Introduction

Across a variety of different industries and markets, sustainability has become an increasingly important factor of consideration for both firms and political entities as the world becomes more focused on ethics – in consumption and production – and the climate. Most recently, the United States rejoined the Paris Agreement, signifying a renewed American commitment to sustainability and climate change mitigation (United Nations Framework Convention on Climate Change 2021).

One of the most common definitions of sustainability comes from the United Nations’ World Commission on Environmental Development, which states that “sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (World Commission on Environment and Development 1987). In the context of the fashion industry, the UN’s definition can be interpreted to mean efforts to minimize any undesirable environmental effects of a clothing product’s life cycle by ensuring the efficient and careful use of natural resources, selecting renewable energy sources at every stage, and maximizing repair, remake, reuse, and recycling of the product, its components, and its packaging.

Here, sustainable practices go hand in hand with fair and ethical practices in terms of labor and treatment of human capital. Among the many environmental and sustainability problems originating from the fashion industry – most notably the “fast fashion” sector (Bick, Halsey, and Ekenga Reference Bick, Halsey and Ekenga2018) – labor transparency and fair labor have been identified as key areas that require improvement in the growing pursuit of “sustainable” fashion (Yang, Song and Tong Reference Yang, Song and Tong2017). The horrific working conditions of sweatshops in developing countries are depicted in films like The True Cost, which vividly captures images of underpaid workers being beaten and overworked in the pursuit of a final garment. Most often, however, the consumer is unaware of such conditions when they purchase the garment, because, ultimately, one key element missing in the fashion industry is transparency (Bray, Johns and Kilburn Reference Bray, Johns and Kilburn2011; McNeill and Moore Reference McNeill and Moore2015; Wiederhold and Martinez Reference Wiederhold and Martinez2018). Though this seems to be acknowledged as a primary issue, there is not a common set of criteria to judge a brand’s approach to ethics and sustainability with regard to labor practices (Winter and Lasch Reference Winter and Lasch2016). Furthermore, firms can choose to certify their products as ethically or sustainably produced on a completely voluntary basis with no body of enforcement, and there are a plethora of certification options to choose fromFootnote 1 – yielding a lack of clarity for the consumer (Henninger, Alevizou and Oates Reference Henninger, Alevizou and Oates2016).

A lack of consumer clarity is further compounded by the fact that sustainable fashion falls into the category of credence goods, which are defined by economists as goods whose quality is unable to be determined or verified by the consumer even after consumption (Dulleck and Kerschbamer Reference Dulleck and Kerschbamer2006). For a piece of clothing, even if it was sustainably produced, the consumer is unable to ascertain its true nature of sustainability after purchasing or wearing the garment. Thus, the consumer is heavily reliant on the word of firms or certification agencies, which can easily claim that a garment was made sustainably even if it was not. Not surprisingly, as economists have shown, markets for credence goods are plagued by fraudulent behavior and inefficiencies (Dulleck and Kerschbamer Reference Dulleck and Kerschbamer2006).

At the firm level – across several industries, including the fashion industry – attempts have been made to improve labor standards and increase labor transparency. However, these efforts have yielded minimal success. The mining industry, for example, created an industry-wide framework that outlined principles of ethical business practices and steps for monitoring and implementing their own certification agency (Sethi and Emelianova Reference Sethi, Emelianova and Sethi2011). Nevertheless, because of the framework’s lack of clarity and the clear bias that arises from having an industry-controlled certification agency, the mining industry failed to accomplish its own goals and gain any credibility with the public (Sethi and Emelianova Reference Sethi and Emelianova2006).

Even the fashion industry has recognized their failings with regard to the ethical use of labor. Nike, the athletic wear brand, implemented a company code of ethics and enforced adherence through monitoring. However, in this case, just as with the mining industry, a private certification agency and an ambiguous code of conduct failed to produce tangible results (Locke, Qin and Brause Reference Locke, Qin and Brause2007).

From the consumer’s perspective, ethics are becoming increasingly crucial in the consumption decision process through a trend known as ethical consumption (Lundblad and Davies Reference Lundblad and Davies2016). Evidence suggests that consumers are willing to pay a higher price for a product when it is confirmed to be produced sustainably as opposed to when it is not (De Pelsmacker, Janssens, Sterckx and Mielants Reference De Pelsmacker, Janssens, Sterckx and Mielants2005; Ha-Brookshire and Norum Reference Ha-Brookshire and Norum2011). This aspect of consumer decision-making is largely in keeping with the popularized notion of corporate social responsibility, which suggests that firms are responsible to themselves, their stakeholders – which may include shareholders and workers – and – almost more crucially – the public, who in some cases may also be considered stakeholders of the firms (Rokka and Uusitalo Reference Rokka and Uusitalo2008). Given a firm’s responsibility to all of these parties, the idea of corporate social responsibility argues that the firm should be aware of the impact they are having on society as a whole, which includes the environmental, social, and economic ramifications of their actions (Ryznar and Woody Reference Ryznar and Woody2014).

Thus, from firms’ perspective, if their goal is to maximize profit and maintain a level of accountability to these various stakeholders, should they not consider consumers’ preferences toward sustainability and ethical consumption when manufacturing their products? Moreover, if firms are not incentivized – through market mechanisms or government interventions – to create labor transparency and abide by a set of ethical standards, will they do so of their own accord? As mentioned above, previous attempts by several industries to move in the direction of ethical and sustainable production have proven ineffective, which suggests that alternative market or institutional arrangements are necessary. Therefore, a major question from a policy perspective is, under what conditions will firms comply with labor transparency certifications or standards, and, furthermore, how can policymakers help bring these conditions about?

In this paper, we attempt to answer this question theoretically by presenting and analyzing a game theory model of a firm’s production decision. The model takes into account the strategic interdependence among the choices of the firm, the consumers, and – assuming that one is in place – a certification agency that monitors the firm’s actions. Although sustainability issues in the fashion industry serve as the motivation for our analysis, it should be noted that our model framework, results, and implications are applicable to other industries in which sustainability and ethical production are major areas of concern. We also note that several scholars have previously examined theoretically how to induce firms – through certification and labeling mechanisms (see Bonroy and Constantatos (Reference Bonroy and Constantatos2015) for a review of the literature) – to produce high-quality and costlier goods when quality is not easily observable by consumers. These findings show that the existence of credible third-party monitoring is necessary for the market to produce these goods and to increase social welfare (see, e.g., Kirchhoff Reference Kirchhoff2000; McCluskey Reference McCluskey2000; Walter and Chang Reference Walter and Chang2017). We extend these earlier works by examining the credibility of the certitifcation process itself and considering more closely the incentives of the certificaton agency to monitor the firm.

The results of our analysis show that when the certification agency is controlled by the firm, or when it is an independent private entity that seeks to maximize its own profit, then there is no equilibrium of the model in which the firm chooses to produce in an ethical or sustainable manner. This follows since monitoring and certifying products is itself a credence good, the provision of which – as mentioned above – is subject to inefficiencies and opportunistic behavior (Yokessa and Marette Reference Yokessa and Marette2019). These findings are in accord with the empirical findings discussed above and provide a theoretical rationale for why several industry-led efforts to move toward a more sustainable mode of production have been unsuccessful.

We also consider what would happen if the certification agency were a government entity with a mandate to monitor and audit the firm’s production process or an ethically minded independent agency. We show that – combined with tax incentives or subsidies for the firm if necessary, and greater specificity regarding what is fair or sustainable – there exists an equilibrium in which the firm would choose to engage in sustainable production in this case. We analyze extensions of the model to examine conditions under which the phenomenon of greenwashing can arise as an equilibrium outcome. Finally, we propose a “bounty system” that the government can implement to incentivize monitoring of firms’ production processes, and we show how such a policy can induce more sustainable production practices by firms. Our main results suggest that greater government involvement, along with the appropriate institutional arrangement and incentive schemes such as tax breaks, subsidies, or bounties, would be more effective in moving the fashion industry toward sustainable modes of production.

The model

The set of players

Considering the actors involved in the creation of and compliance with labor transparency standards in the fashion industry, these include the firms or the producers; a certification board or agency tasked with monitoring the firms and certifying whether they comply with the given standards; and, finally, the consumers. While one might argue that the only relevant actors in such a model of ethical or sustainable production are the firms and the consumers, without a certification agency the possibility of ensuring transparency and credibility is extremely limited. Without some form of monitoring altogether, there is nothing to guarantee that the firms will adhere to their initial promise of sustainability, especially if their objective is purely the maximization of profit.

Below, we discuss in greater detail the role of the different actors in the market. For convenience, we will use the term “sustainable” and its variants throughout our exposition to refer to any green or ethical production process.

The firm: In the production of a final product, the firm has the ultimate burden of fabricating the garment in the context of the fashion industry. The firm hires laborers. We assume the firm has complete control over working conditions given their ultimate control of the supply chain, but this may not always be true in the real world due to, for example, the use of subcontractors. We leave the issue of subcontractor certification for future work and focus on the main firm in this paper.

As noted previously, a firm’s desire to produce sustainably is largely dependent on its beliefs about the nature of corporate social responsibility and the level to which the firm feels accountable to its employees, the consumers, and the environment. As Ryznar and Woody (Reference Ryznar and Woody2014) suggest, a firm’s “value system” with regard to these issues is largely dictated by internal management and the company’s founding set of governing principles. If a firm is created with a part of its mission statement devoted to the addressing of sustainability, as several recent companies have done, the firm is attempting to demonstrate from the outset a high level of corporate social responsibility and a willingness to take action. For many firms, however, attitudes toward sustainability may be largely driven by market forces and a pure profit motive. The increased costs associated with producing sustainably – such as increased workers’ wages and investments to improve working conditions within factories – can deter brands from engaging in such production (Ryznar and Woody Reference Ryznar and Woody2014). Furthermore, even if a firm claims to operate sustainably, if no one is holding them to a set of standards or monitoring their production process, they could easily act duplicitously. Hence, the need for another actor in the market: the certification agency.

