Introduction

Major depressive disorder is a leading contributor to disability worldwide, affecting more than 300 million people at any time (World Health Organization, 2017). Although people with depression experience impairments in decision-making that contribute to their disorder (Clark et al., Reference Clark, Hops, Lewinsohn, Andrews, Seeley and Williams1992; Eshel & Roiser, Reference Eshel and Roiser2010; Husain & Roiser, Reference Husain and Roiser2018; Pulcu, Thomas, Trotter, & McFarquhar, Reference Pulcu, Thomas, Trotter and McFarquhar2015), our knowledge of maladaptive decision-making processes in depression remains incomplete. Understanding such depression-related impairments may aid our attempts to improve the quality of life for those that struggle with this disorder.

Although people with anhedonic forms of depression exhibit dysfunctional evaluation of immediately-available, yet superficially appetitive outcomes, those with other forms of depression (e.g. those associated with helplessness) may exhibit maladaptive assessment of outcomes that occur only after extended sequences of decisions (Dayan & Huys, Reference Dayan and Huys2008; Huys et al., Reference Huys, Lally, Faulkner, Eshel, Seifritz, Gershman and Roiser2015b). Addressing the substantial computational challenge associated with planning during multi-step decision-making lies at the heart of modern reinforcement learning. Such multi-step decision-making requires searching a decision-tree of options in which the first choice constrains future choices. These searches are difficult and necessitate the use of certain heuristics.

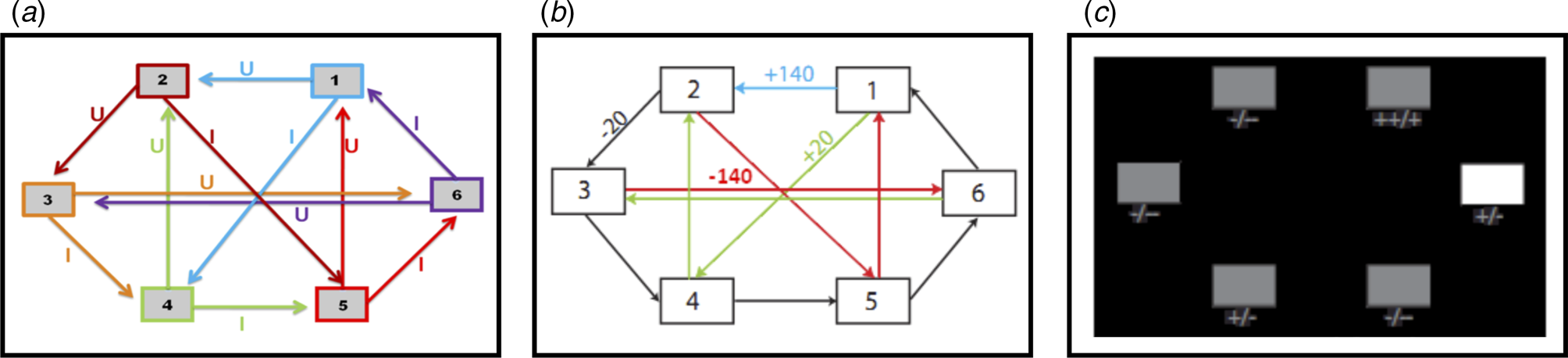

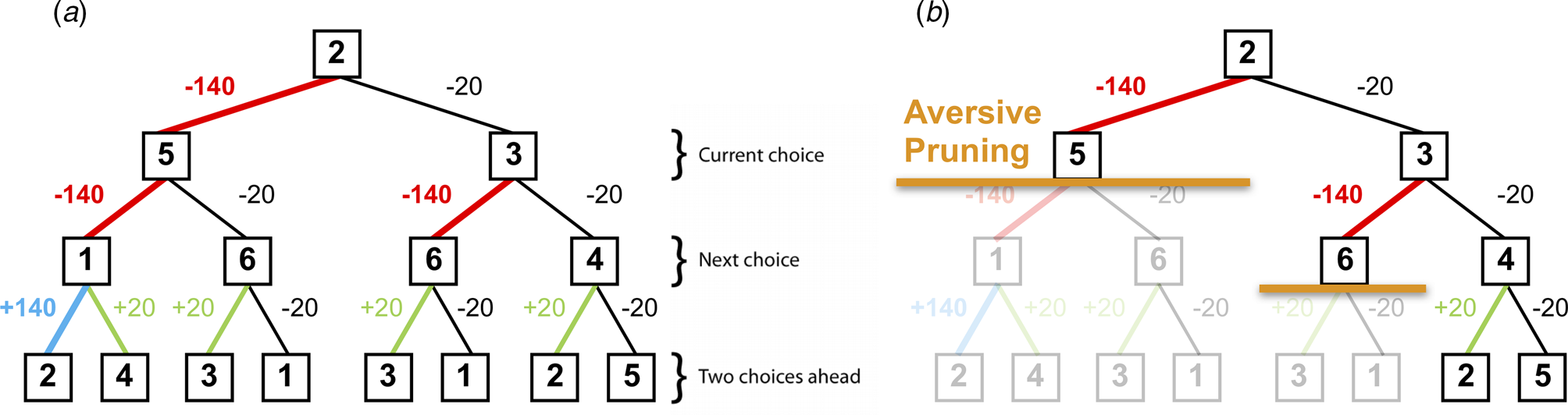

Using the multi-step decision-making task in Fig. 1, we investigated various heuristics that healthy individuals use to approximate the best possible overall outcome without exhausting cognitive resources. One particular heuristic we identified is the ‘pruning’ of branches of a decision-tree that contain very negative outcomes in a Pavlovian manner (Huys et al., Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012; Huys, Daw, & Dayan, Reference Huys, Daw and Dayan2015a). Specifically, healthy individuals selected the optimal sequence of decisions when potential paths did not contain a large loss, although they were dramatically impaired at doing so when the optimal sequence began with a large loss at the first decision step (Fig. 2).

