1. Introduction

Under the classical risk model, a compound Poisson process is used to model aggregate claims. In the actuarial literature, it is common to employ a homogeneous Poisson process as the counting process for claim arrivals. It is noteworthy that this is an equi-dispersed process. Moreover, the classical ruin model is meant for single-claim occurrences. In reality, more often than not, insurers receive several claims at a time. For example, dental, medical and car insurance policies yield frequent claims that arrive several at a time. Albrecher et al. [Reference Albrecher, Araujo-Acuna and Beirlant1] provide an example of housing claims resulting from fires. It has been commonly suggested by researchers to combine simultaneously arriving claims into single amounts. Unfortunately, such an approach poses modeling difficulties as these augmented claims become heavy-tailed. Instead, in this paper, we discuss another way of looking at the classical risk model where the claim-counting process is a compound Poisson process. This way allows for simultaneous claim occurrences while considering each claim as a single amount instead of amalgamating it into a larger claim. There are studies on this topic already. For instance, the Pólya-Aeppli process proposed by Minkova [Reference Minkova8] is obtained by compounding a homogeneous Poisson process with a zero-truncated geometric process. Sendova and Minkova [Reference Sendova and Minkova9] propose the Poisson-Logarithmic process, where the compounded distribution is logarithmic and the compounding distribution is Poisson. Li and Sendova [Reference Li and Sendova6] introduce a surplus processes involving a Poisson-Negative-Binomial or a Poisson-Binomial counting process. To deduce specific expressions, exponential or Erlang claim amounts are assumed. As noted in Remark 2.1 in Li and Sendova [Reference Li and Sendova6], any compound Poisson counting process is an over-dispersed process. Finally, there are studies of more general claim-counting processes than the compound Poisson one. The drawback there is that fewer quantities of interest in ruin theory may be deduced. For example, Sendova and Minkova [Reference Sendova and Minkova10] propose a non-homogeneous compound-birth process to be employed for modeling claim counts. The probability-generating function (p.g.f.) of the claim-counting process is obtained in a fairly general setting.

In this paper, we focus on the Gerber-Shiu function that was first introduced in Gerber and Shiu [Reference Gerber and Shiu5] to evaluate the discounted penalty at ruin. This function was very soon explored in the actuarial literature to deduce several quantities, which are the function's special cases and, at the same time, may be interpreted as risk measures of an insurer's business. Examples include the density of the time to ruin (see Dickson and Willmot [Reference Dickson and Willmot3]), the joint moments of the time of ruin, the surplus before ruin and the deficit at ruin (see Lin and Willmot [Reference Lin and Willmot7]), the marginal moments of the time of ruin where the general solution is given by Willmot [Reference Willmot13] and is applied in the case of phase-type claims by Drekic and Willmot [Reference Drekic and Willmot4], and several others.

Our work here shows that when the Laplace transform of the probability density function (p.d.f.) of the batch-claim amounts is in the ![]() $R_n$ class of distributions, the ultimate ruin probability may be expressed explicitly. Subsequently, we are able to provide explicit expressions of some ruin-related quantities in terms of the ultimate ruin probability. These are the marginal moments of the time of ruin and the proper joint density of the surplus before ruin and the deficit at ruin. Therefore, in this paper, we consider applications for three kinds of classical compound Poisson models where the counting process is a compound Poisson process with a compounded distribution that is a zero-truncated geometric or zero-truncated negative-binomial or zero-truncated binomial distribution. Under these three models, the batch-claim numbers all have rational Laplace transforms. Moreover, the batch claims can either accommodate both over-dispersed and under-dispersed data (zero-truncated geometric distribution and zero-truncated negative-binomial distribution), or only accommodate under-dispersed data (zero-truncated binomial distribution), while the resulting compound Poisson process is always over-dispersed.

$R_n$ class of distributions, the ultimate ruin probability may be expressed explicitly. Subsequently, we are able to provide explicit expressions of some ruin-related quantities in terms of the ultimate ruin probability. These are the marginal moments of the time of ruin and the proper joint density of the surplus before ruin and the deficit at ruin. Therefore, in this paper, we consider applications for three kinds of classical compound Poisson models where the counting process is a compound Poisson process with a compounded distribution that is a zero-truncated geometric or zero-truncated negative-binomial or zero-truncated binomial distribution. Under these three models, the batch-claim numbers all have rational Laplace transforms. Moreover, the batch claims can either accommodate both over-dispersed and under-dispersed data (zero-truncated geometric distribution and zero-truncated negative-binomial distribution), or only accommodate under-dispersed data (zero-truncated binomial distribution), while the resulting compound Poisson process is always over-dispersed.

With respect to the batch arrivals, we further discuss the special cases of exponential and of Erlang claim sizes for illustration purposes. We derive specific expressions for ruin-related quantities under the resulting compound Poisson models, such as the ultimate ruin probability, marginal moments of the time of ruin, and the proper joint density of the surplus before ruin and the deficit at ruin.

To illustrate our results, we provide numerical examples with claim amounts following an exponential distribution or an Erlang distribution. Graphs of some ruin-related quantities are supplied under our different compound Poisson models. These examples indicate that batch-claim arrivals should be imbedded in the risk model whenever the relevant data implies that claims arrive indeed in batches. Otherwise, all risk quantities would be underestimated. We also noticed that compared with the zero-truncated geometric and the negative-binomial batch arrivals, the binomial-batch arrivals have less effect on the risk quantities. This observation implies that the Poisson-Binomial model may yield less significant modeling improvements compared with the Poisson-Geometric and Poisson-Negative-Binomial models.

Finally, it is of note that the way of accounting for simultaneously arriving claims that we are proposing in this paper may be easily extended to other well-studied models involving compound Poisson aggregate claims. In particular, models involving diffusion, interest earned on the premium, taxation and several others may be extended in a fairly straightforward way. Additionally, given the computational challenges surrounding risk measures in general, deducing explicit expressions as we do in Subsection 2.3 has impact for practitioners.

This paper is organized as follows. In Section 2, we list relevant definitions and properties under the classical compound Poisson model. Then, in Section 3, we consider applications involving the Poisson-Geometric, Poisson-Negative-Binomial and Poisson-Binomial counting processes. Finally, in Section 4, numerical examples are discussed.

2. Preliminaries

In this section, we recall the classical compound Poisson model and some relevant definitions as well as theorems we need further in the paper.

2.1. Relevant results

Now, we recall the definitions of the Laplace transform and the translation transform:

Definition 1 The Laplace transform of a real-valued integrable function ![]() $\varphi (y), \ y\geq 0,$ is defined as

$\varphi (y), \ y\geq 0,$ is defined as

Definition 2 The translation operator ![]() $T_s$ on a function

$T_s$ on a function ![]() $\varphi$ is defined by

$\varphi$ is defined by

Properties of the Laplace transform may be found in Chapter 1 of Spiegel [Reference Spiegel12].

2.2. The compound Poisson claim-counting process

Definition 3 We introduce the counting process ![]() $\{N(t), t\geq 0\}$ as follows:

$\{N(t), t\geq 0\}$ as follows:

where ![]() $\{M(t), t\geq 0\}$ is a homogeneous Poisson process with intensity parameter

$\{M(t), t\geq 0\}$ is a homogeneous Poisson process with intensity parameter ![]() $\lambda >0$ and probability mass function (p.m.f.) given by

$\lambda >0$ and probability mass function (p.m.f.) given by

![]() $\{X_1,X_2,\ldots \}$ are independent and identically distributed (i.i.d.) discrete random variables, which have the same p.m.f.

$\{X_1,X_2,\ldots \}$ are independent and identically distributed (i.i.d.) discrete random variables, which have the same p.m.f. ![]() $p_n,\ n=1,2,\ldots,$ as a generic random variable (r.v.)

$p_n,\ n=1,2,\ldots,$ as a generic random variable (r.v.) ![]() $X$, and are independent of

$X$, and are independent of ![]() $M(t)$.

$M(t)$.

It is noteworthy that Remark 2.1 in Li and Sendova [Reference Li and Sendova6] states that the process ![]() $N(t)$ is over-dispersed regardless of the distribution of

$N(t)$ is over-dispersed regardless of the distribution of ![]() $X$.

$X$.

Definition 4 The surplus process ![]() $\{U(t), t \geq 0\}$ is given by

$\{U(t), t \geq 0\}$ is given by

\begin{equation} U(t) = u+ct-\sum^{N(t)}_{i=1}{Y_i}, \end{equation}

\begin{equation} U(t) = u+ct-\sum^{N(t)}_{i=1}{Y_i}, \end{equation}where ![]() $u \geq 0$ is the initial surplus and

$u \geq 0$ is the initial surplus and ![]() $c > 0$ is the constant premium rate.

$c > 0$ is the constant premium rate. ![]() $\{Y_1,Y_2,\ldots \}$ are i.i.d. random variables, representing the successive individual claim amounts.

$\{Y_1,Y_2,\ldots \}$ are i.i.d. random variables, representing the successive individual claim amounts. ![]() $\{Y_1,Y_2,\ldots \}$ and

$\{Y_1,Y_2,\ldots \}$ and ![]() $N(t)$ are further assumed to be mutually independent. We also denote by

$N(t)$ are further assumed to be mutually independent. We also denote by ![]() $F$ and

$F$ and ![]() $f$ the cumulative distribution function (c.d.f.) and the p.d.f., respectively, of the associated generic r.v.

$f$ the cumulative distribution function (c.d.f.) and the p.d.f., respectively, of the associated generic r.v. ![]() $Y$.

$Y$.

The surplus process ![]() $U(t)$ is based on the assumption that claims arrive according to a general compound Poisson process. The aggregate losses are then given by

$U(t)$ is based on the assumption that claims arrive according to a general compound Poisson process. The aggregate losses are then given by

$$S(t) = \sum_{i=1}^{N(t)} Y_i,\quad t\geq 0,$$

$$S(t) = \sum_{i=1}^{N(t)} Y_i,\quad t\geq 0,$$where ![]() $S(t)$ is a compound random variable with Laplace transform

$S(t)$ is a compound random variable with Laplace transform

where ![]() $\mathcal {P}_X$ denotes the p.g.f. of

$\mathcal {P}_X$ denotes the p.g.f. of ![]() $X$.

$X$.

In other words, ![]() $S(t)$ may be interpreted as a compound Poisson process with parameter

$S(t)$ may be interpreted as a compound Poisson process with parameter ![]() $\lambda >0$ and compounded distribution having Laplace transform

$\lambda >0$ and compounded distribution having Laplace transform ![]() $\mathcal {P}_X[\tilde {f}(s)]$. Thus, the surplus process

$\mathcal {P}_X[\tilde {f}(s)]$. Thus, the surplus process ![]() $U(t)$ defined in (2.2) may be regarded as a classical Poisson model with claim sizes having the latter Laplace transform. This is the same as having i.i.d. exponential inter-event times with mean

$U(t)$ defined in (2.2) may be regarded as a classical Poisson model with claim sizes having the latter Laplace transform. This is the same as having i.i.d. exponential inter-event times with mean ![]() $1/\lambda$, while each event is a compound r.v. that we will denote by

$1/\lambda$, while each event is a compound r.v. that we will denote by ![]() $Z$. In other words, we have a number of i.i.d. claims occurring at the same time. Therefore, known results under the classical model also apply to the surplus process

$Z$. In other words, we have a number of i.i.d. claims occurring at the same time. Therefore, known results under the classical model also apply to the surplus process ![]() $U(t)$.

$U(t)$.

Let ![]() $F^{*n}(y)$ be the

$F^{*n}(y)$ be the ![]() $n$-fold convolution of

$n$-fold convolution of ![]() $F(y)$ with itself. Define

$F(y)$ with itself. Define ![]() $H(y)$ to be the c.d.f. of the compound r.v.

$H(y)$ to be the c.d.f. of the compound r.v. ![]() $Z$, so that

$Z$, so that

$$H(y) = \sum^{\infty}_{n=1} p_n F^{*n}(y), \quad y\geq 0,$$

$$H(y) = \sum^{\infty}_{n=1} p_n F^{*n}(y), \quad y\geq 0,$$which is the c.d.f. of a batch claim. Subsequently, the p.d.f. and the survival function of ![]() $Z$ are denoted, respectively, by

$Z$ are denoted, respectively, by ![]() $h(y)$ and

$h(y)$ and ![]() $\bar {H}(y)=1-H(y)$.

$\bar {H}(y)=1-H(y)$.

Also, ![]() $\mathbb {E}\{Z\} =\mu \mathbb {E}\{X\},$ where

$\mathbb {E}\{Z\} =\mu \mathbb {E}\{X\},$ where ![]() $\mu = \mathbb {E}\{Y\}$.

$\mu = \mathbb {E}\{Y\}$.

The Laplace transform of the associated p.d.f. is ![]() $\tilde {h}(s) = \mathcal {P}_X[\tilde {f} (s)],$ which is the p.g.f. of

$\tilde {h}(s) = \mathcal {P}_X[\tilde {f} (s)],$ which is the p.g.f. of ![]() $X$ calculated at

$X$ calculated at ![]() $\tilde {f} (s)$.

