I. Introduction

The scope of public administration has greatly expanded in recent decades. As the tasks performed by governments have grown in number and complexity, an increasingly larger number of economic activities are regulated by rules created by state bureaucracies and by relatively independent regulatory agencies. These rules, commonly referred to as “administrative law,” are an alternative and complement to both the laws created directly by legislatures and to the common law resulting from the body of judicial precedents. The increasing reliance on administrative law is an important and controversial development of modern democracies.Footnote 2 Independent regulatory agencies (IRAs) are particularly controversial as they are the least accountable to voters. In both the United States and the European Union, IRAs have become more numerous, have seen their staffing grow, and have received increasingly larger budgets.Footnote 3

Should we welcome this development, as a path to greater competency,Footnote 4 or is this trend worrying? In his classic justification of public administration, Woodrow Wilson noted that public administration should be “removed from the hurry and strife of politics … Administration questions are not political questions. Although politics sets tasks for the administration, it should not be suffered to manipulate its offices.”Footnote 5 But, as Aligica, Boettke, and TarkoFootnote 6 point out, while eliminating the separation between politics and public administration would indeed “undermine the goal of building a competent and professional public administration,” “[i]nsisting too much on this separation unavoidably makes public administration less democratic.” RichardsonFootnote 7 argues that the Wilsonian desideratum of “agency instrumentalism” is not even theoretically possible because the public administration will unavoidably add its own goals in the process of establishing its rules and guidelines. ChristianoFootnote 8 defends Wilson’s claim that politics and public administration can be in principle separated, but he also notes that, in practice, “the system seems to be set up in a way that those in the bureaucracy have more power than other citizens to make controversial matters” and “[h]ence, the division of labor in the modern state seems incompatible with the ideal of equality that animates democracy.”

Democratic capitalist countries use a combination of institutions—markets, civil society, courts, referenda (direct democracy), representative democracy, federalism, public-private partnerships, independent regulatory agencies, international treaties, and so on—to try, ideally, to maximize self-governance and provide public goods as efficiently as possible.Footnote 9 These institutions, however, can also be (and often are) corrupted, that is, they are made to serve private interests at the expense of more general interests. Markets can be made uncompetitive,Footnote 10 charities are driven by warm glow rather than effective altruism,Footnote 11 courts can have persistent biases and overreach their competency,Footnote 12 democratic elections can suffer from voters’ ignorance and biases,Footnote 13 the federal system can become overly-centralized and is vulnerable to inefficient transfers between jurisdictions,Footnote 14 public-private partnerships can be a major source of rent-seeking, IRAs can be captured by private industry and can suffer from the hubris of experts,Footnote 15 international treaties can be unenforceable or mere covers for domestic politics, and so on.

How can we best take advantage of all these institutional options, while minimizing corruption and increasing self-governance? The standard idea is to have checks and balances between these different institutions, but, given their diversity and complexity, analyzing the situation is difficult. To simplify the problem, it is common to compare only two options, for instance asking whether we should rely more on markets or on politics, or asking whether government should be more or less centralized. The analysis of administrative law usually reflects a similar simplified binary perspective, contrasting administrative law with the legislature. For example, HamburgerFootnote 16 argues that much of administrative law in the United States is unconstitutional, and that rulemaking should be returned to Congress. By contrast, others argue that it is unfeasible and/or misguided to assign these tasks to legislatures;Footnote 17 and, indeed, JonesFootnote 18 argues that more tasks should be assigned to independent agencies. Furthermore, there are important political economy reasons why politicians have decided to assign these tasks to regulatory agencies in the first place.Footnote 19

A better analysis of public administration needs to compare it with more than just the legislature, asking, for example, which regulatory agencies could be replaced by more efficient mechanisms, from certification markets to tort law, and, also framing the analysis within a discussion of federalism. We need to ask not only what alternatives there are to IRAs, but also about the proper scale at which different problems should be addressed. For example, should the United States have a federal level Environmental Protection Agency (EPA), or would most environmental problems be solved more effectively by decentralizing this task to the state level? Should the U.S. Federal Drug Administration (FDA) exist, or should we rely instead on a certification market, similar to the way industrial safety is currently regulated? Is there a simple way to conceptualize such complex questions?

This essay does not engage in typical policy analysis, but elaborates instead the constitutional political economy framework of James Buchanan and Gordon TullockFootnote 20 and combines it with the idea of “robust political economy.”Footnote 21 The argument goes from general to particular. I first present a general framework for answering the question “Which institutions should we use for addressing different types of collective problems?” and then apply this framework to the specific case of public administration.

Section II describes the calculus of consent framework and the connection to the idea of self-governance. In my view, the calculus is the best and most rigorous account of self-governance we currently have. Section III shows how to use the calculus to better formalize “robust political economy”—the idea that institutions should be designed to work well even under weak assumptions about decision-makers’ knowledge and benevolence. Section IV applies the expanded calculus framework to the case of the administrative state. The main conclusions are that, compared to what self-governing persons would choose, the current federal bureaucracy tends (1) to over-regulate private goods (such as medicine), (2) to under-regulate public goods (such as enabling too much pollution), and (3) to be overcentralized.

II. The Calculus of Consent as a Theory of Self-Governance

A. Dahl’s self-governance dilemma

Robert DahlFootnote 22 highlighted the fundamental problem of self-governance as follows: “to live in association with others necessarily requires that [one] must sometimes obey collective decisions that are binding on all members of the association. The problem, then, is to discover a way by which the members of an association may make decisions binding on all and still govern themselves.” Similarly, Buchanan wrote about the “paradox of ‘being governed’, ” and pointed out that “the individual does not enter into social contract [with others] for the purpose of imposing constraints on himself,” but in order to “secure the benefits of behavioral limitations on their part.”Footnote 23

Living with others brings about significant benefits, but it requires building consensus about how to govern collective affairs, and about what counts as a collective or private affair, that is, about the legitimate scope of collective decision-making and, conversely, the extent of the private sphere. Building such a consensus is often far from trivial. It takes time and effort to discuss matters and to negotiate various possible schemes for compensating losses; and, ultimately, consensus might still be impossible due to some irreconcilable values.