Fig. 1. (a) Deterministic transition matrix presented to participants during the training phase to aid learning. (b) Deterministic reward matrix. Note that this was never presented to participants; they must instead learn the reward structure through trial and error. (c) Task as presented to participants. The white box denotes the state that the participant is currently in. Symbols below each state denote the deterministic reward achieved by transitioning away from that state; ‘++’ = +140 points; ‘+’ = +20 points; ‘-’ = −20 points; ‘--’ = −140 points.

Fig. 2. (a) A typical decision-tree and financial outcomes up to a depth of 3 starting from state 2. Numbers in each box denote the state number. (b) Same decision-tree starting, aversively pruned due to a large negative outcome at the first step. Note that this aversive pruning also avoids the large positive transition, but almost halves the computational load.

Pruning of decision branches that contain a large loss can reflect the rational allocation of computational resources. Importantly, such pruning may also promote emotional wellbeing; curtailing a tree search in the face of a large punishment avoids aversive outcomes and the consequent negatively-biased valuation of one's surroundings (Dayan & Huys, Reference Dayan and Huys2008). Conversely, an oversampling of branches associated with unsavoury outcomes (i.e. a consistent selection of branches or options that typically result in punishments) can contribute to a more negatively-biased valuation of one's surroundings and can thus promote depression (Dayan & Huys, Reference Dayan and Huys2008; Huys et al., Reference Huys, Daw and Dayan2015a). Indeed, research indicates that depression may be associated with an oversampling of aversive information and outcomes (e.g. Garrett et al. Reference Garrett, Sharot, Faulkner, Korn, Roiser and Dolan2014; Joormann, Hertel, Brozovich, & Gotlib, Reference Joormann, Hertel, Brozovich and Gotlib2005; Joormann & Gotlib, Reference Joormann and Gotlib2008). For example, Garrett et al. (Reference Garrett, Sharot, Faulkner, Korn, Roiser and Dolan2014) report that when constructing beliefs about the likelihood of future positive and negative events occurring, non-depressed individuals exhibit a bias towards the processing of information that supports a positively-skewed view of future positive events occurring, while ignoring information to the contrary. However, the authors also report that clinically-depressed individuals consider such information as much as they consider information that supports a negatively-skewed view of future events, and as such overevaluate aversive information. In addition, Joormann and Gotlib (Reference Joormann and Gotlib2008) report that negatively-valenced but irrelevant words interfere with the ability to update working memory (indexed by response latencies on a recognition task) in depressed participants more than in healthy individuals. These results further indicate that depression may be associated with an overevaluation of aversive information, and that people with depression might sub-optimally prune decision trees by oversampling branches associated with negative outcomes.

Pavlovian pruning of decision trees has been hypothesized to depend on the brain's serotonin system (Dayan & Huys, Reference Dayan and Huys2008). Specifically, reductions in central serotonin are proposed to result in a decrease in Pavlovian behavioural inhibition, and an increased choice of options that result in negative outcomes due to decreases in pruning (Dayan & Huys, Reference Dayan and Huys2008). This hypothesis was based on observations that serotonin influences behavioural inhibition in response to losses (Cools, Nakamura, & Daw, Reference Cools, Nakamura and Daw2011; Crockett, Clark, & Robbins, Reference Crockett, Clark and Robbins2009). Because depression is associated with dysfunction in a number of neurotransmitter systems, including the serotonin system (Anderson, Reference Anderson2000; Cannon et al., Reference Cannon, Ichise, Rollis, Klaver, Gandhi, Charney and Drevents2007; Parsey et al., Reference Parsey, Oquendo, Ogden, Olvet, Simpson, Huang and Mann2003), this theory provides one possible mechanism by which depressed individuals exhibit negatively-biased valuations of themselves and their surroundings (Clifford and Hemsley, Reference Clifford and Hemsley1987).

The current study aimed to determine whether depression is associated with sub-optimal pruning of decision trees. We compared the performance of depressed and healthy participants on a sequential decision-making task designed to reveal pruning behaviours. Standard, Bayesian and computational analyses were utilized. It was predicted that (1) compared to healthy individuals, depressed individuals would exhibit less pruning of decision-tree branches that begin with a large punishment, and (2) that in depressed individuals, those with the highest levels of depression would demonstrate the lowest pruning.

Methods

Participants

This study employed a between-subjects design. Thirty depressed individuals were recruited via the Camden and Islington NHS Foundation Trust Psychological Therapy Services, while 31 healthy controls were recruited via online and print advertisements. All participants gave written informed consent after receiving a detailed explanation of the study (approved by the London – Queen Square NHS Research Ethics committee). Exclusion criteria [assessed by the Mini International Neuropsychiatric Inventory (MINI); Sheehan et al., Reference Sheehan, Lecrubier, Sheehan, Amorim, Janavs, Weiller and Dunbar1998] for the healthy control participants included past or present major depressive disorder, bipolar disorder, psychosis, anxiety disorders, substance/alcohol dependence or recent (<6 months) abuse, any neurological disorder and not being a native English speaker. Depressed participants were subject to the same exclusion criteria, except they had to endorse depressive symptoms for a minimum of 10 days within the last 2 weeks (number of past depressive episodes was not important for inclusion), and could also have a diagnosis of an anxiety disorder, or historical substance/alcohol dependence that was restricted to a depressive episode. Exclusion criteria for depressed participants included the use of antidepressants within the last month. All participants provided written informed consent and were compensated £30 for participation, as well as an additional £0–20 depending on task performance.

Procedure

All participants were initially contacted over the telephone (depressed participants were contacted after a referral from the Camden and Islington NHS Foundation Trust Psychological Therapy Services, while non-depressed participants responded to the advert). At this point, participants were questioned to determine whether they had ever experienced any symptoms of a psychiatric disorder. Importantly, the specifics of such symptoms or disorders were not discussed at this stage; detailed information pertaining to this was to be obtained in-person via administration of the MINI interview, as instructed by the London – Queen Square Research Ethics Committee. However, individuals who at this stage endorsed previously or currently experiencing such symptoms/disorders were not invited to attend the testing session. The testing session took place at the Institute of Cognitive Neuroscience, University College London. Participants completed one testing session each, in which they initially underwent full screening to determine eligibility (via administration of the MINI), and then completed a battery of questionnaires before being trained on and performing the sequential decision-making task.