$\tilde {f} (s)$.

Define the equilibrium tail distribution of ![]() $Z$ as

$Z$ as

Then the associated p.d.f. is

with Laplace transform

We will further assume that the relative security loading ![]() $\theta$ satisfies the following relationship:

$\theta$ satisfies the following relationship:

\begin{align} ct & = (1+\theta) \mathbb{E}\left\{\sum_{i=1}^{N(t)}Y_i\right\} = (1+\theta) \mathbb{E}\{N(t)\}\mathbb{E}\{Y\}\nonumber\\ & = (1+\theta)\lambda t\mu\mathbb{E}\{X\}, \quad t \geq 0, \end{align}

\begin{align} ct & = (1+\theta) \mathbb{E}\left\{\sum_{i=1}^{N(t)}Y_i\right\} = (1+\theta) \mathbb{E}\{N(t)\}\mathbb{E}\{Y\}\nonumber\\ & = (1+\theta)\lambda t\mu\mathbb{E}\{X\}, \quad t \geq 0, \end{align}where ![]() $c$ should satisfy the inequality

$c$ should satisfy the inequality

to make sure ![]() $\theta$ is strictly positive.

$\theta$ is strictly positive.

2.3. Ruin-related quantities

2.3.1. The Gerber-Shiu function

Definition 5 The Gerber-Shiu function is defined by

where ![]() $\delta \geq 0$ is a discount factor,

$\delta \geq 0$ is a discount factor, ![]() $\tau = \inf \{t\geq 0 : U(t) <0\}$ is the time to ruin,

$\tau = \inf \{t\geq 0 : U(t) <0\}$ is the time to ruin, ![]() $\omega (x, y)$,

$\omega (x, y)$, ![]() $x \geq 0$,

$x \geq 0$, ![]() $y>0$, is a penalty function,

$y>0$, is a penalty function, ![]() $U(\tau -)$ is the surplus before ruin,

$U(\tau -)$ is the surplus before ruin, ![]() $|U(\tau )|$ is the deficit at ruin, and

$|U(\tau )|$ is the deficit at ruin, and ![]() $I(\cdot )$ is the indicator function.

$I(\cdot )$ is the indicator function.

The Gerber-Shiu function was first introduced by Gerber and Shiu [Reference Gerber and Shiu5]. (See Eq. (2.10) there.)

Theorem 1 Let ![]() $\omega : [0,\infty )\times [0,\infty )\to [0,\infty )$ be a bounded (Borel-measurable) function, the relative security loading be positive, and the claim-size distribution have a finite second moment. Then, the Gerber-Shiu function satisfies the defective renewal equation

$\omega : [0,\infty )\times [0,\infty )\to [0,\infty )$ be a bounded (Borel-measurable) function, the relative security loading be positive, and the claim-size distribution have a finite second moment. Then, the Gerber-Shiu function satisfies the defective renewal equation

where ![]() $\rho$ is the non-negative root to the generalized Lundberg's fundamental equation

$\rho$ is the non-negative root to the generalized Lundberg's fundamental equation

\begin{align*} & \lambda + \delta -cs = \lambda \tilde{h}(s),\\ & \pi(\rho) = \frac{\lambda}{c}\,T_\rho\bar{H}(0)\in (0,1),\\ & \zeta(u) = \int_u^{\infty} \omega(u,y-u)\,dH(y),\\ & \bar{B}(y;\rho) = 1-B(y;\rho) =\frac{T_\rho \bar{H}(y)}{T_\rho\bar{H}(0)}, \end{align*}

\begin{align*} & \lambda + \delta -cs = \lambda \tilde{h}(s),\\ & \pi(\rho) = \frac{\lambda}{c}\,T_\rho\bar{H}(0)\in (0,1),\\ & \zeta(u) = \int_u^{\infty} \omega(u,y-u)\,dH(y),\\ & \bar{B}(y;\rho) = 1-B(y;\rho) =\frac{T_\rho \bar{H}(y)}{T_\rho\bar{H}(0)}, \end{align*}and ![]() $T_s f(y)$ is defined as in identity (2.1).

$T_s f(y)$ is defined as in identity (2.1).

Equation (2.5) corresponds to identity (2.34) in Gerber and Shiu [Reference Gerber and Shiu5].

2.3.2. The ultimate ruin probability

We denote the ultimate ruin probability by

Restating Eq. (4.11) in Gerber and Shiu [Reference Gerber and Shiu5], we have the following.

Corollary 2.1 When ![]() $\delta = 0$ and

$\delta = 0$ and ![]() $\omega (x, y) = 1$ for all

$\omega (x, y) = 1$ for all ![]() $x \geq 0,\ y >0$, the Gerber-Shiu function

$x \geq 0,\ y >0$, the Gerber-Shiu function ![]() $m$ reduces to the probability of ultimate ruin

$m$ reduces to the probability of ultimate ruin ![]() $\psi$, which satisfies the defective renewal equation

$\psi$, which satisfies the defective renewal equation

The solution to (2.6) is the compound geometric survival function

$$\psi(u) = \frac{\theta}{1+\theta} \sum^{\infty}_{n = 1} \left(\frac{1}{1+ \theta}\right)^{n} \overline{H^{*n}}_e(u), \quad u \geq 0,$$

$$\psi(u) = \frac{\theta}{1+\theta} \sum^{\infty}_{n = 1} \left(\frac{1}{1+ \theta}\right)^{n} \overline{H^{*n}}_e(u), \quad u \geq 0,$$whose Laplace transform is

\begin{equation} \tilde{\psi} (s) =\frac{1-\tilde{h}_e(s)}{s[1+\theta- \tilde{h}_e(s)]}. \end{equation}

\begin{equation} \tilde{\psi} (s) =\frac{1-\tilde{h}_e(s)}{s[1+\theta- \tilde{h}_e(s)]}. \end{equation} We now make a connection with the ![]() $R_n$ family of distributions, i.e., those distributions whose Laplace transform of the respective p.d.f. is a rational function. As discussed in Subsection 2.1 of Sendova and Zhang [Reference Sendova and Zhang11], the

$R_n$ family of distributions, i.e., those distributions whose Laplace transform of the respective p.d.f. is a rational function. As discussed in Subsection 2.1 of Sendova and Zhang [Reference Sendova and Zhang11], the ![]() $R_n$ class of distributions is fairly large and is not a subclass of the phase-type distributions.

$R_n$ class of distributions is fairly large and is not a subclass of the phase-type distributions.

Remark 1 According to the relationships among ![]() $\tilde {h}(s)$,

$\tilde {h}(s)$, ![]() $\tilde {h}_e(s)$ and

$\tilde {h}_e(s)$ and ![]() $\tilde {\psi }(s)$ in equations (2.3) and (2.7), if the batch-claim distribution is in the

$\tilde {\psi }(s)$ in equations (2.3) and (2.7), if the batch-claim distribution is in the ![]() $R_n$ family, then the resulting

$R_n$ family, then the resulting ![]() $\tilde {h}_e(s)$ and

$\tilde {h}_e(s)$ and ![]() $\tilde {\psi }(s)$ are also in that family. Therefore, we are able to provide an explicit expression of the ultimate ruin probability. Consequently, more ruin-related quantities, such as the marginal moments of the time of ruin and the proper joint density of the surplus before ruin and the deficit at ruin are also expressed explicitly.

$\tilde {\psi }(s)$ are also in that family. Therefore, we are able to provide an explicit expression of the ultimate ruin probability. Consequently, more ruin-related quantities, such as the marginal moments of the time of ruin and the proper joint density of the surplus before ruin and the deficit at ruin are also expressed explicitly.

We formalize this observation in the following result:

Lemma 1 Whenever the distribution of batch claims belongs to the ![]() $R_n$ family of distributions, the probability of ruin also belongs to that family.

$R_n$ family of distributions, the probability of ruin also belongs to that family.

2.3.3. The defective joint density of the surplus before ruin and the deficit at ruin

The solution to the defective renewal Eq. (2.5) with ![]() $\delta = 0$ may be utilized to determine the defective joint density of the surplus before ruin and the deficit at ruin.

$\delta = 0$ may be utilized to determine the defective joint density of the surplus before ruin and the deficit at ruin.

The defective joint density of the surplus before ruin and the deficit at ruin ![]() $f_d(x,y|u)$ was obtained in Section 7 in Dickson [Reference Dickson2].

$f_d(x,y|u)$ was obtained in Section 7 in Dickson [Reference Dickson2].

We then deduce the proper joint density of the surplus before ruin and the deficit at ruin

\begin{align} f(x,y\,|\,u) & = \frac{f_d(x,y\,|\,u)}{\int_0^{\infty} \int_0^{\infty} f_d(x,y\,|\,u) \,dy \,dx}\nonumber\\ & = \begin{cases} \displaystyle{\frac{[\psi(u)-\psi(u-x)]h(x+y)}{\mathbb{E}\{Z\}\int_{0}^{u}\bar{H}_e(u-t)\,d\psi(t)}}, & 0\le x< u,\ y>0 \\[6pt] \displaystyle{\frac{[\psi(u)-1]h(x+y)}{\mathbb{E}\{Z\}\int_{0}^{u}\bar{H}_e(u-t)\,d\psi(t)}}, & x>u,\ y>0 \end{cases},\quad u\ge 0. \end{align}

\begin{align} f(x,y\,|\,u) & = \frac{f_d(x,y\,|\,u)}{\int_0^{\infty} \int_0^{\infty} f_d(x,y\,|\,u) \,dy \,dx}\nonumber\\ & = \begin{cases} \displaystyle{\frac{[\psi(u)-\psi(u-x)]h(x+y)}{\mathbb{E}\{Z\}\int_{0}^{u}\bar{H}_e(u-t)\,d\psi(t)}}, & 0\le x< u,\ y>0 \\[6pt] \displaystyle{\frac{[\psi(u)-1]h(x+y)}{\mathbb{E}\{Z\}\int_{0}^{u}\bar{H}_e(u-t)\,d\psi(t)}}, & x>u,\ y>0 \end{cases},\quad u\ge 0. \end{align}2.3.4. Marginal moments of the time of ruin

With the defective marginal moments ![]() $\psi _k$ for

$\psi _k$ for ![]() $k = 1,2,\ldots,$ given by

$k = 1,2,\ldots,$ given by

we have the proper moments of the ruin time provided by

Then mean of the time of ruin is

its second moment is

and therefore, its variance is given as

As discussed in Section 6 of Willmot [Reference Willmot13], ![]() $\psi _1(u)$ satisfies the following difference equation

$\psi _1(u)$ satisfies the following difference equation

and ![]() $\psi _2(u)$ satisfies

$\psi _2(u)$ satisfies

According to the Heaviside Expansion Theorem, which can be found on p. 46 of Spiegel [Reference Spiegel12], if the Laplace transform of ![]() $\psi (u)$ is of the form

$\psi (u)$ is of the form ![]() $\tilde {\psi }(s) = R(s)/P(s),$ where

$\tilde {\psi }(s) = R(s)/P(s),$ where ![]() $R(s)$ is a polynomial of degree less than the degree of the polynomial

$R(s)$ is a polynomial of degree less than the degree of the polynomial ![]() $P(s),$ i.e.,

$P(s),$ i.e., ![]() $\tilde {\psi }(s)$ is a rational function, and if

$\tilde {\psi }(s)$ is a rational function, and if ![]() $P(s)$ has

$P(s)$ has ![]() $d$ distinct roots

$d$ distinct roots ![]() $\rho _j$,

$\rho _j$, ![]() $j=1,2,\ldots,d,$ with negative real part, then the probability of ultimate ruin is given by

$j=1,2,\ldots,d,$ with negative real part, then the probability of ultimate ruin is given by

$$\psi(u) = \sum_{j=1}^{d} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u}, \quad u \geq 0.$$

$$\psi(u) = \sum_{j=1}^{d} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u}, \quad u \geq 0.$$Therefore, ![]() $\psi _1(u)$ and

$\psi _1(u)$ and ![]() $\psi _2(u)$ may be expressed explicitly as linear combinations of exponents.

$\psi _2(u)$ may be expressed explicitly as linear combinations of exponents.

3. Applications

This section is dedicated to applications of the classical compound Poisson model where claims are assumed to arrive in batches and are thus modeled by a compound r.v. (![]() $Z$). Alternatively, this setup may as well be interpreted as compound Poisson counts of claim arrivals (

$Z$). Alternatively, this setup may as well be interpreted as compound Poisson counts of claim arrivals (![]() $N(t$)) combined with continuous i.i.d. claim amounts (

$N(t$)) combined with continuous i.i.d. claim amounts (![]() $Y_1, Y_2,\ldots$).

$Y_1, Y_2,\ldots$).

There are three distinct compound Poisson models that we consider here: Poisson-Geometric (also known as the Pólya-Aeppli model), Poisson-Negative-Binomial and Poisson-Binomial.