We can define self-governance as the capacity of a community to live under rules of its own choice, and to produce social-economic outcomes that most members of the community find desirable. As ChristianoFootnote 24 puts it, “[t]he citizens ought to play the role of defining the basic aims the society ought to pursue and the legislative institutions ought to be concerned with reconciling the different aims of citizens and defining broad means for implementing these aims.”

In a democratic system, self-governance can be undermined in several ways:

-

• External interference: an external party, which may have its own interests (at odds with the interests of the community), establishes and enforces some rules upon the community—even if most people in the community disagree with those rules (for example, the federal government may impose various rules upon states and local jurisdictions, or an IRA establishes rules that most people dislike)—or imposes uncompensated costs on the community (for example, a community may be subjected to pollution from a nearby source, or a jurisdiction may be required to provide financial aid to another);

-

• Internal polarization: the community may suffer from extreme disagreements with respect to some public issues, and, whatever rules they establish or decisions they adopt, a large fraction of the community will end up subjected to a rule or decision they disagree with (for example, conflicts in a local community regarding the use of public property, such as whether to facilitate industrial development at the expense of the natural environment; or large-scale conflicts about moral issues like abortion, sexuality, foreign policy, immigration, or income inequality);

-

• Special interests: the dilemma of “concentrated benefits and dispersed costs” is created by the fact that those suffering the dispersed costs find it more difficult to organize than those enjoying the concentrated benefitsFootnote 25—as a result, well-organized minorities can establish rules that harm the less well organized majorities;

-

• Lack of competence: the community may agree to implement certain policies that, in fact, lead to consequences opposite to those desired. Furthermore, in the aftermath of such errors, the lack of competence may lead the community to misidentify the true causes of the problem, and compound the error by adopting additional failing policies.

Self-governance is valuable because it creates political legitimacy and enables a more economically efficient system, that is, a system that maximizes preference satisfaction not only with respect to the delivery of various private goods and services, but also with respect to the overall nature of society.Footnote 26 In practice, political legitimacy is also important because it allows the creation of greater state capacity. If the community trusts its collective choice institutions, these institutions will be able to solve more problems, more cheaply and with fewer conflicts.Footnote 27

Ideally, all these self-governance problems would be minimized, but, in practice, trade-offs are present. For example, decentralization allows the satisfaction of a greater diversity of social preferences,Footnote 28 but it also generates larger externalities between jurisdictions and it makes collective decisions about larger-scale problems more difficult.Footnote 29 Decentralization also doesn’t address some of the pervasive causes of moral polarization, which can occur at all scales, rather than clustering geographically. In such cases, relying on overlapping civil society organizations and non-territorial governanceFootnote 30 may be better alternatives, but such approaches increase heterogeneity and often decrease social trust.Footnote 31 Gerald Gaus refers to the heterogeneity of values as the “fundamental diversity dilemma” facing all societies aiming to be self-governing.Footnote 32

Similar trade-offs affect our reliance on the administrative state. Relying on experts to devise better policies may improve competence, but it can also create problems if the experts have their own normative agendas, which may differ from the values of the community at large, or if experts are captured by special interests. How can we think about these trade-offs in a more systematic manner?

B. Bargaining and deliberation when transaction costs are large

In the “Problem of Social Cost,” Ronald CoaseFootnote 33 argued that, setting aside the option of violence, it should be possible to build consensus and set up compensation schemes, such that all the gains from trade could be achieved, as long as transaction costs were low enough.Footnote 34 In practice, however, especially for large-scale collective problems involving people with diverse opinions and values, transaction costs are not negligible.

The “calculus of consent” framework proposed by Buchanan and TullockFootnote 35 takes these transactions costs into account and provides a theory of constrained utopia or what David SchmidtzFootnote 36 has called realistic idealism. Consensus is valuable, but it does not come cheap. People usually have better things to do than debate things with no end in sight. Buchanan and Tullock refer to the opportunity costs involved in this process of reaching consensus as “decision-making costs.” Decision-making costs become increasingly larger as more people are included, and as a greater variety of interests and opinions are given a voice.

Buchanan and Tullock call the harms created by a collective decision its “external costs,” referring to the fact that the consensus reached within the decision-making group is inflicting a negative externality upon those who disagree with that consensus but, nonetheless, have to obey it. The external costs are suffered both by people within the jurisdiction who disagree with the decision, as well as by people outside of the jurisdiction, if the decision has some spillover effects on other jurisdictions. As more of the people affected by the decision are given a voice and are included in the decision-making process, the external costs decline.

The calculus of consent offers a theory of the highest degree of democratic inclusion that is worth having, given the difficulties of building consensus. Ideally, everyone who is affected by the issue would be included in the deliberation, and compensated if they are subjected to a rule they disagree with.Footnote 37 In practice, reaching full consensus is too difficult. Beyond a certain degree of inclusion, the social gains of inclusion (due to reducing the external costs of the collective choice) become smaller than the increase in decision-making costs involved in the attempt to further expand the consensus. As such, a self-governing community will want to expand the consensus group as much as possible, in order to minimize the potential harm of the collective decision, but not beyond the point where the marginal gains become smaller than the marginal decision-making costs. This is Buchanan and Tullock’s solution to Dahl’s self-governance dilemma.