Questionnaire measures

The Beck Depression Inventory (BDI; Beck, Steer, & Brown, Reference Beck, Steer and Brown1996) was administered to quantify the severity of depression. This self-report questionnaire consists of 21 items, each of which is scored on a 0–3-point scale. A total score of 0–9 indicates minimal depression, while total scores of 10–18, 19–29 and 30–63 indicate ‘mild’, ‘moderate’ and ‘severe’ depression, respectively.

The State/Trait Anxiety Inventory (STAI; Speilberger, Gorsuch, Lushene, Vagg, & Jacobs, Reference Speilberger, Gorsuch, Lushene, Vagg and Jacobs1983) is a 40-item self-rating anxiety measure. Participants score each item as either 1 (‘do not agree at all’), 2 (‘agree somewhat’), 3 (‘agree moderately’) or 4 (‘very much agree’). Scores from questions 1–20 and 21–40 are then separately summed to respectively determine state and trait anxiety.

The Wechsler Test of Adult Reading (WTAR; Wechsler, Reference Wechsler2001) was used to quantify verbal IQ. Participants were required to read a list of 50 increasingly-uncommon words, and received one point for each correct pronunciation.

Decision-making task

This task is described in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), and is presented in Fig. 1. Participants were required to initially complete a training phase, during which they learned how to transition throughout a matrix of six states by referring to the schematic of the transition matrix presented in Fig. 1a. Importantly, as in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), participants were only allowed to proceed to the task phase after demonstrating successful learning of this transition matrix by completing a test without the aid of the schematic.

The task phase began with a further, shorter, training phase designed to teach participants the deterministic financial outcomes associated with each transition. Participants were not presented with a schematic of the action-reward matrix (see Fig. 1b), but learned via trial and error. To help them, the values of the deterministic financial outcomes associated with each transition out of a state were depicted symbolically below each state (but without being identified with the choice options ‘U’ or ‘I’), both during this final training phase and throughout the entire task; ‘++’ denotes a £1.40 gain, ‘+’ denotes a 20 pence gain, ‘--’ denotes a £1.40 loss, and ‘-’ denotes a 20 pence loss. Upon completion of this final training, participants completed 48 trials of the task, each of varying length (2–8 moves). On each trial, participants began in a random state and were instructed to complete a sequence of transitions of a pre-specified length (2–8 moves) to maximize financial gain. On 50% of the trials, transitions were made immediately after each key press, followed by the presentation of the financial outcome for that transition. On the remaining trials (termed ‘plan-ahead’ trials), participants were instructed to plan ahead the remaining (2–4) moves and complete the full sequence of transitions; the transitions and resultant financial outcomes were only presented after the final key press had been made. A schematic of the decision-tree when starting in state 2 can be seen in Fig. 2a.

Model-based statistical analyses

As in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012) the first 24 of the 48 trials were considered an extension of the reward matrix training, and data from these trials were not analysed. However, we also performed an analysis of data from all 48 trials; whilst doing so did not change the overall significance (or lack thereof) of our findings, these are reported in the online Supplementary Materials. A set of eight increasingly complex models was fit to the data using a Bayesian model comparison approach; these models are fully defined in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012). Briefly, each successive model had an extra parameter to explain the data, and was assessed according to its Bayesian Information Criterion (BICint) which is based on the likelihood that the model can accurately explain the data and penalizes the model for its extra complexity.

The first model was a simple ‘Lookahead’ model, which assumed that subjects evaluate the entire decision-tree to choose the optimal sequence of transitions. That is, for a trial of length d, this model assumed that participants considered all 2d possible sequences of transitions and chose the financially most beneficial sequence. Specifically, the Q-value of each action (a) in the present state (s) was given by the sum of the immediate reward R(a,s) and the value of the optimal action from the next state s' = T(a,s):

This equation is iterated until the end of the tree has been reached. Because a search of the entire tree is unlikely for depths >3 due to the large computational demands, more complex models were fit to the data which allowed for testing of hypotheses pertaining to pruning. The first of these, termed the ‘Discount’ model, built upon the previous model by including a ‘discount’ factor that assumed participants exhibit a general tendency to fail to evaluate all 2d (i.e. up to 28 = 256) sequences. Specifically, this model assumed that evaluation stopped at any stage along a path with probability γ. This is equivalent to the standard model of exponential discounting in economics, and implies that the deeper into the tree an outcome, the less likely it is to be included in the calculation:

where, at each step, the next transition is weighted by the probability (1–γ) that is encountered.

The next model, termed the ‘Pruning’ model, is central to this study's hypotheses. This model splits the above γ parameter that quantifies the tendency to stop a tree-search into two separate parameters. The first of these is a ‘general pruning’ parameter (γG) that quantifies the proportion of trials on which tree searches were curtailed due to a general failure to look ahead (identical to the ‘discount’ parameter in the previous model). The second is termed a ‘specific pruning’ parameter (γS) that quantifies the proportion of trials on which the tree search was stopped specifically when the next transition would incur a large loss (see Fig. 2b for an example):

The next model, termed the ‘Pruning and Pavlovian’ model, accounted for ‘Learned Pavlovian’ attraction/repulsion to states that are associated with future financial rewards that are not achievable because too few moves remain to obtain them. Specifically, it accounted for such learning due to the addition of a second state-action value which depends on the long-term average value of the states, which is itself learned by standard temporal difference learning after multiple exposures: ←

where V is the value that is learned by standard temporal difference learning:

where $V( {s{\rm^{\prime}}} )$![]() is set to zero at the final transition.

is set to zero at the final transition.