As discussed in Subsection 2.2, the batch claims (![]() $Z$) follow a compound distribution. The compounding r.v. (

$Z$) follow a compound distribution. The compounding r.v. (![]() $X$) is the number of claims in a batch and the compounded r.v. (

$X$) is the number of claims in a batch and the compounded r.v. (![]() $Y$) is the individual claim size. Our choice of distributions for

$Y$) is the individual claim size. Our choice of distributions for ![]() $X$ is motivated by Lemma 1. All three of the geometric, the negative-binomial and the binomial distributions have p.g.f. that, combined with an appropriate distribution of the individual claim sizes, yield a batch-claim distribution that is in the

$X$ is motivated by Lemma 1. All three of the geometric, the negative-binomial and the binomial distributions have p.g.f. that, combined with an appropriate distribution of the individual claim sizes, yield a batch-claim distribution that is in the ![]() $R_n$ family. Conversely, if the batch claims follow a distribution that is not in the

$R_n$ family. Conversely, if the batch claims follow a distribution that is not in the ![]() $R_n$ family, for example, a distribution in the transformed beta family or in the transformed gamma family, we are not able to treat the resulting ruin model in the same way.

$R_n$ family, for example, a distribution in the transformed beta family or in the transformed gamma family, we are not able to treat the resulting ruin model in the same way.

3.1. Poisson-Geometric model (or Pólya-Aeppli model)

Now, assume that ![]() $X$ follows the zero-truncated geometric distribution with parameter

$X$ follows the zero-truncated geometric distribution with parameter ![]() $\beta$. We then have a Poisson-Geometric counting process

$\beta$. We then have a Poisson-Geometric counting process ![]() $N(t)$.

$N(t)$.

The p.m.f. of ![]() $X$ is given by

$X$ is given by

Since ![]() $\text {Var}\{X\} / \mathbb {E}\{X\} = \beta$, then when

$\text {Var}\{X\} / \mathbb {E}\{X\} = \beta$, then when ![]() $\beta <1,$ the zero-truncated geometric distribution is under-dispersed. Otherwise, it is over-dispersed. Therefore, this distribution can accommodate both over-dispersed and under-dispersed batch-claim arrivals.

$\beta <1,$ the zero-truncated geometric distribution is under-dispersed. Otherwise, it is over-dispersed. Therefore, this distribution can accommodate both over-dispersed and under-dispersed batch-claim arrivals.

3.1.1. General claim amounts

Now, we consider the most general case of the Poisson-Geometric model with the claim-size r.v. ![]() $Y$ following an unspecified distribution

$Y$ following an unspecified distribution ![]() $f(y),\ y>0$. We derive some ruin-related quantities under this model.

$f(y),\ y>0$. We derive some ruin-related quantities under this model.

Identity ![]() $\tilde {h}(s) = \mathcal {P}_X[\tilde {f} (s)]$ implies that the batch-claim amount distribution has Laplace transform

$\tilde {h}(s) = \mathcal {P}_X[\tilde {f} (s)]$ implies that the batch-claim amount distribution has Laplace transform

\begin{align} \tilde{h}(s) & = \sum^ \infty _{n = 1} \frac{ \beta^{n-1}}{(1+ \beta)^{n}} [\tilde{f} (s)]^{n} \nonumber\\ & = \frac{\tilde{f}(s)}{1+\beta -\beta \tilde{f}(s)}. \end{align}

\begin{align} \tilde{h}(s) & = \sum^ \infty _{n = 1} \frac{ \beta^{n-1}}{(1+ \beta)^{n}} [\tilde{f} (s)]^{n} \nonumber\\ & = \frac{\tilde{f}(s)}{1+\beta -\beta \tilde{f}(s)}. \end{align}Equation (2.3), together with ![]() $\mathbb {E}\{Z\}=\mu (1+\beta )$, then produce

$\mathbb {E}\{Z\}=\mu (1+\beta )$, then produce

\begin{equation} \tilde{h}_e(s) = \frac{1-\tilde{f}(s)}{\mu s [1+\beta-\beta\tilde{f}(s)]}.\end{equation}

\begin{equation} \tilde{h}_e(s) = \frac{1-\tilde{f}(s)}{\mu s [1+\beta-\beta\tilde{f}(s)]}.\end{equation}Hence, with the help of (2.7), we have

\begin{equation} \tilde{\psi} (s) = \frac{\mu s[1+\beta-\beta\tilde{f}(s)]-1+\tilde{f}(s)}{s\{\mu s(1+\theta)[1+\beta-\beta\tilde{f}(s)]-1+\tilde{f}(s)\}} . \end{equation}

\begin{equation} \tilde{\psi} (s) = \frac{\mu s[1+\beta-\beta\tilde{f}(s)]-1+\tilde{f}(s)}{s\{\mu s(1+\theta)[1+\beta-\beta\tilde{f}(s)]-1+\tilde{f}(s)\}} . \end{equation}Equation (2.4) results in the following expression for the relative security loading:

In the following two subsections, we consider the claim-size r.v. ![]() $Y$ following two specific distributions.

$Y$ following two specific distributions.

3.1.2. Exponential claim amounts

Assume ![]() $Y$ follows an exponential distribution with mean

$Y$ follows an exponential distribution with mean ![]() $\mu$, and p.d.f.

$\mu$, and p.d.f.

The Laplace transform of ![]() $f(y)$ is then

$f(y)$ is then

Hence, the Laplace transform of ![]() $h(y)$ is by (3.1)

$h(y)$ is by (3.1)

Identity (3.2) then produces the Laplace transform of the equilibrium distribution

Notice that this indicates an exponential distribution with mean ![]() $1/\mu (1+\beta )$. Therefore, Eq. (3.3) produces

$1/\mu (1+\beta )$. Therefore, Eq. (3.3) produces

Inversion yields an explicit expression for the ultimate ruin probability. Namely,

Hence, starting from (2.9), the defective mean of the time of ruin reduces to

which implies that the proper mean of the ruin time is

Similarly, implementing identity (2.10), the defective second moment of the time of ruin is given by

and the second moment of the ruin time is

Therefore, from (3.5) and (3.6), the variance of the time of ruin is

Observe that the mean and the variance of the ruin time are linear functions of ![]() $u$.

$u$.

Finally, (2.8) provides the proper joint density of the surplus before ruin and the deficit at ruin

$$f(x,y\,|\,u)=\begin{cases} \displaystyle{\frac{(1+\theta)\lambda}{c\theta \mu (1+\beta)}}[e^{{\theta x}/{\mu(1+\beta)(1+\theta)}}-1]\,e^{-{(x+y)}/{\mu(1+\beta)}}, & 0 \leq x< u,\ y>0\\[6pt] \displaystyle{\frac{(1+\theta)\lambda}{c\theta\mu (1+\beta)}}[(1+\theta)\,e^{{\theta u}/{\mu(1+\beta)(1+\theta)}}-1]\,e^{-{(x+y)}/{\mu(1+\beta)}}, & x> u,\ y>0 \end{cases},\quad u\ge 0.$$

$$f(x,y\,|\,u)=\begin{cases} \displaystyle{\frac{(1+\theta)\lambda}{c\theta \mu (1+\beta)}}[e^{{\theta x}/{\mu(1+\beta)(1+\theta)}}-1]\,e^{-{(x+y)}/{\mu(1+\beta)}}, & 0 \leq x< u,\ y>0\\[6pt] \displaystyle{\frac{(1+\theta)\lambda}{c\theta\mu (1+\beta)}}[(1+\theta)\,e^{{\theta u}/{\mu(1+\beta)(1+\theta)}}-1]\,e^{-{(x+y)}/{\mu(1+\beta)}}, & x> u,\ y>0 \end{cases},\quad u\ge 0.$$Interestingly, the above density depends on the initial surplus only through its relative position with respect to the surplus before ruin.

3.1.3. Erlang( $k$) claim amounts

$k$) claim amounts

Assume ![]() $Y$ follows an Erlang(

$Y$ follows an Erlang(![]() $k$) distribution with mean of

$k$) distribution with mean of ![]() $k\mu$, and p.d.f.

$k\mu$, and p.d.f.

Then, we obtain the Laplace transform of ![]() $f(y)$

$f(y)$

The Laplace transform ![]() $\tilde {h}(s)$ is expressed from (3.1) as

$\tilde {h}(s)$ is expressed from (3.1) as

Applying the Heaviside Expansion Theorem, if there are ![]() $n$ roots

$n$ roots ![]() $\eta _1,\ldots,\eta _n$ with negative real parts, which are all distinct,

$\eta _1,\ldots,\eta _n$ with negative real parts, which are all distinct, ![]() $h(y)$ is then

$h(y)$ is then

$$h(y) = \sum_{j=1}^{n} \frac{1}{k \mu (1+\beta)(1+\mu \eta_j)^{k-1}}\,e^{\eta_j y}.$$

$$h(y) = \sum_{j=1}^{n} \frac{1}{k \mu (1+\beta)(1+\mu \eta_j)^{k-1}}\,e^{\eta_j y}.$$Applying ![]() $\mathbb {E}\{Z\}=k\mu (1+\beta )$ and Eq. (3.2),

$\mathbb {E}\{Z\}=k\mu (1+\beta )$ and Eq. (3.2), ![]() $\tilde {h}_e(s)$ is then

$\tilde {h}_e(s)$ is then

Hence, with the help of (3.3) with ![]() $\mu$ replaced by

$\mu$ replaced by ![]() $k\mu,$ we have

$k\mu,$ we have

and the relative security loading is

Observe that ![]() $\tilde {\psi }(s)$ may be presented as

$\tilde {\psi }(s)$ may be presented as ![]() $\tilde {\psi }(s) = R(s)/P(s),$ and then the Heaviside Expansion Theorem applies. If the polynomial

$\tilde {\psi }(s) = R(s)/P(s),$ and then the Heaviside Expansion Theorem applies. If the polynomial ![]() $P(s)$ has

$P(s)$ has ![]() $m$ distinct roots

$m$ distinct roots ![]() $\rho _1, \rho _2,\ldots,\rho _m$ with negative real parts, then the probability of ultimate ruin is given explicitly by

$\rho _1, \rho _2,\ldots,\rho _m$ with negative real parts, then the probability of ultimate ruin is given explicitly by

$$\psi(u) = \sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u},$$

$$\psi(u) = \sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u},$$where

and

\begin{align*} P'(\rho_j) & = k\mu\rho_j(1+\theta)(1+\beta)(1+\mu\rho_j)^{k-1}(2+2\mu\rho_j+k \mu\rho_j)\\ & \quad -2k \beta (1+\theta)\mu\rho_j-(1+\mu\rho_j)^{k-1}(1+\mu \rho_j+k\mu \rho_j)+1. \end{align*}

\begin{align*} P'(\rho_j) & = k\mu\rho_j(1+\theta)(1+\beta)(1+\mu\rho_j)^{k-1}(2+2\mu\rho_j+k \mu\rho_j)\\ & \quad -2k \beta (1+\theta)\mu\rho_j-(1+\mu\rho_j)^{k-1}(1+\mu \rho_j+k\mu \rho_j)+1. \end{align*}Finally, the proper joint density of the surplus before ruin and the deficit at ruin is

\begin{align*} & f(x,y|u) =\begin{cases} \displaystyle{\frac{\sum_{i=1}^{n}\sum_{j=1}^{m} \frac{1}{k^{2} \mu^{2} (1+\beta)^{2}(1+\mu \eta_i)^{k-1}}\frac{R(\rho_j)}{P'(\rho_j)}\,e^{\eta_i (x+y)+\rho_j u}(1-e^{-\rho_j x})}{\sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}(e^{\rho_j u}-1)-\sum_{i=1}^{n}\sum_{j=1}^{m} \frac{(1+\mu \eta_i)^{k}-1}{k\mu\eta_i\left[(1+\beta)(1+\mu \eta_i+k \mu \eta_i)(1+\mu \eta_i)^{k-1}-\beta\right]}\frac{R(\rho_j)}{P'(\rho_j)}\left[\frac{\eta_i}{\rho_j-\eta_i}e^{\rho_j u}-\frac{\rho_j}{\rho_j-\eta_i}e^{\eta_i u}+1\right]}}, \\ {\rm where} \ 0\le x< u,\ y>0,\\ \displaystyle{\frac{\sum_{i=1}^{n} \frac{1}{k^{2} \mu^{2} (1+\beta)^{2}(1+\mu \eta_i)^{k-1}}\,e^{\eta_i (x+y)}\left[\sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}e^{\rho_j u}-1\right]}{\sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}(e^{\rho_j u}-1)-\sum_{i=1}^{n}\sum_{j=1}^{m} \frac{(1+\mu \eta_i)^{k}-1}{k\mu\eta_i\left[(1+\beta)(1+\mu \eta_i+k \mu \eta_i)(1+\mu \eta_i)^{k-1}-\beta\right]}\frac{R(\rho_j)}{P'(\rho_j)}\left[\frac{\eta_i}{\rho_j-\eta_i}e^{\rho_j u}-\frac{\rho_j}{\rho_j-\eta_i}e^{\eta_i u}+1\right]}}, \\ {\rm where} \ x>u,\ y>0 \end{cases}. \end{align*}

