1. Introduction

In an attempt to protect the domestic aluminum foil industry of some of its member countries, the EU imposed anti-dumping (AD) duties on aluminum foil imported from Armenia, Brazil, and China in 2009 for a period of five years. The final duties ranged from 6.4% to 30% depending on country and exporting firm.

A priori, the EU-imposed anti-dumping duties should have resulted in reduced imports from the targeted countries. Such an outcome, which is observed in EU trade statistics, should not come as a surprise. A related question of interest is whether the anti-dumping duties had any other indirect effects on trade in aluminum foil. In particular, were exports from the targeted countries diverted to the US, the next largest destination market for aluminum foil?Footnote 1 Did the exports from unaffected countries to the EU increase post-ruling to displace those from the targeted countries? The existing literature addresses these questions in a more general setting, whereas this paper offers a very precise and focused case study.

Because the targeted countries vary greatly in country size, stage of development, distance, and production structure and capacity, the response to anti-dumping duties may also vary by country. China, for instance, as the ‘world's manufacturing powerhouse’ may have the capacity to absorb the duties or switch to producing very close substitute products. The latter point is particularly relevant as the EU levied anti-dumping duties on aluminum foil rolls in excess of 10 kg in weight, and exempted rolls under 10 kg in weight.

At the other extreme, Armenia is a small landlocked country with GDP under $10 billion, and with aluminum foil virtually representing the only industrial export to the EU, amounting to 15 million euros in 2007, albeit rapidly growing, prior to the anti-dumping investigation. It does not have China's capacity to absorb the duties nor the ability to switch to a close substitute. While it is much closer to Europe than Brazil and China, it is burdened by a closed Georgian–Russian border, which adds to the cost of imported raw materials from Russia, and a closed border with Turkey, which may add to shipping costs. But Armenia is also unique in that the sole producer of aluminum foil, Armenal, is a subsidiary of the Russian producer, Rusal. Intra-firm dynamics may shape Armenia's response to the anti-dumping duties, and provide a glimpse of how multinational corporations may respond to the AD rulings.

Anti-dumping duties may affect the targeted countries directly and indirectly, as well as alter the exports of other countries. Following Bown and Crowley (Reference Bown and Crowley2006), these effects may take the form of trade destruction, trade depression, trade diversion, and trade deflection.Footnote 2 In our context, an increase in US imports of aluminum foil from Armenia, Brazil, and China would capture the trade deflection effect, while a decrease in US imports from Russia or any other unaffected country, the trade depression effect. The trade destruction and diversion effects would be represented by a decrease in EU imports of aluminum foil from affected countries and an increase in imports from unaffected countries, respectively.