Certification agency: Once a firm has decided to either adhere to a code of conduct in terms of labor standards or opt to avoid sustainable production for cost reasons, a second actor – a certification board or agency – may become involved in the production and supply process. It is important to note that such an entity can exist in many forms. While this actor can serve as a private, independent body, they can also be affiliated with the firm itself, which can present problems in terms of monitoring biases and conflicts-of-interests. Additionally, such a certification agency could be administered by a non-profit organization, regulated by the government, or even be part of the government (e.g., the Environmental Protection Agency). As mentioned previously, engaging in sustainable production in general could lead to increased production costs. However, additional costs are incurred when a certification agency is utilized (Sethi and Emelianova Reference Sethi and Emelianova2006). For example, the firm may need to invest resources to build the necessary infrastructure to enable a certification agency to assess labor conditions. In addition, the firm may have to pay for the services of a certification agency. Moreover, the certification agency itself needs to incur the cost of monitoring and inspection in fulfilling its role. As Bick, Halsey and Ekenga (Reference Bick, Halsey and Ekenga2018) put it, “ethically and environmentally sound supply chains are difficult and expensive to audit.”

Consumers: The consumers are the final entity in the market that make purchasing decisions based on their judgment about the firm and its products. Looking at the literature on consumer behavior, researchers have shown that a significant proportion of consumers have a preference for sustainable products across a variety of fields. After studying Belgian consumers, De Pelsmacker et al. (Reference De Pelsmacker, Janssens, Sterckx and Mielants2005) found that consumers attach great importance to the “ethical” label placed on fair trade coffee in making their purchase decisions. Rokka and Uusitalo (Reference Rokka and Uusitalo2008) found a similar result in regard to consumer preferences for green packaging. Regardless of price, brand, and convenience, consumers appear to prioritize the sustainability and “greenness” of the products’ packaging, further emphasizing the environmental and ethical dimensions of consumer decision-making. Consumers can also publicly criticize a firm and stop buying from the brand altogether if the firm fails to abide by certain labor standards, thus using market forces to alter a firm’s behavior. Much published research in the area of consumer behavior point to the conclusion that consumers often prefer ethically and environmentally friendly alternatives over the average good (Nielsen 2015; McKinsey & Company 2020). Furthermore, consumers demonstrate a higher willingness-to-pay per item when the product is produced sustainably.

We note that we are confining our analysis to a setting in which there is only one firm and one certification agency in order to focus on how credible the certification process is. We therefore do not address issues related to how firms in a market – in seeking a competitive advantage – may use certifications as a means of differentiating their products in order to entice more consumers to buy from them (Li Reference Li2020; Xia, Fan and Lou Reference Xia, Fan and Lou2021).

The game tree

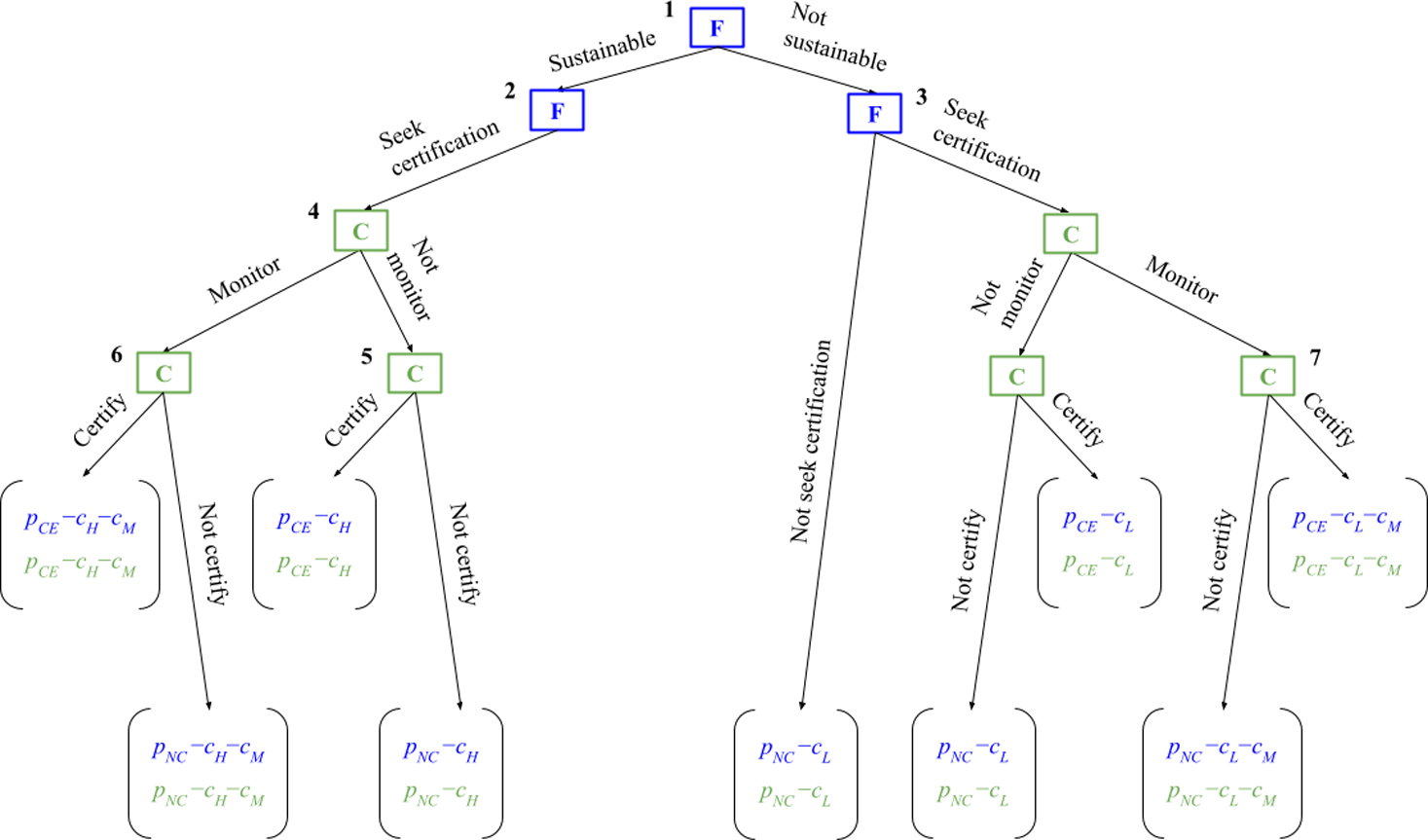

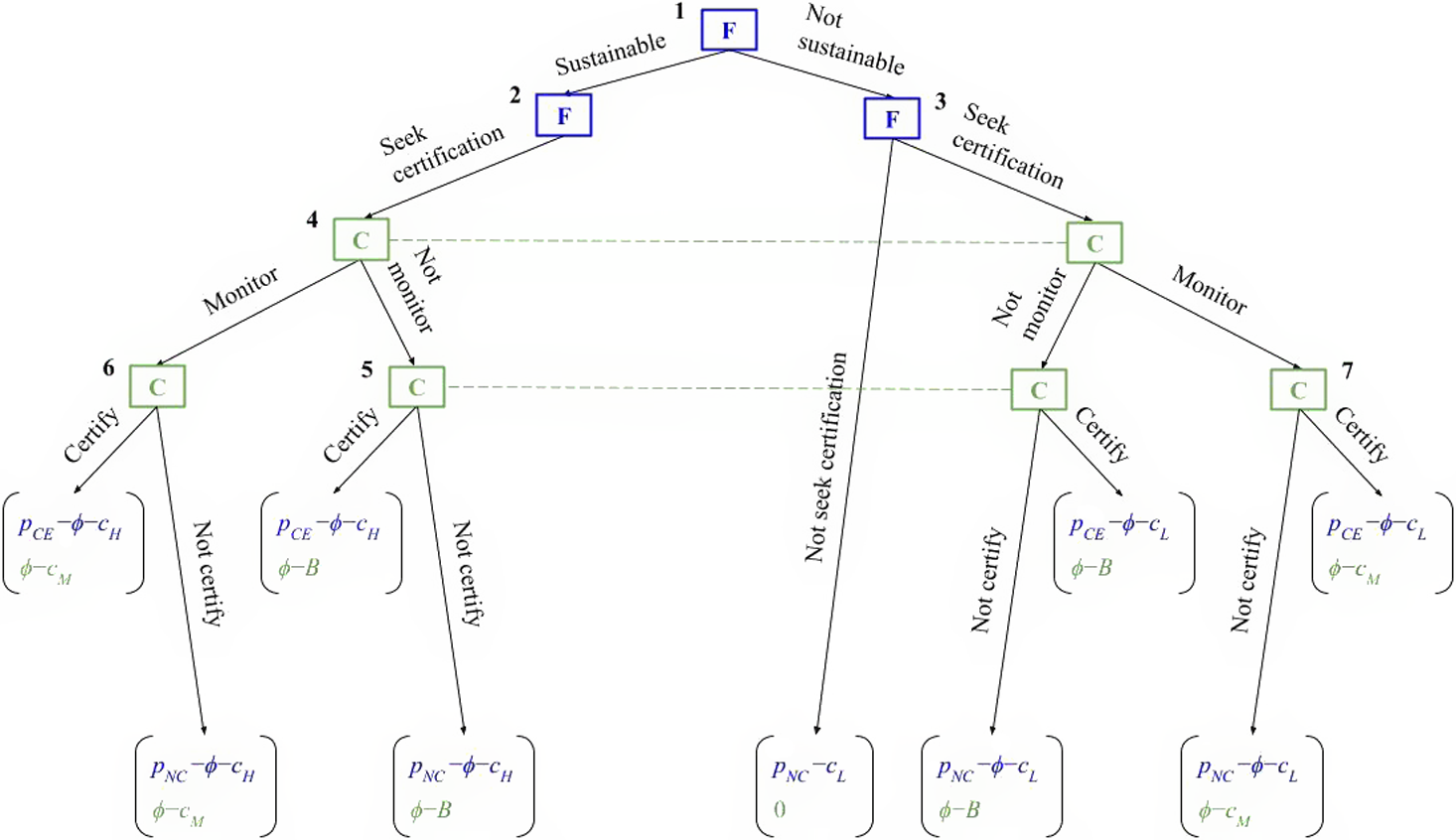

In understanding the interactions of firms and consumers in terms of the adoption of sustainable practices, a game tree as shown in Figure 1 depicts the actors involved as well as the actions available to each actor at their decision nodes. Our model is an extremely simplified version of the clothing production process in order to make the game-theoretic analysis as simple and clear as possible.

