Mounting evidence suggests that the American presidency may fall well short of a normatively appealing, nationally representative Executive—loyal only to the public interest. In particular, a burgeoning research agenda has highlighted the distributive politics of presidential power (Berry, Burden and Howell Reference Berry, Burden and Howell2010; Hudak Reference Hudak2014; Kriner and Reeves Reference Kriner and Reeves2015a; Kriner and Reeves Reference Kriner and Reeves2015b). Contrary to past studies, which focus almost exclusively on legislators’ efforts to secure funding for their districts, this research has shown that federal resources tend to be allocated in a way that redounds to the benefit of the president and presidential co-partisans.

We further this line of inquiry in two ways. First, scholarship on presidential distributive politics has focused almost exclusively on federal domestic spending.Footnote 1 Yet, presidential influence on public policy extends well-beyond grant allocation. It is plausible, then, that the particularistic imperative would affect other areas of presidency-driven politics. We analyze one of those areas: trade politics. Since the early 20th century, the president has had substantial discretion to adjust tariff schedules and non-tariff barriers (NTBs) “with the stroke of a pen” (Mayer 2001).Footnote 2 In the Reciprocal Trade Agreements Act (RTAA) of 1934 and the Trade Reform Act of 1974, the president was granted wide discretion to adjust trade barriers through presidential directives. These trade adjustments via presidential directive allow us to test the logic of presidential particularism in an area of policy understudied among presidency scholars. Second, trade represents an “intermestic” political issue, in that it has direct implications for the foreign affairs of the United States and the prospects of American producers. Given this, the systematic evidence we present is a rare and important example of the president’s domestic, particularistic incentives directly affecting the foreign affairs of the United States.

We study unilateral adjustments to trade policies between 1917 and 2006, with a detailed analysis of those made between 1986 and 2006 (which allows us to compare our findings with prior work on presidential distributive politics that has been confined to a similar period). Specifically, we link protectionist adjustments to the interests they directly benefited, and the corresponding political units wherein those interests operated. By connecting protectionist measures for a given commodity and top state producers, we identify which states benefited most from changes in trade policy. We find that presidents, in accordance with electoral incentives, strategically adjust trade barriers. In presidential election years, presidents provide consistent protection to states that are hotly and weakly contested—relative to states that are firmly controlled. And, contrary to prior research, we find presidents are not significantly more likely to allocate protectionist measures to politically vulnerable co-partisans in the House or Senate. These findings suggest that the president’s distributive imperative extends beyond domestic spending—into an area of substantial executive discretion.

Presidential Particularism

Recent, provocative analyses of federal grants have demonstrated that the distribution of domestic spending reflects the partisan and electoral interests of a particularistic president (Berry, Burden and Howell Reference Berry, Burden and Howell2010; Hudak Reference Hudak2014; Kriner and Reeves Reference Kriner and Reeves2015a; Kriner and Reeves Reference Kriner and Reeves2015b). Faced with strong incentives as party leaders (Galvin Reference Galvin2010; Milkis, Rhodes and Charnock Reference Milkis, Rhodes and Charnock2012), presidents use their influence at multiple stages of the budgetary process to aid co-partisans, sway key states in the electoral college, and reward core supporters. The absolute impact of this behavior on federal outlays is striking: Kriner and Reeves, for example, show that between 1984 and 2008, a county within a swing state saw “$27.8 million more in federal spending than [did] a comparable county in a non-swing and non-core state” (Reference Kriner and Reeves2015b, 137). Hudak (Reference Hudak2014) finds this county-level effect meaningfully aggregates to the state level, with swing states receiving in excess of $1.5 billion in additional spending during election years.

Though this work has reinvigorated the study of the president’s role in the American political system, it leaves unanswered some fundamental questions about presidential particularism. This limitation is a function of the most common object of interest: federal grants. In the stylized congressional context, particularistic behavior often manifests itself in “pork-barrel” spending—with national receipts reallocated for local use to the benefit of legislators’ electoral interests. Presidential influence occurs as individual earmarks and requests are aggregated to the budgetary level—and ultimately implemented by federal agencies. Identification of presidential incentives, together with the presence of strong correlations between those incentives and grant allocation, indicate that presidential influence is both operative and impactful. However, the precise mechanism by which presidential preferences are brought to bear on the distribution of federal spending is difficult to tease out.

