Recent developments and the baseline forecast

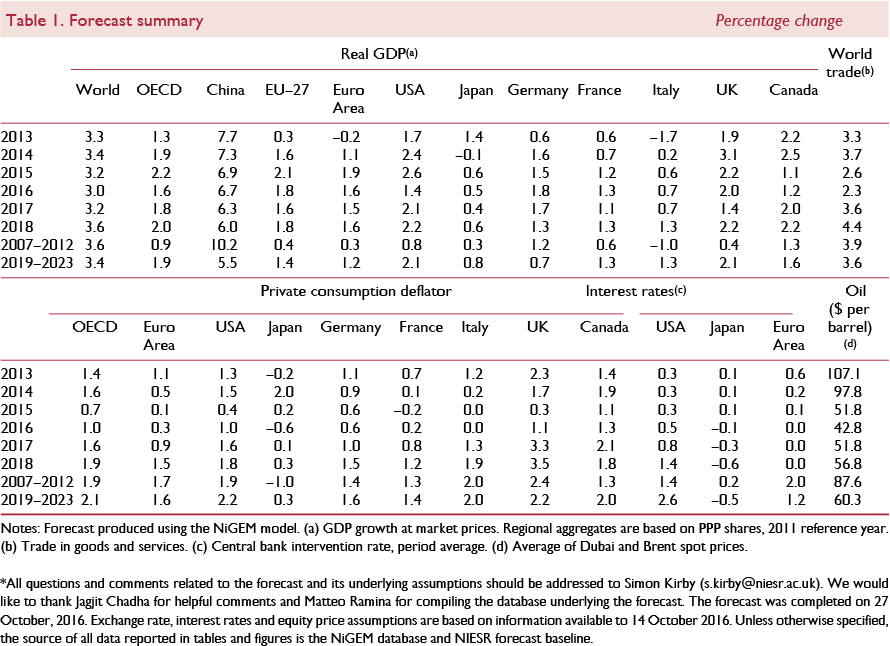

The world growth outlook is little changed from our August Review. Our forecast of global GDP growth this year is unchanged, at 3.0 per cent, the slowest annual growth rate since the 2009 recession; downgrades for some countries, most notably the United States, have been offset by upward revisions for others, including China, Germany and the United Kingdom. Our projection for global output growth in 2017 has been revised down marginally to 3.2 per cent, with a modest pickup to 3.6 per cent expected for 2018. For the medium term, 2019–23, we forecast average growth of 3.4 per cent, significantly slower than the 4.2 per cent average growth rate in the decade before the global financial crisis.

Recent growth in the advanced economies has remained mediocre. In the United States growth has been disappointing since late last year, while in the Euro Area progress in reducing unemployment stalled in the spring. Unemployment is relatively low in some cases – notably the United States, Japan and Germany, as well as the UK – but even in these countries wage and price pressures have remained limited, so that questions remain about the true tightness of labour markets and the size of output gaps. Consumer price inflation has remained below central banks’ targets, by wide margins in Japan and the Euro Area. Among the major emerging market economies, activity seems to be stabilising in Brazil and Russia after deep recessions, with inflation falling towards targets. Growth in India remains the fastest among the major economies, while the slowing of China's expansion seems to have remained close to the government's targeted path.

The only adjustment to monetary policy among the major advanced economies in recent months has been the introduction in September by the Bank of Japan of a new ‘inflation overshooting commitment’ intended to raise inflation expectations and a zero target for the yield on 10-year government bonds to guide asset purchases under its programme of ‘quantitative and qualitative easing’ (QQE). The ECB announced in September that it would evaluate options for adjusting its asset purchase programme in order to ensure its continued smooth operation, given the reduction in the supply of assets eligible for purchase resulting from the declines in government bond yields in recent months. The conclusions of this evaluation will be announced in December. The US Federal Reserve (Fed) has kept the federal funds rate unchanged at the level to which it was raised last December, while indicating that an increase of 25 basis points is likely to be appropriate by the end of the year. In the major emerging market economies, waning inflationary pressures have allowed some central banks to lower official interest rates. Russia's Central Bank lowered its key interest rate by 50 basis points, to 10.0 per cent, in mid-September, while India's Reserve Bank lowered its benchmark rate by 25 basis points, to 6.25 per cent, in early October. Also Brazil lowered its benchmark rate by 25 basis points to 14.0 per cent in late October. Official interest rates have also been lowered since late July in Argentina, Australia, Iceland and New Zealand, but raised in Mexico on currency pressures.

