Introduction

The extensive growth of farmers markets in Canada and worldwide has been advocated by various agents including governments, private entrepreneurs, and consumers over the past decades with the goal of improving healthfulness, access to fresh produce, and environmental sustainability (Hunt Reference Hunt2007; Feagan and Morris Reference Feagan and Morris2009; Farmer et al. Reference Farmer, Babb, Minard and Veldman2019; Garner Reference Garner2019). Many regional governments expand local food systems through the promotion of farmers markets as a way to facilitate public health and promote local economic development (Gillespie et al. Reference Gillespie, Hilchey, Hinrichs and Feenstra2008; Wittman et al. Reference Wittman, Beckie and Hergesheimer2012; Kahin et al. Reference Kahin, Wright, Pejavara and Kim2017; Malagon-Zaldua et al. Reference Malagon-Zaldua, Begiristain-Zubillaga and Onederra-Aramendi2018). Private entrepreneurs also argue for the creation of new farmers markets by emphasizing the reduction in food miles from supporting local producers (Martinez et al. Reference Li, Joh, Lee, Kim, Park and Woo2010).

Consumers also have various motivations to support farmers markets. Some consumers value farmers markets for their perceived higher quality and freshness of food products (Ruelas et al. Reference Ruelas, Iverson, Kiekel and Peters2012; Dodds et al. Reference Dodds, Holmes, Arunsopha, Chin, Le, Maung and Shum2014; Yu et al. Reference Yu, Gibson, Wright, Neal and Sirsat2017). Others view farmers markets as places committed to enhancing social embeddedness through social connection, mutual exchange, and trust (Hunt Reference Hunt2007; Feagan a Morris Reference Feagan and Morris2009; Burns et al. Reference Burns, Cullen and Briggs2018). Additional motivations include environmental sustainability and supporting small farms and urban agriculture (Toler et al. Reference Toler, Briggeman, Lusk and Adams2009; Misyak et al. Reference Misyak, Ledlie Johnson, McFerren and Serrano2014; Giampietri et al. Reference Giampietri, Koemle, Yu and Finco2016). Because farmers markets can generate positive externalities for nearby residents by providing better and easier access to fresh food and increasing the overall quality of life, people may be willing to pay higher housing prices to live nearby. However, not all people support farmers markets and may not value farmers markets positively. The residents of adjacent or very proximal properties may instead require compensation to live close to farmers markets due to negative externalities including increased garbage, noise, traffic, petty crimes, and the presence of a large influx of strangers in the neighborhood. Given that farmers markets may generate both positive and negative externalities for nearby residents, the willingness to pay (WTP) or willingness to accept (WTA) for farmers market accessibility will depend on the relative importance of these factors.

A clearer understanding of the economic impact of farmers markets on nearby property values is important as this information can be useful to municipal policy makers who typically have the final decision on the location of these markets. If there is local opposition to the construction of new markets, then findings that show a positive economic impact may provide sufficient incentive to convince residents to support the initiative. Pope and Pope (Reference Pope and Pope2015) showed that – contrary to popular opinion – the arrival of Walmart stores actually increased housing prices by 1–3% for homes located within one mile of the store. Rising housing prices may increase the fiscal revenue of local municipalities/communities, which can also contribute to better provisioning of local public goods and services. Alternatively, if farmers markets have a negative effect on housing prices, this may encourage policy makers to situate them in areas away from residential neighborhoods. Therefore, the decision of where to situate farmers markets can affect both housing prices and local fiscal revenue, which in turn affects the quality and supply of local public services.

A second motivation for this study is to address a gap in the literature on the economic impact of greater food access. There is a large literature that examines the impact of grocery stores on housing prices (e.g., Caceres and Geoghegan Reference Caceres and Geoghegan2017) and food access more generally (e.g., Warsaw and Phaneuf Reference Warsaw and Phaneuf2019). However, it is not clear where farmers markets belong along the continuum of food sources due to their unique characteristics, such as being available only on certain days and/or during certain seasons and generally offering higher end products that cater to a wealthier clientele (Feagan and Morris Reference Feagan and Morris2009; Collins Reference Collins2020).

To the best of our knowledge, there are no published studies that explicitly investigate WTP or WTA for living in close proximity to farmers markets. This study fills this gap by estimating spatial hedonic pricing models (HPMs). The empirical setting is Edmonton, Canada, for which we have data on housing transactions covering the period 2015–2017. Our results show that households’ valuations of farmers markets were dependent on the proximity to nearby farmers markets. For a house located 2.86 km (mean distance) away from a farmers market, the negative effects associated with farmers markets dominated the positive ones, and the household was willing to pay a premium of C$2,724 for every kilometer further away from the market.Footnote 1 In addition, we find a nonlinear effect suggesting that a household’s marginal WTP for living away from farmers markets decreased as their distance from the market increases. At the aggregate level, we also detect the dominance of the negative effects. The total reduction in transacted housing values is estimated to be C$23,190,452. Using the 2019 property tax rate (0.9%), we further derive a C$208,714 annual reduction in property tax revenue. Our findings show that when local governments decide to improve people’s access to fresh food through the establishing of new or relocating of existing farmers markets, they need to consider the economic implications.

The rest of the paper is structured as follows. In the next section, we present a conceptual framework to analyze the relationship between the location of farmers markets and the WTP/WTA. Section 3 introduces the spatial HPM and the estimation steps for calculating WTP/WTA. Section 4 describes the study area and data sources. Section 5 summarizes the results and Section 6 concludes.

Conceptual framework

A farmers market is typically a collection of booths, tables, or stands where a group of local farmers sell fresh fruits, vegetables, animal-based food products, prepared foods, beverages, plants, and handicrafts directly to consumers (Wang et al. Reference Wang, Qiu and Swallow2014; Collins Reference Collins2020). Farmers markets are often lauded for the positive externalities they generate in the form of better access to fresher foods and social activities (Hunt Reference Hunt2007; Feagan and Morris Reference Feagan and Morris2009; Freedman et al. Reference Freedman, Vaudrin, Schneider, Trapl, Ohri-Vachaspati, Taggart and Flocke2016). As the scale of farmers markets grows, new features like live music, cooking demonstrations, and gardening tips are added, which may also benefit the surrounding businesses, enhance the attractiveness of nearby communities, and further increase the welfare of neighbors. Moreover, farmers markets can support small and midsize farms and stimulate local economies, which may improve land values (Wang et al. Reference Wang, Qiu and Swallow2014; Collins Reference Collins2020).