\begin{align*} & f(x,y|u) =\begin{cases} \displaystyle{\frac{\sum_{i=1}^{n}\sum_{j=1}^{m} \frac{1}{k^{2} \mu^{2} (1+\beta)^{2}(1+\mu \eta_i)^{k-1}}\frac{R(\rho_j)}{P'(\rho_j)}\,e^{\eta_i (x+y)+\rho_j u}(1-e^{-\rho_j x})}{\sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}(e^{\rho_j u}-1)-\sum_{i=1}^{n}\sum_{j=1}^{m} \frac{(1+\mu \eta_i)^{k}-1}{k\mu\eta_i\left[(1+\beta)(1+\mu \eta_i+k \mu \eta_i)(1+\mu \eta_i)^{k-1}-\beta\right]}\frac{R(\rho_j)}{P'(\rho_j)}\left[\frac{\eta_i}{\rho_j-\eta_i}e^{\rho_j u}-\frac{\rho_j}{\rho_j-\eta_i}e^{\eta_i u}+1\right]}}, \\ {\rm where} \ 0\le x< u,\ y>0,\\ \displaystyle{\frac{\sum_{i=1}^{n} \frac{1}{k^{2} \mu^{2} (1+\beta)^{2}(1+\mu \eta_i)^{k-1}}\,e^{\eta_i (x+y)}\left[\sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}e^{\rho_j u}-1\right]}{\sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}(e^{\rho_j u}-1)-\sum_{i=1}^{n}\sum_{j=1}^{m} \frac{(1+\mu \eta_i)^{k}-1}{k\mu\eta_i\left[(1+\beta)(1+\mu \eta_i+k \mu \eta_i)(1+\mu \eta_i)^{k-1}-\beta\right]}\frac{R(\rho_j)}{P'(\rho_j)}\left[\frac{\eta_i}{\rho_j-\eta_i}e^{\rho_j u}-\frac{\rho_j}{\rho_j-\eta_i}e^{\eta_i u}+1\right]}}, \\ {\rm where} \ x>u,\ y>0 \end{cases}. \end{align*}with the help of (2.8).

3.2. Poisson-Negative-Binomial model

Assume that ![]() $X$ follows the zero-truncated negative-binomial distribution with parameters

$X$ follows the zero-truncated negative-binomial distribution with parameters ![]() $\alpha$ and

$\alpha$ and ![]() $r$. Then we call this risk model a Poisson-Negative-Binomial risk model as the counting process

$r$. Then we call this risk model a Poisson-Negative-Binomial risk model as the counting process ![]() $N(t)$ is a Poisson-Negative-Binomial process.

$N(t)$ is a Poisson-Negative-Binomial process.

The p.m.f. of ![]() $X$ is

$X$ is

When ![]() $\alpha <(1+r)^{{1}/{r}-1}$, the zero-truncated negative-binomial distribution is under-dispersed. Otherwise, it is over-dispersed. Therefore, this distribution can accommodate both over-dispersed and under-dispersed batch arrivals.

$\alpha <(1+r)^{{1}/{r}-1}$, the zero-truncated negative-binomial distribution is under-dispersed. Otherwise, it is over-dispersed. Therefore, this distribution can accommodate both over-dispersed and under-dispersed batch arrivals.

3.2.1. General claim amounts

Now, we consider the most general case of the Poisson-Negative-Binomial model with the claim-size r.v. ![]() $Y$ following a general distribution. We then derive some ruin-related quantities under this model.

$Y$ following a general distribution. We then derive some ruin-related quantities under this model.

The Laplace transform of ![]() $h(y)$ is deducted to be

$h(y)$ is deducted to be

\begin{align*} \tilde{h}(s) & = \frac{1}{(1+\alpha)^{r}-1}\sum^ \infty _{n = 1} \dbinom{r+n-1}{n}\left(\frac{\alpha}{1+\alpha}\right)^{n} [\tilde{f} (s)]^{n} \\ & = \frac{1}{(1+\alpha)^{r}-1} \left\{\frac{1}{[1-({{\alpha}/{(1+\alpha)}})\tilde{f} (s)]^{r}}-1 \right\}. \end{align*}

\begin{align*} \tilde{h}(s) & = \frac{1}{(1+\alpha)^{r}-1}\sum^ \infty _{n = 1} \dbinom{r+n-1}{n}\left(\frac{\alpha}{1+\alpha}\right)^{n} [\tilde{f} (s)]^{n} \\ & = \frac{1}{(1+\alpha)^{r}-1} \left\{\frac{1}{[1-({{\alpha}/{(1+\alpha)}})\tilde{f} (s)]^{r}}-1 \right\}. \end{align*}With ![]() $\mathbb {E}\{Z\}={\mu r \alpha }/{(1-(1+\alpha )^{-r})}$ and (2.3),

$\mathbb {E}\{Z\}={\mu r \alpha }/{(1-(1+\alpha )^{-r})}$ and (2.3), ![]() $\tilde {h}_e(s)$ is expressed as

$\tilde {h}_e(s)$ is expressed as

Therefore, Eq. (2.7) reduces to

\begin{equation} \tilde{\psi} (s) = \frac{(\mu r \alpha s-1)[1+\alpha-\alpha\tilde{f}(s)]^{r}+1}{s\{[(1+\theta)\mu r \alpha s-1][1+\alpha-\alpha\tilde{f}(s)]^{r}+1\}},\end{equation}

\begin{equation} \tilde{\psi} (s) = \frac{(\mu r \alpha s-1)[1+\alpha-\alpha\tilde{f}(s)]^{r}+1}{s\{[(1+\theta)\mu r \alpha s-1][1+\alpha-\alpha\tilde{f}(s)]^{r}+1\}},\end{equation}with relative security loading

3.2.2. Exponential claim amounts

Assume ![]() $Y$ follows an exponential distribution with mean

$Y$ follows an exponential distribution with mean ![]() $\mu$. From the results obtained in Section 5.1.1 in Li and Sendova [Reference Li and Sendova6], the Laplace transform of

$\mu$. From the results obtained in Section 5.1.1 in Li and Sendova [Reference Li and Sendova6], the Laplace transform of ![]() $h(y)$ is given by

$h(y)$ is given by

By identity (3.8), the Laplace transform of ![]() $h_e(y)$ is

$h_e(y)$ is

The Laplace transform of the probability of ultimate ruin is obtained by Eq. (3.9) and formula (3.4) to be

which recovers Eq. (35) in Li and Sendova [Reference Li and Sendova6]. Moreover, as ![]() $\tilde {\psi }(s)$ is a rational function,

$\tilde {\psi }(s)$ is a rational function, ![]() $\psi (u)$ may be presented as a linear combination of exponentials as is done in Eq. (38) in Li and Sendova [Reference Li and Sendova6].

$\psi (u)$ may be presented as a linear combination of exponentials as is done in Eq. (38) in Li and Sendova [Reference Li and Sendova6].

Finally, the proper joint density of the surplus before ruin and the deficit at ruin is calculated through (2.8), where

\begin{align*} & \int_0^{u}\bar{H}_e(u-t)\,d\psi(t) \\ & \quad =\sum_{j=1}^{m}\frac{R(\rho_j)}{P'(\rho_j)}\left\{\left[1-\frac{1-(1+\alpha)^{{-}r}}{\mu r \alpha \rho_j}\right](e^{\rho_j u}-1)+\frac{1-(1+\alpha)^{{-}r}}{\mu r \alpha }u\right\}\\ & \qquad +\frac{1}{\mu r \alpha (1+\alpha)^{r}}\sum_{i=1}^{r} \sum_{j=1}^{m}\dbinom{r}{i} \alpha^{i} \frac{R(\rho_j)}{P'(\rho_j)}\left[\left(\frac{1}{\rho_j}-i\right)(e^{\rho_j u}-1)-u\right]\\ & \qquad-\frac{1}{\mu r \alpha (1+\alpha)^{r}}\sum_{i=1}^{r} \sum_{w=0}^{i-1} \sum_{n=0}^{w} \sum_{j=1}^{m} \sum_{h=0}^{n}\dbinom{r}{i}\alpha^{i} \frac{R(\rho_j)}{P'(\rho_j)}\frac{\rho_j}{(n-h)!} \frac{[(1+\alpha)\mu]^{h-n+1}u^{n-h}}{[(1+\alpha)\mu\rho_j+1]^{h+1}}\,e^{- {u}/{\mu(1+\alpha)}}. \end{align*}

\begin{align*} & \int_0^{u}\bar{H}_e(u-t)\,d\psi(t) \\ & \quad =\sum_{j=1}^{m}\frac{R(\rho_j)}{P'(\rho_j)}\left\{\left[1-\frac{1-(1+\alpha)^{{-}r}}{\mu r \alpha \rho_j}\right](e^{\rho_j u}-1)+\frac{1-(1+\alpha)^{{-}r}}{\mu r \alpha }u\right\}\\ & \qquad +\frac{1}{\mu r \alpha (1+\alpha)^{r}}\sum_{i=1}^{r} \sum_{j=1}^{m}\dbinom{r}{i} \alpha^{i} \frac{R(\rho_j)}{P'(\rho_j)}\left[\left(\frac{1}{\rho_j}-i\right)(e^{\rho_j u}-1)-u\right]\\ & \qquad-\frac{1}{\mu r \alpha (1+\alpha)^{r}}\sum_{i=1}^{r} \sum_{w=0}^{i-1} \sum_{n=0}^{w} \sum_{j=1}^{m} \sum_{h=0}^{n}\dbinom{r}{i}\alpha^{i} \frac{R(\rho_j)}{P'(\rho_j)}\frac{\rho_j}{(n-h)!} \frac{[(1+\alpha)\mu]^{h-n+1}u^{n-h}}{[(1+\alpha)\mu\rho_j+1]^{h+1}}\,e^{- {u}/{\mu(1+\alpha)}}. \end{align*}3.2.3. Erlang( $k$) claim amounts

$k$) claim amounts

Assume ![]() $Y$ follows an Erlang(

$Y$ follows an Erlang(![]() $k$) distribution with mean

$k$) distribution with mean ![]() $k\mu$. Therefore, identity (3.9) together with formula (3.7) imply that

$k\mu$. Therefore, identity (3.9) together with formula (3.7) imply that

which is the result of Subsection 5.1.2 in Li and Sendova [Reference Li and Sendova6]. We may then write ![]() $\tilde {\psi }(s) = R(s)/P(s)$, where

$\tilde {\psi }(s) = R(s)/P(s)$, where ![]() $R$ and

$R$ and ![]() $P$ are known polynomials. If

$P$ are known polynomials. If ![]() $P(s)$ has

$P(s)$ has ![]() $m$ distinct roots

$m$ distinct roots ![]() $\rho _1, \rho _2,\ldots,\rho _m$ with negative real parts, then the Heaviside Expansion Theorem implies that the probability of ultimate ruin is given explicitly by

$\rho _1, \rho _2,\ldots,\rho _m$ with negative real parts, then the Heaviside Expansion Theorem implies that the probability of ultimate ruin is given explicitly by

$$\psi(u) = \sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u},$$

$$\psi(u) = \sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u},$$where

and

\begin{align*} P'(\rho_j) & = \mu kr\rho_j (1+\alpha)(1+\mu \rho_j)^{k-1}[k\mu\rho_j r \alpha(1+\theta)-1][(1+\alpha)(1+\mu \rho_j)^{k}-\alpha]^{r-1} \\ & \quad +[2k\mu\rho_j r \alpha(1+\theta)-1][(1+\alpha)(1+\mu \rho_j)^{k}-\alpha]^{r}+ [\rho_j \mu(kr+1)+1](1+\mu\rho_j)^{kr-1}. \end{align*}

\begin{align*} P'(\rho_j) & = \mu kr\rho_j (1+\alpha)(1+\mu \rho_j)^{k-1}[k\mu\rho_j r \alpha(1+\theta)-1][(1+\alpha)(1+\mu \rho_j)^{k}-\alpha]^{r-1} \\ & \quad +[2k\mu\rho_j r \alpha(1+\theta)-1][(1+\alpha)(1+\mu \rho_j)^{k}-\alpha]^{r}+ [\rho_j \mu(kr+1)+1](1+\mu\rho_j)^{kr-1}. \end{align*}Note that here the relative security loading is

3.3. Poisson-Binomial model

Assume that ![]() $X$ follows the zero-truncated binomial distribution with parameters

$X$ follows the zero-truncated binomial distribution with parameters ![]() $l$ and

$l$ and ![]() $q$. Then the risk model is called a Poisson-Binomial risk model with a Poisson-Binomial counting process

$q$. Then the risk model is called a Poisson-Binomial risk model with a Poisson-Binomial counting process ![]() $N(t)$.

$N(t)$.

