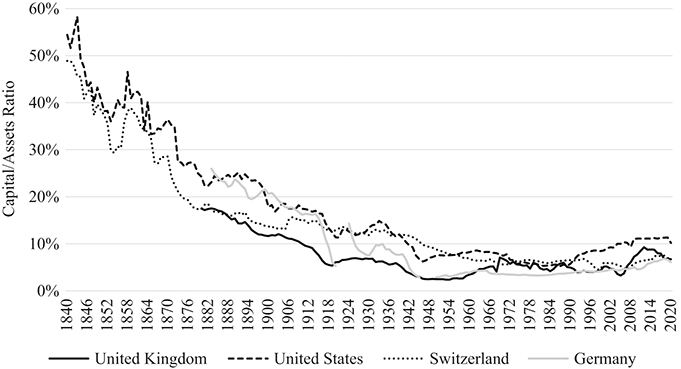

Commercial banks have steadily increased the amount of debt capital compared to their equity capital since their emergence in the nineteenth century. The capital/assets ratio allows the tracing of this evolution in the long run and for various countries. This chapter considers the capital/assets ratios of four countries – the United States, the United Kingdom, Switzerland, and Germany – from 1840 to 2020. Banks in all four countries show a remarkable downward trend in the capital/assets ratio, except for a few periods of recovery.

Presenting a time series covering 180 years requires diligent work, but is ultimately not very complex. However, little emphasis has been given to issues related to the collection and aggregation of data so far. The time series showing capital/assets ratios for the four countries under consideration, for example, consist of thirteen different aggregated time series. Many of these time series do not fully represent the respective banking market. Certain banking groups, for example, are missing for specific periods. Moreover, the underlying definition of a bank, capital, and accounting standards varies between countries.

Other aspects that have received limited attention in a very long-run perspective are structural changes in banks’ balance sheets. A key issue is that the underlying risk of assets in banking might have changed over time. The risk of default, for example, is fundamentally different if a bank holds 80% government debt on its balance sheet compared to a bank investing 80% of its assets in low-rated corporate bonds. Were capital ratios still decreasing if such risks of assets were considered? A simple Basel I methodology is applied in a historical context to adjust for the degree of risk. As such calculations require detailed balance sheet data, only British, Swiss, and US banks are analysed. This exercise highlights that decreasing capital ratios are not simply the result of structural changes on the assets side but can be observed even after accounting for such structural differences.

Finally, two other aspects can substantially alter capital ratios: a bank’s ‘actual’ capital position may differ from the published figures because of hidden (undisclosed) reserves or due to unpaid shareholder capital.

2.1 Capital Ratios Since 1840

Figure 2.1 shows the evolution of bank capital as a percentage of the total assets from 1840 to 2020 for Germany, the United Kingdom, the United States, and Switzerland. From the early 1880s, data is only available for Switzerland and the United States. The capital/assets ratios in both countries remained above the 30% threshold until 1871 (Switzerland) and 1873 (United States). In the subsequent decade, both countries’ capital/assets ratios experienced a further decline, falling to the 20% level.

Figure 2.1 Capital/assets ratios, 1840–2020Footnote 1

From the 1880s until the end of the First World War, the capital/assets ratios of all four countries fell rapidly. By 1918, the ratio stood at 9.3% in Germany, 13.1% in Switzerland, 5.5% in the United Kingdom, and 13.3% in the United States. During the war, the ratios fell by 7.1 percentage points (pp) in Germany, 1.9pp in Switzerland, 3.7pp in the United States, and 2.8pp in the United Kingdom.

During the inter-war period (1918–39), the capital/assets ratios in all four countries recovered somewhat. The ratios grew after the First World War and accelerated their growth during the years of the Great Depression. Towards 1939, the ratios started to decline again. They then deteriorated even more rapidly during the Second World War. In Germany, the ratios dropped by 4.8pp during the Second World War, in the United Kingdom by 2.5pp, in Switzerland by 1.6pp, and in the United States by 5.3pp. The ratios of the four countries converged during the second half of the twentieth century. Capital/assets ratios grew again for US banks from the 1990s, and in Switzerland, the United Kingdom, and Germany after the last financial crisis.

Compared to the other countries, US banks’ capital/assets ratio seems to have been the highest over most of the period covered. On the other hand, the capital/assets ratios in the United Kingdom were comparably low for a long time. However, in the second half of the twentieth century, there was less variation among the capital/assets ratios of the four countries.Footnote 2

2.2 The Problems of Constructing Long-Run Time Series

Presenting capital ratios over 180 years seems to be a simple exercise and has been done in many publications. However, most publications do not discuss the cascade of issues related to showing long-run data. One of the critical problems is that reliable time series covering capital/assets ratios for more than one century seldom exist. For some years, there might be no data, or the data might be based only on a small number of banks. Moreover, long-run time series often consist of several individual datasets. Many of these sources are secondary sources, and obtaining the original source is not always possible. In addition, only a few sources discuss the methodology used in collecting and aggregating the data. However, identical definitions of capital and assets across time and space would be a condition for producing consistent data. A case in point is illustrated in Figure 2.1. It might give the impression of presenting four different time series covering four countries; in fact, thirteen individual time series have been aggregated to provide a long-run view of capital ratios.

A second issue is that datasets sometimes cover different groups of banks. Finding datasets without a selection bias is difficult or even impossible for some periods. The German dataset before 1920 only incorporates certain bank types: joint-stock banks (Aktien-Kreditbanken) with a balance sheet total above one million DM and mortgage banks (Hypothekenbanken).Footnote 3 Other banking groups, most notably the savings banks (Sparkassen), are neglected.