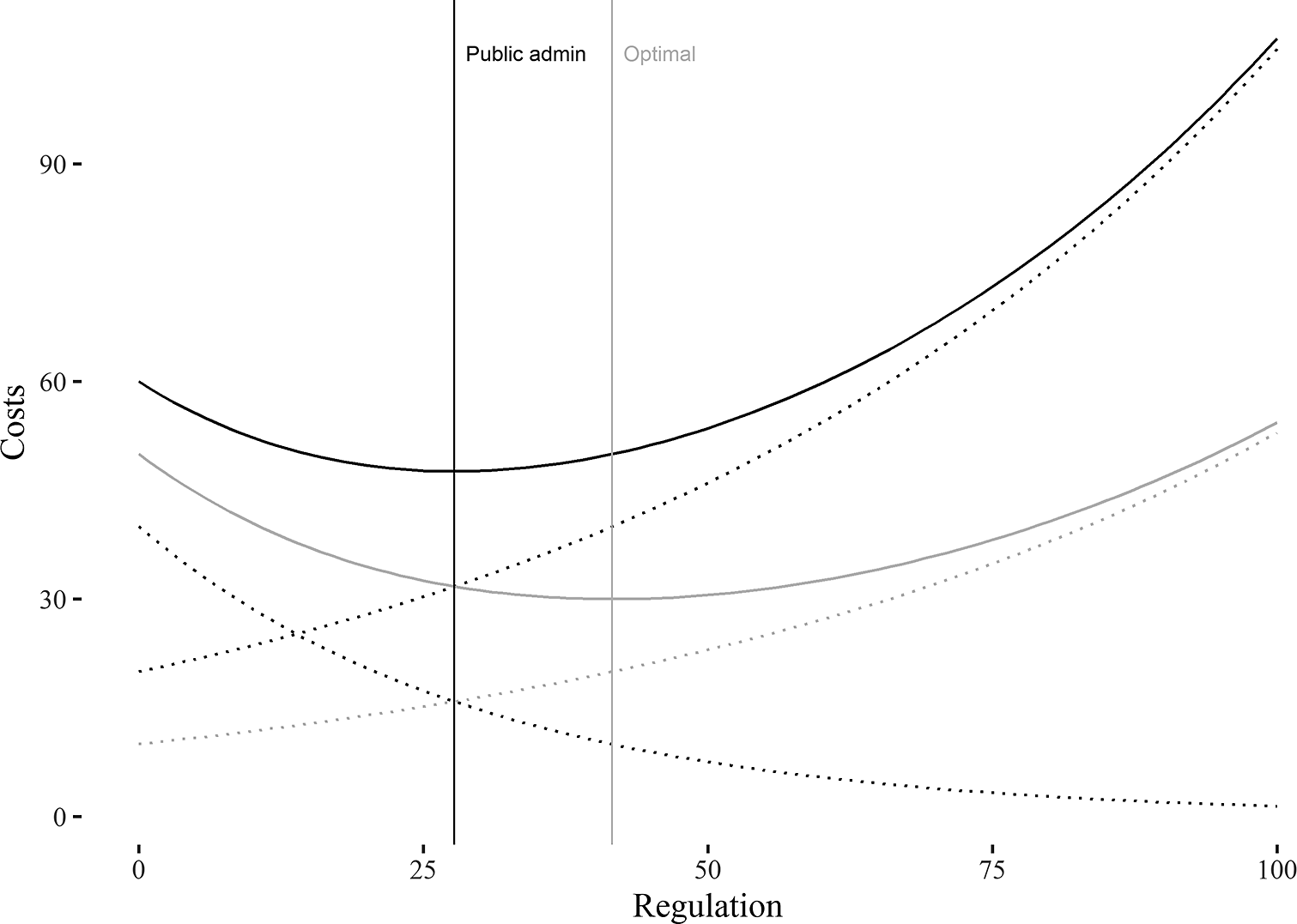

As we increase the level of inclusion, the external costs curve is declining while the decision-making cost curve is increasing. The optimal level of consensus, that is, the optimal “decision rule,” is that for which the total costs are minimized (Figures 1 and 2). Comparing this optimal level of consensus with the level of consensus provided by our real-world institutions allows us to draw normative implications about the desirable institutional reforms. This is a very different approach from the standard cost-benefit policy analysis. The analysis here is done from the point of view of self-governance. We are asking: How can our institutions governing various collective issues be made more inclusive?

Figure 1. Calculus of consent, high decision-making costs

Figure 2. Calculus of consent, low decision-making costs

By contrast, standard cost-benefit policy analysis stipulates an analyst who is outside the system they are trying to reform, who knows what the people in the system want, who often knows better than them how their wants could be best satisfied, and who is altruistically attempting to find what is best for them. None of these assumptions are even remotely realistic.Footnote 38 Furthermore, even if one thinks that these assumptions are somewhat plausible or harmless, they are also not robust: the more power we give to such presumably altruistic expert reformers, and the less we hold them democratically accountable, the less likely it becomes that these assumptions will continue to hold.

BuchananFootnote 39 described the role of the economist in the self-governance paradigm as follows: “[T]he political economist is concerned with discovering ‘what people want’ [The economist’s] task is that of locating possible flaws in the existing social structure and in presenting possible ‘improvements’.” However, in the aftermath of Arrow’s impossibility theorem, we must accept that “no objective social criterion exists,” and, hence, “the economist qua scientist is unable to recommend” some objectively “good” reform.Footnote 40 Instead, the political economist “does not recommend policy A over policy B. [The economist presents] policy A as a hypothesis subject to testing… . The conceptual test is consensus among members of the choosing group, not objective improvement in some measurable social aggregate.” Given that people disagree about which are the most relevant “measurable social aggregates,” the focus needs to be on consensus.

The self-governance perspective is also justified pragmatically. Elinor and Vincent Ostrom noted that the calculus of consent “gave us basic tools for acquiring some analytical leverage in addressing particular problems … about public affairs,” and in particular Buchanan and Tullock’s “principle of conceptual unanimity gave meaning to what [we] had observed and what was accomplished.”Footnote 41 In a nutshell, the “principle of conceptual unanimity” can be understood as the idea that self-governing groups create institutions in an inclusive fashion, avoiding inflicting severe external costs on some members of their community. Self-organizing groups invent collective choice institutions that lower their decision-making costs such that they can feasibly increase inclusion and lower the inflicted external costs; that is, they try to change from a situation like that in Figure 1 to one like that in Figure 2.