However, farmers markets may also generate negative externalities for nearby neighbors. The potential negative externalities include a variety of nuisances, such as bringing noise, litter, and congestion to nearby neighbors, increasing the likelihood of petty crimes such as burglary and vandalism, and introducing nuisances such as strangers trespassing on private property (Collins Reference Collins2020). Appendix 1 summarizes the potential positive and negative externalities associated with farmers market.

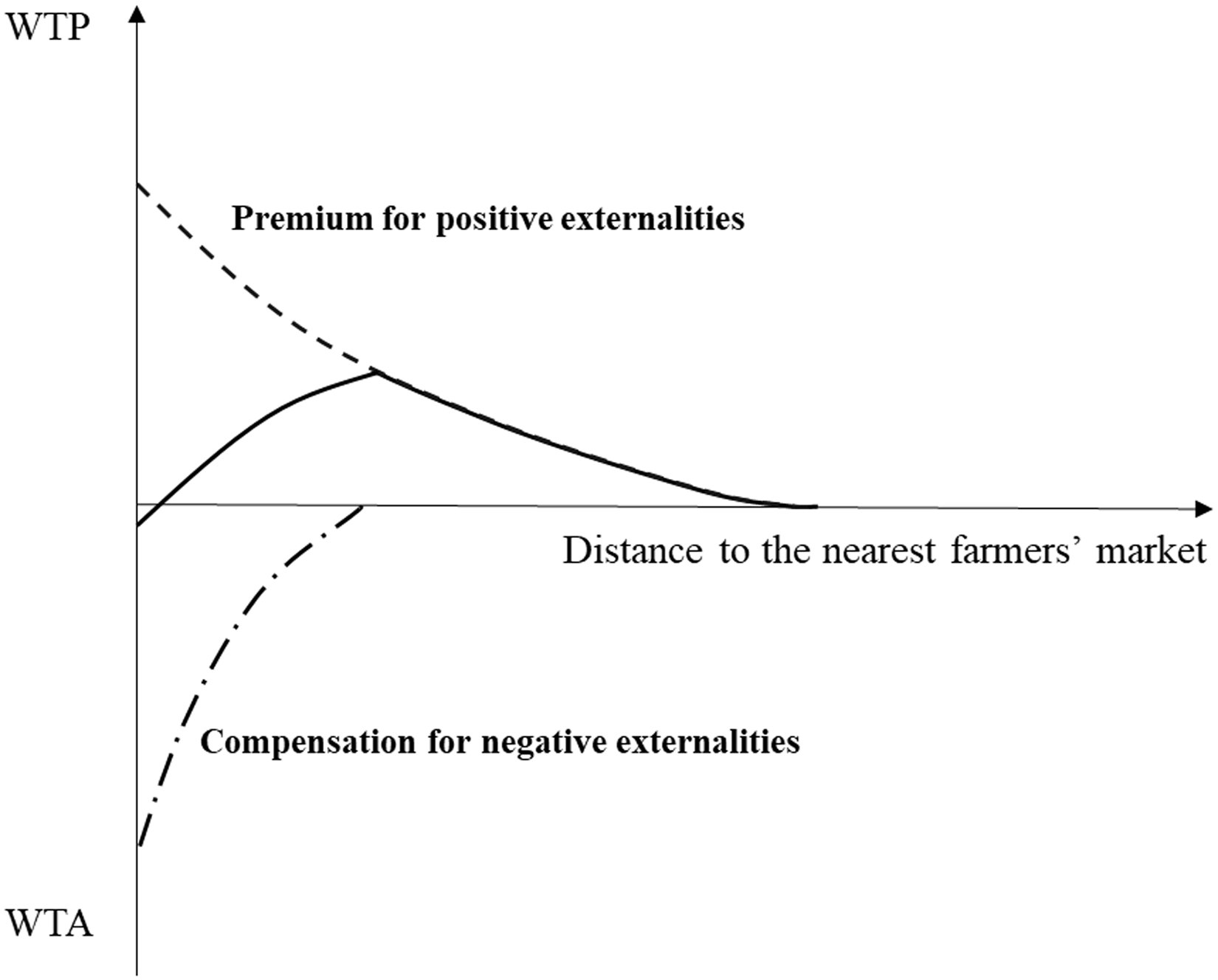

Because of the coexistence of the two contrasting externalities, people’s valuations for living in close proximity to farmers markets will depend on their relative importance. To better illustrate the relationship between distance to farmers markets and people’s WTP/WTA to live nearby, we modify the conceptual model developed by Li and Brown (Reference Li and Brown1980) and Collins (Reference Collins2020). The research by Li and Brown (Reference Li and Brown1980) was the first study that constructs a conceptual model to illustrate how the positive and negative impacts of micro proximity influence property values. Building on Li and Brown (Reference Li and Brown1980), Collins (Reference Collins2020) developed a model to illustrate the relationship between access to farmers markets and property values.

The main assumptions of our conceptual framework are the following. First, we assume people are willing to pay premiums for the positive externalities associated with easier accessibility to farmers markets such that their WTP decays as the distance to the market increases. Second, people require compensation for the negative externalities created by farmers markets (e.g., noise, litter, traffic, and crimes). The required compensation will decrease with the distance to the farmers markets. Third, we hypothesize that the required compensation decays more steeply with distance than the premium. As illustrated in Fig. 1, if valuations of farmers markets are equal to the vertical sum of premium and compensation, then the relationship between the valuation and the distance to farmers markets may be nonlinear, with an initially upward-sloping and then downward-sloping trend.

Figure 1. Conceptual framework of the relationship between people’s WTP/WTA and distance to farmers markets.

Note: The dotted lines represent the premium or compensation associated with proximity to the nearest farmers market, and the solid line represents the corresponding net WTP/WTA.