Similar problems exist in the case of Switzerland. The time series from 1840 to 1906 consists of note-issuing banks only, which were usually regionally active banks with a primary focus on mortgage lending and receiving savings from customers (apart from note-issuing). Two important bank types are missing: small savings banks and large joint-stock banks.Footnote 4 The issue is even more apparent when considering that savings banks in Switzerland (and Germany, too) were often organised as ‘clubs’ or cooperatives, starting their business with little or no capital.Footnote 5 The data availability for Switzerland allows some insights into how representative the time series from 1840 to 1906 is. Only 7% (measured in the number of banks) or 37% (measured in total assets) of the bank population is covered from 1840 to 1906.Footnote 6

Similar problems appear with the time series of banks in the United Kingdom. Until 1968, the time series covers joint-stock banks only. The banking model of private banks is not represented in the time series, even though private banks (based on partnerships) were the standard banking model until the 1830s. The number of private banks gradually fell towards the beginning of the twentieth century. Regarding joint-stock banks, however, the dataset represents the banking market, even though the data from 1968 to 1983 consists of only the ‘Big Four’ banks. The market at the time was highly concentrated.Footnote 7 Moreover, data on the whole market produced by the Bank of England (BoE) did not provide details on bank capital.

Another even more fundamental problem for bank statistics in British banking during the 1960s and 1970s emerges when considering the definition of a bank. The BoE asked only the so-called statistical banks in the United Kingdom to contribute their data to its statistical publications. The BoE defined statistical banks as banks that were on the Schedule 8 or Schedule 127 lists.Footnote 8 Therefore, a substantial part of the market that emerged during that time – the secondary banks – was not represented in official statistics. The definition of a bank is a general problem: in order to measure, statistical offices or central banks need to define what is measured. Entities outside that definition are not covered.

Finally, the time series for the United States supposedly consists of ‘all banks’ for most of the years covered. However, ‘all banks’ is inaccurate, even though the US Bureau of the Census used the term in its statistical publications. The primary source of the data until the end of the nineteenth century was the Comptroller of the Currency, which discloses an incomplete coverage of banks as non-national banks were underrepresented.Footnote 9 The data after 1971 consists of FDIC-insured banks only. Moreover, investment banks regulated by the US Securities and Exchange Commission (SEC) were excluded.Footnote 10

The shortcomings of long-run time series on capital/assets ratios are numerous. The data may serve as an analytical departure point but require further differentiation. Awareness of the problems of long-run data is therefore crucial when it comes to interpreting it, along with an understanding that long-run time series are more an approximation than an exact measurement.

2.3 Structural Changes in Balance Sheets

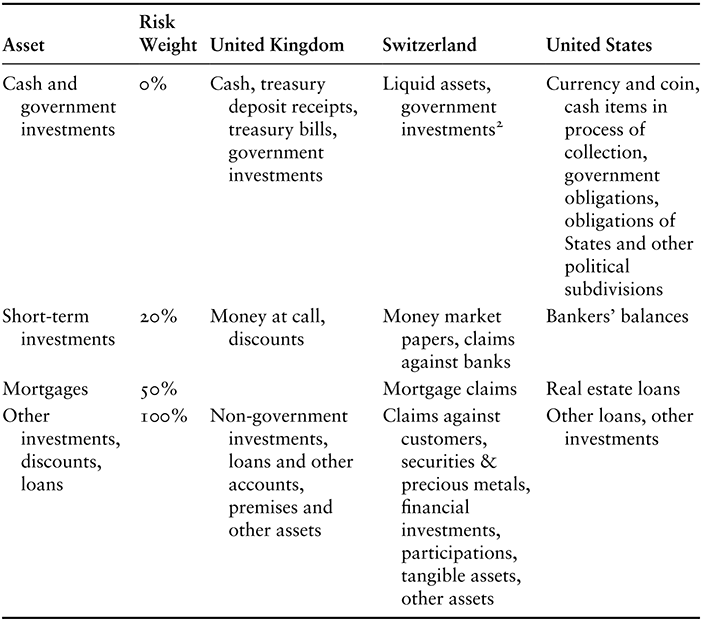

Figure 2.1 shows decreasing capital/assets ratios in the long run, but did the leverage among banks increase once the risks on the asset side were considered? The Basel Capital Accord of 1988 provides a straightforward methodology to address this question. It allows for measuring structural changes in the balance sheets over long periods.

In 1988, the member countries of the Basel Committee on Banking Supervision at the Bank for International Settlements agreed on a common framework for the regulation of the capital adequacy of international banks. Basel I put forward a methodology that aimed to measure the credit risks of assets.Footnote 11 Each asset group carried a particular risk weight. Cash and government securities, for example, were given a zero risk weight. If a bank held USD 50 million in cash, it did not contribute to the overall total of risk-weighted assets (RWA) since its weight was 0%. Investments in company shares carried more risk and were weighted with 100%. This risk-weighting process led to total assets substantially lower than the non-risk-weighted asset total. The capital requirements were set relative to these RWA total at a minimum of 8%, of which half had to be so-called core capital (equity capital and disclosed reserves).Footnote 12

A Basel I simulation requires relatively granular data – for example, on banks’ investment portfolios. The available data allows applying the Basel framework for British banks from 1880 to 1966, US banks from 1896 to 1980 and from 1984 to 2020, and Swiss banks from 1924 to 2020.Footnote 13 Table 2.1 shows the weights for calculating the RWA as defined by Basel I and the classification of the main balance sheet items in the respective countries.Footnote 14 The methodology used in this thesis differs slightly from the Basel I approach because of limited data availability: off-balance-sheet items could not be considered. Regarding capital, the calculations in Figure 2.2 only incorporate shareholder capital and disclosed reserves (defined as Tier I in Basel I). Other forms of capital according to Basel I (hidden reserves, subordinated debt, defined as Tier II) are excluded.

