According to classic theories of representation and accountability, voters evaluate politicians along two general dimensions. First is how well they deliver on “valence” issues voters broadly value. Economic expansion is the valence issue par excellence. As Stokes (Reference Stokes1963: 374) observed, “prosperity has been one of the most influential valence-issues of American politics. All parties and the whole electorate have wanted it. The argument has had only to do with which party is more likely to achieve it.” The canonical economic voting model is, thus, at base a valence model: when the economy improves, voters reward incumbents but when it declines, voters turn away.

Second, voters judge how closely politicians' stances on political issues match their own. In the economic realm, this “positional” dimension includes stances on issues related to the distribution of economic gains and policy benefits across constituencies. And as recent research highlights (Johns and Kölln, Reference Johns and Kölln2020), position-taking has implications for how valence appeals are received by the public. Although growth fuels income gains across the spectrum, how proportionately they trickle down the income ladder depends on economic structures and redistributive policies. Indeed, growth tends to reduce poverty less (Ravallion, Reference Ravallion1997, Reference Ravallion2014; Hanmer and Naschold, Reference Hanmer and Naschold2000) and benefit the poor less (Kenworthy, Reference Kenworthy2011) in contexts of more inequality. Growth is inherently distributional.

Voters can therefore evaluate politicians' ability to grow the economy, a valence issue, as well as how the benefits of growth are distributed, a positional issue. Viewing this through the lens of economic voting begs the question: do citizens tend to reward leaders for growth, conditional on how much it benefits them personally? Does the underlying logic of valence apply when the gains from economic growth are not felt equally across the electorate? Should voters reward growth if they are no better off for it? Such a conclusion would seem consistent at once with models of economic and issue voting. This question is absent in existing critiques of valence models such as those undergirding the economic voting paradigm.

We argue citizens do not treat growth as pure valence. Rather, they reward “pro-constituency growth”—growth consistent with leaders' distributional positions, the gains from which should accrue disproportionately to their primary constituents. Hence, left-leaning incumbents should benefit more from growth in equal societies, where gains are concentrated among their poorer supporters. Conversely, rightist incumbents should reap more rewards from growth where inequality is high since growth's benefits are likely to flow to their wealthier constituents. If this is the case, growth functions more like a positional issue than a valence issue. It also speaks to our understanding of accountability, the public's ability to “discern whether governments are acting in their interest and sanction them appropriately” (Manin et al., Reference Manin, Przeworski, Stokes, Przeworski, Stokes and Manin1999: 40). If elections are potent but rare opportunities to hold executives accountable (O'Donnell, Reference O'Donnell, Schedler, Diamond and Plattner1999), then public evaluations between elections approximate a continual accountability mechanism, capturing public reactions to policy reforms and changing environments (Morgan Kelly, Reference Morgan2003; Johnson and Schwindt-Bayer, Reference Johnson and Schwindt-Bayer2009; Lee et al., Reference Lee, Jensen, Arndt and Wenzelburger2017). A convergence between valence and positional issues suggests accountability is more tightly wedded to issue representation than previously recognized.

Below we develop a pro-constituency theory of accountability. Our model predicts that inequality mediates the effects of growth on incumbent support. We then test our theoretical claims using original data from 18 countries in Latin America, where inequality is high, on average, but variable (Cornia, Reference Cornia2015). Results suggest the effects of economic growth on presidential approval depend on (a) the president's distributive orientation and (b) how the gains from growth are actually distributed. We also demonstrate that both components are essential to understanding popular support. Finally, lending further support to our distributional model, individual-level analyses uncover a plausible transmission mechanism: income inequality, a proxy for who most benefits from growth, shapes how rich and poor constituents perceive their own economic welfare.

Our study makes several theoretical contributions. First, we establish the joint importance of distributive economic conditions and economic policy positions in the study of political accountability. Unless gains are distributed consistent with the leader's distributive vision, growth is not enough to guarantee his or her popularity. Hence, our research speaks to current developments in the study of economic voting. Our approach and findings are consistent with recent study on “positional economic voting” (Hellwig and McAllister, Reference Hellwig and McAllister2019; Lewis-Beck and Nadeau, Reference Lewis-Beck and Nadeau2011). Yet, rather than treat positional and valence issues as distinct, we show how positions influence valence (Adams et al., Reference Adams, Merrill and Grofman2005). And by uncovering the importance of the distribution of economic gains, our findings lend credence to the rediscovery of “pocketbook” concerns in study on economic voting (e.g., Healy et al., Reference Healy, Persson and Snowberg2017) by reminding us that respondents prefer growth delivered to them and to their group, and not growth generally. To the study of political representation, we add insights from retrospective valence models of policy performance (e.g., Clarke et al., Reference Clarke, Sanders, Stewart and Whiteley2009) to forward-looking models of mandate representation (e.g., Stokes, Reference Stokes2001). Finally, we contribute to the study of political behavior in new democracies by showing that presidents' positions are more than just weak cues for poorly-informed citizens (Zechmeister, Reference Zechmeister, Carlin, Singer and Zechmeister2015); they shape expectations about how leaders should govern.

1. Valence, position, and the economic bases of popular support

As a backdrop to our theory, consider how valence and positional appeals influence executive accountability. In advanced industrial democracies, vote and popularity functions assume citizens use the economy as a referendum on incumbent performance: “Boom encourages government support, economic bust discourages it” (Lewis-Beck and Stegmaier, Reference Lewis-Beck and Stegmaier2008: 303). Thus, a strong economy is considered a valence issue, by which all voters judge leader competency, and is expected to benefit all incumbents equally.

In contrast, accounts informed by partisan theory posit different types of economic outcomes disproportionately favor certain kinds of incumbents. A cornerstone of that framework is parties and leaders develop strong reputations for policy competencies and economic priorities. Drawing on notions of a short-term exploitable Phillips curve, Hibbs (Reference Hibbs1977, Reference Hibbs1982) argues that left parties emphasize full employment and income redistribution whereas right parties prize price stability and balance of payments equilibria. These reputations are sticky because parties' economic goals reflect the class cleavages undergirding their electoral constituencies (e.g., Bartels, Reference Bartels2009; Gilens and Page, Reference Gilens and Page2014). Voters, in turn, anchor economic expectations about unemployment and inflation in the ideological complexion of the government (Anderson, Reference Anderson1995; Alesina et al., Reference Alesina, Roubini and Cohen1997; Berlemann and Elzemann, Reference Berlemann and Elzemann2006; Fowler, Reference Fowler2006; Gandrud and Grafström, Reference Gandrud and Grafström2015) and, chiefly, reward the government to the extent that it delivers outcomes consistent with these policy expectations.