Method

Spatial hedonic pricing model

With roots in Lancaster’s (Reference Lancaster1966) theoretical model of the demand for complex goods, the HPM was first developed and used in the field of real estate and urban economics by Rosen (Reference Rosen1974). Assuming that housing is a composite and heterogeneous good, the price is determined by a combination of structural (e.g., house size, age, type, number of bedrooms and bathrooms, other housing features), locational (e.g., distance to road, transport facility, and other amenities and disamenities), and neighborhood characteristics (e.g., school quality, average income level, population density, unemployment rate) (Anselin and Lozano-Gracia Reference Anselin and Lozano-Gracia2008; Collins Reference Collins2020; Hu et al. Reference Hu, Kobori, Swallow and Qiu2022). In a standard HPM, the log of property prices is often specified as a linear function of a set of related structural, locational, and neighborhood characteristics:

where

![]() $P$

is an

$P$

is an

![]() $n \times 1$

vector of the transacted property values; S, L and N are

$n \times 1$

vector of the transacted property values; S, L and N are

![]() $n \times k$

vectors of house structural variables, locational variables, and neighborhood variables;

$n \times k$

vectors of house structural variables, locational variables, and neighborhood variables;

![]() ${\beta _1}$

,

${\beta _1}$

,

![]() ${\beta _2},$

and

${\beta _2},$

and

![]() ${\beta _3}$

are

${\beta _3}$

are

![]() $k \times 1$

vectors of estimated regression coefficient; and

$k \times 1$

vectors of estimated regression coefficient; and

![]() $\varepsilon $

is the error term.

$\varepsilon $

is the error term.

Although previous studies have widely employed the general hedonic model to examine the economic effects of various environmental amenities on housing values, they did not account for spatial dependence and were thus plagued by the problem of confounding variables at the neighborhood level. Property values are spatially correlated because houses in the same community share neighborhood characteristics, and the externalities generated by the neighborhood characteristics can be reflected in property values (Kim et al. Reference Kim, Phipps and Anselin2003; Mueller and Loomis Reference Mueller and Loomis2008; Hu et al. Reference Hu, Kobori, Swallow and Qiu2022). Ignoring spatial dependence in the hedonic model can cause biased estimates of parameters and inefficient statistical inference (Anselin Reference Anselin1998; Lesage and Pace Reference Lesage and Pace2009). Therefore, it is necessary to employ spatial HPMs to mitigate the potential impact of spatially omitted variables. In addition, the utilization of spatial HPMs allows us to control for unobserved heterogeneity, which is mostly related to the neighborhood effects.

This study employs a spatial autoregressive (SAR) model to address spatial dependence. The SAR model assumes spatial autocorrelation is in the dependent variable (natural logarithm of property value) and allows the weighted average of property values to affect the price of a particular house (Anselin Reference Anselin and Baltagi2001; Lesage and Pace Reference Lesage and Pace2009). The spatial lag term is a weighted average of random variables at neighboring locations and is interpreted as a spatial smoother (Anselin Reference Anselin and Baltagi2001; Lesage and Pace Reference Lesage and Pace2009). A general SAR model is specified as:

where

![]() $\rho $

is the coefficient denoting the strength of spatial autocorrelation;

$\rho $

is the coefficient denoting the strength of spatial autocorrelation;

![]() $W$

is an

$W$

is an

![]() $n \times n$

weight matrix;

$n \times n$

weight matrix;

![]() $W\ln P$

denotes the weighted average of the dependent variable

$W\ln P$

denotes the weighted average of the dependent variable

![]() $\ln P$

; and

$\ln P$

; and

![]() $\varepsilon $

is a vector of normally distributed errors.

$\varepsilon $

is a vector of normally distributed errors.

In this study, our main objective is to examine the impact of the proximity to farmers markets on property values. To allow for the presence of nonlinearity, we incorporate both the linear and squared terms of distance to farmers markets into Equation (2):

where FM and FM

2 denote the distance to farmers markets and its square, and

![]() ${\alpha _1}$

and

${\alpha _1}$

and

![]() ${\alpha _2}$

are the corresponding coefficients. In this study, we consider both the distance band and the k-nearest neighbor to define the weight matrices. The distance band weight matrix identifies a house

${\alpha _2}$

are the corresponding coefficients. In this study, we consider both the distance band and the k-nearest neighbor to define the weight matrices. The distance band weight matrix identifies a house

![]() $i$

as the neighbor of

$i$

as the neighbor of

![]() $j$

if the distance between them is less than a specified threshold distance. We consider both the 800 m and 1000 m as the threshold distance.Footnote

2

The k-nearest neighbor matrix designates house

$j$

if the distance between them is less than a specified threshold distance. We consider both the 800 m and 1000 m as the threshold distance.Footnote

2

The k-nearest neighbor matrix designates house

![]() $i$

as a neighbor of house

$i$

as a neighbor of house

![]() $j$

if it is among the k-nearest neighbors of house

$j$

if it is among the k-nearest neighbors of house

![]() $j$

. To examine the the robustness of the spatial regression results, we adopt the 20-nearest and 30-nearest houses as neighbor definitions.

$j$

. To examine the the robustness of the spatial regression results, we adopt the 20-nearest and 30-nearest houses as neighbor definitions.

Measures of marginal effects

Compared with nonspatial linear regression models, the interpretation of marginal effects in SAR models is different. Due to the spatially structured endogeneity in the SAR model, a change in an explanatory variable in one location can have a direct impact on the dependent variable in that location and also indirectly affect the dependent variable in all other locations. To better illustrate the marginal effects in an SAR model, we define the marginal effects for a specific exogenous location variable r in Equation (3) as

![]() ${M_r}\left( W \right)$

:

${M_r}\left( W \right)$

:

$${M_r}\left( W \right) = \left[ {\matrix{ {{{\partial \ln {P_1}} \over {\partial {l_{1r}}}}} \quad \cdots \quad {{{\partial \ln {P_1}} \over {\partial {l_{nr}}}}} \cr \vdots \quad\quad \ddots \quad \quad\vdots \cr {{{\partial \ln {P_n}} \over {\partial {l_{1r}}}}} \quad \cdots \quad {{{\partial \ln {P_n}} \over {\partial {l_{nr}}}}} \cr } } \right] = {({I_n} - \rho W)^{ - 1}}\left[{\matrix{ \!\!{{\beta _r}} \ \cdots \quad 0 \cr \quad\vdots \quad \ddots \quad \quad\!\!\!\!\vdots\quad \cr \ \ 0 \quad \cdots \quad {{\beta _r}} \cr } } \right]\; = {({I_n} - \rho W)^{ - 1}}{\beta _r}.$$

$${M_r}\left( W \right) = \left[ {\matrix{ {{{\partial \ln {P_1}} \over {\partial {l_{1r}}}}} \quad \cdots \quad {{{\partial \ln {P_1}} \over {\partial {l_{nr}}}}} \cr \vdots \quad\quad \ddots \quad \quad\vdots \cr {{{\partial \ln {P_n}} \over {\partial {l_{1r}}}}} \quad \cdots \quad {{{\partial \ln {P_n}} \over {\partial {l_{nr}}}}} \cr } } \right] = {({I_n} - \rho W)^{ - 1}}\left[{\matrix{ \!\!{{\beta _r}} \ \cdots \quad 0 \cr \quad\vdots \quad \ddots \quad \quad\!\!\!\!\vdots\quad \cr \ \ 0 \quad \cdots \quad {{\beta _r}} \cr } } \right]\; = {({I_n} - \rho W)^{ - 1}}{\beta _r}.$$