For example, when Elinor Ostrom studied water management in West Basin, California, she found that adjudicating water rights was driven by intuitive considerations of “equity jurisprudence,” which can be understood as seeking “to achieve conceptual unanimity in establishing the nature of the problem, in adjudicating water rights, in formulating the rules that were constitutive of water user associations, the way they related to one another, and in monitoring performance.”Footnote 42 Numerous other studies went along very similar lines, and with similar conclusions.Footnote 43

The bottom line is that a focus on self-governance is trying to achieve the same thing as an honest cost-benefits analysis, but self-governance provides a better and more reliable policy guideline because it has more realistic political economy assumptions, and it addresses Gaus’s “fundamental diversity dilemma” head-on, rather than pretending that we have pre-defined, objective criteria about what a society should maximize.

C. Optimal inclusion inside and across jurisdictions

What are the steps for deciding how to deal with any particular collective problem? To answer this, consider a sequence of three institutional choices.

Step 1 is to determine the scale of the potential problem. This depends on the geographical expanse of the possible negative externalities, and of people’s opinions about what is or isn’t a problem. If there are no negative externalities, the issue should be left to private decision-making, while small-scale personal conflicts can be solved privately or via courts. Tort law can cope with fairly large problems, especially given the possibility of class action suits, but only if the source of negative externality is easily identifiable. Local, state, and federal governments, as well as international treaties, deal with problems occurring at larger scales, which, presumably, cannot be solved better by private means, by civil society, or by courts.

Having identified the scale of the problem, we move to step 2 (what the Ostroms and Buchanan call the “constitutional” level of analysis)—deciding what collective choice mechanism to use for subsequently deciding what to do about the problem. Different collective choice mechanisms aggregate beliefs and interests in different ways. How inclusive should collective choice be, given the nature of the problem? For example, we might decide to do nothing about certain problems, and just live with them; for other types of problems, we might decide to use a legislature, a public administration bureaucracy (for example, an IRA) or direct democracy (a referendum) for creating rules to regulate the issue; and, for other types of problems, we might have the executive make discretionary decisions. Each of these institutions is a tool for making collective decisions and has different degrees of citizen inclusion and accountability to voters (Table 1).

Table 1. Basic institutional tools for collective decision-making

Finally, step 3 is to adopt specific policies for each potential problem. The collective choice mechanism chosen at step 2 is used to select a policy. For example, a legislature can decide how healthcare should be provided. Or an independent regulatory agency decides whether or under what conditions to allow some activities. A wide variety of policies can be adopted, corresponding to more or less government intervention.Footnote 44 We can have markets regulated by tort law, markets regulated by legislation, markets with Pigouvian taxes or subsidies, markets with vouchers, public goods produced via public-private partnerships, and interventions that range all the way to full government ownership and control.

The trade-off between external and decision-making costs at the core of the calculus of consent allows us to think about both the optimal geographical scale at which a problem should be addressed, that is, the size of jurisdictions, and about the level of inclusion within a given jurisdictionFootnote 45—that is, it provides an account of the first two steps described above. The third step is outside the subject of the present paper. I’m not concerned here with specific policies, but only about whether we have the proper institutions, from a self-governing perspective, for making policies.Footnote 46

The optimal size of the jurisdiction is determined by the size of the interjurisdictional externalities, compared to the costs of building consensus across jurisdictions. As an example, consider the case of air pollution in California in the late 1950s.Footnote 47 At first, the air pollution problem was addressed at the local level, but the industrial pollution created in one county affected neighboring counties, which meant that a local government might not have jurisdiction over the cause of the problem. The problem was addressed by moving the issue from the local to the state level. This has increased the decision-making costs, as all the different local jurisdictions represented at the state level would need to reach some degree of consensus, but it was worth it because the inter-jurisdictional externalities were significant.

We can thus see the calculus as, first of all, a bottom-up theory of the emergence of federal structures. The extent of inter-jurisdictional externalities and the difficulties of creating consensus and enforcing rules across a given geographical expanse create naturally-sized jurisdictions.Footnote 48

Interestingly, markets can also be understood using the same framework. Private property is simply the limit case of federalism—the case of comparatively small spillovers relative to high decision-making costs. In other words, private property is the efficient institution either when allowing individuals to unilaterally decide what to do with their property generates small social costs, or when the issues are so contentious that trying to build consensus is prohibitively costly. That is, the costs of the collective decision-making are higher than the costs of the market failure generated by private property.Footnote 49

Second, once various issues are allocated to different levels of government, we need to decide how to address them. As mentioned earlier, we have a large variety of institutions at our disposal.Footnote 50 We can simplify this complexity somewhat by noting that different institutions implement different effective decision rules. For example, some decisions, such as constitutional changes, have such high potential external costs that they should be made by super-majorities. Other issues have large enough potential externalities that a simple majority is required. Finally, some issues might have significant potential externalities but resist a broad consensus. Under such conditions, a lower than 50 percent decision-rule might be optimal, which is achieved with institutions like courts and IRAs. Emergency situations have even smaller optimal decision rules—the decision-making costs are too high, while the external costs due to having a small decision group are small because everyone tends to agree about what needs to be done. For example, a single person is enough to raise the fire alarm (rather than requiring a consensus among more people).

