in the USA from 2000 to 2020 averaging around 1.70%, this value is also compatible with US experience.

$\overline{R}=6\mathrm{\% }$

so that the steady-state inflation rate becomes 2% for both monetary policies.Footnote

20

With the inflation rate in the USA from 2000 to 2020 averaging around 1.70%, this value is also compatible with US experience.

For fiscal policies, the average value of the US government consumption-GDP ratio from 2000 to 2019 is 15.04%.Footnote

21

Thus, setting

![]() $G=0.115$

, the share of government consumption in output is

$G=0.115$

, the share of government consumption in output is

![]() $G/Y^{*}=15.13\% .$

Footnote

22

For simplicity, the tax rates on labor and capital income are set at

$G/Y^{*}=15.13\% .$

Footnote

22

For simplicity, the tax rates on labor and capital income are set at

![]() $20\%,$

which are close to the average rates for the USA over the period 2000–2020. Setting

$20\%,$

which are close to the average rates for the USA over the period 2000–2020. Setting

![]() $B^{*}=0.6040$

together with

$B^{*}=0.6040$

together with

![]() $\chi =0.003$

implies the ratio of bonds-money of

$\chi =0.003$

implies the ratio of bonds-money of

![]() $B^{*}/M^{*}=1.3330$

, which is both close to the average US government bonds-money ratio over the period 2009 and 2019 of 1.349 and is also consistent with the long-run solvency of the government.

$B^{*}/M^{*}=1.3330$

, which is both close to the average US government bonds-money ratio over the period 2009 and 2019 of 1.349 and is also consistent with the long-run solvency of the government.

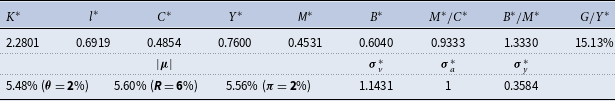

While our calibration is motivated by consistency with an initial steady state, it is also important that it be compatible with the transitional dynamics and specifically the speed of convergence. Empirical studies over the years have suggested some range in these estimated rates of convergence. Early estimates by Barro and Sala-i-Martin (Reference Barro and Sala-I-Martin1992) and Mankiw et al. (Reference Mankiw, Romer and Weil1992) yielded annual rates of convergence of around 2%. But subsequent studies have suggested that these estimates are downwardly biased, and more recent studies by Evans (Reference Evans1997), Islam (Reference Islam1995), and others argue that estimates in the range of 5% are more accurate. The parameter values chosen above yield asymptotic convergence rates of 5.48% and 5.60% for the

![]() $\overline{\theta }=2\mathrm{\% }$

and

$\overline{\theta }=2\mathrm{\% }$

and

![]() $\overline{R}=6\%$

policies. respectively, which are close to the estimate of 5.8% suggested by Evans (Reference Evans1997).

$\overline{R}=6\%$

policies. respectively, which are close to the estimate of 5.8% suggested by Evans (Reference Evans1997).

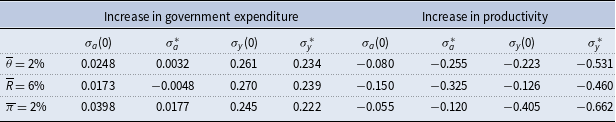

Table 3 also shows the coefficients of variation of the various measures discussed in Section 4. Comparing the measures, we see that they satisfy

![]() $\sigma _{a}^{*}\gt \sigma _{y}^{*}$

, consistent with the qualitative ranking summarized in empirical estimates of the respective Gini coefficients.Footnote

23

$\sigma _{a}^{*}\gt \sigma _{y}^{*}$

, consistent with the qualitative ranking summarized in empirical estimates of the respective Gini coefficients.Footnote

23

Table 3. Steady-state values (benchmark)