Figure 1. Game tree for our model of sustainable production. The firm is denoted by “F”; the certification agency is denoted by “C”; and the consumers or buyers are denoted by “B.” The dashed lines indicate information sets – two decision nodes for a player belong to the same information set if the player cannot distinguish between those two nodes (which occurs when there is a lack of information). Payoffs for specific situations are given in the following texts and figures.

The game is a one-shot, sequential one with the firm moving first. The firm chooses whether to employ a sustainable mode of production or not. Assuming a certification agency exists in the market that could monitor the firm’s production process, the firm also makes a decision regarding whether to seek certification or not.

If the firm chooses to get certified for adopting sustainable practices, then the certification agency gets to move next in the game. It chooses whether or not to monitor or audit the firm’s production process – without conducting an audit, the certification agency would not be able to establish whether the firm is producing in a sustainable manner or not. We assume that, once the certification agency audits the firm, it has perfect knowledge regarding the firm’s production process, that is, it would know if the firm utilized a sustainable mode of production. Additionally, whether or not an audit is actually conducted by the certification agency, it has to make a decision regarding whether or not to certify the firm’s products.

The buyer moves last in the game and makes a decision about purchasing the firm’s product. The buyer is unable to tell directly whether the product was produced sustainably or not – since we assume the buyer cannot observe the firm’s supply chain or production process – but the buyer can see whether the product has been certified by the certification agency or not. Note that, even if the final product has been certified as sustainable, the buyer may not be completely sure of the validity of this certification because the certification agency could have given its “stamp of approval” without actually conducting an audit.

Specification of payoffs

To complete the description of the model, we need to specify the payoffs of the players in the game. Note that because the product can be supplied in two forms – with or without certification – we need to have two prices in our model:

![]() ${p_{CE}}$

, which is the price of the product that comes with certification; and

${p_{CE}}$

, which is the price of the product that comes with certification; and

![]() ${p_{NC}}$

, which is the price of the uncertified product. Without loss of generality, all payoffs below are presented in terms of how much it would cost to produce, certify, or purchase a single unit of good.

${p_{NC}}$

, which is the price of the uncertified product. Without loss of generality, all payoffs below are presented in terms of how much it would cost to produce, certify, or purchase a single unit of good.

The firm: Let

![]() ${c_L}$

denote the cost to the firm of producing its good conventionally, that is, non-sustainably, and let

${c_L}$

denote the cost to the firm of producing its good conventionally, that is, non-sustainably, and let

![]() ${c_H}$

denote the cost of producing it sustainably. As discussed above, it should be the case that

${c_H}$

denote the cost of producing it sustainably. As discussed above, it should be the case that

![]() ${c_H} \gt {c_L} \ge 0$

.

${c_H} \gt {c_L} \ge 0$

.

In utilizing a certification agency, the firm may incur additional costs associated with it. For example, if the certification agency is an independent entity that charges a fee for its services, then that fee,

![]() $\phi $

, is an additional cost that the firm needs to pay for if it chooses to seek certification for its product.

$\phi $

, is an additional cost that the firm needs to pay for if it chooses to seek certification for its product.

The firm’s revenue depends on whether its product receives certification or not: if it is certified, then the revenue is

![]() ${p_{CE}}$

; otherwise, the revenue is

${p_{CE}}$

; otherwise, the revenue is

![]() ${p_{NC}}$

. Combining all these pieces of information regarding the revenue and costs of the firm thus allows us to compute the firm’s profit given any decision that it and the certification agency make.

${p_{NC}}$

. Combining all these pieces of information regarding the revenue and costs of the firm thus allows us to compute the firm’s profit given any decision that it and the certification agency make.

We assume that the firm is perfectly competitive and acts as a price-taker: its objective is to maximize its profit given the prices

![]() ${p_{CE}}$

and

${p_{CE}}$

and

![]() ${p_{NC}}$

by choosing its mode of production and whether or not to seek certification. While we could model the firm as having some intrinsic preference for fair and sustainable ways of production in addition to profit, we restrict our analysis to the case in which the firm cares only about profit in order to focus on how best to incentivize all types of firms – including those that have no direct concern for sustainability – to produce in a sustainable manner.

${p_{NC}}$

by choosing its mode of production and whether or not to seek certification. While we could model the firm as having some intrinsic preference for fair and sustainable ways of production in addition to profit, we restrict our analysis to the case in which the firm cares only about profit in order to focus on how best to incentivize all types of firms – including those that have no direct concern for sustainability – to produce in a sustainable manner.

Certification agency: If the certification agency undertakes an audit, then it incurs a monitoring cost of

![]() ${c_M} \gt 0$

. If it is an entity – whether an independent, private agency or a government agency – that charges for its services, then it generates a revenue of

${c_M} \gt 0$

. If it is an entity – whether an independent, private agency or a government agency – that charges for its services, then it generates a revenue of

![]() $\phi \gt 0$

when the firm chooses to utilize it.

$\phi \gt 0$

when the firm chooses to utilize it.

In the analysis below, we will consider three types of certification agency.

-

Firm-owned certification agency: The certification agency is merely an extension of the firm itself, and thus its payoff is equal to the firm’s payoff.

-

Independent private certification agency: The certification agency is a private entity that collects a fixed fee

$\phi $

if hired by the firm to conduct an audit. We will analyze different scenarios corresponding to whether the certification agency is a for-profit entity that purely seeks to maximize the difference between its revenue and its costs, or a non-profit organization that has a different objective.

$\phi $

if hired by the firm to conduct an audit. We will analyze different scenarios corresponding to whether the certification agency is a for-profit entity that purely seeks to maximize the difference between its revenue and its costs, or a non-profit organization that has a different objective. -

Government-operated certification agency: The certification agency is a government organization whose mandate is to monitor the production sector and check whether goods and services are produced in a sustainable manner.

Buyer: Let

![]() ${b_H}$

denote the buyer’s benefit or willingness-to-pay for a product that is sustainably produced, and let

${b_H}$

denote the buyer’s benefit or willingness-to-pay for a product that is sustainably produced, and let

![]() ${b_L}$

denote the willingness-to-pay for a product that is produced non-sustainably. As prior research has shown, we have

${b_L}$

denote the willingness-to-pay for a product that is produced non-sustainably. As prior research has shown, we have

![]() ${b_H} \gt {b_L}$

. In what follows, we will assume that

${b_H} \gt {b_L}$

. In what follows, we will assume that

![]() ${b_H} - {c_H} \gt {b_L} - {c_L} \gt 0$

, which implies that it is more efficient from society’s perspective for the firm to produce the good sustainably.

${b_H} - {c_H} \gt {b_L} - {c_L} \gt 0$

, which implies that it is more efficient from society’s perspective for the firm to produce the good sustainably.

As shown in Figure 1, when the buyer makes her purchase decision in the model, she cannot directly observe whether the product was made in a sustainable manner or not. Moreover, she could be in one of two situations.

-

Case 1: The product comes certified and is priced at

${p_{CE}}$

. Since the buyer does not possess firsthand knowledge regarding how the product was manufactured, let

${p_{CE}}$

. Since the buyer does not possess firsthand knowledge regarding how the product was manufactured, let

${E_{CE}}\left[ b \right]$

denote her expected willingness-to-pay for the product given that it comes certified. The expected value

${E_{CE}}\left[ b \right]$

denote her expected willingness-to-pay for the product given that it comes certified. The expected value

${E_{CE}}\left[ b \right]$

is a weighted average of

${E_{CE}}\left[ b \right]$

is a weighted average of

${b_H}$

and

${b_H}$

and

${b_L}$

, that is,

${b_L}$

, that is,

${E_{CE}}\left[ b \right] \equiv {q_{CE}}{b_H} + \left( {1 - {q_{CE}}} \right){b_L}$

, where

${E_{CE}}\left[ b \right] \equiv {q_{CE}}{b_H} + \left( {1 - {q_{CE}}} \right){b_L}$

, where

${q_{CE}} \in \left[ {0,\,1} \right]$

is the probability that a certified product was produced sustainably. Therefore, the buyer’s net benefit from purchasing the good is

${q_{CE}} \in \left[ {0,\,1} \right]$

is the probability that a certified product was produced sustainably. Therefore, the buyer’s net benefit from purchasing the good is

${E_{CE}}\left[ b \right] - {p_{CE}}$

.

${E_{CE}}\left[ b \right] - {p_{CE}}$

. -

Case 2: The product is not certified and is priced at

${p_{NC}}$

. The buyer’s net benefit from purchasing the good in this case is

${p_{NC}}$

. The buyer’s net benefit from purchasing the good in this case is

${E_{NC}}\left[ b \right] - {p_{NC}}$

, where

${E_{NC}}\left[ b \right] - {p_{NC}}$

, where

${E_{NC}}\left[ b \right] \equiv {q_{NC}}{b_H} + \left( {1 - {q_{NC}}} \right){b_L}$

is the expected willingness-to-pay for the product given that it is not certified, and

${E_{NC}}\left[ b \right] \equiv {q_{NC}}{b_H} + \left( {1 - {q_{NC}}} \right){b_L}$

is the expected willingness-to-pay for the product given that it is not certified, and

${q_{NC}} \in \left[ {0,\,1} \right]$

is the probability that a non-certified product was produced sustainably. The buyer’s net benefit from purchasing a non-certified product is

${q_{NC}} \in \left[ {0,\,1} \right]$

is the probability that a non-certified product was produced sustainably. The buyer’s net benefit from purchasing a non-certified product is

${E_{NC}}\left[ b \right] - {p_{NC}}$

.

${E_{NC}}\left[ b \right] - {p_{NC}}$

.