D. Public administration from a constitutional political economy perspective

The first to apply the calculus of consent framework to the analysis of public administration were the Ostroms. They noted that the calculus indeed makes it possible to justify the less-than-majoritarian decision-making of regulatory agencies and of other state bureaucratic structures, but this justification is more restrictive than the classic Wilsonian argument in favor of public administration.Footnote 51

They first noted that the essential problem is that reduced inclusion leads to increased expected external costs—the experts are enabled to make a wide range of decisions under weaker requirements to satisfy popular preferences. This is justified on knowledge grounds, but the incentive problem cannot be ignored:

The possibility of reducing expected external costs to a low order of magnitude so that advantage might be taken of the low decision costs potentially inherent in a bureaucratic ordering can be realized only if (1) appropriate decision-making arrangements are available to assure the integrity of substantial unanimity at the level of constitutional choice, and (2) methods of collective choice are continuously available to reflect social preferences of members of the community for different public goods and services. The rationale for bureaucratic organization in a democratic society can be sustained only if both these conditions are met.Footnote 52

The reference to “constitutional choice” refers to the process of choosing the collective choice mechanism (in this case bureaucratic governance). In other words, while bureaucratic governance itself is not very inclusive, the decision to use bureaucratic governance for given issues must have been taken in an inclusive fashion. Otherwise, the bureaucracy is more likely to be authoritarian.

The Ostroms’ use of the calculus here implies that IRAs are created too easily. They are generally created by legislatures using majority voting—but this is far from being inclusive enough. The decision to use an IRA is a “constitutional” choice (in the Buchanan-Tullock-Ostrom sense of the word), and, hence, should be made with near unanimity, because, once the IRA is created, it enables a small minority to make decisions imposed on everyone—which has potentially high external costs.

The way to limit such potentially large harms is to achieve a high degree of consensus when creating the IRA in the first place. The delegation to administrative law should, thus, be done with super-majorities. Otherwise, a small majority is creating an agent for itself that is then allowed to make decisions with even smaller decision-rules. Simple majorities fluctuate over time. As such, IRAs created by simple majority rule decisions are a tool for perpetuating a small temporary majority long into the future—a scenario that is both illegitimate from the point of view of self-governance and economically inefficient (that is, does not accurately reflect the preferences of the population as time goes on).

The second point highlights the concern that experts might fail to properly reflect broad-based preferences. Moreover, the lack of options that citizens have in the Wilsonian model of a fully integrated hierarchical bureaucracy hampers both the ability of citizens to express and reveal their preferences, and the ability of the public administration to receive feedback:

The interests of the users of public goods and services will be taken into account only to the extent that producers of public goods and services stand exposed to potential demands of those users. If producers fail to adapt to changing demands or fail to modify conditions of supply to meet changing demands, then the availability of alternative administrative political, judicial, and constitutional remedies may be necessary for the maintenance of an efficient and responsive system of public administration.Footnote 53

This leads them to argue for an alternative model to the hierarchical bureaucracy—polycentric governance, characterized by “overlapping jurisdictions so that the larger jurisdictions are able to control for externalities while allowing substantial autonomy for the same people organized as small collectivities to make provision for their own welfare.”Footnote 54 Vincent Ostrom later expanded his critique of Wilsonian public administrationFootnote 55 and further used the calculus of consent perspective as a foundation for federalism.Footnote 56

The argument has so far focused primarily on the problem of incentives. By contrast, the main arguments in favor of administrative law focus on knowledge. We thus need to bring together the issues of incentives and knowledge. This is the topic of “robust political economy”.

III. Robust Political Economy

Robust political economy is the attempt to build robust institutions.Footnote 57 An institution is considered robust if it works well even if decision-makers lack perfect knowledge and are not entirely benevolent.Footnote 58 By contrast, an institution is fragile if it only works well when decision-makers can be trusted not to be venal, and when accurate information is available. Robust institutions have checks-and-balances such that decision-makers, even if they are self-interested, are forced to “do the right thing” by the constraints they face. Similarly, robust institutions have fairly large margins of error, that is, even when decisions are made based on flawed information, disaster does not follow. Moreover, robust institutions have feedback mechanisms not only with respect to incentives, but also with respect to knowledge—robust institutions facilitate learning and error correction.Footnote 59

A. Markets, democracy, and public administration

Markets are a robust institution for the production and delivery of private and club goods. The profit-and-loss mechanism incentivizes self-interested entrepreneurs to produce and deliver goods that other people value (hence, no generosity is needed for the system to work), and to quickly switch direction when they fail to do so (errors lead to losses, while learning leads to gains). In other words, the market is robust with respect to both the incentive problem and the knowledge problem. But what about the production and delivery of collective goods?

Broadly speaking, democracy is superior to nondemocratic collective choice mechanisms on the same robustness grounds. On the one hand, the election process incentivizes politicians to care about what voters want, and the process works even if we assume that politicians are self-interested—even if they care only about being elected or reelected, they still have to pay attention to what voters want. By contrast, authoritarian regimes only work well if the rulers happen to be benevolent. On the other hand, in a democracy, policy errors reduce the chances of reelection. Voters punish politicians for bad outcomes even when voters themselves have little knowledge about why the bad outcomes have happened. Following Hayek,Footnote 60 WohlgemuthFootnote 61 and Boettke, Tarko, and AligicaFootnote 62 argue that this epistemic feedback affects even voters. The democratic process enables not only politicians to learn what voters want and how to best deliver it, but, over the medium to long term, it also enables voters to learn what kind of policies to support or reject. By comparison, in authoritarian regimes, rulers are more shielded from the consequences of their errors, and the lack of voice for the population at large also means that errors do not increase public knowledge more broadly.

This, of course, is a somewhat idealized picture of democracy,Footnote 63 as in practice we face the self-governance problems mentioned earlier, but it does provide a robust political economy argument in favor of democracy over autocracy. As such, considering that administrative law is a move in the direction of less inclusive decision-making, it provides a prima facie concern about it.