Finally, to distinguish the effect of pruning from the effect of loss aversion (i.e. the notion that a loss of a given amount is more aversive than a reward of the same amount is appetitive), we replicated the above four models but relaxed how they treated the different outcomes. In the original model, preferences for financial outcomes were assumed to be proportional (e.g. a loss of £1.40 was assumed to exactly cancel out a gain of £1.40). In the new models, we fitted separate parameters for each of the financial outcomes, so that individuals could weight outcomes in a non-proportional manner. These four models are termed ‘rho’ (i.e. ‘Lookahead rho’, ‘Discount rho’, ‘Pruning rho’ and ‘Pruning and Pavlovian rho’), with each having three additional parameters (a parameter for each outcome, but no overall scaling parameter as in the original models). In principle, this allowed participants to be attracted to a reward and repelled from a loss, and vice versa. If pruning is observable above and beyond an individual's simple preferences for rewards and losses, the differential sensitivities to rewards and punishments cannot, by themselves, account for the pruning effects in the above four (i.e. non-‘rho’) models.

Group comparisons and psychometric correlation analyses

Once the best-fitting model was identified, its parameter estimates were extracted and compared between groups. Frequentist analyses were performed using the Statistical Package for Social Scientists version 26 (SPSS Inc., Chicago, Illinois, USA). Bayesian analyses were also performed using JASP [JASP Team (2019), version 0.11.1] because they provide Bayes Factors, which depict a ratio of the probability of the evidence for one hypothesis (i.e. the null) relative to another (i.e. the experimental). Comparing evidence in this way allows one to demonstrate support for the null hypothesis, as opposed to simply failing to reject the null as when using frequentist approaches (Wetzels et al., Reference Wetzels, Matzke, Lee, Rouder, Iverson and Wagenmakers2011).

To determine the effects of depression status on parameter estimates from the most parsimonious model, frequentist and Bayesian independent samples t tests were performed, with the relevant parameter estimate added as the dependent variable. To examine relationships between parameter estimates and psychometric questionnaire data, frequentist and Bayesian bivariate correlation analyses were performed.

For the frequentist analyses, a significance threshold of α = 0.05 (two-tailed) was adopted. For the Bayesian analyses, on the basis of Jeffreys (Reference Jeffreys1961), we considered Bayes Factors (BF 10; NB: not logarithmically transformed) smaller than 1/100 to be extreme evidence for the null hypothesis, a BF 10 between 1/100 and 1/30 to be very strong evidence for the null, a BF 10 between 1/30 and 1/10 to be strong evidence for the null, a BF 10 between 1/10 and 1/3 to be moderate evidence for the null, and a BF 10 between 1/3 and 1 to be not worth more than a bare mention. Conversely, we considered BF 10 larger than 100 to be extreme evidence for the experimental hypothesis, a BF 10 between 100 and 30 to be very strong evidence for the experimental hypothesis, a BF 10 between 30 and 10 to be strong evidence for the experimental hypothesis, a BF 10 between 10 and 3 to be moderate evidence for the experimental hypothesis, and a BF 10 between 3 and 1 to be not worth more than a bare mention.

Results

Participant characteristics

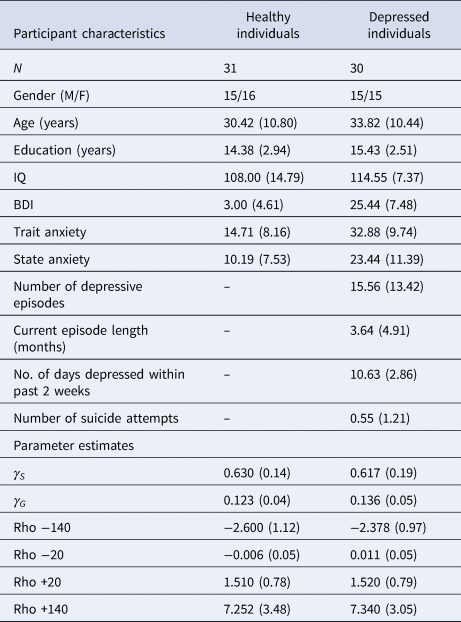

Compared to healthy controls, depressed participants self-reported higher depression scores on the BDI [t(59) = 13.779; p < 0.001, BF 10 = 1.11×10+16], greater trait anxiety on the STAI [t(59) = −7.601; p < 0.001, BF 10 = 1.672×10+7] and greater state anxiety on the STAI [t(59) = −5.219; p < 0.001, BF 10 = 4987.46]. Frequentist t tests failed to reject the null hypothesis that depressed and healthy individuals did not differ in terms of age, years of education or IQ, although Bayesian analyses failed to provide support for or against the null hypothesis that these two groups did not differ in these characteristics; [age: t(59) = 1.227; p = 0.225, BF 10 = 0.496; years of education: t(59) = 1.491; p = 0.141, BF 10 = 0.660; IQ: t(59) = 1.780; p = 0.083, BF 10 = 1.058]. A full description of participant characteristics is presented in Table 1.

Table 1. Participant characteristics and parameter estimates from the winning pruning ‘rho’ model

All values expressed as means (s.d.), except for no. of subjects (N) and gender.