After a period of unusually low volatility in financial markets between late July and early September,1 movements in market prices subsequently became somewhat more pronounced. Since late July, government bond yields have risen moderately in the advanced economies – generally by 10–20 basis points at the 10-year maturity – following the significant declines seen earlier. In Japan, the 10-year yield has risen from about −0.25 per cent in late July to levels only marginally below zero in late October, close to the Bank of Japan's new target. The corresponding yield in Germany has fluctuated around zero. The increases in bond yields in the advanced economies seem mainly attributable to changes in expectations about monetary policy, following both the recent signals from the Fed and announcements by the Bank of Japan and the ECB that have disappointed some expectations of increased accommodation. The rise in rates may also reflect expectations of more expansionary fiscal policies, given signs of increased recognition that monetary policies have become over-burdened and are close to their expansionary limits. In the major emerging markets, by contrast, government bond yields have fallen in the past three months, reflecting waning inflationary and currency pressures.

In foreign exchange markets, the largest movement in the past three months has been the further depreciation of sterling against other major currencies – by about 7 per cent both against the US dollar and in trade-weighted terms – continuing the decline that began immediately after the June referendum decision to exit the EU. The yen has remained the strongest currency among the advanced economies, rising by about 2 per cent against the US dollar since late July. In late October, the yen's trade-weighted value was about 22 per cent above its trough of mid-2015, but still about 20 per cent below its pre-Abenomics peaks of mid-2012. The trade-weighted value of the US dollar in late October was about 2 per cent higher than in late July. Among the emerging market currencies, the Chinese renminbi has depreciated slightly further against the US dollar and in trade-weighted terms, while the Brazilian, Indian and Russian currencies have all appreciated against the US dollar, the rouble by the most – about 6 per cent – reflecting the upturn in oil prices.

Global oil prices have risen from about $42 a barrel in late July to about $51 a barrel in late October, still less than half the level of prices that prevailed in 2011–13. The rise in prices seems due mainly to an informal agreement reached in late September among OPEC countries to reduce production to 32.5–33.0 million barrels a day from the recent level of about 33.3 mbd. Details of the agreement remain to be decided at the next formal OPEC meeting in late November. If formalised, this would be the first OPEC agreement on production cuts in eight years. Meanwhile, large inventories continue to weigh on prices. Other commodity prices have generally risen slightly in US dollar terms in the past three months.

Movements in advanced economy equity markets have been moderate since late July, the largest move being the rise of about 4 per cent in the UK. This is attributable to sterling's depreciation: in common currency terms, the UK market has been the weakest among the advanced economies in recent months. In emerging equity markets, prices have risen by 10–11 per cent in Brazil and Russia since late July, partly reflecting political developments in the former case and oil market developments in the latter. Falling interest rates have also been a factor.

Risks to the forecast and implications for policy

Our baseline forecast shows a gradual strengthening of global economic growth towards rates that would still be significantly below the rates of expansion experienced before the global financial crisis, with average annual growth of 3.4 per cent in 2019–23, compared with 4.2 per cent in the decade that ended in 2007. Although there are risks on both sides of this forecast, it is those on the downside that are more compelling. We discuss three sets of risks that have recently been preoccupying policymakers. We focus mainly on those relating to macroeconomic policies in the advanced economies, and discuss more briefly the political backlash against globalisation and financial risks in China.