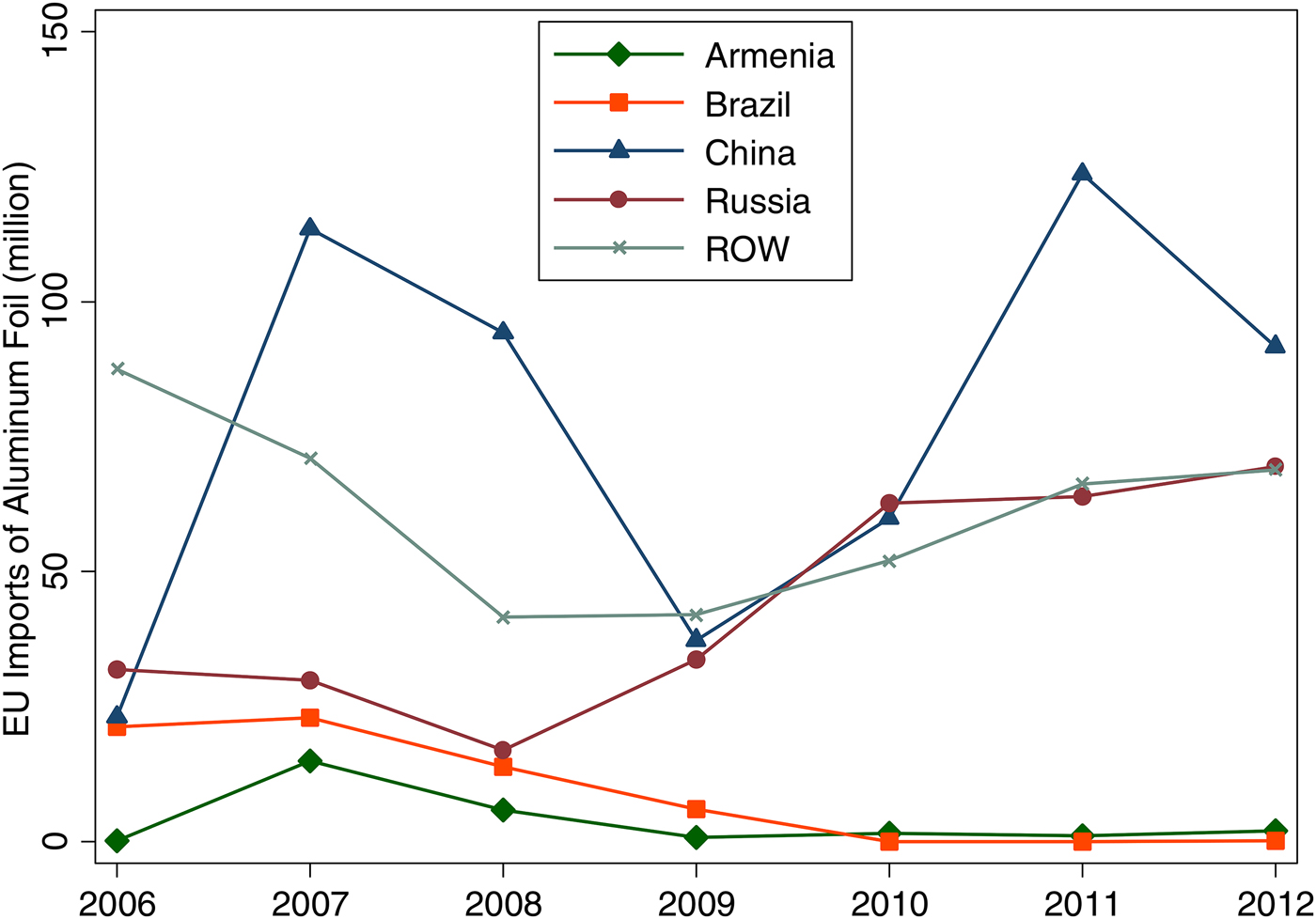

Figure 1 shows the pattern of US imports of aluminum foil from countries affected by the EU anti-dumping duty as well as that from the rest of the world. There is a clear break in the data in 2009, the year the EU imposed AD duties which also coincided with the great recession. The dramatic decline in imports of aluminum foil from Russia and rest of the world (trade depression) is accompanied by sharp rises in such imports from the three countries affected by the EU anti-dumping duties, Armenia, Brazil, and China (trade deflection). Figure 2 further illustrates the potential trade destruction and trade diversion with the imposition of EU anti-dumping duties on imports of aluminum foil from Armenia, Brazil, and China. The decrease in imports from Armenia and Brazil to the EU (trade destruction) coincides with dramatic increase in imports from Russia and rest of the world (trade diversion). There is great variation in imports from China over this period with a dramatic decline in 2009 followed by a quick recovery.Footnote 3

Figure 1. US imports of aluminum foil

Figure 2. EU imports of aluminum foil

This paper quantifies the effect of EU anti-dumping duties on aluminum foil imported from Armenia, Brazil, and China, captured in Figures 1 and 2. In particular, we estimate how much EU and US imports of aluminum foil from affected and unaffected countries have changed due to the EU anti-dumping duties that went into effect in 2009. Because the anti-dumping duties applied selectively to both countries and products, we are able to estimate their impact using triple difference-in-differences (product, country, anti-dumping action).