The list of possible means of achieving presidential particularism in federal grant allocation is long. As Berry, Burden and Howell (Reference Berry, Burden and Howell2010) argue, presidents have both “ex ante” and “ex post” means of influencing policy. They are first-movers in the budgetary process and hold formal legislative powers in the presidential veto (Cameron Reference Cameron2000; McCarty Reference McCarty2000). With congressional approval, they may transfer or reprogram funds. They can construct new bureaus and agencies by directive (Howell and Lewis Reference Howell, Jackman and Rogowski2002; Lewis Reference Lewis2003), politicize agencies (Lewis Reference Lewis2008), and centralize decision making within the White House and Executive Office (Dickinson Reference Dickinson1997; Rudalevige Reference Rudalevige2002). By highlighting these mechanisms, scholars have argued that their empirical findings are the result of a deliberate, systematic effort on the part of presidents and their administrations. However, the critical task of adjudicating between which mechanisms are more or less important is difficult. Each operates at a different stage of the policy-making process and is subject to its own limitations. Of recent work on presidential particularism, only Hudak (Reference Hudak2014) investigates these avenues of influence directly, uncovering suggestive evidence that an increase in the number of political appointees within an agency renders them more responsive to the president’s electoral interests.

The difficulty associated with analyzing the means of presidential particularism stands in sharp contrast to studies of distributive politics in the legislative realm. For members of Congress (MCs), the mechanism is quite clear: produce a law. Legislation produced can be traced to authors, sponsors, and ultimately “yeas” and “nays.” For the president, the distribution of federal spending carries no clear lineage. Federal grant awards do not bear the president’s signature. They are not awarded from the oval office. Ultimately, the multiplicity of mechanisms limits what researchers can argue about hypothetical attempts to limit particularistic allocation on the part of the president. That is, if the process by which presidents facilitate the implementation of policy contains a particularistic side effect, it is not clear what remedy scholars could prescribe.

If presidents’ electoral incentives are powerful enough to merit harnessing the aforementioned tools, we should expect those incentives to extend beyond domestic spending. Presidents are not merely stewards of federal largesse, they supervise (however, indirectly) the implementation of all public policy. Many of these areas of policy carry equal weight in terms of economic impact. Kriner and Reeves (Reference Kriner and Reeves2015b), for example, highlight particularistic trends in military base closings, disaster declarations, and trade. In our view, the latter—trade—provides an excellent opportunity to address the concerns laid out above. In most cases, presidents have been statutorily required to “proclaim” trade barrier revisions. Though the authorization (and reauthorization) of the RTAA and other trade agreements reflects congressional preferences, trade adjustments via presidential directive represent the revealed preferences of the sitting president. In this way, they offer the same direct linkage afforded by pork-barrel legislation.

Trade adjustments also side step many of the potential concerns associated with isolated analyses of federal grants, since agency problems associated with implementation of tariff rates or NTBs are comparatively minimal. More specifically, whereas both federal grants and trade adjustments are subject to ex ante influence on the part of a multitude of actors, trade adjustments are subject to comparatively minor (even non-existent) influences after they acquire the president’s signature. The details of their administration are not left to agents. They are often simple amendments to the existing tariff schedule or quota. This allows us to focus exclusively on incentives (e.g., electoral, partisan, policy) and actors (e.g., legislators, interest groups, voters) that drive presidential behavior. Thus, like any of the unilateral tools identified by past research, the president’s observed behavior will be indicative of the influence of other actors.

Moreover, the political salience of trade policies during the latter half of the 20th century is low, especially compared to the height of tariff battles in Congress between 1870 and 1930. Public information on this issue is limited, and its economic impact—though substantial—is often delayed. Thus, it is unlikely the average (or even attentive) voter would be capable of directly connecting marginal changes in the tariff schedule to changes in the prices of commodities.Footnote 3 Research has also shown that Congress and the Judiciary contest presidential preferences in foreign affairs systematically less often. While this is most apparent in military (Howell, Jackman and Rogowski Reference Howell and Lewis2013) and intelligence (Zegart Reference Zegart2011) affairs, presidents’ preeminence in foreign policy provides them with the opportunity to act on particularistic incentives.

In short, trade is an ideal place to look for evidence of particularism because the president has direct and observable influence, and opposing political forces in Congress, the Judiciary, and the mass public may be less likely to contest direct action.Footnote 4 We will describe in more detail the president’s authority to revise trade policies as a particularistic tool, and identify the audience for such revisions (key industry interests in states), but first we present a short history of presidential particularism and trade to provide historical context and set the stage for the analysis to come.

Presidential Particularism and Trade: A Short History

For the Nation’s first century, determining policy in the area of international trade had been solely the domain of Congress. Beginning in 1816, with the passage of what is generally considered the nation’s first protective tariff (Stathis Reference Stathis2014), Congress began adjusting tariff rates and schedules as a way to help (or hurt) various agricultural and manufacturing interests in their districts or states. Trade policy, therefore, became a prime area of distributive politics in the 19th century, and trade deals often involved intricate logrolls, usually within the majority party and sometimes across parties. These logrolls became increasingly difficult to devise over time, as interests became more numerous and complex and MCs and parties faced more and more demands. As Epstein and O’Halloran note: “The process of building trade legislation item by item can thus lead to a collective dilemma of over-logrolling, similar to the much discussed tragedy of the commons. The end result is that all legislators are made worse off than before” (Reference Epstein and O’Halloran1999, 223).