With regard to macroeconomic policies, Professor Blanchard recently observed that, “Perhaps the most striking macroeconomic fact about advanced economies today is how anemic demand remains in the face of zero interest rates”.2 Since the global financial crisis, central banks in the advanced economies have increased monetary accommodation to the point where their benchmark interest rates are close to zero, and negative in Denmark, the Euro Area, Japan, Sweden, and Switzerland. Only in the United States have short-term rates begun to be raised, and there in only one, 25 basis point, step thus far. Central banks have also gone beyond lowering short rates, taking unconventional measures – large-scale purchases of longer-term securities and forward guidance on policy with regard to short rates – to reduce longer-term interest rates. Such asset purchases were discontinued in the United States two years ago but they continue, at stepped-up paces, in the Euro Area and Japan and have recently resumed in the United Kingdom.

Partly as a result, longer-term interest rates have fallen significantly, in some cases to zero or below. Even at the 10-year maturity, sovereign yields have been negative in Japan since last February and in Germany for most of the time since June. Markets expect negative policy rates in the Euro Area and Japan through the end of this decade. In September 2016, about 40 per cent of advanced economy government bonds outstanding carried negative yields.3 This is unprecedented.4

Yet growth and demand – especially, in many countries, investment – have remained weak. This is even though, more than seven years after the global financial crisis, its legacies, including deleveraging and increased caution in spending by the private sector, and policies of fiscal austerity, which were important factors restraining economic recovery in its aftermath, have diminished in force. The explanation seems likely to lie partly in a downgrading of expectations about future growth, related partly to the slowing of productivity growth that has been widespread among the advanced economies since the crisis (see figure 1).

Figure 1. Labour productivity growth in selected advanced economies

But the weakness of growth at current, low interest rates must also be seen in the context of the marked downward trend in real interest rates since the 1980s (see Box A).5 As observed three years ago by Professor Summers, there seems in recent decades to have been a secular decline in the ‘natural’ or ‘neutral’ rate of interest – that is, the real interest rate consistent with full employment and reasonable price stability – to levels close to zero.6 This downward trend, which is the essence of Summers’ concern about ‘secular stagnation’, is not just a postcrisis phenomenon: even before the financial crisis, when interest rates were low enough to help induce significant bubbles in housing and financial markets, there was little evidence of inflationary pressure in product and labour markets, suggesting that real rates then were not much, if at all, below neutral.

Box A. Secular decline in global interest rates

It is a stylised fact that real interest rates have been declining globally since the 1980s (figure A1). Meanwhile, growth in both prices and demand has been moderate over this period, and more recently notably weak. When taken together, these two facts suggest that the real natural rate of interest has also fallen.

Figure A1. 10-year real government bond yields, monthly frequency

Economic theory tells us that the global neutral rate depends on saving and investment preferences and expectations of global trend growth. Therefore, it would seem that either saving is running ahead of investment demand, or that there has been a persistent downward movement in the expectation of future global output. Reference Rachel and SmithRachel and Smith (2015) find that in recent years, following the financial crisis, a more pessimistic view of future global growth rates has contributed to the decline in interest rates. However global growth was fairly steady in the pre-crisis decades and they find that little of the pre-crisis trend in interest rates can be explained by this channel. We therefore focus on the interaction of saving and investment.

There are a number of candidate explanations for this phenomenon. Reference Rachel and SmithRachel and Smith (2015) effectively characterise these under four headings; demographic change, rising inequality, an emerging markets savings glut and structural shifts since the global financial crisis of 2008. To these we also add a brief discussion of the role of debt dynamics, as highlighted by Reference Borio and DisyatatBorio and Disyatat (2014). Demographic changes can lead to lower rates as the middle-aged have a higher propensity to save. The greater the proportion of the total populous that is middle-aged, the larger the quantity of saving that will occur. Reference Bean, Broda, Ito and KrosznerBean et al. (2015) note that falling interest rates have coincided with an increase in the high-saving middle-aged population's share of total population, relative to the share of the population that is aged 65 and over. If this is a significant driver of falling interest rates then we could reasonably expect real interest rates to rise somewhat as the high-saving middle aged group transition into retirement, while less numerous future generations enter the labour force.