Employing a detailed dataset on US and EU imports of aluminum products (e.g., sheet, foil, and rod) at the 8-digit HS and CN levels from all countries for the years 2006 through 2012, we find strong evidence of trade deflection (increase in US imports of aluminum foil from affected countries), trade depression and trade diversion (decrease in US imports and increase in EU imports of aluminum foil from unaffected countries, respectively), and trade destruction (decrease in EU imports of aluminum foil from affected countries). In particular, imports from Armenia and Brazil to the EU decreased by 94% on average after 2009 (from a pre-duty average of about 7 and 19 million euros for Armenia and Brazil, respectively), while simultaneously imports from Russia to the EU increased by 820% (from a pre-duty average of 26 million euros). These effects are reversed on the US market in that imports from Armenia and Brazil increased by 1,200 and 750%, respectively (from a pre-duty average of $4.5 million for both countries), while imports of aluminum foil from Russia declined by 98% (from a pre-duty average of $50 million). We do not find any significant changes in trade patterns between China and EU, as well as China and US, and we attribute this to the potential measurement error in Chinese imports directly affected by the EU AD duty.Footnote 4 In case of Armenia and Russia, these findings suggest that with the imposition of anti-dumping duties, Rusal, the Russian exporter, has shifted its exports from its Armenian subsidiary to the next largest destination market, the United States, and continued to supply aluminum foil to the EU market from its Russia-based plants.

The remainder of this paper is organized as follows. Section 2 provides an overview of the EU decree and background leading to the imposition of duties, followed by a brief review of the existing literature. Section 3 reviews trends in exports of aluminum foil to the US and EU, describes data sources, and introduces the empirical specification. Results are reported in Section 4, and concluding remarks are provided in Section 5.

2. Background

2.1 EU Anti-dumping investigation

Following a complaint lodged by the European Association of Metals (Eurometaux) on behalf of its members, the European Union initiated an anti-dumping investigation into imports of aluminum foil from Armenia, Brazil, and China in July of 2008.Footnote 5 The allegedly dumped product was aluminum foil of a thickness of not less than 0.008 mm and not more than 0.018 mm, not backed, not further worked than rolled, in reels of a width not exceeding 650 mm, normally declared within CN 8-digit product code 7607.11.10. The EU's preliminary investigation was completed in April 2009, and provisional anti-dumping duties were imposed on imports of aluminum foil originating from Armenia (20%), Brazil (25.9%), and China (ranging from 10.7% to 42.9%).Footnote 6 The final determination resulted in the imposition of definitive anti-dumping duties of 13.4% (Armenia), 17.6% (Brazil), and 6.4–30% (China) in September 2009 for five years.Footnote 7 In case of Armenia, the company that produces aluminum foil, Armenal, is the subsidiary of a Russian company Rusal. Yet Russia was not part of the investigation.Footnote 8

Armenia and China were treated as non-market economies in this anti-dumping investigation, and, therefore, a third country, Turkey, was used to calculate the production costs of aluminum foil. Armenia became a WTO member in 2003, and the Armenian producer repeatedly insisted on Armenia being considered as a market economy. After the AD duties were imposed, the Armenian producer of aluminum foil lodged a complaint with the General Court of the European Union requesting the annulment of the regulation arguing that the calculation of dumping margins was based on erroneous assumptions. On 5 November 2013, the Court annulled the earlier Council Regulation of September 2009 imposing a definitive anti-dumping duty on imports of certain aluminum foil originating in Armenia and ordered the EU Council to pay the costs incurred by Armenal in the case.Footnote 9

One complicating factor in assessing the impact of AD duties on EU imports of aluminum foil is the fact that in 2009 the product code subject to the anti-dumping proceeding (CN 8-digit product 7607.11.10) was split into two separate codes to distinguish aluminum foil by weight – under 10 kg (CN 8-digit product 7607.11.11) and in excess of 10 kg (CN 8-digit product 7607.11.19). The initial complaint lodged by Eurometaux targeted high-weight aluminum foil or so-called jumbo reels. In particular, four domestic producers of jumbo reels, two located in Bulgaria and Greece, were directly competing with imports from Armenia, Brazil, and China.Footnote 10 During the investigation, the representatives of the downstream industry (the rewinders who purchase jumbo reels and convert them into low-weight or so-called consumer rolls) warned against a possible substitution effect if consumer rolls are left out of the AD investigation. The concern raised by the EU domestic rewinders about the possible substitution effect may partly explain the quick rebound in overall imports of Chinese aluminum foil observed in Figure 2. The Council however decided to treat consumer rolls as a different product and not include them in the current investigation.Footnote 11