Table 2.1 Categorisation of balance sheet assets according to Basel I risk-weightsFootnote 1

| Asset | Risk Weight | United Kingdom | Switzerland | United States |

|---|---|---|---|---|

| Cash and government investments | 0% | Cash, treasury deposit receipts, treasury bills, government investments | Liquid assets, government investmentsFootnote 2 | Currency and coin, cash items in process of collection, government obligations, obligations of States and other political subdivisions |

| Short-term investments | 20% | Money at call, discounts | Money market papers, claims against banks | Bankers’ balances |

| Mortgages | 50% | Mortgage claims | Real estate loans | |

| Other investments, discounts, loans | 100% | Non-government investments, loans and other accounts, premises and other assets | Claims against customers, securities & precious metals, financial investments, participations, tangible assets, other assets | Other loans, other investments |

1 Own classification according to the Basel I framework: Basel Committee on Banking Supervision, Basel I, pp. 21–2.

2 Government investments are bonds or debt register claims (Schuldbuchforderungen) from the federal government, cantonal governments, municipalities, and the Swiss Federal Railways, or loans to the respective entities.

Figure 2.2 Capital in percentage of total assets and risk-weighted assets in the United Kingdom, the United States, and Switzerland, 1880–2020Footnote 15

Figure 2.2 shows two ratios for each country: a risk-weighted and a risk-unweighted capital assets ratio. The dotted lines represent the capital as a percentage of the RWA. The capital/RWA ratio often developed parallel to the capital/assets ratio. There were periods, however, where the two ratios deviated. Most apparent are the periods of the 1930s in the United States, the Second World War in all three countries, and the period from 2008 to 2020 in the United States and Switzerland (no data on the United Kingdom is available for 2008–20). The reasons for these deviations can be found in the banks’ increased involvement in government debt or liquid assets. Both categories are weighted with zero per cent, leading to an increase in the capital/RWA ratio.

In the United Kingdom, for example, banks’ capital/assets ratio fell by 2.3 percentage points to 5.2% between 1939 and 1945. At the same time, the capital/RWA ratio grew by 1.4 pp. The change resulted from holdings in British treasury deposits. In 1945, treasury deposits accounted for 30.7% of all assets. Meanwhile, government bonds increased from 21.4% to 23.4% of the total assets.

The time series on Switzerland show similar patterns. The capital/assets ratio fell by 1.5 pp between 1939 and 1945, whereas the capital/RWA ratio slightly increased. As in the United Kingdom, these changes were directly related to government investments. By 1939, 4.6% of the balance sheet total of Swiss banks were loans to the government, government bonds, or government debt register claims (Schuldbuchforderungen) held by the banks. In 1945, government investments as a percentage of the balance sheet total reached 11.5%.Footnote 16

The asset composition of US banks has changed fundamentally from the early 1930s. By 1930, the share of government bonds in the banks’ balance sheet was 10.9%. Six years later, one-third of the assets consisted of government bonds. The capital/assets ratio fell during that period (–2.6pp), while the capital/RWA ratio grew (+6.1pp). A similar effect can be observed from 2008 to 2014, when the share of liquid assets and government securities increased.

2.4 Hidden Reserves

The time series presented so far were based on public figures published in annual reports. Undisclosed (hidden) reserves are not included as part of a bank’s published capital even though such reserves serve as buffers against losses – one of the primary functions of capital. Adjusting the capital for hidden reserves leads to higher capital/assets ratios.

Companies create hidden reserves through two processes if not legally prohibited or limited. Firstly, a reserve is not listed under reserves but as a liability in the balance sheet.Footnote 17 Therefore, the liability is overvalued (book value exceeds the actual market price). Secondly, an asset in the published financial statement is undervalued (book value is below the actual market value) or not listed at all in the balance sheet. By keeping an asset undervalued or a liability overvalued, a bank avoids realising a profit, which would become part of the capital if not paid out to the shareholders. However, if a loss occurs, the bank can revalue an asset or liability and release hidden reserves to cover losses or smooth profits. Hidden reserves are, therefore, a form of capital and a safety cushion in crises when, for example, more loan defaults occur. Consequently, the function of hidden reserves is somewhat similar to that of disclosed reserves, with the notable exception that the public is not aware of their true extent.

Historically, there seemed to be three motives for maintaining hidden reserves. Firstly, many banks aimed for stable profits and stable dividends in order to signal stability. Secondly, banks pay dividends on nominal capital. Especially in the nineteenth century and the first half of the twentieth century, a high dividend was also a matter of reputation. Maintaining high (disclosed or undisclosed) reserves while having a comparatively small nominal capital allows for substantial and stable dividend payments on the nominal capital. Thirdly, building up hidden reserves instead of realising profits might avoid taxes on profits.Footnote 18

Academic literature on hidden reserves in the financial sector is sparse.Footnote 19 Billings and Capie offer the only long-run data on hidden reserves based on internal accounts from archives covering British banks from 1920 to 1970.Footnote 20 For Switzerland and the United States, there are no encompassing assessments of hidden reserves.Footnote 21 Swiss banking regulation provides an alternative method for estimating hidden reserves. From the 1960s onwards, banks could use their hidden reserves as a part of the capital they were required to hold. In order to get hidden reserves approved as part of the required capital, auditors of banks had to submit a form confirming the extent of hidden reserves to the Federal Banking Commission (FBC).