The p.m.f. of ![]() $X$ is given by

$X$ is given by

$$p_n = \frac{\dbinom{l}{n}q^{n}(1-q)^{l-n}}{1-(1-q)^{l}},\quad 0< q<1,\ l = 1,2,\ldots,\ n=1,2,\ldots,l.$$

$$p_n = \frac{\dbinom{l}{n}q^{n}(1-q)^{l-n}}{1-(1-q)^{l}},\quad 0< q<1,\ l = 1,2,\ldots,\ n=1,2,\ldots,l.$$The zero-truncated binomial distribution is under-dispersed, which means that this distribution may only accommodate under-dispersed batch arrivals.

3.3.1. General claim amounts

We now consider the most general case of the Poisson-Binomial model with the claim-size r.v. ![]() $Y$ following a general distribution. Then, we derive some ruin-related quantities under this model.

$Y$ following a general distribution. Then, we derive some ruin-related quantities under this model.

The Laplace transform of ![]() $h(y)$ is expressed as

$h(y)$ is expressed as

$$\tilde{h}(s) = \sum^ \infty _{n = 1} \frac{\dbinom{l}{n}q^{n}(1-q)^{l-n}}{1-(1-q)^{l}}[\tilde{f} (s)]^{n} =\frac{(1-q)^{l}}{1-(1-q)^{l}}\left\{\frac{1}{[1-({q}/{(1-q)})\tilde{f} (s)]^{l-n+1}}-1 \right\}.$$

$$\tilde{h}(s) = \sum^ \infty _{n = 1} \frac{\dbinom{l}{n}q^{n}(1-q)^{l-n}}{1-(1-q)^{l}}[\tilde{f} (s)]^{n} =\frac{(1-q)^{l}}{1-(1-q)^{l}}\left\{\frac{1}{[1-({q}/{(1-q)})\tilde{f} (s)]^{l-n+1}}-1 \right\}.$$Since ![]() $\mathbb {E}\{Z\}={\mu l q}/{(1-(1-q)^{l})}$ and from (2.3), we have

$\mathbb {E}\{Z\}={\mu l q}/{(1-(1-q)^{l})}$ and from (2.3), we have

Hence, identity (2.7) yields the Laplace transform of the ruin time

\begin{equation} \tilde{\psi} (s) = \frac{(\mu lq s-1)[1-q-q\tilde{f} (s)]^{l-n+1}+(1-q)^{2l-n+1}}{s\{[(1+\theta)\mu lq s-1][1-q-q\tilde{f} (s)]^{l-n+1}+(1-q)^{2l-n+1}\}},\end{equation}

\begin{equation} \tilde{\psi} (s) = \frac{(\mu lq s-1)[1-q-q\tilde{f} (s)]^{l-n+1}+(1-q)^{2l-n+1}}{s\{[(1+\theta)\mu lq s-1][1-q-q\tilde{f} (s)]^{l-n+1}+(1-q)^{2l-n+1}\}},\end{equation}with relative security loading

3.3.2. Exponential claim amounts

Assume ![]() $Y$ follows the exponential distribution with mean

$Y$ follows the exponential distribution with mean ![]() $\mu$. From the results obtained in Section 5.2.1 in Li and Sendova [Reference Li and Sendova6], the Laplace transform of

$\mu$. From the results obtained in Section 5.2.1 in Li and Sendova [Reference Li and Sendova6], the Laplace transform of ![]() $h(y)$ is given by

$h(y)$ is given by

$$\tilde{h}(s) = \frac{(1-q)^{l}}{1-(1-q)^{l}}\left\{\left[\frac{1+(1-q)\mu s}{(1-q)(1+\mu s)}\right]^{l}-1\right\}.$$

$$\tilde{h}(s) = \frac{(1-q)^{l}}{1-(1-q)^{l}}\left\{\left[\frac{1+(1-q)\mu s}{(1-q)(1+\mu s)}\right]^{l}-1\right\}.$$Thus, we obtain the Laplace transform of ![]() $h_e(y)$

$h_e(y)$

$$\tilde{h}_e(s) = \frac{1}{\mu lq s}\left\{1-\left[\frac{1+(1-q)\mu s}{1+\mu s}\right]^{l}\right\}$$

$$\tilde{h}_e(s) = \frac{1}{\mu lq s}\left\{1-\left[\frac{1+(1-q)\mu s}{1+\mu s}\right]^{l}\right\}$$by Eq. (3.10). With the help of Eqs. (3.11) and (3.4), the Laplace transform of the probability of ultimate ruin is

which recovers identity (44) in Li and Sendova [Reference Li and Sendova6]. Subsequently, as ![]() $\tilde {\psi }(s)$ is a rational function,

$\tilde {\psi }(s)$ is a rational function, ![]() $\psi (u)$ may be presented as a linear combination of exponentials as is done in Li and Sendova [Reference Li and Sendova6].

$\psi (u)$ may be presented as a linear combination of exponentials as is done in Li and Sendova [Reference Li and Sendova6].

Finally, the proper joint density of the surplus before ruin and the deficit at ruin is given in (2.8), where

\begin{align*} \int_0^{u}\bar{H}_e(u-t)d\psi(t) & = \sum_{j=1}^{m}\frac{R(\rho_j)}{P'(\rho_j)}\left[\left(1-\frac{1-(1-q)^{l}}{\mu l q \rho_j}\right)(e^{\rho_j u}-1)+\frac{1-(1-q)^{l}}{\mu l q }u\right]\\ & \quad +\frac{1}{\mu l q}\sum_{i=1}^{l} \sum_{j=1}^{m}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\left[\left(\frac{1}{\rho_j}-i\right)(e^{\rho_j u}-1)-u\right]\\ & \quad +\frac{1}{\mu l q}\sum_{i=1}^{l} \sum_{w=0}^{i-1} \sum_{n=0}^{w} \sum_{j=1}^{m} \sum_{h=0}^{n}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\frac{\rho_j}{(n-h)!} \frac{\mu^{h-n+1}u^{n-h}}{(\mu\rho_j+1)^{h+1}}e^{-{u}/{\mu}}. \end{align*}

\begin{align*} \int_0^{u}\bar{H}_e(u-t)d\psi(t) & = \sum_{j=1}^{m}\frac{R(\rho_j)}{P'(\rho_j)}\left[\left(1-\frac{1-(1-q)^{l}}{\mu l q \rho_j}\right)(e^{\rho_j u}-1)+\frac{1-(1-q)^{l}}{\mu l q }u\right]\\ & \quad +\frac{1}{\mu l q}\sum_{i=1}^{l} \sum_{j=1}^{m}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\left[\left(\frac{1}{\rho_j}-i\right)(e^{\rho_j u}-1)-u\right]\\ & \quad +\frac{1}{\mu l q}\sum_{i=1}^{l} \sum_{w=0}^{i-1} \sum_{n=0}^{w} \sum_{j=1}^{m} \sum_{h=0}^{n}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\frac{\rho_j}{(n-h)!} \frac{\mu^{h-n+1}u^{n-h}}{(\mu\rho_j+1)^{h+1}}e^{-{u}/{\mu}}. \end{align*}3.3.3. Erlang( $k$) claim amounts

$k$) claim amounts

Assume ![]() $Y$ follows an Erlang(

$Y$ follows an Erlang(![]() $k$) distribution with mean

$k$) distribution with mean ![]() $k\mu$. From the results obtained in Section 5.1.2 in Li and Sendova [Reference Li and Sendova6], the Laplace transform of

$k\mu$. From the results obtained in Section 5.1.2 in Li and Sendova [Reference Li and Sendova6], the Laplace transform of ![]() $h(y)$ is

$h(y)$ is

$$\tilde{h}(s) = \frac{(1-q)^{l}}{1-(1-q)^{l}}\left\{\left[\frac{(1-q)(1+\mu s)^{k}+q}{(1-q)(1+\mu s)^{k}}\right]^{l}-1\right\},$$

$$\tilde{h}(s) = \frac{(1-q)^{l}}{1-(1-q)^{l}}\left\{\left[\frac{(1-q)(1+\mu s)^{k}+q}{(1-q)(1+\mu s)^{k}}\right]^{l}-1\right\},$$since ![]() $\mathbb {E}\{Z\}={k\mu l q}/{(1-(1-q)^{l})}$ and (3.10), the Laplace transform of

$\mathbb {E}\{Z\}={k\mu l q}/{(1-(1-q)^{l})}$ and (3.10), the Laplace transform of ![]() $h_e(y)$ is

$h_e(y)$ is

$$\tilde{h}_e(s) = \frac{1}{k\mu lq s}\left\{1-\left[\frac{(1-q)(1+\mu s)^{k}+q}{(1+\mu s)^{k}}\right]^{l}\right\}.$$

$$\tilde{h}_e(s) = \frac{1}{k\mu lq s}\left\{1-\left[\frac{(1-q)(1+\mu s)^{k}+q}{(1+\mu s)^{k}}\right]^{l}\right\}.$$Hence, we obtain the Laplace transform of the probability of ultimate ruin through Eqs. (3.11) and (3.7):

which recovers the relevant expression in Subsection 5.2.2 in Li and Sendova [Reference Li and Sendova6] and ![]() $\psi (u)$ may be again presented as a known linear combination of exponentials. Namely,

$\psi (u)$ may be again presented as a known linear combination of exponentials. Namely,

$$\psi(u) = \sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u},$$

$$\psi(u) = \sum_{j=1}^{m} \frac{R(\rho_j)}{P'(\rho_j)}\,e^{\rho_j u},$$where

and

\begin{align*} P'(\rho_j) & =\{\mu kl\rho_j [k\mu\rho_j lq(1+\theta)-1]+ [2k\mu\rho_j lq(1+\theta)-1](1+\mu \rho_j)\}(1+\mu \rho_j)^{kl-1} \\ & \quad + \{[1+\mu \rho_j(1+kl)](1-q)(1+\mu \rho_j)^{k-1}+q\}[(1-q)(1+\mu\rho_j)^{k}+q]^{l-1}. \end{align*}

\begin{align*} P'(\rho_j) & =\{\mu kl\rho_j [k\mu\rho_j lq(1+\theta)-1]+ [2k\mu\rho_j lq(1+\theta)-1](1+\mu \rho_j)\}(1+\mu \rho_j)^{kl-1} \\ & \quad + \{[1+\mu \rho_j(1+kl)](1-q)(1+\mu \rho_j)^{k-1}+q\}[(1-q)(1+\mu\rho_j)^{k}+q]^{l-1}. \end{align*}Here, the relative security loading is

Finally, the proper joint density of the surplus before ruin and the deficit at ruin is given in (2.8), where

\begin{align*} \int_0^{u}\bar{H}_e(u-t)\,d\psi(t) & = \sum_{j=1}^{m}\frac{R(\rho_j)}{P'(\rho_j)}\left[\left(1-\frac{1-(1-q)^{l}}{k\mu l q \rho_j}\right)(e^{\rho_j u}-1)+\frac{1-(1-q)^{l}}{k\mu l q }u\right]\\ & \quad +\frac{1}{k\mu l q}\sum_{i=1}^{l} \sum_{j=1}^{m}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\left[\left(\frac{1}{\rho_j}-i\right)(e^{\rho_j u}-1)-u\right]\\ & \quad +\frac{1}{k\mu l q}\sum_{i=1}^{l} \sum_{w=0}^{ki-1} \sum_{n=0}^{w} \sum_{j=1}^{m} \sum_{h=0}^{n}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\frac{\rho_j}{(n-h)!} \frac{\mu^{h-n+1}u^{n-h}}{(\mu\rho_j+1)^{h+1}}\,e^{- {u}/{\mu}}. \end{align*}

\begin{align*} \int_0^{u}\bar{H}_e(u-t)\,d\psi(t) & = \sum_{j=1}^{m}\frac{R(\rho_j)}{P'(\rho_j)}\left[\left(1-\frac{1-(1-q)^{l}}{k\mu l q \rho_j}\right)(e^{\rho_j u}-1)+\frac{1-(1-q)^{l}}{k\mu l q }u\right]\\ & \quad +\frac{1}{k\mu l q}\sum_{i=1}^{l} \sum_{j=1}^{m}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\left[\left(\frac{1}{\rho_j}-i\right)(e^{\rho_j u}-1)-u\right]\\ & \quad +\frac{1}{k\mu l q}\sum_{i=1}^{l} \sum_{w=0}^{ki-1} \sum_{n=0}^{w} \sum_{j=1}^{m} \sum_{h=0}^{n}\dbinom{l}{i}q^{i}(1-q)^{l-i} \frac{R(\rho_j)}{P'(\rho_j)}\frac{\rho_j}{(n-h)!} \frac{\mu^{h-n+1}u^{n-h}}{(\mu\rho_j+1)^{h+1}}\,e^{- {u}/{\mu}}. \end{align*}4. Numerical examples

We dedicate this section to illustrative examples. In particular, we consider zero-truncated geometric, negative-binomial and binomial batch-claim arrivals. With respect to the claim amounts, we consider exponential and Erlang(![]() $k$) distributions. We assume that the claim-size mean is

$k$) distributions. We assume that the claim-size mean is ![]() $\mu =1.5$ (in ten thousands of dollars) and that the relative security loading is

$\mu =1.5$ (in ten thousands of dollars) and that the relative security loading is ![]() $\theta = 0.5$.