In the

![]() ${M_r}\left( W \right)$

matrix, for a change in the explanatory variable r by observation i, there is one direct effect on the dependent variable

${M_r}\left( W \right)$

matrix, for a change in the explanatory variable r by observation i, there is one direct effect on the dependent variable

![]() $\ln {P_i}$

(i.e.,

$\ln {P_i}$

(i.e.,

![]() $\partial \ln {P_i}/\partial {l_{ir}}$

) and

$\partial \ln {P_i}/\partial {l_{ir}}$

) and

![]() $n - 1$

indirect effects on

$n - 1$

indirect effects on

![]() $\ln {P_{j\left( {j \ne i} \right)}}$

(i.e.,

$\ln {P_{j\left( {j \ne i} \right)}}$

(i.e.,

![]() $\partial \ln {P_j}/\partial {l_{ir}}$

). Lesage and Pace (Reference Lesage and Pace2009) showed that summing the marginal effects into average marginal effects is more straightforward than presenting them in a matrix format. The average total effect (ATE) is the average of all column sums of

$\partial \ln {P_j}/\partial {l_{ir}}$

). Lesage and Pace (Reference Lesage and Pace2009) showed that summing the marginal effects into average marginal effects is more straightforward than presenting them in a matrix format. The average total effect (ATE) is the average of all column sums of

![]() ${M_r}\left( W \right)$

and measures the average total effect across all dependent variables

${M_r}\left( W \right)$

and measures the average total effect across all dependent variables

![]() $\ln {P_i}\;$

from a change in the explanatory variable r by the

$\ln {P_i}\;$

from a change in the explanatory variable r by the

![]() ${j^{{\rm{th}}}}$

observation, or:

${j^{{\rm{th}}}}$

observation, or:

Given that we propose the relationship between distance to farmers markets and property values is nonlinear, the ATE of farmers markets on property values can be derived from Equation (5) as:

The average marginal effects of farmers markets on property values not only depend on the estimated coefficients

![]() ${\alpha _1}$

and

${\alpha _1}$

and

![]() ${\alpha _2}$

but also rely on the distance to farmers markets. Based on the average marginal effects of farmers markets on property values, we can further estimate people’s total marginal WTP for living near farmers markets as:

${\alpha _2}$

but also rely on the distance to farmers markets. Based on the average marginal effects of farmers markets on property values, we can further estimate people’s total marginal WTP for living near farmers markets as:

Data

Empirical setting

The empirical analysis is set in Edmonton, Alberta, Canada, which is the capital city of Alberta and the fifth largest municipality in Canada. According to the 2019 census, Edmonton had a population of 972,223 (Statistics Canada 2018; City of Edmonton 2020). By North American standards, Edmonton is a relatively larger urban city surrounded by several suburban communities. The Edmonton Transit Service (ETS) is the primary source of public transportation and includes a light rail transit system and an extensive surface bus system. Due to the cold climate and suburban nature of the city, Edmonton is heavily car dependent.

During the study period, Edmonton citizens had access to 18 farmers markets, 13 of which were located in the city area and the remaining five were located in the surrounding suburban communities. Farmers markets in the suburban communities are considered because they may influence the values of the properties located near the city border. In Edmonton, farmers markets are operated indoor and/or outdoor. Because of the cold climate, operating outdoor farmers markets is particularly challenging in Edmonton so most outdoor markets typically operate once a week for half of the year or less, while indoor ones tend to operate year-round. The Edmonton Downtown Farmers Market and Old Strathcona Farmers Market are the oldest and largest indoor markets in the city. Most farmers markets sell products from locally grown organic produce to handcrafted artisan goods and offer free or street parking.