2.2 Related literature

Blonigen and Prusa (Reference Blonigen and Prusa2016) provide an extensive survey of the existing literature on the impact of AD duties. Prusa (Reference Prusa and Feenstra1997) and Prusa (Reference Prusa2001) provide strong evidence of trade destruction and trade diversion by examining US AD actions initiated between 1980 and 1994; imports from affected countries drop by about 50%, whereas imports from unaffected countries rise by 40–60%. On the contrary, Lasagni (Reference Lasagni2000) and Konings et al. (Reference Konings, Vandenbussche and Springael2001) find limited trade diversion effect from EU AD actions between 1985 and 1990.

Bown and Crowley (Reference Bown and Crowley2006) examine the effect of US AD duties on Japanese exports over the period of 1992–2001 and find significant trade deflection and trade depression effects in the EU market, in addition to the trade destruction and trade diversion effects. Baylis and Perloff (Reference Baylis and Perloff2010) document trade diversion involving a related product: the US AD investigation of fresh tomatoes from Mexico that resulted in a suspension agreement prompted a significant increase in Mexico's exports of tomato paste to the US.Footnote 12

Despite the rich body of research on the trade effects of AD duties, the EU anti-dumping action regarding aluminum foil is unique and deserves a separate examination. First, it affects countries of vastly different stages of development and export capacity. On one hand, China, the manufacturing powerhouse of the world, is a frequent target of EU anti-dumping investigations (about 50 out of 120 AD investigations initiated by the EU between 2006 and 2012 targeted China). On the other hand, Armenia, a small landlocked country with the least diversified export basket with aluminum foil representing about 10% of its total exports, has never been subject to any anti-dumping investigation. Armenia exports less than $100 million annually to the US, and aluminum foil makes up much of this (about 85%). In contrast, Brazil and China export a diverse set of products valued in the billions to the US. Despite these differences, these countries represent the top three source countries of aluminum foil for the US as of 2012 (see Table 2). Second, the trade effects may capture some intra-firm decisions of multinational corporations as they respond to AD duties; in our case, the Armenian producer of aluminum foil is the subsidiary of Russian company Rusal which is not directly affected by the EU AD duties. This case illustrates the inability of anti-dumping duties to generate the desired effects in the presence of multinational corporations with subsidiaries located in different countries when the duties target only one of the countries. Finally, this paper contributes to the existing literature by examining the trade effects of a single anti-dumping action at a very disaggregated level (8-digit product classification) within a narrowly defined industry (aluminum sheet, plate, and foil manufacturing), while previous studies use multiple AD actions initiated over a certain period to examine the effect of a single shock – an initiation of AD investigation – on trade flows.

Table 2. US imports of aluminum products (in million dollars)

Notes: Computed from USITC database.

3. Empirical analysis

3.1 Data

In order to examine the effect of EU anti-dumping duties on EU and US imports, we construct a panel of all countries exporting aluminum products to the EU or US at the CN or HS 8-digit level for the period from 2006 through 2012. To identify these products, we first identify HS 6-digit product categories that correspond to the aluminum sheet, plate, and foil manufacturing industry, defined according to the North American Industry Classification System (NAICS) as a 6-digit industry (331315), and then use all HS or CN 8-digit products within HS 6-digit categories for each country.Footnote 13 The US imported 11 products within this industry, among which only one was subject to the EU anti-dumping duty in 2009 (HS 8-digit product 7607.11.60).Footnote 14 The EU imported 15 products within this industry, of which one was subject to AD duty (CN 8-digit product 7607.11.10). As discussed above, in the midst of AD investigation the EU product classification was changed to distinguish between consumer rolls or rolls below 10 kg (CN 8-digit product 7607.11.11) and jumbo reels or reels in excess of 10 kg of aluminum foil (CN 8-digit product 7607.11.19) with only the latter being the subject of AD investigation. Since data on imports of these two products are not available prior to 2009, the value of EU imports recorded under these two separate product lines after 2009 is combined for use in the empirical investigation. Data on annual US and EU imports of all aluminum products from all countries are obtained from the US International Trade Commission and Eurostat, respectively.Footnote 15