How, then, do voters employ party reputations when judging politicians? Prospective models of issue ownership hold that voters select the party with the best reputation for performance on what they view as the country's most pressing problem (Petrocik, Reference Petrocik1996).Footnote 1 With respect to the economy, the basic prediction is that high unemployment will aid left parties who can credibly claim commitment to, and competence in, creating jobs; high inflation should privilege the more austere, right-leaning parties. Yet, prospective models' empirical record is more mixed (Carlsen, Reference Carlsen2000; Van der Brug et al., Reference Van der Brug, Van der Eijk and Franklin2007) than retrospective alternatives, which posit voters recognize parties' policy reputations and sanction or reward accordingly. Right-leaning governments are sanctioned for inflation, one of their key issue priorities, but not for employment outcomes, an issue they do not prioritize. Left-leaning governments are, similarly, sanctioned for unemployment but not for inflation (Hibbs, Reference Hibbs1982; Powell and Whitten, Reference Powell and Whitten1993; Anderson, Reference Anderson1995; Van der Brug et al., Reference Van der Brug, Van der Eijk and Franklin2007; Dassonneville and Lewis-Beck, Reference Dassonneville and Lewis-Beck2014). Central to our theory, both models converge on the empirical expectation that, on issues they do not own, citizens neither reward incumbents for delivering positive outcomes, nor punish them for negative outcomes.

By positing economic outcomes affect certain groups more strongly than others, the partisan voting literature calls attention to the positional nature of traditional valence issues. However, from the perspective of policy choice, evidence of an inflation-unemployment tradeoff is suspect. This is the case for industrial democracies and lower- and middle-income economies alike. Indeed, recent events in Venezuela and other Latin American countries show that runaway inflation and catastrophic unemployment exist side by side rather than trading off. The absence of an exploitable Phillips curve refocuses analysts' attention on growth as a performance metric.

2. Pro-constituency growth and political accountability

Unlike prices and jobs, whose benefits disproportionally accrue to different constituencies, the literature traditionally treats GDP growth as a straight valence issue: all prefer more to less. But its distributional effects suggest growth cannot be judged solely in valence terms. If growth tends to be “pro-poor” in some contexts, but “pro-rich” in others, then we must consider how “pro-constituency” growth may influence accountability.

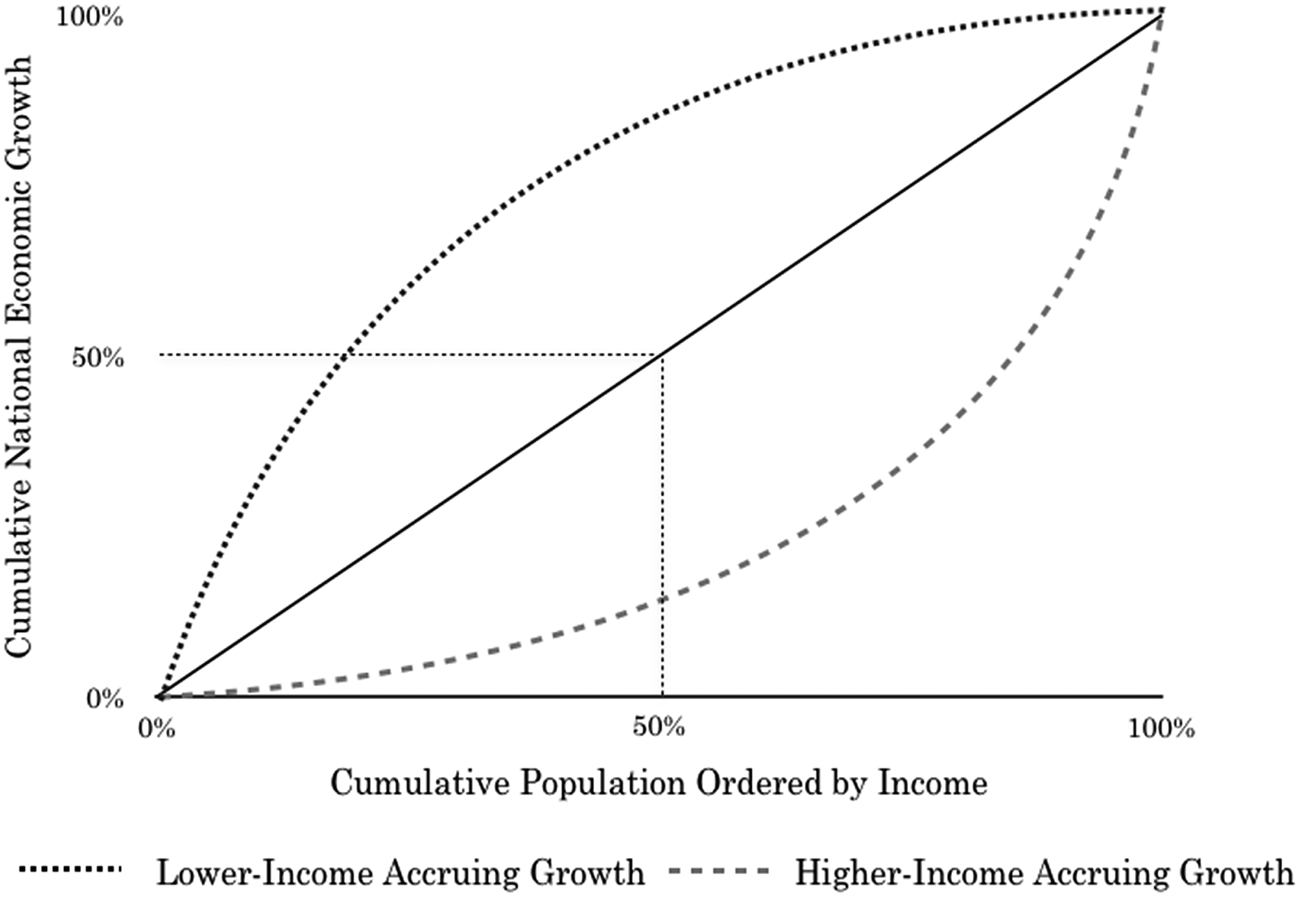

To aid in this regard, Figure 1 illustrates three distinct scenarios regarding the distribution of growth's benefits. The y-axis represents the share of national economic growth as it accumulates to 100 percent; the x-axis represents the population in the order of income percentile. A 45° line depicts perfect equality in the distribution of economic growth's benefits throughout the population. Since the population up to the midpoint (50th percentile) represents society's poorest citizens, let us assume they comprise the left's natural electoral constituency; beyond that point are richer citizens who are assumed to comprise the right's natural electoral constituency. The three lines represent the distribution of growth's benefits in three scenarios. In the first, depicted by the solid line, growth is benefiting all groups equally. In the second scenario, represented by the dashed (concave) line, the rich capture more of the gains than the poor. In the third scenario, shown by the dotted (convex) line, the benefits of growth accrue disproportionally to the poor. In each scenario, the benefits of economic growth are distributed differently—either reinforcing the status quo (scenario 1), or exhibiting pro-rich (scenario 2) or pro-poor (scenario 3) tendencies.