We note that the probabilities

![]() ${q_{CE}}$

and

${q_{CE}}$

and

![]() ${q_{NC}}$

cannot be arbitrarily specified in the model: in a game-theoretic equilibrium, these probabilities must be consistent with the actions chosen by the firm and the certification agency. Roughly speaking, this requirement states that, given the choices that the firm and the certification agency are expected to make, the buyer’s belief regarding what they will do should not be unrealistic or unreasonable. We will define explicitly the conditions

${q_{NC}}$

cannot be arbitrarily specified in the model: in a game-theoretic equilibrium, these probabilities must be consistent with the actions chosen by the firm and the certification agency. Roughly speaking, this requirement states that, given the choices that the firm and the certification agency are expected to make, the buyer’s belief regarding what they will do should not be unrealistic or unreasonable. We will define explicitly the conditions

![]() ${q_{CE}}$

and

${q_{CE}}$

and

![]() ${q_{NC}}$

must satisfy below when defining the equilibrium of our model.

${q_{NC}}$

must satisfy below when defining the equilibrium of our model.

We also assume that the number of potential buyers for the firm’s product is large so that the product price is driven to the buyers’ expected willingness-to-pay. This thus yields

and

This assumption simplifies the analysis considerably since we no longer need to consider the buyers as active players – the game reduces to a two-player game played between the firm and the certification agency. For this reason, we henceforth eliminate the buyer’s decision nodes/information sets in all figures.

Definition of equilibrium

Because the game we consider is a sequential one played between the firm and the certification agency, we employ the concept of subgame perfect equilibrium (SPE) as our solution concept. Note from Figure 1 that, because of the information sets that the certification agency has, the game has only two proper subgames: one starting at the certification agency’s decision node following a decision to monitor the firm given that the firm has chosen to produce sustainably (the decision node labeled “6” in the figure), and one starting at the certification agency’s decision node following a decision to monitor the firm given that the firm has chosen to produce non-sustainably (the decision node labeled “7” in the figure).

We assume – in the spirit of the concept of perfect Bayesian Nash equilibrium for sequential games with incomplete information – that the buyer’s beliefs regarding the firm’s product conditional on observing whether it is certified or not – as captured by the probabilities

![]() ${q_{CE}}$

and

${q_{CE}}$

and

![]() ${q_{NC}}$

– satisfy Bayes’ rule when applicable. When Bayes’ rule does not apply, we impose no restrictions on

${q_{NC}}$

– satisfy Bayes’ rule when applicable. When Bayes’ rule does not apply, we impose no restrictions on

![]() ${q_{CE}}$

and

${q_{CE}}$

and

![]() ${q_{NC}}$

aside from the requirement that they belong to the interval

${q_{NC}}$

aside from the requirement that they belong to the interval

![]() $\left[ {0,\,1} \right]$

. Therefore, we have

$\left[ {0,\,1} \right]$

. Therefore, we have

$${q_{CE}} = \left\{ {\matrix{

{{{\Pr \left[ {{\rm{good \, is \, sustainably \, produced \, and \, gets \, certified}}} \right]} \over {\Pr \left[ {{\rm{good \, gets \, certified}}} \right]}}} & {{\rm{if}}\Pr \left[ {{\rm{good \, gets \, certified}}} \right] > 0} \cr

{{\rm{any}}{\mkern 1mu} {\rm{number}} \, {\mkern 1mu} \, {\rm{in}}{\mkern 1mu} \left[ {0,{\mkern 1mu} 1} \right]} & {{\rm{if}}\Pr \left[ {{\rm{good \, gets \, certified}}} \right] = 0{\rm{ }}} \cr

} } \right.,$$

$${q_{CE}} = \left\{ {\matrix{

{{{\Pr \left[ {{\rm{good \, is \, sustainably \, produced \, and \, gets \, certified}}} \right]} \over {\Pr \left[ {{\rm{good \, gets \, certified}}} \right]}}} & {{\rm{if}}\Pr \left[ {{\rm{good \, gets \, certified}}} \right] > 0} \cr

{{\rm{any}}{\mkern 1mu} {\rm{number}} \, {\mkern 1mu} \, {\rm{in}}{\mkern 1mu} \left[ {0,{\mkern 1mu} 1} \right]} & {{\rm{if}}\Pr \left[ {{\rm{good \, gets \, certified}}} \right] = 0{\rm{ }}} \cr

} } \right.,$$

$${q_{NC}} = \left\{ {\matrix{

{{{\Pr \left[ {{\rm{good \, is \, sustainably \, produced \, and \, is \, not \, certified}}} \right]} \over {\Pr \left[ {{\rm{good \, is \, not \, certified}}} \right]}}} & {{\rm{if}}\Pr \left[ {{\rm{good \, is \, not \, certified}}} \right] > 0} \cr

{{\rm{any}}{\mkern 1mu} {\rm{number}} \, {\mkern 1mu} \, {\rm{in}}{\mkern 1mu} \left[ {0,{\mkern 1mu} 1} \right]{\rm{ }}} & {{\rm{if}}\Pr \left[ {{\rm{good \, gets \, certified}}} \right] = 0{\rm{ }}} \cr

} } \right..$$

$${q_{NC}} = \left\{ {\matrix{

{{{\Pr \left[ {{\rm{good \, is \, sustainably \, produced \, and \, is \, not \, certified}}} \right]} \over {\Pr \left[ {{\rm{good \, is \, not \, certified}}} \right]}}} & {{\rm{if}}\Pr \left[ {{\rm{good \, is \, not \, certified}}} \right] > 0} \cr

{{\rm{any}}{\mkern 1mu} {\rm{number}} \, {\mkern 1mu} \, {\rm{in}}{\mkern 1mu} \left[ {0,{\mkern 1mu} 1} \right]{\rm{ }}} & {{\rm{if}}\Pr \left[ {{\rm{good \, gets \, certified}}} \right] = 0{\rm{ }}} \cr

} } \right..$$

DEFINITION: A SPE in our model is defined by the following conditions:

-

The firm’s choices at its decision nodes 1, 2, and 3 maximize its payoffs given the choices of the certification agency and given prices

$\left( {{p_{CE}},\,{p_{NC}}} \right)$

.

$\left( {{p_{CE}},\,{p_{NC}}} \right)$

. -

The certification agency’s choices at its decision nodes/information sets 4, 5, 6, and 7 maximize its payoffs given the choices of the firm and given prices

$\left( {{p_{CE}},\,{p_{NC}}} \right)$

.

$\left( {{p_{CE}},\,{p_{NC}}} \right)$

. -

The prices

$\left( {{p_{CE}},\,{p_{NC}}} \right)$

satisfy (1)–(4).

$\left( {{p_{CE}},\,{p_{NC}}} \right)$

satisfy (1)–(4).

Observe that in a SPE the firm would never choose to produce sustainably and then not seek certification. This follows since the firm’s payoff from choosing this strategy is

![]() ${p_{NC}} - {c_H}$

, while the payoff from an alternative strategy of producing non-sustainably and thereafter not seeking certification is strictly higher:

${p_{NC}} - {c_H}$

, while the payoff from an alternative strategy of producing non-sustainably and thereafter not seeking certification is strictly higher:

![]() ${p_{NC}} - {c_L} \gt {p_{NC}} - {c_H}$

. We therefore remove the “Not seek certification” choice from the firm’s decision node following a choice of producing sustainably (decision node 2 in Figure 1).

${p_{NC}} - {c_L} \gt {p_{NC}} - {c_H}$

. We therefore remove the “Not seek certification” choice from the firm’s decision node following a choice of producing sustainably (decision node 2 in Figure 1).

Private certification agency

In order to examine the impact of having a certification system in place, let us begin by considering what would happen in our market if there does not exist a certification agency, which is equivalent to assuming that the certification fee

![]() $\phi $

that the firm has to pay the agency is prohibitively high (i.e.,

$\phi $

that the firm has to pay the agency is prohibitively high (i.e.,

![]() $\phi \gt {b_H} - {b_L}$

, where

$\phi \gt {b_H} - {b_L}$

, where

![]() ${b_H} - {b_L}$

is the most that the firm’s gain from certification,

${b_H} - {b_L}$

is the most that the firm’s gain from certification,

![]() ${p_{CE}} - {p_{NC}}$

, can be). In this case, the branches in Figure 1 corresponding to the action “Seek certification” can be eliminated. The firm’s payoff from “Sustainable” is thus

${p_{CE}} - {p_{NC}}$

, can be). In this case, the branches in Figure 1 corresponding to the action “Seek certification” can be eliminated. The firm’s payoff from “Sustainable” is thus

![]() ${p_{NC}} - {c_H}$

, and its profit from “Not sustainable” is

${p_{NC}} - {c_H}$

, and its profit from “Not sustainable” is

![]() ${p_{NC}} - {c_L}$

. Since

${p_{NC}} - {c_L}$

. Since

![]() ${c_H} \gt {c_L}$

by assumption, the firm would never choose to produce sustainably in the absence of any certification scheme.

${c_H} \gt {c_L}$

by assumption, the firm would never choose to produce sustainably in the absence of any certification scheme.

Henceforth, we will assume that the certification fee

![]() $\phi $

is not prohibitively large, which means that there is scope for the firm to utilize the certification agency.

$\phi $

is not prohibitively large, which means that there is scope for the firm to utilize the certification agency.