Administrative law is justified by two primary knowledge-related arguments. First, the general public, as well as the political representatives, may not have the required technical knowledge. Second, even if they may have the knowledge, politicians often face the incentive to focus on the short-term, and may inflict significant long-term costs. The typical example is the Central Bank. On the one hand, monetary policy is a highly technical subject, and, on the other hand, even if politicians know that causing high inflation is economically unadvisable, they would still be temped by the short-term benefits that would increase their reelection prospects.Footnote 64

Such concerns become even stronger if we think that policies should be justified by “public reason.” Kogelmann and StichFootnote 65 note that “[t]here are many kinds of disputes in which persons find themselves, but not all such disagreements are reasonable and thus instances of reasonable pluralism.” The typical members of the general public (or of the legislature for that matter) do not have the knowledge to form informed, and, hence, reasonable positions about advanced public policy disputes. As such, Kogelmann and Stich argue that “[p]ublic reason requires citizens appeal to reasons and thus scientific and social scientific considerations that all can accept or endorse, but the administrative state is desirable precisely because such a set of reasons does not exist” (emphasis in the original).

The calculus of consent framework differs from this public reason perspective on at least two accounts. First, as far as the calculus of consent is concerned, it does not matter whether disagreements are “reasonable” or not. What matters is the cost of reaching agreement.Footnote 66 Second, while the Rawlsian version of public reasonFootnote 67 assumes that consensus needs to be achieved by discussion and deliberation, the calculus of consent allows any method of persuasion (except threats and violence), including monetary compensation or any other form of compensation.Footnote 68 Indeed, the book is somewhat notorious for its defense of logrolling.

Apart from these differences in philosophical assumptions, Kogelmann and Stich’sFootnote 69 conclusion is driven by the error of considering an overly restrictive set of possible institutions. Their assumption is that all collective issues need to be decided either by direct democracy, legislature, or by an IRA. First, even if we agree that IRAs are required because of the expertise problem, we still have to decide the optimal level at which to set up the IRA within the federal system. The expertise required to identify the scale of a problem, or whether we should just live with the problem, is much smaller. Second, market alternatives exist,Footnote 70 and markets often use information much better than even the best experts.Footnote 71 The decision whether to use markets or experts can and should be debated democratically. As mentioned, IRAs would be less problematic, if they were originally set up with a super-majority decision-rule.

B. A calculus of consent account of the trade-off be tween type I and type II errors

The original calculus of consent framework was focused entirely on the incentive problem. This limitation was partially addressed by Elinor OstromFootnote 72 who discussed how learning may change the cost curves. In what follows, I’m providing an adaptation of the classic graphs (like Figures 1 and 2) to the knowledge problem.

From a knowledge perspective, we have two main possible costs. On the one hand, we might adopt a bad policy (false positive). On the other hand, we might fail to adopt a good policy (false negative). In practice, we want to minimize both errors, but we face the typical trade-off between type I and type II errors.

If this is a collective choice, the higher the level of inclusion (that is, the more people are involved in the decision and who can veto it), the higher the likelihood of false negatives and the lower the likelihood of false positives. The inclusion of more people, and, implicitly, of greater epistemic diversity, leads to fewer bad policies,Footnote 73 but this is not without a cost—good policies might not be adopted because too many people need to be convinced. The optimum level of inclusion, based on minimizing the costs due to both types of errors is the minimum of the total costs curve (Figure 3).

Figure 3. Calculus of consent model applied to knowledge problems

Putting together the incentive problem and the knowledge problem, we need to consider the total costs, adding the two U-shaped costs, and find the minimum of this total, as illustrated in Figure 4.

Figure 4. Calculus of consent account of robust political economy

Any institution fails in certain ways, which means that the de facto cost curves embedded in that institution differ to some extent from the idealized self-governing cost curves (which would include everyone affected). In the social contract framework of Buchanan and Tullock, the correct curves are those evaluated behind a veil of uncertainty, where negotiating agents don’t know their real-world positions, and, hence, rules are assessed on their merits, rather than based on narrow self-interest.

To make use of this framework for analyzing a specific institution (such as the public administration) we need to evaluate the actions of decision-makers within that institution and the two types of feedback mechanism they face. On the one hand, how do the informational feedback problems work? Relative to a social contract hypothetical optimum, do they shift the false positive or the false negative curve (or both), and in which direction? On the other hand, what incentive problems do decision-makers face? Again, relative to a social contract hypothetical optimum, do these incentive problems shift the decision-making costs curve or the external costs curve (or both), and in what direction?

In the next section, I illustrate this type of analysis to the question of the likely failures of public administration with respect to regulating private goods and public goods. I argue there that public administration corresponds to the two least ambiguous cases, where the knowledge problem effect and the incentive problem effect act in the same direction.

IV. Incentive and Knowledge Problems in the Public Administration

To apply the robust political economy framework to public administration we need to ask about possible failures with respect to knowledge and incentives. A key observation that is not commonly appreciated is that various parts of the public administration (and various IRAs) face different problems depending on whether they are concerned with public or private goods. In this section, I first consider the regulation of private goods, then the regulation of public goods, and finally the problem of federalism.

A. Regulating private goods

Consider first the problem of rent-seeking and regulatory capture for private goods. Examples include the regulation of medicine, hospitals, or food. In the case of private goods, rent-seeking operates in the direction of reducing competition—incumbents, especially if they are large firms that can afford the costs of regulatory compliance, will support increased regulations as that will reduce their competition. For instance, in thirty-five states in the United States, new hospitals or clinics require “certificates of need”—that is, in order to be allowed to open, they need to demonstrate that their services are “needed”—and this permission needs to be granted by the existing hospitals.Footnote 74 In the calculus framework, increased regulation amounts to a higher decision rule, meaning that there are more possibilities for someone to veto the activity.

This is indeed what the standard calculus of consent cost curves analysis predicts. The increased regulation, preventing competition, has dispersed costs, but concentrated benefits. These benefits (negative costs) are included in the idealized social contract external costs curve, but not in the de facto external costs curve. In other words, the external costs curve is increased relative to the social contract hypothetical, which causes the decision rule to increase (Figure 5). This corresponds to activities of IRAs that regulate private goods, like the FDA, the Consumer Product Safety Commission or the Securities and Exchange Commission.