$\theta = 0.5$.

4.1. Exponential claim amounts

In this subsection, we focus on examples with exponentially distributed claim amounts.

We firstly consider an example in the case of zero-truncated geometric batch arrivals.

As stated in Section 3, zero-truncated geometric batch arrivals may accommodate both under- and over-dispersed data, while the resulting Poisson-Geometric counting process is always over-dispersed. In other words, no matter whether the insurance company receives an under- or over-dispersed number of claims at a time, the total number of claims is always over-dispersed. When ![]() $\beta = 0.5$, the batch arrivals are under-dispersed, while when

$\beta = 0.5$, the batch arrivals are under-dispersed, while when ![]() $\beta = 2$ or 10, the batch arrivals are over-dispersed. In order to measure the efficiency of the compound Poisson model, we also consider the case

$\beta = 2$ or 10, the batch arrivals are over-dispersed. In order to measure the efficiency of the compound Poisson model, we also consider the case ![]() $\beta = 0,$ which results in no-batch arrivals and serves for comparison. The c.d.f. of the zero-truncated geometric distribution in the four cases for

$\beta = 0,$ which results in no-batch arrivals and serves for comparison. The c.d.f. of the zero-truncated geometric distribution in the four cases for ![]() $\beta$ is plotted in Figure 1. As the plot shows, the model whose batch arrivals follow the zero-truncated geometric distribution with larger

$\beta$ is plotted in Figure 1. As the plot shows, the model whose batch arrivals follow the zero-truncated geometric distribution with larger ![]() $\beta$ is more likely to receive larger number of claims at a time. This means that an insurance company with more business requires a model with a larger

$\beta$ is more likely to receive larger number of claims at a time. This means that an insurance company with more business requires a model with a larger ![]() $\beta$. Note that the scale of the liabilities of the insurance company does not only depend on the number of claims per day but also depend on the amount of each claim.

$\beta$. Note that the scale of the liabilities of the insurance company does not only depend on the number of claims per day but also depend on the amount of each claim.

Figure 1. C.d.f. of the zero-truncated geometric distribution.

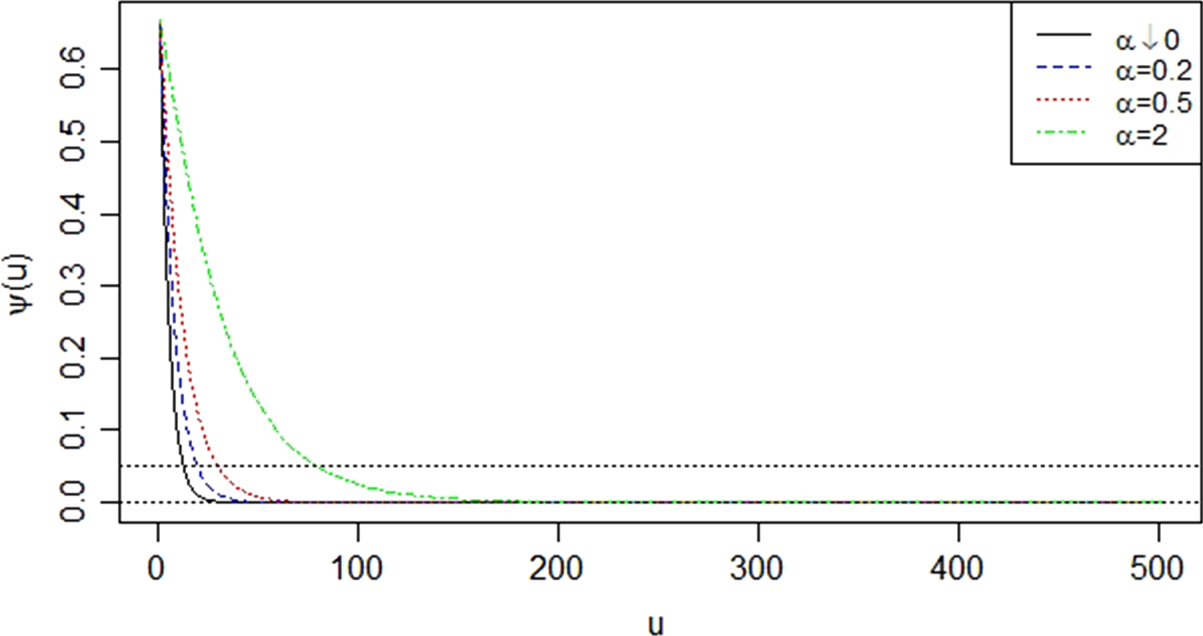

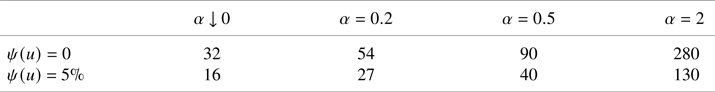

The probability of ultimate ruin for different ![]() $\beta$ is then plotted in Figure 2. Ideally, the ultimate ruin probability should be below

$\beta$ is then plotted in Figure 2. Ideally, the ultimate ruin probability should be below ![]() $5\%$. This is why we add a horizontal line at

$5\%$. This is why we add a horizontal line at ![]() $5\%$ on the plot. Intuitively, the probability of ultimate ruin should decrease with the increase of the initial surplus. In the extreme case, if the insurance company starts with an infinite initial surplus, then there is no risk of ruin. This is confirmed in Figure 2. Moreover, the approximate values of

$5\%$ on the plot. Intuitively, the probability of ultimate ruin should decrease with the increase of the initial surplus. In the extreme case, if the insurance company starts with an infinite initial surplus, then there is no risk of ruin. This is confirmed in Figure 2. Moreover, the approximate values of ![]() $u$ for

$u$ for ![]() $\psi (u) = 0$ and

$\psi (u) = 0$ and ![]() $5\%$ for four different values of

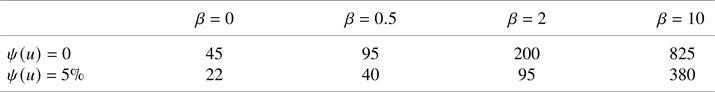

$5\%$ for four different values of ![]() $\beta$ are summarized in Table 1. According to the table, we have seen that for the same level of initial surplus, the larger the

$\beta$ are summarized in Table 1. According to the table, we have seen that for the same level of initial surplus, the larger the ![]() $\beta$, the larger the probability of ruin is. Thus, over-dispersed batch arrivals correspond to a higher risk of ruin. In general, Figure 2 demonstrates that the possibility of batch-claim arrivals should not be underestimated as it influences the probability of ruin in a substantial way. We also observed that the approximate value of

$\beta$, the larger the probability of ruin is. Thus, over-dispersed batch arrivals correspond to a higher risk of ruin. In general, Figure 2 demonstrates that the possibility of batch-claim arrivals should not be underestimated as it influences the probability of ruin in a substantial way. We also observed that the approximate value of ![]() $u$ when the probability of ultimate ruin falls to

$u$ when the probability of ultimate ruin falls to ![]() $5\%$ is approximately half of that when the probability of ultimate ruin reaches zero, especially when

$5\%$ is approximately half of that when the probability of ultimate ruin reaches zero, especially when ![]() $\beta$ is small. This indicates that in order to maintain a relatively low risk of ruin, the insurance companies may only need half of the initial surplus required for reducing the risk of ruin to an exceedingly smaller level.

$\beta$ is small. This indicates that in order to maintain a relatively low risk of ruin, the insurance companies may only need half of the initial surplus required for reducing the risk of ruin to an exceedingly smaller level.

Figure 2. Probability of ultimate ruin.

Table 1. Approximate values of ![]() $u$ for which the respective values for

$u$ for which the respective values for ![]() $\psi$ are reached for the first time.

$\psi$ are reached for the first time.

The mean and variance of the ruin time are plotted in Figures 3 and 4, respectively. These plots illustrate what we already know from Eqs. (3.5) and (3.6), which is that both the mean and the variance of the ruin time are linear functions of the initial surplus. We also observe that for the same level of the initial surplus, the model with a higher ![]() $\beta$ corresponds to lower mean and variance of the ruin time. In other words, over-dispersed batch arrivals lead to shorter ruin time. This is another evidence that the possibility of batch arrivals should not be underrated when building a model.

$\beta$ corresponds to lower mean and variance of the ruin time. In other words, over-dispersed batch arrivals lead to shorter ruin time. This is another evidence that the possibility of batch arrivals should not be underrated when building a model.

Figure 3. Mean of the ruin time.

Figure 4. Variance of the ruin time.