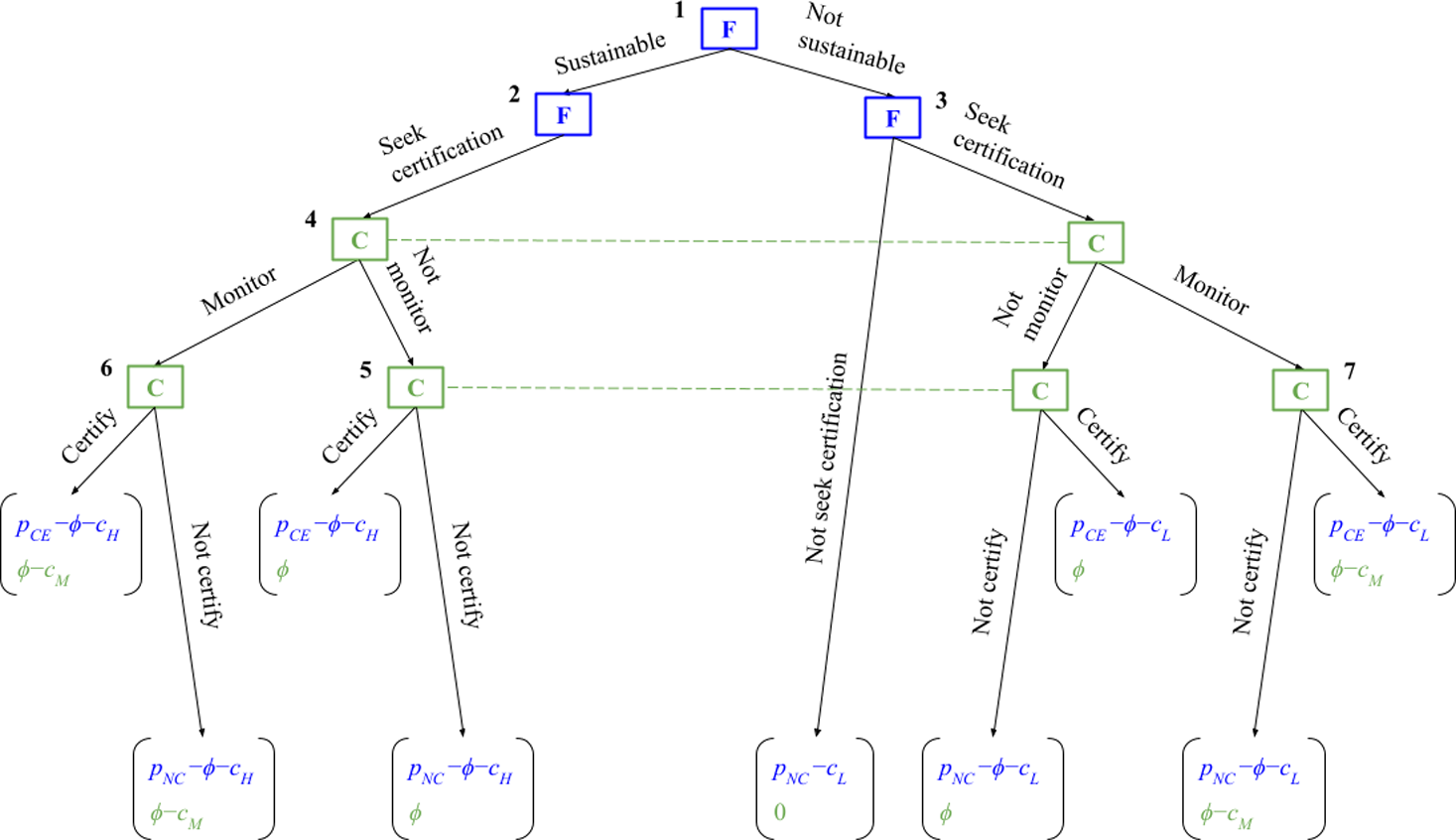

Firm-owned certification agency

We assume in this case that the certification agency is an extension of the firm itself, so that its payoff is exactly equal to the firm’s payoff (see Figure 2). There is no fee paid for certification as this would simply be a transfer between two internal departments of the same firm. Since the certification agency is part of the firm, the agency has perfect information regarding whether the firm chooses to utilize a sustainable mode of production or not. Hence, none of the agency’s decision nodes in Figure 2 belongs to an information set containing another decision node.

Figure 2. Game tree with a firm-owned certification agency. Payoffs are shown for each possible outcome. The number on top is the firm’s payoff, while the number on the bottom is the certification agency’s payoff. Because the certification agency is merely an extension of the firm itself, the payoff of the agency is identical to that of the firm. Since the certification agency is part of the firm, the agency has perfect information regarding the mode of production that the firm chooses in decision node 1. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

Not surprisingly, in this scenario, certification by the agency could never serve as a credible signal to the buyer regarding the nature of the firm’s product. The buyers are not willing to pay a “green premium” for the good, which leads the firm not to adopt the more costly sustainable method of production. In such a market, therefore, the firm would not produce sustainably (see the Appendix for all formal proofs).

PROPOSITION 1: The only SPE in this market is for the firm to choose “Not sustainable” at decision node 1.

Independent private certification agency

Suppose now the certification agency is an independent entity that seeks to maximize its own profit without regard to the firm’s profit. The game tree with the payoffs of the firm and the certification agency in this case is shown in Figure 3. Due to the costliness of private monitoring, the certification agency – once it is guaranteed payment of its service fee

![]() $\phi $

– would have no incentive to choose this option. A profit-maximizing private certification agency, which lacks an ethical or legislative mandate, would opt not to monitor to avoid incurring this certification cost. This, however, ultimately undermines the credibility of this external agent. Since certification in this case is not a credible signal to consumers of how the firm’s product was made, the firm would therefore have no incentive to pay the fee

$\phi $

– would have no incentive to choose this option. A profit-maximizing private certification agency, which lacks an ethical or legislative mandate, would opt not to monitor to avoid incurring this certification cost. This, however, ultimately undermines the credibility of this external agent. Since certification in this case is not a credible signal to consumers of how the firm’s product was made, the firm would therefore have no incentive to pay the fee

![]() $\phi $

to employ the services of the certification agency. Because the firm – if it has chosen to produce sustainably or ethically – has no way to credibly convince buyers that it has chosen to do so, there can be no equilibrium such that the firm will produce sustainably when the certification agency is private.

$\phi $

to employ the services of the certification agency. Because the firm – if it has chosen to produce sustainably or ethically – has no way to credibly convince buyers that it has chosen to do so, there can be no equilibrium such that the firm will produce sustainably when the certification agency is private.

Figure 3. Game tree with an independent private certification agency. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

PROPOSITION 2: The only SPE in this market is for the firm to choose (Not sustainable, Not seek certification).

Examples

Given the equilibrium analysis presented previously, this paper will now turn to real-world examples where private certification agencies have failed to incentivize sustainable production to help us understand the necessary structure and conditions that should be adopted by the fashion industry. Such examples offer insight into the complicated nature of monitoring and compliance with labor transparency standards, and they suggest that an alternative setup is necessary to yield success.

The case of the mining industry

In the case of the mining industry, an industry notable for its extremely dangerous working conditions and therefore subject to significant public criticism, Sethi and Emelianova (Reference Sethi and Emelianova2006) describe the spectrum that exists for codes of conduct: firms can implement codes with high levels of specificity that require independent monitoring, or adopt mission statements about broad principles, which lack clarity. Launched in May of 2003 to much fanfare from the industry itself, the International Council on Mining and Metals created an individual code of conduct called the Sustainable Development framework (SD framework), which falls on the latter end of the spectrum. This type of strategy is plagued with problems of free riding and adverse selection, since firms that have much to gain from participation could engage at no costs to the firm themselves. Furthermore, because of the voluntary nature of the framework, success depends on the individual firms’ willingness to make progress and is damaged by the performance of the group’s weakest members. In such a scenario, Sethi and Emelianova (Reference Sethi, Emelianova and Sethi2011) suggest that, with no independent monitoring, adherence to the framework lacks adequate incentivization. At the time of its launch, the framework received criticism from environmental and sustainability-focused NGOs, who condemned its lack of specificity and commented on the fact that the monitoring body was controlled by the industry, which represents a clear conflict of interest. The SD framework also fails to provide transparency and offers no quantitative standards, thus failing to meet its own objectives and lacking clarity for the consumers.

Across the industry, Sethi and Emelianova (Reference Sethi and Emelianova2006) found that the majority of firms had failed to meet any of the objectives laid out in the framework, including the allocation of financial and human resources to implement the code of conduct for labor standards and the creation of an independent external monitoring program for compliance certification. Due to this, authors suggest that the SD framework is unable to produce actual, tangible results in the industry, and the reports created by the firms during the process lack specificity for consumers. The findings of this case study suggest that while it is clear that such frameworks are necessary for sustainable development and labor transparency, compliance with these codes of conduct should not be completely voluntary because firms lack the incentive to comply. Opting to create refined, unambiguous codes allows for the potential of more success by increasing attainability and overall explicitness. Finally, this case suggests that – as is consistent with Propositions 1 and 2 above – the implementation of such standards cannot be monitored privately or by an industry-owned certification agency as this fails to ameliorate working conditions.

The case of Nike

Turning to the apparel and footwear industry, Locke et al. (Reference Locke, Qin and Brause2007) examined working conditions globally for Nike and Nike’s suppliers. After facing massive backlash in the 1990s over horrific working conditions in their global supply chain, Nike invested significant resources in implementing an internal code of conduct that involved three forms of audits of their factories to monitor conditions, each with different levels of depth. The types of audit include a SHAPE audit, which addresses basic environmental and safety concerns; an M-Audit, which examined management and working conditions in more depth; and finally inspections by the Fair Labor Association. In this case, it is important to note that all three forms of audits are external to the government. Co-founder Phil Knight even noted prior to the implementation of such a code, “(t)he Nike product has become synonymous with slave wages, forced overtime, and arbitrary abuse” (Locke, Qin and Brause Reference Locke, Qin and Brause2007). The company conducted numerous training sessions in their factories and created a team of 90 compliance staff located in 21 countries to tackle environmental, labor, and occupational health problems.

The researchers found that, despite substantial efforts and investments by Nike and its staff to improve working conditions among its suppliers, monitoring of labor standards according to the company code of conduct alone appears to have produced only limited improvements. Locke et al. (Reference Locke, Qin and Brause2007) found that on a scale of 0–100, the mean score in factories was roughly 65, with variation in scores ranging from 20 to 90. The researchers suggested that this variation could be due in part to the factories’ characteristics and the relationship between Nike and the particular supplier. Additionally, the study failed to see significant change over time since the implementation of the code of conduct. Ultimately, these findings suggest that monitoring through audits only produces limited results in terms of progress toward sustainability despite a company-wide adoption of such a code. The case study of Nike thus is also consistent with the theoretical results we have presented above.

A case of government action

Other research has analyzed the effectiveness of government policy measures and tax structures in incentivizing corporate social responsibility in the context of the United States. Such research suggests that corporations in general seek to circumvent regulations and attempt to avoid taxation if possible. Ryznar and Woody (Reference Ryznar and Woody2014) examined the specific case of the Dodd-Frank Act, which was passed in 2010 by Congress to reduce the trade in conflict minerals from the Democratic Republic of the Congo. Under this Act, Congress mandated that firms must disclose to the Securities and Exchange Commission whether or not their product contained conflict minerals. In this case, the requirement is merely one of disclosure and does not mandate changes to the firms’ actual practices within the supply chain. The researchers found that the burden to monitor corporate responsibility ultimately fell on the market, where consumers shamed the firm for producing products that contained these conflict minerals. The researchers concluded that generally if the regulations implemented on the part of the government conflict with a firm’s profit maximization strategy, they will seek to avoid regulation, which undermines the intent of these regulations.