Table 1 provides summary statistics for the EU imports of aluminum foil between 2006 and 2012 with the top panel reporting values for low-weight and high-weight aluminum foil rolls separately starting in 2009 and the bottom panel showing the combined value of these two products, which is used in the empirical analysis. The bottom panel also reports the total import value of other aluminum products imported by the EU. There are several interesting observations. First, China is the largest supplier of aluminum foil to the EU market; both in 2007 and 2008 close to 50% of imports came from China. Second, after the split of the product code in 2009 and the imposition of the anti-dumping duty, Armenia and Brazil which exported predominantly jumbo reels to the EU saw a dramatic decrease in their exports of aluminum foil to the EU which were barely visible on the EU market for aluminum foil by 2012. In contrast, after China's exports plummeted in 2009, they recovered fully and surpassed the pre-recession level by 2011; this was driven by an increase in exports of both jumbo reels and consumer rolls, as predicted by the EU downstream industry producers. The decline in Chinese exports of aluminum foil in 2012 can be attributed to the new AD duties on low-weight aluminum foil. Third, Russia's exports of aluminum foil more than doubled over the sample period, surpassing in growth rates that of the rest of the world. Total EU import demand for aluminum foil and other aluminum products remained relatively stable, except for the sharp decline in 2009 most likely associated with the great recession.

Table 1. EU imports of aluminum foil (in million euros)

Notes: Computed from Eurostat trade database.

Table 2 provides summary statistics on the value of US imports of aluminum products from various countries over the years 2006 through 2012. More specifically, it shows US imports from Armenia, Brazil, China, Russia, as well as those from the rest of the world, for aluminum foil and the combined sum of aluminum products other than aluminum foil. Total US imports of aluminum foil exhibited a slight growth over time, with a sizable decline in 2009 during the great trade collapse. A sharp rise is observed in imports from China and Brazil after 2009; 2008 for Armenia. At the same time, imports from Russia dropped sharply in 2009, and virtually disappeared by 2010. The US imports from the rest of the world declined sharply in 2009 due to depressed US demand in the midst of the great recession and ensuing great trade collapse. They picked up slightly after 2009, but stayed well below the pre-recession levels and contributed little to the overall growth in imports of aluminum foil after 2009.

3.2 Estimation strategy

The trends presented above show that EU imports of aluminum foil from unaffected countries and US imports from the countries subject to EU anti-dumping duties increased dramatically after the imposition of AD duties, while there was a marked decline in EU imports from affected countries and US imports from unaffected countries. Econometric evidence is next presented to better gauge the size of the impact of EU AD protection – trade deflection, depression, diversion and destruction – depicted in Tables 1–2 and Figures 1–2, controlling for trends in imports of aluminum foil from other countries and imports of other aluminum products.

The effect of the EU's AD action on imports into the EU and US is estimated using a triple difference specification. There are other countries that export aluminum foil that are not directly impacted by the EU duties, including most prominently Russia. Also exports of all aluminum products, and not just aluminum foil, may be impacted by shocks that may have coincided with the EU decree applied to aluminum foil. Imports of all other aluminum products from all countries are examined as a control for imports of aluminum foil from the affected countries. Accordingly, the empirical analysis hinges upon a triple-difference regression specification that examines whether imports decline from countries subject to AD duty (first difference) after the imposition of AD duties (second difference) compared to other products in aluminum sheet, plate, and foil manufacturing (third difference):

where Imports cpt, the dependent variable, refers to the EU or US imports of aluminum product p (at the HS or CN 8-digit level) from country c in year t. The variable Country c is a time-invariant dummy that takes the value of 1 for countries Armenia, Brazil, China, and Russia, and 0 otherwise. The variable Foil p is a time-invariant dummy that takes the value of 1 if the product is aluminum foil (HS 8-digit code 7607.11.60 or CN 8-digit code 7607.11.10) and 0 otherwise. The variable AD t is a dummy that switches from 0 to 1 for all countries and products in 2009 when the EU implemented the anti-dumping duties on aluminum foil. The estimated coefficients (aside from the fixed effects) on the four triple-interaction terms, βs, measure the trade deflection or destruction effect of EU anti-dumping duties for Armenia, Brazil, and China, and the trade depression or diversion effect for Russia. The empirical specification allows for the inclusion of a rich set of fixed effects. Our preferred specification includes a full set of interactive fixed effects – country-product, country-year and product-year – to allow for heterogeneity in the level of imports of any product from any country, the overall imports from any country in any year, and the overall imports of any product in any year.

