It is not for me to comment on Gerald Russell's assessment of what I have called hubris syndrome. Reference Russell1 I am impressed, however, at both the precision and the selection of what he has written. His suggestion for recasting the diagnostic criteria is exactly the sort of informed criticism that is needed for I am all too conscious that I have insufficient psychiatric experience and knowledge. I think I can best write an afterword to Russell's analysis by examining the interconnections between the psychological states of the leaders of business in which for the past 15 years I have made my living, and my earlier exposure to political leaders.

In the examination of hubristic behaviour it is worth stressing the element of contempt over which the ancient Greeks were much exercised. I referred to contempt in the political and business world as part of my lecture to the Royal College of Psychiatrists in 2009 and after that in my autobiography Time to Declare, Reference Owen2 in a chapter on the financial crisis that began in 2007. Reference Russell1 In the Diagnostic Interview for Narcissism, the 11th point, under interpersonal relations, has ‘The person devalues other people including feelings of contempt’, and overtly disdainful behaviour is linked to narcissistic personality disorder. Reference Ronningstam3 Lying to Parliament or to a court of law is very serious because it undermines an essential safeguard in our democracy. It is hubristic because the risks entailed in lying suggest the recklessness of someone who has lost touch with reality and the dangers that lie ahead, such as being found out by a court. That loss of touch with reality is itself one of the symptoms of someone in thrall to hubris and the penalty for such loss of touch with reality often is nemesis.

Hubris in corporate business - case studies

Collective hubris in BP

An interesting case study of hubris is the multinational oil company, BP. It is very likely that a culture of hubris existed in BP for some years Reference Lyall4 and began to develop during the tenure of its then chief executive, Lord Browne. It appears that Lord Browne, after the death of his mother, who had a profound influence on him, developed many of the features of hubris syndrome during the last few years of his tenure. He had to resign in May 2007 as chief executive of BP because Mr Justice Eady referred publicly to his ‘willingness to tell a deliberate lie to the court’. 5 He said of the lie that ‘it may be that it should be addressed as contempt or as some other form of criminal offence’, although he added that he had decided not to refer the case to the attorney general for possible prosecution. Eady did say, however:

‘I am not prepared to make allowance for a ‘white lie’ told to the court in circumstances such as these - especially by a man who prays in aid his reputation and distinction, and refers to the various honours he has received under the present government, when asking the court to prefer his account of what took place.’

When Browne's attempts to overthrow this ruling were rejected by the Law Lords, and the injunction was lifted, he had no other option than to step down.

Collective hubris may well prove to be a contributing factor in the risk-taking behind the explosion on the Deepwater Horizon drilling rig with its massive oil leak into the Gulf of Mexico in 2010. Tony Hayward, chief executive of BP, who took over from Lord Browne in 2007, told the Sunday Times that he was ‘gobsmacked’ at the lack of technical and safety rigour in BP. Reference Fortson6 There is good evidence that Hayward was trying to change that culture.

In Lord Browne's case, as in the case of President Clinton, but not in the case of the Secretary of State for War in Harold Macmillan's government, John Profumo, lying about sexual risk-taking was judged as falling into a separate category. A majority of the public seem to understand this and judge a leader's competence and claims to stay in office as a somewhat separate issue. To some extent they accept that lying over sexual activity, even in court, is different. This was evident during Clinton's impeachment procedures. Action under impeachment was the only formal sanction available for his contempt of court; not to have invoked it risked condoning that offence. But, in my view, wisely, the US Congress invoked the impeachment procedure, as they were entitled to do, and used their common sense in reflecting the American people's toleration of Clinton's false responses in his deposition. At the very end of Clinton's period in office, with little publicity, he accepted a 5-year suspension of his law licence in Arkansas and a US$25 000 fine.