One way to avoid this is to incentivize corporate social responsibility through tax incentives instead of regulation. An example of such a tax incentive is one that has been implemented domestically called the Indian Employment Tax Credit (Ryznar and Woody Reference Ryznar and Woody2014). This act provides a credit if a qualified employee, such as someone who is an enrolled member of a Native American tribe or the spouse of such a member, is hired and performs substantially all of her services within a Native American reservation. Such a tax structure was designed to incentivize firms to meet diversity criteria deemed important by the federal government. However, such incentives can be applied in the context of labor transparency. Compared to the insignificant results of pure regulation, Ryznar and Woody (Reference Ryznar and Woody2014) suggest that tax incentivization can yield more success, implying that firms require a form of external motivation in order to achieve corporate social responsibility.

Lessons from previous examples

The failures of the mining and fashion industry highlight a clear problem with private certification schemes and suggest that three conditions are necessary for success in terms of achieving sustainability: the structure of incentivization, the clarity of the code itself, and the level of consumer transparency.

Structure of incentivization: When firms are incentivized to adhere to labor standards as opposed to adopt codes of conduct voluntarily, they appear more willing to do so. As mentioned previously, a voluntary framework with no carrots or sticks allows for minimal enforcement and introduces the problems of free riding and adverse selection. Furthermore, voluntary standards implicitly rely on the assumption that the sponsoring organizations and everyone else share a common interest in improving the underlying conditions and that all parties involved hold the same level of responsibility and stakes in the outcome. This places the burden on firms to monitor and sustain a level of public credibility. However, as seen with the mining industry, this yields limited results. Instead, as shown by Ryznar and Woody (Reference Ryznar and Woody2014), methods of incentivization such as tax credits can yield success in attaining the desired outcome. We note that, to satisfy this incentivization condition of bringing in some carrots and sticks, the government could also choose to subsidize the cost of sustainable production and certification, and it could also serve as the certification agency.

Clarity of framework: Making progress toward sustainable production is also largely contingent on the specificity of the framework itself. When a framework is too broad in nature, as was the case with both the SD framework for the mining industry and Nike’s code of conduct, it fails to accomplish any of the desired outcomes outlined by either the industry or the firm.

Furthermore, expansiveness yields confusion for all actors involved. With the case of the mining industry, Sethi and Emelianova (Reference Sethi and Emelianova2006) conclude that, in an attempt to include the entire industry, the framework convergences to the lowest common denominator in terms of standards. They thus suggest that, as opposed to attempting to implement a framework on the industry level, firms should instead look internally, allowing for specificity in outcomes and standards.

Consumer transparency: For the consumers to want to purchase the final product over non-sustainable alternatives, there must be a level of consumer transparency. In the case of the mining industry, firms failed to offer evidence of compliance with the SD framework, there was no independence in the formal process of monitoring, and the framework failed to offer clear quantitative standards. Because consumer clarity is already an issue when it comes to the certifications available within the fashion industry, a successful framework for certification or code of conduct should seek to minimize confusion and affirm the credibility of the firm. When confusion is minimized, the consumer can be sure that they are purchasing a sustainably made good, operating with complete information about the product. When the government assumes the role of the certification agency, consumer transparency could be enhanced relative to a market with private certification agencies. This follows since, as discussed previously, consumers may not find the certification process credible with private certification agencies that may be more interested in minimizing costs and maximizing profit.

Ultimately, the failings of several industries as seen through the examples above demonstrate an obvious need for change. To ameliorate working conditions, incentivization, specificity, and consumer transparency must work in tandem for firms to want to pursue sustainable and ethical production. As we show below using our theoretical framework, such conditions can be created when the government assumes the role of the certification agency.

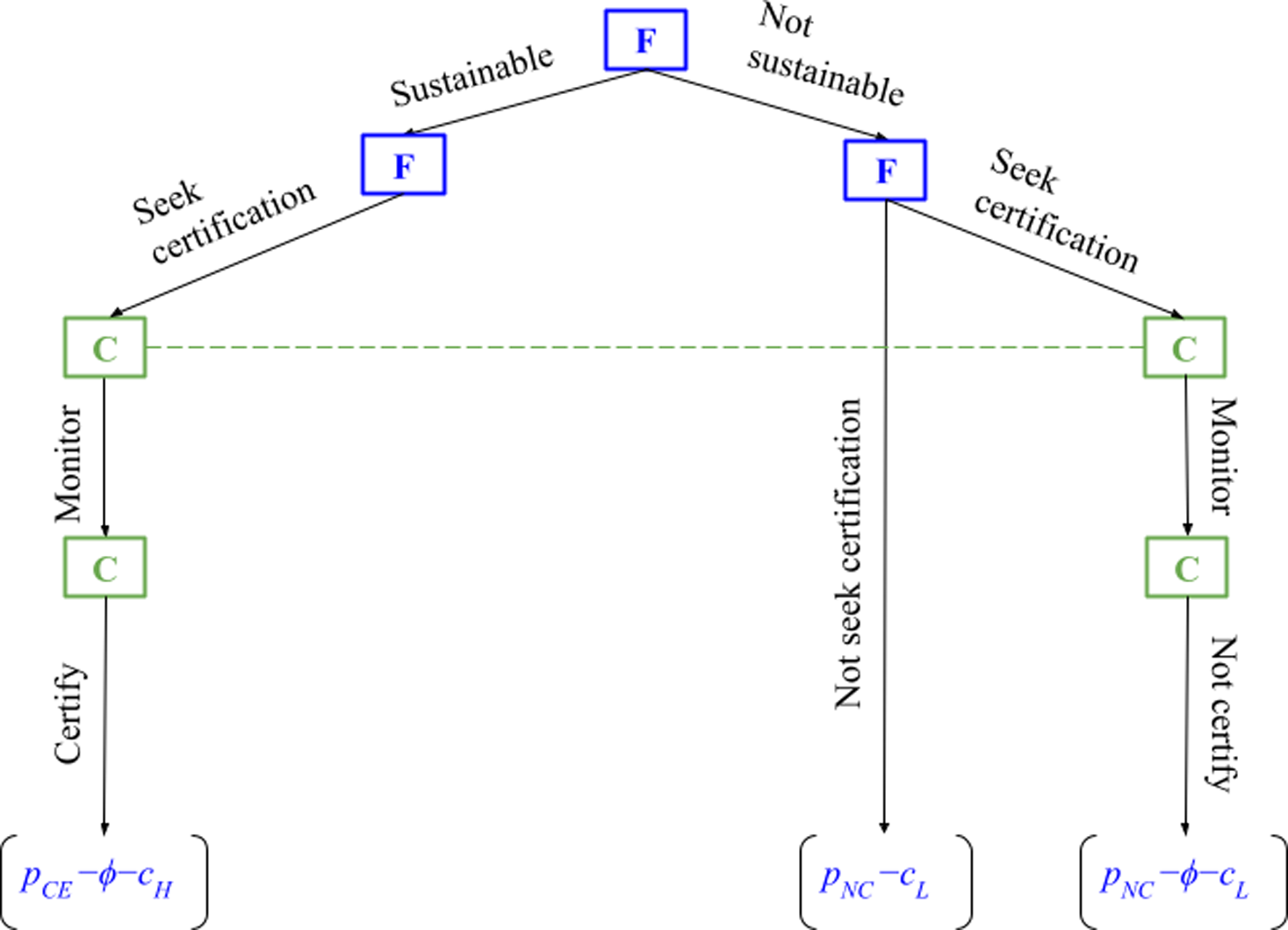

Government-operated certification agency

When the government becomes involved in the certification process of labor standards and subsequently becomes the monitoring agency with a mandate to audit firms’ production process, the game tree in Figure 1 can be reduced to the one shown in Figure 4. This follows because having the government as the monitoring agency essentially removes the choice of “Not monitor’ for the certification agency from the original game tree. Furthermore, as the certification agency, the government absorbs the cost of monitoring

![]() ${c_M}$

or can alternatively subsidize this cost.

${c_M}$

or can alternatively subsidize this cost.

Figure 4. The game tree when the government serves as the certification agency and always chooses to monitor. Only the payoffs for the firm are shown since the certification agency in this case is not considered a “strategic” entity. It is assumed that once the government monitors the firm’s production process, it chooses “Certify” or “Not certify” truthfully, that is, the government certification agency’s action is a perfect signal of the firm’s product type. Therefore, the branches corresponding to the agency not monitoring or not certifying truthfully have been removed from the game tree. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has also been removed from the game tree.

In this case, the firm is the only player in the game because the certification agency has been subsumed by the government that has a mandate to monitor. Assume that the firm still has to pay a fixed fee of

![]() $\phi $

in order to get certified. Let us now consider what the equilibrium is for this market.

$\phi $

in order to get certified. Let us now consider what the equilibrium is for this market.

As can be seen in Figure 4, right away we can eliminate (Not sustainable, Seek certification) since the payoff from it is strictly less than the payoff from (Not sustainable, Not seek certification). Hence, the firm’s decision comes down to a choice between (Sustainable, Seek certification) and (Not sustainable, Not seek certification). The following result states that, as long as

![]() $\phi $

is not too large, there is an equilibrium in which the firm produces sustainably; if, however,

$\phi $

is not too large, there is an equilibrium in which the firm produces sustainably; if, however,

![]() $\phi $

is too high, then the equilibrium is for the firm to produce non-sustainably.

$\phi $

is too high, then the equilibrium is for the firm to produce non-sustainably.

PROPOSITION 3: If

![]() ${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

, then there is a SPE in which the firm chooses (Sustainable, Seek certification). If

${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

, then there is a SPE in which the firm chooses (Sustainable, Seek certification). If

![]() ${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \lt \phi $

, then the only SPE is for the firm to choose (Not sustainable, Not seek certification).

${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \lt \phi $

, then the only SPE is for the firm to choose (Not sustainable, Not seek certification).