As an alternative to measuring the response on the level of imports, the impact of EU anti-dumping duties on market shares of affected countries is also examined. Equation (1) is re-estimated by replacing the dependent variable with the share of a given country in total imports of a given product into the EU or US market. And as a further robustness check, the value of imports in equation (1) is replaced with the quantity of imports.

4. Results

Table 3 reports the first set of empirical results for the impact of EU AD measures on EU and US imports over the 2006–2012 period and presents evidence of trade destruction, trade diversion, trade deflection, and trade depression. Estimated coefficients on imports from each of the four countries are reported with robust standard errors in parentheses. All regressions include a full set of interactive fixed effects.

Table 3. The effect of EU anti-dumping duties on EU and US imports: triple difference

Notes: The dependent variable in all regressions is log US or EU imports or share in imports. All regressions include a full set of interactive fixed effects: country-product, country-year, and product-year. Robust standard errors in parentheses. The marginal effects throughout this paper are calculated as exp(β) − 1 if the dependent variable is lnImports. ***, **, and * indicate significance at the 1%, 5%, and 10% level, respectively.

Column 1 presents estimates from examining the response of EU imports from affected and unaffected countries. Here the estimated coefficients for Armenia, Brazil, and China provide potential evidence of trade destruction, and for Russia, evidence of trade diversion. The estimates suggest statistically and economically significant trade destruction for Armenia and Brazil (implying a 94% drop in imports from both countries into the EU), while point estimates for China are negative but imprecisely measured. One possible explanation for why we find no statistically significant trade destruction effect for China is that, as discussed earlier, the EU imports data could potentially mismeasure the effects of AD action because of the change in the classification of aluminum foil and the need to combine the import values of jumbo reels and consumer rolls. This is likely to underestimate the trade destruction effect for China since China produces and exports both products to the EU, as shown in Table 1. Turning to the estimated coefficient for Russia, the results provide statistically significant evidence of trade diversion – the EU AD action led to an increase in imports from a country not directly affected by AD duty; Russia's exports to the EU increased by more than 800% after 2009.

Column 2 explores the impact of EU AD action on imports from the same four countries into the US. The US imports of aluminum foil from Armenia and Brazil increased dramatically after the imposition of EU anti-dumping duties, which mirrors the trade destruction results for the EU reported in Column 1. The positive and statistically significant coefficient estimates for Armenia and Brazil are indicative of sizable trade deflection. In particular, our estimates imply that Brazil's exports of aluminum foil to the US increased by more than 750% after the imposition of EU AD duties, while Armenia's exports increased by over 1,000%! The latter figure is not surprising as Armenia exported very small amounts of aluminum foil to the US prior to 2009. The imprecisely estimated coefficient on China mirrors the same finding for the EU market: the EU AD duty seems to have not altered much the US sourcing patterns from China. The estimated coefficient for Russia provides evidence of trade depression whereby countries not directly affected by the EU AD action may divert their exports from their existing export destinations, in this case the US, to the EU to fill the void in the EU market. The implied drop in Russian exports of aluminum foil to the US is about 98%. This corresponds to the trade diversion effect found in Column 1 when Russia's exports to the EU market increased, and is consistent with the basic tabulations in Table 2.Footnote 16

Qualitatively similar results are gleaned from Columns 3 and 4 which report the impact of EU AD duties on the EU and US import shares of countries directly and indirectly affected by the duties. Armenia became the top source of aluminum foil for the US with its import share increasing on average by 31 percentage points after the imposition of EU duties (Column 4). The import share of Brazil also increased, by 18 percentage points, whereas Russia's import share declined on average by 20 percentage points. In the EU market, Russia's import share increased by 19 percentage points, while Armenia's and Brazil's import shares declined by 4 and 6 percentage points, respectively. Once again, the estimates for China are imprecisely estimated for reasons explained above.