Data and variables

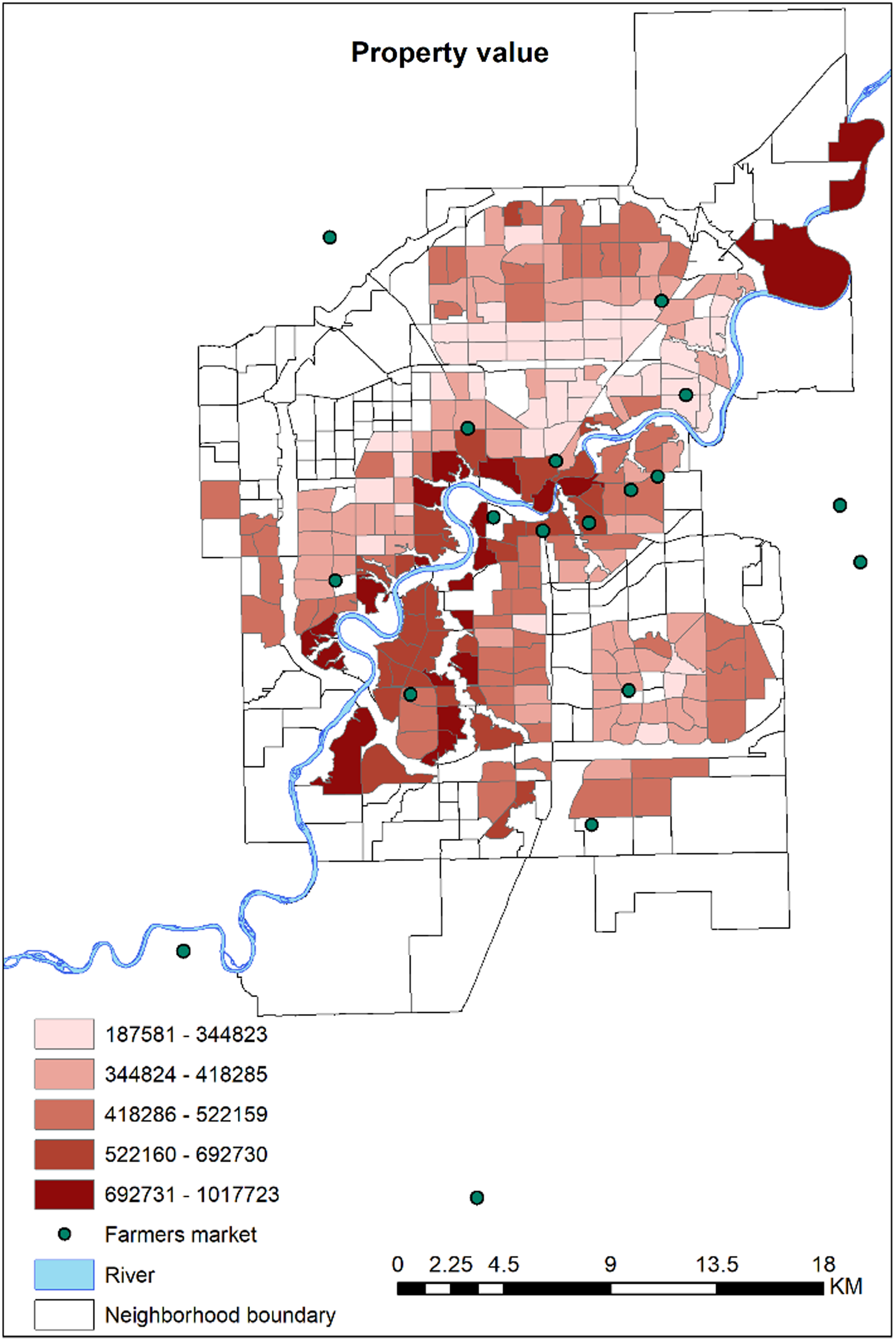

The housing data are from RPS Real Property Solutions (www.rpsrealsolutions.com) and contains 8,241 single-family housing transactions for the period of January 2015–June 2017. We analyze no more than 3 years of data to avoid the risk of compromising the assumption of market equilibrium as suggested by Li et al. (Reference Li, Joh, Lee, Kim, Park and Woo2015). This data set includes transaction prices and detailed housing characteristics such as living area, lot size, number of bedrooms, number of bathrooms, house age, and number of garages, among other variables. The geographic information of each property is also available. Transaction prices are adjusted to 2016 values using the Alberta Consumer Price Index from Statistics Canada (2022). The city of Edmonton has 386 defined neighborhoods, with 109 being nonresidential neighborhoods. Our sampled transactions cover 233 neighborhoods or 84% of total residential neighborhoods, which we believe to be fairly representative of the entire city. Figure 2 presents the average transaction prices in each neighborhood. Transaction prices varied across neighborhoods and showed certain spatial clustering patterns. In particular, we find property values tended to be high in the neighborhoods around the North Saskatchewan River, which bisects the city into the northern and southern sections.

Figure 2. The locations of farmers markets and neighborhood-level property transacted values.

Data for the locational attributes are obtained from multiple sources. The locations of farmers markets are from the Government of Alberta (2022) and shown in Fig. 2. Geocoded data on prominent areas such as the Downtown neighborhood, grocery stores, bars, various golf courses, the North Saskatchewan River and the associated river valley, parks and national reserves, and the University of Alberta (the flagship postsecondary institution in the city) are from the City of Edmonton (2023b). The location information of shopping centers and malls is obtained from Shopping Canada (2023). Last, the locations of hospitals are obtained from DMTI Spatial (2013). Using geographic information systems (GIS) techniques, we create variables to reflect the properties’ locational characteristics. In particular, we calculate road distances to the nearest farmers market, to the center of the Downtown neighborhood, to the center of the University of Alberta North (main) campus, and to the nearest hospital to examine the impacts of their respective proximities on property values. We calculate the total number of shopping centers, grocery stores, and bars within a 1,000-m buffer for each house to control for the effects of commercial centers. We include a dummy variable indicating whether the house was located within the 2-km Euclidian buffer area of the North Saskatchewan River as Euclidean distance to consider the benefits due to scenic views from the property. The accessibilities of green space and golf courses are denoted by the total area of green space (i.e., park and natural preserve) and golf courses within a 600-m buffer for each house, respectively.

Neighborhood socioeconomic characteristics including neighborhood-level population density, unemployment rate, the percentage of the senior population aged over 60, marital status, modes of transportation (walk and public transportation), public school accessibility, income level, and education level are collected from the 2016 municipal Census (City of Edmonton 2020). Finally, each of the housing units in the data is matched to the underlying neighborhood via ArcGIS.