Figure 5. Regulation of private goods

We can use the same Figure 5 to understand the knowledge problem. In the case of IRAs that regulate private goods, they are more likely to suffer from false positives (that is, adopt bad policies). For example, the FDA has harshly restrictive safety procedures for medicine because the incentive structure of the agency tends to make it very risk-adverse—if they approve medicine that later proves harmful, they will suffer a serious public relations scandal, but if they do not approve safe medicine, this goes unnoticed, despite the large social cost of keeping valuable medicine off the market. Aligica, Boettke, and TarkoFootnote 75 note that this is not the case with certification markets, because private certifiers have both financial benefits from approving activities, and financial costs from errors. The FDA has the same cost, but not the benefit, hence its bias. Certification markets do not suffer from the same knowledge problem that affects IRAs.

In the case of IRAs that regulate private goods, both the rent-seeking problem and the knowledge problem point in the same direction—they are likely to overregulate the market. The main alternative in this case is the combination between certification markets, insurance, and tort law. In a certification market, either for-profit firms or non-profits sell certification to producers, in return for these producers satisfying the safety criteria required by the certifiers. The market for certifiers is setting the trade-off between false positives and false negatives. Producers want to obtain the certification in order to increase demand for their good, lower their insurance costs, and lower their risks of being sued.

The FDA has been pressured to streamline the approval process of some drugs, for instance, as a result of the AIDS crisis, but this is still a much weaker type of incentive, as compared to profit maximization in a market. Some attempts to mimic the market incentives have been made, in particular with the Prescription Drug User Fee Act (PDUFA), which allows the FDA to collect fees from manufacturers in return for speeding up the approval process. However, in the absence of certification alternatives to the FDA and the right to ignore the FDA, the PDUFA is nothing but a rent-extraction scheme. The FDA overregulates the market, and then sells the privilege of being less regulated to some firms.

B. Regulating public goods

Consider now the case of IRAs that regulate public goods, such as the EPA or the Federal Reserve.Footnote 76 A dramatic case that can serve as the paradigmatic example of a failure of environmental regulation is the Deepwater Horizon oil spill in 2010. As a result of the disaster, BP paid record damages of $18.7 billion. The actual clean-up costs, however, have been almost three times larger. One can wonder why BP hasn’t been required to pay the entire costs (and further damages), as would normally have happened under regular tort law. The answer is that damages are capped by law. This is an example of socializing risks and privatizing benefits. If the Deepwater Horizon disaster had not happened, BP would have pocketed the entire profits from the oil extraction. But the risks for that activity have been partially passed on to taxpayers. This incentivizes riskier activities than under standard tort law. Why would we have such rules?

In terms of the calculus of consent curves, socializing the risks means that the governing costs of the activity are raised, that is, the costs of agreeing about what the rules are and of enforcing the rules increase. This is because the decision about how to manage risks, instead of being confined to the firm and the insurance market, is spread more broadly. By contrast, the external costs are not changed—the risks and the potential damage remain the same. Raising decision costs leads to a decrease of the decision rule; that is, public goods are under-regulated (Figure 6).

Figure 6. Regulation of public goods

Once again, matters are similar when we consider the knowledge problem. The situation under these circumstances is the reverse of the private goods case. If an environmental disaster occurs, the EPA doesn’t suffer much—it is the private firm that takes the bulk of the blame. By contrast, it is the environmental regulations that are now visible—with regulations being easily blamed for reduced economic activity. As such, the EPA is more likely to engage in false negatives (that is, to not adopt good policy).

The main alternatives in this case are tort law (which would not socialize the risks) and federalism. As described, the problem here is that decision-making costs are too elevated. Decentralization would be a way to decrease decision-making costs, and, hence allow agreement to form for the higher level of regulation—compensating for the bias mentioned above.

Relying on tort law for environmental regulation is sometimes held as a possible alternative to the EPA.Footnote 77 While tort law can indeed sometimes work—the Erin Brockovich case is a famous example—there are some good reasons to be skeptical that it could provide a reliable general alternative. As noted by Fuller,Footnote 78 courts are not particularly good institutions for making decisions that affect numerous people, with diverse interests, and who are not represented in the courtroom. That is precisely the situation in many environmental circumstances. Historically, common law has also not been particularly efficient at protecting the environment.Footnote 79 This is partly because pollution is often due to numerous dispersed sources, rather than a few identifiable sources that can be sued, and it is partly because courts have often sided with industry in the name of “development,” downplaying environmental and health costs.

It is thus not surprising that governments at various levels have created environmental regulations. This is largely in response to a combination of market and court failures. This being said, it is still highly debatable whether a federal-level environmental agency is the best approach.

C. Why administrative law tends to be overcentralized

The case of environmental protection is interesting to evaluate from the point of view of federalism. If we consider the theory of federalism sketched in Section I, subsection C, it is not at all obvious that the federal level is the proper scale for environmental policies. With a few exceptions, like nuclear testing in the atmosphere during the Cold War or the ongoing global warming problem, most environmental externalities are relatively contained geographically, and, hence, having a federal-level EPA seems to artificially increase decision costs with little benefit.Footnote 80

Unfortunately, this problem of overcentralization is inherent in all collective choice by majority rule (rather than by the optimal decision rule). As noted by Buchanan and Tullock,

simple majority voting tends to cause a relative overinvestment in the public sector … [because] majority-voting rule allows the individual in the decisive coalition to secure benefits from collective action without bearing the full marginal costs.Footnote 81

This is the flip side of the standard argument according to which public goods tend to be underproduced by markets because of free riding. In this case, instead of free riding on the benefits, one is free riding on the costs by encountering only a fraction of the costs, and, hence, an oversupply occurs. Public goods are underproduced by markets, and overproduced by majority-rule collective decisions.

A simple everyday version of this problem is the restaurant problem. Suppose a group goes to a restaurant. One possibility is for each of them to pay for their own meal. This aligns costs and benefits at the individual level. Another possibility is for them to split the check equally. This leads the group to overspend, as each individual has the incentive to order a more expensive meal. This is a Prisoner’s Dilemma. The optimal group choice would be for no one to over-order, but the best situation for an individual is for them to over-order, while the others don’t. This creates a temptation to defect from the optimal collective choice, leading to the worst-case situation in which everyone over-orders (or at least some do).