For the United States, the estimations of asset values by the FDIC’s bank examiners are an indication of hidden reserves. The FDIC published data from 1939 to 1951 summarising these adjustments. As part of their supervisory task, bank examiners estimated the value of assets. The examiners noted differences if the value of their assessment deviated from the value stated in the bank’s balance sheet. Additionally, examiners listed assets that were not in the books of banks. Their value, however, was negligible. Between 1939 and 1951, the ratio of ‘assets not on the books’ to total assets was 0.02% on average. Assets that were valued by examiners lower than the published value in the banks’ balance sheet were about four times larger than the ‘assets not on the books’.Footnote 22 If negative and positive value adjustments are netted against each other, the FDIC-insured banks hid losses instead of holding hidden reserves in their balance sheets.

2.4.1 Hidden Reserves in British Banking

Billings and Capie provide data on the extent of hidden reserves for six banks (Barclays Bank, Lloyds Bank, Martins Bank, Midland Bank, National Provincial Bank, Westminster Bank) from 1920 to 1968. Hidden reserves were allowed until 1970.Footnote 23 On average, the capital, including hidden reserves, was about 61% higher than the published capital.Footnote 24 The capital/assets ratio including hidden reserves was 2.5pp higher than the ratio without (minimum: 1.2pp; maximum: 3.4pp).

Figure 2.3 shows the capital/assets ratio of the Big Five banks with and without considering hidden reserves as a part of the banks’ capital. The hidden reserves among the six banks grew until the late 1920s. They fell in 1927–30 and 1932–3 before recovering again. During the Second World War, the ratio of hidden reserves decreased and entered another period of growth until the 1960s. These figures are fairly representative of the banking market in the United Kingdom for most of the time covered by the data in Figure 2.3, as from 1920 onwards, the (originally English) Big Five banks had market shares in the UK banking market of between 80% and 90%.Footnote 25

Figure 2.3 Capital/assets ratio, Big Five banks, including and excluding hidden reservesFootnote 27

The public was aware of the extensive use of hidden reserves in banking. The Journal of the Institute of Bankers, for example, pointed out that ‘It is, of course, common knowledge that all the large banks in England have written down their premises accounts to a fraction of their actual worth.’Footnote 26 Similarly, The Economist pointed out the existence of substantial hidden reserves in the 1920s:

The banks, it must be remembered, have admittedly very large reserves, in addition to those figuring in the balance-sheets. During the past decade an enormous amount has been written off the book value of investments. The latter, mostly British Government securities, have greatly appreciated in value during the past two years, but, as far as we are aware, no bank has written up its investments. Here, therefore, is a very substantial ‘hidden’ reserve, to which may be added the fact that premises, from which large amounts have been steadily written off year by year, must be now worth a great deal more than the figures at which they appear in the balance-sheets.Footnote 28

The statement above is representative of many others made in The Economist’s Banking Supplement, mentioning the presence of undisclosed reserves in English banking as well as the potential use of such reserves to ensure stable dividend payments.

2.4.2 Hidden Reserves in Swiss Banking

In 1934, Switzerland introduced its first national bank regulations. The Banking Act required banks to hold an ‘adequate’ amount of capital, specified in the Banking Ordinance as a 5% or 10% capital/liabilities ratio.Footnote 29 The Banking Ordinance was not revised until 1961. One significant change in capital regulation in 1961 was that hidden reserves were allowed as part of a bank’s statutory capital.Footnote 30 Allowing hidden reserves as part of the required capital became more restricted again between 1990 and 1995.Footnote 31

According to Switzerland’s capital regulations, disclosing hidden reserves was not mandatory. However, if banks wanted to use hidden reserves as part of their required capital, their auditors would have to report them to the bank supervisor: the FBC. Consequently, data on hidden reserves used as a statutory capital component was reported to the FBC and is accessible in its archives. Moreover, the Swiss National Bank (SNB) published annual statistics on hidden reserves for certain years.Footnote 32

Despite these sources, the exact amount of hidden reserves is unknown as the use of hidden reserves for regulatory requirements was limited. From 1961 to 1967, the legally required capital could consist of a maximum of 15% hidden reserves. From 1968 to 1971, the regulator raised the limit to 25%, and in 1972 it removed the limit altogether. Thus, the legally required capital could, theoretically, consist entirely of hidden reserves in 1972. However, if banks had sufficient paid-up capital and disclosed reserves, they might not have reported undisclosed reserves to the supervisor. Data on undisclosed reserves in official statistics and from the archive of the FBC are, therefore, lower-bound estimates only and do not allow for an exact estimate of hidden reserves in Swiss banking.

Figure 2.4 shows the estimates of hidden reserves of all banks in Switzerland as a percentage of the total assets (axis on the left, black bars) and the share that hidden reserves contributed to the required capital (right axis, grey line). On average, banks reported 5.4% (maximum allowed: 15%) of their required capital as hidden reserves from 1961 to 1967. From 1968 to 1971, the average was 11.3% (maximum allowed 25%) and 14% from 1972 to 1994 (no limits).