The arguments surrounding inequality work along similar lines. Since the rich have a higher marginal propensity to save, it is intuitive that rising inequality within countries will result in higher saving rates. As documented by Reference Atkinson, Piketty and SaezAtkinson et al. (2011), the wealth and incomes of the richest segment of the population have been rising much faster than that of the rest of the population over the past several decades.

Reference Bean, Broda, Ito and KrosznerBean et al. (2015) find that China's partial integration into global financial markets and the associated capital outflows have put downward pressure on interest rates. Reference Rachel and SmithRachel and Smith (2015) suggest that this effect has been exacerbated by a significant increase in foreign exchange reserves in many emerging markets as a precautionary measure following the Asian financial crisis in 1998.

Similarly a structural change may also have occurred in advanced economies following the global financial crisis of 2008. Increased risk aversion and/or elevated uncertainty may have resulted in a reduced propensity to invest and thus, for a given level of saving, lowered equilibrium interest rates. Relatedly, there may have been a shift in investor preferences towards safe bonds and away from riskier assets, which may plausibly have reinforced the downward pressure on safe interest rates.

Lastly, the increased levels of indebtedness in advanced economies may be both a consequence and a cause of low interest rates. When debt levels are high, an income shock may cause households, private sector agents, and even governments to reassess their debt position and begin to pay down their debt to a more sustainable level. When done at a macroeconomic level, this can weigh on demand (Reference VliegheVlieghe, 2015). To stimulate demand, the natural reaction of a central bank is to lower rates. However, if households are determined to delever then this deleveraging process will continue regardless and will continue to sap demand from the economy, leading to lower rates (see Reference KooKoo, 2011, for an explanation of this phenomenon).

In practice, the true answer is likely to be a combination of these factors, with some temporary, some cyclical and some permanent structural shifts. However, understanding why the natural rate appears to have fallen to such low levels is an important research agenda. For instance, one cause for concern should low interest rates persist is that, in the event of an adverse shock to the economy, central banks are more likely to be constrained by the lower bound on nominal interest rates. Central banks instead have to resort to unconventional monetary policy instruments, such as quantitative easing and forward guidance, more often. Such instruments are not perfect substitutes for conventional policy, bringing with them uncertain transmission mechanisms and side-effects for financial markets and institutions. What is more, estimates from Reference Lloyd and MeaningLloyd and Meaning (2016) and Reference MeaningMeaning (2016) suggest that the scope for these measures is also approaching its effective lower bound in a number of economies as interest rate expectations and sovereign bond premia appear to be close to their limits (figure A2). Were this to be the case, fiscal policy may be required to play a greater role in offsetting any future adverse economic shocks, while there is the risk that a recession may be longer and deeper in an environment of low trend interest rates.

Figure A2. 10-year term premia in nominal sovereign bond yields

This box was prepared by Jack Meaning and Rebecca Piggott.

The downward trend in the neutral rate has been attributed to various factors, some restraining investment – including a declining relative price of capital goods associated with the increasing importance of information technology, and slower growth of potential output resulting from weaker population growth in many countries as well as slower productivity growth – and others boosting saving – including the ‘glut of saving’ associated with the increased current account surpluses of China and other emerging market economies in recent decades, and rising income inequality in many countries.7 Some of these factors may have waned – the current account surpluses of China and oil-producing countries have narrowed significantly in recent years – but most of these forces seem likely to persist. Indeed, neutral rates could fall further: for example, if low real interest rates are expected to persist, they may further reduce the spending of savers who target an accumulation of wealth, say for retirement.

Current, unusually low, nominal interest rates may therefore be viewed as a consequence partly of low neutral real rates and partly of low inflation expectations. Two kinds of risks then follow.