Figure 1. Schematic of pro-constituency economic growth.

These scenarios, we argue, hold implications for how citizens evaluate leaders' economic performance and, in turn, accountability. As Figure 1 makes clear, the question for citizens is not simply whether growth is sufficiently high or low. Rather, citizens ask whether a growing economy is benefiting them and their economic class. Growth's salience for rich and poor voters is further activated by inequality. Growth will result in fewer gains for the poor in countries where inequality is high. In contexts of lower inequality, the benefits of growth will increasingly accrue to the poorest in society (Chen and Ravallion, Reference Chen and Ravallion2001; Ravallion, Reference Ravallion2004).

Unlike many areas of study, research on economic voting has largely ignored the implications for the distribution of gains from economic growth.Footnote 2 Here, we propose a theory of pro-constituency accountability that combines incumbents' distributional issue positions and the extent to which economic growth benefits their constituents. Although prior research focuses almost exclusively on asymmetric accountability for inflation and unemployment, we argue asymmetry in how citizens evaluate parties of different ideological stripes carries a more general, and more fundamental, implication for how citizens attribute responsibility. Incumbents who oversee good outcomes on an issue they do not own, that is at odds with their stated positions, should not expect to be rewarded because the public cannot plausibly attribute responsibility for the outcomes to the incumbents' instrumental actions. Instead, the public should chalk them up to luck, accident, or happenstance. Citizens may even believe good economic outcomes came about in spite of, rather than because of, incumbents' intentions.

We argue that citizens' evaluations of economic growth account for how growth's benefits are distributed. In societies with more equitable income distributions, economic expansion should be more pro-poor, like the dotted line in Figure 1. As per partisan theories of economic voting, where income growth is concentrated among the poor, we should observe higher support for leftist incumbents than for rightists because the former are achieving their stated goal of making the poor better off. The left's advantage, however, declines when the poor gain relatively less from growth than the rich (the dashed line in Figure 1). Indeed, where structural inequalities ensure income gains from economic booms are captured by the rich, left-leaning leaders may fail to reap gains in popular support from growth because poor citizens feel betrayed, while rich citizens have little reason to believe the intention of the government's policies were to increase their wealth.

The opposite should occur for rightist incumbents, whose policy stances are indifferent, if not antithetical, to income redistribution. Such leaders should not expect substantial rewards for economic expansion in countries with high net income equality since the gains from growth will be widely diffused. Yet, citizens should assign these same right-leaning leaders high levels of support where social policy lets the rich disproportionally capture the gains from an expanding economy. The effectiveness of policymaker efforts may thus be contingent on partisan identity. Shin (Reference Shin2016), for instance, shows that the positive impact of welfare spending on incumbent vote shares is weaker when the government is ruled by right-wing parties because voters do not believe that that increase was part of the right's core mandate.

This theoretical story maps onto what we know about how the electorate uses competence signals to dole out responsibility. Voters tend to discount outcomes perceived to be beyond the government's control because such outcomes tell voters nothing about the government's competence (Duch and Stevenson, Reference Duch and Stevenson2008). If policymakers' perceived intentionality informs attributions of responsibility (e.g., Arceneaux, Reference Arceneaux2006), then voters should equally discount—if not ignore—unintended policy outcomes when judging incumbent competence. Drawing on the partisan theory of Hibbs, Alesina, and others, this line of reasoning creates expectations for how voters respond to economic growth—an outcome purported to benefit all voters, at least in absolute terms. Whether they reward incumbents for growth should, we propose, depends on how economic gains are distributed to their main constituencies. Thus, as in traditional partisan theory, we expect voters hold leaders to accounts differently based on the latter's partisan orientations. However, rather than assume an employment-inflation trade-off, we base our expectations on the extent to which economic growth is “pro-constituency.”

We test the empirical implications of our argument by analyzing the influence of economic inequality on aggregate approval for left- and right-leaning presidents.Footnote 3 As noted, income inequality provides a signal for how growth's benefits are distributed. This distribution affects how leaders are held to accounts, tracked via approval ratings. The last piece is elite partisanship. Where distributive policy channels economic gains to the poor, leftist incumbents will curry favor with voters. But, where policies generate high net inequality, growth will disproportionately favor the well-off and, in turn, bolster support for leaders to the right of center.

These expectations may be conveyed more formally as:

and

where Approval l and Approval r are approval ratings for left- and right-of-center presidents, G is the economic growth rate, I is a measure of economic inequality, ${\bf {\rm X}}$![]() is a vector of control variables, and ɛ and ν are disturbance terms. Per conventional valence models, we expect the parameters on growth, β l and β r, to be positive. The expected impact of our distributive signal, inequality, is undetermined in both cases: some gain from greater inequality, a good deal more lose. Central to our argument, however, is how inequality conditions—or mediates—the impact of growth on approval. We expect the sign of the parameter on this interaction varies with incumbents' distributive positions. For left-leaning incumbents, higher inequality denotes an anti-poor effect of economic policies, and reduces incumbents' reward for growth (δ l < 0). In contrast, higher inequality boosts the gains from growth attributed to right-of-center presidents (δ r > 0).

is a vector of control variables, and ɛ and ν are disturbance terms. Per conventional valence models, we expect the parameters on growth, β l and β r, to be positive. The expected impact of our distributive signal, inequality, is undetermined in both cases: some gain from greater inequality, a good deal more lose. Central to our argument, however, is how inequality conditions—or mediates—the impact of growth on approval. We expect the sign of the parameter on this interaction varies with incumbents' distributive positions. For left-leaning incumbents, higher inequality denotes an anti-poor effect of economic policies, and reduces incumbents' reward for growth (δ l < 0). In contrast, higher inequality boosts the gains from growth attributed to right-of-center presidents (δ r > 0).