A complete solution to this dilemma—delegation of tariff-setting authority to the president—was not resolved until the early New Deal years, but MCs recognized the problem early on and increasingly so after the Civil War. Congress first took steps in the direction of delegated authority during the Gilded Age, with the passage of the McKinley Tariff in 1890.Footnote 5 In that Act, the president was provided with the discretion to enter into limited reciprocal trade agreements with countries that produced certain items, as a way to secure favorable trade concessions for the United States. The reciprocity clause was eliminated in 1892 by the Wilson–Gorman Tariff Act, but reinstated and expanded to include other eligible items in 1897 by the Dingley Tariff. In addition, the Dingley Tariff also provided the president with the ability to enter into agreements that reduced duties in existing statutes. A change was made again in 1909, with the Payne–Aldrich Tariff Act, in which Congress established maximum and minimum tariff rates and delegated administration (and application) of the appropriate rates to the president. The president was also allowed to create the Tariff Board, to improve his informational capacity. In 1913, with the Underwood Tariff Act, the president was provided with another grant of authority, this time to negotiate comprehensive trade agreements, not just pacts over a limited set of specified items.

With the passage of the Revenue Act of 1916, tariff politics entered a new phase. The Revenue Act established the Nation’s first permanent federal income tax, which led to a substantial decline over time in the percentage of federal revenues attributable to custom duties. It also included an anti-dumping provision, to protect domestic industries, and created a Tariff Commission to help establish “objective” tariff rates. In 1921, the Emergency Tariff Act shifted the enforcement of the 1916 Act’s anti-dumping provision from the courts to the executive agencies, and adjusted the remedy from fines and possible imprisonment to higher import duties. The following year, in 1922, the Fordney–McCumber Tariff Act expanded the anti-dumping and anti-discrimination parameters of the previous two acts, but perhaps more importantly, provided the president with the discretion to raise or lower duties (by as much as 50 percent) that were fixed in statute by proclamation (upon an equalization-of-cost-of-production recommendation by the Tariff Commission). The highly protectionist Smoot–Hawley Tariff Act of 1930 carried over the “flexible tariff provision” of the 1922 Act, thus maintaining the president’s proclamatory power to adjust rates fixed in statute, once again per the recommendations of the Tariff Commission.

Finally, in 1934, with the RTAA, congressional delegation of trade authority to the president was effectively complete. The new Democratic majority took aim on the overly protectionist features of Smoot–Hawley and sought to solve the collective dilemma of over-logrolling once and for all. As O’Halloran writes: “Instead of giving the president limited authority to increase or decrease certain tariffs set by Congress either through reciprocal trade concessions or through objective criteria, the president could now enter into commercial agreements and change any rate by proclamation” (Reference O’Halloran1994, 85–6). Moreover, he could do this on his own, without relying on the actions or attention of an external agent (like the Tariff Commission).

In delegating authority for international trade to the president, the Congress also stipulated that such delegation would be renewed regularly. And RTAA extensions were frequent (every two to four years) and sometimes contentious events for the next three decades. The politics of these extensions usually involved Congress working to ensure that domestic industries had input in decision-making processes and that oversight mechanisms were created such that information from the executive was readily reported and shared. In 1962, Congress passed the Trade Expansion Act, which broadened the president’s trade authority by allowing him to negotiate multilateral (as well as bilateral) agreements, while also including additional safeguards to protect domestic industry. Finally, in 1974, Congress passed the Trade Reform Act, which provided the president with the authority to negotiate arrangements to harmonize, reduce, or eliminate trade barriers (both tariffs and NTBs). However, in exchange for this delegation, which would essentially allow the president to alter various domestic codes, Congress required that such international agreements (going forward) receive legislative approval, and set up a new institutional system—known as “fast track”—that would allow the new presidential-congressional system to work. Such a system included (among other things) a pre-negotiation period, which would allow interested parties to provide input; further protections and safeguards for domestic industries; and a short window by which Congress could act on a presidential agreement (and only by an up-or-down vote).

The “modern” era of trade agreements, then, was first marked by the RTAA in 1934 and more recently by the Trade Reform Act of 1974. In the former, the president was provided with wide proclamatory discretion regarding the adjustment of tariff rates and schedules. In the latter, Congress further expanded the president’s authority in the realm of trade, but also provided itself with a formal role in the monitoring of executive action. More recent trade laws have largely been adjustments vis-à-vis the 1974 Act, based on changing world conditions.