Figure 2.4 Hidden reserves reported to the Federal Banking Commission in percent of total assets (left axis) and hidden reserves in percent of required capital (right axis), all Swiss banks, 1961–94Footnote 33

Compared to the total assets, hidden reserves reached, on average, 0.3% (1961–7), 0.6% (1968–71), and 0.9% (1972–94). The reported hidden reserves grew immediately after the regulatory changes in 1968 and 1972, indicating that the newly reported hidden reserves existed already before these changes. While these figures represent lower bound estimates, the figures of one banking group among the Swiss banks provide more accurate insights.

The big banks frequently struggled to meet capital requirements in the 1950s, ’60s and ’70s.Footnote 34 If the big banks had problems meeting capital requirements, they likely reported all their hidden reserves to the supervisor. By 1960, the big banks lacked 16% of the required capital, thus failing to meet capital requirements to a large extent. The big banks narrowly managed to fulfil the capital requirements for some subsequent years but fell below the requirements again in the first half of the 1970s.

Hidden reserves held by the big banks from 1972 to 1994 were on average 1.2% of total assets. The reported hidden reserves reached their high point in 1975 and 1976, reaching 2% of total assets, and fell again rapidly in the 1990s. The reason for this can most likely be found in regulatory changes and the real estate crisis that hit Switzerland in the early 1990s. The revision of the Banking Ordinance in 1995 finally prohibited hidden reserves on a consolidated level. Furthermore, the real estate crisis at the beginning of the 1990s led to losses among the Swiss banks of CHF 42.3bn, of which CHF 30.1bn was attributed to the big banks.Footnote 35 The banks likely covered substantial amounts of these losses with hidden reserves, as the total volume of capital (including reserves) was even increasing at the time, and published profits were stable.Footnote 36

Figure 2.5 shows the capital/assets ratios for ‘all banks’ and the big banks with and without the hidden reserves estimates. It indicates that the actual capital/assets ratios were substantially higher than the capital/assets ratios derived from published accounts. With regards to the whole banking market, the capital/assets ratio, including hidden reserves, was at least 0.8pp higher than the published capital/assets ratio (1961–94). For the big banks, the difference between the actual and the published capital/assets ratio was even more substantial.

Figure 2.5 Capital/assets ratio including and excluding hidden reserves, all banks and big banks, 1961–94Footnote 37

2.5 Extended Shareholder Liabilities

In the absence of extended forms of liabilities, an investor is liable only for the paid-up nominal value of a share. The maximum potential loss is the price paid for the stock. With extended shareholder liabilities, the potential losses for investors can be much higher, either limited to a certain amount or even unlimited. Under which circumstances can or must shareholders pay in more equity capital? It depends on the regulatory framework. First, a bank might be able to call up more capital based on a decision by the bank’s management or the general assembly if needed. There are several reasons to call up additional capital: for example, to expand business activities or to recapitalise after losses and write off a part of the capital. Secondly, capital can be called up if a bank is in liquidation. In that case, calling up capital is contingent on an event (bankruptcy). Given the bank’s limited or unlimited claim on its shareholders’ wealth, it can be argued that such non-contingent or contingent claims are a form of capital. Consequently, capital/assets ratios can be adjusted by shareholder liabilities, providing a more comprehensive view of a bank’s ‘capital strength’ bank.

Estimating the extent of the shareholder liability is straightforward if it is limited to a specific maximum (e.g. double liability, limited to an amount). If it is unlimited, the liability depends on the individual wealth of each shareholder, making the valuation of the liability almost impossible. In England, all banks could limit shareholder liability from 1857 onwards, but most banks only changed to limited liability after the collapse of the City of Glasgow Bank in 1878. In Switzerland, unlimited liability would still be allowed today for cooperative banks.Footnote 38 In practice, however, extended forms of liability lost their importance during the nineteenth century.Footnote 39 The United States, finally, provides numerous examples of extended liabilities in banking on the state level. Moreover, the federally chartered national banks were under double liability provisions from 1864 to 1937.

2.5.1 Shareholder Liability in British Banking

By the mid-nineteenth century, banks in England could operate under three different acts. While the acts of 1826 and 1833 did not allow banks to register with limited liability, it was compulsory under the Banking Act of 1844.Footnote 40 Most banks at the time, however, operated under the Banking Acts of 1826 and 1833.Footnote 41 It was not until 1857 that all English banks could register with limited liability, but only a few banks took the opportunity and changed their legal status.Footnote 42 The collapse of the City of Glasgow Bank in 1878 was a turning point. By 1874, about 20% of English deposits were held by banks with limited liability.Footnote 43 In 1880, only around every fourth bank still operated with unlimited liability. In 1885, almost all joint-stock banks were on limited liability.Footnote 44

Most banks that changed to limited liability after the City of Glasgow failure created a ‘reserve liability’ based on the Companies Act of 1879. This reserve liability could be called up in case of bankruptcy.Footnote 45 Thus, unlimited liability was replaced by a certain amount of uncalled capital and reserve capital. The former could be called up anytime, the latter only in the event of a bank failure. On the one hand, the reserve liability protected shareholders from unwanted and uncontrollable calls for capital from bank directors. Shareholders knew how much of the total amount they were liable for. On the other hand, a reserve was established for the depositors, signalling bank safety.Footnote 46 However, the transition from unlimited to limited liability banking raises the question of whether banks substantially increased their paid-up capital and reserves once they switched from one to the other regime. Turner has shown that banks with limited liability had substantially higher capital ratios than unlimited liability banks.Footnote 47 A look at journalistic articles at the time also shows that an increase of paid-up capital was also expected.