3. Distributional politics and left-right divisions in Latin America

We test these claims in Latin America, a region with significant variation over the last four decades on distributive preferences across social segments, incumbent leaders' positions on redistribution, and inequality. Austerity measures and large-scale structural reforms in the 1990s produced a collapse of incomes which was “practically biblical” in some cases (Hoffman and Centeno, Reference Hoffman and Centeno2003: 368). This dwindled Latin America's middle class, swelled the ranks of the poor (Portes and Hoffman, Reference Portes and Hoffman2003), and exacerbated income inequality (Kanbur and Lustig, Reference Kanbur and Lustig2000; Huber and Solt, Reference Huber and Solt2004; Lustig et al., Reference Lustig, Lopez-Calva and Ortiz-Juarez2013; Cornia, Reference Cornia2015).

Most of these policy reforms took place under rightist governments on the premises that unfettered markets can best achieve economic development, growth raises all boats, and markets should dictate distribution. Such “Washington Consensus” reforms cannot be mistaken as pro-poor. More recently, the right has mobilized support by focusing on non-economic issues, like security, and clientelism. Yet, their economic policies still deemphasize redistribution and inequality and champion low regulation (Luna and Rovira Kaltwasser, Reference Luna and Rovira Kaltwasser2014). Leftists, in contrast, have explicitly campaigned on reducing inequality in many countries. Programmatic differences are, of course, starker in some countries than others (Kitschelt et al., Reference Kitschelt, Hawkins, Luna, Rosas and Zechmeister2010), and candidates sometimes renege on their economic policies (Stokes, Reference Stokes2001). But such tactics are increasingly rare, and switchers are held accountable for whether their policies work as intended (Johnson and Ryu, Reference Johnson and Ryu2010).

Distinct policy priorities between the left and the right are reflected in the electorate. Preferences over redistribution strongly correlate with voter choices between left and right alternatives (Baker and Greene, Reference Baker, Greene, Carlin, Singer and Zechmeister2015). And as the left's rise further spurred elite polarization on economic issues (Singer, Reference Singer2016), Latin Americans increasingly voted along class lines—the poor supporting the left and the wealthy supporting the right (Carlin et al., Reference Carlin, Singer, Zechmeister, Carlin, Singer and Zechmeister2015: 361; Mainwaring et al., Reference Mainwaring, Torcal, Somma, Carlin, Singer and Zechmeister2015). Although these patterns are not equally strong in all Latin American countries, they generally suggest that citizens can distinguish how politicians of the left and right campaign and govern.

With respect to the distribution of wealth, Latin America ranks as one of the most unequal regions in a world where wealth gaps have generally increased. The mean Gini coefficient in our sample is around 0.466, which is higher than the mean among OECD countries (0.295) as well as world overall (0.382), based on data provided by Solt (Reference Solt2019). Yet, the range of inequality in the Latin American region is similar to democracies in other developing parts of the world. According to Solt's data, in comparison with Latin American democracies, African democracies since 1990 have a higher average level and greater range of inequality (mean: 0.51, range: 0.37–0.67) and Asian democracies show a slightly lower average level of inequality but similar variation as Latin America (mean: 0.35, range: 0.28–0.5). Additionally, the region is also characterized by wide differences in economic inequality between countries. In 2013, Uruguay boasted a 90/10 income decile ratio (just over 5) lower than the United States; Peru's ratio (nearly 13) was among the world's highest (LIS, 2019). Since 1980 the most unequal countries are Brazil, Colombia, Honduras, and Peru, with net Gini coefficients averaging at least 0.50. The least unequal—Argentina, Venezuela, and Uruguay—have average net Gini below 0.43 (Solt, Reference Solt2019). Although some rightist governments have, facing strong leftist competition, attempted to reduce inequality (Roberts, Reference Roberts2014), leftist governments have had greater success (Calvo-González, Reference Calvo-González2015; Cornia, Reference Cornia2015).

In short, the region's leaders and their parties hold distinct visions of how economic gains should be distributed and enact policies accordingly. Presidents and their parties campaign on a set of dramatically different claims about what groups they most closely represent and what policies they will implement in order to satisfy the needs of their political base. This makes Latin America an ideal testing ground for our theory's observable implications.