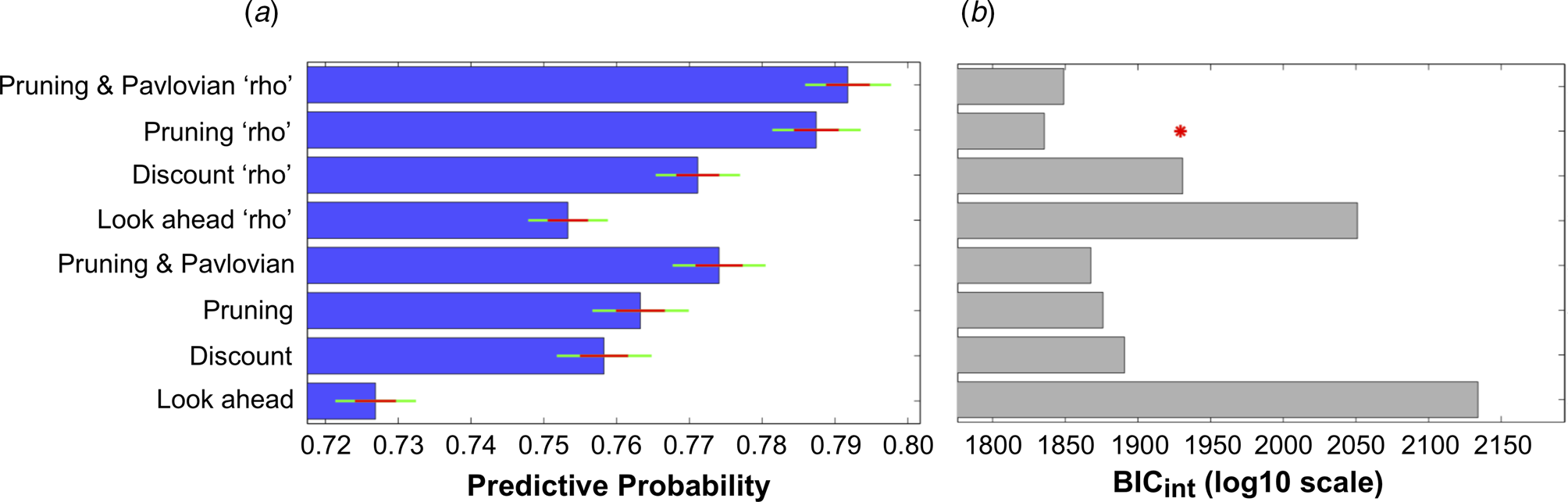

Computational analyses

The ability of all eight models to explain participants' choices can be seen in Fig. 3. The inclusion of each extra parameter improved the predictive probabilities of the models, while the four models that incorporated the ‘rho’ parameter were all able to predict a higher proportion of participants' choices than the corresponding models that did not include this parameter (Fig. 3a). Importantly, the Pruning ‘rho’ model outperformed all others due to it achieving the lowest BICint score (Fig. 3b). As expected, the most complex model, the Pruning and Pavlovian ‘rho’ model, achieves the highest predictive probability (i.e. it is able to accurately predict the highest proportion of participants' choices, as shown in Fig. 3a). However, it is penalized for its added complexity (Fig. 3b). This means that the Pruning ‘rho’ model is considered the most parsimonious, and therefore the winning, model.

Fig. 3. (a) Mean predictive probabilities for all models. All models that include the ‘rho’ parameter fit the data better than the corresponding models that do not contain this parameter. (b) Model comparisons using each model's Bayesian Information Criterion (BICint). Despite the fact that the model that predicts the highest proportion of participants' choices is the ‘Pruning and Pavlovian’ model that contains the ‘rho’ parameter, this model is penalized due to its added complexity. The most parsimonious (i.e. ‘winning’) model is therefore the ‘Pruning’ model that includes the extra ‘rho’ parameter.