Intuitively, what Proposition 3 tells us is that, when the government acts as the certification agency, the certification process is credible; hence, consumers would be willing to pay a higher price for a certified product. When the premium the firm can get from producing sustainably is greater than the added cost from producing sustainably and paying for certification, there is a market equilibrium in which the firm would choose to produce sustainably and get certified. However, if the premium the consumers are willing to pay for a certified product does not offset the greater cost of sustainable production and the cost of certification, then the only market outcome is for the firm to opt for the non-sustainable mode of production.

Some caveats and implications of Proposition 3 are in order at this point.

Efficient allocation for society, taking into account the cost of monitoring: When we factor in the cost to society of having to audit the firm’s production process (

![]() ${c_M}$

), the net benefit to society of having the firm produce sustainably is

${c_M}$

), the net benefit to society of having the firm produce sustainably is

![]() ${b_H} - {c_H} - {c_M}$

(the certification fee

${b_H} - {c_H} - {c_M}$

(the certification fee

![]() $\phi $

does not appear here since it is a transfer between the firm and the government that yields a net gain/loss of 0 in society’s ledger). Note, however, that the benefit to society from the firm engaging in sustainable practices should extend beyond the consumer who buys the good. Such “external benefit,” which we denote by the symbol XB and which may include lower levels of environmental degradation and human rights abuses, should be added to the net benefit derived above when calculating its true net value to society. Therefore, the true net benefit to society when the firm produces sustainably is

$\phi $

does not appear here since it is a transfer between the firm and the government that yields a net gain/loss of 0 in society’s ledger). Note, however, that the benefit to society from the firm engaging in sustainable practices should extend beyond the consumer who buys the good. Such “external benefit,” which we denote by the symbol XB and which may include lower levels of environmental degradation and human rights abuses, should be added to the net benefit derived above when calculating its true net value to society. Therefore, the true net benefit to society when the firm produces sustainably is

![]() ${b_H} + XB - {c_H} - {c_M}$

.

${b_H} + XB - {c_H} - {c_M}$

.

The net benefit to society of the firm producing non-sustainably is

![]() ${b_L} - {c_L}$

. Hence, it would be efficient for the government to promote sustainable production if

${b_L} - {c_L}$

. Hence, it would be efficient for the government to promote sustainable production if

![]() ${b_H} + XB - {c_H} - {c_M} \gt {b_L} - {c_L}$

. Notice that even if

${b_H} + XB - {c_H} - {c_M} \gt {b_L} - {c_L}$

. Notice that even if

![]() $\phi $

is set low enough to just cover the cost of monitoring (

$\phi $

is set low enough to just cover the cost of monitoring (

![]() $\phi = {c_M}$

), it is possible for the following to both be true:

$\phi = {c_M}$

), it is possible for the following to both be true:

![]() ${b_H} + XB - {c_H} - {c_M} \gt {b_L} - {c_L}$

and

${b_H} + XB - {c_H} - {c_M} \gt {b_L} - {c_L}$

and

![]() ${b_H} - {c_H} - \phi \lt {b_L} - {c_L}$

. In other words, it is possible for the equilibrium in the model to be for the firm to produce non-sustainably even though the better outcome for society is for the firm to produce sustainably. This is not surprising since the societal benefit XB is external to the firm and not something it accounts for when making its production decision. In this case, the government could change the equilibrium of the market and bring about the efficient outcome by subsidizing the cost of certification (or, equivalently, by lowering the fee it charges the firm for certification).

${b_H} - {c_H} - \phi \lt {b_L} - {c_L}$

. In other words, it is possible for the equilibrium in the model to be for the firm to produce non-sustainably even though the better outcome for society is for the firm to produce sustainably. This is not surprising since the societal benefit XB is external to the firm and not something it accounts for when making its production decision. In this case, the government could change the equilibrium of the market and bring about the efficient outcome by subsidizing the cost of certification (or, equivalently, by lowering the fee it charges the firm for certification).

The importance of specificity: When the certification process is clear about what constitutes sustainable or ethical practices so that consumers know what they are getting when purchasing a certified product, then there should be a bigger difference between

![]() ${b_H}$

and

${b_H}$

and

![]() ${b_L}$

(i.e.,

${b_L}$

(i.e.,

![]() ${b_H} - {b_L}$

is relatively large) compared to when there is lack of specificity so that consumers are uncertain about what they are getting from a certified product. As Proposition 3 implies, when

${b_H} - {b_L}$

is relatively large) compared to when there is lack of specificity so that consumers are uncertain about what they are getting from a certified product. As Proposition 3 implies, when

![]() ${b_H} - {b_L}$

is small, it is more difficult for the condition for sustainable production to hold. Hence, we would expect a higher likelihood of sustainable production in a market with greater specificity in the certification process.

${b_H} - {b_L}$

is small, it is more difficult for the condition for sustainable production to hold. Hence, we would expect a higher likelihood of sustainable production in a market with greater specificity in the certification process.

Strategic government-operated certification agency: In the above analysis, we have simply assumed that a government certification agency is constrained to monitor the firm and provide truthful certification results. Here, we consider an extension of the model in which the government certification agency is itself a strategic entity with its own objective function. Specifically, we assume that the government agency seeks to maximize social surplus, which is the sum of firm payoff, buyer payoff, government revenue (the certification fee

![]() $\phi $

if it is paid), and external benefit (XB if the firm produces sustainably), minus government cost (the monitoring cost

$\phi $

if it is paid), and external benefit (XB if the firm produces sustainably), minus government cost (the monitoring cost

![]() ${c_M}$

if the government agency monitors the firm). Because of our assumption that the product price is equal to buyers’ willingness-to-pay, buyer payoff is zero. Hence, the game tree is as shown in Figure 5.

${c_M}$

if the government agency monitors the firm). Because of our assumption that the product price is equal to buyers’ willingness-to-pay, buyer payoff is zero. Hence, the game tree is as shown in Figure 5.

Figure 5. The game tree when the government serves as the certification agency and seeks to maximize social surplus. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

In this case, there cannot exist a SPE in which the firm chooses to produce sustainably. This follows since, no matter what strategy the government agency uses, the firm’s payoff from (Sustainable, Seek certification) would always be less than the payoff from (Not sustainable, Seek certification).

Note from Figure 5 that assuming that the government certification agency seeks to maximize social surplus does not necessarily imply that it would provide truthful certification. Let us now assume that, in addition to social surplus, the government agency derives some benefit from certifying truthfully: it receives a payoff

![]() $T \gt 0$

when it monitors and certifies when the firm produces sustainably, or when it monitors and does not certify when the firm produces non-sustainably. The game tree in this case is shown in Figure 6.

$T \gt 0$

when it monitors and certifies when the firm produces sustainably, or when it monitors and does not certify when the firm produces non-sustainably. The game tree in this case is shown in Figure 6.

Figure 6. The game tree when the government serves as the certification agency and seeks to maximize social surplus. The government agency derives an additional benefit T when it provides truthful certification: monitoring and certifying when the firm produces sustainably, or monitoring and not certifying when the firm produces non-sustainably. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

In contrast to the case in which the government agency cares only about social surplus, there exists an equilibrium in which the firm produces sustainably if the certification fee

![]() $\phi $

is not too high and the benefit to the government agency from truthful certification T is sufficiently high.

$\phi $

is not too high and the benefit to the government agency from truthful certification T is sufficiently high.

PROPOSITION 4: If

![]() ${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

and

${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

and

![]() $T \ge {\rm{Max}}\left\{ {{c_M},\,{b_H} - {b_L}} \right\}$

, then there is a SPE in which the firm chooses (Sustainable, Seek certification).

$T \ge {\rm{Max}}\left\{ {{c_M},\,{b_H} - {b_L}} \right\}$

, then there is a SPE in which the firm chooses (Sustainable, Seek certification).

Extensions

In this section, we consider some other extensions of our model in order to examine the implications of various features of the market for fashion and their connection to sustainability.

Greenwashing

The phenomenon of greenwashing – whereby firms and corporations make misleading claims about the environmental benefits of their products or practices – has increased in recent years as consumers have become more aware and concerned about sustainability issues (Lyon and Montgomery Reference Lyon and Montgomery2015). We have seen in a previous section that if consumers are fully rational and use Bayes’ rule to update their beliefs about products, then greenwashing could never arise in equilibrium (Propositions 1 and 2) with a firm-owned or an independent private certification agency. This occurs since buyers’ skepticism about how a product is produced would lower their willingness-to-pay for a certified product, which in turn would reduce a firm’s incentive to engage in sustainable practices.

If, however, buyers’ beliefs are not updated according to Bayes’ rule and are overly “optimistic” about the sustainability claims of corporations and firms, then our model shows that it is indeed possible for greenwashing to occur as an equiilbrium outcome. To see this, let us be specific and consider the situation in which the certification agency is firm-owned so that the payoff structure is as shown in Figure 2. Assume in this case that the buyers’ beliefs

![]() ${q_{CE}}$

and

${q_{CE}}$

and

![]() ${q_{NC}}$

do not satisfy (3) and (4). In particular, assume that

${q_{NC}}$

do not satisfy (3) and (4). In particular, assume that

![]() ${q_{CE}}$

and

${q_{CE}}$

and

![]() ${q_{NC}}$

are such that

${q_{NC}}$

are such that

![]() ${p_{CE}} \gt {p_{NC}}$

. Proposition 5 below tells us that, as long as buyers are willing to pay more for certified products—without considering how credible the certification mechanism is—and as long as the cost to the firm of obtaining the certification is not too large, then there is an equilibrium with greenwashing.

${p_{CE}} \gt {p_{NC}}$

. Proposition 5 below tells us that, as long as buyers are willing to pay more for certified products—without considering how credible the certification mechanism is—and as long as the cost to the firm of obtaining the certification is not too large, then there is an equilibrium with greenwashing.

PROPOSITION 5: If

![]() ${p_{CE}} - \phi \ge {p_{NC}}$

, then there is a SPE in which the firm chooses (Not sustainable, Seek certification), and the certification agency’s strategy is:

${p_{CE}} - \phi \ge {p_{NC}}$

, then there is a SPE in which the firm chooses (Not sustainable, Seek certification), and the certification agency’s strategy is:

-

Information set/decision node 4: Not monitor

-

Information sets/decision nodes 5, 6, 7: Certify.