Hubristic behaviour in UK banks

It appears that a climate of hubris also existed in the Royal Bank of Scotland (RBS) prior to it having to be bailed out by the British taxpayer in 2008 under its then chief executive, Sir Fred Goodwin. Goodwin's success in the takeover of NatWest appears to have encouraged him and the then RBS chairman to make the decision to take over ABN Amro, which led to disaster. In another UK bank failure at HBOS, which has so damaged Lloyds Bank when it took HBOS under their wing, Peter Cummings, the head of corporate lending, went on lending even after a global economic crisis was in full swing. It appears the HBOS chairman, Lord Stevenson, and the chief executive, Andy Hornby, failed to rein him in.

It is in the public interest that we know more about both Goodwin's and Cummings’ state of mind and whether it changed during the time they were in positions of power. Other leaders of the UK banking sector during the 2007-2009 financial crisis deserve to come under scrutiny through the Financial Services Authority and possibly in the courts, something already under way in the USA. Such scrutiny will start to reveal not just biographical details but possible information about their psychological state and personality. It is important that the psychiatric profession and other related professions do not stand aside from examining any personality changes that may be shown to have developed. There is a need to try to understand more about the developing and acquired psychological state of leaders in all walks of life, not just politics. There can be disadvantages as well as advantages that stem from hubristic traits in many leaders’ personalities, for the power of their position enables such leaders to wreak havoc when their decision-making goes awry.

In her book Fool's Gold: How Unrestrained Greed Corrupted a Dream, Shattered Global Markets and Unleashed a Catastrophe, Gillian Tett writes: ‘I am still trying to make sense of the last decade of grotesque financial mistakes. I have found myself drawing on my training as a social anthropologist before I became a journalist… What social anthropology teaches is that nothing in society ever exists in a vacuum or in isolation’ (pp. 298–9). Reference Tett7 The assessment of personality needs psychiatrists, psychologists, neurologists, anthropologists and above all wise, well-grounded people who can spot changes in personality. Such changes often emerge so slowly that people nearest to those affected fail to spot that something has changed.

The recent massive global financial bubble, from the bursting of which we are now all suffering, raises important questions about collective hubris. When I asked a banker friend why no one had been able to blow the whistle on what was going on his answer was simple. He said that anyone in banking who had had the temerity to argue that his bank was following the wrong course would simply have lost his job. There is some evidence that this did happen to a few whistleblowers. What makes collective hubris so alarming is that it is often built on an ignorance of the facts in the decision-making process, which is blanketed out by the ‘group think’ effect. Those participating at high levels in the financial bubble now confess publicly, as before a few admitted privately, that they simply did not understand the game that they were playing in. The complexity of the securitised financial world, collateral debt obligations, credit default swaps, etc., was beyond many leaders’ comprehension.

Standards in business culture that contribute to collective hubris

Another feature of collective hubris in business is that individuals become susceptible collectively to what John Maynard Keynes called ‘animal spirits’. Alan Greenspan, the former chairman of the US Federal Reserve Board, called it ‘irrational exuberance’. He has had the grace to apologise for his own contribution to such excess, not something we have heard from many politicians. Yet booms and busts go with the territory of risk-taking capitalism: sweep all risk-taking aside and you are left merely with a bureaucracy. We need to maintain a readiness to take risk, but calculated risk. We also need to be able to assess independently the risk profile as part of good corporate governance and develop mentoring techniques for individuals who are showing telltale early signs of hubris. Independent directors on boards of public companies have the powers to sack powerful decision makers who are becoming uncontrollable. Without such constraints on banking and financial institutions, we can be certain that the ‘animal spirits’ will return.

The American psychologist Robert Hare has done much to bring rigour to the study of psychopathy and related disorders such as antisocial personality disorder. In their book Snakes in Suits: When Psychopaths Go to Work, Reference Babiak and Hare8 Babiak & Hare point to the tendency of many businesses to abandon the old, massive, bureaucratic organisational structures in which people got on by not rocking the boat, in favour of what has been called a ‘transitional’ organisational style - one that has fewer layers, simpler systems and controls, and more freedom to make decisions. They focus attention on how these organisations encourage the recruitment of people who can ‘shake trees’. In this changed business climate they claim ‘egocentricity, callousness, and insensitivity suddenly became acceptable trade-offs in order to get the talents and skills needed to survive in an accelerated, dispassionate business world’ (p. xii). Yet such people wear these characteristics on their sleeve - and we need to be aware of, and alert to, possible progression.