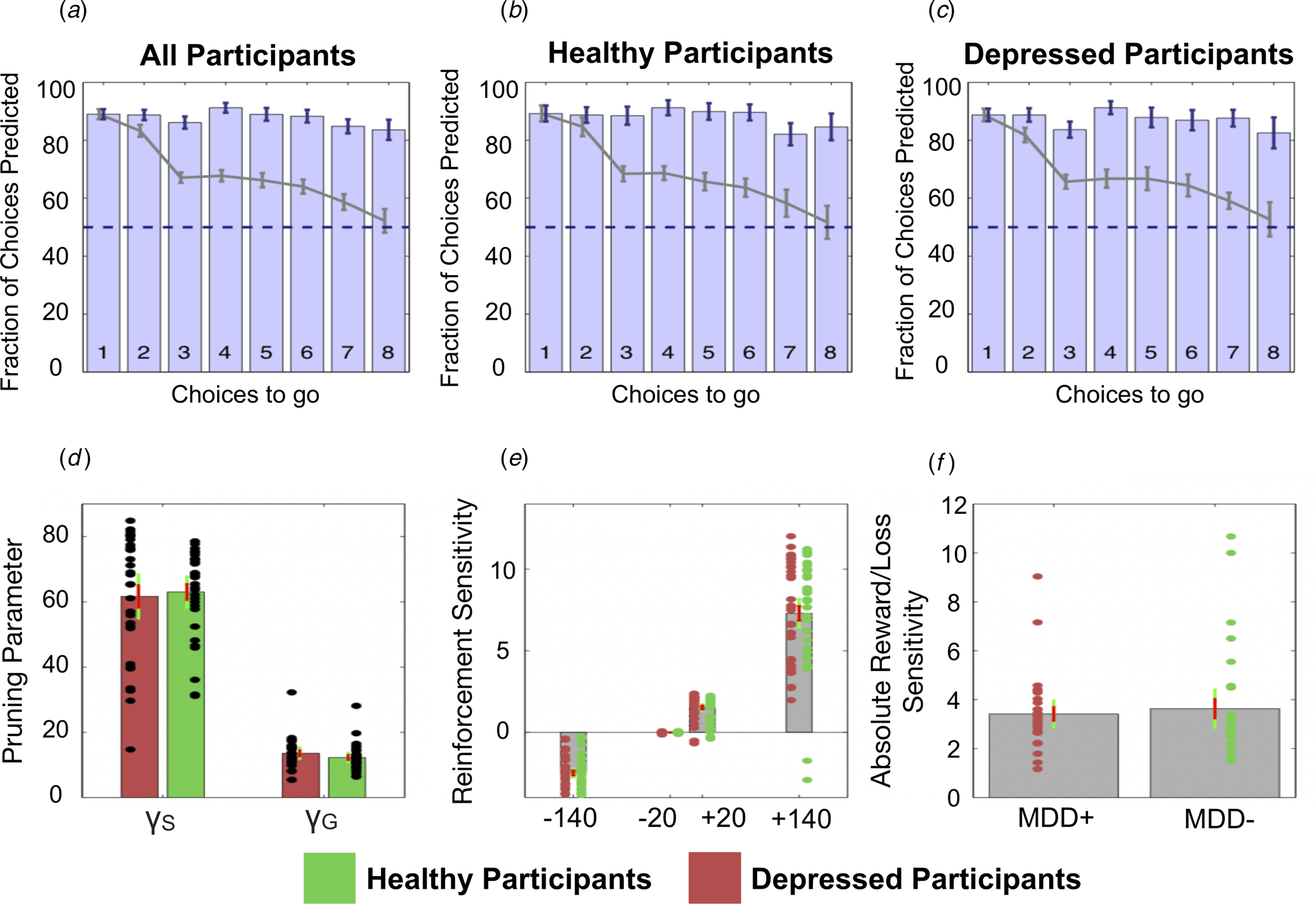

Specifically, the winning Pruning ‘rho’ model included both γS and γG parameters, which suggests that loss-specific pruning had a robust influence on behaviour. The fraction of choices that was correctly predicted by this winning model can be seen in Fig. 4a–c. Because this Pruning ‘rho’ model outperforms all others, the γS and γG parameter values, as well as the reward sensitivities to each of the four transition types, were extracted from this model and compared between depressed and healthy participants.

Fig. 4. Top: The fraction of choices correctly predicted by the best-fitting model (the Pruning ‘rho’ model). (a) All participants combined. (b) Healthy participants only. (c) Depressed participants only. Each bar depicts this as a function of the number of choices remaining on each trial. For example, the right most bar (i.e. bar ‘8’) depicts the fraction of choices at a depth of 1 on eight-choice trials that were correctly predicted by this model; the third rightmost bar (i.e. bar ‘6’) depicts both the fraction of choices that were correctly predicted by this model at (1) a depth of 1 on six-choice trials, (2) a depth of 2 on seven-choice trials and (3) a depth of 3 on eight-choice trials, and so on. Grey lines depict the full ‘Lookahead’ model. The blue dashed lines depict chance (i.e. 50%). The winning model correctly predicts choices of both depressed participants and healthy controls to roughly the same extent. Further, the full Lookahead model is only able to correctly predict decisions that are eight choices away in the sequence on roughly 50% of trials (i.e. at chance level). The winning model correctly predicts all choices to roughly the same extent, no matter how many choices are remaining. Note that these models include data from, and disregard differences between, trials in which transitions were displayed immediately after each button press and trials in which participants had to enter the entire sequence of transitions at once (i.e. so-called ‘plan-ahead’ trials.). Bottom: Parameters of the winning Pruning ‘rho’ model. (d) Specific and general pruning parameters. (e) Reinforcement sensitivity to each transition type. (f) Absolute ratio of reward (+140) to loss (−140) sensitivity. Red denotes depressed participants, green denotes healthy participants. Error bars denote 1 standard deviation above/below the mean (red) and 95% confidence intervals (green).

Group comparisons

Frequentist and Bayesian analyses indicated that depressed and healthy individuals did not differ in terms of total money won on the task [t(59) = 0.345; p = 0.731, BF 10 = 0.274]. Further, depressed and healthy individuals did not differ in terms of γS [t(59) = 0.320; p = 0.750, BF 10 = 0.272]. However, while the frequentist analysis indicated that depressed and healthy individuals did not differ in terms of γG either, the Bayesian analysis failed to provide support for or against there being a group difference in this variable: [t(59) = −1.123; p = 0.266, BF 10 = 0.442]. These data can be seen in Fig. 4d. There were no differences between the groups in terms of reward sensitivities for the +140 transitions [t(59) = −0.105; p = 0.917, BF 10 = 0.262], +20 transitions [t(59) = −0.073; p = 0.942, BF 10 = 0.261] or the −20 transitions [t(59) = 0.459; p = 0.648, BF 10 = 0.285]. Again, while a frequentist analysis indicated that depressed and healthy individuals did not differ in their sensitivity to the −140 transitions, the results of the Bayesian analysis narrowly missed out on providing support for the null hypothesis that these two groups did not differ in this variable [t(59) = −0.831; p = 0.409, BF 10 = 0.348]. These data can be seen in Fig. 4e.

In depressed participants, BDI scores did not correlate with γS (r = 0.068; p = 0.748, BF 10 = 0.261), γG (r = −0.083; p = 0.693, BF 10 = 0.267), or reward sensitivities to the +140 transitions (r = 0.038; p = 0.857, BF 10 = 0.252) or the −140 transitions (r = −0.137; p = 0.514, BF 10 = 0.304). Further, frequentist analyses indicated that BDI scores also did not correlate with the +20 transitions or −20 transitions, although the Bayesian analyses did not provide support for or against the null hypothesis that BDI scores did not correlate with the sensitivity to these two transition types (+20 transitions: r = −0.226; p = 0.276, BF 10 = 0.435; −20 transitions: r = 0.261; p = 0.207, BF 10 = 0.528).

In addition, in depressed participants, trait anxiety scores did not correlate with γS (r = 0.083; p = 0.694, BF 10 = 0.267), γG (r = 0.084; p = 0.688, BF 10 = 0.268), or reward sensitivities to the +140 transitions (r = 0.156; p = 0.457, BF 10 = 0.323), the +20 transitions (r = 0.309; p = 0.133, BF 10 = 0.724), the −20 transitions (r = 0.066; p = 0.755, BF 10 = 0.260) or −140 transitions (r = −0.070; p = 0.740, BF 10 = 0.261).

Finally, both frequentist and Bayesian analyses indicated that state anxiety scores did not correlate with γS (r = −0.092; p = 0.662, BF 10 = 0.272) in depressed participants. However, while the frequentist analysis indicated that state anxiety did not correlate with γG, results of the Bayesian analysis narrowly missed out on providing support for there being no relationship between these two variables (r = −0.177; p = 0.397, BF 10 = 0.349). Both frequentist and Bayesian analyses indicated that state anxiety was not related to sensitivities to the +140 transitions (r = −0.048; p = 0.820, BF 10 = 0.254), +20 transitions (r = −0.013; p = 0.950, BF 10 = 0.249), −20 transitions (r = −0.004; BF 10 = 0.248, p = 0.985) or −140 transitions (r = 0.068; p = 0.745, BF 10 = 0.261).