As a check on the robustness of results from the triple difference specification, the sample is restricted to imports of aluminum foil only and a standard difference-in-differences specification is estimated. This reduces the sample to 199 observations for the EU and 187 for the US. The regressions here include country and year fixed effects, with results reported in Table 4. This estimator identifies the EU AD duty effect solely from the relative change in imports of aluminum foil from targeted versus non-target countries. The results broadly mirror the earlier ones from triple difference estimation but with marked differences for imports value regressions. In particular, the estimates of trade deflection in the US market are much larger and statistically significant for all three countries targeted by the EU AD duty. Thus, the effect of EU AD duty is overestimated as the estimates fail to take into account the overall increase in US imports for all categories of aluminum products from 2009 to 2012. The estimates for Armenia in the EU market are imprecisely measured in this specification, while the estimates for Russia (trade diversion effect) are now smaller in magnitude. These changes in estimates highlight the importance of controlling for trade in non-foil aluminum products.

Table 4. The effect of EU anti-dumping duties: standard difference-in-differences

Notes: The sample is limited to imports of aluminum foil only. The dependent variable in all regressions is log US or EU imports or share in imports. All regressions include country and year fixed effects. Robust standard errors in parentheses. ***, **. and * indicate significance at the 1%, 5%, and 10% level, respectively.

The results reported so far examine the impact of the EU AD duties on values of imports into the EU and US. This effect is further disentangled into the impact on the volume of imports and unit values. Table 5 replicates the results from Table 3 replacing the dependent variable with log quantity of imports and log unit value. The trade destruction and trade diversion effects on the EU market, as well as trade deflection and trade depression effects on the US market remain statistically and economically significant in real terms; the quantity of imports from Armenia to the EU drops by 95% and to the US rises by more than 2,300%, the quantity of imports from Russia to the EU rises by more than 1,000% and to the US falls by 97%, and, finally, the quantity of imports from Brazil to the US increases by about 700%. These results confirm that the EU AD action has resulted in significant trade destruction, diversion, deflection, and depression effects in both nominal and real terms.

Table 5. The effect of EU anti-dumping duties on volume of EU and US imports and unit values

Notes: The dependent variable in all regressions is the US or EU log quantity of imports or log unit value. All regressions include a full set of interactive fixed effects: country-product, country-year, and product-year. Robust standard errors in parentheses. ***, **, and * indicate significance at the 1%, 5%, and 10% level, respectively.

Furthermore, the results in Columns 3 and 4 in Table 5 reveal virtually no price effects from the EU AD action, except for unit values of aluminum foil imported from Armenia. The EU AD duty promoted a 25% increase in the unit value of aluminum foil imported into the EU market and a 46% decline in the unit value of the same product imported into the US market. The former seems to suggest that the Armenian producer may have strategically increased the price of the exported aluminum foil to the EU to head off any further anti-dumping investigation.

5. Conclusion

This paper explores the consequences of the EU anti-dumping duties levied on aluminum foil imports from Armenia, Brazil, and China in 2009. In the aftermath of the duties, exports from these countries to the EU declined considerably. More interestingly, this decline was accompanied by a simultaneous increase in exports from these countries to the US suggesting substantial trade deflection. Armenia represents an interesting case where exports to the US increased dramatically, reflecting not only trade deflection but also possible intra-company adjustments as a consequence of the imposed duties; the Armenian producer of aluminum foil is a subsidiary of the Russian company Rusal. The results can be used to speculate that in response to EU AD action, Rusal may have channeled the exports of aluminum foil produced in its Russian plants to the EU market, meanwhile redirecting the exports of aluminum foil produced in its Armenian plant from the EU to the US market. These findings suggest that in the presence of multinational corporations, the intended outcome of anti-dumping duties may be difficult to achieve given that producers of the same product may own plants in multiple countries and hence could strategically switch destination markets for their exports originating in subject and non-subject countries. In such instances, the trade diversion becomes an intra-firm matter and is likelier to occur.

Appendix

Table A1. Products within NAICS industry 331315 (aluminum sheet, plate, and foil manufacturing)

Table A2. Robustness check: the effect of EU anti-dumping duties on US imports