Understanding Presidential Trade Authority

How might we understand the president’s authority to revise trade policies as a particularistic tool? Answers to this question follow from comparing and contrasting trade barriers with federal grants. First, unlike redistribution via grant (Cox and McCubbins 1986; Londregan and Dixit 1996), tariffs and NTBs cut across traditional interest groups. The protection of a particular commodity benefits both labor and management. Second, by influencing a single commodity, they impose diffuse costs on consumers while providing an immediate benefit to American producers. Similarly, grants impose diffuse costs (via taxation) in order to provide localized benefits. Third, the use of trade barriers is not subject to an obvious resource constraint—in that, they actually raise government revenue. Given this, we argue that while trade policies will likely reflect the particularistic imperatives identified by Kriner and Reeves (Kriner and Reeves Reference Kriner and Reeves2015a; Kriner and Reeves Reference Kriner and Reeves2015b) and others, with the key modification that co-partisan legislator’s should not benefit from the President’s discretion in this area.

Trade policies are linked to a range of domestic industries and are often broad in scope. Even provisions that target a specific industry will affect producers beyond self-contained geographic units (districts and even states)—in addition to cutting across traditional interest group fault lines. Thus, relative to grants, which can be geographically targeted, trade barriers are comparatively blunt instruments. Yet, grants are less unilateral in orientation and require greater cross-institutional collaboration. Thus, in exchange for unilateral discretion, the president wields a less precise instrument. To enter the world of metaphors, grants might be thought of as “sniper rifles,” whereas trade barriers are closer to “shotguns.” We argue variance in downrange groupings renders the latter ineffective at aiding the electoral fortunes of presidential co-partisans. Grants, on the other hand, are appropriate instruments for targeting narrowly defined geographic areas (like House districts) and thus, are suitable for helping co-partisans in Congress.

Extending the study of particularism to trade policies also raises additional questions about the interaction of the instruments. That is, if the president has a variety of tools that could be used to satisfy a particularistic imperative, is it reasonable to assume those tools could be substitutes? More specifically, are federal grants and tariff barriers exchangeable? Here again, it is important to highlight key differences between the two. Trade barriers—despite their bluntness—serve as an effective mechanism to satisfy the needs of particular kinds of “attentive publics” (Arnold Reference Arnold1990), namely key industry interests affected by international competition and trade.Footnote 6 As Kriner and Reeves note: “presidents have … routinely provided relief from foreign competition for select industries, particularly those with considerable political clout” (Reference Kriner and Reeves2015b, 53).

This mechanism is distinct from those identified in studies of federal spending, in which scholars argue (implicitly or explicitly) that citizens vote based upon the economic conditions in their local community (see Kriner and Reeves Reference Kriner and Reeves2012 for a summary of this literature). As grants directly improve local economic outcomes, voters will be more likely to perceive presidents favorably as a result—and reward them at the ballot box. Though trade barriers may trickle-down to the citizen level, we argue that their primary audience will be key industries in states—which play close attention to the administration’s willingness to protect them from foreign competition, and can marshal the necessary resources to support or oppose the president come election time. These differences underscore a basic point: trade barriers and grants—despite their usefulness for redistribution—serve different audiences. This means their impact is not exchangeable and—as a result—we do not expect presidents use them as substitutes.

Finally, as previous work largely demonstrates, there is a key temporal aspect to presidents’ redistributive policies. Thus, if presidents indeed use such trade authority for electoral benefit, we would expect adjustments to align with presidential election cycles. That is, we should be more likely to observe protectionist revisions during presidential election years, as those years provide the clearest opportunity for satisfying presidents’ assumed electoral goals.

Protectionism in Unilateral Orders

The study of presidential particularism in the area of trade policy offers a unique opportunity to identify politically motivated changes. Unlike the allocation of federal grants, trade modifications bear the president’s signature—as such, they are comparatively “unilateral.”Footnote 7 Moreover, though there is some variance in the type of directive used to effectuate these changes, presidents have been statutorily required to publish changes in the Federal Register.Footnote 8 For this reason, they can be analyzed across a long time-series—whereas analyses based on grant allocations and the Federal Assistance Award Data System are typically restricted to the 1970s and beyond. Our data set contains 345 presidential directives issued between 1917 and 2006.