First, there are the risks associated with low interest rates themselves. The actions taken by central banks to reduce interest rates have been aimed at stimulating demand partly by encouraging more risk-taking by producers, consumers and wealth-owners. An associated danger to the economy and to our forecast is excessive risk-taking, leading to unsustainable rises in asset prices that will eventually come to grief in market collapses that destabilise the economy. This has been discussed in earlier issues of this Review. Central bank officials have continued to argue that while the danger is real, asset market developments have not, as yet, been such as to cause material concern. This is although some markets (for example, the US stock market) have reached historically high levels relative to variables relevant to judging their sustainability (such as cyclically adjusted corporate earnings).

Two other kinds of risk associated with low interest rates have recently come to the fore. One concerns the possibility of a flight from bank deposits to cash, particularly if deposits carry a negative rate. This could hinder the transmission of monetary policy as well as reduce the supply of bank credit. Thus far, there has been little sign of this occurring. Although commercial banks in some countries (including Germany and Switzerland) have reportedly started to pass on their central banks’ negative deposit rates to large corporate clients, charges for deposit holding appear not to have been imposed on other, retail, clients except in a few minor cases. However, if central banks were to push rates even further into negative territory, this situation would be likely to change.8

The second risk that has recently risen to prominence concerns the effects of low – especially negative – interest rates and a flattened yield curve on bank profitability, and hence potentially on the supply of credit and the stability of the financial system. The interest spread between banks’ assets and liabilities is likely to have been squeezed not only by the flattening of yield curves but also by negative interest rates on reserves, given the difficulty of passing on negative rates to retail customers. Concerns about bank profitability have been evident recently in stock markets, especially in Europe (see figure 2), with several banks taking action to reduce their operating costs and shore up their capital positions. The ECB, echoed by the IMF, has tended to downplay these concerns, arguing that the profitability problems of European banks are due less to accommodative monetary policy – from which they may, in fact, have benefited, on net – than to inefficiencies related partly to excessively large branch networks.

Figure 2. Stock prices in the US and Europe

These risks – of over-extended asset markets, a flight to cash, and reduced bank profitability – point to dangers that could be involved in pushing accommodative monetary policy further.

However, there is a second kind of risk to be taken into account. What if there was an economic downturn in the advanced economies in the near future? Nowhere is there room to cut interest rates by anything like the rate reductions seen in the typical recessions of recent decades. For the United States, for example, the typical interest rate reduction in the recessions of recent decades is 400–500 basis points. Professor Summers has called this problem “the primary monetary and indeed macroeconomic policy challenge of our generation”.9

With ‘neutral’ real interest rates having apparently been in steady decline internationally over the past three decades, reaching zero by some estimates, real interest rates would need to be reduced significantly below zero to provide sufficient stimulus for demand to counter recession. But how could this be done when inflation is close to zero, and given a lower bound on nominal rates that is presumably not far below zero and not far below current levels? In her recent Jackson Hole speech, Fed Chair Janet Yellen cited model-based evidence suggesting that if, by the time recession hits, the federal funds rate has been raised to its projected longer-tem level of 3 per cent, then asset purchases and forward guidance would be sufficient to complement the feasible reduction in interest rates to produce the demand stimulus required.10 But this assumes a starting official rate of 3 per cent – significantly higher than where it stands today – an effectiveness of unconventional measures that may be exaggerated, and an availability of suitable assets for purchase that may not apply. (See Box B.)

These considerations together suggest first, that while there is probably only limited scope for further reductions in nominal interest rates (or expansions in asset purchases) in the advanced economies, it is important that current economic recoveries not be jeopardised by a premature tightening of monetary conditions. Second, although the scope for further expansionary adjustment of monetary instruments may be severely limited, frameworks of monetary policy may still be adjusted to provide additional stimulus by raising inflation expectations and thus lowering real interest rates. One possibility is for central banks to announce that they aim to overshoot their inflation targets, as the Bank of Japan has recently done. Another is for inflation targets to be raised. But third, with monetary policy now increasingly constrained, the case for a more balanced use of policy instruments, including expansionary fiscal policy – particularly through public investment financed by the exceptionally low-cost borrowing now available to governments – and structural policies that boost demand as well as potential output, is now even stronger than on the several occasions when such measures been advocated in issues of this Review over recent years.