Grossman and Imai also show that uncalled capital and reserve liability restrained the banks’ risk-taking. English banks with higher amounts of uncalled capital and reserve liability tended to take less risk. Their loan portfolios grew more slowly, and their assets were less risky.Footnote 48

Assessing the value of the unlimited liability depends on the individual wealth of a bank’s shareholders. Based on an analysis of the City of Glasgow’s shareholder composition, Acheson and Turner showed that the bank’s shareholders were ‘from the wealthier sections of society’.Footnote 49 Looking at the shareholders of four different banks in a separate study, Turner came to a similar result.Footnote 50 The same can be concluded when looking at the socio-occupational backgrounds of shareholders.Footnote 51 Turner also argued that wealthier individuals had a great incentive to act as the directors of banks in order to conduct a vetting role. In the period of unlimited liability, the vetting of shareholders allowed their directors to avoid a dilution of the aggregate shareholder wealth, which would have increased their own liability.Footnote 52

In the period of unlimited liability, quantifying the actual value of the joint and several liabilities would require an analysis of each individual shareholder. For the period after the 1870s, however, the amount of the limited liability can be measured for most of the banks, assuming the limited liability could be paid up entirely by the shareholders in the case of a failure. Including this contingent capital, the total capital resources would consist of (1) the subscribed capital, divided into paid-up and unpaid (uncalled and reserve) capital, (2) the banks’ reserves, (3) retained profits, and (4) hidden reserves.

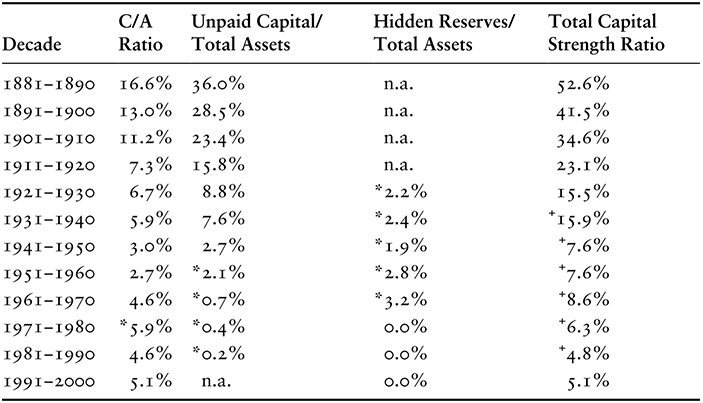

Table 2.2 shows the unpaid capital, hidden reserves and the ‘total capital strength’ (summarising all capital components) of British joint-stock banks.Footnote 53 Most major banks extinguished their unpaid capital between 1956 and 1958 in a capital reorganisation led by the BoE.Footnote 54 The small amounts of unpaid capital in later years result from the difference in the authorised share capital and the called-up share capital (allotted and fully paid).Footnote 55

Table 2.2 Total capital resources in percent of total assets, British banks, averages per decade, 1881–2000Footnote 1

| Decade | C/A Ratio | Unpaid Capital/ Total Assets | Hidden Reserves/ Total Assets | Total Capital Strength Ratio |

|---|---|---|---|---|

| 1881−1890 | 16.6% | 36.0% | n.a. | 52.6% |

| 1891−1900 | 13.0% | 28.5% | n.a. | 41.5% |

| 1901−1910 | 11.2% | 23.4% | n.a. | 34.6% |

| 1911−1920 | 7.3% | 15.8% | n.a. | 23.1% |

| 1921−1930 | 6.7% | 8.8% | *2.2% | 15.5% |

| 1931−1940 | 5.9% | 7.6% | *2.4% | +15.9% |

| 1941−1950 | 3.0% | 2.7% | *1.9% | +7.6% |

| 1951−1960 | 2.7% | *2.1% | *2.8% | +7.6% |

| 1961−1970 | 4.6% | *0.7% | *3.2% | +8.6% |

| 1971−1980 | *5.9% | *0.4% | 0.0% | +6.3% |

| 1981−1990 | 4.6% | *0.2% | 0.0% | +4.8% |

| 1991−2000 | 5.1% | n.a. | 0.0% | 5.1% |

1 Author’s calculations. Data: Unpaid capital, 1951–90: Individual balance sheets of Big Five/Big Four, collected by author; 1881–50: ‘The Economist Banking Supplement, Various, 1861–1946’. Hidden reserves: Billings and Capie, Capital in British Banking. Other data: Sheppard, The Growth and Role of UK Financial Institutions. Notes: * denotes the Big Five/Big Four banks. This data was used due to a lack of alternative data covering the whole market. + marks estimated figures, as these figures mix data from the whole market with aggregated data for the Big Five/Big Four banks. Note that all forms of capital are measured against the same amount of total assets. This is a theoretical view with a constant standard of comparison. In practice, however, a higher capital in the balance sheet would increase the total assets. For a similar analysis comparing the total capital resources to deposits, see also Turner, Banking in Crisis, p. 128, figure 5.1.

The calculations highlight that the extended limited liability was an integral part of the capital resources in the banking system. In the 1890s, for example, the unpaid capital amounted to 28.5% of the total assets. Compared to the deposits, 55% of the banks’ deposits were covered by capital resources of various forms in the 1890s. The importance of unpaid capital decreased over time. In the 1930s, the unpaid capital as a percentage of the total assets was down to 2.7%.