The event of theoretical interest is a unilateral change in trade policy made by a president. This is most commonly achieved by proclamation, but in the data collection process, we discovered a handful of executive orders (3) and memoranda (16) that produced similar changes. For sources, we use Rottinghaus and Lim’s (Reference Rottinghaus and Lim2009) database of presidential proclamations, executive orders available at Wooley and Peter’s American Presidency Project website, and presidential memoranda collected by Lowande (Reference Lowande2014).Footnote 9 This data gathering produced 630 trade-related presidential directives. We then imposed a few additional criteria for inclusion. First, several of these trade-related directives do not prescribe policy changes; instead, they delegate policy-making authority to a bureaucratic agent. Since these directives do not contain the changes themselves, they are not included in the analysis.Footnote 10 Second, many other directives are country specific, rather than industry specific. That is, they are direct responses to policies enacted by other nations. We omit these directives for two reasons. Linking presidential directives to elections requires identifying beneficiaries—a task muddied by country-specific responses. On the one hand, all competing domestic producers may benefit from trade barriers such as these, but there may be some “target” beneficiary that motivated the change. Since this suggests that some cases of particularism will be concealed, we believe this biases our analysis toward null findings. Moreover, it is likely that a separate data generating process governs these observations. That is, the president’s discretion in this area is constrained by the actions of foreign political actors, who enact the trade barriers that precipitate a reciprocal response. Thus, our data set contains proclamations, executive orders, and memoranda that explicitly amend trade policies by targeting specific industries—either to protect domestic producers or promote trade liberalization.

As an initial descriptive exercise, we code whether or not these orders were protectionist (1) or universalistic (0), to investigate whether their content varies in a way consistent with presidential particularism. Recall that we expect presidents to strategically allocate protectionist orders to aid their electoral fortunes.Footnote 11 Trade barriers artificially inflate the prices of goods, allowing domestically produced commodities to remain competitive in the US market. In effect, they provide a localized benefit to those producers, with a collective cost (higher prices) diffused at the national level. Therefore, we might expect to see particularistic directives to be concentrated in presidential election years.

In Table 1, we estimate whether an order was protectionist on an indicator variable for presidential election years.Footnote 12 The unit of analysis is a unilateral directive issued between 1917 and 2006. To account for the possibility that the result may be a function of the non-random distribution of directives, we include divided government (coded “1” if either chamber of Congress is controlled by the opposition), unemployment rate,Footnote 13 an indicator for major war years,Footnote 14 and presidential fixed effects. In addition, since the RTAA of 1934 and Trade Act of 1974 substantially adjusted the president’s discretion to alter tariff schedules and NTBs, we include appropriate indicator variables—the first, coded “1” for all years post-1934, the second, coded “1” for all years post-1974. To explore whether these dramatic statutory shifts influenced patterns in presidential protectionism, we also interact these indicators with presidential election years.Footnote 15

Table 1 Protectionism in Unilateral Directives, 1917–2006

Note: Dependent variable: whether directive raised tariffs; logit coefficients with robust standard errors in parentheses; presidential fixed effects omitted.

RTAA=Reciprocal Trade Agreements Act.

*p<0.1, **p<0.05, ***p<0.01, two-tailed tests.

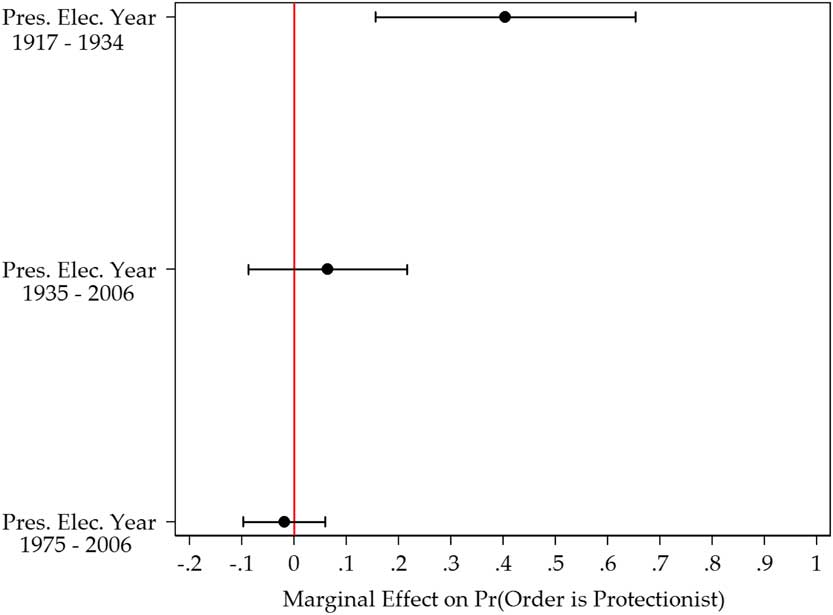

In keeping with our general expectation, directives are more likely to be protectionist in presidential election years. Roughly 55 percent of the directives in our data set are protectionist; however, in general, those issued during presidential election years are more likely to be protectionist. In column (a) of Table 1, a presidential election year results in a 13 percentage point increase in the probability an order is protectionist. After controlling for the enactment of the RTAA and 1974 Act in column (b), the magnitude of this effect remains the same. We find, however, that this effect appears to be largely driven by years prior to the enactment of the RTAA. More specifically, in model (c), we allow the effect of presidential election years to vary based on the RTAA and 1974 Act by interacting presidential election years with each enactment. The results suggest that the RTAA dampened the tendency for orders to be protectionist during presidential election years, whereas the 1974 Act had little additive impact. Figure 1, which provides the marginal changes in probability by enactment period, illustrates this. Though a broader consideration of the effect of these statutory changes is beyond the scope of this study, these results suggest that it may be more difficult to observe evidence of presidential particularism in trade policies during later periods. This is important, because the analysis that we present in the following sections relies on orders from 1986 through 2006, which may bias against empirical support for our hypothesis.