Discussion

We previously showed that healthy individuals prune decision trees to render complex sequential decisions manageable. Here, we tested the hypothesis that depressed individuals are less able to optimally use this heuristic, and that this inability may be related to their severity of depression. However, contrary to predictions, depressed and healthy individuals in this study did not differ in their pruning behaviours.

The finding that participants pruned branches of decision trees that began with a large loss, regardless of the potential utility of that branch, replicates our previous work (Huys et al., Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012, Reference Huys, Lally, Faulkner, Eshel, Seifritz, Gershman and Roiser2015b). The most parsimonious model in the current study was the same as the ‘winning’ model in Lally et al. (Reference Lally, Huys, Eshel, Faulkner, Dayan and Roiser2017). However, the most parsimonious model in our original study (Huys et al., Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012) included a Pavlovian parameter which indicated that participants had a reflexive attraction/aversion to certain states, whereas including this Pavlovian parameter weakened model parsimony in the current study, meaning that participants did not display strong attractions/aversions to specific states in this dataset.

The addition of four separate parameters to the model (one for each of the four financial outcomes) allowed for the possibility that there was a difference between how participants weighted gains and losses. This is important to avoid confusing pruning with loss aversion. Replicating the findings of Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), we found that these ‘rho’ parameters indeed improved the predictive probability of the models. However, as for the healthy individuals in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), the current participants did not exhibit typical loss aversion. Instead, the large gain (+140) was roughly three times more appetitive than the large loss (−140) was aversive. Interestingly, sensitivity to −140 transition types was found to be significantly weaker, while sensitivity to the +140 transitions was significantly greater, in the ‘winning’ (Pruning ‘rho’) model than in the model that did not quantify participants' pruning behaviours (i.e. the ‘lookahead’ model; see online Supplementary Materials). Taken together, these results suggest that loss aversion certainly fails to explain away pruning, although pruning may uncover a form of risk seeking.

Importantly, the current findings failed to support our hypotheses that (a) depressed individuals sub-optimally prune decision trees, and that (b) in depressed individuals, those with the highest levels of depression would demonstrate the lowest pruning. Our latter hypothesis was based partly on the results of Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), which indicated a relationship between pruning and level of depression. However, it must be noted that the specific relationship reported in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012) was a significant positive correlation between specific pruning and sub-clinical depression scores on the BDI in healthy participants, not depressed individuals. Further, this relationship was also not replicated by our subsequent studies (i.e. Huys et al., Reference Huys, Lally, Faulkner, Eshel, Seifritz, Gershman and Roiser2015b). While it currently appears that no relationship between pruning and magnitude of depression exists in depressed individuals who share similar characteristics to those who participated in the current study, future research should attempt to determine the replicability of the initial finding of a relationship between pruning and sub-clinical depression in healthy individuals. Further, it is unlikely that we failed to observe sub-optimal pruning in the current depressed individuals because the current healthy participants also pruned sub-optimally, because the latter demonstrated specific pruning to a very similar magnitude as the healthy participants included in Lally et al. (Reference Lally, Huys, Eshel, Faulkner, Dayan and Roiser2017) (pruning parameter estimate = ~0.6), and they actually pruned slightly more than those in Huys et al. (Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012). While this does not explain why the current results do not support the theory put forward by Dayan and Huys (Reference Dayan and Huys2008), there may be a number of factors that do.

First, levels of depression in our participants may not have been great enough to promote sub-optimal pruning. While the current depressed participants exhibited similar levels of depression to those in studies that report maladaptive decision-making in depression (Joormann & Gotlib, Reference Joormann and Gotlib2008; Kumar et al., Reference Kumar, Goer, Murray, Dillon, Beltzer, Cohen and Pizzagalli2018; McFarland & Klein, Reference McFarland and Klein2009; Ubl et al., Reference Ubl, Kuehner, Kirsch, Ruttorf, Diener and Flor2015), they were all undergoing ‘low-intensity treatments’ due to being deemed to exhibit mild/intermediate levels of depression. Indeed, this may be one reason as to why our depressed patients failed to exhibit greater sensitivity to losses than healthy participants, or indeed loss aversion at all, as highly depressed patients (Baek et al., Reference Baek, Kwon, Chae, Chung, Kralik, Min and Jeong2017; with mean BDI = 30.10) exhibit heightened aversion to losses, while patients with lower levels of depression do not (Charpentier, Aylward, Roiser, & Robinson, Reference Charpentier, Aylward, Roiser and Robinson2017; mean BDI = 16.96). Future studies could therefore examine the pruning behaviours of more severely depressed participants.

Second, Pavlovian pruning of decision trees has been hypothesized to depend on the brain's serotonin system (Dayan & Huys, Reference Dayan and Huys2008). Specifically, reductions in central serotonin are proposed to result in a decrease in Pavlovian behavioural inhibition, increasing the choosing of options that result in negative outcomes due to decreases in pruning (Dayan & Huys, Reference Dayan and Huys2008). Because serotonin is considered to influence behavioural inhibition in response to losses (Cools et al., Reference Cools, Nakamura and Daw2011; Crockett et al., Reference Crockett, Clark and Robbins2009), and because depression is associated with dysfunction in a number of neurotransmitter systems including the serotonin system (Anderson, Reference Anderson2000; Cannon et al., Reference Cannon, Ichise, Rollis, Klaver, Gandhi, Charney and Drevents2007; Parsey et al., Reference Parsey, Oquendo, Ogden, Olvet, Simpson, Huang and Mann2003), it has been argued that depressed participants may exhibit maladaptive pruning due to serotonergic dysfunction (e.g. Dayan & Huys, Reference Dayan and Huys2008; Huys et al. Reference Huys, Daw and Dayan2015a). However, there is no way of knowing whether the current depressed participants exhibit serotonergic dysfunction because no neurochemical measures were collected. Further, depression has been associated with altered dopaminergic functioning (Nestler & Carlezon, Reference Nestler and Carlezon2006), and dopamine is thought to influence decision-making in an opponent fashion to serotonin (Boureau & Dayan, Reference Boureau and Dayan2010; Daw, Kakade, & Dayan, Reference Daw, Kakade and Dayan2002; Dayan & Huys, Reference Dayan and Huys2009). For example, reductions in serotonin via acute tryptophan depletion can enhance the motivational influence of aversive stimuli on instrumental responding, while reductions in dopamine can diminish the influence of appetitive stimuli on such responding (Hebart & Gläscher, Reference Hebart and Gläscher2014). To truly determine the influence of serotonergic function on decision-tree pruning, future studies may consider examining the effects of a serotonin challenge such as acute tryptophan depletion on performance on this task.