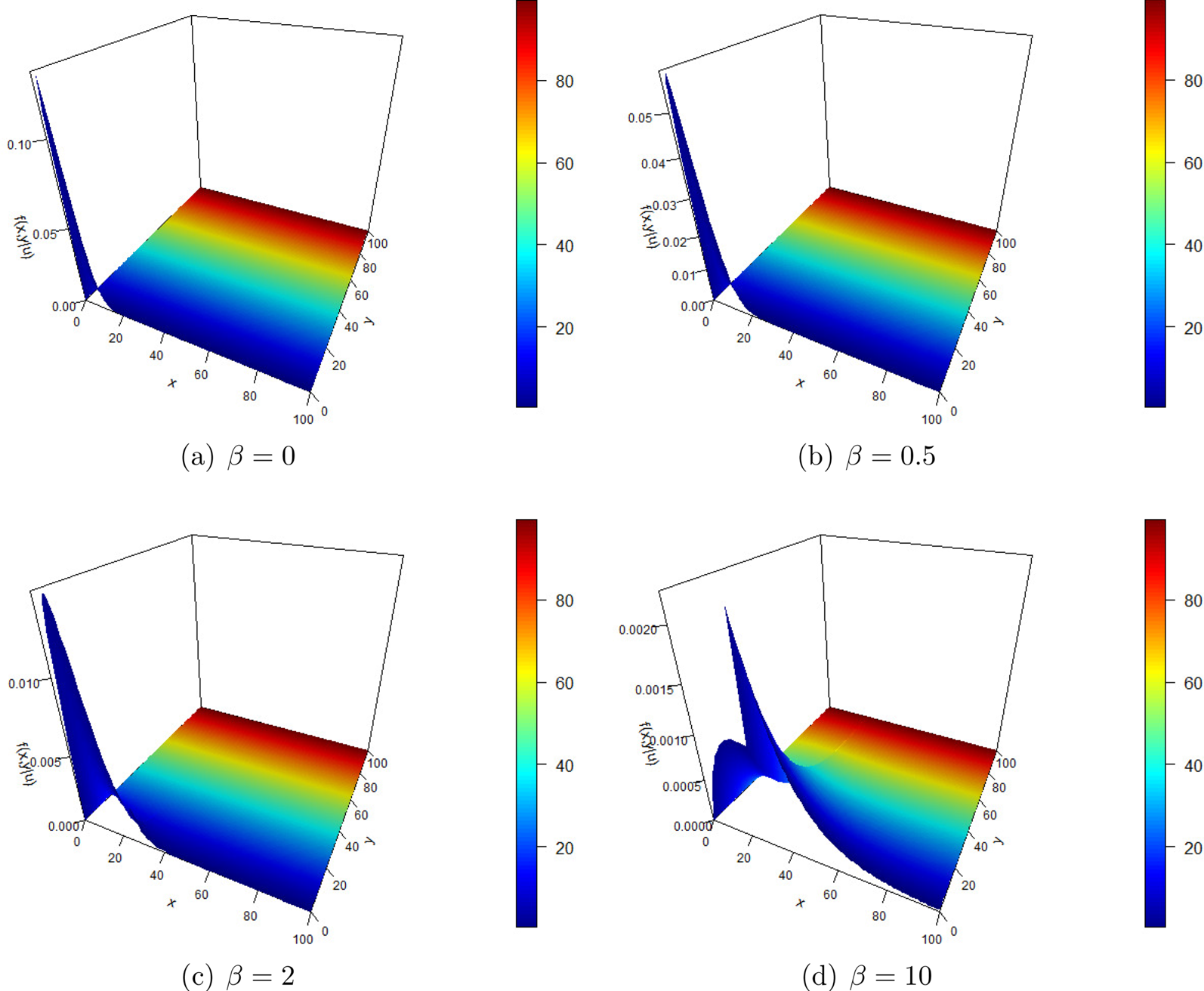

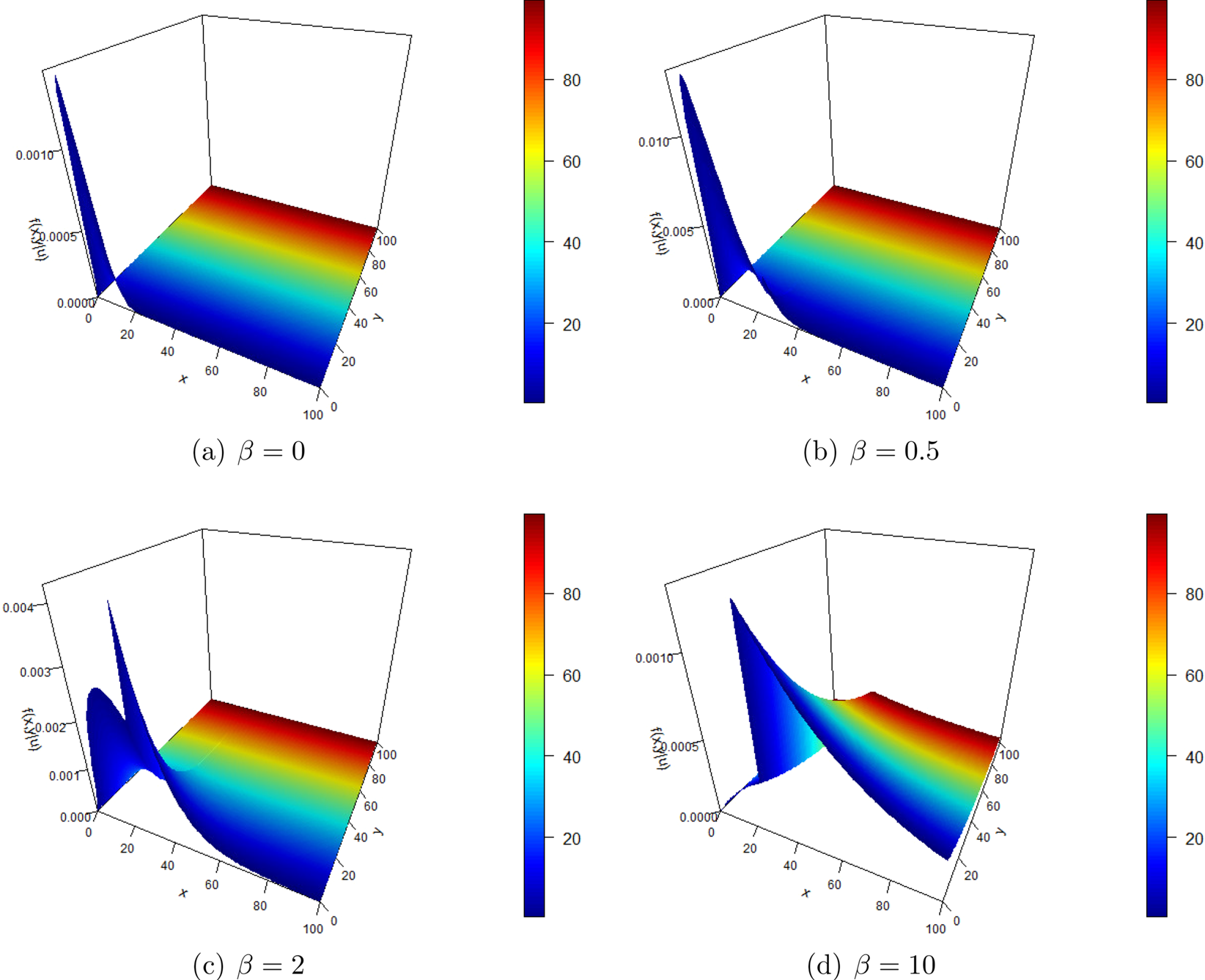

Assume that ![]() $u=25$. The proper joint density of the surplus before ruin and the deficit at ruin for different

$u=25$. The proper joint density of the surplus before ruin and the deficit at ruin for different ![]() $\beta$ are plotted in Figure 5. It seems that most frequently, ruin occurs when the current surplus drops below the initial surplus. When

$\beta$ are plotted in Figure 5. It seems that most frequently, ruin occurs when the current surplus drops below the initial surplus. When ![]() $\beta$ is larger, ruin may also happen when the current surplus is larger than the initial surplus. Besides, the joint density comes to a higher peak when

$\beta$ is larger, ruin may also happen when the current surplus is larger than the initial surplus. Besides, the joint density comes to a higher peak when ![]() $\beta$ is small. It shows that when the Poisson-Geometric model is employed, especially for over-dispersed batch arrivals, ruin happens more dispersedly compared with the no-batch-arrivals case (

$\beta$ is small. It shows that when the Poisson-Geometric model is employed, especially for over-dispersed batch arrivals, ruin happens more dispersedly compared with the no-batch-arrivals case (![]() $\beta =0$).

$\beta =0$).

Figure 5. Proper joint density of the surplus before ruin and the deficit at ruin for different ![]() $\beta$.

$\beta$.

Second, we consider an example with zero-truncated negative-binomial batch arrivals and exponential claim amounts.

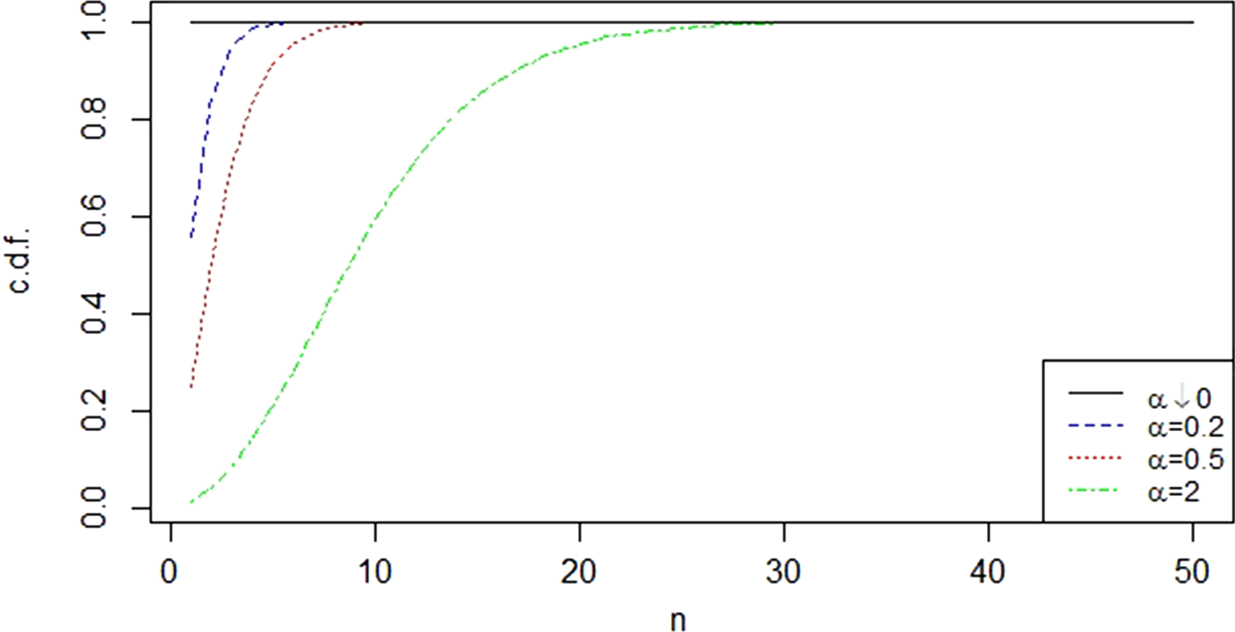

As stated in Section 3, zero-truncated negative-binomial batch arrivals may also accommodate both under- and over-dispersed data, while the resulting Poisson-Negative-Binomial counting process is still over-dispersed. Let ![]() $r = 5$. When

$r = 5$. When ![]() $\alpha = 0.2$, the batch arrivals are under-dispersed, while when

$\alpha = 0.2$, the batch arrivals are under-dispersed, while when ![]() $\alpha = 0.5$ or 2, the batch arrivals are over-dispersed. We also consider the single-claim-arrival case for comparison and denote its parameter by

$\alpha = 0.5$ or 2, the batch arrivals are over-dispersed. We also consider the single-claim-arrival case for comparison and denote its parameter by ![]() $\alpha$

$\alpha$ ![]() $\downarrow$ 0 as

$\downarrow$ 0 as ![]() $\alpha = 0$ is not admissible for the negative binomial distribution, and we may then define this case as

$\alpha = 0$ is not admissible for the negative binomial distribution, and we may then define this case as ![]() $p_1=1,$ which in turn will result in the classical compound Poisson model. The c.d.f. of the zero-truncated negative binomial distribution in the four cases for

$p_1=1,$ which in turn will result in the classical compound Poisson model. The c.d.f. of the zero-truncated negative binomial distribution in the four cases for ![]() $\alpha$ are plotted in Figure 6. The plot implies that the model whose batch arrivals follow the zero-truncated negative binomial distribution with larger

$\alpha$ are plotted in Figure 6. The plot implies that the model whose batch arrivals follow the zero-truncated negative binomial distribution with larger ![]() $\alpha$ is more likely to receive a larger number of claims at a time. This means that an insurance company with more business requires a model with a larger

$\alpha$ is more likely to receive a larger number of claims at a time. This means that an insurance company with more business requires a model with a larger ![]() $\alpha$.

$\alpha$.

Figure 6. C.d.f. of the zero-truncated negative binomial distribution.

The probability of ultimate ruin for different ![]() $\alpha$ is then plotted in Figure 7. It is confirmed in Figure 7 that the probability of ultimate ruin decreases with the increase of the initial surplus and reaches zero when the initial surplus is large enough. Moreover, the approximate values of

$\alpha$ is then plotted in Figure 7. It is confirmed in Figure 7 that the probability of ultimate ruin decreases with the increase of the initial surplus and reaches zero when the initial surplus is large enough. Moreover, the approximate values of ![]() $u$ for

$u$ for ![]() $\psi (u) = 0$ and

$\psi (u) = 0$ and ![]() $5\%$ for four different values of

$5\%$ for four different values of ![]() $\alpha$ are summarized in Table 2. Based on the results in the table, for the same level of initial surplus, the larger the

$\alpha$ are summarized in Table 2. Based on the results in the table, for the same level of initial surplus, the larger the ![]() $\alpha$, the larger the probability of ruin is. Thus, over-dispersed batch arrivals correspond to a higher risk of ruin as it should be expected. Moreover, Figure 7 stresses further that the possibility of batch-claim arrivals has a significant effect on the probability of ruin and should not be underestimated. Again, the approximate value of

$\alpha$, the larger the probability of ruin is. Thus, over-dispersed batch arrivals correspond to a higher risk of ruin as it should be expected. Moreover, Figure 7 stresses further that the possibility of batch-claim arrivals has a significant effect on the probability of ruin and should not be underestimated. Again, the approximate value of ![]() $u$ when the probability of ultimate ruin drops to

$u$ when the probability of ultimate ruin drops to ![]() $5\%$ is nearly half of that when the probability of ultimate ruin reaches zero, especially when

$5\%$ is nearly half of that when the probability of ultimate ruin reaches zero, especially when ![]() $\alpha$ is small. This implies that the insurance companies may only require half of the initial surplus needed for avoiding the vast majority of the risk of ruin to maintain a relatively low risk of ruin.

$\alpha$ is small. This implies that the insurance companies may only require half of the initial surplus needed for avoiding the vast majority of the risk of ruin to maintain a relatively low risk of ruin.

Figure 7. Probability of ultimate ruin.

Table 2. Approximate values of ![]() $u$ for which the respective values for

$u$ for which the respective values for ![]() $\psi$ are reached for the first time.

$\psi$ are reached for the first time.

The mean and variance of the ruin time are plotted in Figures 8 and 9, respectively. These plots seem to present linear patterns, which contradict Eq. (35) in Li and Sendova [Reference Li and Sendova6]. Obviously, when ![]() $\alpha$

$\alpha$ ![]() $\downarrow$ 0, the mean and the variance of the ruin time are indeed linear functions of the initial surplus. After more careful analysis, we may confirm that when

$\downarrow$ 0, the mean and the variance of the ruin time are indeed linear functions of the initial surplus. After more careful analysis, we may confirm that when ![]() $\alpha >0,$ e.g., when

$\alpha >0,$ e.g., when ![]() $\alpha = 0.2$, 0.5 or 2, the mean and the variance of the ruin time are not linear. More specifically, the mean of the ruin time seems to be a concave function, which implies that the mean of the ruin time increases slower when the initial surplus is larger. Meanwhile, the variance of the ruin time seems to have a convex shape, which indicates that the variance increases faster as the initial surplus gets larger. We also observe that for the same level of the initial surplus, the model with a higher

$\alpha = 0.2$, 0.5 or 2, the mean and the variance of the ruin time are not linear. More specifically, the mean of the ruin time seems to be a concave function, which implies that the mean of the ruin time increases slower when the initial surplus is larger. Meanwhile, the variance of the ruin time seems to have a convex shape, which indicates that the variance increases faster as the initial surplus gets larger. We also observe that for the same level of the initial surplus, the model with a higher ![]() $\alpha$ corresponds to lower mean and variance of the ruin time. In other words, over-dispersed batch arrivals lead to shorter ruin time. This is another indication that the possibility of batch arrivals should not be underestimated when a model is being built.