Fig. 1 Protectionism in unilateral directives, by period

The estimated relationships are also distinct from trends in protectionism during midterm elections. In fact, the estimated relationship is slightly negative, implying that protectionism is less likely in these directives. There is also some evidence that orders are less likely to be protectionist under divided government. This suggests that an opposition-controlled Congress may constrain the president’s ability to enact revisions. Overall, these results suggest that particularistic trends among trade orders warrant further investigation. If, as others have argued (e.g., Karol Reference Karol2007), presidents have incentives to promote free trade, there are few plausible alternative explanations for why they would concentrate protectionist actions during election years.Footnote 16 However, to investigate this further, we must shift our empirical focus to state-level benefits derived from unilateral changes in trade policy. If presidents use trade protection as a “particularistic” tool, it is not enough to observe that these orders tend to be concentrated near election years—we must determine whether their allocation of benefits follows the electoral incentives of the president.

State-Level Analysis: Data and Empirical Strategy

In the early 20th century, presidential directives were systematically more likely to enact protectionist trade adjustments in presidential election years. By contrast, we found little evidence that elections affect the nature of unilateral trade adjustments in the post-RTAA era. We further investigate these findings by analyzing which states benefit from protective orders between 1986 and 2006. Following Kriner and Reeves (Reference Kriner and Reeves2015b), we are primarily interested in detecting electoral calculations that may affect the decision to enact federal trade adjustments. Consequently, we test whether or not presidents use their discretion to benefit (1) presidential “swing” states, (2) presidential “hostile” states, (3) states with vulnerable senators of the president’s party, and (4) states with a large proportion of vulnerable House members from the president’s party. Finally, we consider the conditioning effect of election cycles on each of these explanatory variables. Below we discuss the extensive data and conditional empirical strategy employed to test these expectations.

Our dependent variable, State Protected, is an indicator variable that identifies which states were the most affected by a protectionist trade adjustment.Footnote 17 To generate this variable, we first code the direction of each unilateral trade adjustment between 1986 and 2006. Presidential actions were coded either as protectionist or not-protectionist, where protectionist actions restricted foreign imports through tariffs and NTBs and non-protectionist actions generally liberalized trade arrangements. Next, we identified the industry (or industries) affected by a given unilateral action, and code the five states most likely to be affected by protectionist trade policy for that specific industry.Footnote 18 In general, we relied upon official government resources to code the top five states affected by a presidential trade adjustment. Because these coding decisions are specific to a particular industry in a particular year, we relegate additional information on the construction of this variable to the Online Appendix—which provides a full list of data sources used to identify the states most affected by individual trade adjustments.Footnote 19 The final product of these data efforts is a dichotomous variable, which is coded “1” if a state is among the top five affected by a unilaterally implemented protectionist adjustment in a given year and “0” otherwise.

The most obvious place we might detect particularism in trade politics is among the most competitive states in presidential electoral politics. Our first electoral predictor of interest is thus Swing States, a binary indicator for states that were highly contested in recent presidential elections. If we believe that presidents target vital business interests with trade adjustments, swing states provide opportunities to shore up their vote share. Following Kriner and Reeves (Reference Kriner and Reeves2015b), we identify swing states as those states in which the losing candidate averaged 45 percent or more of the two-party vote over the past three presidential election cycles. These data were obtained from The American Presidency Project.

By contrast, presidents may be unlikely to provide particularistic benefits to Hostile States, as these states are unlikely to generate electoral support for the president. We again follow Kriner and Reeves (Reference Kriner and Reeves2015b) by defining “hostile” states as those states that the president’s party received, on average, <45 percent of the two-party presidential vote share in the previous three election cycles. Coupled with the Swing State variable, our Hostile State variable creates a third, mutually exclusive baseline category: “core” states in which the president’s party received, on average, >55 percent of the two-party vote over the last three contests.