4. Data, measurement, and models

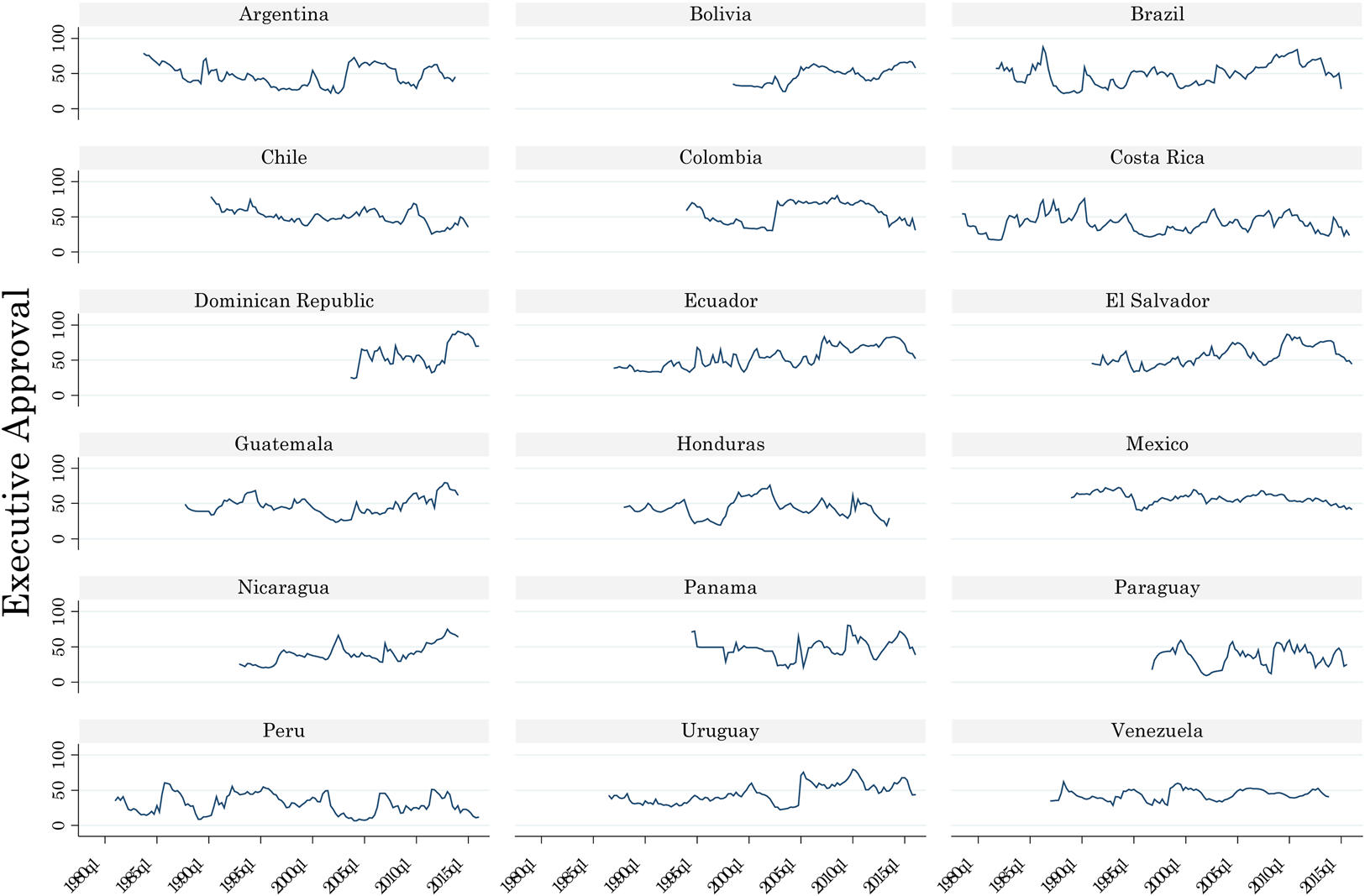

Our research design leverages data at the aggregate and individual levels. By employing aggregate-level data, our research design is able to eschew measurement issues that can plague analysis of survey responses, whereas analyses of individual-level data then provide a test of the underlying mechanism. Our ability to look at aggregate data from a large number of time periods and contexts also allows for sufficient variation in the key contextual variables of presidential ideology, growth, and inequality to be confident in the findings' robustness. Initial tests rely on time-series cross-sectional models of incumbent support as a function of economic growth, net inequality, and presidential ideology for over 122 presidential administrations in 18 Latin American countries, for a total of over 1600 quarters. In these models, the dependent variable is quarterly Presidential approval from the Executive Approval Database 1.0. The measure uses approval series from multiple polling firms and uses Stimson's (Reference Stimson1991) dyads-ratio algorithm to estimate a single time series of approval that can be compared across administrations, countries, and time (Carlin et al., Reference Carlin, Hartlyn, Hellwig, Love, Martinez-Gallardo and Singer2016). Figure 2 depicts temporal coverage of our dependent variable across the sample.

Figure 2. Quarterly estimates of presidential approval in Latin America.

Informed by Equations 1 and 2, we analyze three explanatory variables. First is per capita GDP Growth, taken from the IMF International Financial Statistics and aggregated from monthly observations to quarterly averages. We include the contemporaneous measure of growth and a one-quarter lag to capture possible delayed effects (De Boef and Keele, Reference De Boef and Keele2008). Second, we seek to tap pro-constituency growth. Unfortunately, data coverage for “pro-poor growth,” based on income quintiles, is very limited across our sample. Instead we employ net income Inequality, measured with national-level Gini coefficients derived from household surveys of post-tax and transfer income from the Standardized World Income Inequality Database (Solt, Reference Solt2019).Footnote 4 A third variable is the president's left-right policy position, as determined by expert surveys (Wiesehomeier and Benoit, Reference Wiesehomeier and Benoit2009; updated by Baker and Greene, Reference Baker and Greene2011). Presidents who score to the left of the mid-point qualify as left. In our sample, just 29 percent of the country-quarters had leftist presidents, reflecting the right's dominance in the 1990s (Baker and Greene, Reference Baker and Greene2011).Footnote 5 Although previous study links growth directly to presidential support, our pro-constituency theory predicts growth's effects on approval depend jointly on the distribution of gains from growth and the president's ideology. As per Equations 1 and 2, we test for these expectations by interacting Growth with Inequality for leftist and rightist presidents.

Models also control for the election cycle with a dummy variable marking the quarter a president takes office (or is reelected), Inauguration, and its two lags to capture honeymoon effects, along with dummies for the two quarters prior to Inauguration to capture end-of-term bumps (Carlin et al., Reference Carlin, Hartlyn, Hellwig, Love, Martínez-Gallardo and Singer2018). Finally, models control for quarterly inflation—which, regardless of growth, has been the undoing of many Latin American presidents. Data are from the IMF which we transform using the natural log to address skewness in some cases.Footnote 6 Tables A1 and A2 in the online Appendix display descriptive statistics and sample range.

Our workhorse is the feasible generalized least-squares estimator. Because our time series are relatively long (i.e., t > j) time-correlated errors can bias our estimates. To account for significant heterogeneity in the autocorrelation structure across panels we use a panel-specific AR(1) correction (Beck and Katz, Reference Beck and Katz1995). We choose this method over a dynamic modeling approach for two reasons. First, the empirical implications of our theoretical framework are most likely to be observed cross-sectionally. Since inequality changes slowly and countries often maintain consistent leadership ideology for a decade or more, much of variance in the data is between cases, rather than within. Second, the estimated AR(1) correction varies considerably between panels, suggesting that a single pooled time correction, either a lagged dependent variable or pooled AR(1) term, would not adequately capture the serial correlation in the data. Both an augmented Dickey–Fuller test and an Im–Pesaran–Shin test indicate that all panels do not have a unit root.