$\alpha$ corresponds to lower mean and variance of the ruin time. In other words, over-dispersed batch arrivals lead to shorter ruin time. This is another indication that the possibility of batch arrivals should not be underestimated when a model is being built.

Figure 8. Mean of the ruin time.

Figure 9. Variance of the ruin time.

Assume that ![]() $u=25$. The proper joint density of the surplus before ruin and the deficit at ruin for different

$u=25$. The proper joint density of the surplus before ruin and the deficit at ruin for different ![]() $\alpha$ are plotted in Figure 10. We also observe that most often ruin happens when the current surplus drops below the initial surplus. When

$\alpha$ are plotted in Figure 10. We also observe that most often ruin happens when the current surplus drops below the initial surplus. When ![]() $\alpha$ is larger, ruin may also occur when the current surplus is larger than the initial surplus. It shows that when the Poisson-Negative-Binomial model is utilized, especially for over-dispersed batch arrivals, ruin happens more dispersedly compared with the no-batch-arrival case (

$\alpha$ is larger, ruin may also occur when the current surplus is larger than the initial surplus. It shows that when the Poisson-Negative-Binomial model is utilized, especially for over-dispersed batch arrivals, ruin happens more dispersedly compared with the no-batch-arrival case (![]() $\alpha$

$\alpha$ ![]() $\downarrow$ 0).

$\downarrow$ 0).

Figure 10. Proper joint density of the surplus before ruin and the deficit at ruin for different ![]() $\alpha$.

$\alpha$.

As we can see, the results obtained in the case of zero-truncated geometric batch arrivals are in tune with the results obtained in the case of zero-truncated negative-binomial batch arrivals, which reflects the fact that the zero-truncated geometric distribution is a special case of the zero-truncated negative-binomial distribution.

Third, we consider an example with zero-truncated binomial-batch arrivals and exponential-claim amounts.

As stated in Section 3, the zero-truncated binomial-batch arrivals may only accommodate over-dispersed data, while the resulting Poisson-Binomial counting process is always over-dispersed. Let ![]() $l = 5$. When

$l = 5$. When ![]() $q = 0.2$, 0.5 or 0.8, the batch arrivals are all over-dispersed. The single-claim arrival case

$q = 0.2$, 0.5 or 0.8, the batch arrivals are all over-dispersed. The single-claim arrival case ![]() $q$

$q$ ![]() $\downarrow$ 0 is also considered for comparison. We use

$\downarrow$ 0 is also considered for comparison. We use ![]() $q$

$q$ ![]() $\downarrow$ 0 this value of

$\downarrow$ 0 this value of ![]() $q$ as it as

$q$ as it as ![]() $q = 0$ is not admissible, so we may define it additionally to result in

$q = 0$ is not admissible, so we may define it additionally to result in ![]() $p_1=1$. The c.d.f. of the zero-truncated binomial distribution in the four cases for

$p_1=1$. The c.d.f. of the zero-truncated binomial distribution in the four cases for ![]() $q$ is plotted in Figure 11. The plot indicates that the model whose batch arrivals follow the zero-truncated binomial distribution with larger

$q$ is plotted in Figure 11. The plot indicates that the model whose batch arrivals follow the zero-truncated binomial distribution with larger ![]() $q$ is more likely to receive larger number of claims at a time. This means that an insurance company with more business requires a model with a larger

$q$ is more likely to receive larger number of claims at a time. This means that an insurance company with more business requires a model with a larger ![]() $q$.

$q$.

Figure 11. C.d.f. of the zero-truncated binomial distribution.

The probability of ultimate ruin for the different values of ![]() $q$ is then plotted in Figure 12. This plot verifies that the probability of ultimate ruin decreases with the increase of the initial surplus and reaches zero when the initial surplus is large enough. Namely, the approximate values of

$q$ is then plotted in Figure 12. This plot verifies that the probability of ultimate ruin decreases with the increase of the initial surplus and reaches zero when the initial surplus is large enough. Namely, the approximate values of ![]() $u$ for

$u$ for ![]() $\psi (u) = 0$ and

$\psi (u) = 0$ and ![]() $5\%$ for the four different values of

$5\%$ for the four different values of ![]() $q$ are summarized in Table 3. Hence, we have seen that for the same level of initial surplus, the larger the

$q$ are summarized in Table 3. Hence, we have seen that for the same level of initial surplus, the larger the ![]() $q$, the larger the probability of ruin is. Figure 12 implies that batch-claim arrivals under this model do influence the probability of ruin, but the influence might not be that significant compared with the zero-truncated geometric and the negative-binomial batch arrivals cases. In addition, the approximate value of

$q$, the larger the probability of ruin is. Figure 12 implies that batch-claim arrivals under this model do influence the probability of ruin, but the influence might not be that significant compared with the zero-truncated geometric and the negative-binomial batch arrivals cases. In addition, the approximate value of ![]() $u$ when the probability of ultimate ruin falls to

$u$ when the probability of ultimate ruin falls to ![]() $5\%$ is approximately half of the initial surplus when the probability of ultimate ruin reaches zero. This means that in order to maintain a relatively low risk of ruin, the insurance companies may only require half of the initial surplus needed for eliminating most of the risk of ruin.

$5\%$ is approximately half of the initial surplus when the probability of ultimate ruin reaches zero. This means that in order to maintain a relatively low risk of ruin, the insurance companies may only require half of the initial surplus needed for eliminating most of the risk of ruin.

Figure 12. Probability of ultimate ruin.

Table 3. Approximate values of ![]() $u$ for which the respective values for

$u$ for which the respective values for ![]() $\psi$ are reached for the first time.

$\psi$ are reached for the first time.

The mean and variance of the ruin time are plotted in Figures 13 and 14. These plots show approximately linear patterns. Obviously, when ![]() $q \downarrow 0$, the mean and the variance of the ruin time are indeed linear functions of the initial surplus. However, when

$q \downarrow 0$, the mean and the variance of the ruin time are indeed linear functions of the initial surplus. However, when ![]() $q\in (0,1),$ e.g.,

$q\in (0,1),$ e.g., ![]() $q = 0.2$, 0.5 or 0.8, empirical analysis shows that the mean and the variance of the ruin time are not linear. To be specific, the mean of the ruin time seems to be concave, which implies that when the initial surplus is larger, the mean of the ruin time increases slower. At the same time, the variance of the ruin time seems to be convex, which indicates that the variance increases faster when the initial surplus is larger. All in all, for the same level of the initial surplus, the model with a higher

$q = 0.2$, 0.5 or 0.8, empirical analysis shows that the mean and the variance of the ruin time are not linear. To be specific, the mean of the ruin time seems to be concave, which implies that when the initial surplus is larger, the mean of the ruin time increases slower. At the same time, the variance of the ruin time seems to be convex, which indicates that the variance increases faster when the initial surplus is larger. All in all, for the same level of the initial surplus, the model with a higher ![]() $q$ corresponds to lower mean and variance of the ruin time.

$q$ corresponds to lower mean and variance of the ruin time.

Figure 13. Mean of the ruin time.

Figure 14. Variance of the ruin time.

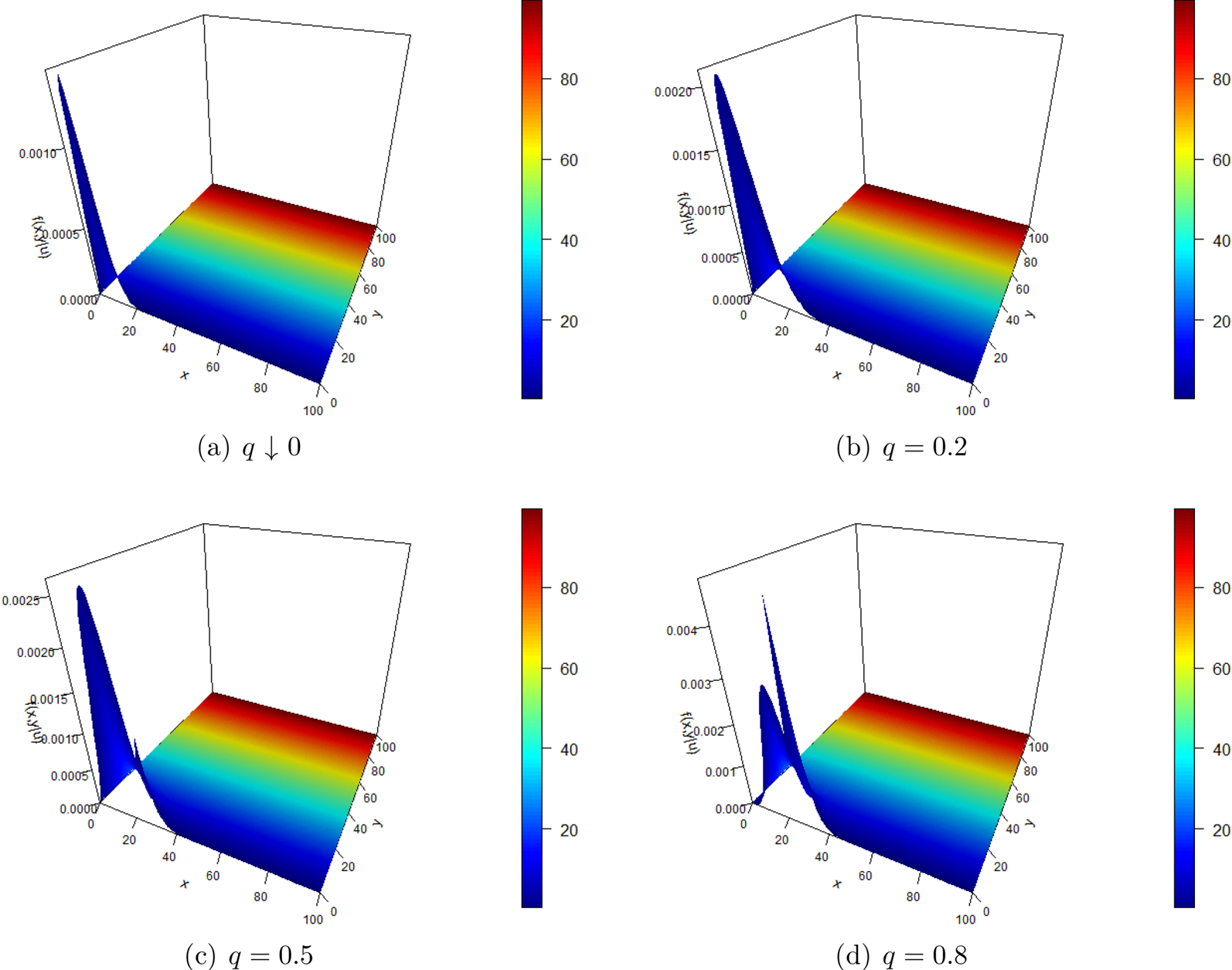

Assume that ![]() $u=25$. The proper joint density of the surplus before ruin and the deficit at ruin for different

$u=25$. The proper joint density of the surplus before ruin and the deficit at ruin for different ![]() $q$ are plotted in Figure 15. Notice that whenever ruin occurs, it happens with exceedingly high probability that when the current surplus drops below the initial surplus. The value of

$q$ are plotted in Figure 15. Notice that whenever ruin occurs, it happens with exceedingly high probability that when the current surplus drops below the initial surplus. The value of ![]() $q$ has relatively small effect on the distribution of the surplus before ruin and the deficit at ruin. It shows that the Poisson-Binomial model may not yield significant modeling improvements compared with the no-batch-arrival case.

$q$ has relatively small effect on the distribution of the surplus before ruin and the deficit at ruin. It shows that the Poisson-Binomial model may not yield significant modeling improvements compared with the no-batch-arrival case.

Figure 15. Proper joint density of the surplus before ruin and the deficit at ruin for different ![]() $q$.

$q$.

4.2. Erlang( $k$) claim amounts

$k$) claim amounts

This subsection is dedicated to Erlang(![]() $k$) claim amounts and we choose

$k$) claim amounts and we choose ![]() $k=3$. For comparison reasons, we will utilize the same parameter values as in the examples with exponential-claim amounts in Subsection 4.1.

$k=3$. For comparison reasons, we will utilize the same parameter values as in the examples with exponential-claim amounts in Subsection 4.1.

Firstly, we consider an example in the case of zero-truncated geometric batch arrivals.

As before, we choose ![]() $\beta = 0$, 0.5, 2 and 10. The c.d.f. of the zero-truncated geometric distribution in the four cases for

$\beta = 0$, 0.5, 2 and 10. The c.d.f. of the zero-truncated geometric distribution in the four cases for ![]() $\beta$ is plotted in Figure 1 in Subsection 4.1.

$\beta$ is plotted in Figure 1 in Subsection 4.1.

The probability of ultimate ruin for different ![]() $\beta$ is then plotted in Figure 16. As is shown in the plot, the probability of ultimate ruin decreases with the increase of the initial surplus and reaches zero when the initial surplus is large enough. The approximate values of