The hardest people to be on one's guard over are apparently ‘normal’ people who acquire hubris syndrome. They do not have bipolar disorder, nor known personality disorders, but they often have hubristic traits which have been present long before they ever exercised power as leaders within their organisation. There is also a difficulty which business has in relation to detecting hubris that in my experience the political world to some extent escapes. Both attract people with a propensity to hubris and who already may exhibit hubristic traits. But the modern commercial world is collectively more susceptible to hubris, making it harder to single out individuals who are especially hubristic. Andrew Oswald, professor of economics at the University of Warwick, wrote about herd behaviour:

‘Herding happens when relative position matters. Think of sheep in a field or fish in a pool. They cluster together because safety from outside predators comes from being on the inside of the group. Although most do not recognise it in themselves, human beings are like other animals.’ Reference Oswald9

Expanding the business and taking risks to achieve higher profits motivates business people. Of course, there are politicians who are drawn to similarly expansive goals and evince the same willingness to take risks to achieve them; but what politicians primarily seek is re-election and that may often lead them, temporarily at least, to put aside such goals and to eschew risk-taking. Doing little or even on rare occasions nothing is sometimes a wise course in politics in a way that is rarely the case in business. Consequently, hubristic leaders incapable of being cautious tend to stand out in politics and in many instances that brings, at least initially, success, whereas they can be camouflaged in business.

Hubris and developments in neuroscience

It is fascinating how adrenaline features in so much lay language over hubris. In our article for the journal Brain, Jonathan Davidson and I speculated on the neurobiology of hubris syndrome. Reference Owen and Davidson10 We mentioned one study that had identified frontostriatal and limbic-striatal dopaminergic pathways as important regulators of impulsive and/or rigid behaviours. Reference Cools, Sheridan, Jacobs and D'Esposito11 There have been many other interesting findings in the area of neuroscience since that article. But one recent study in 2010 is worth highlighting. It showed that, in 35 patients with Parkinson's disease, an individual's strength of belief in their being likely to improve can of itself directly modulate brain dopamine release. Reference Lidstone, Schulzer, Dinelle, Mak, Sossi and Ruth12 What Lindstone et al call conscious expectation in this randomised study describes the probability the individual is given that they will be receiving active medication with levodopa. Among those who were actually given a placebo but with a 75% probability of it being active medication, there was significant endogenous dopamine release in the ventral striatum. No such release occurred with the lesser probability of 25 or 50%. What we need now are more studies on brain dopamine levels in decision makers. The neurobiological effects of conscious expectation in this experimental context may be similar to the conscious expectations which go along with the intoxication of power in hubris syndrome.

Another neurobiological approach has been described in a review article in Philosophical Transactions of The Royal Society. Reference Coates, Gurnell and Sarnyal13 The findings surveyed in this review ‘suggest the possibility that economic agents are more hormonal than is assumed by theories of rational expectations and efficient markets’. A trader on a London trading floor with high levels of testosterone may see only opportunity in a set of facts, whereas the same individual with chronically elevated cortisol may see only risk. If hormones affect risk-taking, the authors ask whether financial markets might be more stable if there were more women traders to give endocrine diversity since there are grounds for thinking that women may be less ‘hormonally reactive’ when it comes to financial risk-taking. If hormones can exaggerate market moves, Coates et al Reference Coates, Gurnell and Sarnyal13 see the age and gender composition among traders and asset managers affecting the levels of instability in financial markets.

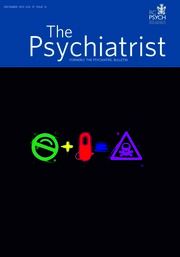

Hubris influenced politicians and businessmen in their support for the heady economics of the booming 1990s through to the first years of the 21st century. There are important lessons for the future in trying to prevent this happening again, and psychiatrists have a role in what must be a multidisciplinary approach to analysing the behavioural aspects of such individual decision makers. To help raise funds for such research, the Daedalus Trust has been established ([email protected]).

eLetters

No eLetters have been published for this article.