5. Growth, inequality, and presidential approval: testing expectations

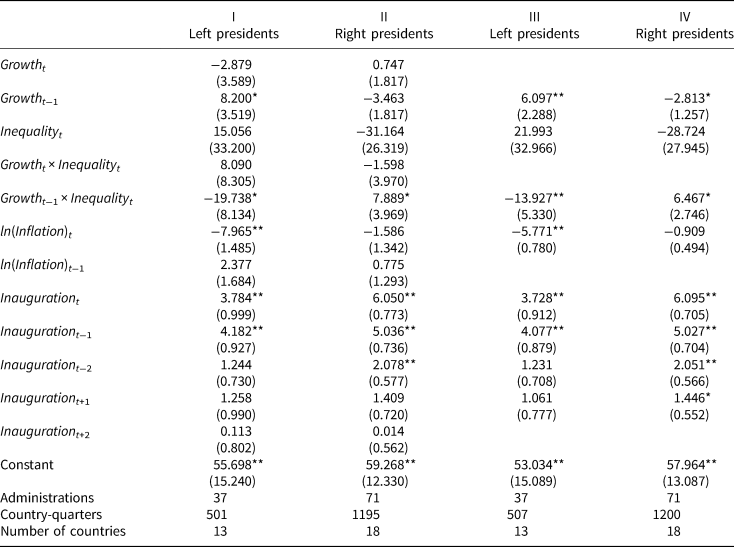

Table 1 displays results of our time-series cross-sectional models. Specifications in models I and II follow from Equations 1 and 2. Regression results are broadly consistent with the literature on executive popularity in Latin America (Lewis-Beck and Ratto, Reference Lewis-Beck and Ratto2013; Singer and Carlin, Reference Singer and Carlin2013; Gélineau and Singer, Reference Gélineau, Singer, Carlin, Singer and Zechmeister2015; Carlin et al., Reference Carlin, Hartlyn, Hellwig, Love, Martínez-Gallardo and Singer2018) and beyond (Lewis-Beck and Stegmaier, Reference Lewis-Beck and Stegmaier2008, Reference Lewis-Beck and Stegmaier2013). On average, low inflation makes presidents more popular (although effects are weaker for center-right presidents). Approval also responds consistently to the political cycles of elections and inaugurations. In all models, presidents enjoy a first-quarter honeymoon that fades over the next two quarters. These estimates lend face validity to our empirical strategy.Footnote 7

Table 1. Effects of growth and inequality on approval for left and right presidents

Note: Cells report generalized least squares estimates with panel-specific AR1 correction and heteroskedastic consistent standard errors in parentheses. Models I and III estimate a single quarter for the Dominican Republic. Results are unchanged if the country is excluded. See Table A3 in the online Appendix. **p < 0.01, *p < 0.05, two-tailed test.

The validity of our pro-constituency model of accountability, however, hinges on the joint effects of economic growth and inequality. In both models I and II, the influence of Growth on Approval is conditioned by the level of inequality. The direction of this influence, however, differs in line with expectations. For left presidents (model I), the negative sign on the interaction term coefficient supports our argument that left-leaning presidents require low inequality to be rewarded for economic growth. In contrast, presidents on the right benefit more from growth under high inequality, as conveyed by the positively signed interaction coefficient in model II. Because Growth and its lag are highly correlated, and only the interaction on the lag of Growth is significant, models III and IV drop the coefficient for lagged Growth from models I and II, respectively. We also remove ln(Inflation)t −1 and Inaugurationt +2 from the models since both remain insignificant in all specifications. Again, the evidence matches our theoretical prior: in the sample of leftist presidents, higher growth raises popularity when inequality is low; in the sample of rightist presidents, growth boosts approval when inequality is high.

In sum, estimates from all four models are consistent with our contention that whether presidents are rewarded for growth hinges on the political-distributional impact of growth—whether it is “pro-constituency.” To put our results in more substantive terms, Figure 3 plots the effects of growth on approval, conditional on inequality, for left and right presidents based on models III and IV.Footnote 8 As the left panel highlights, under left-leaning presidents the coefficient on Growth is positively signed and precisely estimated, provided inequality is low. Publics reward leftist leaders more for aggregate national growth if it is pro-constituency growth, that is, distributed with greater equity and, thus, of greater benefit to their core base of support. But above a net-income Gini coefficient of 0.48, growth does not consistently boost leftists' approval; rather, its effects turn negative. For reference, this is roughly the level of net inequality in Peru in recent years, El Salvador in the late mid-late 2000s, and Ecuador in the 1990s. In line with the logic of pro-constituency growth, leftist leaders are not rewarded for growth that tends to flow to the right's wealthier base.Footnote 9

Figure 3. The conditional effects of growth on approval. Note: Figures are produced with 95 percent confidence intervals using estimates from Table 1, models III and IV. Black dashes at the bottom of both graphs show observed values of inequality (Gini coefficients).

Turning to right-leaning incumbents, our first expectation is borne out: rightists in relatively equal societies see no benefit from economic growth. In fact, growth's effect is negative when inequality is at our sample's minimum, suggesting growth may damage their approval under such conditions. However, in contexts where inequality is above the sample mean (0.46, median is 0.47) growth benefits rightist presidents. As Figure 3 highlights, growth's effect on right presidents' popularity is significant and substantial in the most unequal countries; it is also significantly different than growth's effect for left presidents. These findings provide strong support for our pro-constituency theory of economic accountability: growth only helps rightist presidents in highly unequal societies while it only helps leftists in more equal contexts.

Online Appendix Table A3 reports a series of robustness checks. Results using ordinary least squares (OLS) and panel-corrected standard errors are substantively identical. Likewise, fixed-effects estimation (Table A4) produces similar results. Our results are also robust to the exclusion of inflation and cases of hyperinflation (Argentina, Peru, Brazil, or Venezuela), political instability (Venezuela), and persistent political violence (Colombia). Finally, modeling the conditional relationships our theory implies as triple interaction produces similar results (Table A4 and Figure A1).

In sum, citizens reward pro-constituency growth. In contexts where growth is equitably distributed and, thus, benefits the poor, only leftists are rewarded. However, where the gains from macroeconomic growth are concentrated among the wealthy, only right-leaning presidents are rewarded. Growth even has the potential to suppress incumbent support when its benefits are not concentrated among their core supporters. Who delivers growth, and to whom, matters.

6. Growth, inequality, and presidential approval: alternative models

The foregoing analyses lend support for a pro-constituency model of economic accountability. However, it could be that these outcomes can be explained by a more direct pathway. Accordingly, in this section we consider a pair of alternatives through which economic inequality may influence evaluations of the president.

The first considers the redistributive preference of the median voter under majority voting rules. According to Meltzer and Richard (Reference Meltzer and Richard1981), the higher the inequality, the more redistribution the median voter would prefer. If this account is correct, inequality might depress incumbent approval outright (Dassonneville and Lewis-Beck, Reference Dassonneville and Lewis-Beck2020). Our pro-constituency theory of economic accountability, by contrast, views inequality as mediator, shaping growth's impact on public assessments of the president without directly affecting approval itself.