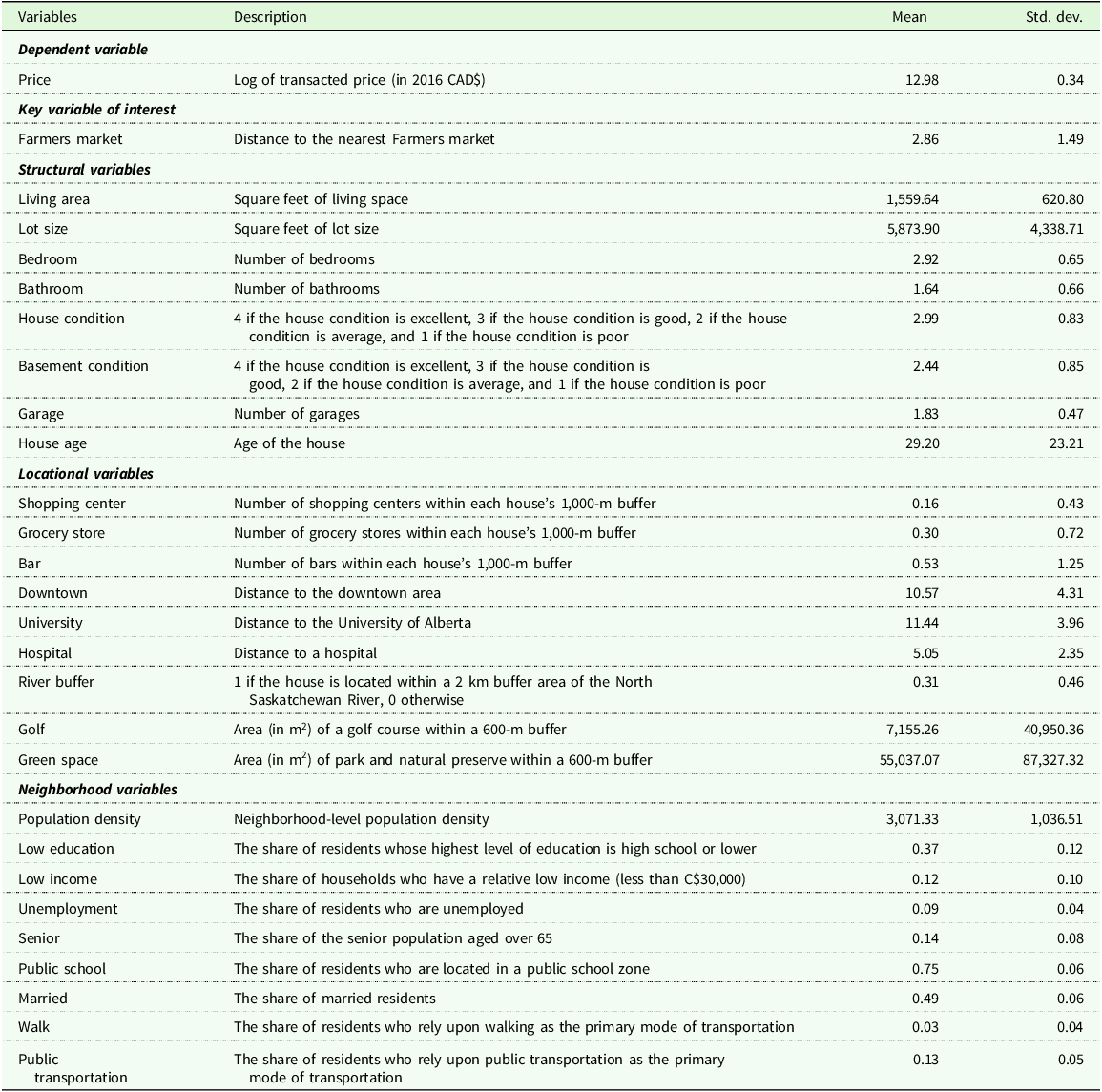

Table 1 presents the descriptive statistics and variable definitions. The average house that sold during the study period was 29 years old with three bedrooms and two bathrooms with 1,559.64 square feet of above grade living area. The average house was sold for approximately C$460,794 and was located about 2.86 km from the nearest farmers market.

Table 1. Variable definition and summary statistics

Results

Estimation results

Before model estimation, we first conduct Moran’s I test to examine the presence of spatial autocorrelation in our data set. Moran’s I statistics are derived from the ordinary least squares (OLS) residuals under the null hypothesis of no spatial autocorrelation. To further identify the type of spatial autocorrelation, we conduct Lagrange multiplier (LM) and robust LM tests using different weights matrices (Anselin Reference Anselin1988). Test results are presented in Table 2 and confirm that SAR models fit the spatial pattern of the data.

Table 2. Results of spatial dependence testing

Note: Asterisks denote levels of significance (***for 1%).

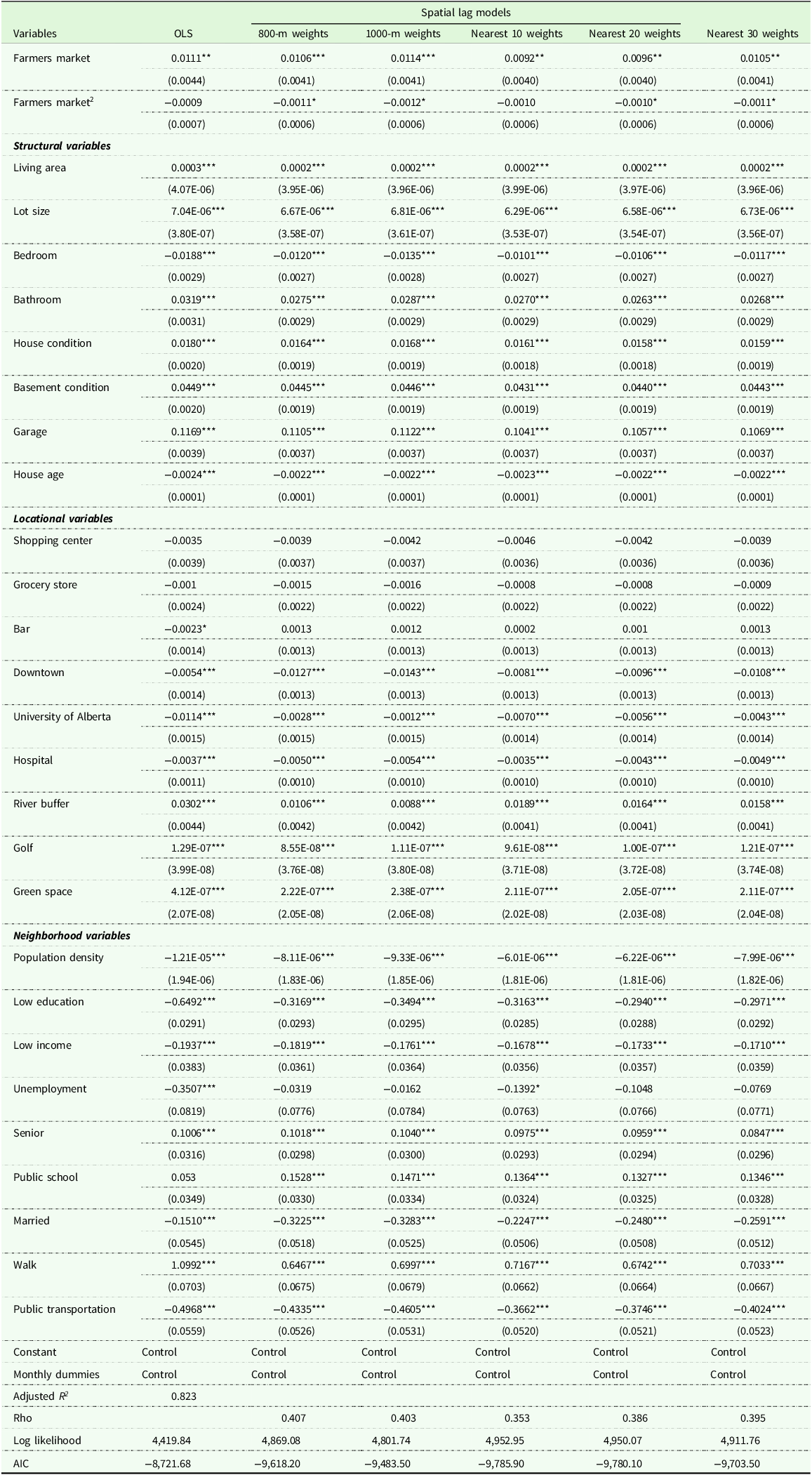

The parameter estimates of the OLS and SAR models are shown in Table 3. The coefficients on the spatially lagged dependent variable from the four SAR models (i.e.,

![]() $\rho $

) are positive and significant, which confirm the presence of spatial dependence and the necessity of employing spatial HPMs. Therefore, the rest of the section only discusses the estimates from the spatial models and omits the discussion of the biased OLS estimates.