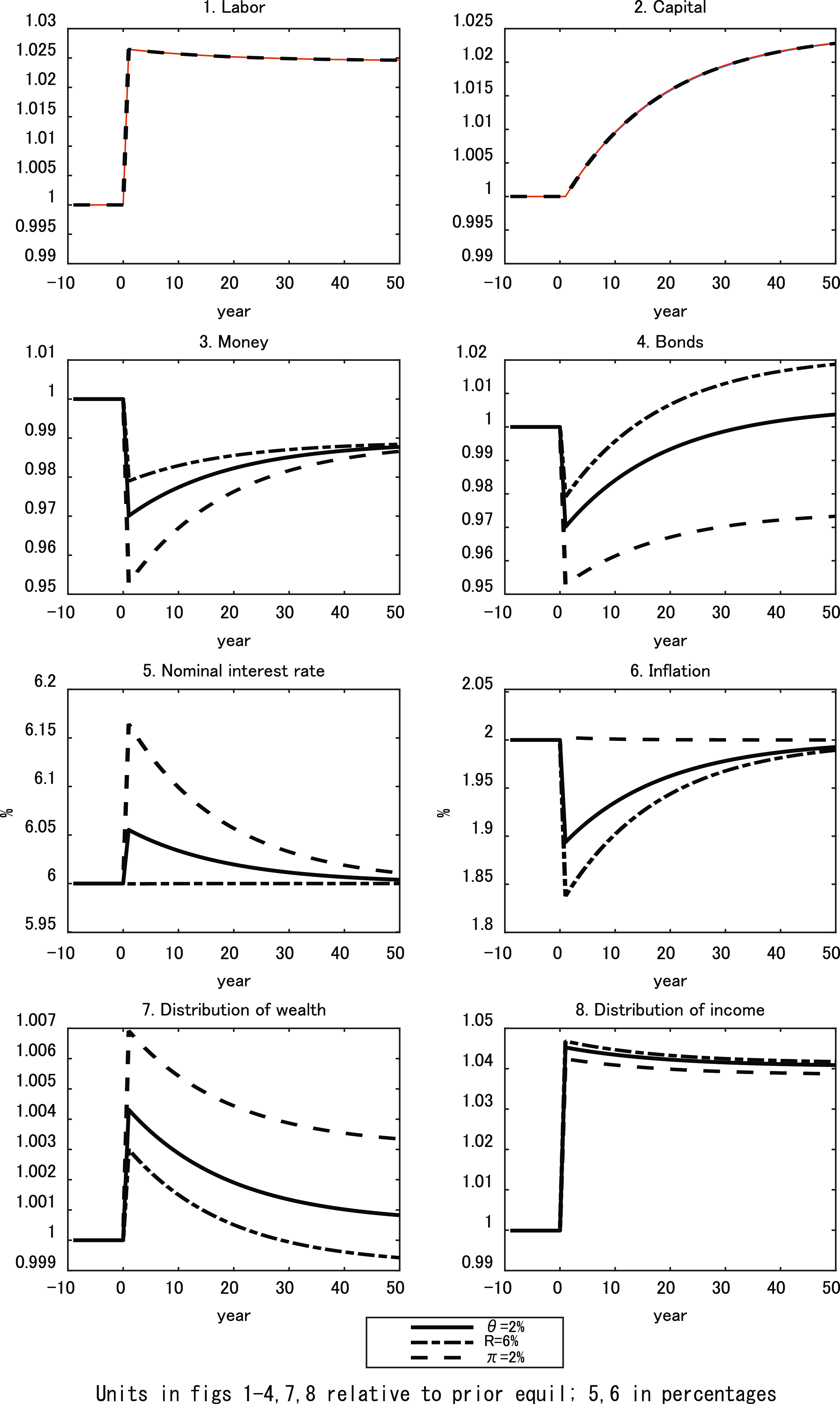

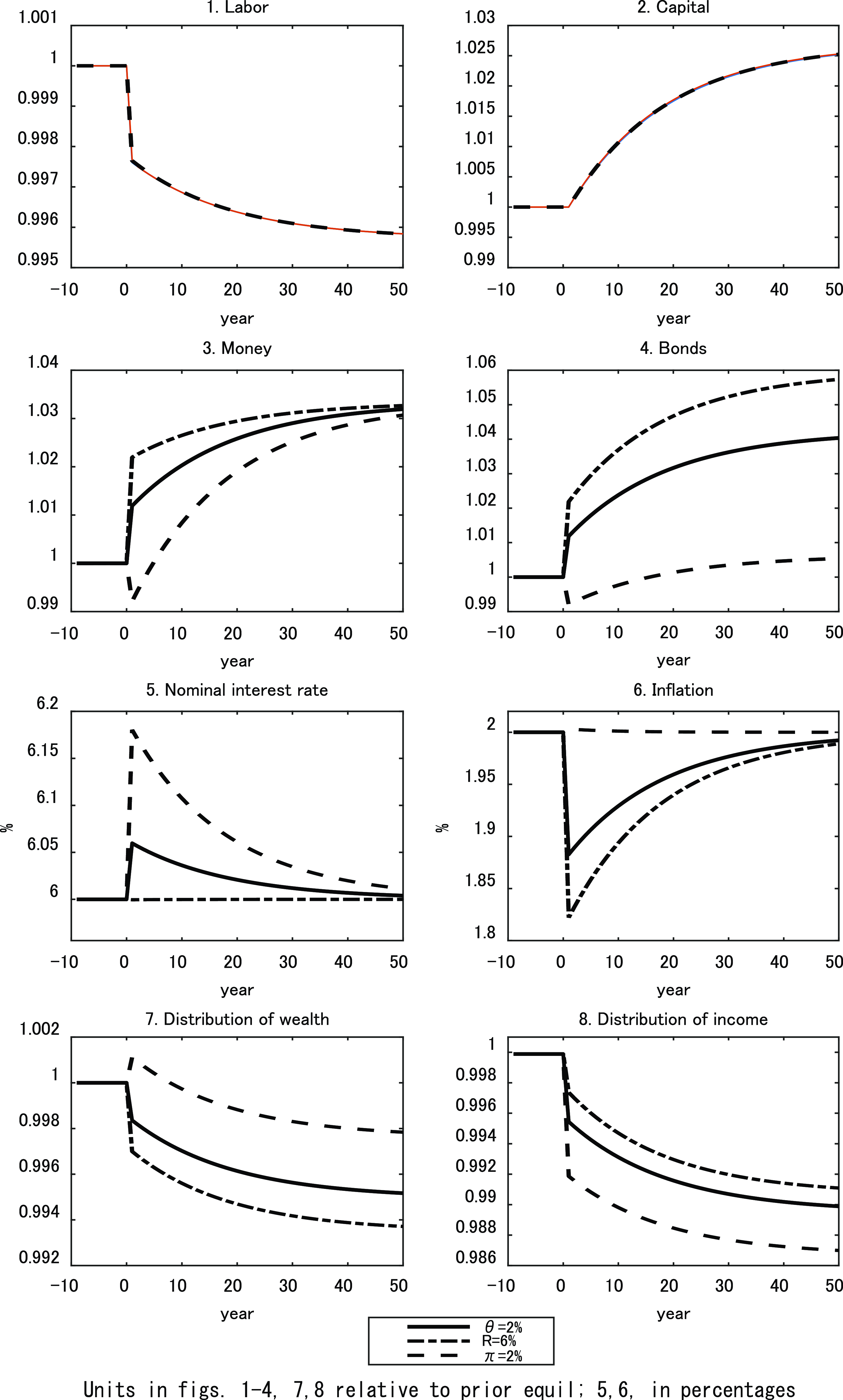

7. Impact of monetary policy on the dynamics of inequality