2.5.2 Shareholder Liability in Swiss Banking

So far, academic literature has not yet estimated the extent of shareholder liabilities in Swiss banking. Swiss corporate law was and still is part of the Swiss Code of Obligations, introduced in 1883. Besides regulating basic principles, such as accounting standards, disclosure requirements, and audits, it also dealt with the liability of shareholders. According to the Code of Obligations, only 20% of the capital of a joint-stock company had to be paid-up.Footnote 56 Consequently, there was no unlimited liability for the shareholders of joint-stock banks after 1883, but the size of the liability in the form of unpaid capital varied up to a limit of four-fifths of a bank’s total capital. A different rule applied to banks with the legal form of a cooperative. Many savings banks were founded as cooperatives. If not stated otherwise in the articles of association of a bank, the cooperation members were jointly liable with their personal wealth in the case of bankruptcy.Footnote 57

Besides the general regulatory framework provided by the Code of Obligations, the Federal Banknote Act, also introduced in 1883, was the first law on a national level to regulate a particular banking activity.Footnote 58 The Act obliged note-issuing banks to hold a paid-up capital of at least CHF 500,000. If the paid-up capital was above CHF 500,000, note-issuing banks could – theoretically – still operate with unpaid capital. The paid-up capital of CHF 500,000, however, would have to represent 20% of the total capital (according to the Code of Obligations).

When Switzerland’s first National Banking Act was introduced in 1934, it allowed the use of unpaid capital for regulatory purposes, therefore building on the corporate law anchored in the Code of Obligations. The Banking Act stipulated a so-called required capital: the statutory minimum threshold of capital. Both joint-stock banks and cooperative banks could use up to 50% of their unpaid capital as being counted as their required capital from a legal point of view. The regulatory practice of allowing unpaid capital to be part of the statutory capital was maintained until 2012.Footnote 59

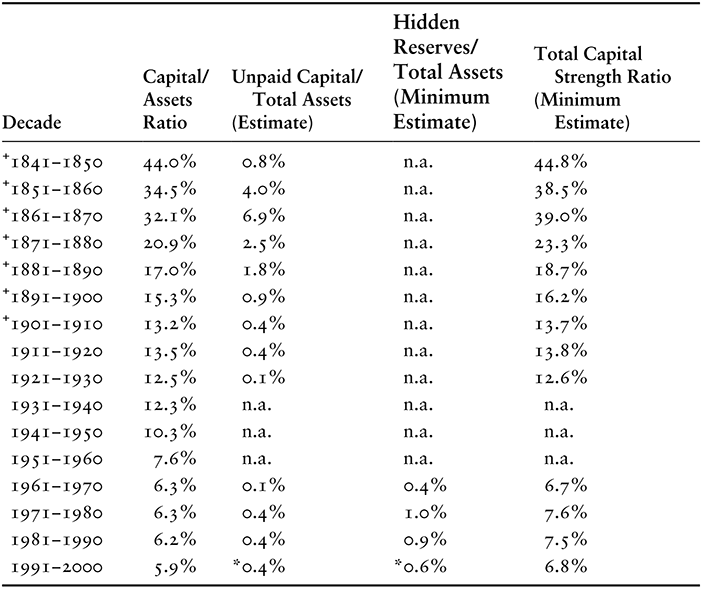

Based on the regulatory framework, extensive use of unpaid capital and unlimited liability was possible. Table 2.3 provides estimates for the extent of unpaid capital as well as the ‘total capital strength’ (including both unpaid capital and hidden reserves) of the Swiss banking system from 1841 to 2000. The data availability for the nineteenth century is low. The numbers shown in Table 2.3 up to 1906 are taken from Adolf Jöhr’s compilation and cover only note-issuing banks.Footnote 60 Small banks are underrepresented in this period. After 1906, the data in Table 2.3 become increasingly representative of the banking market as the SNB started to collect and aggregate data. In the first decade of the SNB banking statistics, however, the SNB also struggled to obtain a complete set of data. The reason for this can be found in the lack of publication requirements. According to the Code of Obligations, banks were not obliged to produce an annual public statement. Moreover, providing data to the SNB was not mandatory. Many of the smaller savings banks did not publish a balance sheet or income statement for the public.Footnote 61 Publication requirements in banking were only introduced with the Banking Act in 1934.

Table 2.3 Total capital resources in percent of total assets, Swiss banks, averages per decade, 1841–2000Footnote 1

| Decade | Capital/Assets Ratio | Unpaid Capital/ Total Assets (Estimate) | Hidden Reserves/ Total Assets (Minimum Estimate) | Total Capital Strength Ratio (Minimum Estimate) |

|---|---|---|---|---|

| +1841−1850 | 44.0% | 0.8% | n.a. | 44.8% |

| +1851−1860 | 34.5% | 4.0% | n.a. | 38.5% |

| +1861−1870 | 32.1% | 6.9% | n.a. | 39.0% |

| +1871−1880 | 20.9% | 2.5% | n.a. | 23.3% |

| +1881−1890 | 17.0% | 1.8% | n.a. | 18.7% |

| +1891−1900 | 15.3% | 0.9% | n.a. | 16.2% |

| +1901−1910 | 13.2% | 0.4% | n.a. | 13.7% |

| 1911−1920 | 13.5% | 0.4% | n.a. | 13.8% |

1921−1930 | 12.5% | 0.1% | n.a. | 12.6% |

| 1931−1940 | 12.3% | n.a. | n.a. | n.a. |

| 1941−1950 | 10.3% | n.a. | n.a. | n.a. |

| 1951−1960 | 7.6% | n.a. | n.a. | n.a. |

| 1961−1970 | 6.3% | 0.1% | 0.4% | 6.7% |

| 1971−1980 | 6.3% | 0.4% | 1.0% | 7.6% |

| 1981−1990 | 6.2% | 0.4% | 0.9% | 7.5% |

| 1991−2000 | 5.9% | *0.4% | *0.6% | 6.8% |

1 Data: 1841–1900: Adolf Jöhr, Die Schweizerischen Notenbanken; Capital/Assets Ratios 1901–2010: Swiss National Bank, Die Banken in der Schweiz (annual issues 1906–2015). Various Issues 1906–2010. Notes: The period from 1841 to 1900 covers note-issuing banks only. * The data is available from 1991–4 only. + Note-issuing banks only, no other data available. Please note that all forms of capital are measured against the same amount of total assets. This is a theoretical view with a constant standard of comparison. In practice, however, a higher capital in the balance sheet would increase the total assets.