It appears that there may now be a stronger international consensus in favour of a more balanced approach. The over-burdening of monetary policy seems to have become an increasingly common observation of policy makers, and recent communiqués agreed by ministers in meetings of such international bodies as the G20 and the IMF have put increased emphasis on the need for a more balanced approach.

Moreover, there are signs that policymakers are turning to fiscal stimulus, or less fiscal stringency, in a number of countries: in Canada, the new government introduced expansionary fiscal measures last March; in the United States, the policy proposals of both main presidential candidates appear to imply fiscal stimulus; in the Euro Area, the decision by the European Commission in July not to recommend the levying of fines on Portugal and Spain for not taking effective action to reduce their deficits may be a sign of an easing of the discipline involved in the Stability and Growth Pact; fiscal policy in Germany is expected to be moderately expansionary both this year and next; and Japan is in the process of enacting a package of stimulus measures worth close to 1 per cent of GDP in the fiscal year ending next March. Thus the UK is not the only economy where fiscal policy is taking an expansionary turn. Expansionary fiscal action should, of course, be tailored to national circumstances, including the fiscal space available, and be combined with longer-term consolidation measures as appropriate.

The second set of risks that has recently gained increased attention – although it was discussed in the August 2016 Review in the context of the UK's June referendum on Brexit – concerns the threat to the internationally open global economy arising from the advocacy of protectionist, nationalist, and inward-looking policies by ‘populist’ politicians who have gained significant public support, including in the current US presidential election. This is occurring in the context of an already apparent slowing down of globalisation. The volume of world trade in goods and services has grown by just over 3 per cent a year since 2012, half the average rate of expansion during the previous three decades and barely matching the growth of global GDP. Thus the long-term rise in the ratio of world trade to GDP has stalled (see figure 3). The World Trade Organization recently lowered its forecast of merchandise trade growth in 2016 to 1.7 per cent, which would be the slowest growth since the financial crisis. Meanwhile, progress with international trade liberalisation has ground to a halt and discriminatory trade measures have burgeoned. There have also been notable declines, since the crisis, in foreign direct investment in the advanced economies and in international bank lending.

Figure 3. World trade to world GDP ratio

The grounds for continuing to believe that open international economic relations are beneficial to a country's welfare remain solid, and world economic history is replete with examples of countries where economic progress has been stymied by defensive, inward-looking policies. However, there have been losers as well as winners from globalisation. If support for international economic integration is to be maintained so that the risk of damaging protectionist policies is to be averted, more active policies are needed to compensate and support globalisation's losers, and this may require higher taxes on globalisation's winners. These issues were discussed more fully in the August 2016 Review.

The third set of risks is related to the continuing vulnerability of growth in China to fragilities in its financial system. The pickup in Chinese credit growth since mid-2015 has helped the authorities keep GDP growth on its targeted path, but it may also have increased financial fragility and built up problems for the medium term. It seems to have contributed to a recent steep rise in housing prices in the major cities; the risk of a destabilising correction has been of increasing concern, and more than 20 municipal governments have recently taken macro-prudential measures to contain the rise. Also associated with the recent acceleration of credit has been a renewed growth of shadow credit products, some of which are repackaged bad loans that continue, non-transparently, to impair banks’ balance sheets; they tend to be characterised by relatively high default risk. There has also been increased reliance by banks on wholesale funding, which tends to be less stable than deposits. Also associated with the recent expansion of domestic credit has been a further growth of corporate debt, including in the state-owned enterprise sector. These developments indicate some of the significant risks that remain in China's path of restructuring its economy while moderating the slowdown of economic growth.