In a related way, a second alternative account maintains that wealth correlates with distributive preferences which, in turn, correlate with citizen support for leaders they believe will make their socioeconomic class relatively better off (Evans, Reference Evans1999). Leftists should, thus, campaign on raising living standards for the poor (i.e., via redistribution), and rightists should promise programs that economically advantage wealthier groups (i.e., through regressive policies). This pure mandate theory of accountability also predicts a direct influence of inequality but asserts its effects will vary based on ideology: higher (lower) inequality props up approval ratings for the right (left).Footnote 10

Table 2 reports estimates from models specified to test these two alternatives to our distributive-policy model. Model I simply regresses Approvalt on Inequalityt and the other covariates described above for all administrations in our dataset. We find no significant direct effect of inequality on presidential approval in Latin America. Citizens, it appears, are not concerned by the level of net income inequality, per se, when assessing the president's job performance. Models II and III replicate this specification for left- and right-leaning presidents separately. The mandate model predicts the coefficient on Inequality will be positively signed for left presidents and but negatively signed for the right. However, according to our results, neither leftist nor rightest presidents are hurt or rewarded for differing levels of inequality.Footnote 11

Table 2. Direct and conditional effect of inequality on approval

Note: Cells report generalized least squares estimates with panel-specific AR1 correction and heteroskedastic consistent standard errors in parentheses. **p < 0.01, *p < 0.05, two-tailed test.

7. Growth, inequality, and economic perceptions across constituencies

Our results show that growth's distributional effects matter: citizens care not only whether the economic pie has expanded but how it is sliced. Citizens care about the national economy insomuch as it informs their own economic circumstances, as represented by their place in the distribution.Footnote 12 Undergirding this macro-level pattern is an assumption about the micro-level mechanism: individuals' perceptions of their own well-being are a function not only of the health of the national economy, as provided by growth rates, but also by whether the gains from growth accrue to them personally. Is this the case?

Assessing this question will establish the micro-foundations of our aggregate-level results. To do so, we analyze individual-level data on personal economic perceptions in a pooled sample of Latinobarómetro surveys for 18 countries from 1995 and 2016.Footnote 13 This yields a dataset of 251 country-years, spanning a wide range of economic conditions.

The dependent variable, Household finances, is based on the item, “Do you consider your economic situation and that of your family to be better, about the same, or worse than 12 months ago?”Footnote 14 We code responses such that high values represent more positive views of household finances. Individual wealth is measured in quintiles produced by factor-analyzing ownership of household goods in each survey year (Córdova, Reference Córdova2009). Congruence captures the respondent's ideological distance from the president on the left-right scale, measuring the president's ideology with data from Baker and Greene (Reference Baker and Greene2011), in the expectation that individuals ideologically close to the president hold biased evaluations of their personal finances.Footnote 15 Furthermore, we add contextual measures for economic growth and inequality, taken from the same sources as above.Footnote 16 Controls for gender, age, and education help rule out non-economic biases in economic perceptions (Duch et al., Reference Duch, Palmer and Anderson2000).Footnote 17

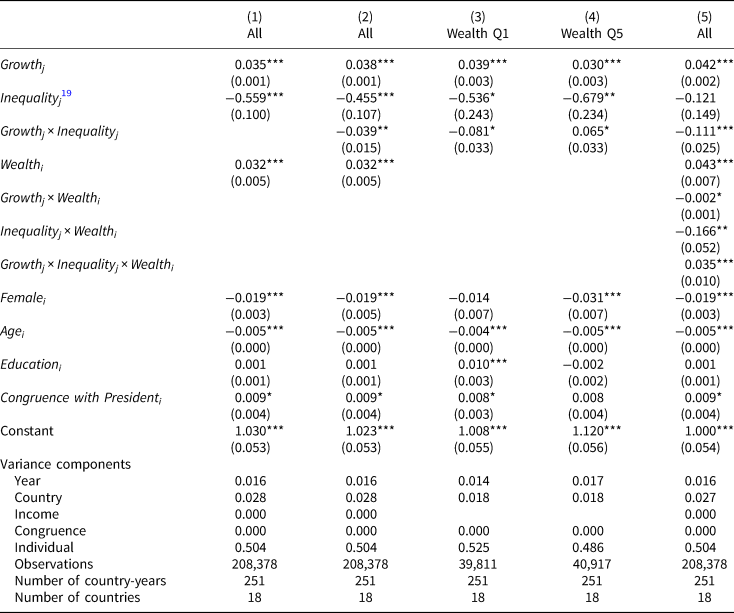

To facilitate interpretation of the interaction terms, we linearly transform the Gini scores such that the sample minimum has the value of 0.

Table 3 reports estimates from a series of multilevel mixed regression models that nest individuals within countries and years.Footnote 18 Although we expect Growth to have a positive effect on Household finances, our pro-constituency argument predicts this relationship is contingent on individual wealth levels and on the distribution of economic gains as captured by the Gini coefficient. Accordingly, we report a series of regressions to show how growth and inequality affect economic perceptions directly and conditionally through individual wealth levels. Model I shows that individuals rate their household's financial situation more positively when growth is high than when it is low. And, all else equal, inequality depresses economic perceptions. As we might expect, wealth is positively associated with perceptions. Model II includes the Growth × Inequality interaction. Its coefficient suggests growth's positive influence on economic perceptions weakens under higher inequality. Does this moderating effect apply equally across economic classes or does it vary in line with our pro-constituency theory of accountability? To probe this observable implication of our theory, in models III and IV we stratify the sample and report results for individuals in the first and fifth wealth quintiles, respectively. For the former, inequality deactivates the influence of growth on economic perceptions. For the latter, inequality actually amplifies the growth-perceptions connection.

Table 3. Effects of growth and inequality on household finances

Note: Cells report estimates from multilevel mixed-effects linear regressions with standard errors in parentheses. The measure of Inequality is shifted so that the minimum value equals 0. ***p < 0.001, **p < 0.01, *p < 0.05 (two-tailed).

The last column in Table 2 provides the full specification to capture this wealth effect using an interaction term. Figure 4 uses these estimates to display the effect of a one percent increase in Growth across levels of Inequality separately for poor and rich individuals. In all cases, growth has a positive and statistically significant effect on respondents' perceptions of their personal finances. However, in line with our expectations, for the poor this effect is much stronger where net income Gini coefficients are low. In persistently unequal societies, the poor do not perceive nearly as much benefit from growth as they do in contexts of lower inequality. Insomuch as the poor are the natural constituents of left-leaning presidents, this pattern is consistent with the patterns of presidential approval reported above and with our theory of pro-constituency accountability.