Ethically minded private certification agency

When examining the model with an independent private certification agency in a previous section, we assumed that the agency cared solely about maximizing its profit. Our model could, however, also accommodate a certification agency that is more “socially conscious” and has an objective that is not purely profit driven.

For example, a certification agency could be established that, beyond profit, takes its societal mission of verifying a firm’s production process seriously. For such an agency, there is some “ethical benefit”

![]() $B \gt 0$

to monitoring the firm; equivalently, the firm would incur the cost

$B \gt 0$

to monitoring the firm; equivalently, the firm would incur the cost

![]() $B$

if it does not engage in monitoring. In this case, the payoff structure for our game is shown in Figure 7.

$B$

if it does not engage in monitoring. In this case, the payoff structure for our game is shown in Figure 7.

Figure 7. Game tree with an independent private certification agency when it derives an “ethical benefit” from monitoring. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

Not surprisingly, when this ethical benefit is too low (i.e.,

![]() $B \lt {c_M}$

), the certification agency behaves no differently from one that is driven purely by profit maximization. Hence, in this case, there can be no equilibrium in which the firm chooses to produce sustainably.

$B \lt {c_M}$

), the certification agency behaves no differently from one that is driven purely by profit maximization. Hence, in this case, there can be no equilibrium in which the firm chooses to produce sustainably.

On the other hand, if this ethical benefit is sufficiently high (i.e.,

![]() $B \ge {c_M}$

), then the certification agency would behave no differently from a government-operated certification agency with a mandate to monitor the firm’s production process. In this case, therefore, there is a SPE in which the firm chooses (Sustainable, Seek certification) as long as the fee for certification is not too high. Put differently, as long as the certification agency is sufficiently socially conscious, sustainable practices could be supported in the model as an equilibrium outcome.

$B \ge {c_M}$

), then the certification agency would behave no differently from a government-operated certification agency with a mandate to monitor the firm’s production process. In this case, therefore, there is a SPE in which the firm chooses (Sustainable, Seek certification) as long as the fee for certification is not too high. Put differently, as long as the certification agency is sufficiently socially conscious, sustainable practices could be supported in the model as an equilibrium outcome.

PROPOSITION 6: If

![]() $B \ge {c_M}$

and

$B \ge {c_M}$

and

![]() ${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

, then there is a SPE in which the firm chooses (Sustainable, Seek certification).

${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

, then there is a SPE in which the firm chooses (Sustainable, Seek certification).

To be clear, in this setup, the ethical benefit does not arise directly from having a preference for the sustainably produced good over the alternative; rather, it is a benefit derived from honesty – performing the task the certification agency is paid for. We leave for future work to consider extensions in which the certification agency cares about – rather than honesty – having products that are sustainably produced in the market.

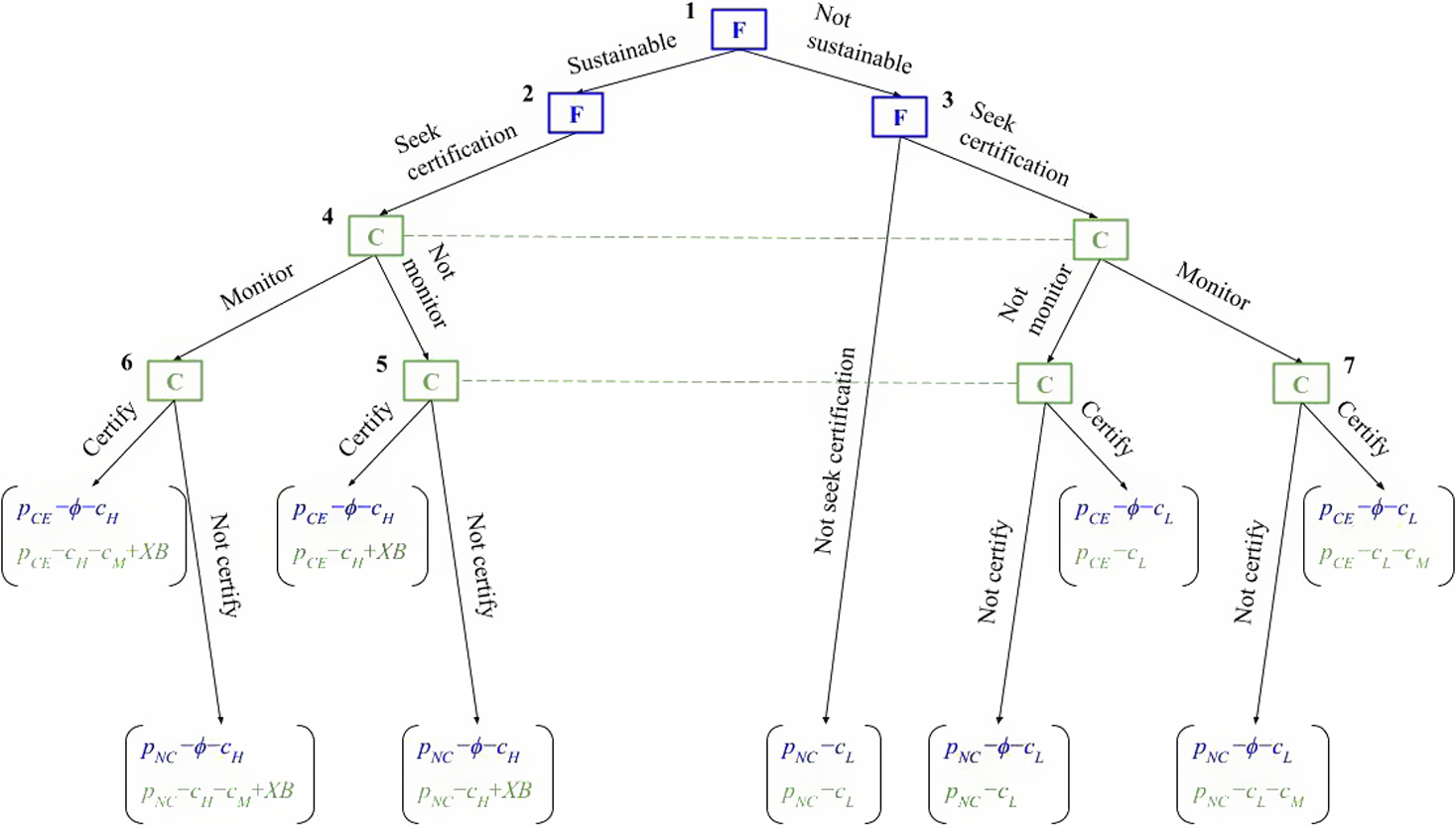

A “Bounty” system to incentivize monitoring

As we saw in “Private Certification Agency” when examining the model with an independent private certification agency (i.e., purely profit driven), there is no equilibrium in which the firm produces sustainably because the certification agency has no incentive to monitor the firm’s production process. Without monitoring and a credible certification system, the firm would never choose to produce sustainably. A potential solution to this sustainability problem is thus to design an incentive scheme that would motivate the certification agency financially to engage in monitoring if the firm seeks certification. In this subsection, we consider a policy whereby the government rewards the certification agency with a “bounty” of

![]() $R \gt 0$

when it can credibly prove to the government that it did monitor the firm.

$R \gt 0$

when it can credibly prove to the government that it did monitor the firm.

Consider the following two possibilities.

Bounty System 1: A reward for proving that the firm engaged in sustainable practices. Let us assume now that, when the firm chooses to produce sustainably and when the certification agency chooses to monitor, the agency is able to obtain proof of the firm’s sustainable practice for the government to examine. The payoff structure is shown in Figure 8. In this case, if the reward R is sufficiently high and the cost of certification

![]() $\phi $

is sufficiently low, then there is an equilibrium in which the firm chooses (Sustainable, Seek certification).

$\phi $

is sufficiently low, then there is an equilibrium in which the firm chooses (Sustainable, Seek certification).

Figure 8. Game tree when the government provides a reward of R to the certification agency when it can prove that the firm produced its product sustainably. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

Proposition 7: If

![]() ${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

and

${b_H} - {c_H} - \left( {{b_L} - {c_L}} \right) \ge \phi $

and

![]() $R \ge {c_M}$

, then there is a SPE in which the firm chooses (Sustainable, Seek certification).

$R \ge {c_M}$

, then there is a SPE in which the firm chooses (Sustainable, Seek certification).

Bounty System 2: A reward for proving that the firm did not engage in sustainable practices. Let us assume now that, when the firm does not produce sustainably – and seeks certification – and when the certification agency chooses to monitor, the agency is able to obtain proof of the firm’s non-sustainable practice for the government to examine. The payoff structure is shown in Figure 9. In this case, even if the reward R is sufficiently high and the cost of certification

![]() $\phi $

is sufficiently low, there is no equilibrium in which the firm chooses (Sustainable, Seek certification). This follows simply because the certification agency would have no incentive to monitor; hence, certification cannot serve as a credible signal. However, there exists a mixed strategy equilibrium in which the firm randomizes between the two strategies (Sustainable, Seek certification) and (Not sustainable, Seek certification). In other words, this bounty system can give rise to “partial” sustainability practice as an equilibrium. In such an equilibrium, the certification agency would choose to monitor the firm with a non-zero probability that is strictly less than one.

$\phi $

is sufficiently low, there is no equilibrium in which the firm chooses (Sustainable, Seek certification). This follows simply because the certification agency would have no incentive to monitor; hence, certification cannot serve as a credible signal. However, there exists a mixed strategy equilibrium in which the firm randomizes between the two strategies (Sustainable, Seek certification) and (Not sustainable, Seek certification). In other words, this bounty system can give rise to “partial” sustainability practice as an equilibrium. In such an equilibrium, the certification agency would choose to monitor the firm with a non-zero probability that is strictly less than one.

Figure 9. Game tree when the government provides a reward of R to the certification agency when it can prove that the firm did not produce its product sustainably when the firm seeks certification. Because the firm strategy (Sustainable, Not seek certification) can never be optimal, that branch has been removed from the game tree.

Proposition 8: If

![]() $R \gt {c_M}$

and

$R \gt {c_M}$