To advance his agenda, the president may also adjust trade policy to benefit congressional co-partisans. Unilateral trade adjustments may also be used to satisfy industry leaders who are in a position to support like-minded legislators. By this logic, presidents may target states with vulnerable co-partisans as a complementary strategy in distributive politics. Testing this conjecture requires the construction of two additional variables. First, we use electoral data provided by the Database on Ideology, Money in Politics, and Elections to create a Senate Co-Partisan Vulnerability measure (Bonica Reference Bonica2013). This is a dichotomous measure of whether or not an incumbent senator from the president’s party received up to 55 percent of the two-party vote in the most recent election cycle. Second, we use Gary Jacobson’s House election data to construct the proportion of vulnerable presidential co-partisans in each state, where vulnerability is measured as winning in the most recent congressional election cycle with no >55 percent of the two-party vote share.Footnote 20 This provides our House Co-Partisan Vulnerability variable, which is bounded between 0 and 1.

Finally, we control for potentially confounding “substitution effects” of federal grant allocations to these states. To avoid biasing the inferences drawn from our electoral variables, we use data from Kriner and Reeves (Reference Kriner and Reeves2015b) for the logged amount of federal dollars each state received in each year for the duration of our time-series. These data were originally compiled using Consolidated Federal Funds Reports on each federal program.Footnote 21 As we have argued, there is good reason to believe that these tools may not be simple substitutes, but it is important to test this empirically.

If electoral calculations drive presidential trade adjustments, the effect of these variables should be particularly pronounced in crucial moments throughout the general election campaign. To capture this electoral conditioning effect, we interact each of our explanatory variables with a dichotomous indicator for relevant election years. Hostile States and Swing States are interacted with Presidential Election Year. Our House Co-Partisan Vulnerability measure is interacted with an indicator for a Midterm Election Year, and our Senate variable is interacted with a state-specific indicator for Senate Election Year.Footnote 22 We estimate the electoral influence of presidential trade revisions with a logistic regression model.

State-Level Analysis: Results

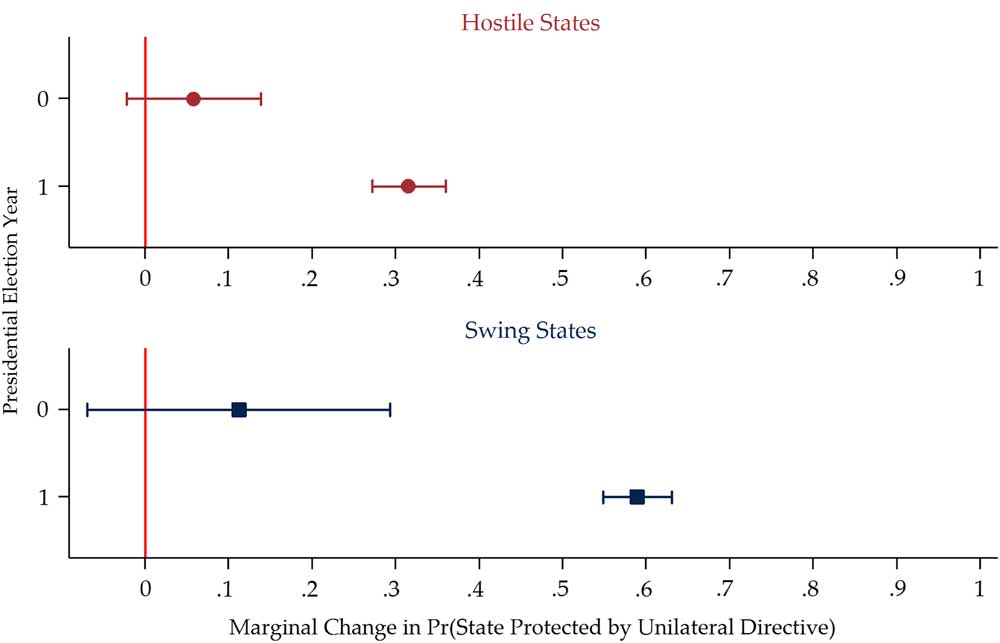

Our results suggest that the use of unilateral trade adjustments is conditioned by presidential election cycles. States that are electorally valuable to the president are significantly more likely to have their industries protected in presidential election years. Surprisingly, this conditional affect also increases the probability of receiving protectionist benefits for states that consistently support the opposing party. By contrast, we find no evidence that protectionist adjustments have been used strategically to assist co-partisans in the House or Senate. Our full results are provided in Table 2.Footnote 23 We provide marginal effects plots for the presidential interactions in Figure 2, and predicted probabilities are reported in the Online Appendix (Figure A2). All results include standard errors clustered by state.

Fig. 2 Protecting state industries, 1986–2006

Table 2 Protecting State Industries, 1986–2006

Note: Dependent variable: state protected by unilateral directive (0, 1); logit coefficients with robust standard errors, clustered by state, in parentheses.

*p<0.1, **p<0.05, ***p<0.01, two-tailed tests.

In non-presidential election years, when the president provides protection to industries through executive action, his actions benefit states irrespective of their electoral value. Specifically, we find that hostile states and swing states are no more likely to receive protectionist trade adjustment than presidents’ core states. The marginal effect on the probability of receiving protectionist benefits is 0.06, but we cannot reject the null hypothesis of no effect. Swing State results are similar, with a marginal effect of 0.11 (p>0.1).

