No CrossRef data available.

Article contents

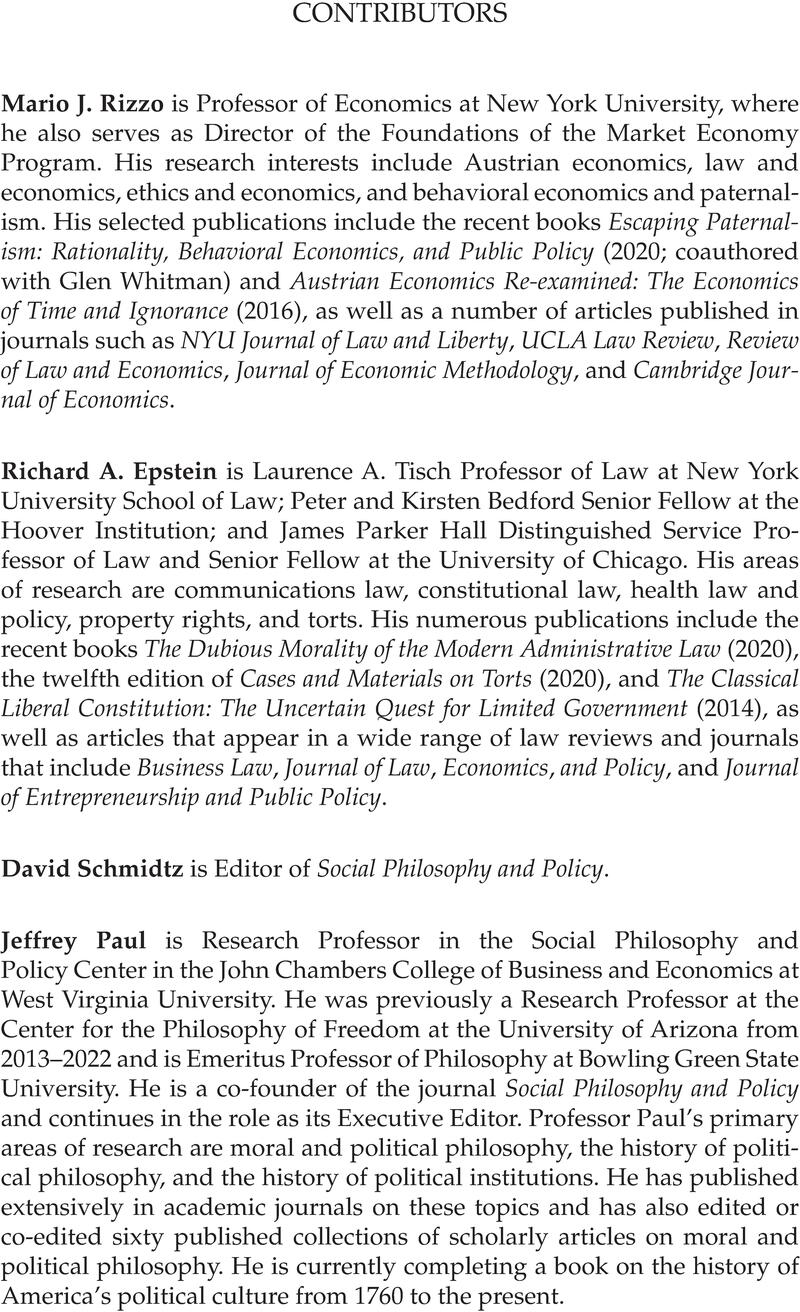

CONTRIBUTORS

Published online by Cambridge University Press: 14 August 2023

Abstract

An abstract is not available for this content so a preview has been provided. Please use the Get access link above for information on how to access this content.

- Type

- Contributors

- Information

- Copyright

- © 2023 Social Philosophy and Policy Foundation