The data in Table 2.3 underline that unpaid capital was common and substantial in the nineteenth century. Measured as a percentage of total assets, unpaid capital reached its highest point at 6.9% in the 1860s. The numbers were substantially lower during the twentieth century for the whole banking market. In the 1970s, for example, unpaid capital added, on average, 0.4pp to the capital/assets ratio of 6.3%. Including hidden reserves, this would lead to an adjusted capital/assets ratio of 7.6%, which was still 20% higher than the published capital/assets ratio.

2.5.3 Shareholder Liability in US Banking

The United States offer a broad experience of experimenting with liability provisions, ranging from limited (single) liability to unlimited liability. Early commercial banks in the United States often operated without extended liability for shareholders. However, during the period leading up to the US Civil War, there was a clear trend towards double liability among banks chartered by states.Footnote 62 Double liability typically meant that shareholders were, in addition to their initial investment in the stock, liable for the par (nominal) value of the stock in case of bankruptcy.

The trend toward double liability was further accelerated on the federal level by the introduction of the National Banking Act of 1864.Footnote 63 Newly chartered national banks all operated under double liability.Footnote 64 Many states followed and implemented liability provisions for state banks. By 1910, for example, eleven states had no additional liability requirements or no incorporation laws for banks. Out of the thirty-two states that required additional liability, however, thirty states imposed double liability.Footnote 65 In 1930, only a few states were left with single or voluntary liability, which left the introduction of liability to the banks.Footnote 66

Double liability became increasingly unpopular in the 1930s. Macey and Miller identify three reasons for the demise of double liability. The high number of bankruptcies between 1929 and 1932 showed that double liability did not contribute to banking stability. Moreover, the bank failures also led to bankruptcies among individual shareholders. Finally, the introduction of federal deposit insurance in 1933 made double liability redundant.Footnote 67

The Banking Acts of 1933 and 1935 led to the end of double liability in the national banking system. The Act of 1933 allowed banks to issue shares without double liability.Footnote 68 The Act of 1935 repealed double liability on existing shares of all national banks from July 1937.Footnote 69 At the state level, every state had dropped double liability provisions by 1941.Footnote 70

Measuring the extent of double liability for state banks is challenging due to the variety of liability provisions and frequent regulatory changes. However, national banks’ liability provisions were stable from 1864 to 1937. Official statistics by the Office of the Comptroller of the Currency, responsible for administering the federal banking system and chartering national banks, provide insights into the capital structure of national banks.

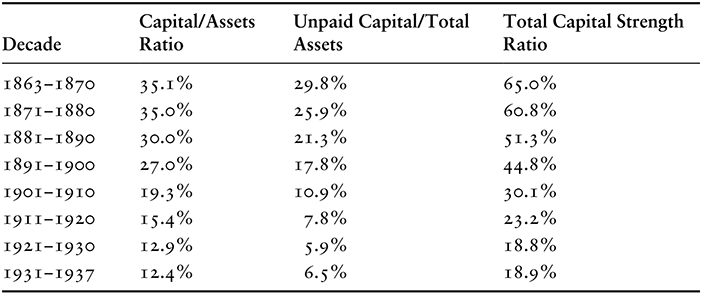

Table 2.4 shows the capital/assets ratio, the unpaid capital relative to total assets, and the ‘total capital strength’ ratio of national banks from 1863 to 1937. The double liability led to a substantial amount of unpaid capital during the nineteenth century. Over time, the importance of double liability diminished to some extent as banks accumulated reserves. At the turn of the century, for example, such published reserves already made up nearly 40% of the national banks’ published capital.

Table 2.4 Total capital resources in percent of total assets, United States national banks, averages per decade, 1863–1937Footnote 1

| Decade | Capital/Assets Ratio | Unpaid Capital/Total Assets | Total Capital Strength Ratio |

|---|---|---|---|

| 1863−1870 | 35.1% | 29.8% | 65.0% |

| 1871−1880 | 35.0% | 25.9% | 60.8% |

| 1881−1890 | 30.0% | 21.3% | 51.3% |

| 1891−1900 | 27.0% | 17.8% | 44.8% |

| 1901−1910 | 19.3% | 10.9% | 30.1% |

| 1911−1920 | 15.4% | 7.8% | 23.2% |

| 1921−1930 | 12.9% | 5.9% | 18.8% |

| 1931−1937 | 12.4% | 6.5% | 18.9% |

1 Data: 1863–1931: Office of the Comptroller of the Currency, ‘Annual Report of the Comptroller of the Currency 1931’, 1932, pp. 1021–2, Tab. 95. 1932–9: Office of the Comptroller of the Currency, ‘Annual Report of the Comptroller of the Currency 1939’, 1940, p. 301, Tab. 59. Note that all forms of capital are measured against the same amount of total assets. This is a theoretical view with a constant standard of comparison. In practice, however, a higher capital in the balance sheet would increase the total assets.