Figure 4. The marginal effects of growth rate on egotropic perceptions. Note: Figures are produced with 95 percent confidence intervals using estimates from Table 3, model V. Dashes at the bottom represent levels of inequality observed in our sample (Gini coefficients).

As for the rich, the significant three-way interaction term in model IV shows their household financial perceptions improve when growth coincides with high (as opposed to low) inequality. Figure 4 shows this conditioning effect for the rich is, however, smaller in magnitude than what we observe for the poor. Moreover, it is dwarfed by growth's direct positive influence on household financial perceptions. The weaker connection between inequality and economic perceptions might explain why, as observed above, pro-constituency accountability is weaker for right-leaning presidents. The finding may also suggest the effects we observe are truncated by the relatively high-levels of inequality throughout space and time in Latin America.

In sum, these analyses of economic perceptions suggest a micro-foundation for the macro-level relationships observed in our first set of analyses. Inequality conditions the transmission of economic growth into positive political evaluations by shaping how citizens on different ends of the income ladder link the nation's economic prosperity to their household's prosperity. Hence, accountability of pro-constituency economic performance observed as the macro level appears to have a logical political-economic foundation at the individual level.

8. Conclusion

Without some degree of inequality, capitalism is untenable as a system of production and exchange. And although we know income inequality determines who stands to gain most from economic growth, we know little about how this central aspect of capitalism affects the democratic ideal of accountability. Combining insights from the literatures on inequality, responsibility attribution, and partisan theory, we advance a pro-constituency model of accountability: incumbents are rewarded for growth to the extent that its benefits are captured by their core constituencies—the poor, for the left, and the rich, for the right. Results from time-series cross-sectional analyses of 18 Latin American countries over the last four decades are consistent with this theory. Furthermore, multilevel models of survey data taken from Latin America's rich and poor offer a potential mechanism: inequality shapes the translation of national economic growth into individuals' perceptions of their household finances. In all, a great deal of empirical evidence—derived from two distinct units of analysis and two very different modeling strategies—augurs in favor of our theoretical expectations.

By showing that citizens behave in ways consistent with our pro-constituency theory of accountability, this study holds three more general theoretical and political implications. First, contrary to widespread assumptions, growth is not purely a valence issue because growth is not distribution-neutral. Our analysis shows that growth is intrinsically a position-issue. So, although citizens generally value prosperity for the country, they also want prosperity for themselves and support whomever they believe will benefit their group. Thus, leaders commonly enter office with an incentive to first deliver on promises to their base. Given the lack of consensus within the electorate about how the benefits of growth should be distributed, leaders face tradeoffs over the kinds of growth they might pursue and whether and how to pair growth with redistribution.

Our findings, therefore, challenge the very underpinnings of the economic voting paradigm. It might not be reasonable to assume public evaluations of incumbents represent a simple referendum on the economy. Rather, economic voting on the basis of growth is, at any and all levels of income inequality, a form of issue voting that takes into account who benefits from that growth. And if growth is not a pure valence issue, it raises the possibility that there are no pure economic valence issues. Instead citizens may filter the distribution of income, trends in jobs, swings in prices, etc., through the lenses of winners and losers within society according to incumbents' political constituency.

Second, the foregoing analyses not only highlight how citizens consider growth's distributive consequences but also suggest that the public is capable of monitoring whether incumbents benefit core constituents, incorporating this information in their economic evaluations, and holding policymakers accountable for these outcomes. This finding has implications for the study of mass politics more generally because it paints a portrait of a fairly sophisticated mass public. This stands in contrast to portrayals of voters, in democracies new and old, as lacking the sophistication to attribute responsibility for economic outcomes and, in turn, to exact accountability. Instead, we argue that citizens, at least in the aggregate, can link economic growth to presidential approval by weighing evidence in light of structural conditions and making nuanced causal attributions. Citizens are not hyper-informed. Sometimes, they may fail to correctly attribute responsibility for outcomes and may be swayed by events outside politicians' control (e.g., Achen and Bartels, Reference Achen and Bartels2016; Campello and Zucco, Reference Campello and Zucco2016). Yet, our findings reinforce the general conclusion out of economic voting that citizens are more sophisticated than scholars often give them credit for (e.g., Duch and Stevenson, Reference Duch and Stevenson2008). Even in a region like Latin America with considerable intra- and inter-country differences, voters can use their knowledge of politicians' stated priorities to evaluate their intentions and performance.

Third, these results also remind us that respondents are looking at the national economy through the lens of personal interest. Recent studies have refocused our attention on the importance of pocketbook issues in motivating voter behavior (e.g., Healy et al., Reference Healy, Persson and Snowberg2017). Some classic studies have argued that sociotropic voting should be evaluated through this personalistic frame, arguing that the public uses the national economy or group outcomes as an indicator for the kinds of opportunities that the government is creating for people like them (see Kiewiet and Lewis-Beck, Reference Kiewiet and Lewis-Beck.2011). Our results suggest that voters are also attuned to the distributional consequences of government actions and take into account both the potential benefits that they are likely to receive and the degree to which those outcomes reflect government intentions when deciding whether to reward or punish the incumbent.

Finally, our results illuminate a non-obvious, but ultimately hopeful, pattern in representative democratic politics. If citizens reward leaders for economic expansion to the extent that it aligns with their policy positions, then from a normative perspective, leaders' incentives all run in the right direction. And when their incentives flow the same way, it emboldens candidates to campaign strongly on distributive issues. Once elected, executives have incentives to carry out their distributive mandate; in so doing they maintain ideological consistency and uphold their end of the representation bargain. Moreover, if they succeed, they can expect to enhance their own, or their party's, political support throughout their term and into the next election. As such, the normative implications of our findings are very much in keeping with democratic theory.

A lingering question is whether these patterns are particular to Latin America. We chose to test our argument Latin America not only because of its significant variation in inequality between countries and within them over time but also because distributional questions have been central to the politics of the region in the past three decades. Nevertheless, we see no reason why this pattern should be confined to Latin America. Anywhere politics is polarized over questions of distribution, valence-issues may morph into position-issues by cutting into the common ground upon which the elite and the electorate otherwise stand. Further research should observe how citizens respond to shifting distributive dynamics and examine whether incumbents are, indeed, held accountable for whether the economy matches their distributive promises, not just whether it is performing at all.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/psrm.2021.25