In presidential election years, we find dramatically different results. States are significantly more likely to receive presidential protection when their electoral value is most salient. More specifically, the predicted probability that Swing States receive protection from presidential directives increases from effectively 0 in non-presidential election years to 0.6 in presidential election years.Footnote 24 These results are also consistent across both models, and the marginal effects for these variables in the full model are reported in Figure 2.

Counter to our expectations, we also find statistically significant results for Hostile States. While the magnitude of the effect is significantly lower, our model estimates a 0.3 increase in the marginal change in probability of receiving presidential protection. We can think of several possible motivations for the preference given to Hostile States. First, it is possible that the president attempts to move a Hostile State into contention early in the election cycle through trade adjustments. Alternatively, he may try to mute industry opposition capable of mobilizing electoral support for his competition. By providing benefits to the opposing party’s most loyal states, the president may force his opponents to invest resources they might otherwise pour into swing states. Ultimately, this finding suggests that presidential targeting of trade adjustments differ from that of federal grants—though the current results do not allow us to adjudicate between alternative explanations.

Moreover, in contrast to existing work, we find no support for a complementary, congressional strategy of distributive benefits. The marginal change in probability for states with vulnerable legislators is consistently indistinguishable from 0. Simply put, the president’s co-partisans in both the House and Senate do not appear to benefit from the president’s discretion over trade barriers. In fact, we find that states without vulnerable House co-partisans experience a small (0.04) increase in the probability of protection during midterm election years, but we have less confidence rejecting the null (p<0.1, with a 95 percent confidence interval of [−0.01, 0.09]).

While the coefficient on presidential election years appears to be strong and in the opposite direction of our descriptive results, the marginal change in probability for this variable indicates that core states are less likely to receive protection in presidential election years than other years—but the effect size remains effectively 0. Simply put, core states almost never receive protection from unilateral directives. Finally, we find no substitution effects for federal grant allocation in our models. This may suggest that grant allocations and trade adjustments are indeed tools used for distinct political goals, but we hesitate to interpret these null findings further.

In sum, our results suggest that presidential particularism in the area of trade policy is a conditional phenomenon. Presidents generally do not appear to be electorally motivated when they issue trade adjustments, but the probability that a state benefits from the president’s discretionary authority over trade increases dramatically if (a) the state is electorally valuable to the president and (b) it is a presidential election year. This finding is consistent with a growing literature on presidential particularism.

Conclusion

In the American political system, the president’s influence touches nearly all areas of public policy. In the pursuit of electoral gain, it is conceivable that presidents would use this influence to strategically distribute government benefits. This basic point is as old as presidential systems themselves, but recent work has found that—in the American context—it may explain variation in federal spending. There is little reason to believe that the particularistic imperative should be confined exclusively to this area. We have found preliminary—but no less compelling—evidence that presidents use protectionist actions to advance their political objectives. This suggests that presidents’ electoral incentives extend into other areas of policy. Moreover, it shows that an important area of international relations may be determined, in part, by the domestic politics of presidential election cycles.

While we find that trade adjustments may follow a particularistic imperative, it is important to underscore the differences (in both impact and otherwise) between them and federal grants. First, unlike federal grants, the institutional steps of the policy-making process for trade policy revision are clear and comparatively unilateral. That is, the mediating effects associated with agency problems in the bureaucracy, as well as the continued influence of Congress in a multi-stage institutional process, means that the empirical relationship between presidential preferences and grant allocations may be far more complicated than the correlations uncovered by past work. Trade directives side step those agency problems somewhat, by bearing the president’s signature (and thus, representing his revealed preferences). Moreover, trade adjustments may be a categorically different distributive benefit. They are far less targeted, in that they affect entire industries—which are not confined to states, let alone congressional districts. Their impact provides a different kind of material benefit, with indirect benefits to the larger political units affected. Put simply, trade adjustment is a more blunt tool—despite the fact that it is often under the direct control of the president.

Our findings also point to additional avenues of research. First, our state-level analysis considered a relatively recent period in the history of US trade, during which liberalization was the dominant paradigm. The president’s discretion over trade policy dates to the end of the 19th century, suggesting that a historical extension of this analysis could provide more precise and intriguing estimates of the president’s particularism in the area of trade. Second, though we found evidence of particularism, our results do not merely replicate the findings of past work in a new policy area. Importantly, we do not find that presidents use tariff schedules or NTBs to reward core states. This suggests that the president may possess a “particularistic toolkit,” and that different policy tools may be more or less appropriate given specific electoral or party needs. Both possibilities highlight the importance of trade policy in understanding the scope of the particularistic president.