$\rho $

) are positive and significant, which confirm the presence of spatial dependence and the necessity of employing spatial HPMs. Therefore, the rest of the section only discusses the estimates from the spatial models and omits the discussion of the biased OLS estimates.

Table 3. Regression estimation results

Note: Asterisks denote levels of significance (*for 10%, **for 5%, ***for 1%).

Our key variables of interest are Farmers Market and Farmers Market 2 . The positive and significant coefficients on Farmers Market and the negative and significant coefficients on Farmers Market 2 from four out of the five SAR models suggest an inverted U-shaped relationship between distance to farmers markets and property values. The only exception is the specification using the nearest 10 weight, which is less suitable than the nearest 20 and nearest 30 specifications based on Z-scores from a spatial autocorrelation test. Specifically, it indicates that property values were valued the highest when the distance to the nearest farmers market was around 4.60 km to 4.90 km depending on the weighting matrix.Footnote 3 When the distance to the nearest farmers market was below this benchmark, property values fell as the distance dropped. This might be attributable to the negative externalities such as congestion and noise brought by the farmers markets. Even though farmers markets also generate positive externalities for nearby residents, negative externalities may offset the positive ones. Moreover, when the distance to the nearest farmers market was above the benchmark, property values fell as the distance increased. This might be due to the fact that residents were not able to enjoy the benefits brought by farmers markets when living too far away. Though Edmonton citizens were car-dependent, a 4.5-km drive typically took approximately 10 min. Overall, the results show property values initially increased and then decreased with the distance to farmers markets, which is consistent with our conceptual hypothesis. Our results regarding the dominance of negative externalities seem to be in contrast with previous studies (e.g., Collins Reference Collins2020) that found the opposite, that is, that positive externalities dominate, and housing values decrease with proximity to a farmers market. Our finding is not wholly unexpected because the effect of the farmers market on housing values is likely to be context- and/or region-specific. Edmonton is a large urban city, and its two most prominent farmers markets are very large and attract a large clientele. In fact, Collins (Reference Collins2020) noted that “nuisances are more likely to be associated with larger, well-established markets,” which is an apt description of Edmonton’s main farmers markets.

Nearly every coefficient on the structural variables has the expected sign and is statistically significant. The results suggest that larger houses with better conditions tended to be more highly priced than others. In particular, property values benefited from an increase in basement and house conditions, the number of bathrooms and size of garages, as well as the square feet of living area and lot size. The lot size had a very small effect on housing values, which is consistent with other studies such as Feng and Humphreys (Reference Feng and Humphreys2018). Property values were penalized for older age. One unexpected finding is the negative and statistically significant coefficient on the number of bedrooms. Other studies that found a similar result (e.g., Li et al. Reference Li, Joh, Lee, Kim, Park and Woo2015) proposed energy cost as the possible explanation.

Almost all locational attributes are found to have capitalization effects on property values. For the five variables controlling for the effects of commercial activities (shopping center, grocery stores, bars, the downtown area, and the University of Alberta), we find property prices increased as the household got closer to the downtown area and the University of Alberta, which is in accordance with existing studies (e.g., Morancho Reference Morancho2003; Jim and Chen Reference Jim and Chen2006). Similarly, living close to hospitals in general positively affected property prices. Good accessibility to green space and golf courses, as well as better scenic river views, were also positively related to housing values. Our results consistently support the positive contribution of water bodies, golf courses, parks, and public reserves to the increasing house values, as suggested by numerous empirical studies (Larson and Perrings Reference Larson and Perrings2013; Sander and Polasky Reference Sander and Polasky2009; Samad et al. Reference Samad, Abdul-Rahim, Yusof and Tanaka2020).

In terms of the neighborhood characteristics, the results show that property values tended to be higher if they were located in neighborhoods with a lower population density and a higher portion of senior residents. Property values also benefited from an increase in the percentage of residents who were located in public school zones and relied on walking as the primary mode of transportation. On the other hand, property values were lower if the neighborhoods had a higher proportion of residents with low education, low income, and who were married. Property values were also penalized for being in an area with a large percentage of residents who relied upon public transportation as the primary mode of transportation. One potential reason is that properties in such neighborhoods tended to have better access to transportation infrastructure, and while accessibility to public transportation could have a positive effect due to convenience, the negative effect caused by congestion, noise, and pollution may dominate the positive effect. Moreover, about 83% of the residents in the sampled neighborhoods had cars, and this may explain why people do not value public transportation in Edmonton as highly as in other cities.

Valuing marginal effects and quantifying marginal WTP/WTA

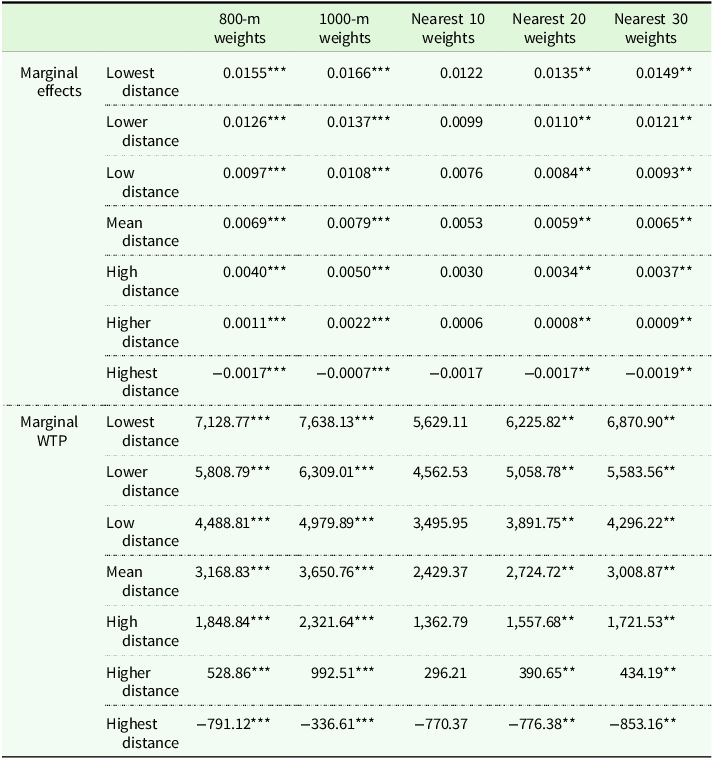

We calculate the marginal effects and marginal WTP/WTA for distance to farmers market using seven distance points: mean distance (