The same situation occurs when people vote on a problem—the costs are shared. Similarly, when states centralize, say, environmental protection, they will overspend on it. But the situation is even worse here. In the restaurant problem individuals at least get a better meal. In the EPA case, the states get worse environmental protection, as compared to what decentralized state-level EPAs would provide, because the federal-level EPA creates a one-size-fits-all policy, which does not in fact fit all.

Generally speaking, centralizing IRAs (such as the EPA), leads to overspending for their services. And, if the externalities between states are in fact small, that is, the federal-level agency is not justified from a calculus of consent perspective, the service delivered by these federal-level IRAs will also be lower quality than the hypothetical state-level alternative.Vincent and Elinor Ostrom note that

Costs must be proportioned to benefits if people are to have any sense of economic reality. Otherwise beneficiaries may assume that public goods are free goods, that money in the public treasury is “the government’s money,” and that no opportunities are forgone in spending that money. When this happens, the foundations of a democratic society are threatened.Footnote 82

Buchanan and Tullock argue that, under the above logic, legitimate reasons for transfers between jurisdictions can quickly get out of hand:

[S]uppose that the issue confronted is that of providing federal funds to aid the depressed coal-mining area of West Virginia. For such a measure the levy of special taxes on citizens of West Virginia would be self-defeating. Nevertheless, it is relatively easy to see that, if such aid is to be financed out of general tax revenue, a veritable Pandora’s box may be opened. Depressed fishing villages along the Gulf coast, depressed textiles towns in New England, depressed automobile production centers in Michigan, depressed zinc-mining areas in Colorado, etc., may all demand and receive federal assistance. As a result excessive costs will be imposed on the whole population.Footnote 83

I discuss elsewhereFootnote 84 various methods that can be employed for reducing the scale of this problem. Some of these methods have been adopted by both the United States and the European Union for partially containing the abuse of transfers toward local and state levels (the main method is to require co-payments from recipient states). I mention this to highlight that the problem is in fact recognized and taken seriously in certain contexts. The problem has not, however, been given its deserved prominence in discussions about the administrative state and the desirability of centralized IRAs.

Before concluding I should briefly mention a concern that is often raised when decentralization is advocated. Wouldn’t this lead to a race to the bottom? There are two points to consider.

First, the optimal situation is one of diversity, rather than of one-size-fits-all. As such, decentralization will lead to, say, weaker environmental protection in some areas, but stronger protections in others. Tiebout competition works reasonably well,Footnote 85 and, even considering its imperfections, it remains a better mechanism for making such allocative decisions than centralized decision-making. Centralized decision-making lacks the proper local knowledge to make such decisions well, and it is also subject to federal-level politics, which often leads to inefficient and unequitable decisions. For example, from a self-governance perspective, who should decide whether to drill for oil in the Arctic National Wildlife Refuge, the U.S. federal government or the Alaskan government?

Second, as argued earlier, the IRAs tend to underregulate public goods. As such, the overall effect of decentralization (on average) should be to increase environmental regulations and the regulation of other public goods. In the absence of significant negative externalities between jurisdictions, giving a say to outsiders of the affected jurisdiction is a departure from self-governance, and it tends to downplay the costs. For example, outsiders of a jurisdiction will have the incentive to vote in favor of oil drilling: they would experience the benefits (lower gas prices), but not the possible costs (only the locals would suffer from these). Centralizing such decisions thus gives a say to people who shouldn’t have a say, and, predictably lowers environmental protections.

V. Conclusion

The analysis of administrative law in general, and of independent regulatory agencies in particular, needs to consider many possible alternatives. The legislature is not a viable alternative to administrative law, but neither is it the only possible alternative. Certification markets can replace the activities of agencies that regulate private goods, especially in conjunction with insurance markets and tort law. The regulation of public goods is more difficult. We might consider tort law, which would probably provide stronger regulations than the existing ones. But tort law only works for a limited range of cases. Federalism should also be considered more carefully, especially bearing in mind the inherent logic that tends to push majoritarian democracies toward overcentralization. This means that many activities are probably overcentralized at the moment.

Existing federal-level IRAs are too undemocratic—alternative (market-based or federalist) institutions that are more inclusive, and allow the coexistence of a greater diversity of views and preferences, are not just feasible, but would predictability have lower external costs than IRAs. Low-inclusivity institutions like IRAs can be justified from a self-governance perspective only if the decision-making costs involved in the alternative institutions are prohibitive. But this is not the case with IRAs, once we consider market-based or federalist alternatives.

The main case for IRAs rests on the importance of expertise. This is a good argument against using the legislature or direct democracy. By contrast, both markets and decentralized polycentric systems (federalism and common law) tend to have superior capacity to aggregate knowledge and make new discoveries. Centralized systems based on few experts are not particularly well suited to make best-informed decisions on a reliable basis. Furthermore, when errors are made, everybody is affected. In decentralized systems, errors are contained to a smaller scale, are easier to identify (because one can compare to other jurisdictions), and, when one jurisdiction suffers the consequences of a bad decision, help is usually available from the other jurisdictions.Footnote 86

The concept of self-governance is in many ways subtle and complicated. The present essay argued that we can get quite far in the analysis and conceptualization of self-governance by using the calculus of consent framework, even if it does not account for many social choice complications (for instance, the ways in which a voting process can be manipulated by agenda control, strategic voting, and so on). Interestingly, although the framework was initially developed purely in terms of incentive problems, it can also be easily used to make sense of the trade-off between type I and type II errors, as applied to policy errors. As such, the calculus can be used as the fundamental framework for “robust political economy”, that is, for institutional analysis that takes into account both the possibility that the decision-makers are self-interested rather than benevolent, and the possibility that they have access to less-than-perfect information.