Third, while no group difference was observed in task performance, this does not mean that there are no group differences in the brain regions that are recruited during aversive pruning. We have recently shown that aversive pruning recruits the pregenual anterior cingulate cortex and subgenual anterior cingulate cortex (sgACC) (Lally et al., Reference Lally, Huys, Eshel, Faulkner, Dayan and Roiser2017). Interestingly, the sgACC is overactive in depression (Drevets, Savitz, & Trimble, Reference Drevets, Savitz and Trimble2008; Drevets et al., Reference Drevets, Price, Simpson, Todd, Reich, Vannier and Raichle1997; Mayberg et al., Reference Mayberg, Brannan, Mahurin, Jerabek, Brickman, Tekell and Fox1997), while the degree of sgACC reactivity to negatively-valenced stimuli can predict treatment response in depressed patients (Roiser, Elliott, & Sahakian, Reference Roiser, Elliott and Sahakian2012). In addition, depression-related reductions in serotonin 1A receptor availability are greatest in the sgACC (Moses-Kolko et al., Reference Moses-Kolko, Wsiner, Price, Berga, Drevets, Hanusa and Meltzer2008). Therefore, comparing the neural mechanisms of pruning in depressed and healthy individuals may reveal group differences in pruning-related sgACC function.

While the above factors may explain why the current results do not support the theory put forward by Dayan and Huys (Reference Dayan and Huys2008), the fact remains that on the basis of the current findings, it may simply be that depressed individuals may not experience or exhibit maladaptive pruning behaviours during multi-step planning, and that sub-optimal pruning may not promote depressive behaviours. However, pruning is only one heuristic that people use to render complex, sequential decisions manageable. Specifically, healthy participants solve problems by fragmenting deep sequences (i.e. sequences with a depth >3) into sub-sequences of shorter lengths (termed ‘fragmenting’), and recall and re-use previous fragmented solutions on subsequent trials (termed ‘memoization’), rather than always searching the tree anew each time (Huys et al., Reference Huys, Lally, Faulkner, Eshel, Seifritz, Gershman and Roiser2015b). Unlike the case for pruning (Dayan & Huys, Reference Dayan and Huys2008; Huys et al., Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), neither theoretical nor empirical studies have suggested that altered use of fragmenting or memoization during planning may promote depression. However, future studies might compare the use of these two heuristics, along with the use of pruning, in highly-depressed and healthy individuals.

Our study has several limitations. First, the sample size was relatively limited, which reduced our ability to detect small effects, or to determine the effects of individual differences on task performance; this could be particularly pertinent as Huys et al. (Reference Huys, Lally, Faulkner, Eshel, Seifritz, Gershman and Roiser2015b) report that individuals use certain heuristics to solve planning problems in an idiosyncratic fashion. Another potential limitation is the fact that our healthy and depressed individuals may have differed in age, years of education and IQ. While frequentist analyses found no evidence that these two groups differed in such characteristics, Bayesian analyses provided, at best, only anecdotal evidence that these two groups did not differ in this way. Whilst there were no relationships between any of these characteristics and task performance (see online Supplementary Materials), it is therefore possible, although unlikely, that our sampling method may have introduced extraneous variables into our dataset that influenced findings. A further potential limitation is that we did not investigate whether pruning abilities differed as a function of specific clinical depression sub-type, such as anhedonic v. non-anhedonic forms of depression. However, we did quantify self-reported anhedonia using one item of the BDI, and examined whether it related to pruning behaviours (see online Supplementary Materials). Relationships between anhedonia and sensitivity to each of the +140, +20 and −140 transition types were observed, suggesting that patients with higher anhedonia were less sensitive to both rewards and punishments, although these results remain preliminary due to our sample size. However, no relationships with pruning were detected. Future studies should determine the association between specific symptoms of depression and pruning behaviours in larger samples of depressed participants. Further, while we have reported that pruning is insensitive to the magnitude of the large loss (Huys et al., Reference Huys, Eshel, O'Nions, Sheridan, Dayan and Roiser2012), pruning becomes mathematically more disadvantageous as the magnitude of the large loss decreases (relative to the magnitude of the large reward). However, the current data do not indicate whether depressed individuals prune sup-optimally when pruning is more disadvantageous (i.e. when the large loss costs 70 points rather than 140), or whether overpruning in these circumstances can promote depression. Finally, our calculated reward sensitivities in Fig. 4e indicate that, once pruning is taken into account, participants are three times more ‘sensitive’ to the large reward than to the large loss. However, pruning and risk seeking are rather entangled in the current task, and it would be interesting to combine it with a compatible, but independent measure of risk seeking.

In summary, we replicated previous findings that people prune decision trees to solve complex planning problems. However, we failed to provide support for the hypothesis that depressed individuals prune sub-optimally. Future research is needed to achieve a more complete understanding of whether misuse of certain heuristics in sequential decision-making can contribute to depression.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S0033291721000799.

Financial support

This work was supported by a Medical Research Council Ph.D. Studentship awarded to Dr Paul Faulkner. Professor Peter Dayan was funded by the Gatsby Charitable Foundation, the Max Planck Society and the Alexander von Humboldt Foundation. The funders had no role in the study design, data collection or analysis.

Conflict of interest

None.

Ethical standards

The authors assert that all procedures contributing to this work comply with the ethical standards of the relevant national and institutional committees on human experimentation and with the Helsinki Declaration of 1975, as revised in 2008.