![]() $2.68\;{\rm{km}}$

), lowest distance (0.63 km = mean distance − 1.5 S.D), lower distance (1.37 km = mean distance − 1 S.D), low distance (2.12 km = mean distance − 05 S.D), high distance (3.60 km = mean distance + 0.5 S.D), higher distance (4.35 km = mean distance + 1 S.D), and highest distance (5.10 km = mean distance + 1.5 S.D). Total marginal effects and marginal WTP/WTA are reported in Table 4. Although the magnitude of marginal effects and marginal WTP/WTA varies by weight matrix, the sign and statistical significance remain the same. Because the SAR model with the nearest 20 weights has the lowest AIC value and the highest log-likelihood value, the following discussion focuses on the estimation results from this model.

$2.68\;{\rm{km}}$

), lowest distance (0.63 km = mean distance − 1.5 S.D), lower distance (1.37 km = mean distance − 1 S.D), low distance (2.12 km = mean distance − 05 S.D), high distance (3.60 km = mean distance + 0.5 S.D), higher distance (4.35 km = mean distance + 1 S.D), and highest distance (5.10 km = mean distance + 1.5 S.D). Total marginal effects and marginal WTP/WTA are reported in Table 4. Although the magnitude of marginal effects and marginal WTP/WTA varies by weight matrix, the sign and statistical significance remain the same. Because the SAR model with the nearest 20 weights has the lowest AIC value and the highest log-likelihood value, the following discussion focuses on the estimation results from this model.

Table 4. Marginal Effects and WTP/WTA for Access to Farmers Markets

Note: Asterisks denote levels of significance (**for 5%, ***for 1%).

The results indicate that at the mean distance level, property values increased by 0.59% of the average property price if their distance to the nearest farmers market increased by 1 km. Its estimated range is from 1.35% for houses located at the lowest distance (0.63 km) away from a farmers market to −0.17% for houses located at the highest distance (5.09 km) away from a farmers market.

For houses located 2.68 km (the mean distance) away from a farmers market, our estimates suggest that households were willing to pay C$2,724.72 to live 1 km further away. For houses located at the lowest distance (0.63 km) away from a farmers market, the households were willing to pay C$6,225.82. At the other end, for houses located at the highest distance (5.1 km) away from a farmers market, the households were willing to accept C$776.38 to live 1 km further away. The estimation results are consistent with our conceptual framework assumptions: people’s marginal WTP for living further away from farmers markets declines with the average distance to farmers markets. Using the transaction values of individual houses and their distances to the nearest farmers market, we further derive the total economic effect of farmers markets on the prices of all houses sold during the study period. At the aggregate level, we find that the negative externalities generated by farmers markets dominate the positive ones. The reduction in transacted housing values is estimated to be C$23,190,452. Using the 2019 property tax rate (0.9%), the annual reduction in tax revenue from these transacted houses was about C$208,714 (City of Edmonton 2023a).

Conclusion

Farmers markets may generate both positive and negative externalities for nearby residents, which may influence how they value the presence of these markets when evaluating housing options. However, little attention is paid to quantify people’s WTP/WTA for living in close proximity to farmers markets. By employing SAR models, this study examines the impact of proximity to farmers markets on property values and estimates people’s marginal WTP/WTA for living near farmers markets. The results suggest that the relationship between property values and proximity to farmers markets was nonlinear, with an ideal distance (i.e., highest value) of approximately 4.60– 4.90 km. In terms of the corresponding WTP values, our estimates suggest that at the mean distance (2.86 km) to a farmers market, households were willing to pay C$2,724.72 for every 1-km increase in the distance to the farmers market. Moreover, households’ marginal WTP for living further away from a farmers market decreased with their distance to the farmers market. Overall, we find the negative externalities associated with farmers markets dominated the positive ones, resulting in a C$23,190,452 reduction in transacted housing values. Assuming a 0.9% property tax rate, the annual reduction in tax revenues from those houses is estimated to be about C$208,714.

This study does have several limitations. First, like Warsaw and Phaneuf (Reference Warsaw and Phaneuf2019) and Collins (Reference Collins2020), there is a potential for endogeneity bias in the location of farmers markets. That is, it is possible that housing values in a particular area are influencing the location of farmers markets rather than vice versa. We have attempted to address this potential bias as best we can with our commercial controls and spatial approach but it remains a potential issue. Therefore, we recommend that the reader interprets the effect as correlational instead of causal.

Our findings have several implications. First, introducing new farmers markets to improve a neighborhood’s food environment may lead to some unintended consequences. When the distance to the nearest farmers market is below a certain threshold, the value of the property falls as its distance to a farmers market drops. Because property taxes are the most substantial source of a municipality’s revenue, decreased property values might result in substantial revenue loss, which could lead to reduced supplies of public goods and services. Second, for neighborhoods with limited access to farmers markets, the local government can introduce new farmers markets or relocate the existing ones because our results show that when the distance to the nearest farmers market was above certain a threshold, people required compensation to live further away from the farmers market. When making the locating or relocating decisions, governments should take proximity to farmers markets into consideration. Last, to reduce the potential negative externalities associated with larger farmers markets, greater consideration should be given to improve the operation of farmers market and limit the nuisance effects during market hours. This may include enhanced traffic control, expanded street and sidewalk cleaning services, and a greater police or security presence during market hours in the surrounding area.

Data availability statement

The data that support the findings of this study are available from RPS Real Property Solutions (RPS) but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are however available from the authors upon reasonable request and with permission of RPS.

Acknowledgments

We are grateful to RPS Real Property Solutions (RPS) for providing the property value data. Our thanks go to Dr. Brent Swallow for his efforts in facilitating a data usage agreement with RPS and to Larry Laliberte, the GIS Librarian, for supplying the road network data and assisting with data processing. Lastly, we thank the editor and two anonymous reviewers for their useful comments and suggestions.

Competing interests

The authors declare no conflicts of interest.

Appendix 1.

The positive and negative externalities of farmers markets.